Key findings from this year’s first regional report

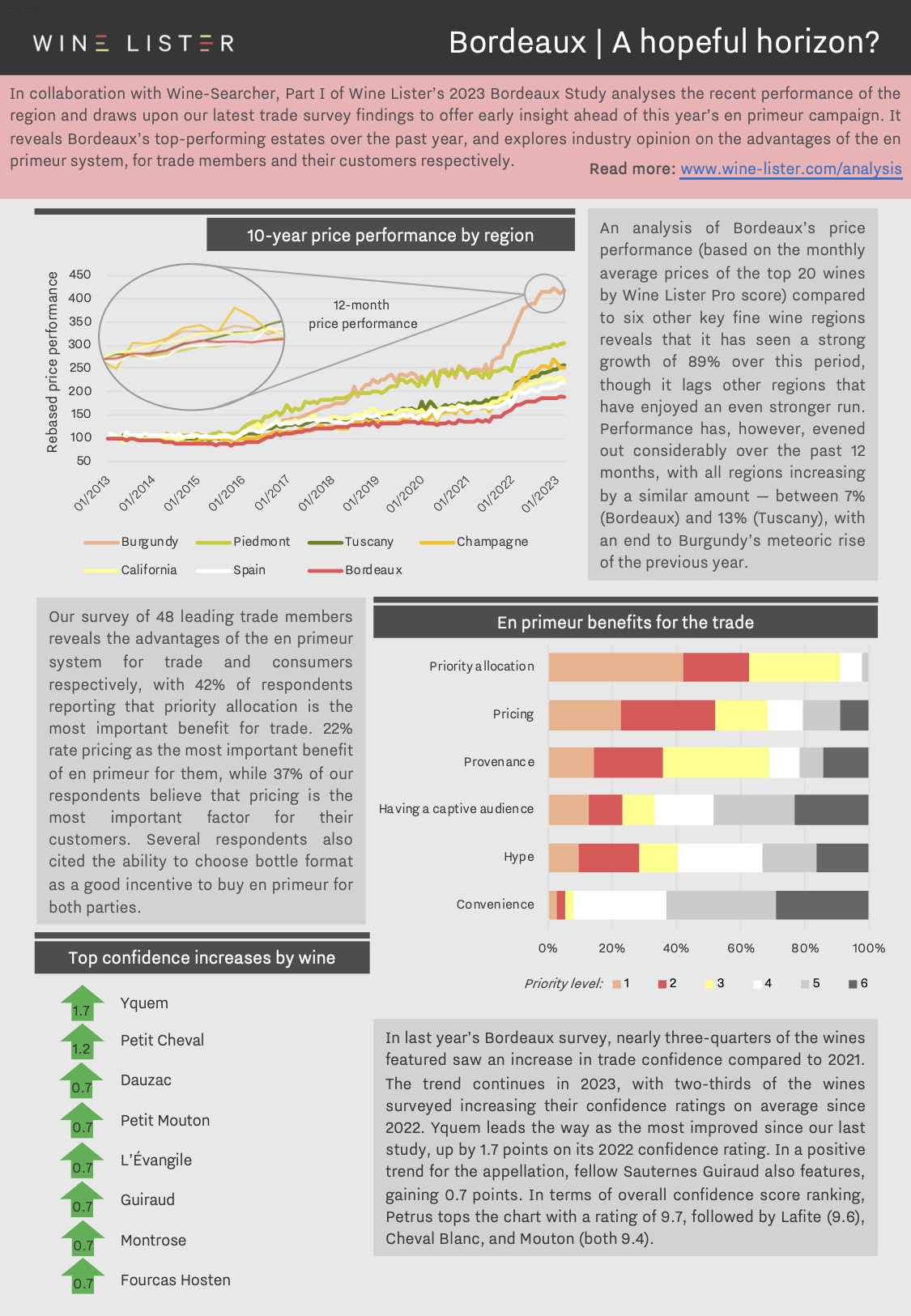

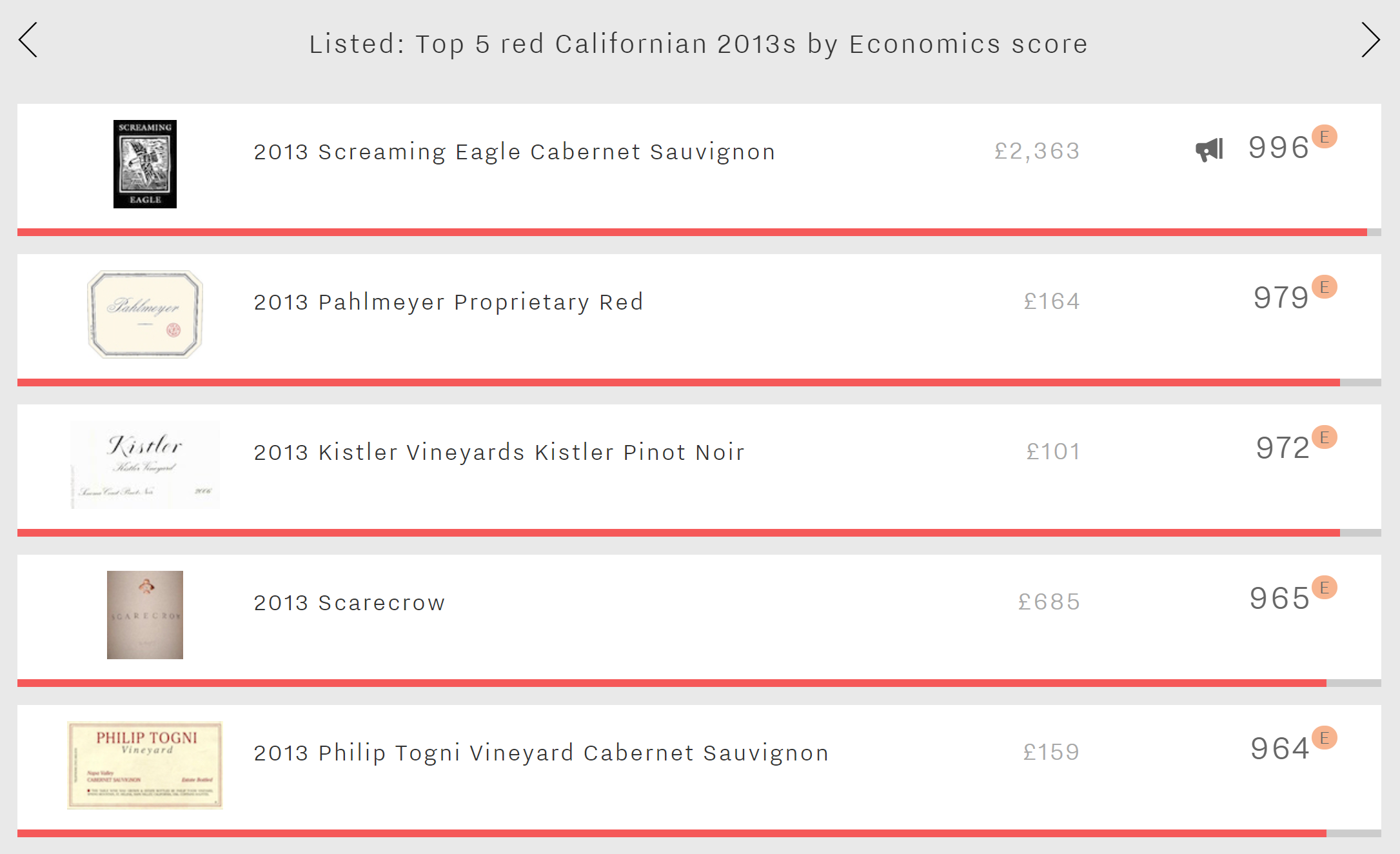

In anticipation of this year’s en primeur releases, Wine Lister has published Part 1 of its annual in-depth Bordeaux Study. In collaboration with Wine-Searcher, our market overview examines the region’s price performance and comparative popularity progression, and examines the wines that have seen the greatest increase in Wine Lister Quality, Brand, and Economic scores over the last year. Drawing upon valuable insight from 48 leading trade survey respondents, the study also identifies which properties have benefited from a rise in trade confidence over the past year, and explores the key benefits of the en primeur system.

Please see our key findings below, or download the study digest in English: Bordeaux Study Digest Part 1 – 2023 ENG or in French: Bordeaux Study Digest – 2023 FR.

