With Burgundy 2018 en primeur in full swing, soaring prices for some of Burgundy’s best can add to the January blues. While Burgundy prices tend to rise more quickly after release than any other region (making the en primeur buying system therefore extremely worthwhile), other regions provide better sources of good value wines for drinking, rather than cellaring for future consumption. To wave goodbye to any remaining blues as January come to a close, Wine Lister therefore looks this week at Value Picks from across fine wine regions.

Wine Lister’s Value Pick algorithm simply flags wines with the best quality-to-price ratios of all the wines in our database. A coefficient is applied to allow exceptional quality to be recognised, even for higher-priced wines.

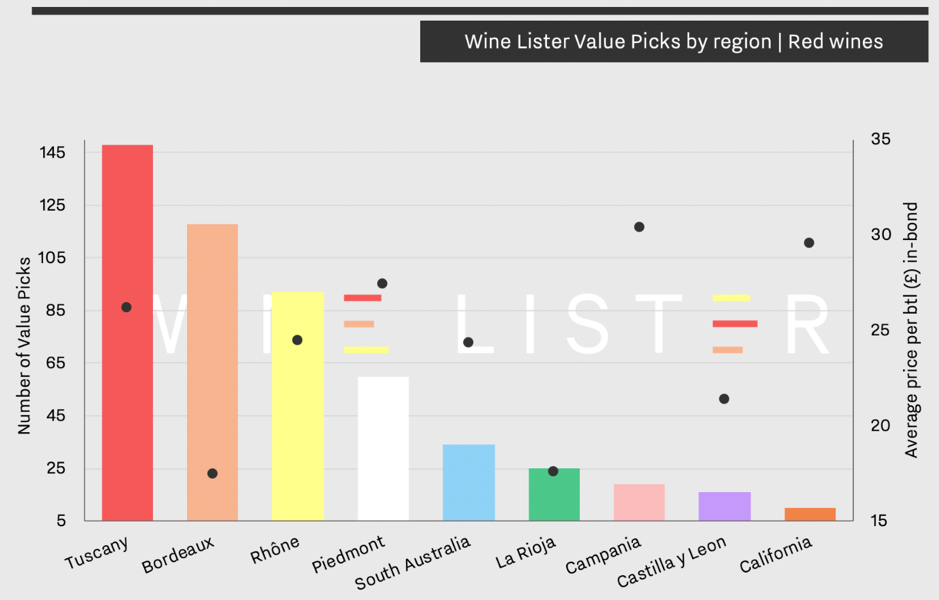

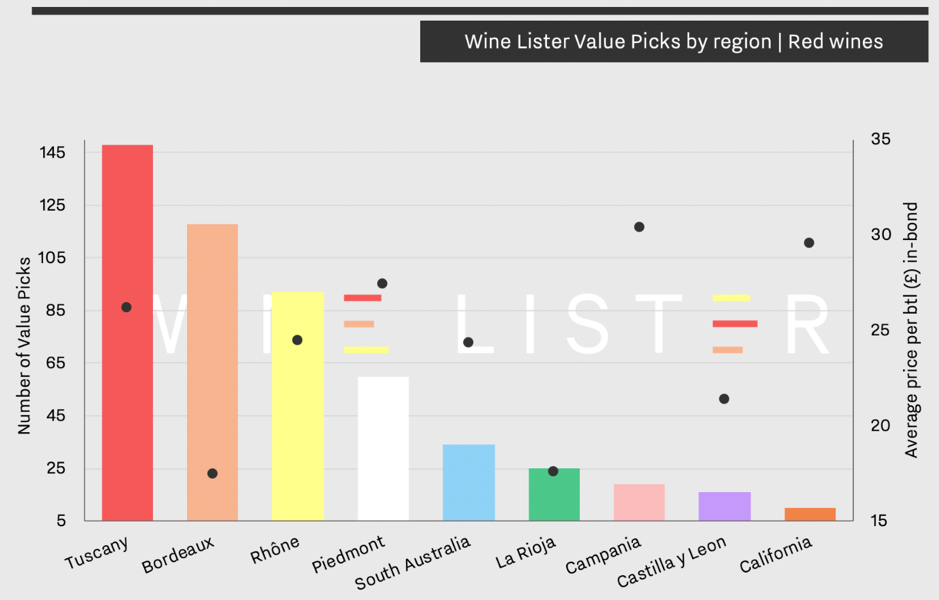

The chart below shows the top nine regions for red Value Picks, and their average price per region.

Italy takes the lead for number of best-value wines overall, with 227 Value Picks from across three regions – Tuscany, Piedmont, and Campania. Indeed, the top 10 Value Picks by WL score all hail from Tuscany, with wines such as Fontodi’s Chianti Classico Vigna del Sorbo Riserva, Isole e Olena’s Collezione Privata Syrah, and Castello dei Rampolla’s Sammarco making the cut.

Piedmont does not go wanting for Value Picks, with a wide range of suggestions, from Domenico Clerico’s Barolo Ciabot Mentin to Vietti’s Langhe Nebbiolo Perbacco.

France also does well for Value Picks, with 210 reds entries between Bordeaux and the Rhône. The former region has the lowest average price of all Value Pick regions shown above (£17.47 per bottle in-bond – when buying a full case), and includes Crus Classés from across appellations such as Malartic-Lagravière Rouge and Grand Mayne, as well as some second wines of Grands Crus châteaux (e.g. Pichon Comtesse’s Réserve de la Comtesse, and La Dame de Montrose).

The Rhône is home to 93 Value Picks from both north and south, and provides a list particularly strong in back vintages. Entries include Ferraton’s Hermitage Les Dionnières 2004, and Clusel Roch’s Côte Rôtie 2009.

The new world is well-represented by Value Picks from Australia across the McLaren Vale and Barossa Valley. California also makes an appearance, although perhaps expectedly, its 10 Value Picks earn the highest average price of any region shown in the chart above.

Search through all red Value Picks here.

Burgundy is, quite noticeably, missing from the top red Value Picks chart. It achieves just four in total: 2002 Joseph Drouhin Gevrey-Chambertin, 2003 Confuron-Cotetidot Echezeaux, 2017 Bertrand Ambroise Nuits-Saint-Georges, and 2007 Bouchard Volnay Clos des Chênes. However, Burgundy is much more present for whites – watch this space for white Value Picks later in the week.

