It was with a heavy heart that the global fine wine trade learned of the passing of Barolo legend, Giuseppe Rinaldi, last week. Known for their elegant style and lengthy ageing potential, Rinaldi’s Barolos are not only some of the best that the region has to offer, but also some of the priciest.

In ‘Beppe’ Rinaldi’s honour, Wine Lister looks this week at the top five most expensive wines in Barolo. And there is good reason for these Barolos to be so pricey, with all of the five achieving a Quality score that falls into the “strongest” category on Wine Lister’s 1,000 point scale. On top of this, the first three qualify as Buzz Brands – Wine Lister’s group of wines that combine outstanding restaurant presence with online popularity.

Giacomo Conterno’s Barolo Monfortino Riserva takes first place. At £637 per bottle it is more than twice the price of the rest of this week’s top five. In fact, it is the most expensive Italian wine on Wine Lister. However, it is no coincidence that Conterno’s Monfortino takes first place as it also achieves the group’s best Quality and Brand scores (977 and 969 respectively). Conterno Monfortino is actually the number one Italian wine and 11th best of all wines on Wine Lister, with an impressive overall score of 972.

This week’s second spot is occupied by Azienda Agricola Falletto (Bruno Giacosa) Barolo Rocche Falletto. Even though it competes well with Conterno Monfortino – with Quality and Brand scores of 974 and 914 respectively – it is a considerably cheaper option at £282 per bottle. In fact, despite its lower price, its Economics score is slightly superior to this week’s overall number one wine (969 vs 967), and is the group’s best. Furthermore, it is the second best of all Italian wines on Wine Lister – only beaten by Falletto’s Barbaresco Asili Riserva. The phenomenal Economics score is partly due to a three-year compound annual growth rate (CAGR) of 21.8%.

Giuseppe Rinaldi Barolo Brunate Le Coste takes third place at £247 per bottle. As perfect evidence of Rinaldi’s prowess, it is very consistent across each of Wine Lister’s three rating categories, with each score putting it amongst the very best wines in the world. Confirming its upward trajectory, it records a remarkable three-year CAGR of 36.7% – if it manages to keep that up, it will soon start to narrow the gap to Conterno’s Monfortino in this battle of the Barolos.

The two remaining wines in this group are not only very close in price but they also have the same Quality score (928). This week’s number four – at £242 per bottle – is Vietti Barolo Villero Riserva, followed closely by Poderi Aldo Conterno Barolo Granbussia Riserva at £239. Visible in 17% of the world’s top restaurants, Aldo Conterno’s Granbussia has the second-highest restaurant presence of the group. It is only beaten by this week’s number one, Conterno’s Monfortino, which is visible in 23% of top establishments.

Buzz Brands are wines that are sure to turn heads, destined to cause a stir whenever they are opened. They combine excellence across Wine Lister’s two Brand criteria – restaurant presence and online popularity – whilst also being held in the highest regard by the fine wine trade – as confirmed by Wine Lister’s Founding Members’ survey which gathers the opinions of around 50 key players in the international wine trade. This week, the Listed section focuses on Italy’s top five Buzz Brands by overall Wine Lister score.

Barolo is home to four of Italy’s top five Buzz Brands, two of which are produced by Giacomo Conterno – the flagship Monfortino in first place (973) and Francia not far behind in second place (954). The Monfortino achieves Italy’s best Quality score (977), the result of remarkable consistency from vintage to vintage, having achieved a score of 993 or above in seven of the past 10 vintages. Its best ever vintage was 2004 (998), thanks to a perfect 100-point score from Antonio Galloni, who writes: “I imagine the 2004 Monfortino will give readers an utterly spellbinding drinking experience for the next few decades”.

Whilst the Francia is pipped at the post in each category by its illustrious stablemate (trailing by 17 points in the Quality category, 11 in the Brand category, and 34 in terms of Economics), it does manage superior restaurant presence, visible in 30% of the world’s top establishments, compared to the Monfortino’s 23%. This is presumably due to over three times as many bottles of it being produced each year on average.

In third place is Azienda Agricola Falletto’s Rocche Falletto Riserva (953). It records the best Economics score of the five (969) and Italy’s second-best, beaten only by Falletto’s Barbaresco Asili Riserva (978). It does so thanks to the combination of very strong growth rates – it has recorded a three-year compound annual growth rate of 21% and has added 8% to its value over the past six months alone – and strong liquidity – its top five vintages having traded 398 bottles at auction over the past year. Perhaps collectors have been eager to get their hands on a bottle after the passing of Bruno Giacosa in January.

Proving that Super Tuscans can mix it with Piedmont’s top nebbiolos, Sassicaia takes fourth place. Whilst it cannot keep pace with Barolo’s finest in the Quality and Economics categories, Sassicaia stretches out a comfortable lead in the Brand category thanks to an extraordinary score of 998. This near-perfect score puts it alongside Haut-Brion, Margaux, and Petrus, beaten only by the Pauillac First Growths, Dom Pérignon Vintage Brut, and Yquem. Its brand dominance is the result of outstanding restaurant presence (49%) and online popularity – receiving well over three times as many searches each month as Conterno’s Monfortino, which is the group’s second-most popular wine.

Rounding out the five is Bartolo Mascarello’s Barolo. Its brand is its strongest asset, its score of 964 making it Barolo’s second-strongest brand behind Conterno’s Monfortino. Despite receiving over 20% fewer online searches each month than the Monfortino, it matches its level of restaurant presence – perhaps the azienda’s famous “no barrique no Berlusconi” message strikes a chord with sommeliers.