The insider’s guide to fine wine trends, and the most compelling wines to watch

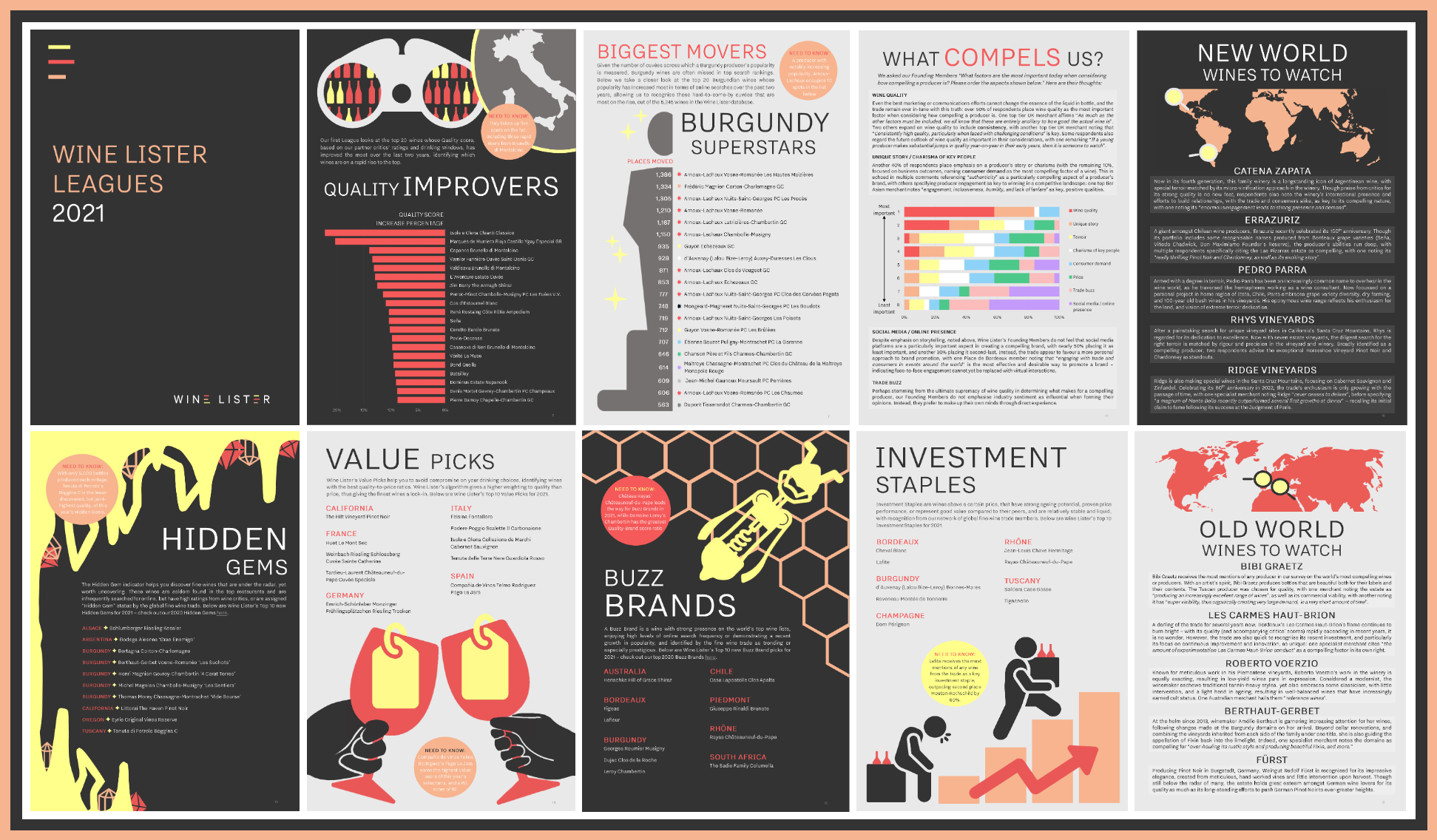

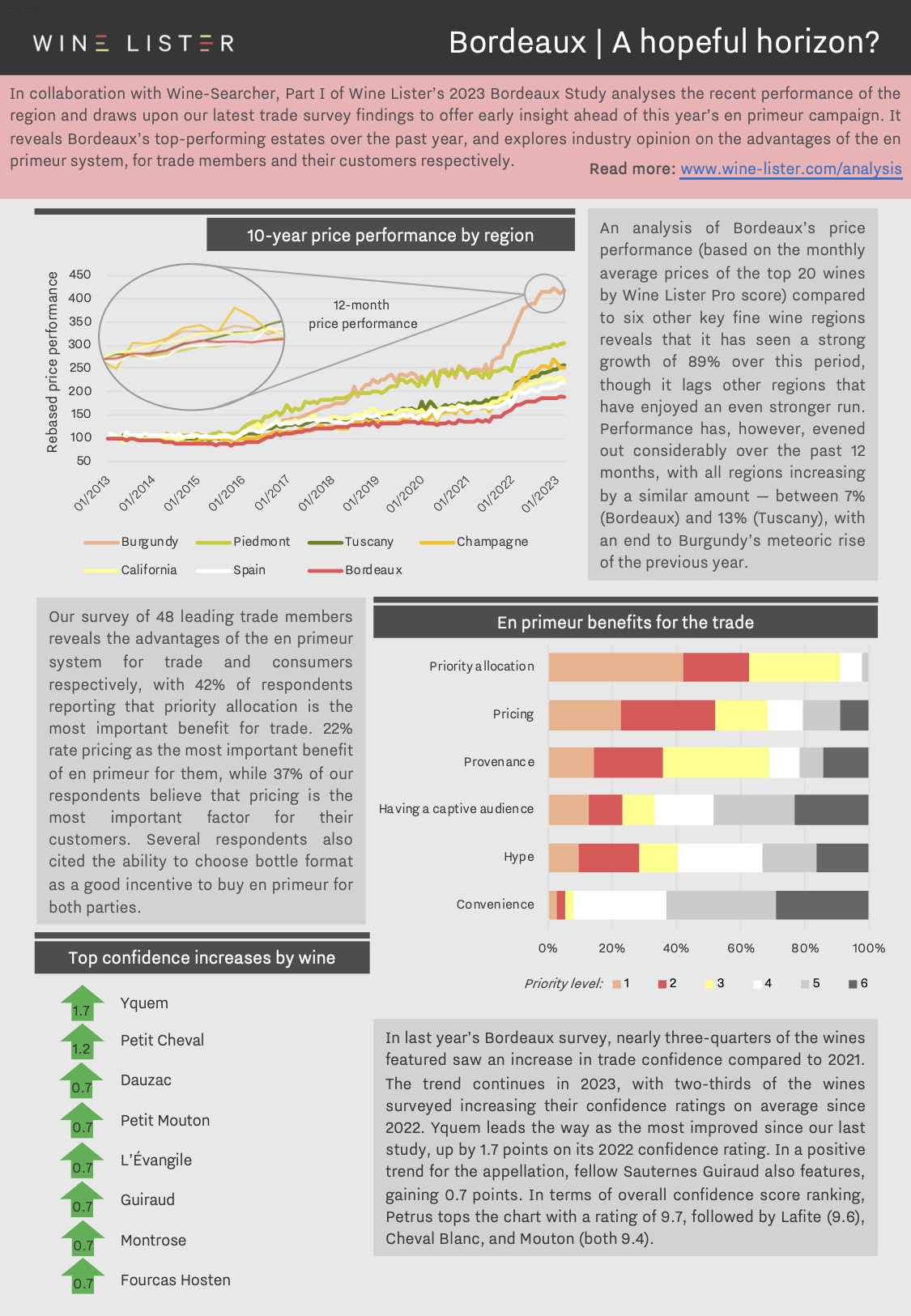

Wine Lister has released its second annual Wine Leagues, celebrating some of the top-performing wines and producers in today’s new and much-diversified fine wine era. Informed by an in-depth trade survey with leading industry figures, the report provides a 360° view of those regions, producers, and wines that have seen strides in quality, popularity, economic promise, and more in 2021.

Wine Lister’s annual in-depth survey sees our expert panel of 47 CEOs, MDs, and wine department heads share their insight on some of the fine wines to have on your radar, as we ask them:

“What are the most compelling wines and producers in the market today?”

Respondents singled out 188 wines and producers collectively, that span no less than 20 major regions. Within the list, our team identifies Bibi Graetz, Les Carmes Haut-Brion, Roberto Voerzio, Berthaut-Gerbet, and Fürst as wines to watch in the Old World, whilst calling out the New World wonders of Catena Zapata, Errazuriz, Pedro Parra, Rhys Vineyards, and Ridge Vineyards.

The report also includes rankings across:

- Biggest quality improvers, which show impressive movement from Italy (occupying five places in the list of the top 20 by Quality score progression), with Isole e Olena Chianti Classico leading the pack

- Best search rank movers, wherein Bordeaux represents eight of the top 20 wines whose popularity has increased most in terms of online searches (including Smith Haut Lafitte, Domaine de Chevalier, Figeac, and Léoville Poyferré)

- Burgundy superstars, focusing on popularity movements from the trade’s darling region – Arnoux-Lachaux features 10 times in the list of top 20 Burgundian wines whose online searches have increased the most over the last two years

- Wine Lister’s top-10 recommendations per Wine Lister Indicator; Hidden Gems, Value Picks, Buzz Brands, and Investment Staples in 2021

For the full analysis, download your free copy of Wine Lister’s 2021 Leagues here.

As 2020 draws to a close, Wine Lister has compiled a report celebrating the top-performing wines and producers within a series of categories over the past year. Using our axes of Quality, Brand, and Economics, and the several factors that constitute these values, we have created seven leagues that paint a panoramic view of some of the world’s best wines, ranked within their areas of excellence.

