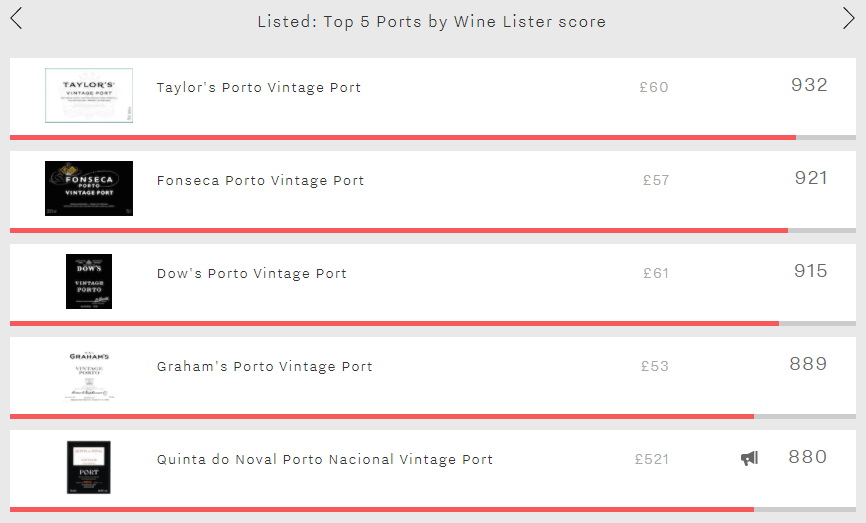

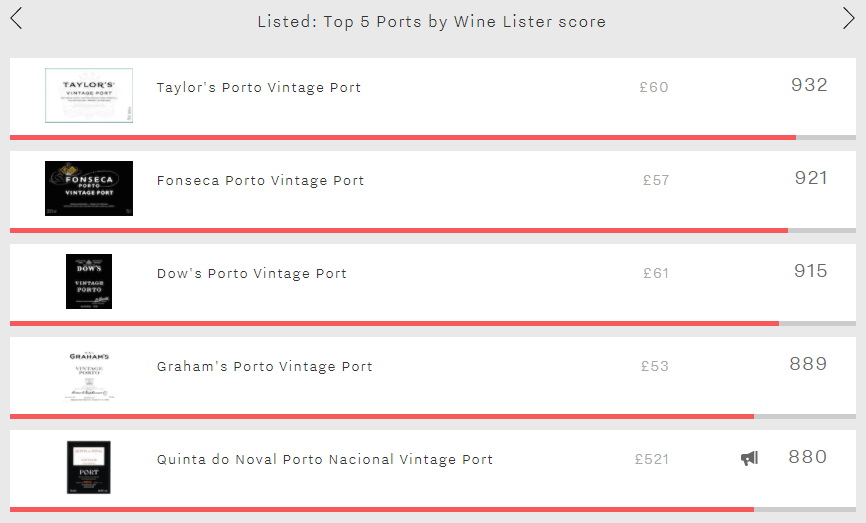

This week’s top five takes Wine Lister to the Douro Valley in search of its vintage ports. In some ways this top five is very much a four plus one, with the fifth placed Quinta do Noval Nacional, costing nine to ten times more than each of the others. It is also the only one to enjoy Buzz Brand status. At a total Wine Lister score of 880 and £521 per bottle, against the top-ranked Taylor’s 932 and £60, that constitutes quite a buzz.

Here is a classic case of all metrics count but some count for more than others when it comes to cost. With a stonking 981 for Quality and the longest drinking window in its peer group the Quinto do Noval is clearly the nichest of the niche; its relatively low restaurant presence (9%) and monthly searches (2,457, on average, to Taylor’s 10,787) make its Wine Lister Brand score (825) well below Taylor’s and the other three.

With an overall score of 932, an excellent Quality score of 967, and a Brand score of 965 based on decent restaurant presence (23%) and over 10,700 average monthly searches, Taylor’s tops the Vintage ports. Fonseca comes a close second at an overall 921. With almost identical Quality (965) and slightly lower Brand (942), Fonseca just pips Taylor’s for liquidity, with 1,072 (against 1,061) of its top five vintages traded at auction in the past year.

