As the first major week of Bordeaux 2019 en primeur releases draws to a close, this morning (Friday 5th June) saw the release of the “first of the Firsts”, and the other reds from the Lafite stable.

Carruades de Lafite 2019 opened the stage with a price of £158 per bottle (in-bond), making it the least expensive Carruades available on the market. The Wine Lister team felt the quality of Carruades saw a significant jump up in 2018, and from what we have heard, the 2019 matches it. With this in mind, and given that volume released onto the market is 50% less than last year, this is a sure buy for anyone seeking access to the Lafite prestige with more approachability.

The grand vin, Lafite 2019, has been released at £426 per bottle in-bond – a discount of c.20% on the 2018’s current market price. The crucial factor this year are the volumes available – also 50% less than last year. On top of this, the single tranche released means buyers will only have one shot to get their hands on the 2019 en primeur (as far as we know). Domaines Baron de Rothschild’s Commercial Director, Jean-Sébastien Philippe, calls Lafite a “modern classic” in 2019, with precision, length, and finesse, but impressive ripeness, making it more approachable than the likes of 2018 or 2016.

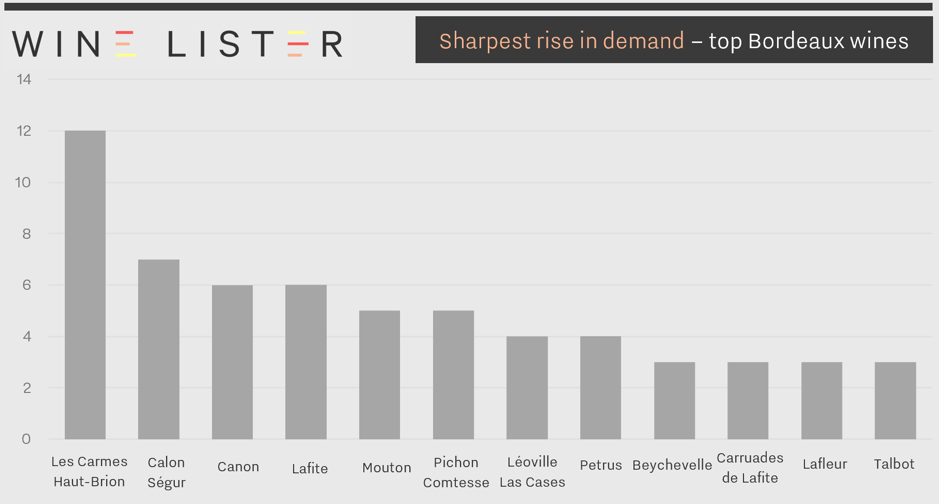

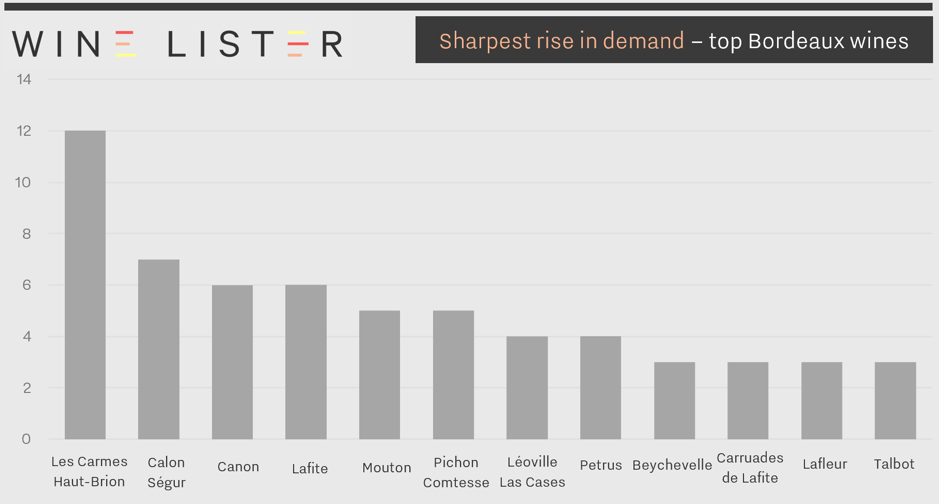

Both Lafite and Carruades were cited by the trade as seeing sharp rises in demand (see below) according to Wine Lister’s 2020 Founding Members’ survey. Competition to access both of these wines will therefore likely be high.

Lafite’s Pomerol property, L’Evangile, has released its 2019 grand vin at £146 per bottle in-bond, 15% below the current market price of the 2018. Once again, the Wine Lister team noticed a distinct quality step up in Evangile’s 2018, which we’ve heard has been equalled in 2019. The 2019 reportedly expresses well the move towards a more modern style, and a wine of increasing tension, florality, and freshness, without losing the plush Pomerol profile.

Duhart-Milon 2019 has also been released, at £52 per bottle in-bond. Though the release price puts it more or less in line with market prices of back vintages 2018 and 2016, there is justification to be found in the excellent quality that the Lafite team believe is there in 2019. Philippe explains that Duhart-Milon’s vines sit on a cooler terroir than those of the estate’s Pauillac neighbours, which means in cooler vintages, the wine can be somewhat “austere”. The increasing average temperatures that Bordeaux has seen during recent growing seasons (2018, 2016, and 2015 vintages) therefore only serve to improve the quality of Duhart-Milon, and 2019 certainly had its fair share of heat.

Keep up to date with further Bordeaux 2019 en primeur releases through Wine Lister’s twitter, or through our dedicated en primeur page.

This week has seen a flurry of further 2019 en primeur releases, including the likes of Palmer, Cos d’Estournel, and Domaine de Chevalier’s red and white.

Released this morning (Thursday 4th June) are wines from the Guinaudeau family, including one of the most in-demand wines from Bordeaux, Château Lafleur. Lafleur 2019 is available (for the lucky few who can get their hands on it) for c.£1,550 per 3 pack case in-bond – the same release price as in 2018. While this goes against the 30%-35% discount on last year’s prices that the trade believe may just make the 2019 campaign a success across the board, Lafleur is one of the few exceptions to this rule.

