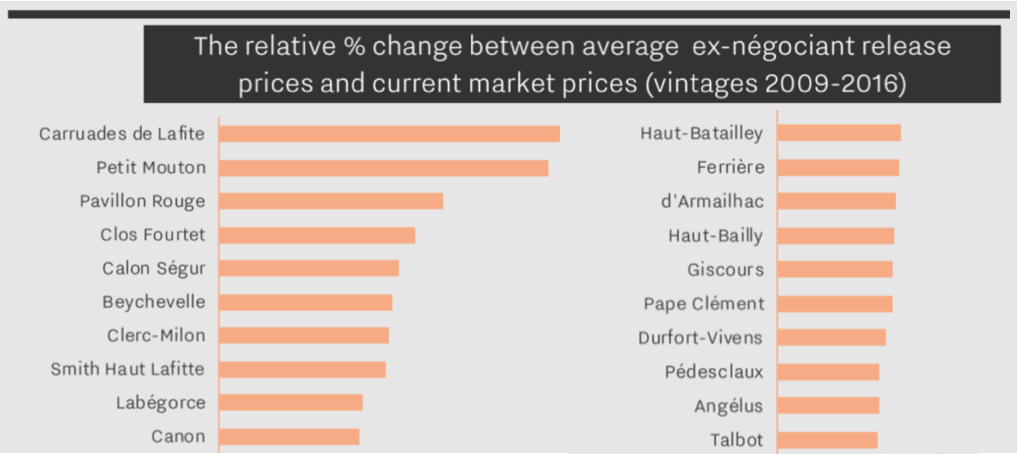

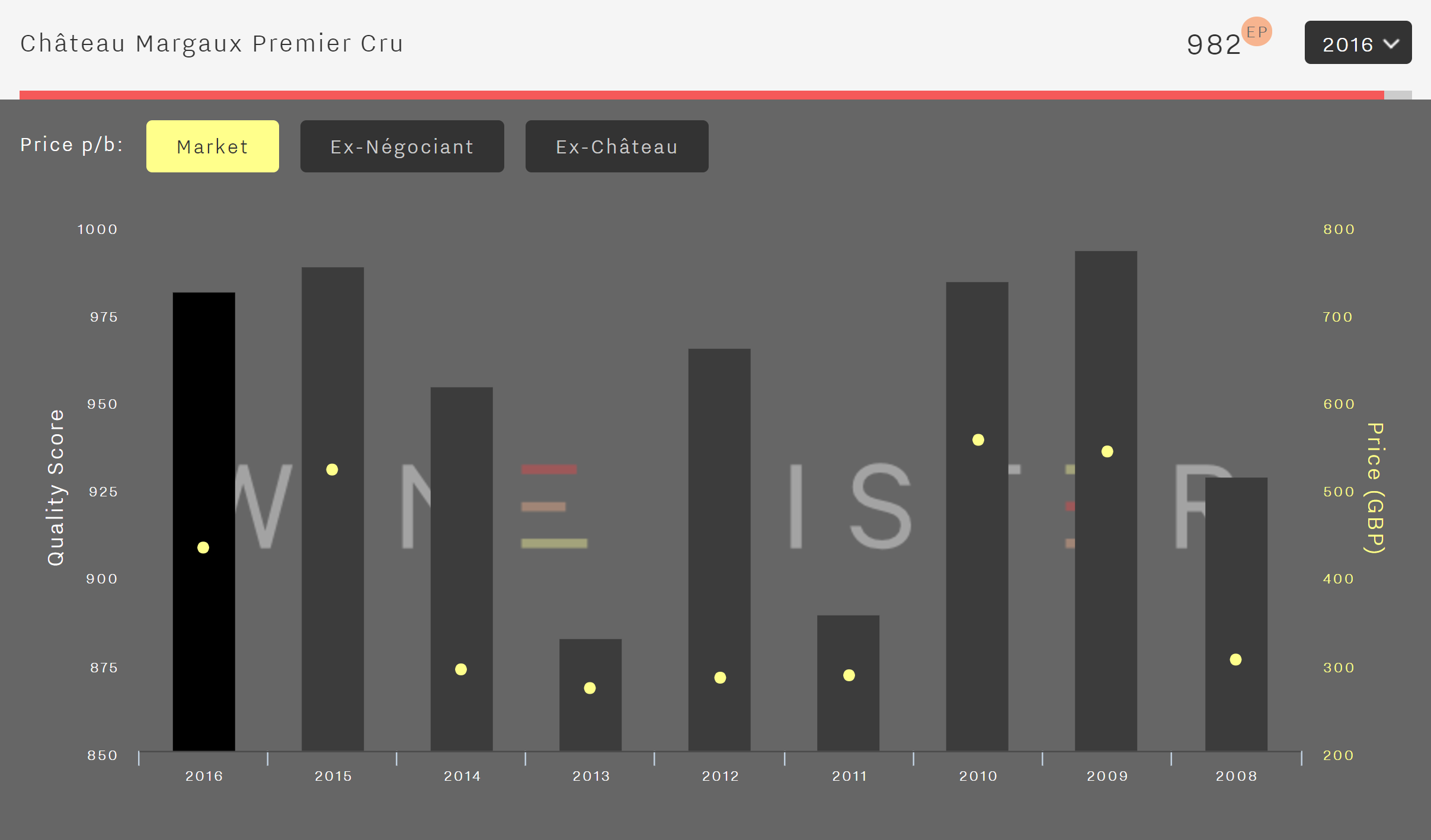

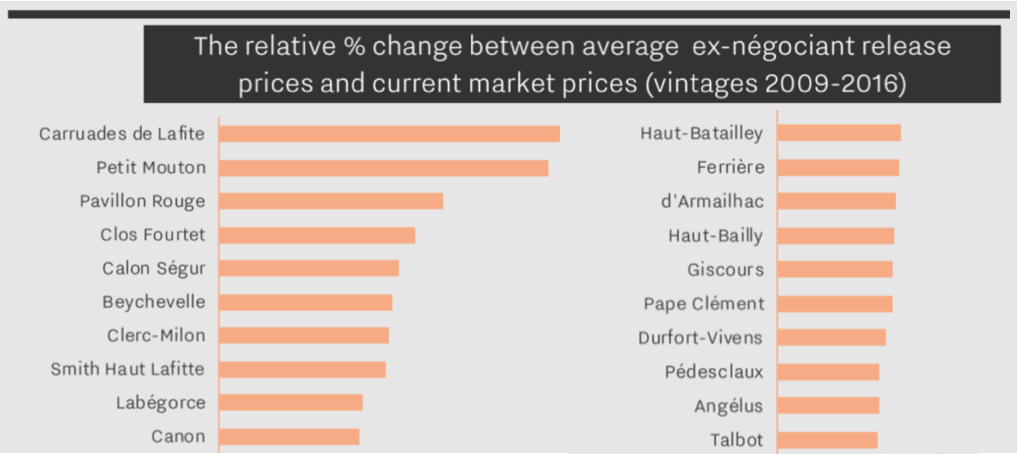

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.

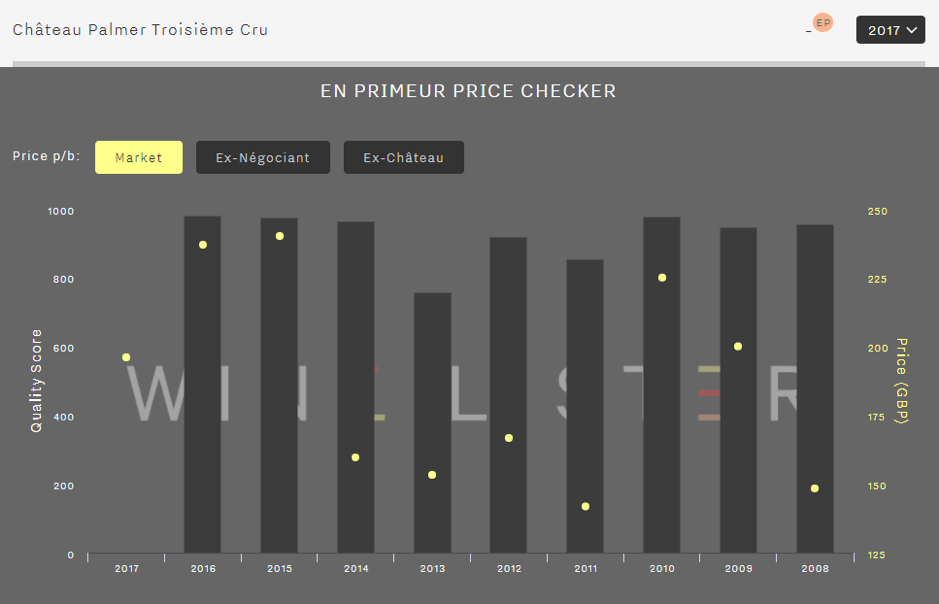

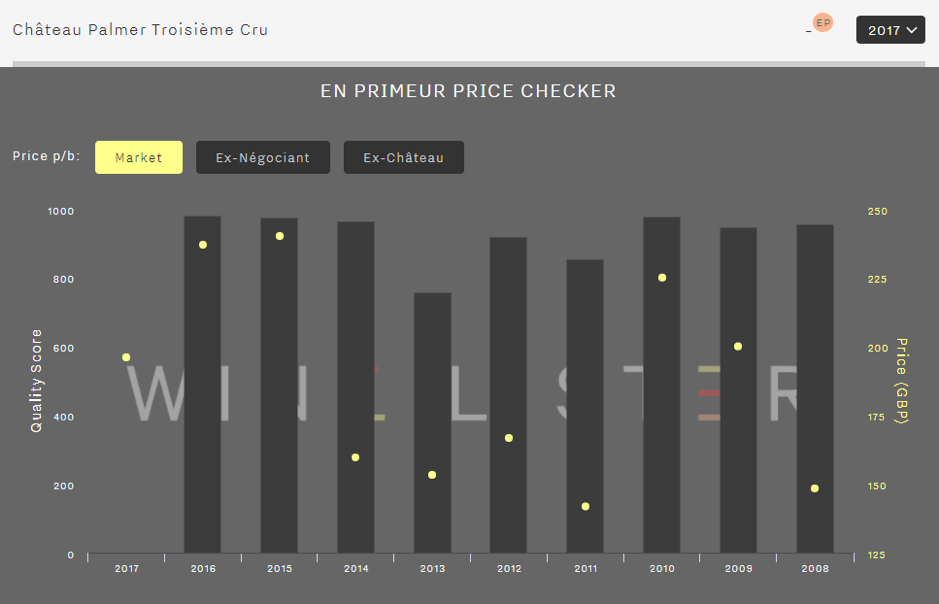

Margaux’s Château Palmer made a surprise move on Monday morning, releasing its 2017 vintage en primeur before anybody expected. At €192 ex-négociant, its price decrease of 20% on the 2016 (€240) is symbolically significant.

For several years the château has only released 50% of its Grand Vin en primeur each year, which has allowed it to develop an aggressive pricing policy, positioning itself well above other third growths and even second growths. The wine’s price had risen 14% for the 2016 vintage, giving it some margin to come down again this year. This neatly places the 2017 between the 2014 and 2015, both in terms of original release prices and current market prices:

This was a smart and strategic move by Managing Director, Thomas Duroux. When we tasted at the château in the second week of April, he shared his thoughts on the campaign, and it was clear he had considered the dynamics of 2017 Bordeaux en primeur very carefully.

Duroux was cautious about the campaign, saying “It’s going to be complicated as there are lots of discouraging factors.” He believes it’s difficult to achieve three good campaigns in a row, and that there is not a huge amount of demand from consumers. He spoke of a confusion around price and volumes, explaining that “just because there’s less wine doesn’t mean consumers are ready to pay more – they don’t care.” As it happens, the Grand Vin was spared frost damage in April 2017, while 15ha of the second wine was hit. Alter Ego was released at just a 2% discount on the 2016.