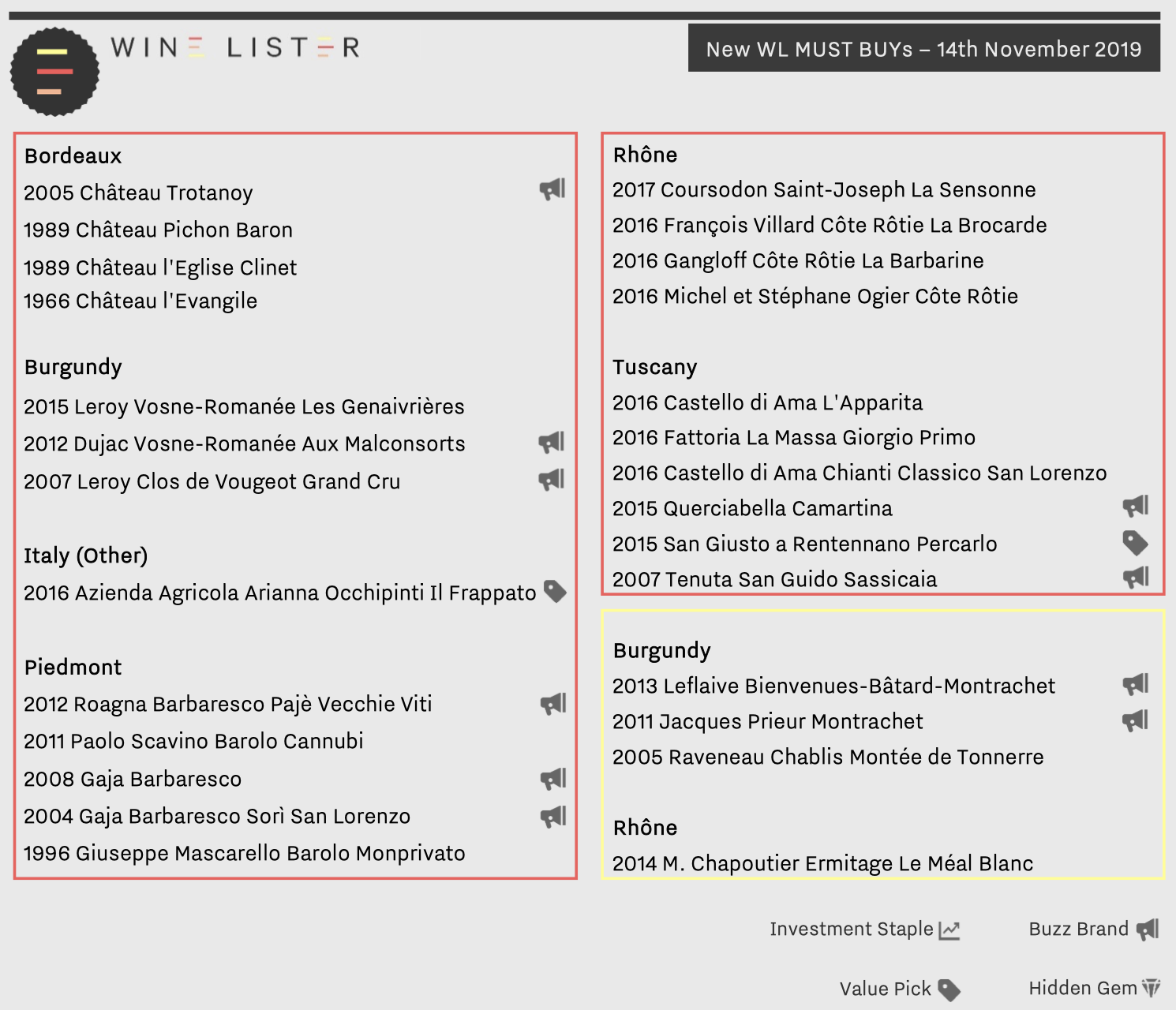

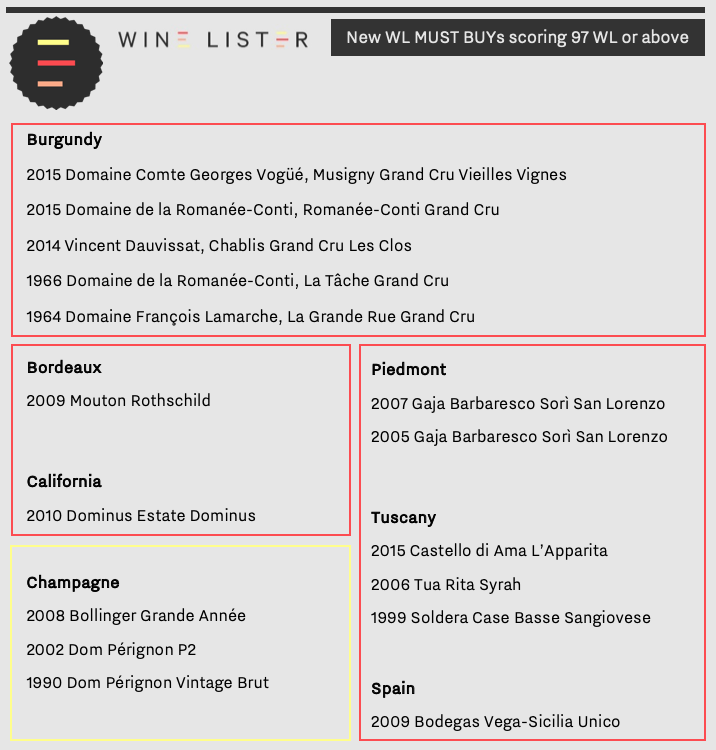

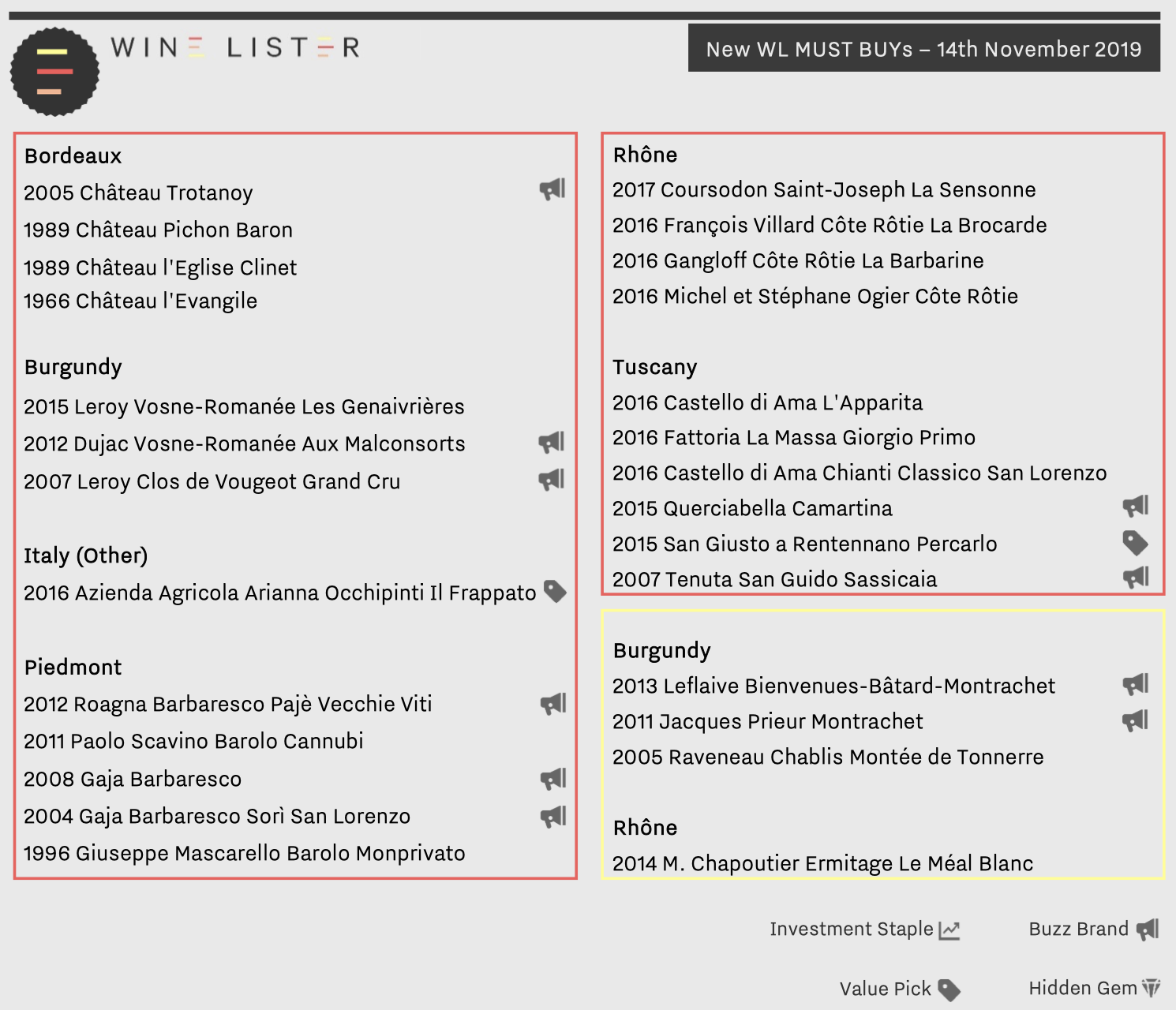

For the last three consecutive updates, Burgundy has worn the crown for highest number of new MUST BUY entries. This week it shares its prime position with Tuscany, as the two regions hold six wines each of the 27 new MUST BUYs. Whilst previous updates have been geographically diverse, this week’s countries of focus are France and Italy only.

All but one of this week’s new Tuscan MUST BUYs can be considered “Super Tuscans”. Buzz Brands Querciabella and Sassicaia make the cut for their 2015 and 2007 respectively. Producer Fattoria La Massa earns another place this week for Giorgio Primo, making its 2016 the sixth MUST BUY vintage of this same wine. 2015 Percarlo from San Giusto a Rentennano and 2016 l’Apparita from Castello di Ama complete the new “Super Tuscans”. A second offering from Castello di Ama is this week’s only new Chianti Classico entry, and brings the producer’s MUST BUY total to eight, equalling Italy’s other top MUST BUY producers, Castello dei Rampolla, and Isole e Olena, in number.

Further North in Italy, Piedmont is by no means overlooked, with Roagna and Paolo Scavino featuring on the new MUST BUY list for Barolo this week (in 2012 and 2011 vintages respectively), alongside Giuseppe Mascarello’s 1996 Barolo Monprivato. Gaja is represented twice, and completes the Piedmont five with the straight Barbaresco and the Sorì San Lorenzo.

France’s chief MUST BUY region, Burgundy, offers three reds and an equal number of whites, with Leroy representing two of the three Pinot Noirs (2015 Vosne-Romanée Les Genaivrières and 2007 Clos de Vougeot). Vosne-Romanée earns another mention through Dujac for its 2012 Aux Malconsorts. Domaine Leflaive, Jacques Prieur, and an older vintage of Raveneau take this week’s new white Burgundy MUST BUY places.

Outside Burgundy, France is also well-represented by the Rhône, with a 2017 from Coursodon, together with 2016s from François Villard, Gangloff, and Michel et Stéphane Ogier. Chapoutier’s 2014 Ermitage Le Méal Blanc completes the latest additions of MUST BUY whites. Older vintages of Bordeaux also make the cut, including a 1966 from l’Evangile, and one 1989 from each bank – l’Eglise Clinet and Pichon Baron.

To help keep track of the weekly updates, check out our latest tool on the search page to help you browse only the newest additions to the full MUST BUY list.

2017 was perhaps the most difficult of recent Bordeaux vintages. Looking back at our harvest report on this frost-ridden vintage, the Wine Lister team attended the annual UGC re-tasting with some trepidation last week.

Indeed, new president of the Union des Grands Crus Classés, Ronan Laborde, reminded us that 2017 had been a “vintage of challenges”, requiring “patience, determination, and energy” to battle against the frost. Even still, some producers lost their entire crop, and many that didn’t produced their “smallest quantities of recent years”.

Troubled though the vintage might have been, you wouldn’t know it from the hoards of London trade that flocked to taste Bordeaux’s latest deliverable vintage, nor indeed from many of the wines we tasted, which followed a general trend of being exceedingly approachable.

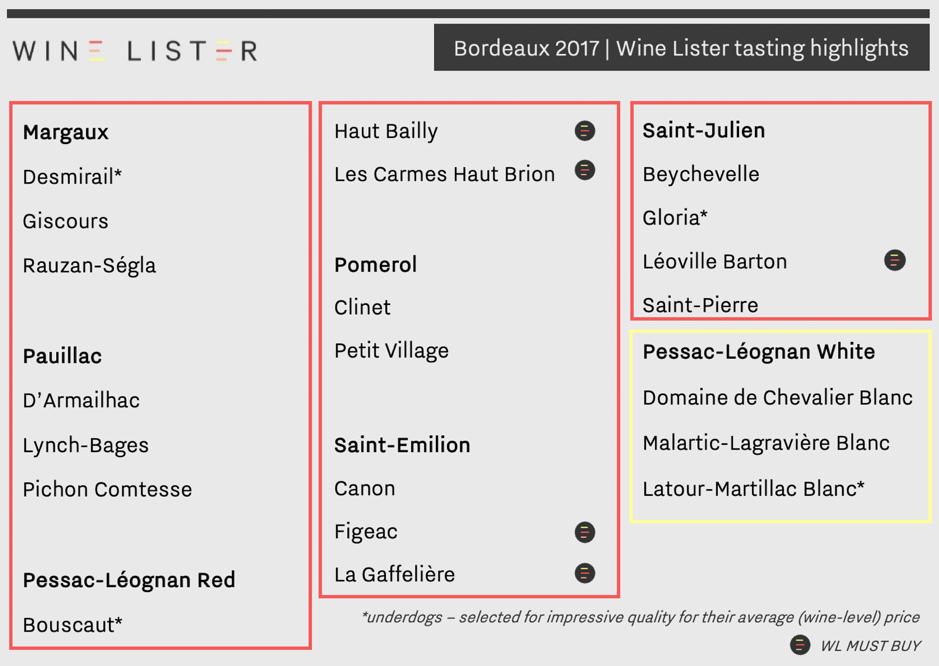

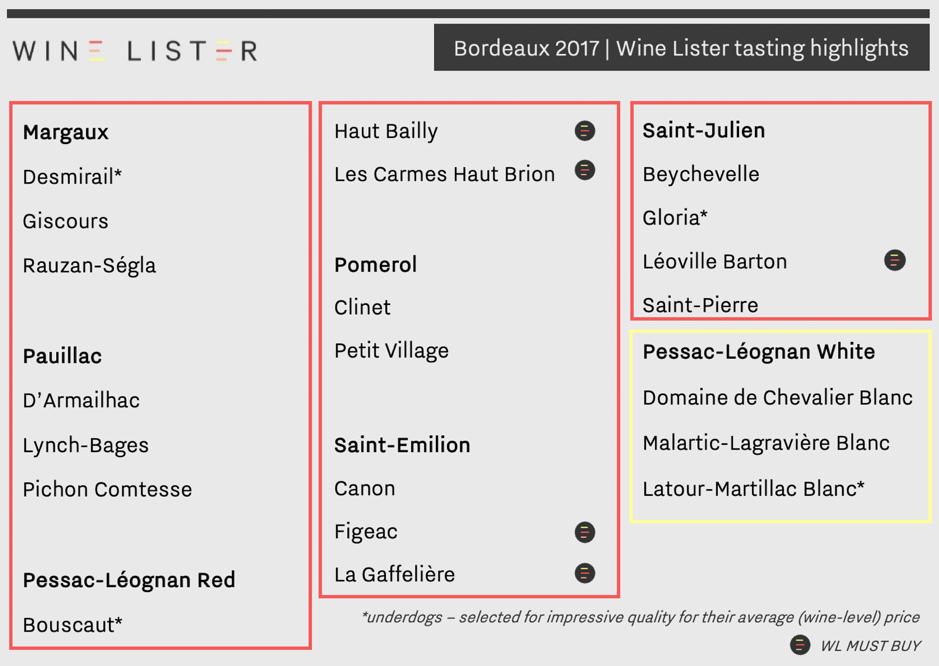

Out of some 120 wines tasted, the Wine Lister team highlights its selection of 17 top dogs, and four underdogs below.

The team’s highlights include five out of the six 2017 Bordeaux WL MUST BUYs (vs. 19 in 2018 Bordeaux), while the other 16 are those we felt showed the best of those in attendance at the UGC tasting, in the context of the 2017 vintage.

Saint-Julien was our top-performing red appellation, with exemplary wines such as “poised” Léoville Barton, as well as two great successes from Domaines Henri Martin: Saint-Pierre was a “real triumph in the vintage,”, while underdog Gloria was “lithe, lovely, and beguiling”. Elsewhere on the left bank, Margaux and Pauillac earn three highlights apiece, including “hedonistic” Giscours and Wine Lister’s top pick of the tasting, “magical, brooding” Pichon Comtesse.

Pessac-Léognan performed equally well for whites as reds. Domaine de Chevalier Blanc was “explosive yet precise”, and underdog Latour-Martillac Blanc showed impressive roundness and balance. Haut Bailly had “an incredible elegance”, while Les Carmes Haut Brion showed “purity and savoury spice”.

Saint-Emilion’s Figeac was the best of the right bank bunch – “muscular” in texture but balanced by “succulent fruit”. Pomerol was well-represented by “floral and velveteen” Clinet, and “powerful” Petit Village.

Other wines included in Wine Lister’s 2017 tasting highlights are: Rauzan-Ségla, D’Armailhac, Lynch Bages, Bouscaut, La Gaffelière, Canon, Beychevelle, and Malartic-Lagravière Blanc.

