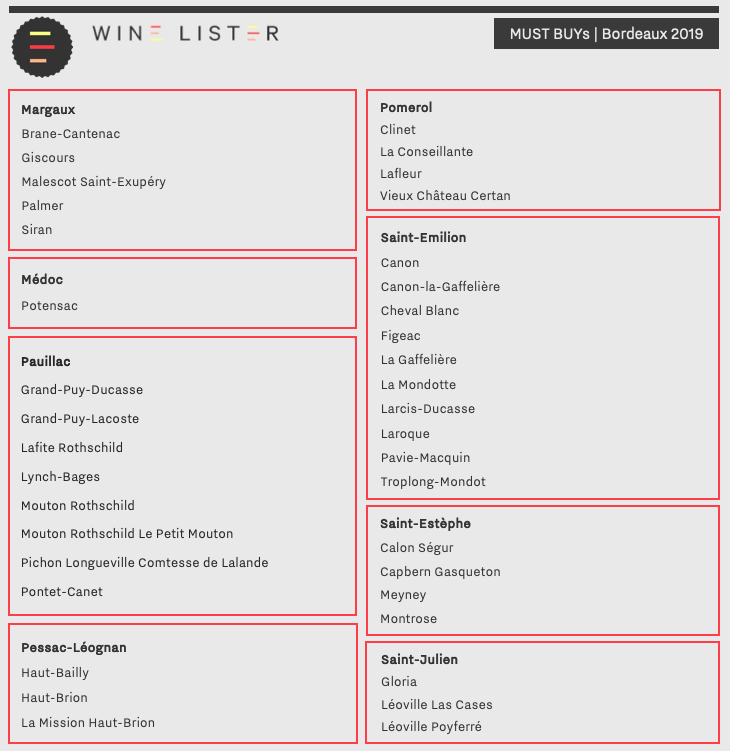

With the Bordeaux 2019 en primeur campaign now concluded, we bring you 38 new Wine Lister MUST BUYs. The tasting of Bordeaux 2019 has thus far confirmed the notable quality of the vintage, from which we have filtered some obvious campaign buys that can be expected to see increased prices, and decreased availability in the future.

Wine Lister’s MUST BUY recommendation algorithm takes into account a wine’s quality and value within its vintage and appellation, as well as the latest industry intelligence from key players in the global fine wine trade. These results are then filtered through an intelligence-based, human overlay, which identifies MUST BUY wines based on our tasting of Bordeaux 2019, and observation of the reception of each release in the market.

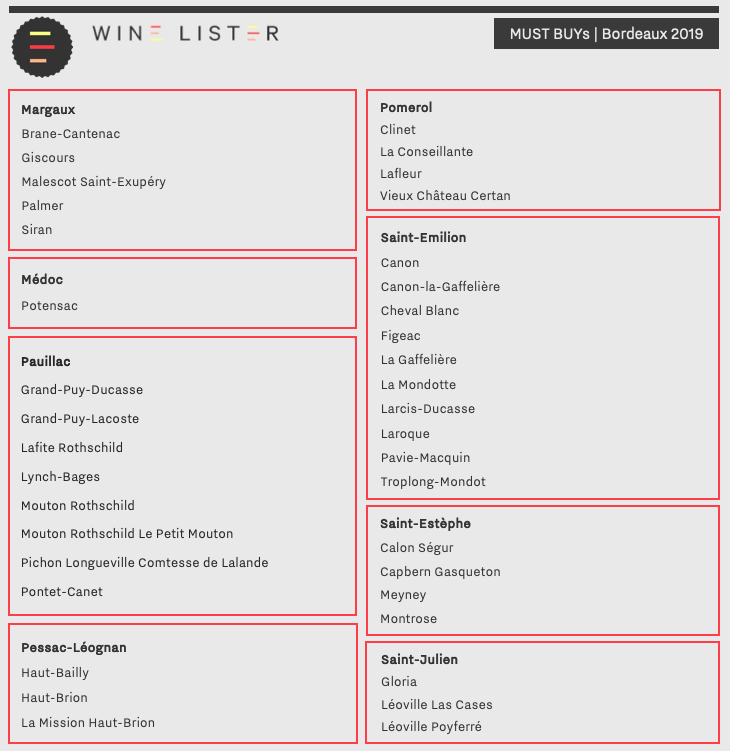

As illustrated below, there are 38 Bordeaux 2019s that are now recognised as MUST BUYs – suggesting that the benefit of buying en primeur is more obvious than last year (there were 24 Bordeaux 2018 en primeurs recognised as MUST BUYs following its campaign). They are all red:

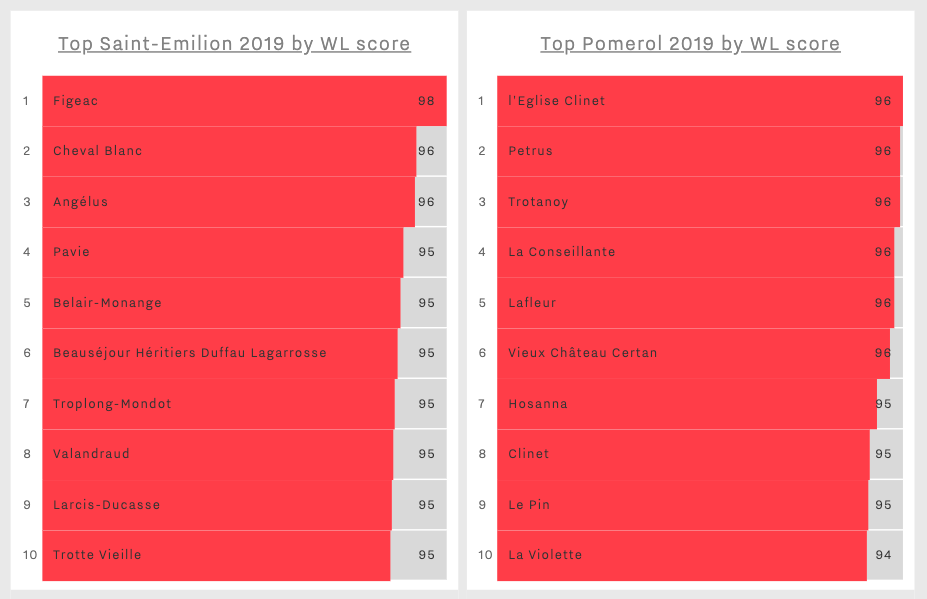

In keeping with last year’s MUST BUY picks, Saint-Emilion once again ranks as the most recommended appellation – this year offering 10 MUST BUYs, including the top-scoring wine of the vintage: Figeac 2019. With a WL score of 98, Figeac’s latest vintage has sustained the château’s upward quality trajectory.

With a WL score of 93 at £18 per bottle (in-bond), Laroque 2019 exhibits excellent value relative to 2019 Saint-Emilions of comparable quality. Alongside its MUST BUY status, Laroque’s latest vintage is also a Value Pick, making it an essential acquisition for the savvy Bordeaux buyer. Wine Lister partner critic, Antonio Galloni, notes, “raspberry jam, spice and red plum meld into the juicy finish”, stating that “the 2019 is very nicely done”.

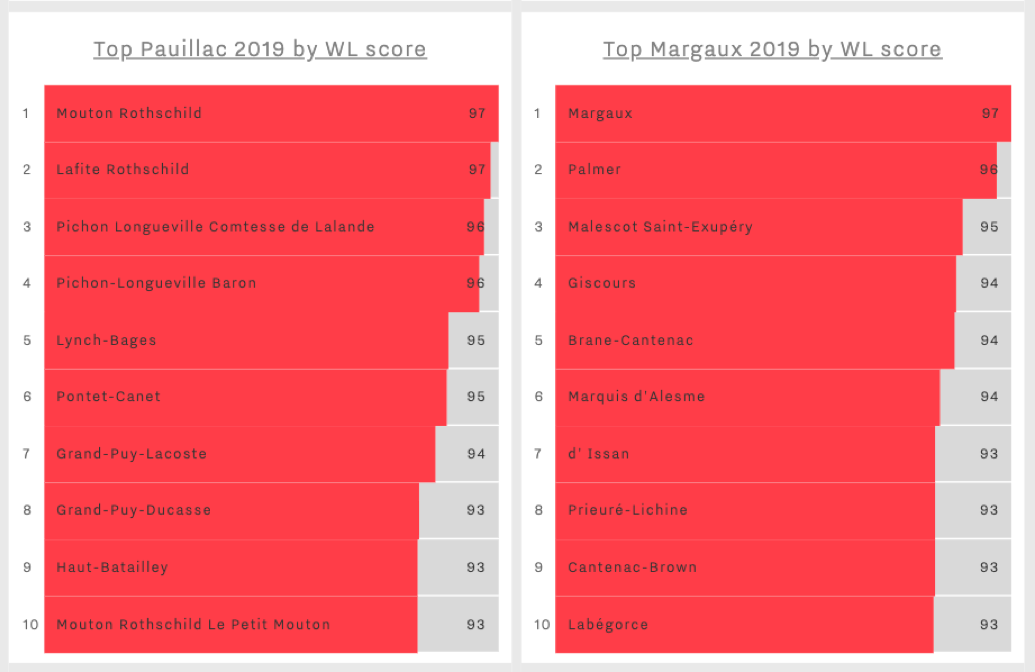

Pauillac houses eight Bordeaux 2019 MUST BUYs, including first growths Lafite and Mouton, which both achieve WL scores of 97. Grand-Puy-Ducasse 2019 is both a MUST BUY and a Value Pick, having achieved a WL score of 93 at £23 per bottle (in-bond). Writing for Jancisrobinson.com, James Lawther muses whether the 2019 is the, “best of recent vintages?”, suggesting that it “certainly has more structure and power with additional mid-palate flesh”. As proposed in a previous Bordeaux 2019 en primeur blog, Pichon Comtesse is another notable Pauillac purchase for wine collectors, given the estate’s impressive popularity, and its vast reduction in volume released this year.

Within its five MUST BUY picks (four at under £50 per bottle in-bond), Margaux contains two Value Picks, with Malescot Saint-Exupery and Siran priced at £31 and £20 per bottle (in-bond), respectively. At £167 per bottle (in-bond) Palmer 2019 shows good value within the context of its previous vintages (31% below the 2018 and 2016 release prices), which, alongside its limited quantity released en primeur, makes this a must for Margaux enthusiasts.

