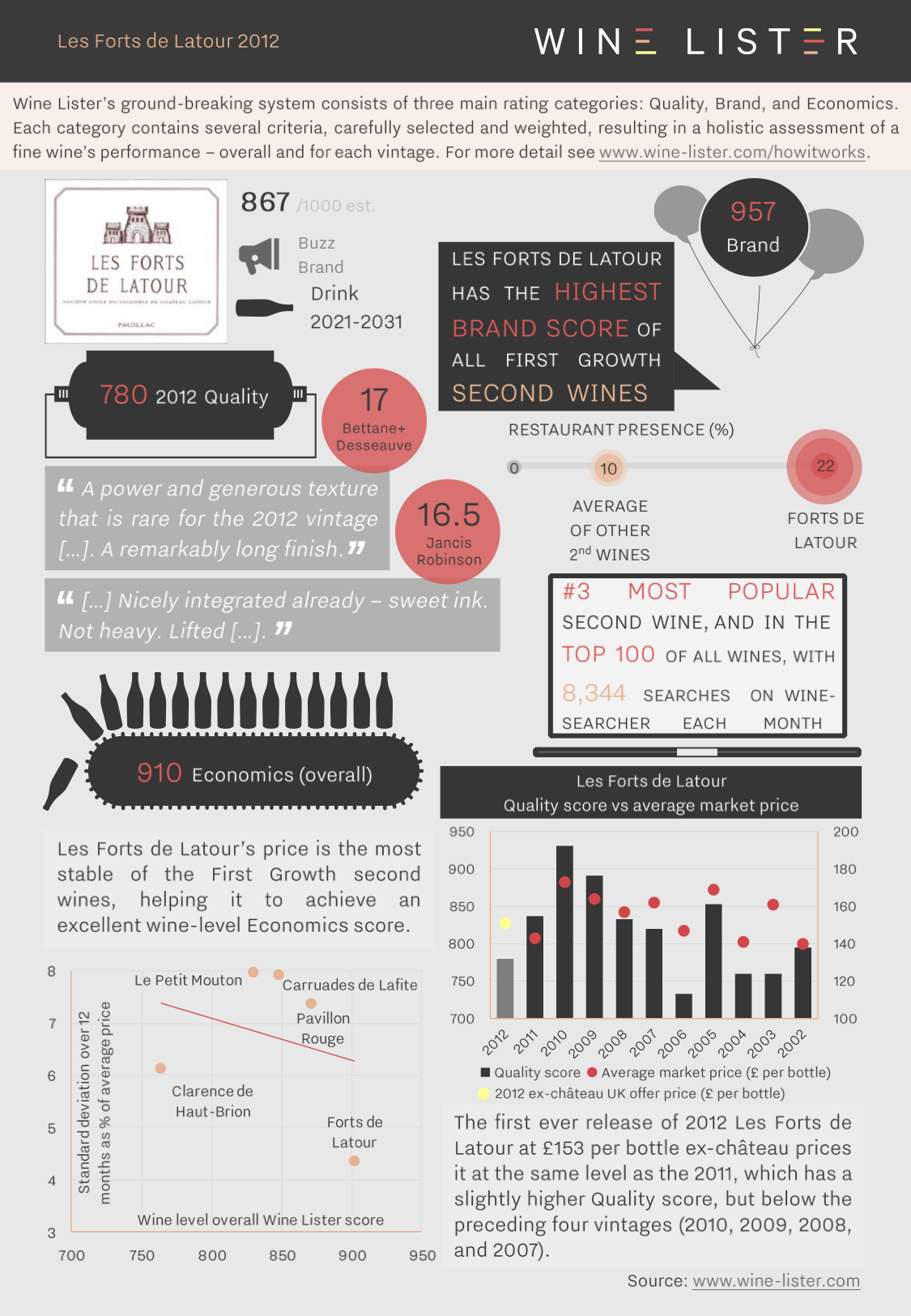

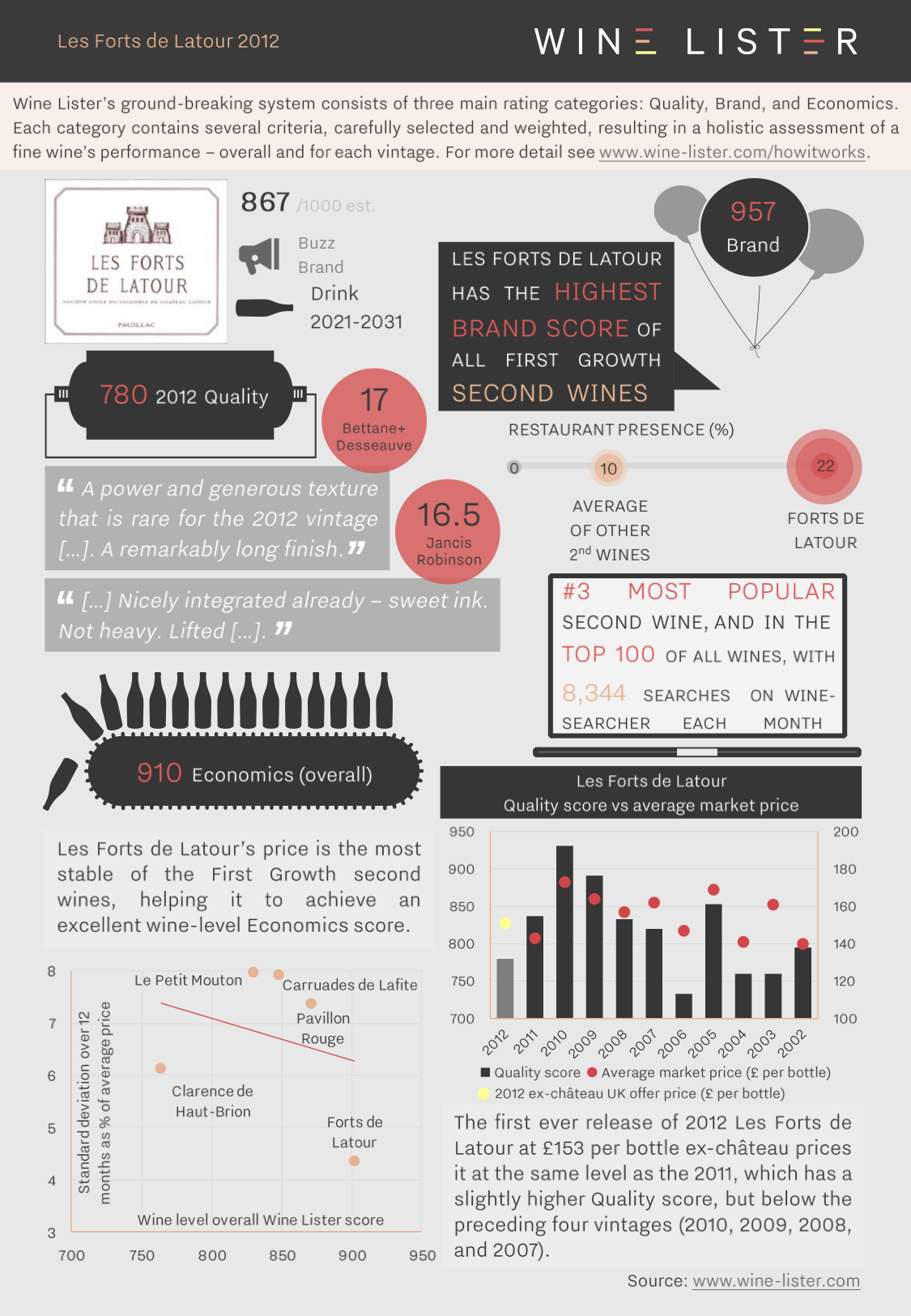

Château Latour has released a first parcel of Les Forts de Latour 2012 this morning at €145 per bottle ex-negociant. It is being offered in the UK at c.£153 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Les Forts de Latour 2012

Wine Lister Economics scores not only reflect a fine wine’s economic clout, but also predict its future price performance. The economics of fine wine are increasingly important. Some purists wish it weren’t the case (wouldn’t it be wonderful if quality could exist in isolation from pecuniary concerns?), but consider the plight of the producer making an exceptional wine, that without any brand recognition or commercial strategy doesn’t ever see the light of day. It never finds an importer, or its way into the consumer’s glass, let alone the investor’s portfolio.

That is why Wine Lister scores capture 12 data points across three rating categories, to measure the all-round performance of a fine wine in its journey from vine to glass. After Quality and Brand, the third Wine Lister rating category is Economics. The Economics score shows the producer whether its commercial strategy is working, but more than that, it can also serve to indicate to the collector whether the wine makes an economically sound investment.

