Wine Lister periodically studies the movements of wines in and out of the four Wine Lister Indicator categories. One of these, Buzz Brands, denotes wines that achieve outstanding online popularity (measured through search rankings based on monthly searches on Wine-Searcher), and presence in the world’s best restaurants.

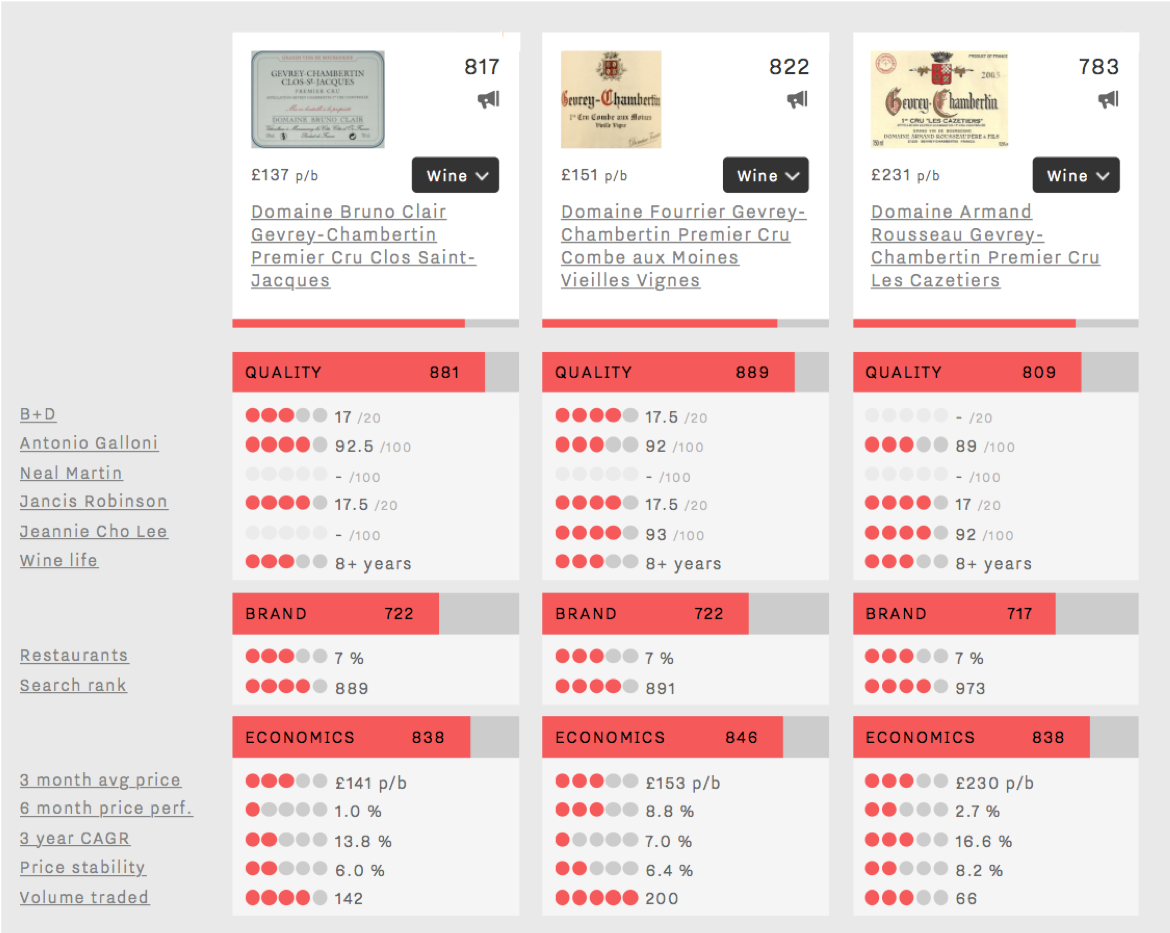

After analysing newcomers to the Buzz Brand segment in June, Burgundy dominates once again in our findings for October. Red Burgundy, and in particular, Gevrey-Chambertin, takes three out of the four places of this month’s new Buzz Brands.

However, it is in fact the only white, Domaine Leflaive’s Bourgogne Blanc, that achieves the highest Brand score of the group at 815. All of the Domaine Leflaive wines on Wine Lister are now Buzz Brands but one – their most expensive Grand Cru, Montrachet (at £6,059 per bottle compared with £218, the average price of the rest). Indicative, maybe, of drinkers being priced out of the top wines and refocussing their interest lower down the ladder.

Perhaps it is also the sign of a good brand strategy in action, with the rising profile of the Domaine’s top wines filtering all the way down to the regional wines, via the premiers crus. The new addition of the regional offering here follows two previous new Leflaive mentions in Wine Lister’s last Buzz Brand audit (of Puligny-Montrachet Les Combettes and Meursault Sous le Dos d’Ane).

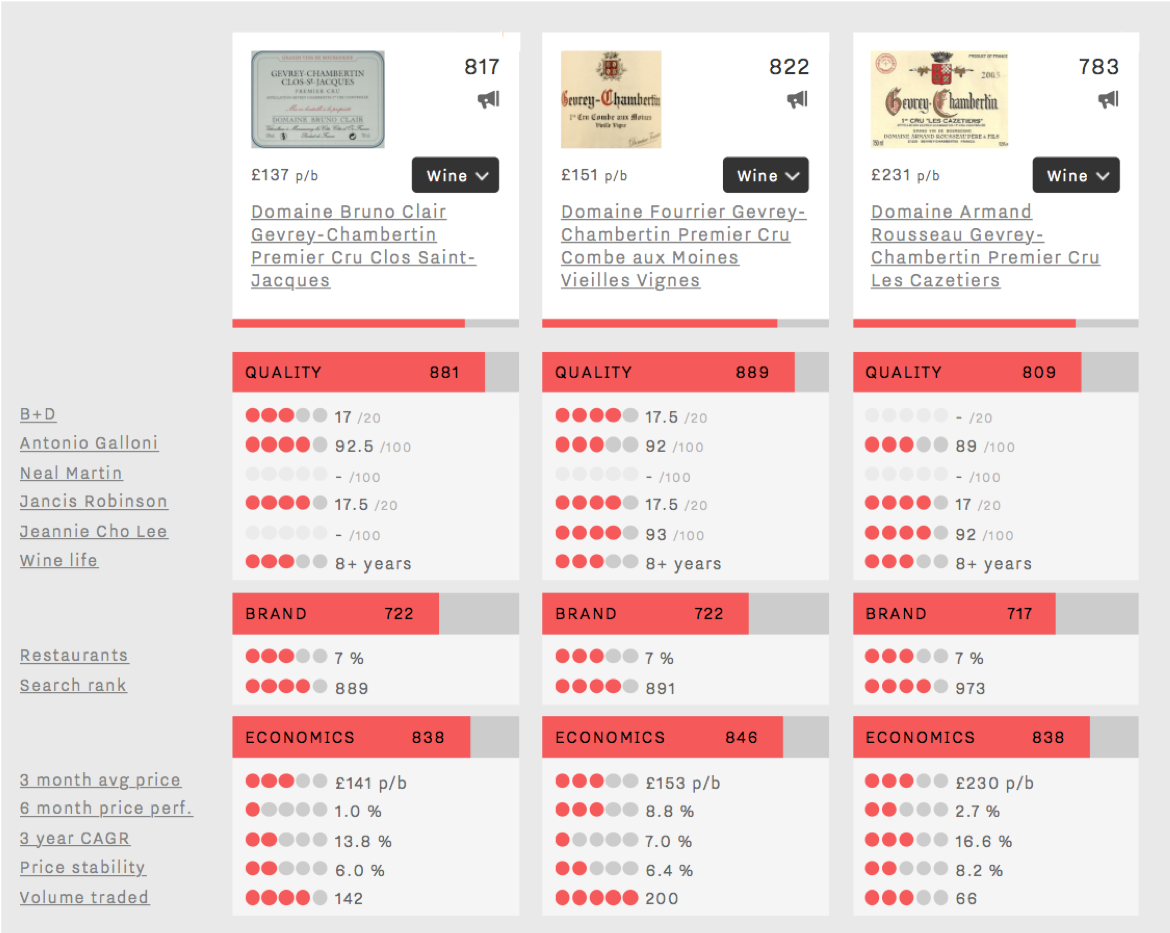

Of the three reds, two hold the same Brand score of 722, and near identical Brand profiles (see restaurant presence and search rank in the image below). The Gevrey-Chambertin Clos Saint-Jacques is the first of Bruno Clair’s wines to become a Buzz Brand. Domaine Fourrier’s Combe aux Moines Vieilles Vignes has the highest Quality score of all three new red Burgundy Buzz Brands with a score of 889. This, coupled with a slightly better Economics score helps bring it very slightly ahead for overall Wine Lister score.

Though Domaine Armand Rousseau’s Les Cazetiers is third of the Gevrey group qualitatively, it is geographically sandwiched between the first two. These wines together form a neat representation of three of the best premier cru vineyards of Gevrey-Chambertin. Incidentally, this is the last of Rousseau’s wines on Wine Lister to achieve Buzz Brand status. The domaine’s highest Brand score is won by the better-known Clos Saint-Jacques (unsurprising given that it owns roughly one third of the entire vineyard parcel) with a Brand score of 964.

It was with a heavy heart that the global fine wine trade learned of the passing of Barolo legend, Giuseppe Rinaldi, last week. Known for their elegant style and lengthy ageing potential, Rinaldi’s Barolos are not only some of the best that the region has to offer, but also some of the priciest.

In ‘Beppe’ Rinaldi’s honour, Wine Lister looks this week at the top five most expensive wines in Barolo. And there is good reason for these Barolos to be so pricey, with all of the five achieving a Quality score that falls into the “strongest” category on Wine Lister’s 1,000 point scale. On top of this, the first three qualify as Buzz Brands – Wine Lister’s group of wines that combine outstanding restaurant presence with online popularity.