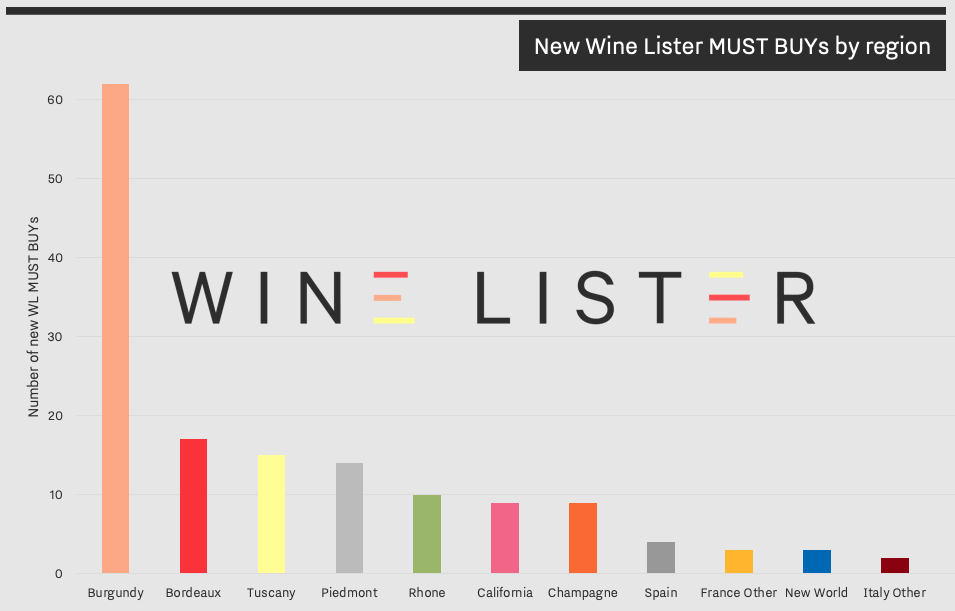

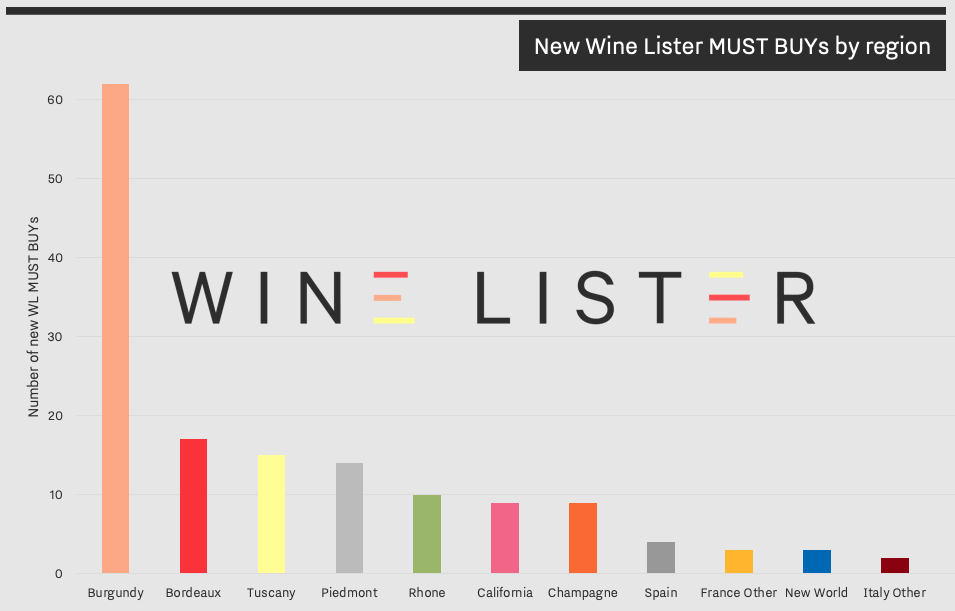

Wine Lister has almost 150 new MUST BUYs. Since we launched MUST BUYs officially in September, the list has been updated based first on the most recent prices and relative regional or appellational value within vintages, and subsequently on Wine Lister’s most recent trips and tastings. The full MUST BUY list has reduced by 109 (1,693 wines vs. 1,802), and includes 149 new entries.

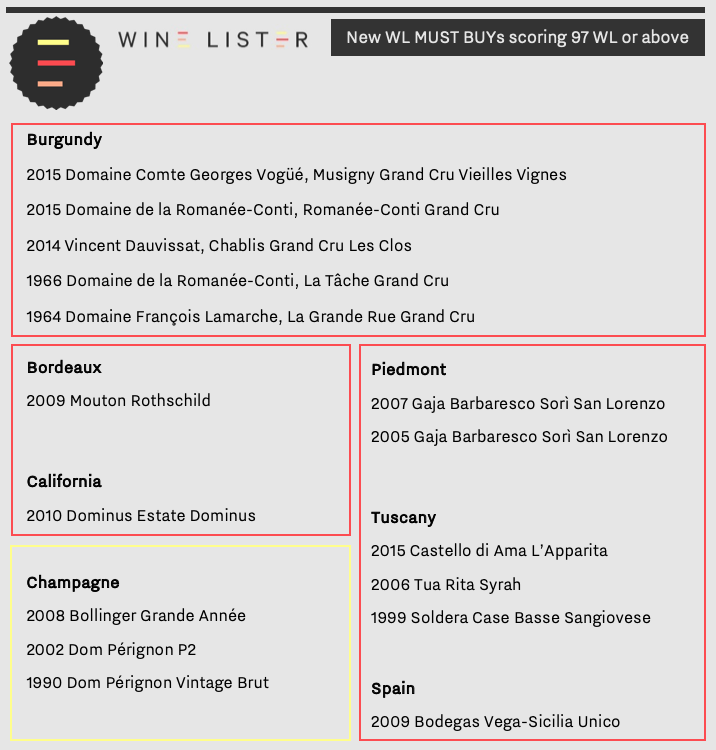

Perhaps unsurprisingly, 62 (or 42%) of new MUST BUYs hail from Burgundy. The 2017 vintage (released for the most part at the beginning of this year) yields 17 results, all worth getting hold of before availability reduces, and prices inevitably rise. Antoine Jobard achieves three mentions, all for 2017 Meursaults (Genevrières, Blagny, and Les Tillets), while Burgundy négociants are well-represented by additional MUST BUYs from Maisons Louis Latour, Louis Jadot, and Joseph Drouhin, who now count totals of 14, 42, and 20 MUST BUYs respectively. The Maisons de Négoce increasingly represent unparalleled value for money as the quality of their wines continues to increase, while their prices have not exploded in the same way as for many domaine wines.

Bordeaux gains 17 new entries, including a 2018 en primeur listing – Domaine de Chevalier Blanc. The remaining new Bordeaux MUST BUYs are mainly older vintages, with premiers and deuxièmes crus from 1982-1999 that are worth uncovering ahead of the festive season. Two Value Picks stand out from the Wine Lister team’s own tasting experiences of late – Capbern 2014 and Haut Carles 2015.

Italy reaps particular success in this new round of MUST BUYs, with 31 listings in total, split between Piedmont (14), Tuscany (15), Veneto (1), and Sicily (1). Gaja leads the charge in Piedmont with two vintages a piece for Barolo Sperss (2005 and 2014), and Barbaresco Sorì San Lorenzo (2005 and 2007). In Tuscany, a fourth vintage of Soldera’s Case Basse makes it into the MUST BUY list (1999), alongside existing MUST BUY vintages 2008, 2009, and 2013. The indomitable Castello dei Rampolla also gains an additional vintage each for Sammarco (1991), and Alceo (2008), making it the most “essential” producer to buy in Italy.

The Wine Lister team was pleased to be able to select from new wines rendered by the MUST BUY algorithm a few gems from recent tastings, including Deutz Cuvée William 2008 and Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs 2010 from a recent trip to Champagne, and Cheval des Andes 2016 – one of the team’s favourites from the September releases through the Place de Bordeaux.

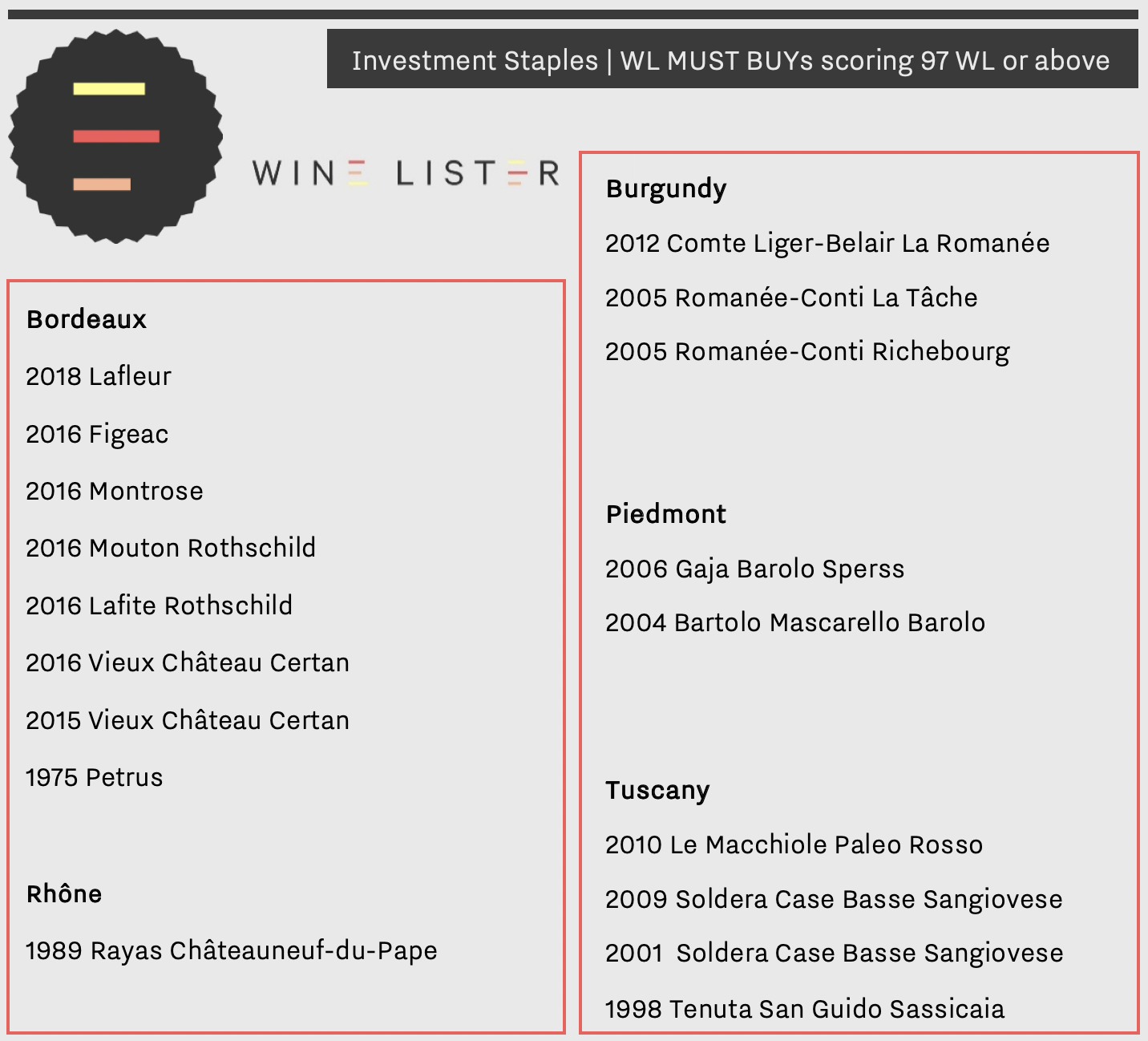

All MUST BUYs are qualified by a minimum quality level, but at the very top of the new MUST BUY scoreboard are 16 wines with WL scores of 97 and above. While Burgundy outperforms Italy in number of new MUST BUYs, they each earn five places in the top scorers, as shown below.

See the full list of MUST BUYs here, and watch this space for weekly MUST BUY updates from here on in.