Wine Lister’s 2020 Leagues include rankings of Quality Consistency (wines that show the smallest standard deviation between Quality scores over the last 20 vintages), and Biggest Movers (wines whose popularity has increased most in terms of online searches over the past year). Our team has also put together its top-10 wines per Wine Lister Indicator, revealing our recommendations for Hidden Gems, Value Picks, Buzz Brands, and Investment Staples.

We end the Leagues with a list of 21 Ultimate MUST BUYs for 2021, compiling a selection of MUST BUY highlights hand-picked by our fine wine experts, that offer an impressive addition to any fine wine portfolio in 2021. These are some of the picks that would feature in Wine Lister’s “fantasy cellar”.

Download your free copy of Wine Lister’s 2020 Leagues here.

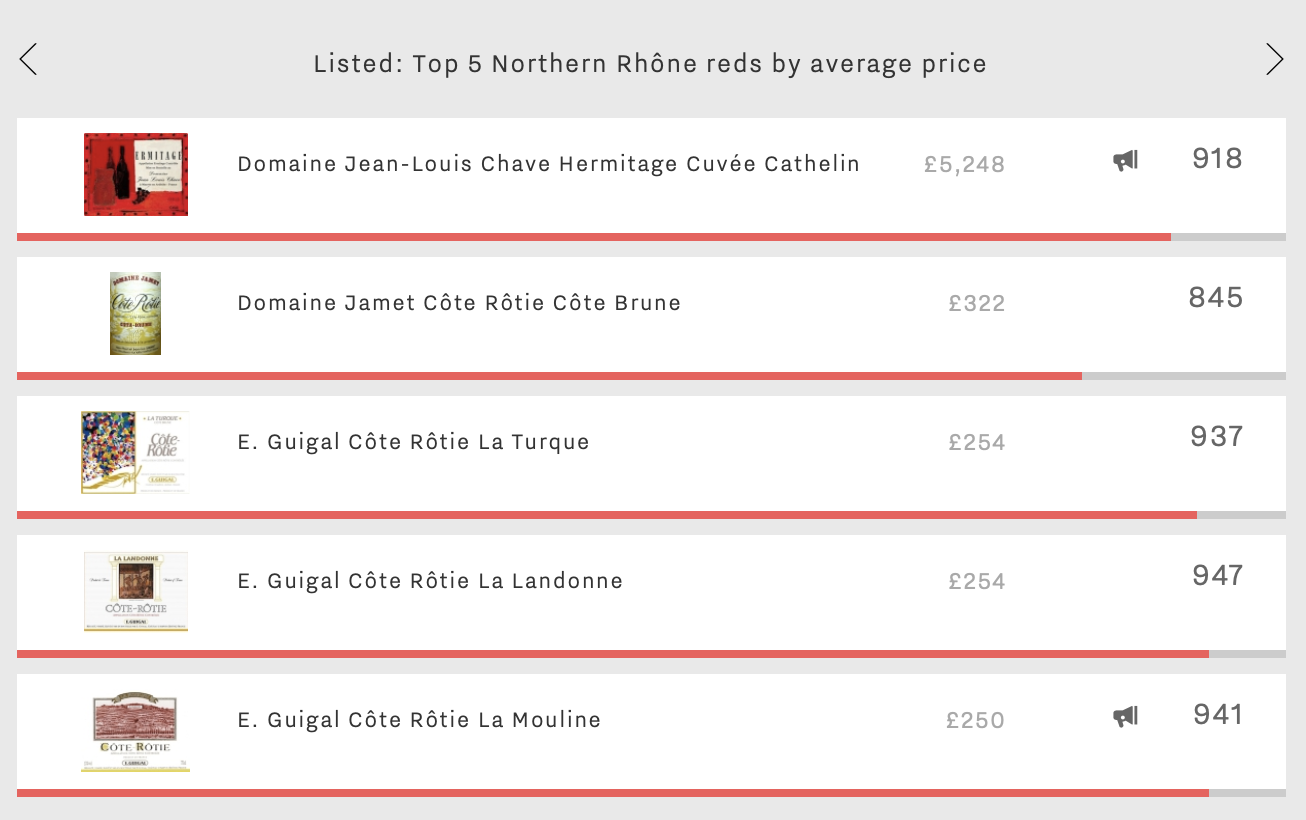

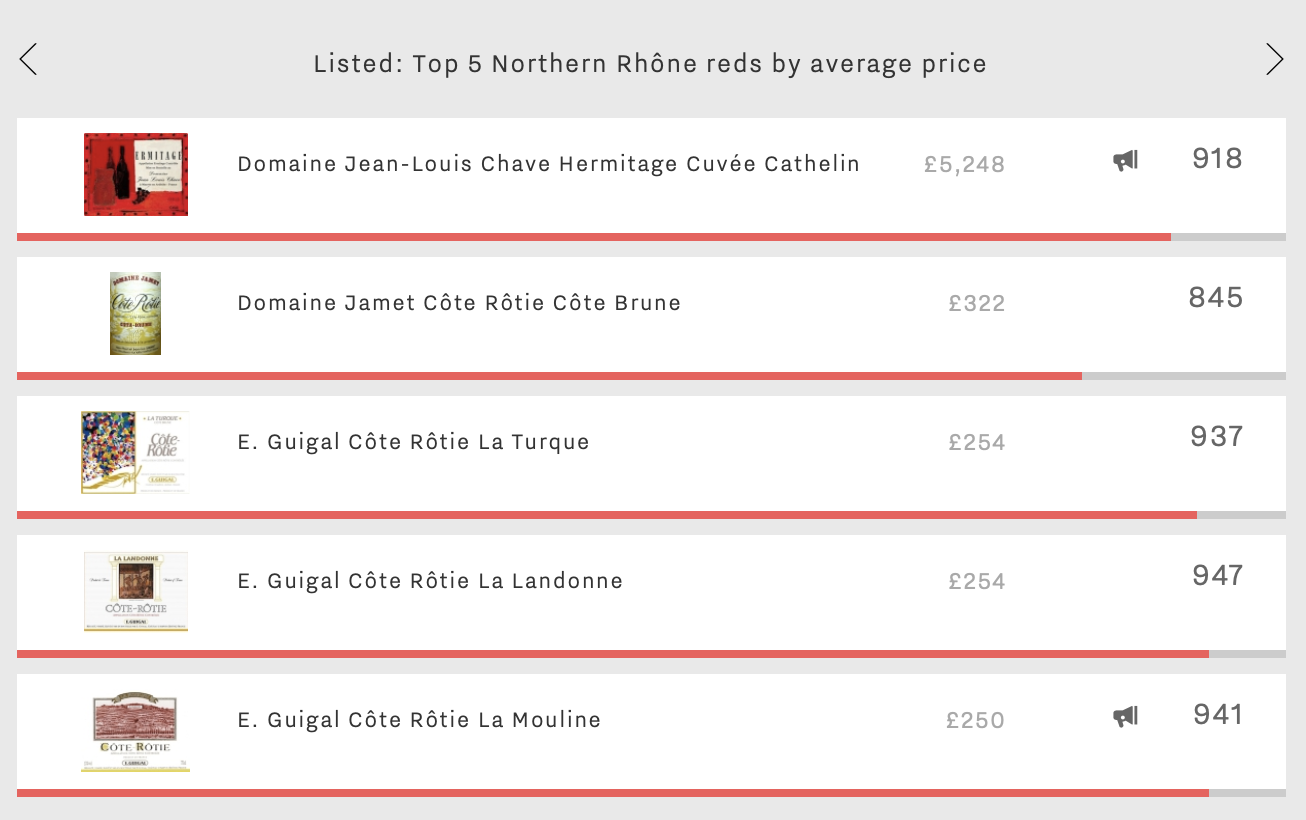

Price and price performance have been hot topics for Wine Lister’s recent blog posts across several regions (Burgundy, Champagne, Tuscany). The Rhône Valley flies further under the radar than these as a region for investment, perhaps in part because its two distinct vineyard areas – North and South – are too different to be cast under the same umbrella. This week’s top five examines the highest prices in the Northern Rhône.

In first place is Domaine Jean-Louis Chave’s Hermitage Cuvée Cathelin. With an average price of £5,248 (per bottle in-bond), it is almost 20 times more expensive than the average of the other four wines in this week’s group. The small quantity of wine, made only in the best years, combined with a Quality score of 977 – the best of this week’s top five – go some way to explaining the four-figure price tag. (Interestingly, the most expensive wine in the Southern Rhône, Buzz Brand Château Rayas’ Chateauneuf-du-Pape, costs an average of £478, or just 9% of the Cuvée Cathelin).

Back in the Northern Rhône, the next of this week’s top five is Domaine Jamet’s Côte Rôtie Côte Brune. Although £4,926 less expensive than this week’s number one, at £322 per bottle in-bond, it actually achieves the best three-year price performance, with a compound annual growth rate (CAGR) of 24.7%. With an average production volume of just 2,400 bottles per year, it is perhaps unsurprising that the wine’s Brand and Economics scores (at 763 and 759 respectively) are lower than its Quality score (946), as it appears in only 8% of the world’s best restaurants, and just three bottles were traded at auction internationally last year.