In Pomerol, La Conseillante, Lafleur, and Vieux Château Certan achieve WL scores of 96, while Clinet follows shortly behind with 95. At £54 per bottle (in-bond) the latter is notably cheaper than its Pomerol peers, and has made a major leap up in quality from previous vintages. Awarding it 97-99 points, Neal Martin writes that Clinet 2019 “is just so fragrant on the nose”, stating that, “the purity that Ronan Laborde and his team have achieved should be applauded”.

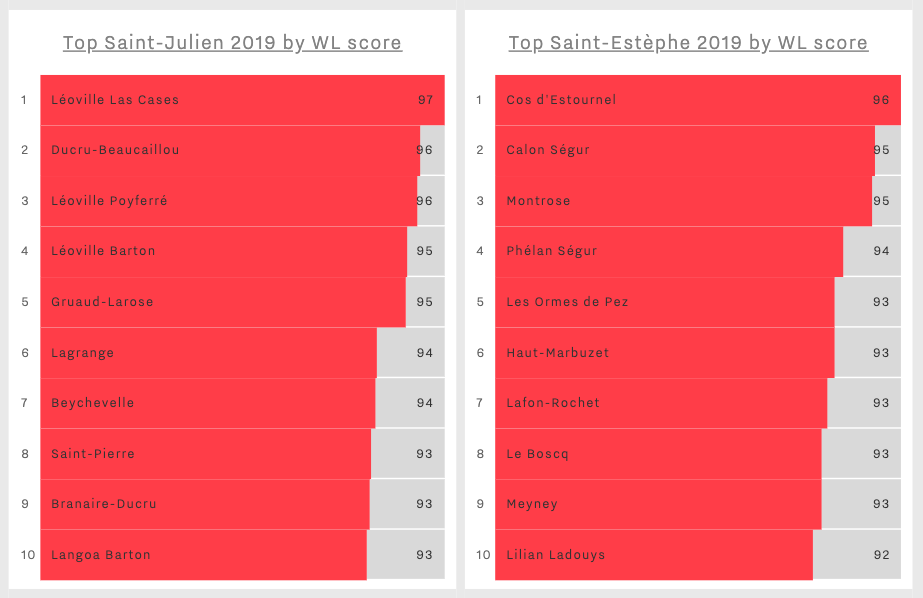

Calon Ségur and Montrose lead Saint-Estèphe’s four MUST BUYs with a shared WL score of 95, while Meyney and Capbern provide testament to the value proposition available in the appellation, having been priced at £19 and £15 per bottle (in-bond), respectively.

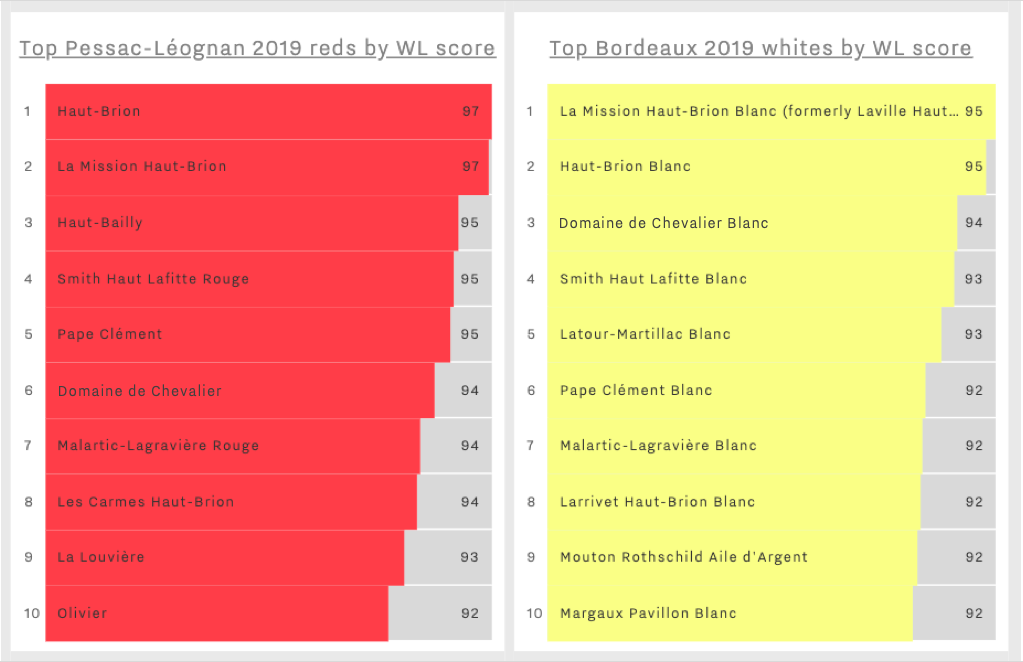

Sharing three picks apiece are further left bank appellations Saint-Julien and Pessac-Léognan, which are both home to high-scoring 2019s. In Saint-Julien, Léoville Las Cases achieves a WL score of 97 – matched by Pessac-Léognan first growth Haut-Brion, and neighbour, La Mission.

Other wines featured in Wine Lister’s Bordeaux 2019 MUST BUYs are: Brane-Cantenac, Canon, Canon-la-Gaffelière, Cheval Blanc, Giscours, Gloria, Grand-Puy-Lacoste, Haut-Bailly, Le Petit Mouton, La Gaffelière, La Mondotte, Larcis-Ducasse, Léoville Poyferré, Lynch-Bages, Pavie-Macquin, Pontet-Canet, Potensac, and Troplong-Mondot.

Wine Lister has now released Part II of its annual in-depth Bordeaux Study, examining the price and quality of Bordeaux 2019, relative to previous vintages. Purchase the full report here, or download using your Pro subscription (available in both English and French).

Despite wide speculation over whether an en primeur campaign could proceed at all in 2020, this year’s campaign is now more or less complete, and Wine Lister’s scores are in. Bordeaux 2019s exhibit high quality across the board, receiving frequent comparison with recent great vintages – 2016, 2015, 2010, and 2009.

