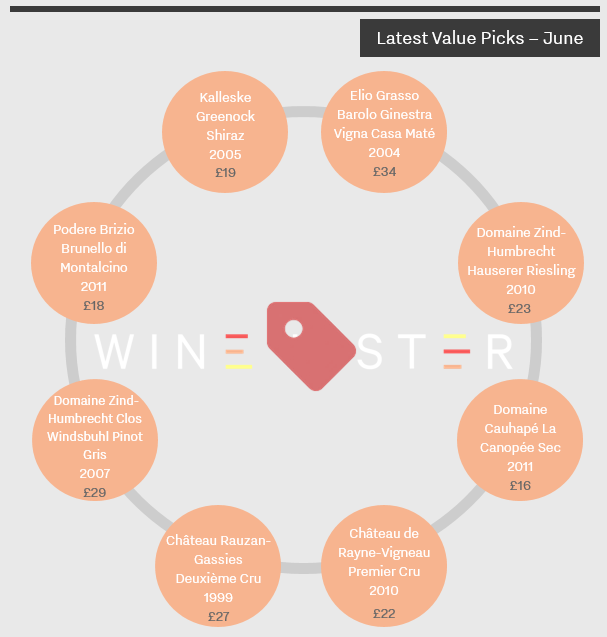

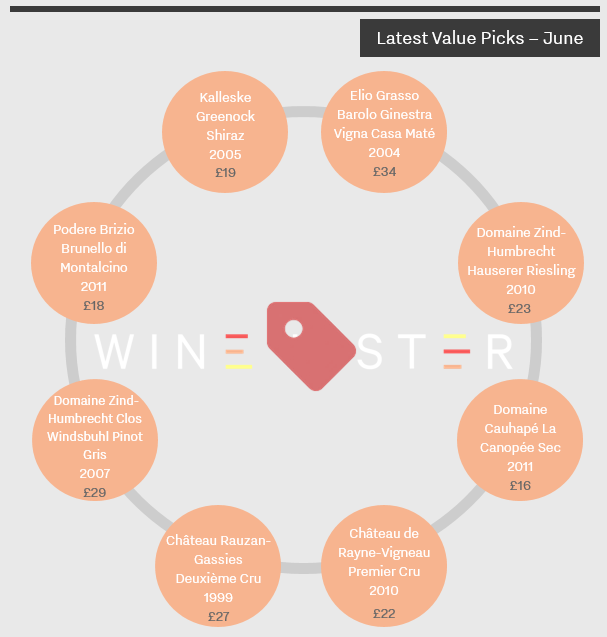

Like Buzz Brands, which we explored last week, Value Picks are one of the four Wine Lister indicators, designed to highlight particularly interesting wines for our subscribers by isolating sub-sets of data. The Value Pick indicator helpfully identifies the wines and vintages which have the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus allowing the finest wines a look-in).

This month, five of our eight new Value Picks are from France – but with a Sauternes, Riesling and left bank Bordeaux to choose from the options are still diverse. Most affordable is Domaine Cauhapé La Canopée Sec 2011, from Jurançon, at just £16 per bottle and with a Quality score of 733.

The most expensive wine – but still at only £34 per bottle – is one of the two Italians that feature this month: Elio Grasso Barolo Ginestra Vigna Casa Maté 2004, which has an exceptional Quality score of 971. The other wine in the table with a Quality score above 900 is Domaine Zind-Humbrecht Clos Windsbuhl Pinot Gris 2007, from Alsace, priced at under £30 and with a Quality score of 906.

Please see our previous Value Pick blog for a note on prices.

