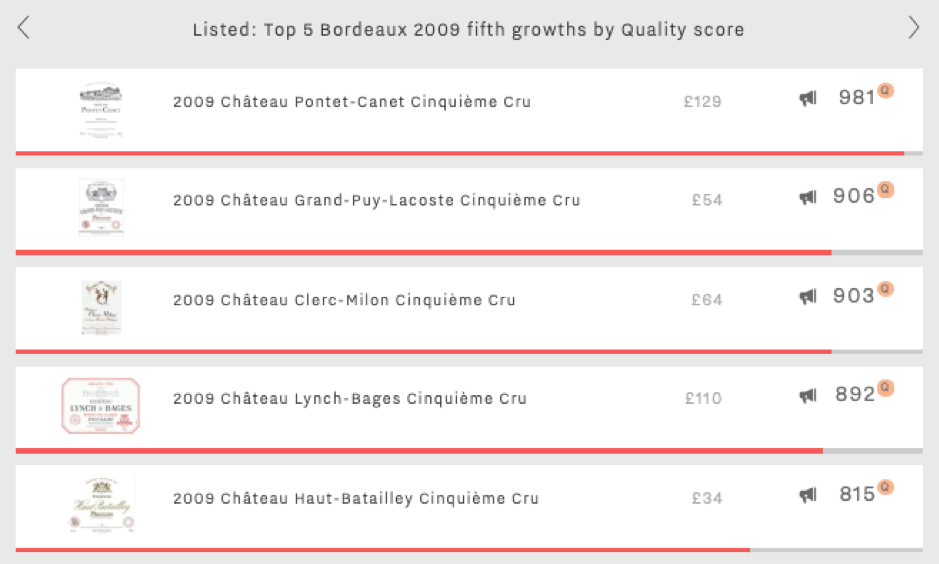

Wine Lister recently analysed the Bordeaux 2009 vintage in two parts. The first – a tasting and subsequent selection of top picks by Wine Lister’s founder, Ella Lister, revealed sublime quality across both banks. The second – a two-page analysis of the vintage overall – reveals that alongside top quality, prices of Bordeaux 2009s are high, and it is therefore all the more difficult to find good value, particularly among the left bank’s classified growths.

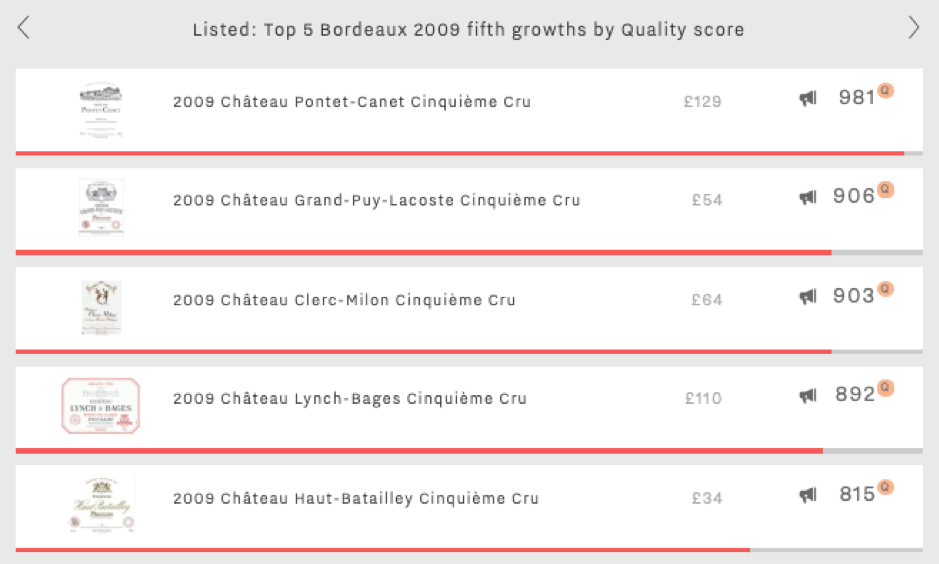

With this in mind, our Listed: top five blog this week explores the highest-quality Bordeaux fifth growths from the 2009 vintage. Despite the great quality across appellations, all five hail from Pauillac. They are all also Wine Lister Buzz Brands.

In first place is Pontet-Canet 2009. Its Quality score of 981 sits a full 102 points above the average of the other four wines in this week’s top five. This presumably contributes to its price of £129 per bottle in-bond – the highest of the group.

Next is Grand-Puy-Lacoste 2009, with a Quality score of 906 and the second-lowest price of this week’s top five (£54 per bottle in-bond). It is the only one of the group to appear among top picks from the recent 2009 re-tasting.

Just three points behind Grand-Puy-Lacoste, in third place, is Clerc-Milon 2009. In the economics department it outperforms the rest of the group significantly, with an Economics score of 905 and a compound annual growth rate (CAGR) of 17.3% – over two and a half times higher than the average of the other four wines in this week’s top five.

This week’s last two wines now fall under the same ownership, that of the Cazes Family. Nonetheless, the 2009 vintages of Lynch-Bages and Haut-Batailley, which achieve Quality scores of 892 and 815 respectively, present quite different profiles. Lynch-Bages is this week’s “brand king” with a Brand score of 996 – the highest of this week’s top five – and a price of £110 per bottle in-bond. Though Haut-Batailley 2009 achieves a Quality score 7% lower than Lynch-Bages, its price of £34 is 69% lower than that of its sibling, therefore providing exceptional value. After the acquisition and subsequent repositioning of Haut-Batailley through its 2017 en primeur release, it will be interesting to see how both châteaux fare in the upcoming 2018 campaign.

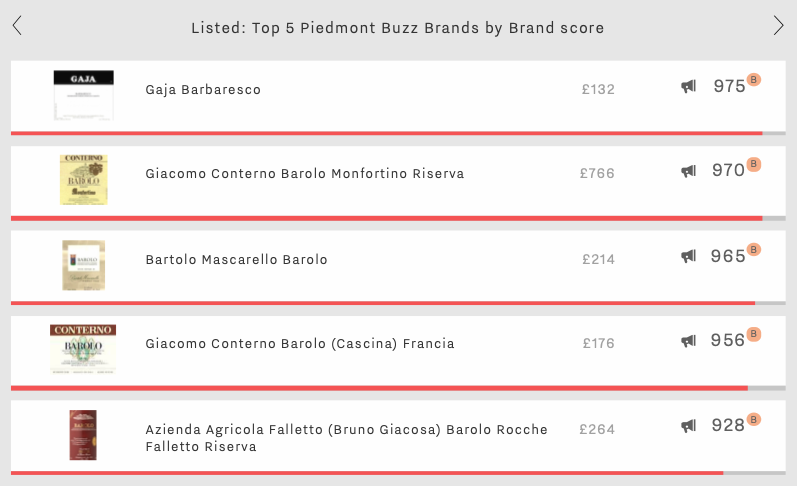

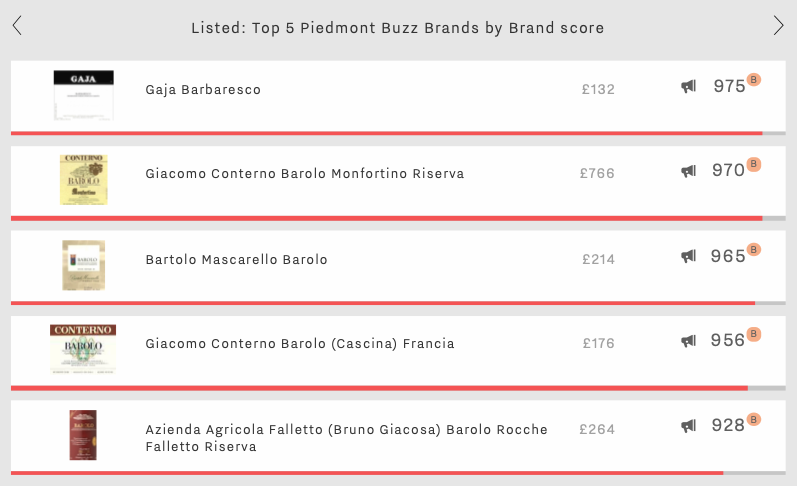

With the first major set of releases for 2019 in full swing (Burgundy 2017), the Wine Lister team are already looking ahead for what else is in store for wine collectors and trade members alike. In February we expect to see the release of Barolo 2015s – set to be a more concentrated and riper vintage than the previous due to high temperatures throughout the summer. In anticipation of these, Wine Lister is examining the top five Piedmont Buzz Brands by Brand score.

Ironically, the highest-scoring brand of this week’s top five is in fact not a Barolo at all. Gaja’s Barbaresco takes the top spot with a Brand score of 975. Wine Lister partner critic Antonio Galloni gives the 2014 vintage 96 points, and comments, “this is one of the most tightly wound, intense versions of Gaja’s Barbaresco I can remember tasting. Don’t miss it”.