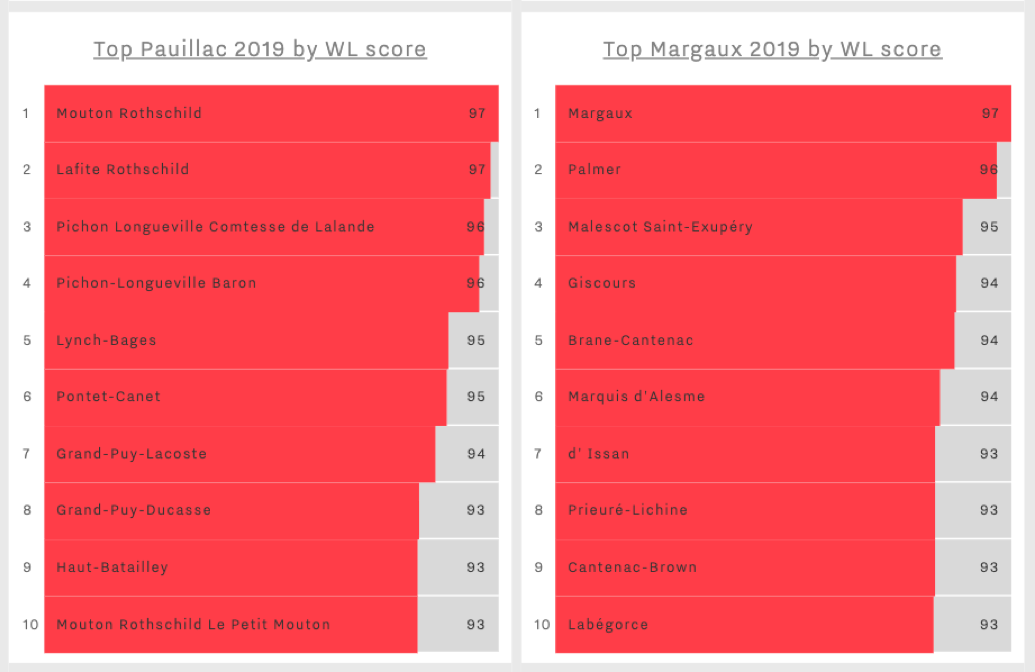

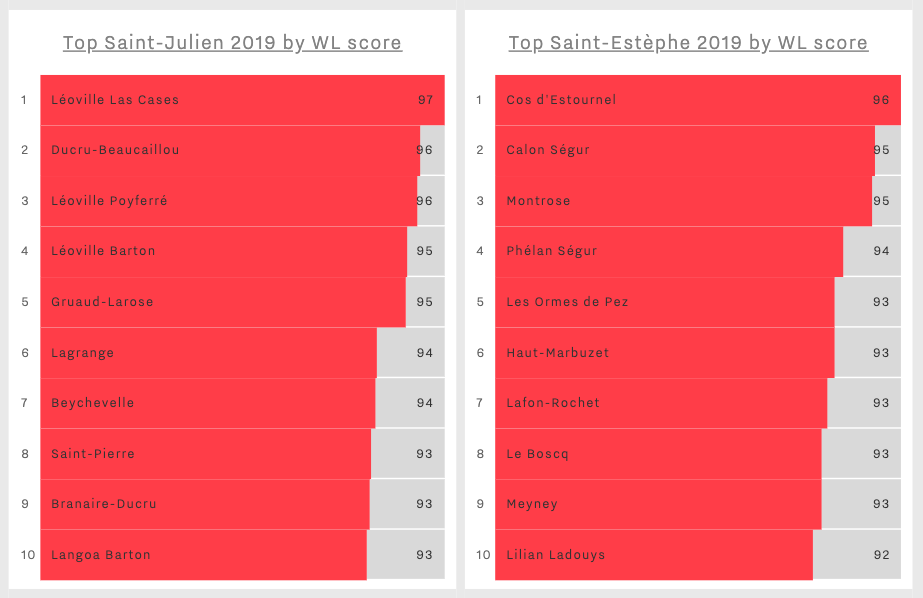

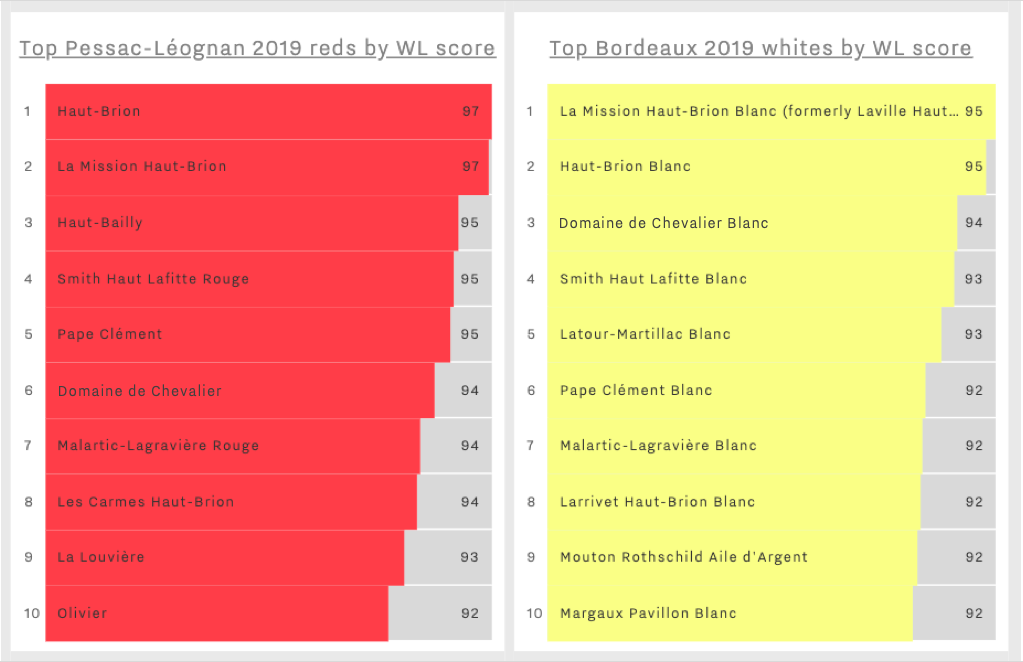

Wine Lister has now published its latest Wine Leagues on the new vintage – examining which Bordeaux 2019s rank best for WL score in each major appellation.

Pauillac First Growths, Lafite and Mouton, lead the appellation’s league of top 2019s by WL score, with a joint score of 97. Pichon Comtesse and Pichon Baron follow suit with 96 – the latter achieving its highest WL score since its 2016 vintage. Wine Lister partner critic Neal Martin describes Pichon-Baron 2019 as having “a very refined bouquet” and a “silky smooth, creamy texture”, stating it “retains all the classicism you could ask for”.

The league of Margaux 2019s by WL score is topped by the appellation’s namesake property, whose latest release joins fellow Pauillac Firsts with a score of 97. Following Palmer’s entry with 96, Malescot Saint-Exupéry 2019 achieves the château’s highest ever WL score (95). Wine Lister partner critic, Antonio Galloni notes that the 2019 is “a striking wine that is sure to find many admirers”, recounting an “interplay of earthy and savoury notes with rich, dense fruit… utterly captivating”.

There are four Value picks featured in the league of Margaux 2019s by WL score, with Labégorce, Malescot Saint-Exupéry, Marquis d’Alesme, and Prieuré-Lichine all achieving scores of 93 and above, at under £35 per bottle (in-bond).

In Saint-Julien, Léoville Las Cases 2019 achieves a WL score of 97, matching that of its 2018 and 2016 vintages. Ducru-Beaucaillou and Léoville Poyferré appear in joint-second place with 96 – achieving their highest WL scores since 2016 and 2015, respectively. Ducru-Beaucaillou 2019 performed notably well at tastings, with Neal Martin, awarding it 96-98 points. He notes its “filigree tannins, pitch perfect acidity and a sensual, satin-like texture”, concluding that the wine is “outstanding in terms of persistence”.

With a score of 96, Cos d’Estournel 2019 tops the league for Saint-Estèphe 2019s by WL score, matching its successful 2018 and 2016 vintages. Writing for JancisRobinson.com, James Lawther describes the vintage as “powerful but carefully constructed and precise”, noting “a lovely mellow quality to such a muscular wine”. While both falling one WL score below their previous vintage, Calon Ségur and Montrose appear second in the appellation’s league, with a shared score of 95.

Branaire-Ducru 2019 and Meyney 2019 exhibit notable value within their appellations – both achieving WL scores of 93 at £29 and £19 per bottle (in-bond), respectively.

Haut-Brion and La Mission Haut-Brion perform notably well in 2019, achieving joint-first place in the league of top Pessac-Léognan 2019 reds by WL score. As examined in a previous Bordeaux 2019 en primeur blog, the en primeur darling, Les Carmes Haut-Brion, shows clear qualitative success in 2019, and its small production levels and smart en primeur pricing has once again made it a clear campaign buy. Another promising pick from Pessac-Léognan, Olivier 2019 achieves Value pick status at c.£20 per bottle (in-bond), and achieves the château’s highest WL score (92). Antonio Galloni recounts “smoke, licorice, cured meat, graphite and savory herbs infuse the 2019 with striking aromatic intensity to play off its sumptuous fruit”, concluding that the wine is “Very good”.

Haut-Brion and La Mission Haut-Brion attain joint-first place for their whites as well as reds in 2019, achieving scores of 95 in the league of top Bordeaux 2019 whites by WL score. Latour-Martillac Blanc 2019 achieves the highest WL score seen across its vintages (93) – one WL score above Pape Clément Blanc’s 92. At c.£21 per bottle (in bond) Latour-Martillac Blanc 2019 enters the market 10-30% below the current market prices of vintages 2016-2018, showing good value for its quality. Neal Martin notes on the latest vintage: “subtle tropical notes of pineapple and orange rind with hints of strawberry come through on the finish”.

On the right bank, the league of top 10 Saint-Emilion 2019s is crowned by Figeac’s high-scoring 2019. Up one point on its 2018, Figeac’s latest release achieves the highest WL score of all Bordeaux 2019s (98). Figeac 2019 illustrates the château’s impressive upward quality trajectory, which has seen its WL score slowly but surely increase from 91 in 2008. Neal Martin gives the latest vintage 97-99 points, describing it as “exquisitely defined… a deeply impressive, intellectual Figeac”.

La Conseillante, Lafleur, l’Eglise Clinet, Petrus, Trotanoy, and Vieux Château Certan share the top WL score of Pomerol 2019s (96), separated by mere decimals. A release of note, l’Eglise Clinet 2019 is the last vintage of the late Denis Durantou, who sadly passed away in May. Neal Martin’s impressive score of 97-99 suggests the last vintage was his best, adding, “the perfect way to remember and raise a toast to one of Pomerol’s finest vignerons”.

Click here to view all Wine Leagues. Pro users have access to a more extensive set of Leagues and can log in to access here.

We say it every year – the prices have to be “right”. While the Bordeaux 2019 en primeur campaign may be exceptional operationally, the same message resounds from the trade as in many a previous en primeur campaign – the prices have to be right.

Chairman of Farr Vintners, Stephen Browett, defines the crux of the matter succinctly; “one thing that is absolutely crystal clear is that for this en primeur campaign to work, Bordeaux must return to the fundamental (and recently ignored) concept that en primeur wines need to reach the consumer at lower prices than physically available vintages”. For at least the last three Bordeaux en primeur campaigns, release prices have generally been too high. The key difference this year is that the Bordelais have a unique opportunity – COVID-19 and the ensuing global economic crisis – to bring prices down significantly without losing face, or undermining the pricing of previous vintages.

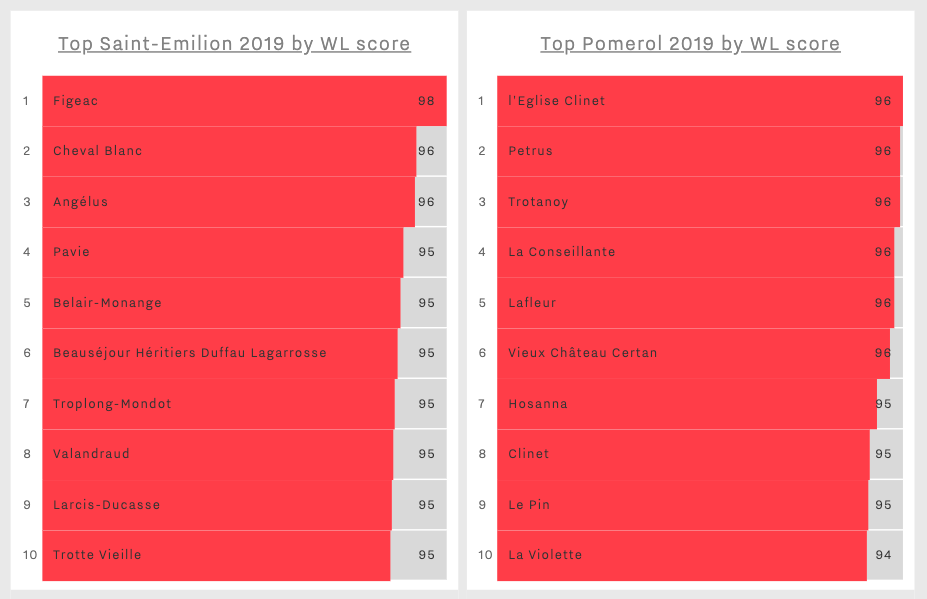

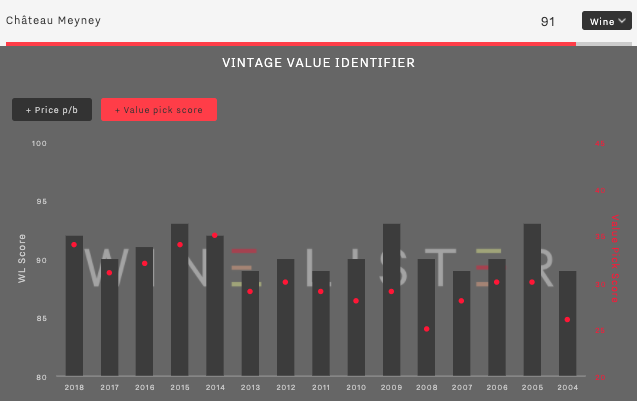

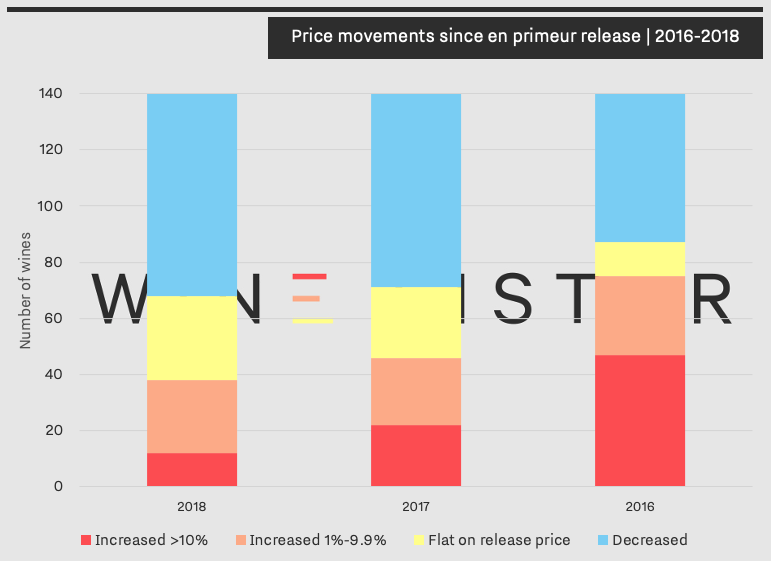

Analysing a basket of 140 top Bordeaux wines, the chart below looks at price movements of the last three vintages on the fine wine market since their respective releases.