At around £60 per bottle on average, Taylor’s and Fonseca are each affordable flutters with future Christmases in mind. Even illustrious older vintages such as 1970 and 1977 – in their drinking prime this Christmas – can be found at two to three times the price.

The same goes for third-placed Dow’s (£61) and fourth-placed Graham’s (£53). At an overall 915 Dow’s has a slightly lower Quality score than the top two. 943 is nevertheless still highly creditable. Graham’s edges Dow’s on Quality at 948 but a relatively lowly 650 for Economics brings it down to 889 overall.

All in all, Taylor’s and Fonseca merit their top two spots. If Santa has very deep pockets then consider adding Quinto do Noval 1994 to your wishlist (at a cool £1,229).

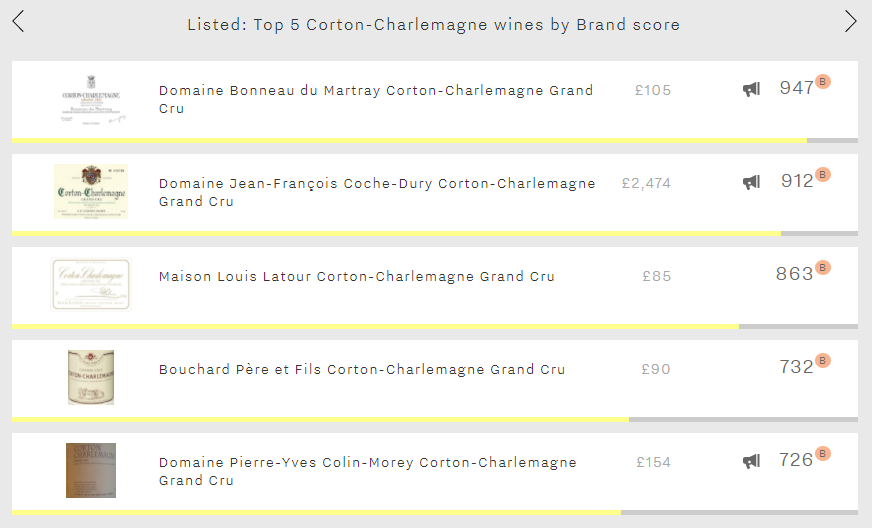

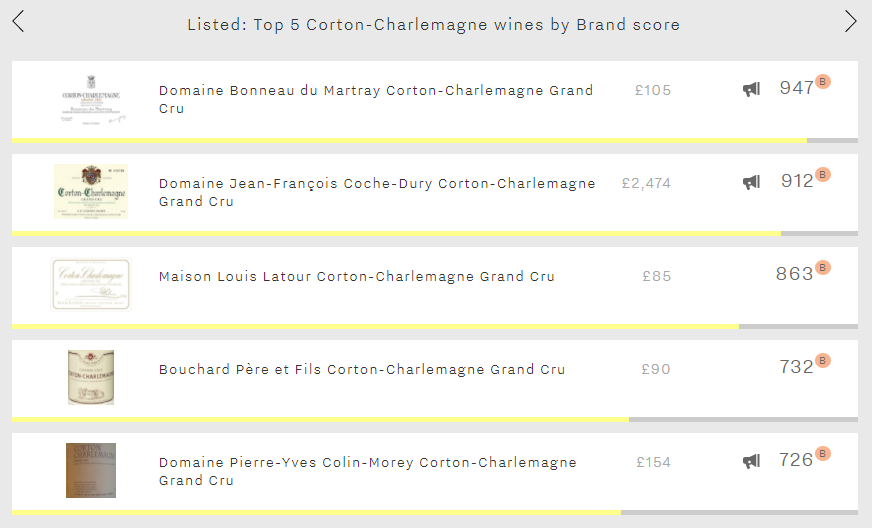

As the temperature drops, the natural reaction can be to reach for structured reds and hearty meals. The great Chardonnays of Corton-Charlemagne also warm the cockles, and belong in pride of place on any Christmas table. Here we look at the appellation’s top five brands.