Giacomo Conterno’s Barolo Monfortino Riserva takes first place. At £637 per bottle it is more than twice the price of the rest of this week’s top five. In fact, it is the most expensive Italian wine on Wine Lister. However, it is no coincidence that Conterno’s Monfortino takes first place as it also achieves the group’s best Quality and Brand scores (977 and 969 respectively). Conterno Monfortino is actually the number one Italian wine and 11th best of all wines on Wine Lister, with an impressive overall score of 972.

This week’s second spot is occupied by Azienda Agricola Falletto (Bruno Giacosa) Barolo Rocche Falletto. Even though it competes well with Conterno Monfortino – with Quality and Brand scores of 974 and 914 respectively – it is a considerably cheaper option at £282 per bottle. In fact, despite its lower price, its Economics score is slightly superior to this week’s overall number one wine (969 vs 967), and is the group’s best. Furthermore, it is the second best of all Italian wines on Wine Lister – only beaten by Falletto’s Barbaresco Asili Riserva. The phenomenal Economics score is partly due to a three-year compound annual growth rate (CAGR) of 21.8%.

Giuseppe Rinaldi Barolo Brunate Le Coste takes third place at £247 per bottle. As perfect evidence of Rinaldi’s prowess, it is very consistent across each of Wine Lister’s three rating categories, with each score putting it amongst the very best wines in the world. Confirming its upward trajectory, it records a remarkable three-year CAGR of 36.7% – if it manages to keep that up, it will soon start to narrow the gap to Conterno’s Monfortino in this battle of the Barolos.

The two remaining wines in this group are not only very close in price but they also have the same Quality score (928). This week’s number four – at £242 per bottle – is Vietti Barolo Villero Riserva, followed closely by Poderi Aldo Conterno Barolo Granbussia Riserva at £239. Visible in 17% of the world’s top restaurants, Aldo Conterno’s Granbussia has the second-highest restaurant presence of the group. It is only beaten by this week’s number one, Conterno’s Monfortino, which is visible in 23% of top establishments.

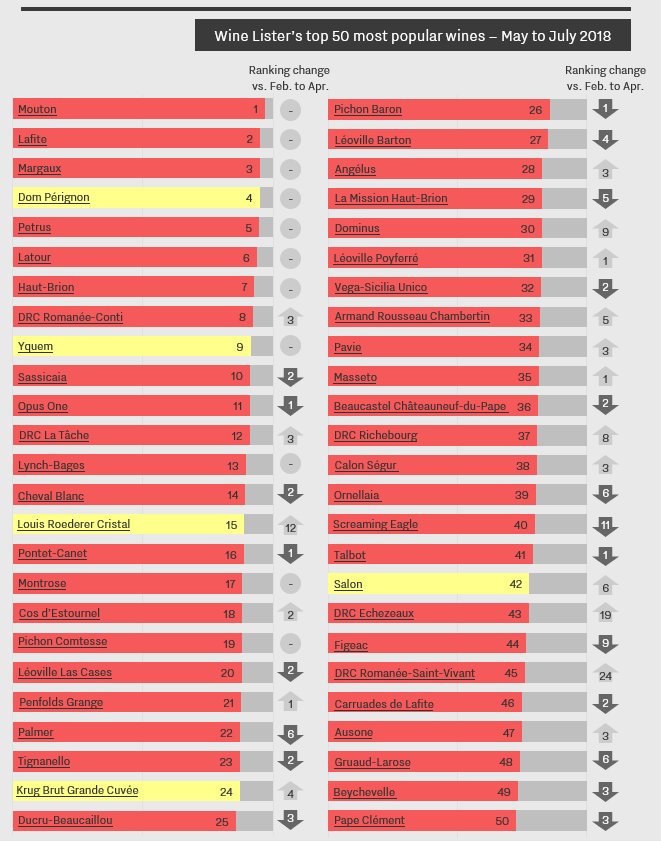

As part of our Brand score, Wine Lister measures popularity using the three-month rolling average searches on the world’s most visited wine site, Wine-Searcher.

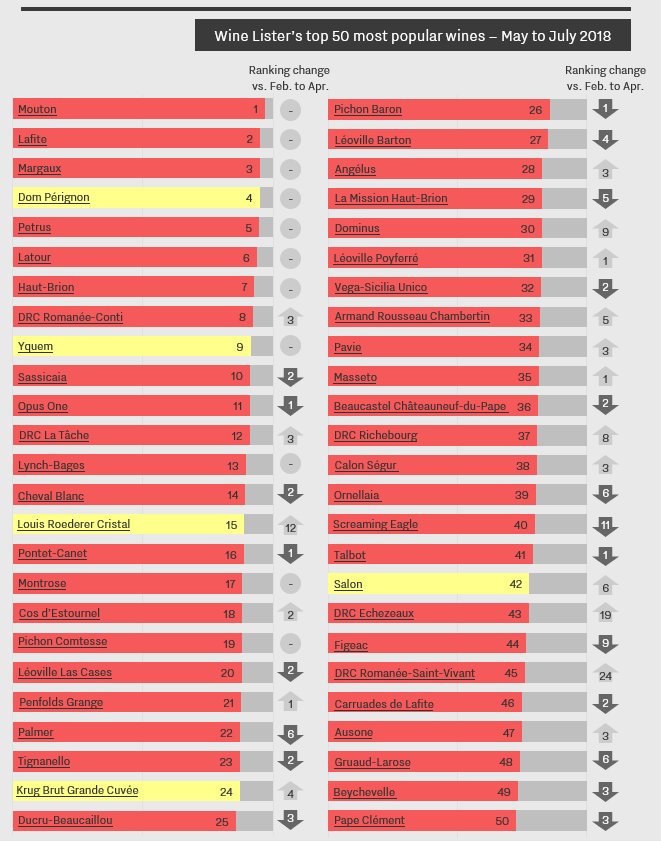

We have recently updated our treatment of this data to provide relative results for all 4,000+ wines on Wine Lister. Expressing each wine’s search frequency as a ranking will make it easier for our users to interpret the data. For example, Mouton is the #1 most searched-for wine of all wines on Wine Lister, according to monthly searches on Wine-Searcher.

To mark this transition, here we examine the top 50 most popular fine wines in the world.

The first seven most searched-for wines for the period of May, June, and July include the five Bordeaux left bank first growths (Mouton, Lafite, Margaux, Latour, and Haut-Brion), right-bank powerhouse, Petrus, and Champagne super-brand, Dom Pérignon. It is perhaps of no surprise that these rankings remain unchanged since the previous period (February to April) .

Burgundian searches in the top 50 are dominated by Domaine de la Romanée-Conti, with Romanée-Conti, La Tâche, Echezeaux, and Romanée-Saint-Vivant all achieving better rankings versus the previous period. These four together achieve an average ranking of 30th place, and an average movement up the search ranking of 11 places.

Other than Dom Pérignon, the two remaining Champagnes featured in the top 50 most searched-for wines have moved up the rankings for May-July 2018 compared to the previous three-month period. Louis Roederer’s Cristal was up 12 places, presumably due to the release of its 2008 vintage in June. Krug’s most recent Grande Cuvée (166th edition) was released in late May, explaining its jump four spots up the rankings into 24th place.

More than half of the top 50 most popular wines are Bordeaux, with 30 wines hailing from the region. However, Bordeaux did not see the boost to their search ranking one might have expected during Bordeaux’s en primeur 2017, with one fewer of the region’s wines featuring in the top 50 than before the campaign kicked off. In fact, supporting Wine Lister’s analysis of this year’s lacklustre campaign, searches for many top Bordeaux châteaux actually fell during this period. For instance, Figeac, despite achieving Bordeaux’s 10th best Quality score of the 2017 vintage, slipped nine spots down the rankings.

Price nearly always plays a part in the decision-making process of purchasing wine. Typically, much emphasis is placed on the importance of “value” – “how much quality am I getting for the price of this bottle”, for which Wine Lister has its very own indicator, Value Picks. However is simply offering “good value” enough?

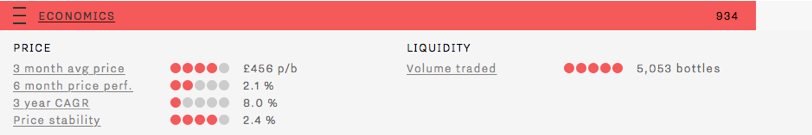

Wines purchased for long-term cellaring carry financial risk just as investment does. With this in mind, Wine Lister’s Economics scores reflect not only a wine’s price, but the performance of that figure over time. As well as a three-month average market price, and six-month / three-year price growth, Wine Lister’s algorithm takes into account price stability as a factor in determining a wine’s Economic strength.

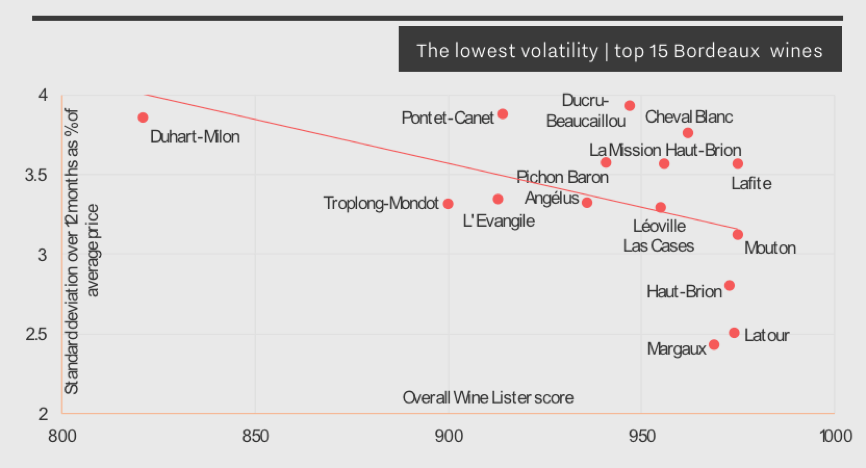

Using historical prices provided by our data partner, Wine Owners, we calculate the standard deviation of a price over the last 12 months, expressed as a proportion of the average price over the same period.

Volatility can be caused by price movements both up and down. Nobody wants to see the price of a wine plummet after purchase, but equally, wines with prices rising too high and too fast display risk too, and are therefore also sanctioned with lower Economics scores.