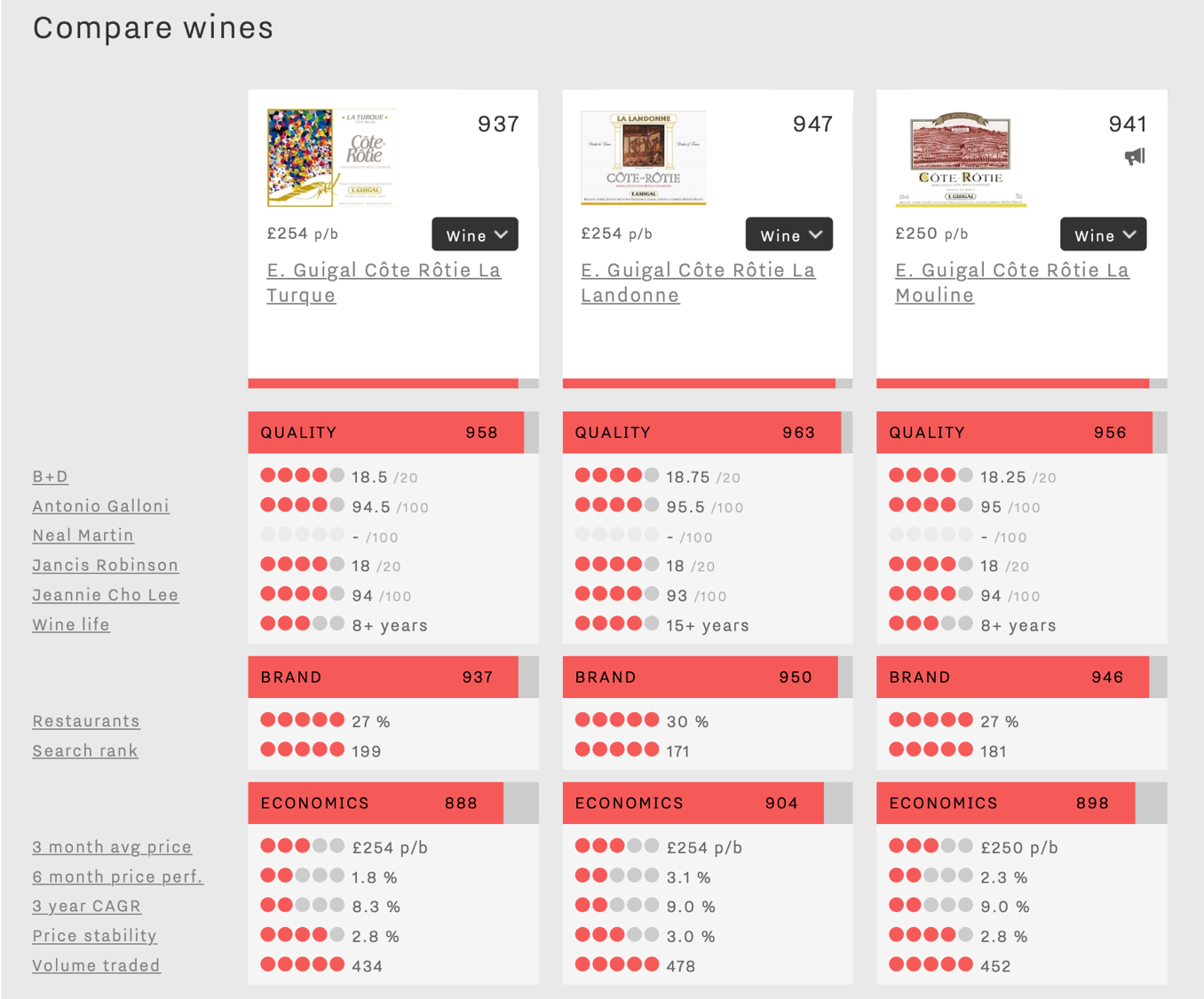

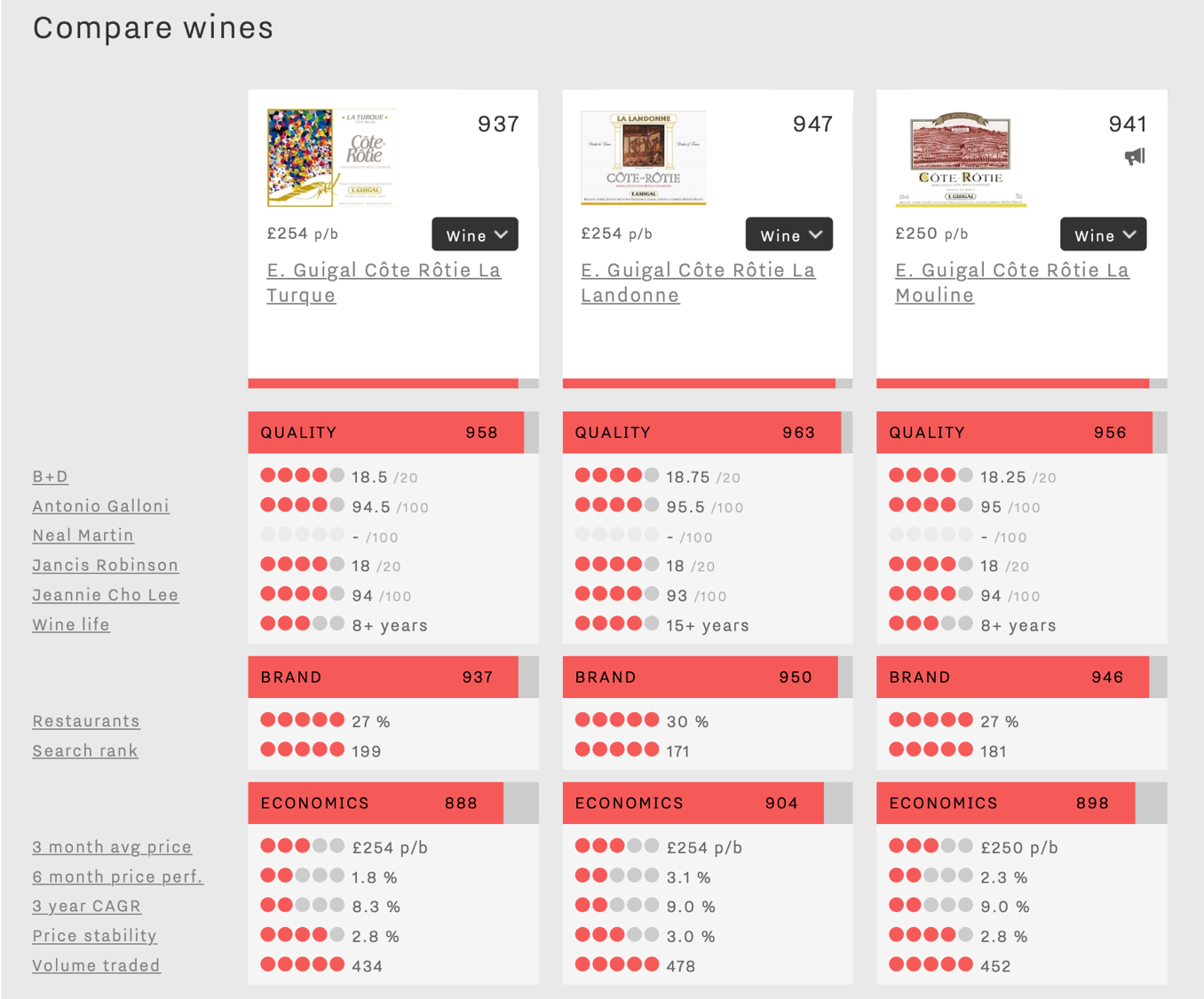

The remaining wines of this week’s top five hail from the same producer, Guigal, and come as a trio affectionately-known to the trade as “La-Las”. Though close together in price, it is interesting to see the subtle differences between these three Côte Rôtie across Wine Lister’s 13 score criteria.

The chart above, created using Wine Lister’s Comparison tool, proves La Turque to be the lowest-scoring of the three overall. It shows slightly less demand with a lower search rank of 199 out of the c.4,000 wines on Wine Lister, whereas its siblings earn more monthly searches on Wine-Searcher. It also under-performs against the other two in economic terms, with lower long- and short-term price growth, and fewer bottles traded annually at auction.

By contrast, La Landonne achieves the top Quality score of 963 (and an average wine life just under twice that of its siblings), the best brand strength, and the highest average number of bottles traded annually at auction (478).

While La Mouline has the lowest average price of the three (£250 per bottle in-bond), it is the only one to earn Wine Lister’s Buzz Brand stamp, and achieves the joint-best three-year price performance with La Landonne – a CAGR of 9%.

