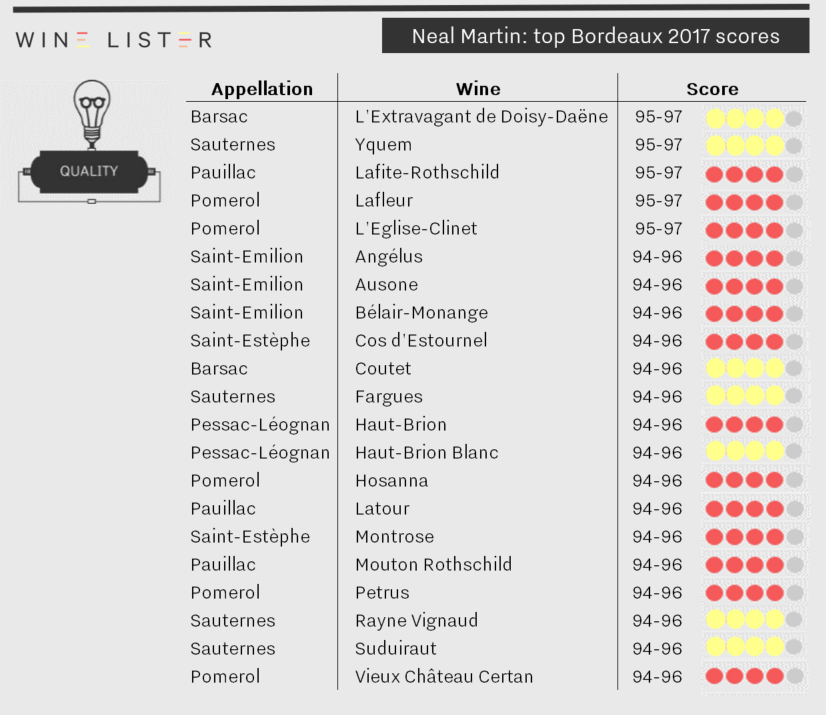

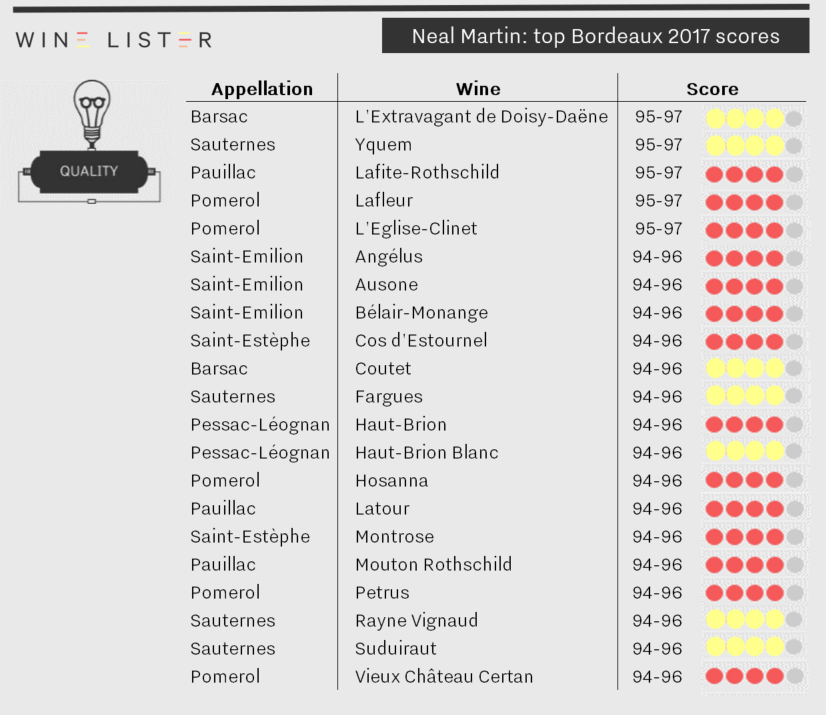

Bordeaux 2017 en primeur scores are now out from Neal Martin for Vinous.com – our US partner critic, and one of the most prominent voices of international wine criticism today. (Antonio Galloni’s scores are due out this Thursday, 3rd May). This is the first time Wine Lister has featured Neal Martin’s scores after he joined Vinous in February this year. Below are his scores equal to or above 94-96:

No wines earned perfect scores this year (in contrast with 2016, where Martin awarded a potential 100 points to eight wines), with five wines achieving Martin’s highest potential score of 97.

With a score of 95-97, Yquem sits in the top score bracket for the third time, already awarded 18.5 and 19.5-20 by Julia Harding MW (on behalf of Jancis Robinson) and Bettane+Desseauve respectively.

Similarly to Bettane+Desseauve, Martin’s appreciation for the quality of Sauternes and Barsac in 2017 is clear, with five other sweet whites making his top 21 (L’Extravagant de Doisy-Daëne, Coutet, de Fargues, Rayne Vignaud, and Suduiraut).

Lafite is Martin’s highest scoring Médoc first growth, which he describes as “classic from start to finish”. Joining the high rankings are first growths Haut-Brion (and its white), Latour, and Mouton, all earning 94-96 points.

The right bank figures strongly too. Two Pomerols (Lafleur and L’Eglise-Clinet) equal Lafite’s score, with three more earning 94-96, alongside three wines from Saint-Emilion. Ausone, like Yquem, makes its third appearance in top scores for Bordeaux 2017 from Wine Lister partner critics. “What a great Ausone this is destined to be,” comments Martin.

Bélair-Monange is perhaps the stand-out entry, described by Martin as, “the jewel in the crown of J-P Moueix… an assured, and bewitching Saint-Emilion”.

Other wines scoring 94-96 from Neal Martin include: Angélus, Cos d’Estournel, Hosanna, Montrose, Petrus, and Vieux Château Certan.