A new “normal” seems to be developing for Bordeaux.

After a fleeting trip around Bordeaux properties on both banks at the start of harvest, the Wine Lister team is excited to see the 2019 vintage take shape.

We must admit this was not our sentiment on the 23rd September, when, on arrival in a dreary, damp Bordeaux, our first thought went to the poor pickers, and of course to the grapes and potential spread of disease in such wet conditions.

Thankfully this worry was quickly cast aside – “the grapes are in an incredibly healthy state. For grape health, this has been a dream year”, said Château Dassault’s Valérie Befve. This, she further explained, was thanks to the combination of a good spring without too much humidity, budburst that was a little cold but without rain, and a dry summer that was hot without having placed too much water stress on the majority of the vines.

The summer heat wave and consequential drought, similar in timing and nature to 2018 (and to an extent, 2016), will likely result in another year where freshness and caution in extraction are key. Befve put this succinctly, noting that the “skin to juice ratio will require delicate management”. This theme, recurring in several of the last Bordeaux vintages, highlights the importance of careful handling in the cellars, and explains in part the purposeful movement towards a fresher, more approachable style, and away from big tannins and high alcohol that need time in bottle to soften.

Left: Sorting of the first Merlot grapes at Pichon Baron. Right: Pichon Baron now uses small vats on wheels to transport freshly-picked grapes into fermentation tanks, since they cause less breakage of grape skins than traditional pumps.

Comparable characteristics seem in play on the left bank too. At Pichon Baron we tasted some of the very first 2019 Merlot grapes, and though the berries are a little smaller than usual (because of the drought), they are in perfect health. Axa Millésimes’ Commercial Director Xavier Sanchez was quick to say that it was far too soon to speculate on quality levels, but that the very early analyses “resembled 2018 and 2016”.

Grapes of high sugar content will need to be vinified with caution in order to balance potentially high alcohol levels. The rain that has fallen in the past 10 days will likely be a welcome gift to the Cabernet Sauvignon from the “grands terroirs” on this front, the majority of which are set to be picked this week.

Sara Lecompte Cuvelier, Managing Director of Léoville Poyferré and Le Crock echoed the positive sentiment on the general quality of grapes for both her properties, in Saint-Julien as in Saint-Estèphe – “We’re hopeful it will be another beautiful vintage, for both quantity and quality this year”.

While successions of good years are by no means unusual for the bordelais, harvests following heatwaves are becoming a pattern. All that remains to be seen is how the winemakers of Bordeaux deal with this “new normal” in the cellar. We are looking forward to finding out next year!

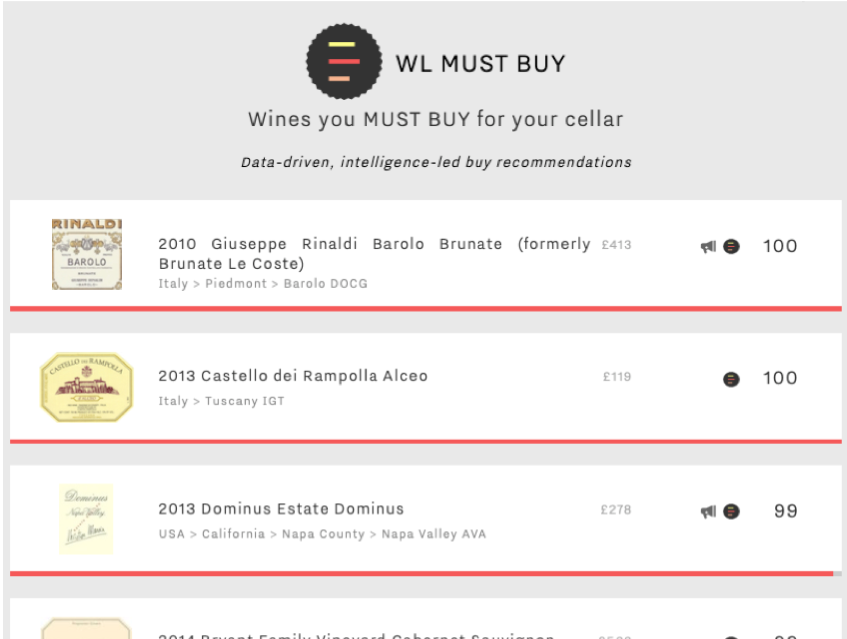

Last week we introduced Wine Lister’s new toy, a dynamic guide to the ultimate wines any fine wine lover should consider for their cellar – WL MUST BUY. While the full list is approximately 1,800 recommendations strong, Wine Lister provides some useful segments to help cut into all that data, aside from the usual criteria that can be found in our advanced search function (region, price, colour, score etc).

Wine Lister Indicators are designed to provide suggestions for your specific buying purpose, whether it be to discover something new (Hidden Gems), impress at a dinner party (Buzz Brands), drink well without breaking the bank (Value Picks), or add to your investment portfolio (Investment Staples).

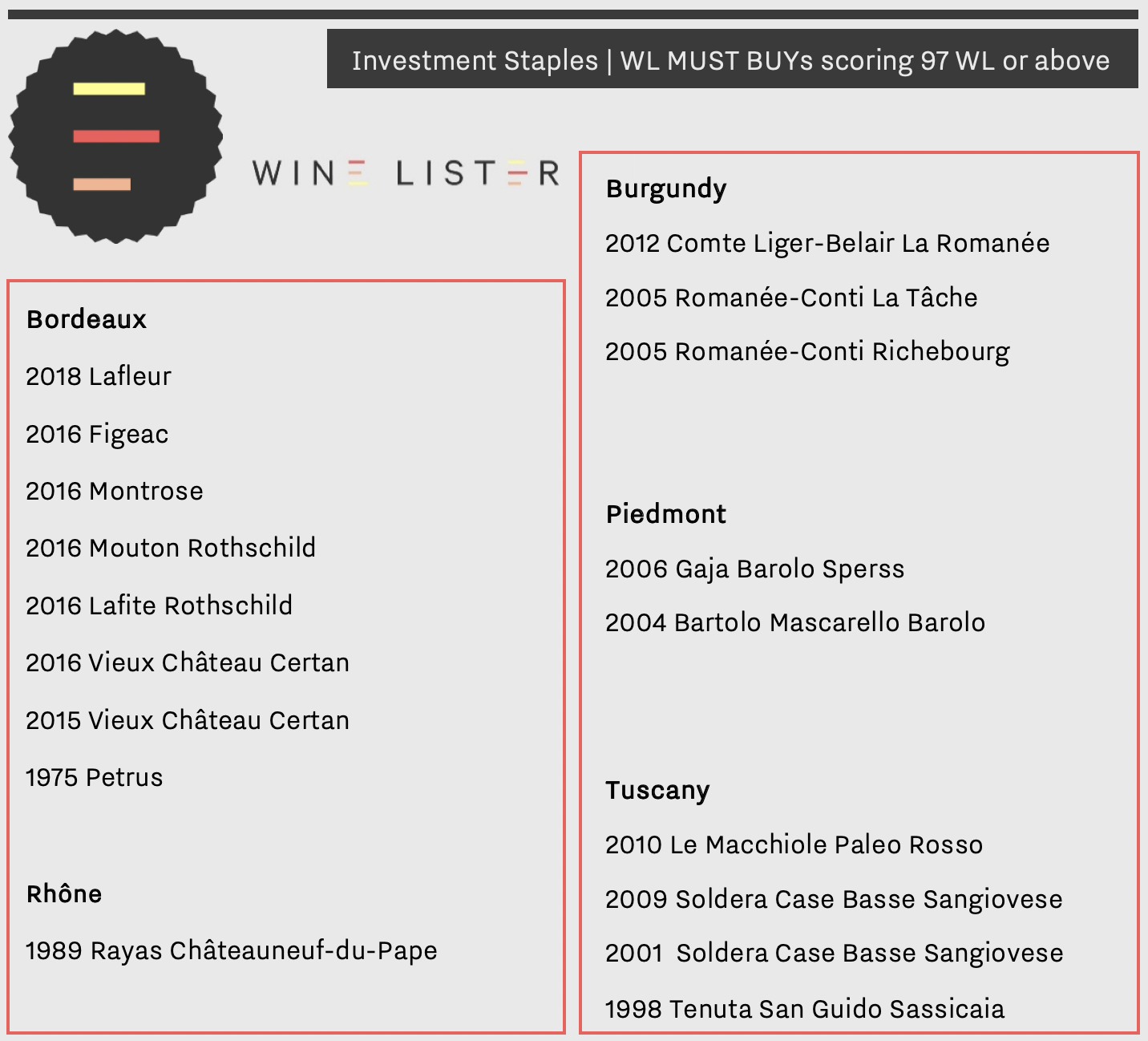

MUST BUYs and Indicators together provide a ready-made source list of the best wines to meet your needs. Below we look at the combination of our MUST BUY algorithm with Investment Staples.

Investment Staples are wines above a certain price, that are long-lived (but not too old), have proven wine price performance or represent good value compared to their peers, and are relatively stable and liquid, with recognition from our network of global fine wine trade members.

There are 18 MUST BUY Investment Staples that score 97 WL points or above. Perhaps unsurprisingly, Bordeaux represents almost half of these, with eight MUST BUYs, including two first growths (2016 Mouton, and 2016 Lafite), and 1975 Petrus.

These eight Bordeaux have an average price of £511 per bottle, or just under an eighth of the average price of the three Burgundies to qualify as MUST BUY Investment Staples. However, as investments, some of them may require patience – the prices of those from 2016 have yet to increase any significant amount. By contrast, DRC’s La Tâche 2005, Richebourg 2005, and Comte Liger-Belair La Romanée 2012 are testament to Burgundy’s impressive upward price trajectory, having already achieved three-year CAGR (compound annual growth rates) of 21.8%, 23.4%, and 33.1% respectively.

Outside of Bordeaux and Burgundy, Italy holds court with MUST BUY Investment staples from Bartolo Mascarello, and the indomitable Soldera among others.

You can see the full list of MUST BUY Investment Staples here, or check out some other MUST BUY lists, such as MUST BUY Hidden Gems, or MUST BUY Value Picks.

Don’t forget that the MUST BUY list changes weekly. Revisit MUST BUY Investment Staples again next week to see new entries.

Wine Lister is excited to announce the arrival of its new consumer site, aimed at supporting fine wine lovers as they navigate the fine wine seas. All users now have unlimited, free access to the world’s most comprehensive fine wine data hub. Start learning how to buy wine like a pro now, or read on to find out more.

WL MUST BUYs

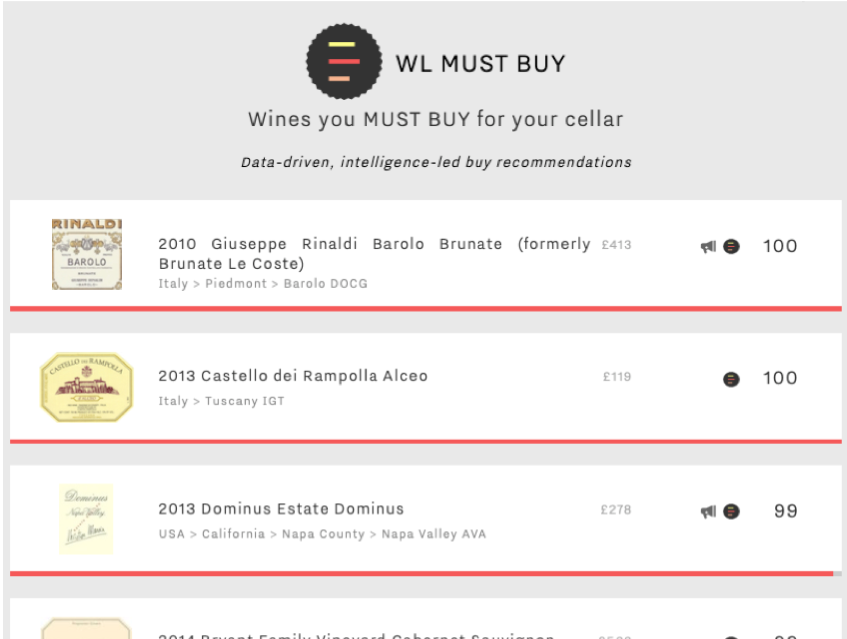

Wine Lister has created its own buy recommendation tool, which combines Wine Lister data with human intelligence (such as the opinion of key members of the global fine wine trade, plus insight from the Wine Lister team’s trips and tastings), to provide a dynamic list of wines any fine wine buyer should consider for their cellar. All MUST BUYs represent high quality, and value within their respective appellations and vintages.