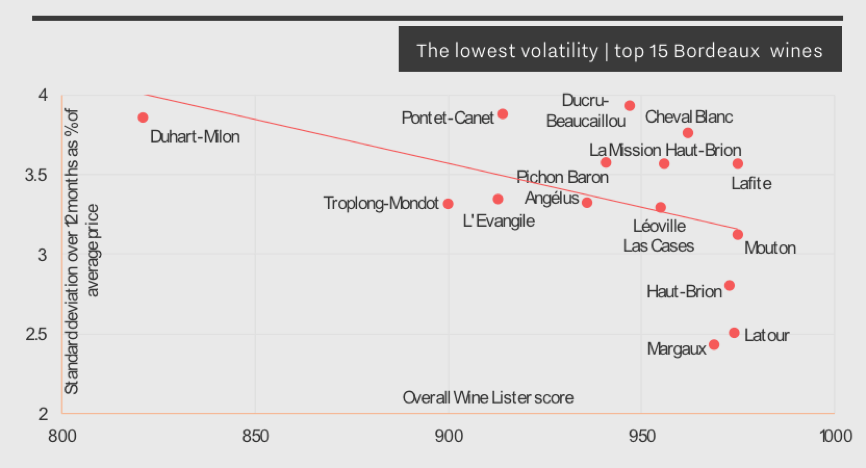

Below is an extract from this year’s Bordeaux Market Study featuring the 15 most stable Bordeaux wines. All five left bank first growths appear, testament that higher-scoring wines tend to experience less volatility. This is also tied in with liquidity: frequently traded wines tend to benefit from multiple reference points allowing a consistent market price to be determined. Conversely, a wine traded less frequently often sells at a markedly different price from one transaction to the next, resulting in a much more volatile market price.

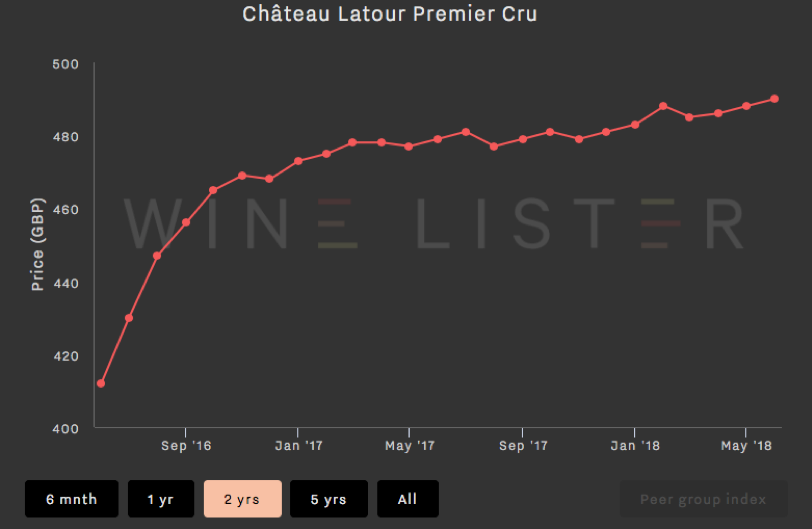

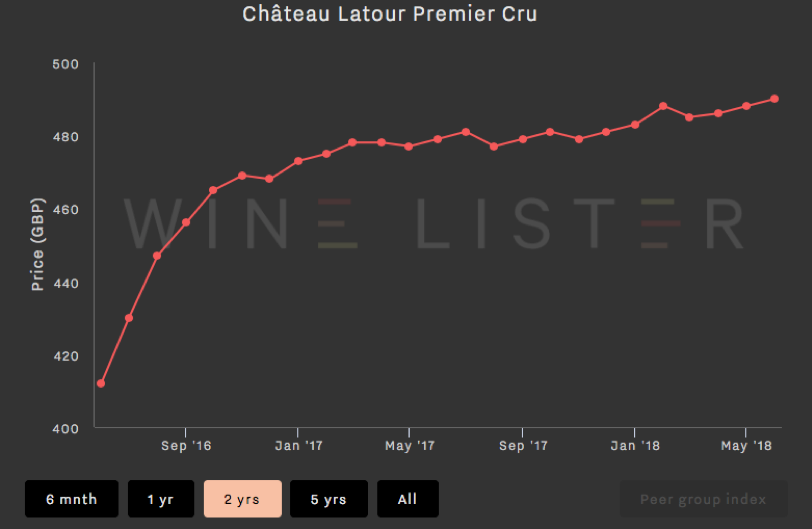

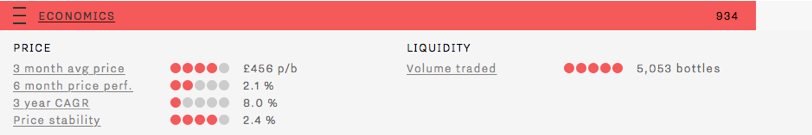

While Château Latour’s slow and steady price growth (as shown in the chart below) results in relatively low six-month price performance and three-year compound annual growth rate (CAGR) ratings, its strong Economics score is thanks to a high three-month average price, a high volume of bottles traded at auction, and a low price deviation of just 2.4% over the last 12 months.

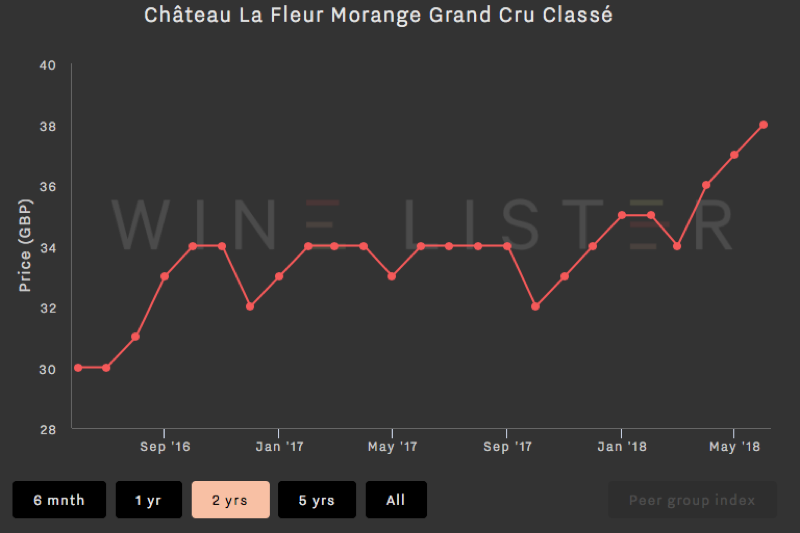

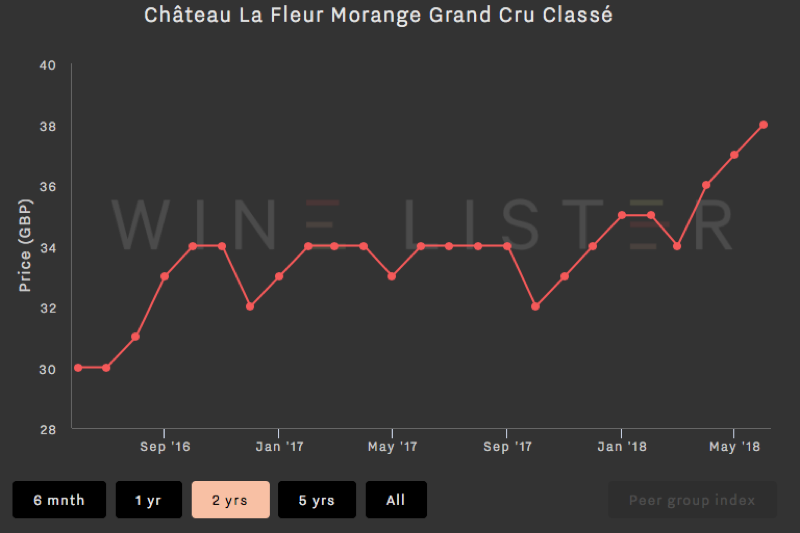

The chart below shows a very different picture – this wine has experienced a 14.7% price increase in six months. Though this in itself is positive, its price has therefore deviated 12.5% in the last 12 months, and the yo-yoing nature of the price over the longer term earns it a much lower Economics score (492).

Our in-depth study of Burgundy earlier this year showed that its prices continue to rise at a faster pace than those of any other fine wine region. With such high prices and tiny availability, wine buyers seeking good value drinking wines may often find their cellar a little light on Burgundy.

However, alongside the virtually unattainable wines at the most prestigious end of the Burgundy scale, there are some Value Picks to be found.

One of four Wine Lister Indicators, Value Picks are wines with the best quality to price ratios. Wine Lister’s proprietary Value Pick algorithm allows more expensive wines with exceptional quality to shine by reducing the impact of price in calculating the ratio.

The simple answer to good value for white Burgundy is Chablis.

For exceptional value at everyday drinking level in particular, Domaine William Fèvre stands out. Seven out of the last eight vintages of the domaine’s straight Chablis are identified as Value Picks, with prices per bottle under £13 and an average Quality score of 553 (above average on Wine Lister’s 1000-point scale).

