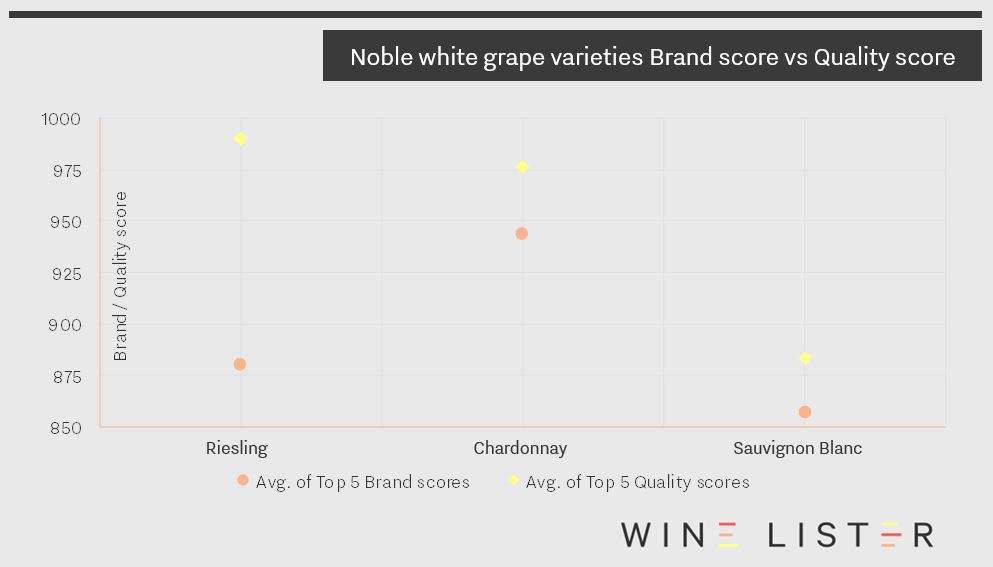

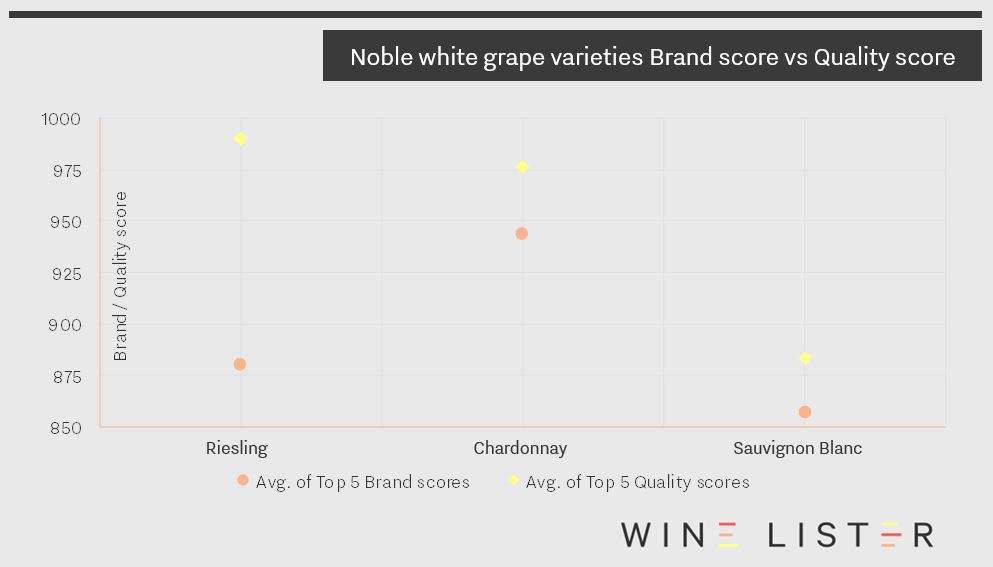

While the jury is still out on pricing for Bordeaux 2017 (since the majority of key wines are yet to be released) Wine Lister can confirm, through scores from our partner critics, that the sweet whites from Sauternes and Barsac are some of the quality triumphs for 2017. The top five highest Quality scores for sweet whites all appear in the top 20 overall highest scores for Bordeaux 2017.

The highest Quality scorer not only for 2017 sweet whites, but for all 2017 Bordeaux is Château d’Yquem (988). Quality here is impressively consistent, with scores of 964-993 for the last 12 vintages (with the exception of 2012, when no wine was made for fear of compromising on quality following poor weather conditions throughout the growing season). Yquem is also a Brand tour de force, earning Wine Lister’s highest Brand score (matching Dom Pérignon Vintage Brut and three of the five red first growths, Lafite, Latour, and Mouton).

In second place, again not just for sweet white, but for Bordeaux 2017 in general, is L’Extravagant de Doisy Daëne. With a Quality score of 986, it is Wine Lister partner critic Antonio Galloni’s only potential 100-point scorer, earning 97-100 points and a laudatory tasting note; “…could very well turn out to be the wine of the vintage in Sauternes and Barsac…L’Extravagant is a total head-turner.” Doisy Daëne produced only 1000 37.5cl bottles of L’Extravagant this year (half their usual production level) – a fact that perhaps offers an explanation for the 2017 release price tag of c.£280 per 75cl, above current back vintages available on the market.

Suduiraut is Sauternes and Barsac’s third highest Quality scorer in 2017 (954). At wine level, Suduiraut performs better for Brand and Economics than L’Extravagant, and for a much lower price (£36 versus £256 on average per bottle). It benefits from presence in the world’s best restaurants and monthly online searches, both eight times those of L’Extravagant, no doubt due in part to production levels, which are 50 times higher.

Numbers four and five on this week’s top five list are Rieussec and Lafaurie-Peyraguey. Lafaurie-Peyraguey achieves its highest Quality score since 2007 (944). Rieussec’s Quality score of 963 places the 2017 vintage within reach of some of the greats for the domaine in recent years (namely 2015, 2009, and 2001). Its Quality strength is matched by a strong brand, benefitting from its place under the Domaines Barons de Rothschild umbrella.