Browse the full MUST BUY list here.

Browse the full MUST BUY list here.

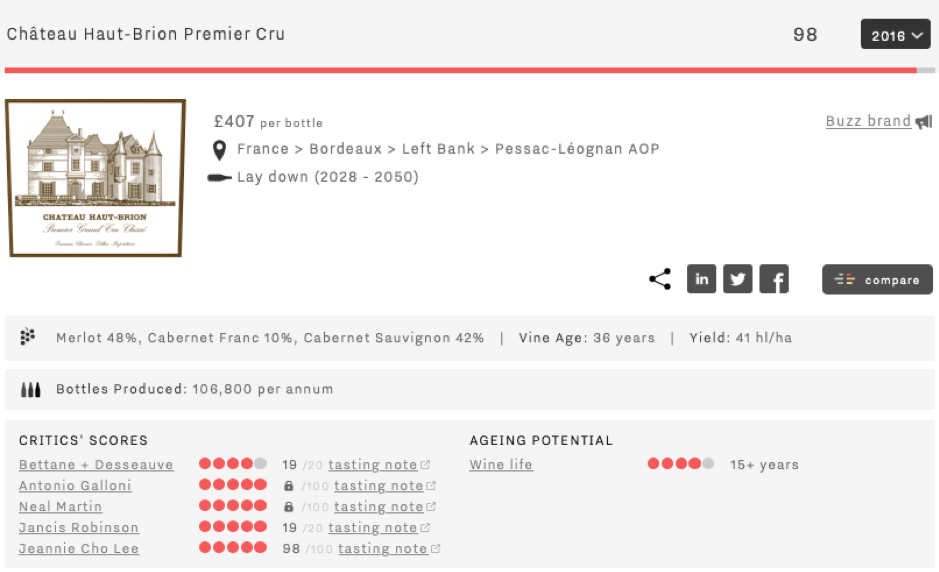

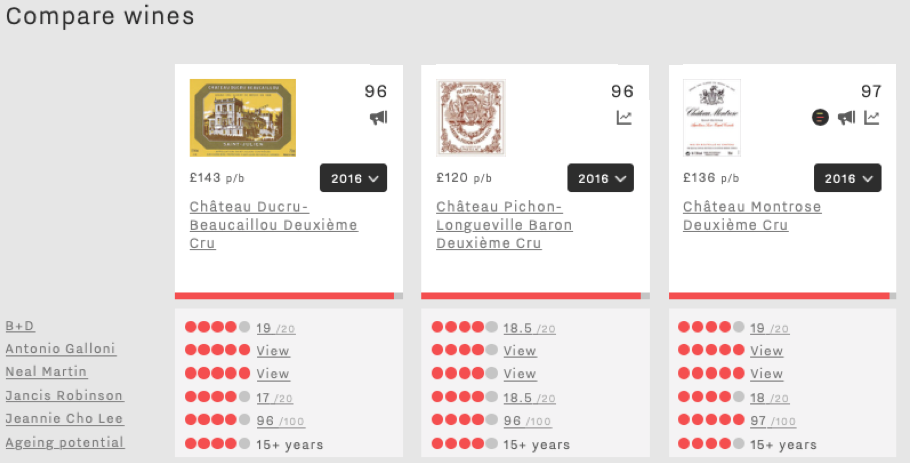

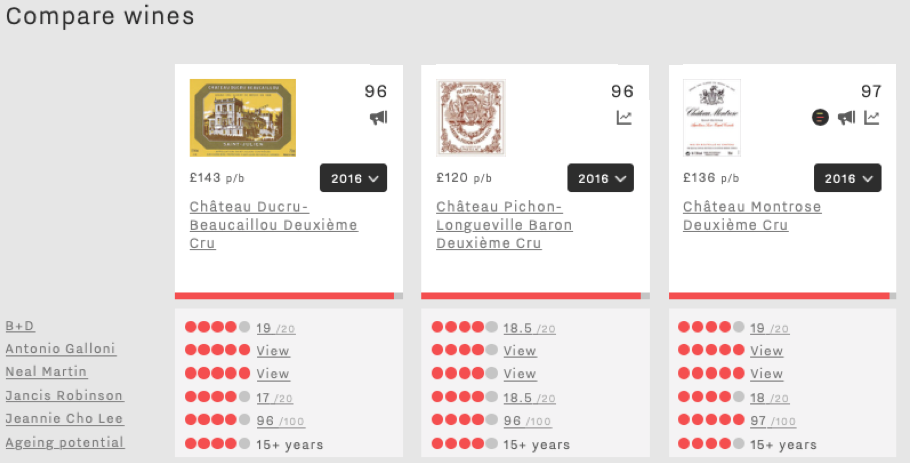

Aggregated, 100-point score

With a focus on quality, the new 100-point Wine Lister Score combines the ratings of five of the world’s most respected wine critics – Jancis Robinson, Antonio Galloni and Neal Martin (Vinous), Bettane+Desseauve, and Jeannie Cho Lee, together with a smaller weighting for the wine’s ageing potential. The score is as objective an indication of wine quality as possible, allowing users to make site-wide comparisons across the 30,000+ wine-vintages on Wine Lister.

See this comparison, or create your own here.

Further analysis tools

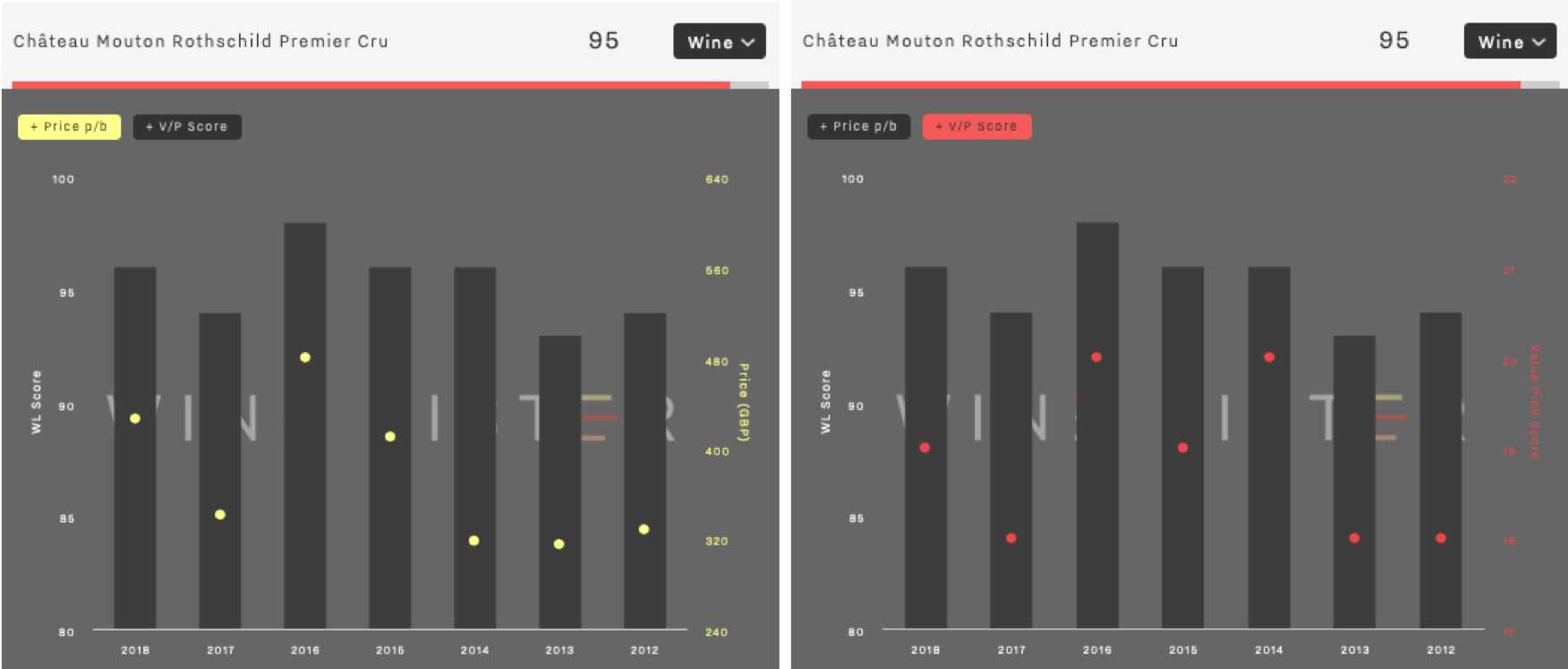

Dynamic charts give users the chance to explore wines they might consider buying or selling in more detail.

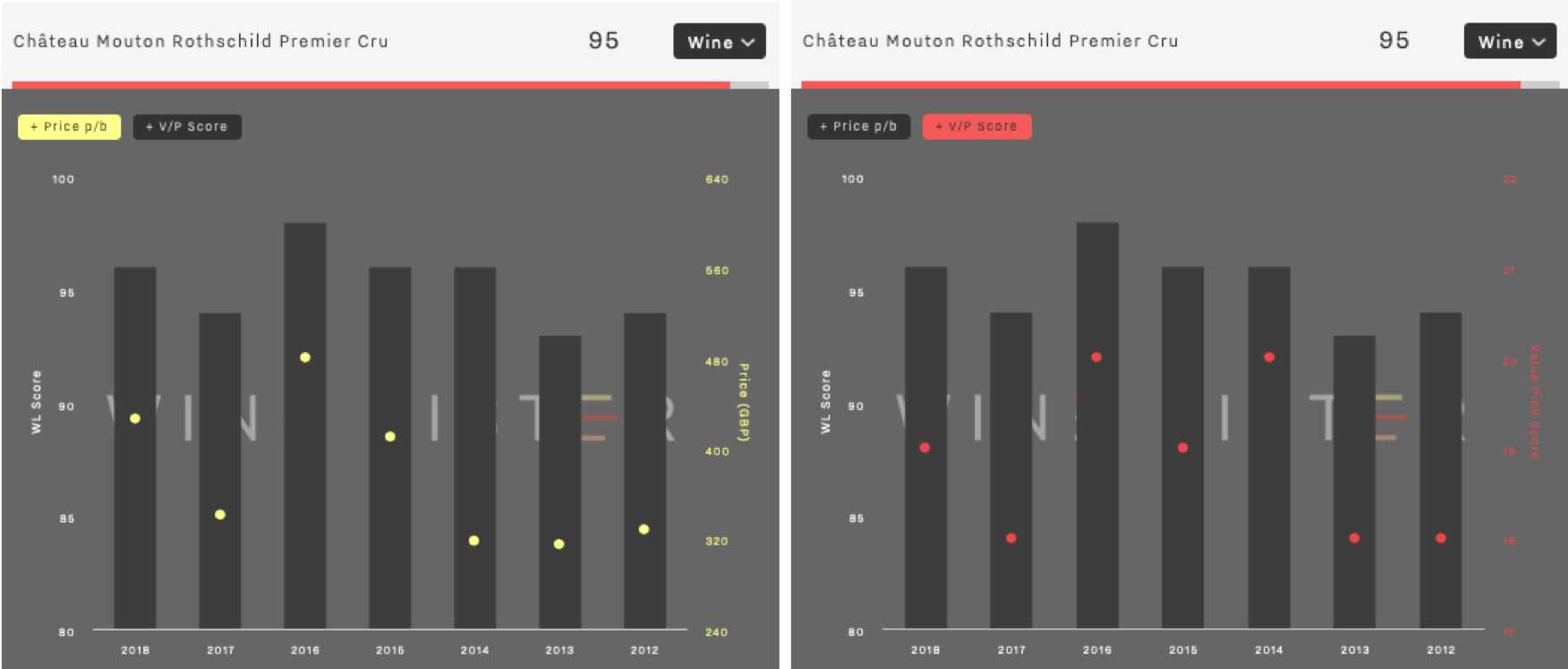

The Vintage Value Identifier gives users a clear visual of price to quality ratios across vintages of a given wine, applying a score to this measure of relative value. See the example below for Mouton Rothschild: while the 2016 vintage is higher quality than 2014, its accompanying high price means that both the 2016 and 2014 vintages present the same level of value (the joint-highest of all recent back vintages shown)

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

See the chart for Mouton Rothschild, or search for another wine here.

