Having stopped off last week in Syrah’s spiritual home – the Northern Rhône – in search of the region’s leading wines for the 2015 vintage, this week Wine Lister’s Listed section ventures to Australia, surely Syrah’s most famous home from home. Australian Shiraz might differ stylistically from the Northern Rhône’s finest Syrahs, but the Land Down Under’s foremost brands have certainly managed to establish themselves as a force to be reckoned with on the international fine wine market.

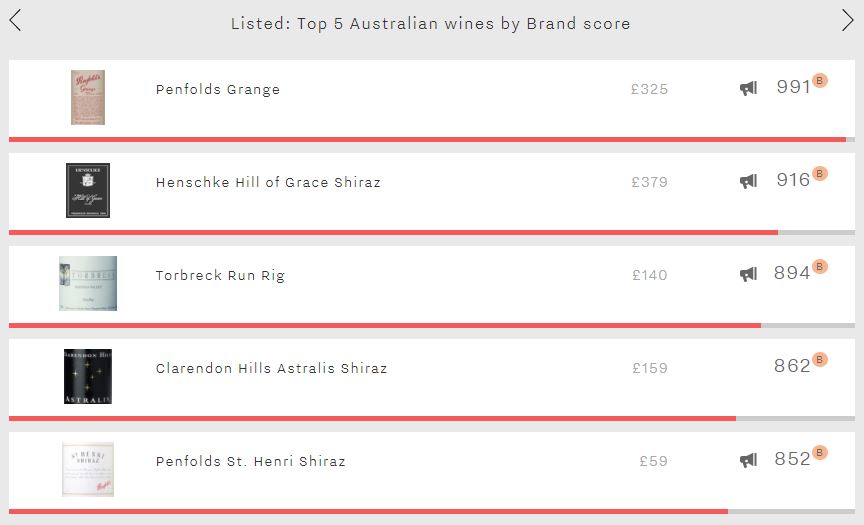

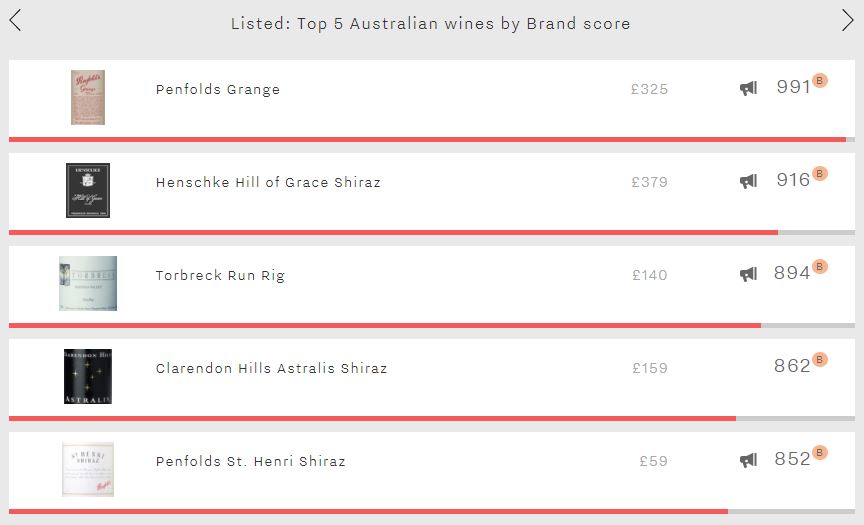

Penfolds’ flagship Grange is Australia’s runaway leader in the Brand category. Its formidable score of 991 is not only 75 points ahead of Australia’s second strongest brand – Henschke Hill of Grace Shiraz – but also nudges ahead of the Northern Rhône’s top brand – Jaboulet Hermitage La Chapelle. Whilst Grange can’t quite match La Chapelle in terms of the number of the world’s top restaurants in which it features (34% vs 43%), establishments in which it does appear list 1.5 times more vintages / formats on average (4.5 vs 3.0). Grange is also considerably more popular than La Chapelle, receiving nearly twice as many searches each month on Wine-Searcher. Within Australia no other wine comes close to its level of brand strength. It is visible in nearly twice as many restaurants as the group’s next-best wine in the criterion – Henschke Hill of Grace Shiraz – and is searched for almost five times more frequently than the second-most popular wine of the five – Penfolds St. Henri Shiraz. Last year’s release of g3, a blend of 2008, 2012, and (the as yet unreleased) 2014 Grange will only serve to secure Grange’s standing as Australia’s top brand. Click here to see all of Grange’s vintages. Confirming Penfolds as Australia’s most prestigious producer, the St. Henri Shiraz bookends the top five with a score of 852.

Other than Grange, the only Australian wine to enjoy a Brand score above the 900-point mark – and thus making the “strongest” band on Wine Lister’s 1,000-point scale – is Henschke Hill of Grace Shiraz (916). As previously mentioned, Eden Valley’s leading light achieves the group’s second-best level of restaurant presence. It is also the third-most popular wine of the five, receiving 4,107 searches each month on average and, notably, is by far the most expensive of the group.

The two remaining spots are filled by Torbreck Run Rig and Clarendon Hills Astralis Shiraz (894 and 862 respectively). Whilst they receive a very similar number of searches each month, Torbreck Run Rig edges ahead thanks to superior restaurant presence (17% vs 11%) – presumably in part due to producing over twice as many bottles each year as Clarendon Hills Astralis.

