With the Burgundy 2016 campaign underway, our first blog of the new year sheds some light on an all too often complex region. In our inaugural Burgundy study, Wine Lister reveals some key findings. Read on to find out more or click here to access the full study (non-subscribers can see a preview of the study here).

Price: the unstoppable force?

While the region’s Brand scores are no match for Bordeaux, Burgundy’s supply and demand dynamic(emphasised by a five-year stock shortage) and high quality are driving prices ever skywards. The majority of top Burgundy wines cost between £100 and £500 a bottle, with 18 wines costing more than £2000 per bottle.

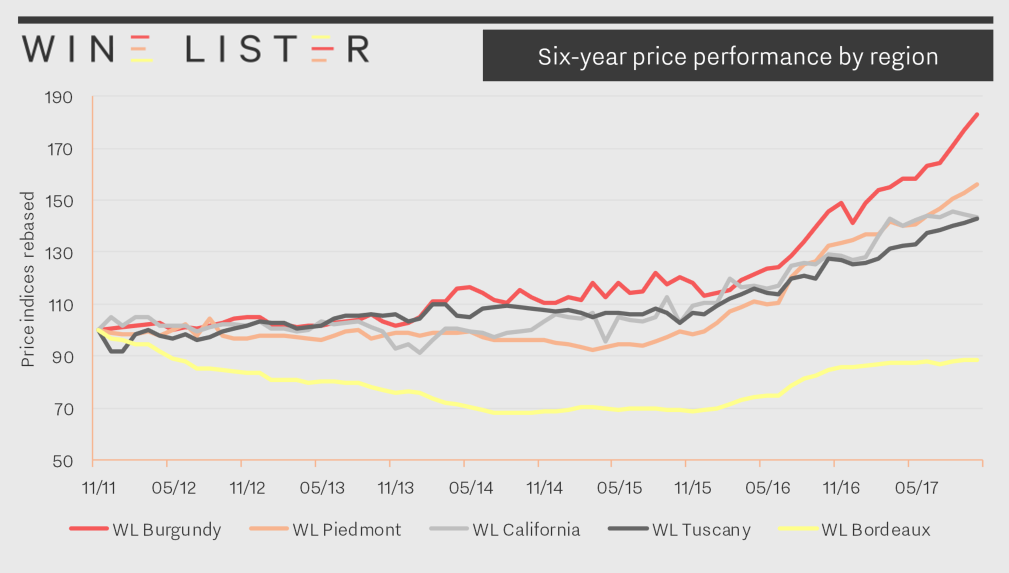

Among the impressive Economics scores (994 being the highest) it is no surprise that producers such as Domaine de la Romanée-Conti (DRC) and Domaine Leroy hold many of the top spots (note that the only whites to enter into the Top 25 for Economics are from Coche-Dury). However, the region as a whole rises above the rest on price performance. Burgundy‘s prices have risen more quickly than any other top fine wine region and show no sign of decelerating.