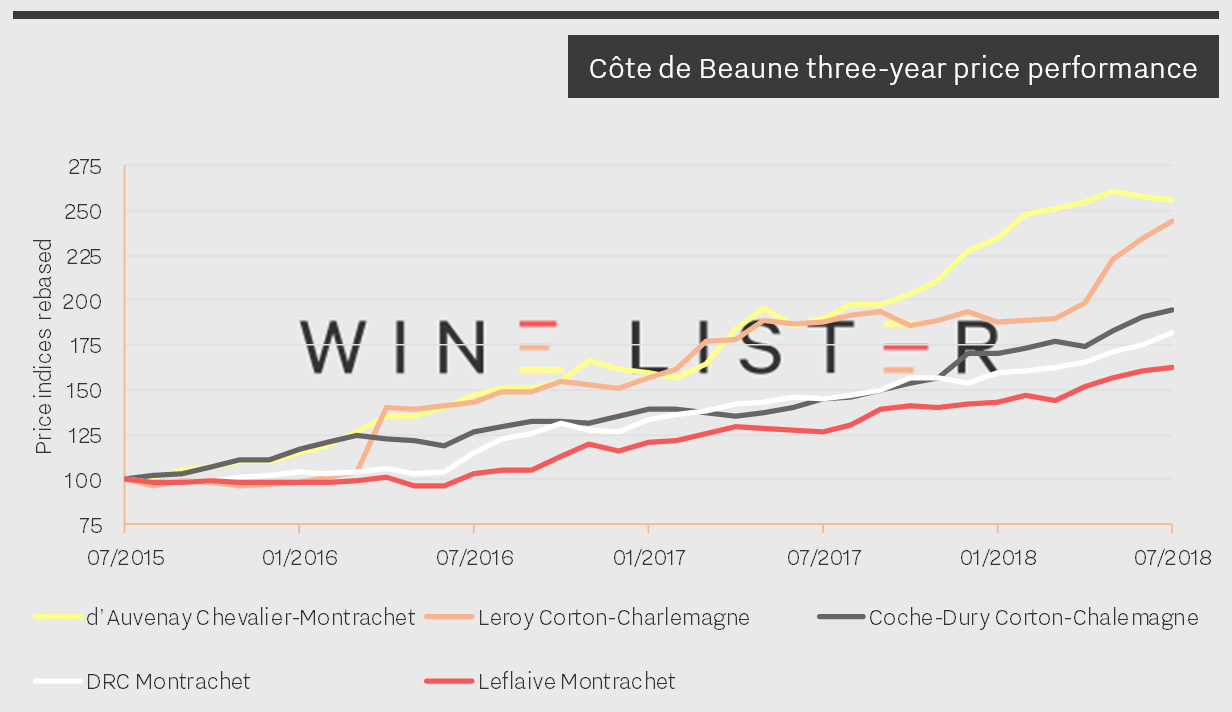

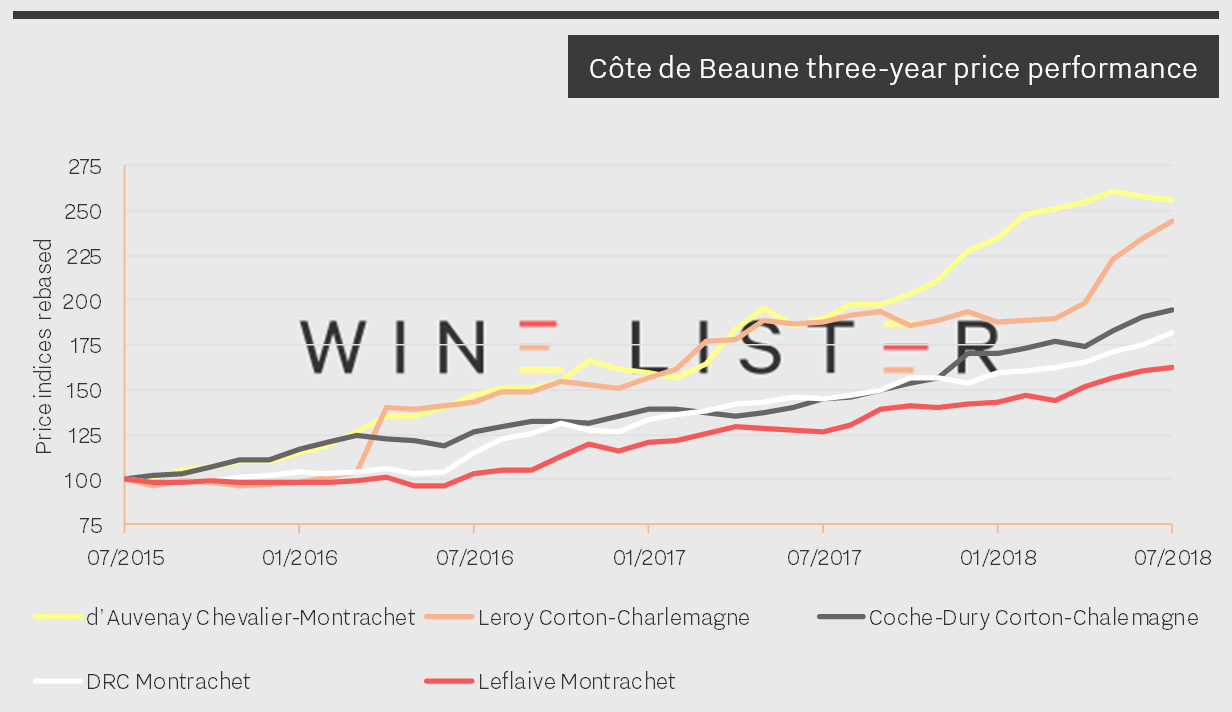

This week’s Listed blog will for most be an exercise in window shopping (or perhaps lèche-vitrine might be more appropriate). Not just the eye-watering prices, but also the extreme rarity of this week’s top five – just 500 bottles of d’Auvenay’s Chevalier-Montrachet are produced each year – act as bouncers stopping all but the most fortunate from entering this exclusive Burgundian showroom. Nevertheless, we can at least vicariously get as close to Chardonnay nirvana as possible with the Côte de Beaune’s five most expensive wines.

And these five really do get close to Chardonnay perfection, with a remarkable average Quality score of 975, putting them all amongst the top 15 still dry whites for Quality on Wine Lister. Perhaps reassuringly, Leflaive’s Montrachet, the Côte de Beaune’s most expensive wine, achieves the group’s best Quality score (985). 2010 was its best ever vintage, with a Quality score of 990, Jancis Robinson awarding it 19.5/20 and calling it: “[…] Not rich but gorgeous. Pale gold and obviously much fuller and deeper than Leflaive’s other grands crus. Rich yet so fresh! Nutty. Amazing concentrated fruit has already triumphed over the new oak. Very racy […]”. Interestingly, at £4,400 per bottle the 2010 is currently priced below all recent vintages other than the 2003.

Descending from the dizziest of heights, in second place is DRC’s Montrachet (£4,807). It is not just the Côte de Beaune’s overall top-scoring wine, but the best still dry white on Wine Lister (972). It is remarkably consistent across each of Wine Lister’s three rating categories, with Quality, Brand, and Economics scores of 975, 960, and 987 respectively. It is its Brand score that helps it nudge ahead in this Côte de Beaune showdown, with Coche-Dury’s Corton-Charlemagne the only one of the group to get close (924), the other three lagging c.250-290 points behind. Its brand superiority is the result of dominating both in terms of restaurant presence (visible in 26% of the world’s best establishments, comfortably above the Coche-Dury’s 19%) and online popularity (receiving 65% more searches each month than the Coche-Dury).

Whilst the Coche-Dury can’t quite match DRC’S Montrachet in the Brand or Quality categories, it does achieve the same phenomenal Economics score (987), having registered a superior three-year compound annual growth rate (25% vs 22%) and being the most-traded of the group at auction.

Lalou Bize-Leroy features twice in the list, first with d’Auvenay’s Chevalier-Montrachet (£3,368) and secondly with Domaine Leroy’s Corton-Charlemagne (£2,238). If ever there was proof of the life-altering potential of these hallowed wines, of his first taste of d’Auvenay’s Chevalier-Montrachet 1996, Wine Lister’s newest partner critic Neal Martin writes: “I took a large sip. It was like a thunderbolt hitting my senses: the tension, the complexity and intensity sent shivers down my spine. It was difficult to put down in words, yet this wine became instantly and indelibly etched onto my brain. Now I understood why oenophiles genuflected at the altar of white Burgundy”. With the d’Auvenay achieving a three-year compound annual growth rate of 45% and having added 18% to its value over the past six months alone, experiences such as Martin’s are only getting further out of reach for most.