While it is no longer breaking news to see such high quality Barbaresco emerging from under Barolo’s shadow, the making of such a well-recognised brand is impressive. This is achieved by presence in 31% of the world’s best restaurants, and a search rank of 76 out of the c.4,000+ wines on Wine Lister. Gaja’s single vineyard Barbarescos, Sorì San Lorenzo, Sorì Tildin, and Costa Russi are also popular with an average Brand score of 915.

In second place for top Piedmont Buzz Brands is Giacomo Conterno’s Barolo Monfortino Riserva. Sitting just outside the top 50 most-searched-for wines (in 51stplace), it is both the highest quality and the most expensive wine of this week’s top five, with a Quality score of 977, and an in-bond per bottle price of £766. The price tag, which is just under four times higher than the average price of the other four wines of this week’s group, is perhaps due to the tiny production quantities of just c.7,000 bottles per year.

Giacomo Conterno also takes a second spot in this week’s top five – fourth place, with his Barolo Cascina Francia, which earns a Brand score of 956 and a Quality score of 960. Despite score gaps between these two wines of a mere 14 and 17 points respectively, an average of three times as many bottles are produced of Cascina Francia than its grander (and much rarer) sibling. It is available at just 23% of the price of the Barolo Monfortino Riserva – £176 per bottle in-bond.

In third place of this week’s top five is Bartolo Mascarello’s Barolo with a Brand score of 965. While its scores across the board sit in the mid-range of this week’s top five, it achieves the best long-term price performance, with a three-year compound annual growth rate (CAGR) of 34.7%.

Lastly, at number five of this week’s group is Bruno Giacosa’s Barolo Rocche Falletto Riserva with a Brand score of 928. Although the Barolo Rocche Falletto Riserva has the lowest search rank of this week’s top five (158th), online searches for this wine saw impressive increases last year (read more here). It achieves a Quality score of 974 – just two points under the best Quality performer of the group (Conterno’s Barolo Monfortino Riserva). Indeed at vintage level these two wines share a near-perfect Quality score of 998 for their respective 2004 vintages, both earning 100/100 from Antonio Galloni.

It is interesting to note the high quality that accompanies these top Piedmont Buzz Brands (an average Brand score of 959 vs. 945 for Quality). The disparity between scores is more accentuated for the equivalent group in Tuscany, which achieves a Brand score of 991 for a Quality score of 932, or in other words, a 59-point gap.