With our founder, Ella Lister, just back from tasting the latest releases at Benvenuto Brunello in Montalcino, we thought we’d dig deeper into the data behind the appellation’s top wines. The pyramid system in the region means that most producers make at least three wines: in the middle, a Brunello di Montalcino DOCG Annata (or “vintage”); in good years, a Riserva (with longer ageing but also nearly always the best selection of grapes from the estate); and at the bottom of the pyramid, a Rosso di Montalcino DOC, producing fresher, approachable wines requiring less ageing.

This allows, and indeed encourages, a healthy level of selection in the region. At last weekend’s event, the vintages on show were 2013 Brunello Riserva (excellent), 2014 Brunello Annata (a tricky vintage, with some producers declassifying to Rosso di Montalcino), and Rosso di Montalcino 2017. There is also a trend in the Brunello DOCG towards vineyard-specific crus, such as Casanova di Neri’s Tenuta Nuova or Il Marroneto’s Madonna delle Grazie, both of which feature in this week’s top five: top Brunellos by Economics score.

When examining the economic profile of Brunello wines, we see that Riservas tend to have higher Economics scores than Annatas, in line with their higher Quality scores. The best-performing Brunello by Economics score is Biondi Santi’s Brunello di Montalcino Riserva, with a score of 902. It earns the number one spot of this week’s top five with the highest price at £315 per bottle in-bond, and annual auction trading volumes of 458 bottles. The wine also outperforms the rest of the group for both Brand and Quality scores (904 and 938 respectively).

While Riservas are strong economically speaking, Annatas often have stronger Brand scores than their longer-aged counterparts, being produced in larger quantities and thus achieving greater visibility. In second place is Valdicava’s Brunello di Montalcino Madonna Piano Riserva, with an Economics score of 892, whereas its straight Brunello has a Brand score 57 points above its “big” brother, an example of the potential branding conundrum surrounding Brunello and other parts of Tuscany with a Riserva denomination. Nonetheless, the Riserva shows better price performance, with a compound annual growth rate (CAGR) of 15.2%, and an average of 257 bottles sold at auction annually.

Specific “crus” can also perform better than their straight Brunello Annatas in economic terms. In third place is Casanova di Neri’s Brunello di Montalcino Tenuta Nuova with an Economics score of 865. Despite having the lowest Quality score (841) and lowest price (£70) of the group, it earns this week’s second-highest Brand score (887).

In fourth place is Il Marroneto’s Brunello di Montalcino Madonna delle Grazie, the winery’s top cru, produced from grapes grown around the historic chestnut flour store house, and below the church by the same name. It has an Economics score of 847, benefitting from by far the best long-term price performance of this week’s top five, with a compound annual growth rate (CAGR) of 22.9%. Moreover, it sits just one point shy of this week’s number one in Quality terms (937) at 40% of the price – £130.

Rounding out the group is Poggio di Sotto’s Brunello, with an Economics score of 815.

While Super-Tuscans have been recognised for their investment potential for some time, Brunello still sits rather in the shadow of its Bordeaux-blend brothers. In Wine Lister’s first Tuscany market study, conducted in 2017, Brunello held nine places out of the top 25 Tuscan Economics scores. Today that number has increased to 14, as Brunello – Montalcino’s very own, highly ageworthy selection of the Sangiovese grape – goes from strength to strength.

At the end of last year, Wine Lister released its first ever Champagne report. As well as exploring a handful of key trends as identified by Wine Lister’s Founding Members, the report also sheds light on top Champagnes as compared to other regions in terms of economic performance.

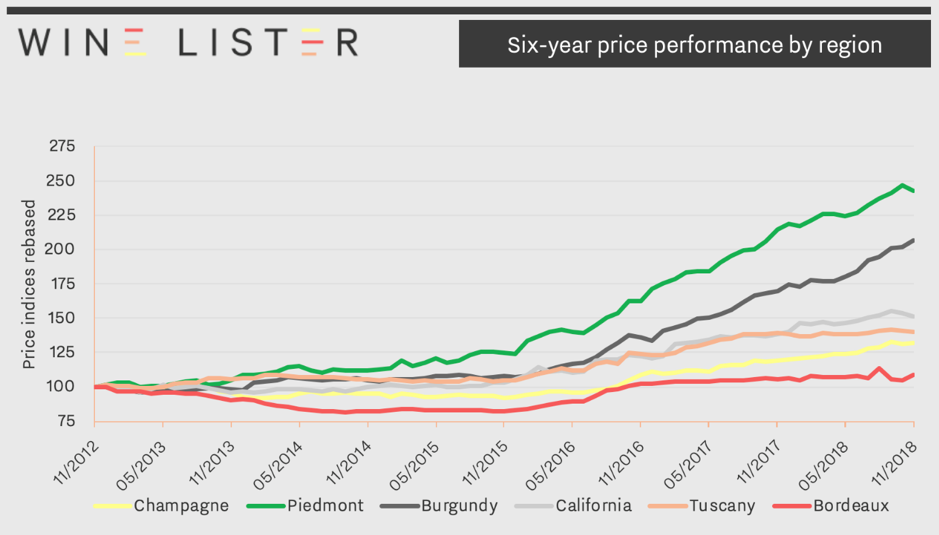

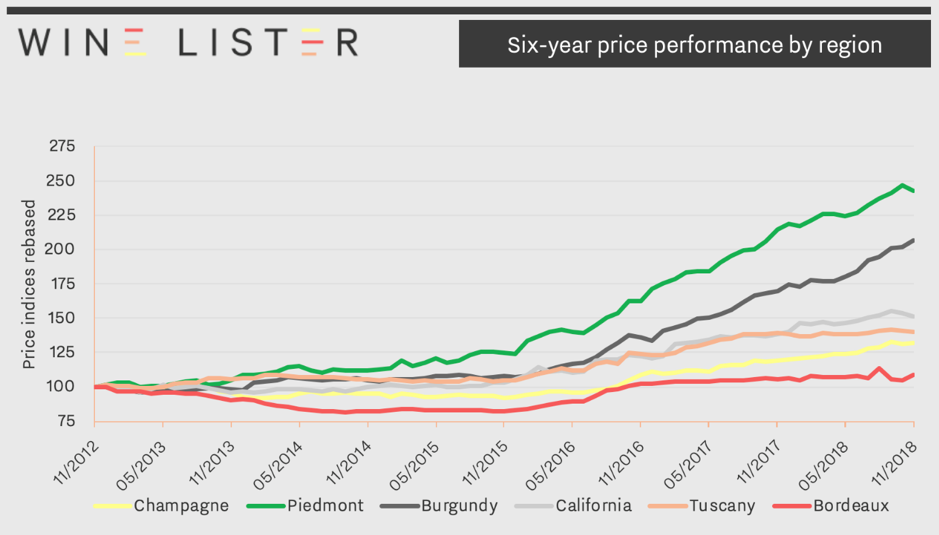

Prices of the top Champagnes (Dom Pérignon, Krug Vintage, Louis Roederer Cristal, Salon Le Mesnil and Dom Pérignon Rosé) have seen a compound annual growth rate (CAGR) of 4.8% over the last six years. Relative to other major fine wine regions, this long-term growth is slow, as shown in the chart below, but also stable.

