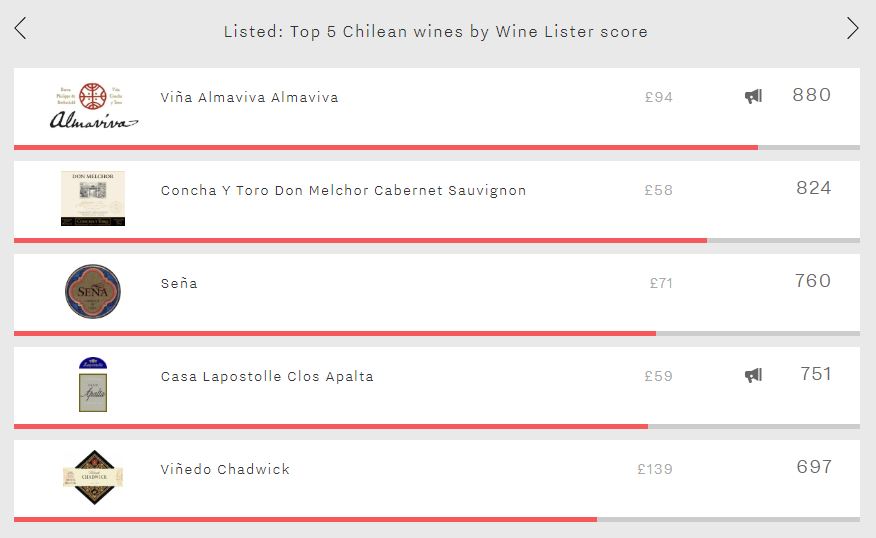

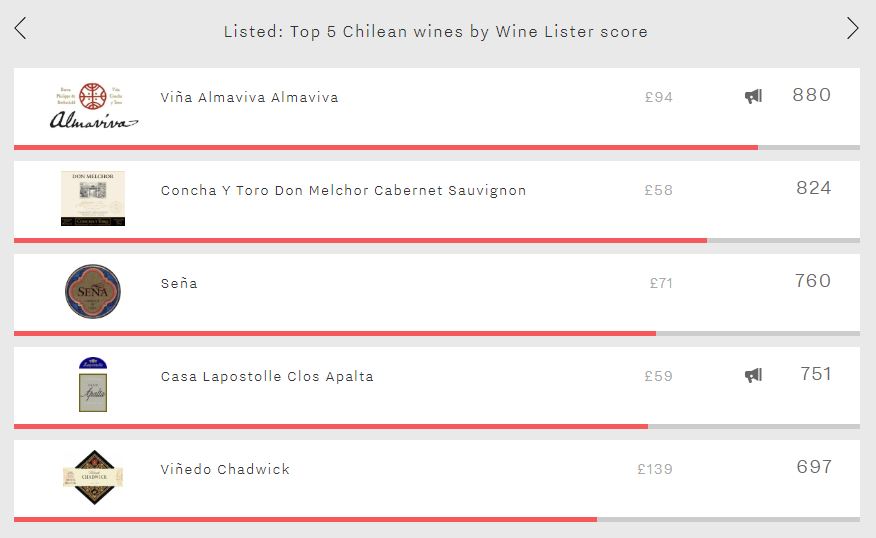

Taking inspiration and occasionally investment from Bordeaux’s most prestigious châteaux, Chile’s leading producers have, over a relatively short timeframe, become serious contenders in the fine wine market. Having had the opportunity to carefully select their sites, and benefitting from a more consistent climate than their Old World counterparts, Chile’s foremost wines continue to go from strength to strength. This week, we consider the overall top-scoring wines from the long sliver of land that has the cool Pacific on one side and the vertiginous Andes on the other.

Leading the way is Almaviva (880). One of two Chilean Buzz Brands, this joint project between Baron Philippe de Rothschild and Concha y Toro achieves Chile’s strongest Brand score (917), the result of not only featuring in more of the world’s top restaurants but also being twice as popular as any other Chilean wine. Surely Almaviva’s association with Mouton has played a significant role in its ability to build its brand to such a level over a short period of time – its first vintage was in 1998. It also manages Chile’s highest Economics score (787) – still ranking it within the “very strong” segment of Wine Lister’s 1,000-point scale, but indicating that it is the area in which Chilean wines currently struggle to compete with their Old World counterparts.

Further proof that economic success is the department in which Chile’s best wines have the most room to improve, Chadwick achieves the country’s best Quality score (904), yet only manages a score of 295 in the Economics category. This modest score is due to a combination of negative price performance over the past six months and a failure to trade a single bottle at auction over the past year, resulting in Chadwick slipping down to fifth place overall (697).

Don Melchor is Chile’s second-best wine (824) – completing a one-two for the Concha y Toro stable. It earns its second place thanks to consistency across each of Wine Lister’s three rating categories, finishing third in the Quality and Brand categories (872 and 853 respectively), and achieving Chile’s second-best Economics score (662). It is, however, considered Chile’s most ageworthy wine, with an average predicted drinking window of 11 years, 30% longer than any other Chilean wine.

The two remaining spots are filled by Seña – the second wine from the Errazuriz stable (alongside Chadwick) – and Casa Lapostolle Clos Apalta, with scores of 760 and 751 respectively. They present contrasting profiles, Clos Apalta achieving a better Quality score (829 vs 811) and Brand score (872 vs 770), but experiencing a significantly lower Economics score (364 vs 626).