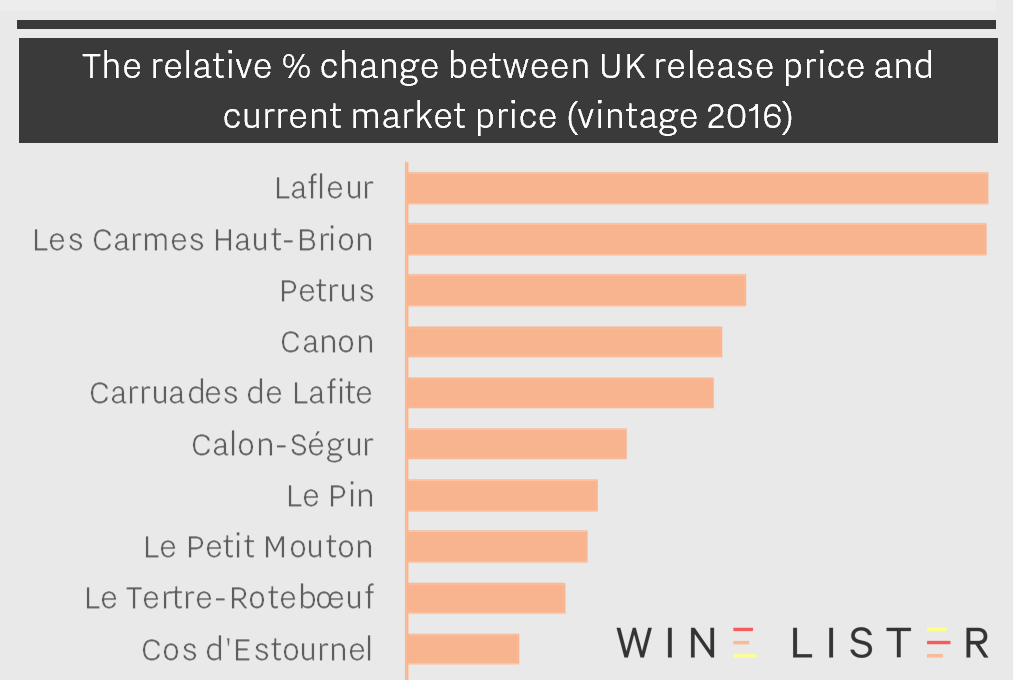

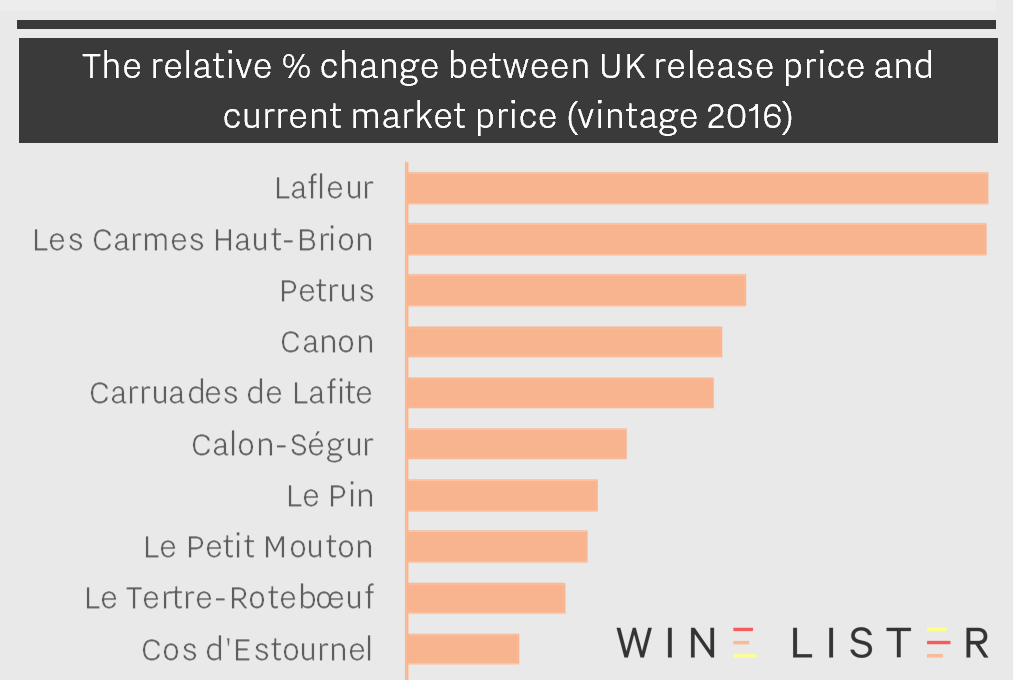

Bordeaux 2016s were released three years ago. As shown in the chart above, today just over half of them are worth more than they were en primeur – these 75 wines have increased by an average of 18% since the spring of 2017, although they include the likes of Les Carmes Haut-Brion, Lafleur, and Petrus, which have seen mammoth price increases of 111%, 109%, and 64% respectively. 65 of the top Bordeaux 2016s have either stayed flat or have decreased in price since en primeur release. Assuming an in-bond storage cost of £12 per case for the last year on these, the chances are that many buyers would have saved more money purchasing 2016s now.

The picture is worse for 2017 and 2018 releases, with approximately half of wines having decreased in value. Last year the high quality of the vintage coupled with small quantities available was cited repeatedly as a reason for price hikes. This year, however, there is no glass door to hide behind. The quality of the 2019 vintage is reportedly excellent, but volumes are also good. Add to this the unprecedented context of a campaign during a global pandemic, and the pressure is on more than ever for prices to drop significantly.

Buying Director of BBR, Max Lalondrelle, tells me, “in order for the consumer to put their faith in the product without knowing too much about the quality or style, the wineries will have to offer some relatively good prices to entice consumers to take the risk”. Members of the trade have elsewhere qualified what “good prices” might mean – a price reduction of 30-35% on 2018s. Flying blind and relying on the historical quality of solid brands to make choices in 2019 (in the absence of all the usual critics scores) is one thing – doing so in the face of such an uncertain future for many is another entirely. For releases to work this year, sacrifices will need to be made by the châteaux – quality of the wine must be put aside, as context, and getting the market to bite during such difficult times, will be everything.

The first major release so far has listened to the market – Pontet-Canet’s 2019 is priced 30% lower than 2018s release. Feedback on the release has been good – Chief Executive of Goedhuis, Tom Stopford Sackville, tells us it was “a very encouraging start to the campaign”, and a “positive signal regarding 2019 pricing in general”. If other châteaux follow suit, the campaign could be a memorable one, that, as Browett puts it, inspires “a new confidence” in en primeur “after recent disappointing campaigns”.

The fine wine trade (Wine Lister included) is rooting for Bordeaux, willing its unique selling system to deliver. The equation for pricing this year could in some ways not be simpler – it is hoped that a sufficient number of properties will take this into account, and present prices the market can embrace.

Releases are set to begin in earnest from tomorrow – 2nd June. Follow them through Wine Lister’s Twitter, or through our dedicated en primeur page.

Chloe Ashton

June 1, 2020

While we would normally be packing our bags in preparation for one of Wine Lister’s favourite weeks of the year, the postponement of this year’s Bordeaux en primeur tasting week comes as a blow for all. Until we can sample the eagerly-awaited 2019 vintage, we can comfort ourselves in self-isolation with the abundance of physical Bordeaux vintages still available for delivery.

In celebration of the brilliant wines that are helping keep Wine Lister’s glasses half-full during the pandemic, this week we focus on some of the best red Bordeaux Value Picks, so that you too can avoid compromising on your quarantine drinking preferences without breaking the bank.

Wine Lister’s Value Pick score is calculated based on the quality-to-price ratio of a wine and vintage, as informed by price data and reviews from our partner critics. See the image below for five of our top Bordeaux Value Picks over the past four vintages.

- Château Capbern

Capbern obtains an average Value Pick score of 35 across the last four deliverable Bordeaux vintages, and offers excellent value for money. This Saint-Estèphe château is the sister property of Calon-Ségur. Described by one of our partner critics, Jancis Robinson, as a ‘veritable steal’, the 2014 vintage ‘continues to look exceptionally good and still fully deserving of its score of 17 en primeur’. The 2016 vintage achieves Capbern’s highest WL Value Pick score (36.2) of the four vintages, and we highly recommend getting your hands on some, available by the dozen in-bond starting from £200, from UK merchants including Farr Vintners and FINE+RARE. Millésima USA and Millésima HK also deliver this brilliant wine.

- Château Grand Village

Achieving Value Pick status for three of the four vintages examined (2017, 2016, 2015), Grand Village exhibits a dependably high quality-to-price ratio. As the original Bordeaux home of the Guinaudeau family – the producers of Lafleur – Grand Village is the accessible answer to the same exceptionally high winemaking standards applied to its parent wine. Its classification as a Bordeaux Supérieur plays a part in its inherently reasonable price (c.£13 per bottle in-bond, when buying by the case). Grand Village’s 2017 vintage achieves the highest Value Pick score (38) of all five wines and four vintages here mentioned, and is available for delivery from the Guinaudeau family wines’ UK agent, Justerini & Brooks.