All these scores are now live on the wine pages of our website for subscribers to view (alongside those of Bettane+Desseauve and Julia Harding), with links through to Neal Martin’s tasting notes on Vinous.com. Read Neal Martin’s coverage of Bordeaux 2017 here.

Vinous coverage will be completed by Antonio Galloni’s scores, due for release on Thursday 3rd May.

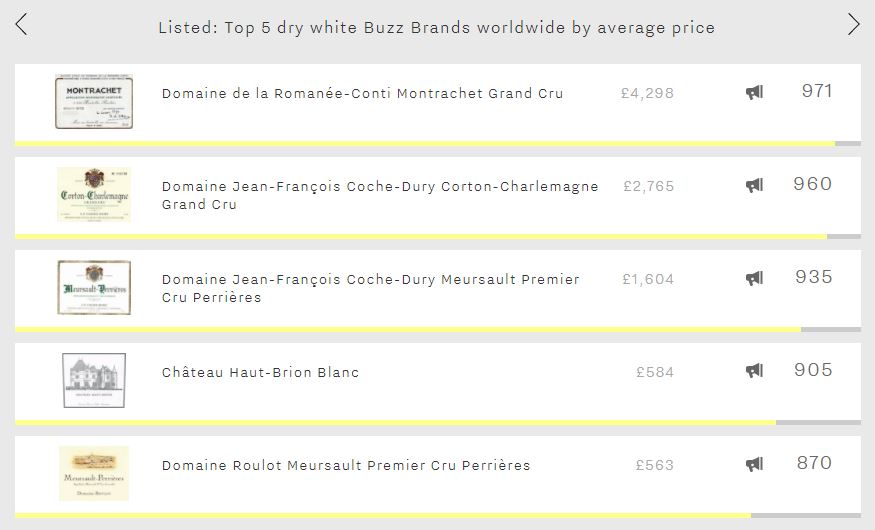

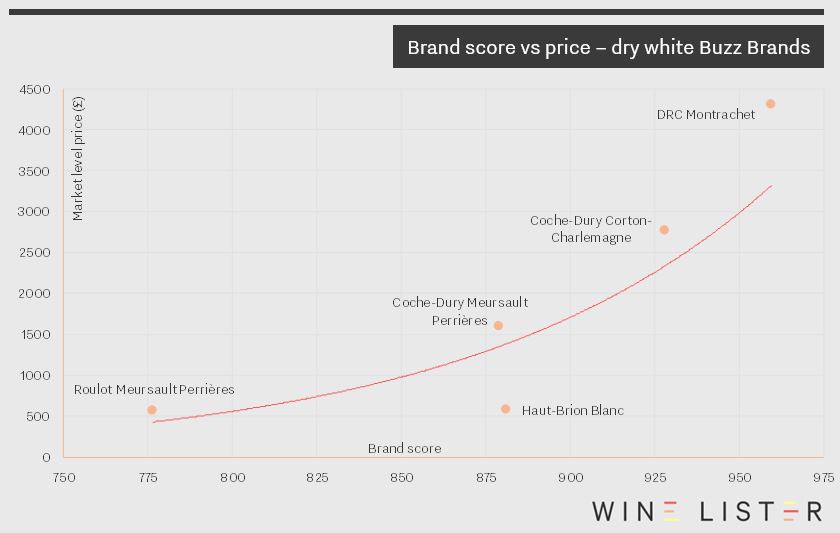

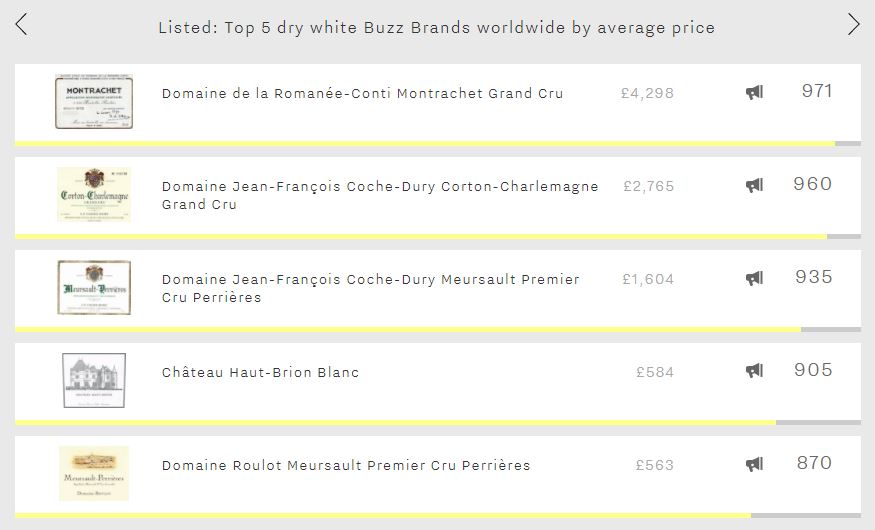

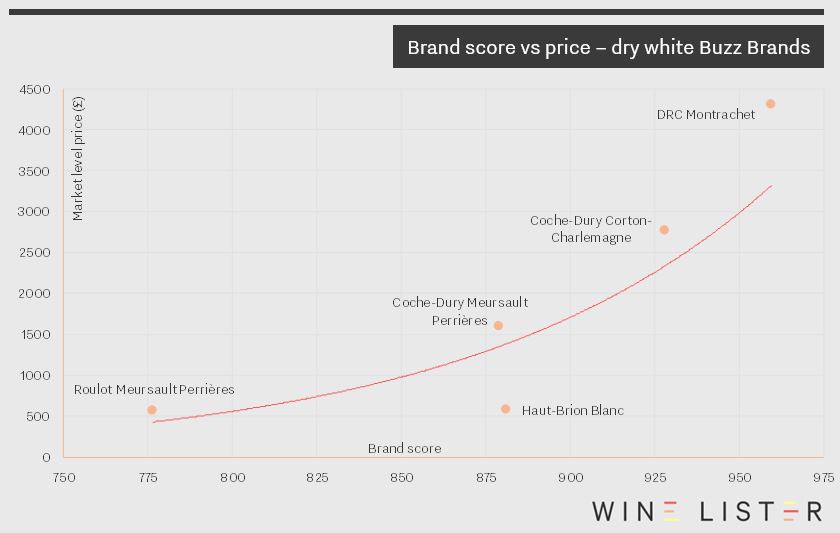

“Buzz Brands” is one of the four Wine Lister Indicators developed to help our users identify wines for different scenarios. A Buzz Brand is a wine with strong distribution in the world’s top restaurants, enjoying high levels of online search frequency or demonstrating a recent growth in popularity, and identified by the fine wine trade as trending or especially prestigious. As such, you wouldn’t expect them to come cheap, and the five most expensive dry whites definitely don’t, costing around £2,000 on average.

Perhaps unsurprisingly given the miniscule production of its top wines, Burgundy fills four of the five spots (and two of these are from Coche-Dury). DRC Montrachet is the world’s second-most expensive dry white – behind Leflaive’s Montrachet which fails to achieve Buzz Brand status. It achieves the best Quality score of this week’s top five (976), just pipping Coche-Dury’s Corton-Charlemagne to the post (971). It also enjoys the highest Brand score of the group – or any dry white for that matter (960) – the result of appearing in considerably more of the word’s top restaurants than Coche-Dury’s Corton-Charlemagne, which comes second in that criterion (26% vs 19%), and also being nearly 50% more popular than any of the rest of the five.

Whilst Coche-Dury’s Corton-Charlemagne has to settle for second place in the Quality and Brand categories, it not only manages the group’s top Economics score (991), but also the highest of any dry white on Wine Lister. This is thanks to formidable price growth. It has recorded a three-year compound annual growth rate (CAGR) of 25%, and has added 14% to its price over the last six months alone.

It is to be expected that wines from two of Burgundy’s most hallowed grand cru vineyards command the group’s highest prices, but it might come as more of a surprise that two Meursaults from the premier cru Perrières vineyard feature. With over £1,000 separating the considerably more expensive offering from Coche-Dury and Roulot’s expression, it becomes clear that Brand score is a significant driver of price at this rarefied end of the scale, particularly within Burgundy.