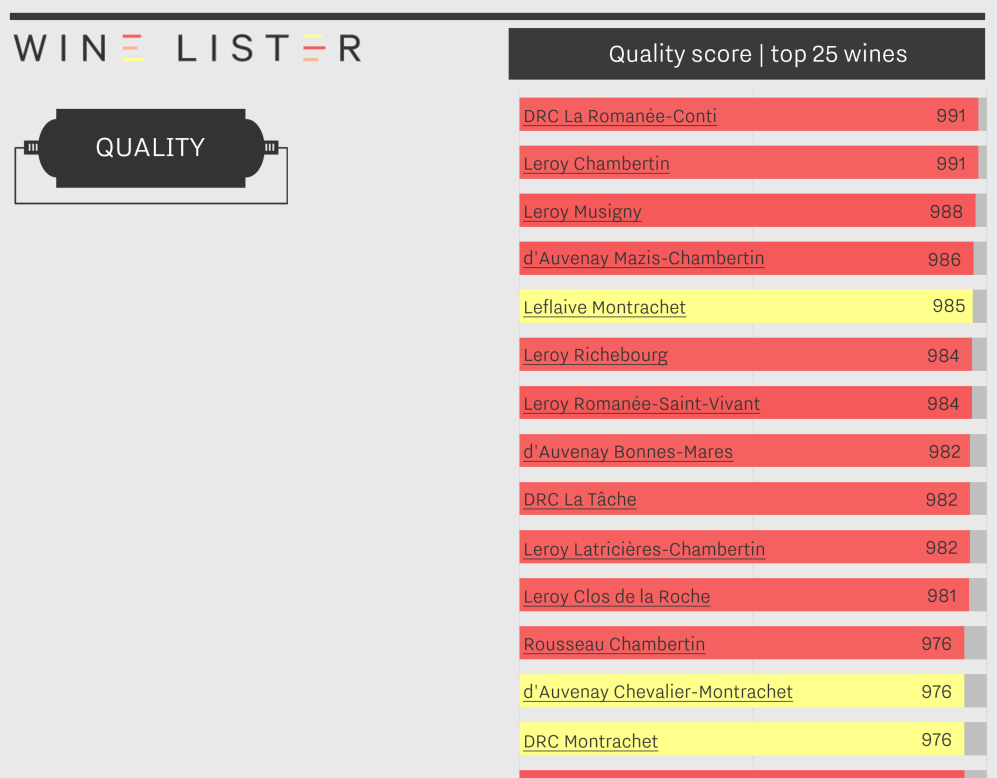

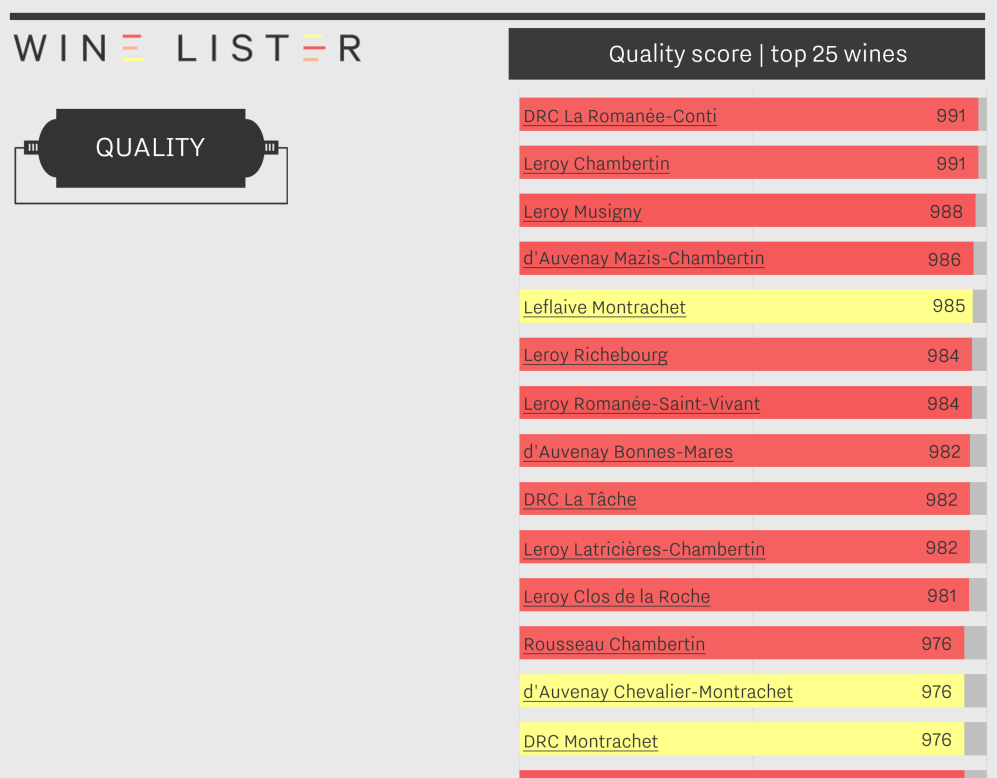

Quality: the clear winners

Indeed, DRC and Domaine Leroy consistently top the charts across all Wine Lister scores. However, Lalou Bize-Leroy is Quality queen, with 11 wines in the Quality top 25 between Leroy and d’Auvenay.

DRC and Armand Rousseau stand out as being the only two producers to gain the trade’s full confidence. Our Founding Members give the domaines a confidence rating of 10/10 (no Bordeaux chateau scores above 9/10).

Trends: what the future holds for Burgundy

Further insight from Wine Lister’s 52 Founding Members (key global fine wine trade figures)includes growth trends for Burgundy.

One commonality throughout the trade was the noticeable rise in the popularity of Saint-Aubin (Burgundy is the region home to more “rising star” producers than any other fine wine region). Other observations included a general shift towards higher quality and greater purity in winemaking style, as well as less sulphur and more whole bunch fermentation.

Subscribers can read the full study here. Non-subscribers can access a preview of the full version or subscribe here.

