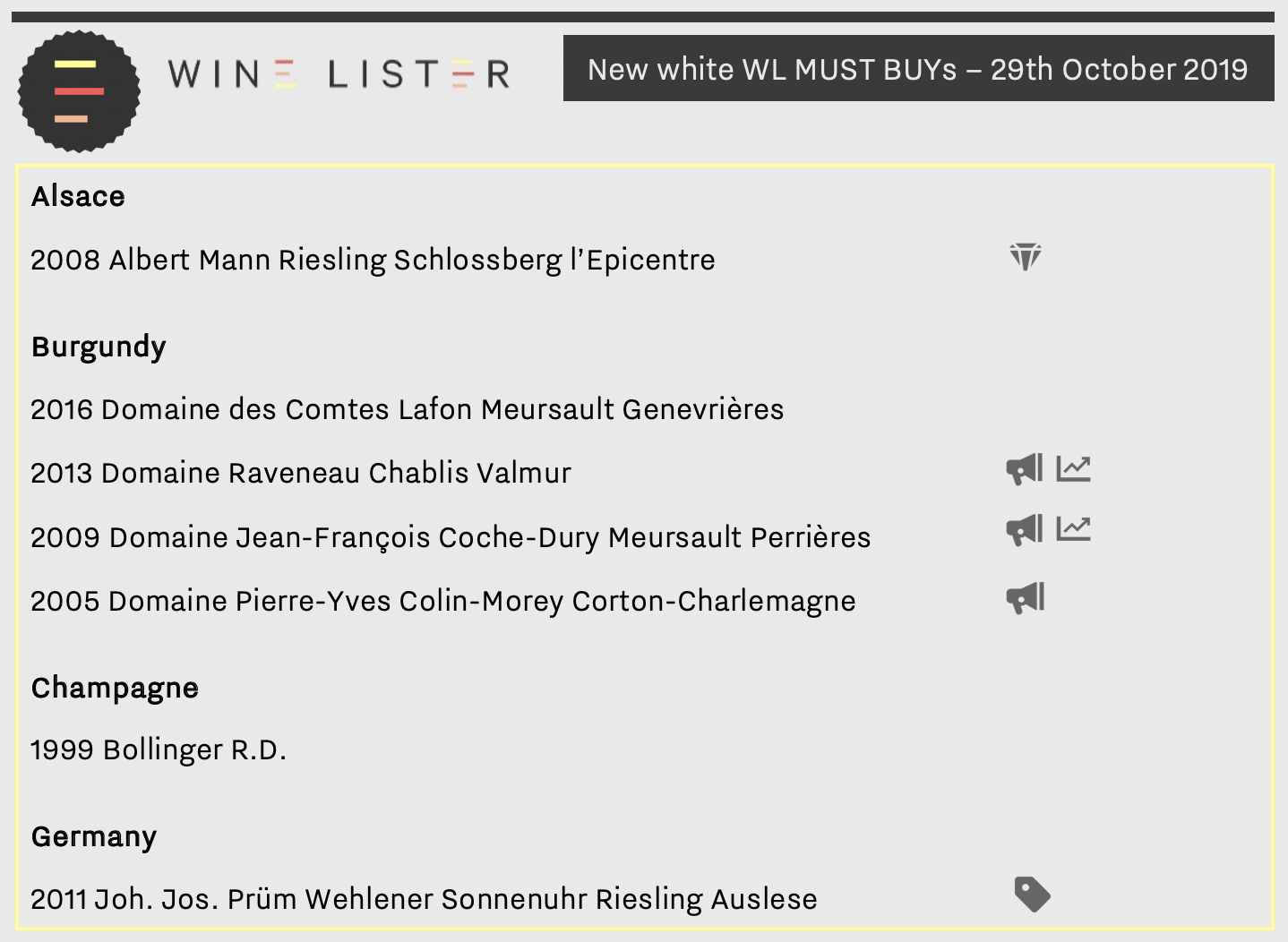

Since its launch in September, Wine Lister’s MUST BUY list has unveiled fine wines across multiple regions, vintages, price points, and drinking occasions, all with the common theme of being so good, that they simply must find their place in fine wine fanatics’ cellars. Wine Lister’s prices are updated weekly, and since price (in the form of value) plays a major part in the MUST BUY algorithm, MUST BUYs too will henceforth be updated weekly.

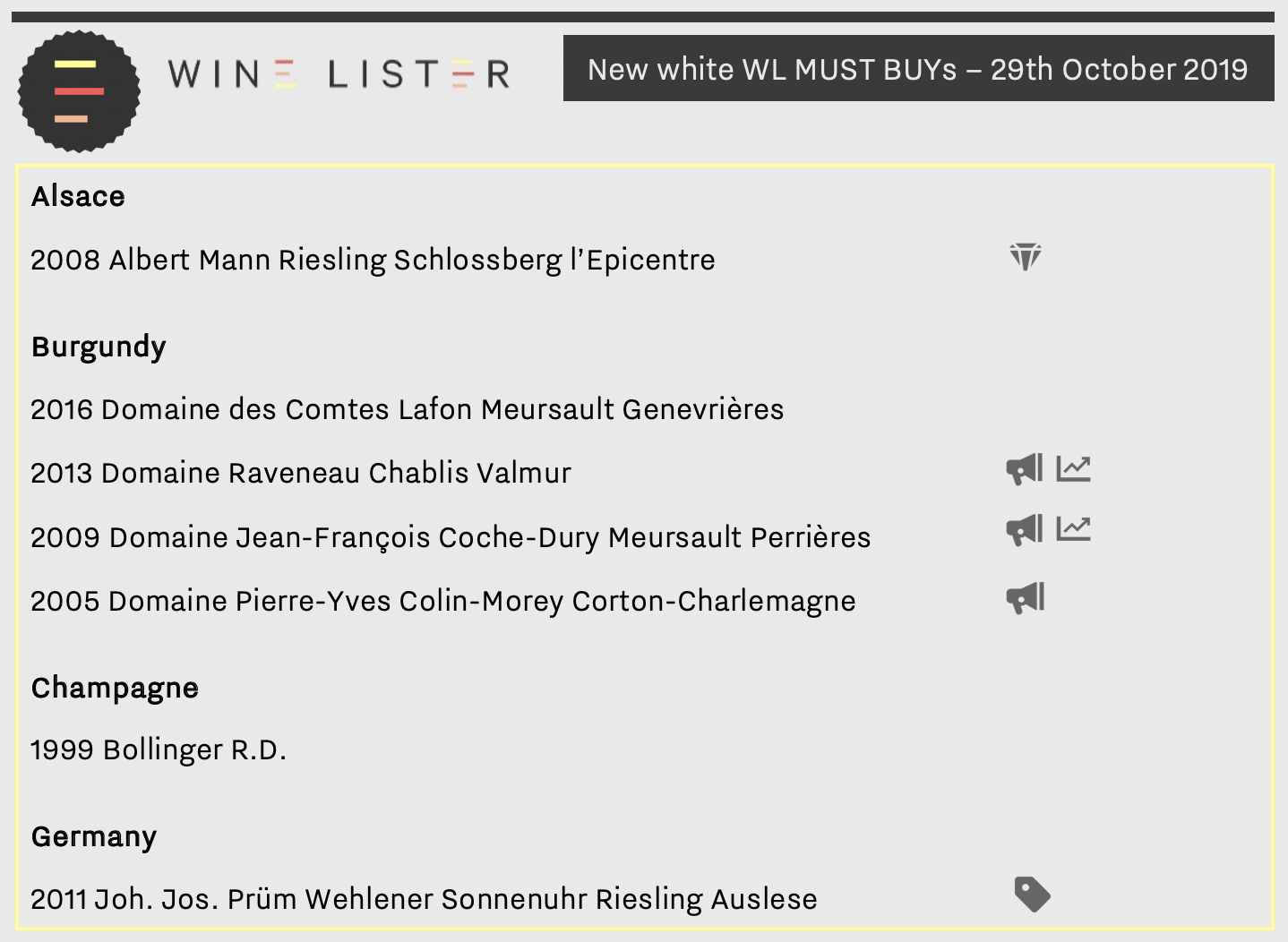

Since its last update, the MUST BUY list has grown by four wines (to 1,697), with 22 new entries, and 18 wines that have fallen off the list. Following the same trend as last week, nine out of the 22 new MUST BUYs (or 41%) are Burgundian. Big names in Burgundy continue to do well, with three new white Buzz Brands hailing from Raveneau, Jean-François Coche-Dury, and Pierre Yves Colin-Morey respectively.