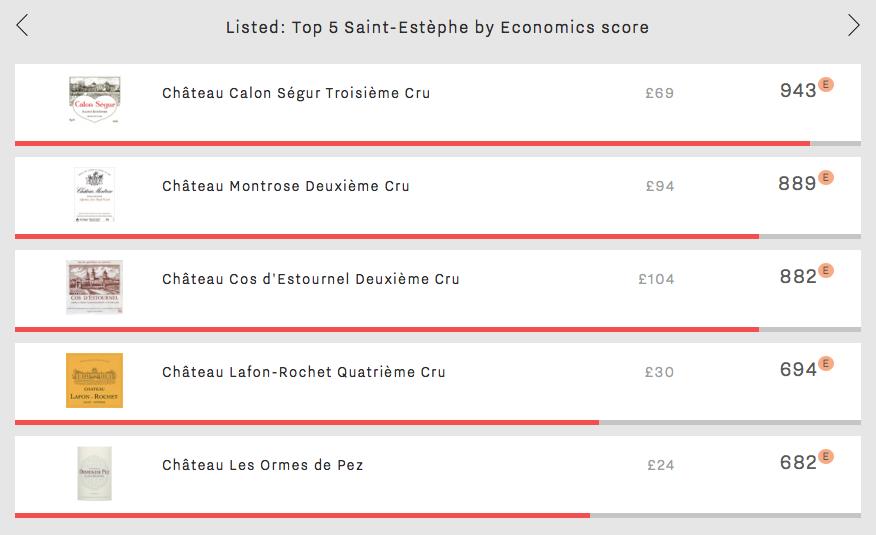

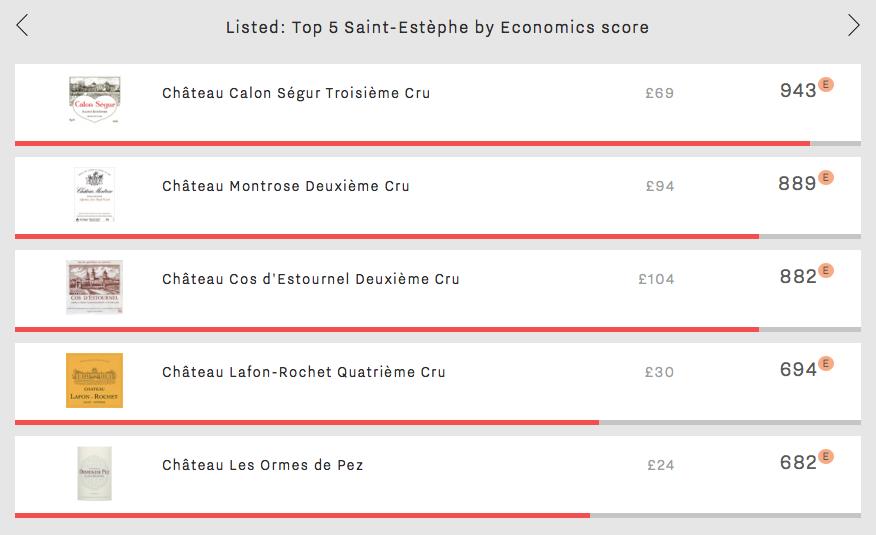

The eyes and ears of the industry are focused on Bordeaux 2017. Price is always a key factor in the commercial success of a fine wine, but never more so than during the annual en primeur period, when release pricing can make or break a wine’s en primeur campaign.

It is therefore timely to take a look at some Bordeaux Economics score successes, this week from Saint-Estèphe. Wine Lister’s Economics score combines five criteria – based on price and volume data – to measure a wine’s commercial success (read more on the Economics score calculation here).

Calon-Ségur has the highest Economics score of all Saint-Estèphe wines (943). Not only does it score 53 points higher than the next wine in its peer group, it is also the number one third growth for Economics score, sitting in eleventh place for Economics of all Bordeaux wines. This is particularly impressive, considering that the average price per bottle of those ranking in the top 10 is £614, nine times higher than Calon-Ségur’s comparatively modest average price tag of £69 (read more about Calon-Ségur’s pricing in the en primeur: part II blog).

The number two Economics score in Saint-Estèphe is held by Montrose (889). It has the highest average Quality score of the five (936) and an average wine life of 15 years. Its steady price growth over the last two years (30%) makes it one to watch for investment potential.

Cos d’Estournel is the most expensive Saint-Estèphe wine at £104 per bottle. Though it comes in third place for Economics, it has the best Saint-Estèphe Brand score of 996, thanks to presence in 52% of the world’s best restaurants and over 23,000 online monthly searches. Its popularity is also clear from its position as the most traded of the five at auction (calculated using data from one of our partners, The Wine Market Journal).

Lafon-Rochet and Les Ormes de Pez take fourth and fifth places, with Economics scores of 694 and 682 respectively. Both are a level below the top three in terms of price per bottle and Quality score, but they match Montrose on long term price performance, with compound annual growth rates (CAGR) of 9%. Saint-Estèphe is an appellation on the rise.

