At the end of last year, Wine Lister released its first ever Champagne report. As well as exploring a handful of key trends as identified by Wine Lister’s Founding Members, the report also sheds light on top Champagnes as compared to other regions in terms of economic performance.

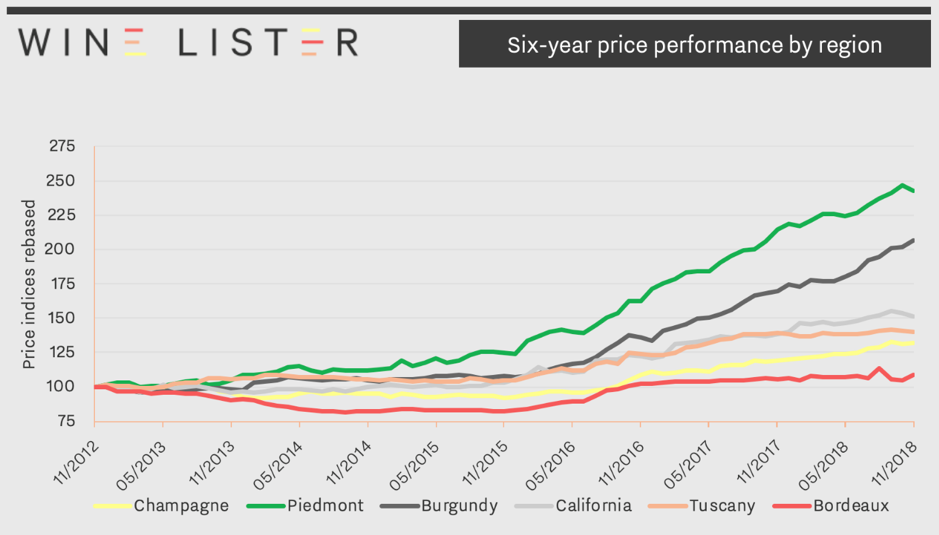

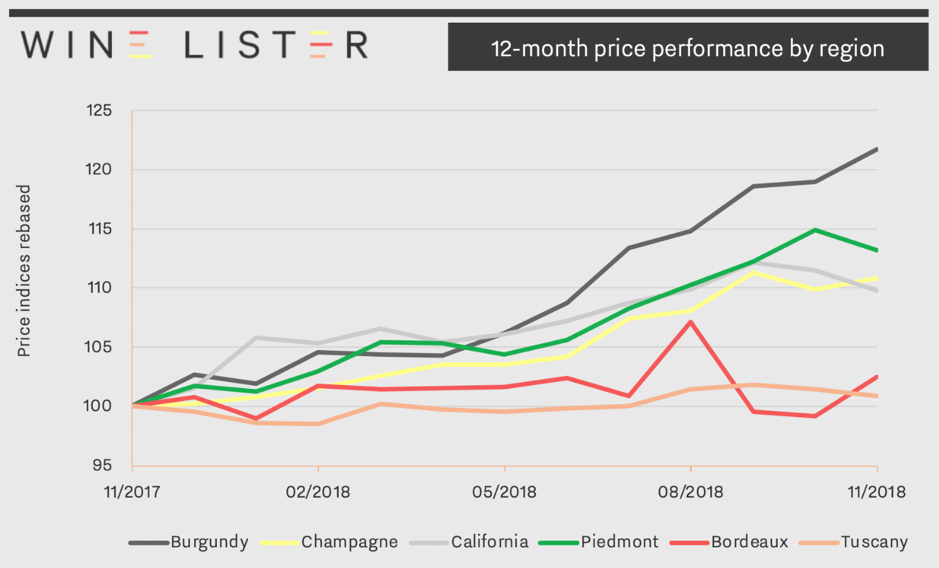

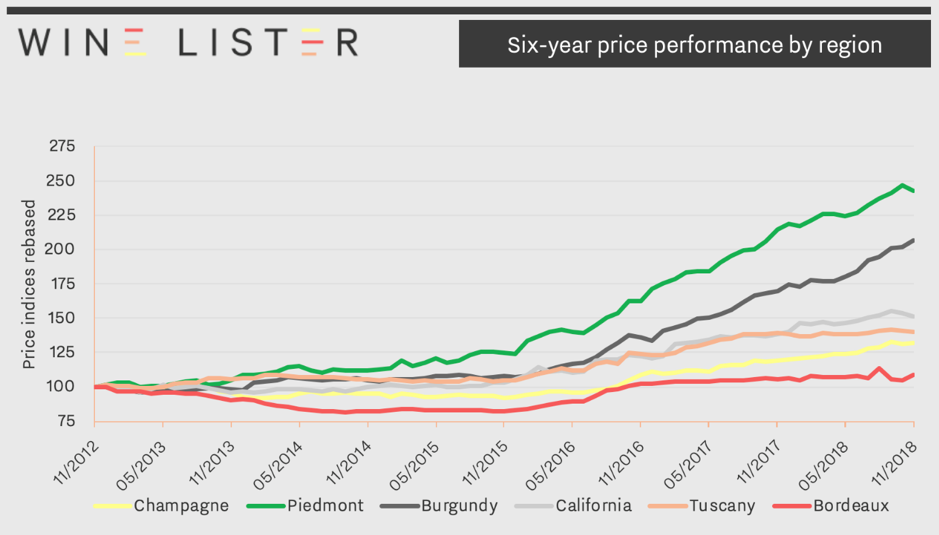

Prices of the top Champagnes (Dom Pérignon, Krug Vintage, Louis Roederer Cristal, Salon Le Mesnil and Dom Pérignon Rosé) have seen a compound annual growth rate (CAGR) of 4.8% over the last six years. Relative to other major fine wine regions, this long-term growth is slow, as shown in the chart below, but also stable.

One notable advantage of Champagne as an investment option it its low volatility. Indeed, Champagne prices show a much better level of stability in the secondary market (deviating by just 2.5% from the average price over 12 months) than any other major fine wine region. Slow and steady wins the race.

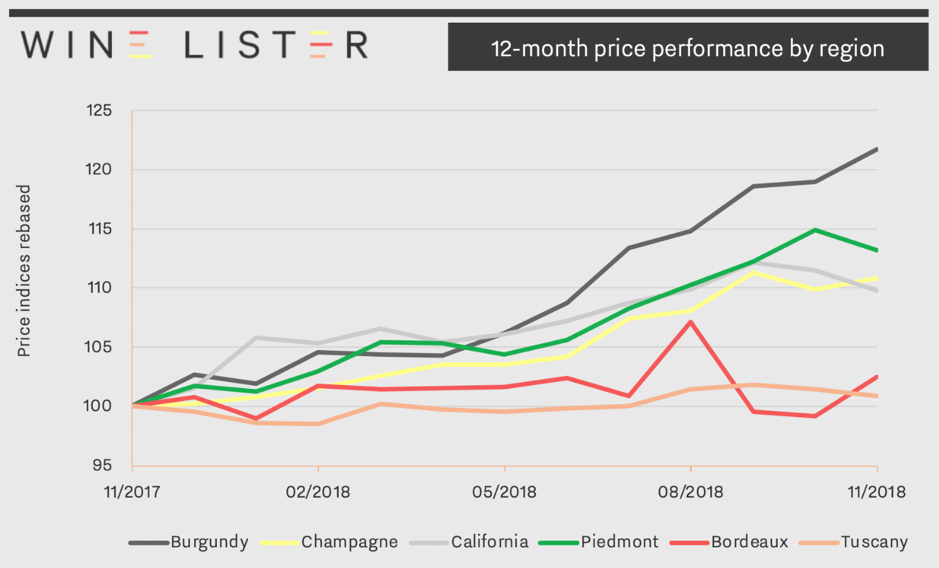

Moreover, recent price performance shows Champagne accelerating. Prices of top Champagnes are starting to grow at a faster rate than their counterparts in California, Bordeaux, and Tuscany, beaten only by Piedmont and the seemingly unmatchable Burgundy. Indeed, as of December 2018 top Champagnes had seen a 12-month price growth of 11%. The region’s potential for long-term investment is already being acknowledged by the trade, with one of our Founding Members, a top tier UK merchant commenting “Champagne (Salon especially) has experienced solid growth and has become a reliable investment for collectors”.

Salon Le Mesnil is the number one performing Champagne for price performance, with an Economics score of 978, closely followed by Krug’s Clos d’Ambonnay (962). Krug also tops the Champagne Economics charts with its Clos du Mesnil, Brut Vintage, and Collection. Interestingly the only NV Champagne to appear within the top 10 Champagnes for Economics is grower Jacques Selosse’s Brut Initial, with an Economics score of 911. Its price, £106 (per bottle in-bond), is a mere 18% of the average price of the other nine top Champagnes by Economics score.

To read more key findings from our in-depth Champagne study, read the free summary here. (The key findings and full study are also available to download in French on the Analysis page.)