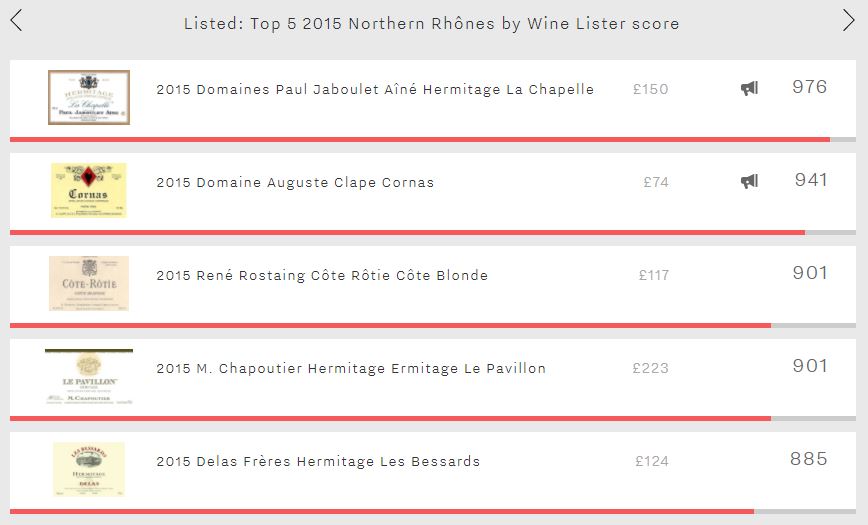

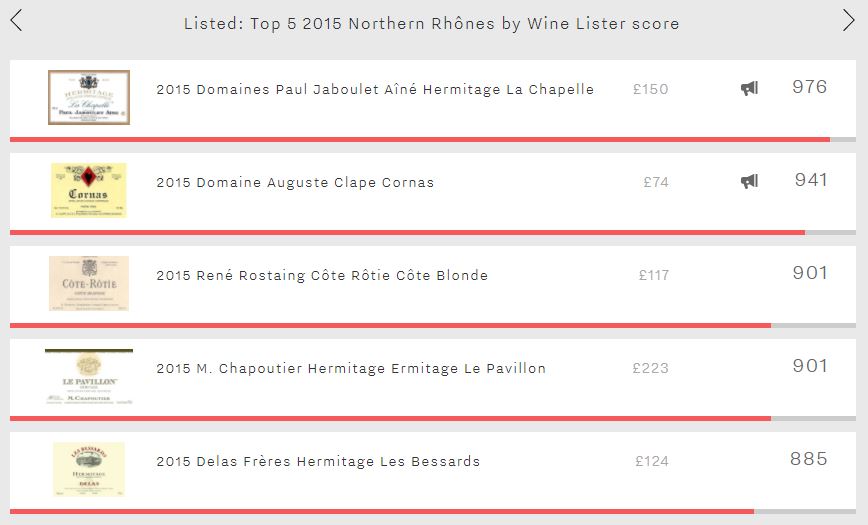

The 2015 vintage was widely hailed as one of the Northern Rhône’s best ever. This is reflected in the vintage’s outstanding Quality scores, with the top two wines – Guigal’s La Turque and La Mouline – both achieving exceptional scores of 993, their best on record. However, neither makes it into the top five by overall Wine Lister score.

With the vintage’s outstanding quality not in doubt, this week we throw brand and economics into the mix too, looking at 2015’s overall top-scoring Northern Rhônes. It is interesting to note that Jaboulet Hermitage La Chapelle is the only one of the overall top five whose 2015 Quality score (985) is also one of the top five Quality scores for the vintage.

Jaboulet La Chapelle’s outstanding 2015 Quality score – its best since the fabled 1989 vintage – helps it to top the table here with an excellent overall Wine Lister score of 976, 35 points ahead of any other wine. It backs up its excellent quality with the Northern Rhône’s best Brand score (985), and the vintage’s third-best Economics score (941).

In second spot is Clape’s Cornas. Its appearance in the top five is thanks to its 2015 Quality score being 105 points (13%) above its average (937 vs 832). Despite being by far the cheapest of the group, it also achieves the Northern Rhône’s second-best Economics score for the vintage (944) – the result of having added 16.6% to its price over the past six months.

In joint third place with 901 points – just making into the “strongest” band of the Wine Lister 1,000-point scale – are Rostaing’s Côte Rôtie Côte Blonde and Chapoutier’s Ermitage Le Pavillon. Whilst they achieve very similar Quality scores (963 and 975 respectively), their profiles differ elsewhere. Chapoutier’s Le Pavillon possesses a stronger brand (891 vs 849), but interestingly its 2015 Economics score can’t keep pace (752), 19% below its average Economics score (931), and over 100 points below Rostaing Côte Blonde’s score (854).

In fifth place is Delas Frères Hermitage Les Bessards (885). It earns its spot in the group thanks to currently achieving the Northern Rhône’s best Economics score for the vintage (970), thanks to formidable short-term price performance – it has added 26.3% to its price over the past six months alone.