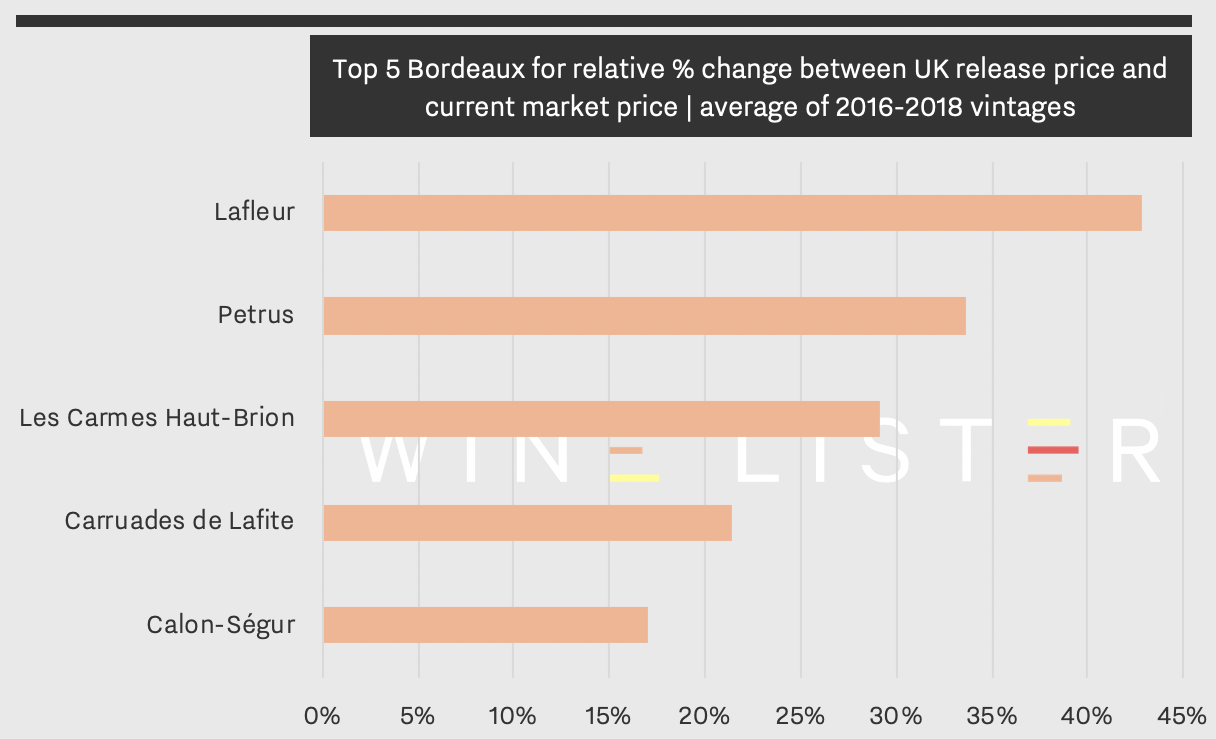

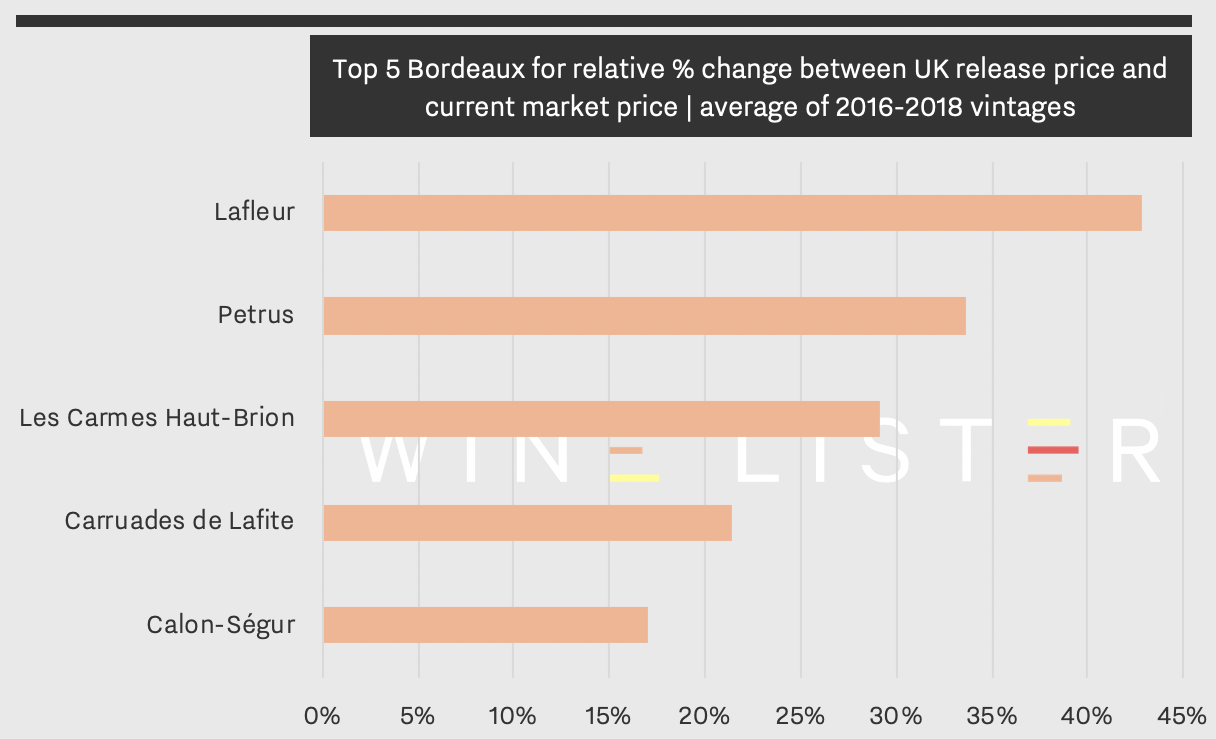

Aside from its impressive and consistent quality, Lafleur boasts one of the smallest-sized estates (4.5ha) for any top Bordeaux property. With rarity on its side, the grand vin is the number one performer for price appreciation after en primeur release.

The chart above shows the top five Bordeaux wines for average percentage increase of the last three vintages – 2018, 2017, and 2016, since their respective releases. The last three releases of Lafleur have seen an average market price increase to date of 43% – 9% more than Petrus.

Perhaps also contributing to the popularity of the Guinaudeau family’s wines is their more “Burgundian” approach to winemaking, with vineyards planted on three separate plots of very different soil types, and the final products aiming to reflect these differences.

For those unable to achieve the dizzy heights of an allocation of the grand vin, the estate’s Perrières de Lafleur (available for £256 per 6-pack in-bond for the just-released 2019 vintage) does exactly this, typically showing mineral, chalky notes from its limestone terroir. Perrières de Lafleur was officially “born” last year, after 15 years of research and testing under the wine’s beta pseudonym, “Acte”.

Finally, at the opposite end of the price spectrum to the flagship wine is Grand Village – the family’s Bordeaux Supérieur, whose quality has come on leaps and bounds over the last few vintages. Grand Village is a Value Pick in every single vintage listed on Wine Lister (2018-2013). If the 2019 is anywhere near the quality of last year, it will surely offer the same impressive quality-to-price ratio.

Follow Bordeaux 2019 en primeur releases through Wine Lister’s twitter, or through our dedicated en primeur page.

We say it every year – the prices have to be “right”. While the Bordeaux 2019 en primeur campaign may be exceptional operationally, the same message resounds from the trade as in many a previous en primeur campaign – the prices have to be right.

Chairman of Farr Vintners, Stephen Browett, defines the crux of the matter succinctly; “one thing that is absolutely crystal clear is that for this en primeur campaign to work, Bordeaux must return to the fundamental (and recently ignored) concept that en primeur wines need to reach the consumer at lower prices than physically available vintages”. For at least the last three Bordeaux en primeur campaigns, release prices have generally been too high. The key difference this year is that the Bordelais have a unique opportunity – COVID-19 and the ensuing global economic crisis – to bring prices down significantly without losing face, or undermining the pricing of previous vintages.

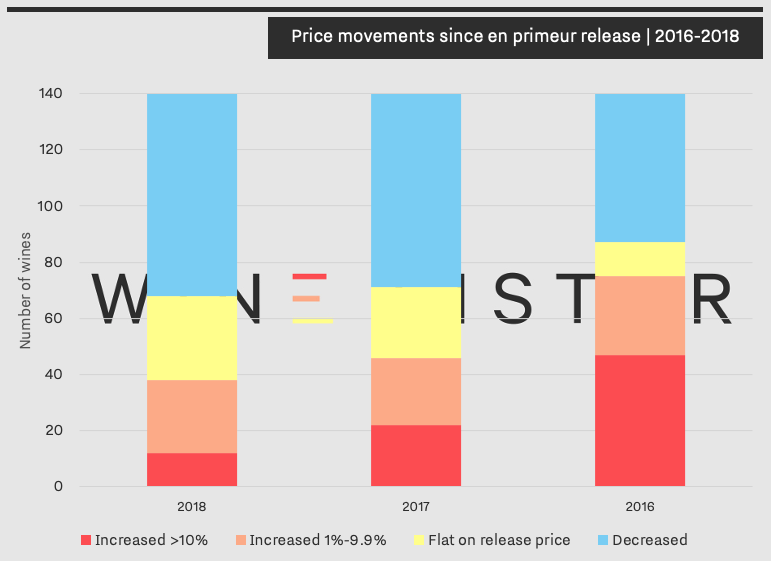

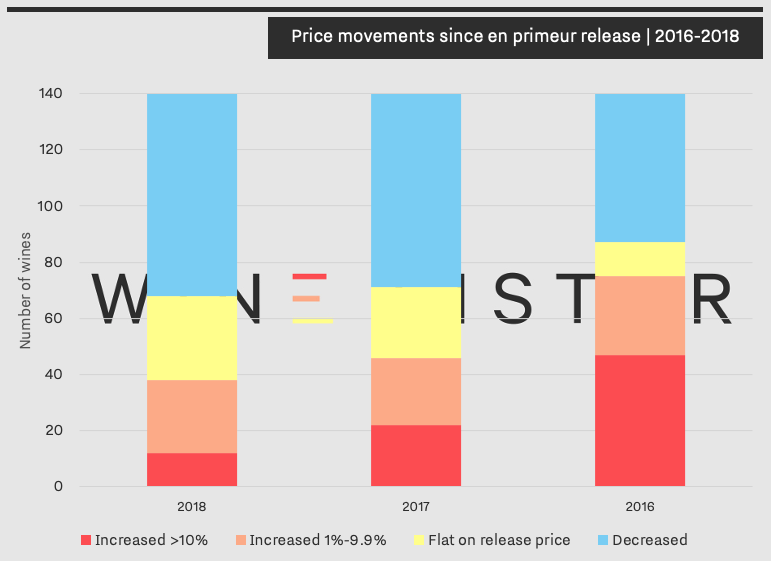

Analysing a basket of 140 top Bordeaux wines, the chart below looks at price movements of the last three vintages on the fine wine market since their respective releases.

Bordeaux 2016s were released three years ago. As shown in the chart above, today just over half of them are worth more than they were en primeur – these 75 wines have increased by an average of 18% since the spring of 2017, although they include the likes of Les Carmes Haut-Brion, Lafleur, and Petrus, which have seen mammoth price increases of 111%, 109%, and 64% respectively. 65 of the top Bordeaux 2016s have either stayed flat or have decreased in price since en primeur release. Assuming an in-bond storage cost of £12 per case for the last year on these, the chances are that many buyers would have saved more money purchasing 2016s now.

The picture is worse for 2017 and 2018 releases, with approximately half of wines having decreased in value. Last year the high quality of the vintage coupled with small quantities available was cited repeatedly as a reason for price hikes. This year, however, there is no glass door to hide behind. The quality of the 2019 vintage is reportedly excellent, but volumes are also good. Add to this the unprecedented context of a campaign during a global pandemic, and the pressure is on more than ever for prices to drop significantly.

Buying Director of BBR, Max Lalondrelle, tells me, “in order for the consumer to put their faith in the product without knowing too much about the quality or style, the wineries will have to offer some relatively good prices to entice consumers to take the risk”. Members of the trade have elsewhere qualified what “good prices” might mean – a price reduction of 30-35% on 2018s. Flying blind and relying on the historical quality of solid brands to make choices in 2019 (in the absence of all the usual critics scores) is one thing – doing so in the face of such an uncertain future for many is another entirely. For releases to work this year, sacrifices will need to be made by the châteaux – quality of the wine must be put aside, as context, and getting the market to bite during such difficult times, will be everything.