The Price History chart tracks a wine’s price performance over time, relative to its peer group. This can be done at vintage level, helping collectors to see performance history of a specific wine they might own. See below the example of Domaine Hubert Lignier’s Clos de La Roche 2016, whose price growth over the last year is one of the most impressive of all wines on Wine Lister (57.8%).

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

The same dynamic chart can be used at wine level (an average across vintages, with a stronger weighting for more recent vintages), to give a general indication of a wine’s price trajectory, and therefore whether or not the wine in question could be an investment buy. See below an example for Armand Rousseau’s Chambertin, which on average sees steady price growth, and a CAGR (compound annual growth rate) of 31.8% (though the price has flattened out this year).

Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years

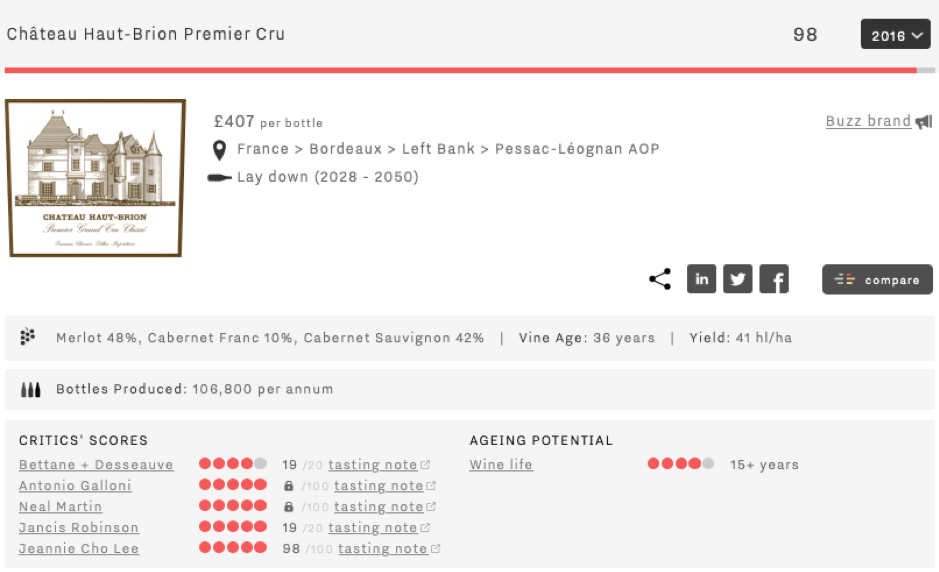

On top of these tools, each wine page gives users further information about the wine in question, including whether the wine qualifies for one of Wine Lister’s four Indicators. Haut Brion, as shown in the example below, is a Buzz Brand. See more information on other segments – Hidden Gems, Value Picks, and Investment Staples, or start browsing here.

We hope that you find the new site informative and useful for developing your fine wine collection. Feedback from our users is always welcome – please don’t hesitate to contact us with any questions or comments here.

Wine Lister spent a week in Bordeaux tasting the 2018 vintage in April, and has dedicated the last two months to covering en primeur releases for its Pro Subscribers. After what has been an unpredictable and puzzling Bordeaux en primeur campaign, we have conducted more than 20 interviews with our Pro Subscribers and Founding Members to find out how it went for them.

Below you will find our conclusions on the Bordeaux 2018 en primeur campaign, which combine our own intimate knowledge of the campaign and its peculiarities with invaluable insights from the trade.

Timing

The campaign lasted 62 days compared to 59 last year (from the date of the first major release to the last standard-channel releases). One clear improvement, thanks to a concerted effort by courtiers, was the spacing out of releases more evenly over the period. However, this did not address the more acute concern around the overall length of the campaign, with the wine trade expected to concentrate on the new Bordeaux vintage for two whole months of the year.

Pricing

A more major frustration was pricing. Over 80% of Wine Lister Pro Subscribers / Founding Members surveyed said prices were too high. On average, prices were up 13% on 2017 and 2% on 2016 release prices. This only made sense where 2016s had gone up in the market since release – not often enough the case. As a result, 2018s came onto the market on average 1% above the current market price of 2016, despite the latter – one of the vintages of the century – being physically available.

Needless to say, many wines stalled upon release due to over-ambitious pricing. When we asked the trade which wines sold the worst, more than once the reply was, “too many to mention”.

Desire

However, one of the more unfathomable motifs of the campaign was that in several instances, this highly ambitious pricing was accepted by the market, and the wines sold through. These were wines with good momentum behind them and a particularly loyal following, but most of all they were wines with a specific story that superseded any thought of value relative to prior vintages.

Examples of this phenomenon are Domaine de Chevalier and Palmer. Both were released into the market above every recent back vintage, and yet both met with demand thanks to the stories behind each wine. Domaine de Chevalier’s owner, Olivier Bernard, started sowing the seed several months before the campaign saying his 2018 was the best wine he’d ever made, a statement reiterated by the rest of his family and gradually absorbed through the fine wine chain. Unable to use conventional sprays, Palmer lost two-thirds of its crop to mildew, and made a striking, unusual wine that Managing Director Thomas Duroux said would “go down in history”.

“The market is very smart and only follows brands that it’s imperative to buy en primeur,” states Laurent Bonnet, Export Director of négociant L.D. Vins.

It was a campaign that favoured top names, not value wines. Wines below €50 were largely unsuccessful (with a few exceptions such as Laroque, Capbern, and Potensac – the three most affordable Bordeaux 2018 Wine Lister MUST BUYs).

David Suire, Managing Director of Château Laroque – a Bordeaux 2018 WL MUST BUY

Volume

After pricing, the most cited frustration was reduced volumes. On average, leading properties released around 20% less wine than last year. “The number one cause of reduced volumes is lower production in 2018 compared to previous years,” said Mathieu Chadronnier, Managing Director of négociant CVBG, who, like other participants in the campaign would have liked to have more volume to sell of certain wines. “It is a frustration, but there’s nothing we can do about it,” he concluded.

Certainly several properties produced less wine due to mildew and a very dry summer. Others made a commercial decision to keep back more wine – a continuation of the gradual trend for Bordeaux châteaux to release less wine en primeur, whether to create an impression of rarity, and / or to partake in the future upside by selling the bottled wine later once it has – they hope – increased in value.

Bonnet underlines the irony of having less and less stock of the wines that sell well, and too much of those that don’t: “The ‘not enough of in-demand wines / too many wines to hold as stock’ equation is difficult for négociants to resolve,” says Bonnet, cautioning that, “the financial stakes are high.”

Good news stories

While Asian buyers were reported to be less present than in previous years, other geographies remained strong – the US, continental Europe, and especially the UK.

The 10 greatest success stories of the campaign included six Wine Lister MUST BUYs: Calon Ségur, Canon, Carmes Haut-Brion, Rauzan-Ségla, Léoville Las Cases, Mouton Rothschild, and Lynch-Bages.

Revenues were up on 2017 across the board, in many cases very significantly. The majority of respondents reported en primeur revenues the same as or above 2015 levels, with only a couple of exceptions. However, very few managed to equal 2016 revenues.

Future(s)

On the one hand, it seems obvious that the 2018 Bordeaux en primeur campaign could have been more of a roaring success with more astute pricing and in some cases a bit more volume to go around. On the other, many of our Pro Subscribers and Founding Members have been pleasantly surprised by the outcome, and will conclude their campaigns with better revenues than they expected.

This leaves many convinced of the merits of en primeur, if frustrated that it’s not reaching its full potential. “We could have done £35m,” said Max Lalondrelle, Fine Wine Buying Director of UK merchant Berry Bros. & Rudd, which in fact made c.£22m in revenues on the 2018 Bordeaux en primeur campaign.

Meanwhile other members of the trade have ceased their Bordeaux en primeur activity altogether over recent years, and some are questioning its future viability. For the time being, the sun has set on this year’s campaign, but it will rise again next year on the utterly unique global marketing and distribution tool that is en primeur.

Read more about our new MUST BUY tool in our recent blog here.