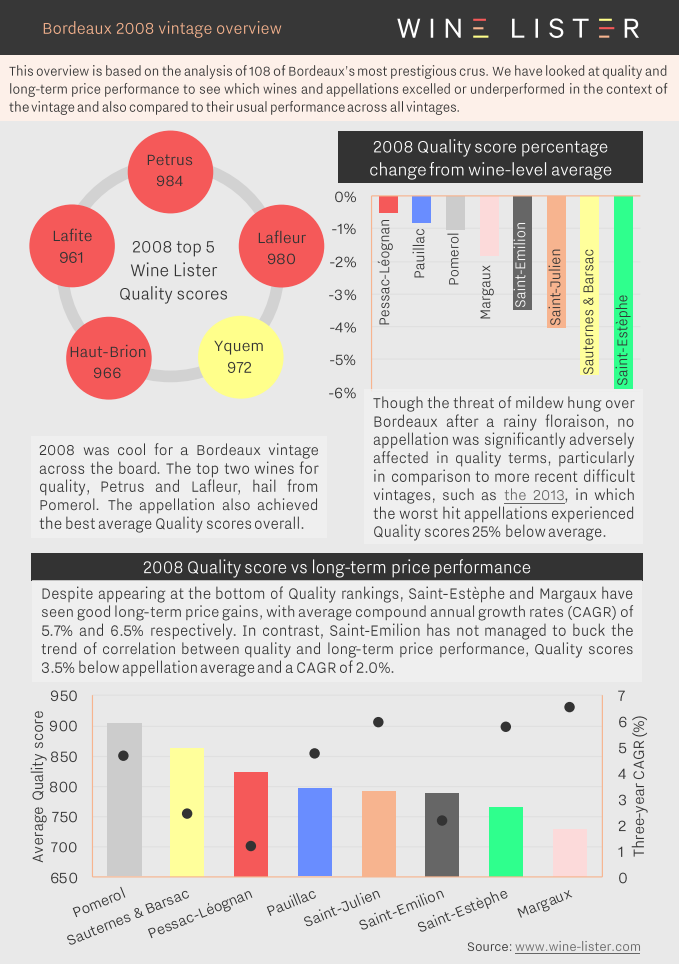

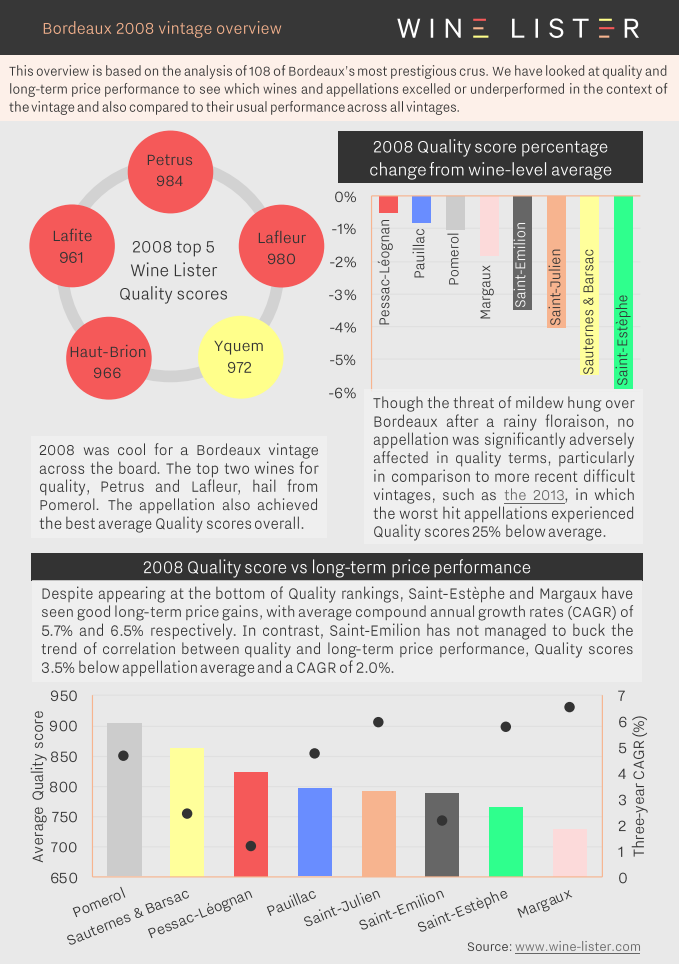

Last week we were lucky enough to taste through the 2008 vintage of Bordeaux grands crus classés at BI Fine Wines’ 10 years on tasting. Below we explore what light Wine Lister scores have to shed on the quality and price performance of different appellations in 2008.

Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download the slide here: Wine Lister Bordeaux 2008 vintage overview

Featured wines: Petrus, Lafleur, Yquem, Haut-Brion, Lafite

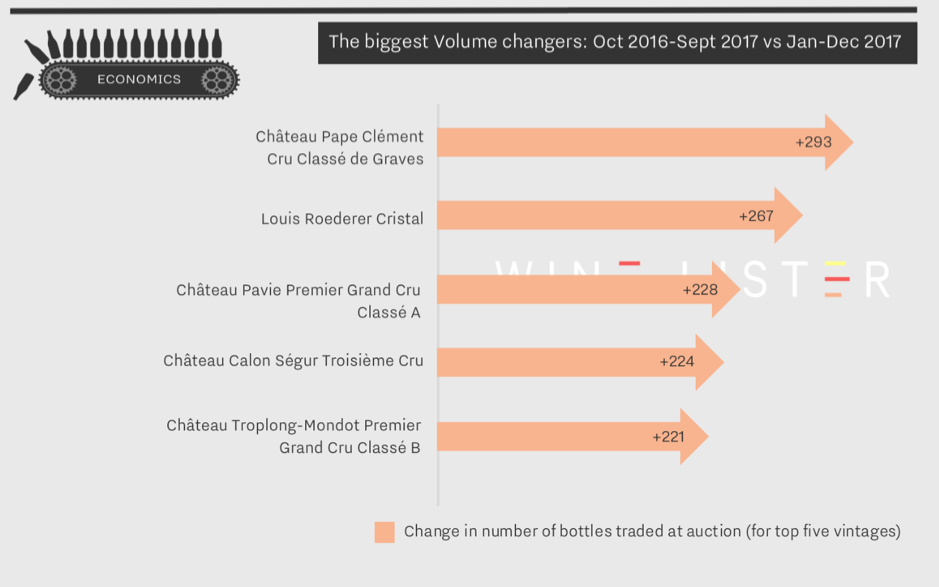

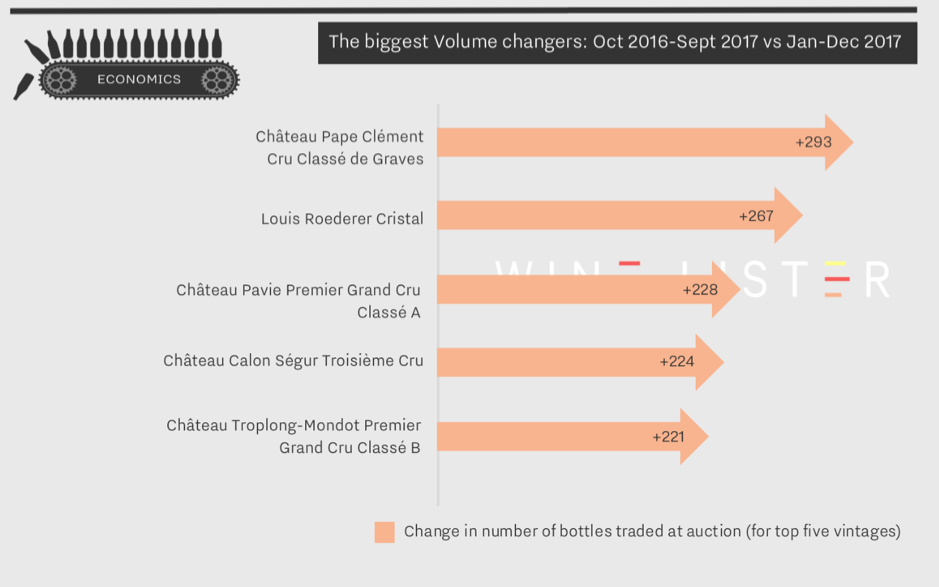

After two quarters of Bordeaux dominance, the latest trading volume data has room at the top for one non-Bordeaux wine. Among the five wines with the greatest incremental increase in trading volumes for the period of January-December 2017 (calculated using figures collated by Wine Market Journal from sales at the world’s major auction houses), sits Louis Roederer’s Cristal in second place.

Volumes of Cristal traded increased by 267 bottles, helped along by a Sotheby’s auction in New York in November where 37 bottles went under the hammer. While this translates into a small Economics score increase of just one point, the wine nevertheless holds the highest overall Wine Lister score of the five at 975/1000.

Château Pavie appears high up the list for a consecutive quarter, with a further 228 bottles added to its trading volume count compared to October 2016-September 2017. Though in third place for incremental change, Pavie has the highest overall volume of bottles traded of the top five (2,466).

The number one spot for increased trading volumes is taken by Château Pape Clément, with 293 more bottles traded over the course of 2017 compared to the previous dataset period. Pape Clément has the lowest Quality score of the top five (825), however high Economics (952) and Brand (960) scores pull the overall score up to 898.

Château Calon Ségur and Château Troplong-Mondot fall in fourth and fifth place for biggest change in trading volumes.

It is interesting to note that Larrivet Haut-Brion Blanc has the highest growth of Economics score, moving up a huge 376 points since Q4 2016, to 669. With the recent spike in trading volumes of the red (as seen in our last analysis), trading volumes of the château’s wines are increasing across the board.