The first major release so far has listened to the market – Pontet-Canet’s 2019 is priced 30% lower than 2018s release. Feedback on the release has been good – Chief Executive of Goedhuis, Tom Stopford Sackville, tells us it was “a very encouraging start to the campaign”, and a “positive signal regarding 2019 pricing in general”. If other châteaux follow suit, the campaign could be a memorable one, that, as Browett puts it, inspires “a new confidence” in en primeur “after recent disappointing campaigns”.

The fine wine trade (Wine Lister included) is rooting for Bordeaux, willing its unique selling system to deliver. The equation for pricing this year could in some ways not be simpler – it is hoped that a sufficient number of properties will take this into account, and present prices the market can embrace.

Releases are set to begin in earnest from tomorrow – 2nd June. Follow them through Wine Lister’s Twitter, or through our dedicated en primeur page.

Chloe Ashton

June 1, 2020

Wine Lister is a big fan of Bordeaux – the city, the people, the wines (of course), and we even have a soft spot for its idiosyncratic system for selling wines. This year has thrown us, as we learn about the 2019 vintage from our desks, confined to our homes, rather than out on the “Médoc highway” or between the walled roads of the right bank.

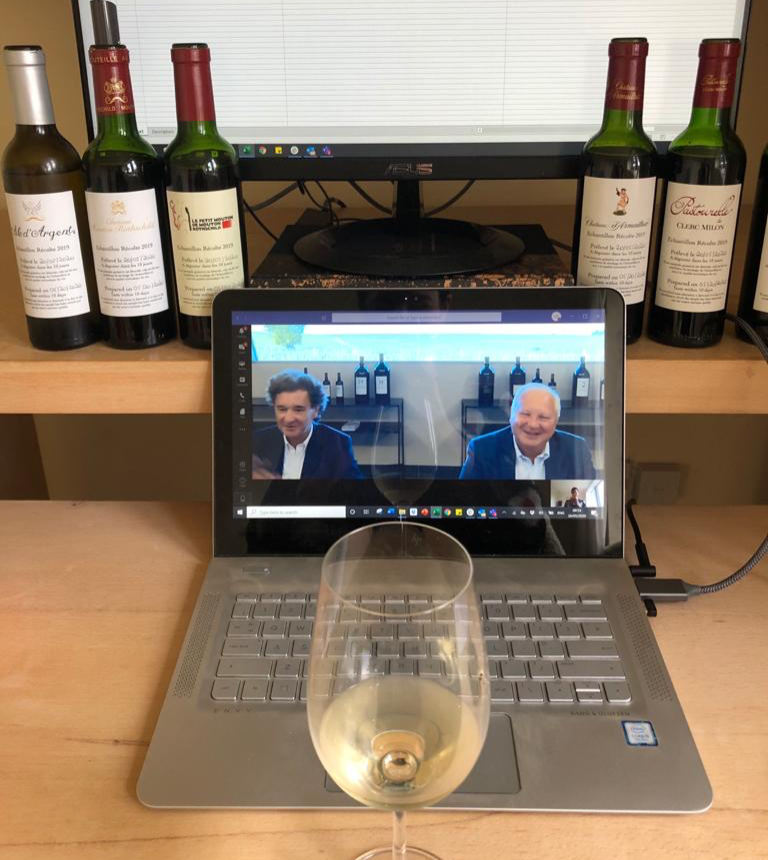

Virtual tasting – Wine Lister’s Founder & CEO, Ella Lister, tastes the Baron Philippe de Rothschild 2019s with Philippe Sereys de Rothschild and Managing Director, Philippe Dhalluin.

Virtual tasting – Wine Lister’s Founder & CEO, Ella Lister, tastes the Baron Philippe de Rothschild 2019s with Philippe Sereys de Rothschild and Managing Director, Philippe Dhalluin.

From what we have heard and read (and from the little we have tasted so far), the 2019 vintage in quality terms is in line with recent greats – 2018, 2015, 2010, and 2009. The current global pandemic makes for an unlucky welcome party for a wine that had luck on its side all through the growing season. Climatic events for the 2019 vintage were far less extreme than for 2018 or 2017. Frost threatened, and heat waves came, but each time the majority of vineyards escaped from disaster. “There was heat, but rain each time we needed it at the precise right moment”, explains Cos d’Estournel’s owner Michel Reybier. He names his Grand Vin in 2019 “miraculous”, and adds that Cos d’Estournel Blanc is the “best white they’ve ever made”. Miracles occurred further south in the Médoc, too – Technical Director Nicolas Glumineau believes that Pichon Comtesse 2019 has finally overtaken the heights of his heretofore “hero wine”, Montrose 2010.

Many producers we have spoken to echo this sentiment, underlining the high quality of the wines made in 2019, and notably, their impressive balance. The best examples in 2019 have reportedly achieved the vinous holy grail: equilibrium between the triumvirate of flavour concentration, structure (from tannin and alcohol), and acidity, thanks in part to the “balanced” weather conditions throughout the growing season.

The winter of 2018-2019 was unusually mild, causing budbreak to occur between five days and two weeks early. While such a phenomenon might normally cause the rest of the season to be premature, including harvest, the vinous clock soon righted itself thanks to a cool spring. Bordeaux spent several nights on frost-alert from late March to mid-May. Véronique Sanders, Director of Haut Bailly tells us they lit fires in the vineyards to protect from frost on at least five occasions during the spring of 2019 – on 27th and 28th March, 13th April, and 5th and 6th May. With no frost damage, and flowering back to “normal” timing, the next challenge facing the 2019 vintage was heat. France’s south-west experienced another hot summer in 2019, but rain arrived just in time on three occasions: one in July, once in August, and then some light showers in early-mid September, bringing freshness and energy to the grapes before harvesting.

Hot and dry spells through the summer have made 2019 a Cabernet Sauvignon vintage; the grape takes up a slightly higher proportion than normal of the blend of many Grands Vins. By the same token, the cooler spells have resulted in good freshness for Merlot. Philippe Dhalluin, Managing Director at Baron Philippe de Rothschild, says that Merlot across the group’s châteaux is the best since 2010, but that the Cabernet Sauvignon is so good, that the high quality of the former will be of benefit largely to the second wines. Mouton Rothschild is made up of 90% Cabernet Sauvignon in 2019, a higher proportion than average.

2019 was lucky in volume, as well as in quality. Dhalluin tells us production volumes of the Baron Philippe stable are normal-to-generous, and he is not alone. On the right bank, Director of La Gaffelière, Thomas Soubes, says “we are lucky to have quality and quantity this year”. Where in 2018 properties across both banks were forced to triage vigorously because of mildew, and started with lower yields due to severe heat stress on the vines, 2019 evaded both of these afflictions. Also contributing to good volumes at many properties were exceedingly healthy grapes at the time of harvest. Director of Talbot, Jean-Michel Laporte explains, “thanks to the impressive health of the grapes, sorting in 2019 was purely about choosing the very best quality”. The first Merlot grapes harvested at Pichon Baron certainly seemed a hopeful sign for the liquid to come.

23rd September 2019 – some of the first Merlot grapes to be harvested at Pichon Baron.

23rd September 2019 – some of the first Merlot grapes to be harvested at Pichon Baron.

Though the Wine Lister team is yet to taste the majority of Bordeaux 2019s, their quality appears to be a good news story for a world on lockdown. While the current market could be considered a rather ill-fitting stage for a vintage with such qualitative promise, the releases have just begun (with Pontet-Canet the first major release). Early signs are that the Bordelais are listening, and might just reduce prices in line with the global crisis. For anyone with the headspace for en primeur in the current context, this is a campaign not to be missed.

Wine Lister looks forward to tasting more of the wines as soon as it becomes possible. In the meantime, we will be providing the usual campaign coverage, in the form of real-time release emails for Wine Lister Pro Subscribers, and Twitter alerts for all our followers, as well as live updates on our dedicated en primeur page.

A second post on Bordeaux 2019 will focus on the campaign, and discuss pricing within the unprecedented context of this year’s releases. Watch this space.

Throughout the late 20th century, Riesling gained a somewhat tarnished reputation, particularly within the UK, as a consequence of the abundance of overly sweet, low-quality Rieslings being released onto the market. Over the past two decades, however, it has made a comeback – especially the dry styles of top-quality wines with ageing potential and great value. The high acidity and complexity of tertiary flavours in Riesling have led to it being a favourite among wine industry professionals, including Jancis Robinson, who hails it “the greatest white wine grape”.

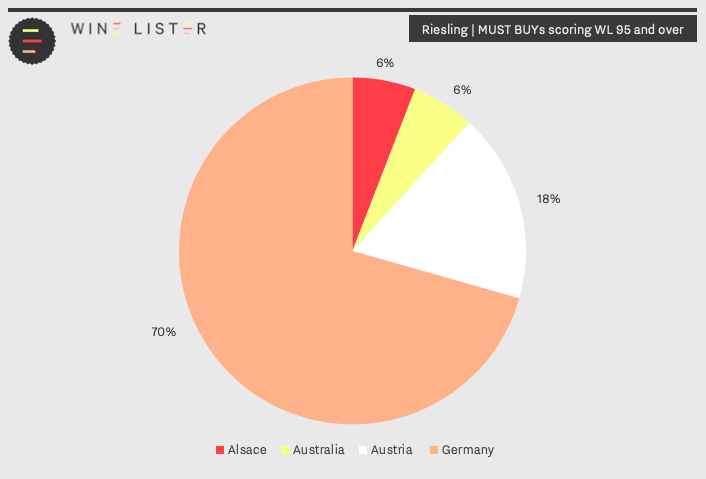

To help you uncover Germany’s noble grape, this week we examine some iconic dry and off-dry Riesling MUST BUYs with WL scores above 95.