Proving that expensive Buzz Brands are not only to be found in Burgundy, Haut-Brion Blanc makes an appearance in the top five. Whilst it is the most liquid of the group – its top five traded vintages have traded 49% more bottles than any other wine in the five – it has experienced by far the lowest growth rates, with a three-year CAGR of 9% compared to the Burgundy quartet’s remarkable average of 22%.

With its top ten wines by Quality score costing £225 per bottle on average, Piedmont might seem overindulgent for a low key midweek meal. However, with a little bit of help in the shape of Wine Lister’s Value Pick search tool, it is easy to find wines that will deliver maximum enjoyment at reasonable prices. Value Picks represent the very best quality-to-price ratio wines, with a higher coefficient applied to allow exceptional quality to be recognised. With a remarkable average Quality score of 976, and costing £40 on average, these five Piedmontese wines prove that outstanding quality is available at all price points.

If you’re after top Nebbiolo at a fair price, then Produttori del Barbaresco’s 2013s appear a safe bet, filling three spots. However, the trade-off for top value will be patience – none of the three will enter its drinking window until 2023. However, with each of them lasting over 18 years, you will be able to make the most of your prudent purchases for years to come. And what better way to explore Barbaresco’s crus in an outstanding vintage than with these three? The Asili Riserva achieves the top Quality score of the three (987), 75 points above its wine-level average. It is also the most expensive, but £42 per bottle doesn’t seem unreasonable for such quality. The Montestefano Riserva really outperformed in the 2013 vintage with a Quality score of 972, 125 points above its average score. The market is yet to react – the 2013’s price is currently 16% below its wine-level average.

Proving that if you’re looking for value for money in Piedmont, it’s not just Barbaresco that you should look out for, Domenico Clerico Barolo Ciabot Mentin 2007 is the region’s number one Value Pick. With a Quality score of 989 – thanks to a 98 point score from Antonio Galloni – it is not hard to see why. What’s more, whereas the Produttori del Barbaresco 2013s require cellaring, the Ciabot Mentin is just entering its drinking window.

Showing that Piedmont is not all about Nebbiolo, Giacomo Conterno’s Barbera d’Alba Cascina Francia 2013 fills the remaining spot. The group’s only Buzz Brand, this would be an excellent way to sample one of Giacomo Conterno’s wines at a fraction of the cost of the domaine’s top cuvées – the hallowed Monfortino Riserva costs £608 per bottle on average.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