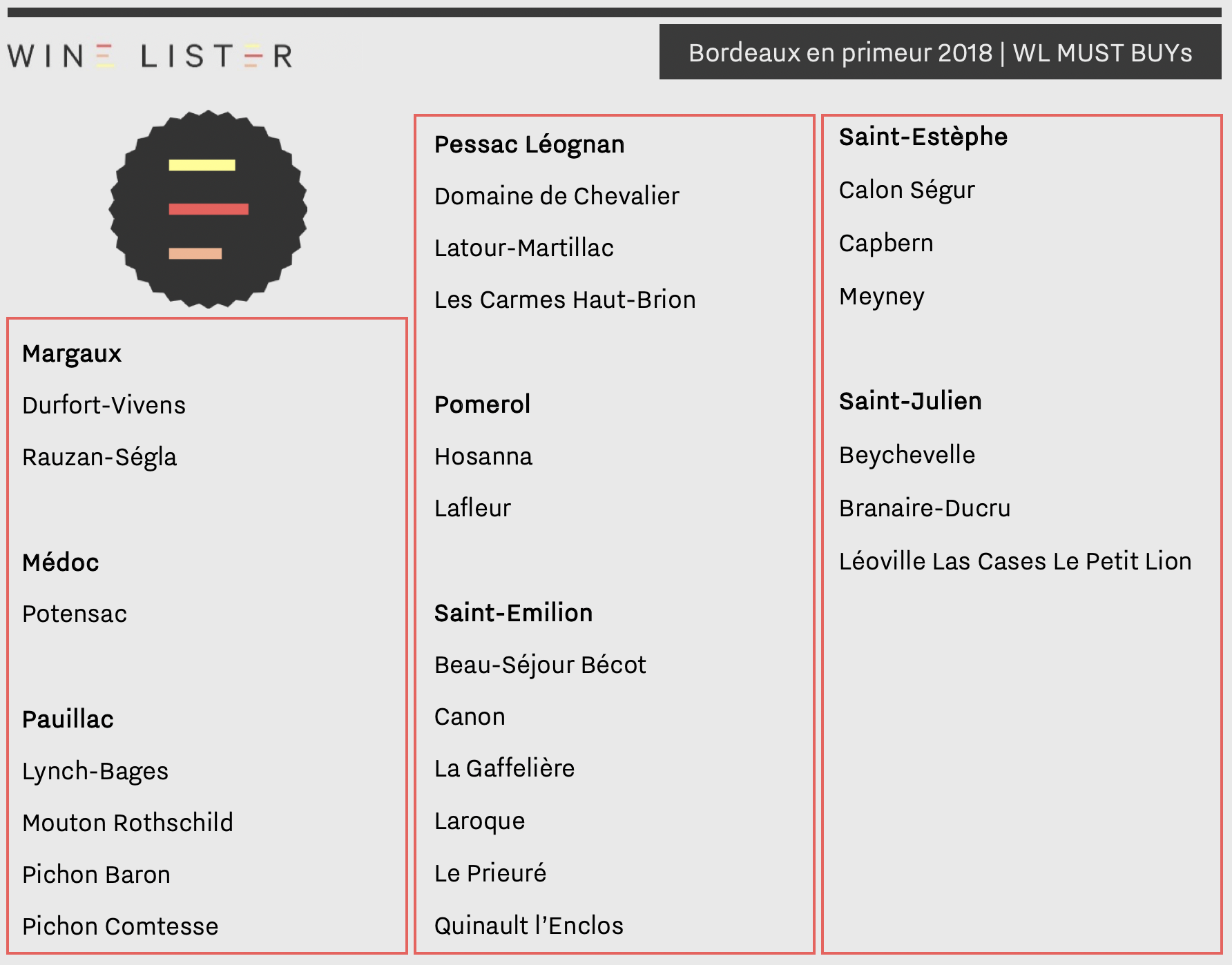

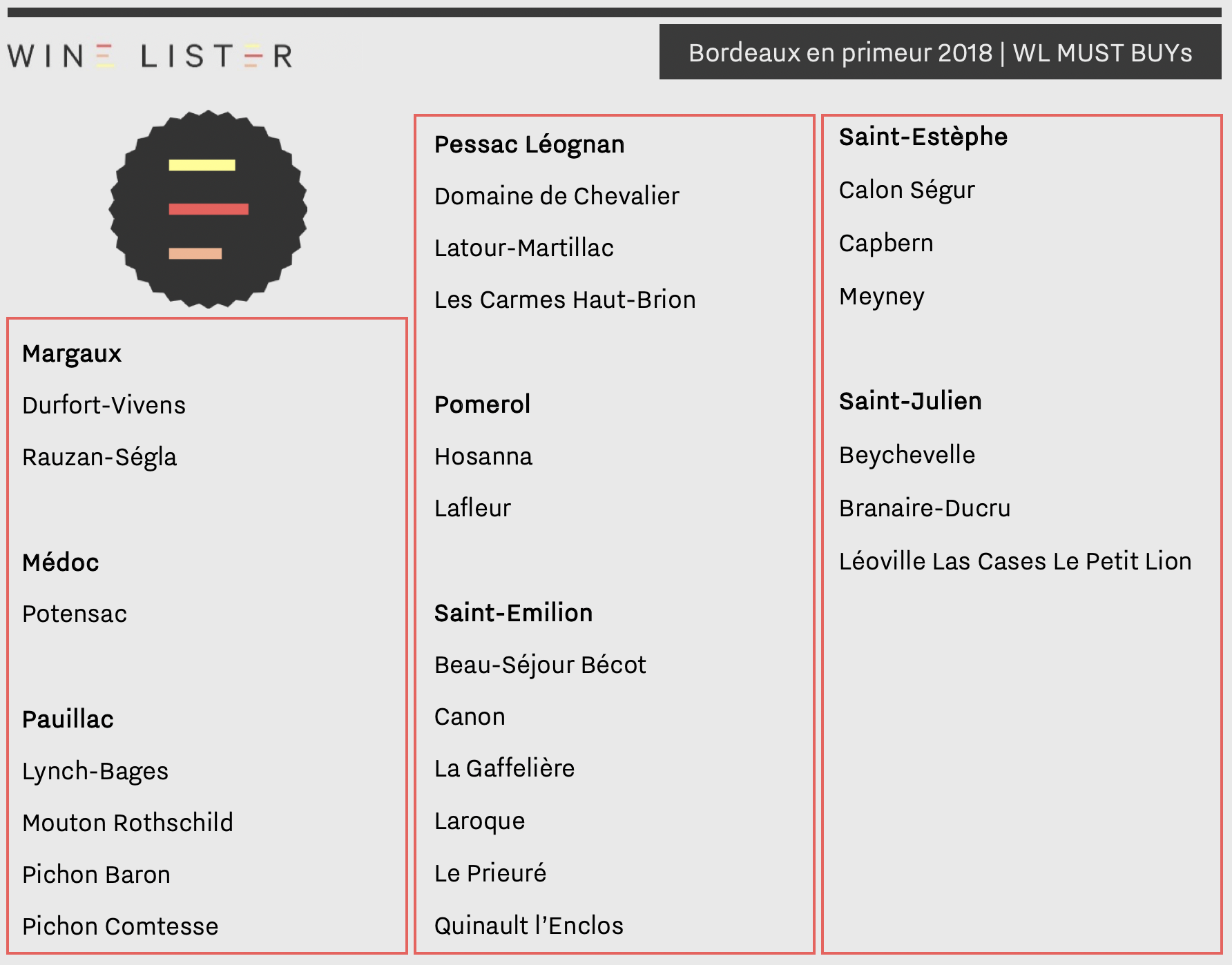

The Bordeaux 2018 en primeur campaign is over. While the quality of wines available is, for the most part, unquestionably good, release prices have been on the high side to say the least, making the benefit of buying en primeur less obvious than in previous years.

Wine Lister’s brand-new website feature, WL MUST BUY, was launched this week*, especially for Bordeaux 2018 wines, to give valuable guidance as to which wines really are worth snapping up now.

Our ground-breaking MUST BUY recommendations are data-driven, with an intelligence-based, human overlay. The algorithm takes into account a wine’s quality and value within its vintage and appellation, as well as the latest industry intelligence from key players in the global fine wine trade. The Wine Lister team have scoured these results to identify must-buy wines based on our own tastings of Bordeaux 2018s, and insider market knowledge.

Given the dominance of reds in the top Bordeaux 2018 Quality scores, it is no surprise that all of these WL MUST BUYs are red.

Saint-Emilion ranks as our most recommended appellation, with six WL MUST BUYs, including the indomitable Canon, and value successes Le Prieuré, Quinault l’Enclos, and Laroque. These three achieve WL MUST BUY status by first passing the quality filter of Wine Lister’s MUST BUY algorithm (they exceed their collective Quality score average by 192 points in 2018). Their respective prices relative to similar quality 2018s from Saint-Emilion push them through the algorithm’s second step – the value filter. Finally, they have been identified by the fine wine trade and/or the Wine Lister team as wines to watch: Quinault l’Enclos is made by the elite winemaking team of Cheval Blanc, and their best yet, while Laroque has been taken to new heights by winemaker David Suire (who cut his teeth at Larcis-Ducasse).

Pauillac houses four of the “top end” Bordeaux 2018 MUST BUYs – Mouton (released at £426 per bottle in bond), both powerhouse super-seconds, Pichon Baron and Pichon Comtesse, and Buzz Brand Lynch Bages.

Sharing three picks apiece are further left bank appellations Saint-Julien, Saint-Estèphe, and Pessac-Léognan. Capbern, Meyney, and Latour-Martillac are testament to the value proposition available in Saint-Estèphe and Pessac-Léognan respectively. Saint-Julien MUST BUYs are represented by two fourth-growth staples, Branaire-Ducru and Beychevelle, and the second wine of Léoville Las Cases, Le Petit Lion.

Margaux earns two MUST BUYs – Rauzan-Ségla, and biodynamic Durfort Vivens (who made a huge step up in quality this year, and whose 2018 yield was less than a quarter of its usual volume). Pomerol equals this number with Lafleur and Hosanna.

Other wines featured in Wine Lister’s Bordeaux 2018 MUST BUYs list are: Beau-Séjour Bécot, Calon Ségur, Domaine de Chevalier Rouge, La Gaffelière, Les Carmes Haut-Brion, and Potensac.

*Wine Lister launched its MUST BUY tool on Monday at a Telegraph event entitled “Wine for Pleasure or Profit?”, where founder & CEO Ella Lister spoke about going “Back to Bordeaux” for both. You can see slides from the presentation relevant to Bordeaux 2018 MUST BUYs here: Telegraph Back to Bordeaux

