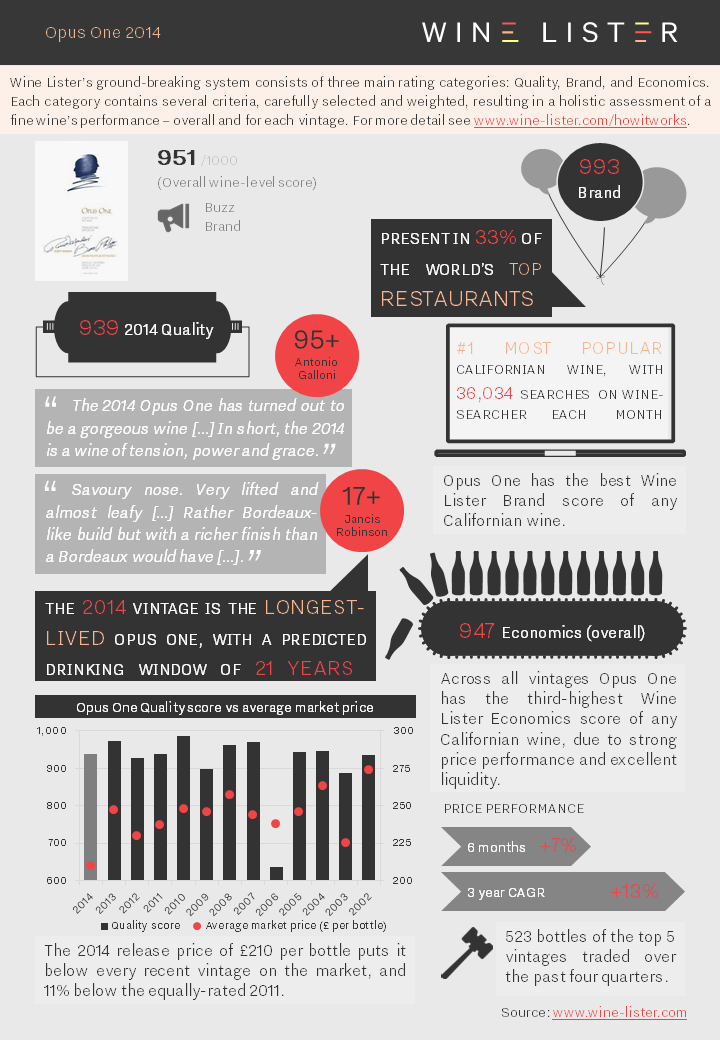

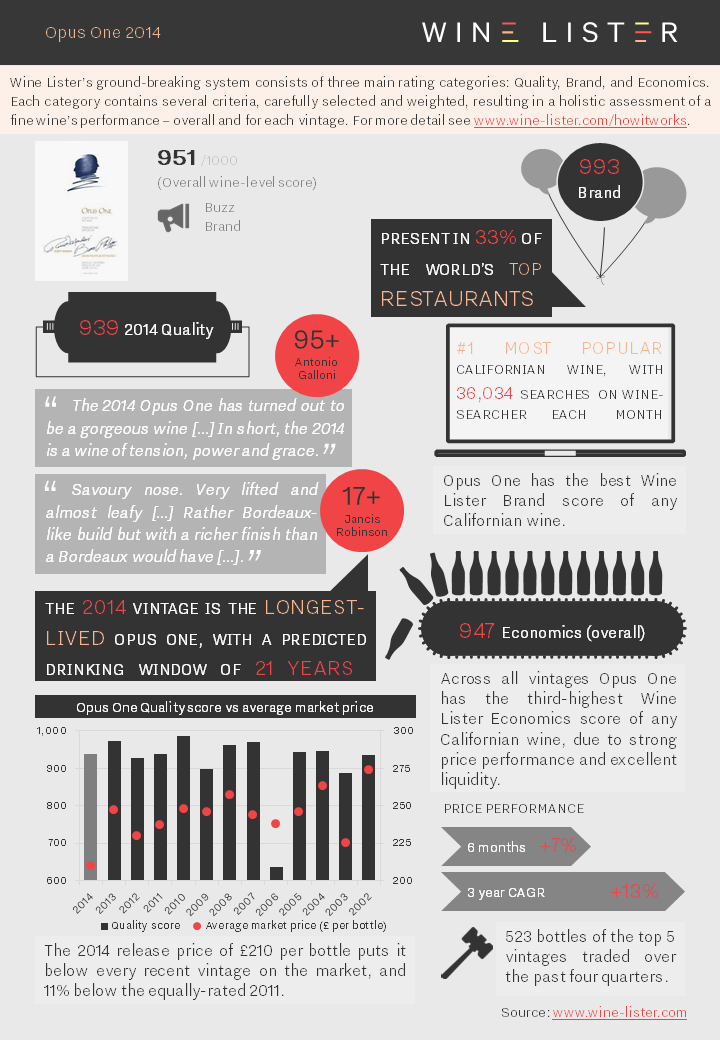

Opus One 2014 was released today at £210 per bottle. Described as a “gorgeous wine” by Wine Lister partner critic Antonio Galloni, we summarise all the key information below:

You can download the slide here: Wine Lister Factsheet Opus One 2014

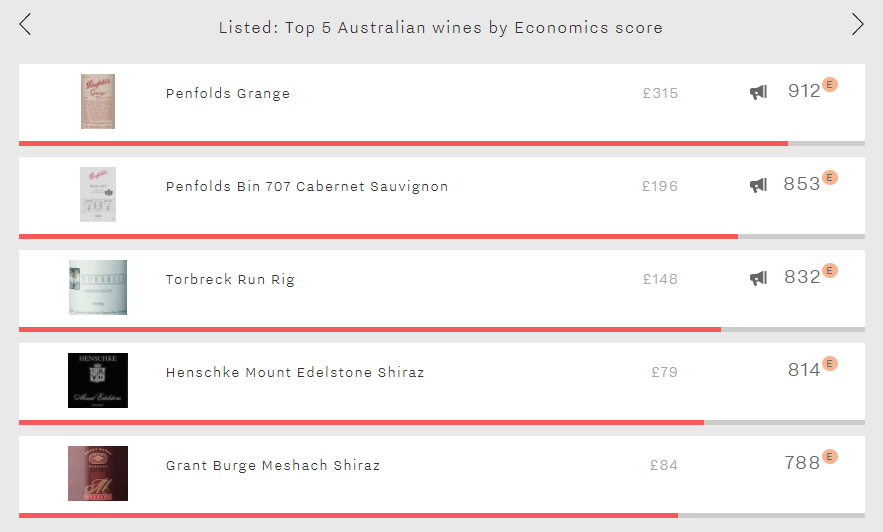

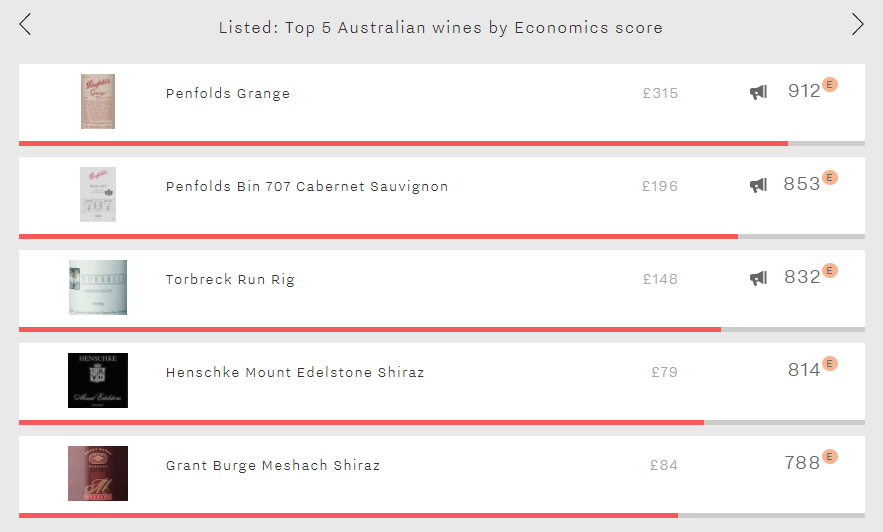

Wine Lister’s Economics scores are based on a variety of price and liquidity metrics, including a wine’s three-month average bottle price, six-month price performance, and three-year CAGR. This week’s newly updated Listed section features the five top-scoring Australian wines by Economics score. Noticeably, all are red, and red wines outperform for Australia in this category (the top white, Leeuwin Estate Art Series Chardonnay, has an Economics score of 498, its top traded vintages only trading 10 bottles in auction over the past year). While there is quite a difference in points between the first and fifth wine on today’s list, all are considered very strong (750–900) or among the strongest (900+) wines in Wine Lister’s database.