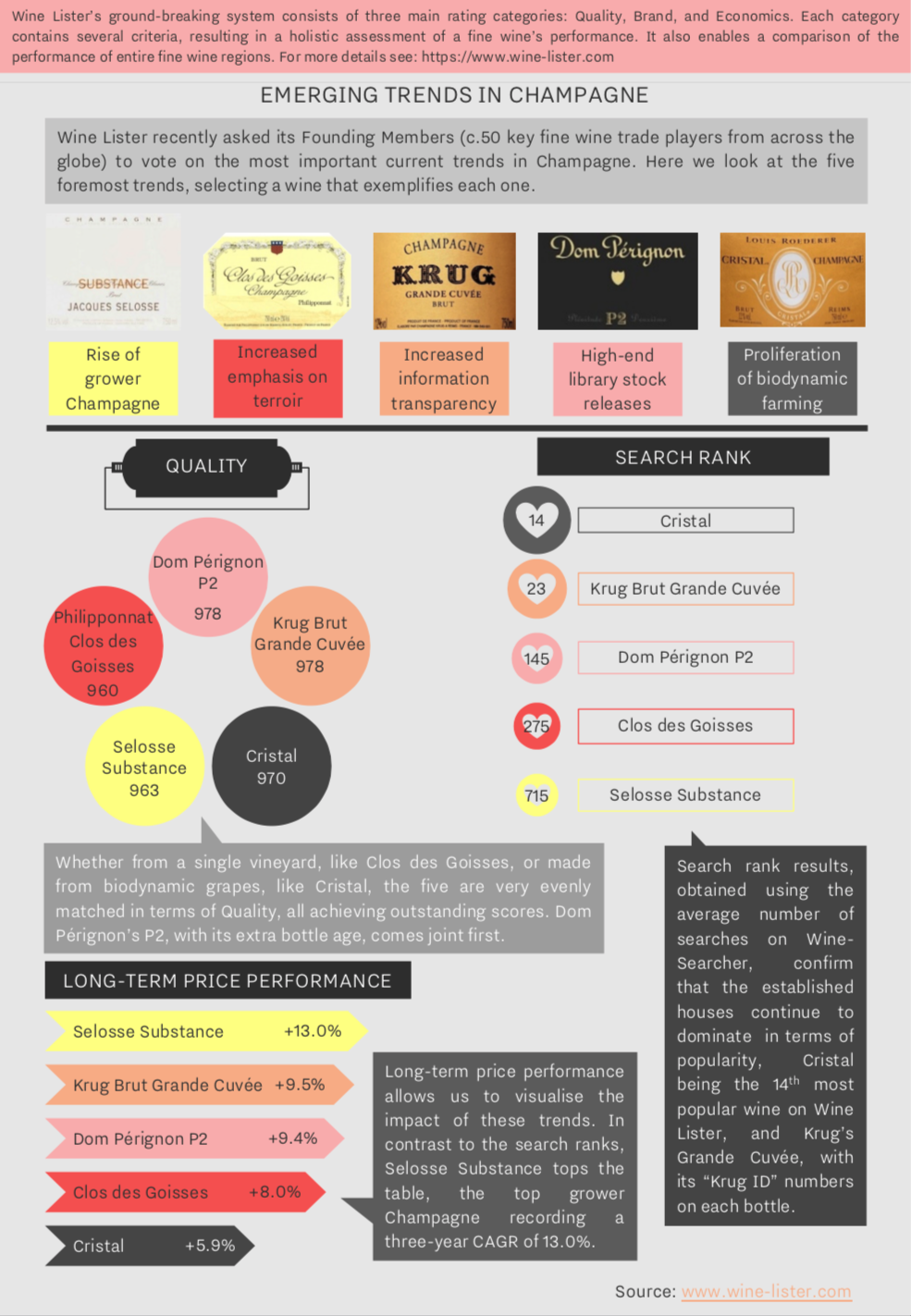

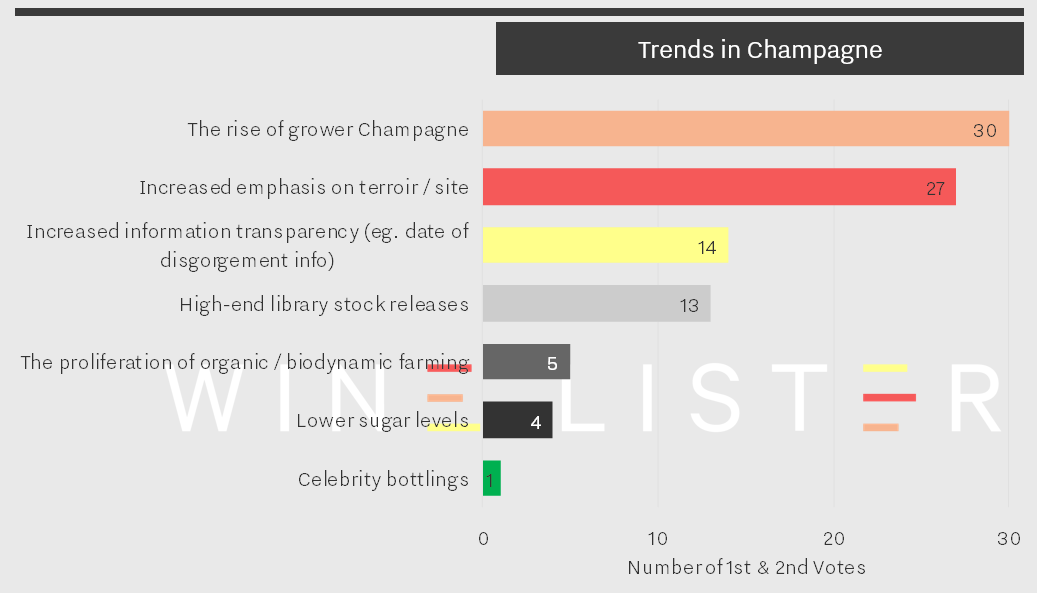

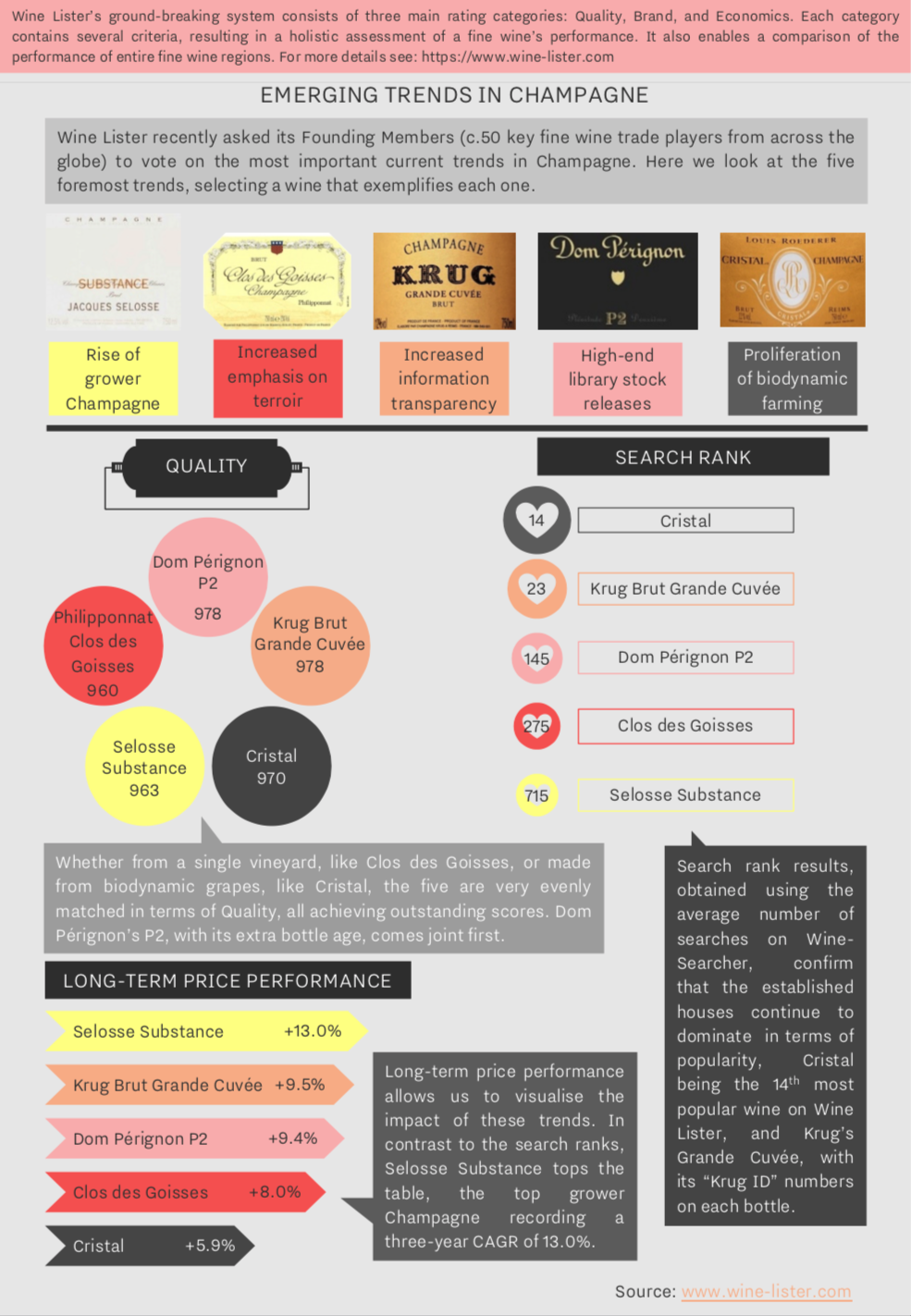

At the beginning of this new year, Wine Lister is prolonging the festive sparkle through a look at the major trends to emerge from our first Champagne report. Wine Lister’s Champagne study analyses a basket of 109 top wines from the world’s premier sparkling region, and includes insight into the major trends of the Champagne market as identified by Wine Lister Founding Members (c.50 key players in the international fine wine trade).

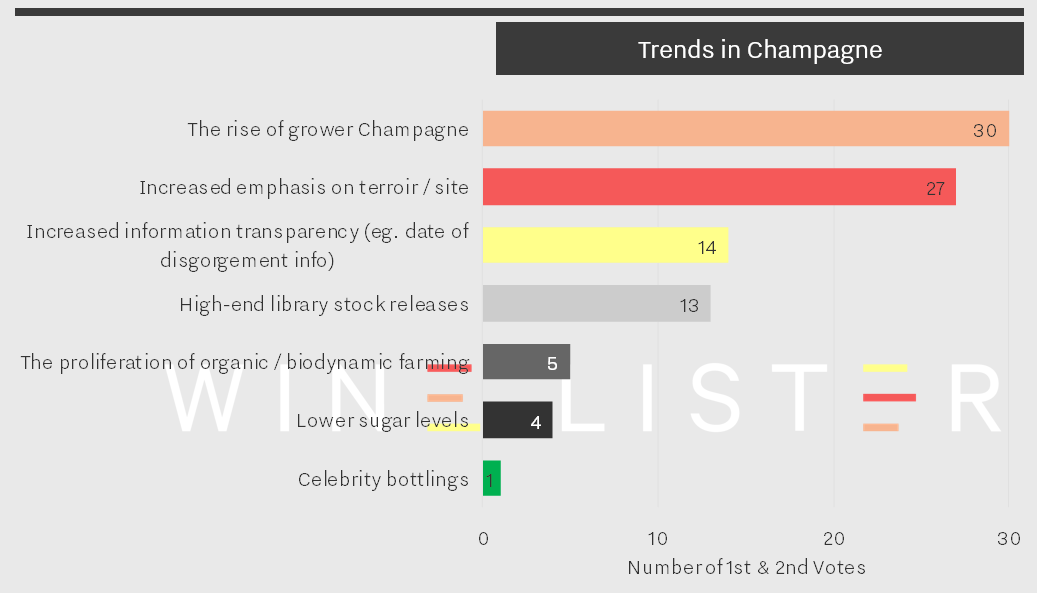

While quality across the board is something to keep us celebrating well in to 2019 (see more on this here), the notable trends could indicate an increase in year-round enjoyment of Champagne. The chart below shows responses to our question, “What are the most important trends in Champagne?” by number of votes.

The trend most-frequently ranked as number one or two by Wine Lister Founding Members was the rise of grower Champagnes, closely followed by the increased emphasis on terroir / site Champagnes. One U.K. merchant remarked that “Consumers are now identifying with specific terroir in Champagne and understanding the value of the grower…” – a comment that further leads us to suspect an increased appreciation of Champagnes as wines, and not just celebratory bubbles.

The “rise of the grower” trend is, however, juxtaposed by continued demand for big brands. Of the basket of wines treated in the study, the grower Champagne segment has seen an increase in popularity (measured by search rank) of 9% since the beginning of 2017. Though this performance is superior to the maison segment’s slight decline in popularity (-4%), grower Champagnes still sit twice as far down the popularity rankings, with an average search rank of 1,620 compared to 775.