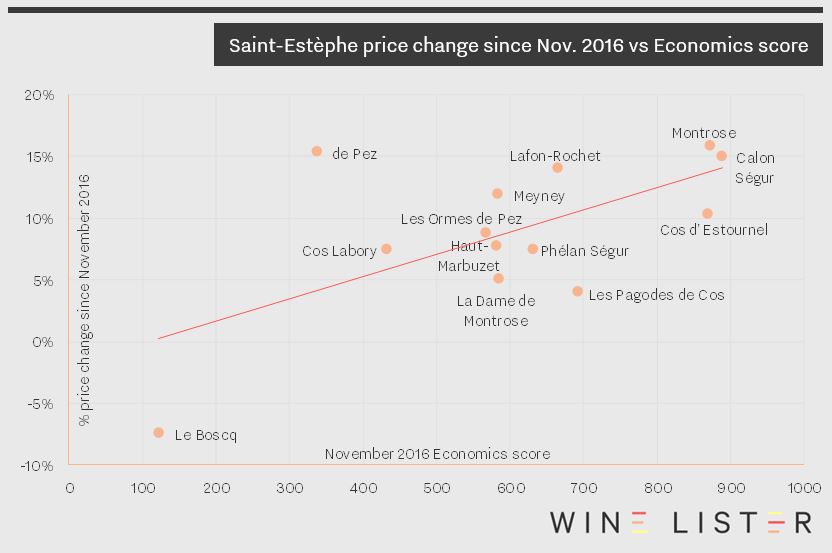

Wine Lister Economics scores not only reflect a fine wine’s economic clout, but also predict its future price performance. The economics of fine wine are increasingly important. Some purists wish it weren’t the case (wouldn’t it be wonderful if quality could exist in isolation from pecuniary concerns?), but consider the plight of the producer making an exceptional wine, that without any brand recognition or commercial strategy doesn’t ever see the light of day. It never finds an importer, or its way into the consumer’s glass, let alone the investor’s portfolio.

That is why Wine Lister scores capture 12 data points across three rating categories, to measure the all-round performance of a fine wine in its journey from vine to glass. After Quality and Brand, the third Wine Lister rating category is Economics. The Economics score shows the producer whether its commercial strategy is working, but more than that, it can also serve to indicate to the collector whether the wine makes an economically sound investment.

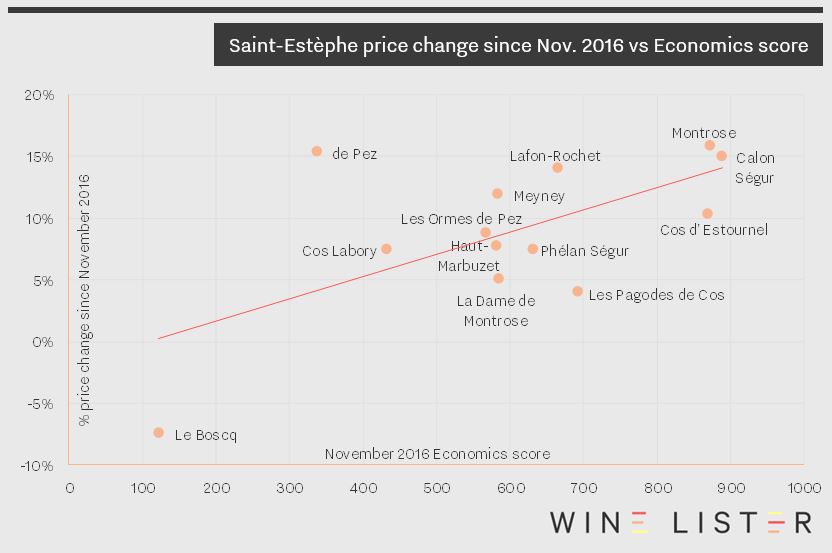

Bordeaux wines with an Economics score above 900 in November 2016 had increased by 17% in price on average by January 2018. By contrast, those with Economics scores below 600 gained just 8% subsequently. We can see this pattern in action in the chart below, which looks at Saint-Estèphe wines over the same 14-month period. The wines with the highest Economics scores at the beginning of the period proceeded to increase more in price than those with lower scores as a general rule.

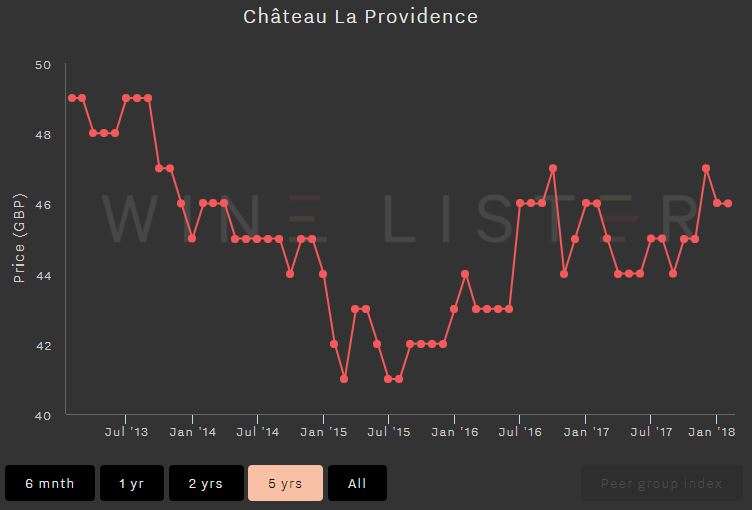

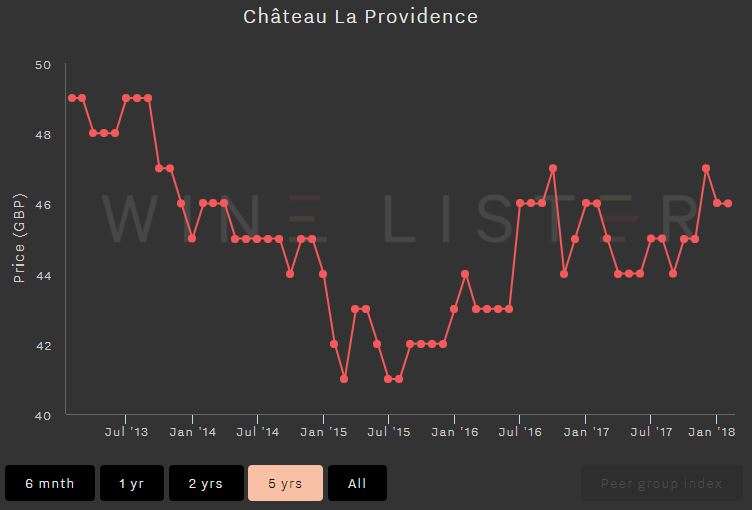

The below screenshots of Wine Lister’s price history tool illustrate graphically the difference between two wines with different economic profiles. Vieux Château Certan’s Economics score lies in the “strongest” portion of the Wine Lister 1000-point scale at 907/1000. While Château La Providence’s Quality score is strong (708/1000) its low Economics score of 389 is the result of a lower price, weak price performance, volatile prices, and modest trading volumes.