Wine Lister’s Brand score measures a wine’s prestige – as indicated by its visibility in the world’s top restaurants – and popularity – as shown by the number of searches it receives each month on Wine-Searcher. Corton-Charlemagne’s top brand is Bonneau du Martray’s offering (947). This outstanding Brand score is the result of achieving by far the greatest level of restaurant presence of the group – it is visible in nearly twice as many of the world’s top establishments as the next-best of the five (Coche-Dury’s Corton-Charlemagne) – coupled with being comfortably the most popular of the group, receiving 24% more searches each month than the runner-up. No wonder it is one of the group’s three Buzz Brands.

In second place is Coche-Dury’s offering with a score of 912 for Brand, in fact its weakest category – perhaps unsurprising given its formidable Economics and Quality scores (985 – the highest of any white Burgundy – and 969 respectively). Its economic might is the result of its extraordinary price (£2,474), which is over 15 times higher than the second-most expensive wine of the group (the Pierre-Yves Colin-Morey (£154).

Almost 50 points further behind is Maison Louis Latour’s Corton Charlemagne (863). Unlike the Coche-Dury, its Brand score is its best facet. This is thanks to very strong performance across both brand criteria – it features in 13% of top restaurants and receives 2,500 searches each month on average.

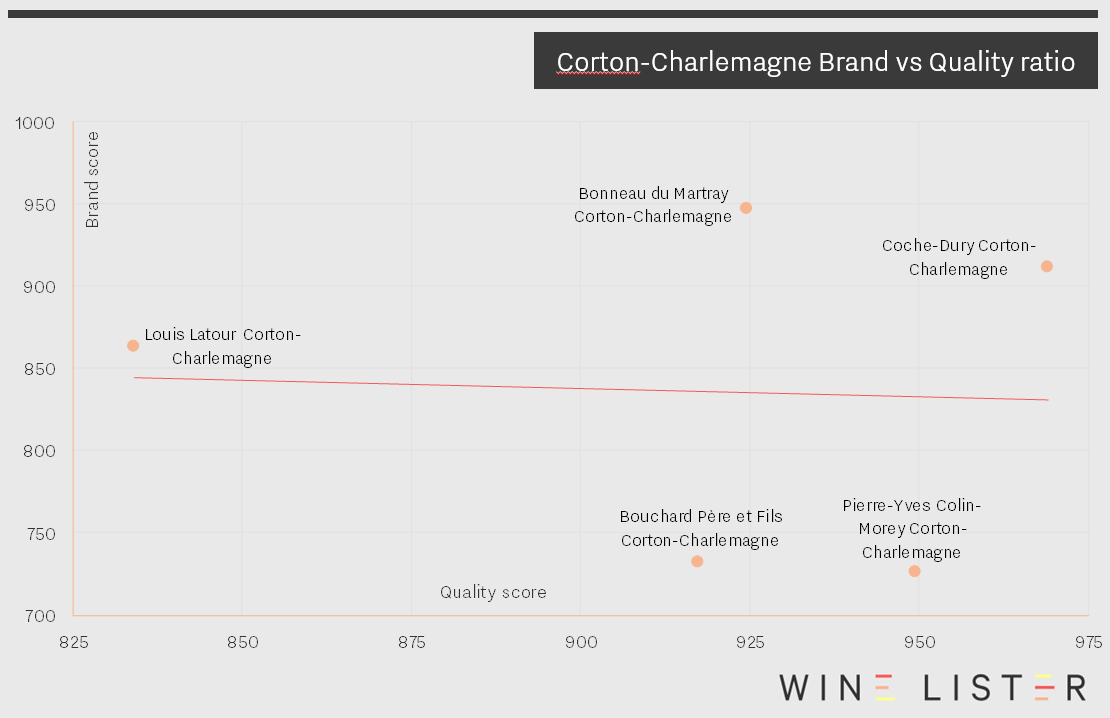

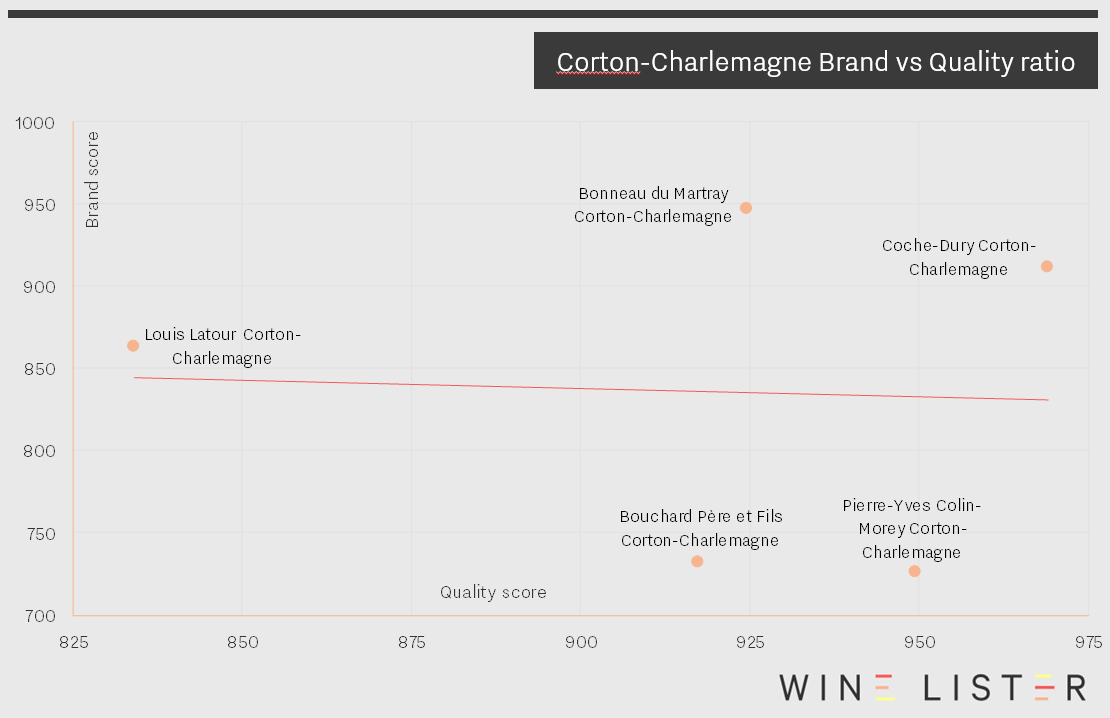

Trailing over 130 points further behind, Corton-Charlemagne’s next-strongest brands are separated by just six points – Bouchard Père et Fils (732) and Pierre-Yves Colin-Morey (726). Whilst strong, their Brand scores are no match for their excellent quality scores (917 and 950 respectively). In fact, it seems that quality doesn’t play an obvious role in establishing brand strength within Corton-Charlemagne:

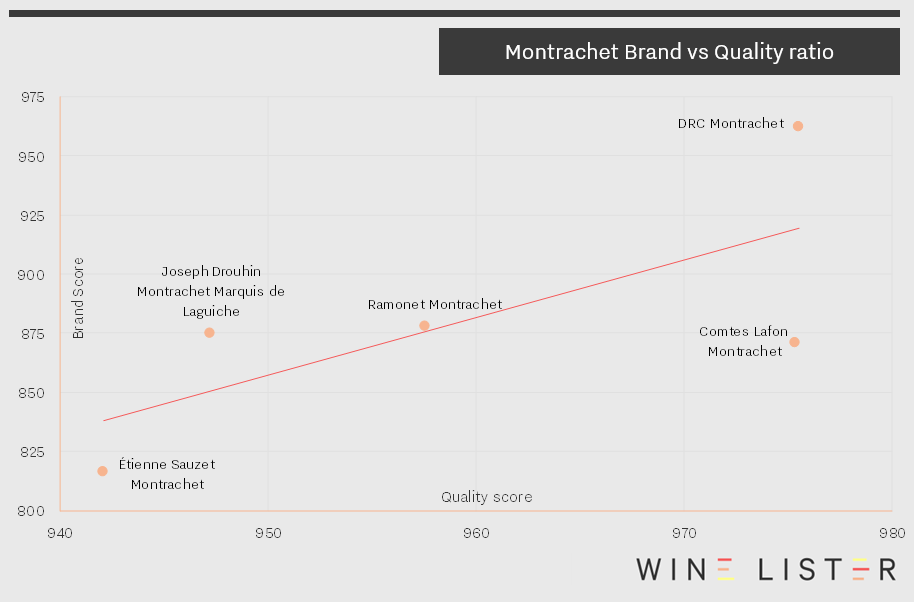

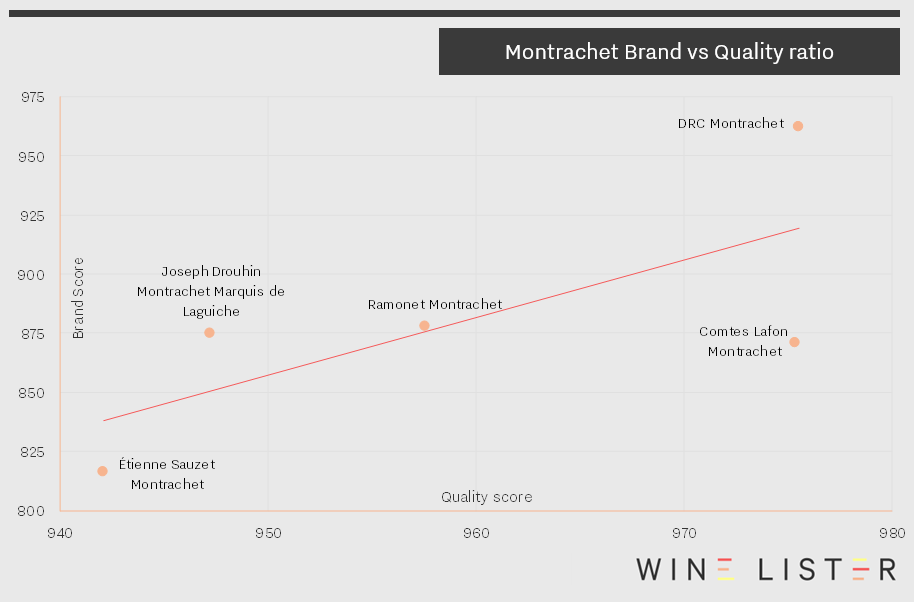

Whilst Corton-Charlemagnes’s top five Brands display no correlation between quality and brand recognition, as indicated by the flat trendline, quality is much more of a factor for the top brands of another of Burgundy’s most prestigious appellations, Montrachet:

Remember that even if you don’t currently have a Wine Lister subscription you can access all the underlying data behind these five wines as well as those featured in other recent Top 5s, giving you an insight into the wealth of tools at our subscribers’ disposal.