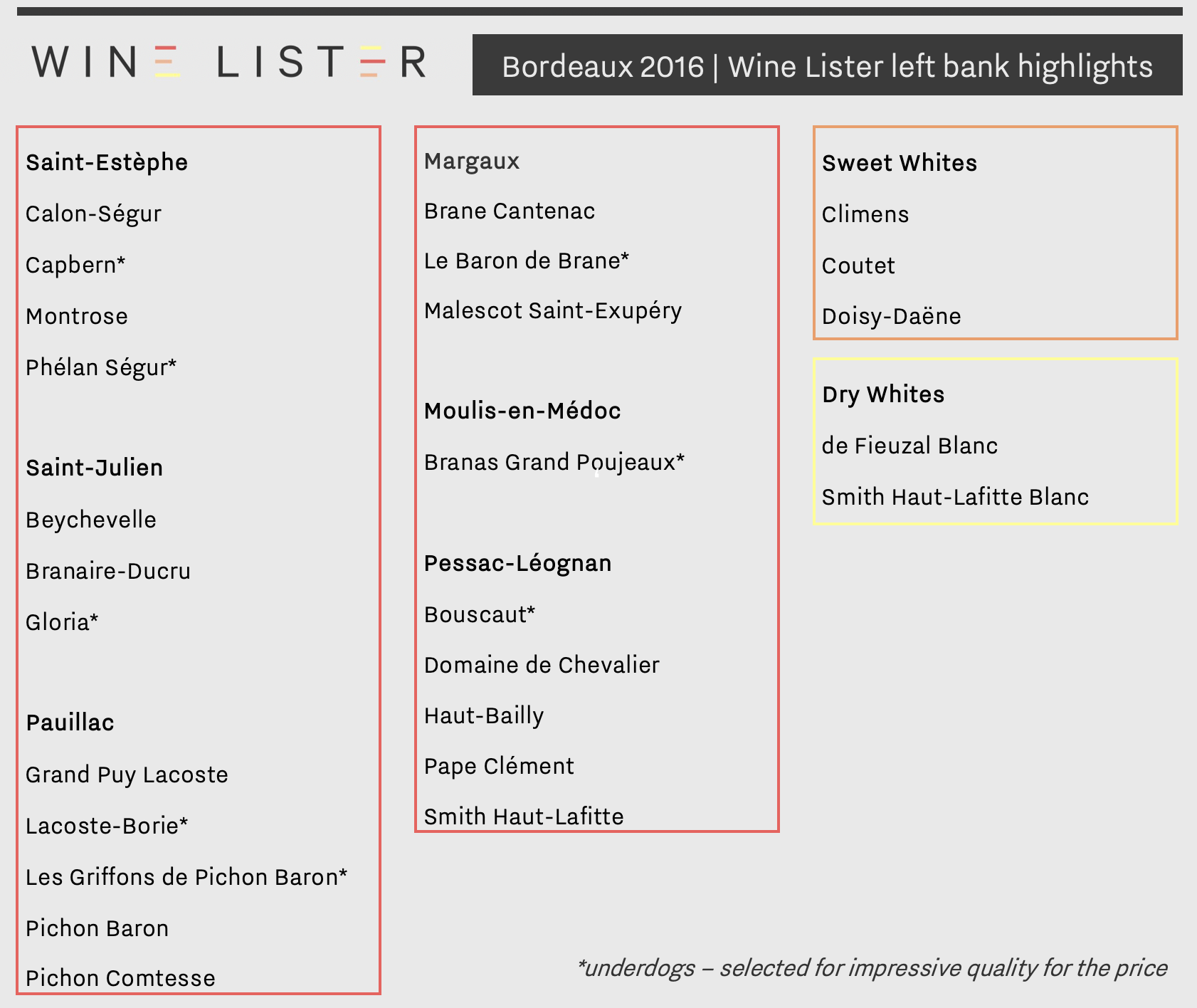

Last week Wine Lister shared top picks from Burgundy 2017 tastings. This week the focus is Bordeaux, after Wine Lister’s founder, Ella Lister, re-tasted through the 2016 vintage with Wine Lister partner critics Michel Bettane and Thierry Desseauve, thanks to négociants Joanne and CVBG.

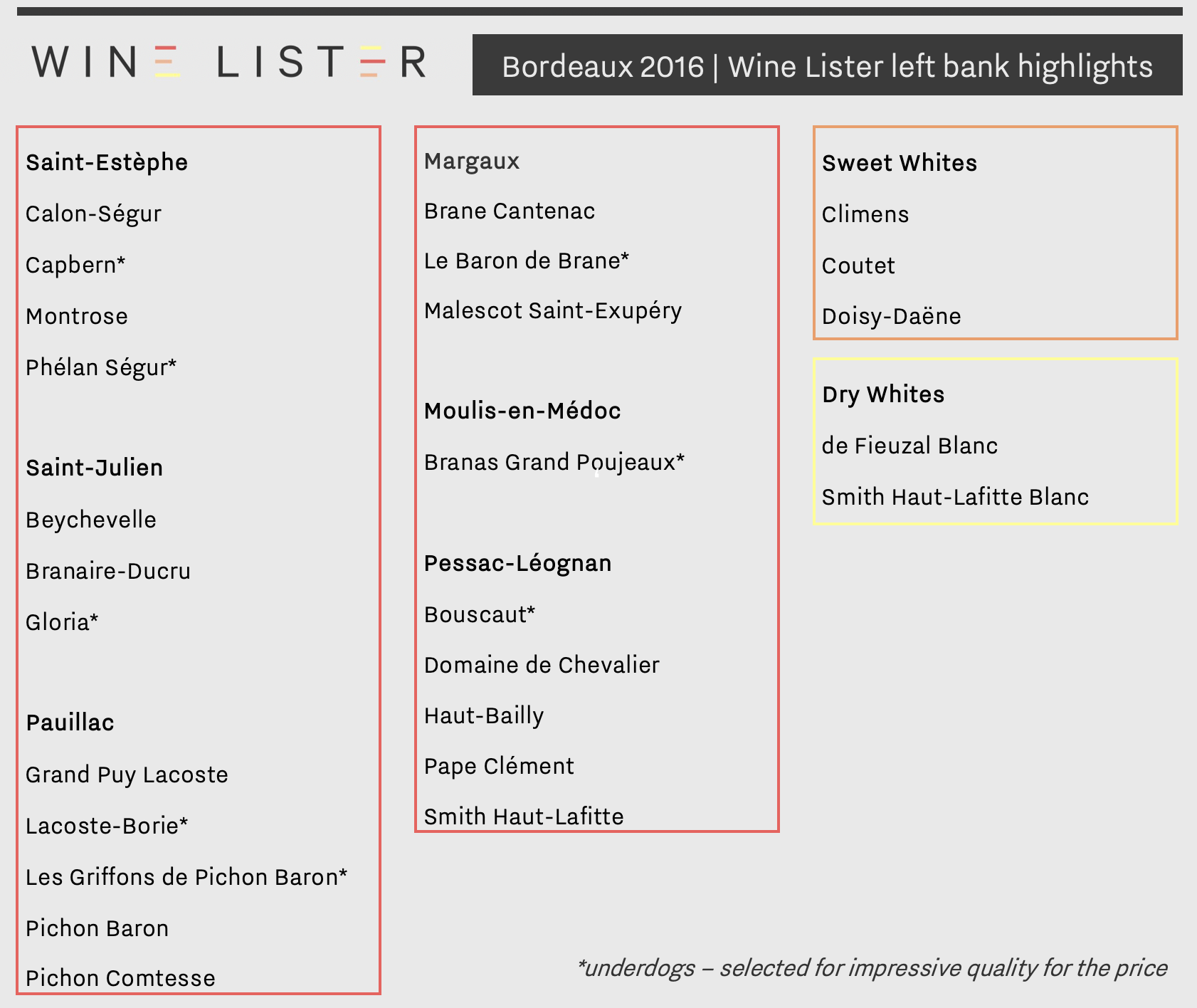

We are in the process of updating Wine Lister Quality scores based on new, in-bottle scores from Wine Lister partner critics Bettane+Desseauve, Antonio Galloni, and Neal Martin, and in the meantime we share Ella’s left bank picks below.

N.B. The tasting did not include first growths, or wines such as Cos d’Estournel, Palmer, Léoville Las Cases, Ducru Beaucaillou, and Pontet-Canet.

N.B. The tasting did not include first growths, or wines such as Cos d’Estournel, Palmer, Léoville Las Cases, Ducru Beaucaillou, and Pontet-Canet.

The spread of favourites from across left bank appellations reflects the homogeneity of the 2016 vintage overall.

Saint-Estèphe was a standout appellation in 2016. Two top dogs, Calon-Ségur and Montrose earned significant praise – Calon is described as having “ballet slipper poise” and a “core of energetic fruit”, where Montrose appeared “elegant, silky and delectable”, with a much-improved integration of oak than the en primeur sample. Beside these sit two underdogs, Capbern and Phélan Ségur, which punch above their expected qualitative weight.

Saint-Julien earns three picks, with Beychevelle being a particular highlight, hailed “ravishing, with vitality and a satin finish”. In Pauillac, Pichon Baron and Pichon Comtesse were both notable, with the former appearing “refined, aristocratic and accomplished”, the latter “exciting, racy, and moreish”. Both Brane-Cantenac and Malescot Saint-Exupéry brought signature Margaux elegance to the tasting mix.

Pessac-Léognan reds were showing particularly well, earning an equal number of highlights as powerhouse Pauillac overall. Haut Bailly made the cut alongside Domaine de Chevalier, Pape Clément and Smith Haut-Lafitte. Bouscaut stood out as the underdog of the Graves.

A few further surprises arose across red appellations, including Gloria, Lacoste-Borie (the second wine of Grand-Puy-Lacoste), and Branas Grand Poujeaux.

Less surprising was the high quality of sweet staples, Climens, Doisy Daëne, and Coutet. Of dry whites, the stand-outs were Smith Haut-Lafitte Blanc (labelled “tonally a step above”), and de Fieuzal Blanc.

Other wines featured in the Bordeaux 2016 left bank highlights are: Branaire-Ducru, Le Baron de Brane, and Les Griffons de Pichon Baron.

At the beginning of this new year, Wine Lister is prolonging the festive sparkle through a look at the major trends to emerge from our first Champagne report. Wine Lister’s Champagne study analyses a basket of 109 top wines from the world’s premier sparkling region, and includes insight into the major trends of the Champagne market as identified by Wine Lister Founding Members (c.50 key players in the international fine wine trade).