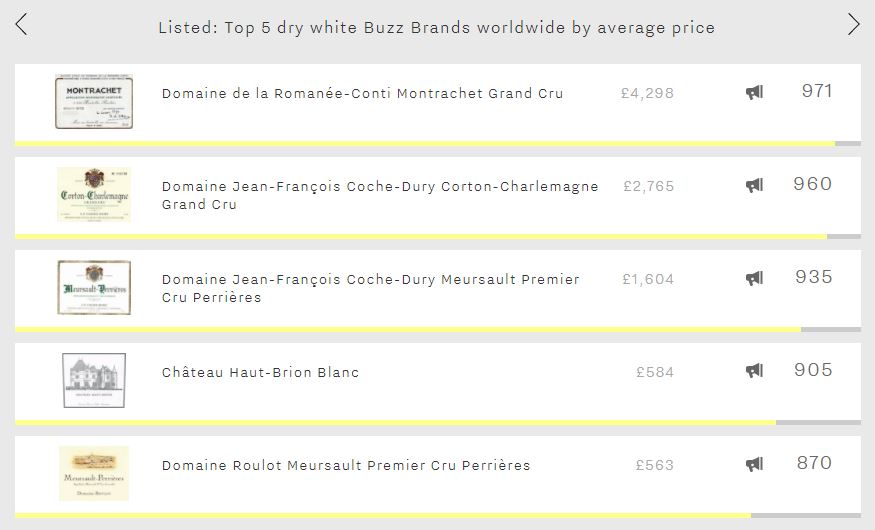

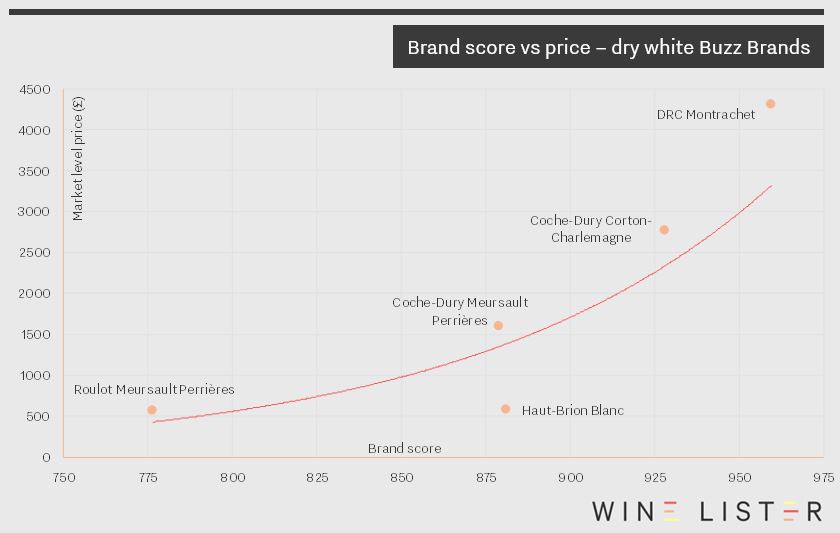

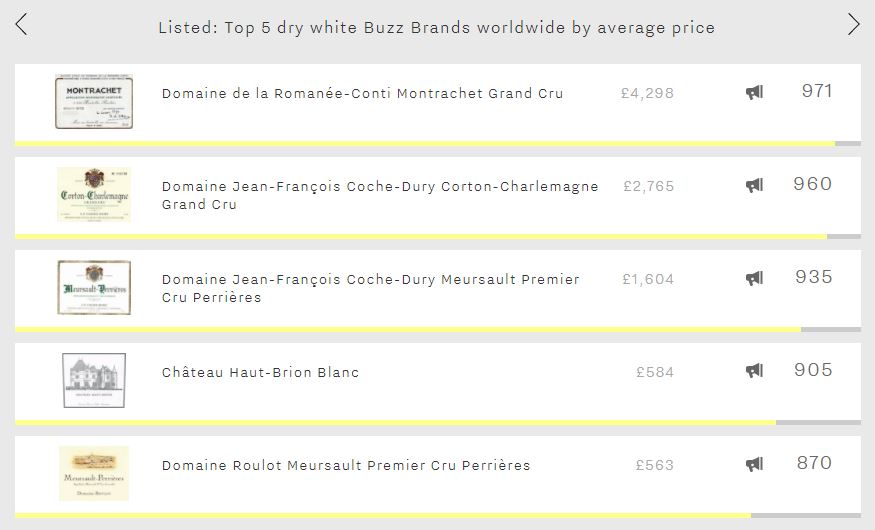

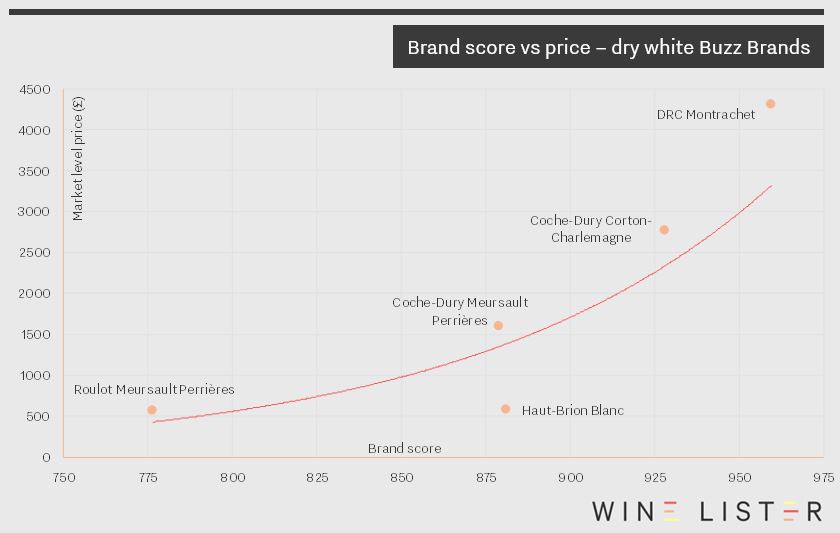

“Buzz Brands” is one of the four Wine Lister Indicators developed to help our users identify wines for different scenarios. A Buzz Brand is a wine with strong distribution in the world’s top restaurants, enjoying high levels of online search frequency or demonstrating a recent growth in popularity, and identified by the fine wine trade as trending or especially prestigious. As such, you wouldn’t expect them to come cheap, and the five most expensive dry whites definitely don’t, costing around £2,000 on average.

Perhaps unsurprisingly given the miniscule production of its top wines, Burgundy fills four of the five spots (and two of these are from Coche-Dury). DRC Montrachet is the world’s second-most expensive dry white – behind Leflaive’s Montrachet which fails to achieve Buzz Brand status. It achieves the best Quality score of this week’s top five (976), just pipping Coche-Dury’s Corton-Charlemagne to the post (971). It also enjoys the highest Brand score of the group – or any dry white for that matter (960) – the result of appearing in considerably more of the word’s top restaurants than Coche-Dury’s Corton-Charlemagne, which comes second in that criterion (26% vs 19%), and also being nearly 50% more popular than any of the rest of the five.