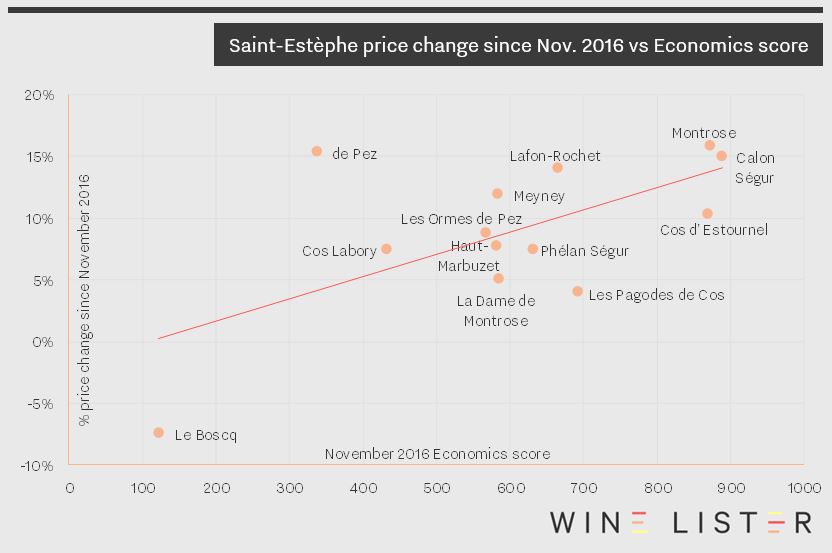

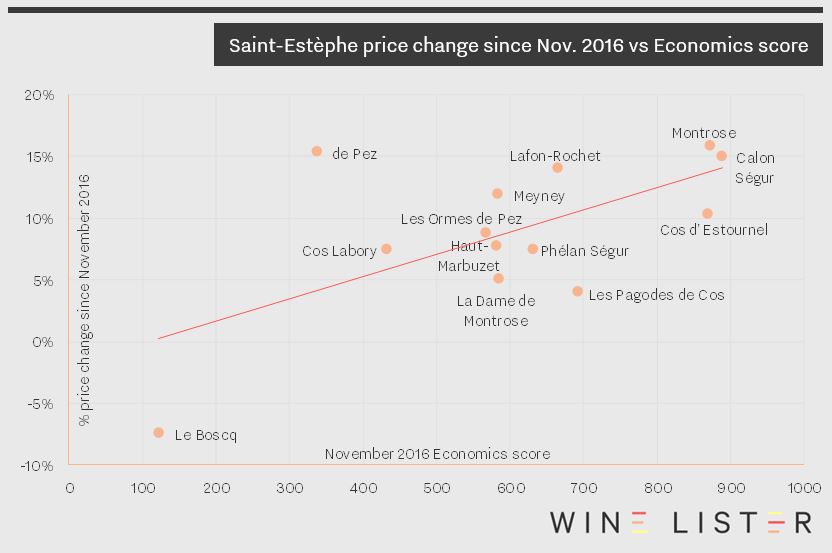

Bordeaux wines with an Economics score above 900 in November 2016 had increased by 17% in price on average by January 2018. By contrast, those with Economics scores below 600 gained just 8% subsequently. We can see this pattern in action in the chart below, which looks at Saint-Estèphe wines over the same 14-month period. The wines with the highest Economics scores at the beginning of the period proceeded to increase more in price than those with lower scores as a general rule.

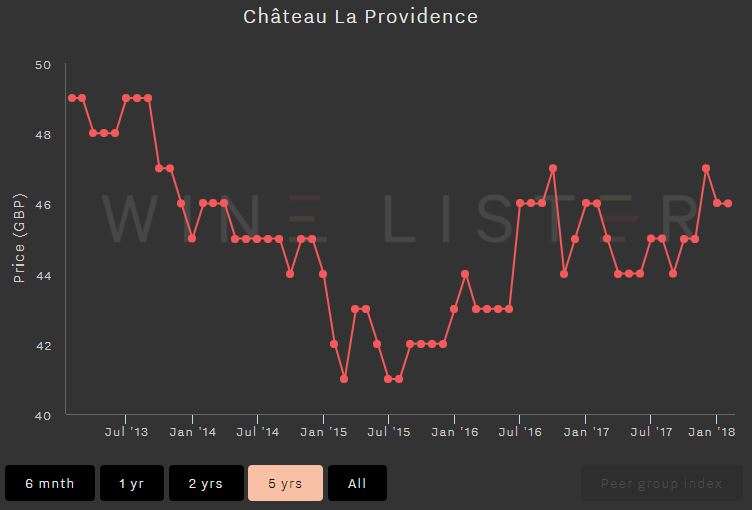

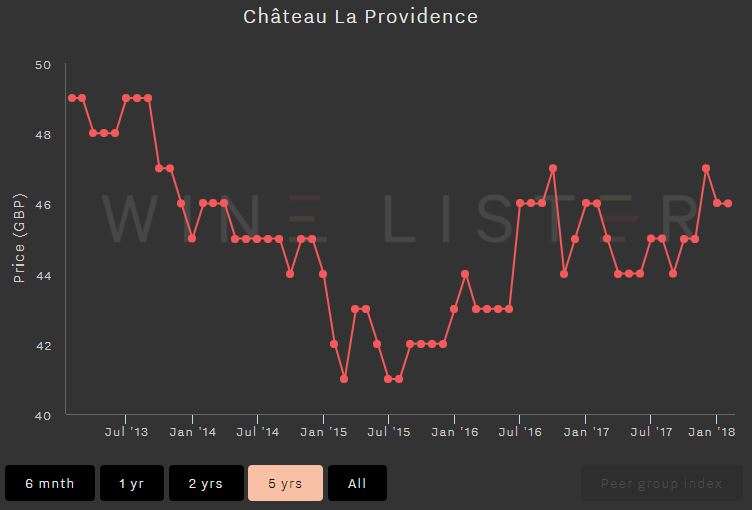

The below screenshots of Wine Lister’s price history tool illustrate graphically the difference between two wines with different economic profiles. Vieux Château Certan’s Economics score lies in the “strongest” portion of the Wine Lister 1000-point scale at 907/1000. While Château La Providence’s Quality score is strong (708/1000) its low Economics score of 389 is the result of a lower price, weak price performance, volatile prices, and modest trading volumes.

Wine Lister analyses five criteria in order to measure a wine’s economic strength, expressed as an Economics score out of 1,000. Four of these criteria use pricing data from our data partner, Wine Owners, while the fifth uses trading volume figures from the Wine Market Journal:

- 3 month average bottle price

This “market price” is the ultimate measure of what people are willing to pay for each wine in each vintage. Data is updated weekly, and bases prices on a three-month rolling average. Prices are shown In Bond per bottle.

- Short-term price performance

A wine’s financial strength also depends on its price performance. Wine Lister calculates price changes over six months for an indication of short-term price trends.

- Long-term price performance

Long-term performance measures a wine’s compound annual growth rate over three years.

- Price stability

Price fluctuations over a 12-month period are distilled into the measure of a wine’s stability. Wines with less volatility are more consistent, less risky and therefore earn a better Economics score.

- Volume traded

Added to pricing information is data on a wine’s liquidity. A wine can have good price performance but lack the current market demand, potentially making it a less attractive wine for investment.

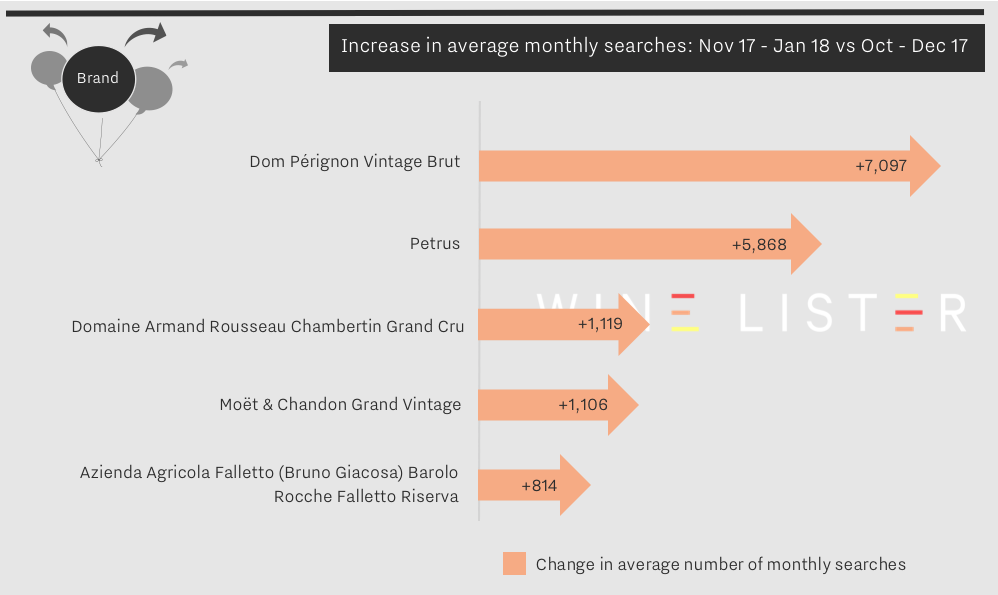

Wine Lister uses search frequency data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis. Wines with the highest search frequency numbers tend to be consistent, with the Bordeaux left bank premiers crus classés generally taking the top spots.