The d’Auvenay is not alone in its soaring prices. As the chart below shows, demand for all of this week’s top five has skyrocketed over the past three years, each having added at least 62% to its value since July 2015. It seems the majority of us will have to satisfy ourselves with window-shopping for a little while longer.

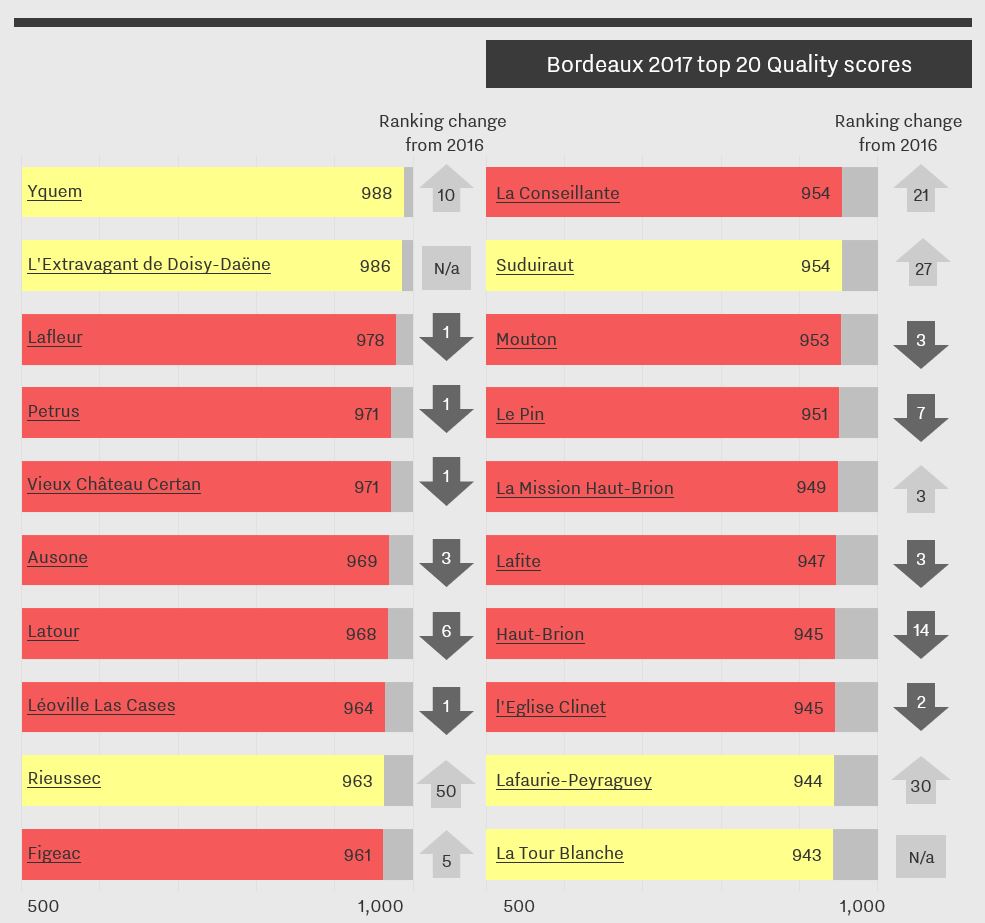

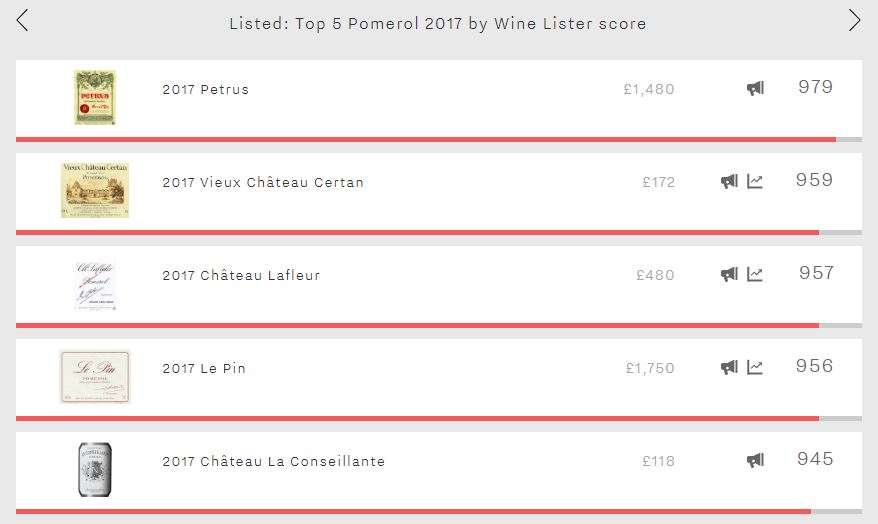

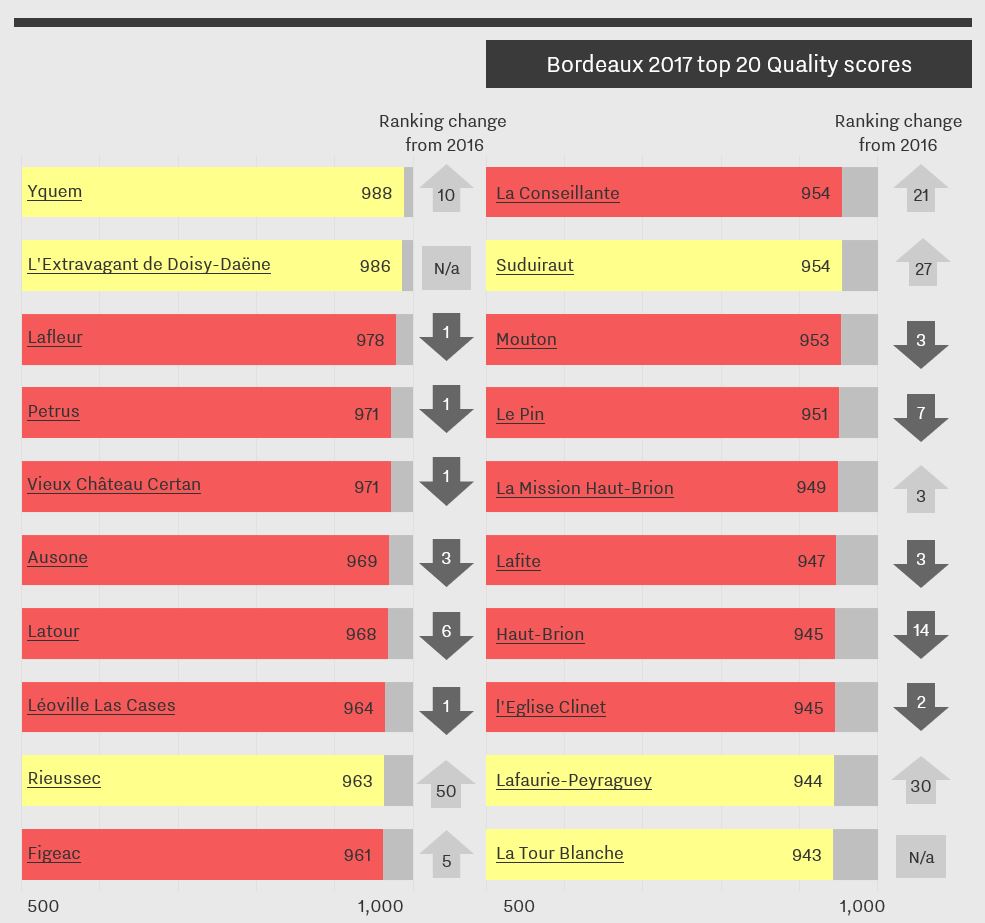

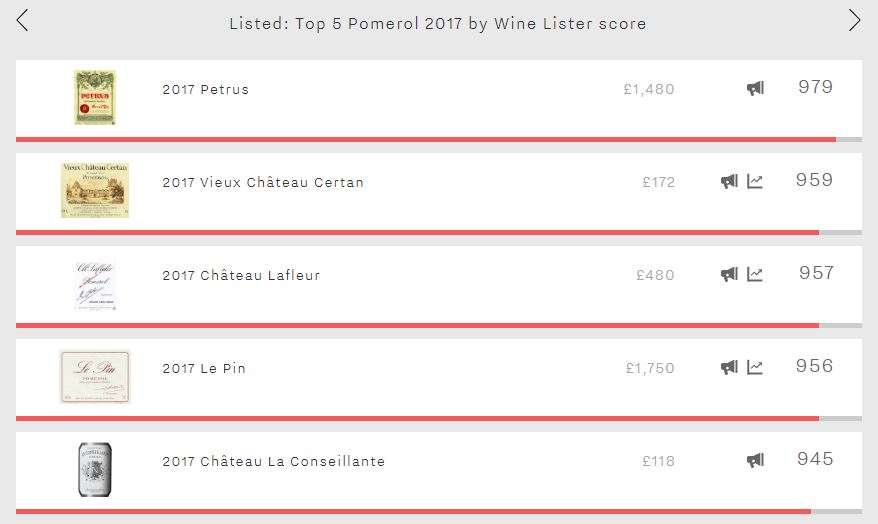

As a sort of postscript to the difficult 2017 en primeur campaign (read our CEO Ella’s thoughts here), over the past week or so Pomerol powerhouses Petrus and Le Pin were released at £1,480 and £1,750 per bottle respectively. With Pomerol wines achieving the top three Quality scores of all reds for 2017 – and five of the top 10 – it was the top-performing red appellation of the vintage.

Now that we have release prices for all of Pomerol’s top wines, we can see which came out on top in terms of overall Wine Lister score*.

With a score of 979, Petrus was not just Pomerol’s leading wine of 2017, but the number one wine in Bordeaux. This is perhaps unsurprising given that it received the joint-second best Quality score of the vintage of all reds (971) – alongside Vieux Château Certan – and also has a Brand score of 998 (beaten only by Lafite, Latour, Mouton, Yquem, and Dom Pérignon Vintage Brut) along with a wine-level Economics score of 978 (third-best in Bordeaux). With Wine Lister’s Founding Members voting it the second-most prestigious wine in the world in a recent survey, behind DRC La Romanée-Conti, Petrus is currently unbeatable in Bordeaux.

