Hidden Gems are one of four Wine Lister “Indicators”, segmenting wines that meet specific sets of criteria into groups. Hidden Gems are those wines rarely found in the top restaurants, and not often searched for online, but which either have high ratings from wine critics, or have been singled out as a hidden gem by Founding Members in Wine Lister surveys.

Last week, Wine Lister celebrated its second birthday with a special tasting of a selection of 27 “raw” hidden gems, identified by our Founding Members (c.50 key players from the international fine wine trade) when asked which wines they rated highly, but which they felt were underappreciated.

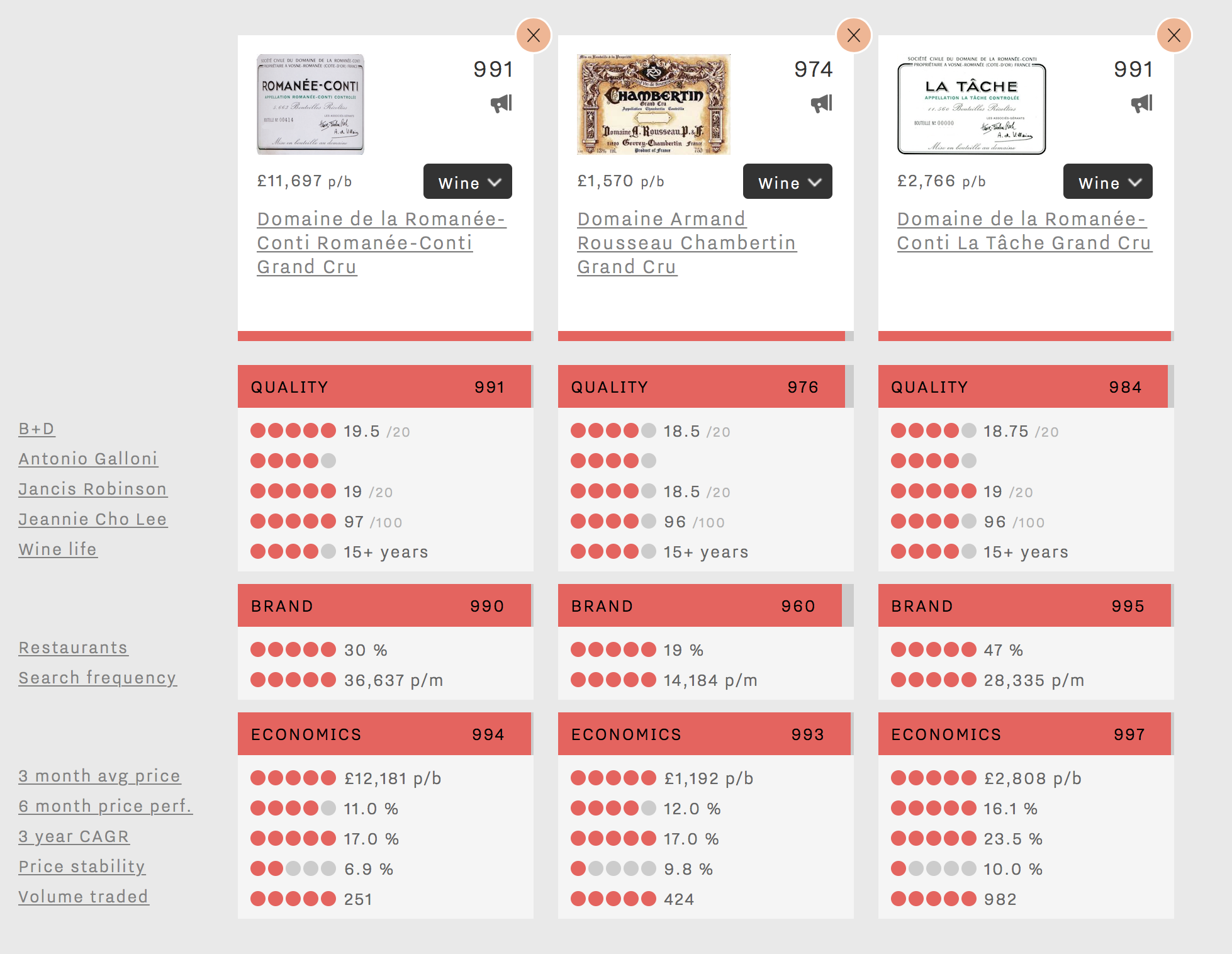

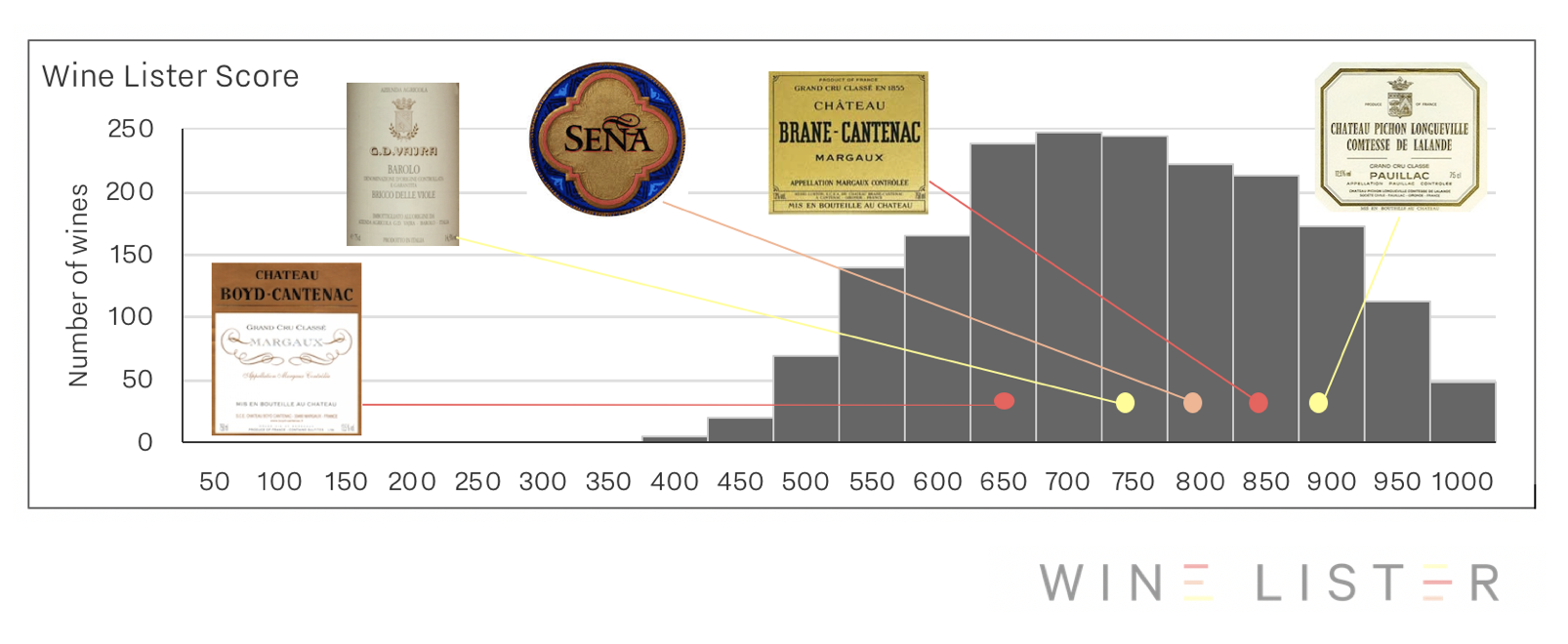

Founding Members’ Hidden Gems hail from a variety of regions, producers and vintages. Their average Wine Lister scores vary too, as shown on the histogram below, where the grey columns represent the total number of fine wines currently listed on Wine Lister which fall into each score bucket.

The full list of wines tasted is available here: Wine Lister Founding Members’ Hidden Gems

The Wine Lister team was joined by some of our trade Founding Members, data partners, and other supporters of Wine Lister. We encouraged tasters to share their comments by writing on the tasting table. All the wines were showing beautifully, and G.D. Vajra’s Barolo Bricco delle Viole 2009, tasted from magnum, won widespread praise from all the guests. It also holds the highest Quality score (927) of all wines in the room. One taster even went so far as to name it “the Lafite of Barolo”!