Whilst Coche-Dury’s Corton-Charlemagne has to settle for second place in the Quality and Brand categories, it not only manages the group’s top Economics score (991), but also the highest of any dry white on Wine Lister. This is thanks to formidable price growth. It has recorded a three-year compound annual growth rate (CAGR) of 25%, and has added 14% to its price over the last six months alone.

It is to be expected that wines from two of Burgundy’s most hallowed grand cru vineyards command the group’s highest prices, but it might come as more of a surprise that two Meursaults from the premier cru Perrières vineyard feature. With over £1,000 separating the considerably more expensive offering from Coche-Dury and Roulot’s expression, it becomes clear that Brand score is a significant driver of price at this rarefied end of the scale, particularly within Burgundy.

Proving that expensive Buzz Brands are not only to be found in Burgundy, Haut-Brion Blanc makes an appearance in the top five. Whilst it is the most liquid of the group – its top five traded vintages have traded 49% more bottles than any other wine in the five – it has experienced by far the lowest growth rates, with a three-year CAGR of 9% compared to the Burgundy quartet’s remarkable average of 22%.

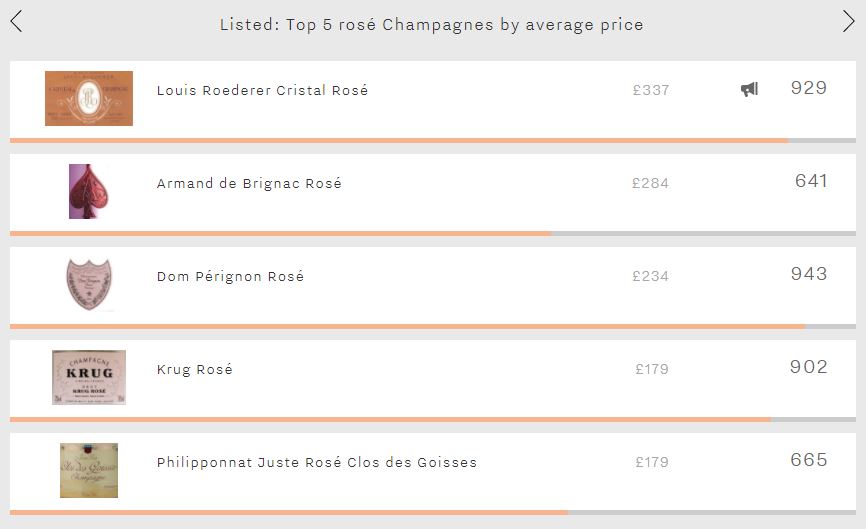

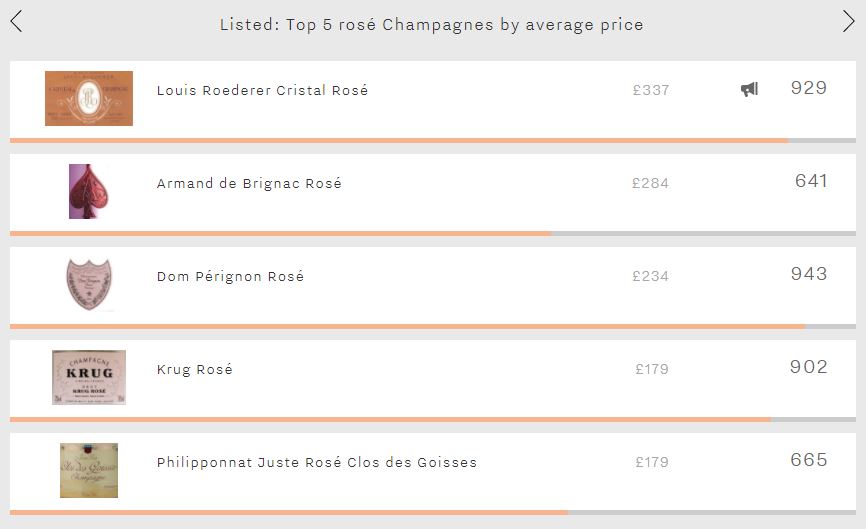

Unintentionally coinciding with today’s International Women’s Day – really, it was a complete accident – this week our Listed section looks at “pink Champagne”, namely the five most expensive rosé Champagnes. We are a bit embarrassed that it looks like we are jumping on the bandwagon and touting the colour pink today. However, as these five contenders show, top rosé Champagne represents a serious vinous offering worthy of any day or occasion.

