This week saw the launch of Louis Roederer Cristal 2009. Addressing the London audience at the Shard on Tuesday 11th October, the Champagne house’s CEO, Frédéric Rouzaud, called the launch an effort “to help lift you out of depression after Brexit”.

The wine had been released in July, before the critics had tasted the wine, offered at £1,100 per case (91.67 per bottle) by UK merchants. It is still available at this price from BI Wines & Spirits, which seems like a good deal, the cheapest of any available (see the chart below).

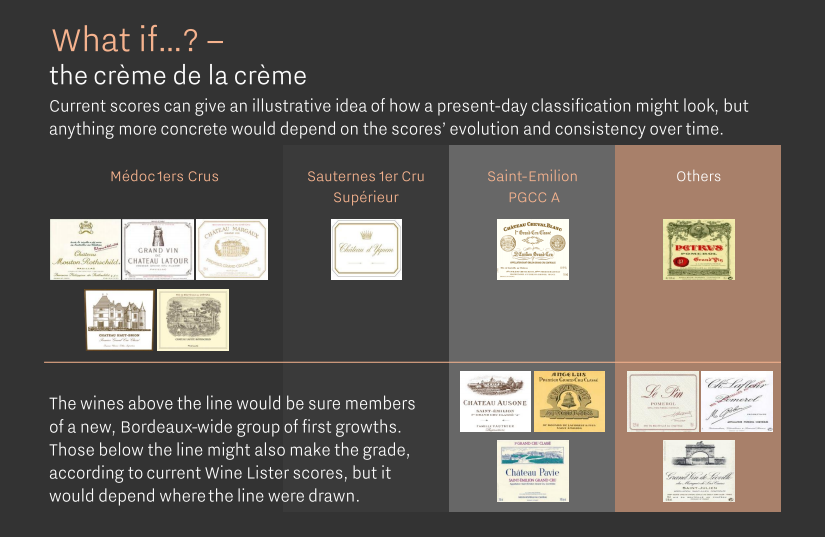

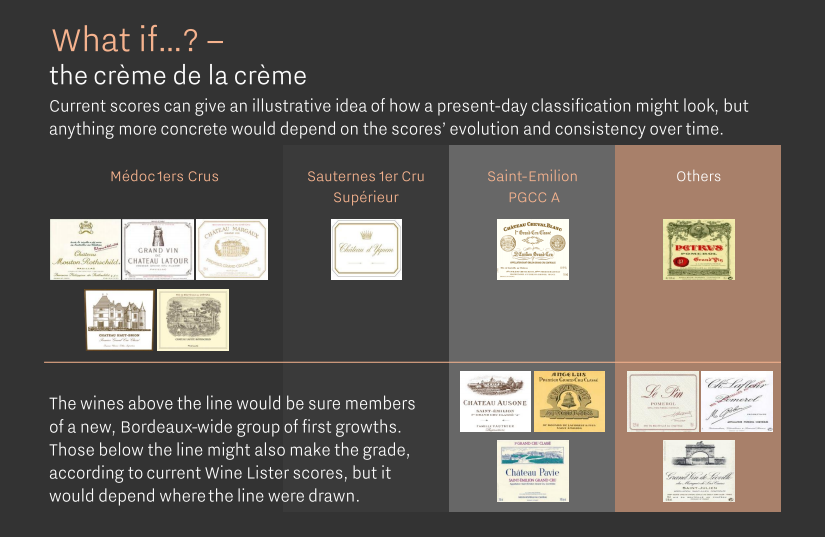

Scores are now in from Wine Lister’s three partner critics (Vinous, Jancis Robinson, and Bettane+Desseauve) who are unanimous in their praise of the wine. See their scores alongisde a wealth of other data and analysis below:

You can download the slide here: wine-lister-factsheet-cristal-2009

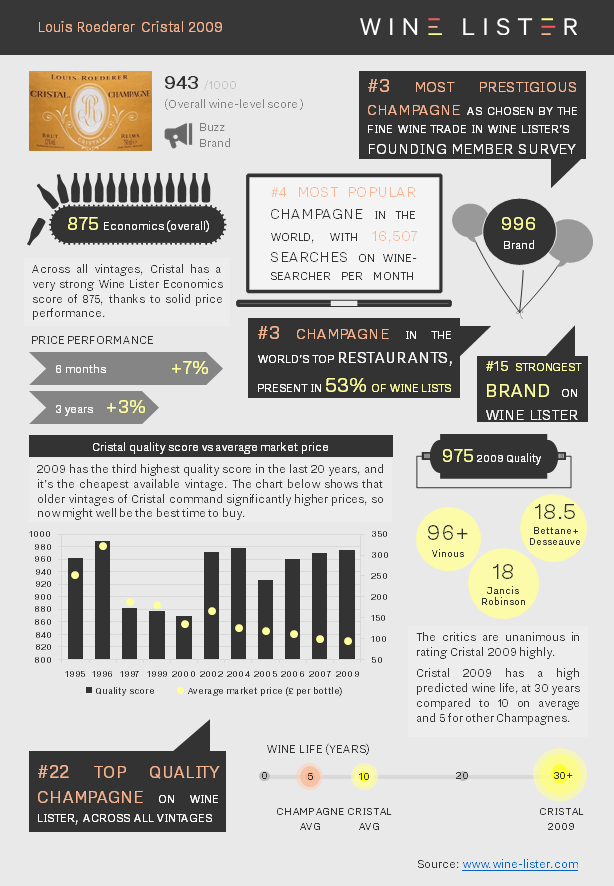

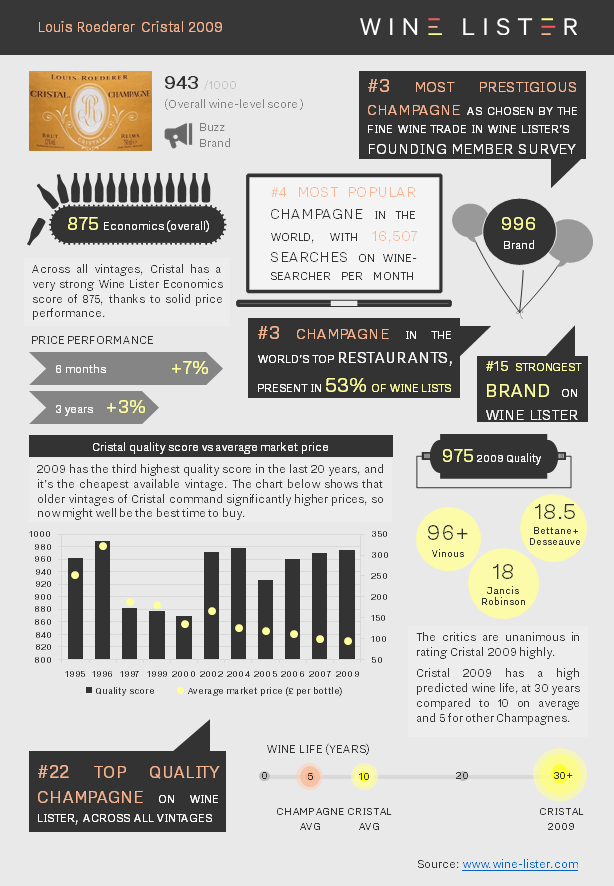

Today saw by far the largest release of Latour direct from the cellars since the property withdrew from the en primeur system starting with the 2012 vintage. Château Latour has released c.3,000 cases of its 2007, the first real test of its new distribution strategy, and reports from the Place are positive. Courtiers and négociants say the price has worked (for the first time the ex-château stock is released at market level, with no “provenance premium”), and report that the entire parcel has been sold, with demand “very strong”.

Using Wine Lister’s unique combination of data, we’ve created a visual guide to this exceptional château and its 2007 vinatge:

You can download the slide here: latour-2007-slide

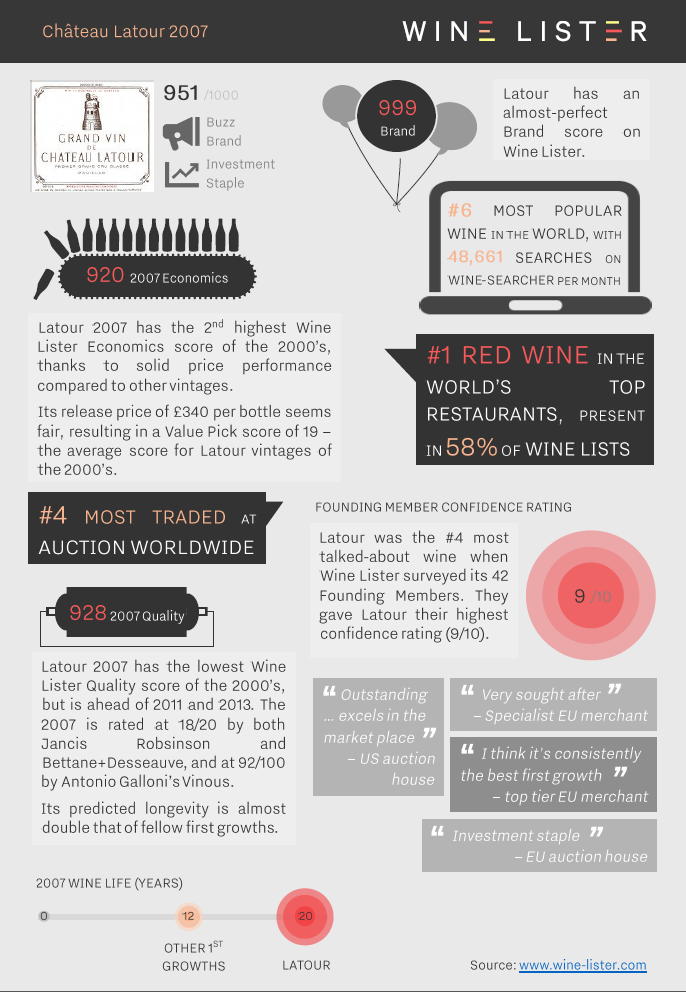

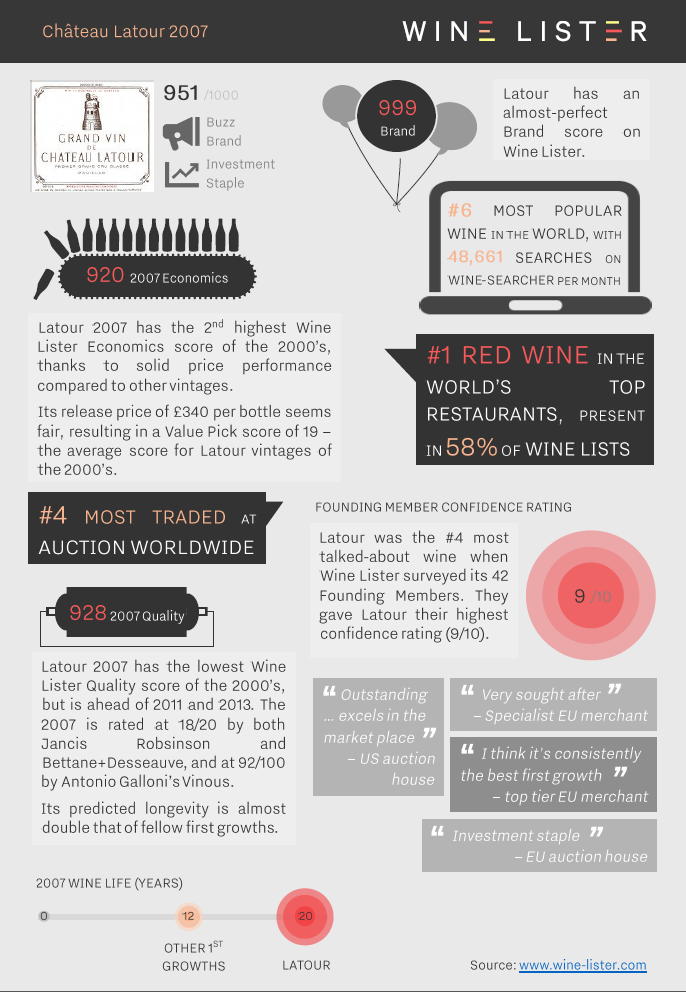

Yesterday, Monday 19th September, saw the release of Château d’Yquem 2014 – the vintage with the highest Quality score in 10 years.

Drawing on the wealth of information in the Wine Lister database, as well as the views of some of the trade’s key players, we put together a collection of extraordinary facts and figures about this iconic sweet wine:

You can download the slide here: yquem-2014-slide

We have updated our scoring algorithm to remove the impact of very old vintages on wine-level attributes and scores. Our wine-level score is an overall score for a wine computed from both wine attributes such as search frequency for a cru (regardless of vintage), and its individual vintage data, e.g. critic ratings or price performance.

For data that exists by vintage, the equivalent wine-level attribute is calculated by taking an average across vintages, which is then used to compute a score at wine level.

Prior to the update, data from all vintages of a wine would be incorporated into the wine level average and, although vintages were weighted such that more recent vintages had a greater influence (recency weighting), we still found that very old vintages were disproportionately impacting our results.