However, like most Sauternes, its Economics score is weak. Rieussec does not have the best track record of price performance post-release (as seen on p.14 of our Bordeaux study), and this year released at €42 ex-négociant for the fourth consecutive year, above market prices for all recent vintages.

You can see more Bordeaux 2017 Quality scores on our en primeur page. Follow Wine Lister on Twitter for real time release updates throughout the Bordeaux en primeur campaign.

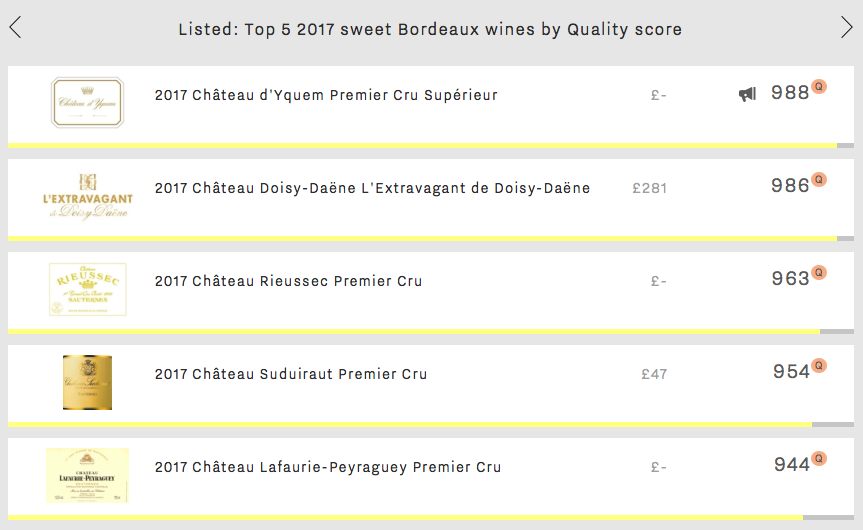

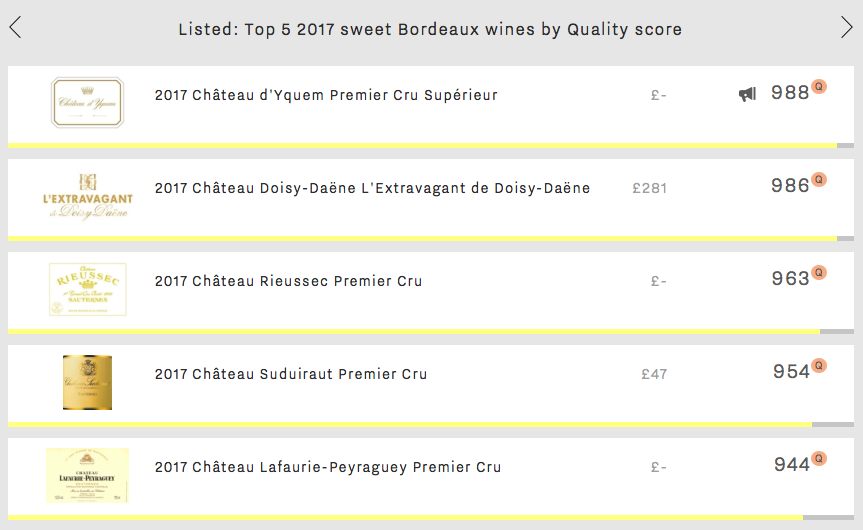

Taking inspiration and occasionally investment from Bordeaux’s most prestigious châteaux, Chile’s leading producers have, over a relatively short timeframe, become serious contenders in the fine wine market. Having had the opportunity to carefully select their sites, and benefitting from a more consistent climate than their Old World counterparts, Chile’s foremost wines continue to go from strength to strength. This week, we consider the overall top-scoring wines from the long sliver of land that has the cool Pacific on one side and the vertiginous Andes on the other.

Leading the way is Almaviva (880). One of two Chilean Buzz Brands, this joint project between Baron Philippe de Rothschild and Concha y Toro achieves Chile’s strongest Brand score (917), the result of not only featuring in more of the world’s top restaurants but also being twice as popular as any other Chilean wine. Surely Almaviva’s association with Mouton has played a significant role in its ability to build its brand to such a level over a short period of time – its first vintage was in 1998. It also manages Chile’s highest Economics score (787) – still ranking it within the “very strong” segment of Wine Lister’s 1,000-point scale, but indicating that it is the area in which Chilean wines currently struggle to compete with their Old World counterparts.

Further proof that economic success is the department in which Chile’s best wines have the most room to improve, Chadwick achieves the country’s best Quality score (904), yet only manages a score of 295 in the Economics category. This modest score is due to a combination of negative price performance over the past six months and a failure to trade a single bottle at auction over the past year, resulting in Chadwick slipping down to fifth place overall (697).

Don Melchor is Chile’s second-best wine (824) – completing a one-two for the Concha y Toro stable. It earns its second place thanks to consistency across each of Wine Lister’s three rating categories, finishing third in the Quality and Brand categories (872 and 853 respectively), and achieving Chile’s second-best Economics score (662). It is, however, considered Chile’s most ageworthy wine, with an average predicted drinking window of 11 years, 30% longer than any other Chilean wine.

The two remaining spots are filled by Seña – the second wine from the Errazuriz stable (alongside Chadwick) – and Casa Lapostolle Clos Apalta, with scores of 760 and 751 respectively. They present contrasting profiles, Clos Apalta achieving a better Quality score (829 vs 811) and Brand score (872 vs 770), but experiencing a significantly lower Economics score (364 vs 626).