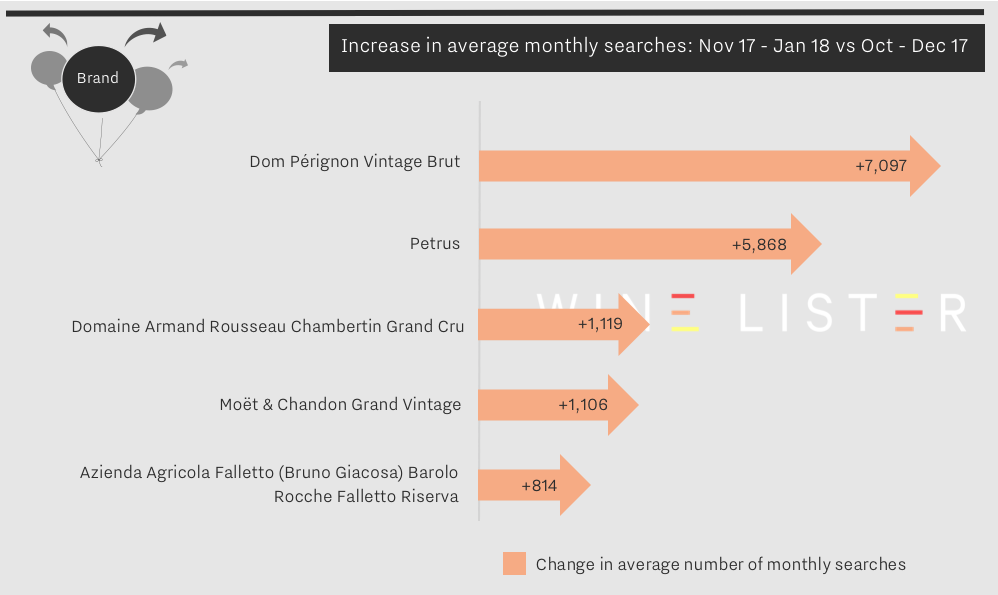

This month’s biggest search frequency gainers also rank as some of the most searched-for wines on Wine-Searcher. Dom Pérignon Vintage Brut is the third most popular wine with over 84,000 searches after Lafite and Mouton, closely followed by Petrus in fourth place. Armand Rousseau’s Chambertin and Moët & Chandon Grand Vintage appear in the top 50, while Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva comes lower down at number 148 out of the circa 5,000 wines on Wine Lister, but its search frequency has recently increased by 15%.

Our last post on online search frequency revealed Wine Lister’s first ever perfect Brand score. Moving on from the Christmas period, Champagne brands still show marked increases in search frequency, but this time they do not stand alone at the top.

Dom Pérignon Vintage Brut is the largest gainer in popularity for the second time running. Increasing at a slower rate than in December, its popularity nonetheless grew by 7,097 searches into January, maintaining its 1000-point Brand score. Dom Pérignon remains the only wine to achieve a perfect score from any of the Wine Lister score categories. The other Champagne still riding high on searches is Moët & Chandon Grand Vintage, which increased by 6%.

Bordeaux creeps back onto the map for online searches at the beginning of 2018, with the first growths having featured heavily in searches up to December 2017. Petrus is in second place after Dom Pérignon, with an 8% increase in search frequency. It will be interesting to see if search increases for Bordeaux follow the same pattern as last year as we approach the 2017 en primeur campaign.

Armand Rousseau’s Chambertin appears in third place. Armand Rousseau was only one of two producers to achieve a perfect confidence rating from our Founding Members in our recent Burgundy study.

In fifth place for increased popularity is a bittersweet entry. Searches for Barolo Rocche Falletto Riserva from Azienda Agricola Falletto increased as the wine world learned of the sad passing in January of Piedmont legend, Bruno Giacosa. You can read more on Bruno Giacosa’s legacy in a recent blog on Barbaresco, here.

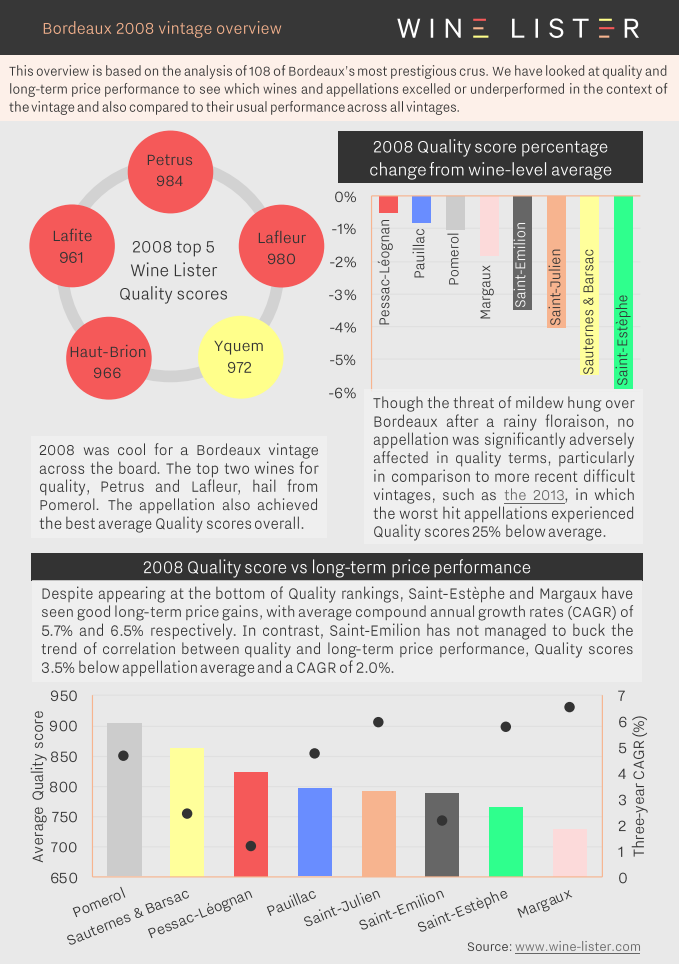

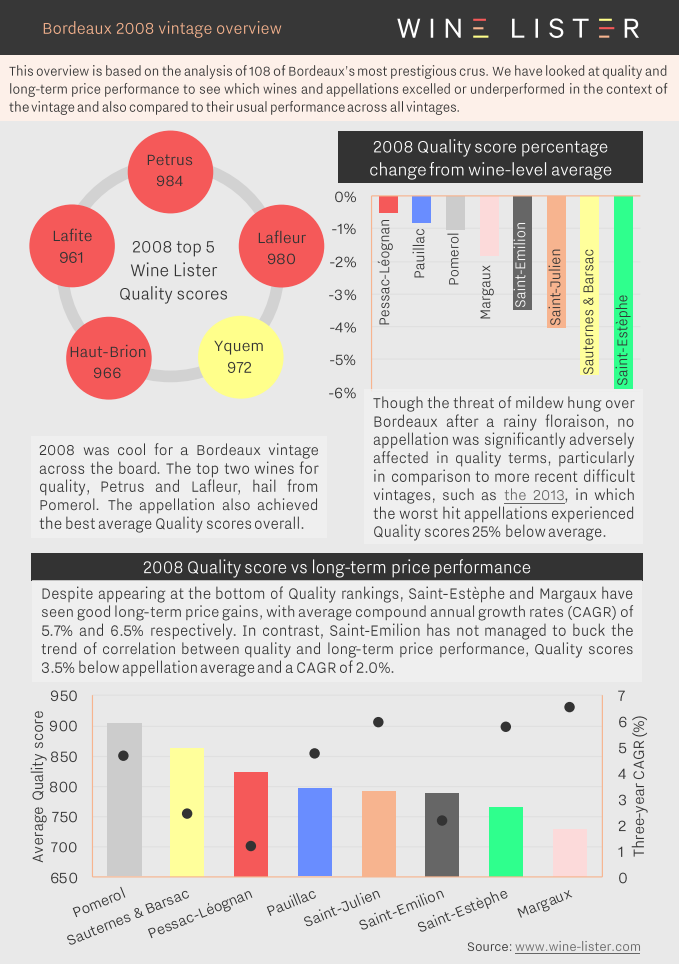

Last week we were lucky enough to taste through the 2008 vintage of Bordeaux grands crus classés at BI Fine Wines’ 10 years on tasting. Below we explore what light Wine Lister scores have to shed on the quality and price performance of different appellations in 2008.

Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download the slide here: Wine Lister Bordeaux 2008 vintage overview

Featured wines: Petrus, Lafleur, Yquem, Haut-Brion, Lafite

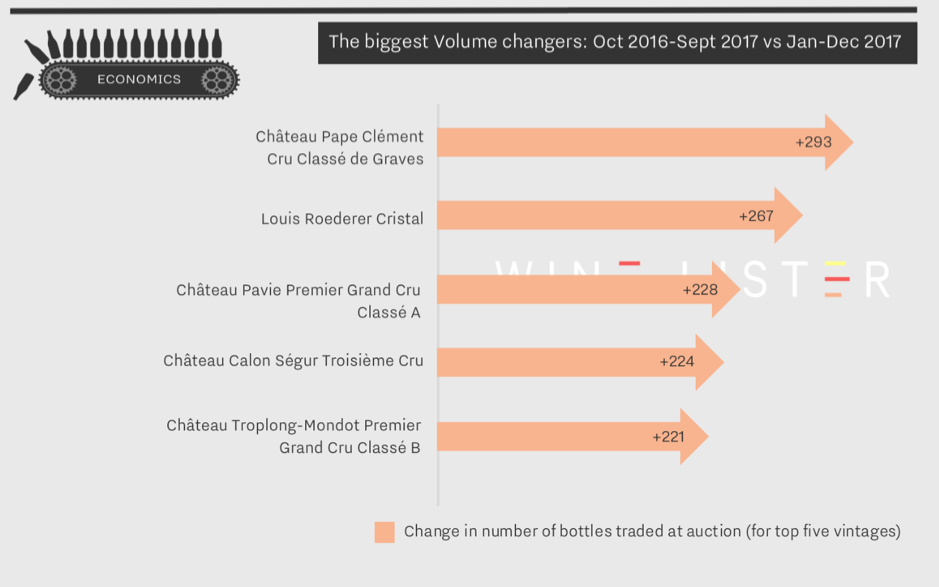

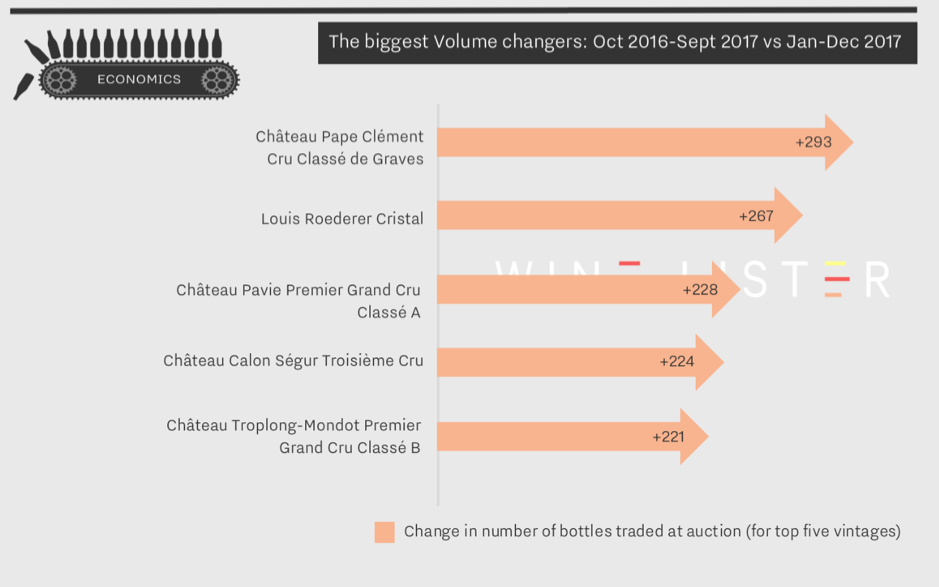

After two quarters of Bordeaux dominance, the latest trading volume data has room at the top for one non-Bordeaux wine. Among the five wines with the greatest incremental increase in trading volumes for the period of January-December 2017 (calculated using figures collated by Wine Market Journal from sales at the world’s major auction houses), sits Louis Roederer’s Cristal in second place.

Volumes of Cristal traded increased by 267 bottles, helped along by a Sotheby’s auction in New York in November where 37 bottles went under the hammer. While this translates into a small Economics score increase of just one point, the wine nevertheless holds the highest overall Wine Lister score of the five at 975/1000.

Château Pavie appears high up the list for a consecutive quarter, with a further 228 bottles added to its trading volume count compared to October 2016-September 2017. Though in third place for incremental change, Pavie has the highest overall volume of bottles traded of the top five (2,466).

The number one spot for increased trading volumes is taken by Château Pape Clément, with 293 more bottles traded over the course of 2017 compared to the previous dataset period. Pape Clément has the lowest Quality score of the top five (825), however high Economics (952) and Brand (960) scores pull the overall score up to 898.

Château Calon Ségur and Château Troplong-Mondot fall in fourth and fifth place for biggest change in trading volumes.

It is interesting to note that Larrivet Haut-Brion Blanc has the highest growth of Economics score, moving up a huge 376 points since Q4 2016, to 669. With the recent spike in trading volumes of the red (as seen in our last analysis), trading volumes of the château’s wines are increasing across the board.