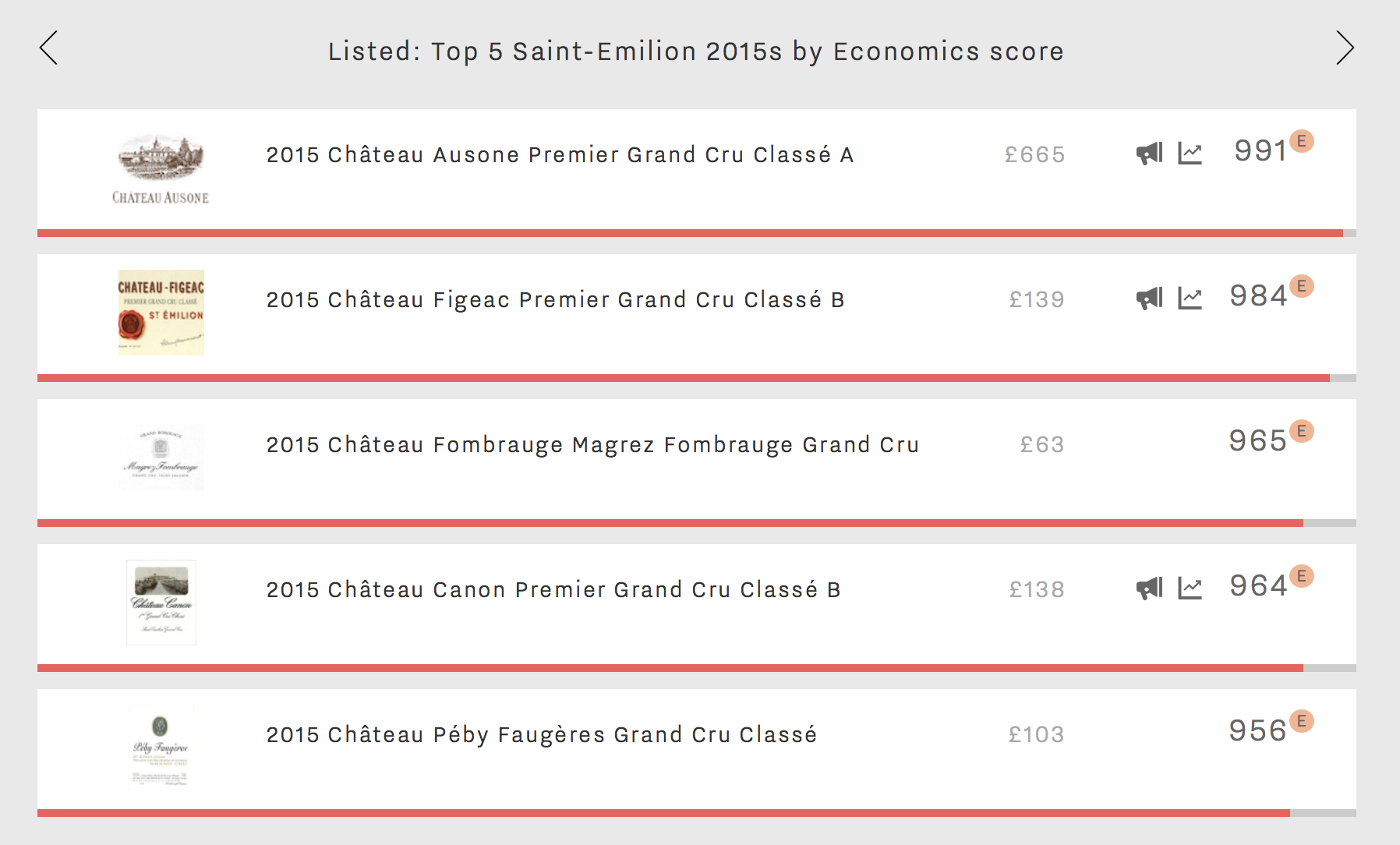

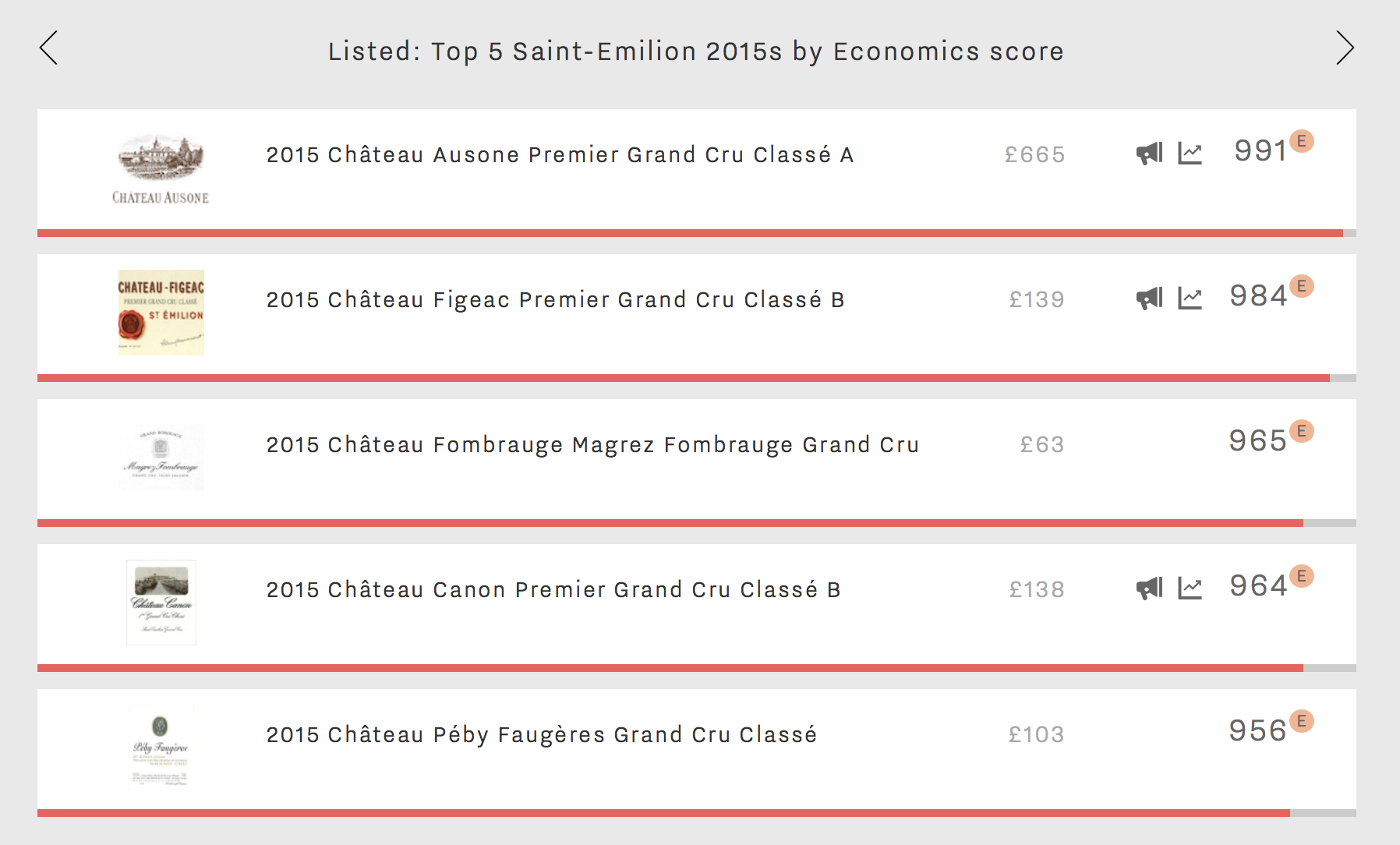

The Bordeaux 2015 vintage broke a more lacklustre run since the formidable 2010, and seemed to prove the wine trade legend of vintages ending in 5. En primeur tastings took place at the crest of “Bordeaux Bashing”, with some journalists reluctant to praise the vintage too highly, and there was talk of inconsistency between appellations. Saint-Estèphe was said to have suffered from more rain than its southerly neighbours, for example. Meanwhile in Saint-Emilion, a lack of homogeneity allowed each wine to express its terroir and its identity to the utmost.

Now that the wines have been bottled, it seems a suitable time to revisit the vintage. Our CEO, Ella Lister, has just got back from tasting over 200 wines from across the two banks with Wine Lister’s partner critics Michel Bettane and Thierry Desseauve. She reports Saint-Estèphe as “exceptional and wrongly dismissed as rained-out”, and names Figeac and Canon as two highlights, both “stunning”. The two Saint-Emilion wines are among the top five Quality scores for the vintage on Wine Lister.

Figeac and Canon both also feature in this week’s top 5: Saint-Emilion 2015 Economics scores, showing that the market recognises their worth. Coming in second and fourth place, both hold premier grand cru classé B status since the reclassification of Saint-Emilion in 2012. Château Figeac 2015 achieves its best Economics score to date with an impressive six-month price performance of 18%.