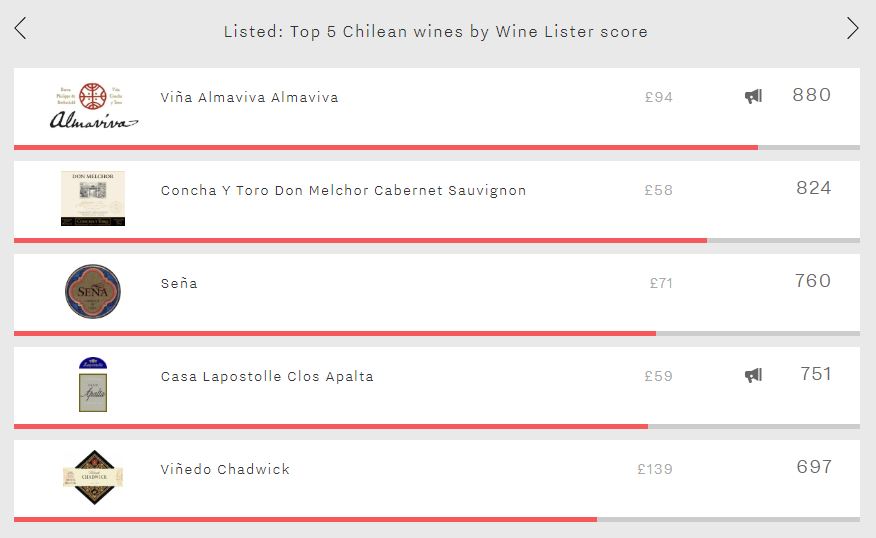

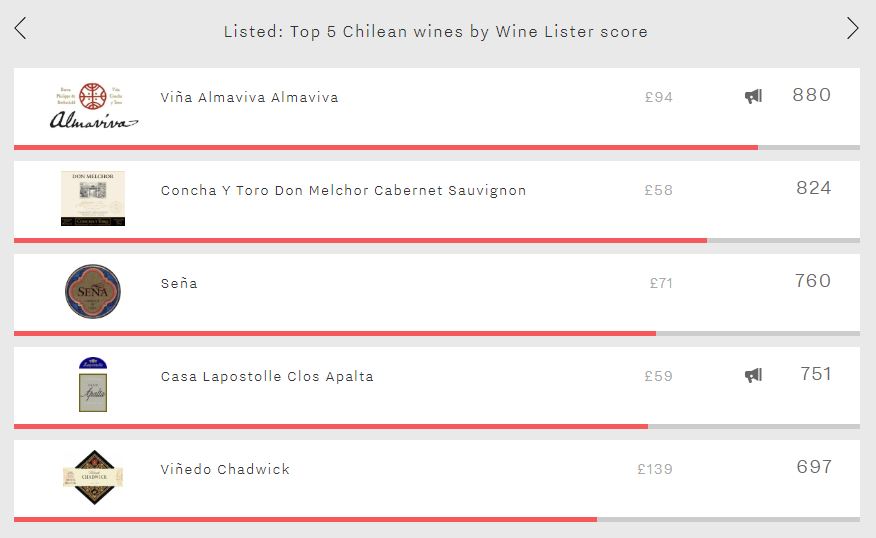

This week, the Listed section travels to the Rhône to consider the region’s top brands. As might be expected, all are red – Chave’s Hermitage Blanc, the region’s top white brand (924), is only the Rhône’s overall 12th strongest. However in a battle between North and South, it is the latter that comes out on top in the form of Beaucastel’s Châteauneuf-du-Pape with a Brand score of 993 – putting it amongst the top 25 brands on Wine Lister.

By far the cheapest of the five, Beaucastel leads across both Wine Lister Brand score criteria – presence in the world’s top restaurants and online popularity. However, whilst it is visible in 49% of the world’s finest establishments (just pipping Chave Hermitage’s 47% to the post), with 2.6 references per wine list on average it achieves the weakest vertical restaurant presence of the group, where Chave’s Hermitage manages the greatest depth (3.9 listings). If Beaucastel’s dominance within the world’s top restaurants is less clear-cut, when it comes to popularity amongst consumers it opens up a wider lead over the competition, receiving 16,565 searches on Wine-Searcher each month on average – 40% more than Jaboulet’s Hermitage La Chapelle – the group’s second-most popular wine.

Tied for second place with a Brand score of 987 are the two Hermitages from Chave and Jaboulet (La Chapelle). Whilst Chave leads in terms of restaurant presence (47% vs 43%), Jaboulet’s La Chapelle receives 6% more searches each month on average. Despite their identical Brand scores, Chave’s Hermitage is the clear winner elsewhere, with comfortable leads in the Quality category (959 vs 910) and Economics category (935 vs 863). Chave’s reward is a 36-point lead at overall Wine Lister score level (964 vs 928), and a price tag over twice that of Hermitage La Chapelle’s.

The Rhône’s overall top wine – Rayas (968) – is the region’s fourth-strongest brand (982). The group’s second Châteauneuf-du-Pape, it comprehensively outperforms the Beaucastel in terms of Quality (961 vs 876) and Economics (959 vs 823). It is thus perhaps the Beaucastel’s significantly larger annual production – roughly seven times Rayas’ – that has helped raise its brand to such lofty heights.

Rounding out the five is Guigal’s Côte Rôtie La Mouline with a score of 959. Whilst it can’t quite keep pace with the remainder of this week’s top five, it leads the two remaining “La Las” – La Landonne and La Turque – by six and 12 points respectively in the Brand category. Similarly to the Rayas, it is perhaps the extremely limited production of the “La Las” that keeps them from achieving even higher Brand scores – the combined annual output across the three cuvées is c.18,000 bottles.