The world’s most expensive pink Champagne is Louis Roederer’s Cristal Rosé (£337 per bottle). It also achieves the highest Quality score of all rosé Champagnes (972). Whilst it receives excellent scores from each of Wine Lister’s partner critics, it is the outstanding average rating of 97/100 from Antonio Galloni’s Vinous that stands out. Cristal Rosé also pips its white counterpart to the post in the Quality category (972 vs 970), and is over twice as expensive (£337 vs £165 per bottle). However, despite its superior quality, Cristal Rosé trails its white counterpart in the Brand category by 56 points – it features on under half as many of the world’s top wine lists and is searched for 82% less frequently.

The second-most expensive rosé, Armand de Brignac’s offering, is a newcomer to the fine wine world, born in 2006. It experiences the group’s lowest Quality and Economics scores, and second-weakest Brand score. Its high price (£284) can therefore be attributed to its association with Jay-Z. The American rapper featured Armand de Brignac’s white Champagne in the video for “Show Me What You Got” in 2006 – before it even had a US importer – and eventually bought a significant portion of the house in 2014, further aligning the brand with his high-flying lifestyle.

In third place is Dom Pérignon’s rosé (£234). Whilst unable to match the peerless brand recognition of its white counterpart, it does enjoy the best Brand score of any pink Champagne (984). This is thanks to receiving on average 2.5 times as many online searches each month as the second-most popular wine of the five (Cristal Rosé).

The last two spots are filled by Krug’s rosé and Philipponnat Juste Rosé Clos des Goisses, each costing £179. The fact that the Krug enjoys a lead of 237 points in terms of overall Wine Lister score yet costs the same shows that when it comes to rosé Champagne, prices don’t always have a rational explanation. The chart below confirms a lack of correlation between price and overall Wine Lister score for these five wines.

With Burgundy having dominated our thoughts recently, we thought it was time for a change. So this week, our Listed section continues on its travels, this time stopping in the USA, to consider the country’s overall top five whites. However, whilst the landscape might be different to the Côte d’Or, the grape certainly is not. As might be expected, the USA’s top five whites are all Chardonnays – and all Californian.

Leading the pack is Marcassin Vineyard Chardonnay, with an excellent score of 918 – putting it amongst the very best on Wine Lister. Its score – 55 points above second-placed Kongsgaard Chardonnay – is the result of excellent consistency across Wine Lister’s three categories. Whilst it comes second in terms of Quality (927), it leads in the Economics category (968), and is well out in front in the Brand category (879). The dominance of its brand is the result of achieving the group’s best restaurant presence – both horizontal and vertical – and being the most popular of the five – it receives nearly twice as many searches each month on Wine-Searcher as the second-most popular wine in the group.

Next comes Kongsgaard Chardonnay (863). The cheapest of the five (£86 per bottle), it experiences the group’s second-weakest Economics score (873). However, it starts to climb back up the table with the group’s third-best Quality score (894), and cements its position with the second-best Brand score of the five (817).

The three final wines in the group are evenly matched, with just 27 points separating Kistler’s straight Chardonnay, Peter Michael’s Point Rouge Chardonnay, and Kistler’s Vine Hill Vineyard Chardonnay. The two Kistlers display contrasting profiles. Whilst the straight Chardonnay comfortably outperforms the Vine Hill Vineyard in the Quality category (892 vs 805), the roles are reversed in the Economics category, with the Vine Hill Vineyard’s very strong three-year CAGR (16.5%) helping it to an excellent score of 951, c.70 points ahead of the straight Chardonnay. In the Brand category, despite achieving very similar scores, again they display contrasting profiles. The straight Chardonnay is over twice as popular as the Vine Hill Vineyard, but features in half the number of the world’s top restaurants.

Peter Michael Point Rouge Chardonnay – the USA’s fourth-best white – has a somewhat topsy-turvy profile. It enjoys the group’s best Quality score (933), but the worst Brand and Economics scores (641 and 827 respectively). Thanks to an extraordinary three-year CAGR of 47.7% it is also by far the most-expensive of the five, with a three-month average price of £457.