Several of Australia’s best-known producers feature in our top five, including Penfolds, which accounts for the top two entrants: Penfolds Grange and Penfolds Bin 707 Cabernet Sauvignon. While both wines excel on three-month average bottle price and three-year CAGR, Penfolds Grange is particularly strong for liquidity, its top five trading vintages having traded 626 bottles over the past four quarters.

The third wine on this list, Torbreck Run Rig, experiences good trading volumes but has the lowest three-year CAGR of the five (3.27%). Fourth place goes to Henschke Mount Edelstone Shiraz, which is the lowest in price and sees fewer bottles traded than the others, but has an excellent six-month price performance of 11.88% and good price stability. Finally, the list is completed by Grant Burge Meshach Shiraz, which has one of the higher three-year CAGRs, at 6.4%.

Don’t forget – if you’re not yet a subscriber to Wine Lister, you can still fully explore this week’s five Listed wines, and those for the previous four weeks, via the homepage.

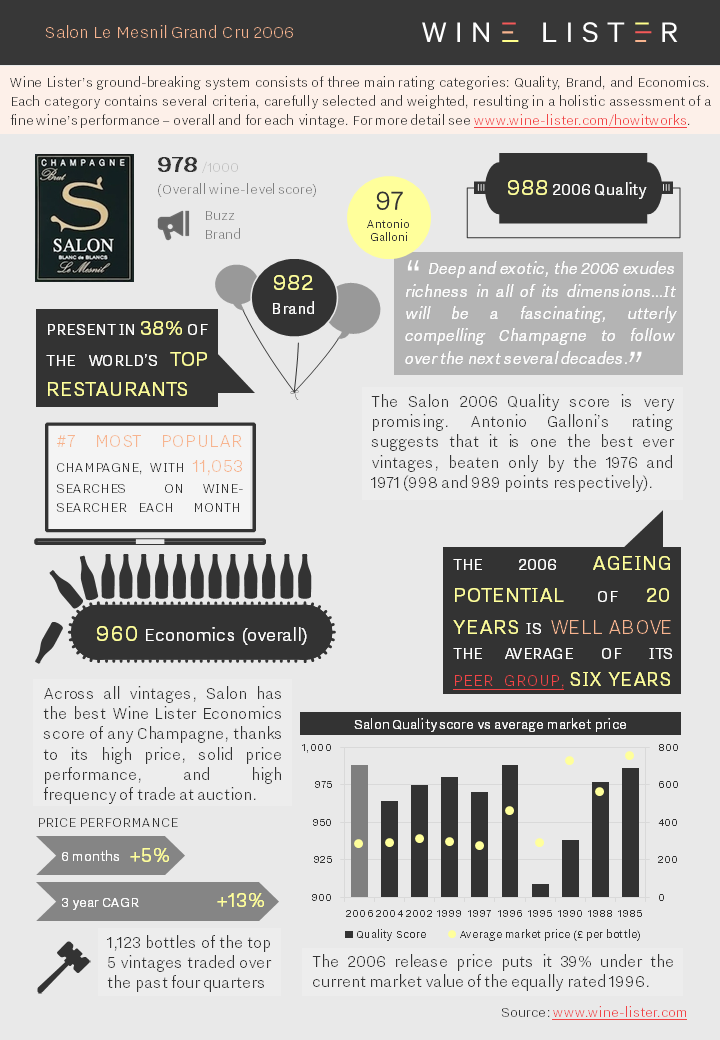

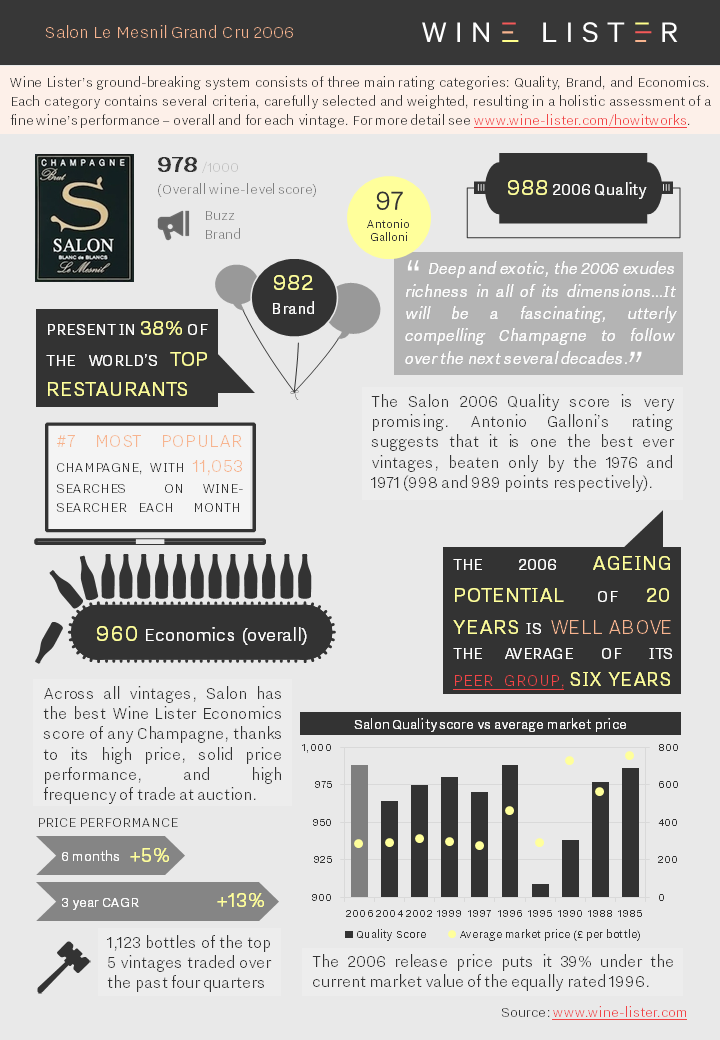

Earlier this month Salon Le Mesnil 2006 was released, the Champagne house’s 40th vintage. Described as “a fascinating, utterly compelling Champagne” by our partner critic Antonio Galloni, we summarise all the key data below:

You can download the slide here: Wine Lister Factsheet Salon 2006

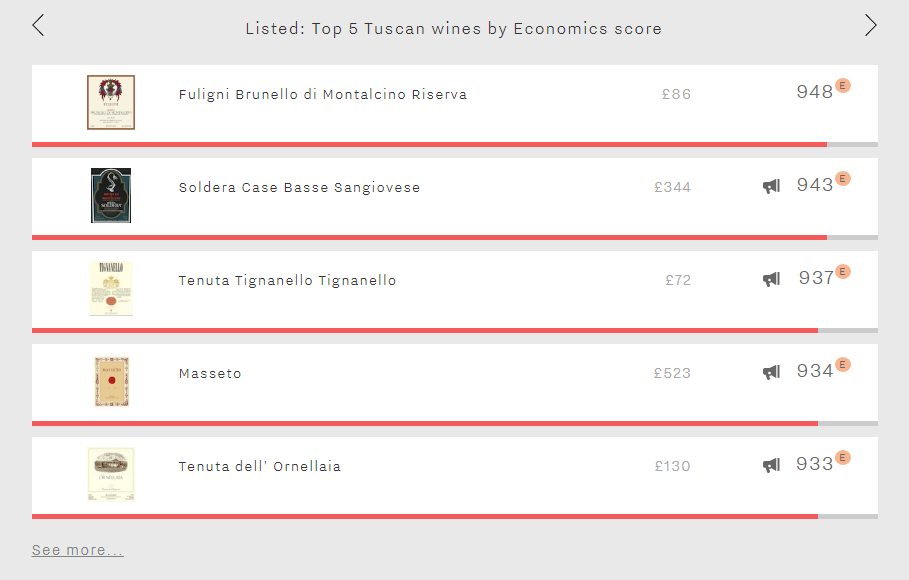

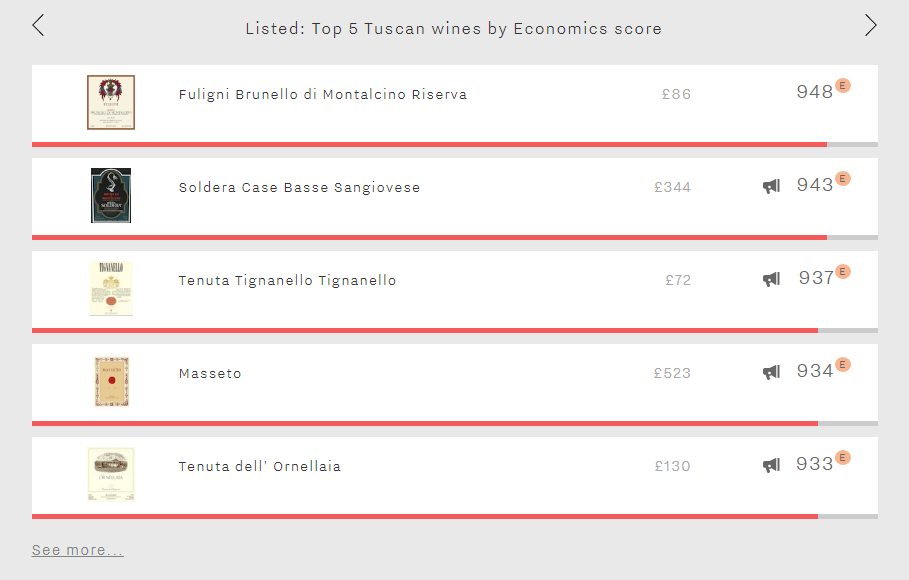

You may have noticed a subtle re-design today on the Wine Lister homepage. This includes moving up and expanding the scope of the “Listed” section: a changing Top 5 of wines from around the world, updated each week.

You can now explore the five most recent Top 5s, even if you’re not yet a subscriber to Wine Lister. For as long as the list is live, this includes access to all the underlying vintage-level data that feeds into one of our Listed wines, including critic scores, restaurant presence, search frequency, and price performance. Simply click on the Listed wine that takes your interest, then select from the drop-down of vintages at the top right of the wine page. What’s more, this allows you to play with tools such as interactive price history and vintage value identifier charts.

Our Listed section addresses a variety of tastes and priorities – some weeks you will see our best Value Picks from a particular region, other weeks will focus specifically on wines with top Brand or Economics scores, or wines of the highest quality from a specific vintage.

To access independent wine ratings, tools, and analysis for all of the thousands of wines and vintages in our database you’ll need to subscribe – or why not try a free 14-day trial?

What makes the perfect wine?

Using the entirety of a 1,000-point scale, Wine Lister’s scores are calculated using nine criteria that define iconic wines. These fall into the categories of Quality, Brand and Economics, giving a 360° view of the finest wines in the world.

Unlike wine critics’ scores, which sporadically feature a perfect 100/100, a perfect Wine Lister score of 1,000/1,000 is practically, though not theoretically, impossible. The perfect wine would have to be the best in the world across every single criterion – a magical combination of ingredients.

The perfect wine does not belong to any one region. In terms of quality, it has the perfect critic score of Sauterne’s unsurpassed Château d’Yquem (1), and the ageing potential of Cockburn’s Vintage Port (2). Its brand is legendary: like Dom Pérignon, it is found throughout the world’s top restaurants (3), and its online monthly searches rival those of Lafite (4).

The perfect wine outperforms on price. Already with a price per bottle to match that of Romanée-Conti (5), its vintages see price increases in both the short- (6) and long-term (7), without undue fluctuation (8). Finally, like Mouton, the perfect wine is traded in large volumes (9).

Download a PDF version here.

First published in French in En Magnum.

When it comes to wine scores, we’re all used to looking at quality and critic ratings. Wine Lister scores incorporate two other crucial measures: Economics and Brand. Today, we take a closer look at these categories in the context of the top Bordeaux crus in our 2017 Bordeaux Market Study.