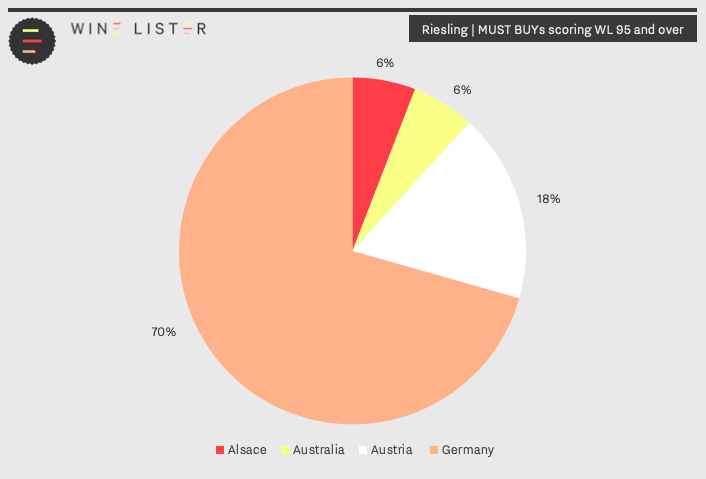

Top quality Riesling is now produced around the world, from the traditional regions of the Mosel and Alsace, through to Australia and South America. 70% of dry Riesling MUST BUYs scoring above WL 95 hail from Germany (25 wines), of which just over half (19 wines) are produced in the Mosel. The other German regions in the list comprise two entries from the Rheinhessen, and one each from the Rheingau, Nahe, and Pfalz respectively.

Austria achieves six entries on the list of Riesling MUST BUYs scoring WL 95 and over (18%), which all hail from Niederösterreich, while the Alsace and Australia’s Clare Valley both earn two entries respectively.

A Mosel Must – 2010 Joh. Jos. Prüm Wehlener Sonnenuhr Riesling Auslese Goldkapsel

With a WL Score of 97 at just £59 (per bottle in-bond), the 2010 Wehlener Sonnenuhr Auslese Goldkapsel exemplifies the excellent quality-to-price ratio of JJ Prüm’s wines. Long considered one of the Mosel’s, if not the whole of Germany’s most revered estates, its Wehlener Sonnenuhr vineyard is situated on steep south-facing, blue slate slopes, resulting in its complex minerality. Scoring it 19/20 points, Wine Lister partner critic, Jancis Robinson recounts that the 2010 vintage of this off-dry Riesling “Dances out of the glass on the nose. Such delicacy and life! Racy”. This vintage is available to purchase from Lay & Wheeler, where a case of six starts at £330 (in bond).

An essential Alsace – 2008 Trimbach Riesling Frédéric Emile

Dating back to 1626, 13 generations of the Trimbach family have contributed to the estate’s winemaking, now considered one of Alsace’s top properties. Cuvée Frédéric Emile is a blend of two Grand Cru vineyards, Geisberg and Osterberg, that share complex soils of alkaline clay and limestone, producing a wine of intense minerality. Both sites benefit from evening winds (the Tahlwendala), which allow extended ripening periods. The 2008 Trimbach Riesling Frédéric Emile achieves a WL Score of 95, and is available to purchase by the case from Cru World Wines for £390 (in bond).

A need for Niederösterreich – 2013 F.X. Pichler Riesling Kellerberg Smaragd

Described by Jancis Robinson as “Big and opulent with some lychee flavours”, the 2013 was a notably good vintage for F.X. Pichler’s Kellerberg Smaragd. Achieving the best WL Score since 1995 (96), it showcases Pichler’s attempt to refine his style and prioritise purity of fruit and balance over power. Although the narrow stone terraces of the Kellerberg vineyard necessitate farming and harvesting by hand, this wine has an impressive quality-to-price ratio. At £34 (per bottle in bond), the 2013 vintage is also a Wine Lister Value pick, and is available to purchase from BI Wines & Spirits (by the case of 12).

A New World necessity – 2013 Grosset Polish Hill Riesling

Often coined one of Australia’s most renowned Riesling winemakers, Jeffrey Grosset’s Polish Hill plot was planted in 1996, following years of research into the effect of soil, rock, and altitude on Riesling. This eight-hectare plot is thus at 460 metres altitude, ensuring cool nights and longer ripening of its Riesling grapes. Planted in an area termed “hard rock”, the Polish Hill vineyard is situated on a crust of clay over slate, which, alongside the cool growing season, causes stress on the vines, resulting in smaller but more complex-flavoured grapes. The 2013 vintage achieves a WL score of 95, and is available to purchase from Lay & Wheeler for £50 (per bottle in bond).

See the full list of Riesling MUST BUYs here.

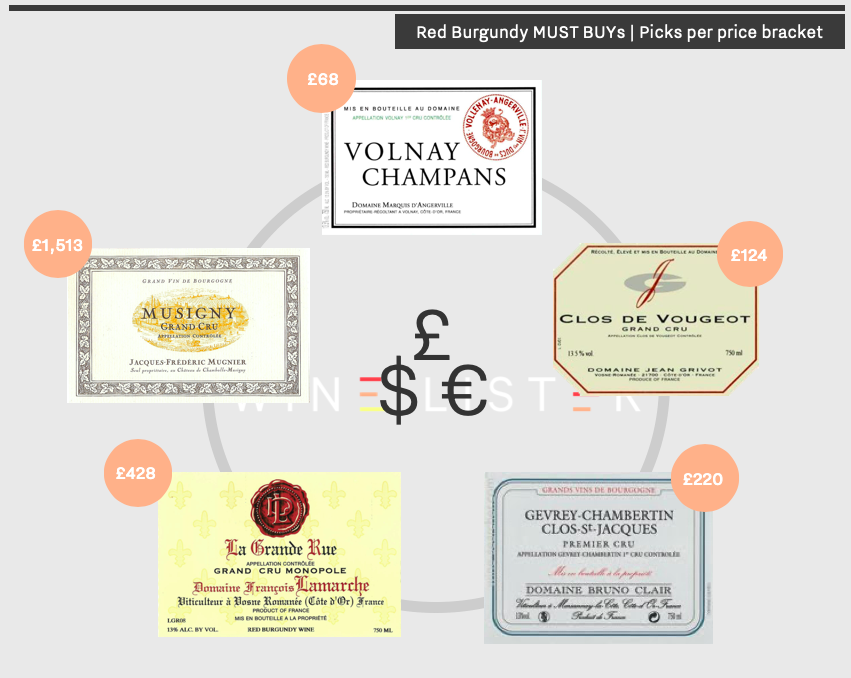

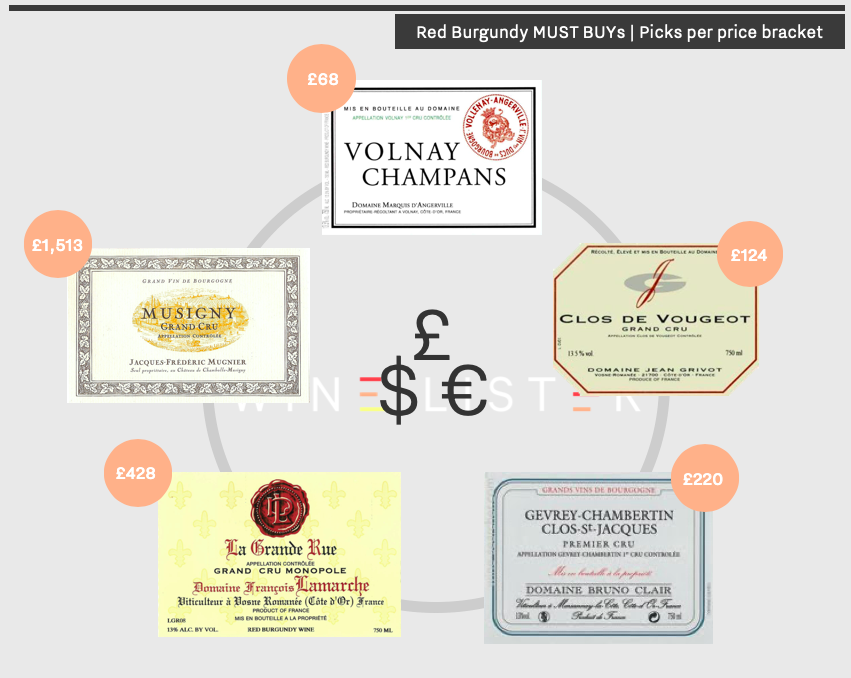

Following our recent investigation into white Burgundy at five different price points, we now turn to red Burgundy – which represents a considerable 23% of Wine Lister’s MUST BUY hoard (376 wines).

These wines cover an even greater range of prices than their white counterparts, from £51 (per bottle in-bond) up to £15,352. Read on below for our picks of red Burgundy MUST BUYs at five different price points.

Prices are shown per bottle in-bond (when buying by the case).

Prices are shown per bottle in-bond (when buying by the case).

Under £75 – 2012 Marquis d’Angerville Volnay Champans

Marquis d’Angerville is widely considered one of the top producers in the Côte de Beaune, and the reference producer in Volnay. Indeed, the domain’s vineyards represent over 10% of all Premier Cru Volnay plantings. D’Angerville’s Volnay Champans is less than half of the cost of its flagship Volnay wine, Clos des Ducs. While both vineyards have south-easterly exposure, Clos des Ducs has calcareous, stony, white marl soil, while the soil in Champans is more clay-driven. The Champans is thus richer and fuller, while the Clos des Ducs (which also enjoys the highest elevation in Volnay) has more complexity and definition. The 2012 Marquis d’Angerville Volnay Champans performs particularly well, achieving a WL Score of 94 – this wine can be purchased from BI Wines & Spirits for £66.67 (per bottle in bond).