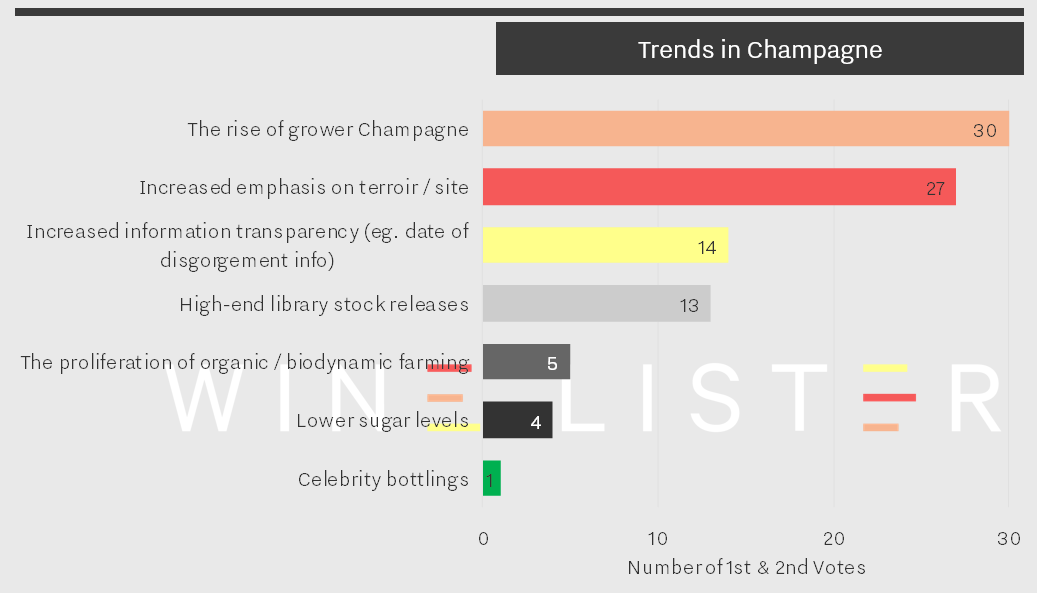

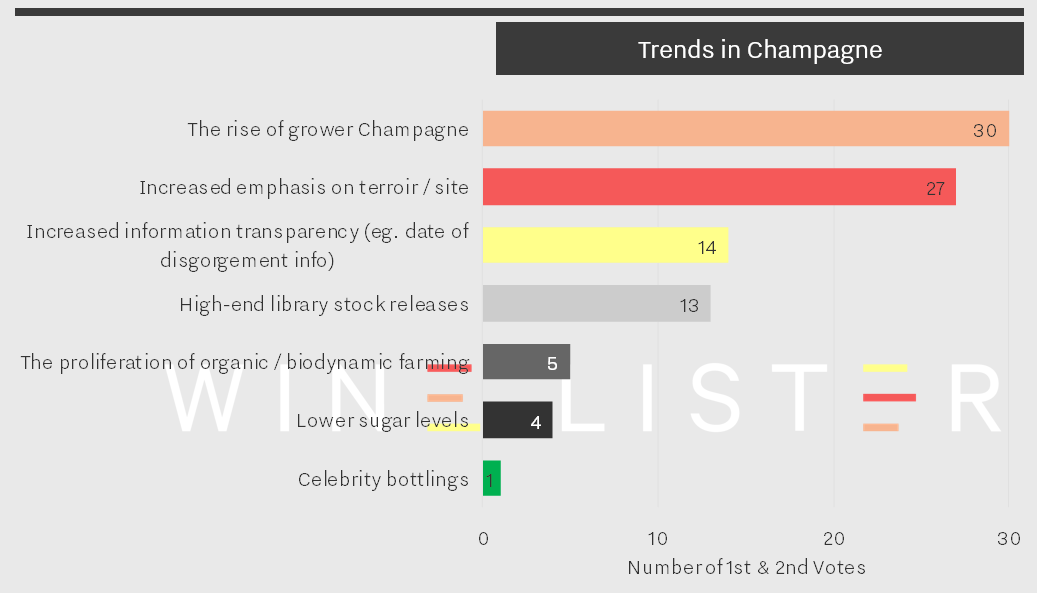

While quality across the board is something to keep us celebrating well in to 2019 (see more on this here), the notable trends could indicate an increase in year-round enjoyment of Champagne. The chart below shows responses to our question, “What are the most important trends in Champagne?” by number of votes.

The trend most-frequently ranked as number one or two by Wine Lister Founding Members was the rise of grower Champagnes, closely followed by the increased emphasis on terroir / site Champagnes. One U.K. merchant remarked that “Consumers are now identifying with specific terroir in Champagne and understanding the value of the grower…” – a comment that further leads us to suspect an increased appreciation of Champagnes as wines, and not just celebratory bubbles.

The “rise of the grower” trend is, however, juxtaposed by continued demand for big brands. Of the basket of wines treated in the study, the grower Champagne segment has seen an increase in popularity (measured by search rank) of 9% since the beginning of 2017. Though this performance is superior to the maison segment’s slight decline in popularity (-4%), grower Champagnes still sit twice as far down the popularity rankings, with an average search rank of 1,620 compared to 775.