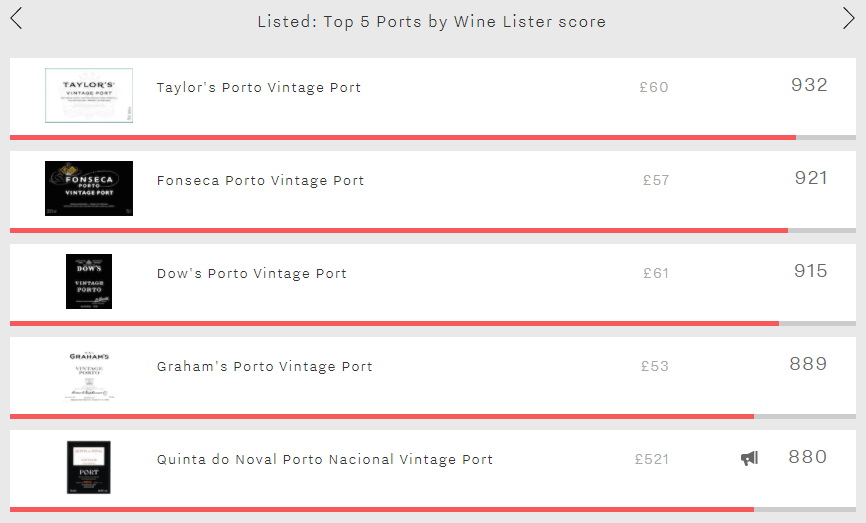

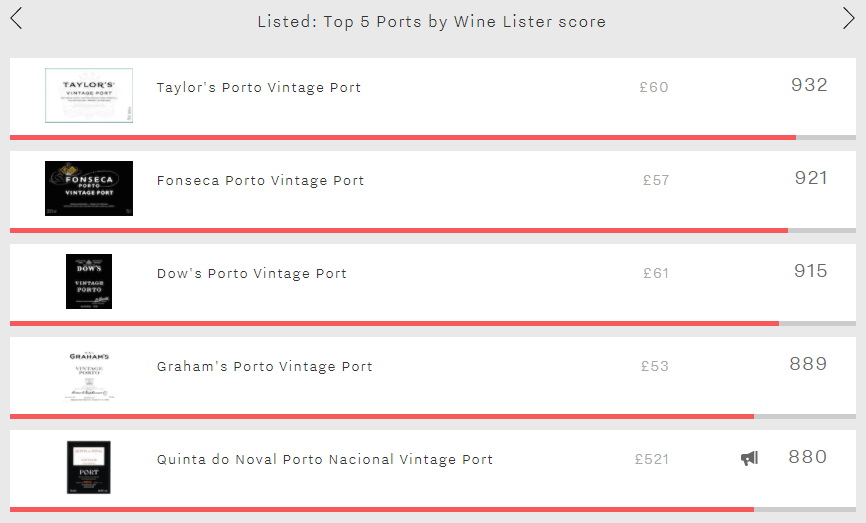

This week’s top five takes Wine Lister to the Douro Valley in search of its vintage ports. In some ways this top five is very much a four plus one, with the fifth placed Quinta do Noval Nacional, costing nine to ten times more than each of the others. It is also the only one to enjoy Buzz Brand status. At a total Wine Lister score of 880 and £521 per bottle, against the top-ranked Taylor’s 932 and £60, that constitutes quite a buzz.

Here is a classic case of all metrics count but some count for more than others when it comes to cost. With a stonking 981 for Quality and the longest drinking window in its peer group the Quinto do Noval is clearly the nichest of the niche; its relatively low restaurant presence (9%) and monthly searches (2,457, on average, to Taylor’s 10,787) make its Wine Lister Brand score (825) well below Taylor’s and the other three.

With an overall score of 932, an excellent Quality score of 967, and a Brand score of 965 based on decent restaurant presence (23%) and over 10,700 average monthly searches, Taylor’s tops the Vintage ports. Fonseca comes a close second at an overall 921. With almost identical Quality (965) and slightly lower Brand (942), Fonseca just pips Taylor’s for liquidity, with 1,072 (against 1,061) of its top five vintages traded at auction in the past year.

At around £60 per bottle on average, Taylor’s and Fonseca are each affordable flutters with future Christmases in mind. Even illustrious older vintages such as 1970 and 1977 – in their drinking prime this Christmas – can be found at two to three times the price.

The same goes for third-placed Dow’s (£61) and fourth-placed Graham’s (£53). At an overall 915 Dow’s has a slightly lower Quality score than the top two. 943 is nevertheless still highly creditable. Graham’s edges Dow’s on Quality at 948 but a relatively lowly 650 for Economics brings it down to 889 overall.

All in all, Taylor’s and Fonseca merit their top two spots. If Santa has very deep pockets then consider adding Quinto do Noval 1994 to your wishlist (at a cool £1,229).

Confirming the outstanding economic performance of Piedmont’s top crus, Italy’s top five wines for economics all hail from Barolo and Barbaresco. Tuscany doesn’t get a look-in. Featuring just two producers – Giacomo Conterno and Bruno Giacosa – this week’s listed section boasts wines achieving outstanding Economics scores of over 960.

Wine Lister’s Economics score combines five criteria: three-month average price, six-month-price performance, three-year compound average growth rate (CAGR), price stability, and liquidity (volume traded).

A three-month average price of £595 per bottle tips the Economics rating in favour of Giacomo Conterno’s Barolo Monfortino Riserva, which scores a mighty 978. Its three-month average price is over double that of the second-most expensive wine.

Seven points behind in second place is the Barbaresco Asili Riserva from Giacosa’s Azienda Agricola Falletto, with an Economics score of 971. Just one point behind that, in third place, with an Economics score of 970, Giacomo Conterno’s second wine to make the top five is the Barolo (Cascina) Francia. Following a slump in its score at the end of 2016, it bounced back January and continued to rise throughout the year.

Giacosa’s Azienda Agricola Falletto Barbaresco Rabajà is fourth-highest with a score of 963. This wine has the strongest three-year CAGR of the group, at 27.5%.