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

Find out what else was said about the wines by following this link to more photos of the event.

Wines featured in the tasting: Louis Roederer Brut Premier, E. Guigal Condrieu La Doriane 2016, Casa Lapostolle Clos Apalta 2014, Seña 2010, Henschke Mount Edelstone Shiraz 2014, Isole e Olena Syrah Collezione Privata 2011, Tenuta San Guido Guidalberto 2016, Tenuta dell’Ornellaia Le Serre Nuove 2015, 2011, 2007, Produttori del Barbaresco Barbaresco 2014, G.D. Vajra Barolo Albe 2013, G.D. Vajra Barolo Bricco delle Viole 2009, Domaine Duroché Gevrey-Chambertin Les Jeunes Rois 2015, Domaine Duroché Chambertin Clos de Bèze Grand Cru 2015, Domaine Tempier Cuvée Cabassou 2007, Château La Gaffelière 2014, Le Marquis de Calon Ségur 2014, Château Haut-Bailly La Parde 2012, Château Les Carmes Haut-Brion 2014, Château Boyd-Cantenac 2013, Château d’Issan 2011, Château Branaire-Ducru 2012, Château Pédesclaux 2014, Château Pichon Longueville Comtesse de Lalande 2005, Château Brane-Cantenac 2005, Château Lafon Rochet 2010.

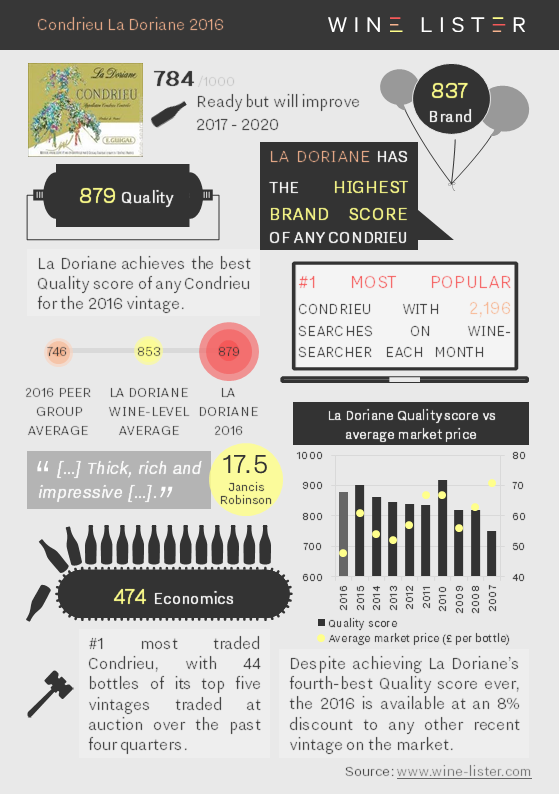

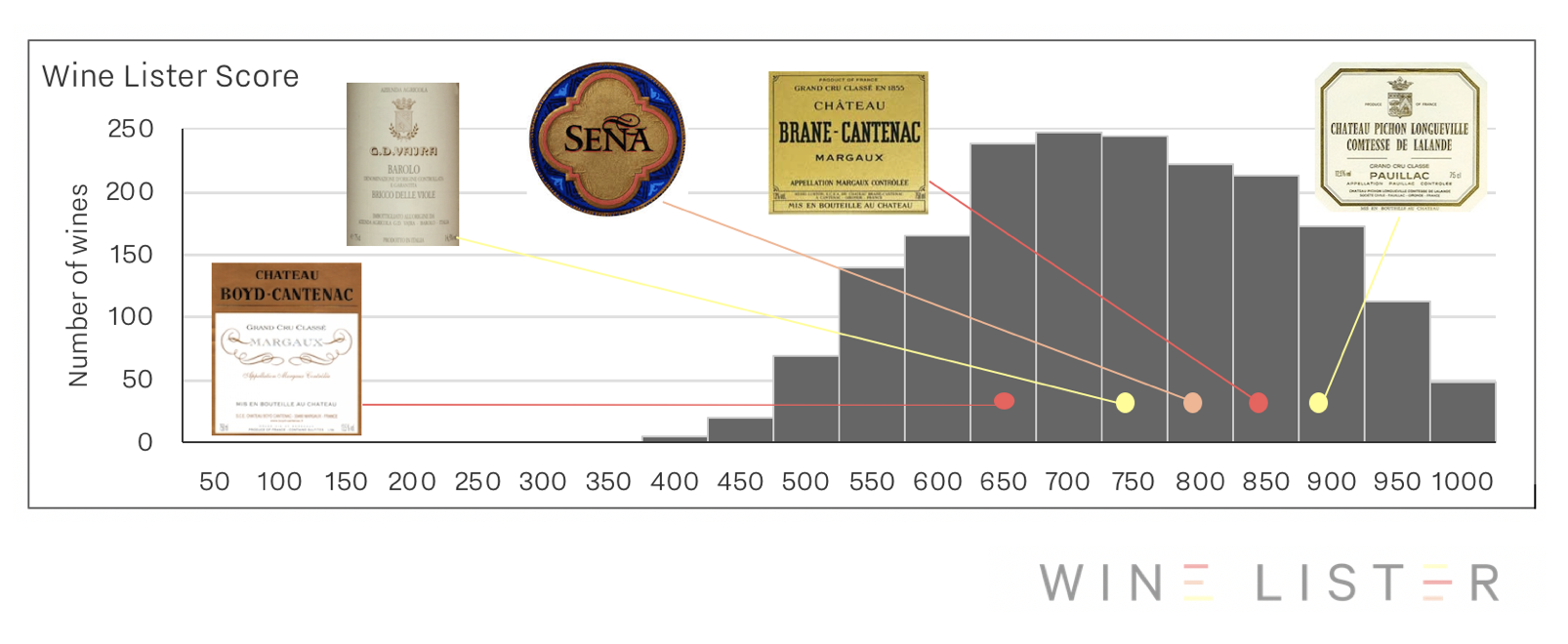

On Tuesday Wine Lister held a tasting of Hidden Gem wines, as identified by our Founding Members from the wine trade. All the wines showed beautifully, including Guigal’s Condrieu La Doriane 2016. Below we summarise all the facts.

You can download the slide here: Wine Lister Factsheet E. Guigal La Doriane 2016

Yes, that question: “which are better, Old World or New World wines?” Traditionalists may argue that the latter lack the prestige and quality of their Old World counterparts. Those with a preference for the New World might see these wines as better value for money, free of the price tag accompanying wines from famously exclusive Old World vineyards.