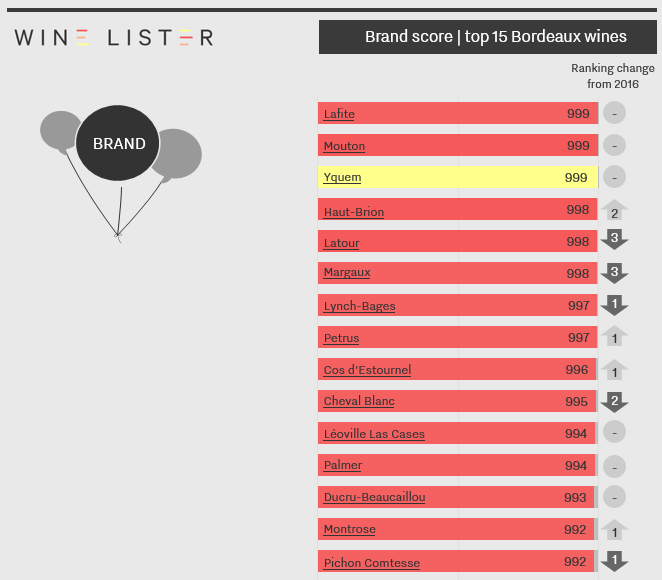

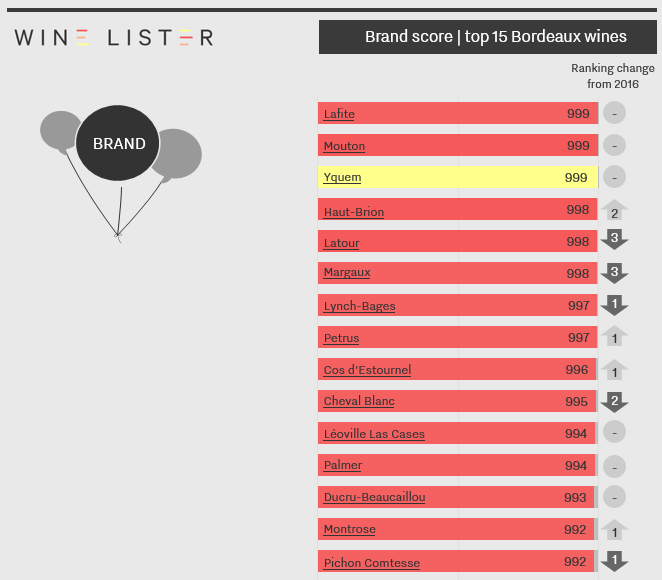

Brand: not much in it

We begin with the Brand category, based on search frequency and distribution. The first thing to notice is that score differentials are incredibly narrow. The 15th wine in Economics terms achieves a score of 932, while the 15th wine in the Brand table gets 992 – testament to the incredible brand strength of Bordeaux crus in general.

Three wines share the top spot, with near-perfect scores of 999 apiece: Lafite, Mouton, and Yquem. Latour and Margaux have lost one point since last year, putting them in joint fourth with Haut-Brion, up one place, while Pauillac and Pomerol powerhouses, Lynch-Bages and Petrus, share seventh position. Only two right bank wines achieve Brand scores in the top 15, and Cheval Blanc is the only Saint-Emilion premier grand cru classé A to feature.

Economics: all change at the top

We now move onto the Economics score, based on a variety of price metrics and liquidity. Unsurprisingly, due to the constantly changing nature of its component parts, the Economics category displays significant changes over a 12-month period. The order of wines in the top 15 has completely changed from the previous year. Compared with the Brand table, the top 15 is also very different: wines have moved in and out, and the order has shifted.

In a continued display of commercial strength, Angélus has moved up three places into pole position, while second and third places are also occupied by right bank wines: Pomerol’s Le Pin and Petrus. The first growths have all moved up the table since last year, in part thanks to improved price performance, although Latour still trails the others. The wine that has most improved on 2016 – a new entrant into the top 15 – is Ausone, up 26 places, while Beychevelle has also seen significant improvement. Pavillon Rouge is the only second wine in the top 15.

For the top Bordeaux crus in terms of overall Wine Lister score – which takes into account a wine’s Quality score as well as those for Economics and Brand – take a look here.

These are excerpts from Wine Lister’s 48-page Bordeaux Market Study – subscribers can download the full report from the Analysis page.