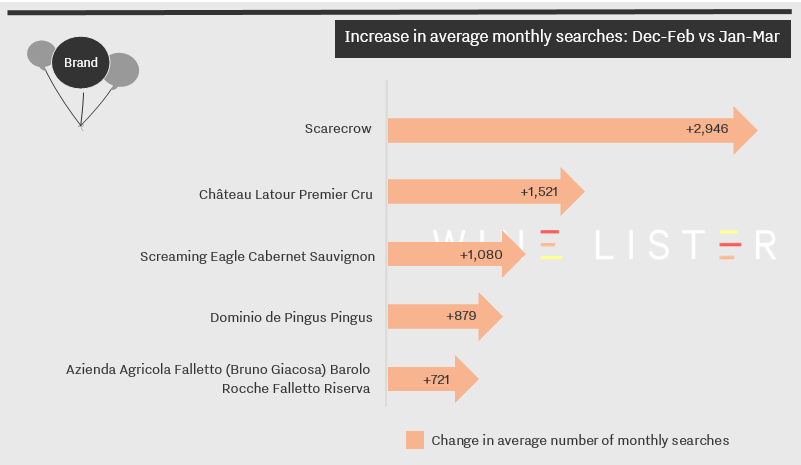

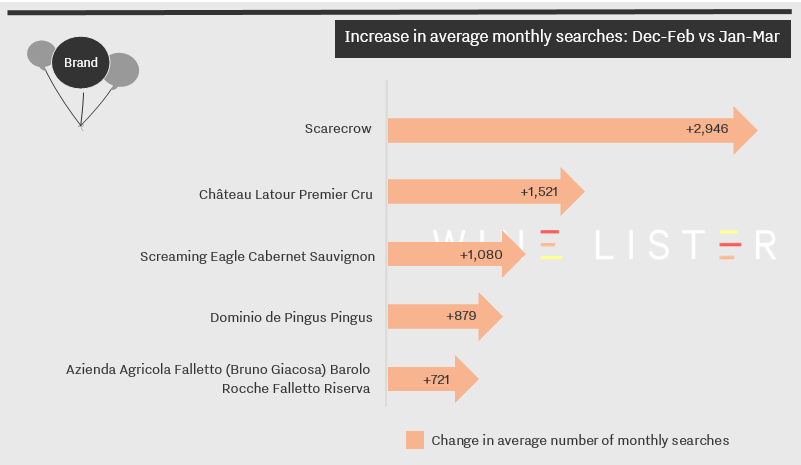

With the latest data now in from Wine Searcher, we took a look at which wines have seen their average monthly searches soar in the last month. The US boasts two wines in this top 5, with searches continuing to increase for Screaming Eagle, and Scarecrow seeing a significant uptick. Bottled relatively recently, Scarecrow 2014 scored 96+ from our US partner critic Antonio Galloni, who described it as “a wine of finesse.” At the end of February, Scarecrow 2014 was the top lot in a Premiere Napa Valley auction, selling for $200,000. The increase in searches has boosted Scarecrow’s Brand score from 868 to 885.

Latour was the only wine from France to see its popularity rise last month, with searches for the Bordeaux first growth no doubt increasing as a result of the ex-château release in mid-March of Latour 2005, for €670 per bottle ex-négociant. Latour has the highest Brand score of all the wines in the table, with a near-perfect 999.

The final two wines to have seen a rise in popularity are Spain’s Pingus, whose 2014 recently received a 100-point score in the Wine Advocate, and Italy’s Azienda Agricola Falletto (Bruno Giacosa) Barolo Rocche Falletto Riserva. In March, Antonio Galloni praised “the genius of Bruno Giacosa” in a vertical tasting, and the increase in searches resulted in the wine’s Brand score rising from 812 to 822.

How is the popularity score calculated and how does it fit into the overall Wine Lister score?

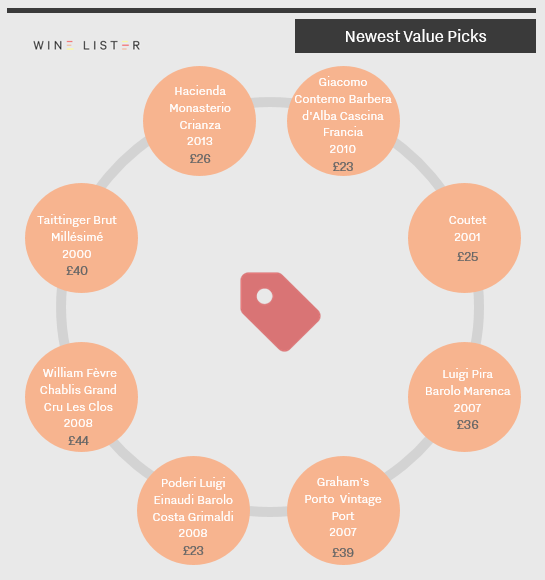

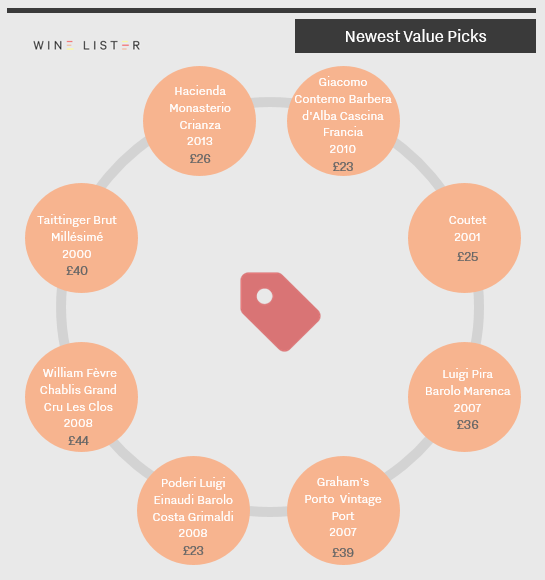

The latest price data is in, enabling Wine Lister’s algorithm to award new Value Pick status to those wines that achieve the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus allowing the finest wines a look-in).