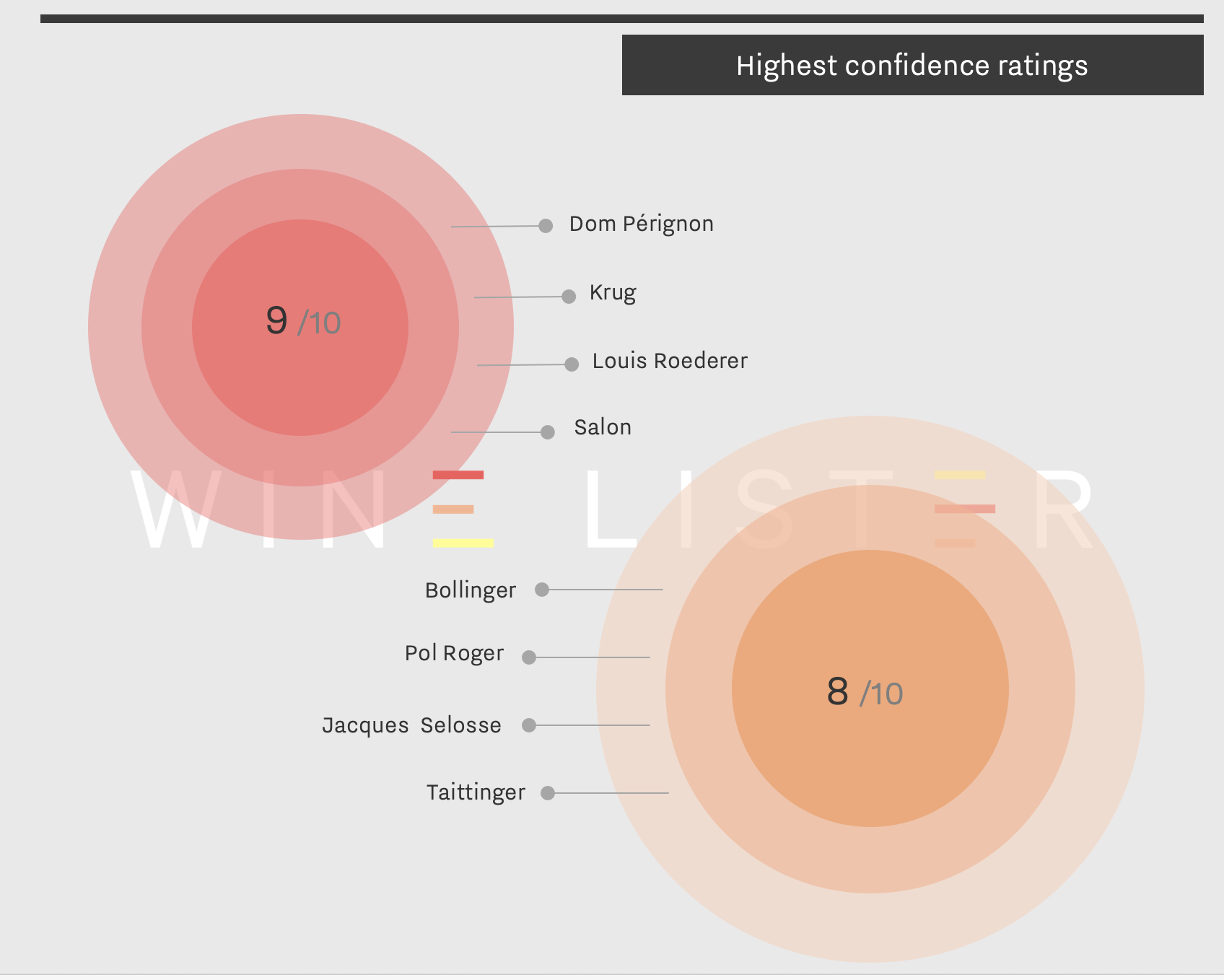

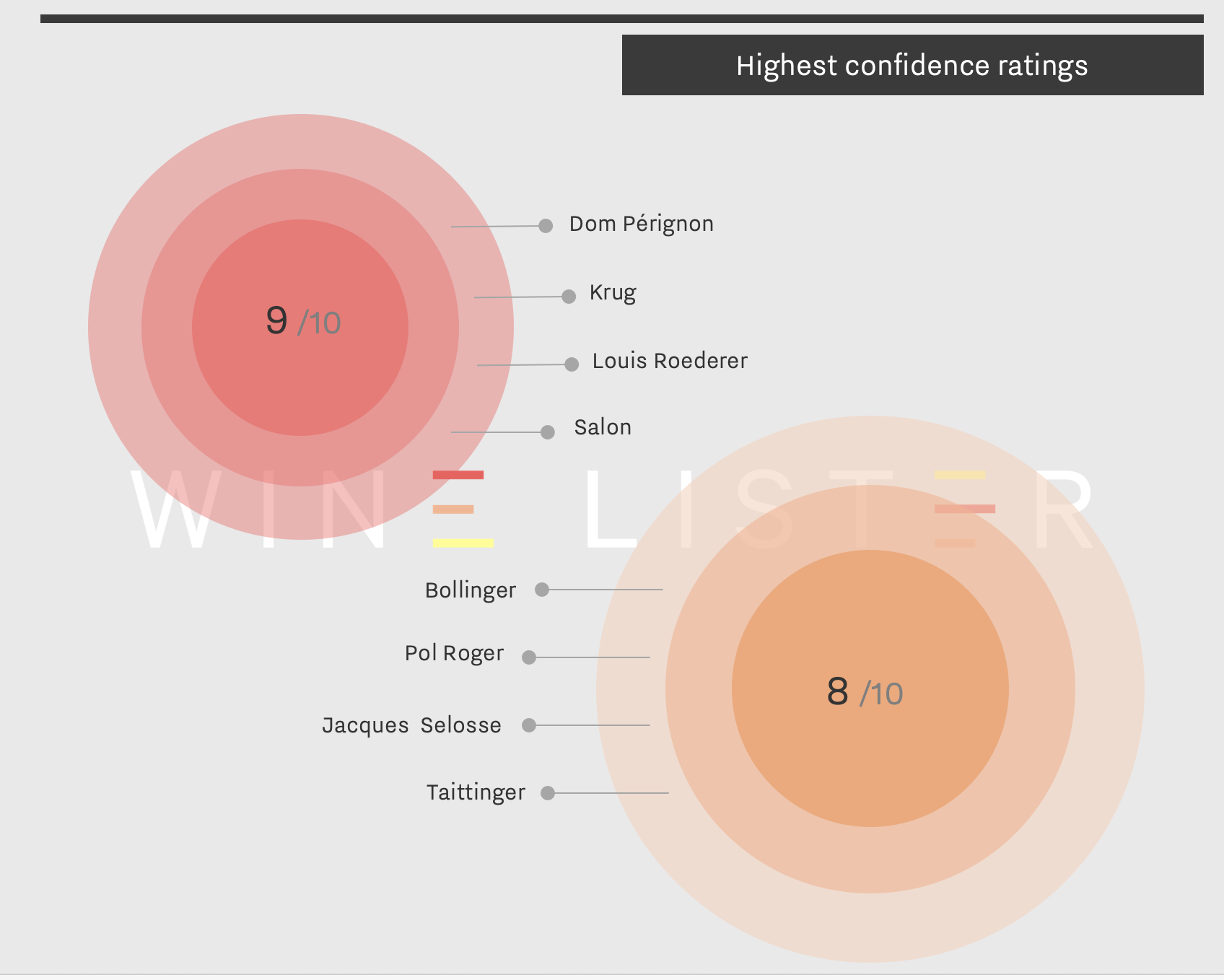

Perhaps predictably, big brands still win the race when it comes down to the bottom line. A U.K. merchant commented, “Small growers are getting much better press, but I suspect the big name cuvées still rule the roost for sales/investment”. Indeed, when asked to award confidence ratings to specific Champagne producers, the trade cited only one grower champagne within the top two confidence scores (9/10 and 8/10), Jacques Selosse. The houses to earn top confidence ratings were Dom Pérignon, Krug, Louis Roederer, Salon, Bollinger, Pol Roger, and Taittinger, as shown on the chart below.

A top tier merchant offers some explanation into the difference in picture painted between the top Champagne trend and Champagne confidence ratings: “Production needs to be small but not so small as to result in a proliferation of Champagnes which the vast majority have never heard of. The big brands which produce great quality are still finding serious demand in the market!”

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

Wine Lister’s three-pronged rating system, which measures a wine’s Quality, Brand strength, and Economic performance, gives a uniquely holistic outlook on the world’s finest wines. Wine Lister’s Economics score comes courtesy of data partnerships with Wine Owners and Wine Market Journal, the former supplying price data and the latter auction trading volumes from the world’s major fine wine auction houses.

Thanks to an expansion of the data we receive from both Wine Owners and Wine Market Journal, we have recently added Economics scores, and therefore overall Wine Lister scores, to c.1,250 wines on Wine Lister.

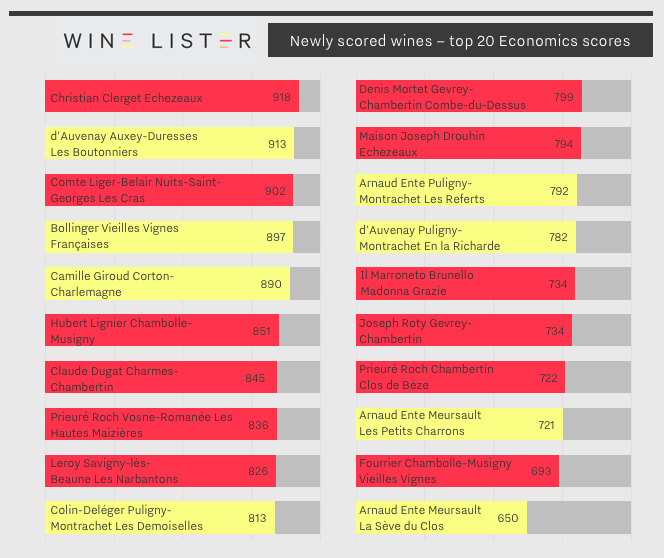

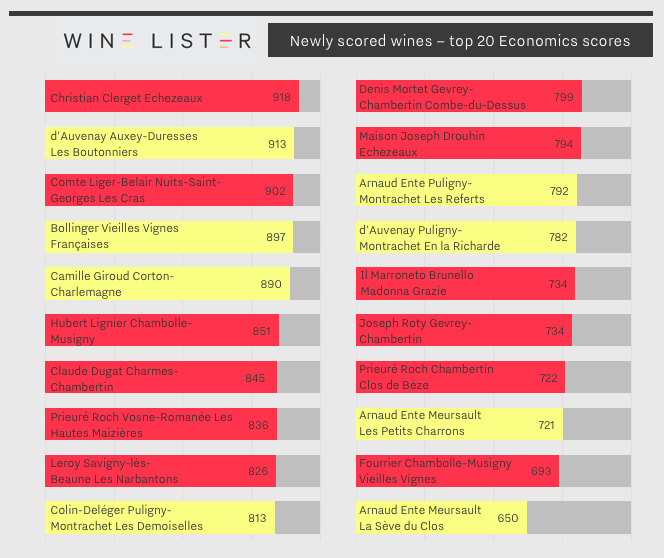

Having examined the top overall scorers last week, below we look at the top 20 highest Economics scorers of this new batch.

Whilst Burgundy represents 58% of wines newly-armed with full Wine Lister scores, the region claims 90% of the group’s top 20 Economics scores. Ten of these hail from the Côte de Nuits, earning an impressive average Economics score of 809, and including the best Economics performer of these newly-scored wines, Christian Clerget’s Echezeaux (918). Clerget’s Echezeaux has traded 48 bottles at auction over the past year, just over 1% of its 4,000-bottle annual production volume.

Next in line from the Côte de Nuits – and the only Nuits-Saint-Georges in the top 20 – is Les Cras from Domaine du Comte Liger-Belair, which takes the third-best Economics score of this new batch (902), despite having traded just 14 bottles at auction over the past 12 months. It does so thanks to excellent short and long-term price performance. It has added 20.2% to its price over the past six months and recorded a three-year compound annual growth rate (CAGR) of 25.4%. It also has a high average price of £394.

The Côte de Beaune features eight times, with Domaine d’Auvenay’s Auxey-Duresses Les Boutonniers coming second overall with a score of 913. However, Puligny-Montrachet takes the lion’s share of the Côte de Beaune’s spots. The first is Colin-Deléger Les Demoiselles with a score of 813, its strong economic performance is the result of a three-year CAGR of 24.4%.

While Arnaud Ente is represented in Puligny-Montrachet by Les Referts, which achieves an Economics score of 792, the domaine features more prominently in Meursault, taking two spots with Les Petits Charrons (721) and La Sève du Clos (650). The latter also records the highest Quality score of any Burgundy in this group (952).

Interestingly, the number one overall scorer of the 20 is in fact one of only two non-Burgundian wines to feature. Champagne Bollinger Vieilles Vignes Françaises achieves a Wine Lister score of 923, at least 98 points ahead of any of the other 19 wines featured here. Its Economics score of 897 is thanks to a three-month average price of £712, a three-year CAGR of 13.8%, and having traded 128 bottles at auction over the past year.

Other wines from the newly-scored list to feature in the top 20 Economics scores are: Domaine Leroy Savigny-lès-Beaune Premier Cru Les Narbantons, Camille Giroud Corton-Charlemagne Grand Cru, Maison Joseph Drouhin Echezeaux Grand Cru, Domaine Prieuré Roch Vosne-Romanée Les Hautes Maizières, Domaine Claude Dugat Charmes-Chambertin Grand Cru, Domaine Hubert Lignier Chambolle-Musigny, Domaine Prieuré Roch Chambertin Clos de Bèze Grand Cru, Domaine Joseph Roty Gevrey-Chambertin, Domaine Colin-Deléger Puligny-Montrachet Premier Cru Les Demoiselles, Il Marroneto di Mori Alessandro Brunello di Montalcino Madonna Grazie, Domaine Fourrier Chambolle-Musigny Vieilles Vignes, and Domaine Denis Mortet Gevrey-Chambertin Combe-du-Dessus.

We are hugely excited to announce a 66% increase in the number of wines with full Wine Lister scores, to a total of 3,140 wines and just shy of 30,000 wine-vintages. That means you are now far more likely to find the wine you are looking for when searching the Wine Lister database.

In a survey, Wine Lister subscribers said they wanted increased wine coverage on the website, allowing them to discover Wine Lister scores and decision-making tools on a broader range of fine wines, and we have worked hard to make this happen.

This important development comes thanks to the expansion of Wine Lister’s data partnerships with Wine Market Journal and Wine Owners, the former supplying unparalleled auction trading data from the world’s major fine wine auction houses, and the latter comprehensive price data.

In particular, Wine Lister’s coverage of Burgundy’s top wines has greatly increased, with 58% of the newly-scored wines hailing from the region. However, the overall top 10 highest-scoring wines in this new batch show a thrilling level of variety:

Users can now find out everything they need to know about wines such as Bollinger’s hallowed pre-phylloxera Vieilles Vignes Françaises, to Keller’s Westhofen Absterde Riesling, Valentini’s ultra-traditional Montepulciano d’Abruzzo, and back to some Côte d’Or heavyweights via top Brunello and Barolo from Il Marroneto and Vietti. The top 10 newly-scored wines confirm the rich diversity of wines on Wine Lister.