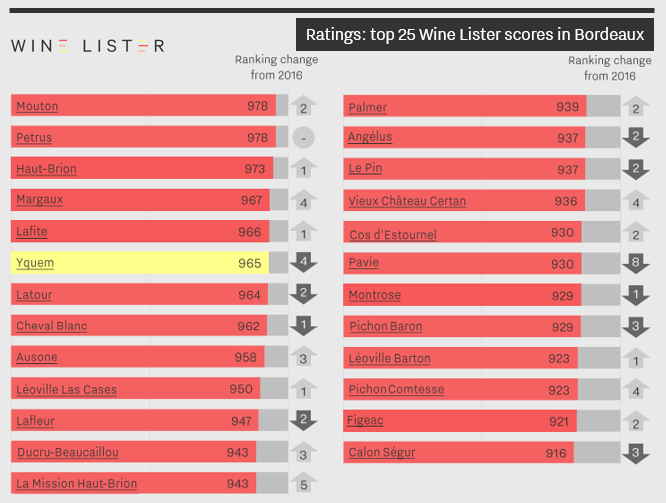

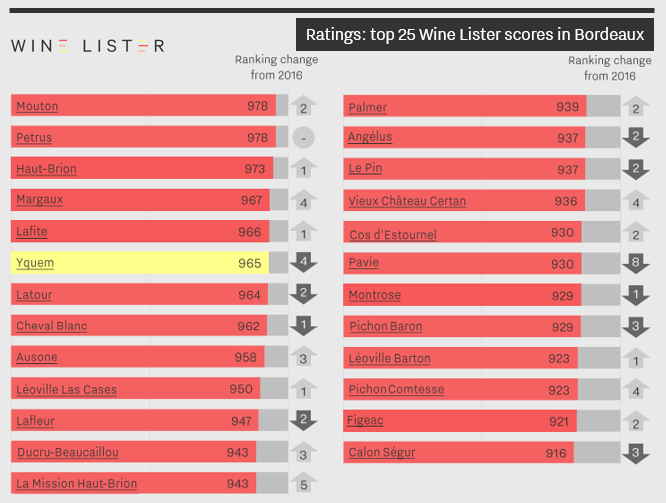

In our third blog post exploring findings from Wine Lister’s recently released Bordeaux Market Study, we look at the top scoring Bordeaux crus as at 28th April 2017. These are the overall Wine Lister scores comprising the three category scores for Quality, Brand, and Economics. They are applied at wine level (an average of the last 30 vintages, with the highest weighting for the most recent vintage – 2016 – and so on).

Nine of the top 25 are from the right bank, and 16 from the left bank. As in last year’s study, the top eight spots are occupied by the five left bank first growths, as well as Petrus, Yquem, and Cheval Blanc, but with a significant reshuffle among these wines. Mouton gains 18 points and climbs two spots to join Petrus at the top of the table this year.

Haut-Brion comes third, one position higher than in 2016. Next come Margaux and Lafite, separated by just one point, although Margaux has surged up the ranking this year, gaining four places.