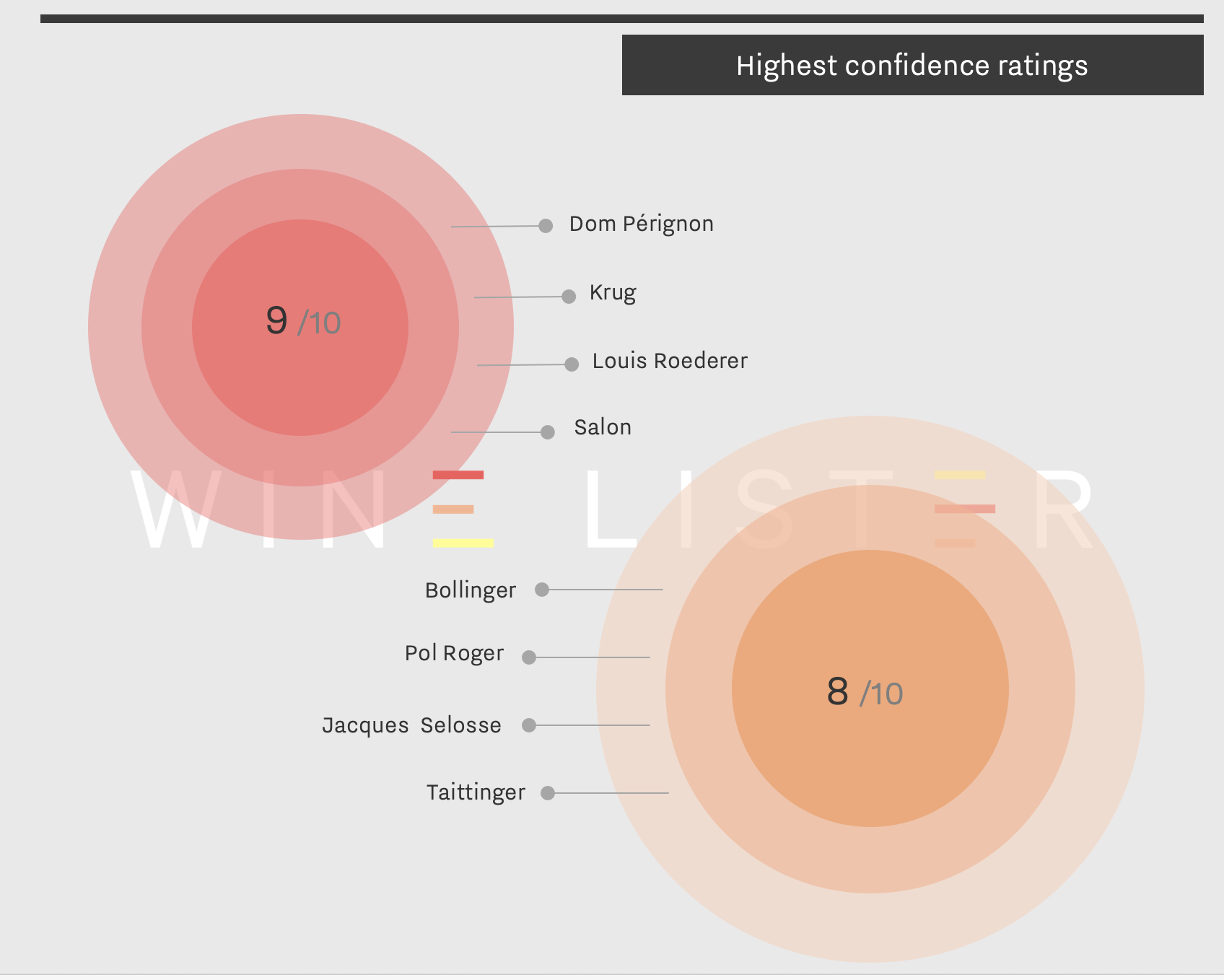

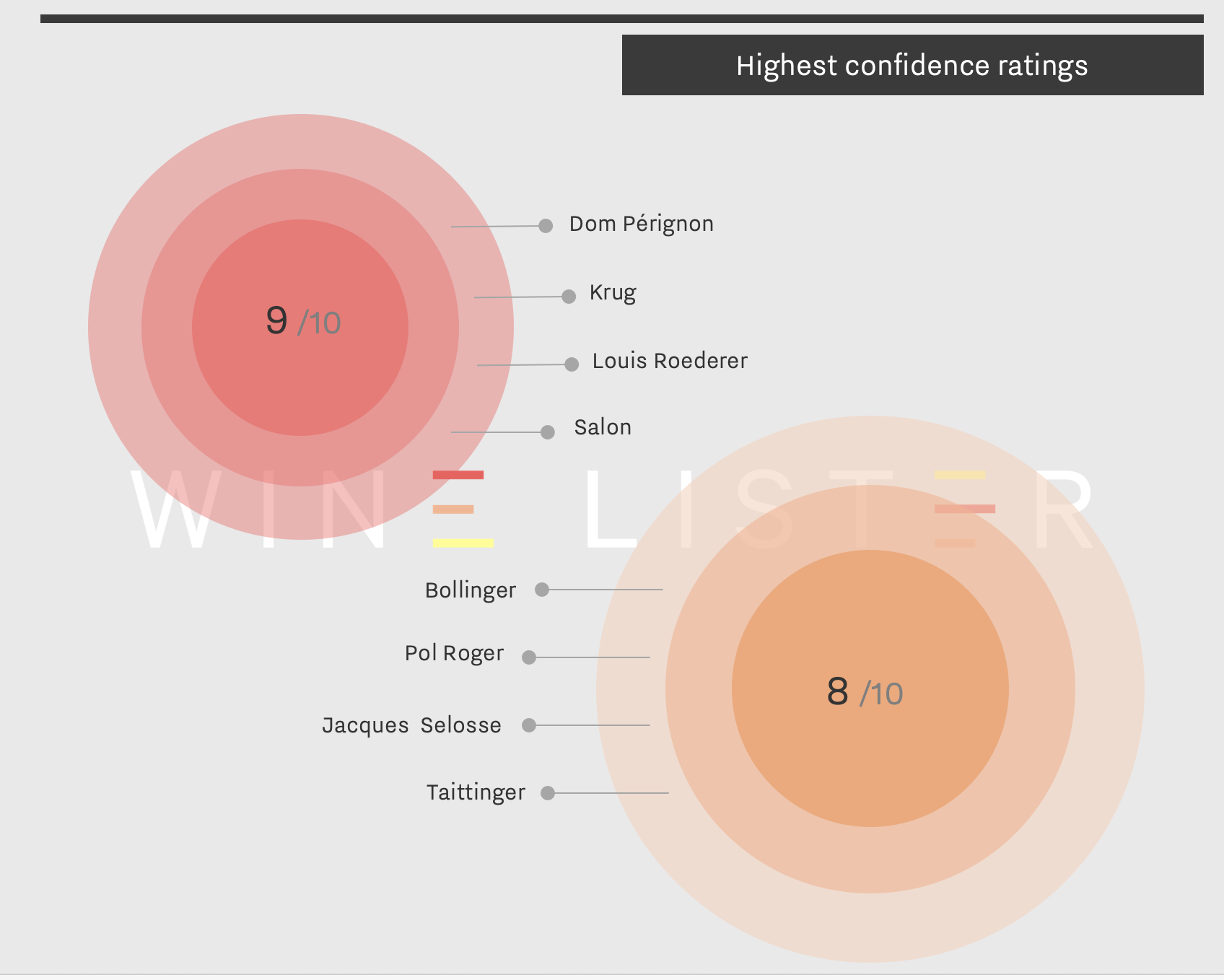

Perhaps predictably, big brands still win the race when it comes down to the bottom line. A U.K. merchant commented, “Small growers are getting much better press, but I suspect the big name cuvées still rule the roost for sales/investment”. Indeed, when asked to award confidence ratings to specific Champagne producers, the trade cited only one grower champagne within the top two confidence scores (9/10 and 8/10), Jacques Selosse. The houses to earn top confidence ratings were Dom Pérignon, Krug, Louis Roederer, Salon, Bollinger, Pol Roger, and Taittinger, as shown on the chart below.

A top tier merchant offers some explanation into the difference in picture painted between the top Champagne trend and Champagne confidence ratings: “Production needs to be small but not so small as to result in a proliferation of Champagnes which the vast majority have never heard of. The big brands which produce great quality are still finding serious demand in the market!”

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

Our latest Listed blog focused on the top Grand Cru Champagnes by Wine Lister score. As the holiday season approaches, we look at a different kind of ‘top five’ on a sparkling theme – five of the major trends for the Champagne region, determined by a recent survey of Wine Lister’s Founding members.

Key members of the global fine wine trade identified the rise of grower Champagnes as an emerging trend. Jacques Selosse reigns supreme, with its Blanc de Noirs La Côte Faron achieving the best Quality score of any grower Champagne on Wine Lister (975). Only an average of 1,250 bottles are produced of this each year – half of the production volume of its Substance Brut.

Founding Members also identified an increased emphasis on terroir as something to look out for. Single vineyard expressions of Champagne are well-known and already extremely sought-after, particularly Krug’s Clos du Mesnil and Clos d’Ambonnay. The latter achieves a Quality score of 970, just 10 points above Philipponnat’s Clos des Goisses, but is over 12 times the price (£1,867 vs. £147).

The phenomenon of increased information transparency is perhaps a sign that buyers are becoming more interested in Champagnes as wines, as opposed to just celebratory bubbles. Krug’s Grande Cuvée has used “Krug ID” numbers since 2011, allowing drinkers to see the vintages, vineyard plots, and grapes included in each bottle. Library releases also cater to more “wine-focused” buyers – Champagne Brand King Dom Perignon’s P2, or Bollinger R.D. are the obvious choices for this.

Finally, interest in biodynamically farmed Champagnes is on the rise, such as Louis Roederer’s Cristal, or any cuvée from Jacques Selosse.

Download a PDF of the slide above here.

First published in French in En Magnum.

Wine Lister periodically studies the movements of wines in and out of the four Wine Lister Indicator categories. One of these, Buzz Brands, denotes wines that achieve outstanding online popularity (measured through search rankings based on monthly searches on Wine-Searcher), and presence in the world’s best restaurants.