“We risk having a campaign where prices go down but not enough to be judged attractive by the consumer,” warned Duroux. It remains to be seen whether Palmer 2017’s 20% decrease is enough. With the trade unprepared, and scores not out yet for many important wine critics (including Wine Lister’s partner critics), it is now a waiting game. Négociants have bought their allocations, and for now they are holding a fair amount of stock of Palmer 2017 in Bordeaux.

Sales by UK merchants are modest for the time being. Depending on scores that will be released over the coming 10 days, Palmer might start to seem like a good deal, particularly when (not if) the discounts start to shrink over the course of the campaign. Or indeed when the discounts become premiums, as we saw this morning with the release of Haut-Batailley 2017 – read the blog post here).

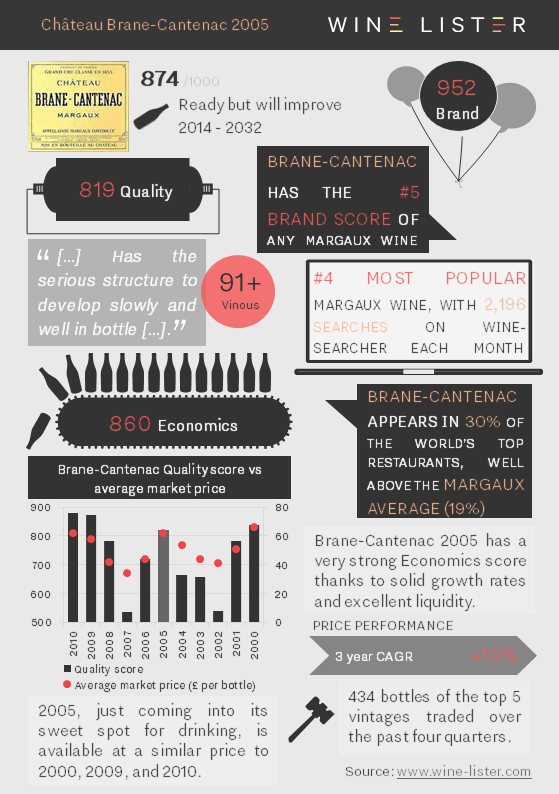

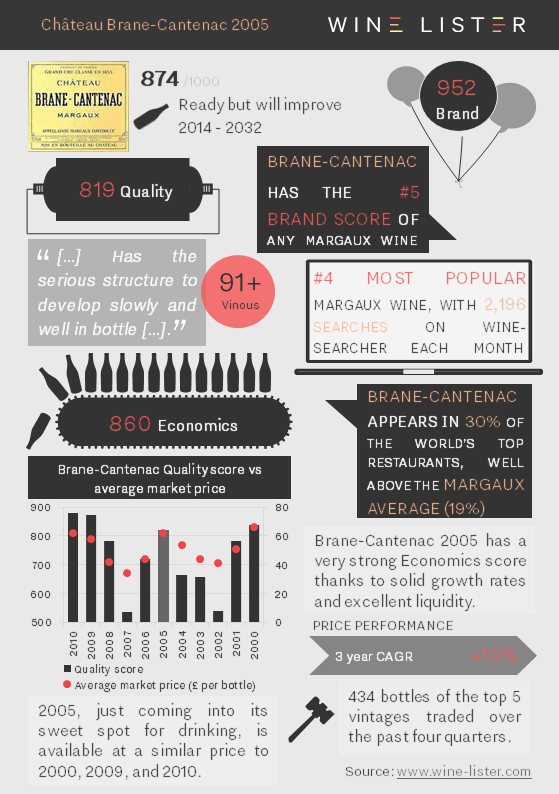

As Bordeaux en primeur 2017 tastings come to a close, we look back at Brane-Cantenac 2005, one of many highlights in our recent Founding Members’ tasting.

You can download the slide here: Wine Lister Factsheet Château Brane-Cantenac 2005