However, Château Canon is the real surprise here. One of the most talked-about wines by the fine wine trade, its Wine Lister scores are improving from vintage to vintage, with its Economics scores, in particular, soaring. It comes in second place among all Bordeaux wines for Economics score in the 2016 vintage. Both Figeac and Canon are Buzz Brands and also Investment Staples (two of the four Wine Lister Indicators), and so is number one on the list…

Beating both of these is premier grand cru classé A, Château Ausone, with an Economics score of 991 – a record high for this producer, even against the strong 2005 vintage. The château also gains the number one spot across all Saint-Emilion 2015s in Quality, with a score of 990. In the context of overall Wine Lister scores, Ausone is just behind Petrus and Margaux as the third highest-scoring Bordeaux of 2015.

Magrez-Fombrauge and Péby Faugères are the ‘underdog’ entries among Saint-Emilion Economics performers. With Quality and Brand scores ranging from average to strong, the overall score of both wines is “strong” according to the Wine Lister 1,000-point scale (the other three entries sit comfortably in the “strongest” category, with overall scores significantly above 900).

In contrast, one might expect some bigger names, such as Cheval Blanc (a Wine Lister Buzz Brand) to appear higher up the list. Its Economics score of 946 puts it in seventh place, with slower price growth (3% over the last six months). Its price per bottle currently stands at around £500, over five times higher than that of Péby Faugères, and seven times more than Magrez-Fombrauge.

