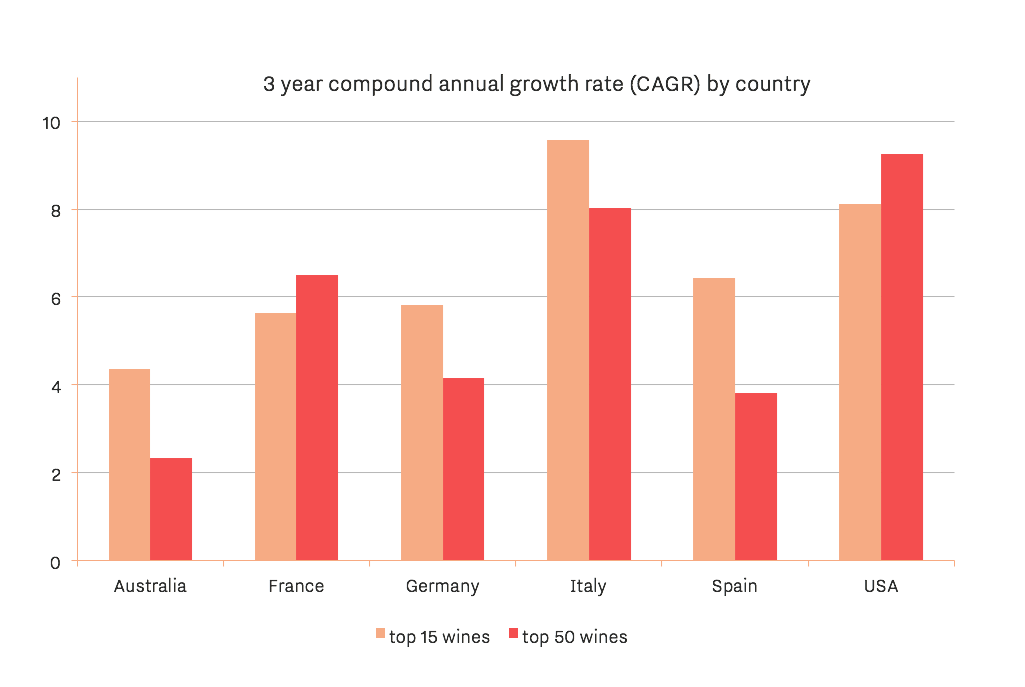

The graph below shows the average long term price performance of top scoring Wine Lister wines by country, and the USA bucks the trend of elites on top (with an early congratulatory nod from France).

We have split out performance for an elite group of the 15 highest-scoring wines, and compared this to performance for a wider panel of 50 wines. For the majority of countries, the elite wines - let's call them the establishment - have seen their stock rise over the last three years.

In the USA, it is the broader-based group (the red column) that has trumped the establishment (gaining more than 9%). The same is true in France, where a broader group of wines has penned a tale of higher returns.

Our measure of long term price performance is the 3 year compound annual growth rate (CAGR) which facilitates comparison to other investment products.

Elsewhere, Italian wines have seen the best returns among their elite group, averaging annual price gains of almost 10% - the most impressive of any group analysed here. One of the top performing wines in Italy's top 15 scorers is Bartolo Mascarello's Barolo (of "no barrique, no Berlusconi" fame), whose average (cross-vintage) price performance is 23% CAGR over the last 3 years.

The elites also outperform the up-and-comers in Spain, Germany, and Australia, perhaps explained by the fact that there are fewer really well established top-end brands in these countries compared to France, and so their respective top 50 groups are less entrenched, and their top 15 groups still have room to grow in recognition and price.