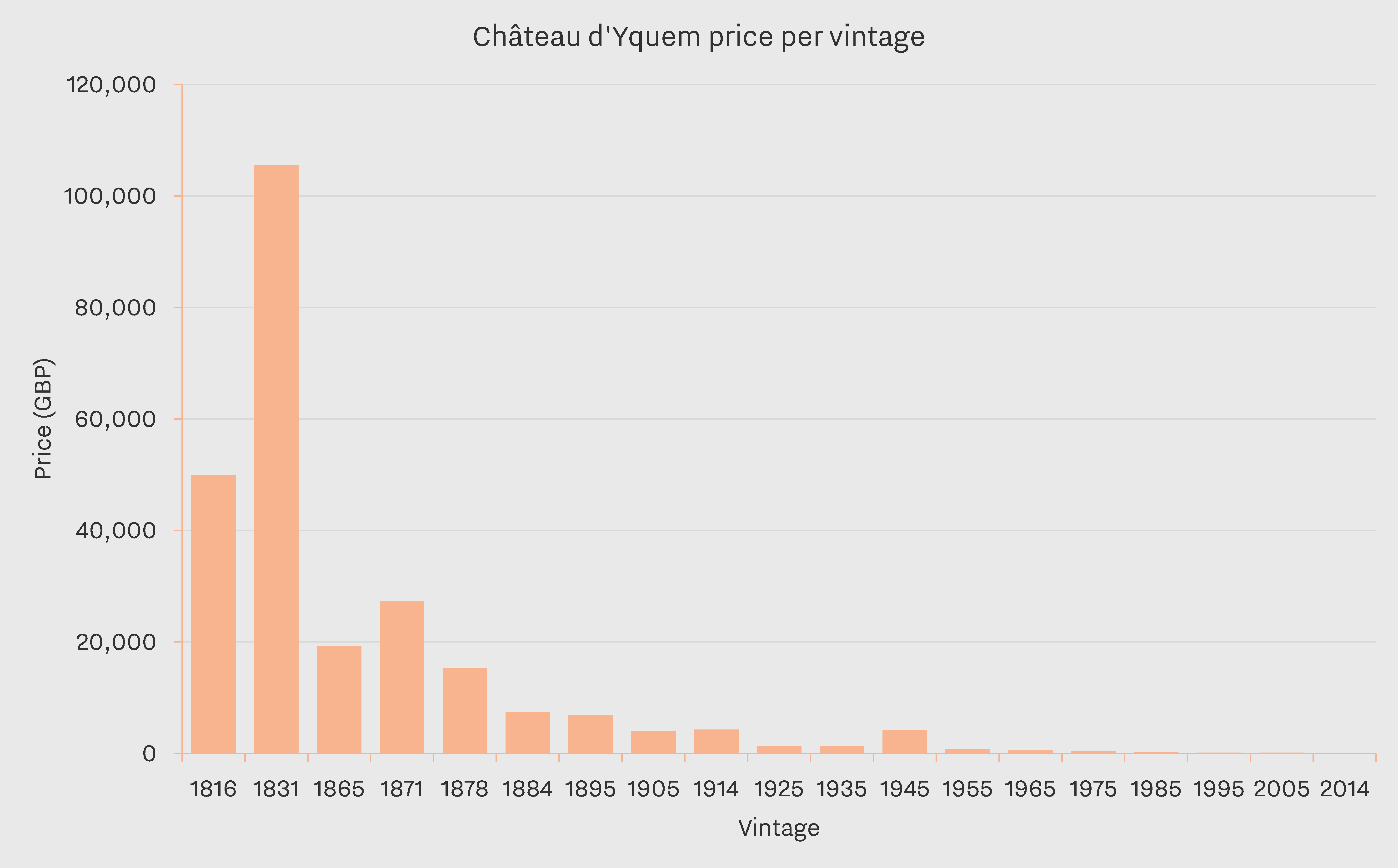

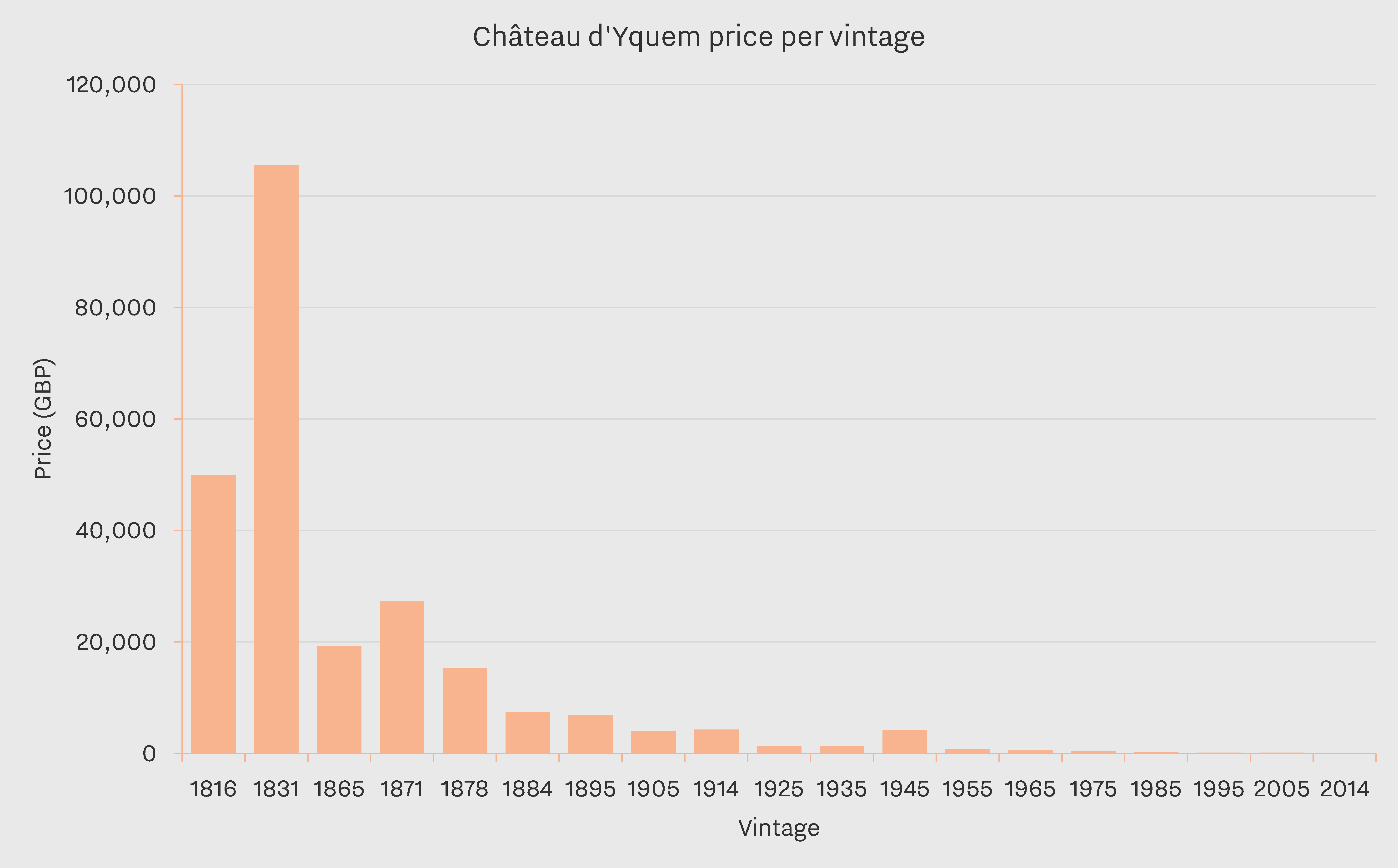

Château d’Yquem serves as an extreme illustration of this phenomenon:

Prior to the update, Château d’Yquem’s average price (incorporating all vintages) was £712 per bottle, which was heavily skewed by very old vintages with very high prices. These vintages are rarely traded or tasted, and as such should not influence the wine-level average and corresponding wine scores.

As of today, we have updated our recency weighting across all criteria to exclude vintages over 30 years old from the wine-level average. Following the update, our average price for Château d’Yquem is £170 per bottle – a considerable reduction, and a much fairer representation of actual trade price expectations.