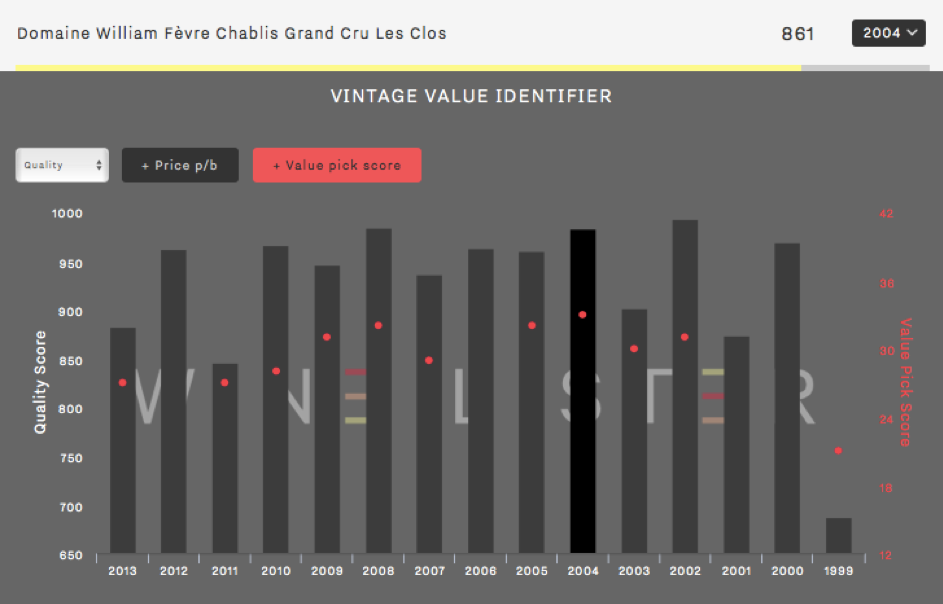

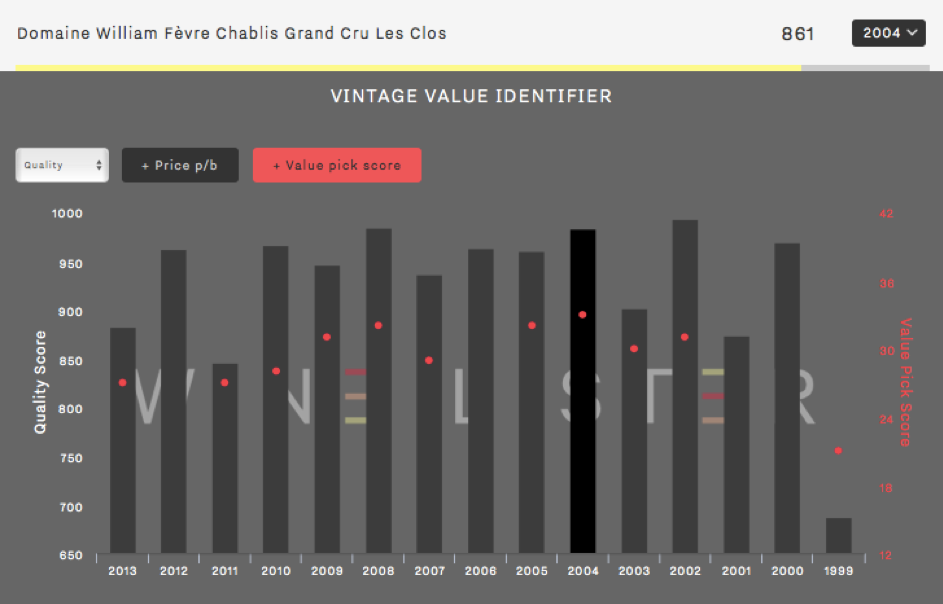

Moving up the price ladder, Domaine William Fèvre’s Chablis Grand Crus Les Clos 2004 shows exceptional value, with a price per bottle of £50 and a Quality score of 982 – shown in the Vintage Value Identifier chart above. At a comparative score (979) for white burgundy in 2004 we find Domaine Leroy’s Corton-Charlemagne Grand Cru, with a price tag 60 times higher – £3,005 per bottle.

Chablis make up all top 10 white Burgundy Value Picks.

The Burgundian Value Pick with the highest Quality score is in fact a red – Domaine de la Pousse d’Or’s Volnay Premier Cru Clos de la Bousse d’Or 1995. At c.£50 per bottle and a Quality score of 983, it earns the highest Quality score for Volnay, and the third-highest for Burgundy’s 1995 vintage (after Méo-Camuzet’s Vosne Romanée Cros Parantoux and Rousseau’s Chambertin Grand Cru, priced at £1,046 and £1,448 respectively). Any lucky owners of the Clos de la Bousse d’Or 1995 should open and enjoy it now. Wine Lister partner critic, Jancis Robinson, puts its drinking window between 2006 and 2019.

As July begins, much of the wine world may feel more grey and drizzly than the weather would suggest, due to a case of post-primeurs blues. Indeed, Wine Lister’s founder, Ella Lister, reports in her recent article for JancisRobinson.com that “…the majority of merchants are reporting revenues down approximately two-thirds on 2016”. In that article, a comparison of Quality scores across recent vintages highlights the value proposition of the 2014 vintage. In this blog post we dig a bit deeper.

A few weeks into this year’s en primeur campaign releases, the Wine Lister team noticed a distinct pattern. With almost every new release, we sounded more and more like broken records, echoing that château X’s 2017 release price, while below the last two vintages, made the 2014 look like good value. While it has been pigeonholed as a good but not great vintage, 2014 achieved consistently high critics’ scores that imply its reputation should be better.

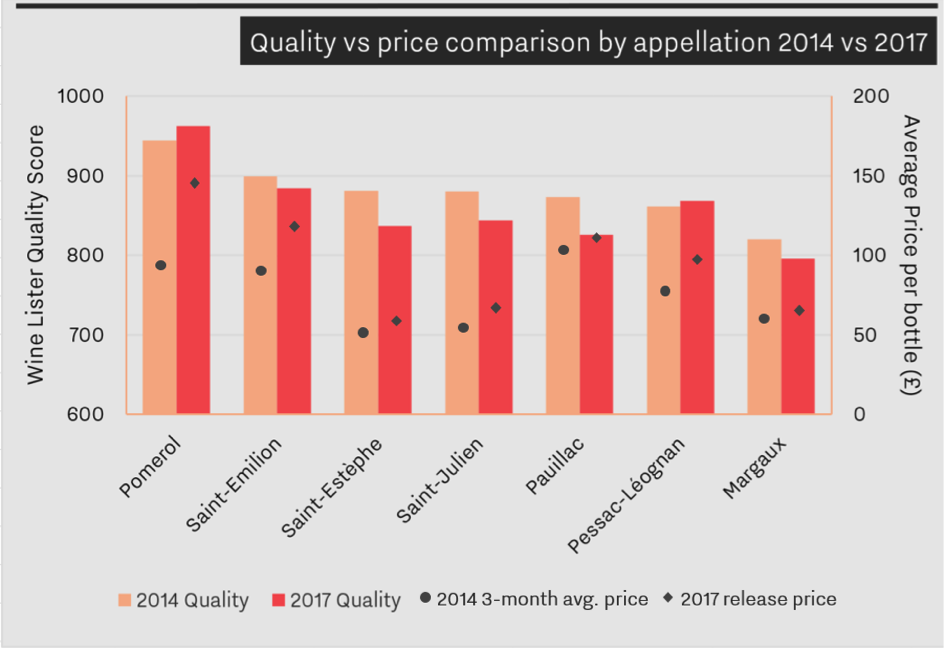

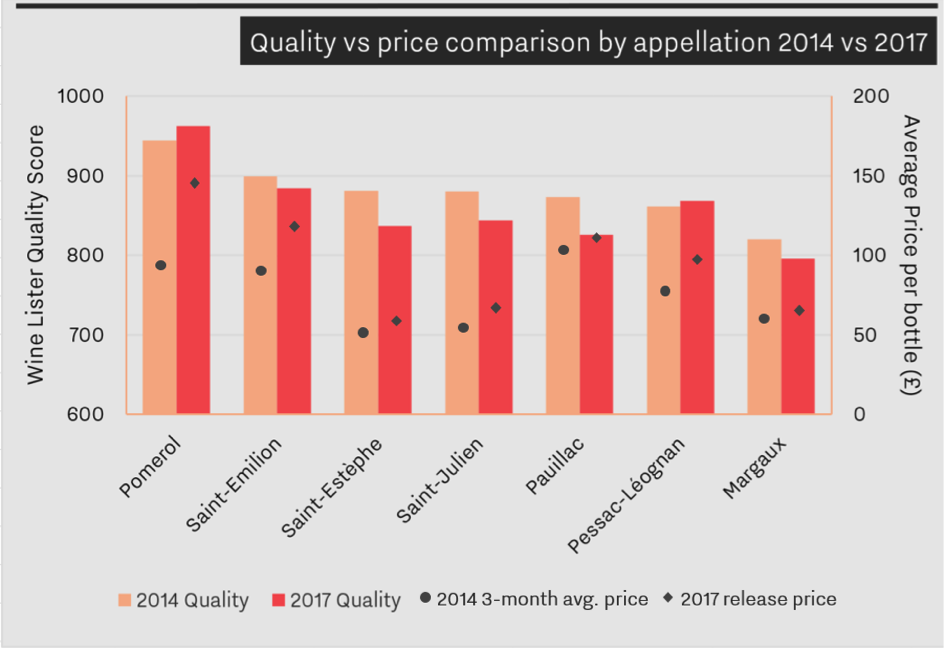

The chart below shows Bordeaux 2014 and 2017 average Quality scores by appellation, comparing 2014 three-month average prices with 2017 release prices.

Based on 75 key Bordeaux classified growths, the chart illustrates the relationship between quality and price (note the price gap for 2014 and 2017 Saint-Émilion, despite similar average Quality scores). Only Pomerol and Pessac-Léognan achieved higher Quality scores on average in 2017 than in 2014, with Wine Lister’s partner critics preferring 2014 across all other appellations.

While the trade puts aside its allocations of 2017 for the time being, perhaps the silver lining is the light this vintage shines on relative value elsewhere. Is it time for merchants and collectors alike to focus on 2014?