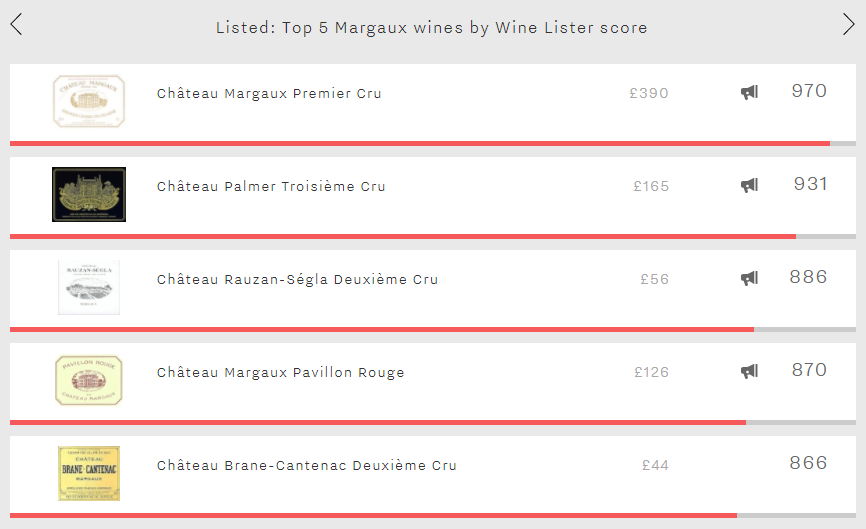

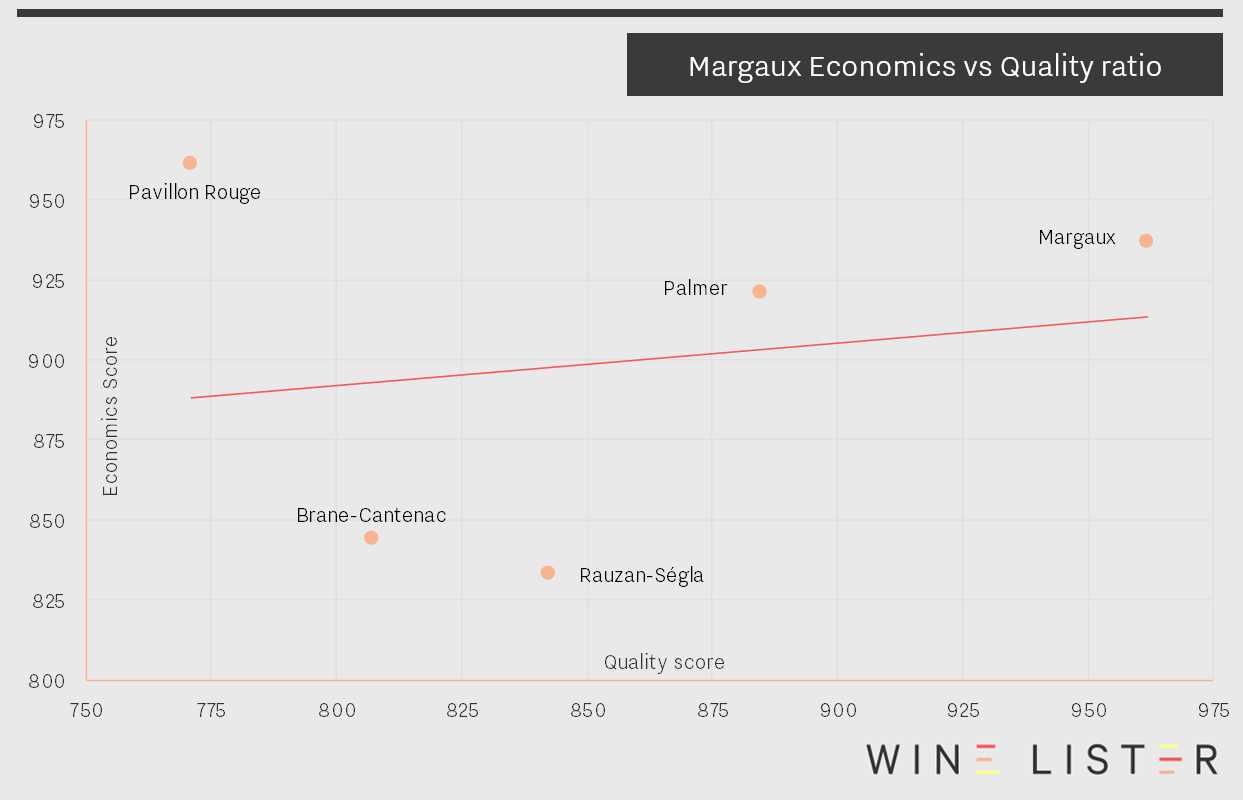

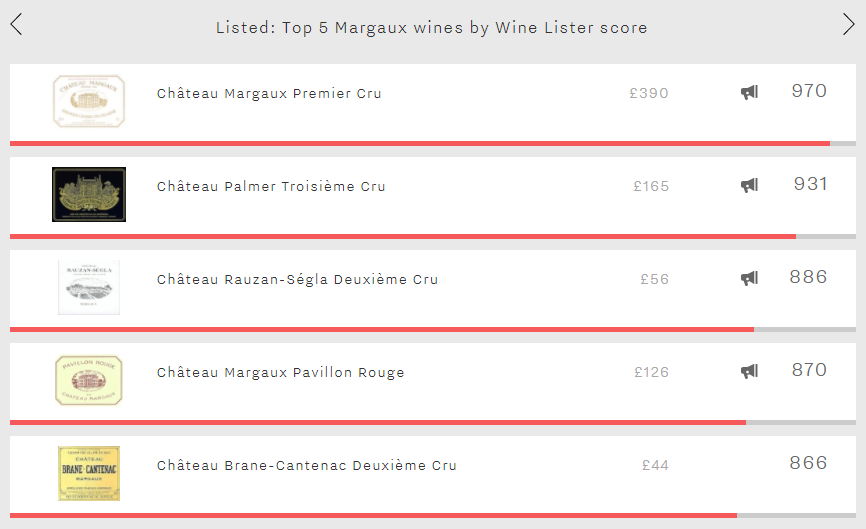

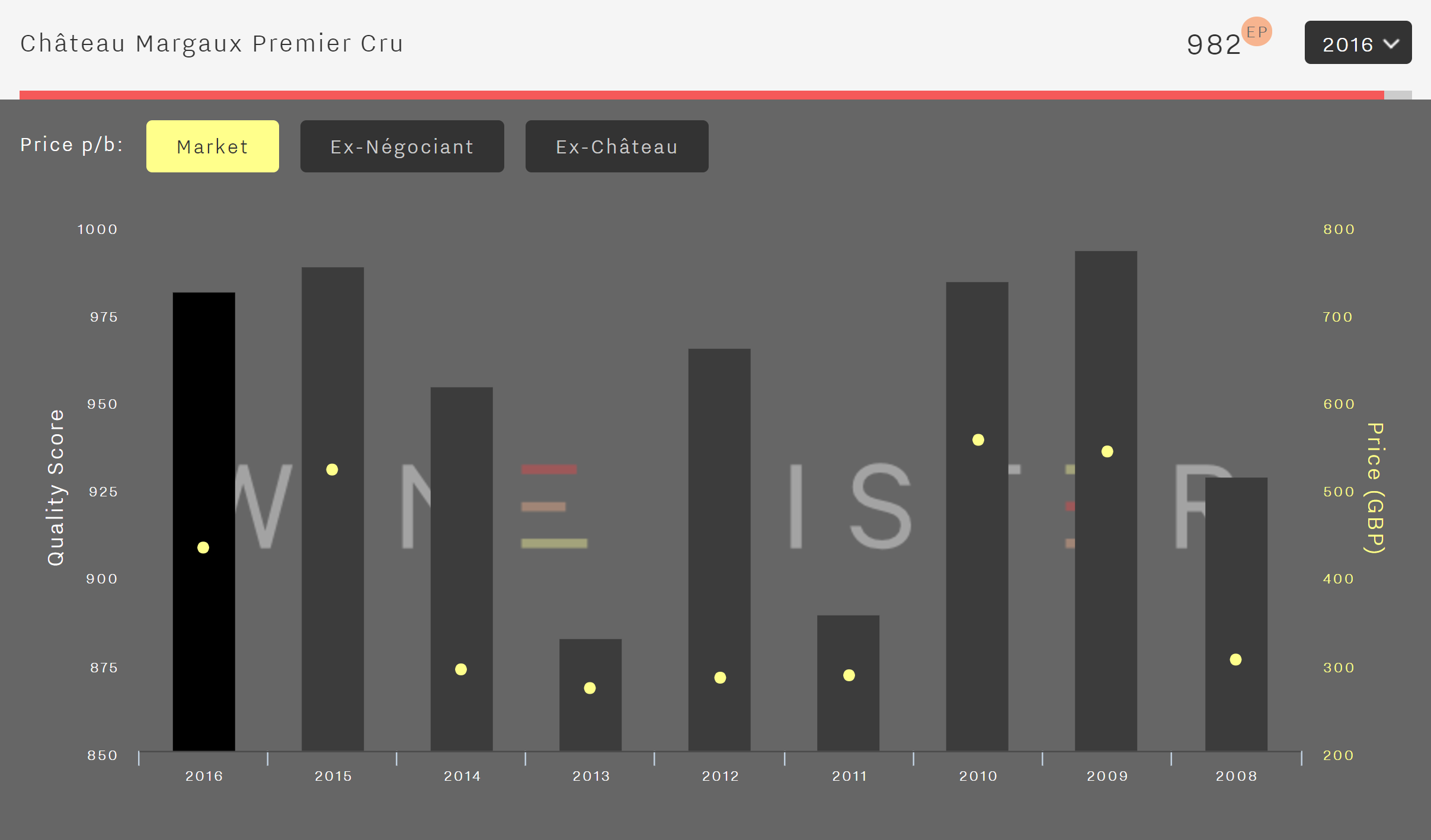

Having considered Chambertin’s top five wines for Quality last week, this week our Listed section travels south-west to look at Margaux’s overall best red wines. Whilst it is to be expected that Margaux’s eponymous first growth tops the table, with an outstanding score of 970, the order of the remaining four wines – and the appearance of second wine Pavillon Rouge – might come as more of a surprise.

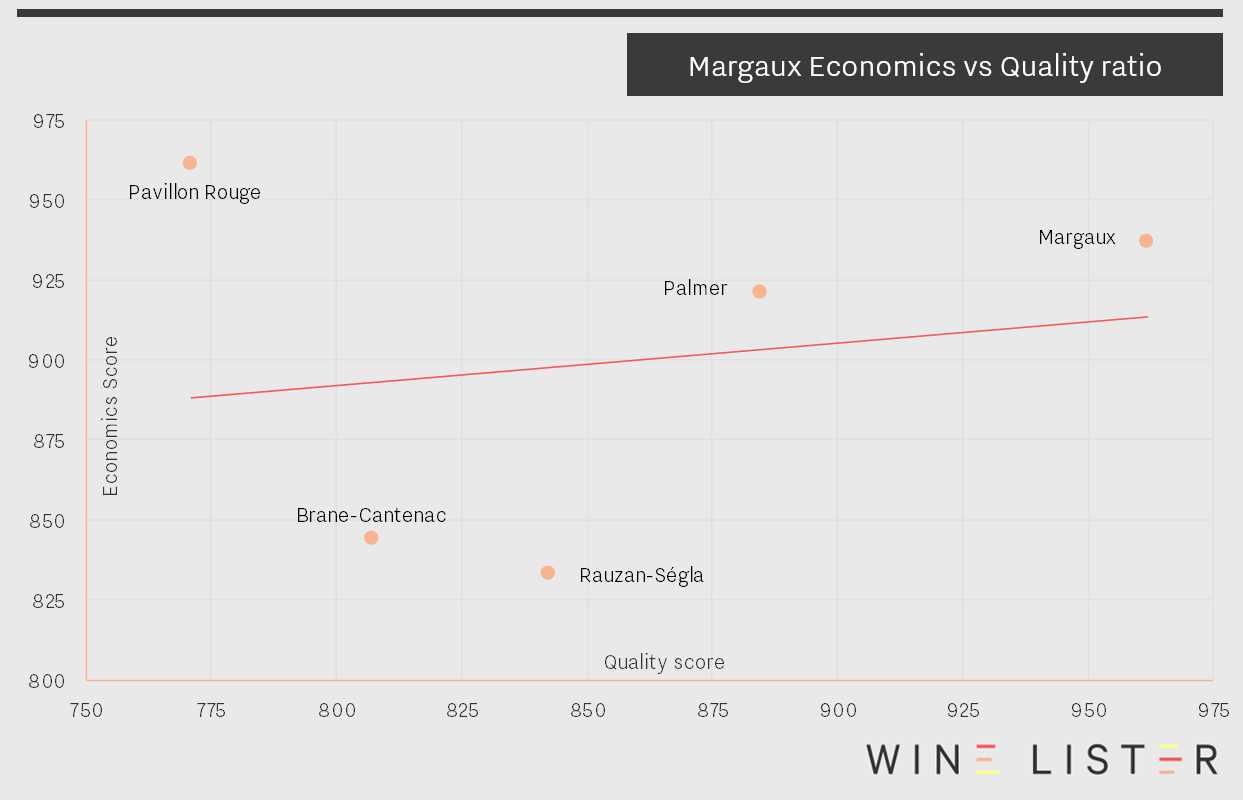

Château Margaux’s dominance is the result of a lead across nine of Wine Lister’s 12 rating criteria, resulting in an advantage in both the Quality and Brand categories. In particular, it outperforms the others in the Quality category with an excellent score of (962), nearly 80 points ahead of the second-best wine in the category – Palmer (885), which leapfrogs the group’s two second growths in terms of quality. However, Château Margaux is pipped to the post in the Economics category by Pavillon Rouge, whose superior price performance helps it to overcome its older sibling.