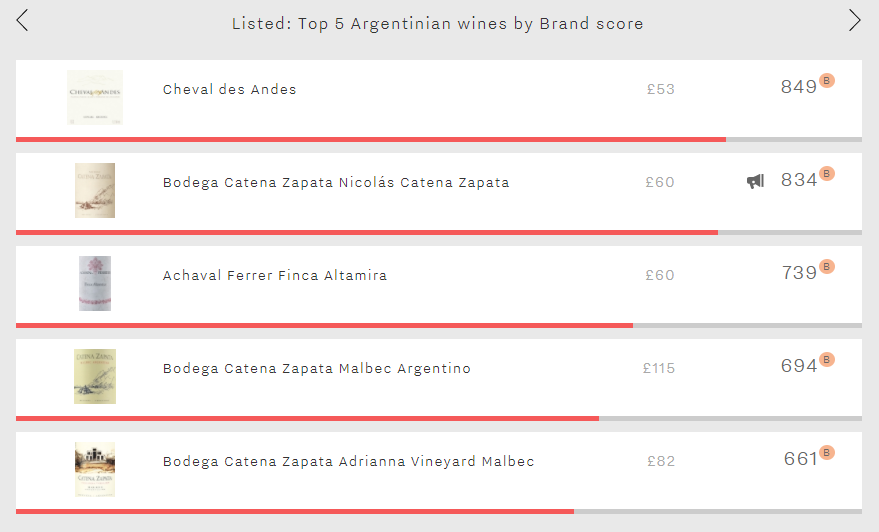

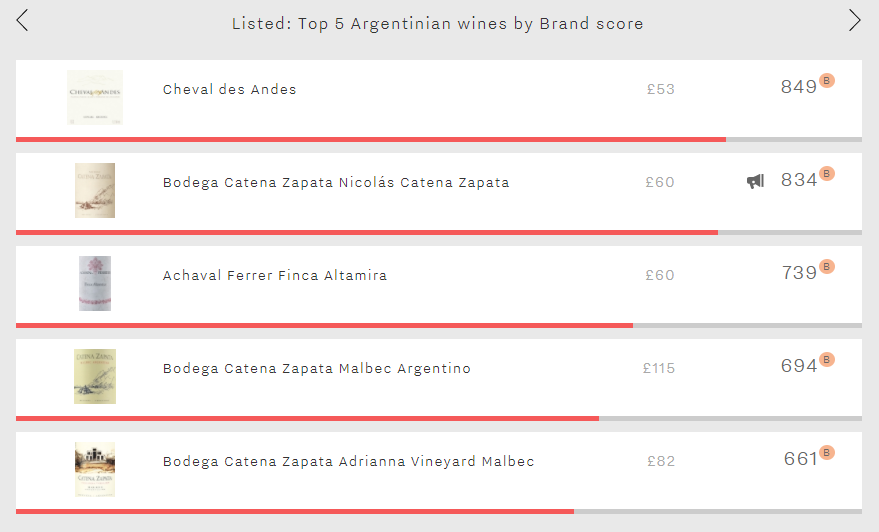

This week’s Listed section ventures out from the Old World to look at Argentina’s top five brands. Wine Lister’s Brand score measures a wine’s performance across two criteria – restaurant presence and online popularity. The five Argentine wines, from three producers, all achieve scores that are either strong or very strong on Wine Lister’s scale, indicating that South America’s strongest brands are now established on the global fine wine market.

With a Brand score of 849, Argentina’s leading icon is Cheval des Andes. A joint venture between Saint-Emilion heavyweight Cheval Blanc and Terrazas de los Andes, it leads the way when it comes to restaurant presence, featuring on 14% of the world’s top wine lists – its closest rival in that criterion, Bodega Catena Zapata Nicolás Catena Zapata appears on 9% of the same lists.

Nicolás Catena Zapata (834) turns the tables in terms of online popularity. The only Buzz Brand of the group, it receives on average 2,349 searches each month on Wine-Searcher, 27% more than Cheval des Andes (1,853). It also achieves the greatest vertical restaurant presence of the group, with 2.7 listings on average per list.

Nearly 100 points behind is third-placed Achaval Ferrer Finca Altamira with a score of 739. Appearing in 7% of restaurants and receiving 999 searches each month, it achieves its best score in the Brand category, comfortably outperforming its Quality score (581) and Economics score (183).

The last two spots are filled by two more wines from Bodega Catena Zapata – Malbec Argentino in fourth place (694) and Adrianna Vineyard Malbec in fifth place (661). Both receive a similar number of searches each month (744 and 793 respectively), and are visible in 6% and 4% of restaurants respectively.