This coverage expansion is the first step in a series of exciting developments that Wine Lister has in store over the coming months, as it approaches its third birthday in May 2019. Each one is designed to help the different facets of the international fine wine community to get the most out of our unparalleled database and intelligence. Watch this space!

Wine Lister Indicators are designed to help you find the perfect fine wine for any occasion. Wine Lister regularly tracks the movements of wines in and out of these segments (such as recent commentary featuring new Buzz Brands for Burgundy). This month we look at newcomers to the Value Pick segment – wines that achieve the best quality to price ratio.

France is the geographical victor of new Value Picks, with a total of seven wines hailing from Bordeaux and the Rhône (and one from the Loire). These traditional regions may appear “uncool” compared with the likes of Burgundy (whose popularity continues to rise). However, it is perhaps thanks in part to their “uncool” status that Bordeaux and the Rhône are also sources of exceptional value for money.

The only two whites of our new Value Picks, Château Guiraud Premier Cru 2001 and Château Suduiraut Premier Cru 2003, actually achieve the highest Quality scores of the group (936 and 929 respectively). Château Guiraud 2001 is priced at £32 per bottle in-bond, and Château Suduiraut 2003 at £27. Sadly, the incredible Quality scores of these Sauternes (as well as others across the board) may be hindered by a lack of demand for the volume produced. Sauternes typically earn poor Economics scores on Wine Lister (Château Guiraud 2001 achieves an Economics score of 212, and Château Suduiraut 2003 345), perhaps due to the pace at which older vintages of these exceptional sweet wines are consumed. With Christmas just around the corner, however, there is every reason to source either of these two for good value for your buck.

Elsewhere in Bordeaux, Pessac-Léognan rules the Value Pick reds with two listings from Château Bouscaut. The 2017 is one of Bouscaut’s new Value Pick vintages, however the real appeal, with 10 years of age, is the physical 2008 vintage, which achieves a Quality score of 768 (vs. 775 for 2017) for a price just £1 above the latest release (at £19 per bottle in-bond). These two vintages join existing Value Picks of Château Bouscaut, namely the 2016, 2015, 2013, and 2004. The latter is interestingly Bouscaut’s highest-scoring vintage ever (868), and therefore provides exceptional value at £21 per bottle in-bond.

In the Rhône, producer Tardieu-Laurent has two newcomers to the Value Pick segment: Châteauneuf-du-Pape Vieilles Vignes 2007 (£32) and Cornas Coteaux 2014 (£23), with Quality scores of 906 and 813 respectively. The Châteauneuf-du-Pape Vieilles Vignes now has an impressive six Value Pick vintages, and the Cornas Coteaux four. Indeed, Tardieu-Laurent (which was recently acquired by EPI, the owner of top Brunello producer Biondi-Santi and both Piper and Charles Heidsieck) appears a good producer to choose for value, with six of the domaine’s ten wines on Wine Lister having vintages in the Value Pick segment. It is perhaps therefore surprising that its Brand scores sit mostly in the average section of Wine Lister’s 1,000-point scale or below – uncool, but with very cool price to quality ratios.

A second Châteauneuf-du-Pape, the 2006 from Domaine Charvin is the third wine from the Rhône to make it to the list, with a Quality score of 869 and available at the modest price of £28 per bottle in-bond.

These French Value Picks convince us that “old-school” wines should not be dismissed as such. With an average price of £25 per bottle in-bond, and an average Quality score of 858, these represent excellent value for money – and that will always be cool.