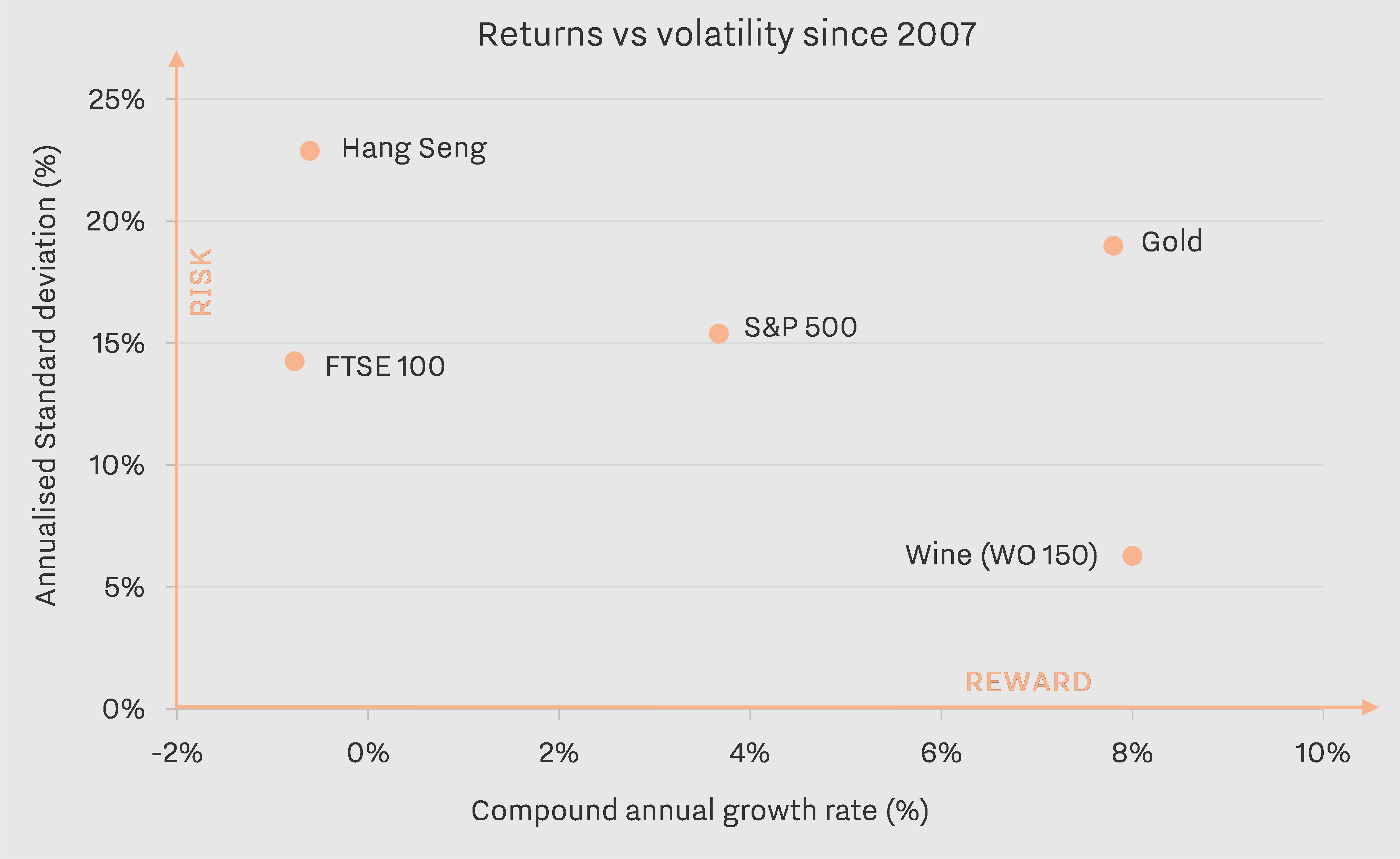

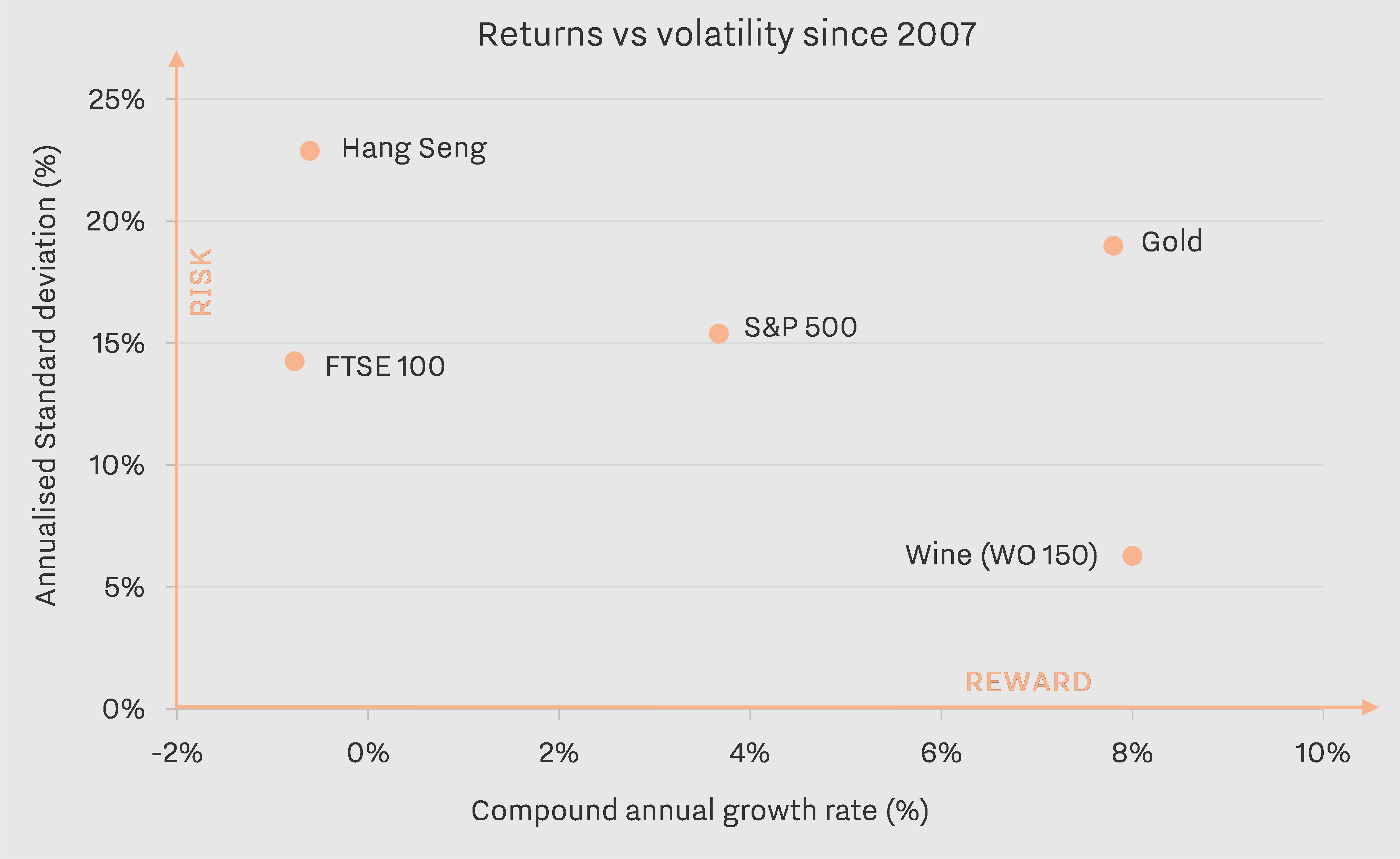

In a new climate of Brexit-induced uncertainty, with volatile fund performance and some economists forecasting recession, can fine wine offer some shelter? Research has consistently shown that wine has weak correlation with traditional financial assets, and can therefore be a useful diversification tool. Moreover, returns have been attractive historically, and less risky.

Attractive growth

The graph above shows returns since June 2007 for fine wine, gold, and three major stock indices. In spite of the fine wine bubble bursting in the summer of 2011, wine has produced the best annual returns over this period, at 8%.

Note that for this analysis we have used our price data partner’s Wine Owners 150 index, which contains a range of wines from different regions and at different price points. This further underlines the wisdom of diversification at every step – a wine portfolio made up solely of Bordeaux first growths would not yet have regained losses suffered in 2011. It should also be noted that the performance of the WO 150 index does not take into account frictional costs associated with fine wine collecting, namely storage, insurance, transportation, and sales commissions.

Low risk

What about the risk profile of fine wine? Despite surpassing the S&P 500, the FTSE 100, and the Hang Seng in terms of return, fine wine displays less volatility. It is also less volatile than gold, while providing similar returns over the nine-year period.

Low correlation

Finally, we ran our own analysis to confirm fine wine’s low correlation with stock markets over the same period – in mathematical terms, the index demonstrates correlation of 0.41, 0.03, and 0.15 with the S&P 500, Hang Seng and FTSE 100 respectively (where 1 is complete correlation, and -1 denotes mirror opposites). Fine wine behaves similarly to gold, often viewed as a refuge value in times of financial turmoil – the two show correlation of 0.8.

To take the plunge?

Fine wine seems to possess at least three characteristics making it a viable – and even attractive – alternative asset; a safe haven in tumultuous times. Independently of Brexit-fuelled uncertainty, now might be an opportune time to buy into wine, as it has shown steady – but not bubble-inducing growth since the beginning of 2016.