- Château Fontenil

A second Value Pick from an ‘outlying’ Bordeaux appellation, Fontenil’s 8.5-ha vineyard is located at the highest elevation on the plateau of Fronsac. As renowned flying winemaker, Michel Rolland’s ‘passion project’, he purchased the site with his wife, Dany, in 1986 with the intention of inhabiting the house that was situated on its land. Taking on the responsibility of attending to the vines that came with it, and creating an entirely new estate, Fontenil is now a boutique wine of excellent quality at an average cost of c.£20 per bottle in-bond. Given its small production volume, Fontenil is not as easy to find as our other four Value Picks, however, in the UK, Laithwaites is the place to buy (as soon as they reopen their website for orders – they are currently experiencing an overload of demand due to lockdown buying).

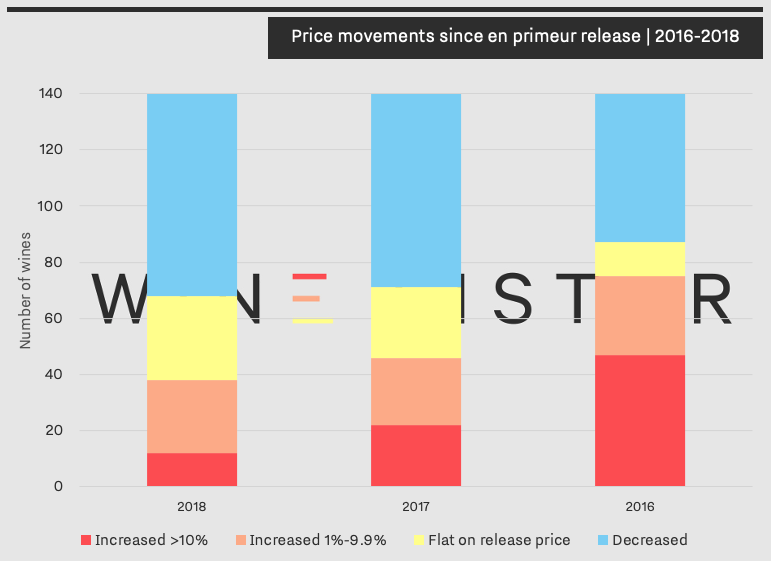

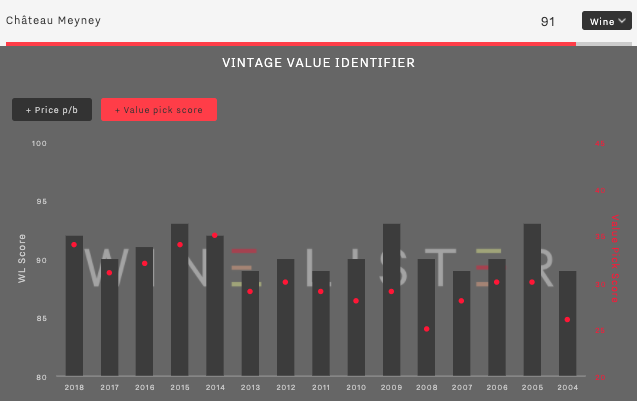

- Château Meyney

Located in the east of Saint-Estèphe, the plots of this Cru Bourgeois are situated next to Montrose. Long considered a wine trade darling for its impressive value, Meyney continues to achieve high WL scores. Its 2015 vintage received particular praise from our partner critics, with Neal Martin describing it as ‘blowing everyone’s expectations, including his own‘. With prices starting at £25 per bottle in-bond, you can order this wine through Goedhuis in the UK, where a case of 6 bottles stands at £200, including VAT. If you are in the USA, you can place your order with Millésima.

- Château Marsau

Like Meyney, Marsau’s 2014 and 2015 vintages are Wine Lister Value Picks. The 2016 is too, and though the wine seems to get better every year, the latter may need a touch more time in bottle before drinking. Marsau is run by Anne-Laurence and Mathieu Chadronnier (Managing Director of the Bordeaux négociant, CVBG). The Marsau vineyards feature 85% Merlot planted on predominantly clay soils, resulting in a classically right-bank wine with soft, round fruit and great balance. The 2014 vintage represents particularly good value – priced at £20 for the bottle in-bond, with a high Value Pick score of 35. The UK-based merchant BI Wines is delivering this vintage, whilst those on the other side of the pond can place their order with JJ Buckley Fine Wines.

You can identify good value in further back vintages of any of the above-mentioned wines by using the Vintage Value Identifier on each wine page. See the example for Meyney below or by clicking through to its wine page here.

Faced with a new generation of fine wine buyers seeking more of the “weird and wonderful”, let alone recent economic obstacles – Coronavirus keeping drinkers off the streets, US tariffs on European wines – Bordeaux can struggle to find space to thrive.

Bordeaux’s traditional image compared to more fashionable regions such as Burgundy, Piedmont, or Champagne means its prices are lagging behind. The silver lining is that Bordeaux appears excellent value for the high quality available in comparison.

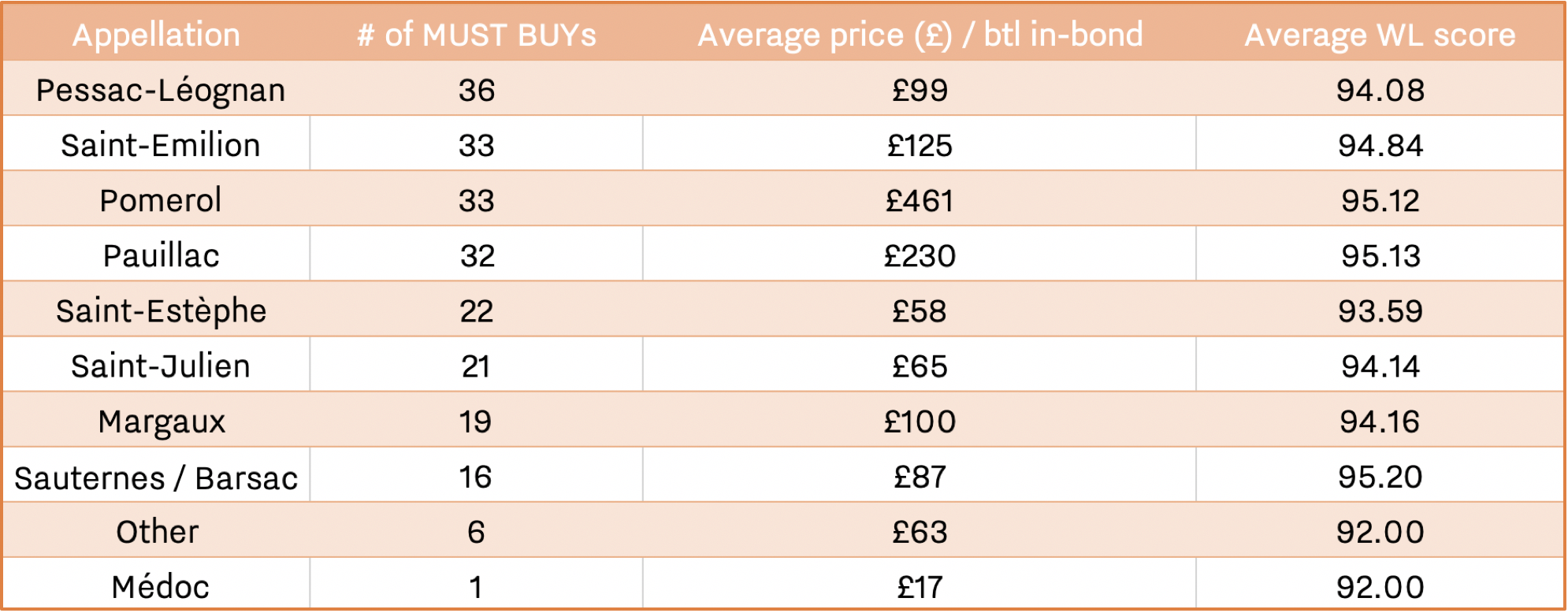

Wine Lister’s dynamic buy recommendation tool currently identifies 219 Bordeaux wines as MUST BUYs – just 19 fewer than the original MUST BUY list from September 2019.

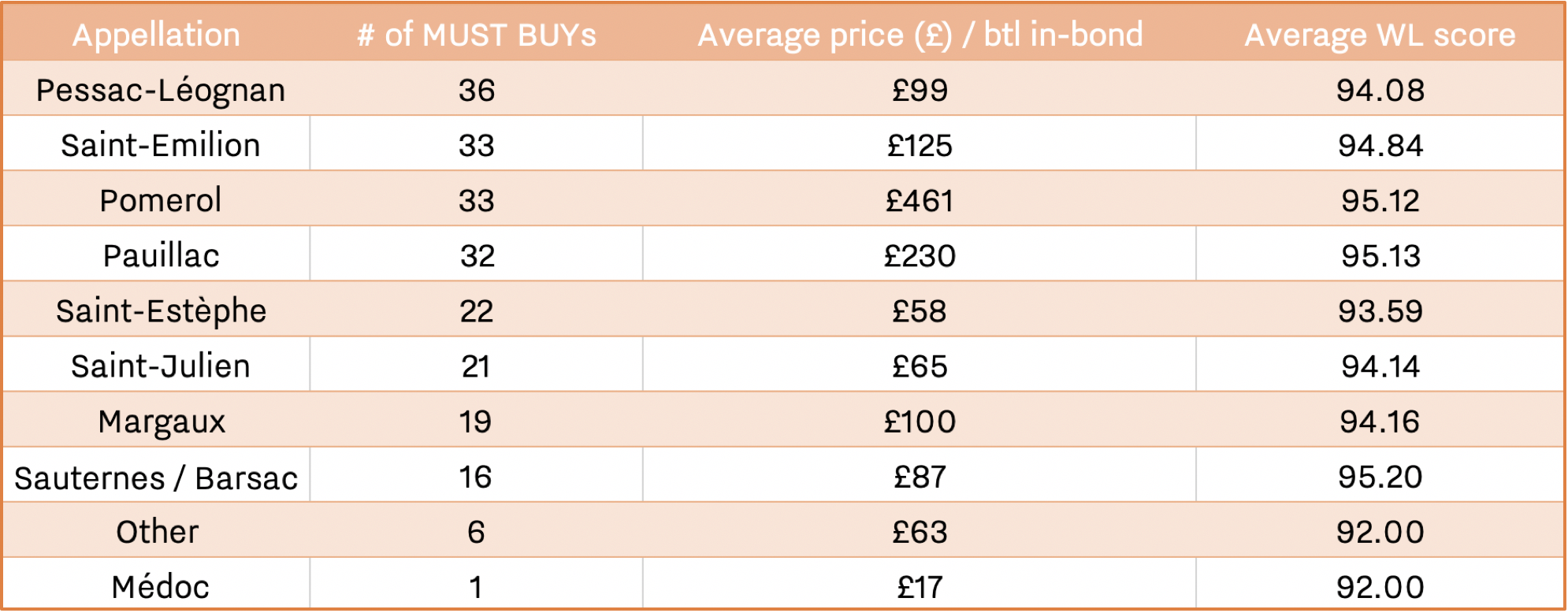

The above table shows each Bordeaux appellation by number of MUST BUYs, as well as average price and WL score of each MUST BUY appellation group. Marking the delayed opportunity presented by slow price evolution post-en primeur, 2016 is the most-featured vintage, achieving 40 entries out of the 219 Bordeaux MUST BUYs (or 18%).