Elsewhere within white entries are two Rieslings, the Alsatian Hidden Gem, Albert Mann’s l’Epicentre 2008, and the indomitable Joh. Jos Prüm’s Wehlener Sonnenuhr, whose 2011 is now one of seven MUST BUY vintages of this sensational Value Pick.

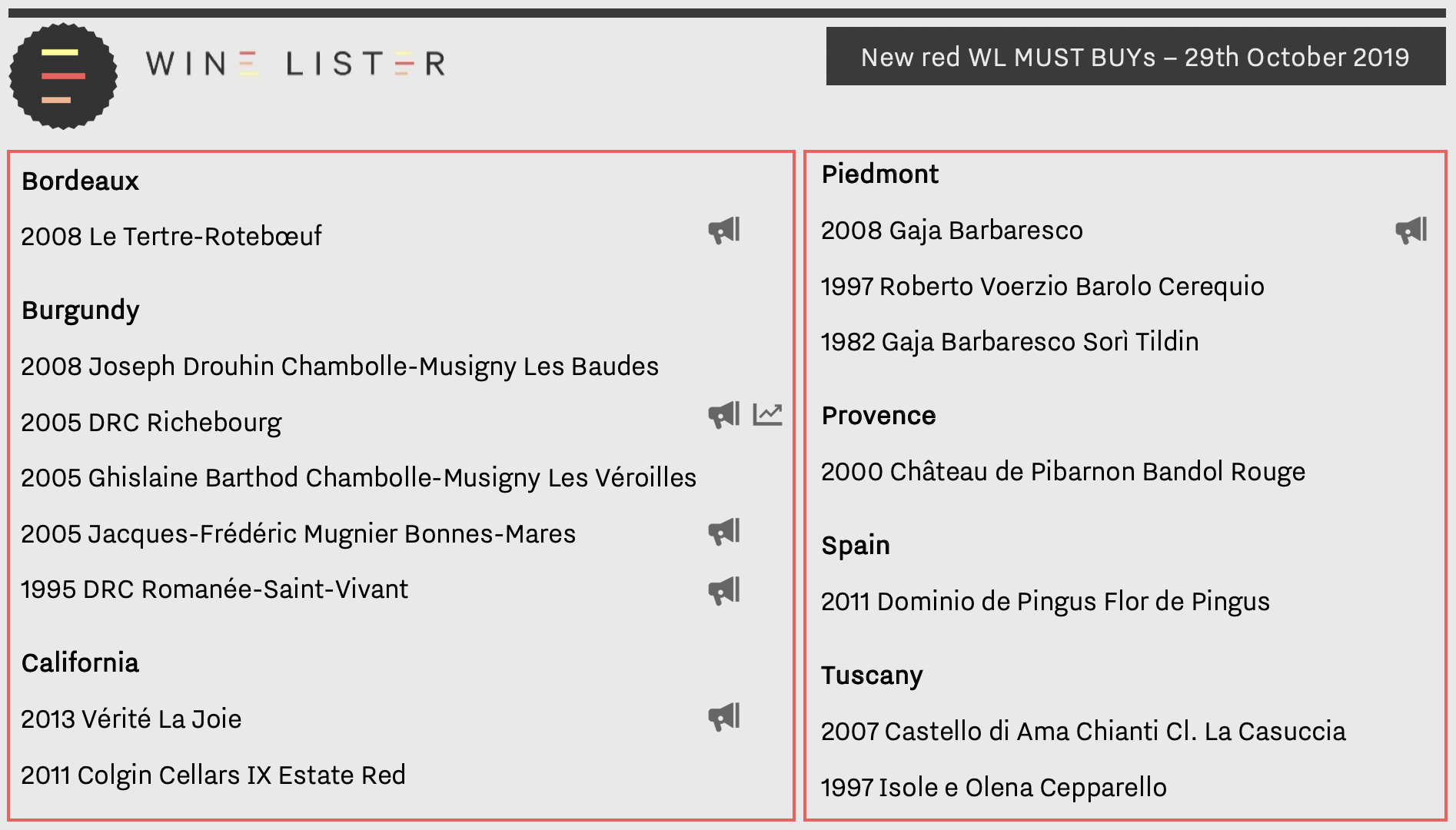

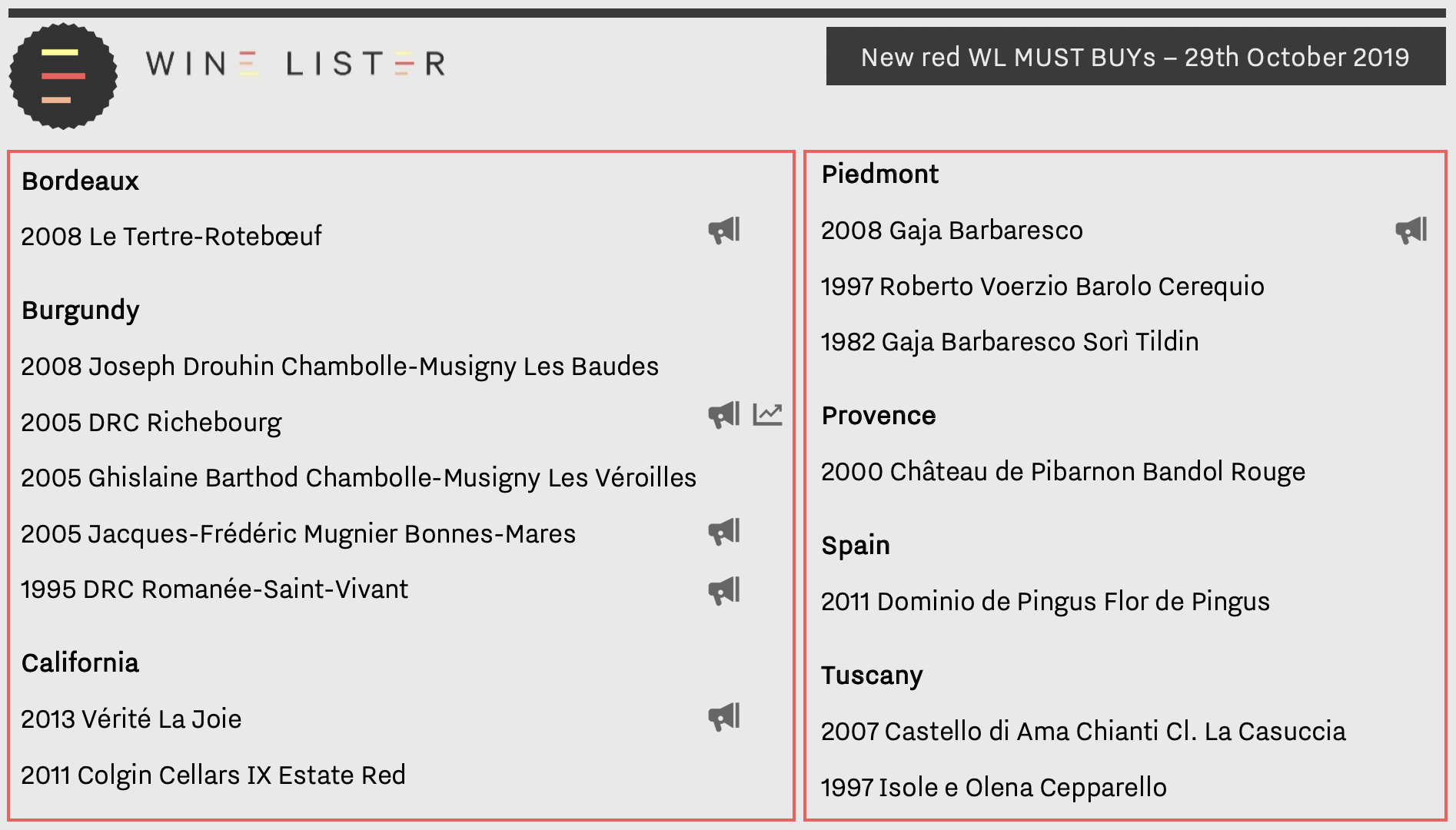

With the clocks turned back and a wintry chill in the air, there are twice as many new red MUST BUYs as white. Burgundy and Italy make the strongest showing, with five reds apiece. Maison Joseph Drouhin sees the addition of its Chambolle-Musigny Les Baudes 2008, bringing the house’s MUST BUY total to 21 wine vintages. Meanwhile Italy’s new MUST BUYs hail from four big name growers: Gaja, Roberto Voerzio, Castello di Ama, and Isole e Olena.

Bordeaux achieves just one entry in Le Tertre-Rotebœuf 2008 (one of nine Bordeaux 2008 MUST BUYs). California also makes its mark, with Vérité’s La Joie 2013 and Colgin Cellars IX Estate Red 2011. Outside of “classic” fine wine regions, Château de Pibarnon’s Bandol Rouge 2000 also enters the fray.

See the full list of current MUST BUYs here.