As a non-mainstream and (ironically) illiquid asset class, fine wine should only ever make up a small proportion of any investment portfolio. And, of course, it is a multi-faceted, non-fungible asset, ultimately made for drinking and enjoying, so we recommend that any notion of investing in wine always be secondary to its primary appeal, and undertaken with expert advice!

See Wine Lister’s Investment Staples and filter by geography, price, score and more.

For more information on a specific wine – relating to quality, brand, and economics – click on any wine and open out the category bars.

Disclaimer: the opinions expressed in this post or elsewhere on the Wine Lister website do not constitute investment advice.

Which producers will see the largest gain in brand recognition in the next two years? That is one of the many questions we asked in a unique survey of our 42 Founding Members – the majority of the world’s largest merchants, top international wine auctioneers, and several high-end retailers, together representing well over one third of global fine wine revenues.

The chart above shows the top 10 brands expected by Founding Members to see their brand recognition increase in the next two years. Unsurprisingly, Burgundy takes the lead, making up six of the ten places. The trade’s picks included rising stars such as Arnaud Ente and Jean-Marc Roulot. Wine Lister’s Founding Members also believe that superstars such as Armand Rousseau will grow even further in brand recognition.

Penfolds also already possesses a brand so strong it is hard to comprehend how it will grow much further, as the trade predict it will. The appearance of three Bordeaux wines also comes as a surpise, given the preeminent position already occupied by brand Bordeaux in the fine wine market. Our Founding Members see room for burgeoning brand power for Châteaux Figeac, Haut-Brion, and Lynch-Bages. Why?

Figeac is causing a stir and is widely held to be on the path to regaining greatness. Haut-Brion is perhaps viewed as having less renown relative to its fellow first growths in the Médoc, in spite of Samuel Pepys fame (“a good and most particular taste”). However, Lynch-Bages is already so many leagues ahead of its peers in terms of brand recognition (check out its impressive distribution in top restaurants and online search frequency on the site), that it’s hard to see where it can go next. Have our Founding Members got it right?

To access more findings from our Founding Member survey, read the complete study, “Bordeaux – Reasons to Hope“. If you are not a subscriber yet, why not try a 14-day free trial!