Palmer achieves Margaux’s second-best overall score (931). The third growth’s brand is its strongest asset. Despite trailing Château Margaux by two points in the category, its score of 995 is the 15th best Brand score in the entirety of Wine Lister’s database. It even sneaks ahead of Château Margaux in terms of restaurant presence (47% vs 46%), although it can’t quite match its illustrious neighbour in terms of vertical presence, with 4.1 vintages / formats offered per list on average, compared to Château Margaux’s 5.7. It is also searched for nearly three times less frequently than Château Margaux.

Pavillon Rouge occupies fourth position. It enjoys the group’s best Economics score, in-keeping with the unstoppable performance of first growths’ second wines in general. This is the result of strong price growth rates – it has a three-year compound annual growth rate (CAGR) of 15.5% and has added over 11.3% to its price in the last sixth months alone. The chart below confirms that its economic strength is not only at odds with its lack of classification, but also with its Quality score, which is the lowest of the group.

Pavillon Rouge is sandwiched between two second growths – Rauzan Ségla (886) and Brane-Cantenac (866). Despite belonging to the same class, they perform quite differently. Rauzan-Ségla experiences the group’s weakest economic profile (836), but climbs back up the table in the Quality and Brand categories (842 and 970 respectively), ahead of fifth-placed Brane-Cantenac.

Any of these wines would be a very worthy addition to your Christmas table. Happy Christmas from the whole team at Wine Lister!