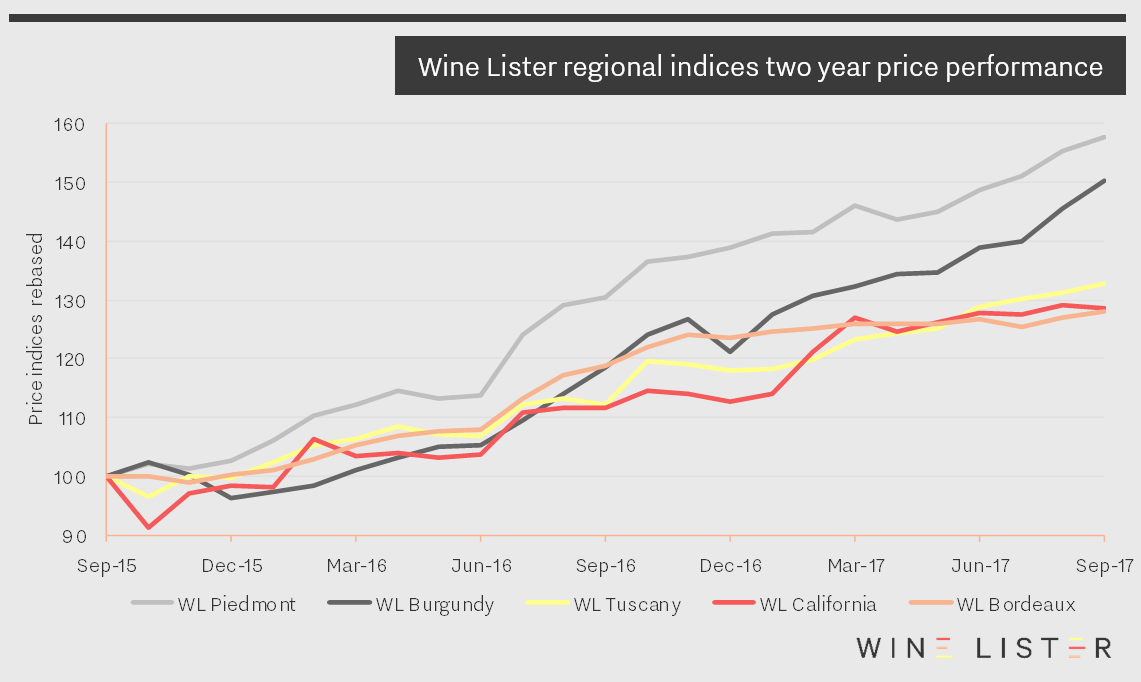

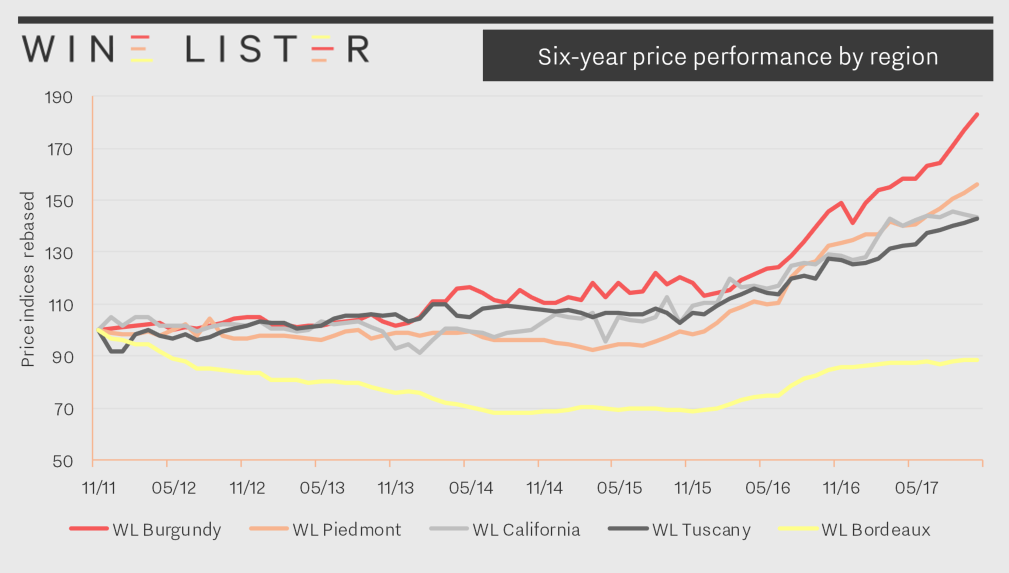

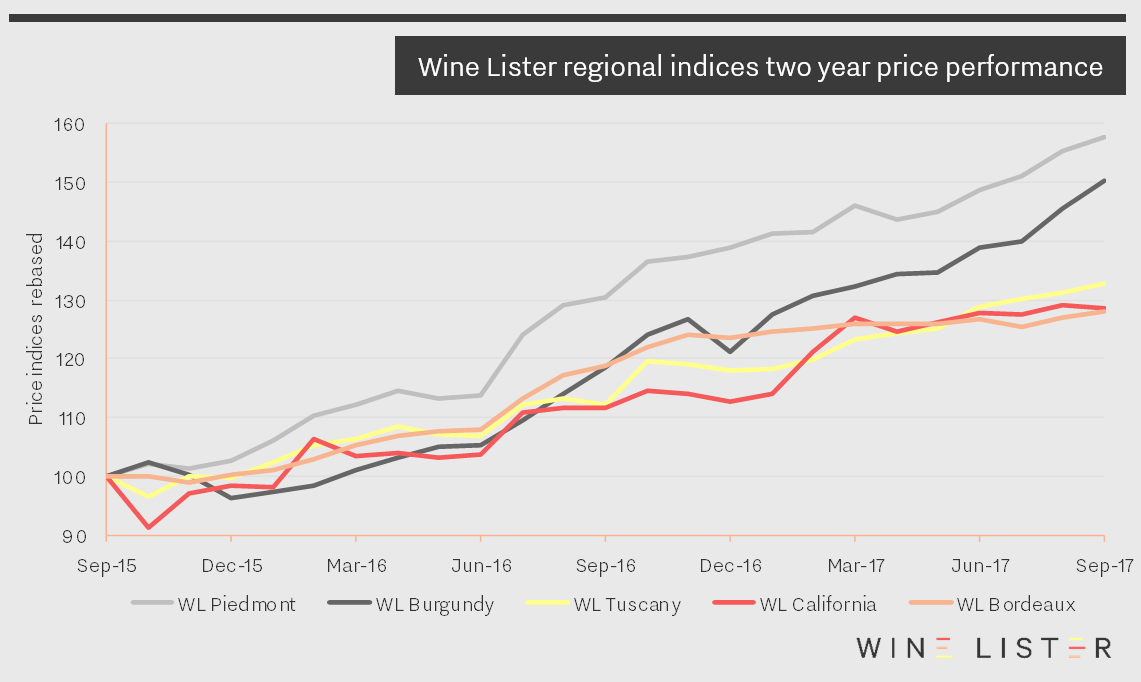

In this blog we look at the price performance of five major fine wine regions over the past two years. Wine Lister’s regional indices use price data from Wine Owners, and each comprises the top five brands in its respective region (according to the Wine Lister Brand score).