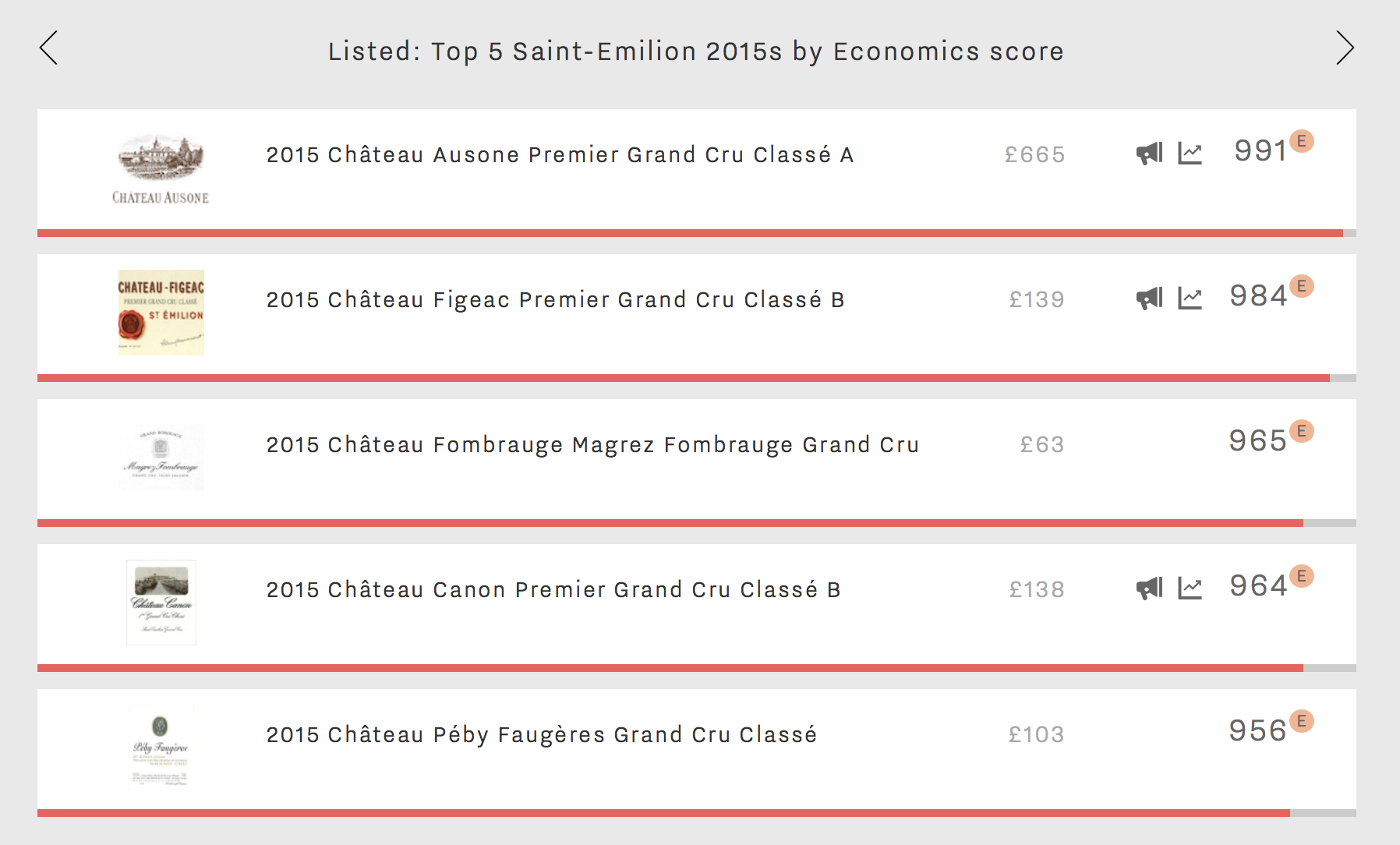

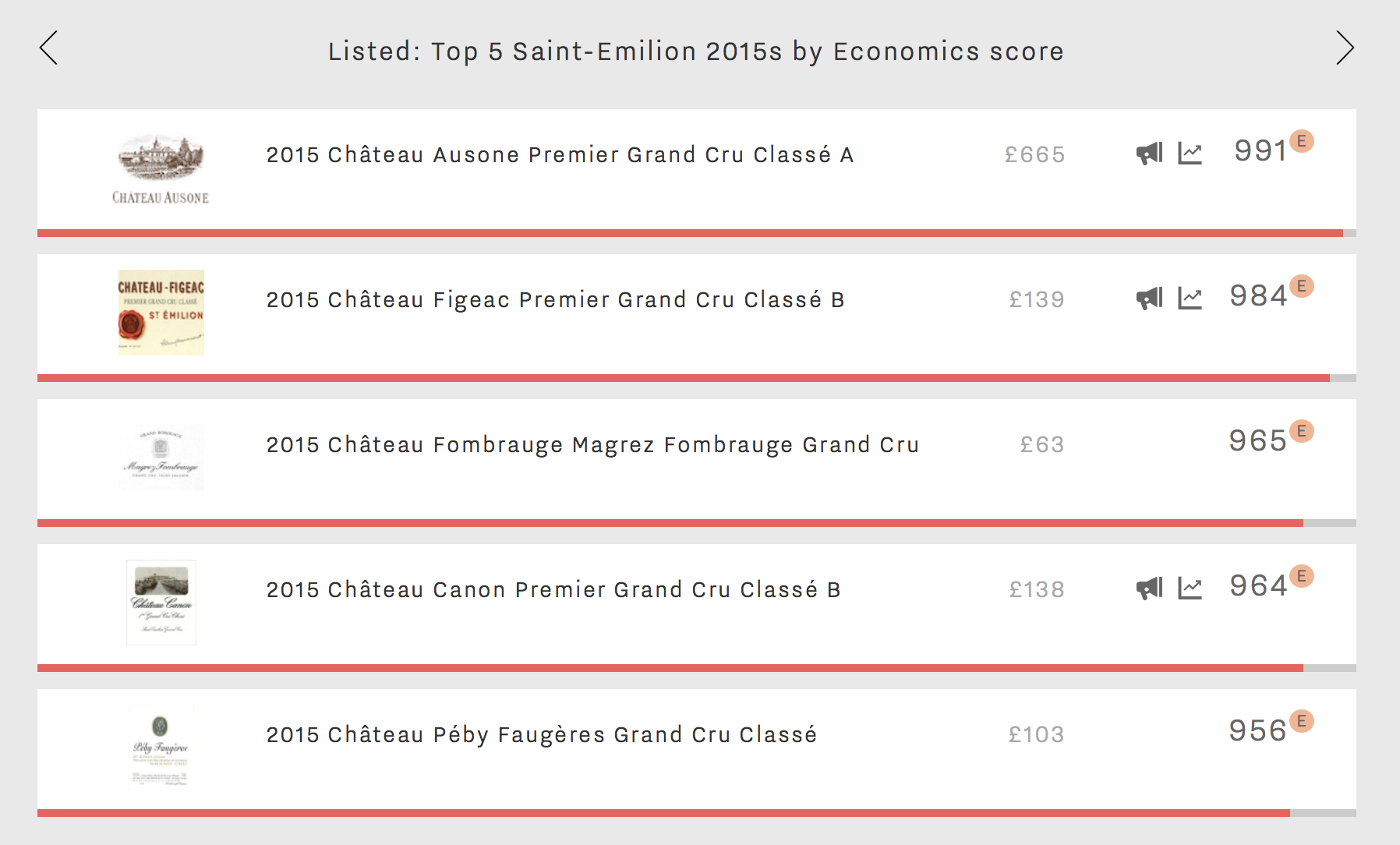

The Bordeaux 2015 vintage broke a more lacklustre run since the formidable 2010, and seemed to prove the wine trade legend of vintages ending in 5. En primeur tastings took place at the crest of “Bordeaux Bashing”, with some journalists reluctant to praise the vintage too highly, and there was talk of inconsistency between appellations. Saint-Estèphe was said to have suffered from more rain than its southerly neighbours, for example. Meanwhile in Saint-Emilion, a lack of homogeneity allowed each wine to express its terroir and its identity to the utmost.

Now that the wines have been bottled, it seems a suitable time to revisit the vintage. Our CEO, Ella Lister, has just got back from tasting over 200 wines from across the two banks with Wine Lister’s partner critics Michel Bettane and Thierry Desseauve. She reports Saint-Estèphe as “exceptional and wrongly dismissed as rained-out”, and names Figeac and Canon as two highlights, both “stunning”. The two Saint-Emilion wines are among the top five Quality scores for the vintage on Wine Lister.

Figeac and Canon both also feature in this week’s top 5: Saint-Emilion 2015 Economics scores, showing that the market recognises their worth. Coming in second and fourth place, both hold premier grand cru classé B status since the reclassification of Saint-Emilion in 2012. Château Figeac 2015 achieves its best Economics score to date with an impressive six-month price performance of 18%.

However, Château Canon is the real surprise here. One of the most talked-about wines by the fine wine trade, its Wine Lister scores are improving from vintage to vintage, with its Economics scores, in particular, soaring. It comes in second place among all Bordeaux wines for Economics score in the 2016 vintage. Both Figeac and Canon are Buzz Brands and also Investment Staples (two of the four Wine Lister Indicators), and so is number one on the list…

Beating both of these is premier grand cru classé A, Château Ausone, with an Economics score of 991 – a record high for this producer, even against the strong 2005 vintage. The château also gains the number one spot across all Saint-Emilion 2015s in Quality, with a score of 990. In the context of overall Wine Lister scores, Ausone is just behind Petrus and Margaux as the third highest-scoring Bordeaux of 2015.

Magrez-Fombrauge and Péby Faugères are the ‘underdog’ entries among Saint-Emilion Economics performers. With Quality and Brand scores ranging from average to strong, the overall score of both wines is “strong” according to the Wine Lister 1,000-point scale (the other three entries sit comfortably in the “strongest” category, with overall scores significantly above 900).

In contrast, one might expect some bigger names, such as Cheval Blanc (a Wine Lister Buzz Brand) to appear higher up the list. Its Economics score of 946 puts it in seventh place, with slower price growth (3% over the last six months). Its price per bottle currently stands at around £500, over five times higher than that of Péby Faugères, and seven times more than Magrez-Fombrauge.