Under £150 – 2014 Jean Grivot Clos de Vougeot

Having taken over from his father Jean in 1990, Étienne Grivot (alongside his wife Marielle) has since adjusted his family’s viticultural and vinification methods. While completing his studies in general agriculture, viticulture, and oenology, Étienne noted that the over-fertilised Burgundian soil had become gradually less capable of producing vins de terroir. As well as reducing his overall yields, he now uses organic farming methods and natural yeasts to preserve the expression of where the grapes come from. The 2014 Clos de Vougeot has a WL Score of 94, and was described by Jancis Robinson as having “massively nuanced fruit” – this vintage can be purchased by the bottle from Wilkinson Vintners for £124 (in bond).

Under £350 – 2015 Bruno Clair Gevrey-Chambertin Clos Saint-Jacques

Bruno Clair’s Clos Saint-Jacques Premier Cru plantings are situated within a 6.7ha vineyard (shared with Sylvie Esmonin, Louis Jadot, Fourrier, and Armand Rousseau) encircled by a two-metre wall. Providing protection from prevailing winds, this fortification creates a micro-climate, which, alongside its steep south-easterly facing slope, enables consistent ripening. The 2015 vintage achieves a WL Score of 95. Wine Lister partner critic, Neal Martin describes it thus: “a hint of dark chocolate emanates from the oak infusing the red and black fruit toward the finish, and touches of marmalade and blood orange linger on the aftertaste”. This vintage is available to purchase from Cru World Wine, where the price of a bottle starts at £355 (in bond).

Under £500 – 2010 François Lamarche La Grande Rue

Having been elevated to Grand Cru status in 1992, La Grande Rue provides the setting for François Lamarche’s most prized domain – from which only c.5,500 bottles are produced per year. As of the 2007 vintage, François’ daughter, Nicole, has had total control of the winemaking, and has implemented organic viticulture (certified in 2010), which she believes makes vines more resilient to biotic stress. Described by Jancis Robinson as exhibiting “lovely freshness yet concentration and subtlety too”, the 2010 vintage achieves Lamarche La Grande Rue’s highest WL Score since its 1964 vintage (96), and is available to purchase from Corney & Barrow, where prices start at £540 per bottle (in bond).

Over £500 – 2008 Jacques-Frédéric Mugnier Musigny

Jacques-Frédéric Mugnier maintains his aim of preserving the purest expression of nature within his wine, with minimal interference from technological practices in the vineyard or the cellar. His Musigny is widely considered to be one of the greatest Burgundy reds, and has been described by Wine Lister’s Burgundy specialist critic, Jasper Morris as “brilliantly fragrant in bouquet and notably persistent on the finish”. With a WL Score of 96, the 2008 Jacques-Frédéric Mugnier Musigny is more difficult to source than the preceding wines, however, it is worth informing your merchant of your interest in purchasing it.

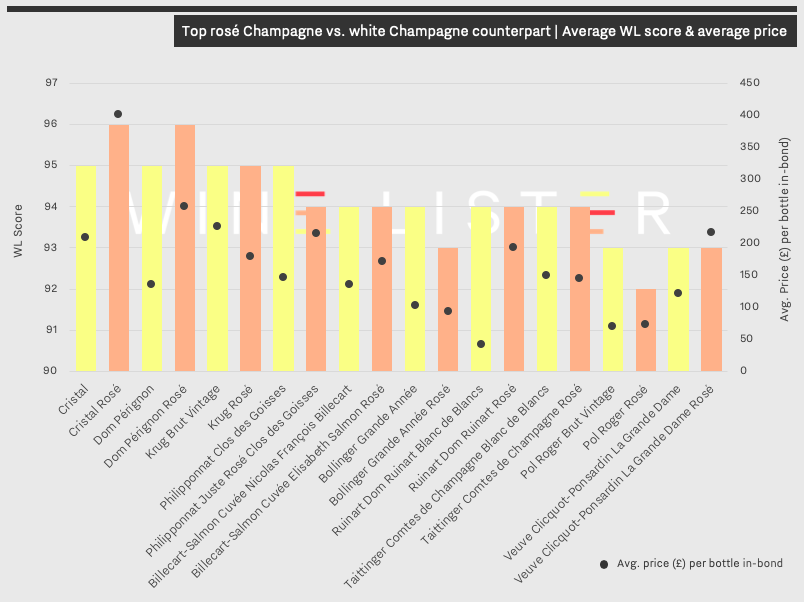

In 2004, WL partner critic Jancis Robinson published an article, “Pink champagne – fashionable but too often dire”, whose title summarises the contemporaneous consensus surrounding rosé Champagne. Long-regarded by Champagne producers as a subsidiary wine – one without the required levels of attention placed on their primary project – its quality often fell short.

15 years later, in September 2019, Robinson conversely wrote a piece titled “Pink champagne – a serious wine now”, outlining the attentive methods of production, and the consequential calibre of rosé Champagne amongst its top producers.

This week’s blog post investigates the victorious return of rosé Champagne, as we examine the upward quality and price trends across 10 of its top brands when compared to their white counterparts.

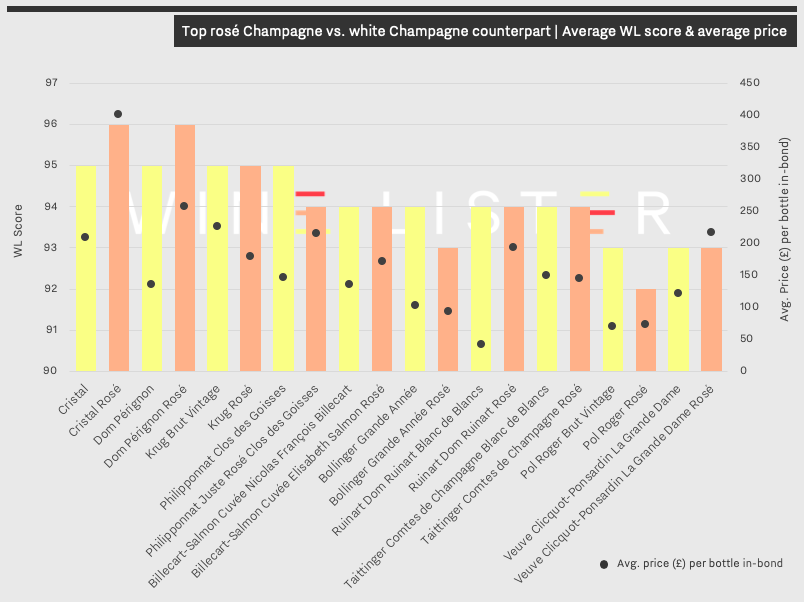

The chart above shows the average WL Score and average price for “pairs” of wines from 10 top rosé Champagne producers whose range includes a rosé.

An initial look at the selected wines reveals the recurrent pattern of rosé Champagnes costing more than their white counterparts, with the exception of Krug Rosé, Bollinger Grande Année Rosé, and Taittinger Comtes de Champagne Rosé. The mean price difference between the two styles of the respective wines is substantial nonetheless, with rosé Champagne costing 46% more on average than its white equivalent (an average of £195 for rosé and £134 for white).

Excluding Pol Roger’s Rosé and Bollinger’s Grande Année Rosé (whose white equivalents supersede them by one WL point), the rosé Champagnes featured above achieve equivalent or higher WL Scores than their white counterparts.

Cristal Rosé is a blend of 55% Pinot Noir and 45% Chardonnay grapes. With a WL Score of 96, at an average price of £401 (per bottle in-bond), this wine is almost double the price of Cristal, which has a WL Score of 95 at £203. Consequential of the generally lower yields of Pinot Noir in continental conditions, Cristal Rosé is Louis Roederer’s rarest and thus most expensive wine, produced solely in years when the grapes have attained perfect maturity.

Similarly made in only exceptional vintages, Dom Pérignon Rosé is considered by its producer to characterise its growing year, hence the fluctuating ratio of Pinot Noir and Chardonnay grapes from vintage to vintage. With a WL Score of 96, at an average price of £277 (per bottle in-bond), Dom Pérignon Rosé is over double the price of its white counterpart. Dom Pérignon Vintage Brut has an average price of £131 and has one less WL Score point than its corresponding rosé wine.

