With the Burgundy 2016 campaign underway, our first blog of the new year sheds some light on an all too often complex region. In our inaugural Burgundy study, Wine Lister reveals some key findings. Read on to find out more or click here to access the full study (non-subscribers can see a preview of the study here).

Price: the unstoppable force?

While the region’s Brand scores are no match for Bordeaux, Burgundy’s supply and demand dynamic(emphasised by a five-year stock shortage) and high quality are driving prices ever skywards. The majority of top Burgundy wines cost between £100 and £500 a bottle, with 18 wines costing more than £2000 per bottle.

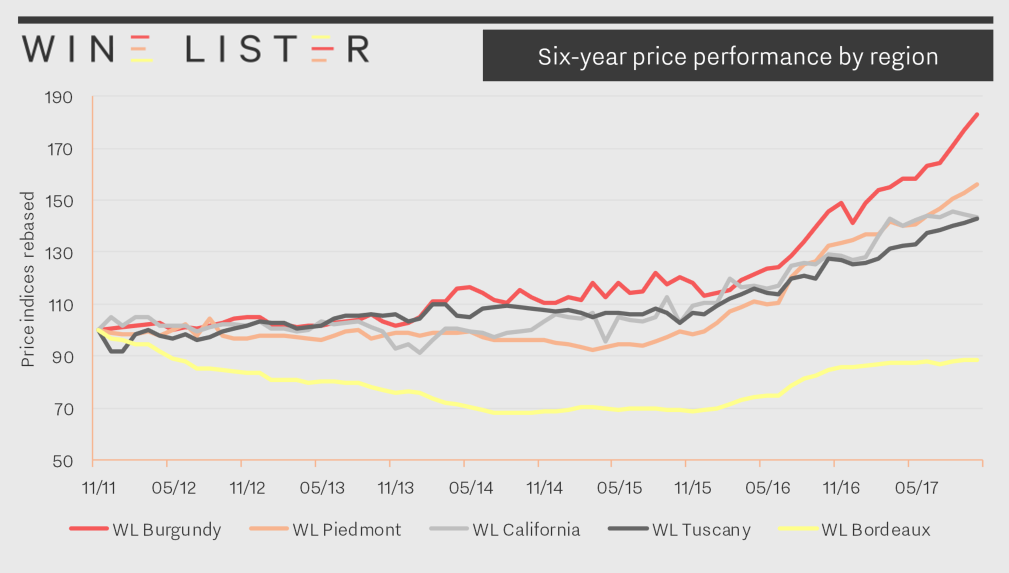

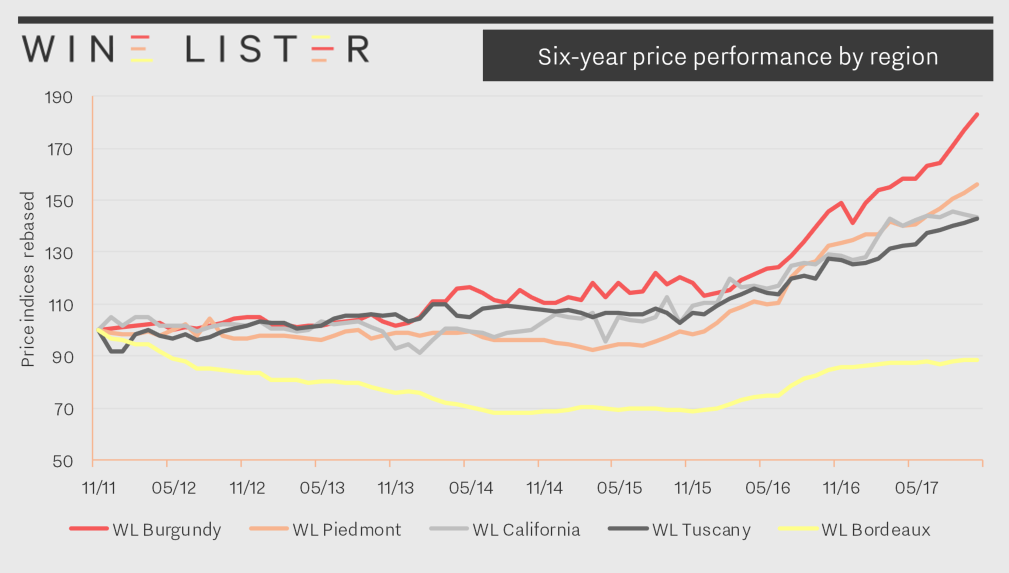

Among the impressive Economics scores (994 being the highest) it is no surprise that producers such as Domaine de la Romanée-Conti (DRC) and Domaine Leroy hold many of the top spots (note that the only whites to enter into the Top 25 for Economics are from Coche-Dury). However, the region as a whole rises above the rest on price performance. Burgundy‘s prices have risen more quickly than any other top fine wine region and show no sign of decelerating.