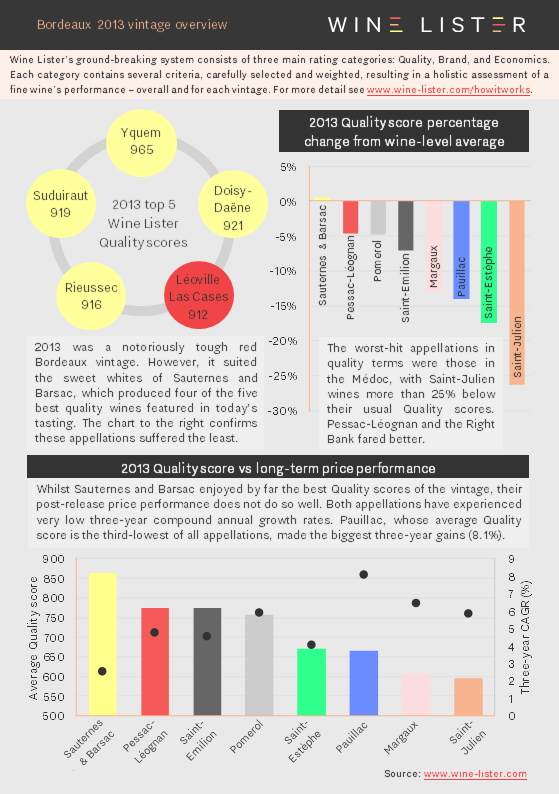

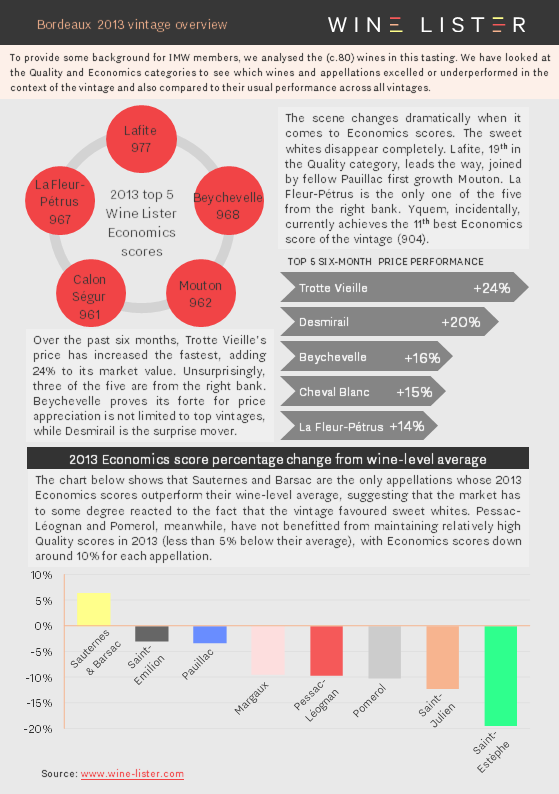

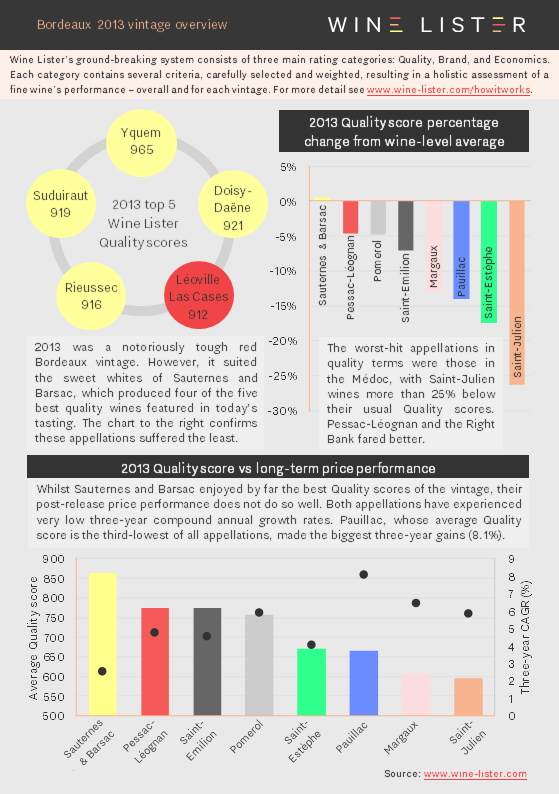

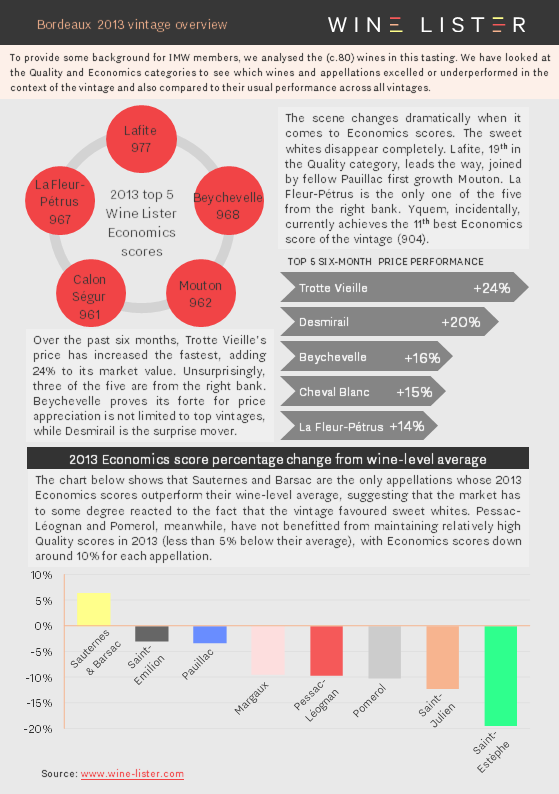

We recently prepared a brief vintage overview for the Institute of Masters of Wine’s 2013 Claret tasting. Analysing the performance of the basket of wines included in the tasting, Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download these slides here: Wine Lister Bordeaux 2013 vintage overview

Watch this space for further regional vintage reports over the coming months.

Bordeaux is renowned for its reds and sweet whites, but its best dry whites should not be forgotten. While the majority of Bordeaux’s top dry whites are not the flagship wine of their respective châteaux, they still achieve overall Wine Lister scores that are amongst the strongest or very strong on Wine Lister’s scale. Furthermore, as part of some of the most prestigious châteaux in Bordeaux, they all achieve Buzz Brand status.

Leading the way is Château Haut-Brion Blanc, with a score of 902. It is by far the most expensive at £569 per bottle. This puts it 62% above the current market price of Haut-Brion’s red, presumably because just one sixteenth the number of bottles are produced each year.

In second place is Château La Mission Haut-Brion Blanc (891). Relabelled in 2009, this was formerly Laville Haut-Brion. It has the best Quality score of the group (908), the result of very strong ratings from each of Wine Lister’s four critics and the longest ageing potential of the group – the last six vintages bottled under the Laville Haut-Brion label will still be drinking well until at least 2020.

Next comes Y d’Yquem with a score of 887. Whilst it can’t match the quality of the botrytised Sauternes for which the château is best known – not many can – it is available at a 34% discount, making it an excellent way of enjoying an iconic producer on a different occasion.

Margaux’s Pavillon Blanc achieves the fourth-best score (878). The only straight Bordeaux AOP in the group, Pavillon Blanc comprehensively outperforms its red counterpart in the Quality category (895 vs 771). That said, Pavillon Rouge has a stronger Brand score (944 vs 831) and Economics score (953 vs 920), in spite of a slightly lower price (£122 vs £138).

Confirming the dominance of the Graves when it comes to Bordeaux’s best dry whites, the last spot is filled by Domaine de Chevalier Blanc (868), the third Pessac-Léognan wine of the group. By far the cheapest of the five (£59), it is an absolute steal given its consistent high quality and ageing capacity. It also achieves the best Brand score (909), thanks to outstanding restaurant presence – it is visible on 23% of the world’s best wine lists.