Number two on the 2017 Pomerol leaderboard is Vieux Château Certan (959). While the confidence rating attributed by Wine Lister’s Founding Members slipped a point over the past year from 9/10 to 8/10, it nevertheless achieves Pomerol’s second-best Brand score (972). Thus, despite its relatively modest Economics score (909) – still putting it amongst the very best on Wine Lister’s 1,000 point scale – the 2017, thanks to its excellent Quality score, manages to edge just ahead of Lafleur in terms of overall Wine Lister score (957).

Lafleur 2017, the best red wine of the vintage for Quality (978), was released in early May at £430 per bottle, a 7% decrease on the 2016 release price. This was Neal Martin’s favourite of the five, Wine Lister’s newest partner critic awarding it a score of 95-97 /100 and commenting: “This is an awesome 2017 from Baptiste Guinaudeau, one of the few that will oblige several years in the cellar”.

Le Pin 2017 was released in the UK at £1,750 per bottle, its 25% decrease on the 2016 release price the largest year-on-year reduction of the five. It experiences the lowest Quality score of the five for the vintage (951), and also has the group’s lowest Brand score (944). The fact that the 2017 betters Lafleur and La Conseillante in terms of overall Wine Lister score is thus the result of its formidable Economics score (980), which it achieves not just because of its high average price but also strong growth rates, which are the best of the group over both the long and short-term.

Rounding out the group is La Conseillante (945). Whilst it is by far the most affordable of the group, it is the only one of the five whose 2017 climbed the Bordeaux Quality score table compared to 2016, surging 21 spots to be the eighth best red and 11th best overall.

Remember that you can catch up on all of the campaign’s releases on our dedicated en primeur page.

* Please note that overall Wine Lister scores for en primeur wines use estimated Economics scores based on the performance of back vintages.