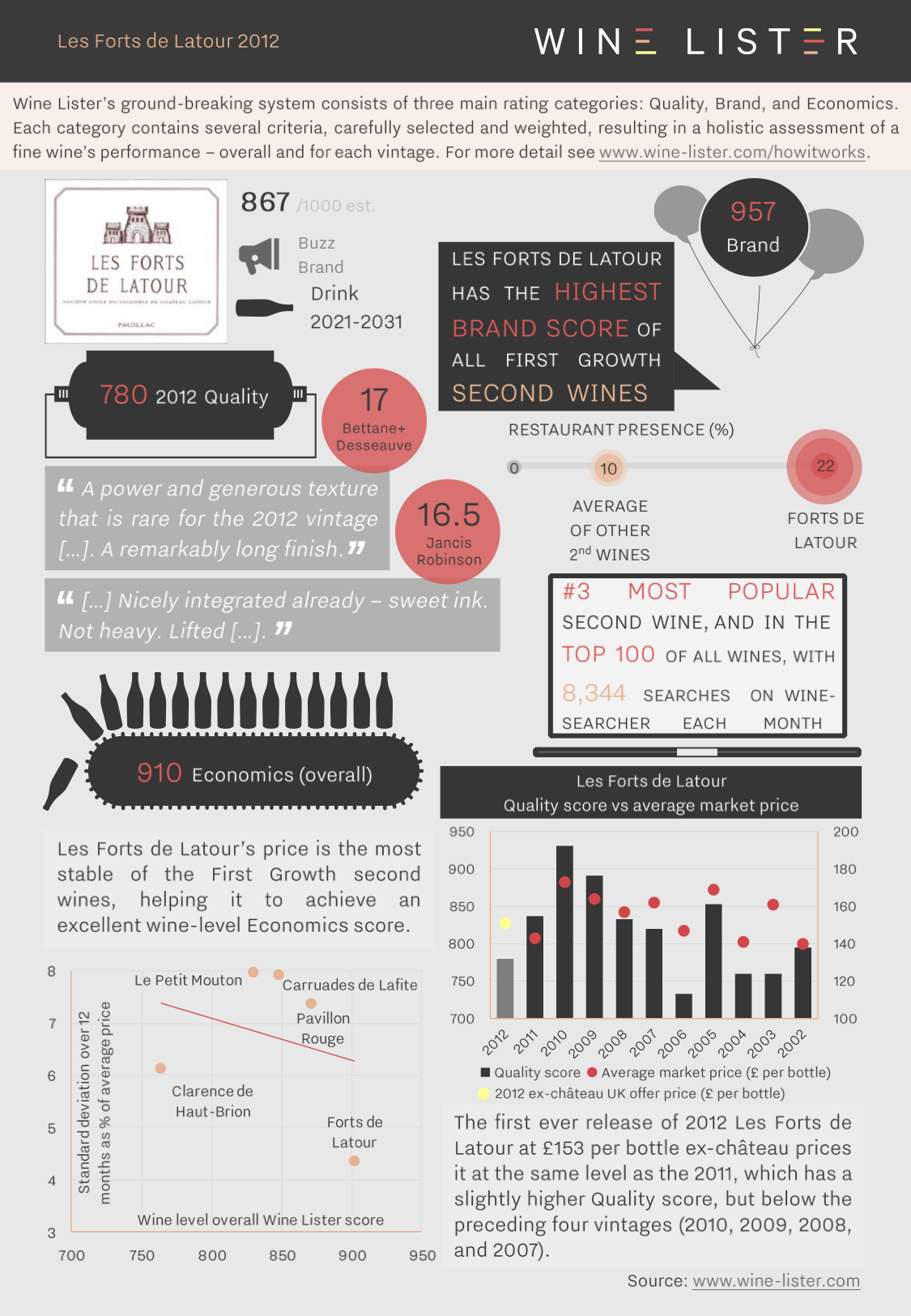

Wine Lister has compared the top 50 wines by Quality score from Old World and New. The average Quality score of the top 50 wines is 983 in the Old World and 948 in the New. Though both Worlds sit comfortably in the “strongest” section of the Wine Lister 1000-point scale for Quality, the price gap tells a different story. The average price for a top 50 ranking Old World wine is £2,114 per bottle – seven times higher than the average New World equivalent (£297).

The wine with the highest Quality score on Wine Lister is Egon Müller’s Scharzhofberger Riesling TBA, which achieves a wine level Quality score of 995, having fallen just one point shy of the perfect 1,000 point score for the 2010 vintage. Riesling’s quality proliferates in the top 50, with 16 entries across Germany and Alsace. The high critics’ scores are balanced by exceptionally high prices, with an average price of £2,509 per bottle.

Though the Old World Quality top 50 is in fact white wine dominant, red Burgundy is well represented, with 13 entries and an average Quality score of 983 at £3,164 per bottle. Even excluding DRC La Romanée-Conti’s remarkable price (£11,722 per bottle), Burgundy’s remaining 12 finest reds command an average price of £2,450 per bottle.

Champagne wins the price vs quality race for the whites, with an average Quality score across its four entries of 981 at £348 per bottle. Even more impressive are the five Port entries, with an average Quality score of 982 at £244 per bottle.

In contrast to the diverse set of regions represented in the Old World top 50, the New World list is dominated by California (with 40 out of 50 wines hailing from the region). These wines achieve an average Quality score of 948 at £315 per bottle – not quite as good value as the Champagnes and Ports, but seemingly better value than their red Burgundian counterparts.

Though there are fewer entries from Australia (seven in total), the New World’s number one wine for quality comes from the Barossa Valley. Torbreck The Laird has a Quality score of 984 points and a price of £427 per bottle. When comparing this to an Old World wine of the same score, the price difference is evident. Domaine Leroy’s Romanée Saint Vivant benefits from the same Quality score, but is nearly five times more expensive, at £1,975 per bottle.

Tucked away in the Westernmost corner of the Veneto, just to the North of Verona is Valpolicella, home to the region’s best wines. The Veneto might conjure up images of Bellinis, Prosecco, and Soave, but it is the region’s predominantly Corvina-based reds that top Wine Lister’s table. With overall scores all falling in the 800s, these five wines might not quite make it into the most elite section of Wine Lister’s 1,000 point scale, but a closer inspection of their performance shows that they are most definitely forces to be reckoned with.

Quintarelli’s Amarone della Valpolicella comes out on top with a score of 892, just two points ahead of Dal Forno Romano’s Amarone. Its lead is thanks to a formidable Quality score (974), comfortably the best of the group. Receiving over 5,500 searches each month on Wine-Searcher, it is also the group’s most popular wine – with perhaps all of Quintarelli’s cuvées benefitting from basketball star LeBron James’ Instagram posts of empty Quintarelli bottles.

Dal Forno Romano fills the second and third spots with its Amarone and Valpolicella Superiore. The Amarone benefits from by far the best restaurant presence of the group, visible in 21% of the world’s top establishments, helping it to the group’s best Brand score (926), 25 points ahead of Allegrini’s Amarone which is the only other wine to achieve a Brand score above 900. Interestingly, it is Dal Forno Romano’s Valpolicella Superiore that achieves the group’s best Economics score (810) despite trailing the Amarone by significant margins in the Quality category (870 vs 928) and Brand category (837 vs 926). It does so thanks in part to being the most liquid of the group – its top five-traded vintages have traded 112 bottles at auction over the past year – but also to the fact that it is the only one of the five wines whose price has not fallen in value over the past six months, instead rising 3.8%.

Quintarelli’s Alzero is the group’s anomaly. The most expensive of the five, it is the only one to eschew indigenous grapes, instead being a Bordeaux blend of Cabernet Sauvignon, Cabernet Franc, and Merlot. With a Quality score of 933, including a formidable average rating of 95.5/100 from Vinous, it seems that international varieties can thrive alongside traditional grapes in Valpolicella.

Château Latour has released a parcel of their 2006 this morning at €450 ex-negociant. It is being offered in the UK at c.£430 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Latour 2006