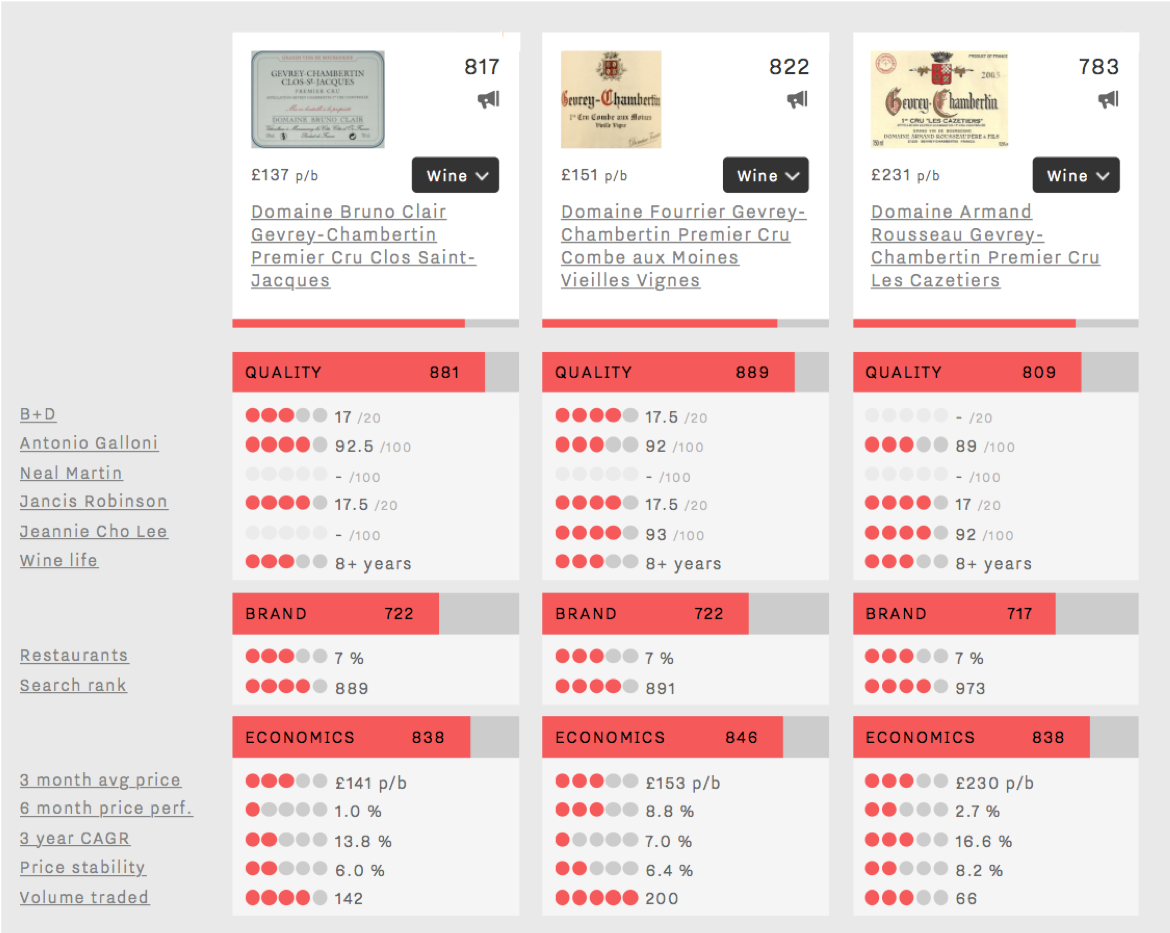

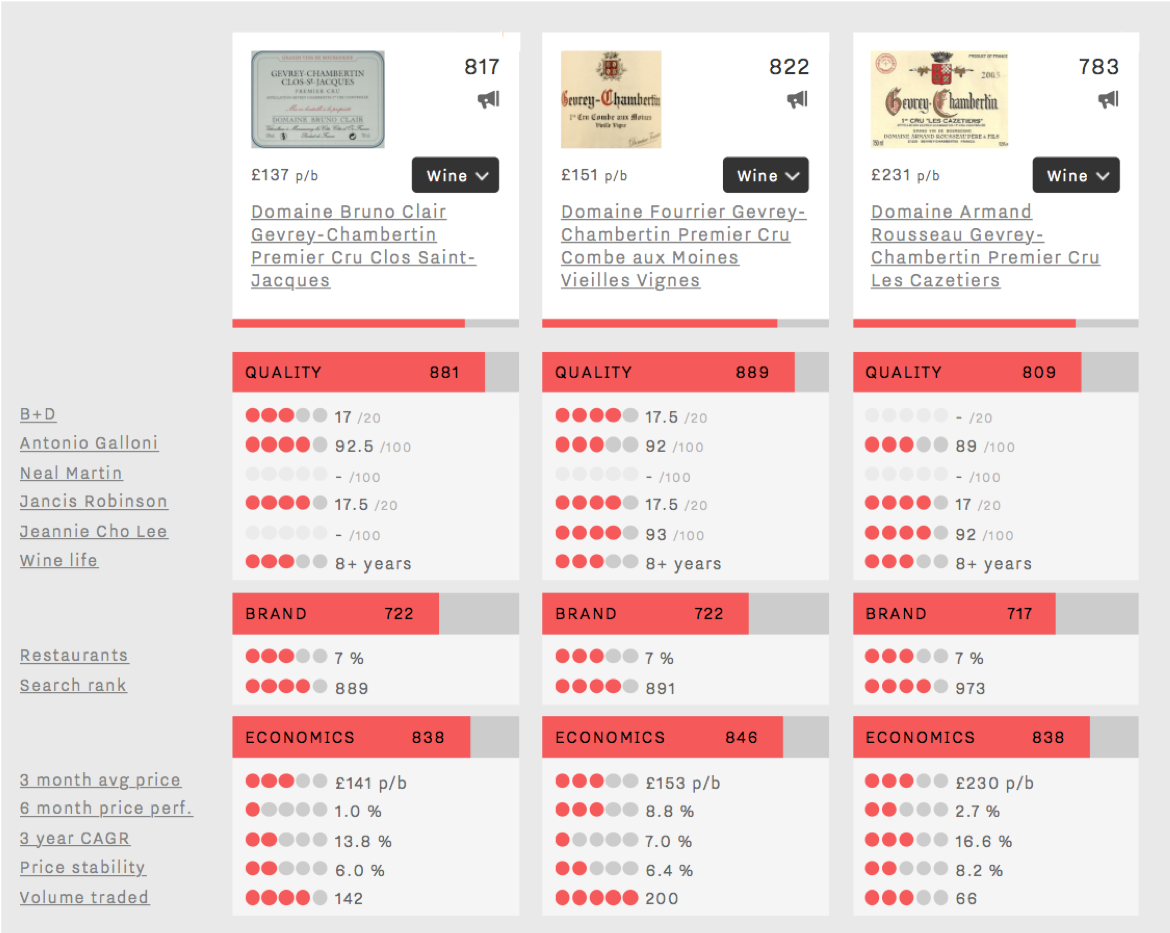

After analysing newcomers to the Buzz Brand segment in June, Burgundy dominates once again in our findings for October. Red Burgundy, and in particular, Gevrey-Chambertin, takes three out of the four places of this month’s new Buzz Brands.

However, it is in fact the only white, Domaine Leflaive’s Bourgogne Blanc, that achieves the highest Brand score of the group at 815. All of the Domaine Leflaive wines on Wine Lister are now Buzz Brands but one – their most expensive Grand Cru, Montrachet (at £6,059 per bottle compared with £218, the average price of the rest). Indicative, maybe, of drinkers being priced out of the top wines and refocussing their interest lower down the ladder.

Perhaps it is also the sign of a good brand strategy in action, with the rising profile of the Domaine’s top wines filtering all the way down to the regional wines, via the premiers crus. The new addition of the regional offering here follows two previous new Leflaive mentions in Wine Lister’s last Buzz Brand audit (of Puligny-Montrachet Les Combettes and Meursault Sous le Dos d’Ane).

Of the three reds, two hold the same Brand score of 722, and near identical Brand profiles (see restaurant presence and search rank in the image below). The Gevrey-Chambertin Clos Saint-Jacques is the first of Bruno Clair’s wines to become a Buzz Brand. Domaine Fourrier’s Combe aux Moines Vieilles Vignes has the highest Quality score of all three new red Burgundy Buzz Brands with a score of 889. This, coupled with a slightly better Economics score helps bring it very slightly ahead for overall Wine Lister score.

Though Domaine Armand Rousseau’s Les Cazetiers is third of the Gevrey group qualitatively, it is geographically sandwiched between the first two. These wines together form a neat representation of three of the best premier cru vineyards of Gevrey-Chambertin. Incidentally, this is the last of Rousseau’s wines on Wine Lister to achieve Buzz Brand status. The domaine’s highest Brand score is won by the better-known Clos Saint-Jacques (unsurprising given that it owns roughly one third of the entire vineyard parcel) with a Brand score of 964.

Buzz Brands are wines that are sure to turn heads, destined to cause a stir whenever they are opened. They combine excellence across Wine Lister’s two Brand criteria – restaurant presence and online popularity – whilst also being held in the highest regard by the fine wine trade – as confirmed by Wine Lister’s Founding Members’ survey which gathers the opinions of around 50 key players in the international wine trade. This week, the Listed section focuses on Italy’s top five Buzz Brands by overall Wine Lister score.

Barolo is home to four of Italy’s top five Buzz Brands, two of which are produced by Giacomo Conterno – the flagship Monfortino in first place (973) and Francia not far behind in second place (954). The Monfortino achieves Italy’s best Quality score (977), the result of remarkable consistency from vintage to vintage, having achieved a score of 993 or above in seven of the past 10 vintages. Its best ever vintage was 2004 (998), thanks to a perfect 100-point score from Antonio Galloni, who writes: “I imagine the 2004 Monfortino will give readers an utterly spellbinding drinking experience for the next few decades”.