Wine Lister analyses five criteria in order to measure a wine’s economic strength, expressed as an Economics score out of 1,000. Four of these criteria use pricing data from our data partner, Wine Owners, while the fifth uses trading volume figures from the Wine Market Journal:

- 3 month average bottle price

This “market price” is the ultimate measure of what people are willing to pay for each wine in each vintage. Data is updated weekly, and bases prices on a three-month rolling average. Prices are shown In Bond per bottle.

- Short-term price performance

A wine’s financial strength also depends on its price performance. Wine Lister calculates price changes over six months for an indication of short-term price trends.

- Long-term price performance

Long-term performance measures a wine’s compound annual growth rate over three years.

- Price stability

Price fluctuations over a 12-month period are distilled into the measure of a wine’s stability. Wines with less volatility are more consistent, less risky and therefore earn a better Economics score.

- Volume traded

Added to pricing information is data on a wine’s liquidity. A wine can have good price performance but lack the current market demand, potentially making it a less attractive wine for investment.

This week, Wine Lister determinedly battles through the cold to bring on spring with the vinous ray of sunshine that is Sauvignon Blanc. The Loire valley is, for many, the holy grail of Sauvignon Blanc production, creating pure, age-worthy examples of the grape. Interestingly, Wine Lister’s top five Loire Valley dry whites for Quality all hail from the Easternmost tip of the Valley – Pouilly-Fumé and Sancerre – thus edging out stiff competition from the more Westerly Chenin Blancs.

Whilst none of the top five breach the 900-point mark – thus not quite making it into the most elite band of Wine Lister’s 1,000-point scale – they don’t miss out by far, and are separated by just 28 points. Notably, two producers dominate – Dagueneau and François Cotat – filling four spots, with Alphonse Mellot’s Edmond taking the remaining place.

In top spot is Dagueneau’s Silex with a score of 895. This iconic Pouilly-Fumé – or Blanc Fumé de Pouilly as the domaine refers to it – might not be the Loire’s longest-lived dry white, but leads thanks to excellent critics’ ratings, with French duo Bettane+Desseauve awarding it 18.5/20 on average. Not only is it the Loire’s top dry white for quality, it also achieves the best Brand score of any Loire Valley wine – it is 68% more popular than any other wine from the region and its famous flint-emblazoned bottle is visible in 39% of the world’s top restaurants.

Second and third spots are taken by two Sancerres from François Cotat – Les Culs de Beaujeu (883) and Les Monts Damnés (879). François Cotat, along with his cousin Pascal inherited their respective domaines when their fathers – Paul and Francis – retired in the early 90s. The cousins decided to split production, with François continuing to make his wines in Chavignol, whilst Pascal built a new winery in Sancerre. François’ Les Culs de Beaujeu and Les Monts Damnés comfortably achieve the longest drinking windows of this week’s top five – 12 and 13 years respectively – at least three years longer than the remainder of the group.

Fourth and fifth spots are filled by Dagueneau’s Les Monts Damnés (869) and Alphonse Mellot’s Edmond (867). Whilst they are separated by just two points in terms of Quality, the former is over 2.5 times more expensive, perhaps thanks to Domaine Dagueneau’s cult status.