This month, the new Value Picks include a Champagne, a Port, and a sweet white Bordeaux, but it is Piedmont that dominates, with three of its wines achieving Value Pick status: Poderi Luigi Einaudi Barolo Costa Grimaldi 2008, Luigi Pira Barolo Marenca 2007 and Giacomo Conterno Barbera d’Alba Cascina Francia 2010.

Each wine is priced at £44 per bottle or less – with half under £30 – and all have impressive Quality scores (based on ratings from our three partner critics) of 845 or above.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

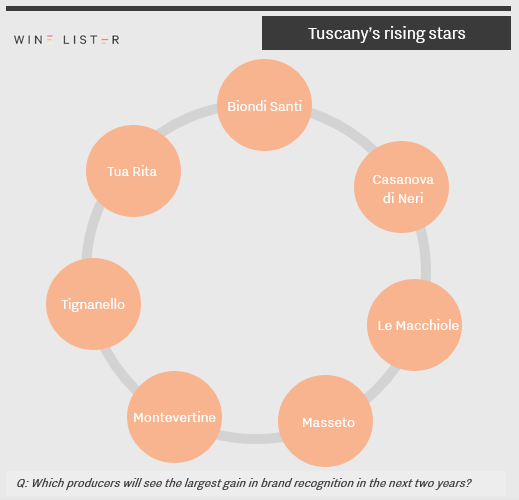

In the latest of our blogs on the findings from Wine Lister’s Tuscany Market Study – following on from a look at the region’s global standing, and the popularity of its appellations – we turn our attention to its individual wines. Here, we have carried out an in-depth survey with our Founding Members (the key fine wine trade players from across the globe, between them representing more than one third of global fine wine revenues), for insight into their confidence in Tuscany’s individual wines.

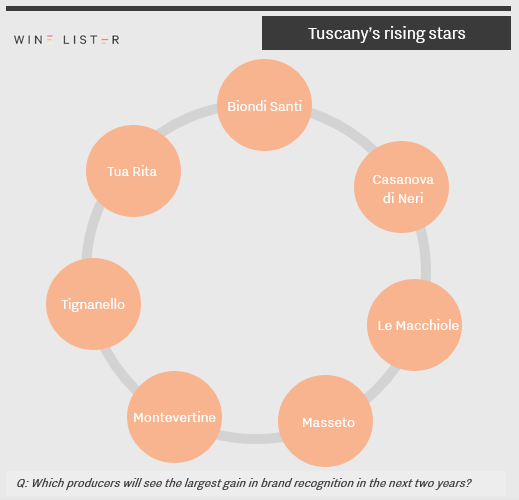

First, we asked respondents which producers are due to see the largest gain in brand recognition in the next two years. More than half those cited are producers whose flagship wines are Super Tuscans / Tuscany IGT: Tenuta Tignanello (Tignanello and Solaia), Masseto, Montevertine (Le Pergole Torte) and Tua Rita (Redigaffi).

Brunello di Montalcino DOCG is home to two contenders, Biondi Santi and Casanova di Neri, while the final producer, Le Macchiole, makes mainly Bolgheri DOC wines.

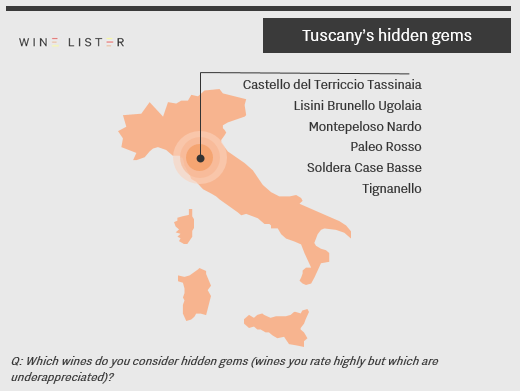

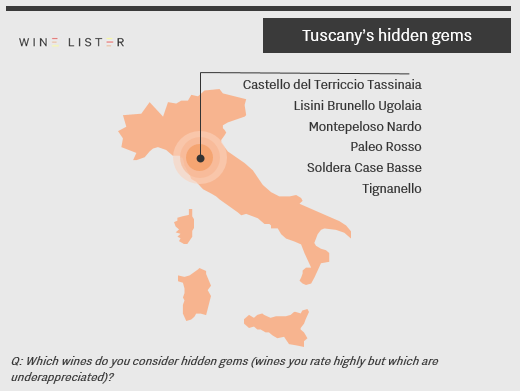

We also asked the trade which individual Tuscan wines they consider to be hidden gems: wines that they rate highly but which they perceive as underappreciated elsewhere. Two of these wines are made by rising star producers above: Tignanello, and Le Macchiole’s Paleo Rosso, suggesting that these wines may not stay underappreciated for long.