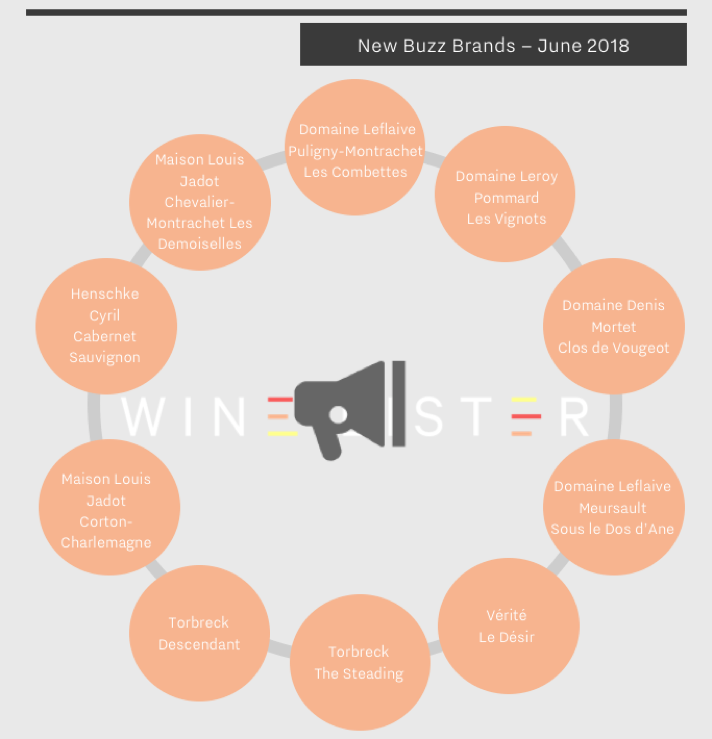

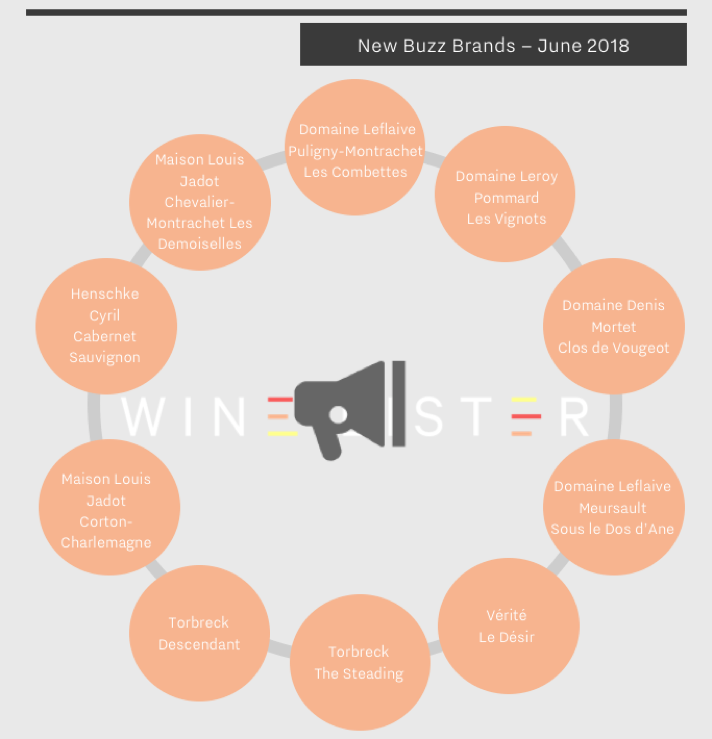

Despite the annual bustle of the en primeur campaign, it is healthy to breathe some non-Bordeaux air once in a while. With Bordeaux 2017 behind us, we examine new Buzz Brands for June from contrasting locations – Burgundy and the New World. One of four Wine Lister Indicators, ‘Buzz Brands’ use Wine Lister’s bespoke algorithms to indicate trending wines found in the highest number of the world’s best restaurants, and with high online search frequency.

This month, 10 new wines have made the Buzz Brand cut, as shown in the image below.

Six Burgundian wines (four whites and two reds) become Buzz Brands in June. This aligns with results of our latest Founding Members’ survey, where Burgundy producers earned the most number of votes (50) from key members of the global fine wine trade as most likely to see the largest brand gains in the next two years.

Louis Jadot and Domaine Leflaive both have two new white Buzz Brand references. Jadot’s Chevalier-Montrachet Les Demoiselles and Corton-Charlemagne have the highest Quality scores of this month’s Buzz Brand additions – 951 and 925 respectively. Domaine Leflaive proves its popularity with presence of its Puligny-Montrachet les Combettes and/or Meursault Sous le Dos d’Ane in 28 out of c.150 of the world’s best restaurants, and votes from the trade as a consistent seller (see p.23 of Wine Lister’s Bordeaux market study 2018 for more).

Of the red Burgundian Buzz Brands, the popularity of Domaine Leroy’s Pommard Les Vignots is perhaps unsurprising, given the producer’s renown, and the wine’s relative affordability (£505 per bottle) compared with Leroy’s more expensive offerings, such as its Musigny Grand Cru (£8,365 per bottle). Denis Mortet’s Clos de Vougeot is the only Côte de Nuits to feature in this month’s Buzz Brand additions.

The remaining four wines all hail from the New World – three from South Australia, and one from California. The latter, Vérité’s Le Désir, wins on all fronts with the highest Quality (949), Brand (740), and Economics (603) scores. The Quality comparison is hardly fair, given Le Désir’s price of £233, over four times higher the average of the three Australian representatives. Torbreck’s The Steading and the Descendant combined are present in 15 of the world’s best restaurants. Henschke’s Cyril Cabernet Sauvignon joins its pricier and better-known siblings, Hill of Grace Shiraz and Mount Edelstone Shiraz, as the producer’s third Buzz Brand.

You can see a full list of Wine Lister Buzz Brands here

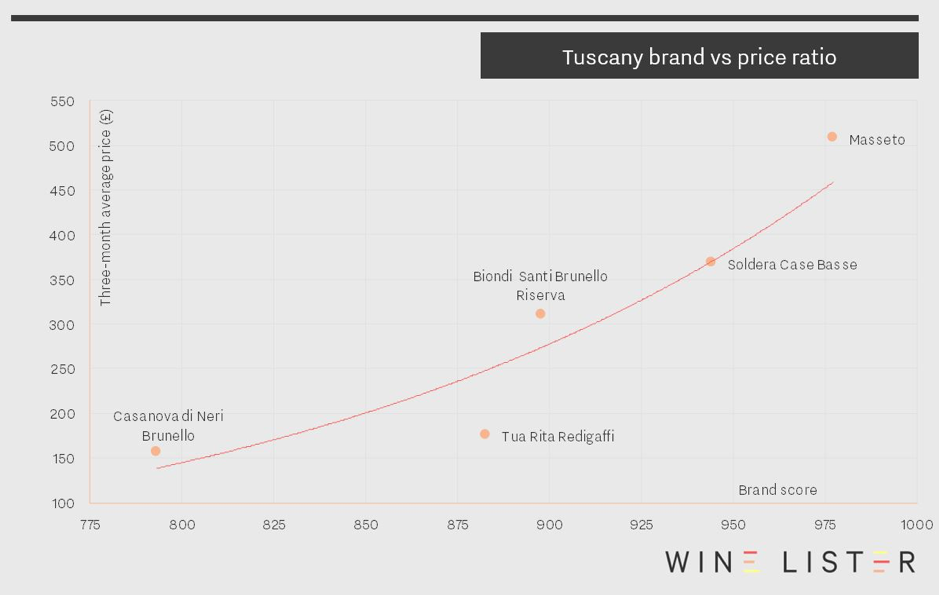

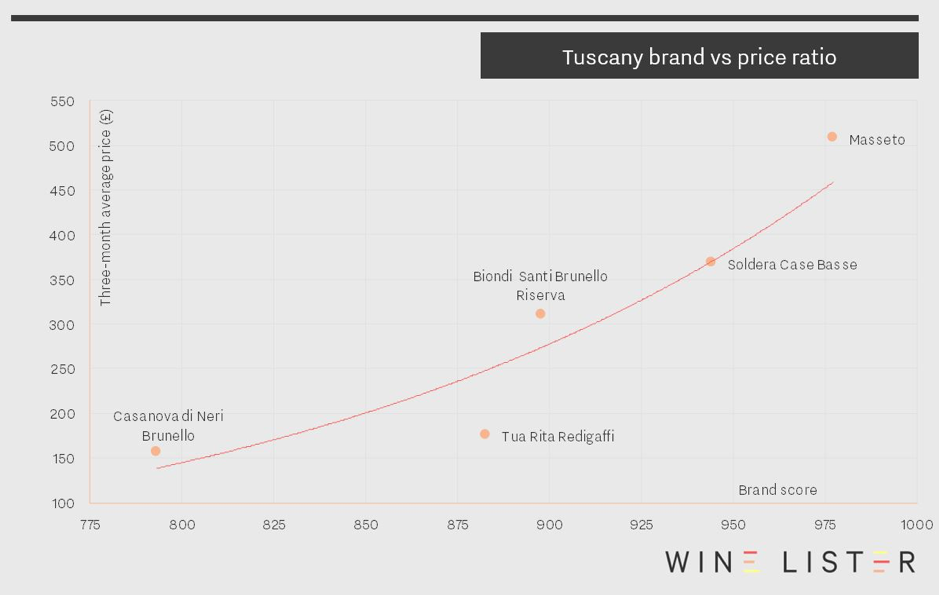

In this week’s top five, we take a break from June’s Bordeaux bias on the vinous calendar to look at the rising prices of Tuscany’s top wines.