Bruno Giacosa’s third entry, completing the top five with an Economics score of 963, is his Barolo Rocche Falletto Riserva. It has the highest liquidity of the group, with 500 bottles of its top five vintages traded in the past year.

All of the top five hold Buzz Brand status, but their soaring prices equate to lower price stability across the group, averaging 8.6% standard deviation compared to 7.1% for the top five Tuscan wines by Economics score. Piedmont might offer more potential upside, but by definition this makes it riskier investment territory.

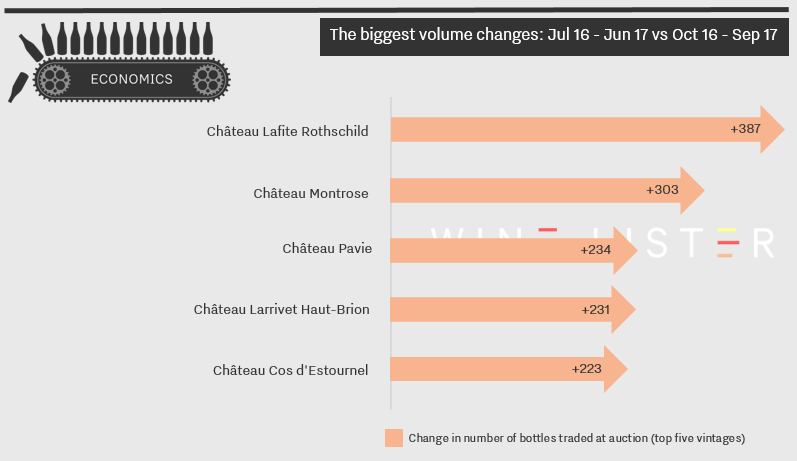

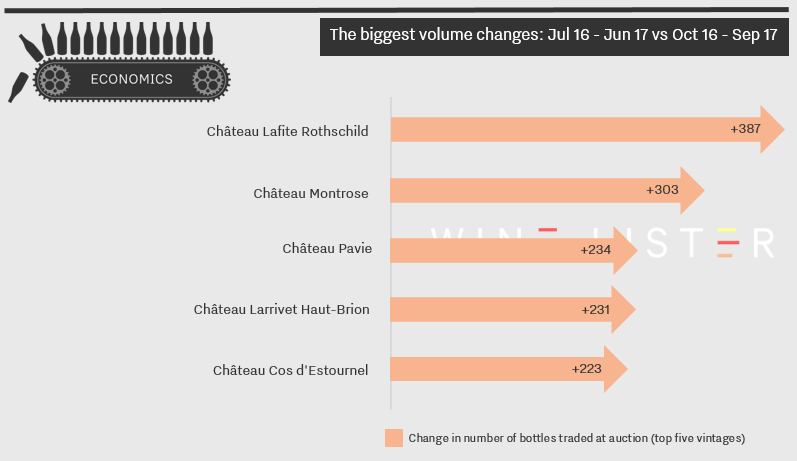

For the second consecutive quarter, the five wines which saw trading volumes rise most were all from Bordeaux. Four of the wines below are big hitters, with overall Wine Lister scores ranging from 921 (Château Montrose) to 963 (Château Lafite Rothschild).

These top crus are also mainstays at global fine wine auctions, with over 2,000 bottles of the top five traded vintages of each wine selling at auction every year, and over 5,000 for Lafite. So, while auction trading volumes – a measure of liquidity – feed into a wine’s Economics score, none of the four has seen a significant enough increase to find their Economics score significantly changed.

There is one anomaly. Château Larrivet Haut-Brion has an average price of £23 per bottle, and from the period of July 2016 until June 2017 its top five vintages sold only 103 bottles at auction. At the end of last month, however, 228 bottles of the wine’s 2000 vintage were sold at a Bonham’s auction, making the wine the most popular of the day. The update to Larrivet Haut-Brion’s trading volumes has had a strong impact on its Economics score, which has risen from 567 to 667, and boosted its overall Wine Lister score from 663 to 684.

We calculate which wines have seen the greatest incremental increases in bottles traded by using figures collated by Wine Market Journal from sales at the world’s major auction houses.

Wine Lister’s holistic, dynamic rating system tracks a wine’s performance over time. By constantly analysing a wine’s brand strength and economic performance, as well as updating its Quality score as it is retasted by our partner critics, Wine Lister’s ratings evolve over time, as demonstrated by our new score history tool.

Wine Lister’s Economics score is a perfect case in point. Reacting to the very latest market data, it analyses a wine’s performance across several criteria: three-month average bottle price; short and long-term price performance; price stability; and liquidity. A strong showing across these criteria is what defines the five wines in this week’s Listed section – Bonnes-Mares’ top wines by Economics score.

Whilst all five achieve Economics scores that put them amongst the very strongest on Wine Lister, it is Domaine Georges Roumier’s Bonnes-Mares that leads the way with an outstanding score of 970. It is the most liquid of the five, its five top-selling vintages having traded 414 bottles over the past four quarters.

In second-place is Domaine d’Auvenay’s Bonnes-Mares (967). Underlining the Queen of Burgundy’s continuing surge in demand, it has a remarkable three-year CAGR of 35.6% (nearly double that of Domaine Jacques-Frédéric Mugnier’s Bonnes-Mares, its closest rival in that criterion). Its price is the highest of the group by a considerable distance, at £1,902.