Whilst the Francia is pipped at the post in each category by its illustrious stablemate (trailing by 17 points in the Quality category, 11 in the Brand category, and 34 in terms of Economics), it does manage superior restaurant presence, visible in 30% of the world’s top establishments, compared to the Monfortino’s 23%. This is presumably due to over three times as many bottles of it being produced each year on average.

In third place is Azienda Agricola Falletto’s Rocche Falletto Riserva (953). It records the best Economics score of the five (969) and Italy’s second-best, beaten only by Falletto’s Barbaresco Asili Riserva (978). It does so thanks to the combination of very strong growth rates – it has recorded a three-year compound annual growth rate of 21% and has added 8% to its value over the past six months alone – and strong liquidity – its top five vintages having traded 398 bottles at auction over the past year. Perhaps collectors have been eager to get their hands on a bottle after the passing of Bruno Giacosa in January.

Proving that Super Tuscans can mix it with Piedmont’s top nebbiolos, Sassicaia takes fourth place. Whilst it cannot keep pace with Barolo’s finest in the Quality and Economics categories, Sassicaia stretches out a comfortable lead in the Brand category thanks to an extraordinary score of 998. This near-perfect score puts it alongside Haut-Brion, Margaux, and Petrus, beaten only by the Pauillac First Growths, Dom Pérignon Vintage Brut, and Yquem. Its brand dominance is the result of outstanding restaurant presence (49%) and online popularity – receiving well over three times as many searches each month as Conterno’s Monfortino, which is the group’s second-most popular wine.

Rounding out the five is Bartolo Mascarello’s Barolo. Its brand is its strongest asset, its score of 964 making it Barolo’s second-strongest brand behind Conterno’s Monfortino. Despite receiving over 20% fewer online searches each month than the Monfortino, it matches its level of restaurant presence – perhaps the azienda’s famous “no barrique no Berlusconi” message strikes a chord with sommeliers.

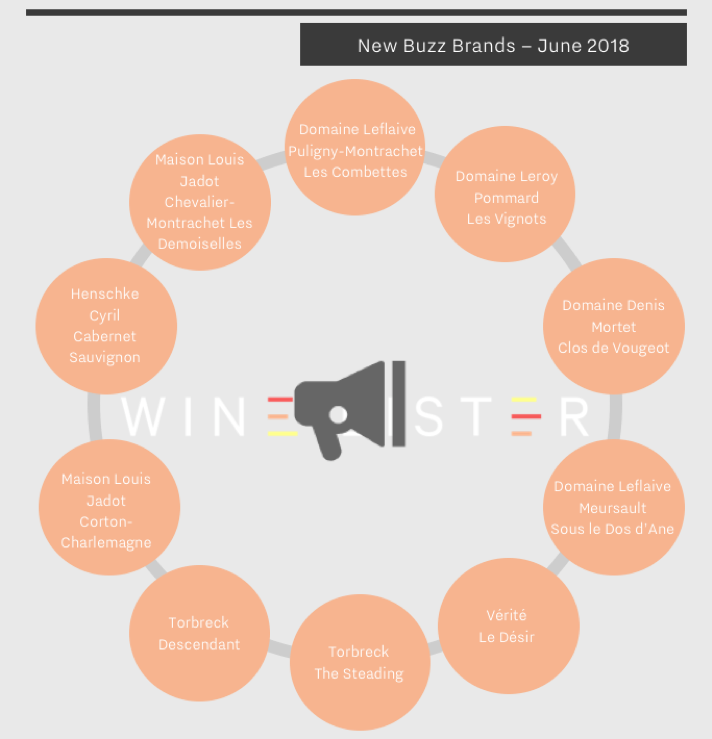

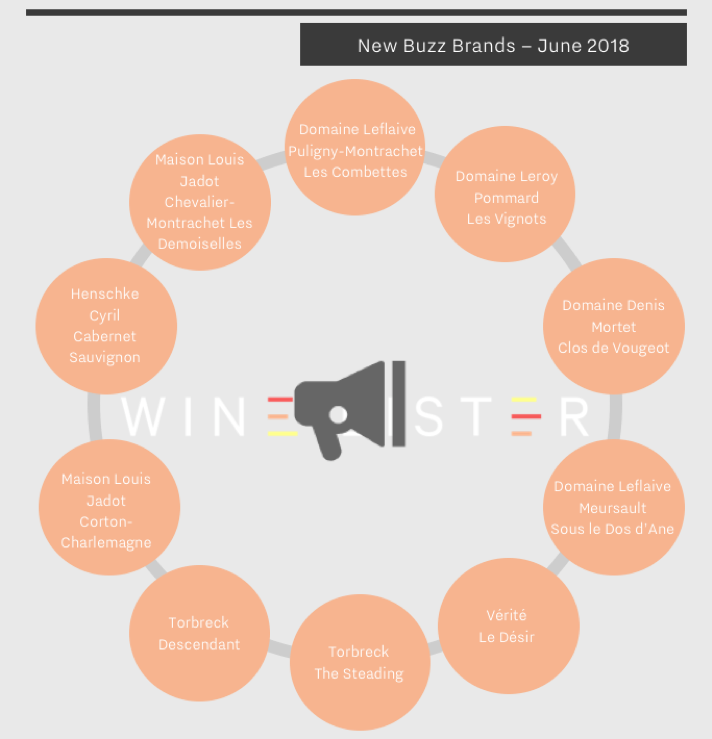

Despite the annual bustle of the en primeur campaign, it is healthy to breathe some non-Bordeaux air once in a while. With Bordeaux 2017 behind us, we examine new Buzz Brands for June from contrasting locations – Burgundy and the New World. One of four Wine Lister Indicators, ‘Buzz Brands’ use Wine Lister’s bespoke algorithms to indicate trending wines found in the highest number of the world’s best restaurants, and with high online search frequency.

This month, 10 new wines have made the Buzz Brand cut, as shown in the image below.

Six Burgundian wines (four whites and two reds) become Buzz Brands in June. This aligns with results of our latest Founding Members’ survey, where Burgundy producers earned the most number of votes (50) from key members of the global fine wine trade as most likely to see the largest brand gains in the next two years.

Louis Jadot and Domaine Leflaive both have two new white Buzz Brand references. Jadot’s Chevalier-Montrachet Les Demoiselles and Corton-Charlemagne have the highest Quality scores of this month’s Buzz Brand additions – 951 and 925 respectively. Domaine Leflaive proves its popularity with presence of its Puligny-Montrachet les Combettes and/or Meursault Sous le Dos d’Ane in 28 out of c.150 of the world’s best restaurants, and votes from the trade as a consistent seller (see p.23 of Wine Lister’s Bordeaux market study 2018 for more).

Of the red Burgundian Buzz Brands, the popularity of Domaine Leroy’s Pommard Les Vignots is perhaps unsurprising, given the producer’s renown, and the wine’s relative affordability (£505 per bottle) compared with Leroy’s more expensive offerings, such as its Musigny Grand Cru (£8,365 per bottle). Denis Mortet’s Clos de Vougeot is the only Côte de Nuits to feature in this month’s Buzz Brand additions.

The remaining four wines all hail from the New World – three from South Australia, and one from California. The latter, Vérité’s Le Désir, wins on all fronts with the highest Quality (949), Brand (740), and Economics (603) scores. The Quality comparison is hardly fair, given Le Désir’s price of £233, over four times higher the average of the three Australian representatives. Torbreck’s The Steading and the Descendant combined are present in 15 of the world’s best restaurants. Henschke’s Cyril Cabernet Sauvignon joins its pricier and better-known siblings, Hill of Grace Shiraz and Mount Edelstone Shiraz, as the producer’s third Buzz Brand.

You can see a full list of Wine Lister Buzz Brands here

Which producers will see the largest gain in brand recognition in the next two years? As part of our recent Bordeaux Market Study, we asked Wine Lister’s Founding Members – c.50 key members of the trade from the world’s largest merchants, top international wine auctioneers and several high-end retailers, together representing well over one third of global fine wine revenues.

While Burgundy achieved the largest number of producers mentioned at least once (50), all 10 of the most-cited producers hail from Bordeaux.

With the en primeur campaign finally in full swing, below are Bordeaux’s biggest rising stars: the region’s top 10 brands expected by Wine Lister Founding Members to see increased recognition in the next two years.

Château Canon received the highest number of votes for the brand likely to see most increased brand recognition over the coming two years, and is therefore the number one rising star in this year’s Bordeaux Study. Canon also achieves the joint-highest confidence rating from the trade (see last week’s blog for details), and appears in the top 10 wines for price performance after en primeur release .

In a show of strength by owner Chanel, another of its properties, Rauzan-Ségla, receives the second-highest number of votes, alongside Les Carmes Haut-Brion.

Haut-Batailley, recently acquired by the Cazes family – and having released no wine in 2016 – is seen as a brand with a bright future (and the new owners clearly think so too – it was released at a very ambitious price of £43 at the end of April).