In Bordeaux, for example, the top five strongest brands (measured by looking at restaurant presence and online search frequency), are the five first growths, Haut-Brion, Lafite, Latour, Margaux, and Mouton. Posting gains of 28% over two years, and largely stagnating over the last year, the Wine Lister Bordeaux index is the worst performer of the five wine price indices shown below.

Piedmont, meanwhile, has enjoyed a remarkable couple of years. Not only has its index grown by an astonishing 58% over the period, it has also been very consistent, experiencing just three months of negative growth – November 2015, May 2016, and April 2017. Sustained high growth rates suggest a region in demand. The Wine Lister Piedmont index consists of two wines from Gaja – Barbaresco and Sperss (now labelled as a Barolo again after several years of declassification to Langhe Nebbiolo), two Barolos from Conterno – the Monfortino and the Cascina Francia, and finally Bartolo Mascarello’s Barolo.

Next comes the Burgundy index (consisting entirely of Domaine de la Romanée-Conti wines), which has grown by more than 50% over the past 24 months, but with a few more blips. It decreased in value by 4% in December 2015, only managing to recover in March 2016. In a repeat of this festive dip, the index dropped over 5% in December 2016, but recovered the losses in just one month on this occasion. It has started to close the gap on Piedmont over recent months, adding over 15% since May.

Tuscany and California* made similar gains to Bordeaux over the period – up 33% and 29% respectively. The Tuscany index has progressed fairly serenely over the past two years, thanks to its liquid Super Tuscan components. Meanwhile the prices of California’s top wines have been less consistent, enduring a fall of nearly 9% in October 2015, recovering with a dramatic 8% rise in February 2016. This year, having enjoyed strong gains during February and March, their growth rate has since cooled off, adding just 1.5% over the past six months.

*As you will know, California has suffered tragic wildfires in recent weeks. Wine Lister’s partner critic, Vinous, is donating to relevant charities the profits from all maps purchased before the end of November 2018.

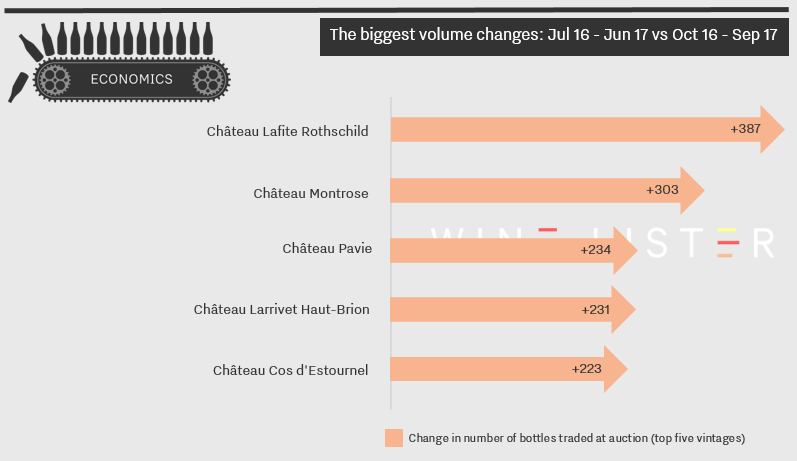

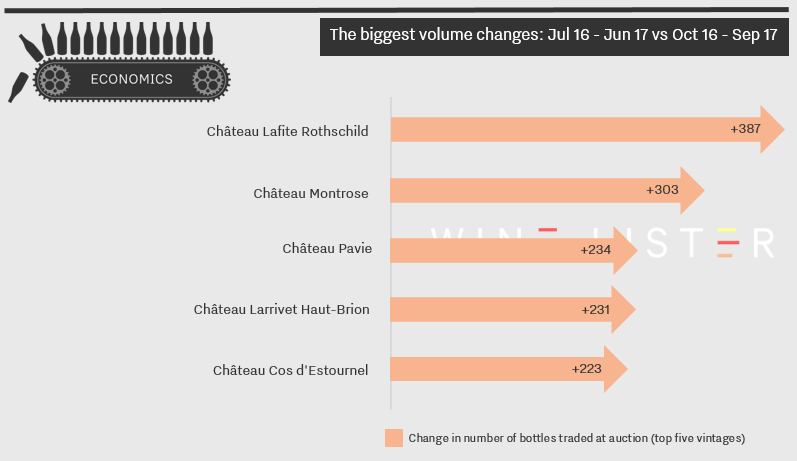

For the second consecutive quarter, the five wines which saw trading volumes rise most were all from Bordeaux. Four of the wines below are big hitters, with overall Wine Lister scores ranging from 921 (Château Montrose) to 963 (Château Lafite Rothschild).

These top crus are also mainstays at global fine wine auctions, with over 2,000 bottles of the top five traded vintages of each wine selling at auction every year, and over 5,000 for Lafite. So, while auction trading volumes – a measure of liquidity – feed into a wine’s Economics score, none of the four has seen a significant enough increase to find their Economics score significantly changed.

There is one anomaly. Château Larrivet Haut-Brion has an average price of £23 per bottle, and from the period of July 2016 until June 2017 its top five vintages sold only 103 bottles at auction. At the end of last month, however, 228 bottles of the wine’s 2000 vintage were sold at a Bonham’s auction, making the wine the most popular of the day. The update to Larrivet Haut-Brion’s trading volumes has had a strong impact on its Economics score, which has risen from 567 to 667, and boosted its overall Wine Lister score from 663 to 684.