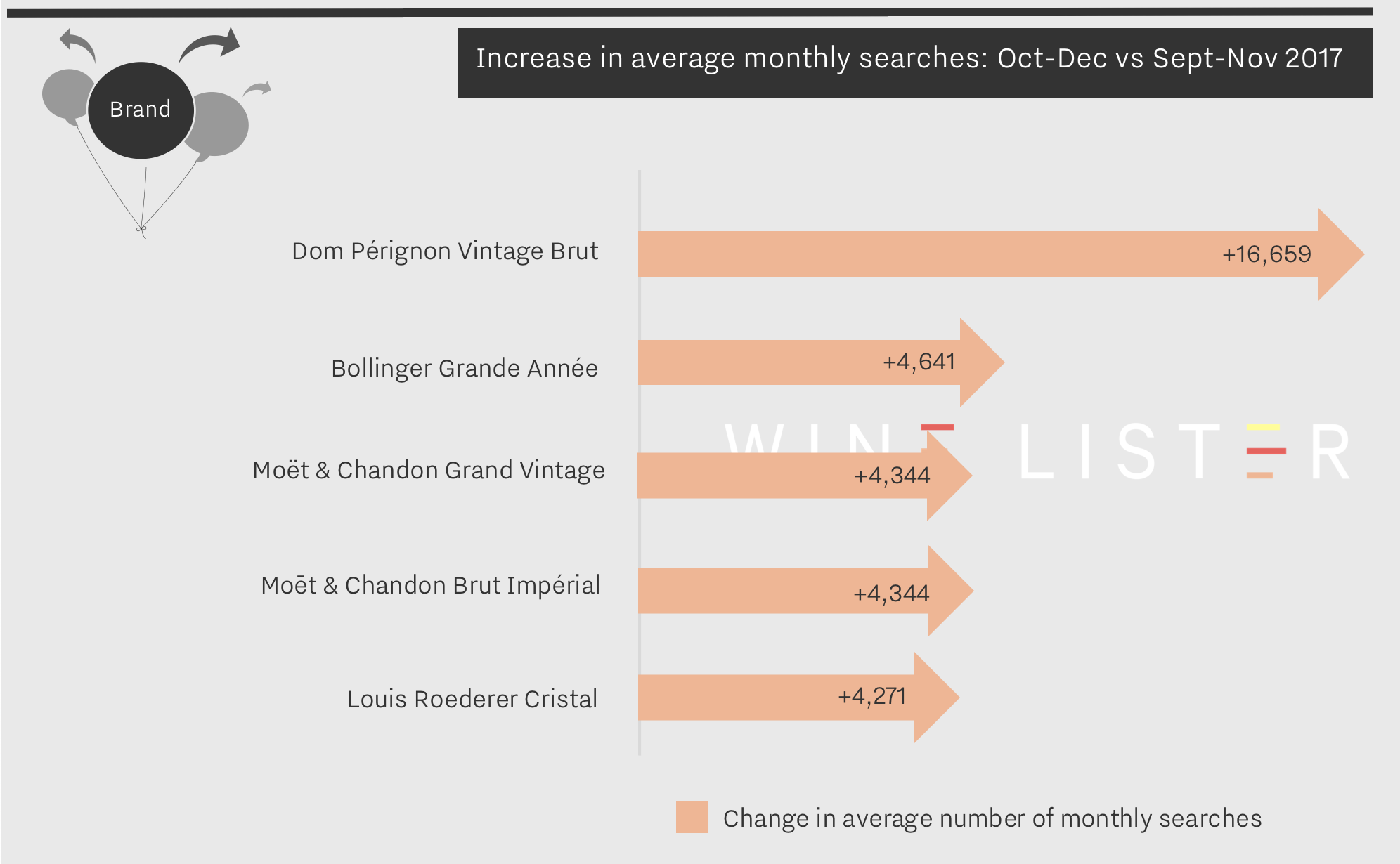

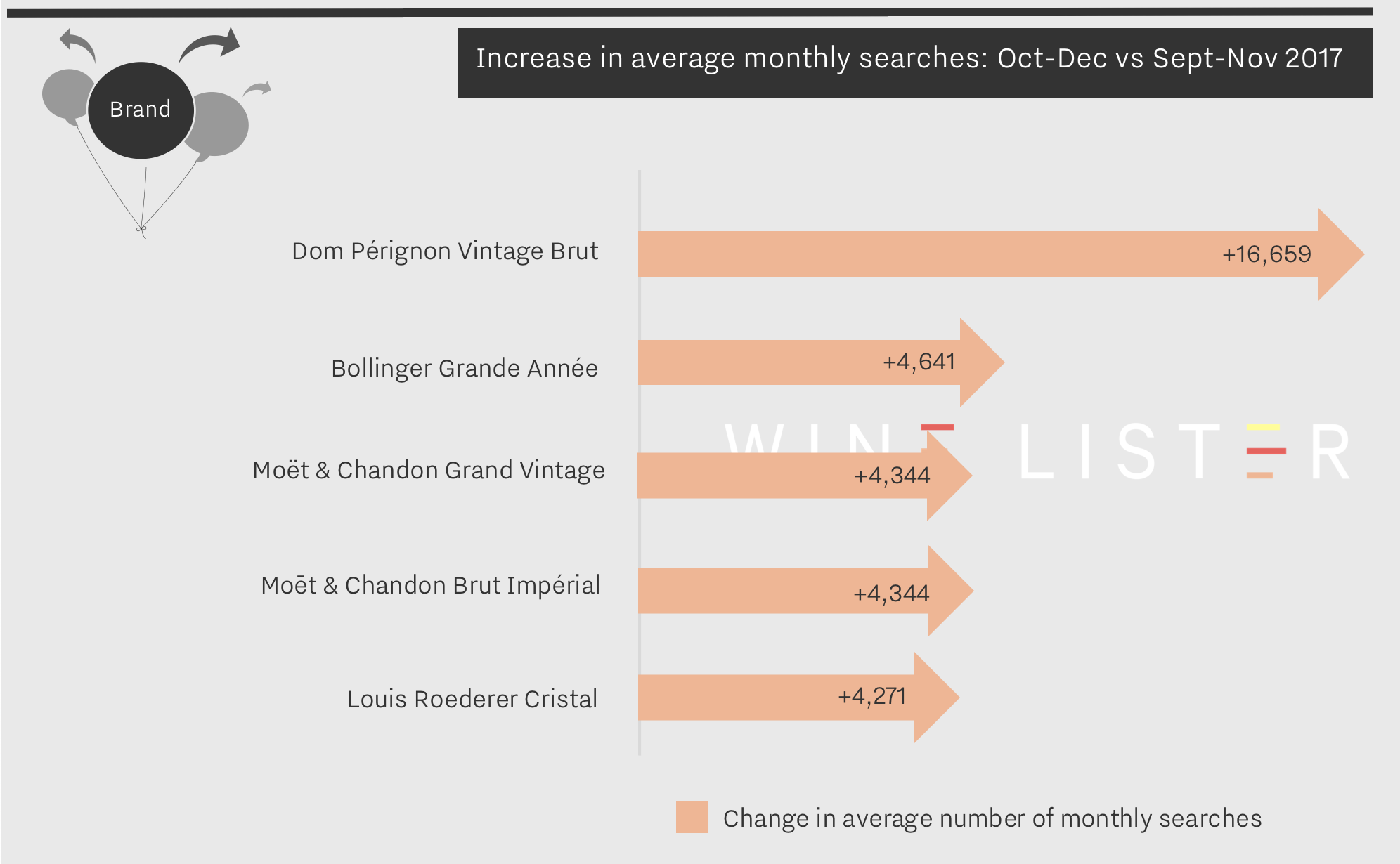

After a distinctly Burgundian start to 2018, we are ringing the changes this week to look at some of our most improved Brand scores, with Champagne dominating.

Alongside presence in the world’s best restaurants, Wine Lister’s Brand score measures a wine’s online popularity – as indicated by the number of searches received on Wine Searcher – as a marker of real consumer demand.

The search frequency data for December is in, and it is no surprise that searches in Champagne increased significantly leading up to the Christmas period.

During arguably the busiest period of the year for searching and purchasing wines, these five wines gained between 20% and 77% increase in search frequency. The appearance of Dom Pérignon Vintage Brut at the top of search frequency lists is a shock to no one considering its position as one of the most searched-for wines of all time. Indeed, it consistently held the number one search spot from July to September last year. The Christmas influence still managed to add 16,659 online searches, allowing this almighty brand to achieve Wine Lister’s first ever perfect Brand score (1000)!

Next on the list is Bollinger Grande Année. Its impressive 77% increase in search frequency at the end of last year can also be attributed to the festive season, but may also have been boosted by the release of the 2007 vintage earlier in the year. Bollinger’s new Brand score is up 16 points on the previous quarter at 975.

Our next two appearances hail from the same owner as the first, Champagne divinity LVMH. Moët & Chandon, often considered the definitive Champagne brand holds not one, but two spots in the top five most searched for wines of the last three months. Moët & Chandon Grand Vintage is perhaps a classic Christmas choice, but the appearance of a non-vintage cuvee, the Moët & Chandon Brut Impérial is testament to the power of the Moët & Chandon brand. Each earned an increase in search frequency of 33%, bringing Brand scores to 987 and 938 respectively.

Last but not least, Louis Roederer Cristal takes fifth place with a search frequency increase of 20%. While achieving a fractional increase in searches (4,271) compared with Dom Pérignon, its presence in 54% of restaurants and consistent high quality (Quality score 970) makes Cristal an all-round achiever, and therefore a choice that’s not just for Christmas.

Champagne’s Brand prowess is clear, but these five are the shining stars of their region. It is interesting to note that the sixth most searched-for wine on our most recent list is in fact not a Champagne at all, but Château Margaux (Brand score 998).