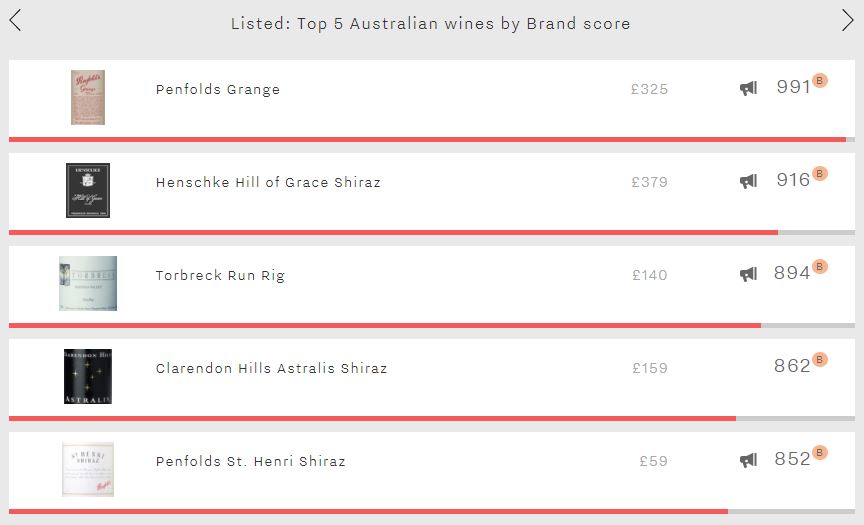

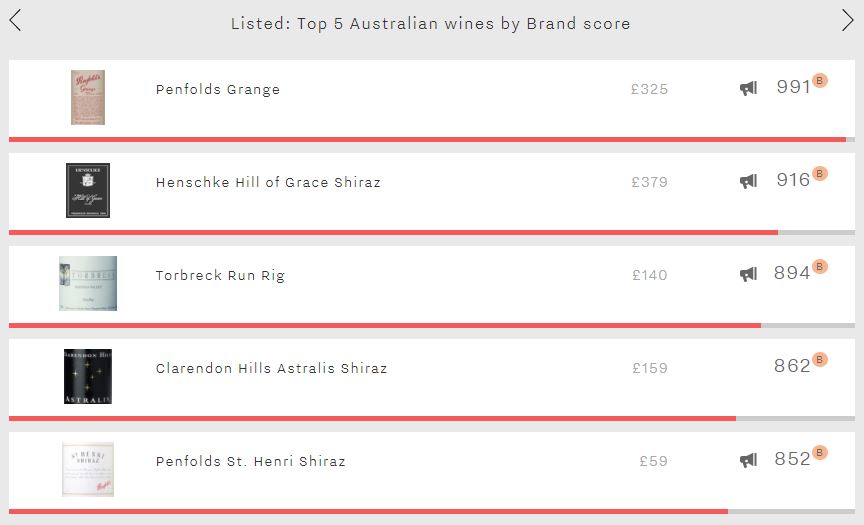

Having stopped off last week in Syrah’s spiritual home – the Northern Rhône – in search of the region’s leading wines for the 2015 vintage, this week Wine Lister’s Listed section ventures to Australia, surely Syrah’s most famous home from home. Australian Shiraz might differ stylistically from the Northern Rhône’s finest Syrahs, but the Land Down Under’s foremost brands have certainly managed to establish themselves as a force to be reckoned with on the international fine wine market.

Penfolds’ flagship Grange is Australia’s runaway leader in the Brand category. Its formidable score of 991 is not only 75 points ahead of Australia’s second strongest brand – Henschke Hill of Grace Shiraz – but also nudges ahead of the Northern Rhône’s top brand – Jaboulet Hermitage La Chapelle. Whilst Grange can’t quite match La Chapelle in terms of the number of the world’s top restaurants in which it features (34% vs 43%), establishments in which it does appear list 1.5 times more vintages / formats on average (4.5 vs 3.0). Grange is also considerably more popular than La Chapelle, receiving nearly twice as many searches each month on Wine-Searcher. Within Australia no other wine comes close to its level of brand strength. It is visible in nearly twice as many restaurants as the group’s next-best wine in the criterion – Henschke Hill of Grace Shiraz – and is searched for almost five times more frequently than the second-most popular wine of the five – Penfolds St. Henri Shiraz. Last year’s release of g3, a blend of 2008, 2012, and (the as yet unreleased) 2014 Grange will only serve to secure Grange’s standing as Australia’s top brand. Click here to see all of Grange’s vintages. Confirming Penfolds as Australia’s most prestigious producer, the St. Henri Shiraz bookends the top five with a score of 852.

Other than Grange, the only Australian wine to enjoy a Brand score above the 900-point mark – and thus making the “strongest” band on Wine Lister’s 1,000-point scale – is Henschke Hill of Grace Shiraz (916). As previously mentioned, Eden Valley’s leading light achieves the group’s second-best level of restaurant presence. It is also the third-most popular wine of the five, receiving 4,107 searches each month on average and, notably, is by far the most expensive of the group.

The two remaining spots are filled by Torbreck Run Rig and Clarendon Hills Astralis Shiraz (894 and 862 respectively). Whilst they receive a very similar number of searches each month, Torbreck Run Rig edges ahead thanks to superior restaurant presence (17% vs 11%) – presumably in part due to producing over twice as many bottles each year as Clarendon Hills Astralis.

For some, Piedmont is virtually synonymous with the DOCG appellation of Barolo. While wines from this famous appellation rank amongst the very best on Wine Lister, its understated sibling Barbaresco also holds its own, as we discover looking at the top five Barbarescos by Wine Lister score below.

With an overall score of 924, Gaja’s Barbaresco takes the top spot. It leads thanks to its excellent Brand score (977), over 120 points ahead of Barbaresco’s second-strongest brand. As the only one of the group with brand as its strongest suit, Gaja’s Barbaresco is present in 33% of the world’s top restaurants, has the widest range of vintages and formats on each wine list, and receives over five times more searches each month on Wine-Searcher than the second-most popular wine of the group. Consequently, the wine has the joint-highest Brand score of all Piedmont wines – alongside Giacomo Conterno’s Barolo Monfortino Riserva.

Numbers two to five on the list share the same legendary producer. The recently departed Bruno Giacosa has left behind him a formidable legacy, reflected in his four-fold appearance in this top five. The domaine Azienda Agricola Falleto’s and Giacosa’s negotiant arm expressions of Barbaresco excel across all three categories that make up their overall Wine Lister score.

Azienda Agricola Falletto’s Asili Riserva has the best Economics score of all Barbarescos (967), with a compound annual growth rate (CAGR) of 18.5%. It is also the most expensive at £222 per bottle, and most traded of the five.

Giacosa’s Barbaresco Rabajà takes third place, but holds the best Quality score (963) and best long-term price performance (27.0%). The former is reflected in the wine’s impressive average ageing potential of 22 years, five years longer than the Asili Riserva. Indeed, Rabajà 2004, which achieves an outstanding Quality score of 993, has only recently entered its drinking window, and will be drinking well until 2034.

Fourth and fifth spots are taken by Giacosa’s Barbaresco Santo Stefano (di Nieve / Albesani) and Barbaresco Asili. They display very similar profiles, each performing best in the Economics category, followed by Quality, and then Brand. Both wines still rank as “very strong” on the Wine Lister 1000-point scale, with overall scores of 874 and 860 respectively.

This is a poignant week for Azienda Agricola Falletto, with many of the great estate’s wines being released for the first time since the passing of Bruno Giacosa.