We calculate which wines have seen the greatest incremental increases in bottles traded by using figures collated by Wine Market Journal from sales at the world’s major auction houses.

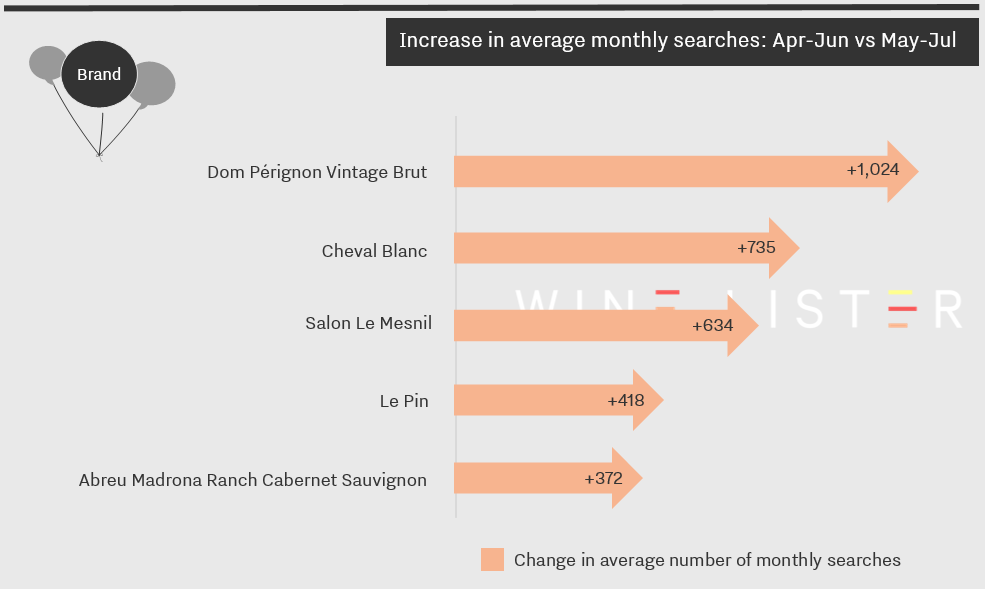

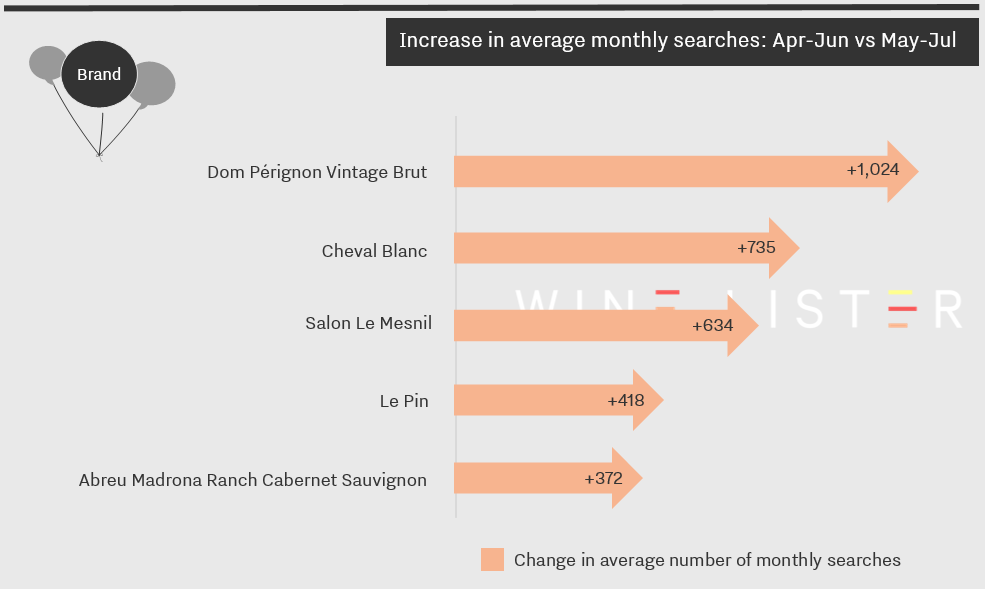

The latest search frequency data is in from Wine-Searcher, and with it we can see which wines enjoyed the greatest popularity gains during July. After the en primeur campaign fuelled the big surges of May and June, July’s top five gainers witnessed more modest gains. There is also more variety this month, with two Champagnes and a Napa joining two Bordeaux right bank heavyweights.

Experiencing the greatest increase in popularity during July was Dom Pérignon Vintage Brut – particularly impressive considering it started from an already extraordinarily strong average of over 54,000 searches each month.

Next came Cheval Blanc, whose 2016 vintage was released in early June, before July saw the release of Salon Le Mesnil 2006. Described by Wine Lister partner critic Antonio Galloni as an “utterly compelling Champagne to follow over the next several decades”, its rise in online popularity suggests that consumers have already started to track its progress.

The last two wines are both produced on very small scales. Le Pin, notoriously rare, released its 2016 vintage in late June, which likely contributed to its increase in online popularity, at least among those lucky few with both an allocation and requisite funds. About 6,000 bottles of Napa Valley’s Abreu Madrona Ranch Cabernet Sauvignon are produced each year. As we saw in our recent post on California’s most expensive wines, production levels play a big role in the region’s prices. Perhaps the rarity of Abreu Madrona, the region’s eighth most expensive wine, is helping to boost its caché.