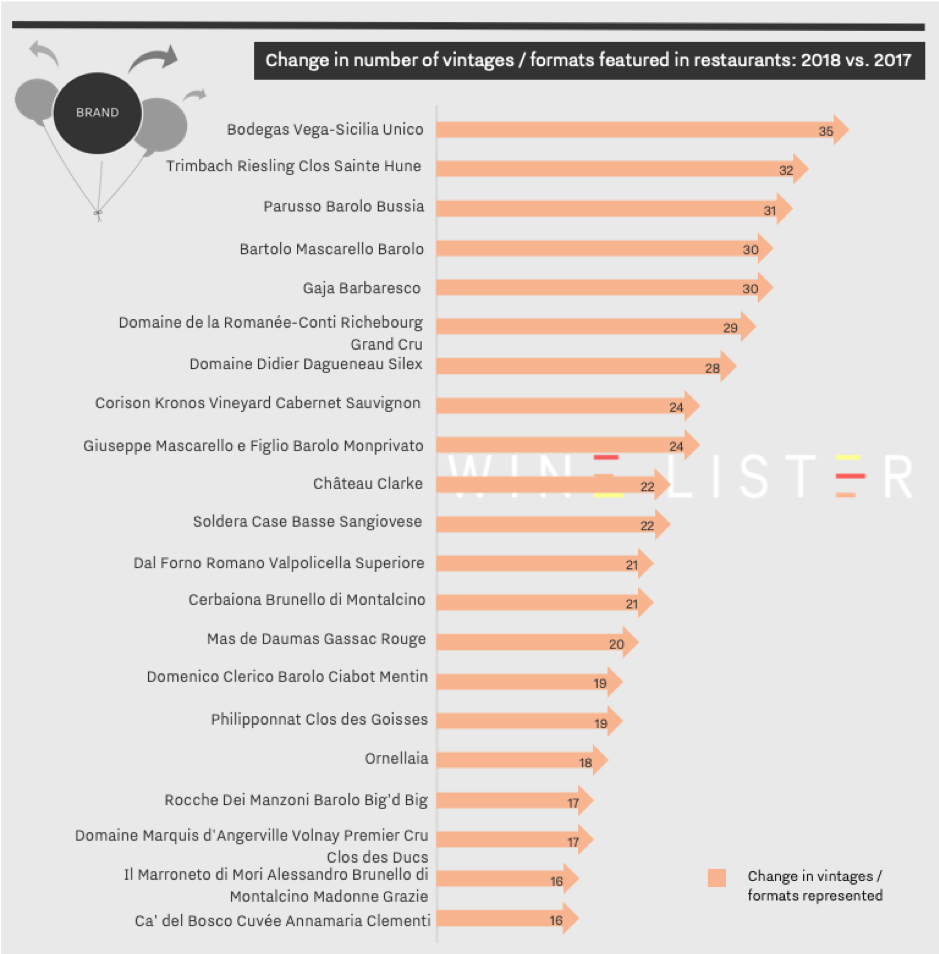

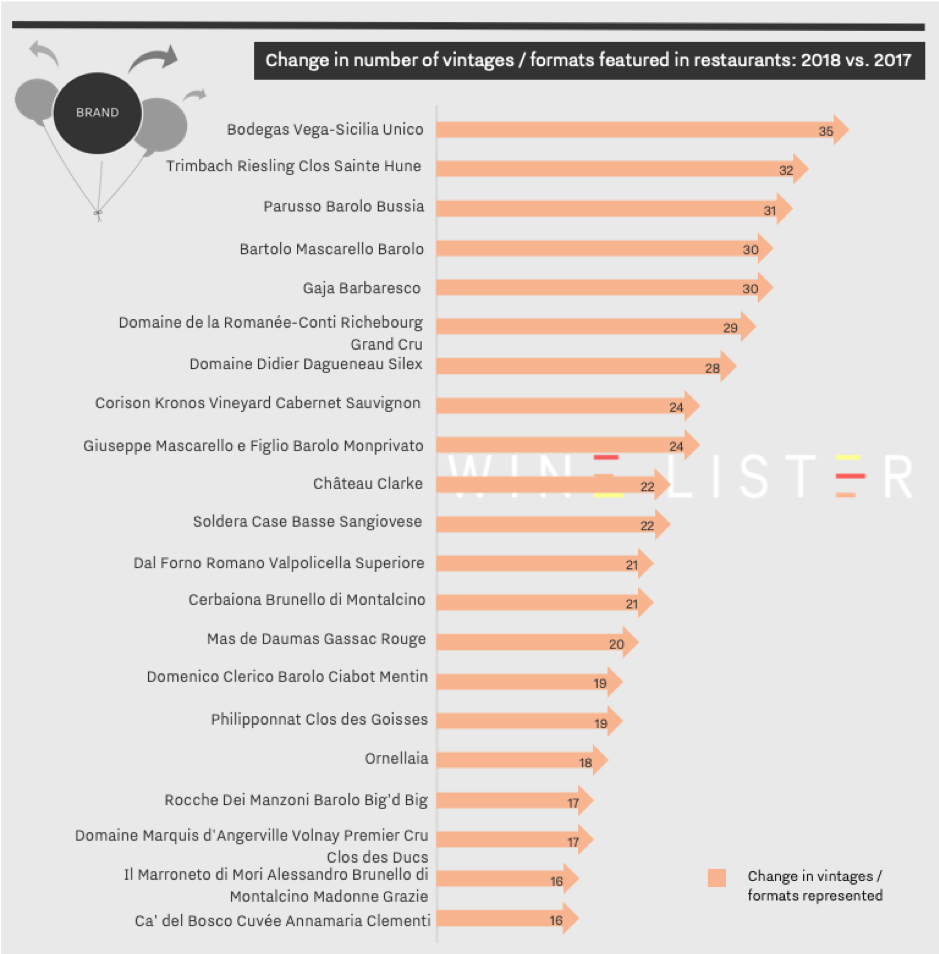

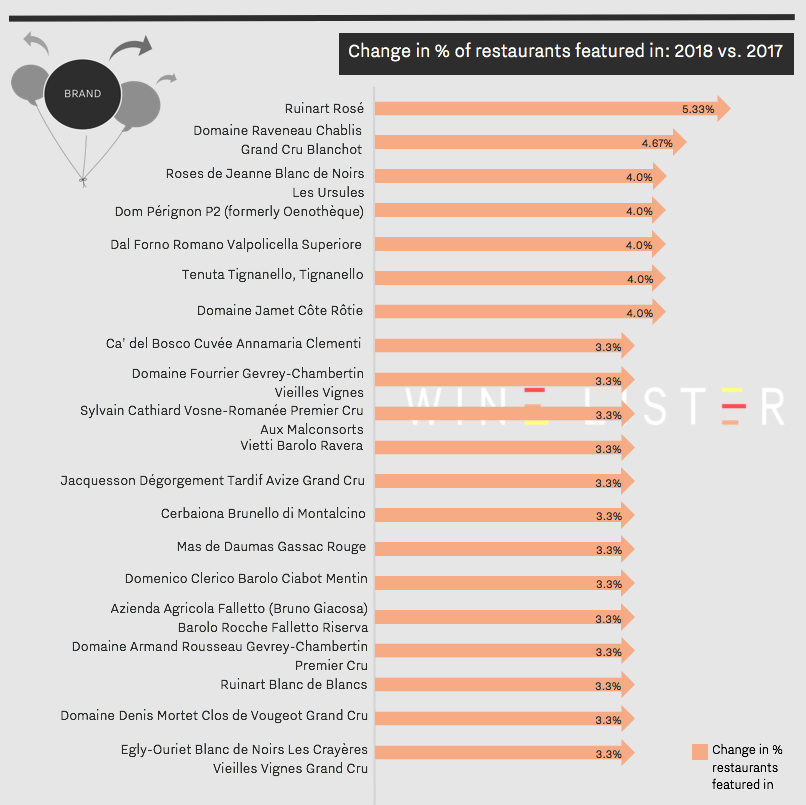

Last week we revealed the top 20 gainers in presence in the world’s best restaurants over the past 12 months. That was in terms of breadth, i.e. the number of restaurants in which a wine features. Wine Lister also analyses the depth of presence – the range of vintages and/or bottle formats of each wine therein. Here we look at the top 21 wines achieving the largest increases in restaurant presence depth since last year.

In first place, with an impressive 35 additional vintages and/or bottle formats listed across the world’s 150 best restaurants since this time last year, is Vega-Sicilia’s Unico. This brings its total references to 250 (almost three and a half in each of the 71 lists in which it features). Given Unico’s average drinking life span of 13 years, and its reputation for longevity (an Unico vertical tasting is an opportunity not to be missed), this result is hardly surprising. Its strong restaurant presence is matched by online popularity (Unico is the 33rd most-searched-for wine in our database), resulting in a Brand score of 992 – the best of any Spanish wine on Wine Lister.

Though Spain takes the number one spot, Italy is the overall biggest mover in increased depth of representation, claiming 12 out of the 21 places shown on the chart below.

Ornellaia is among these, and is also the most thoroughly represented wine of the group, with 280 vintages and/or bottle formats featured across 43% of the world’s best restaurants.

Several others – Cerbaiona Brunello, Dal Forno Romano Valpolicella Superiore, Ca’ del Bosco Cuvée Annamaria Clementi, and Domenico Clerico Barolo Ciabot Mentin – feature in the top gainers for horizontal as well as vertical presence in the world’s best restaurants. The latter is one of five Barolos to feature in the chart above, joined by Parusso Barolo Bussia, Bartolo Mascarello’s Barolo, Giuseppe Mascarello e Figlio Barolo Monprivato, and finally, Rocche Dei Manzoni Barolo Big’d Big, which sees the biggest increase in vertical presence of the whole group. Despite a horizontal representation increase of just 1%, the number of vintages and/or bottle formats listed across the 3% of the world’s best restaurants in which it features has grown from two to 19 in the last 12 months (or in other words, by 850%).