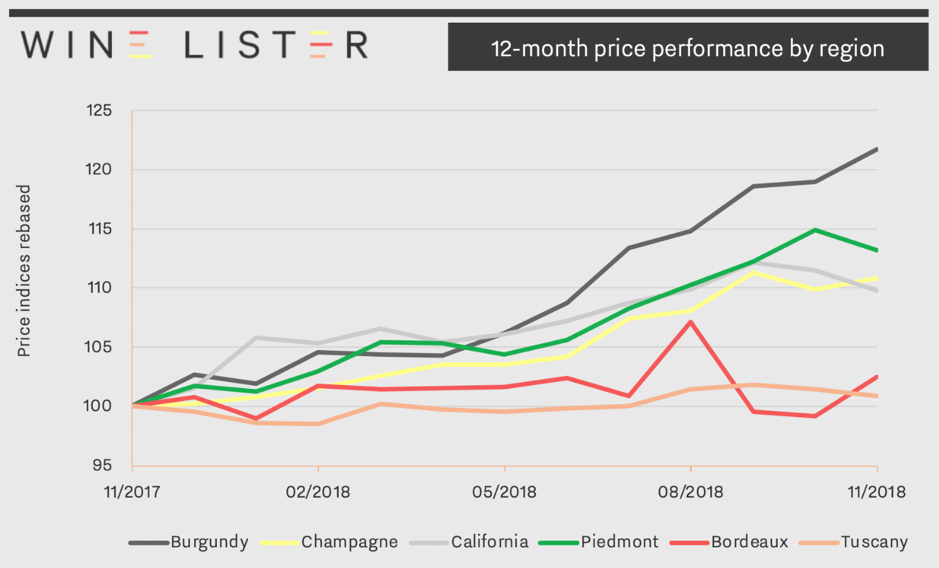

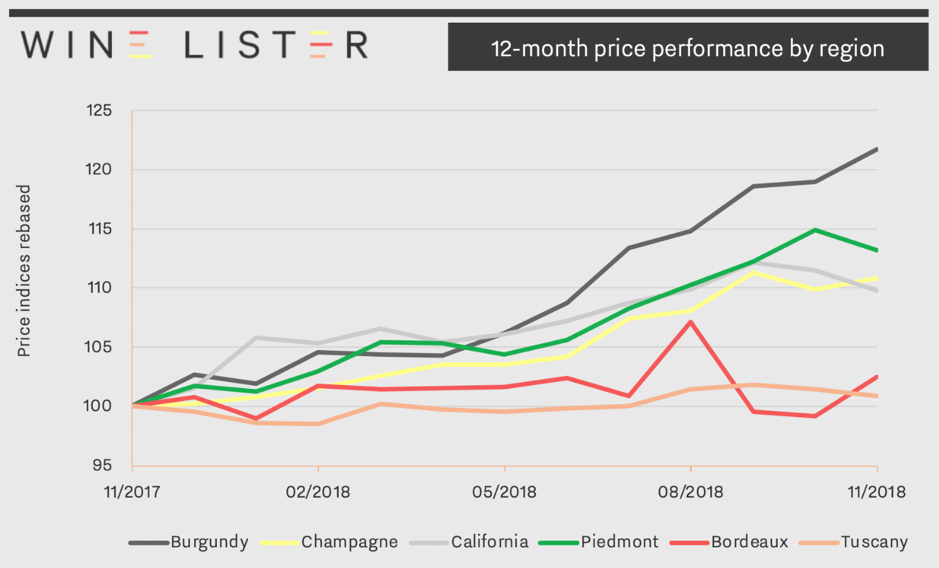

One notable advantage of Champagne as an investment option it its low volatility. Indeed, Champagne prices show a much better level of stability in the secondary market (deviating by just 2.5% from the average price over 12 months) than any other major fine wine region. Slow and steady wins the race.

Moreover, recent price performance shows Champagne accelerating. Prices of top Champagnes are starting to grow at a faster rate than their counterparts in California, Bordeaux, and Tuscany, beaten only by Piedmont and the seemingly unmatchable Burgundy. Indeed, as of December 2018 top Champagnes had seen a 12-month price growth of 11%. The region’s potential for long-term investment is already being acknowledged by the trade, with one of our Founding Members, a top tier UK merchant commenting “Champagne (Salon especially) has experienced solid growth and has become a reliable investment for collectors”.

Salon Le Mesnil is the number one performing Champagne for price performance, with an Economics score of 978, closely followed by Krug’s Clos d’Ambonnay (962). Krug also tops the Champagne Economics charts with its Clos du Mesnil, Brut Vintage, and Collection. Interestingly the only NV Champagne to appear within the top 10 Champagnes for Economics is grower Jacques Selosse’s Brut Initial, with an Economics score of 911. Its price, £106 (per bottle in-bond), is a mere 18% of the average price of the other nine top Champagnes by Economics score.

To read more key findings from our in-depth Champagne study, read the free summary here. (The key findings and full study are also available to download in French on the Analysis page.)

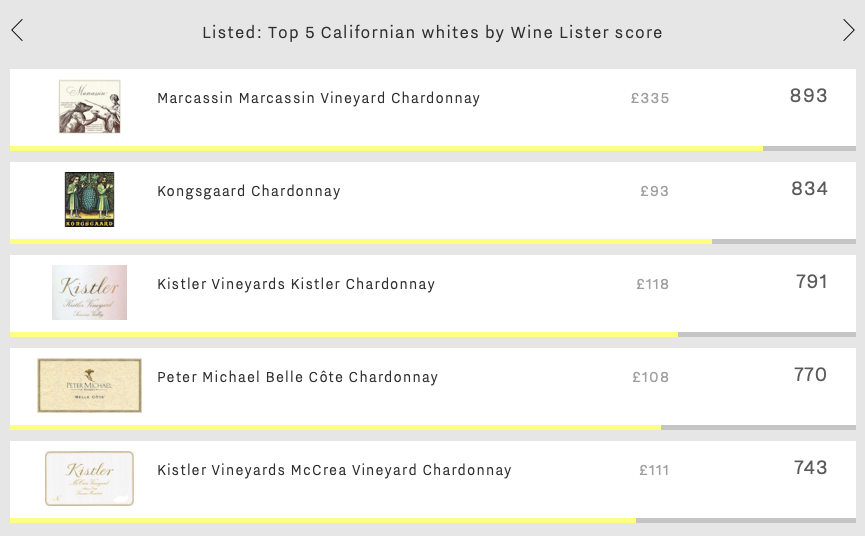

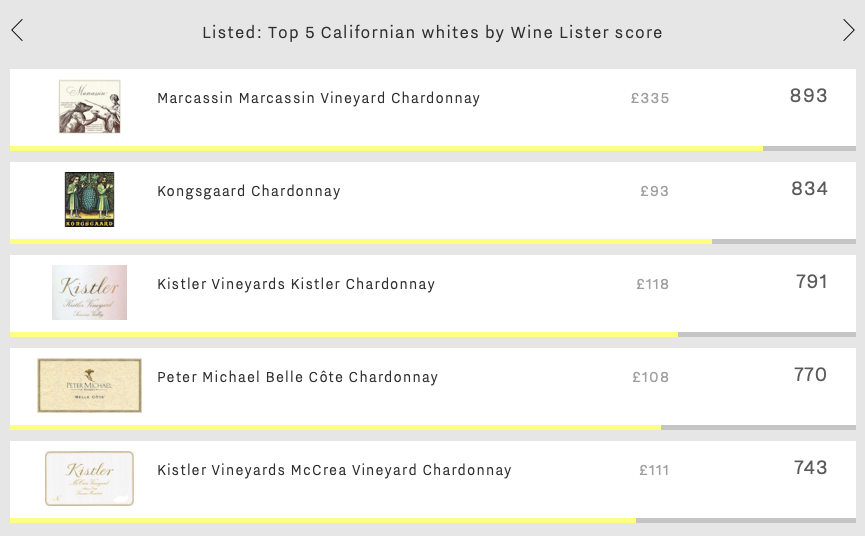

With Christmas and New Year celebrations now behind us, the first Listed blog of 2019 has us dreaming of warmer climes. As an antidote to the January blues, we suggest a dose of California sun in the form of Chardonnay from Sonoma and/or Napa Counties. Below we examine the top five whites from the Golden State by Wine Lister score.

In the context of Chardonnay world-wide, it is worth glancing at regional differences to place the Californian scores in context. While the top five white Burgundies by Wine Lister score outperform their American counterparts by 147 points (953 for Burgundy vs. 806 for California), the Burgundian average price is over 15 times higher (£2,383 vs. £153).

The first of this week’s top five is Marcassin Vineyard’s Chardonnay with a score of 893. Though it beats the other four wines in all three Wine Lister score categories (Quality 927; Brand 843; Economics 903), its Economics score sits 123 points above the next best Economics performer. This is thanks to achieving the highest market price of £335 per bottle (in-bond), and the largest volume of bottles traded in the past four quarters (353).

In second place is Kongsgaard Chardonnay with a score of 834. At vintage level it actually achieves the highest Quality score of all wines in the group – the 2013 earns 966 points, thanks to a score of 95+ from Wine Lister partner critic Antonio Galloni, who calls it “a real knock-out”. This is all the more impressive considering the wine’s average price of £93 per bottle in-bond – just over half the average of the group’s other four wines combined (£168). Given this price to quality ratio, it is perhaps unsurprising that Kongsgaard has the strongest restaurant presence of this week’s top five, featuring in 15% of the world’s best.

Next in this week’s top five is the first of two wines from Kistler Vineyards. Its straight Chardonnay and McCrea Vineyard Chardonnay earn 791 and 743 points respectively, placing them third and fifth. The straight Chardonnay’s Quality score of 892 sits just two points under the quality achieved by Kongsgaard, however its overall score is balanced by a much lower Economics score of 640. This is due to a recent price drop, resulting in short-term price performance of -10.3%. The performance of its sibling from McCrea Vineyard is quite the opposite, with the best short-term price performance of the group (7.7%), and the second-highest Economics score of this week’s top five (780).

Sandwiched between the two Kistler wines in fourth place is Peter Michael’s Belle Côte Chardonnay with an in-bond price of £108 per bottle, and a Wine Lister score of 770.

Wine Lister’s three-pronged rating system, which measures a wine’s Quality, Brand strength, and Economic performance, gives a uniquely holistic outlook on the world’s finest wines. Wine Lister’s Economics score comes courtesy of data partnerships with Wine Owners and Wine Market Journal, the former supplying price data and the latter auction trading volumes from the world’s major fine wine auction houses.

Thanks to an expansion of the data we receive from both Wine Owners and Wine Market Journal, we have recently added Economics scores, and therefore overall Wine Lister scores, to c.1,250 wines on Wine Lister.