Wine Lister is one year old already (we launched in May 2016). To mark our first birthday, we thought we’d take a quick look back at how we’ve grown and developed in the last year.

First, our website has evolved non-stop! As well as bringing you a full, 360° view of thousands of individual wines, we’ve introduced lots of new features to make it easier for you to analyse and compare them. One of these is our wine comparison tool, enabling you to view wines side-by-side: simply search for the wine you’re interested in, and click the Compare button.

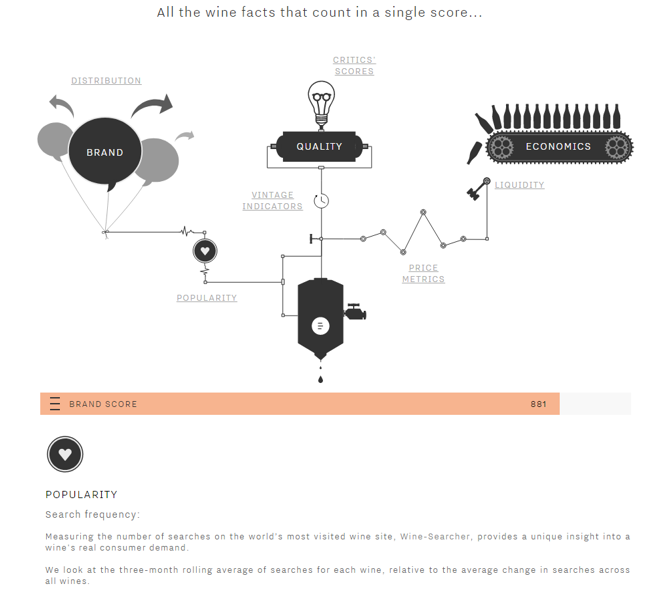

As a birthday treat, we’ve just revamped our home page, and, by popular demand, launched a how it works page, with explanations on the criteria that feed into our three main categories – Quality, Brand and Economics – to arrive at a single wine score using our full 1,000 point scale.

For companies wanting seamlessly to access our proprietary scores and data for publication on their own platforms, we’ve built a dedicated Wine Lister API. To express your interest in accessing our data via this feed, please enroll here.

On the analysis side, we established the Wine Lister blog to bring you proprietary research on fine wine trends, new releases, and exclusive wine trade observations. Plus, you can visit the analysis page of our website to find our popular, highly-visual wine factsheets, alongside in-depth regional reports – the latest of which is Wine Lister’s second annual study on Bordeaux.

Finally, our team has also multiplied, now counting seven members in total, including new colleagues in Bordeaux and Tuscany in addition to our core UK-based team.

Thank you to all of our subscribers and readers for your continued support, and we look forward to updating you with how we evolve in the twelve months to come! If you have any comments or suggestions, please email team@wine-lister.com.