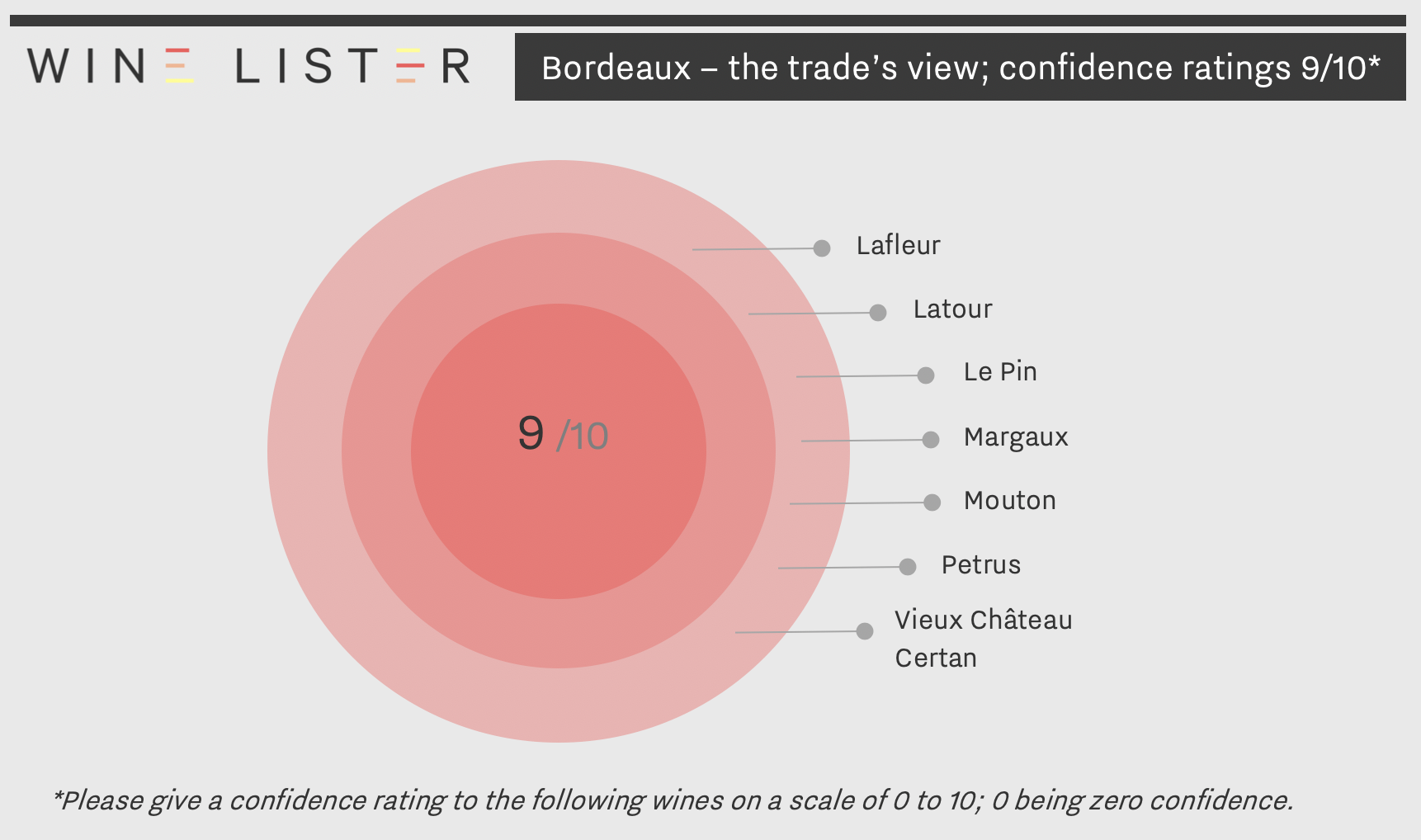

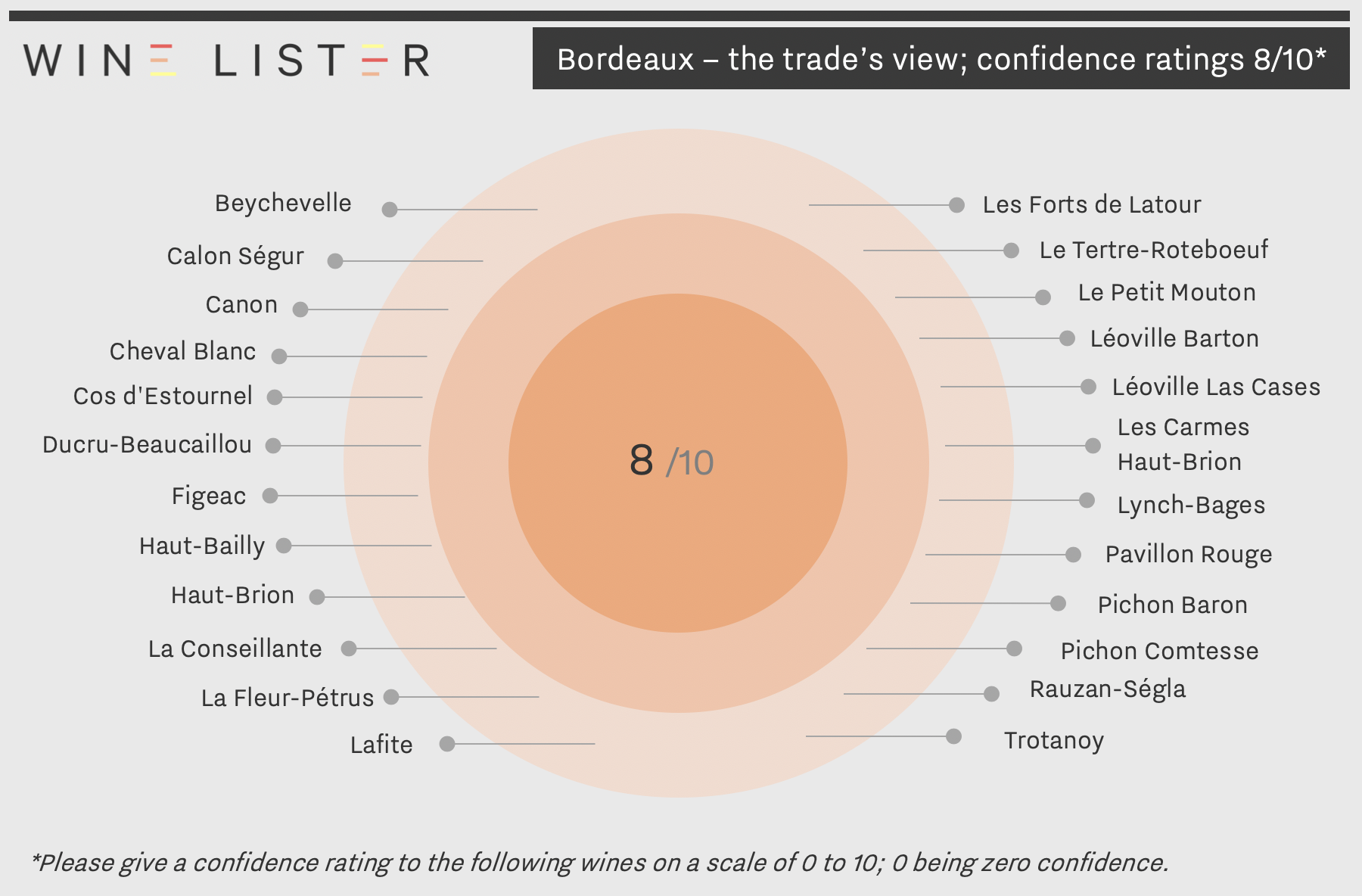

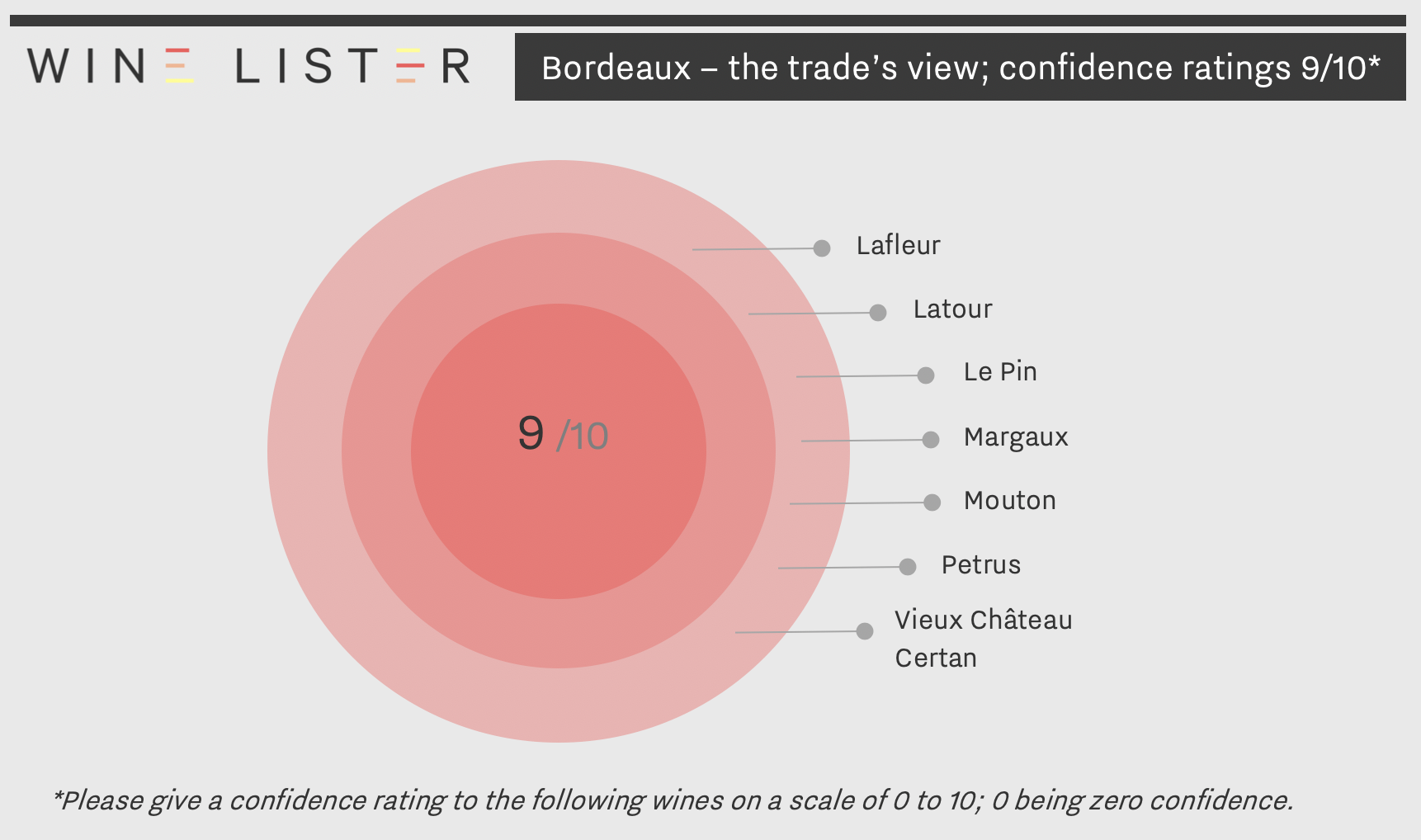

Included in Part II of Wine Lister’s Bordeaux Study 2019 (released last week), are results of our latest trade survey. Wine Lister asks its Founding Members (c.50 key players in the global fine wine trade) to give “confidence” ratings to more than 100 key Bordeaux wines on a scale of 0 to 10; 0 being zero confidence.

For the third consecutive year, no Bordeaux wine received a perfect 10/10. Wines retaining their 9/10 confidence rating since last year are Le Pin, Margaux, Mouton, and Petrus. Joining them in 2019 are Lafleur, Latour, and Vieux Châteaux Certan – the latter being a particular source of interest, given its average price of £139, or just 13% of the average of the rest of the group.

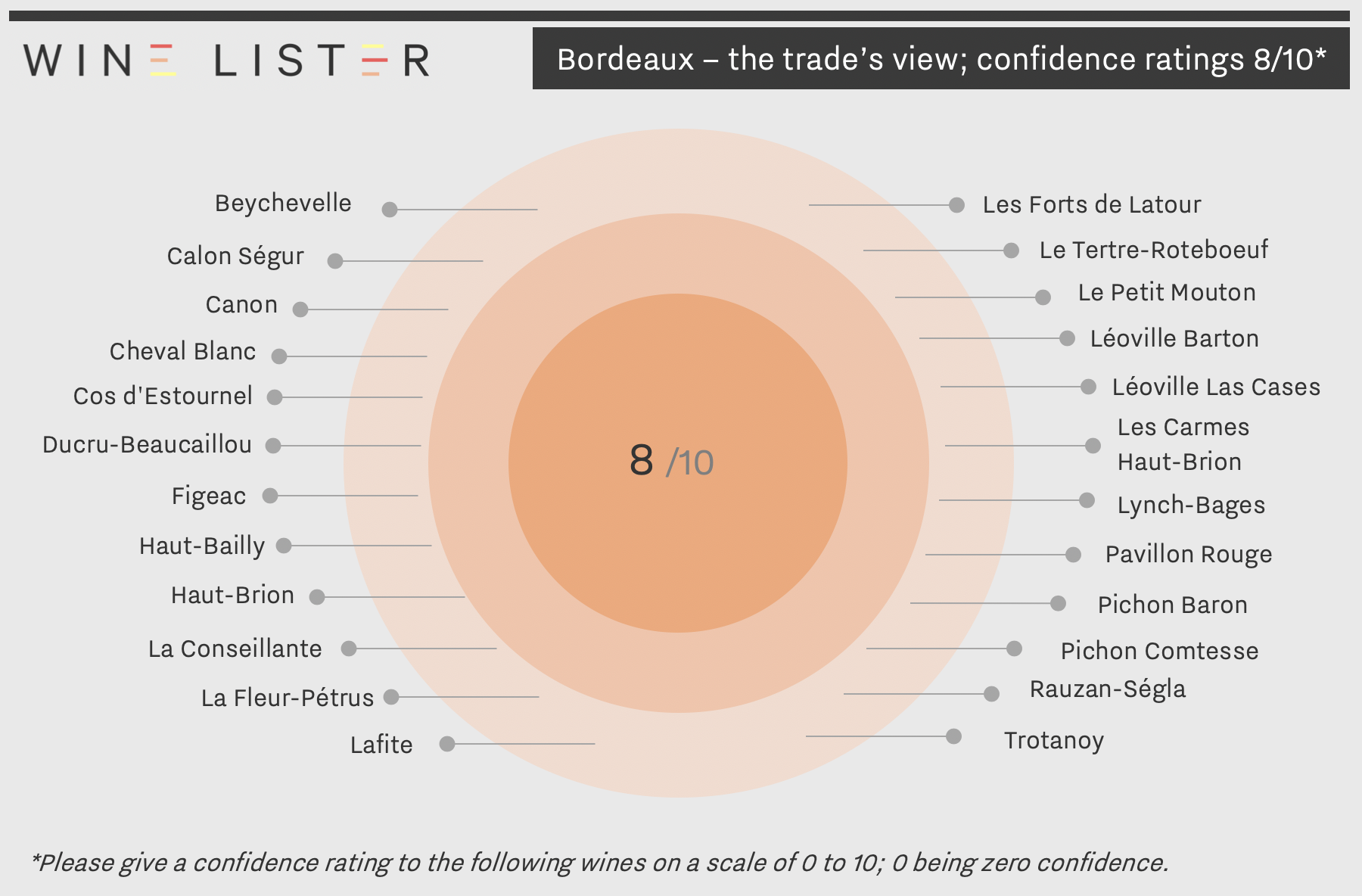

Meanwhile the two remaining left bank first growths, Haut-Brion and Lafite, have slipped down into the next confidence band, receiving an average of 8/10. Saint-Émilion superstar, Canon, has also moved down one point since last year, despite also being cited by the same trade group as a wine seeing the sharpest rise in demand, and a wine of likely future prestige.

The 8/10 category contains 24 wines, compared with 21 in 2018. New entries into the 8/10 category include two of the best performers en primeur – Beychevelle and Les Carmes Haut-Brion. Others moving up to this category are Cos d’Estournel, Les Forts de Latour, and Léoville Barton.

The improved confidence in Pomerol within the top two groups is noticeable, with Lafleur and Vieux Château Certan effectively taking the places of Canon and Lafite, and two wines from the Moueix stable – La Fleur-Pétrus and Trotanoy moving up into the 8/10 category this year (at the expense of Ausone, La Mission Haut-Brion, Léoville Poyferré, Montrose, and Palmer, which have all moved down into the 7/10 group). As well as earning high confidence, Pomerol also achieves the highest number of wines in the 2018 Quality top-25.

Visit Wine Lister’s Analysis page to buy and/or download the full report, and see confidence ratings for all other wines in the study (available in both English and French).

Browse the full MUST BUY list

Browse the full MUST BUY list

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right). Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years