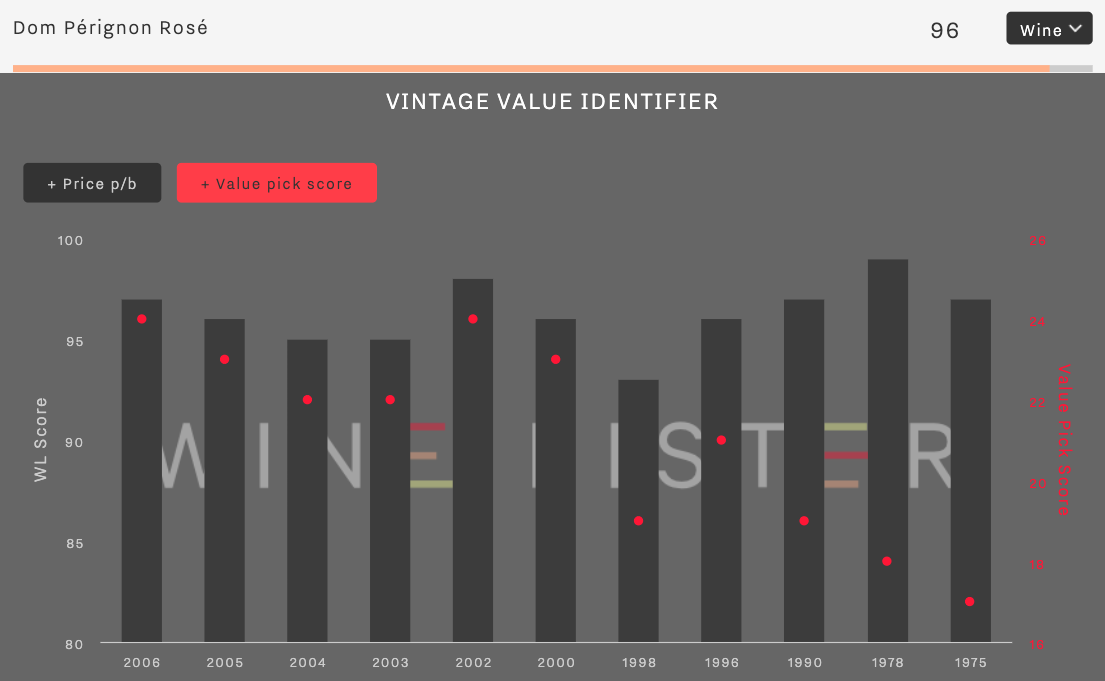

As indicated by its Vintage Value Identifier chart, the 2002 Dom Perignon Rosé exhibits significant quality and value, with a WL Score of 98. Jancis Robinson awarded this wine 20/20 (a rare occurrence), describing it as “pungent and composed with massive energy” – a far cry from her 2004 article. Rosé Champagne has most definitely made a comeback.

The 2002 Dom Pérignon Rosé can be purchased from Berry Bros & Rudd, where a case of three starts at £1,200 (in-bond).

Like a virtual treasure map, Wine Lister’s Hidden gem indicator helps you discover fine wines that are under the radar, yet worth uncovering. These wines are seldom found in the top restaurants, infrequently searched for online, but have high ratings from wine critics, or are assigned “Hidden gem” status by the global fine wine trade.

Of the 1,639 wines that are currently recognised as MUST BUYs by Wine Lister’s proprietary recommendation algorithm, 87 are Hidden gems. To help you uncover these underrated wines, this week we examine the Hidden gem MUST BUYs with WL scores above 95.

A preliminary look at the elected wines reveals a common trend of lower-than-average prices. While achieving WL scores of 95 and over, the 15 red Hidden gems illustrated above have an average price of £67 (per bottle in-bond) – perhaps a consequence of their slight obscurity. By virtue of being “Hidden gems”, these wines are also harder to source, however, it is worth informing your merchant of your interest in purchasing them, in the event of their availability.

Burgundy achieves five entries in this week’s subgroup, with two from a small-production négociant house, Lucien Le Moine. Well-deserving of their Hidden gem status, both wines achieve a WL score of 96. The 2012 Lucien Le Moine Charmes-Chambertin is available from Lay & Wheeler at £173 (per bottle in-bond), and the 2012 Lucien Le Moine Gevrey Chambertin Les Cazetiers can be purchased from BI Fine Wine & Spirits for £83 (per bottle in-bond).

California is represented by two wines of the same vintage and grape. The Ojai Vineyard Bien Nacido Pinot Noir 2014 hails from vines in Santa Barbara’s Santa Maria Valley, whose east-to-west face encourages the flow of cooling Pacific Ocean breezes, apt for the Burgundian variety. The Ryan Vineyard Pinot Noir 2014 from cult California producer, Calera, is produced from vines in several sites across the Central Coast.

Two entries from Rhône’s Tardieu-Laurent show notably good quality-to-price ratios, achieving “Value pick” status. With a WL Score of 96, the 2005 Cornas Vieilles Vignes is priced at £43 (per bottle in-bond), while the 2006 Gigondas Vieilles Vignes has a WL Score of 95 at £24.

A joint venture between two négociants, Dominique Laurent (of Burgundy fame), and Michel Tardieu (Rhône), Tardieu-Laurent is a boutique négociant operation. Buying young wines from growers across the Rhône, the domain completes maturation and blending, before bottling with no fining nor filtration. The 2005 Tardieu-Laurent Cornas Vieilles Vignes is available to purchase from Fine + Rare (in magnum form), and the 2006 Tardieu-Laurent Gigondas Vieilles Vignes can be bought from Wine Bourse (by the case of 12).

Tardieu-Laurent also features twice on the list of white Hidden gem MUST BUYs, with both its 2008 and 2016 Hermitages Blancs achieving WL Scores of 95.

Like their red counterparts, Tardieu-Laurent’s white Hidden gems are Value picks. Jancis Robinson pays compliment to both vintages, describing the 2008 as “Clean, intense, multilayered”, and the 2016 as “Very serious stuff”. Both wines can be purchased from Corney & Barrow (by the case of 12 in-bond).

Five out of the 10 white Hidden gems shown above are Riesling-based. There is no doubt that the noble grape can produce impressive quality wines at reasonable prices, though this remains somewhat of a fine wine trade secret (when compared with the consumer popularity of other white grape varieties and styles).

The two whites from Alsace cover icon Riesling producers Hugel and Albert Mann. Germany’s entries comprise of the 2006 and 2007 vintages of Dr. Loosen Erdener Prälat Riesling Auslese Goldkapsel, which achieve WL Scores of 96 and 95 respectively.

Loosen’s four-acre Erdener Prälat vineyard has south-facing red slate soils, and a notably warm microclimate, which, combined with the warming effect of the river and the heat-retaining cliffs that surround it, ensures ripeness in every vintage. The 2006 Dr. Loosen Erdener Prälat Riesling Auslese Goldkapsel can be purchased from Lay & Wheeler for £47 (per bottle in-bond).

To discover more of Wine Lister’s Hidden gem MUST BUYs, click here.

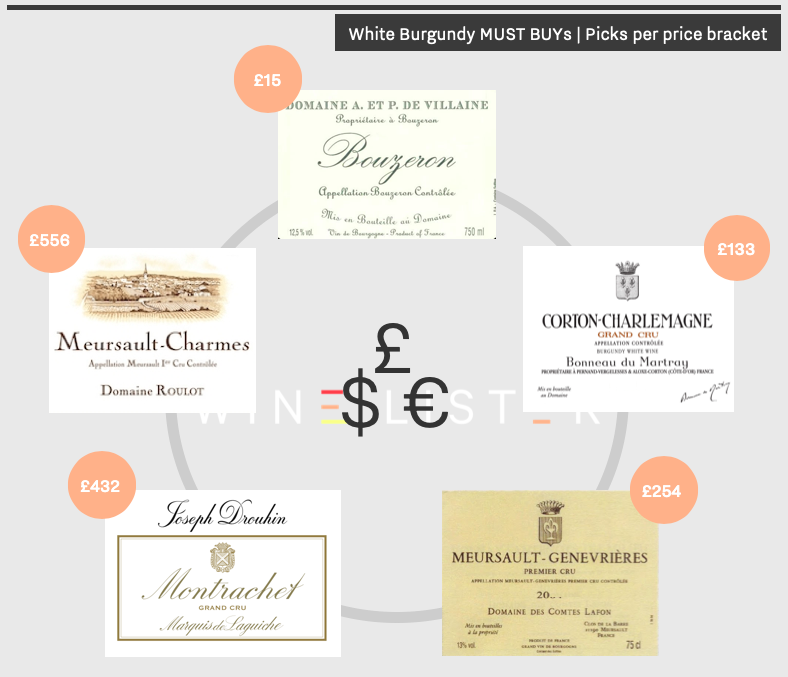

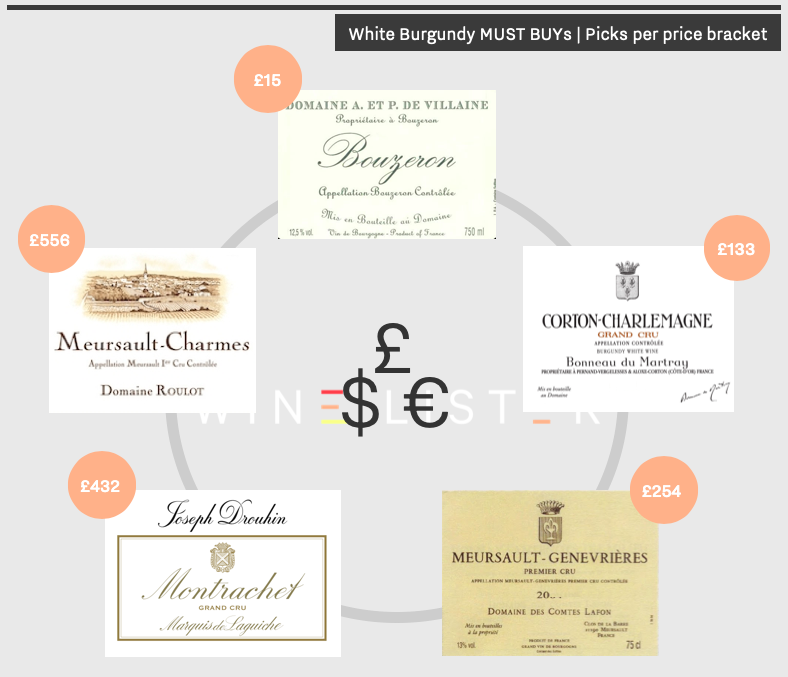

As shown in a recent post on using Wine Lister to build your portfolio, Burgundy is the best-represented region of Wine Lister’s MUST BUY hoard (33%, or 533 wines). 10% of these (161 wines) are white Burgundies, that show high quality and good value within their respective vintages and appellations. These wines cover a vast range of prices, from £15 (per bottle in-bond) up to £1,354.