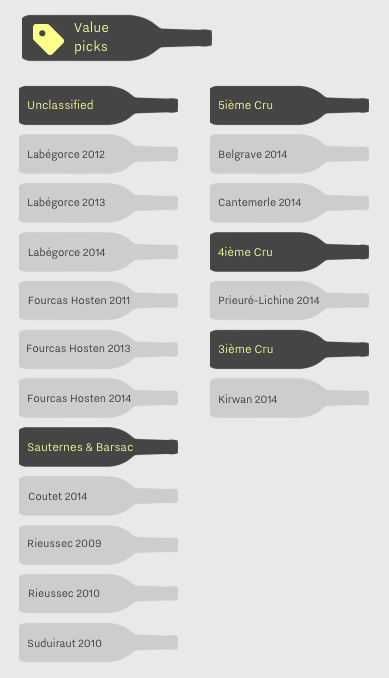

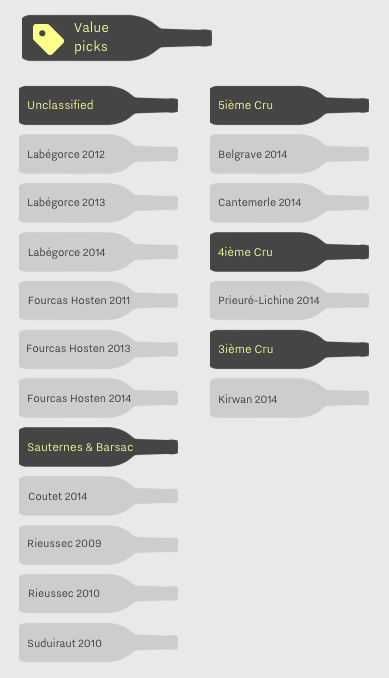

The Wine Lister Indicators have been devised to tell you in one glance the particular characteristics of a wine. One of those is Value Picks: wines which represent exceptional quality for the price. Of all the fine wines in our database, Value Picks have the best quality-to-price ratio, where we have applied a coefficient to allow exceptional quality to be recognised, even for higher-priced wines.

In the image below, taken from our study “Bordeaux – Reasons to Hope”, we list the value picks among the 100 foremost wines of Bordeaux. On our site you can view a wider selection of Bordeaux Value Picks.

To read the complete Bordeaux study, follow this link, and if you are not a subscriber yet, why not try a 14-day free trial.

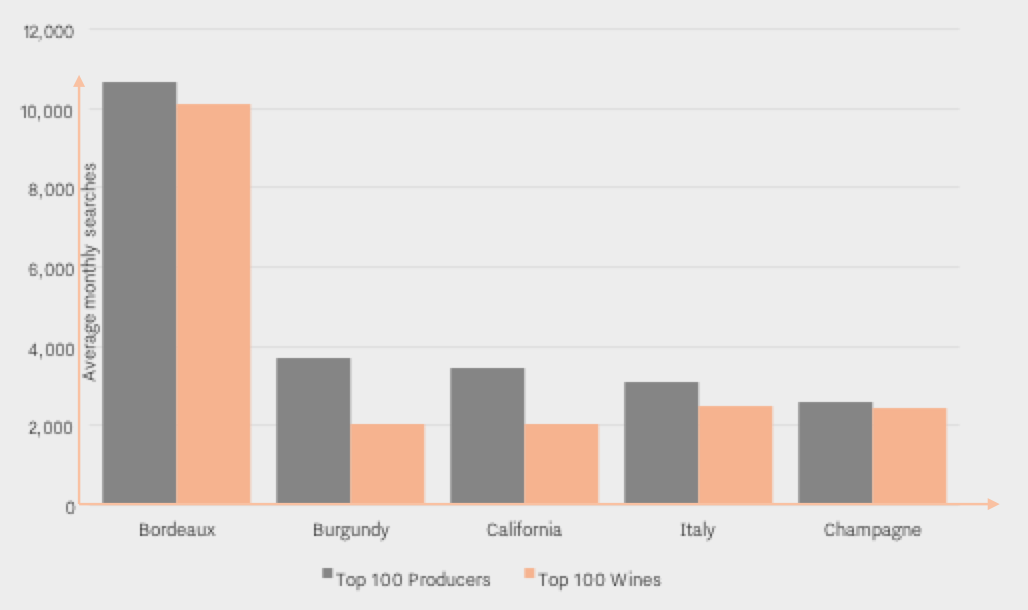

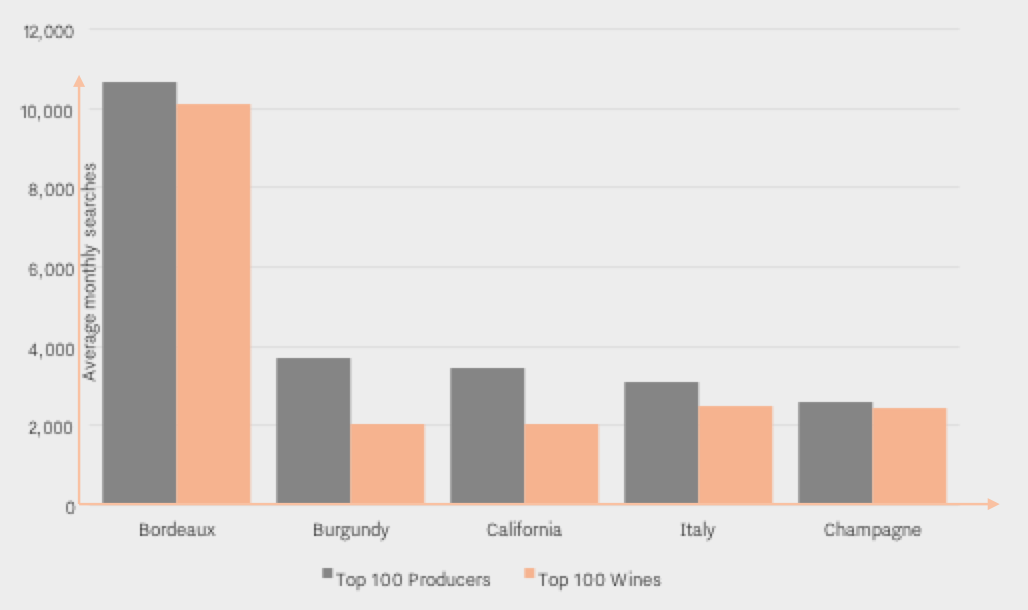

In recent years Bordeaux has been subject to “Bordeaux Bashing”. Commentators decried excessive pricing, and made much of other regions rivalling Bordeaux in popularity terms. However, the chart below, taken from our study “Bordeaux – Reasons to hope”, tells a different story.