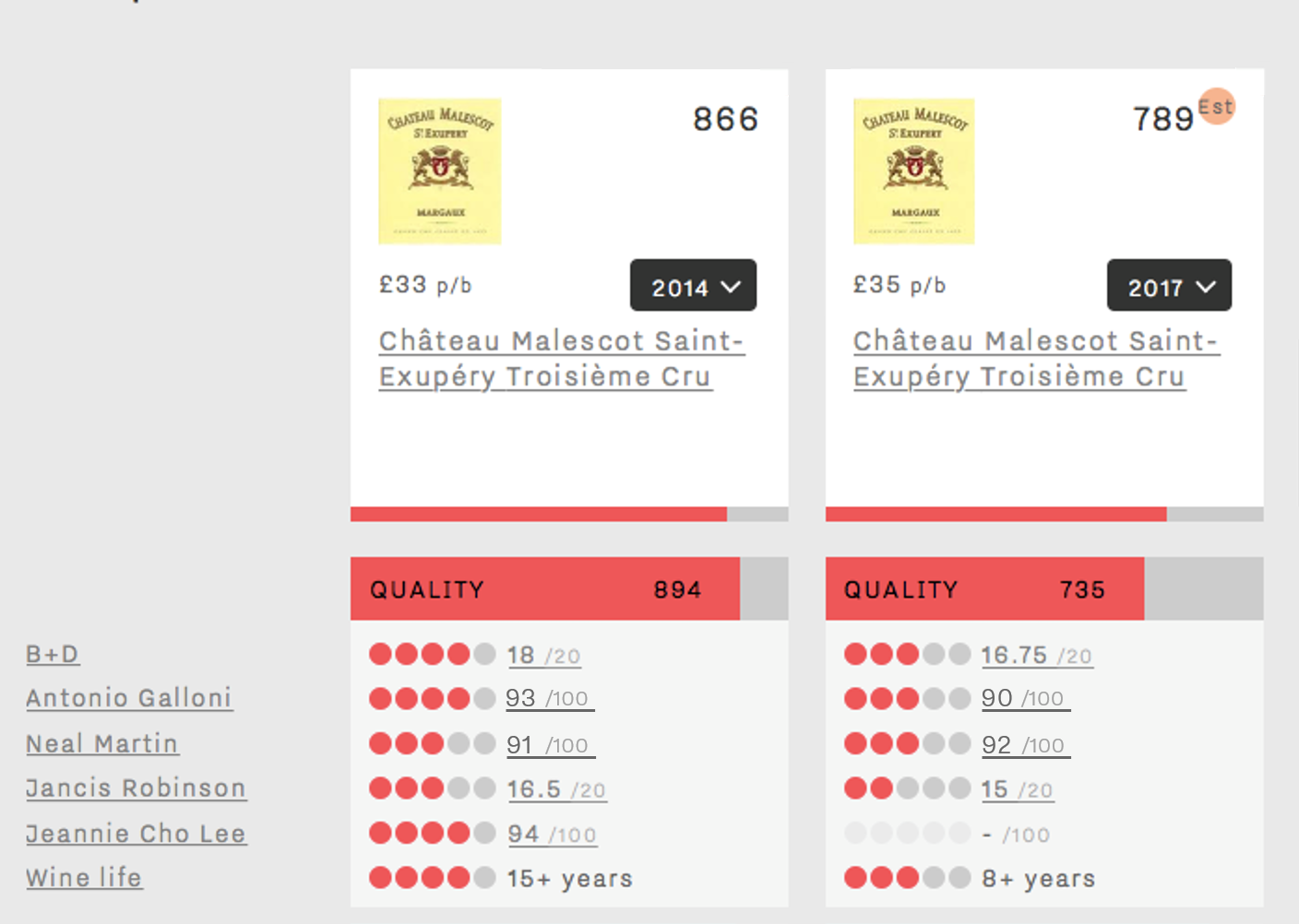

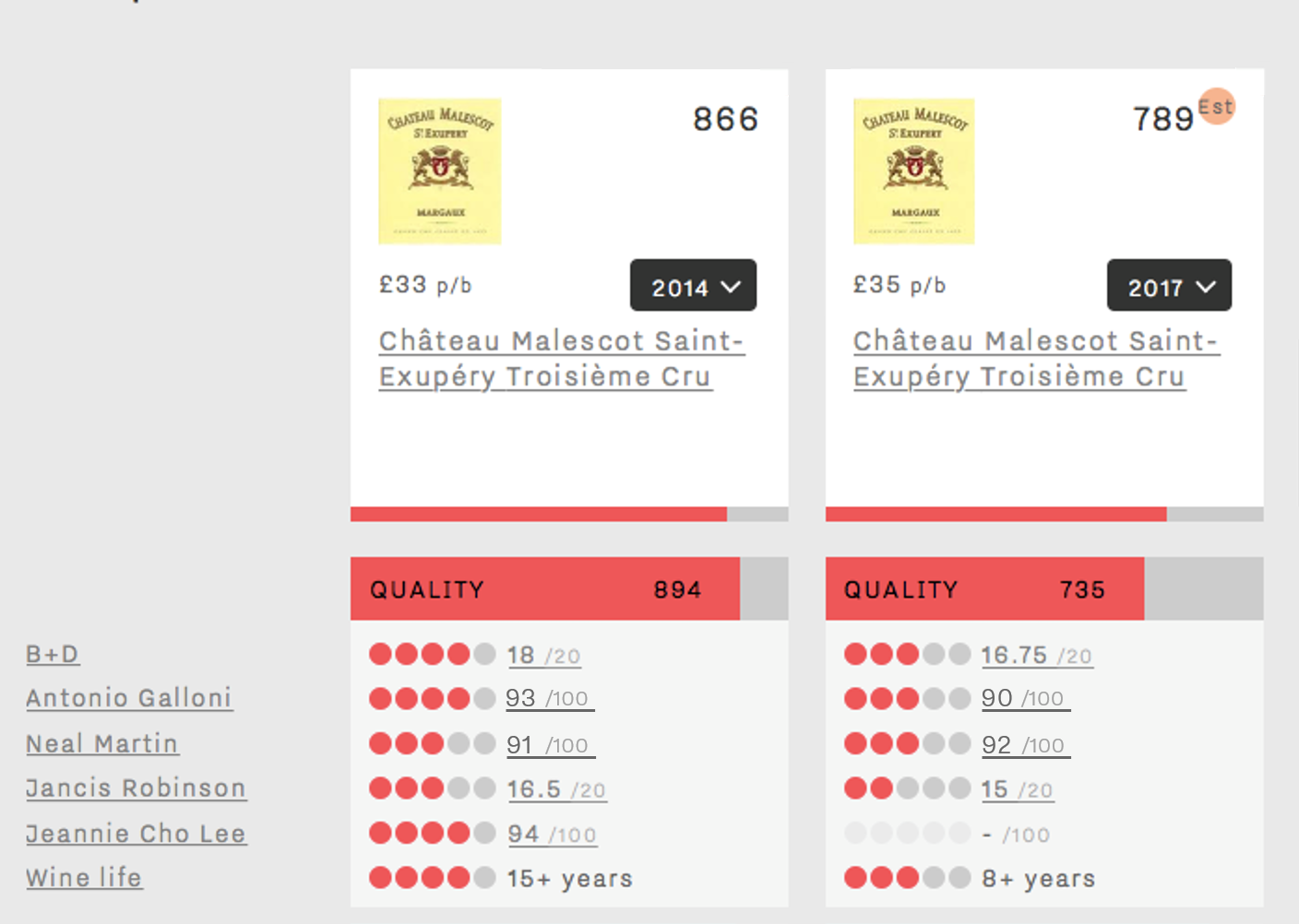

We used Wine Lister’s comparison tool in our search for good-value back vintages in order to compare different vintages and their respective critics’ scores and prices. For example, Malescot Saint-Exupéry achieves a Quality score of 894 in 2014, versus 735 in 2017. Despite the substantial price reduction on the 2016 and 2015 vintages, the 2017 UK market price remains 5% higher than the 2014, the latter receiving higher scores from three of the four Wine Lister partner critics. Neal Martin disagrees, awarding the 2017 a potential 2 points more than 2014 saying, “it is not a complex Malescot St. Exupéry, but I admire the balance and focus”.

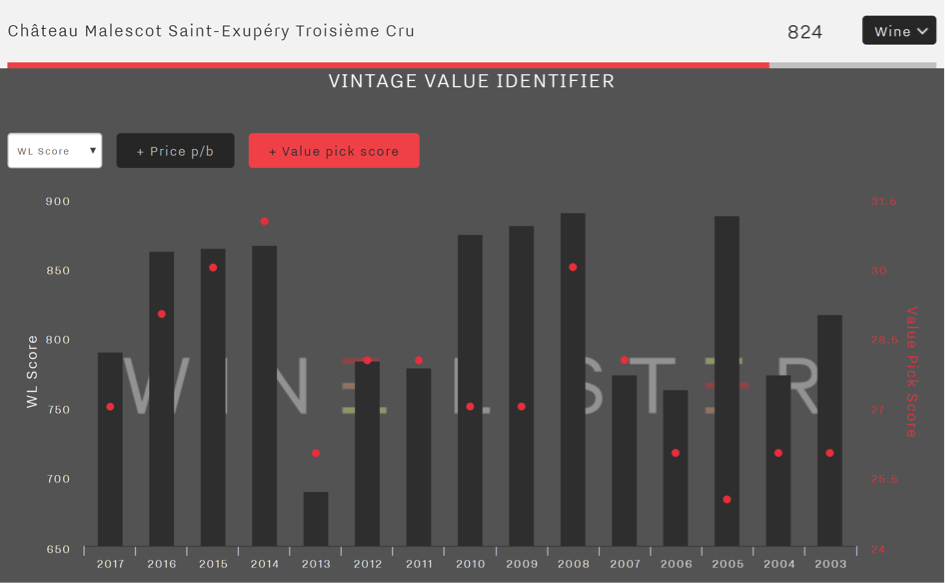

Malescot Saint-Exupéry 2014 has the highest Value Pick score of any recent vintage:

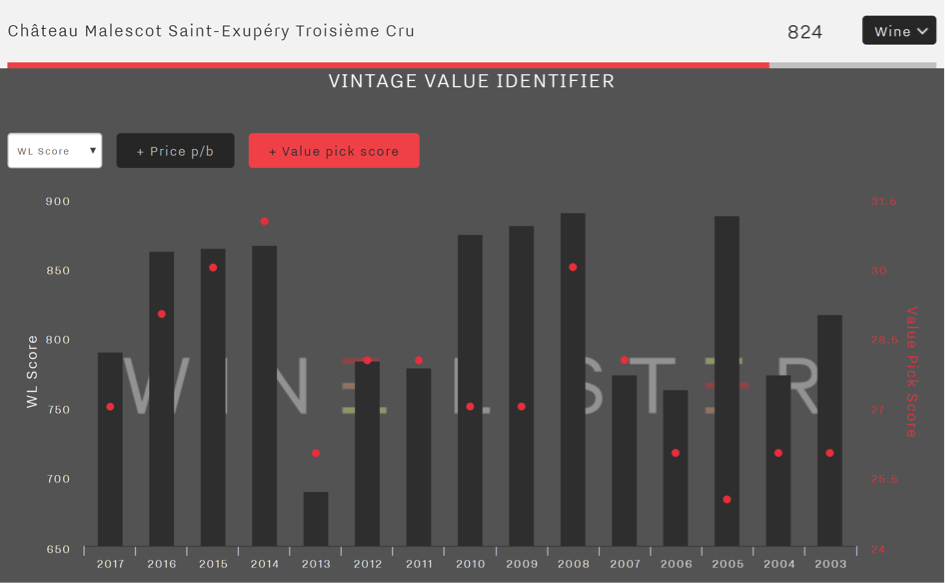

Use the Vintage Value Identifier chart (pictured above) on every wine page to pick out the best value back vintages. For example, Cantenac-Brown’s 2014 looks like a particularly good buy, at £25.50 per bottle for the 2014 (whose Quality score is 800), versus the 2017 at £34.05 per bottle, with a Quality score of 715. Its 2015 looks good too.