Outside Italy, the overall picture of restaurant presence depth somewhat contradicts that of breadth painted last week. Though Champagnes, and in particular grower offerings, have increased significantly in terms of horizontal presence, their vintage and/or format gains have not been sufficient to make this week’s top 20. This suggests that whilst sommeliers are keen to add more variety of Champagne, they aren’t so worried about listing reams of vintages / formats thereof. Only one Champagne features in the group: Philipponnat’s Clos des Goisses.

Bordeaux is conspicuous by its absence in this list, other than Château Clarke, with 26 overall references up from just four. In fact, Bordeaux’s big names are more likely to find themselves at the very bottom of the list, many having seen their vertical entries on restaurant wine lists shrink significantly. This seems to suggest that as restaurants diversify, they are choosing to hold less Bordeaux stock, still listing the top wines, but not necessarily in multiple vintages or formats.

Part of Wine Lister’s Brand score includes a measure of prestige, achieved by analysing a wine’s presence in the world’s best restaurants. Whether a restaurant makes the cut depend on a combination of measures including the Michelin Guide, San Pellegrino 50 Best Restaurants, and World of Fine Wine Best Wine List Awards.

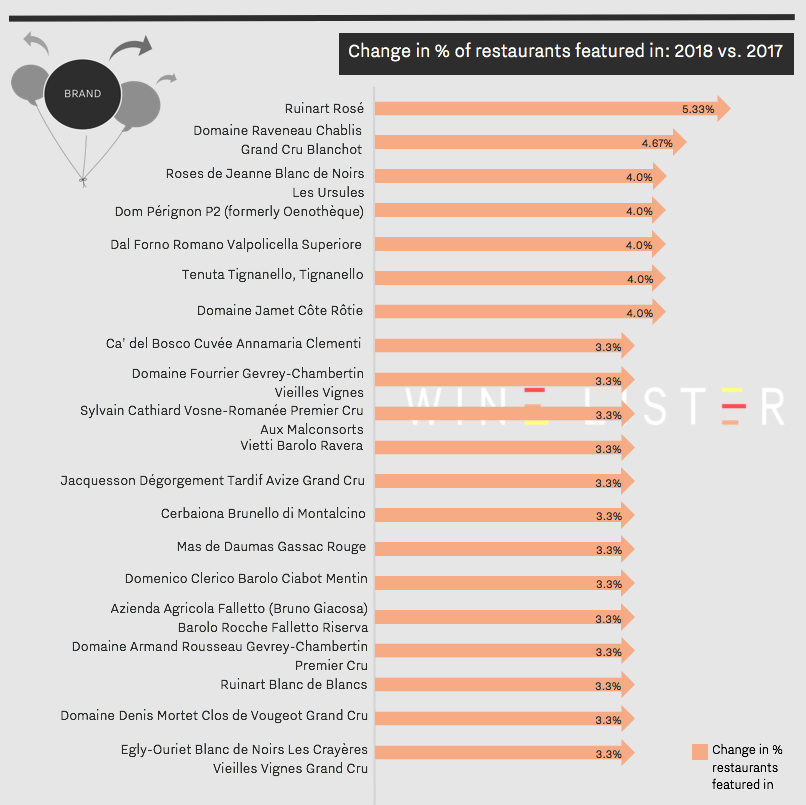

The chosen wine lists are then analysed to give us the breadth (how many restaurants) and depth (how many formats and/or vintages in each restaurant) of presence achieved by each wine on Wine Lister. Looking at the former criterion, the chart below shows the top 20 biggest gainers since our last blog on the subject. (Next week we will be looking at wines with the greatest increase in depth of representation.)

Six out of the 20 wines with the biggest increase in restaurant presence are Champagnes. Ruinart appears twice, with its NV rosé having made the greatest improvement, now appearing in 33% of the world’s best restaurants. However, the overall winner – present in more than double the number of restaurants, is Dom Pérignon’s Vintage Brut. Despite not featuring in the top 20 biggest risers above, the Champagne Brand king is now present in 69% of top restaurants worldwide, overtaking last year’s winner, Yquem.