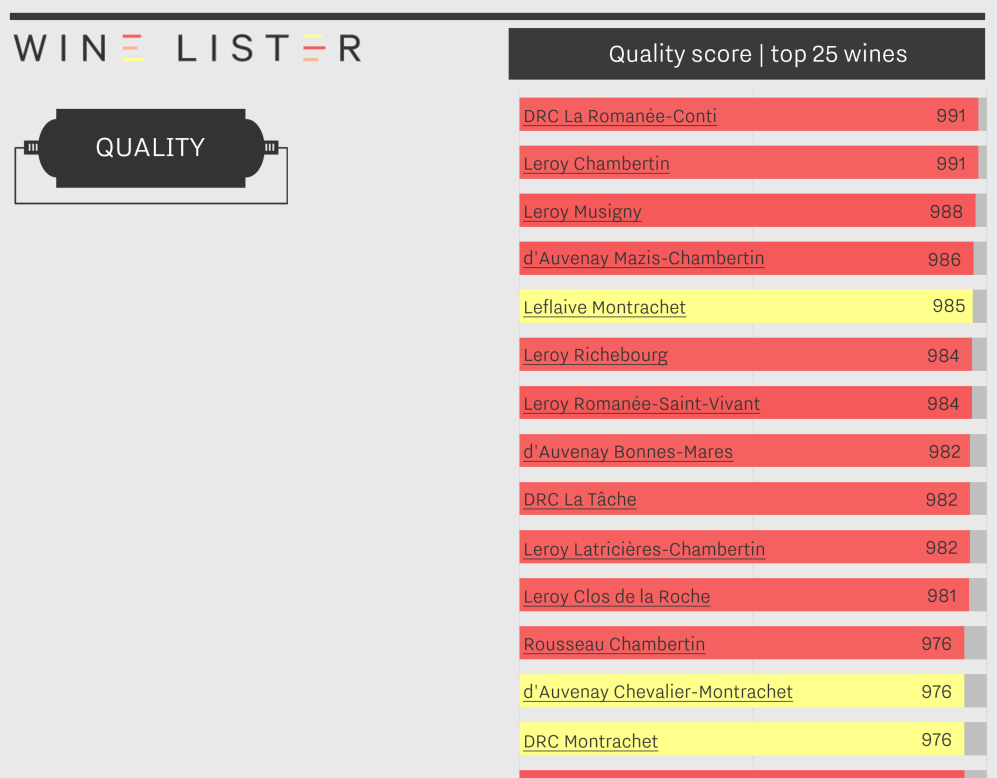

Quality: the clear winners

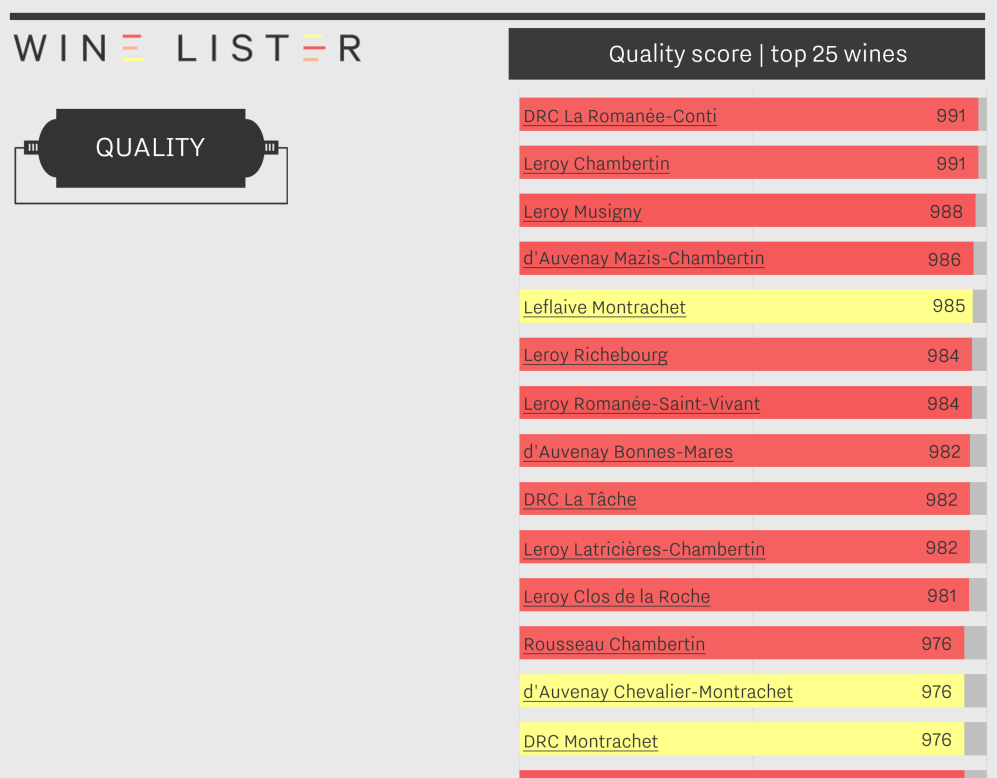

Indeed, DRC and Domaine Leroy consistently top the charts across all Wine Lister scores. However, Lalou Bize-Leroy is Quality queen, with 11 wines in the Quality top 25 between Leroy and d’Auvenay.

DRC and Armand Rousseau stand out as being the only two producers to gain the trade’s full confidence. Our Founding Members give the domaines a confidence rating of 10/10 (no Bordeaux chateau scores above 9/10).

Trends: what the future holds for Burgundy

Further insight from Wine Lister’s 52 Founding Members (key global fine wine trade figures)includes growth trends for Burgundy.

One commonality throughout the trade was the noticeable rise in the popularity of Saint-Aubin (Burgundy is the region home to more “rising star” producers than any other fine wine region). Other observations included a general shift towards higher quality and greater purity in winemaking style, as well as less sulphur and more whole bunch fermentation.

Subscribers can read the full study here. Non-subscribers can access a preview of the full version or subscribe here.

As we edge ever closer to Christmas, it feels appropriate to take a look at sweet wines. Here we consider Alsace’s top 5 sweet whites by overall Wine Lister score. Produced in a thin sliver of land in the far East of France, Alsace’s top sweet whites are separated by just nine points (less than one hundredth of Wine Lister’s 1,000-point scale!). The five wines display very similar profiles, all outperforming in the Quality category, achieiving middling Brand scores, and trailing economically.