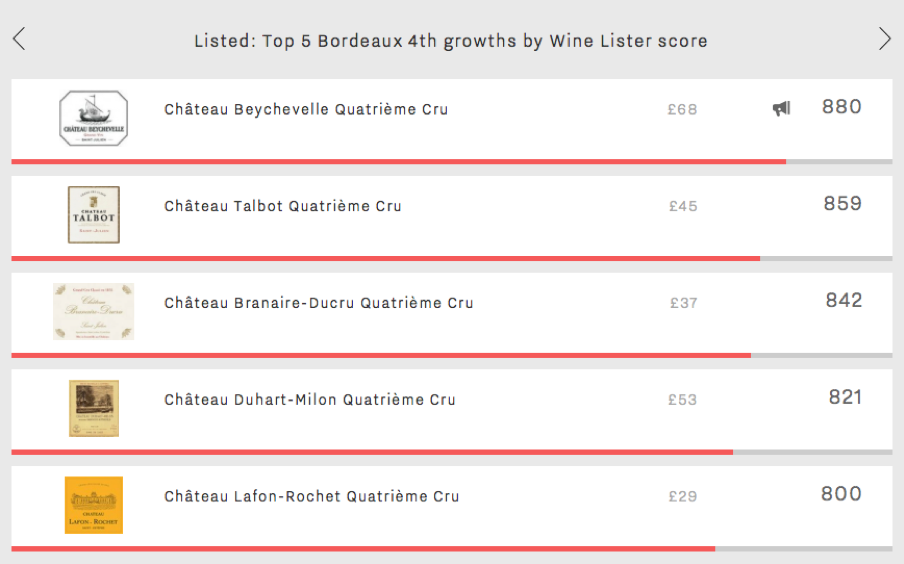

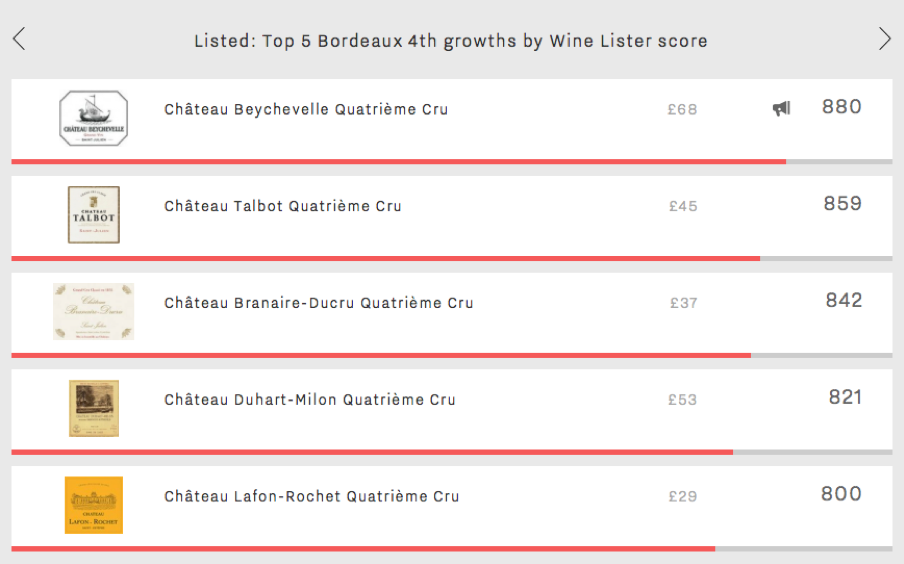

While the wine world lives and breathes Bordeaux during this year’s en primeur season, Wine Lister looks at some high-scoring Bordeaux reds that could easily be overlooked amidst the sea of releases to choose from across Médoc classified growths and beyond. Below we examine the top five fourth growths by overall Wine Lister score.

The highest-scoring Bordeaux fourth growth on Wine Lister is Château Beychevelle, with a score of 879. Its trailing Quality score of 790 is boosted by Brand and Economics scores of 980 and 904 respectively. Meanwhile, Beychevelle’s 2016 and 2015 vintages achieve Quality scores more than 15% higher than its wine-level average. It will be interesting to see how the 2017 vintage (with a Quality score of 805 thus far, based on partner critics Bettane+Desseauve, Neal Martin and Julia Harding MW for Jancis Robinson) is priced during this year’s en primeur campaign in the coming weeks.

In second and third place are Château Talbot and Château Branaire-Ducru, achieving Wine Lister scores of 859 and 842 respectively. Talbot is the most popular of the five, receiving 14,602 searches each month on Wine-Searcher, resulting in the group’s best Brand score (983). Talbot’s position as a ubiquitous Bordeaux brand is no doubt helped by a production level of c.400,000 bottles per annum – over twice as many as Branaire-Ducru.

The fourth entry and only Pauillac to feature, Duhart-Milon, has the lowest Quality score of the five (752), but carries a Brand score of 916 points. It is no surprise that, as part of the Lafite group, it is the most-traded Bordeaux fourth growth at auction, its top five vintages having traded 1,186 bottles over the past four quarters.

Finally, Lafon-Rochet appears in the Listed blog for the second week in a row (previously featuring in the top five Saint-Estèphes by Economics score). At 800 exactly, Lafon-Rochet’s Wine Lister score is safely in the “very strong” category on the 1,000-point scale. In the context of this week’s top five it has the third-highest Quality score (770), but its price per bottle is 41% below the rest – a savvy buy!

The eyes and ears of the industry are focused on Bordeaux 2017. Price is always a key factor in the commercial success of a fine wine, but never more so than during the annual en primeur period, when release pricing can make or break a wine’s en primeur campaign.