Apart from Soldera Case Basse, all of the wines cited have average prices per bottle of £75 and under, combined with strong average Quality scores that vary between 814 (Castello del Terriccio Tassinaia) and 919 (Tignanello).

To take a look at the rest of the survey’s findings – including which Tuscan wines have seen the sharpest rise in demand, which consistently sell out, and which the trade have most confidence in – please log in to Wine Lister and download the report from the Analysis page.

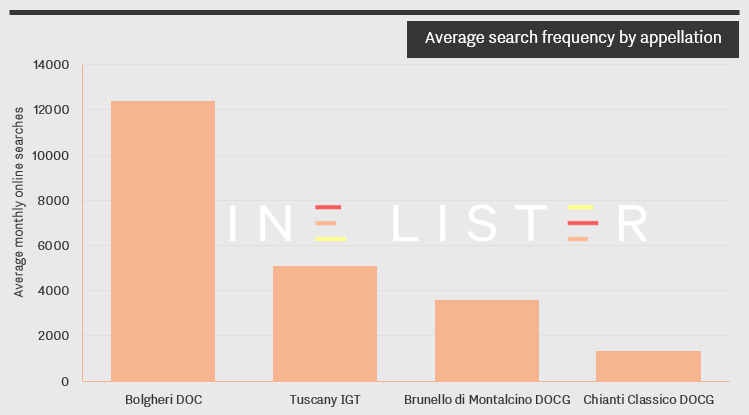

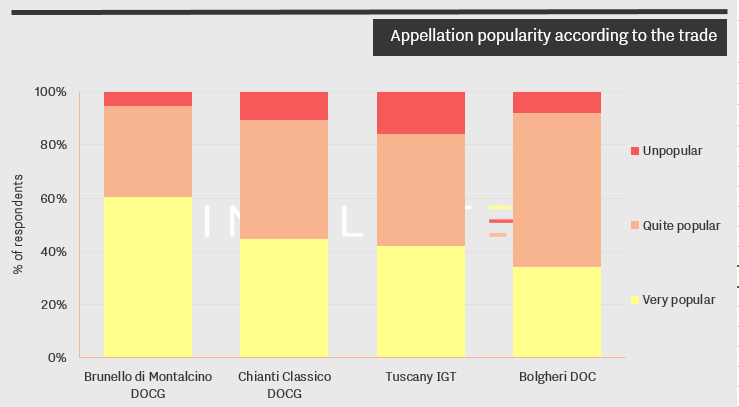

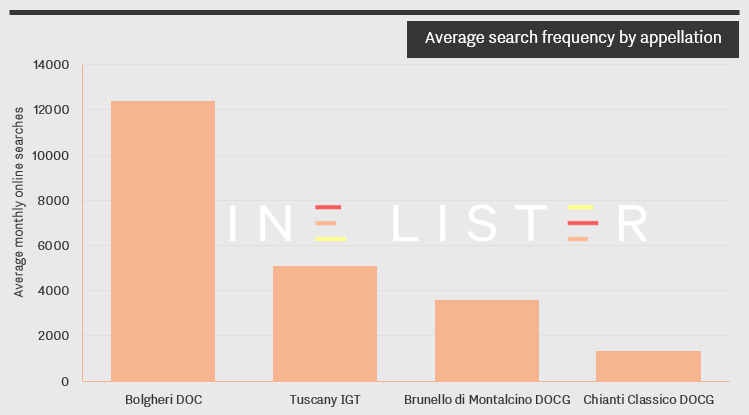

In the second blog exploring some of the findings from Wine Lister’s Tuscany Market Study – following on from our look at how the region ranks globally – we take a look at the popularity of Tuscany’s appellations. The chart below plots the average number of online searches received each month by the 50 wines in this study (based on data from Wine-Searcher), filtered by appellation.

Wines from Bolgheri DOC are by far the most popular amongst consumers, with, on average, more than twice the number of searches than their nearest competitor, Tuscany IGT. They are boosted by internationally established Super Tuscan brands such as Sassicaia and Ornellaia, which have stolen the limelight from more traditional neighbouring DOCGs such as Brunello and Chianti.