Contrary to our last analysis on the subject, not all the biggest Champagne gainers in restaurant presence are big brands. Ruinart Rosé, Dom Pérignon P2, and Ruinart Blanc de Blancs may well fit this bill, with an average Brand score of 878, but the lesser-known three, grower Champagnes Roses de Jeanne Blanc de Noirs Les Ursules, Jacquesson Dégorgement Tardif Avize Grand Cru, and Egly-Ouriet Blanc de Noirs Les Crayères Vieilles Vignes, do not, as shown by a lower collective Brand score average of 664.

If this alone is not an indication of restaurant wine lists branching out, then perhaps the absence of Bordeaux is (indeed, a handful of Bordeaux wines with strong restaurant presence have lost a little ground since last year’s analysis). This diversification does however appear exclusive to the Old World, with no New World wines in the top 20 gainers.

Burgundy is well-represented amongst the top gainers, with one white, Raveneau’s Chablis Blanchot, and four reds: Sylvain Cathiard’s Vosne-Romanée Aux Malconsorts, Denis Mortet’s Clos de Vougeot, Armand Rousseau’s Gevrey-Chambertin, and Fourrier’s Gevrey Chambertin Vieilles Vignes.

Italy brings a show of diversity with six wines hailing from four different appellations across the 20 biggest movers. Vietti’s Barolo Ravera – one of three Barolos to feature in this list – has the lowest restaurant presence of the group (5%) and Solaia’s younger sibling, Tignanello the highest (47%).

Buzz Brands are wines that are sure to turn heads, destined to cause a stir whenever they are opened. They combine excellence across Wine Lister’s two Brand criteria – restaurant presence and online popularity – whilst also being held in the highest regard by the fine wine trade – as confirmed by Wine Lister’s Founding Members’ survey which gathers the opinions of around 50 key players in the international wine trade. This week, the Listed section focuses on Italy’s top five Buzz Brands by overall Wine Lister score.

Barolo is home to four of Italy’s top five Buzz Brands, two of which are produced by Giacomo Conterno – the flagship Monfortino in first place (973) and Francia not far behind in second place (954). The Monfortino achieves Italy’s best Quality score (977), the result of remarkable consistency from vintage to vintage, having achieved a score of 993 or above in seven of the past 10 vintages. Its best ever vintage was 2004 (998), thanks to a perfect 100-point score from Antonio Galloni, who writes: “I imagine the 2004 Monfortino will give readers an utterly spellbinding drinking experience for the next few decades”.

Whilst the Francia is pipped at the post in each category by its illustrious stablemate (trailing by 17 points in the Quality category, 11 in the Brand category, and 34 in terms of Economics), it does manage superior restaurant presence, visible in 30% of the world’s top establishments, compared to the Monfortino’s 23%. This is presumably due to over three times as many bottles of it being produced each year on average.

In third place is Azienda Agricola Falletto’s Rocche Falletto Riserva (953). It records the best Economics score of the five (969) and Italy’s second-best, beaten only by Falletto’s Barbaresco Asili Riserva (978). It does so thanks to the combination of very strong growth rates – it has recorded a three-year compound annual growth rate of 21% and has added 8% to its value over the past six months alone – and strong liquidity – its top five vintages having traded 398 bottles at auction over the past year. Perhaps collectors have been eager to get their hands on a bottle after the passing of Bruno Giacosa in January.

Proving that Super Tuscans can mix it with Piedmont’s top nebbiolos, Sassicaia takes fourth place. Whilst it cannot keep pace with Barolo’s finest in the Quality and Economics categories, Sassicaia stretches out a comfortable lead in the Brand category thanks to an extraordinary score of 998. This near-perfect score puts it alongside Haut-Brion, Margaux, and Petrus, beaten only by the Pauillac First Growths, Dom Pérignon Vintage Brut, and Yquem. Its brand dominance is the result of outstanding restaurant presence (49%) and online popularity – receiving well over three times as many searches each month as Conterno’s Monfortino, which is the group’s second-most popular wine.

Rounding out the five is Bartolo Mascarello’s Barolo. Its brand is its strongest asset, its score of 964 making it Barolo’s second-strongest brand behind Conterno’s Monfortino. Despite receiving over 20% fewer online searches each month than the Monfortino, it matches its level of restaurant presence – perhaps the azienda’s famous “no barrique no Berlusconi” message strikes a chord with sommeliers.

Ornellaia 2015 has been released at £150 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Ornellaia 2015

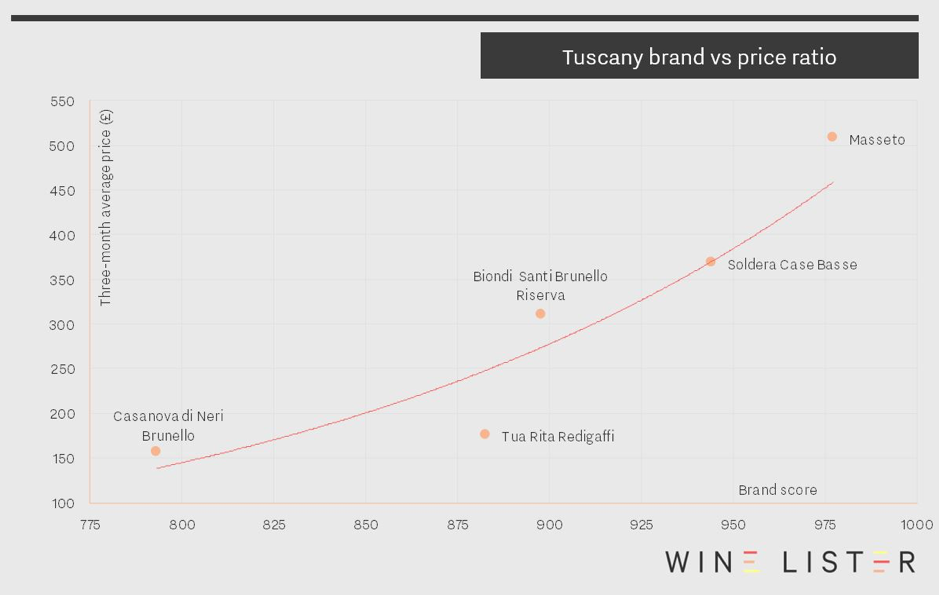

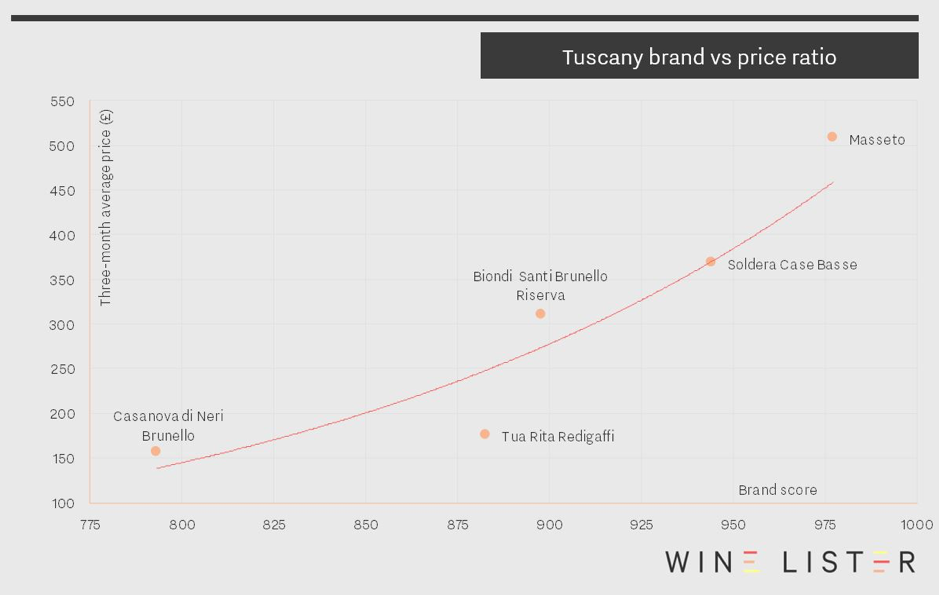

In this week’s top five, we take a break from June’s Bordeaux bias on the vinous calendar to look at the rising prices of Tuscany’s top wines.