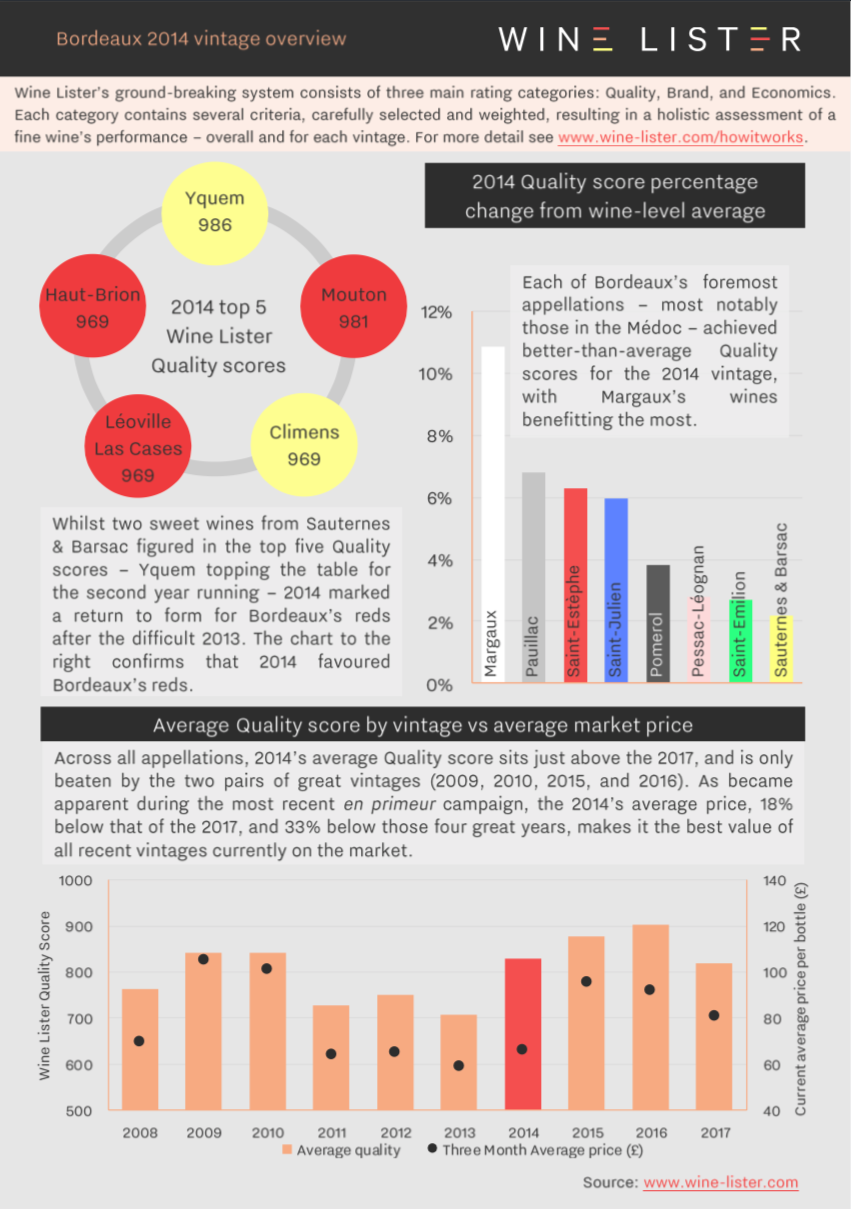

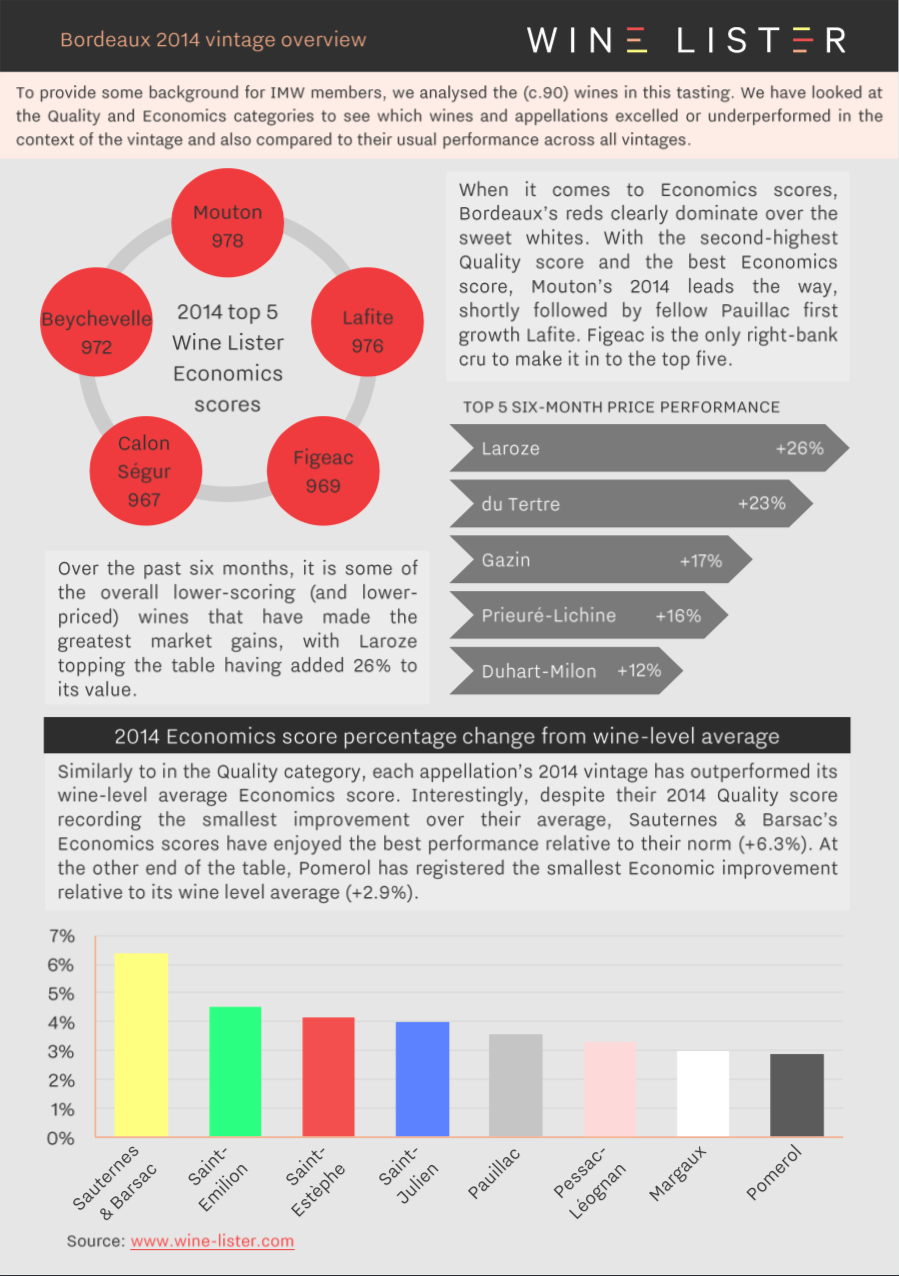

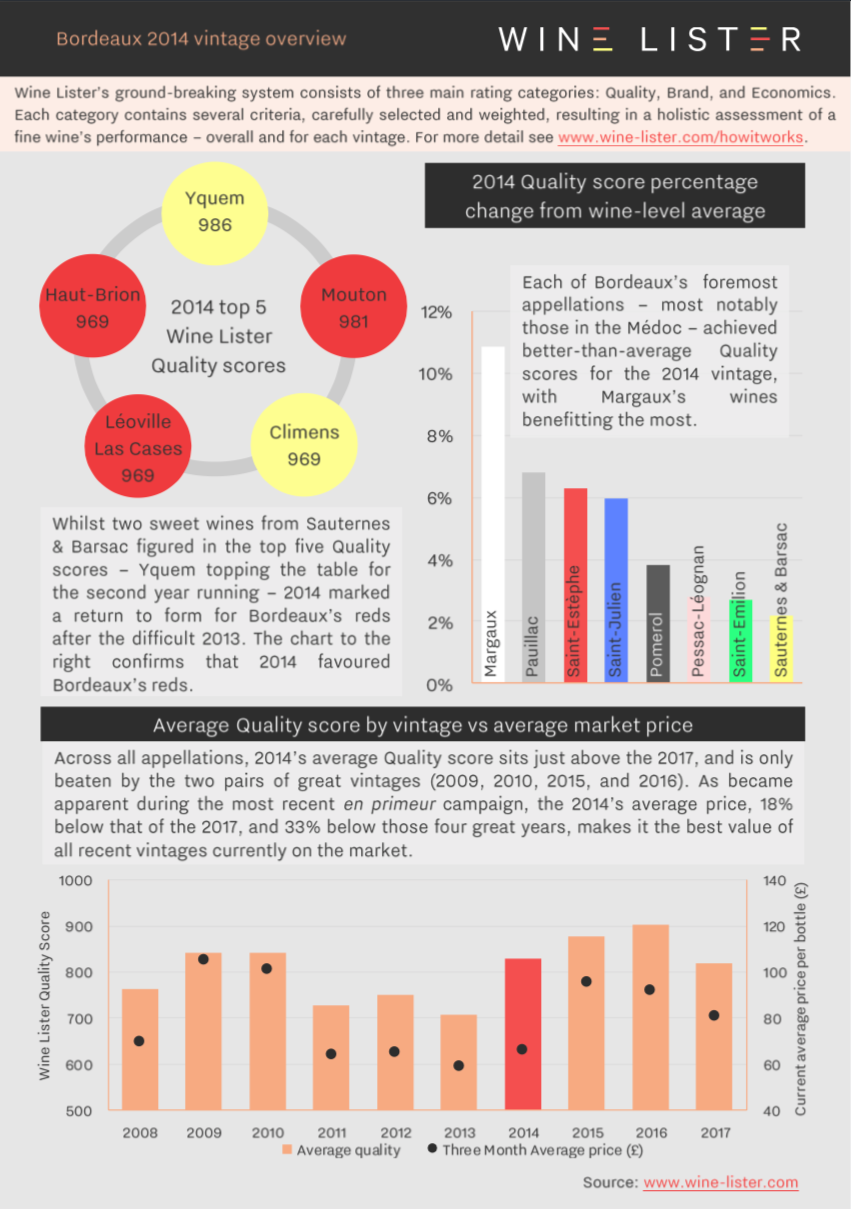

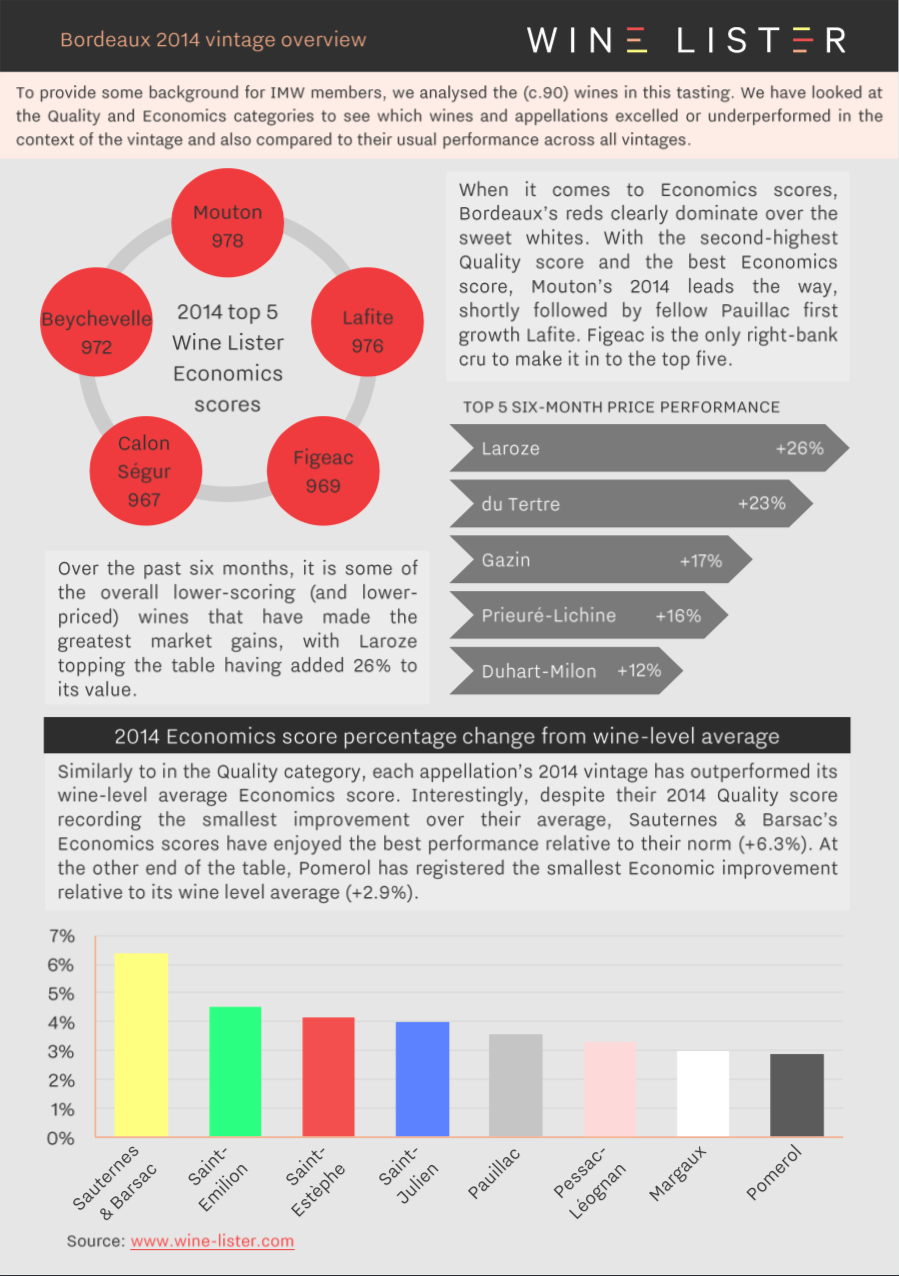

This week some of the Wine Lister team attended the Institute of Masters of Wine‘s Annual Claret Tasting, which this year focused on Bordeaux’s 2014 vintage. Though still young, it is a vintage that is tasting beautifully.

Throughout Wine Lister’s coverage of this year’s en primeur campaign, we found ourselves referring frequently to the 2014 vintage for comparative (and sometimes better) quality, and crucially, better prices. Below we explore the vintage in more detail, looking at Quality and Economics scores by appellation. (Note that this analysis was produced based on the basket of wines represented at the IMW Tasting).

Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download the slide here: Wine Lister IMW 2014 vintage overview