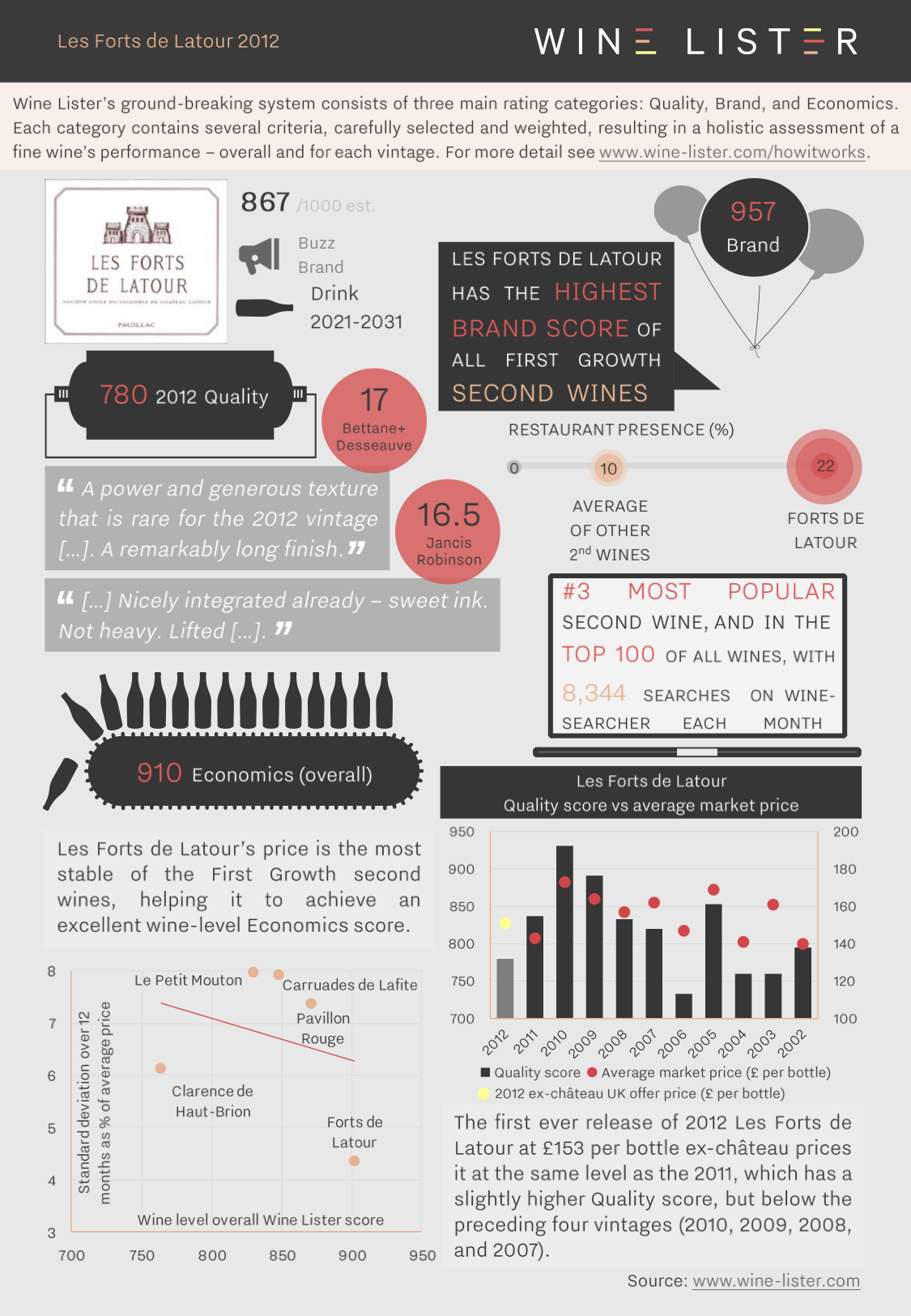

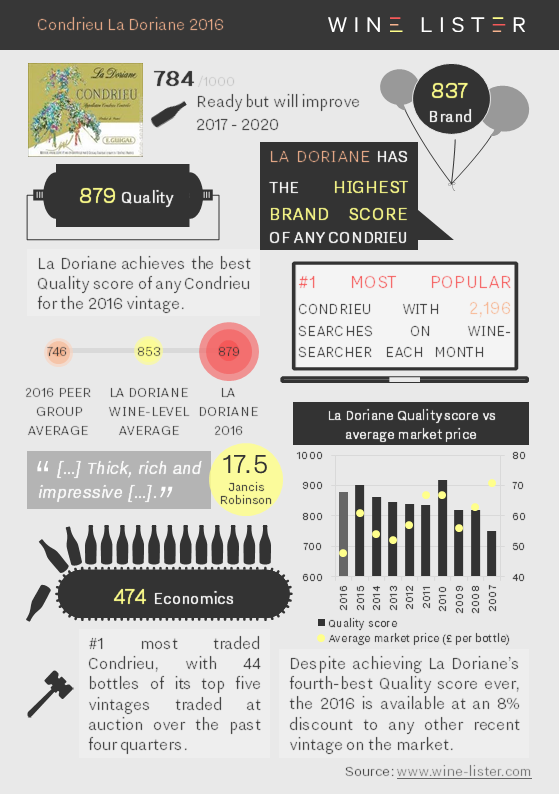

Château Latour has released a first parcel of Les Forts de Latour 2012 this morning at €145 per bottle ex-negociant. It is being offered in the UK at c.£153 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Les Forts de Latour 2012

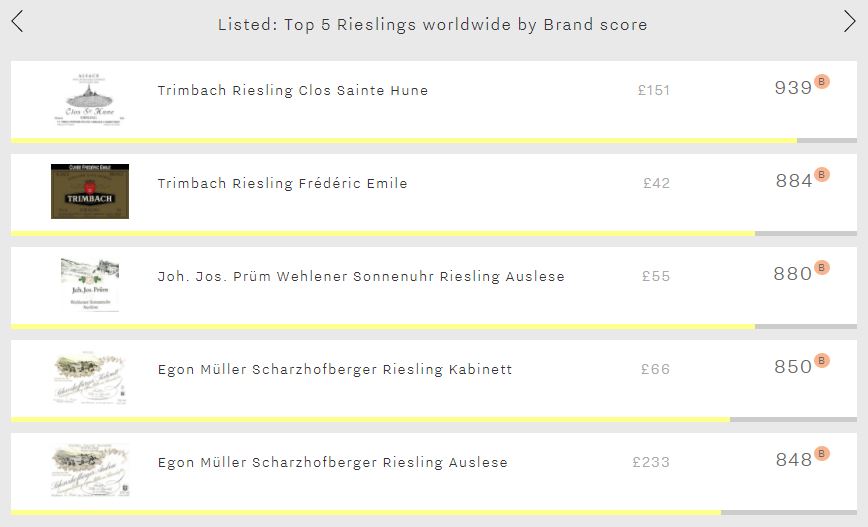

Riesling is amongst the greatest grapes at communicating time and place. Top Riesling is not only one of the most ageworthy of all wines, it is also one of the most versatile grapes, delivering crisp lime-scented examples in South Australia, and heady, honied, petrol aromas in the Mosel. The top five Riesling brands are a good example of this. Despite all hailing from Alsace and the Mosel, they showcase at least some of the variety that can, at times, cause confusion (but don’t extend to the tonguetwisting trockenbeerenauslese or flummoxing fuder numbers).

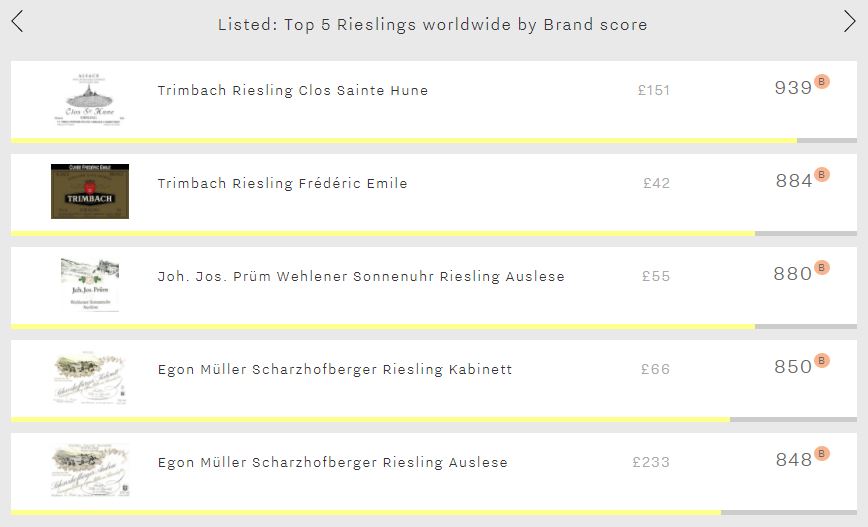

Alsatian heavyweight Trimbach fills the top two spots with its flagship Clos Sainte Hune (939) and Frédéric Emile (884). Clos Sainte Hune is the only Riesling to crack the 900-point mark in the Brand category, thus ranking amongst the most elite Brands on Wine Lister’s database. Its lead is thanks to its popularity – it is searched for twice as frequently as the group’s second-most popular wine (Prüm’s Wehlener Sonnenuhr Auslese). It is in fact Trimbach’s Frédéric Emile that achieves the greatest level of restaurant presence of the group, appearing in 37% of the world’s top establishments, it just pips Clos Sainte Hune to the post (34%). Confirming Trimbach as darling of the trade, the next best wine in the criterion (Prüm’s Wehlener Sonnenuhr Auslese) appears in 22% of top restaurants.