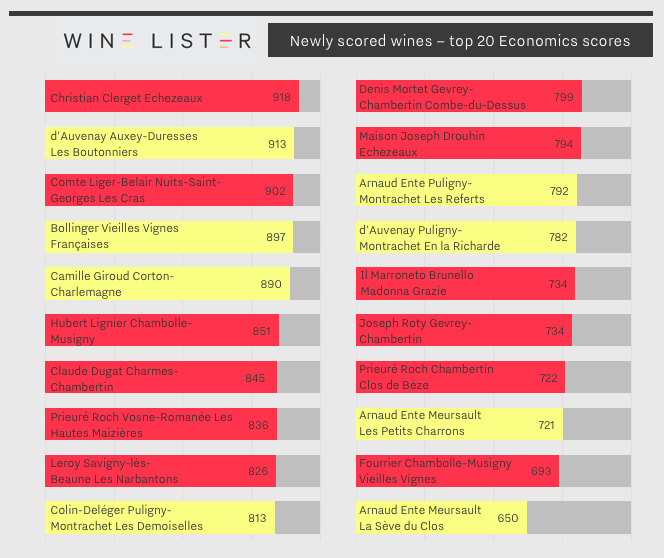

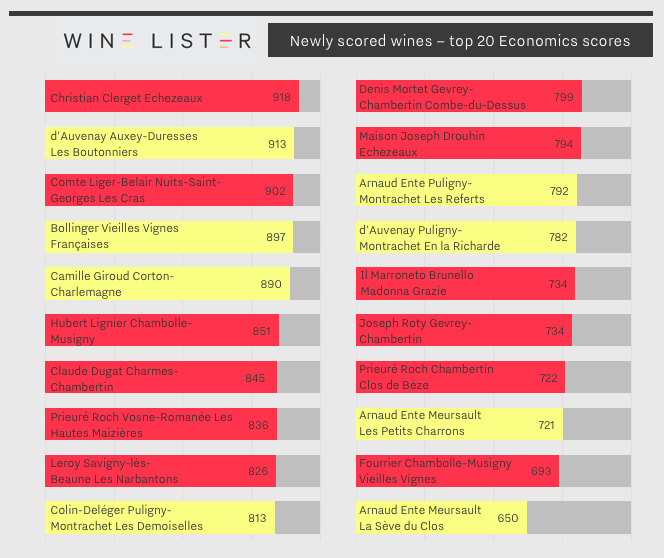

Having examined the top overall scorers last week, below we look at the top 20 highest Economics scorers of this new batch.

Whilst Burgundy represents 58% of wines newly-armed with full Wine Lister scores, the region claims 90% of the group’s top 20 Economics scores. Ten of these hail from the Côte de Nuits, earning an impressive average Economics score of 809, and including the best Economics performer of these newly-scored wines, Christian Clerget’s Echezeaux (918). Clerget’s Echezeaux has traded 48 bottles at auction over the past year, just over 1% of its 4,000-bottle annual production volume.

Next in line from the Côte de Nuits – and the only Nuits-Saint-Georges in the top 20 – is Les Cras from Domaine du Comte Liger-Belair, which takes the third-best Economics score of this new batch (902), despite having traded just 14 bottles at auction over the past 12 months. It does so thanks to excellent short and long-term price performance. It has added 20.2% to its price over the past six months and recorded a three-year compound annual growth rate (CAGR) of 25.4%. It also has a high average price of £394.

The Côte de Beaune features eight times, with Domaine d’Auvenay’s Auxey-Duresses Les Boutonniers coming second overall with a score of 913. However, Puligny-Montrachet takes the lion’s share of the Côte de Beaune’s spots. The first is Colin-Deléger Les Demoiselles with a score of 813, its strong economic performance is the result of a three-year CAGR of 24.4%.

While Arnaud Ente is represented in Puligny-Montrachet by Les Referts, which achieves an Economics score of 792, the domaine features more prominently in Meursault, taking two spots with Les Petits Charrons (721) and La Sève du Clos (650). The latter also records the highest Quality score of any Burgundy in this group (952).

Interestingly, the number one overall scorer of the 20 is in fact one of only two non-Burgundian wines to feature. Champagne Bollinger Vieilles Vignes Françaises achieves a Wine Lister score of 923, at least 98 points ahead of any of the other 19 wines featured here. Its Economics score of 897 is thanks to a three-month average price of £712, a three-year CAGR of 13.8%, and having traded 128 bottles at auction over the past year.

Other wines from the newly-scored list to feature in the top 20 Economics scores are: Domaine Leroy Savigny-lès-Beaune Premier Cru Les Narbantons, Camille Giroud Corton-Charlemagne Grand Cru, Maison Joseph Drouhin Echezeaux Grand Cru, Domaine Prieuré Roch Vosne-Romanée Les Hautes Maizières, Domaine Claude Dugat Charmes-Chambertin Grand Cru, Domaine Hubert Lignier Chambolle-Musigny, Domaine Prieuré Roch Chambertin Clos de Bèze Grand Cru, Domaine Joseph Roty Gevrey-Chambertin, Domaine Colin-Deléger Puligny-Montrachet Premier Cru Les Demoiselles, Il Marroneto di Mori Alessandro Brunello di Montalcino Madonna Grazie, Domaine Fourrier Chambolle-Musigny Vieilles Vignes, and Domaine Denis Mortet Gevrey-Chambertin Combe-du-Dessus.

While Bordeaux may be best-known for its red blends, many a left-bank cru classé also produces a dry white, particularly in Pessac-Léognan. This week we examine the five most expensive dry white Bordeaux wines.

Whilst each of the five frequently stands in the shadow of their red counterpart (or flagship sweet white in the case of Y d’Yquem), their average price is in fact 28% higher (£260 vs £203). This is presumably due to the dry whites being produced in considerably smaller volumes than their red/sweet white counterpart (just 10% on average).

Leading the way is Haut-Brion Blanc at a cool £596 per bottle in-bond, 78% more expensive than Bordeaux’s second-most expensive dry white – its neighbour La Mission Haut-Brion Blanc – and well over three times the average price of the remaining wines in this week’s top five. Whilst its very low production, almost identical to La Mission Haut-Brion Blanc’s and thus the joint-lowest of the five, undoubtedly plays a part in its high price, the fact that it achieves the group’s best Quality and Economics scores (923 and 890 respectively) will also be a contributing factor. Aside from high ratings from each of Wine Lister’s partner critics, its excellent Quality score is also thanks to an average wine life of 10.3 years – the longest of all dry Bordeaux whites on Wine Lister. Indeed, the 2014 vintage, Haut Brion Blanc’s best ever with a Quality score of 975, “should drink well for years and perhaps even decades to come”, according to Antonio Galloni.

Next comes La Mission Haut-Brion Blanc at £331 per bottle in-bond. Relabelled in 2009, this was formerly Laville Haut-Brion. The 2011 is its best vintage since its relabelling, achieving an outstanding Quality score of 974, with Jancis Robinson – who tends to award it her highest scores of the group – calling it “one of the best Bordeaux 2011s”.

In third place is Margaux Pavillon Blanc (£155 per bottle in-bond). Whilst still priced considerably below the whites from Haut-Brion and La Mission Haut-Brion, it is closing the gap, courtesy of vastly stronger growth rates, with a three-year compound annual growth rate of 18% and having added 6% to its value since May. Over both the long and short-term, the two Pessac-Léognan whites have each grown at under half the rate of Pavillon Blanc.

Y d’Yquem is Bordeaux’s fourth most-expensive dry white, at an average price of £119 per bottle in-bond. Boosted by the immense clout of the château’s flagship sweet wine – which enjoys the joint-best Brand score of any wine on Wine Lister (999) – it has the strongest brand of this week’s top five (894). It does so thanks to featuring in the greatest number of the world’s best restaurants of the group (15%), just managing to nudge ahead of Haut-Brion Blanc (12%).

We return to Pessac-Léognan for Bordeaux’s fifth most-expensive dry white, Pape Clément Blanc (£100 per bottle in-bond). The 2017 was its best ever vintage, achieving an excellent Quality score of 903. Whilst it wasn’t quite able to match the scores of Haut-Brion and La Mission Haut-Brion (931 and 939 respectively), it represents considerably better value. At £100 per bottle, it is around one fifth the price of its Pessac-Léognan rivals.