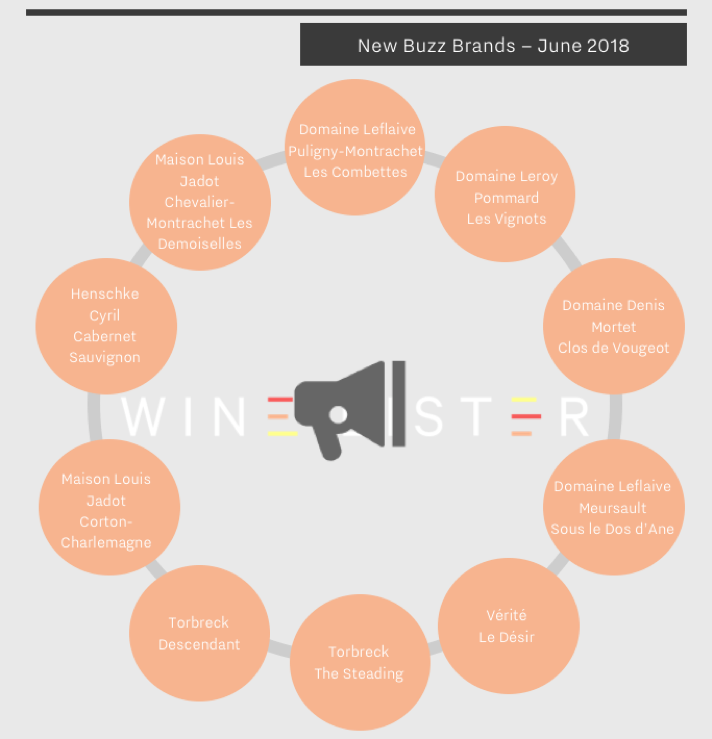

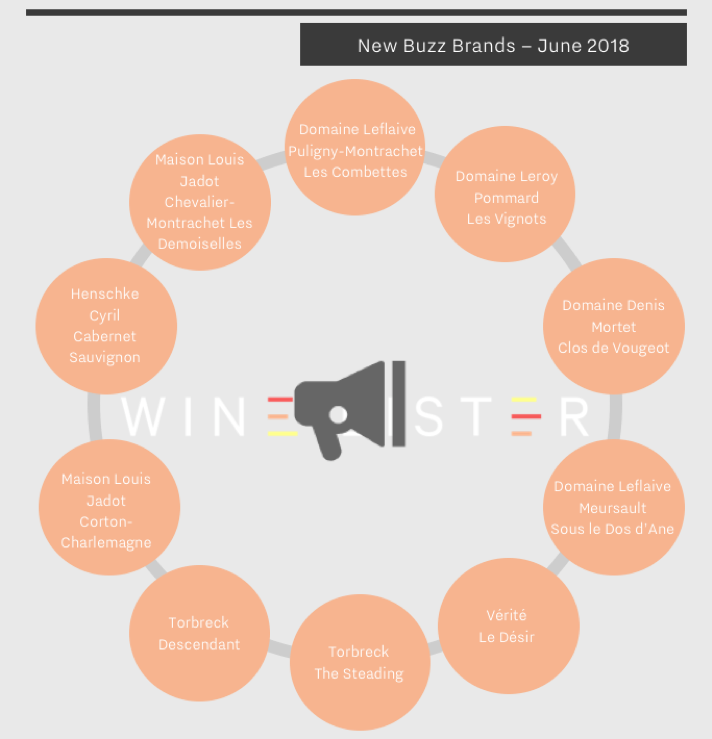

Despite the annual bustle of the en primeur campaign, it is healthy to breathe some non-Bordeaux air once in a while. With Bordeaux 2017 behind us, we examine new Buzz Brands for June from contrasting locations – Burgundy and the New World. One of four Wine Lister Indicators, ‘Buzz Brands’ use Wine Lister’s bespoke algorithms to indicate trending wines found in the highest number of the world’s best restaurants, and with high online search frequency.

This month, 10 new wines have made the Buzz Brand cut, as shown in the image below.

Six Burgundian wines (four whites and two reds) become Buzz Brands in June. This aligns with results of our latest Founding Members’ survey, where Burgundy producers earned the most number of votes (50) from key members of the global fine wine trade as most likely to see the largest brand gains in the next two years.

Louis Jadot and Domaine Leflaive both have two new white Buzz Brand references. Jadot’s Chevalier-Montrachet Les Demoiselles and Corton-Charlemagne have the highest Quality scores of this month’s Buzz Brand additions – 951 and 925 respectively. Domaine Leflaive proves its popularity with presence of its Puligny-Montrachet les Combettes and/or Meursault Sous le Dos d’Ane in 28 out of c.150 of the world’s best restaurants, and votes from the trade as a consistent seller (see p.23 of Wine Lister’s Bordeaux market study 2018 for more).

Of the red Burgundian Buzz Brands, the popularity of Domaine Leroy’s Pommard Les Vignots is perhaps unsurprising, given the producer’s renown, and the wine’s relative affordability (£505 per bottle) compared with Leroy’s more expensive offerings, such as its Musigny Grand Cru (£8,365 per bottle). Denis Mortet’s Clos de Vougeot is the only Côte de Nuits to feature in this month’s Buzz Brand additions.

The remaining four wines all hail from the New World – three from South Australia, and one from California. The latter, Vérité’s Le Désir, wins on all fronts with the highest Quality (949), Brand (740), and Economics (603) scores. The Quality comparison is hardly fair, given Le Désir’s price of £233, over four times higher the average of the three Australian representatives. Torbreck’s The Steading and the Descendant combined are present in 15 of the world’s best restaurants. Henschke’s Cyril Cabernet Sauvignon joins its pricier and better-known siblings, Hill of Grace Shiraz and Mount Edelstone Shiraz, as the producer’s third Buzz Brand.

You can see a full list of Wine Lister Buzz Brands here

What do you do when your drinking tastes far outweigh your wine budget? You could trawl the shops and the internet in search of that bottle that combines high ratings and moderate prices, or alternatively you could use Wine Lister’s Value Picks search tool. It selects top quality wines that are available at reasonable prices, doing the legwork for you. This week’s Listed section shines a spotlight on the top five reds that currently qualify as Value Picks. At present, they are all Tuscan, all available for under £90 – in fact all but one cost less than £50 – and all have Quality scores of over 990, putting them amongst the elitest of the elite on Wine Lister’s 1,000 point scale.

If you are after exceptional value, then look no further than Castello dei Rampolla’s Sammarco. With two vintages in the top five (2010 and 2006), each of which have plenty of life still left in them, they look like wise purchases. The 2010 owes its exceptional Quality score to a perfect 100-point rating from Wine Lister partner critic Antonio Galloni, who called it “stunning as it has always been. In a word: magnificent!”. At £88 per bottle, it might not be the cheapest, but it does look good value compared to the two other 998-point scorers from Tuscany 2010: Cerbaiona Brunello di Montalcino (£248) and Castello dei Rampolla’s Alceo (£128).

Whilst the 2010 is not quite ready to drink, the 2006 has just entered its drinking window. Underlining the wine’s longevity, Galloni, who awarded the wine a 97-point score, remarked: “Readers will have to be exceedingly patient here. There is no denying the 2006’s greatness, though.” The 2006 will be drinking well until 2036, and available for as little as £34 per bottle, looks like an excellent long-term investment (if you can refrain from opening it).

Flying the flag for Chianti is Fontodi’s best ever Chianti Classico Vigna del Sorbo Riserva – the 2010 (£43). Whilst its Quality is not in doubt, its economic performance is slightly less impressive, its price having fallen 11% over the past six months.

The remaining spots are filled by Isole e Olena Collezione de Marchi Cabernet Sauvignon 2008 (£46) and San Giusto a Rentennano Percarlo 2013 (£41). Isole e Olena Collezione de Marchi 2010’s Quality score is the furthest above its wine-level average Quality score (993 vs 934) of the five. The market has not yet reacted to this standout vintage, its price being no different to the wine-level average price. Meanwhile San Giusto a Rentennano Percarlo 2013’s Quality score is the closest to its (formidable) wine-level average (992 vs 967), yet its price is 36% below the wine-level average, underlining the 2013’s excellent value.