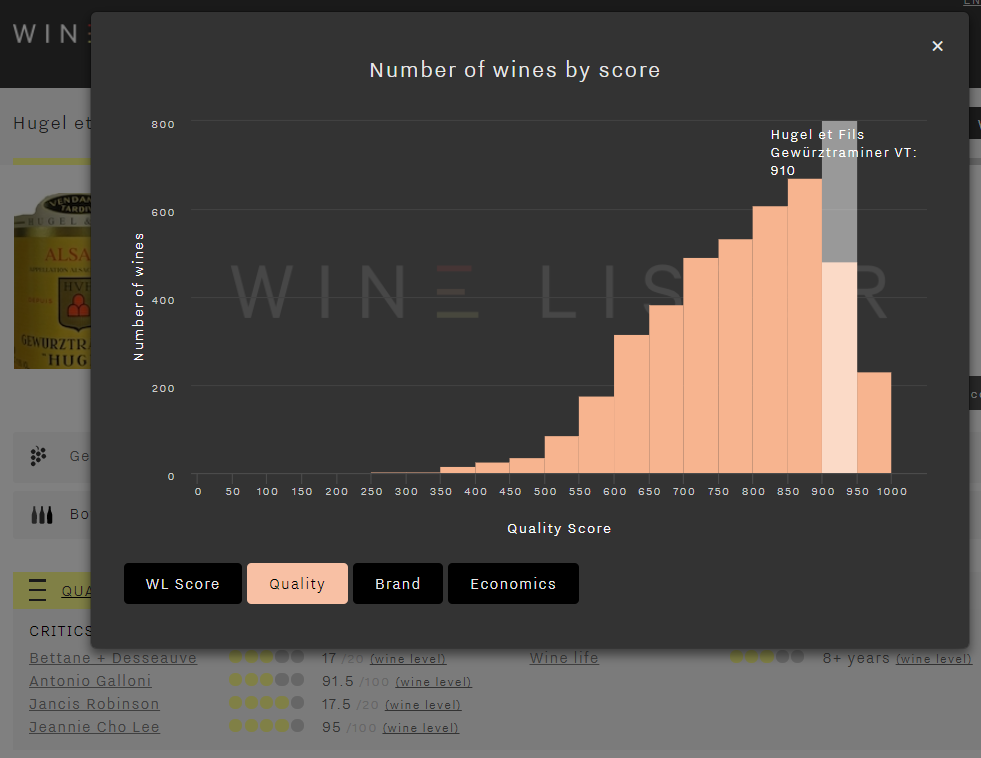

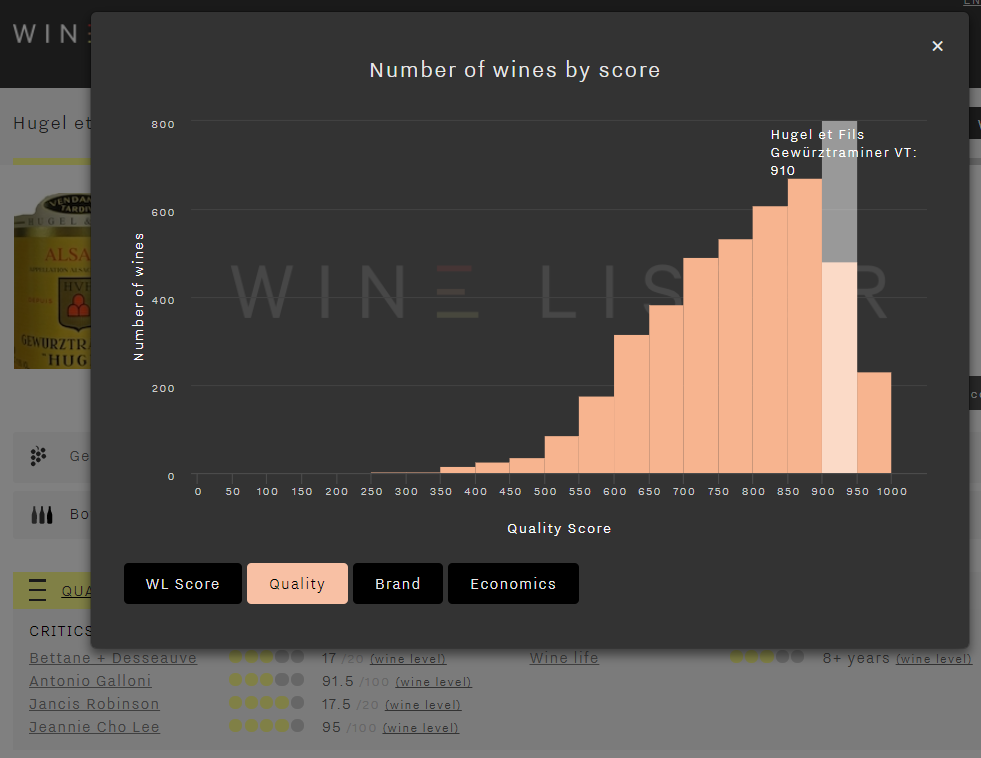

Four break the 900-point boundary in terms of Quality scores, putting them amongst the very top quality wines on Wine Lister. Hugel et Fils Riesling Vendange Tardive (VT) falls just short with 881 points, still a very strong Quality score (thanks to 17/20 from both Jancis Robinson and Bettane+Desseauve, and 92.5/100 from Vinous). The same producer’s Gewürtzraminer VT scores even higher for quality (910) thanks to a 95/100 from Jeannie Cho Lee:

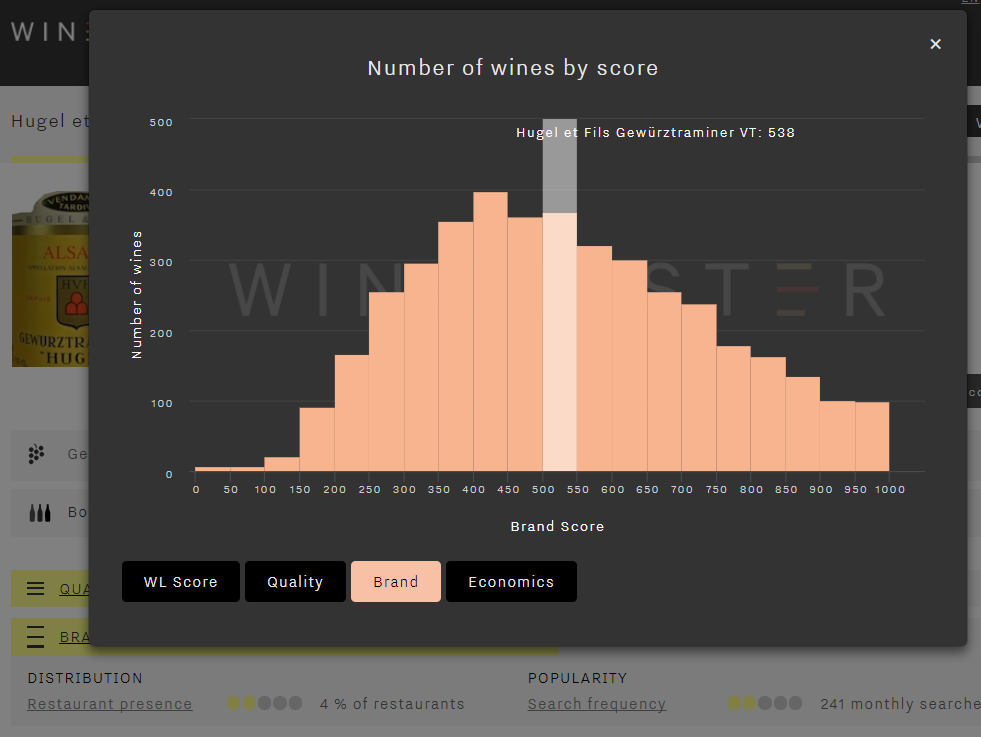

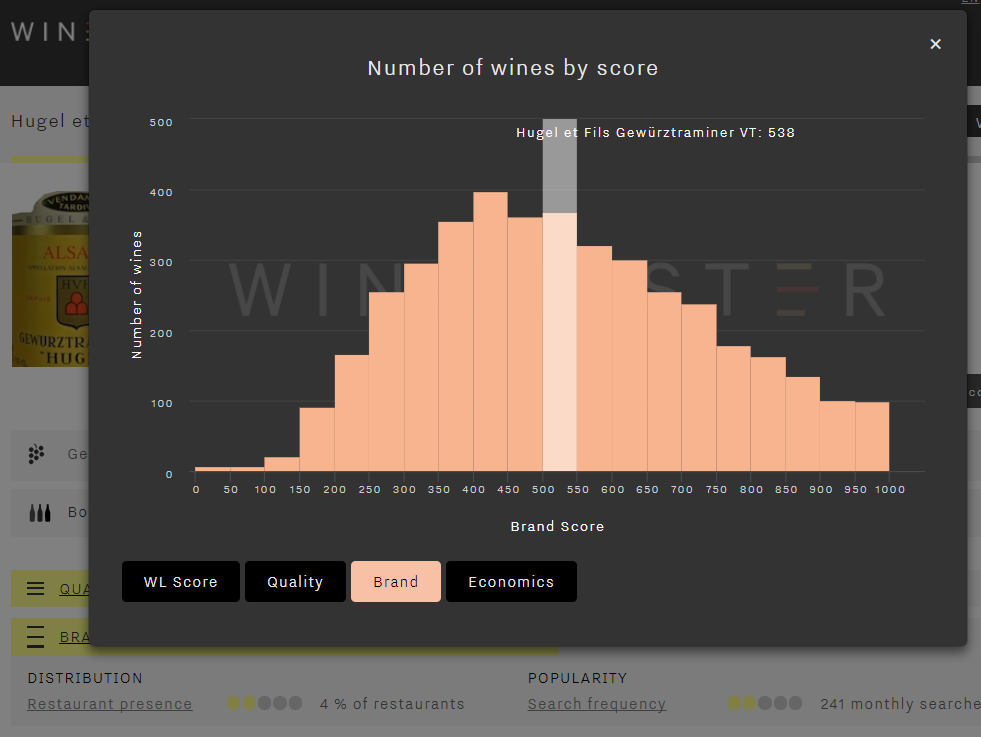

Moving categories, scores drop sharply from an average Quality score of 915 to 550 for Brand – still above the average for all wines on Wine Lister:

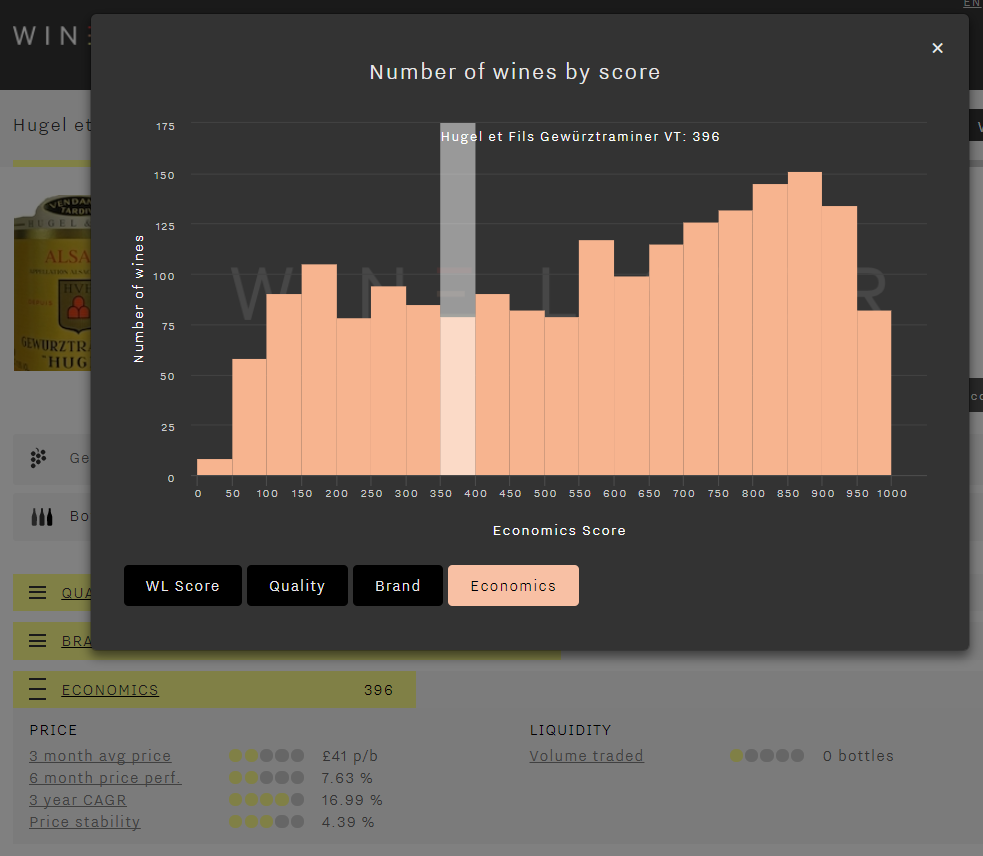

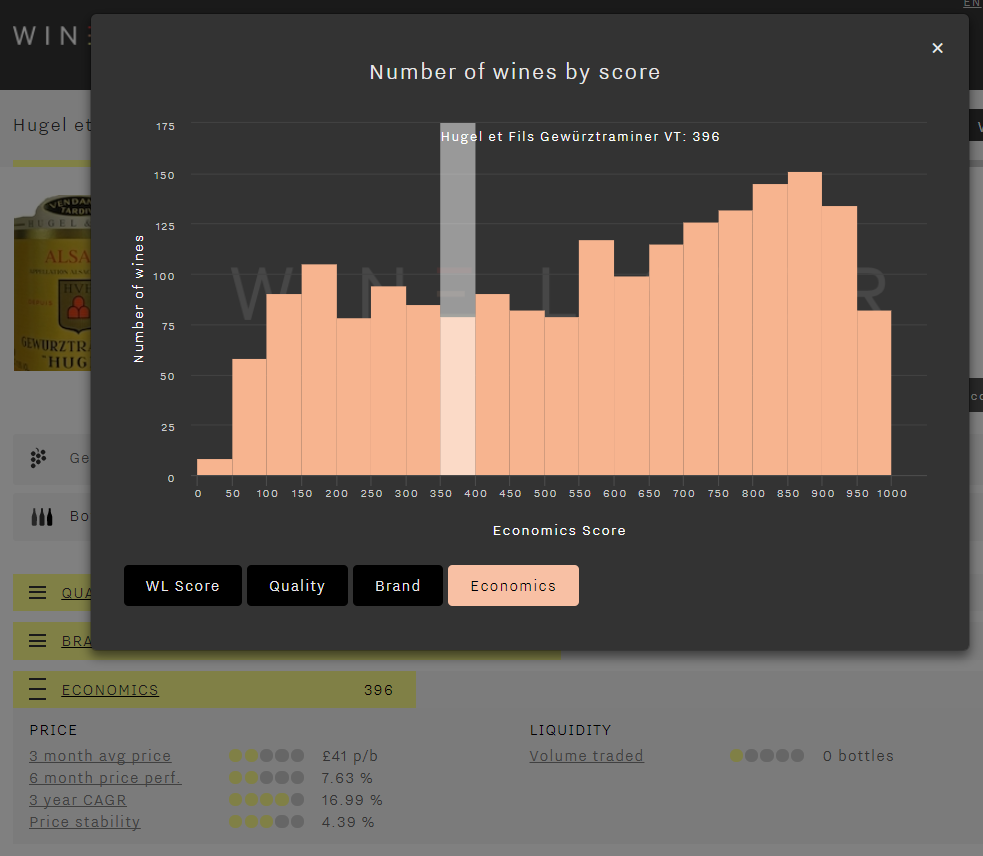

Economics scores trail even further behind, averaging 338, hindered by low liquidity. For example, Hugel’s Gewürtzraminer VT failed to trade a single bottle at auction over the past four quarters (as measured by Wine Market Journal). The chart below shows Economics score in the context of all the wines on Wine Lister – its is well below the average, with a score below 400 putting in the “weak” score band:

Other wines making the top five are Zind-Humbrecht Jebsal Pinot Gris VT (675) and Trimbach Gewürztraminer VT, which achieves the best restaurant presence of the group. However, featuring on just 6% of the world’s best restaurant lists, this suggests that Alsace’s sweet whites are not every sommelier’s must-list bracket, even when produced by the region’s most famous producer. Incidentally, Trimbach’s Clos Sainte Hune appears in 34% of wine lists (compared to 69% for Sauternes’ Château d’Yquem).

The last wine making it into this week’s Listed section is Marcel Deiss Altenberg de Bergheim Grand Cru. The only non-single varietal wine of the group, it is a blend of 13 different varietals planted in the same plot, and is by far Bettane+Desseauve’s preferred wine of the group – the French duo award it an average score of 19/20. It is also the most popular wine of the group. However, its modest average search frequency (380 per month on Wine-Searcher) confirms that Alsace’s sweet whites currently fly well under the radar.

So, when you’re stocking up your cellar for Christmas, give Alsace’s sweet whites a go. They might not be the most prestigious, but the quality is there and prices are pleasing.

Confirming the outstanding economic performance of Piedmont’s top crus, Italy’s top five wines for economics all hail from Barolo and Barbaresco. Tuscany doesn’t get a look-in. Featuring just two producers – Giacomo Conterno and Bruno Giacosa – this week’s listed section boasts wines achieving outstanding Economics scores of over 960.

Wine Lister’s Economics score combines five criteria: three-month average price, six-month-price performance, three-year compound average growth rate (CAGR), price stability, and liquidity (volume traded).

A three-month average price of £595 per bottle tips the Economics rating in favour of Giacomo Conterno’s Barolo Monfortino Riserva, which scores a mighty 978. Its three-month average price is over double that of the second-most expensive wine.

Seven points behind in second place is the Barbaresco Asili Riserva from Giacosa’s Azienda Agricola Falletto, with an Economics score of 971. Just one point behind that, in third place, with an Economics score of 970, Giacomo Conterno’s second wine to make the top five is the Barolo (Cascina) Francia. Following a slump in its score at the end of 2016, it bounced back January and continued to rise throughout the year.

Giacosa’s Azienda Agricola Falletto Barbaresco Rabajà is fourth-highest with a score of 963. This wine has the strongest three-year CAGR of the group, at 27.5%.

Bruno Giacosa’s third entry, completing the top five with an Economics score of 963, is his Barolo Rocche Falletto Riserva. It has the highest liquidity of the group, with 500 bottles of its top five vintages traded in the past year.

All of the top five hold Buzz Brand status, but their soaring prices equate to lower price stability across the group, averaging 8.6% standard deviation compared to 7.1% for the top five Tuscan wines by Economics score. Piedmont might offer more potential upside, but by definition this makes it riskier investment territory.