Egon Müller fills the last two spots with wines from the famous Scharzhofberger vineyard – its Kabinett (850) and Auslese (848). It is interesting that it is the Kabinett that comes out on top in the Brand category, despite trailing its sweeter sibling by significant margins in the Quality category (820 vs 974) and Economics category (523 vs 806). It manages to do so thanks to a greater breadth of restaurant presence (21% vs 16%), despite the Auslese achieving greater depth with 3.6 vintages / formats offered on average (the best of the group).

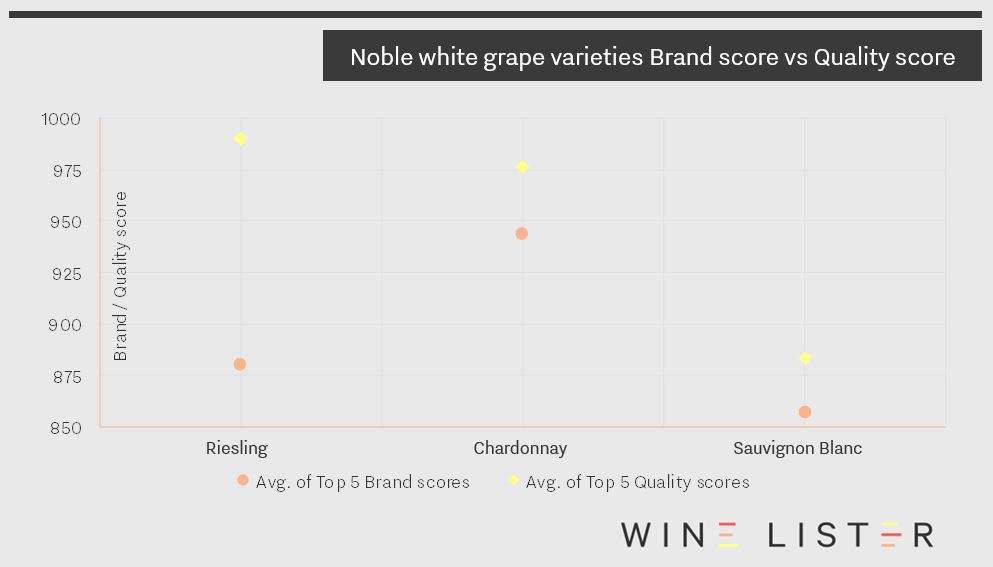

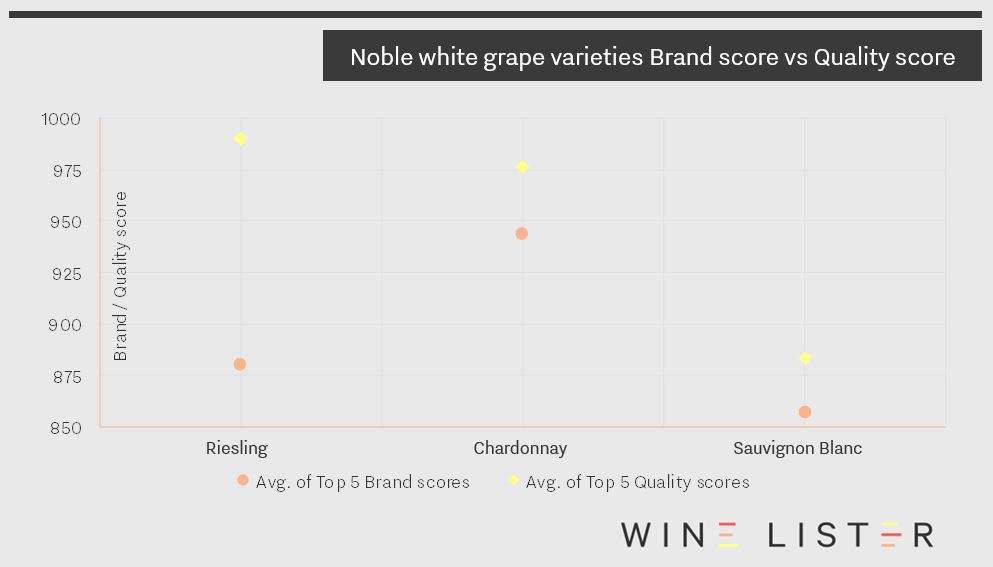

It is worth comparing the performance of Riesling’s top brands to the grape’s top Quality scores. Whilst these five brands achieve an average of 880 in the Brand category, the top five Rieslings by Quality score manage a remarkable average of 990 in the qualitative category. It seems that it is in terms of consumer popularity that Riesling struggles. Trimbach’s Clos Sainte Hune – the most popular Riesling in the world – is only the 241st most popular wine on Wine Lister’s database.

Riesling seems doomed to be perennially underappreciated, perhaps due to its range of sugar levels, or maybe the complexity of the German classification system. Certainly its remarkable quality does not command the brand recognition it deserves. If we compare the average of the top five Brand and Quality scores of 100% Riesling, Chardonnay, and Sauvignon Blanc wines, it is clear to see that Riesling’s outstanding quality does not currently result in a corresponding level of brand strength.

Wine Lister Economics scores not only reflect a fine wine’s economic clout, but also predict its future price performance. The economics of fine wine are increasingly important. Some purists wish it weren’t the case (wouldn’t it be wonderful if quality could exist in isolation from pecuniary concerns?), but consider the plight of the producer making an exceptional wine, that without any brand recognition or commercial strategy doesn’t ever see the light of day. It never finds an importer, or its way into the consumer’s glass, let alone the investor’s portfolio.

That is why Wine Lister scores capture 12 data points across three rating categories, to measure the all-round performance of a fine wine in its journey from vine to glass. After Quality and Brand, the third Wine Lister rating category is Economics. The Economics score shows the producer whether its commercial strategy is working, but more than that, it can also serve to indicate to the collector whether the wine makes an economically sound investment.

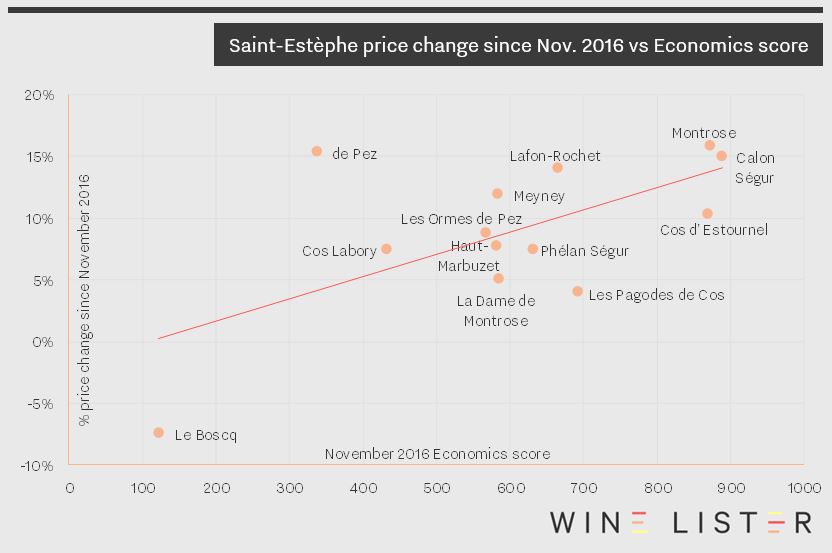

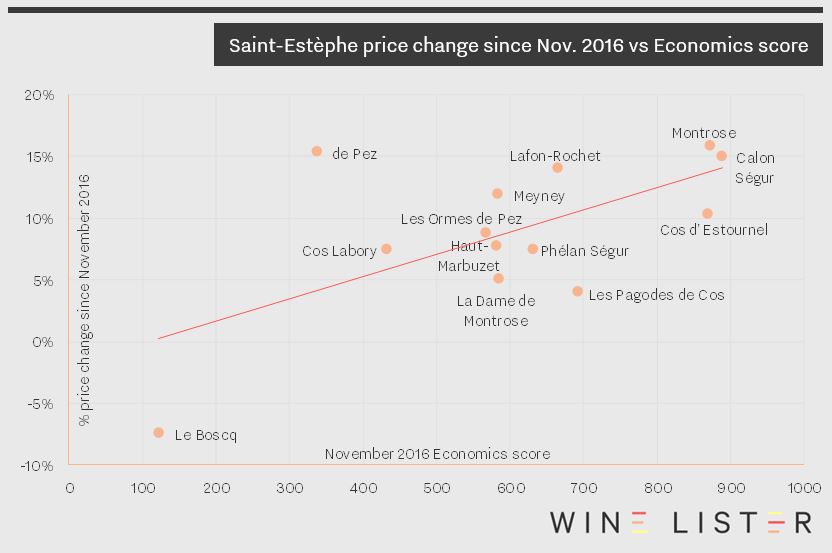

Bordeaux wines with an Economics score above 900 in November 2016 had increased by 17% in price on average by January 2018. By contrast, those with Economics scores below 600 gained just 8% subsequently. We can see this pattern in action in the chart below, which looks at Saint-Estèphe wines over the same 14-month period. The wines with the highest Economics scores at the beginning of the period proceeded to increase more in price than those with lower scores as a general rule.