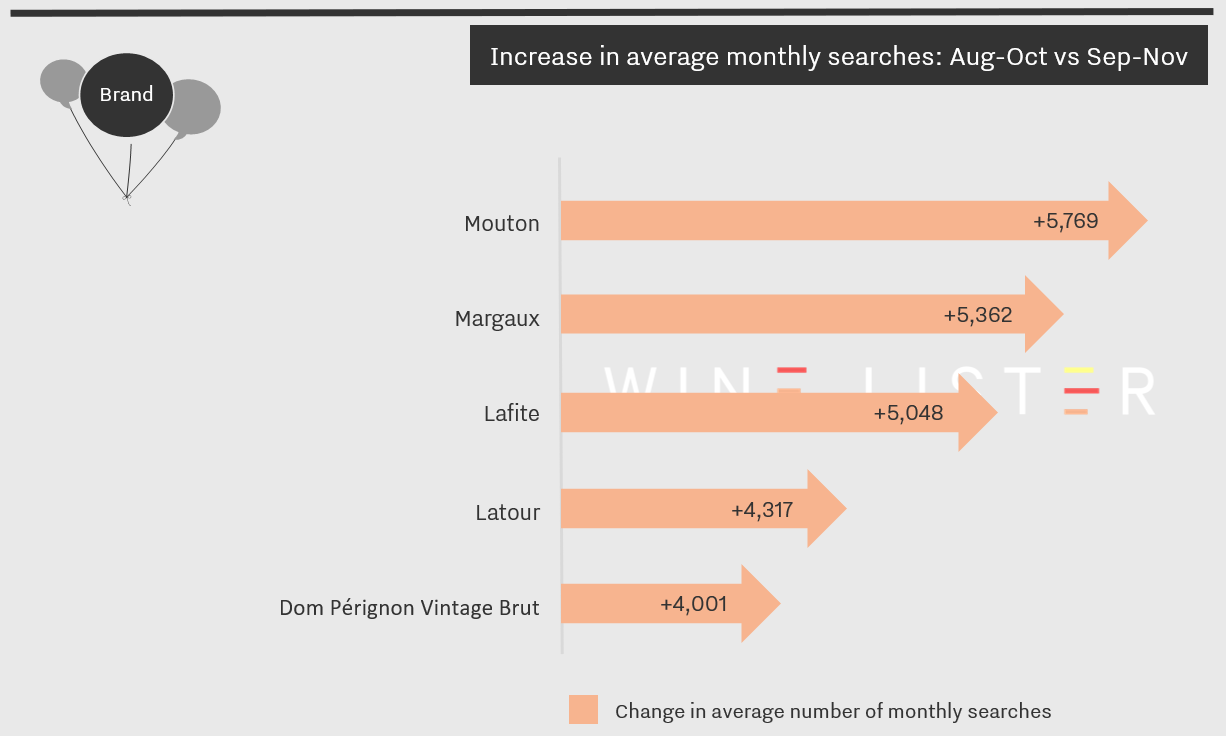

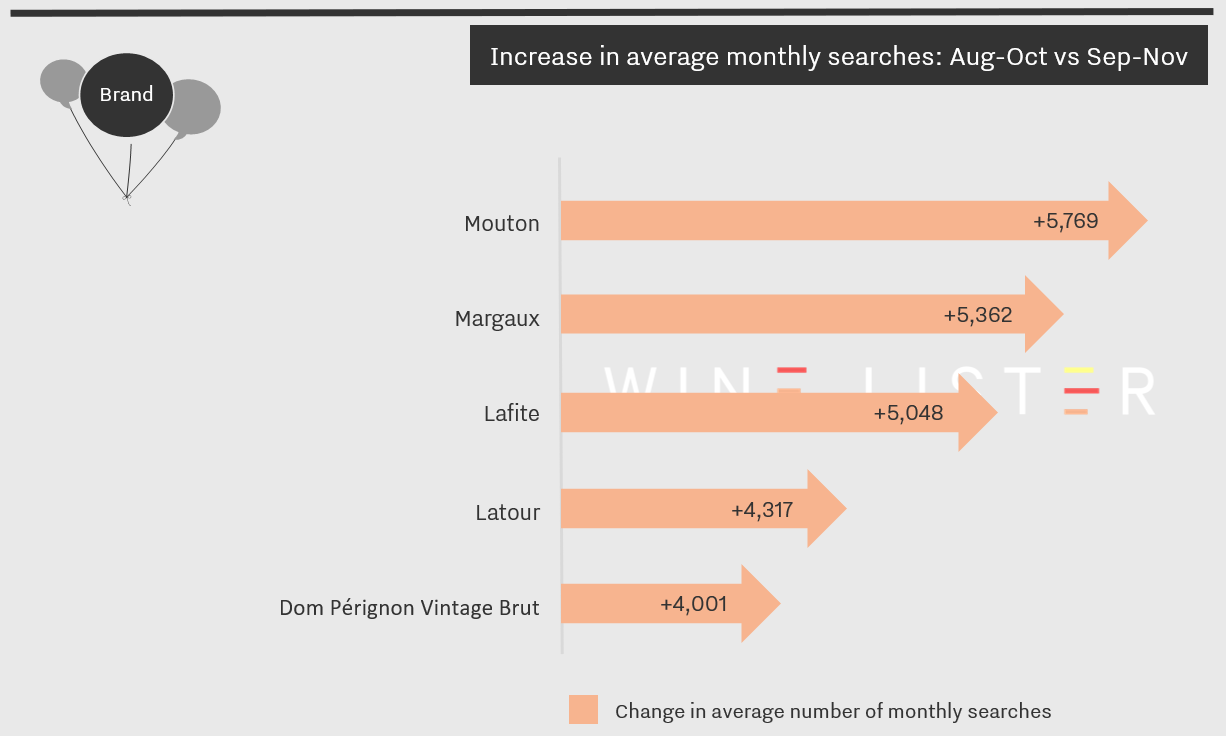

With the latest online search frequency data in from Wine-Searcher, we can see which wines rose in popularity during November. Each month we look at the last three months’ worth of search data, measured against the previous period, to see which wines have grown most in popularity. With five of the world’s six most popular wines making the greatest gains during November, it appears that demand for the biggest brands shows no sign of diminishing, and that the public is quick to pick up on announcements regarding the most famous fine wine producers.

Mouton, the world’s second-most popular wine, made the greatest gains during November. This is likely thanks to the release of the label for the 2015 vintage. It features a witty juxtaposition of Gerhard Richter’s “Flux” with the reiteration of part of Mouton’s motto, “Mouton ne change” (Mouton never changes), in the context of a generational shift as Philippine de Rothschild’s three children take the helm after her death in 2014.

Snapping at Mouton’s heels was Margaux. It too announced during November that it will release its 2015 vintage in a commemorative bottle – the first time the château has done so – paying homage to Paul Pontallier who was winemaker at the property for almost 30 years. With Margaux 2015 achieving one the best Quality scores of the vintage, it seems a fitting tribute.

Lafite came next. In mid-November it was announced that in March 2018 Saskia de Rothschild will be taking over as chairwoman of the château and Jean-Guillaume Prats of Moët Hennessy will become President and CEO. With Lafite currently the most popular wine in the world, and one of just five wines on Wine Lister to achieve a Brand score of 999 – alongside Dom Pérignon Vintage Brut, Mouton, Latour, and Yquem (no wine scores 1,000) – the duo have a formidable reputation to maintain.

Latour was the fourth-biggest gainer, its search frequency increasing 8% (4,317 searches). Whilst the increased interest in the other Médoc first growths can be attributed to a significant announcement, the reason behind Latour’s surge in popularity is less obvious. Related news is of course the acquisition by Artemis Domaines – Latour owner François Pinault’s holding company – of Burgundian Grand Cru monopole Clos de Tart.

Breaking the Bordeaux first growths’ dominance on this month’s popularity stakes was Dom Pérignon, a brand whose online popularity has soared over the second half of the year. Early in November Moët Hennessy announced the launch of Clos19, an online shop selling its prestigious brands – one of which is Dom Pérignon. Cannily introduced before the festive season, during which Champagne’s popularity surges – it seems that the region’s strongest brand has further benefited from the new platform.

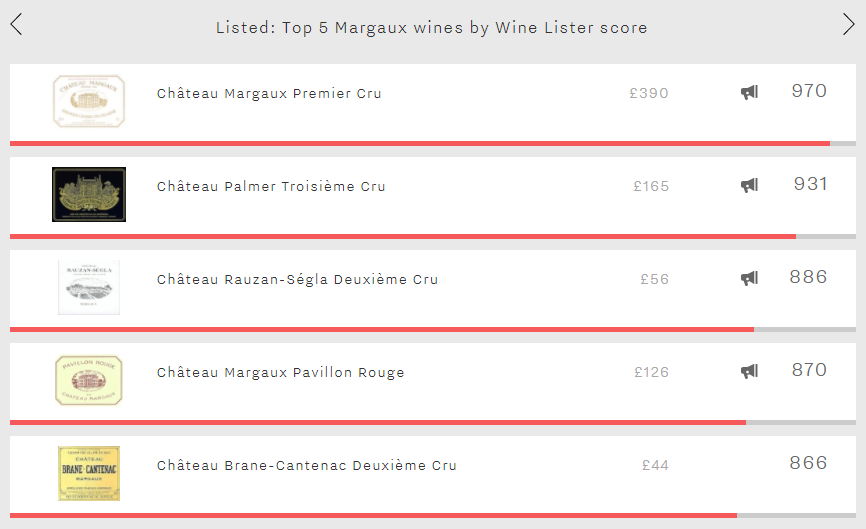

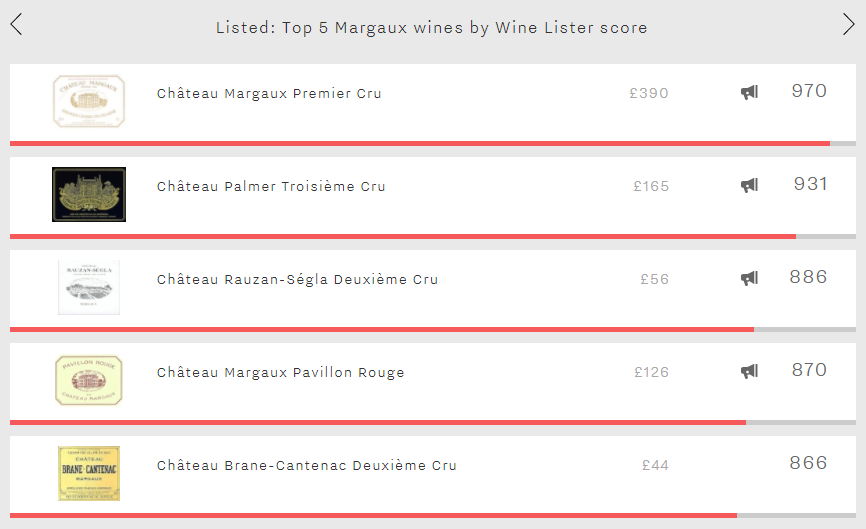

Having considered Chambertin’s top five wines for Quality last week, this week our Listed section travels south-west to look at Margaux’s overall best red wines. Whilst it is to be expected that Margaux’s eponymous first growth tops the table, with an outstanding score of 970, the order of the remaining four wines – and the appearance of second wine Pavillon Rouge – might come as more of a surprise.