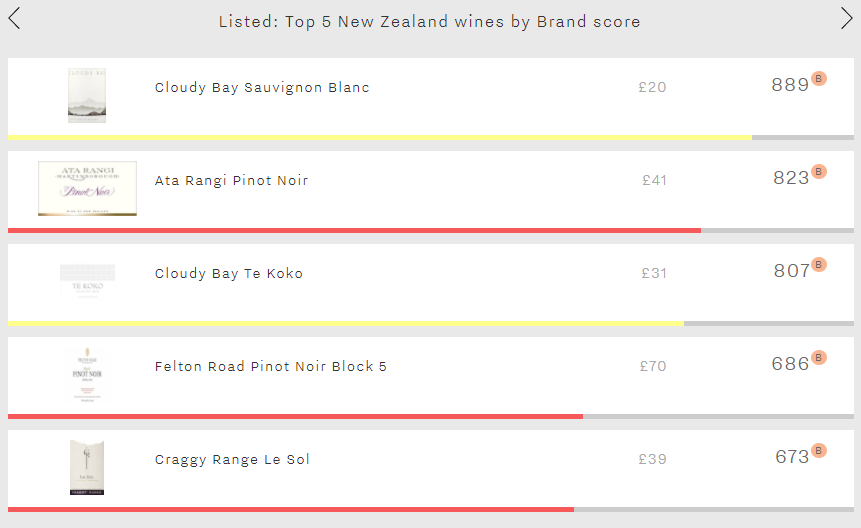

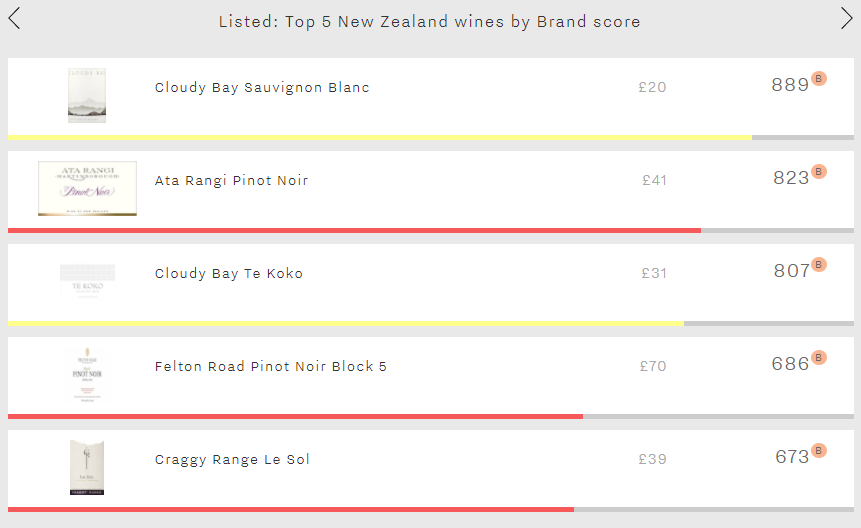

Mention New Zealand, and the first thing that springs to mind will most likely be rugby. The All Blacks are not just the world’s best team, but the foremost brand in rugby. In wine terms, they are the left bank first growths; the team that even people who don’t follow rugby will recognise. Whilst peerless with the oval ball, when it comes to vinous competition New Zealand can’t compete with its Old World counterparts in terms of brand strength. However, as this week’s top five shows, New Zealand’s top brands definitely shouldn’t be discounted.

Cloudy Bay fills two of the five spots with its straight Sauvignon Blanc and Te Koko Sauvignon Blanc. With a very strong score of 889 – putting it ahead of the likes of Haut-Brion Blanc – the straight Sauvignon Blanc dominates the rest of the five across both of Wine Lister’s brand criteria. It receives 56% more searches each month on Wine-Searcher than Ata Rangi Pinot Noir (the group’s second-most popular wine). Te Koko – New Zealand’s third-strongest brand (807) – displays a similar profile to the straight Sauvignon Blanc. Its brand is its strongest facet, comfortably outperforming its Quality and Economics scores (614 and 308 respectively).

Whilst Sauvignon Blanc is New Zealand’s foremost white grape, its most prestigious reds are Pinot Noirs, with Ata Rangi’s offering and Felton Road’s Block 5 both appearing in the top five. Ata Rangi is by far New Zealand’s strongest red brand (823). It is the country’s most visible red in the world’s top dining establishments (11%), and also the most popular with consumers, receiving three times as many searches each month as the Felton Road. Whilst it appears in just 7% of top restaurants, Felton Road Block 5 enjoys the group’s best vertical presence, with two vintages / formats offered on average per list. It is also the most expensive of the five. Incidentally, the two Pinot Noirs comfortably achieve the group’s best Quality scores and are the only two with scores above 800 in the category.

Proving that New Zealand isn’t all Sauvignon Blanc and Pinot Noir, Le Sol – Craggy Range’s Syrah – completes the five, with a Brand score of 673.