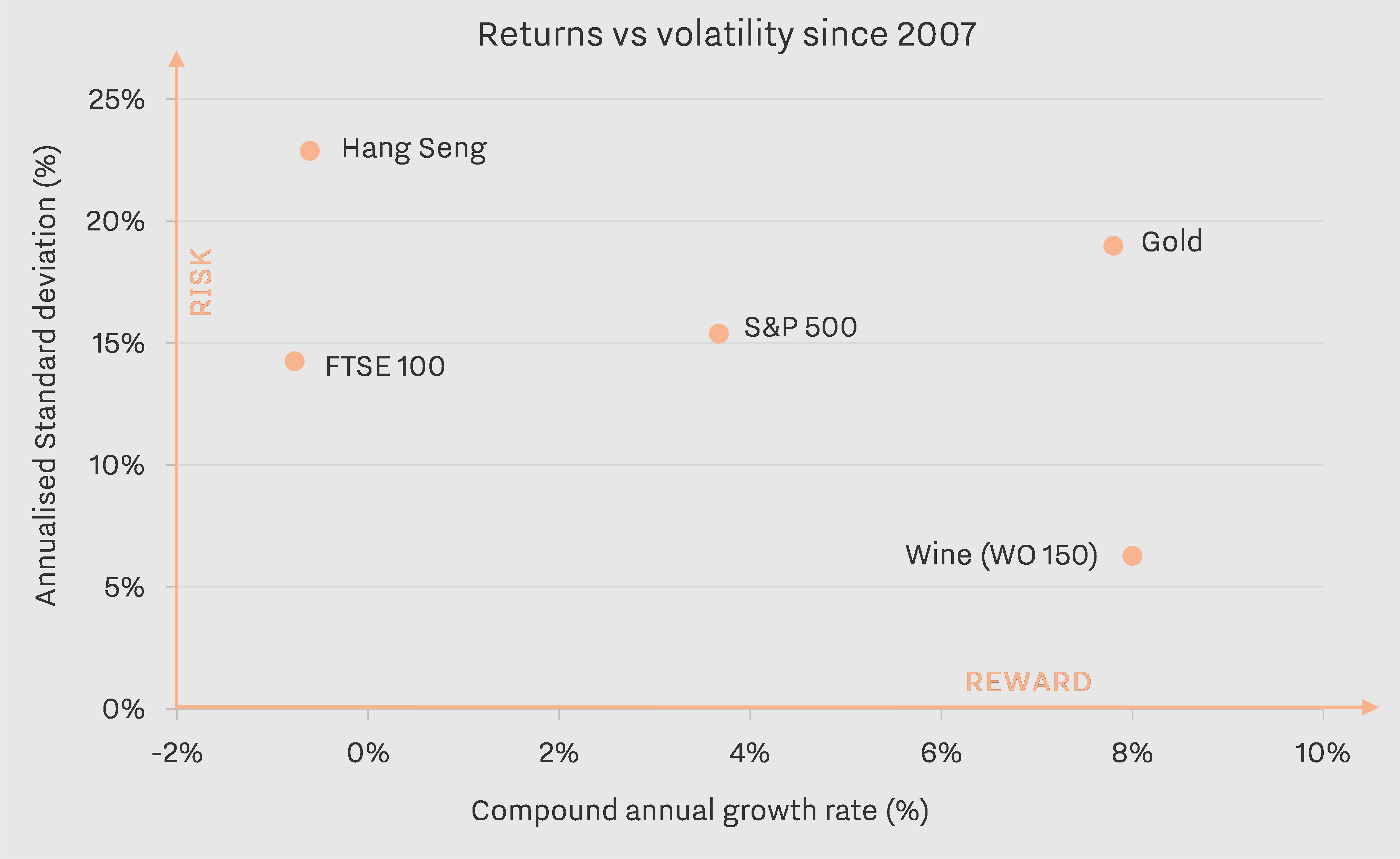

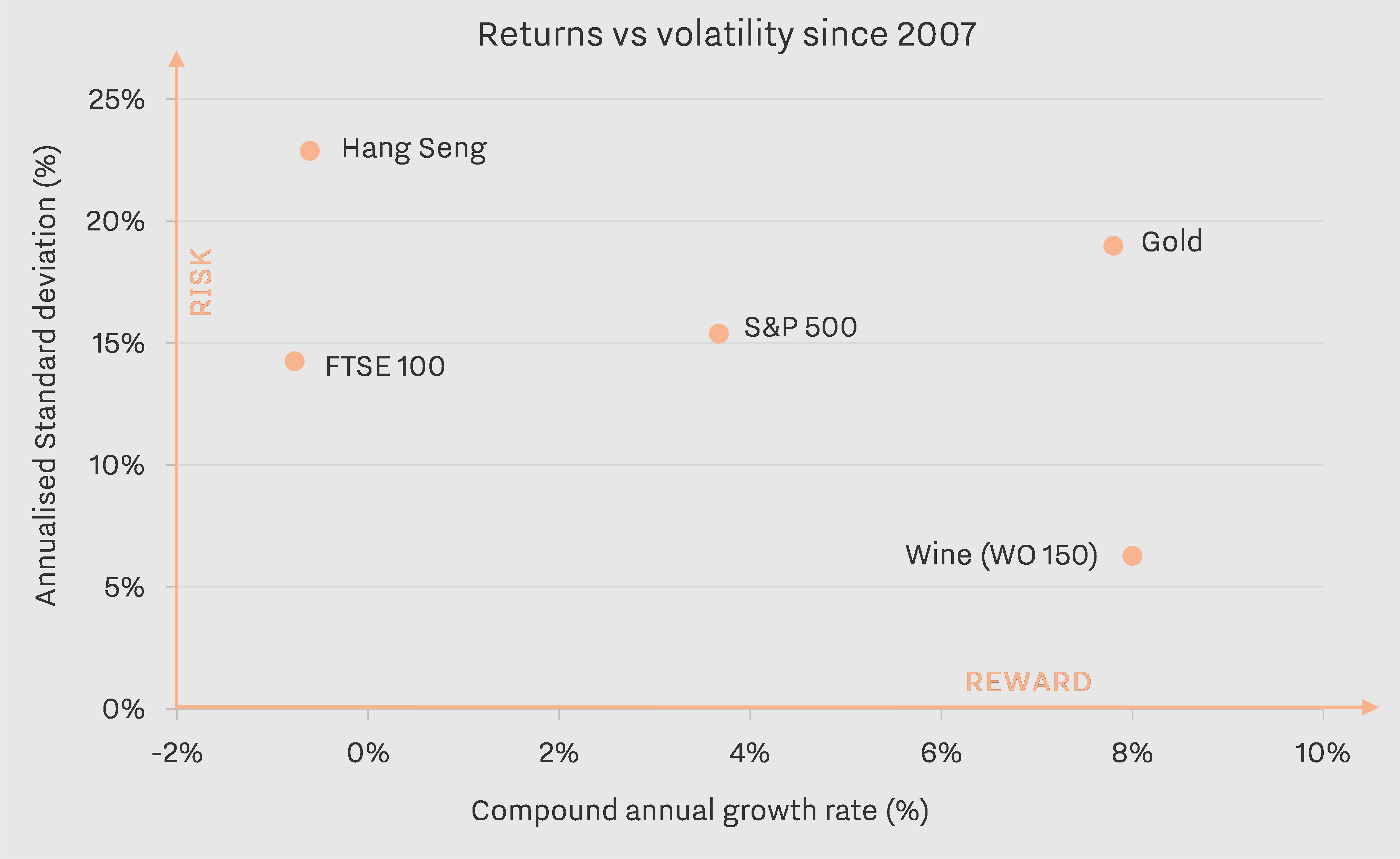

In a new climate of Brexit-induced uncertainty, with volatile fund performance and some economists forecasting recession, can fine wine offer some shelter? Research has consistently shown that wine has weak correlation with traditional financial assets, and can therefore be a useful diversification tool. Moreover, returns have been attractive historically, and less risky.