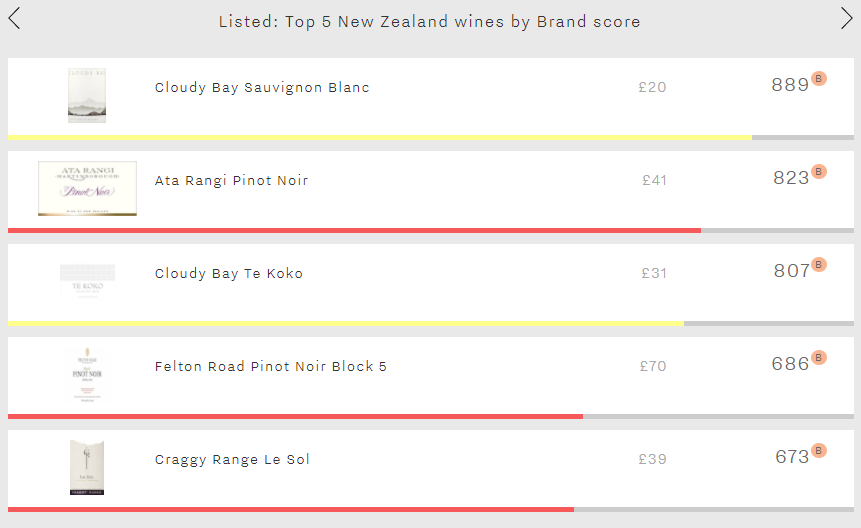

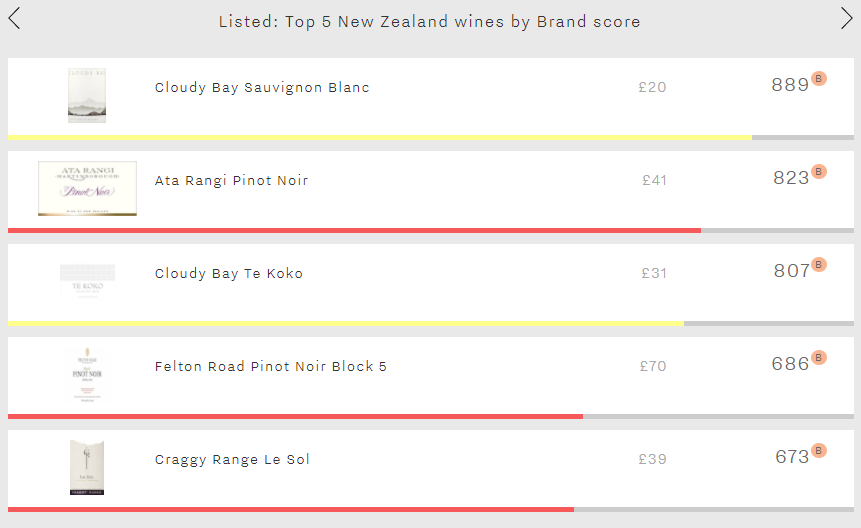

Mention New Zealand, and the first thing that springs to mind will most likely be rugby. The All Blacks are not just the world’s best team, but the foremost brand in rugby. In wine terms, they are the left bank first growths; the team that even people who don’t follow rugby will recognise. Whilst peerless with the oval ball, when it comes to vinous competition New Zealand can’t compete with its Old World counterparts in terms of brand strength. However, as this week’s top five shows, New Zealand’s top brands definitely shouldn’t be discounted.

Cloudy Bay fills two of the five spots with its straight Sauvignon Blanc and Te Koko Sauvignon Blanc. With a very strong score of 889 – putting it ahead of the likes of Haut-Brion Blanc – the straight Sauvignon Blanc dominates the rest of the five across both of Wine Lister’s brand criteria. It receives 56% more searches each month on Wine-Searcher than Ata Rangi Pinot Noir (the group’s second-most popular wine). Te Koko – New Zealand’s third-strongest brand (807) – displays a similar profile to the straight Sauvignon Blanc. Its brand is its strongest facet, comfortably outperforming its Quality and Economics scores (614 and 308 respectively).

Whilst Sauvignon Blanc is New Zealand’s foremost white grape, its most prestigious reds are Pinot Noirs, with Ata Rangi’s offering and Felton Road’s Block 5 both appearing in the top five. Ata Rangi is by far New Zealand’s strongest red brand (823). It is the country’s most visible red in the world’s top dining establishments (11%), and also the most popular with consumers, receiving three times as many searches each month as the Felton Road. Whilst it appears in just 7% of top restaurants, Felton Road Block 5 enjoys the group’s best vertical presence, with two vintages / formats offered on average per list. It is also the most expensive of the five. Incidentally, the two Pinot Noirs comfortably achieve the group’s best Quality scores and are the only two with scores above 800 in the category.

Proving that New Zealand isn’t all Sauvignon Blanc and Pinot Noir, Le Sol – Craggy Range’s Syrah – completes the five, with a Brand score of 673.