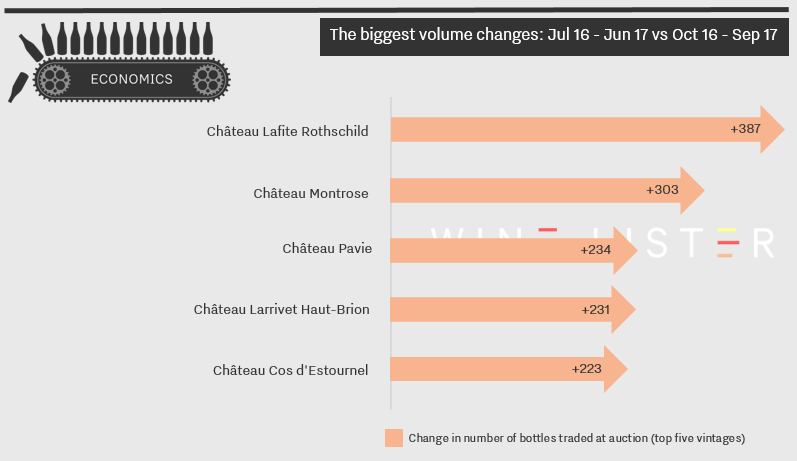

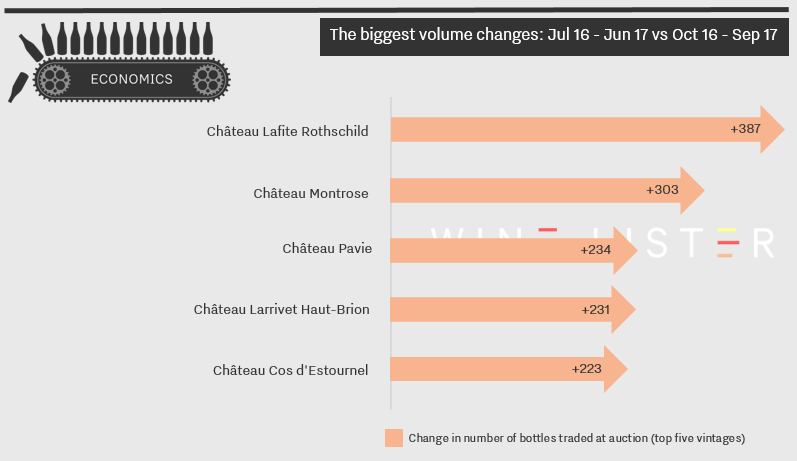

For the second consecutive quarter, the five wines which saw trading volumes rise most were all from Bordeaux. Four of the wines below are big hitters, with overall Wine Lister scores ranging from 921 (Château Montrose) to 963 (Château Lafite Rothschild).

These top crus are also mainstays at global fine wine auctions, with over 2,000 bottles of the top five traded vintages of each wine selling at auction every year, and over 5,000 for Lafite. So, while auction trading volumes – a measure of liquidity – feed into a wine’s Economics score, none of the four has seen a significant enough increase to find their Economics score significantly changed.

There is one anomaly. Château Larrivet Haut-Brion has an average price of £23 per bottle, and from the period of July 2016 until June 2017 its top five vintages sold only 103 bottles at auction. At the end of last month, however, 228 bottles of the wine’s 2000 vintage were sold at a Bonham’s auction, making the wine the most popular of the day. The update to Larrivet Haut-Brion’s trading volumes has had a strong impact on its Economics score, which has risen from 567 to 667, and boosted its overall Wine Lister score from 663 to 684.

We calculate which wines have seen the greatest incremental increases in bottles traded by using figures collated by Wine Market Journal from sales at the world’s major auction houses.