Attractive growth

The graph above shows returns since June 2007 for fine wine, gold, and three major stock indices. In spite of the fine wine bubble bursting in the summer of 2011, wine has produced the best annual returns over this period, at 8%.

Note that for this analysis we have used our price data partner’s Wine Owners 150 index, which contains a range of wines from different regions and at different price points. This further underlines the wisdom of diversification at every step – a wine portfolio made up solely of Bordeaux first growths would not yet have regained losses suffered in 2011. It should also be noted that the performance of the WO 150 index does not take into account frictional costs associated with fine wine collecting, namely storage, insurance, transportation, and sales commissions.

Low risk

What about the risk profile of fine wine? Despite surpassing the S&P 500, the FTSE 100, and the Hang Seng in terms of return, fine wine displays less volatility. It is also less volatile than gold, while providing similar returns over the nine-year period.

Low correlation

Finally, we ran our own analysis to confirm fine wine’s low correlation with stock markets over the same period – in mathematical terms, the index demonstrates correlation of 0.41, 0.03, and 0.15 with the S&P 500, Hang Seng and FTSE 100 respectively (where 1 is complete correlation, and -1 denotes mirror opposites). Fine wine behaves similarly to gold, often viewed as a refuge value in times of financial turmoil – the two show correlation of 0.8.

To take the plunge?

Fine wine seems to possess at least three characteristics making it a viable – and even attractive – alternative asset; a safe haven in tumultuous times. Independently of Brexit-fuelled uncertainty, now might be an opportune time to buy into wine, as it has shown steady – but not bubble-inducing growth since the beginning of 2016.

As a non-mainstream and (ironically) illiquid asset class, fine wine should only ever make up a small proportion of any investment portfolio. And, of course, it is a multi-faceted, non-fungible asset, ultimately made for drinking and enjoying, so we recommend that any notion of investing in wine always be secondary to its primary appeal, and undertaken with expert advice!

See Wine Lister’s Investment Staples and filter by geography, price, score and more.

For more information on a specific wine – relating to quality, brand, and economics – click on any wine and open out the category bars.

Disclaimer: the opinions expressed in this post or elsewhere on the Wine Lister website do not constitute investment advice.

Which producers will see the largest gain in brand recognition in the next two years? That is one of the many questions we asked in a unique survey of our 42 Founding Members – the majority of the world’s largest merchants, top international wine auctioneers, and several high-end retailers, together representing well over one third of global fine wine revenues.

The chart above shows the top 10 brands expected by Founding Members to see their brand recognition increase in the next two years. Unsurprisingly, Burgundy takes the lead, making up six of the ten places. The trade’s picks included rising stars such as Arnaud Ente and Jean-Marc Roulot. Wine Lister’s Founding Members also believe that superstars such as Armand Rousseau will grow even further in brand recognition.

Penfolds also already possesses a brand so strong it is hard to comprehend how it will grow much further, as the trade predict it will. The appearance of three Bordeaux wines also comes as a surpise, given the preeminent position already occupied by brand Bordeaux in the fine wine market. Our Founding Members see room for burgeoning brand power for Châteaux Figeac, Haut-Brion, and Lynch-Bages. Why?

Figeac is causing a stir and is widely held to be on the path to regaining greatness. Haut-Brion is perhaps viewed as having less renown relative to its fellow first growths in the Médoc, in spite of Samuel Pepys fame (“a good and most particular taste”). However, Lynch-Bages is already so many leagues ahead of its peers in terms of brand recognition (check out its impressive distribution in top restaurants and online search frequency on the site), that it’s hard to see where it can go next. Have our Founding Members got it right?

To access more findings from our Founding Member survey, read the complete study, “Bordeaux – Reasons to Hope“. If you are not a subscriber yet, why not try a 14-day free trial!

As the en primeur campaign drew to a close on Tuesday with the release of Cheval Blanc, we take a look back at pricing – first, a basic “how-to” template, and then an example of two châteaux that got it right.

In the chart above, taken from our study “Bordeaux – Reasons to Hope“, we compare the average quality scores from the last seven vintages to the current market price for those vintages (looking at 97 top Bordeaux crus). The closest quality rating to 2015 for this sample is 2010. As such, we applied the quality to price ratio from 2010, in order to arrive at a derived future market price of £169 for the 2015 vintage on average, according to its current quality assessment. Next we have applied négociant and importer margins of around 25-30%, and a discount to the consumer of between 10-20% for buying en primeur. This would imply an average ex-château release price between £98 and £110.

Some releases in the 2015 en primeur campaign failed to follow this logic, with prices that leave little or no upside for the end-buyer, and these wines have been difficult for the négociants to sell on. However, several châteaux made en primeur work for everyone concerned this year.

One was Château Canon, for which 2015, which at 965 has the highest Wine Lister quality score since 1964 (988), performing well over its average quality level of the last decade. Despite such an exceptional quality, it was released 26% cheaper than the current market price for the 2009, the vintage closest to 2015 in terms of quality in recent history (well below at 885).

Among other châteaux experiencing successful campaigns, we also find Château Beychevelle, whose release price for the 2015, with a quality score of 910, was 38% below the current market price for the 2005, the closest vintage for quality in recent history, scoring 864 for quality.

For more detailed insights, have a look at the complete report. If you are not a subscriber yet, it takes seconds to sign up for a 14-day free trial.