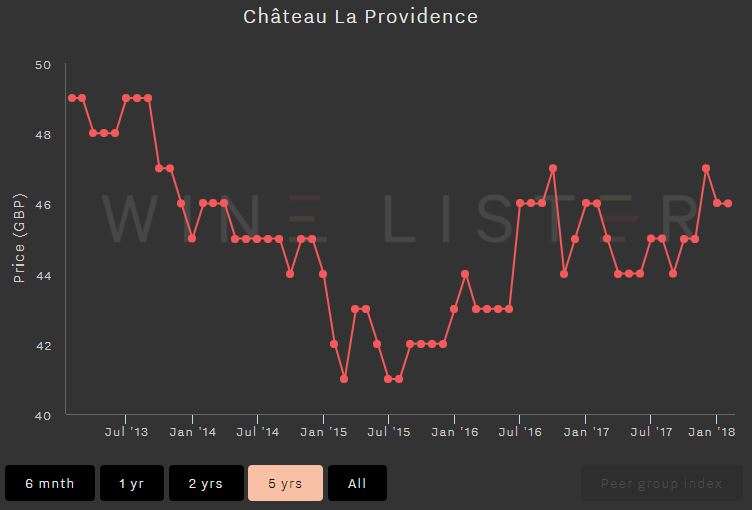

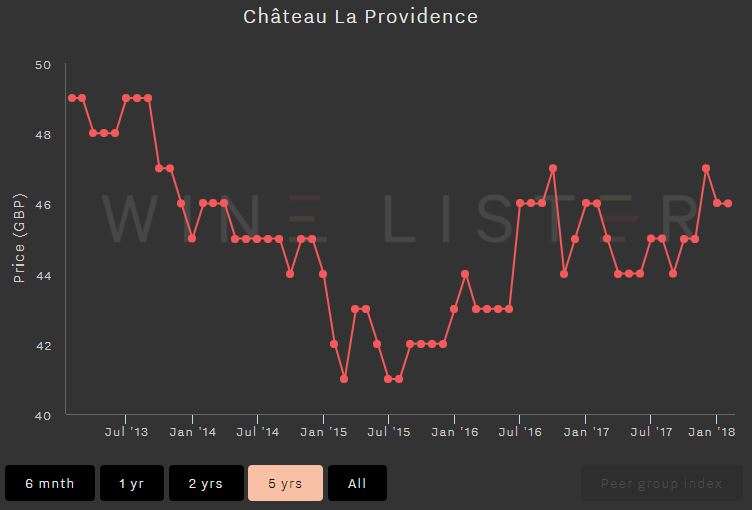

The below screenshots of Wine Lister’s price history tool illustrate graphically the difference between two wines with different economic profiles. Vieux Château Certan’s Economics score lies in the “strongest” portion of the Wine Lister 1000-point scale at 907/1000. While Château La Providence’s Quality score is strong (708/1000) its low Economics score of 389 is the result of a lower price, weak price performance, volatile prices, and modest trading volumes.

Wine Lister analyses five criteria in order to measure a wine’s economic strength, expressed as an Economics score out of 1,000. Four of these criteria use pricing data from our data partner, Wine Owners, while the fifth uses trading volume figures from the Wine Market Journal:

- 3 month average bottle price

This “market price” is the ultimate measure of what people are willing to pay for each wine in each vintage. Data is updated weekly, and bases prices on a three-month rolling average. Prices are shown In Bond per bottle.

- Short-term price performance

A wine’s financial strength also depends on its price performance. Wine Lister calculates price changes over six months for an indication of short-term price trends.

- Long-term price performance

Long-term performance measures a wine’s compound annual growth rate over three years.

- Price stability

Price fluctuations over a 12-month period are distilled into the measure of a wine’s stability. Wines with less volatility are more consistent, less risky and therefore earn a better Economics score.

- Volume traded

Added to pricing information is data on a wine’s liquidity. A wine can have good price performance but lack the current market demand, potentially making it a less attractive wine for investment.

Wine Lister uses search frequency data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis. Wines with the highest search frequency numbers tend to be consistent, with the Bordeaux left bank premiers crus classés generally taking the top spots.