However, there’s no escaping Bordeaux with Tuscany’s most expensive wine, since Masseto is distributed through the Place de Bordeaux. With tiny quantities available to purchase via the Place each year – average annual production is 32,000 bottles – Masseto’s price of £511 per bottle makes it well over a third more expensive than the rest of this weeks’ top five, and also the second-most expensive Italian wine on Wine Lister (beaten only by Giacomo Conterno’s Barolo Monfortino Riserva).

Masseto also achieves the group’s best Brand score (977), the result of featuring in the highest number of the world’s top restaurants (24%) and being over 2.5 times more popular than any of the other four. The chart below confirms a strong relationship between Brand score and price for these wines, with Masseto’s formidable brand strength playing a key role in its high price.

At £367 per bottle, Soldera Case Basse Sangiovese takes the second spot. It achieves the highest Quality and Economics scores of the five (976 and 957 respectively). With an impressive three-year compound annual growth rate (CAGR) of 18.4% – by far the highest of the group – and having added 7.3% to its value over the past six months, Soldera Case Basse continues to cement its position as Tuscany’s second-most expensive wine, and close the gap on Masseto.

Two Brunellos feature amongst Tuscany’s most expensive wines: Biondi Santi’s Brunello Riserva (£289) and Casanova di Neri’s Brunello Cerretalto (£157). Whilst Biondi Santi Brunello Riserva’s appearance might be expected, considering its heritage, the fact that Casanova di Neri Cerretalto is amongst Tuscany’s most expensive wines might be more of a surprise, indicating that Riserva status alone does not currently guarantee higher prices than straight Brunellos.

Rounding out the five is Tuscany’s fourth-most expensive wine and the group’s second 100% merlot – Tua Rita’s Redigaffi. At an average price of £180 per bottle, it is over 2.5 times cheaper than its varietal companion in the group, Masseto.

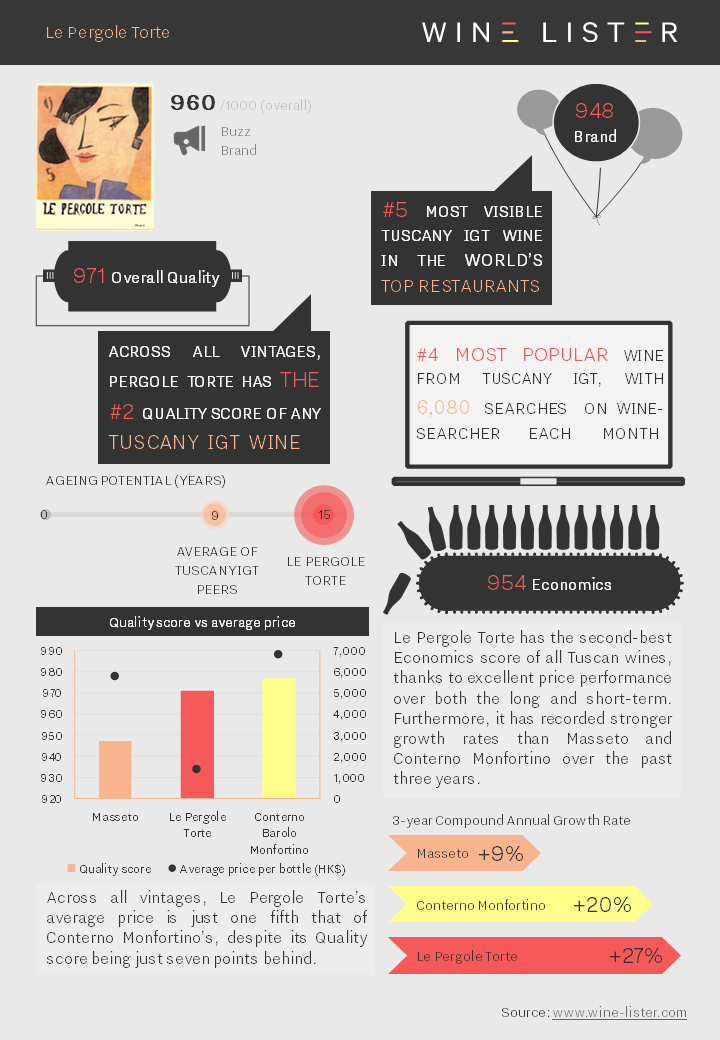

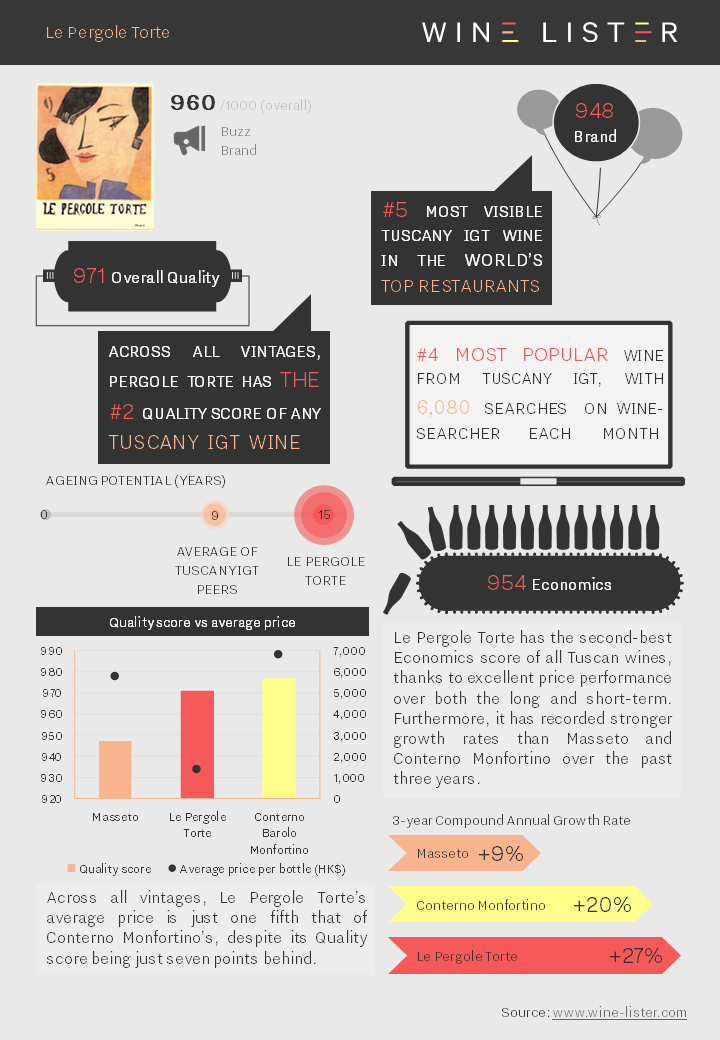

Montevertine Le Pergole Torte is Tuscany’s top-scoring wine. Here we look at the key facts that have helped it top the Tuscan table.