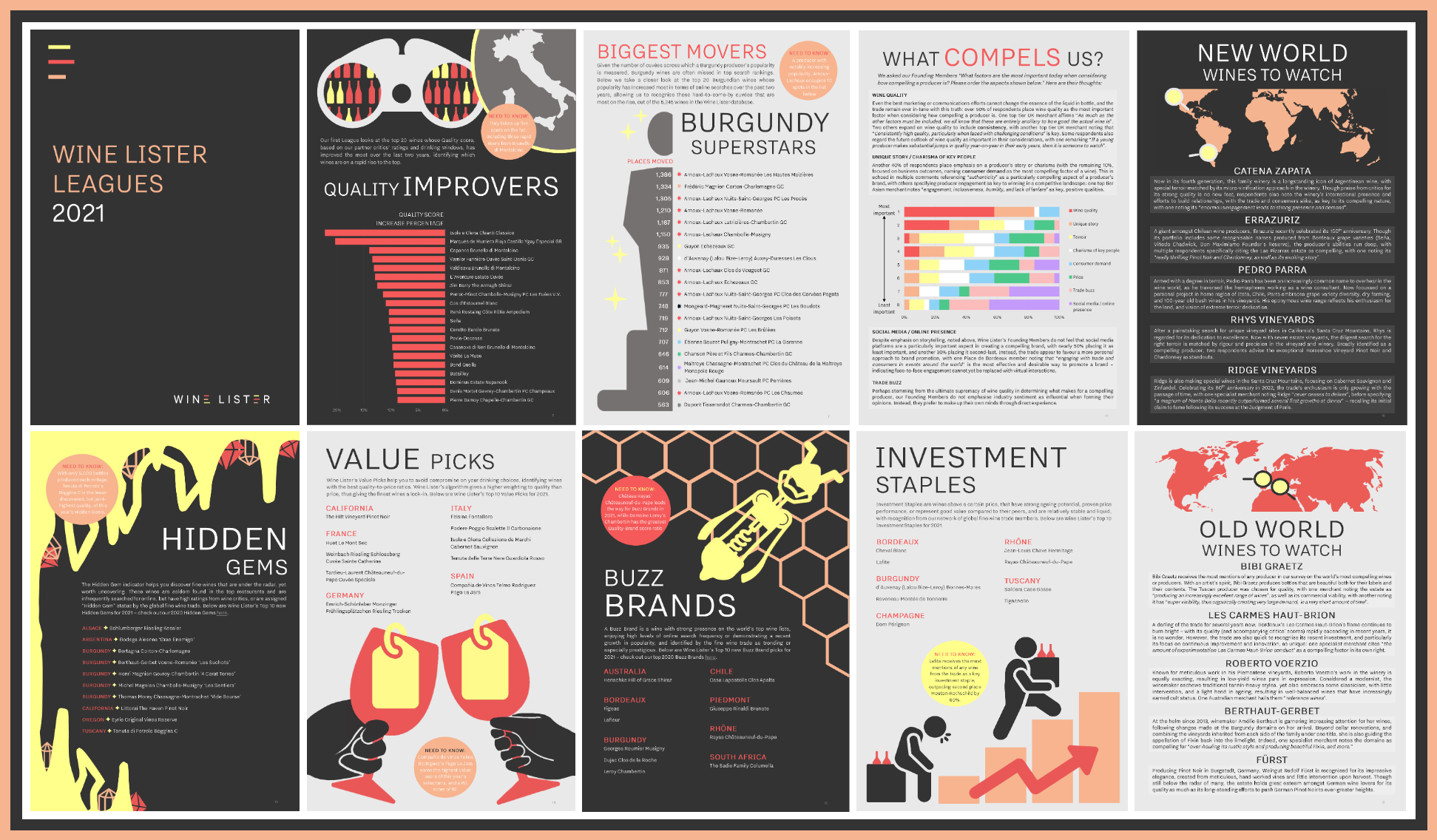

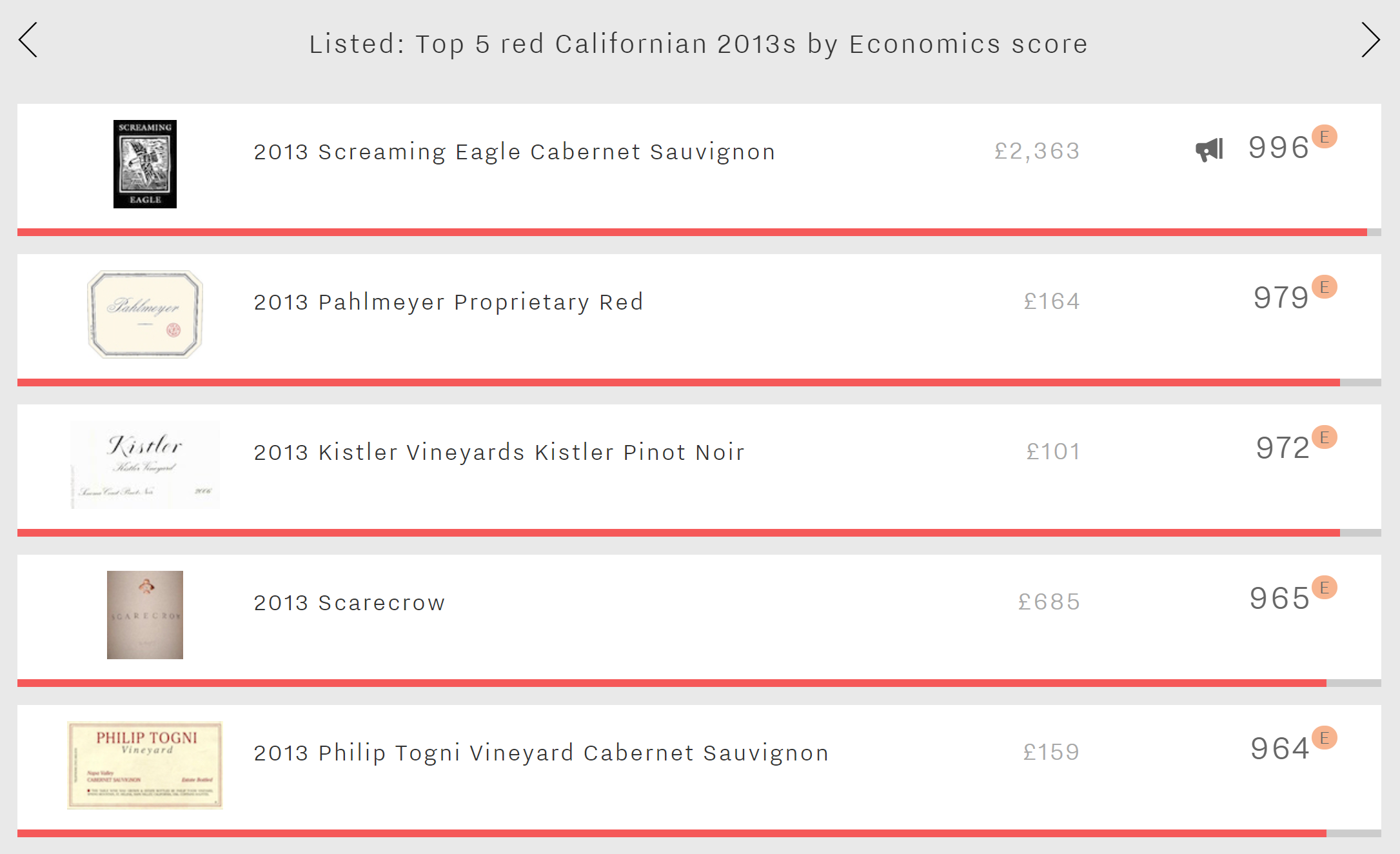

While wines made in The Golden State are not as affected by vintage variation as their European counterparts, the 2013 vintage was for California as close to perfect as they come. The long, hot summer led to Cabernet Sauvignons with extreme fruit concentration and firm structure – a recipe for long-term cellaring. The vintage’s economic credentials seem equally promising, with Economics scores of the top five Californian reds from the 2013 vintage outperforming their respective wine-level average by 114 points (averaging 979 in 2013 versus 864 across all vintages).

Perhaps unsurprisingly, the number one spot is taken by Screaming Eagle Cabernet Sauvignon. At 996, its Economics score is not only the highest of this week’s top five, but of all 2013s on Wine Lister (matched only by 2013 DRC Richebourg). It is also by far the most expensive of the five at £2,363 per bottle – over twice as high as the price of the other four combined. Screaming Eagle’s “mailing list” sales model teamed with tiny production quantities (7,800 bottles per annum on average) means that demand for this wine consistently outweighs supply. This could explain the wine’s strong presence on the secondary market, with 855 bottles traded at auction over the last 12 months (according to figures collated by the Wine Market Journal).

In second place is 2013 Pahlmeyer Proprietary Red. Interestingly, it has the lowest Quality score of the group. Indeed, its 2013 Quality score is 74 points lower than Pahlmeyer’s average (848). Contrastingly, the 2013 vintage receives its best ever Economics score of 979, boosted by a six-month price performance of 18.7%.

The third spot of this week’s top five is occupied by the only Pinot Noir of the group, Kistler Vineyards Pinot Noir, with an Economics score of 972. It is the only wine of the five to have been released before 2016, and thus the only one with a three-year compound annual growth rate (28.2%), whereas Economics scores for the other four 2013s are based upon price performance over the short term only. Kistler’s place in the top five 2013 Californian reds by Economics score is impressive, given its lower price point (£101 per bottle, compared with an £843 average for the other four wines).

The penultimate wine of this week’s top five is 2013 Scarecrow. Alongside its best ever Quality score (987), the 2013 vintage achieves an Economics score of 965, helped by the second-highest three-month average price (£663) and the best price stability of the group (with standard deviation of just 4.1% over the last 12 months).

Last but by no means least is Philip Togni Vineyard Cabernet Sauvignon, with an Economics score of 964. Though fifth for economics, it is number one for Quality, thanks to a 100-point score from Wine Lister partner critic, Antonio Galloni, who calls it “a majestic, towering wine… one of the wines of the vintage”.