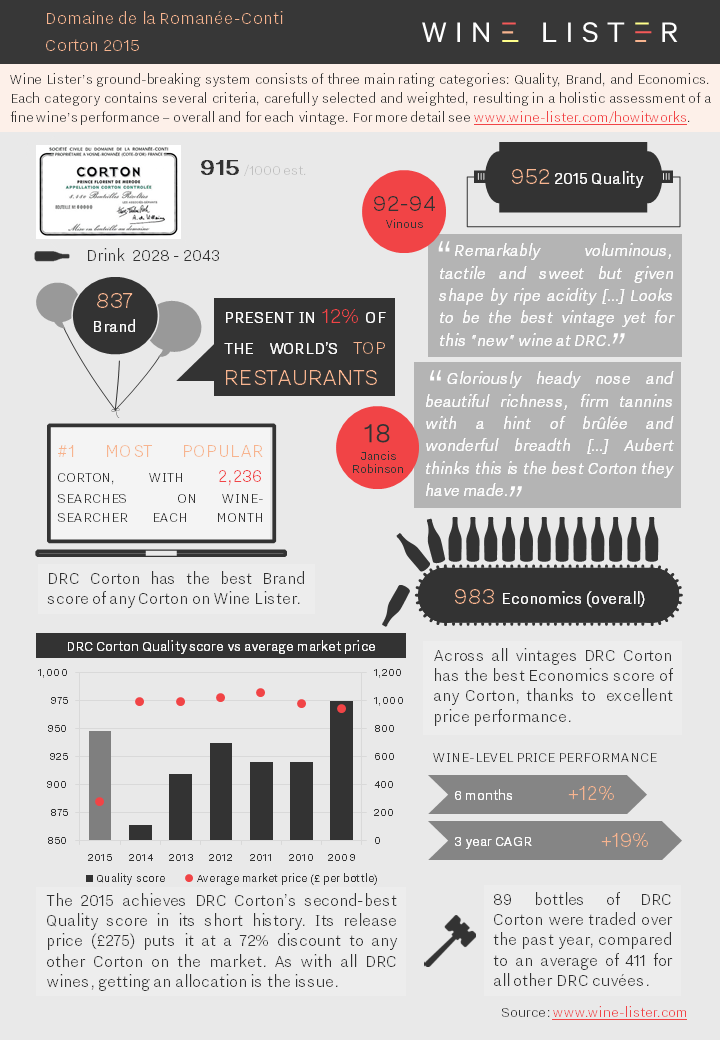

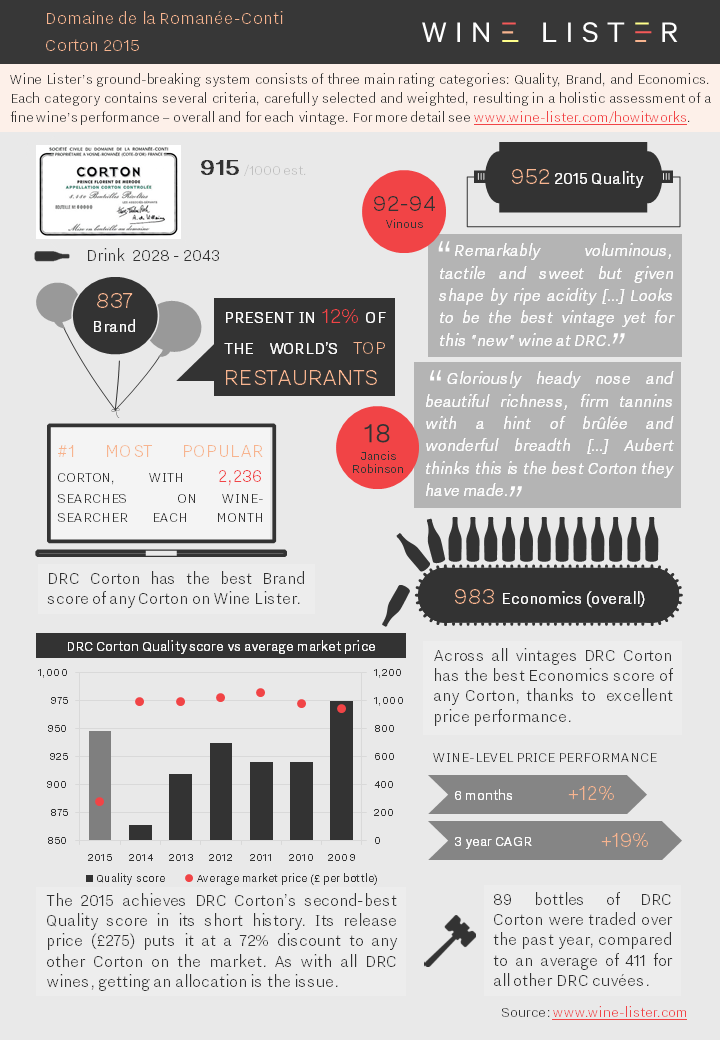

Towards the lower end of the Domaine de la Romanée-Conti spectrum is its Corton. The 2015 vintage was released this morning at £275 per bottle. Below we look at all the facts:

You can download the slide here: Wine Lister Fact Sheet DRC Corton 2015

Our Burgundian blog series continues, bringing you new snippets from our recently published Burgundy market study. Included in the study are findings from a survey answered by Wine Lister’s Founding Members – 52 CEOs, MDs and department heads from companies representing over one third of global fine wine revenues.

The most-cited trend was one that we have already explored in our latest blog on Burgundy price performance, namely untrammelled price increases. However our panel of merchants, retailers and auction houses also identified trends such as new styles of winemaking, as well as pinpointing some of the region’s rising stars.

The new generation of Burgundian winemaker seems as committed to quality as ever, while maintaining a more open outlook than their predecessors. This often means a strong focus on terroir transparency and a light touch in the cellar.

According to the trade, many Burgundy winemakers of today seek lower extraction levels , less sulphur, and less oak influence, concentrating on purity of fruit, sometimes by means of whole bunch fermentation.

Buying trends on the consumer side match this freedom of expression, with merchants citing the lesser-known villages, such as Saint-Aubin and Fixin, as up and coming.

This being said, our Founding Members’ consensus on the new domaines to watch for quality and acclaim remained very much among Burgundy’s upper crust, with the likes of Comte Liger-Belair, Vougeraie and Roulot.

You can read about more trends in the full Burgundy market study by subscribing here. Alternatively, a preview of the first 15 pages is available here.

With Burgundy having dominated our thoughts recently, we thought it was time for a change. So this week, our Listed section continues on its travels, this time stopping in the USA, to consider the country’s overall top five whites. However, whilst the landscape might be different to the Côte d’Or, the grape certainly is not. As might be expected, the USA’s top five whites are all Chardonnays – and all Californian.

Leading the pack is Marcassin Vineyard Chardonnay, with an excellent score of 918 – putting it amongst the very best on Wine Lister. Its score – 55 points above second-placed Kongsgaard Chardonnay – is the result of excellent consistency across Wine Lister’s three categories. Whilst it comes second in terms of Quality (927), it leads in the Economics category (968), and is well out in front in the Brand category (879). The dominance of its brand is the result of achieving the group’s best restaurant presence – both horizontal and vertical – and being the most popular of the five – it receives nearly twice as many searches each month on Wine-Searcher as the second-most popular wine in the group.

Next comes Kongsgaard Chardonnay (863). The cheapest of the five (£86 per bottle), it experiences the group’s second-weakest Economics score (873). However, it starts to climb back up the table with the group’s third-best Quality score (894), and cements its position with the second-best Brand score of the five (817).

The three final wines in the group are evenly matched, with just 27 points separating Kistler’s straight Chardonnay, Peter Michael’s Point Rouge Chardonnay, and Kistler’s Vine Hill Vineyard Chardonnay. The two Kistlers display contrasting profiles. Whilst the straight Chardonnay comfortably outperforms the Vine Hill Vineyard in the Quality category (892 vs 805), the roles are reversed in the Economics category, with the Vine Hill Vineyard’s very strong three-year CAGR (16.5%) helping it to an excellent score of 951, c.70 points ahead of the straight Chardonnay. In the Brand category, despite achieving very similar scores, again they display contrasting profiles. The straight Chardonnay is over twice as popular as the Vine Hill Vineyard, but features in half the number of the world’s top restaurants.

Peter Michael Point Rouge Chardonnay – the USA’s fourth-best white – has a somewhat topsy-turvy profile. It enjoys the group’s best Quality score (933), but the worst Brand and Economics scores (641 and 827 respectively). Thanks to an extraordinary three-year CAGR of 47.7% it is also by far the most-expensive of the five, with a three-month average price of £457.