Leading MUST BUY appellation Pessac-Léognan is made up of 28 reds and eight dry whites. Producer Domaine de Chevalier features particularly heavily, earning MUST BUY status for 1981, 2009, 2014, 2015, and 2018 for its red wine, and 2004, 2009, 2010, and 2013 for white. Its second red wine, L’Esprit de Chevalier, appears for the 2016 vintage.

Smith Haut Lafitte and La Mission Haut-Brion share the remaining white places between them, while Haut-Bailly, Haut-Brion, Latour-Martillac, and Malartic-Lagravière achieve multiple entries for reds only. Price-rising superstar Les Carmes Haut Brion features for just one vintage – the 2017.

Right bank appellations Saint-Emilion and Pomerol share second place, with 33 MUST BUYs each. They both earn slightly better average WL scores than Pessac-Léognan, but at prices 26% and 366% higher respectively on average than Pessac counterparts.

The large price difference is hardly surprising in Pomerol, given that its MUST BUY hoard includes five vintages of Petrus, and one of Le Pin. Without these, the average price of Pomerol MUST BUYs is £171, and there are still options at the more affordable end (such as 2016 Vray Croix de Gay).

Powerhouse Pauillac comes next, and includes 14 first growth entries. Mouton takes the lion’s share of these, featuring seven vintages from 1996-2018. Latour earns five places (including one much older vintage – 1964), and Lafite two. Pichon Comtesse also features heavily, earning five MUST BUYs for its grand vin, and one for the Réserve de la Comtesse.

In terms of pure value for money, the one MUST BUY from the Médoc appellation – Potensac 2018 – wins out, followed more generally by Saint-Estèphe’s 22 MUST BUY entries. Perhaps unsurprisingly, its crowned king is Calon Ségur, earning MUST BUY status for five vintages – 2005, 2009, 2014, 2015, and 2016.

Explore all 219 Bordeaux MUST BUYs here.

A new “normal” seems to be developing for Bordeaux.

After a fleeting trip around Bordeaux properties on both banks at the start of harvest, the Wine Lister team is excited to see the 2019 vintage take shape.

We must admit this was not our sentiment on the 23rd September, when, on arrival in a dreary, damp Bordeaux, our first thought went to the poor pickers, and of course to the grapes and potential spread of disease in such wet conditions.

Thankfully this worry was quickly cast aside – “the grapes are in an incredibly healthy state. For grape health, this has been a dream year”, said Château Dassault’s Valérie Befve. This, she further explained, was thanks to the combination of a good spring without too much humidity, budburst that was a little cold but without rain, and a dry summer that was hot without having placed too much water stress on the majority of the vines.

The summer heat wave and consequential drought, similar in timing and nature to 2018 (and to an extent, 2016), will likely result in another year where freshness and caution in extraction are key. Befve put this succinctly, noting that the “skin to juice ratio will require delicate management”. This theme, recurring in several of the last Bordeaux vintages, highlights the importance of careful handling in the cellars, and explains in part the purposeful movement towards a fresher, more approachable style, and away from big tannins and high alcohol that need time in bottle to soften.

Left: Sorting of the first Merlot grapes at Pichon Baron. Right: Pichon Baron now uses small vats on wheels to transport freshly-picked grapes into fermentation tanks, since they cause less breakage of grape skins than traditional pumps.

Comparable characteristics seem in play on the left bank too. At Pichon Baron we tasted some of the very first 2019 Merlot grapes, and though the berries are a little smaller than usual (because of the drought), they are in perfect health. Axa Millésimes’ Commercial Director Xavier Sanchez was quick to say that it was far too soon to speculate on quality levels, but that the very early analyses “resembled 2018 and 2016”.

Grapes of high sugar content will need to be vinified with caution in order to balance potentially high alcohol levels. The rain that has fallen in the past 10 days will likely be a welcome gift to the Cabernet Sauvignon from the “grands terroirs” on this front, the majority of which are set to be picked this week.

Sara Lecompte Cuvelier, Managing Director of Léoville Poyferré and Le Crock echoed the positive sentiment on the general quality of grapes for both her properties, in Saint-Julien as in Saint-Estèphe – “We’re hopeful it will be another beautiful vintage, for both quantity and quality this year”.

While successions of good years are by no means unusual for the bordelais, harvests following heatwaves are becoming a pattern. All that remains to be seen is how the winemakers of Bordeaux deal with this “new normal” in the cellar. We are looking forward to finding out next year!

Wine Lister spent a week in Bordeaux tasting the 2018 vintage in April, and has dedicated the last two months to covering en primeur releases for its Pro Subscribers. After what has been an unpredictable and puzzling Bordeaux en primeur campaign, we have conducted more than 20 interviews with our Pro Subscribers and Founding Members to find out how it went for them.

Below you will find our conclusions on the Bordeaux 2018 en primeur campaign, which combine our own intimate knowledge of the campaign and its peculiarities with invaluable insights from the trade.

Timing

The campaign lasted 62 days compared to 59 last year (from the date of the first major release to the last standard-channel releases). One clear improvement, thanks to a concerted effort by courtiers, was the spacing out of releases more evenly over the period. However, this did not address the more acute concern around the overall length of the campaign, with the wine trade expected to concentrate on the new Bordeaux vintage for two whole months of the year.

Pricing

A more major frustration was pricing. Over 80% of Wine Lister Pro Subscribers / Founding Members surveyed said prices were too high. On average, prices were up 13% on 2017 and 2% on 2016 release prices. This only made sense where 2016s had gone up in the market since release – not often enough the case. As a result, 2018s came onto the market on average 1% above the current market price of 2016, despite the latter – one of the vintages of the century – being physically available.

Needless to say, many wines stalled upon release due to over-ambitious pricing. When we asked the trade which wines sold the worst, more than once the reply was, “too many to mention”.

Desire

However, one of the more unfathomable motifs of the campaign was that in several instances, this highly ambitious pricing was accepted by the market, and the wines sold through. These were wines with good momentum behind them and a particularly loyal following, but most of all they were wines with a specific story that superseded any thought of value relative to prior vintages.

Examples of this phenomenon are Domaine de Chevalier and Palmer. Both were released into the market above every recent back vintage, and yet both met with demand thanks to the stories behind each wine. Domaine de Chevalier’s owner, Olivier Bernard, started sowing the seed several months before the campaign saying his 2018 was the best wine he’d ever made, a statement reiterated by the rest of his family and gradually absorbed through the fine wine chain. Unable to use conventional sprays, Palmer lost two-thirds of its crop to mildew, and made a striking, unusual wine that Managing Director Thomas Duroux said would “go down in history”.

“The market is very smart and only follows brands that it’s imperative to buy en primeur,” states Laurent Bonnet, Export Director of négociant L.D. Vins.

It was a campaign that favoured top names, not value wines. Wines below €50 were largely unsuccessful (with a few exceptions such as Laroque, Capbern, and Potensac – the three most affordable Bordeaux 2018 Wine Lister MUST BUYs).

David Suire, Managing Director of Château Laroque – a Bordeaux 2018 WL MUST BUY

Volume

After pricing, the most cited frustration was reduced volumes. On average, leading properties released around 20% less wine than last year. “The number one cause of reduced volumes is lower production in 2018 compared to previous years,” said Mathieu Chadronnier, Managing Director of négociant CVBG, who, like other participants in the campaign would have liked to have more volume to sell of certain wines. “It is a frustration, but there’s nothing we can do about it,” he concluded.

Certainly several properties produced less wine due to mildew and a very dry summer. Others made a commercial decision to keep back more wine – a continuation of the gradual trend for Bordeaux châteaux to release less wine en primeur, whether to create an impression of rarity, and / or to partake in the future upside by selling the bottled wine later once it has – they hope – increased in value.

Bonnet underlines the irony of having less and less stock of the wines that sell well, and too much of those that don’t: “The ‘not enough of in-demand wines / too many wines to hold as stock’ equation is difficult for négociants to resolve,” says Bonnet, cautioning that, “the financial stakes are high.”

Good news stories

While Asian buyers were reported to be less present than in previous years, other geographies remained strong – the US, continental Europe, and especially the UK.

The 10 greatest success stories of the campaign included six Wine Lister MUST BUYs: Calon Ségur, Canon, Carmes Haut-Brion, Rauzan-Ségla, Léoville Las Cases, Mouton Rothschild, and Lynch-Bages.

Revenues were up on 2017 across the board, in many cases very significantly. The majority of respondents reported en primeur revenues the same as or above 2015 levels, with only a couple of exceptions. However, very few managed to equal 2016 revenues.

Future(s)

On the one hand, it seems obvious that the 2018 Bordeaux en primeur campaign could have been more of a roaring success with more astute pricing and in some cases a bit more volume to go around. On the other, many of our Pro Subscribers and Founding Members have been pleasantly surprised by the outcome, and will conclude their campaigns with better revenues than they expected.