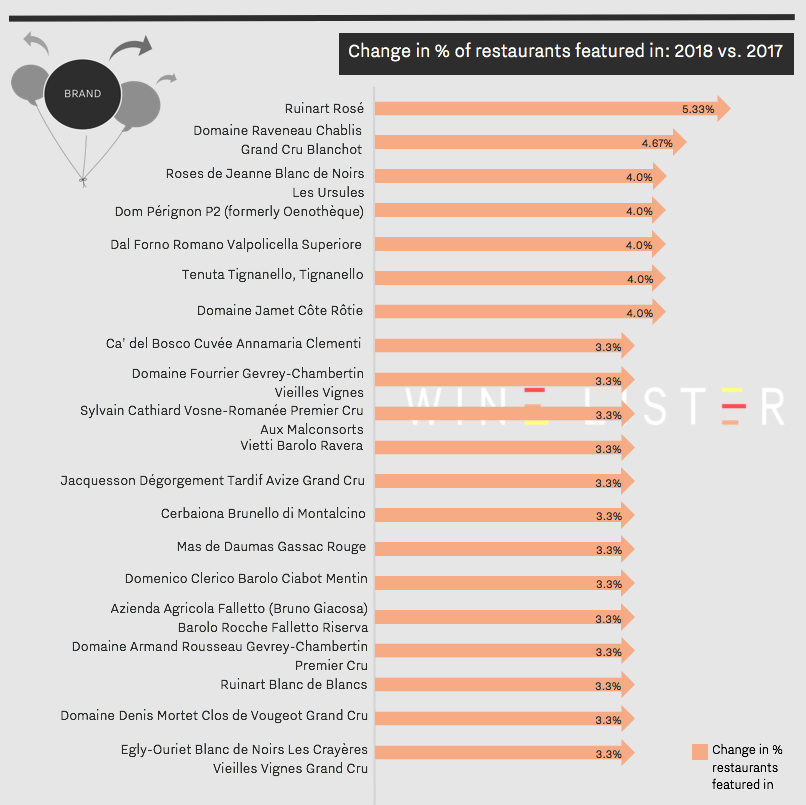

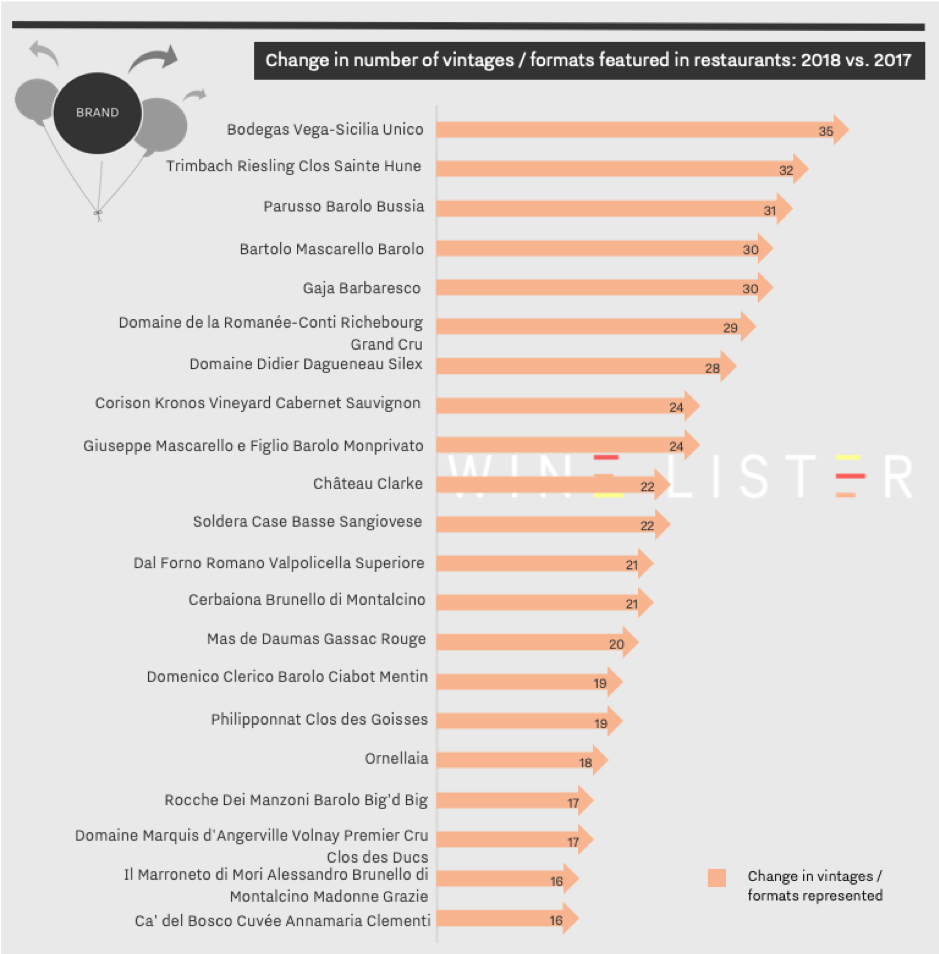

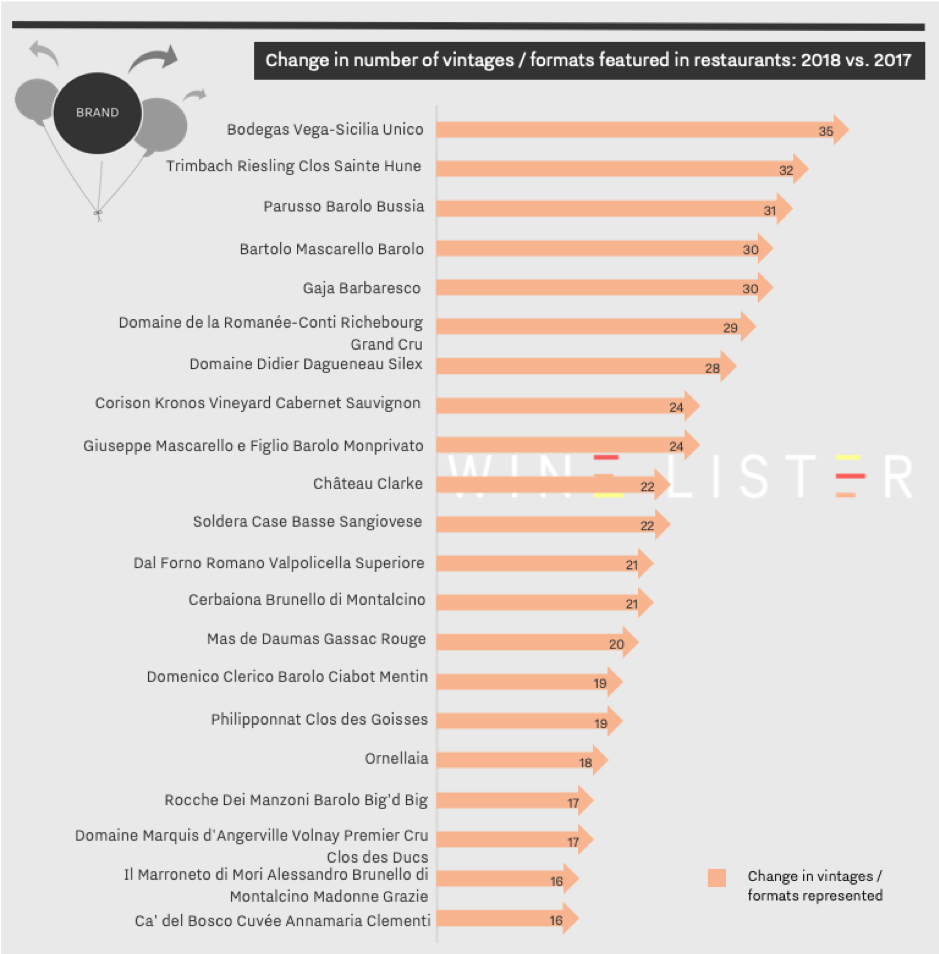

Last week we revealed the top 20 gainers in presence in the world’s best restaurants over the past 12 months. That was in terms of breadth, i.e. the number of restaurants in which a wine features. Wine Lister also analyses the depth of presence – the range of vintages and/or bottle formats of each wine therein. Here we look at the top 21 wines achieving the largest increases in restaurant presence depth since last year.

In first place, with an impressive 35 additional vintages and/or bottle formats listed across the world’s 150 best restaurants since this time last year, is Vega-Sicilia’s Unico. This brings its total references to 250 (almost three and a half in each of the 71 lists in which it features). Given Unico’s average drinking life span of 13 years, and its reputation for longevity (an Unico vertical tasting is an opportunity not to be missed), this result is hardly surprising. Its strong restaurant presence is matched by online popularity (Unico is the 33rd most-searched-for wine in our database), resulting in a Brand score of 992 – the best of any Spanish wine on Wine Lister.

Though Spain takes the number one spot, Italy is the overall biggest mover in increased depth of representation, claiming 12 out of the 21 places shown on the chart below.

Ornellaia is among these, and is also the most thoroughly represented wine of the group, with 280 vintages and/or bottle formats featured across 43% of the world’s best restaurants.

Several others – Cerbaiona Brunello, Dal Forno Romano Valpolicella Superiore, Ca’ del Bosco Cuvée Annamaria Clementi, and Domenico Clerico Barolo Ciabot Mentin – feature in the top gainers for horizontal as well as vertical presence in the world’s best restaurants. The latter is one of five Barolos to feature in the chart above, joined by Parusso Barolo Bussia, Bartolo Mascarello’s Barolo, Giuseppe Mascarello e Figlio Barolo Monprivato, and finally, Rocche Dei Manzoni Barolo Big’d Big, which sees the biggest increase in vertical presence of the whole group. Despite a horizontal representation increase of just 1%, the number of vintages and/or bottle formats listed across the 3% of the world’s best restaurants in which it features has grown from two to 19 in the last 12 months (or in other words, by 850%).

Outside Italy, the overall picture of restaurant presence depth somewhat contradicts that of breadth painted last week. Though Champagnes, and in particular grower offerings, have increased significantly in terms of horizontal presence, their vintage and/or format gains have not been sufficient to make this week’s top 20. This suggests that whilst sommeliers are keen to add more variety of Champagne, they aren’t so worried about listing reams of vintages / formats thereof. Only one Champagne features in the group: Philipponnat’s Clos des Goisses.

Bordeaux is conspicuous by its absence in this list, other than Château Clarke, with 26 overall references up from just four. In fact, Bordeaux’s big names are more likely to find themselves at the very bottom of the list, many having seen their vertical entries on restaurant wine lists shrink significantly. This seems to suggest that as restaurants diversify, they are choosing to hold less Bordeaux stock, still listing the top wines, but not necessarily in multiple vintages or formats.