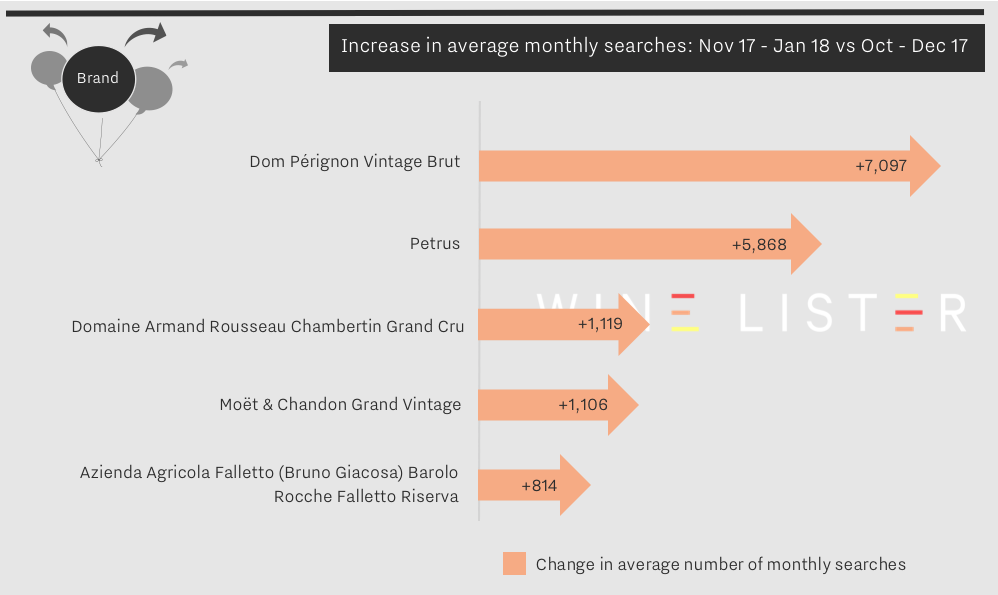

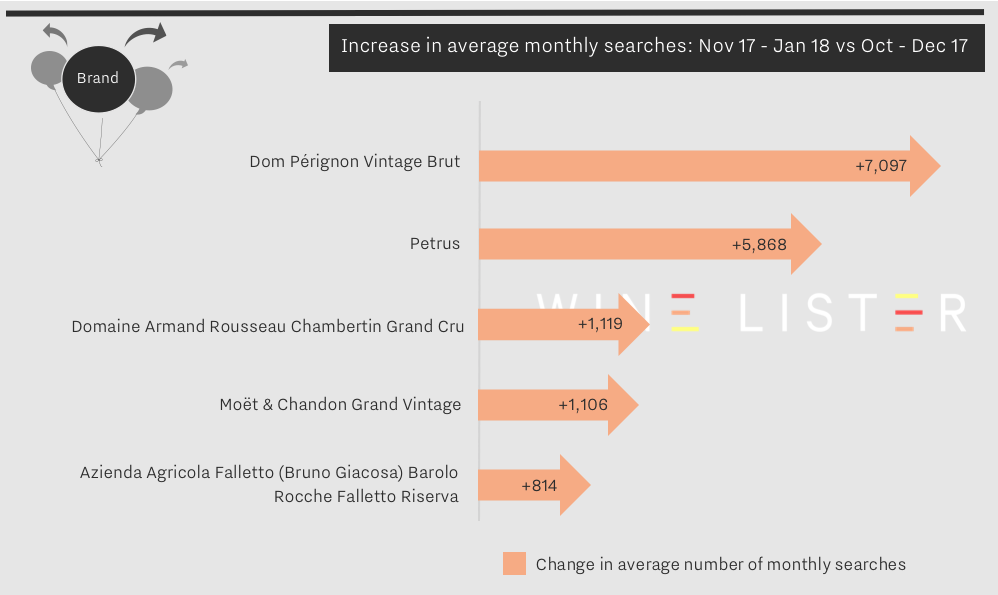

This month’s biggest search frequency gainers also rank as some of the most searched-for wines on Wine-Searcher. Dom Pérignon Vintage Brut is the third most popular wine with over 84,000 searches after Lafite and Mouton, closely followed by Petrus in fourth place. Armand Rousseau’s Chambertin and Moët & Chandon Grand Vintage appear in the top 50, while Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva comes lower down at number 148 out of the circa 5,000 wines on Wine Lister, but its search frequency has recently increased by 15%.

Our last post on online search frequency revealed Wine Lister’s first ever perfect Brand score. Moving on from the Christmas period, Champagne brands still show marked increases in search frequency, but this time they do not stand alone at the top.

Dom Pérignon Vintage Brut is the largest gainer in popularity for the second time running. Increasing at a slower rate than in December, its popularity nonetheless grew by 7,097 searches into January, maintaining its 1000-point Brand score. Dom Pérignon remains the only wine to achieve a perfect score from any of the Wine Lister score categories. The other Champagne still riding high on searches is Moët & Chandon Grand Vintage, which increased by 6%.

Bordeaux creeps back onto the map for online searches at the beginning of 2018, with the first growths having featured heavily in searches up to December 2017. Petrus is in second place after Dom Pérignon, with an 8% increase in search frequency. It will be interesting to see if search increases for Bordeaux follow the same pattern as last year as we approach the 2017 en primeur campaign.

Armand Rousseau’s Chambertin appears in third place. Armand Rousseau was only one of two producers to achieve a perfect confidence rating from our Founding Members in our recent Burgundy study.

In fifth place for increased popularity is a bittersweet entry. Searches for Barolo Rocche Falletto Riserva from Azienda Agricola Falletto increased as the wine world learned of the sad passing in January of Piedmont legend, Bruno Giacosa. You can read more on Bruno Giacosa’s legacy in a recent blog on Barbaresco, here.

For wine lovers the world over, Burgundy is a region to be celebrated all year round. That being said, the modern interpretation of the traditional, post-harvest festival, La Paulée de New York, holds its West Coast counterpart this week, celebrating some of Burgundy’s finest producers in San Francisco’s best restaurants.