This week’s blog post examines white Burgundy MUST BUYs at five different price points, to help the hunt of those buying fine wine at every level.

Prices are shown per bottle in-bond (when buying by the case).

Prices are shown per bottle in-bond (when buying by the case).

Under £20 – 2016 Domaine A. & P. de Villaine Bouzeron

Bouzeron’s location in the north of the Côte Chalonnaise provides the setting for Aubert de Villaine’s personal project – one with a humbler reputation than that of his magnum opus, Domaine de la Romanée-Conti. Dispelling the region’s once-unfavourable reputation, de Villaine’s restricted yields and hand-harvesting produces top quality Aligoté Doré. The 2016 vintage achieves a WL Score of 90, and was described by Neal Martin as having “a touch of salinity towards the finish with judicious hints of stem ginger and a hint of rhubarb”. This wine is available to purchase from Justerini & Brooks, where a case of six starts at £90 (in-bond).

Under £150 – 2015 Domaine Bonneau du Martray Corton-Charlemagne

Bonneau du Martray is the largest single owner of vines in Corton-Charlemagne – an appellation that is often said to rival Montrachet. The 2015 vintage was discussed in Wine Lister’s blog on the top 2015 white Burgundies by WL score, in which it was the second highest overall scorer. As of 2018, around 25% of Bonneau du Martray’s Corton-Charlemagne vineyards has been leased to Romanée-Conti – a factor that could drive its price up in the future. For now, this Corton-Charlemagne remains of exceedingly good value in the context of Grand Cru white Burgundy. The 2015 vintage can be purchased from UK merchants such as Goedhuis, where a case of six costs £916 (in-bond).

Under £350 – 2012 Domaine des Comtes Lafon Meursault Genevrières

Despite lacking the Grand Cru status held by Corton-Charlemagne, the higher cost of Domaine des Comtes Lafon’s Meursault Genevrières (Premier Cru) could in part be reflective of the increasing popularity of Meursault. Dominique Lafon is often considered one of the leading producers in Meursault, as reflected in his meticulous vinification process. Spending two winters in wood, and sleeping in some of the deepest and coldest cellars in the region, his wines are bottled nearly two years after harvest – one of the latest bottlings in Burgundy. Achieving a WL score of 94 and ‘Investment Staple’ status, the 2012 vintage is available to purchase from Four Walls Wine Co., where a bottle costs £225 (in-bond).

Under £500 – 2017 Maison Joseph Drouhin Montrachet Marquis de Laguiche

The second Grand Cru white Burgundy examined here is more expensive than Bonneau du Martray’s Corton-Charlemagne, but nonetheless also good value – this time in the context of Montrachet specifically. Hailing from négociant house Joseph Drouhin, its Montrachet Marquis de Laguiche is priced around £432, while the average price of all Montrachet 2017s on Wine Lister is £1,249. Sourcing grapes from vineyards owned by the Laguiche family, the quality here is just as impressive as several Montrachet wines produced by Burgundy domains. Achieving a WL score of 95, the 2017 vintage was described by Jancis Robinson as “Creamy, deep, powerful and endlessly long”. This wine is available to purchase from Berry Bros. & Rudd, where a case of six bottles starts at £2,750 (in-bond).

Over £500 – 2015 Domaine Roulot Meursault Charmes

The “blowout” wine of this week’s selection is Domaine Roulot’s Meursault Charmes. Having assumed direction of the estate in 1989, Jean-Marc Roulot has been successful in fine-tuning the distinct style of wine developed by his father, Guy Roulot. While many other wines of this village exhibit richness and concentration, the 2015 Meursault Charmes reflects Jean-Marc’s commitment to achieving a brighter style of Meursault – one which expresses its terroir vividly. Speaking on his aversion to excessive lees-stirring, he says, “I prefer to lose a little volume and power on the palate in order to obtain the ‘ligne droite’ [straight line] and the purity. This haunting purity and directness is evident in every wine Roulot produces.” The wine is available from several UK merchants, including Morgan Classic Wines, and Fine+Rare, from which prices start from £425 (per bottle in-bond).