However, there’s no escaping Bordeaux with Tuscany’s most expensive wine, since Masseto is distributed through the Place de Bordeaux. With tiny quantities available to purchase via the Place each year – average annual production is 32,000 bottles – Masseto’s price of £511 per bottle makes it well over a third more expensive than the rest of this weeks’ top five, and also the second-most expensive Italian wine on Wine Lister (beaten only by Giacomo Conterno’s Barolo Monfortino Riserva).

Masseto also achieves the group’s best Brand score (977), the result of featuring in the highest number of the world’s top restaurants (24%) and being over 2.5 times more popular than any of the other four. The chart below confirms a strong relationship between Brand score and price for these wines, with Masseto’s formidable brand strength playing a key role in its high price.

At £367 per bottle, Soldera Case Basse Sangiovese takes the second spot. It achieves the highest Quality and Economics scores of the five (976 and 957 respectively). With an impressive three-year compound annual growth rate (CAGR) of 18.4% – by far the highest of the group – and having added 7.3% to its value over the past six months, Soldera Case Basse continues to cement its position as Tuscany’s second-most expensive wine, and close the gap on Masseto.

Two Brunellos feature amongst Tuscany’s most expensive wines: Biondi Santi’s Brunello Riserva (£289) and Casanova di Neri’s Brunello Cerretalto (£157). Whilst Biondi Santi Brunello Riserva’s appearance might be expected, considering its heritage, the fact that Casanova di Neri Cerretalto is amongst Tuscany’s most expensive wines might be more of a surprise, indicating that Riserva status alone does not currently guarantee higher prices than straight Brunellos.

Rounding out the five is Tuscany’s fourth-most expensive wine and the group’s second 100% merlot – Tua Rita’s Redigaffi. At an average price of £180 per bottle, it is over 2.5 times cheaper than its varietal companion in the group, Masseto.

Which producers will see the largest gain in brand recognition in the next two years? As part of our recent Bordeaux Market Study, we asked Wine Lister’s Founding Members – c.50 key members of the trade from the world’s largest merchants, top international wine auctioneers and several high-end retailers, together representing well over one third of global fine wine revenues.

While Burgundy achieved the largest number of producers mentioned at least once (50), all 10 of the most-cited producers hail from Bordeaux.

With the en primeur campaign finally in full swing, below are Bordeaux’s biggest rising stars: the region’s top 10 brands expected by Wine Lister Founding Members to see increased recognition in the next two years.

Château Canon received the highest number of votes for the brand likely to see most increased brand recognition over the coming two years, and is therefore the number one rising star in this year’s Bordeaux Study. Canon also achieves the joint-highest confidence rating from the trade (see last week’s blog for details), and appears in the top 10 wines for price performance after en primeur release .

In a show of strength by owner Chanel, another of its properties, Rauzan-Ségla, receives the second-highest number of votes, alongside Les Carmes Haut-Brion.

Haut-Batailley, recently acquired by the Cazes family – and having released no wine in 2016 – is seen as a brand with a bright future (and the new owners clearly think so too – it was released at a very ambitious price of £43 at the end of April).

Other Bordeaux wines voted likely to see the largest gains in brand recognition over the next two years are: Brane-Cantenac, Pavie, Calon Ségur, Figeac, Lafleur, and Pichon Comtesse.

Visit Wine Lister’s Analysis page to read the full report (available in both English and French). Go to p.24 to see how many votes each of the above wines received.