Château Margaux’s dominance is the result of a lead across nine of Wine Lister’s 12 rating criteria, resulting in an advantage in both the Quality and Brand categories. In particular, it outperforms the others in the Quality category with an excellent score of (962), nearly 80 points ahead of the second-best wine in the category – Palmer (885), which leapfrogs the group’s two second growths in terms of quality. However, Château Margaux is pipped to the post in the Economics category by Pavillon Rouge, whose superior price performance helps it to overcome its older sibling.

Palmer achieves Margaux’s second-best overall score (931). The third growth’s brand is its strongest asset. Despite trailing Château Margaux by two points in the category, its score of 995 is the 15th best Brand score in the entirety of Wine Lister’s database. It even sneaks ahead of Château Margaux in terms of restaurant presence (47% vs 46%), although it can’t quite match its illustrious neighbour in terms of vertical presence, with 4.1 vintages / formats offered per list on average, compared to Château Margaux’s 5.7. It is also searched for nearly three times less frequently than Château Margaux.

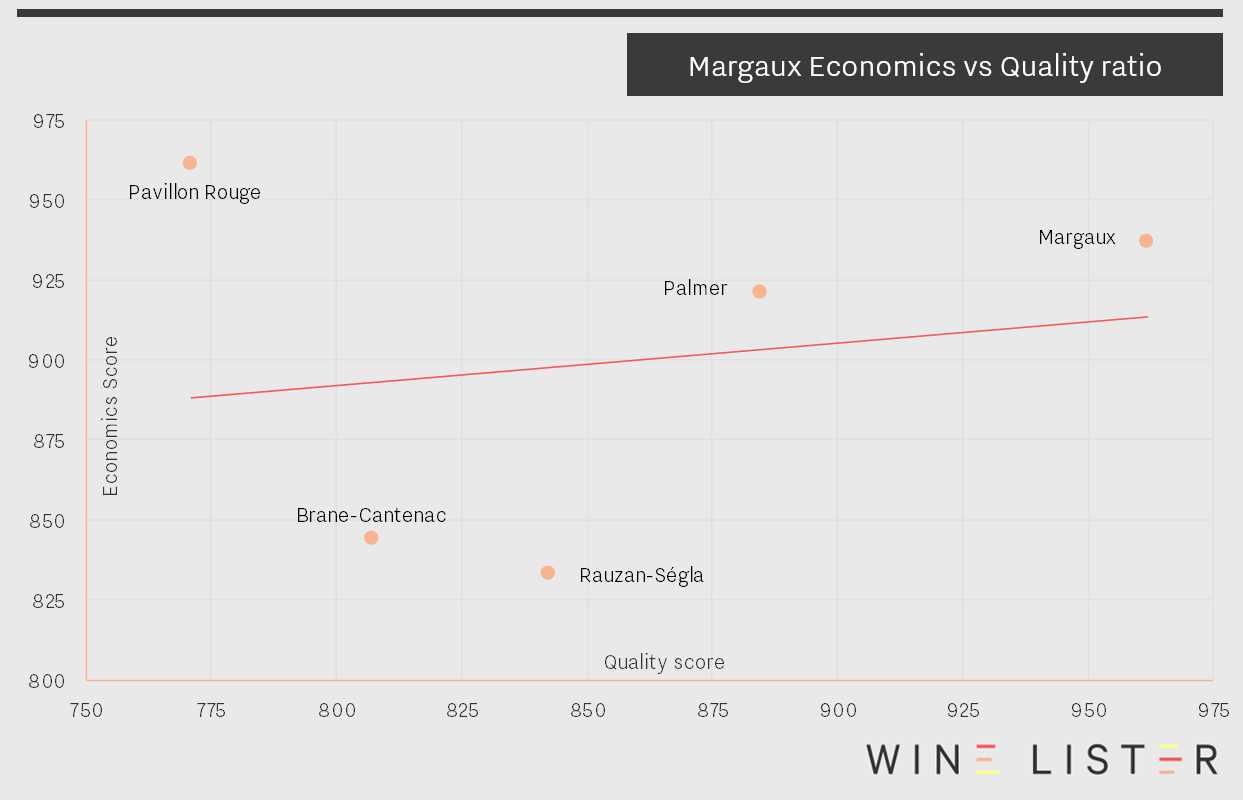

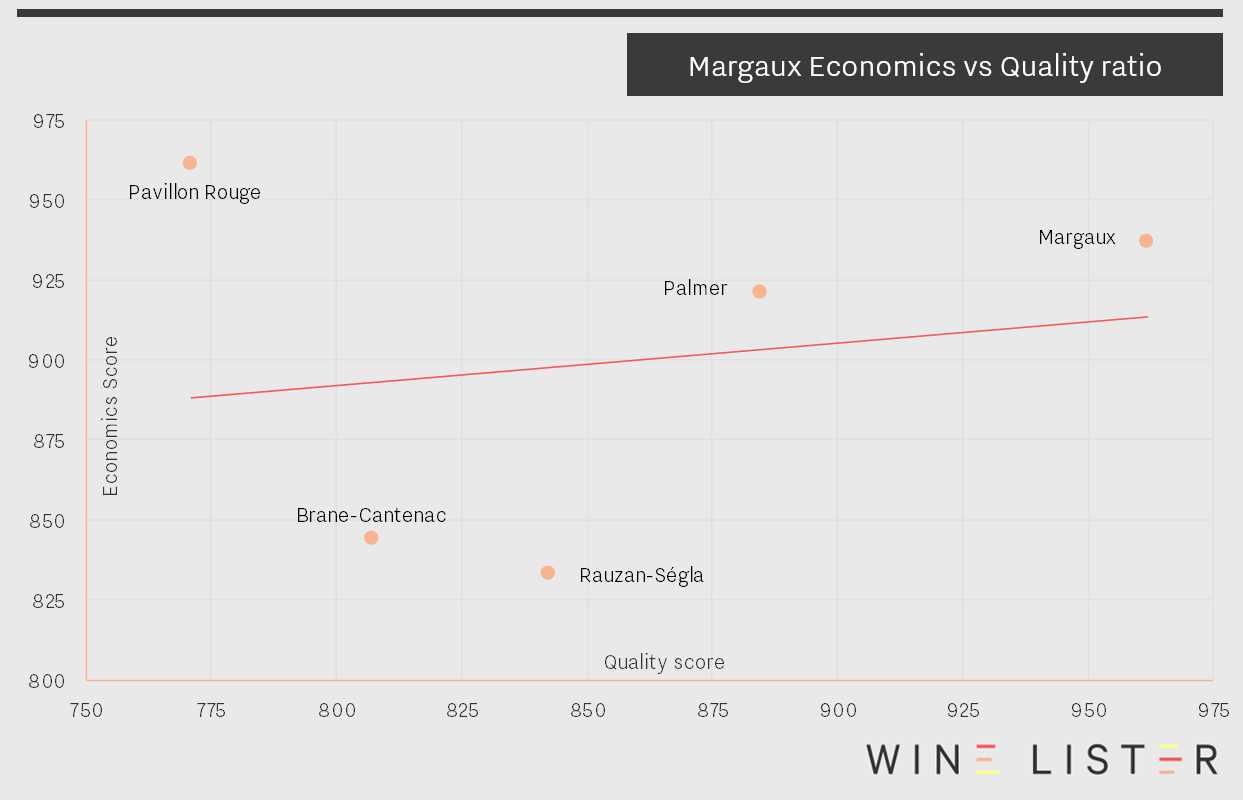

Pavillon Rouge occupies fourth position. It enjoys the group’s best Economics score, in-keeping with the unstoppable performance of first growths’ second wines in general. This is the result of strong price growth rates – it has a three-year compound annual growth rate (CAGR) of 15.5% and has added over 11.3% to its price in the last sixth months alone. The chart below confirms that its economic strength is not only at odds with its lack of classification, but also with its Quality score, which is the lowest of the group.