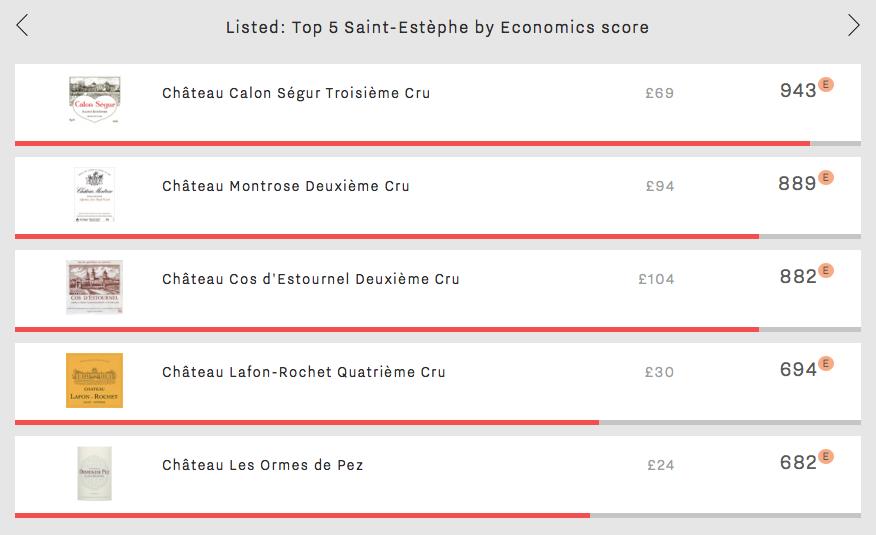

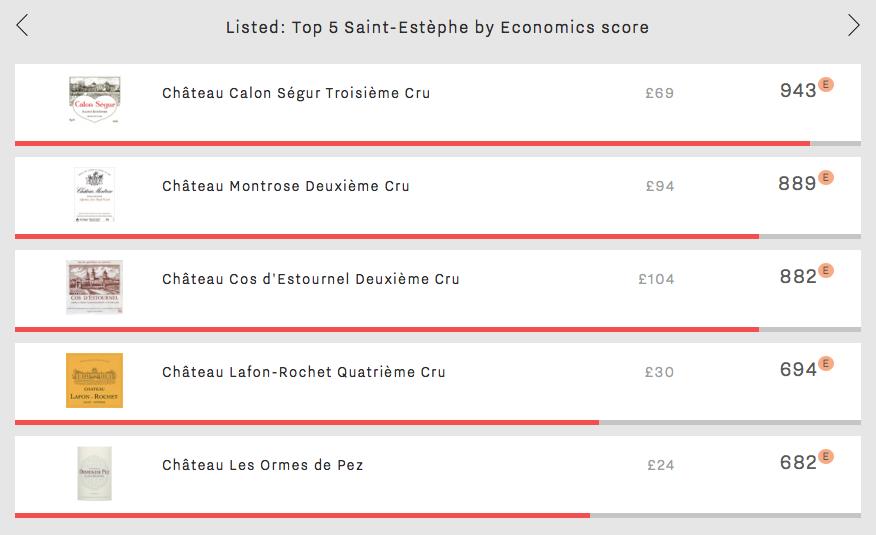

It is therefore timely to take a look at some Bordeaux Economics score successes, this week from Saint-Estèphe. Wine Lister’s Economics score combines five criteria – based on price and volume data – to measure a wine’s commercial success (read more on the Economics score calculation here).

Calon-Ségur has the highest Economics score of all Saint-Estèphe wines (943). Not only does it score 53 points higher than the next wine in its peer group, it is also the number one third growth for Economics score, sitting in eleventh place for Economics of all Bordeaux wines. This is particularly impressive, considering that the average price per bottle of those ranking in the top 10 is £614, nine times higher than Calon-Ségur’s comparatively modest average price tag of £69 (read more about Calon-Ségur’s pricing in the en primeur: part II blog).

The number two Economics score in Saint-Estèphe is held by Montrose (889). It has the highest average Quality score of the five (936) and an average wine life of 15 years. Its steady price growth over the last two years (30%) makes it one to watch for investment potential.

Cos d’Estournel is the most expensive Saint-Estèphe wine at £104 per bottle. Though it comes in third place for Economics, it has the best Saint-Estèphe Brand score of 996, thanks to presence in 52% of the world’s best restaurants and over 23,000 online monthly searches. Its popularity is also clear from its position as the most traded of the five at auction (calculated using data from one of our partners, The Wine Market Journal).

Lafon-Rochet and Les Ormes de Pez take fourth and fifth places, with Economics scores of 694 and 682 respectively. Both are a level below the top three in terms of price per bottle and Quality score, but they match Montrose on long term price performance, with compound annual growth rates (CAGR) of 9%. Saint-Estèphe is an appellation on the rise.

2015 was a phenomenal vintage for reds in Burgundy. However, parts of the Côte de Beaune were affected by frost, and the quality of 2015 whites is therefore less consistent. Below we examine the top five white Burgundy 2015s by overall Wine Lister score.

Domaine Leflaive takes two of the five top spots. Its Chevalier-Montrachet has the highest overall Wine Lister score of all white Burgundies in 2015 (963). This is thanks to a Quality score of 962 (four points higher than the wine’s average across the last fifteen vintages) and an impressive Economics score of 991.

Domaine Leflaive’s Bâtard-Montrachet comes in third place. Both wines benefit from Domaine Leflaive’s position as a superstar white Burgundy brand. Indeed, five of the 10 highest white Burgundy Brand scores are held by wines from Domaine Leflaive.

The second highest overall scorer of white Burgundy 2015 is Domaine Bonneau du Martray’s Corton-Charlemagne (958). It is both the highest Quality scorer (977, 10% above its average) and the lowest priced (£106 per bottle) of the five, presenting an interesting value opportunity. It is also to be found in 36% of the world’s top restaurants, the most prestigious count of this week’s top five.

Chablis is represented by Vincent Dauvissat’s Grand Cru Les Clos. Identified as one of only three Chablis Buzz Brands on Wine Lister, Dauvissat’s Cru Les Clos is present in 23% of the world’s top restaurants, helping it to a Brand score of 907. Its overall Wine Lister score of 938 for the 2015 vintage is completed by a Quality score of 947 and its second strongest ever Economics score of 969.

Finally, Maison Joseph Drouhin’s Montrachet Grand Cru Marquis de Laguiche has the fifth highest Wine Lister score for white Burgundy 2015s (917). Though it has the lowest global restaurant presence, it is more present than the other four wines in top restaurants in Asia.