Yquem, the only white wine in the top 25, drops four places this year, while Latour and Cheval Blanc are also down on last year’s positioning. Ausone comes ninth, up three places from last year, and Léoville Las Cases rounds out the top 10 as the highest placed deuxième cru.

The two newer Saint-Emilion premiers grands crus classés A also feature in the top 25, although Angélus and Pavie have dropped two and eight spots respectively since 2016. Meanwhile Pichon Comtesse and Figeac make their debut into the top 25 this year.

This is just a taster of the Bordeaux Market Study, but you can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

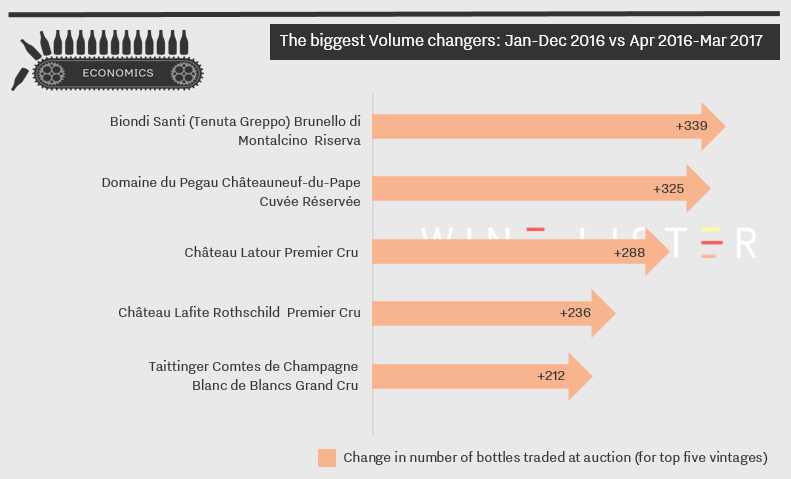

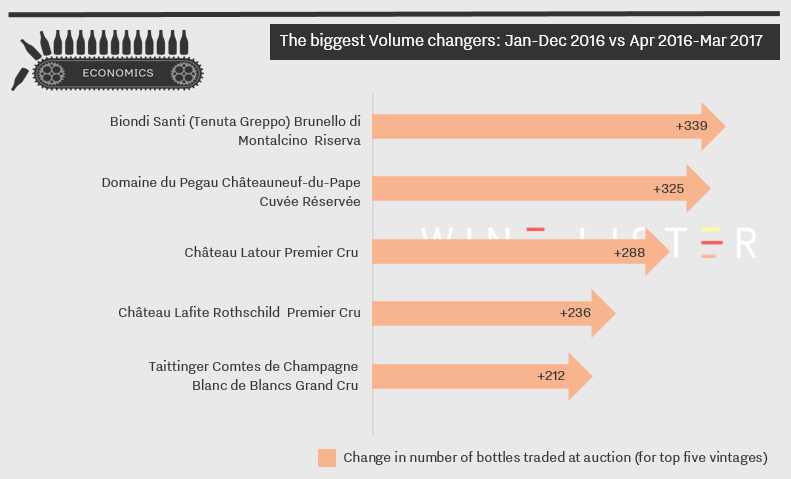

Trading volumes are a key measure of a wine’s success in the marketplace. To evaluate these, Wine Lister uses figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages traded for each wine over the past four quarters.