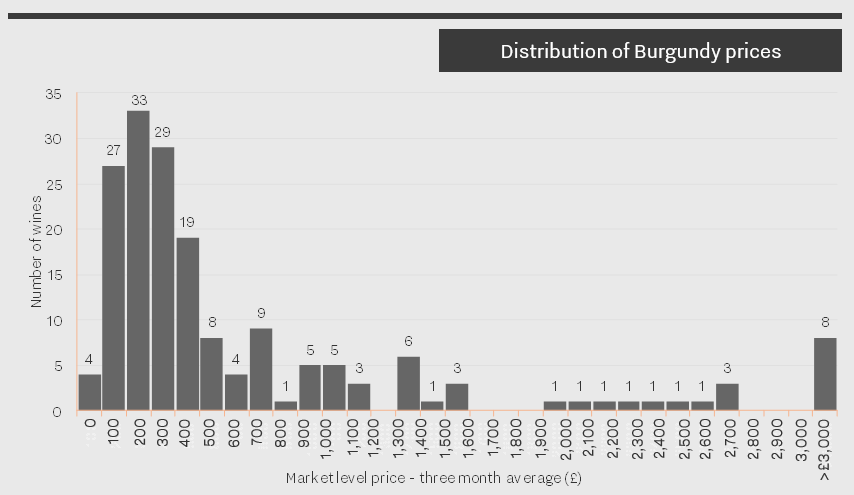

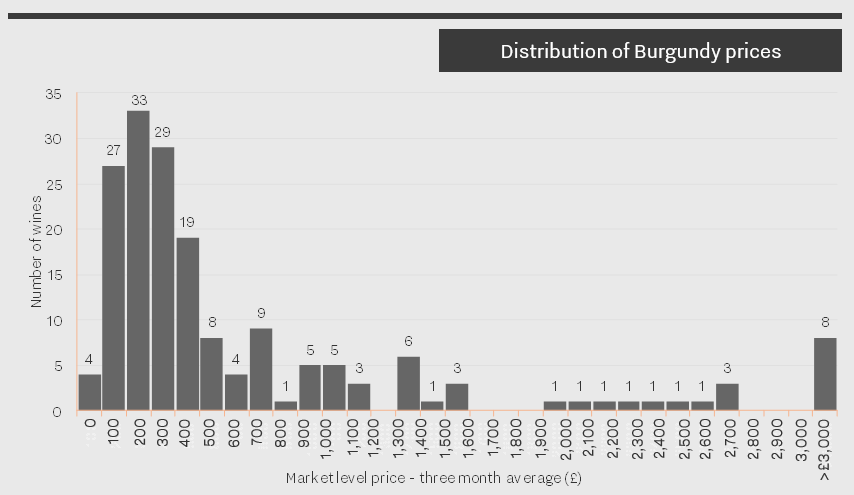

Today marks the close of a busy week of Burgundy 2016 en primeur tastings, with offer prices largely stable on 2015 despite tiny volumes, thanks to the more generous 2017 in the wings. However, prices have been escalating in the secondary market for several years now, with eight of the region’s top wines averaging more than £3,000 per bottle). Eyewatering, yes, but as illustrated in our recently published study, the majority of the region’s top wines are priced between £100 and £500.

To mark this week’s Burgundy en primeur tastings, the latest Listed section picks out the top five red Burgundies priced under £300 per bottle by Wine Lister score. With an outstanding average score of 913 – putting them amongst the very strongest on Wine Lister – and four of the five achieving Buzz Brand status, these wines are worth the price tag.

Leading the way is Grand Cru monopole Clos de Tart with a score of 947. Recently acquired by Artemis Domaines – Latour owner François Pinault’s holding company – it achieves the best Brand and Economics scores of the group (956 and 964 respectively), and is just pipped into second place in the Quality category by Trapet Père et Fils Chambertin Grand Cru (932 vs 940). Its price has increased 9% over the past six months, and now at £275, it looks like it won’t qualify for this group much longer!

Next comes Domaine des Lambrays Clos des Lambrays – part of LVMH’s portfolio since 2014 – with a score of 919. Alongside Marquis d’Angerville Volnay Premier Cru Clos des Ducs, this is the cheapest (or least expensive) of the group (c.£150 each). It enjoys its best score in the Brand category, with the group’s highest level of restaurant presence (25%), and the second-best average monthly online search frequency (5,079).

In third place is Rousseau’s Clos de la Roche Grand Cru with a score of 910. At almost £300 per bottle, it is the most expensive of the group, contributing to its boasting the best score in the Economics category (937). It is also partner critic Jeannie Cho Lee’s favourite wine of the group; she awards it a score of 95/100 on average.

Dropping just below the 900-point mark are Marquis d’Angerville Volnay Premier Cru Clos des Ducs and Trapet Père et Fils Chambertin Grand Cru (899 and 891 points respectively). They display very different profiles. The latter leads the Quality category, with the former lagging 60 points behind (still with a very strong score of 879). However,Trapet’s Chambertin struggles in other categories, with the group’s lowest scores for Brand and Economics (867 and 823). Meanwhile, thanks to the group’s strongest long and short-term growth rates, Marquis d’Angerville’s Volnay Clos des Ducs enjoys an excellent Economics score (939) – the second-best of the five.

If you’d like to discover more about Burgundy and its top wines, then click here if you are a subscriber to view the full regional study, or here to see a preview if you haven’t yet subscribed.

December is an expensive month, a time when many of us push the boat out, embracing the seasonal festivities as the days get ever shorter and the nights longer. But December has now been and gone, and January is here. Whilst it is a time for trying to tighten one’s belt – economically and physically – it needn’t be all doom and gloom.

This is where Wine Lister’s Value Picks come in to their own. One of Wine Lister’s four indicators (designed to highlight particularly noteworthy wines for our subscribers), Value Picks identify the wines and vintages that have the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus giving the finest wines a look-in). This week’s Listed section looks at Spain’s top five Value Picks. Each achieving Quality scores of at least 876, and costing under £40 per bottle, they are sure to brighten up these dark January days. Please note that the prices shown are excluding duty and VAT, and often reflect prices available only when purchasing a full case.

Leading the way is La Rioja Alta Rioja 904 Gran Reserva 2005. With an excellent Quality score of 909, this is a wine that is built to last – it is only now entering its drinking window, and will be drinking well until 2032. Not only does it qualify as a Value Pick, it is also one of Wine Lister’s Buzz Brands. Available for as little as £27 per bottle, it represents outstanding value.

Vega-Sicilia Pintia fills two spots, with the 2004 and 2002. They enjoy the group’s top two highest Quality scores (987 and 965 respectively), having received excellent ratings of 19/20 and 18/20 from Wine Lister partner critic Jancis Robinson. They need drinking up now, so why not start the year as you mean to go on and get your hands on one (or both!) of these.

Numanthia 2012, on the other hand, won’t be ready until 2022. The cheapest of the group – at as little as £26 per bottle – it might be wise to buy a case and forget about it for a few years. Achieving a Quality score of 876, you won’t regret finding a bottle of it tucked away in January 2028!

The last of Spain’s top five Value Picks is Aalto 2011. With a Quality score of 920, and right in the middle of its drinking window, it would be £28 of liquid Spanish sun to brighten up the month.