This leaves many convinced of the merits of en primeur, if frustrated that it’s not reaching its full potential. “We could have done £35m,” said Max Lalondrelle, Fine Wine Buying Director of UK merchant Berry Bros. & Rudd, which in fact made c.£22m in revenues on the 2018 Bordeaux en primeur campaign.

Meanwhile other members of the trade have ceased their Bordeaux en primeur activity altogether over recent years, and some are questioning its future viability. For the time being, the sun has set on this year’s campaign, but it will rise again next year on the utterly unique global marketing and distribution tool that is en primeur.

Read more about our new MUST BUY tool in our recent blog here.

The campaign in 2018 “won’t be a record breaker,” thinks Mathieu Chadronnier, MD of négociant CVBG, “but everything is there for it to work well.” There are also some potential pitfalls. In this article we consider the role that volume, pricing, and timing will play in the success of the 2018 en primeur campaign – already well underway.

Volume

In 2018, yields were often slightly below 2017 levels. Last year, frost damage provided a cover for releasing less volume into the market. Will mildew serve the same purpose in 2018? There were some extreme mildew casualties across the two banks, mainly for organic and biodynamic properties such as Palmer, which produced just 11 hl/ha. In Pomerol, L’Evangile made 20 hl/ha, less than half what it would have produced under conventional agriculture. In Pauillac, Pontet-Canet made just 10 hl/ha in 2018 – one third of its usual production, losing 15 hl/ha to mildew and another 5hl/ha due to dried out grapes.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

François-Xavier Borie, owner of Grand-Puy-Lacoste, believes that the real burning issue for en primeur is the volume released onto the market – or not. Some châteaux release nearly all their production, and others as little as 30%, keeping the rest back to create an artificial rarity in hope of selling the rest at a higher price later. Borie believes the right amount to release en primeur is “at least 80 percent,” cautioning that “releasing 30 percent and pretending it’s a real price is dangerous.”

Nicolas Ballarin of courtier Blanchy et de Lestapis agrees: “The problem of Bordeaux’s distribution is not in the price but in the fact that we don’t put enough wine into the market en primeur,” he states. “The real paradox is that knowing there’s none left at the château makes it more valued,” explains Ballarin, adding, “the négoce know they won’t get more.” He concludes that “prices only go up if there’s no more wine at the château.”

And after all, every producer’s objective is for their prices to go up. Many try to force this through their en primeur release price, while others let the market do the work. More than ever in 2018, there is no one-size-fits-all approach to bringing them onto the market.

As we saw in part I of our en primeur blog, 2018 was a vintage where producers’ decisions counted for a lot. In the words of Nicolas Glumineau, Managing Director of Pichon Comtesse, it is “a year with very important personal choices.” He was talking about the winemaking, but could just as easily be referring to the sale of the wine. “There won’t be any blanket tendencies,” says Frédéric Faye, Managing Director of Figeac, underlining that, “each château has to decide for itself and not look at its neighbours.”

Pricing

The only golden rule that the trade seem to agree on is that the 2018s should not be priced higher than the 2016s were upon release. “It would be a massive mistake for prices to be above those of 2016,” declared George Wilmoth, Head of Sales at UK merchant Justerini & Brooks. In Bordeaux, Edouard Moueix, Managing Director of Etablissements Jean-Pierre Moueix (producer and négociant), agrees, saying 2018 prices, “cannot be higher than 2016, it’s impossible.”

The exception to this rule of course, is where the 2016s have increased significantly since their release. Stephen Browett, Chairman of UK merchant Farr Vintners, reminds us that, “the vast majority of 2016 Bordeaux wines that customers bought en primeur are still available at delivery time at the same price as they paid two years ago, and in some cases less,” but there are exceptions, such as Lafleur, whose 2016 has increased 109% since release. When it released this morning, the château could therefore up its 2016 release price by 12% and still offer a 2018 that remains significantly cheaper than the current market price of the 2016.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

“At the end of the day the châteaux will charge what they can get,” states Mathieu Chadronnier, MD of négociant CVBG. The allocation system in Bordeaux means this is often more than what they should arguably be charging, because négociants don’t want to risk losing share to competitors in future years. However, some did refuse allocations in last year’s campaign, and this could happen again – and maybe on a larger scale – if prices are too ambitious.So far there have only been small instances of this.

Timing

The campaign is a precocious one, with Angélus releasing on 16th April, and a few dozen releases since, including well-known names Branaire-Ducru, Langoa-Barton, and Labégorce. However, it doesn’t really seem to have got going. Some of the Wine Lister team is just back from two days in Bordeaux speaking with négociants and courtiers on the Place, and there is a distinct lack of energy so far.

However, after yesterday’s bank holiday in France, and a handful of releases today, things are set to pick up pace in earnest next week. We expect a series of releases from châteaux that have historically judged their en primeur prices well, and this could breathe some life into the campaign. On the other hand, these are the very same châteaux who can actually conceive of increasing their prices, given their market value has risen sufficiently.

Some fear this will set the wrong precedent for their neighbours, which is why it is more important than ever for each property to consider its pricing strategy in the context of its own performance, and not what its neighbours are doing. Châteaux need to “make sure that their en primeur price to the consumer is lower than that of older vintages,” says Browett. In part I of our recent Bordeaux study, we looked at a case study of a hot property in Bordeaux that did just that in last year’s campaign.

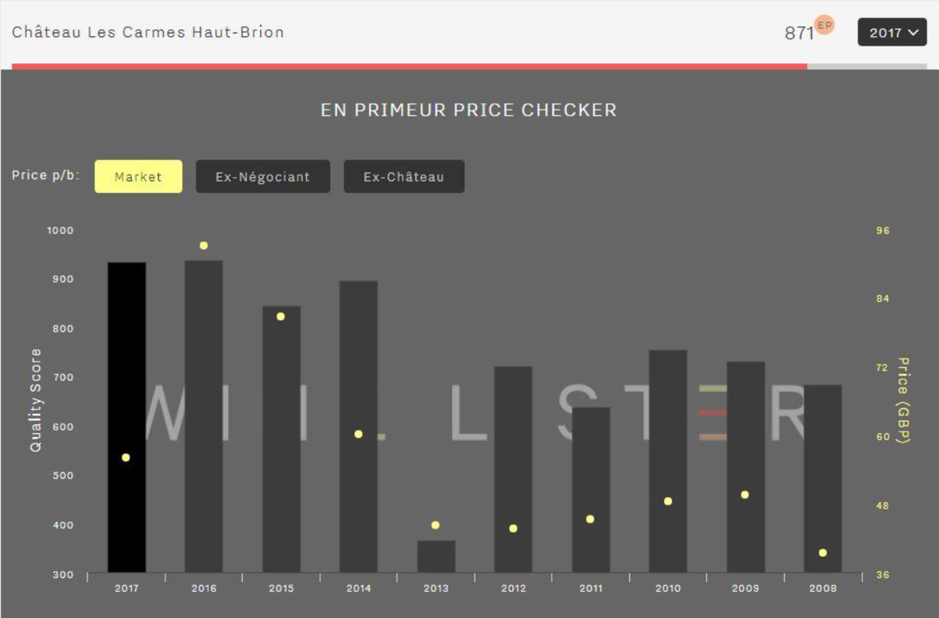

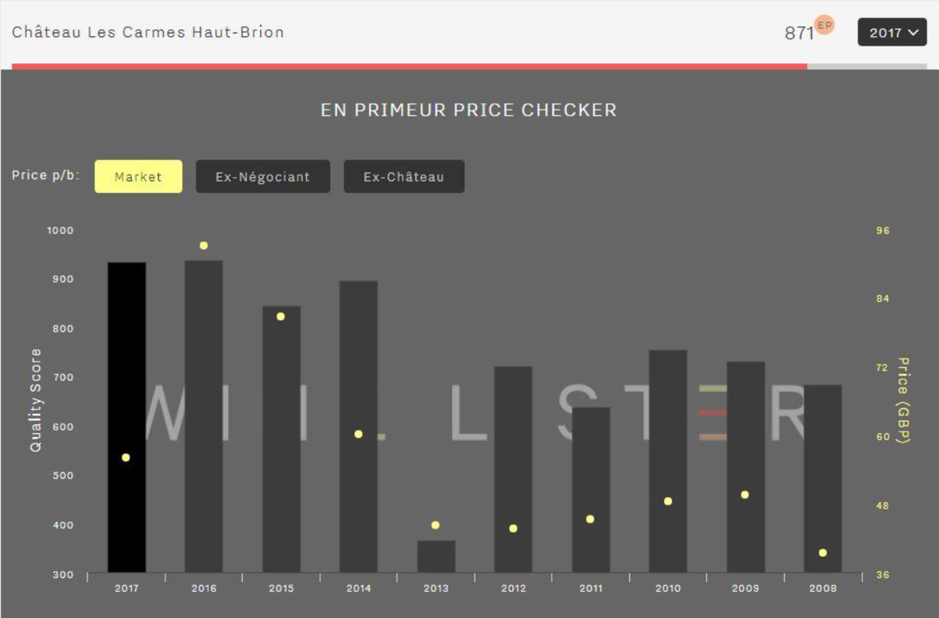

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

Let’s hope that more and more châteaux follow this formula as the campaign continues to unfold next week. The week after that is Vinexpo in Bordeaux, and most big-name releases will begin in earnest from 20th May.

Watch this space for the release of Wine Lister’s Bordeaux Study, Part II, before then.

In June 2018, the idea that Bordeaux had a very good vintage on its hands was laughable. The first half of the year had seen incessant rain in the region. Mildew was rife and vignerons were fighting it all day long, including at weekends (if they could afford to). At Château Corbin, owner Anabelle Cruse cancelled her trip to Vinexpo Hong Kong to be on site to manage treatments. “We couldn’t afford any mistakes after losing nearly all of the 2017 vintage [to frost],” she said.

But then on 18th June, the weather turned, and barely another drop of rain fell until September. 2018 was a year of extremes for Bordeaux. “It started hellish, and finished in ecstasy,” said Sara Lecompte Cuvelier, Managing Director at Léoville-Poyferré. “It started a nightmare and finished a dream,” echoed Guillaume Pouthier, Director at Carmes Haut-Brion.