You can download this slide here: Wine Lister Factsheet Le Pergole Torte

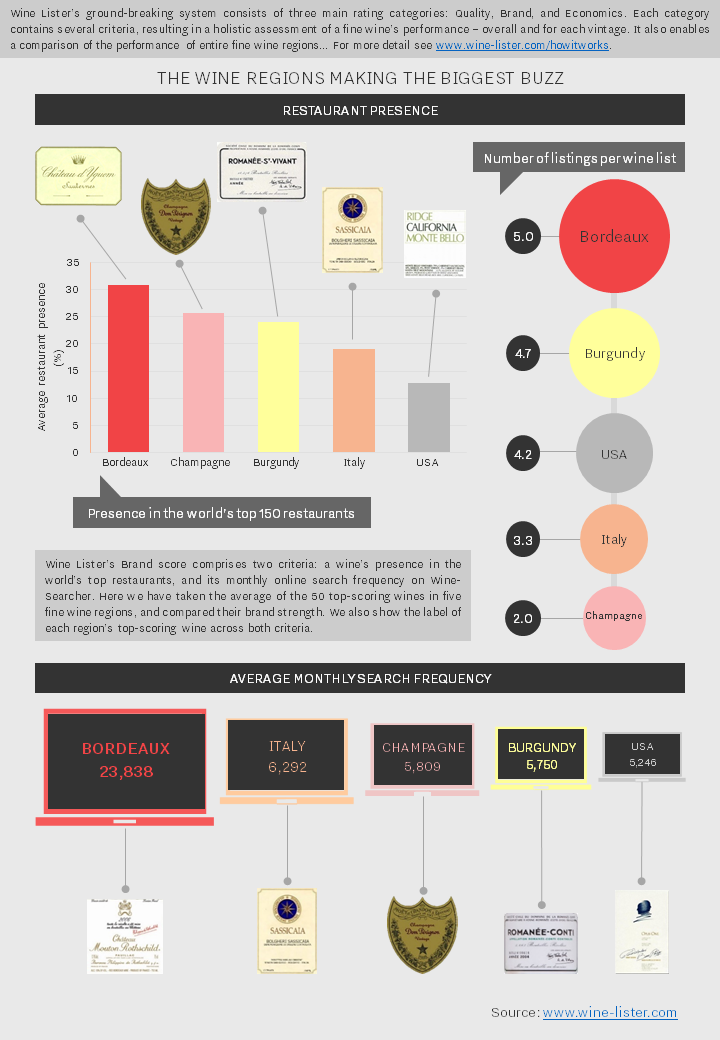

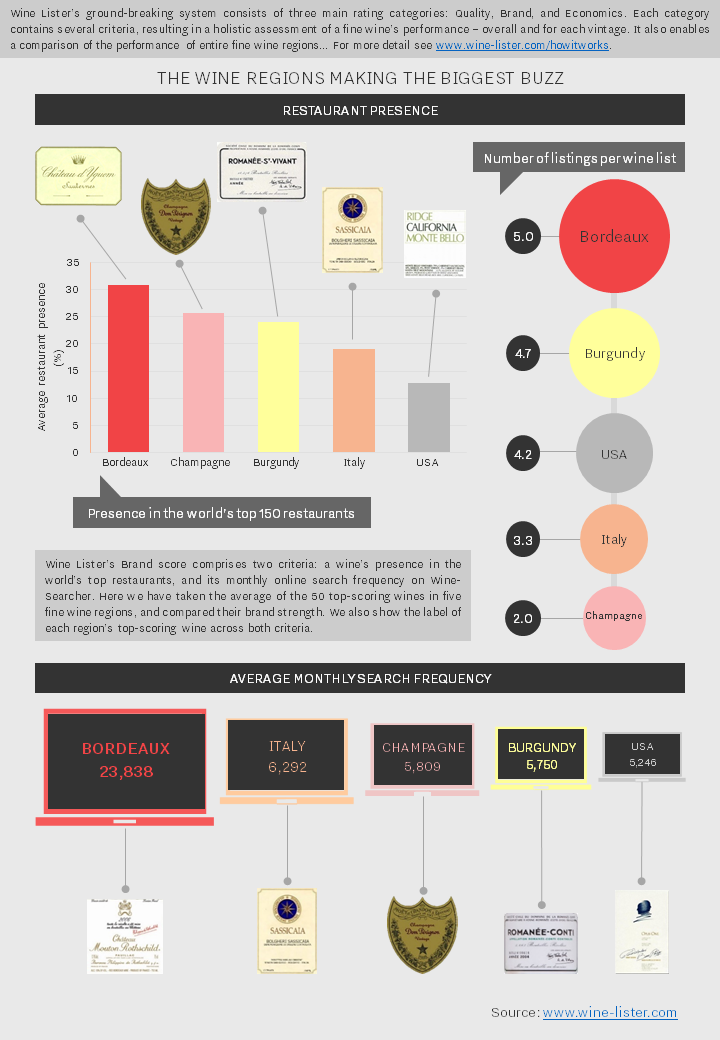

Wine Lister’s Brand category measures a wine’s performance across two criteria: popularity and distribution. In conjunction with its Quality and Economic performance, this allows a holistic assessment of a fine wine. It also enables a comparison of the performance of entire fine wine regions. Below we look at the average scores over both Brand criteria of the top 50 wines in Bordeaux, Burgundy, California, Italy, and the USA.

Bordeaux dominates, with powerhouses Yquem and Mouton demonstrating the success of its classification system and the centuries-old global repute of its top crus. Its best wines are by far the most popular with consumers – searched for nearly four times more frequently on average than second-placed Italy. They are also the best distributed in the world’s most prestigious restaurants, present in 31% on average, and with 5 references per list.

Whilst Champagne comes second in terms of breadth of presence in restaurants, its top wines don’t achieve much depth in terms of vintages or formats listed – presumably because many of them are non-vintage.

Burgundy competes well in terms of restaurant presence, with the likes of Domaine de la Romanée-Conti Romanée-Saint-Vivant Grand Cru enjoying a strong showing in top restaurants. Meanwhile the region is fourth most popular in terms of searches each month on Wine-Searcher.

Italy is unique in that Sassicaia is both its most popular wine and also its best distributed. However, whilst its top wines are the second most popular overall, they also experience the second lowest level of distribution.

Finally, the USA’s best wines achieve a strong level of vertical restaurant presence, but come last in terms of both horizontal presence and popularity, suggesting the New World still has a way to go in terms of brand strength.

Download a PDF version here.

First published in French in En Magnum.