Other Bordeaux wines voted likely to see the largest gains in brand recognition over the next two years are: Brane-Cantenac, Pavie, Calon Ségur, Figeac, Lafleur, and Pichon Comtesse.

Visit Wine Lister’s Analysis page to read the full report (available in both English and French). Go to p.24 to see how many votes each of the above wines received.

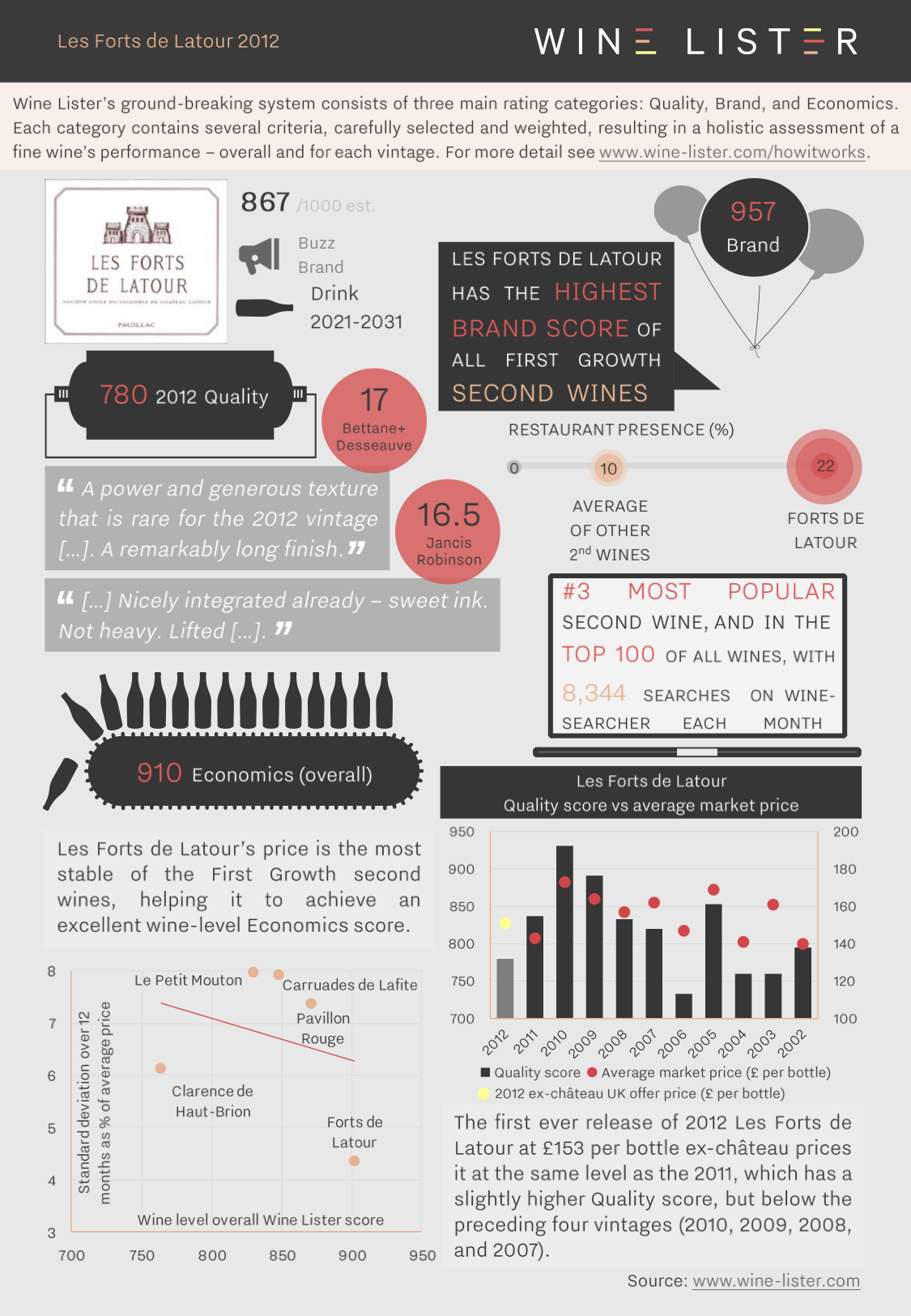

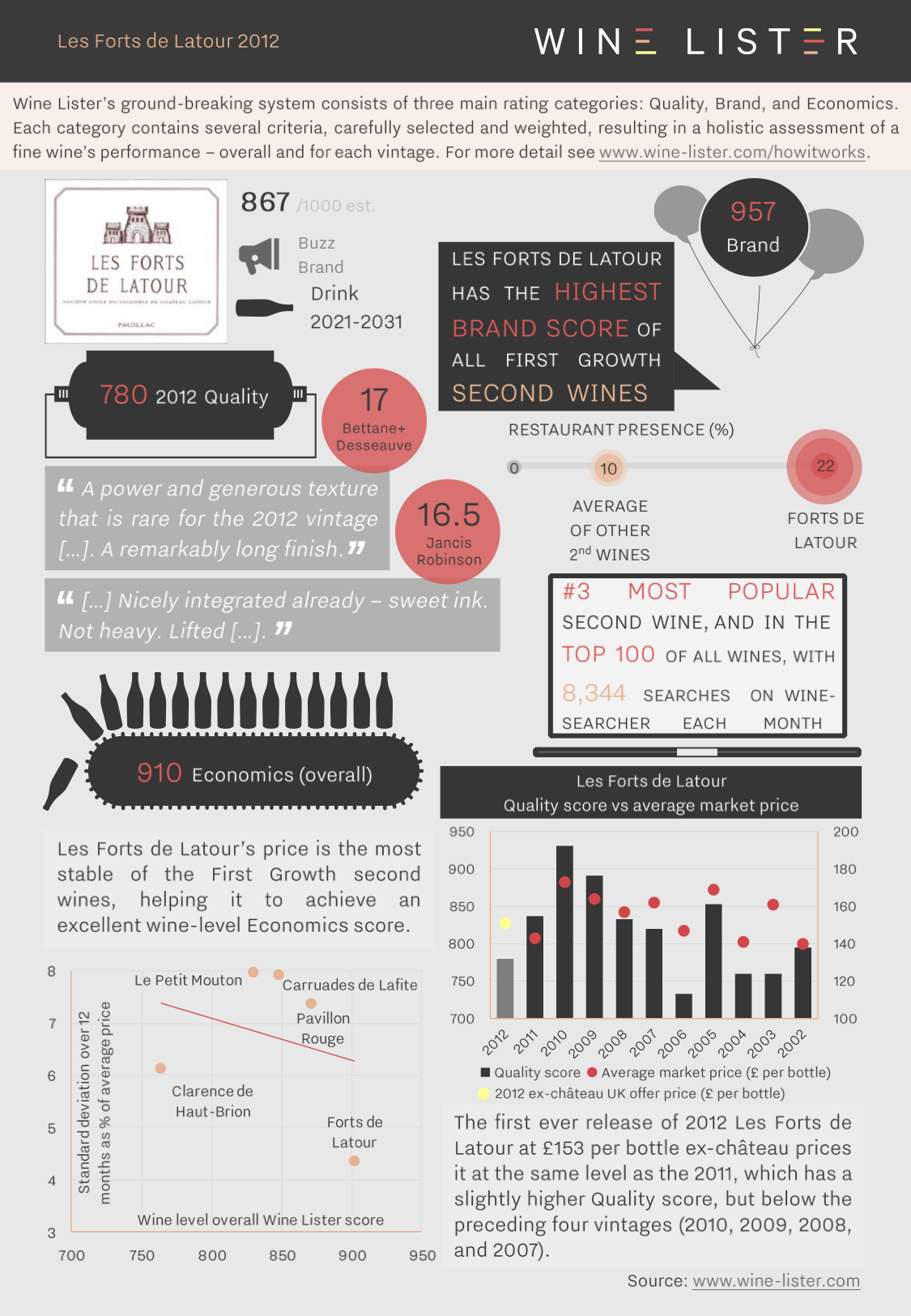

Château Latour has released a first parcel of Les Forts de Latour 2012 this morning at €145 per bottle ex-negociant. It is being offered in the UK at c.£153 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Les Forts de Latour 2012