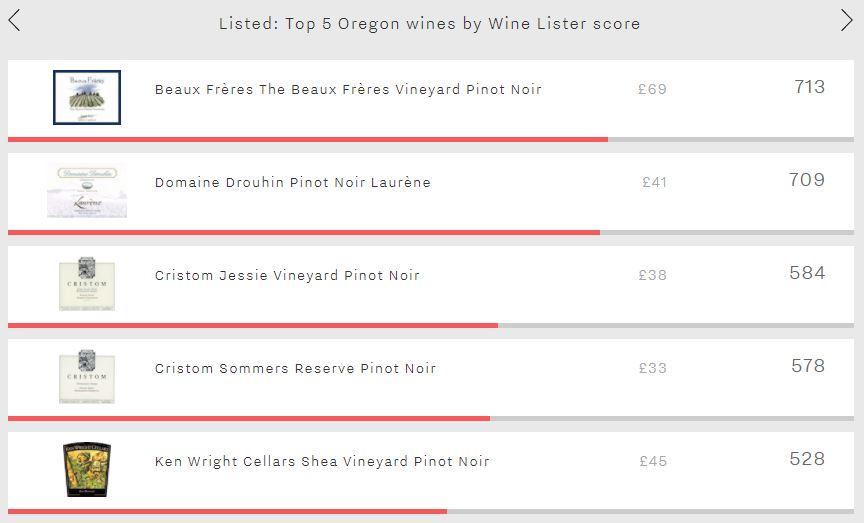

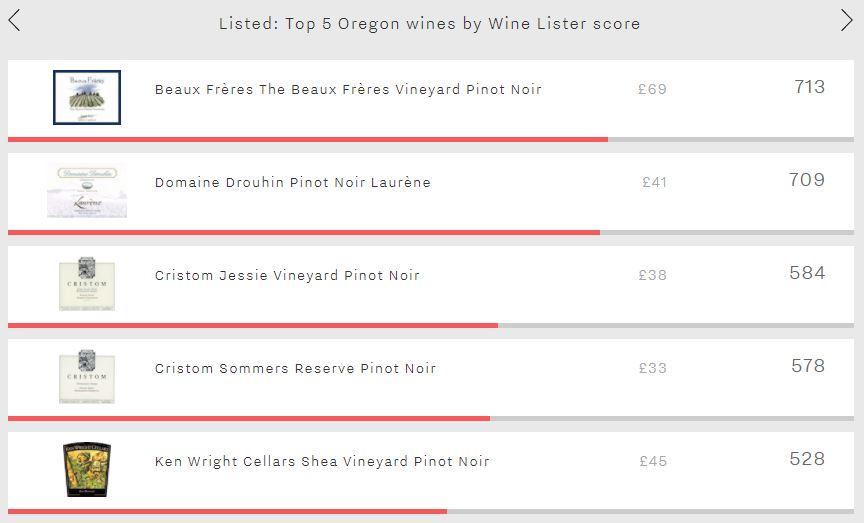

Whilst the wine world – including much of Wine Lister’s team – focuses its attention on Bordeaux for en primeur tastings, this week the blog hops over the pond to consider Oregon’s top wines. As might be expected, Oregon’s top five wines are all Pinot Noirs. Furthermore, in this relatively young fine wine region, its leading wines perform best in the Quality category (averaging 791), with their brand profiles and economic performance not yet able to keep pace (554 and 363 points respectively on average).

Whilst quality is king in Oregon, Beaux Frères Vineyard tops the table not because of its Quality score (785) – the third-best of the five – but for its stronger brand recognition. It leads Drouhin Laurène – second in the Brand category – by 113 points (715 vs 602), thanks to superior restaurant presence (9% vs 4%) and also because it receives 40% more searches on Wine-Searcher each month on average. Its Economics score of 545 is also Oregon’s strongest, but with low trading volumes and negative price growth over the past six months, this only puts it in the “average” range on Wine Lister’s 1,000 point scale, confirming that it is the area in which the region’s wines currently struggle.

Drouhin’s Laurène achieves the group’s highest Quality score (872). Produced by the Oregon offshoot of Burgundy’s Maison Joseph Drouhin, this is deemed to have the greatest ageing potential of the five, with an average drinking window of nine years, three years longer than the second-longest lived of the group – the Beaux Frères Vineyard.

Third and fourth spots are occupied by two wines from Cristom – Jessie Vineyard (584) and Sommers Reserve (578). Despite being separated by just six points at overall Wine Lister level, they display contrasting profiles. While the Jessie Vineyard achieves a superior Quality score (858 vs 770) and Brand score (490 vs 439), the Sommers Reserve nudges ahead in the Economics category (389 vs 133). This is thanks to it being the only wine of the group whose price has not dipped slightly over the past six months, instead adding 12% to its value.

The final wine of the group – Ken Wright Cellars Shea Vineyard – epitomises the profile of Oregon’s top wines, achieving its best score in the Quality category (670), a weaker Brand score (522), before experiencing its lowest score in the Economics category (220). Perhaps as Oregon continues to establish itself on the international fine wine market – and with its quality not in doubt – its leading wines will be able to build up stronger brands and economic profiles able to rival their more southerly Californian peers.

With its top ten wines by Quality score costing £225 per bottle on average, Piedmont might seem overindulgent for a low key midweek meal. However, with a little bit of help in the shape of Wine Lister’s Value Pick search tool, it is easy to find wines that will deliver maximum enjoyment at reasonable prices. Value Picks represent the very best quality-to-price ratio wines, with a higher coefficient applied to allow exceptional quality to be recognised. With a remarkable average Quality score of 976, and costing £40 on average, these five Piedmontese wines prove that outstanding quality is available at all price points.

If you’re after top Nebbiolo at a fair price, then Produttori del Barbaresco’s 2013s appear a safe bet, filling three spots. However, the trade-off for top value will be patience – none of the three will enter its drinking window until 2023. However, with each of them lasting over 18 years, you will be able to make the most of your prudent purchases for years to come. And what better way to explore Barbaresco’s crus in an outstanding vintage than with these three? The Asili Riserva achieves the top Quality score of the three (987), 75 points above its wine-level average. It is also the most expensive, but £42 per bottle doesn’t seem unreasonable for such quality. The Montestefano Riserva really outperformed in the 2013 vintage with a Quality score of 972, 125 points above its average score. The market is yet to react – the 2013’s price is currently 16% below its wine-level average.