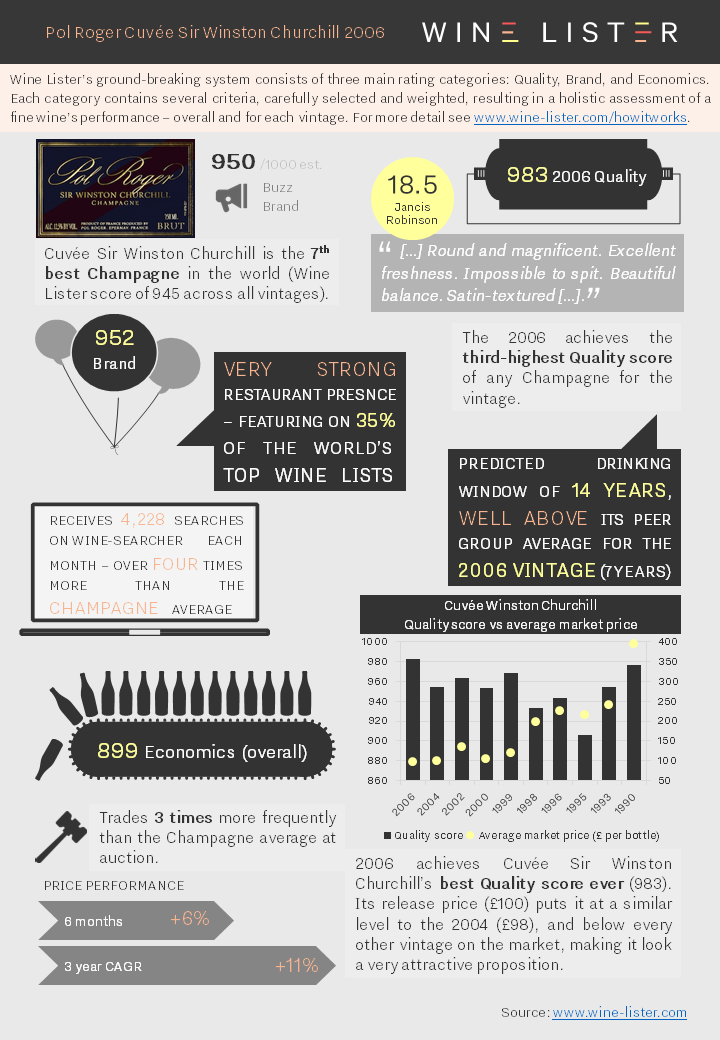

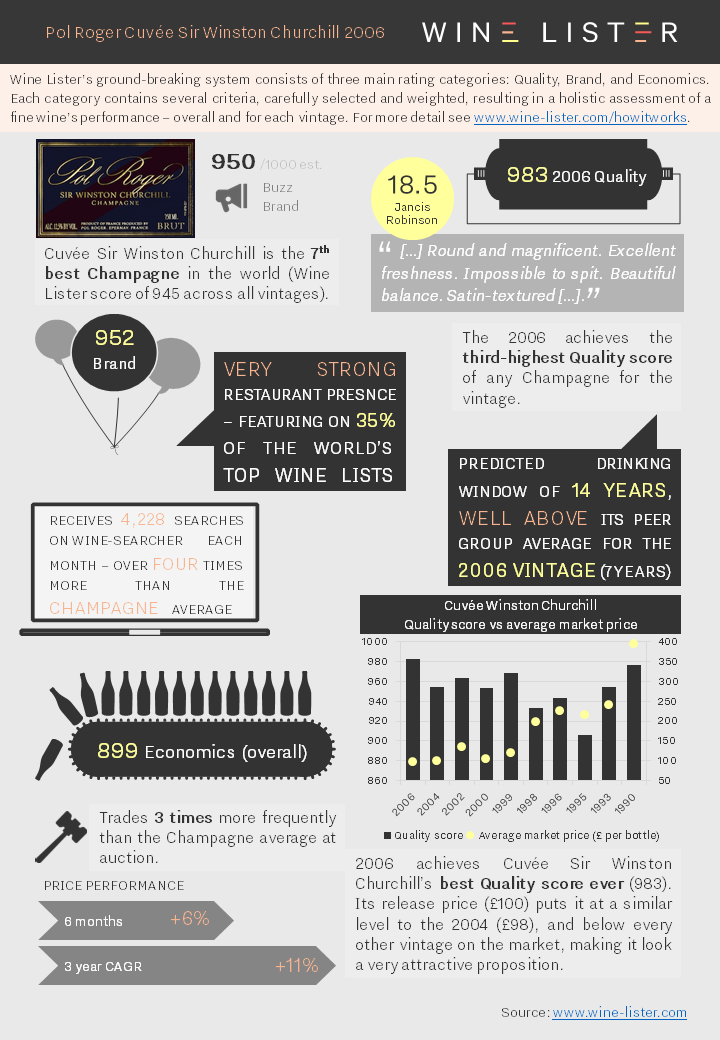

Analysis of Pol Roger Cuvée Sir Winston Churchill 2006, which has been released today in the UK at £100 per bottle, with a Wine Lister Quality score of 983 – its best ever:

You can download the slide here: Wine Lister Fact Sheet Pol Roger Cuvée Sir Winston Churchill 2006

Analysis of Palmer 2006, which has released a tranche this morning at €215 ex-négociant, up 72% on the initial 2007 en primeur release price (€125):

You can download the slide here: Wine Lister Fact Sheet Palmer 2006

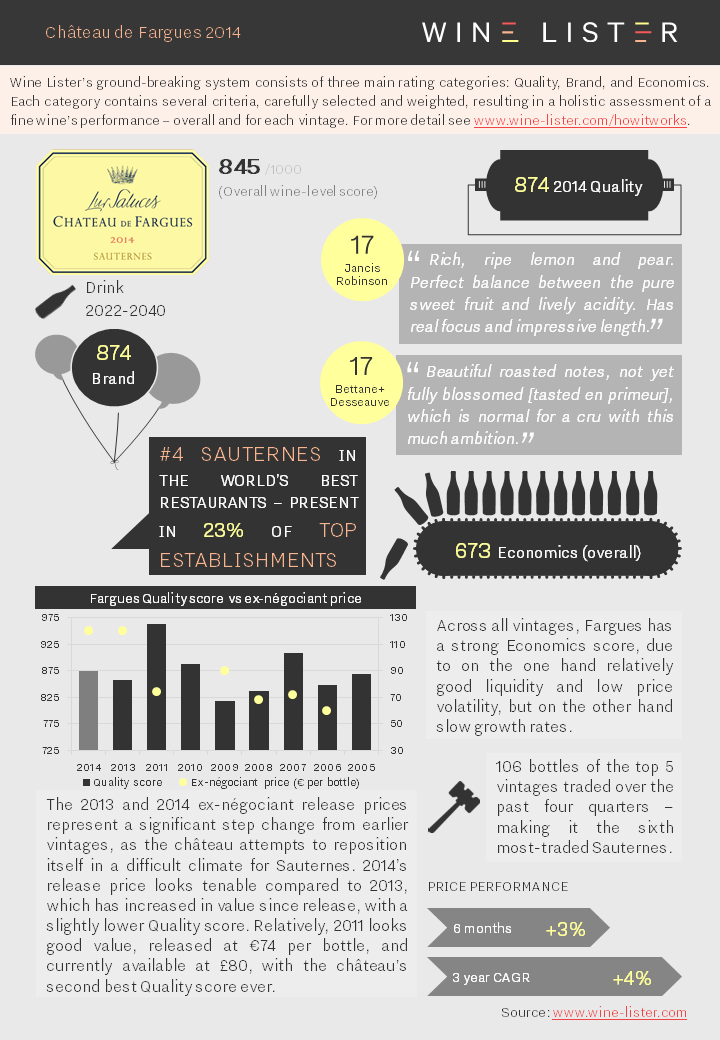

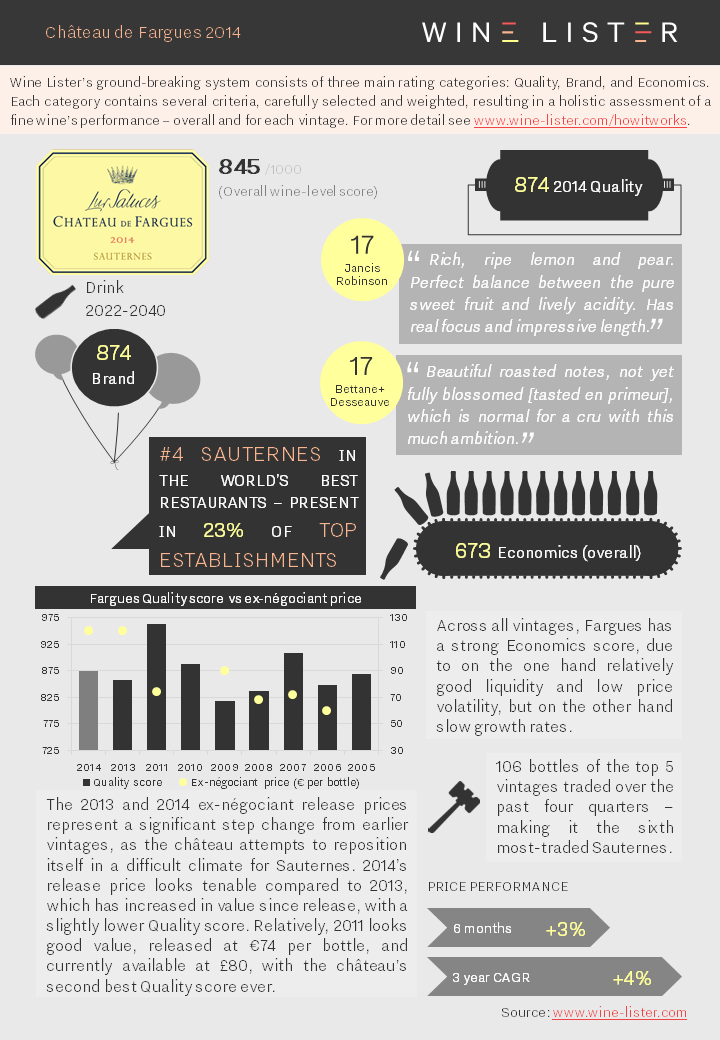

Analysis of Fargues 2014, which was released recently at €120 ex-négociant, the same as the 2013 release price, with a Wine Lister Quality score of 874:

You can download the slide here: Wine Lister Fact Sheet Fargues 2014

Analysis of Les Forts de Latour 2010, which has released a second tranche this morning at €175 ex-négociant, up 8% on the initial 2011 en primeur release price (€162):

You can download the slide here: Wine Lister Fact Sheet Les Forts de Latour 2010

Hommage à Jacques Perrin 2015 has been released today at £247 per bottle. We summarise all the key facts below:

You can download the slide here: Wine Lister Factsheet Hommage à Jacques Perrin 2015

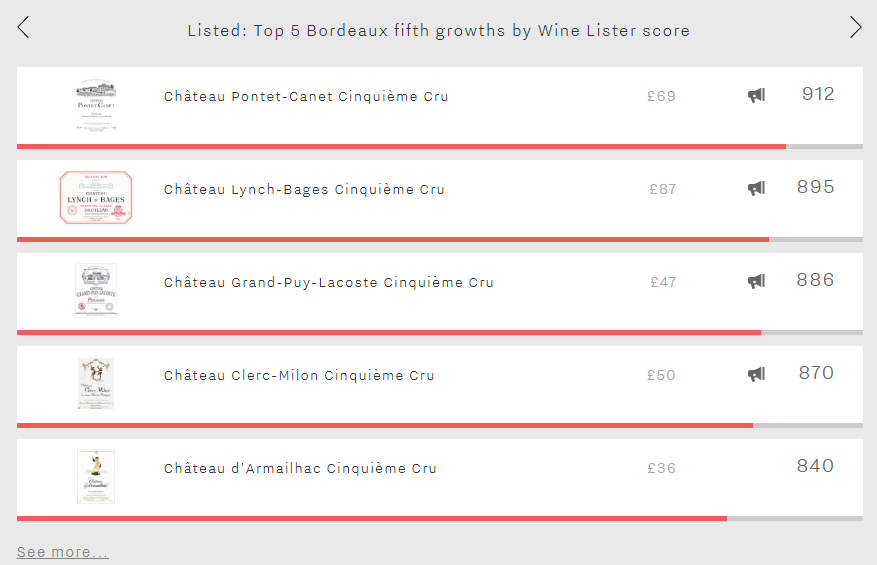

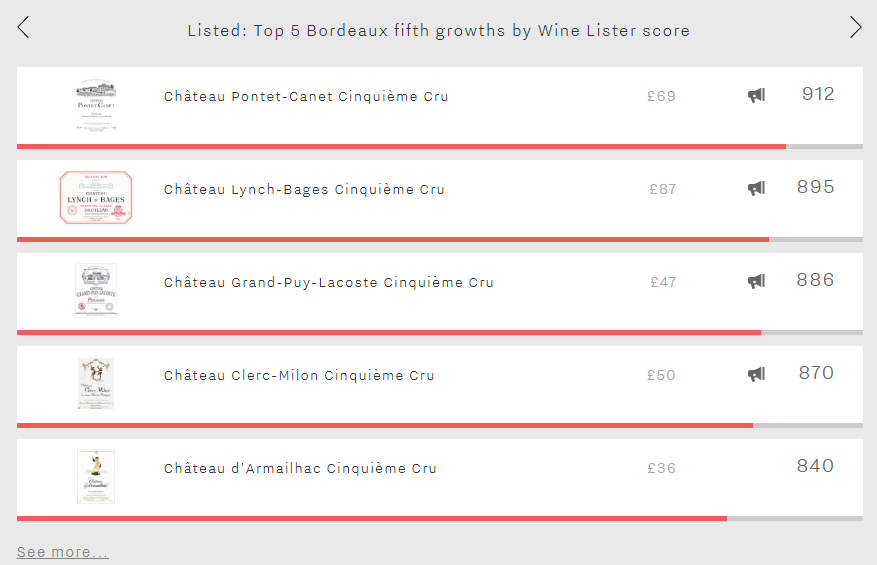

The 1855 Bordeaux classification might well be considered one of the earliest examples of a wine rating system. Classifying wines by six categories – including “unclassified” – might seem restrictive now (compared to Wine Lister’s 1,000 point scale), but the classification has proven to be highly influential and durable. This week’s Listed section focuses on the five Bordeaux fifth growths with the highest overall Wine Lister score, giving us an opportunity to see how the 160-year-old classification stacks up today.

Whilst the 1855 classification used price as the yardstick by which a wine should be rated, Wine Lister’s holistic approach also takes into account quality, brand strength, and other economic metrics. The outcome is that with an average Wine Lister score of 881, these flying fifths outperform both the top five performing third growths and fourth growths (average of 863 and 834 respectively), beating the two classes across every category. Nonetheless, the top fifth growths trail the most highly-rated second growths and the five first growths by 48 and 86 points respectively overall.

Pontet-Canet is the leading fifth growth, with a score of 912. While all five wines perform well in terms of Brand score, Pontet-Canet’s first place position is supported by an excellent Quality score of 905, nearly 60 points above Grand-Puy-Lacoste, the second highest rated of the five in terms of quality.

Lynch-Bages comes next. Whilst it performs well in the Quality and Economics categories, it is in the Brand category that it comes into its own, with a near-perfect score of 998 putting it alongside first growths Haut-Brion and Margaux.

Grand-Puy-Lacoste takes third place with 886, scoring well across the board. It is one of the four Buzz Brands of the group, a fact which confirms that these top fifth growths currently confer more prestige than their third and fourth growth counterparts, which see fewer Buzz Brands within their respective top fives.

The last two spots are filled by wines from the Baron Philippe de Rothschild stable – Clerc-Milon and d’Armailhac. The former achieves the highest Economics score of the group – 908 – thanks to excellent price performance over both the long and short-term. Meanwhile, d’Armailhac’s score of 840, whilst 30 points below Clerc-Milon, puts it above all but four third and fourth growths.

These results blur the lines between the traditional classifications, demonstrating that price can no longer be looked at in isolation, and suggesting that a more nuanced and flexible approach needs to be taken in rating wines.

Remember that there are many ways to search Wine Lister, including by score, geography, and classification – which is how we calculated the findings above.