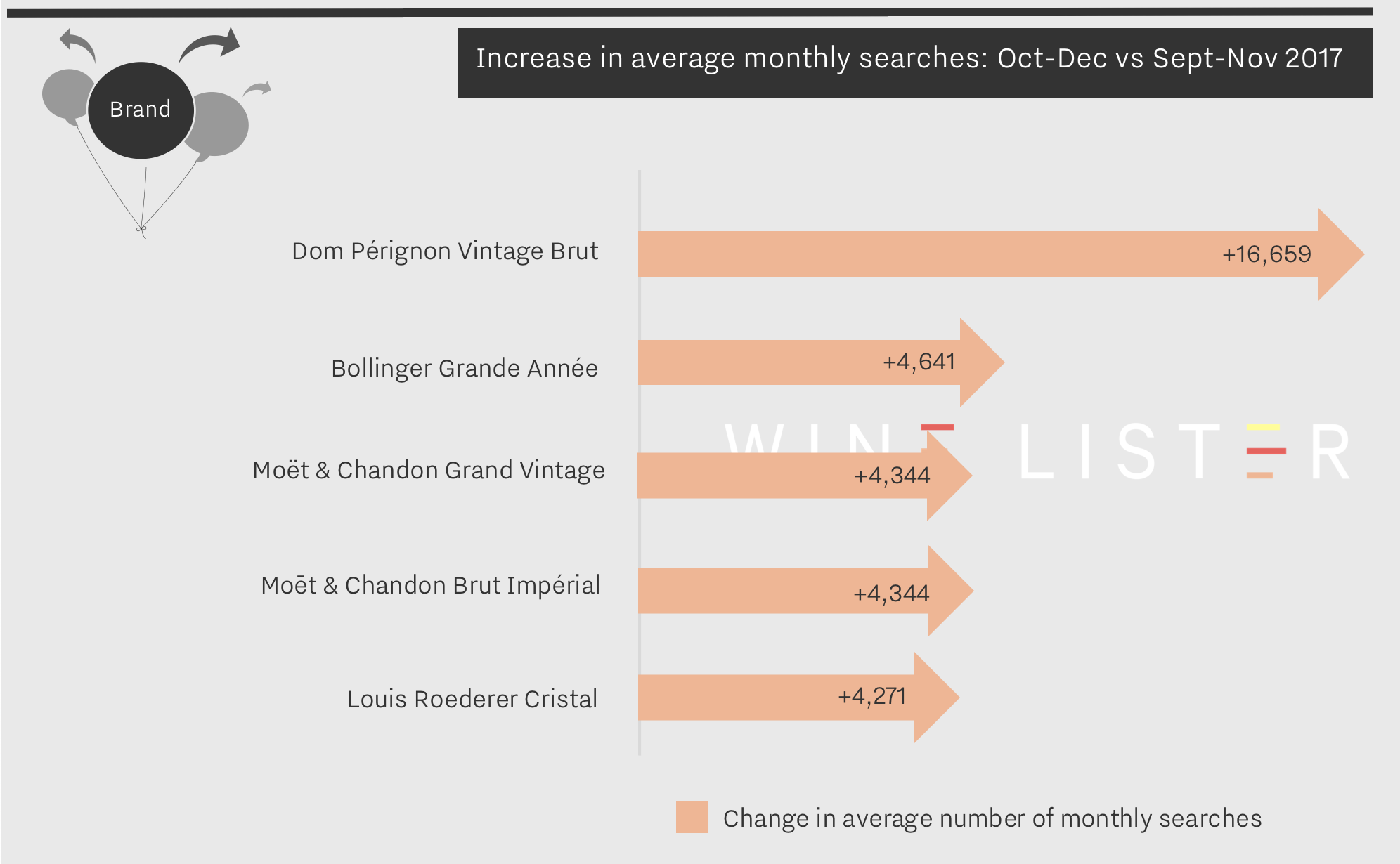

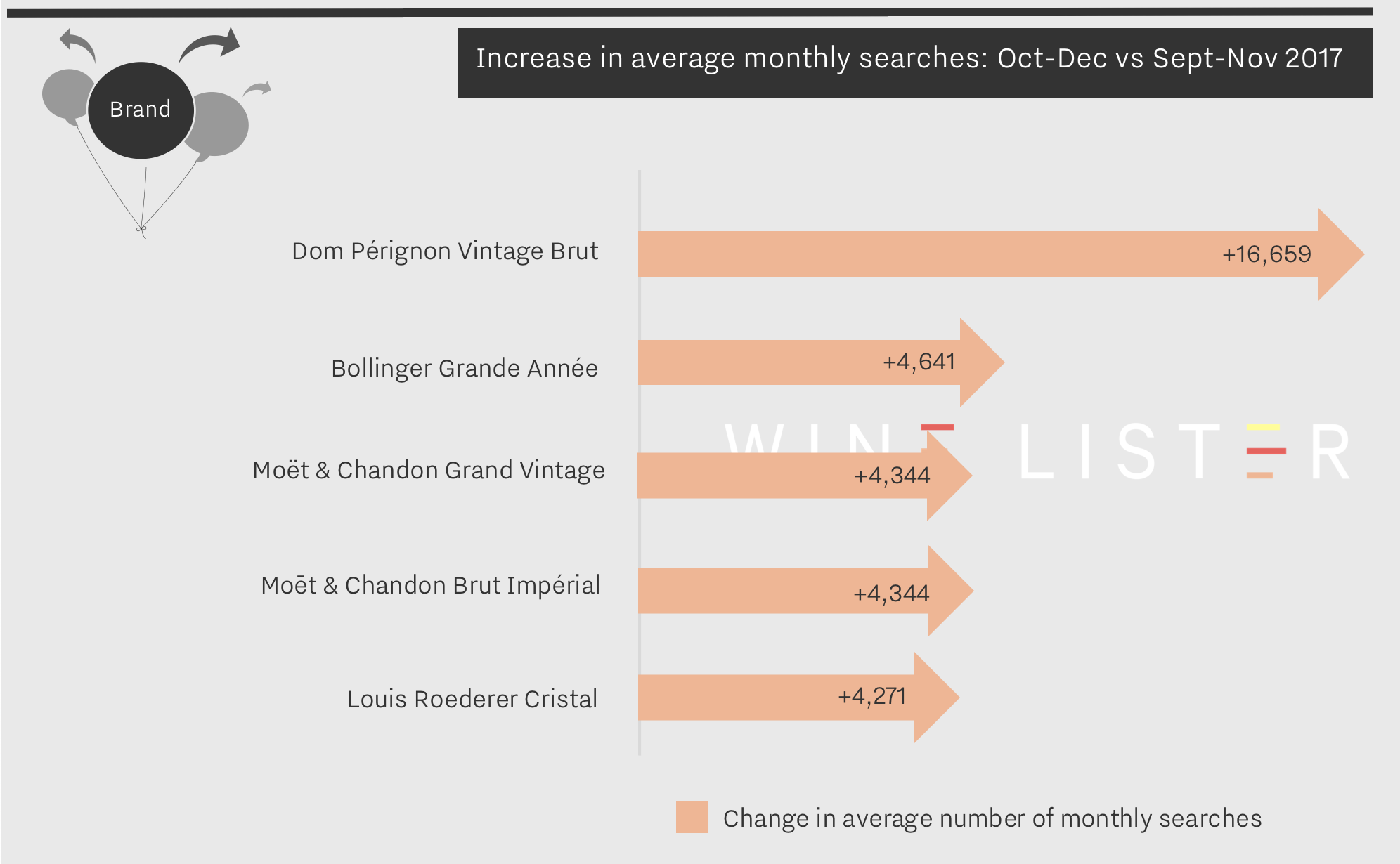

After a distinctly Burgundian start to 2018, we are ringing the changes this week to look at some of our most improved Brand scores, with Champagne dominating.

Alongside presence in the world’s best restaurants, Wine Lister’s Brand score measures a wine’s online popularity – as indicated by the number of searches received on Wine Searcher – as a marker of real consumer demand.

The search frequency data for December is in, and it is no surprise that searches in Champagne increased significantly leading up to the Christmas period.

During arguably the busiest period of the year for searching and purchasing wines, these five wines gained between 20% and 77% increase in search frequency. The appearance of Dom Pérignon Vintage Brut at the top of search frequency lists is a shock to no one considering its position as one of the most searched-for wines of all time. Indeed, it consistently held the number one search spot from July to September last year. The Christmas influence still managed to add 16,659 online searches, allowing this almighty brand to achieve Wine Lister’s first ever perfect Brand score (1000)!

Next on the list is Bollinger Grande Année. Its impressive 77% increase in search frequency at the end of last year can also be attributed to the festive season, but may also have been boosted by the release of the 2007 vintage earlier in the year. Bollinger’s new Brand score is up 16 points on the previous quarter at 975.

Our next two appearances hail from the same owner as the first, Champagne divinity LVMH. Moët & Chandon, often considered the definitive Champagne brand holds not one, but two spots in the top five most searched for wines of the last three months. Moët & Chandon Grand Vintage is perhaps a classic Christmas choice, but the appearance of a non-vintage cuvee, the Moët & Chandon Brut Impérial is testament to the power of the Moët & Chandon brand. Each earned an increase in search frequency of 33%, bringing Brand scores to 987 and 938 respectively.

Last but not least, Louis Roederer Cristal takes fifth place with a search frequency increase of 20%. While achieving a fractional increase in searches (4,271) compared with Dom Pérignon, its presence in 54% of restaurants and consistent high quality (Quality score 970) makes Cristal an all-round achiever, and therefore a choice that’s not just for Christmas.

Champagne’s Brand prowess is clear, but these five are the shining stars of their region. It is interesting to note that the sixth most searched-for wine on our most recent list is in fact not a Champagne at all, but Château Margaux (Brand score 998).