Proving that if you’re looking for value for money in Piedmont, it’s not just Barbaresco that you should look out for, Domenico Clerico Barolo Ciabot Mentin 2007 is the region’s number one Value Pick. With a Quality score of 989 – thanks to a 98 point score from Antonio Galloni – it is not hard to see why. What’s more, whereas the Produttori del Barbaresco 2013s require cellaring, the Ciabot Mentin is just entering its drinking window.

Showing that Piedmont is not all about Nebbiolo, Giacomo Conterno’s Barbera d’Alba Cascina Francia 2013 fills the remaining spot. The group’s only Buzz Brand, this would be an excellent way to sample one of Giacomo Conterno’s wines at a fraction of the cost of the domaine’s top cuvées – the hallowed Monfortino Riserva costs £608 per bottle on average.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

Tucked away in the Westernmost corner of the Veneto, just to the North of Verona is Valpolicella, home to the region’s best wines. The Veneto might conjure up images of Bellinis, Prosecco, and Soave, but it is the region’s predominantly Corvina-based reds that top Wine Lister’s table. With overall scores all falling in the 800s, these five wines might not quite make it into the most elite section of Wine Lister’s 1,000 point scale, but a closer inspection of their performance shows that they are most definitely forces to be reckoned with.

Quintarelli’s Amarone della Valpolicella comes out on top with a score of 892, just two points ahead of Dal Forno Romano’s Amarone. Its lead is thanks to a formidable Quality score (974), comfortably the best of the group. Receiving over 5,500 searches each month on Wine-Searcher, it is also the group’s most popular wine – with perhaps all of Quintarelli’s cuvées benefitting from basketball star LeBron James’ Instagram posts of empty Quintarelli bottles.

Dal Forno Romano fills the second and third spots with its Amarone and Valpolicella Superiore. The Amarone benefits from by far the best restaurant presence of the group, visible in 21% of the world’s top establishments, helping it to the group’s best Brand score (926), 25 points ahead of Allegrini’s Amarone which is the only other wine to achieve a Brand score above 900. Interestingly, it is Dal Forno Romano’s Valpolicella Superiore that achieves the group’s best Economics score (810) despite trailing the Amarone by significant margins in the Quality category (870 vs 928) and Brand category (837 vs 926). It does so thanks in part to being the most liquid of the group – its top five-traded vintages have traded 112 bottles at auction over the past year – but also to the fact that it is the only one of the five wines whose price has not fallen in value over the past six months, instead rising 3.8%.

Quintarelli’s Alzero is the group’s anomaly. The most expensive of the five, it is the only one to eschew indigenous grapes, instead being a Bordeaux blend of Cabernet Sauvignon, Cabernet Franc, and Merlot. With a Quality score of 933, including a formidable average rating of 95.5/100 from Vinous, it seems that international varieties can thrive alongside traditional grapes in Valpolicella.

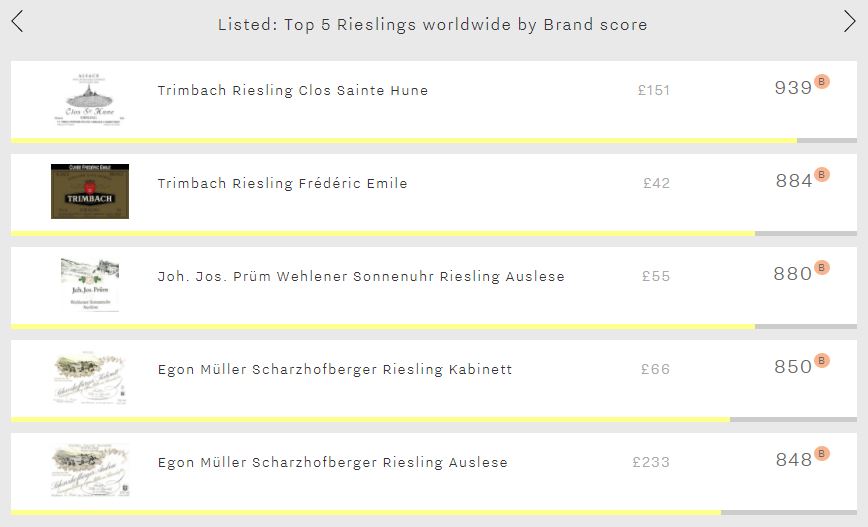

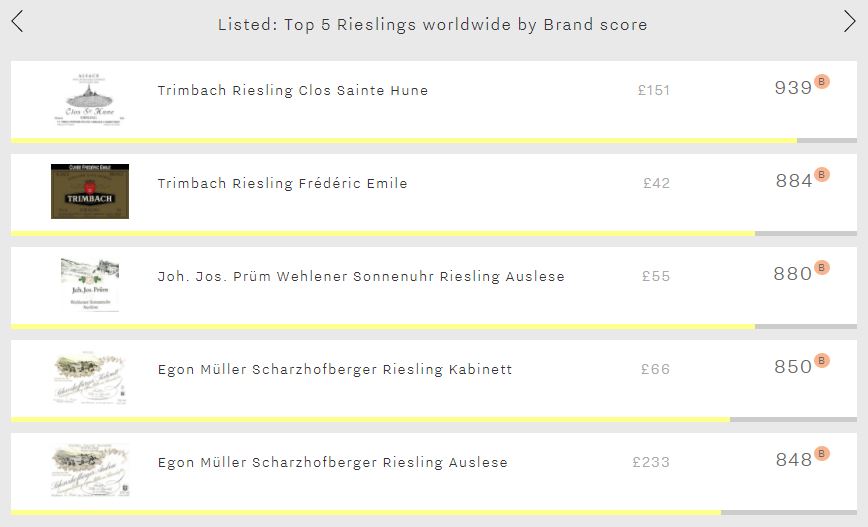

Riesling is amongst the greatest grapes at communicating time and place. Top Riesling is not only one of the most ageworthy of all wines, it is also one of the most versatile grapes, delivering crisp lime-scented examples in South Australia, and heady, honied, petrol aromas in the Mosel. The top five Riesling brands are a good example of this. Despite all hailing from Alsace and the Mosel, they showcase at least some of the variety that can, at times, cause confusion (but don’t extend to the tonguetwisting trockenbeerenauslese or flummoxing fuder numbers).