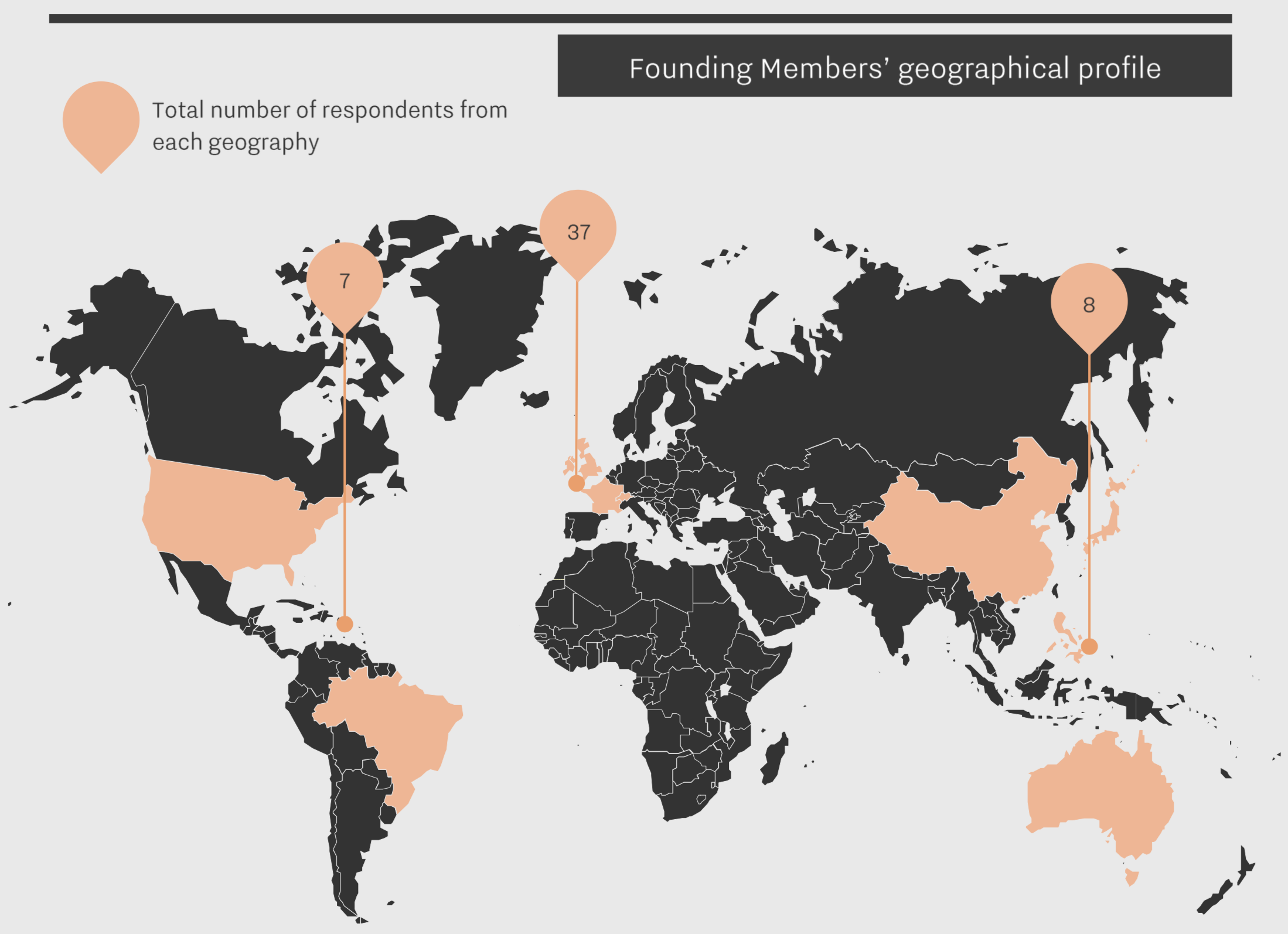

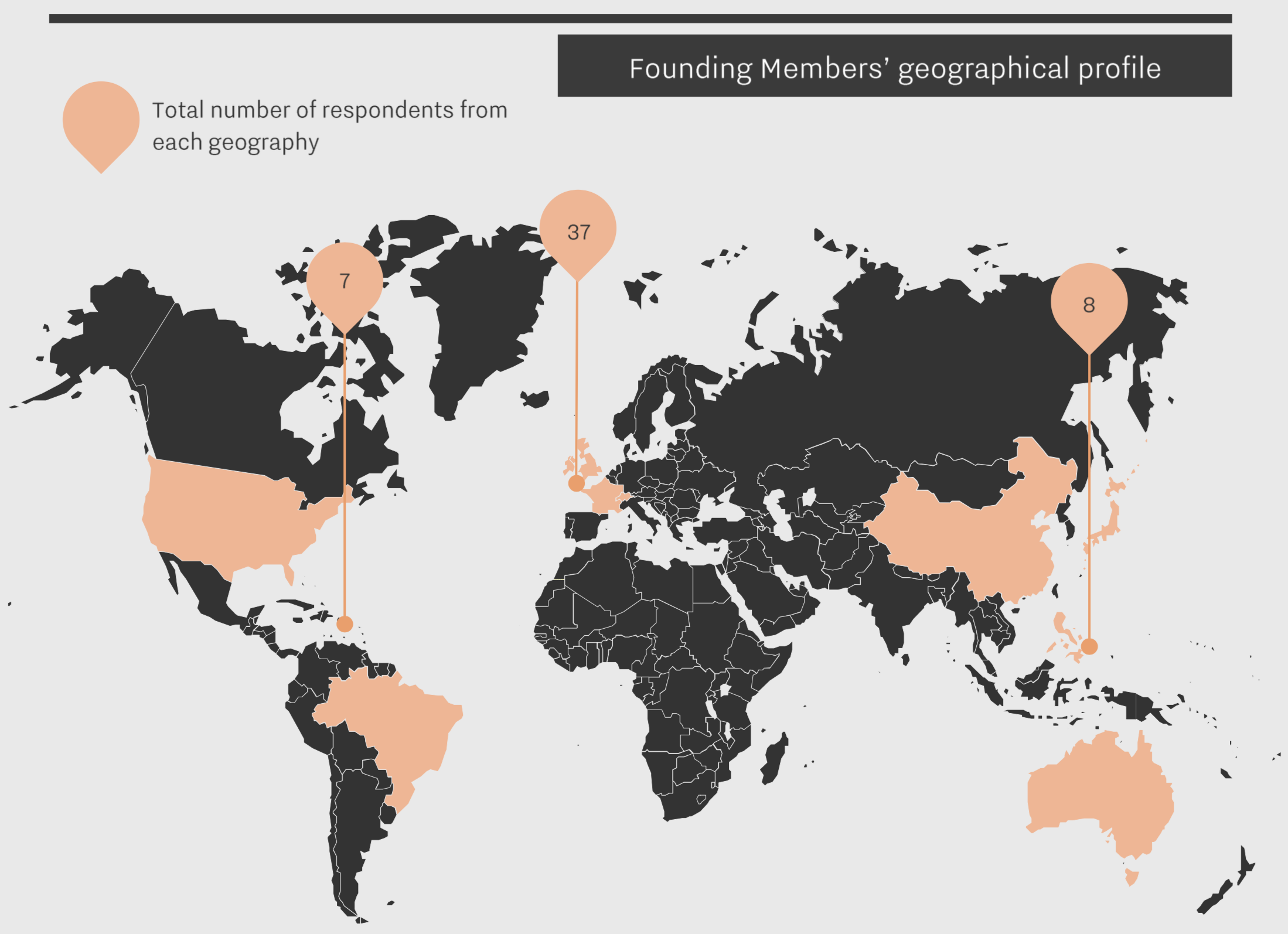

With Burgundy on the brain, we look back at our recent Burgundy study and the results of our Founding Members’ survey. Wine Lister asked 52 key members of the global wine trade across importers, merchants, and auction houses to rate their confidence in certain domaines from 0 to 10.

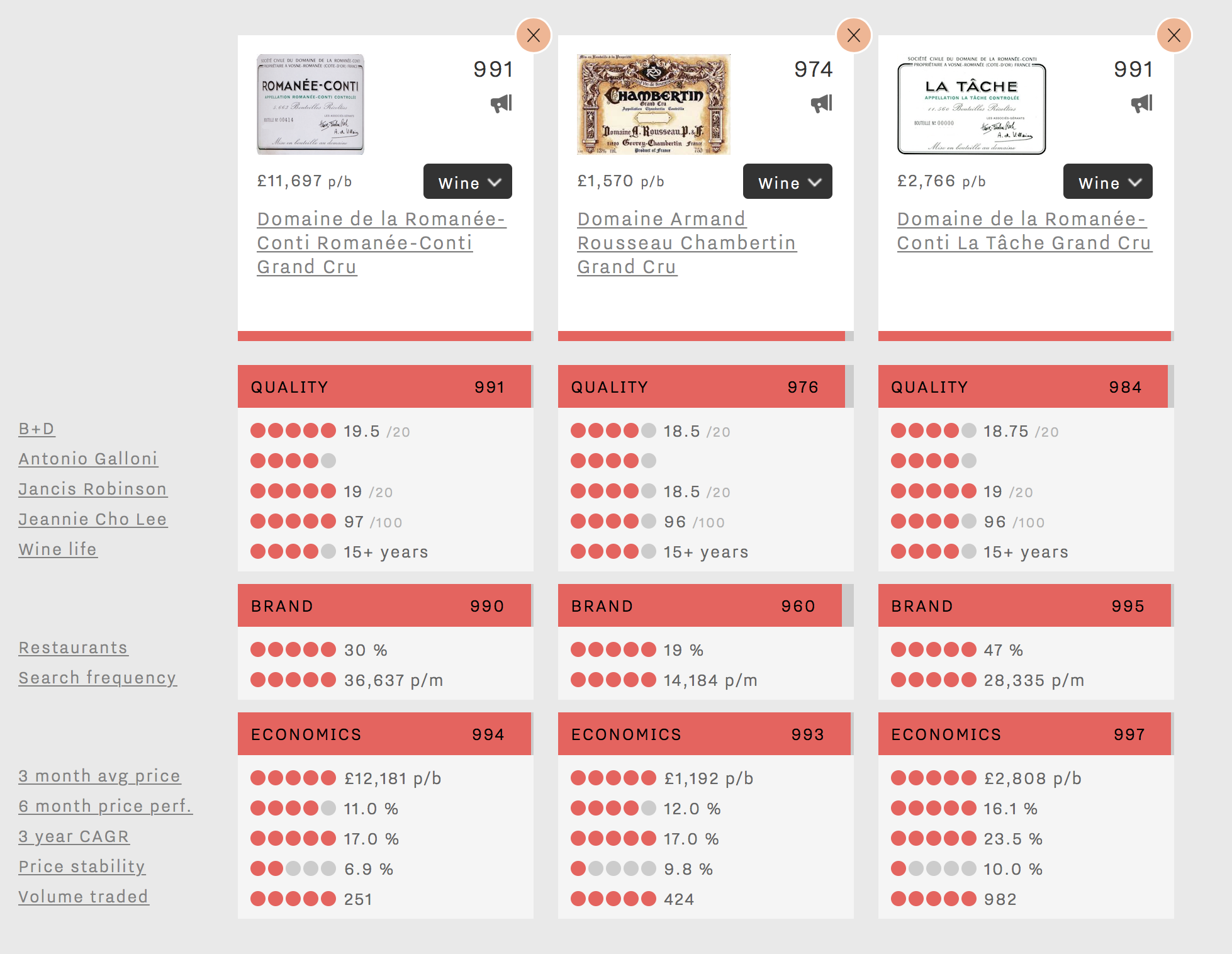

Our Burgundy study is the first to feature producers with a perfect confidence score. In Burgundy, two producers received a rating of 10/10. It perhaps comes as no surprise that Domaine de la Romanée-Conti (DRC) should be one of them. The other, Domaine Rousseau, is likely to have the strong performance of its Chambertin to thank for its perfect confidence score (Rousseau’s Chambertin holds the fifth best overall Wine Lister score in Burgundy, after four DRC wines).

Six producers achieved a confidence rating of 9/10. D’Auvenay and Domaine Leroy’s marks confirm the trade’s outstanding level of confidence in Lalou Bize-Leroy. Whilst Mugnier and Roumier fly the flag for Burgundy’s top red producers, Coche-Dury and Raveneau show that the trade is sure about the prospects of the region’s most prestigious white wine producers.

26% of producers included in the survey gained a confidence rating of 8/10. Among them, Comtes Lafon, Ente, and Roulot confirm the prospects of Meursault and its top producers.

36% of producers received a score of 7/10 – still a strong result and underlining the trade’s high level of confidence in Burgundy. This confidence seems linked to the region’s consistent price performance, as one US fine wine auction house notes: “The single most interesting trend is pricing. Demand on the primary and secondary market is high, and it’s amazing to see that prices have not gone down at all…in years.”

For context, no Burgundy producer scored below 5/10, compared to 5% of Bordeaux wines in Wine Lister’s Bordeaux study last year.

For more detail on which Burgundy producers achieve top confidence ratings, see our full Burgundy study here, or subscribe to gain access.

For those joining the La Paulée festivities, we wish you a very happy Burgundy week!

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.