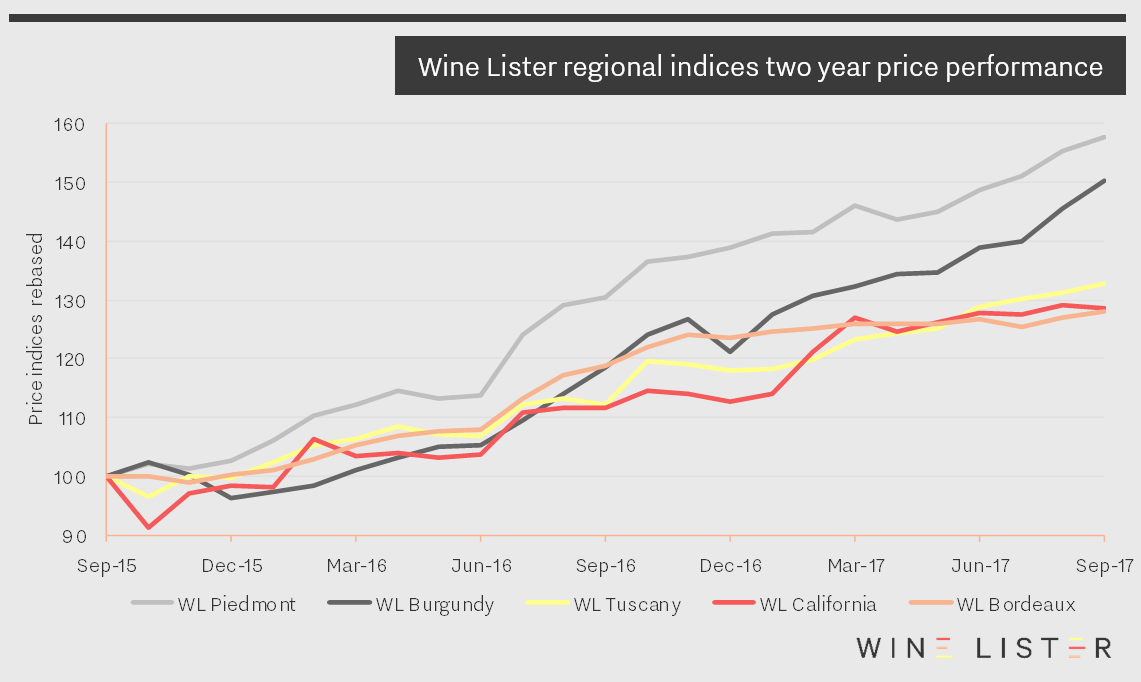

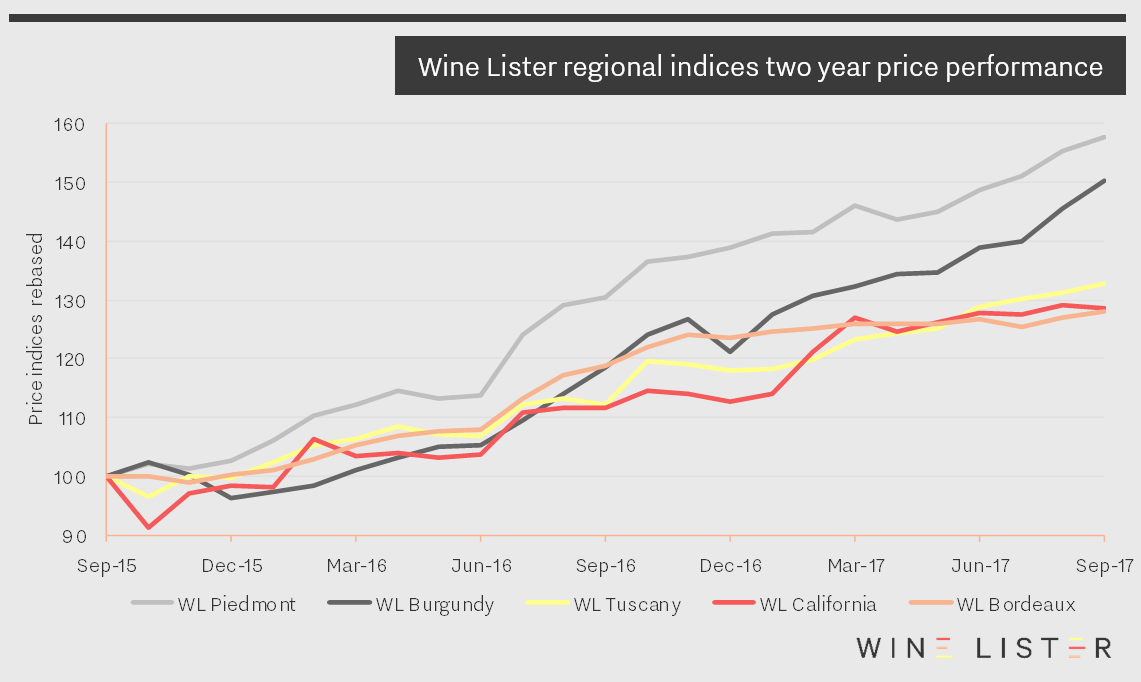

In this blog we look at the price performance of five major fine wine regions over the past two years. Wine Lister’s regional indices use price data from Wine Owners, and each comprises the top five brands in its respective region (according to the Wine Lister Brand score).

In Bordeaux, for example, the top five strongest brands (measured by looking at restaurant presence and online search frequency), are the five first growths, Haut-Brion, Lafite, Latour, Margaux, and Mouton. Posting gains of 28% over two years, and largely stagnating over the last year, the Wine Lister Bordeaux index is the worst performer of the five wine price indices shown below.

Piedmont, meanwhile, has enjoyed a remarkable couple of years. Not only has its index grown by an astonishing 58% over the period, it has also been very consistent, experiencing just three months of negative growth – November 2015, May 2016, and April 2017. Sustained high growth rates suggest a region in demand. The Wine Lister Piedmont index consists of two wines from Gaja – Barbaresco and Sperss (now labelled as a Barolo again after several years of declassification to Langhe Nebbiolo), two Barolos from Conterno – the Monfortino and the Cascina Francia, and finally Bartolo Mascarello’s Barolo.

Next comes the Burgundy index (consisting entirely of Domaine de la Romanée-Conti wines), which has grown by more than 50% over the past 24 months, but with a few more blips. It decreased in value by 4% in December 2015, only managing to recover in March 2016. In a repeat of this festive dip, the index dropped over 5% in December 2016, but recovered the losses in just one month on this occasion. It has started to close the gap on Piedmont over recent months, adding over 15% since May.

Tuscany and California* made similar gains to Bordeaux over the period – up 33% and 29% respectively. The Tuscany index has progressed fairly serenely over the past two years, thanks to its liquid Super Tuscan components. Meanwhile the prices of California’s top wines have been less consistent, enduring a fall of nearly 9% in October 2015, recovering with a dramatic 8% rise in February 2016. This year, having enjoyed strong gains during February and March, their growth rate has since cooled off, adding just 1.5% over the past six months.

*As you will know, California has suffered tragic wildfires in recent weeks. Wine Lister’s partner critic, Vinous, is donating to relevant charities the profits from all maps purchased before the end of November 2018.

Analysis of Palmer 2006, which has released a tranche this morning at €215 ex-négociant, up 72% on the initial 2007 en primeur release price (€125):

You can download the slide here: Wine Lister Fact Sheet Palmer 2006

Château Margaux was the final first growth to release its 2016 wines en primeur yesterday (although we still await a second tranche from Château Lafite – see our blog post on the first tranche). The price of €420 per bottle ex-négociant matched that of Mouton and Haut-Brion, and represents an increase of 9% on 2015.

The reception was very positive all round, with pricing and volumes were both considered to be expertly judged, with one member of the Place de Bordeaux referring to the release as “very professional”, and another saying it was difficult to imagine any problems selling the stock, and “we’d be more than happy to hold a bit more back if necessary!”

A particularly astute move by the commercial team at Margaux was the decision to set a UK RRP this year, which effectively served to negate the weak pound, by curbing any possibility for UK merchants to allow themselves a larger margin, as they had done last year (when they quite rightly judged the immense demand for the very well rated 2015 – Wine Lister Quality score of 988). This means the 2016 represents a relatively modest year-on-year increase of 9% in pounds as well as in euros, rendering the RRP of £432 per bottle more palatable to UK customers.

Margaux also kept the trade happy releasing at least the same amount of the grand vin as last year, if not a little more in some cases, with UK merchants still clamouring for more. The second wine, Pavillon Rouge, was up 20% in volume terms. Bien joué.