Alsatian heavyweight Trimbach fills the top two spots with its flagship Clos Sainte Hune (939) and Frédéric Emile (884). Clos Sainte Hune is the only Riesling to crack the 900-point mark in the Brand category, thus ranking amongst the most elite Brands on Wine Lister’s database. Its lead is thanks to its popularity – it is searched for twice as frequently as the group’s second-most popular wine (Prüm’s Wehlener Sonnenuhr Auslese). It is in fact Trimbach’s Frédéric Emile that achieves the greatest level of restaurant presence of the group, appearing in 37% of the world’s top establishments, it just pips Clos Sainte Hune to the post (34%). Confirming Trimbach as darling of the trade, the next best wine in the criterion (Prüm’s Wehlener Sonnenuhr Auslese) appears in 22% of top restaurants.

Egon Müller fills the last two spots with wines from the famous Scharzhofberger vineyard – its Kabinett (850) and Auslese (848). It is interesting that it is the Kabinett that comes out on top in the Brand category, despite trailing its sweeter sibling by significant margins in the Quality category (820 vs 974) and Economics category (523 vs 806). It manages to do so thanks to a greater breadth of restaurant presence (21% vs 16%), despite the Auslese achieving greater depth with 3.6 vintages / formats offered on average (the best of the group).

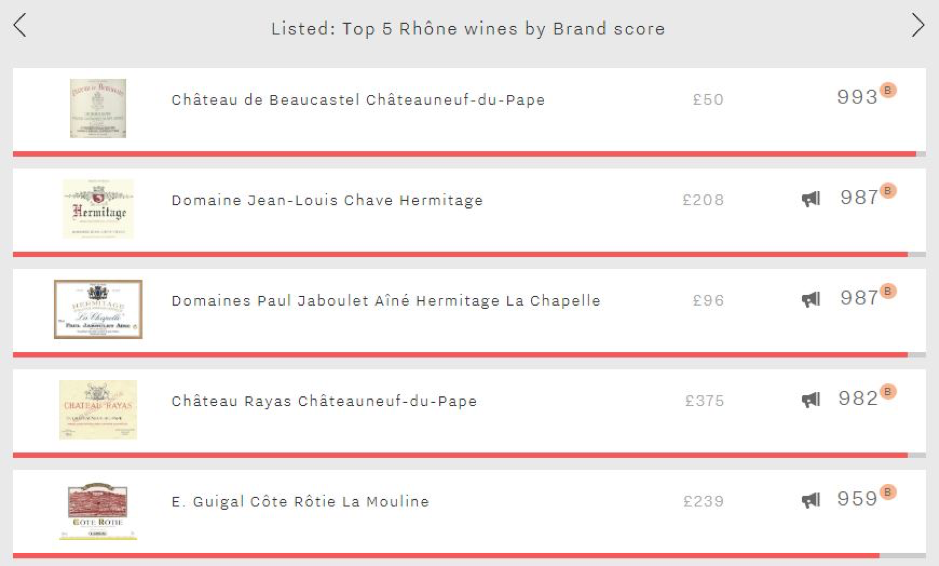

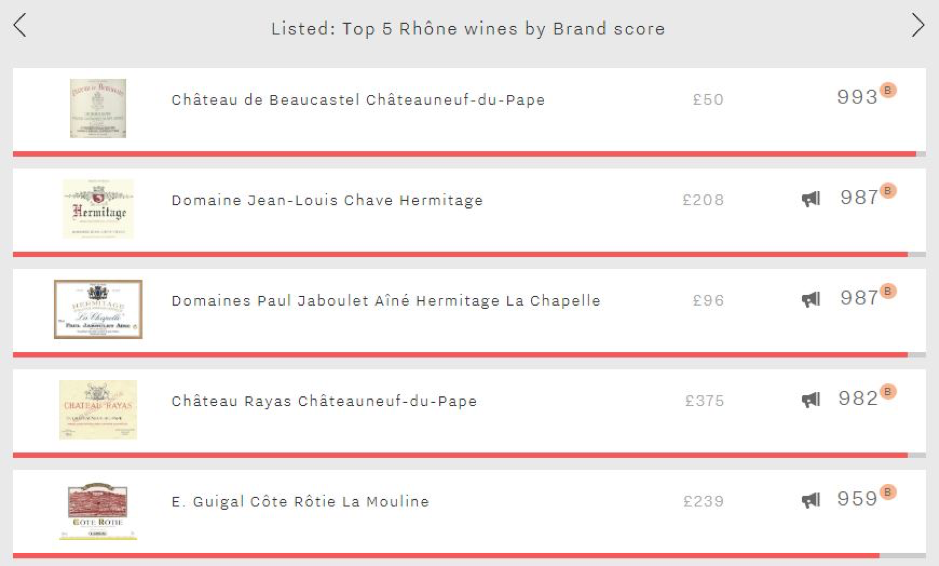

It is worth comparing the performance of Riesling’s top brands to the grape’s top Quality scores. Whilst these five brands achieve an average of 880 in the Brand category, the top five Rieslings by Quality score manage a remarkable average of 990 in the qualitative category. It seems that it is in terms of consumer popularity that Riesling struggles. Trimbach’s Clos Sainte Hune – the most popular Riesling in the world – is only the 241st most popular wine on Wine Lister’s database.

Riesling seems doomed to be perennially underappreciated, perhaps due to its range of sugar levels, or maybe the complexity of the German classification system. Certainly its remarkable quality does not command the brand recognition it deserves. If we compare the average of the top five Brand and Quality scores of 100% Riesling, Chardonnay, and Sauvignon Blanc wines, it is clear to see that Riesling’s outstanding quality does not currently result in a corresponding level of brand strength.