Against all odds, some truly extraordinary wines were made. “Technically, it’s the most accomplished wine we have made since I joined,” said Nicolas Glumineau, Managing Director of Pichon Comtesse since 2012. Adrien Bernard declared, “the 2018 [red] is the greatest wine my dad has made” – the Bernard family bought Domaine de Chevalier in 1983. But 2018 was not a great vintage across the board like 1982, 1989, or 2010. It wasn’t a vintage where you could make a great wine with your eyes closed. On the contrary, 2018 is a vintage where human choices really mattered, and at the top level, happily, these choices were usually the right ones.

Happy with their 2018s: Guillaume Pouthier, Pierre-Olivier Clouet, and Nicolas Glumineau

Happy with their 2018s: Guillaume Pouthier, Pierre-Olivier Clouet, and Nicolas Glumineau

Concentration in the 2018s is at unprecedented levels: grapes were lost to mildew in the spring, and then the summer drought left remaining berries very small, without much juice. Picking dates were key: the temptation to leave the grapes hanging in the Indian summer was strong, but success in 2018 was all about retaining freshness to counter the high levels of alcohol and tannin.

Even those who picked early were still facing unknown territory. Many producers recounted the topsy turvy ratio of marc to juice in the vats (more skins and pips than liquid). As a result, tannin levels were off the scale, with IPTs (Indice de Polyphénols Totaux) at their highest ever recorded for many producers. At Lynch-Bages, Technical Director Nicolas Labenne explained that, “a normal IPT would be 70, a good year is 80, and we’re at 95 in 2018.”

“But it’s the quality of the tannins that’s important,” Pouthier reminded us. This colossal potential needed taming by the winemakers if they were to make gentle giants, and not monsters in 2018. “This was a year where you couldn’t go into the cellar and say, ‘well every year I do it like this so I’ll do the same’,” said Lillian Barton. “You had to be careful with the extraction,” she explained.

During our tastings last week, producers of the best wines explained their use of more gentle, less frequent extraction, and vinification at lower temperatures than normal. At Petrus, winemaker Olivier Berrouet explained that, “In a hot vintage it’s tempting to go further, but we wanted to keep delicacy; we let the wine infuse like tea.” He was not the only one to talk about “infusion”, some châteaux foregoing altogether the use of extraction techniques such as pumping over and punching down. This allowed subtler winemakers to achieve silky, creamy tannins that melt in the mouth, while retaining all the generous flavours from the uniquely concentrated grapes.

The 2018 vintage really is one of a kind. “It’s impossible to compare it to another vintage other than to say 2016 plus plus,” offered Pierre Graffeuille, Managing Director at Léoville Las Cases, because it has “more of everything.” More alcohol, more tannin, more flavour, but also in the best examples (and there are many), more freshness and more silkiness (some of which have been highlighted in Wine Lister’s 2018 tasting favourites). So if you believe that more is more, this is a vintage for you. Just beware that some wines have all the beast and none of the beauty.

In part II of this en primeur round-up we will look at production volumes before considering the upcoming campaign – its context, as well as likely timing and pricing. Watch this space.

Part I of our annual Bordeaux study is available here, and part II will be released to subscribers in May. Follow us on Twitter for the 2018 Bordeaux en primeur release updates, or for real-time analysis enquire here about subscription to Wine Lister Pro.

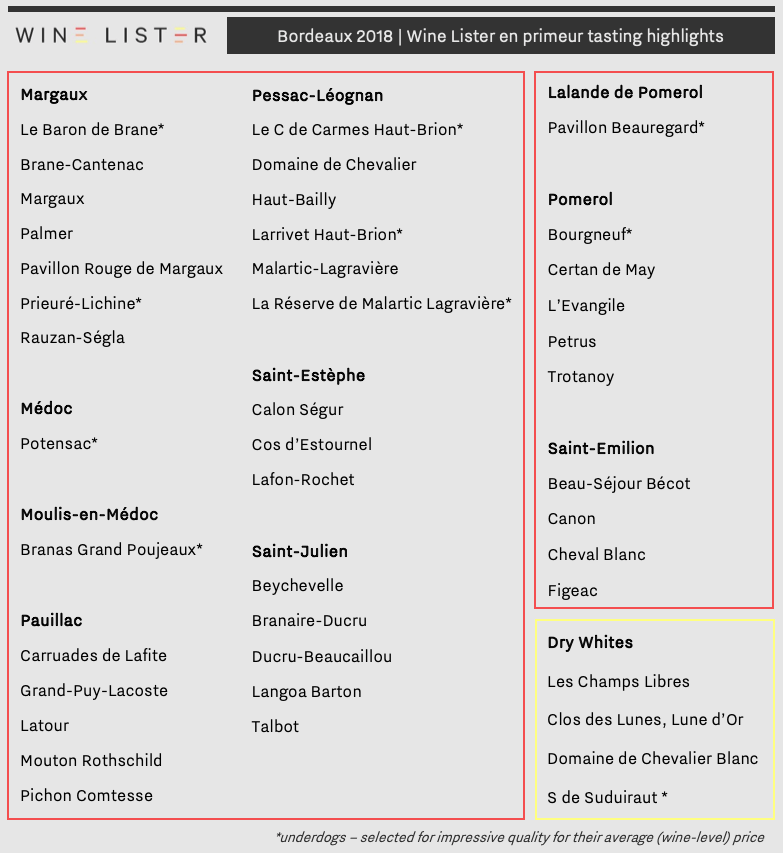

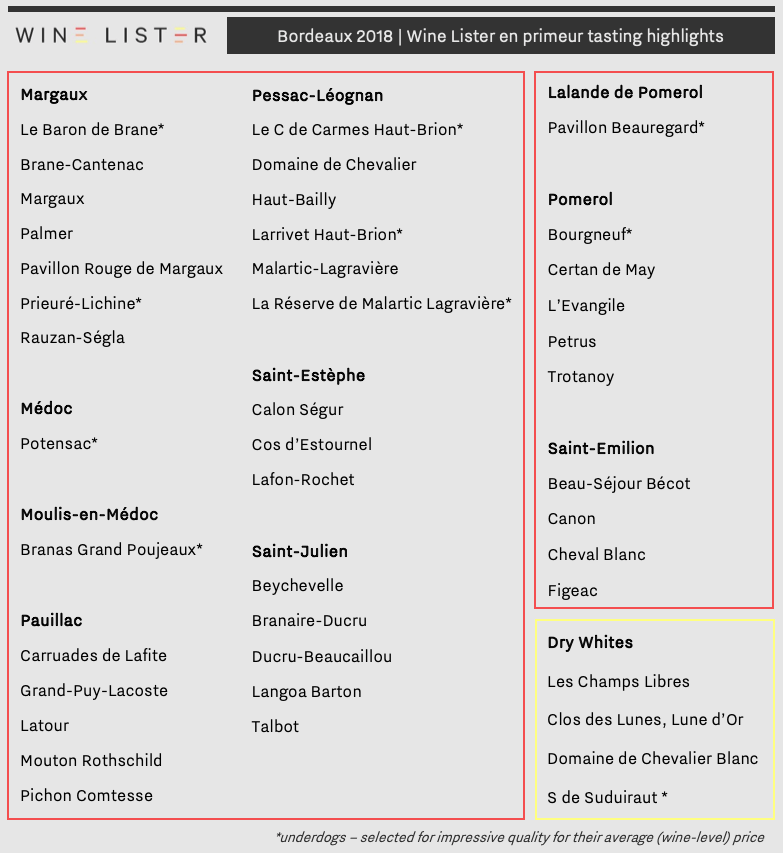

Last week, members of the Wine Lister team were in Bordeaux tasting hundreds of Bordeaux 2018s en primeur. Our full report of the 2018 vintage (similar to last year’s article on 2017) will be out soon, and in the meantime we examine below some 2018 tasting highlights.

Quality across the wines we tasted is extremely high. We have selected 42 highlights, including 10 underdogs – those wines we felt surpassed our quality expectations.

The Wine Lister team found beautiful wines in all the left bank appellations. Margaux and Pessac-Léognan appeared the most consistent for high quality, earning seven and six highlights respectively. These two appellations are home to five of Wine Lister’s 10 underdogs of 2018 en primeur tastings.

The former includes its first-growth namesake, Château Margaux, which was precise, addictive, and harmonious. Pavillon Rouge de Margaux also made the cut thanks to its intriguing and soft fruit character. Brane-Cantenac is becoming a Wine Lister staple after appearing in both 2016 and 2009 tasting highlights. Its 2018 was pure, fresh, and a perfect balance between power and finesse.

In Pessac-Léognan, Domaine de Chevalier had piercing intensity balanced with a floral softness, while Haut-Bailly impressed with a playful fruit character and velvet texture.

Elsewhere on the left bank, Branas Grand Poujeaux surprised with its classy, energetic, dark fruit. Pauillac produced examples of intense fruit handled with a delicate touch (Grand-Puy-Lacoste and Pichon Comtesse). Saint-Estèphe presented beguiling wines with great freshness and elegance (Cos d’Estournel). Saint-Julien showed depth of flavour and complexity in equal measure (Langoa Barton, Ducru-Beaucaillou).

The right bank was just as impressive, with an equal proportion of highlights for Wine Lister as the left (in each case, 19% of wines tasted made the cut). These include one underdog (and new discovery for Wine Lister) from Lalande de Pomerol, five stand-outs from Pomerol, and four from Saint-Émilion.

In Pomerol, Petrus was alluring, generous, and floral, while Trotanoy had delicate strength and never-ending energy. Saint-Émilion produced favourites of varying styles, including Cheval Blanc – a magical, mesmerising boudoir-style wine, and Canon – dancing, racy, and fresh.

Readers should note that these 42 wines are some of the team’s favourites from last week’s tastings, but that we will be releasing official Wine Lister Buys throughout the campaign as prices become known. WL Buys take into account a wine’s quality (based on our partner critics’ scores, which we look forward to adding as soon as they are released), and value within the vintage and appellation, as well as Wine Lister’s personal opinion based on our own tastings and market insights.

Trade members wishing to gain full access to Wine Lister’s en primeur campaign coverage will need to subscribe to Wine Lister Pro. Register your interest here.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew. An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago. A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release). Happy with their 2018s: Guillaume Pouthier, Pierre-Olivier Clouet, and Nicolas Glumineau

Happy with their 2018s: Guillaume Pouthier, Pierre-Olivier Clouet, and Nicolas Glumineau