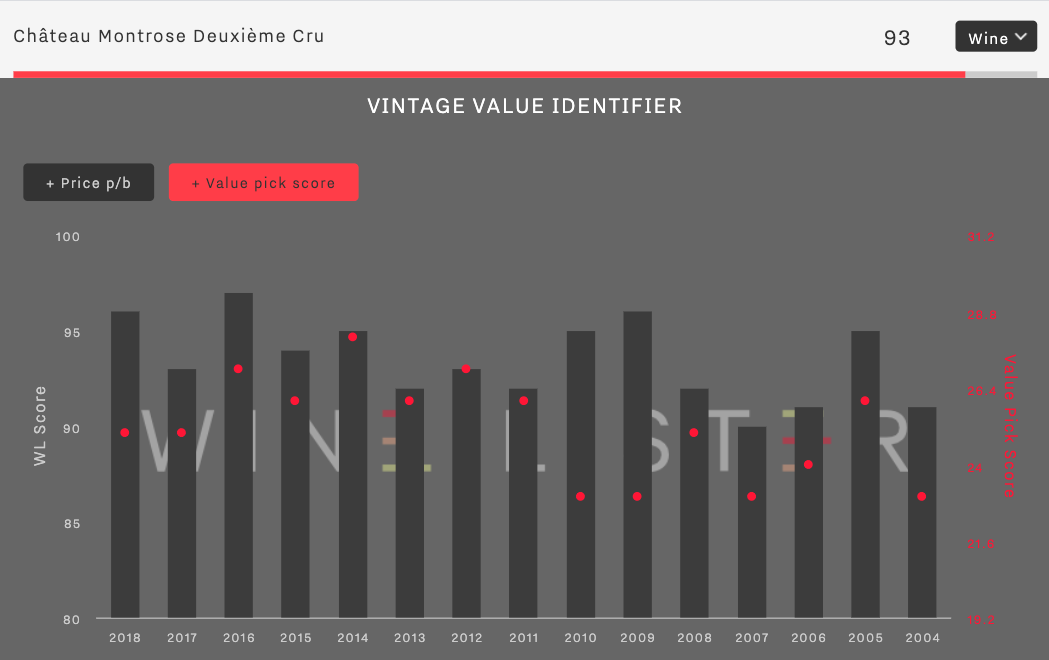

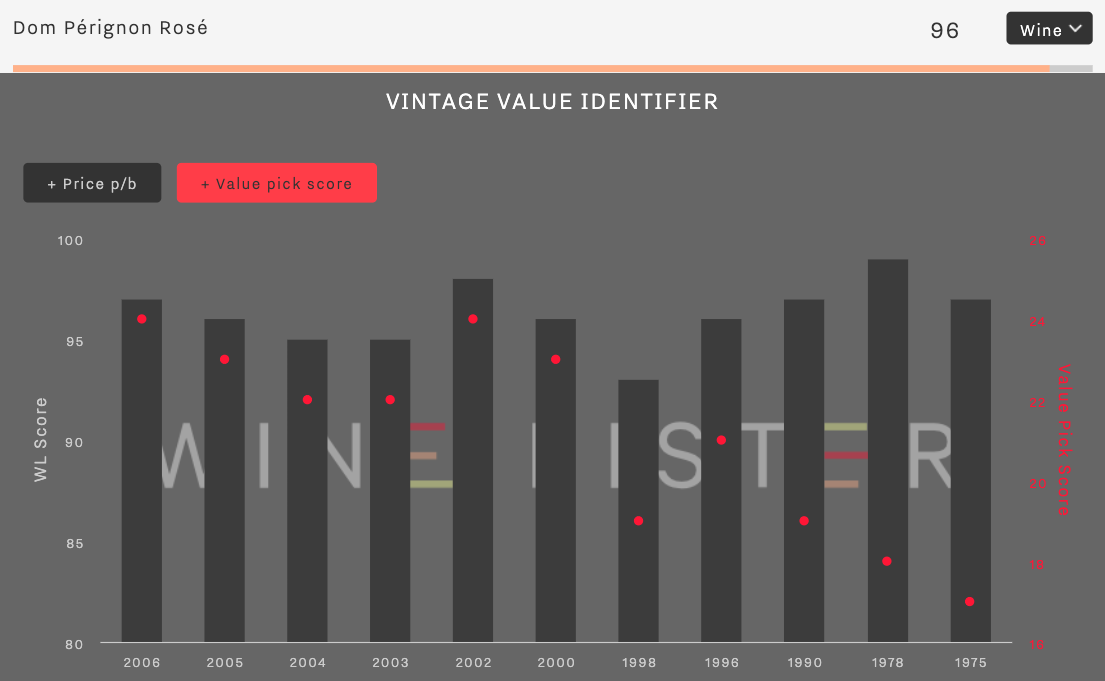

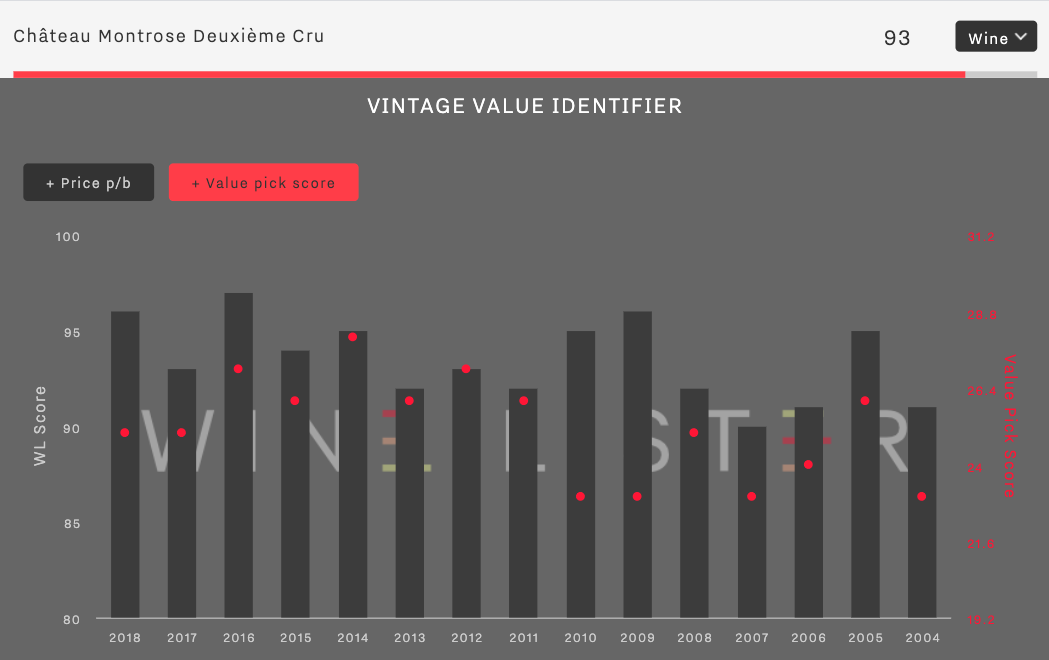

Last week’s blog post examined two of the most popular Wine Lister website features amongst collectors: the MUST BUY recommendation tool and the Compare Tool. Wine Lister’s Vintage Value Identifier helps the modern wine collector to further refine their online investigations.

Featured on each wine page, the dynamic Vintage Value Identifier gives a clear visual of quality-to-price ratios across the vintages of a given wine, and applies a Value Pick Score to measure the relative value.

By performing the price analysis for you, this tool pinpoints exact vintages of your favourite wines that are the best options to buy or sell, based on the impressive quality for their price.

See the example of Montrose below, or by exploring its wine page here.

As indicated by the red dots, and values on the right-hand axis, Montrose’s Value Pick Score fluctuates between vintages. The 2004, 2007, 2009 and 2010 vintages share the lowest Value Pick Score (23), while the 2014 Montrose achieves the highest score of 28.

The 2014 vintage tends to represent excellent value across the board in Bordeaux. This is due to its good (if not excellent) quality overall, and its release after the lesser-quality 2013 (which kept release prices down). Montrose’s 2014 was awarded 96 points by Wine Lister partner critic, Neal Martin, who notes, “a bouquet that exudes class and sophistication: pure and mineral-driven black fruit, cedar and pencil lead, hints of blueberry developing with aeration although it never impedes upon the sense of terroir”.

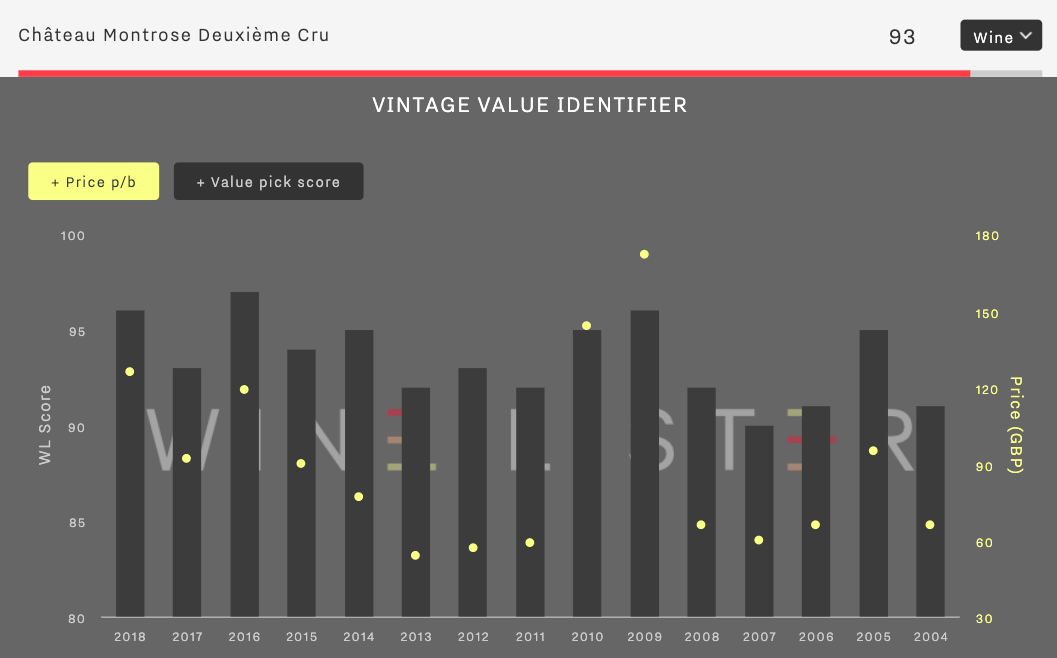

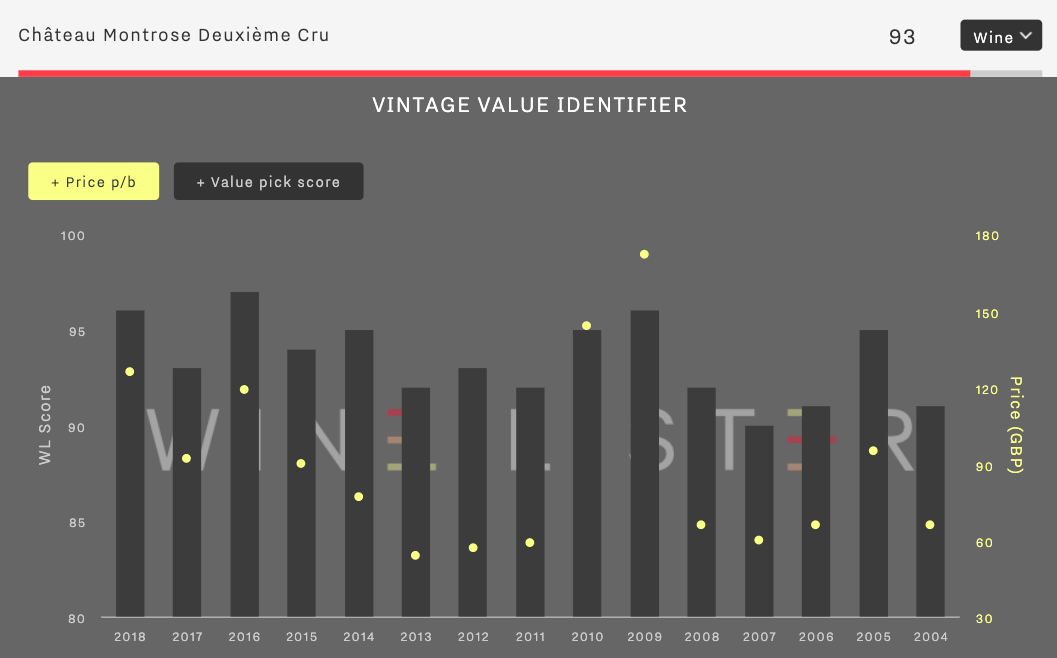

While the true benefit of the Vintage Value Identifier lies in the Value Pick Score, it is still possible to view the pure price vs. quality analysis, as illustrated below:

While Montrose 2009 achieves the second-highest WL Score of the featured vintages, it also commands the highest price (£172 per bottle in-bond, when buying by the case). Achieving MUST BUY status, the 2014 vintage is conversely priced at £77 per bottle in-bond for a similar level of quality (hence the higher Value Pick Score). The 2014 Montrose is available to purchase from Corney & Barrow, Cult Wines, Justerini & Brooks, and BI Fine Wines (the latter in magnums only).

Guiding your future purchases, you can identify good value in back vintages of any wines by using the Vintage Value Identifier on each wine’s page. Click here to start your own analysis.

Wine Lister is currently offering a range of portfolio analysis services to private clients. If you are interested in having your wine collection analysed by our team of fine wine data experts, please don’t hesitate to contact us.

Virtual tasting – Wine Lister’s Founder & CEO, Ella Lister, tastes the Baron Philippe de Rothschild 2019s with Philippe Sereys de Rothschild and Managing Director, Philippe Dhalluin.

Virtual tasting – Wine Lister’s Founder & CEO, Ella Lister, tastes the Baron Philippe de Rothschild 2019s with Philippe Sereys de Rothschild and Managing Director, Philippe Dhalluin. 23rd September 2019 – some of the first Merlot grapes to be harvested at Pichon Baron.

23rd September 2019 – some of the first Merlot grapes to be harvested at Pichon Baron.