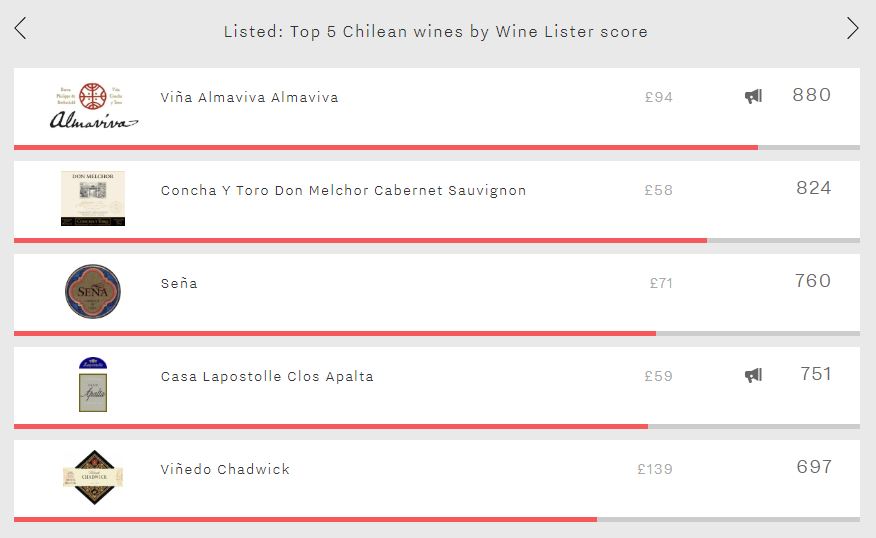

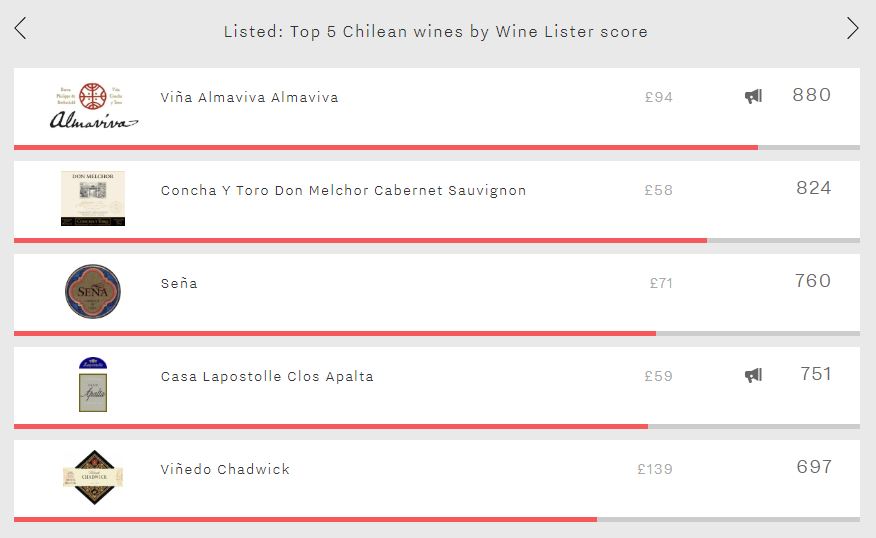

Taking inspiration and occasionally investment from Bordeaux’s most prestigious châteaux, Chile’s leading producers have, over a relatively short timeframe, become serious contenders in the fine wine market. Having had the opportunity to carefully select their sites, and benefitting from a more consistent climate than their Old World counterparts, Chile’s foremost wines continue to go from strength to strength. This week, we consider the overall top-scoring wines from the long sliver of land that has the cool Pacific on one side and the vertiginous Andes on the other.

Leading the way is Almaviva (880). One of two Chilean Buzz Brands, this joint project between Baron Philippe de Rothschild and Concha y Toro achieves Chile’s strongest Brand score (917), the result of not only featuring in more of the world’s top restaurants but also being twice as popular as any other Chilean wine. Surely Almaviva’s association with Mouton has played a significant role in its ability to build its brand to such a level over a short period of time – its first vintage was in 1998. It also manages Chile’s highest Economics score (787) – still ranking it within the “very strong” segment of Wine Lister’s 1,000-point scale, but indicating that it is the area in which Chilean wines currently struggle to compete with their Old World counterparts.

Further proof that economic success is the department in which Chile’s best wines have the most room to improve, Chadwick achieves the country’s best Quality score (904), yet only manages a score of 295 in the Economics category. This modest score is due to a combination of negative price performance over the past six months and a failure to trade a single bottle at auction over the past year, resulting in Chadwick slipping down to fifth place overall (697).

Don Melchor is Chile’s second-best wine (824) – completing a one-two for the Concha y Toro stable. It earns its second place thanks to consistency across each of Wine Lister’s three rating categories, finishing third in the Quality and Brand categories (872 and 853 respectively), and achieving Chile’s second-best Economics score (662). It is, however, considered Chile’s most ageworthy wine, with an average predicted drinking window of 11 years, 30% longer than any other Chilean wine.

The two remaining spots are filled by Seña – the second wine from the Errazuriz stable (alongside Chadwick) – and Casa Lapostolle Clos Apalta, with scores of 760 and 751 respectively. They present contrasting profiles, Clos Apalta achieving a better Quality score (829 vs 811) and Brand score (872 vs 770), but experiencing a significantly lower Economics score (364 vs 626).

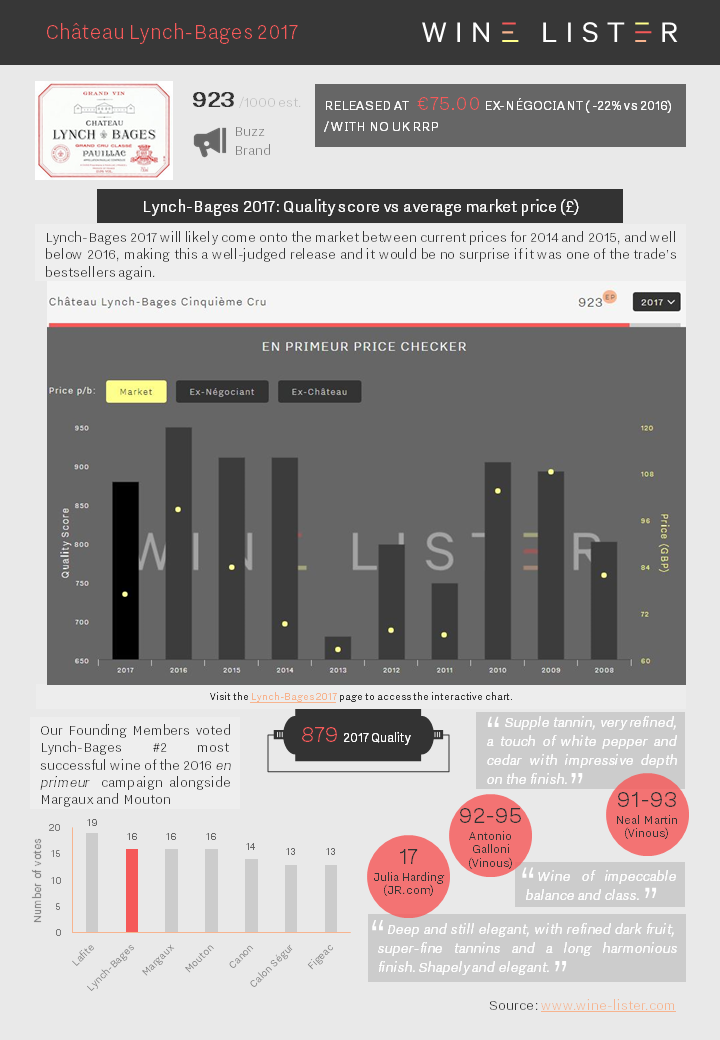

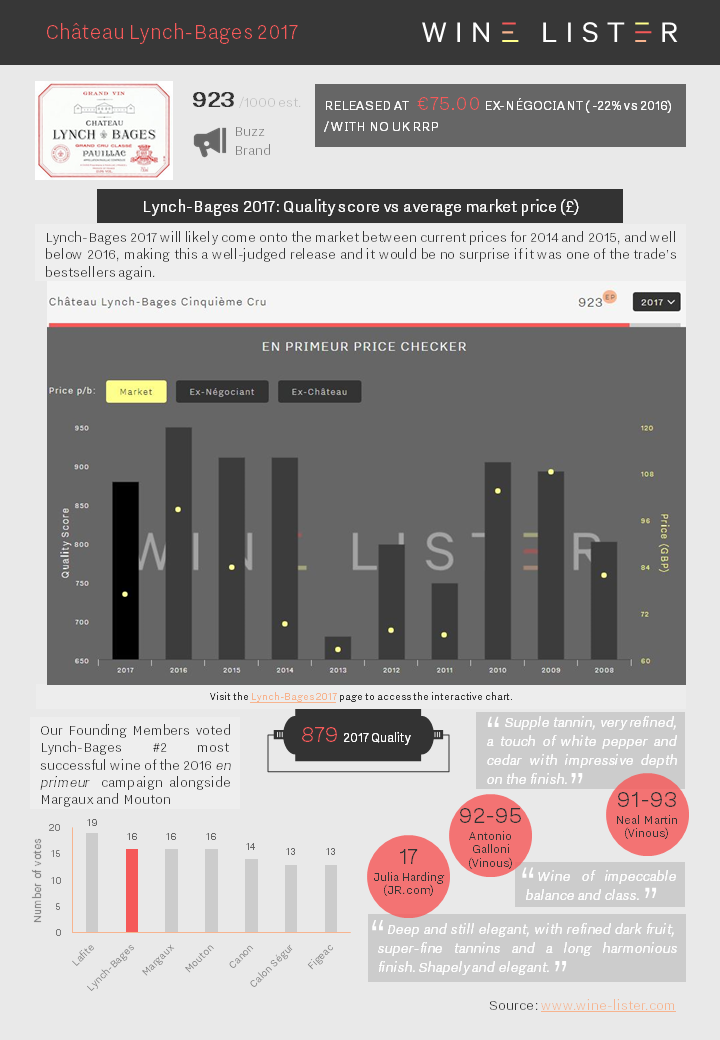

Lynch-Bages 2017 released at €75 ex-négociant (22% down on 2016), with no UK RRP. Its Quality score was down 7% on 2016 (879 vs 949).