Please note that prices shown are excluding duty and VAT, and often reflect prices available only when purchasing a full case. They are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

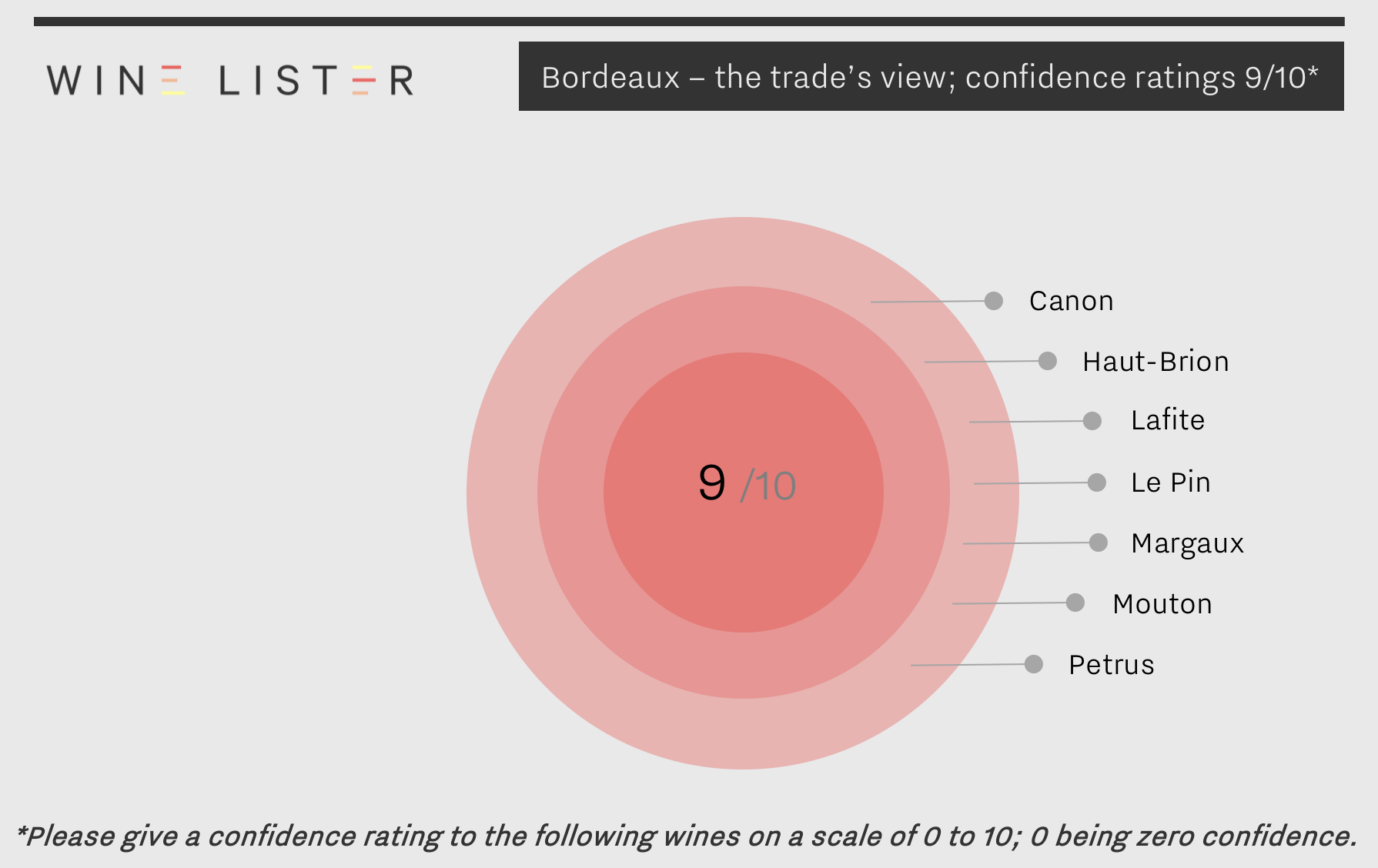

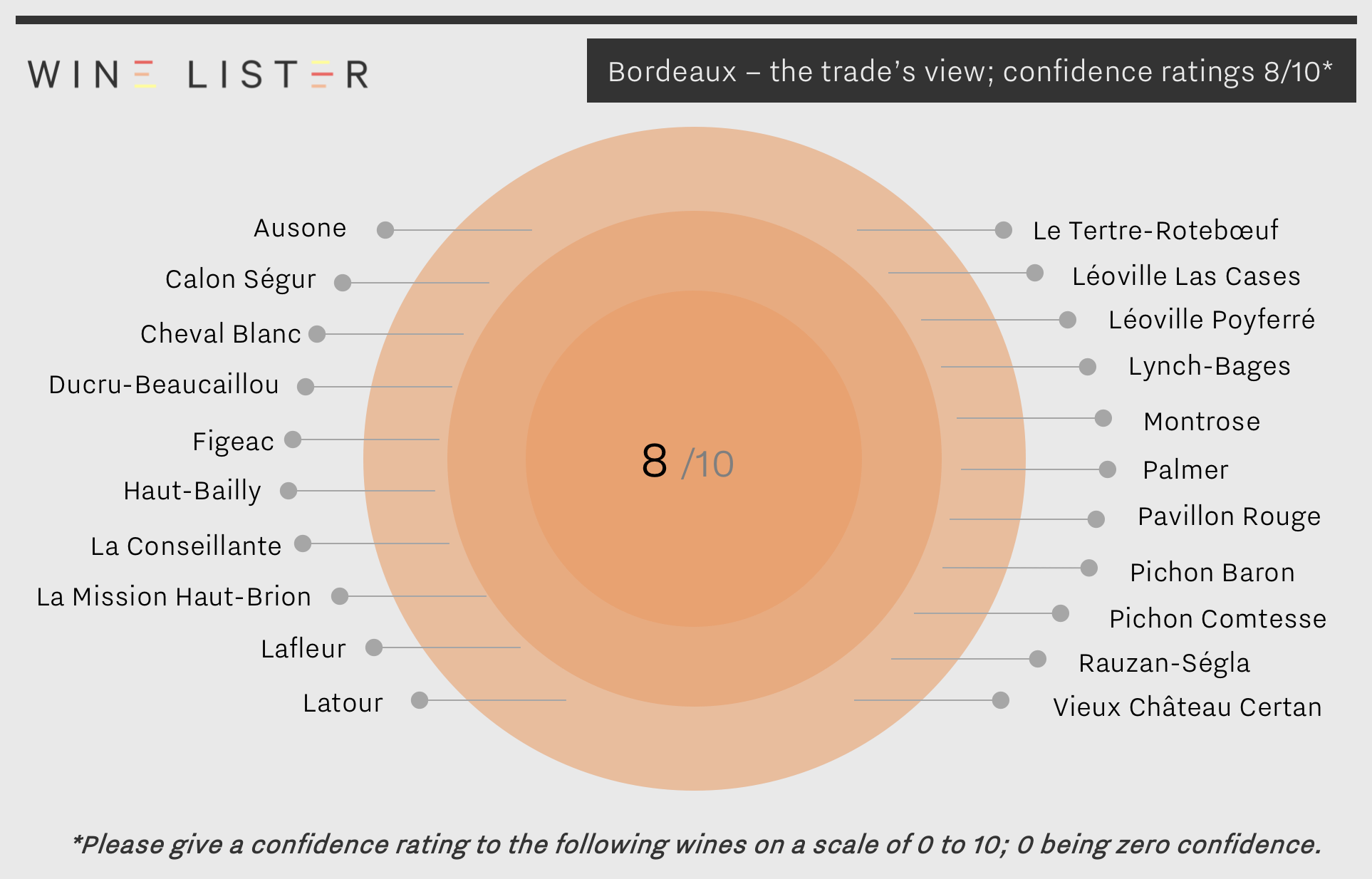

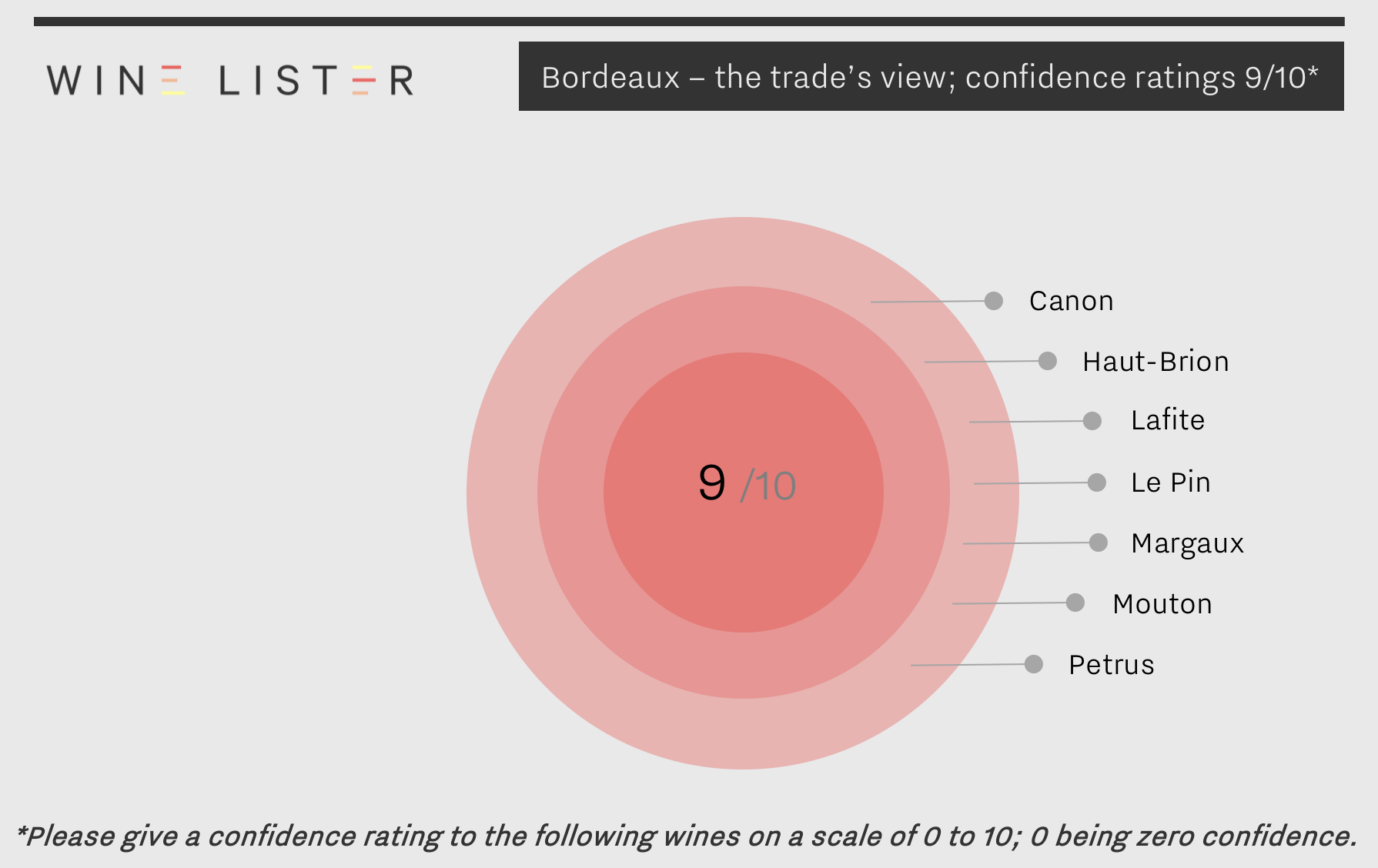

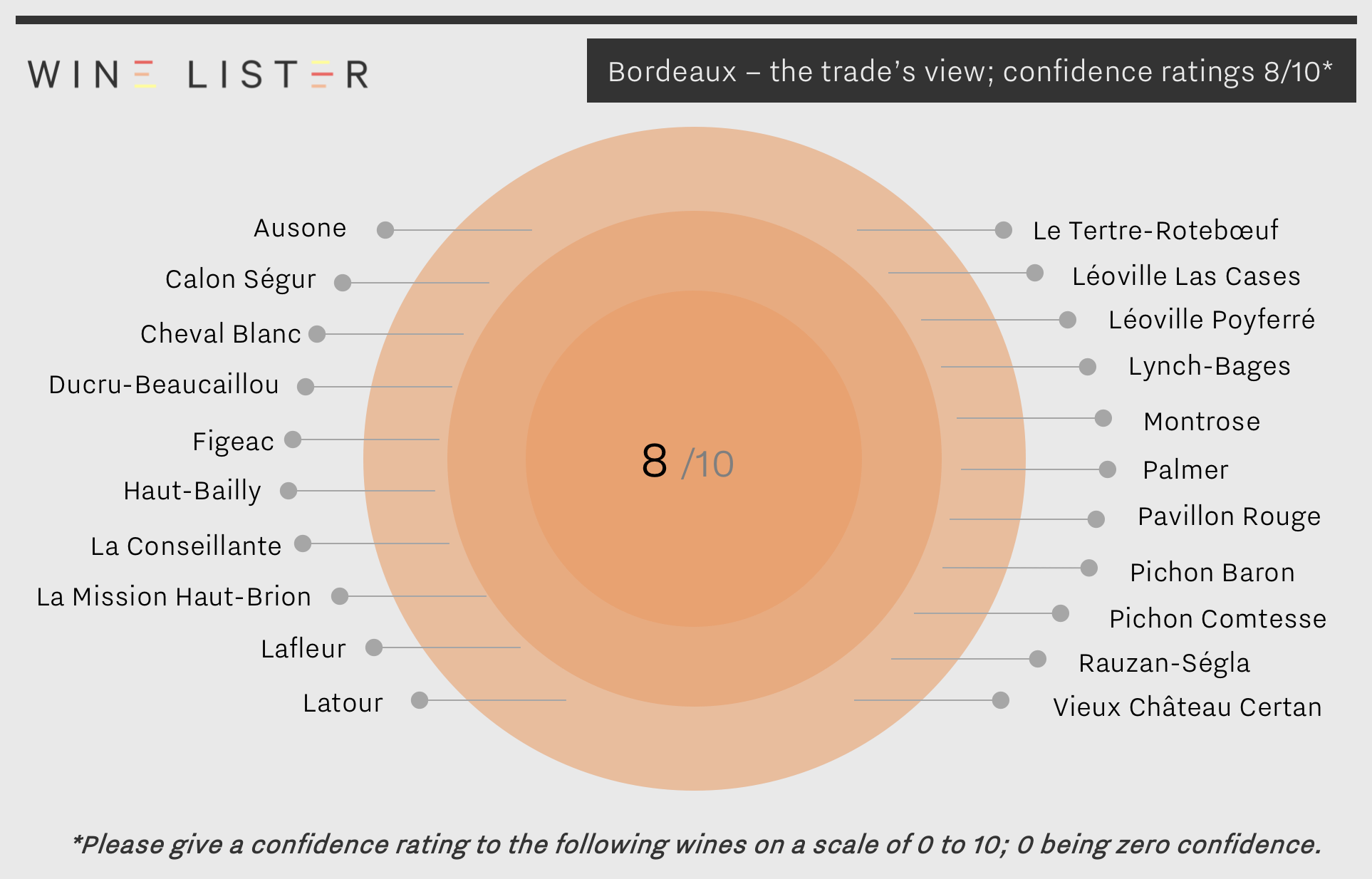

As part of our recently-released Bordeaux study, Wine Lister asked its Founding Members (c.50 key members of the global fine wine trade) to give “confidence” ratings to more than 100 key Bordeaux wines on a scale of 0 to 10; 0 being zero confidence.

For the second year in a row, no wine received a perfect 10/10, unlike Burgundy, whose Domaine de la Romanée-Conti and Rousseau – as rated across all of their respective cuvées – achieved the perfect score in a survey carried out in Autumn 2017.

Seven wines received a confidence rating of 9/10 from the trade; Canon, Haut-Brion, Lafite, Le Pin, Margaux, Mouton & Petrus. These same seven were awarded 9/10 in last year’s founding members’ survey. Vieux Château Certan is the only château to have dropped down a spot to 8/10.

Canon’s place here is distinctive not just as the only Saint-Émilion to feature, but also as a wine with market prices around £74 per bottle, sitting amongst a group whose average price per bottle is £950. A Wine Lister Buzz Brand, Canon is one of the most talked about wines by the trade.