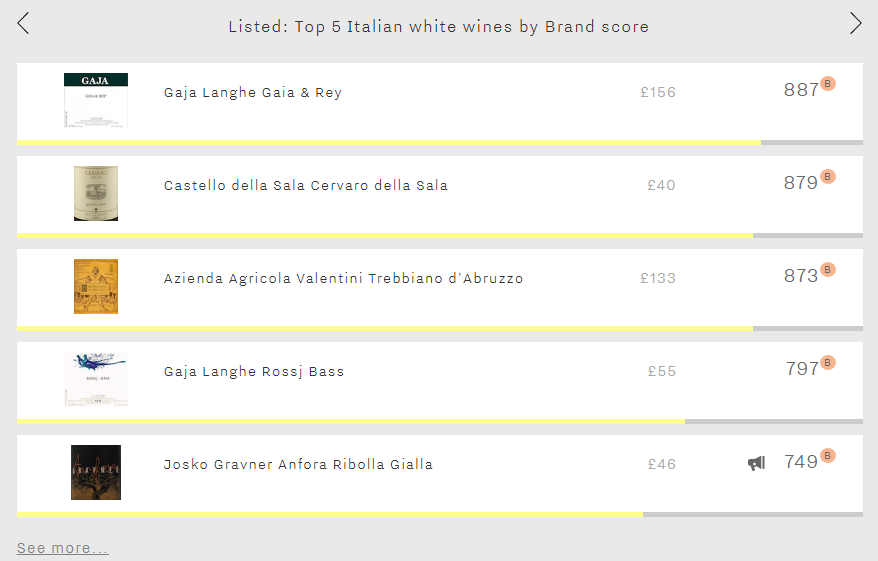

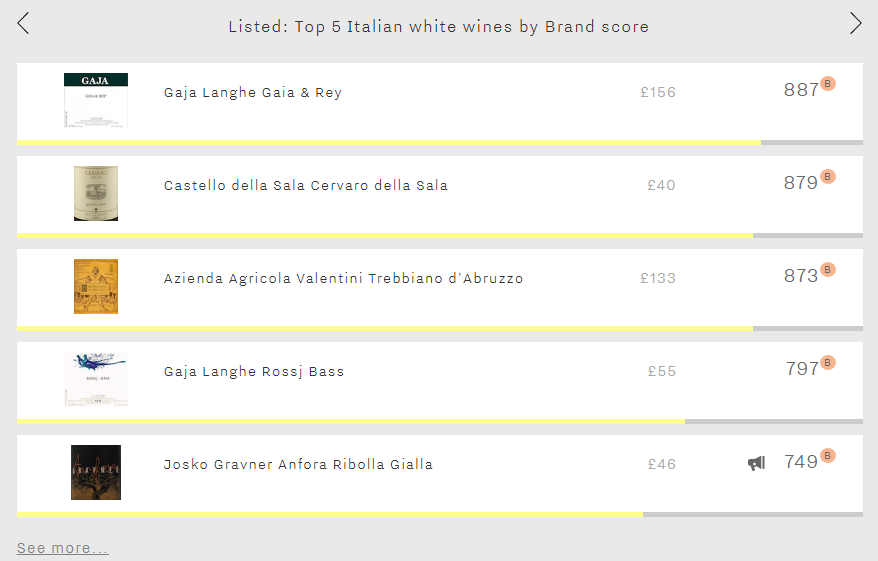

This week’s Listed section features the five Italian white wines with the strongest brands. They comprise two Langhes from Gaja (Gaia & Rey and Rossj Bass), two of Italy’s cult whites (Valentini Trebbiano d’Abruzzo and Gravner Anfora Ribolla Gialla), and Cervaro della Sala (from the Antinori stable).

Whilst these wines all enjoy strong or very strong Brand scores, they do not command the same level of brand recognition as the top five Italian red wine brands, trailing them by c.90-250 points in the Brand category. Tuscan powerhouses Sassicaia, Tignanello, Ornellaia, Solaia, and Gaja’s Barbaresco all achieve Brand scores of over 975 points, with Sassicaia’s outstanding 997 points putting it ahead of the likes of Cheval Blanc and DRC La Tâche.

Wine Lister’s Brand scores comprise restaurant presence and consumer popularity. It is in the latter category that the whites have the most ground to make up. For example Gaja Langhe Gaia & Rey, which featured in our latest blog on new Investment Staples, is present in well over half the number of restaurants of its close relative Gaja Barbaresco, but it receives under a quarter of the number of searches each month on Wine-Searcher. If sommeliers are convinced that these top Italian whites can grace the tables of the finest establishments, they still fly well under the radar of most consumers.

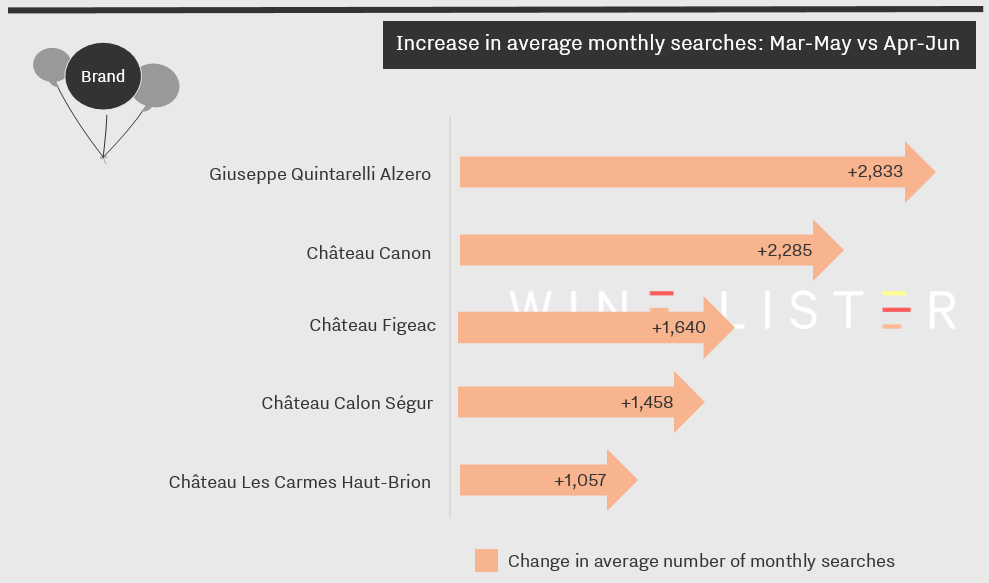

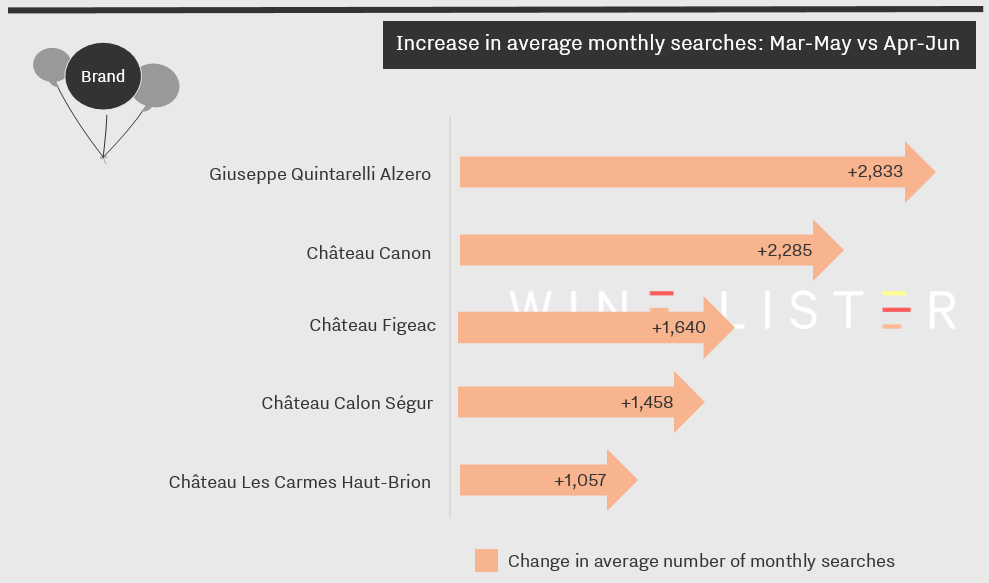

The latest online search frequency data is in from Wine-Searcher, and with it we can see which wines surged in popularity during June. As with May’s results, the effect of the 2016 en primeur campaign is evident, with four of the five spots filled by Bordeaux crus that released their 2016 vintage on or after 31st May.

However, if the en primeur effect is to be expected, the likely reason for Giuseppe Quintarelli Alzero’s appearance at the top of the table could not have been foreseen. On 18th June, NBA star LeBron James posted a photo on Instagram of a bottle of Giuseppe Quintarelli Alzero 2007 that he was enjoying, having spent the day hosting his son’s birthday party. To date it has received well over 200,000 likes, surely contributing to its 168% increase in online search frequency. It appears that whilst La Place de Bordeaux is the fine wine world’s premier marketing machine, it is no match for LeBron James and his 31.8 million Instagram followers.

Returning to the en primeur effect, Canon 2016 was released at £73.35 per bottle on 1st June to great acclaim, having achieved its second-best Quality score ever. The leap in search frequency confirms its upward trajectory. Figeac repeats its May performance, surging even further in popularity in June. The 2016 vintage – Figeac’s best since 1989 – was released on 13th June, its 67% increase on the 2015 sterling release price signalling its clear intent to reposition itself.

Calon Ségur and Les Carmes Haut-Brion both comfortably achieved their best ever Quality scores with their 2016 offerings, and sold out quickly, no doubt prompting their surges in online search frequency during June. The next step is to get a famous sportsperson to post a photo of themselves drinking it.