You can download the slide here: Wine Lister Factsheet Lynch-Bages 2017

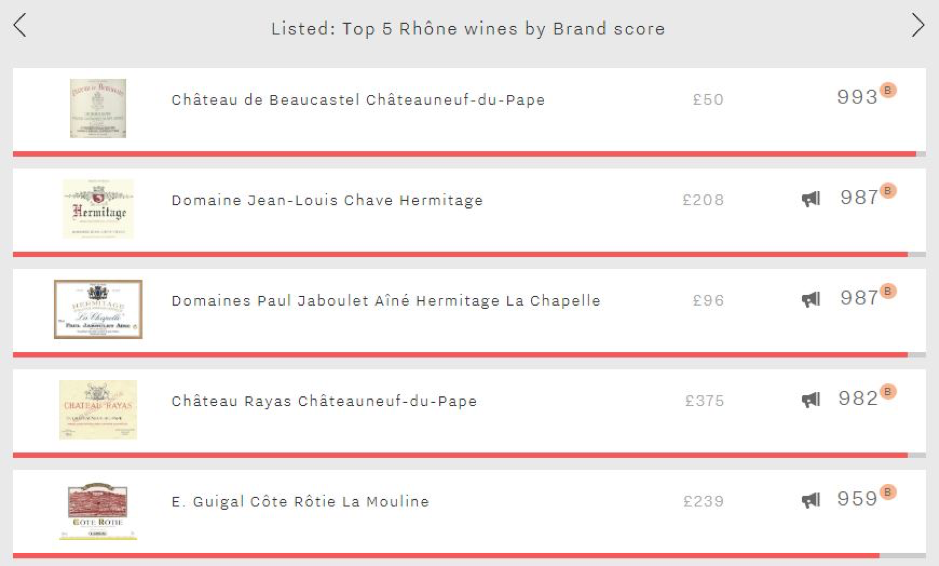

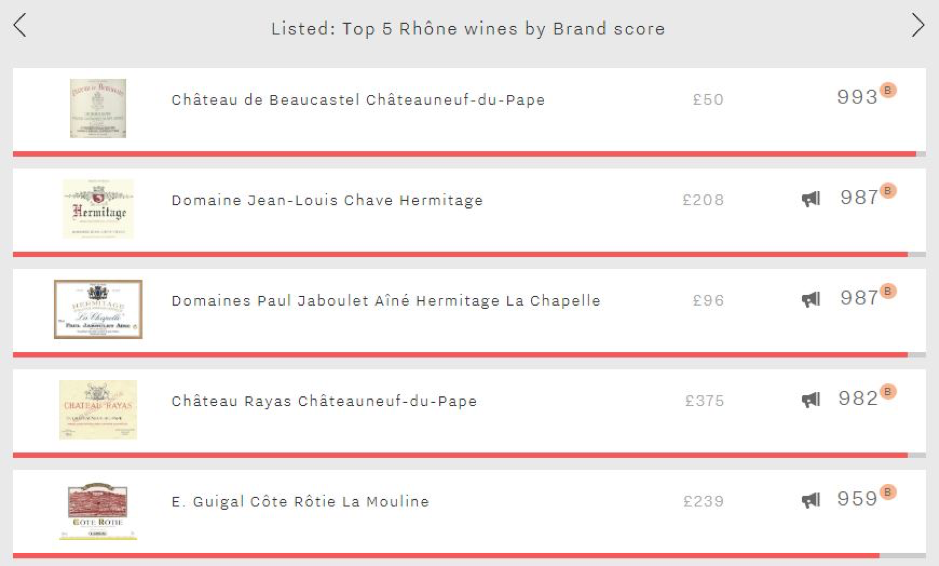

This week, the Listed section travels to the Rhône to consider the region’s top brands. As might be expected, all are red – Chave’s Hermitage Blanc, the region’s top white brand (924), is only the Rhône’s overall 12th strongest. However in a battle between North and South, it is the latter that comes out on top in the form of Beaucastel’s Châteauneuf-du-Pape with a Brand score of 993 – putting it amongst the top 25 brands on Wine Lister.

By far the cheapest of the five, Beaucastel leads across both Wine Lister Brand score criteria – presence in the world’s top restaurants and online popularity. However, whilst it is visible in 49% of the world’s finest establishments (just pipping Chave Hermitage’s 47% to the post), with 2.6 references per wine list on average it achieves the weakest vertical restaurant presence of the group, where Chave’s Hermitage manages the greatest depth (3.9 listings). If Beaucastel’s dominance within the world’s top restaurants is less clear-cut, when it comes to popularity amongst consumers it opens up a wider lead over the competition, receiving 16,565 searches on Wine-Searcher each month on average – 40% more than Jaboulet’s Hermitage La Chapelle – the group’s second-most popular wine.

Tied for second place with a Brand score of 987 are the two Hermitages from Chave and Jaboulet (La Chapelle). Whilst Chave leads in terms of restaurant presence (47% vs 43%), Jaboulet’s La Chapelle receives 6% more searches each month on average. Despite their identical Brand scores, Chave’s Hermitage is the clear winner elsewhere, with comfortable leads in the Quality category (959 vs 910) and Economics category (935 vs 863). Chave’s reward is a 36-point lead at overall Wine Lister score level (964 vs 928), and a price tag over twice that of Hermitage La Chapelle’s.

The Rhône’s overall top wine – Rayas (968) – is the region’s fourth-strongest brand (982). The group’s second Châteauneuf-du-Pape, it comprehensively outperforms the Beaucastel in terms of Quality (961 vs 876) and Economics (959 vs 823). It is thus perhaps the Beaucastel’s significantly larger annual production – roughly seven times Rayas’ – that has helped raise its brand to such lofty heights.

Rounding out the five is Guigal’s Côte Rôtie La Mouline with a score of 959. Whilst it can’t quite keep pace with the remainder of this week’s top five, it leads the two remaining “La Las” – La Landonne and La Turque – by six and 12 points respectively in the Brand category. Similarly to the Rayas, it is perhaps the extremely limited production of the “La Las” that keeps them from achieving even higher Brand scores – the combined annual output across the three cuvées is c.18,000 bottles.