In carrying out the survey, we did not dictate what factors should influence the respondents’ confidence in the prospects of a wine. Given that they are members of the trade, their considerations are likely to be commercially-driven, taking into account everything from improvements in quality and investment in marketing to new management teams. Canon was deemed a success by trade members for both “ratings and quality improvement”, and its “sales and management team”.

Latour is the only first growth not to feature in the highest-rated group. It was given a confidence rating of 8/10, alongside 20 other wines shown below. Three of these, Pichon Comtesse, Calon Ségur and Rauzan-Ségla (alongside its abovementioned sibling from owners Chanel, Canon) also make the trade’s list of Rising Stars – wines that will see the largest gain in brand recognition in the next two years (more on Bordeaux’s Rising Stars to come next week).

Nine wines have dropped one point in 2018 to a confidence rating of 7/10, however these have been replaced in equal number by Cheval Blanc, Figeac, La Conseillante, Tertre-Rotebœuf, Léoville Las Cases, Pavillon Rouge, Montrose, Palmer, and Pichon Baron, all up one point from their ratings in 2017.

Other wines to receive a confidence rating of 8/10 from the international fine wine trade are Ausone, Ducru-Beaucaillou, Haut-Bailly, La Mission Haut-Brion, Lafleur, and Lynch-Bages.

Visit Wine Lister’s Analysis page to read the full report and see confidence ratings for other wines in the study (available in both English and French).

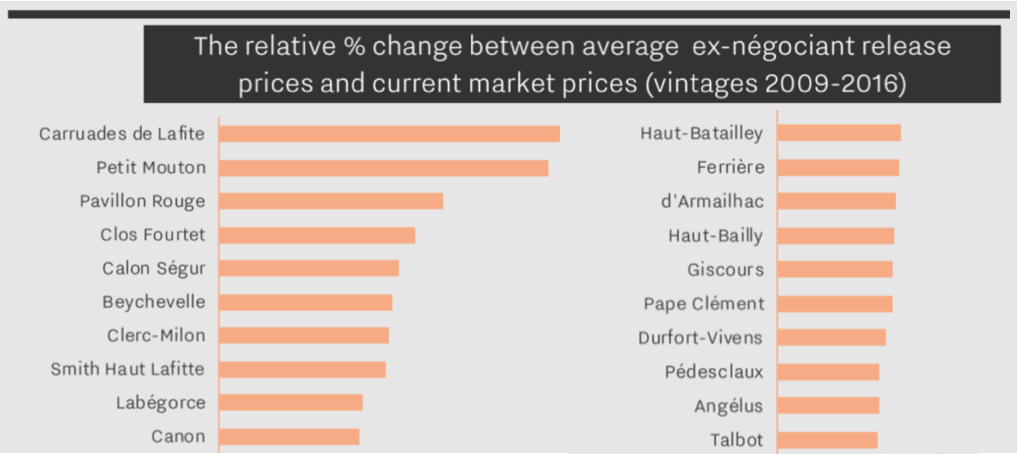

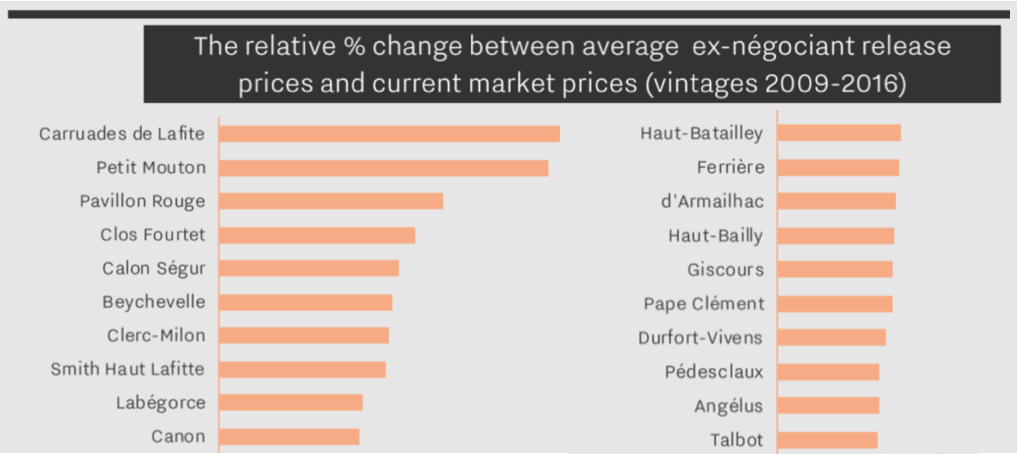

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.