Pavillon Rouge is sandwiched between two second growths – Rauzan Ségla (886) and Brane-Cantenac (866). Despite belonging to the same class, they perform quite differently. Rauzan-Ségla experiences the group’s weakest economic profile (836), but climbs back up the table in the Quality and Brand categories (842 and 970 respectively), ahead of fifth-placed Brane-Cantenac.

Any of these wines would be a very worthy addition to your Christmas table. Happy Christmas from the whole team at Wine Lister!

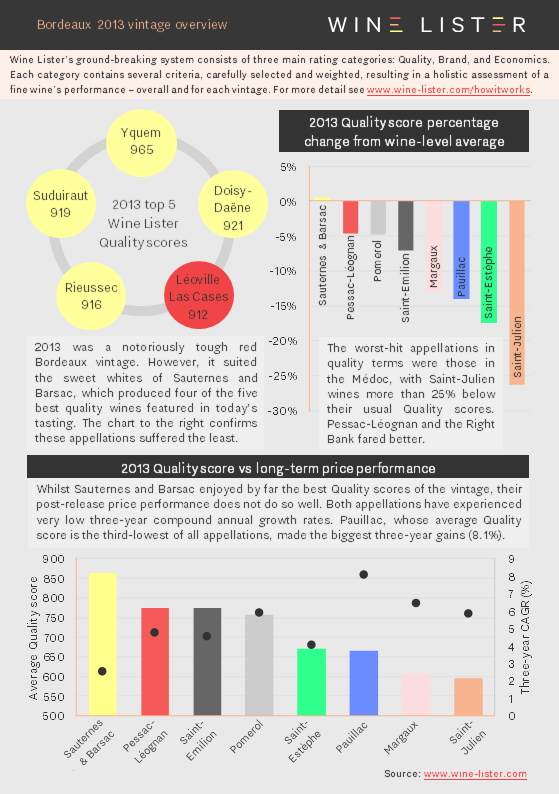

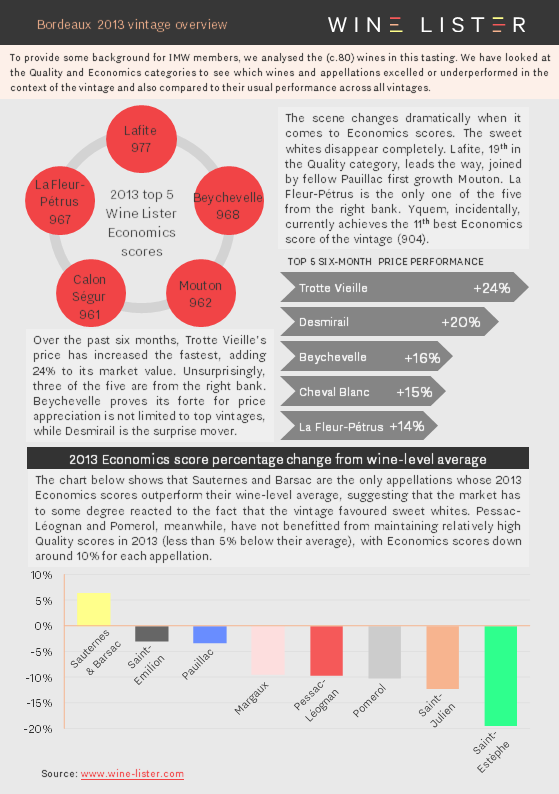

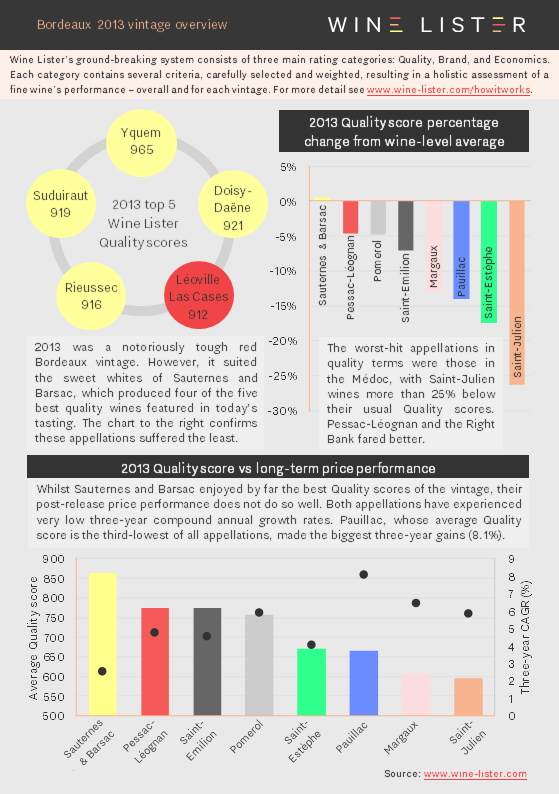

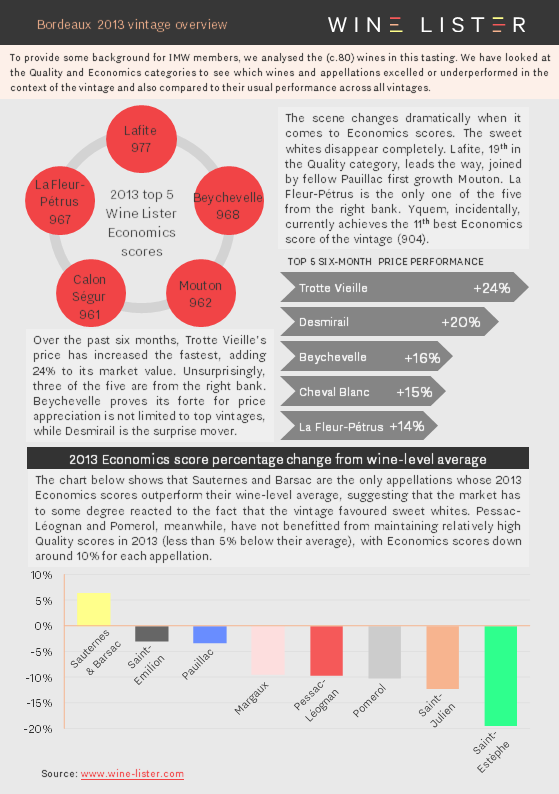

We recently prepared a brief vintage overview for the Institute of Masters of Wine’s 2013 Claret tasting. Analysing the performance of the basket of wines included in the tasting, Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download these slides here: Wine Lister Bordeaux 2013 vintage overview

Watch this space for further regional vintage reports over the coming months.

Bordeaux is renowned for its reds and sweet whites, but its best dry whites should not be forgotten. While the majority of Bordeaux’s top dry whites are not the flagship wine of their respective châteaux, they still achieve overall Wine Lister scores that are amongst the strongest or very strong on Wine Lister’s scale. Furthermore, as part of some of the most prestigious châteaux in Bordeaux, they all achieve Buzz Brand status.

Leading the way is Château Haut-Brion Blanc, with a score of 902. It is by far the most expensive at £569 per bottle. This puts it 62% above the current market price of Haut-Brion’s red, presumably because just one sixteenth the number of bottles are produced each year.

In second place is Château La Mission Haut-Brion Blanc (891). Relabelled in 2009, this was formerly Laville Haut-Brion. It has the best Quality score of the group (908), the result of very strong ratings from each of Wine Lister’s four critics and the longest ageing potential of the group – the last six vintages bottled under the Laville Haut-Brion label will still be drinking well until at least 2020.

Next comes Y d’Yquem with a score of 887. Whilst it can’t match the quality of the botrytised Sauternes for which the château is best known – not many can – it is available at a 34% discount, making it an excellent way of enjoying an iconic producer on a different occasion.

Margaux’s Pavillon Blanc achieves the fourth-best score (878). The only straight Bordeaux AOP in the group, Pavillon Blanc comprehensively outperforms its red counterpart in the Quality category (895 vs 771). That said, Pavillon Rouge has a stronger Brand score (944 vs 831) and Economics score (953 vs 920), in spite of a slightly lower price (£122 vs £138).

Confirming the dominance of the Graves when it comes to Bordeaux’s best dry whites, the last spot is filled by Domaine de Chevalier Blanc (868), the third Pessac-Léognan wine of the group. By far the cheapest of the five (£59), it is an absolute steal given its consistent high quality and ageing capacity. It also achieves the best Brand score (909), thanks to outstanding restaurant presence – it is visible on 23% of the world’s best wine lists.