Domaine Comte Georges de Vögué fills the third spot with its Bonnes-Mares’ Economics score of 942. One of the group’s two Buzz Brands, it is the second most-traded of the five (327 bottles), and has strong short-term price performance, its price having increased 11.2% over the past six months.

The Bonnes-Mares from Domaine Jacques-Frédéric Mugnier and Maison Joseph Drouhin fill the last two spots. Whilst they display similarly modest levels of liquidity (having traded 63 and 68 bottles over the past four quarters respectively), Mugnier leads Drouhin thanks to its considerably higher price (£436 vs £281) and superior long-term price performance (three-year CAGR of 18.2% vs 13.9%).

And thanks to Wine Lister’s approach, these scores will continue to change over time, meaning that they are always relevant and reflect the wine’s evolving position in the market.

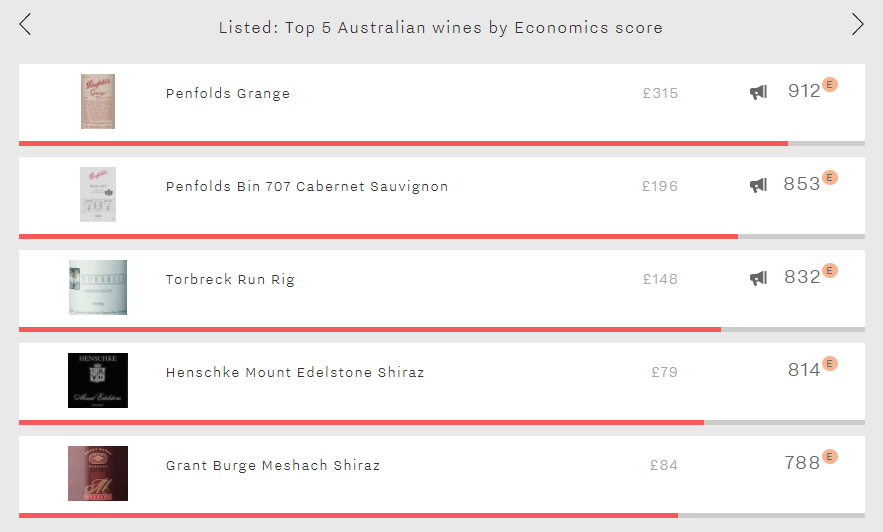

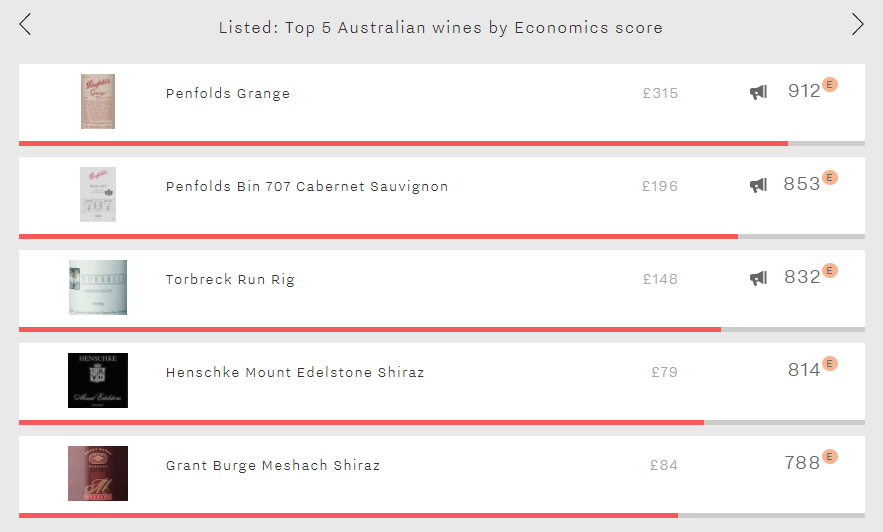

Wine Lister’s Economics scores are based on a variety of price and liquidity metrics, including a wine’s three-month average bottle price, six-month price performance, and three-year CAGR. This week’s newly updated Listed section features the five top-scoring Australian wines by Economics score. Noticeably, all are red, and red wines outperform for Australia in this category (the top white, Leeuwin Estate Art Series Chardonnay, has an Economics score of 498, its top traded vintages only trading 10 bottles in auction over the past year). While there is quite a difference in points between the first and fifth wine on today’s list, all are considered very strong (750–900) or among the strongest (900+) wines in Wine Lister’s database.

Several of Australia’s best-known producers feature in our top five, including Penfolds, which accounts for the top two entrants: Penfolds Grange and Penfolds Bin 707 Cabernet Sauvignon. While both wines excel on three-month average bottle price and three-year CAGR, Penfolds Grange is particularly strong for liquidity, its top five trading vintages having traded 626 bottles over the past four quarters.

The third wine on this list, Torbreck Run Rig, experiences good trading volumes but has the lowest three-year CAGR of the five (3.27%). Fourth place goes to Henschke Mount Edelstone Shiraz, which is the lowest in price and sees fewer bottles traded than the others, but has an excellent six-month price performance of 11.88% and good price stability. Finally, the list is completed by Grant Burge Meshach Shiraz, which has one of the higher three-year CAGRs, at 6.4%.

Don’t forget – if you’re not yet a subscriber to Wine Lister, you can still fully explore this week’s five Listed wines, and those for the previous four weeks, via the homepage.