We compared the popularity of five top wine-producing regions based on the number of online searches on the world’s most visited wine site, Wine-Searcher, thanks to our unique data partnership allowing us to provide a unique insight into a wine’s overall popularity and desirability.

The 100 most consulted Bordeaux crus were searched for around five times more than the top 100 crus in other regions. Even when you combine searches for wines by producer, to account for regions where each producer makes significantly more cuvées than in Bordeaux, and instead take the 100 most searched-for producers from each region, Bordeaux is still almost three times more popular in search terms. That should give Bordeaux one concrete reason to hope.

To learn of others, read the complete report by clicking on the link below. If you are not a subscriber yet, why not try a 14-day free trial?

https://www.wine-lister.com/reports

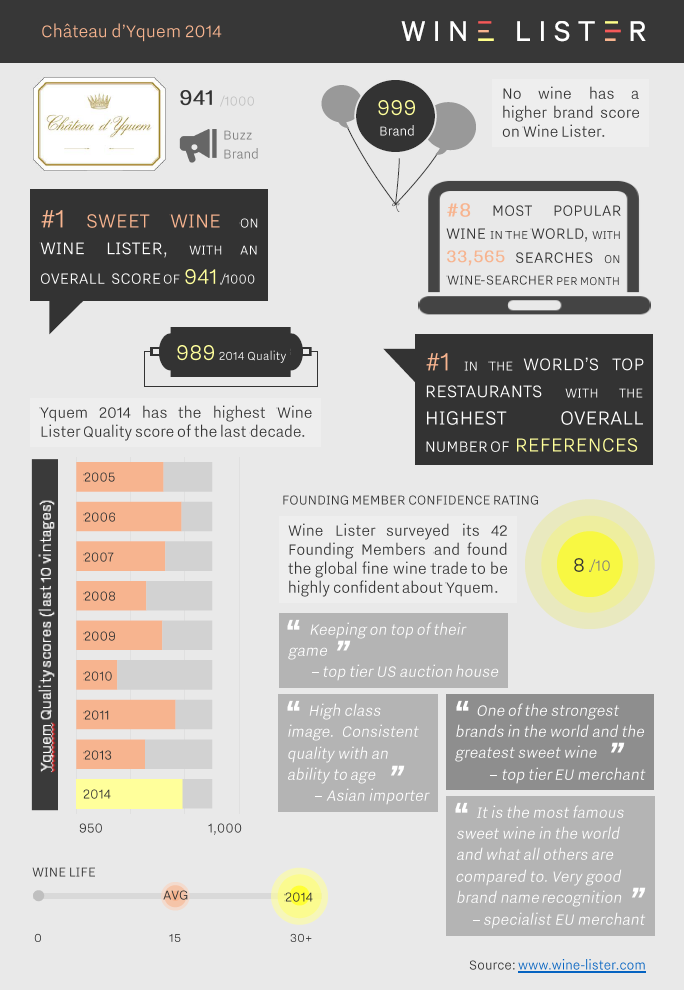

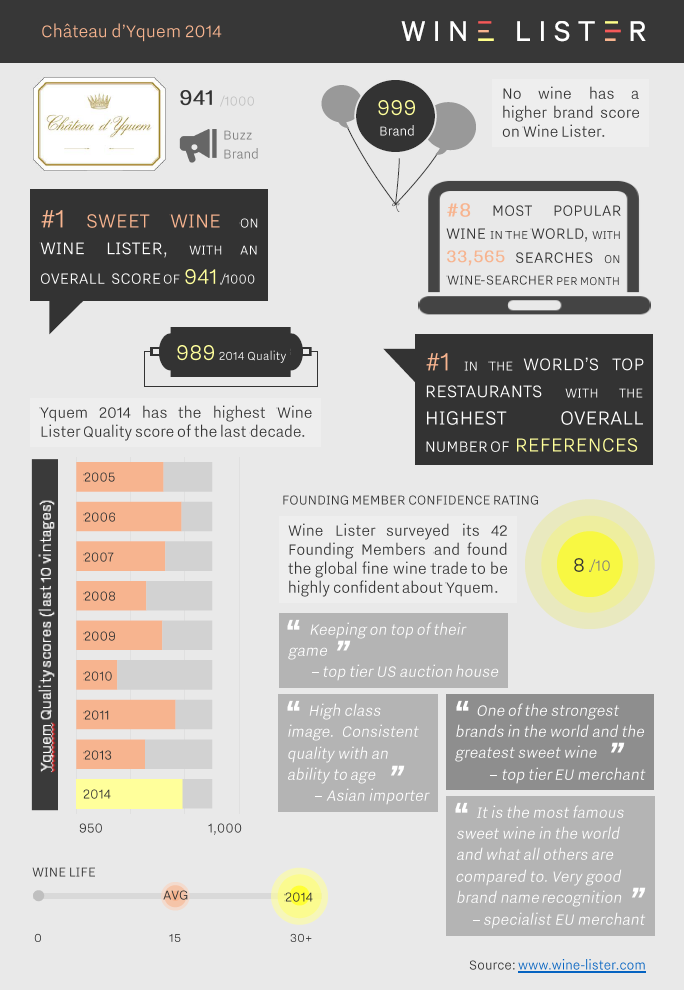

Would a new rating system confirm or upset existing Bordeaux classifications? Wine Lister examined this question at a conference at Vinexpo Hong Kong.

View the full 33-page presentation.