With the first quarter data now in, we look at which wines saw the greatest incremental increase in bottles traded. Although the list is dominated by French wines, top of the table is a Tuscan, Biondi Santi Brunello di Montalcino Riserva. The producer was recently highlighted as one to watch in a survey of Wine Lister’s Founding Members. The rise in auction sales for this wine has had a significant impact on its Economics score, boosting it from 911 to 945/1000. Volume is just one of the five criteria that feed into a wine’s Economics score, along with four different price-related metrics.

The wine seeing the second largest gain in trading volumes, Domaine du Pegau Châteauneuf-du-Pape Cuvée Réservée, also has the lowest Economics score of the table, at 789. Nonetheless, its overall Wine Lister score is very strong at 846 (lifted by a high score for Brand), and with the latest data in from Wine Market Journal its Economics score is on the rise.

The final three wines of the table – two Bordeaux first growths and a prestigious Champagne (Taittinger Comtes de Champagne) – also benefitted from increased trades in the last quarter. All three enjoy very high Economics scores, with Lafite Rothschild the highest, at 955/1000. Meanwhile it seems that 2017 has been a positive year so far for Latour, which was also among the top five wines that saw its number of searches increase significantly in March.

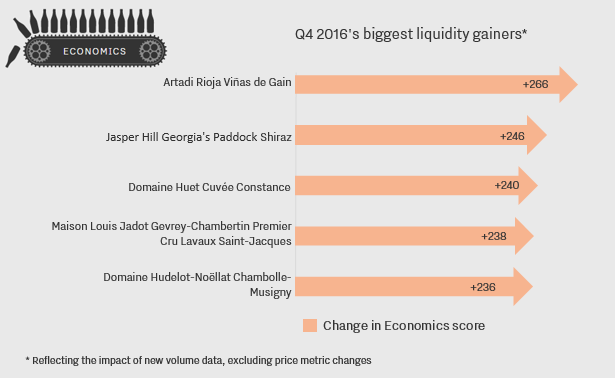

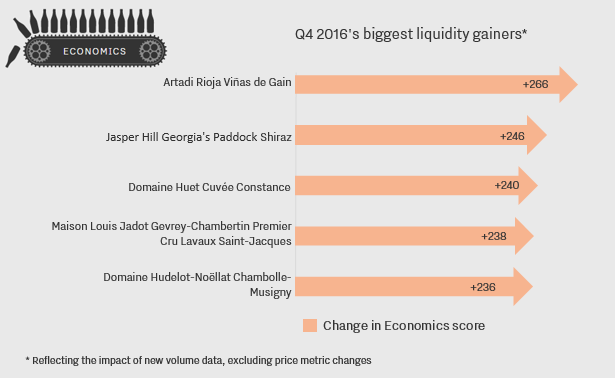

Trading volumes are a key measure of a wine’s success in the marketplace. To evaluate these, Wine Lister uses figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages traded for each wine over the past four quarters.

A change in trading volumes impacts a wine’s Economics score. The chart below pulls out the biggest gainers in the last quarter of 2016, comparing auction data from the 12 months leading up to the end of Q3 2016 to data for the calendar year.

Wines from a variety of regions saw their Economics scores boosted by auction sales in the final quarter of 2016, suggesting a healthy broadening of interest in addition to the usual suspects.

Gaining most was Artadi Rioja Viñas de Gain, which saw trading volumes from January-December 2016 increase tenfold. Its Economics score remains relatively low, at 420/1000.

Australia and the Loire also made an appearance. Domaine Huet Cuvée Constance enjoys a very strong Economics score of 796/1000, and also excels in terms of Quality and Brand, leaving it with a very strong overall Wine Lister rating of 856/1000.

Burgundy is still on the rise at auction, and was the only region to feature twice, with Maison Louis Jadot Gevrey-Chambertin Premier Cru Lavaux Saint-Jacques and Domaine Hudelot-Noëllat Chambolle-Musigny.