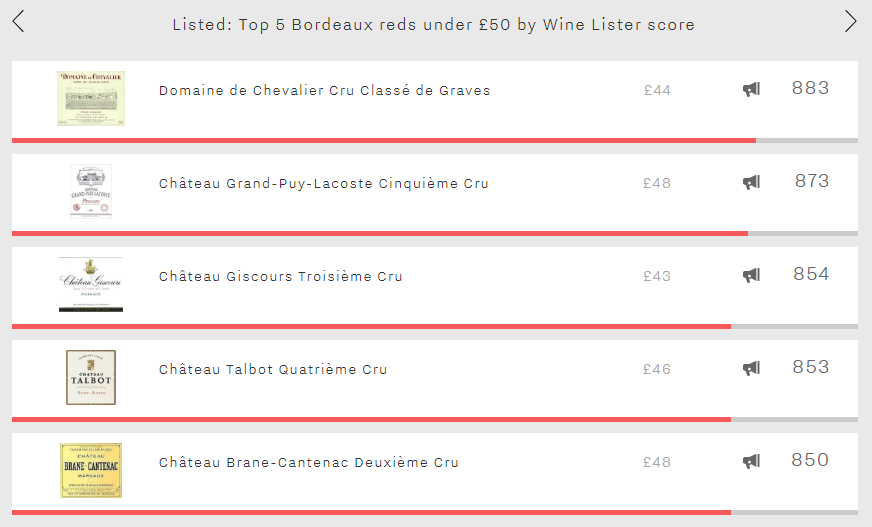

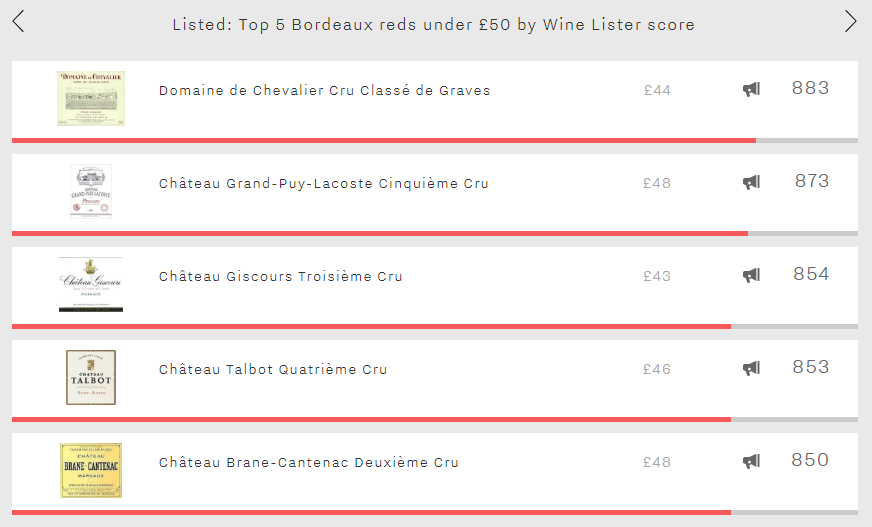

With just over eight weeks to go until Christmas, part of the pre-season ritual of any respectable wine lover is surely agonising over which wines to drink with the holiday meal. Whether that means digging into the cellar or making new purchases, perhaps this week’s top five can provide some inspiration. Since claret is a frequent feature at the Christmas table, this week we consider the best red Bordeaux under £50 by Wine Lister score (although note that prices are based on the per bottle average of in-bond case prices across vintages).

Each of this week’s top five are Buzz Brands, with every wine earning its best score in the Brand category. They also all hail from the left bank, and achieve an average Wine Lister score of 863, 75 points higher than the right bank’s top reds under £50 (788).

First of this week’s top five both overall and for Quality is Domaine de Chevalier, with scores of 883 and 885 respectively, and an average price of £44 per bottle. Though its most qualitative vintage (2015) is only just physical, and therefore not suitable for drinking straight away, there are plenty of vintages around the same in-bond per-case price point to choose from. For example, the 2011 holds a Quality score of 864 and a price of £36, and the 2008 a Quality score of 855 for £40.

Next on the list is Grand-Puy-Lacoste, with a Wine Lister score of 873, and coming in at £48 on average. The 2014 Grand-Puy-Lacoste provides by far the best Quality to price ratio of recent vintages, with a Quality score of 946 and an in-bond per-case price of £41 per bottle. Wine Lister partner critic Neal Martin awards it 95 points, and notes, “the purity and elegance of this Pauillac cannot be denied – a quite brilliant contribution to the 2014 vintage”. This is a wine to give to a loved one for Christmas for them to stow away and open several years down the line – its drinking window ranging from 2022 to 2040.

To view quality to price ratios for every wine on Wine Lister, on each wine page use the Value Pick score on Vintage Value Identifier charts, as above.

To view quality to price ratios for every wine on Wine Lister, on each wine page use the Value Pick score on Vintage Value Identifier charts, as above.

Wines three, four, and five of this week’s Listed blog stand within a mere four points of each other. The two Margaux wines to feature, Giscours and Brane-Cantenac, achieve Wine Lister scores of 854 and 850 respectively, and have an identical Quality score (804). However, their profiles differ elsewhere, Brane-Cantenac being the better performer for Economics (806 vs 791), whereas Giscours excels for Brand strength (956 vs 934).

Sandwiched between the two in this week’s top five line-up is Talbot, which claims the group’s highest Brand score (984), if also the lowest Quality score (748), and an average price of £46.

A final commonality of all five wines (and of course of top Bordeaux red as a whole) is the long ageing potential. These five left bank reds have an average drinking window of 13 years, with some more recent vintages expected to be drinking well until beyond 2040 – testament to the tradition of buying claret to lay down for life, and not just for Christmas.

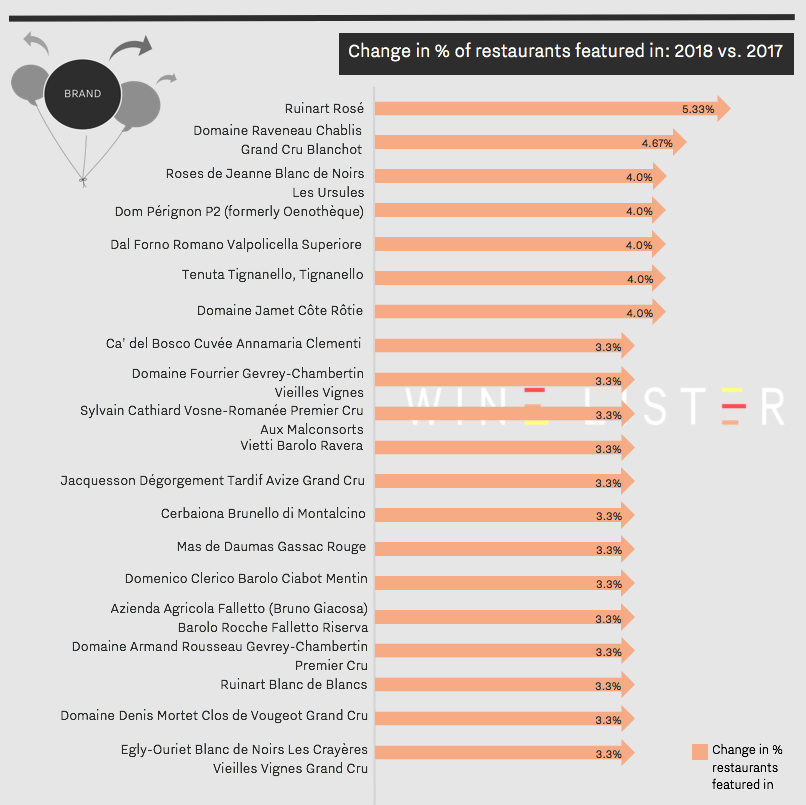

Part of Wine Lister’s Brand score includes a measure of prestige, achieved by analysing a wine’s presence in the world’s best restaurants. Whether a restaurant makes the cut depend on a combination of measures including the Michelin Guide, San Pellegrino 50 Best Restaurants, and World of Fine Wine Best Wine List Awards.

The chosen wine lists are then analysed to give us the breadth (how many restaurants) and depth (how many formats and/or vintages in each restaurant) of presence achieved by each wine on Wine Lister. Looking at the former criterion, the chart below shows the top 20 biggest gainers since our last blog on the subject. (Next week we will be looking at wines with the greatest increase in depth of representation.)

Six out of the 20 wines with the biggest increase in restaurant presence are Champagnes. Ruinart appears twice, with its NV rosé having made the greatest improvement, now appearing in 33% of the world’s best restaurants. However, the overall winner – present in more than double the number of restaurants, is Dom Pérignon’s Vintage Brut. Despite not featuring in the top 20 biggest risers above, the Champagne Brand king is now present in 69% of top restaurants worldwide, overtaking last year’s winner, Yquem.

Contrary to our last analysis on the subject, not all the biggest Champagne gainers in restaurant presence are big brands. Ruinart Rosé, Dom Pérignon P2, and Ruinart Blanc de Blancs may well fit this bill, with an average Brand score of 878, but the lesser-known three, grower Champagnes Roses de Jeanne Blanc de Noirs Les Ursules, Jacquesson Dégorgement Tardif Avize Grand Cru, and Egly-Ouriet Blanc de Noirs Les Crayères Vieilles Vignes, do not, as shown by a lower collective Brand score average of 664.

If this alone is not an indication of restaurant wine lists branching out, then perhaps the absence of Bordeaux is (indeed, a handful of Bordeaux wines with strong restaurant presence have lost a little ground since last year’s analysis). This diversification does however appear exclusive to the Old World, with no New World wines in the top 20 gainers.

Burgundy is well-represented amongst the top gainers, with one white, Raveneau’s Chablis Blanchot, and four reds: Sylvain Cathiard’s Vosne-Romanée Aux Malconsorts, Denis Mortet’s Clos de Vougeot, Armand Rousseau’s Gevrey-Chambertin, and Fourrier’s Gevrey Chambertin Vieilles Vignes.

Italy brings a show of diversity with six wines hailing from four different appellations across the 20 biggest movers. Vietti’s Barolo Ravera – one of three Barolos to feature in this list – has the lowest restaurant presence of the group (5%) and Solaia’s younger sibling, Tignanello the highest (47%).

N.B. The tasting did not include first growths, or wines such as Cos d’Estournel, Palmer, Léoville Las Cases, Ducru Beaucaillou, and Pontet-Canet.

N.B. The tasting did not include first growths, or wines such as Cos d’Estournel, Palmer, Léoville Las Cases, Ducru Beaucaillou, and Pontet-Canet.

To view quality to price ratios for every wine on Wine Lister, on each wine page use the Value Pick score on Vintage Value Identifier charts, as above.

To view quality to price ratios for every wine on Wine Lister, on each wine page use the Value Pick score on Vintage Value Identifier charts, as above.