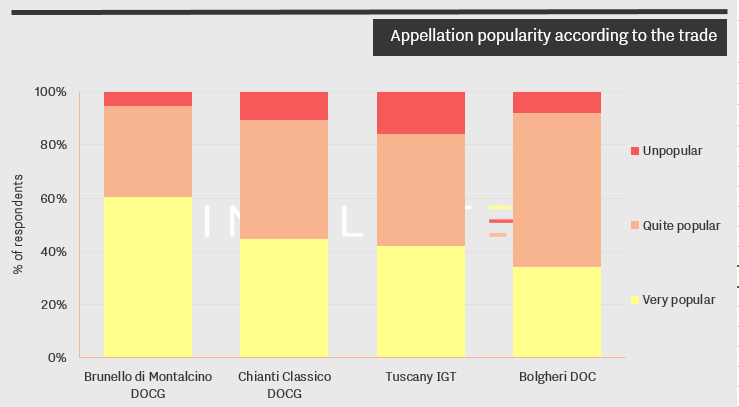

However, perception of each appellation’s popularity tells a different story. At the end of 2016, Wine Lister asked key members of the international fine wine trade about the relative popularity of Tuscan appellations amongst their clientele. Brunello di Montalcino – the third most searched for appellation – came out on top, with nearly 60% of respondents stating that it was very popular with their customers, followed by Chianti Classico.

Tuscany IGT and Bolgheri DOC trail slightly behind, emphasising that it has been the wines themselves, rather than the appellations, that have achieved fame.

In our final blog post on the Tuscany Market study we will focus in on the individual wines themselves: the trade’s view on which are the region’s consistent sellers and which are its rising stars. Wine Lister subscribers can read the full 35-page report here.

Wine Lister has produced its second in-depth regional study, this time on Tuscany – a many-faceted fine wine region that is fast-building its position on the global fine wine stage. We will be revealing some of the findings on the blog in the next few weeks, but the full 35-page report is available for subscribers on the Analysis page.

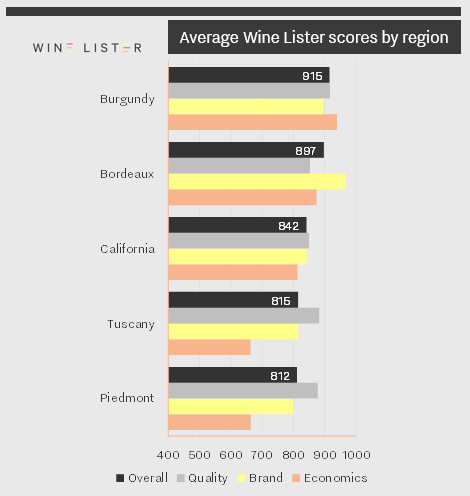

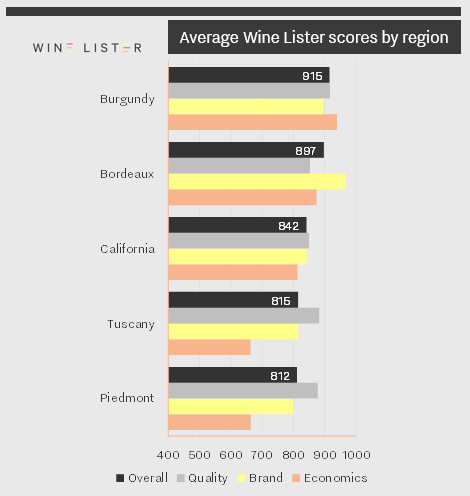

The study focuses on 50 top Tuscan wines, which we have compared below with 50 wines from Piedmont, Bordeaux, Burgundy, and California. Using the three categories that comprise an overall Wine Lister score – Quality, Brand, and Economics – we can put the region’s global positioning in context.

Although Tuscany comes fourth overall – just ahead of Piedmont – its Quality score is bettered only by Burgundy, scoring 883 points to Burgundy’s 917. Quality scores are derived from Wine Lister’s partner critics’ scores and a wine’s ageing potential, and Tuscany’s excellence in this category may be one explanation for its rising appeal.

Tuscany’s Brand score is the fourth best of the group, suggesting that after a handful of top brands such as the Super Tuscans, the rest of the top 50 do not confer the same level of prestige as wines in Bordeaux, Burgundy, or even California. Meanwhile, the region’s commercial clout is the weakest of the group, scoring one point less than Piedmont in the Economics category.

In upcoming posts, we will delve into the trade’s view on Tuscany’s foremost appellations and which are the wines to watch.

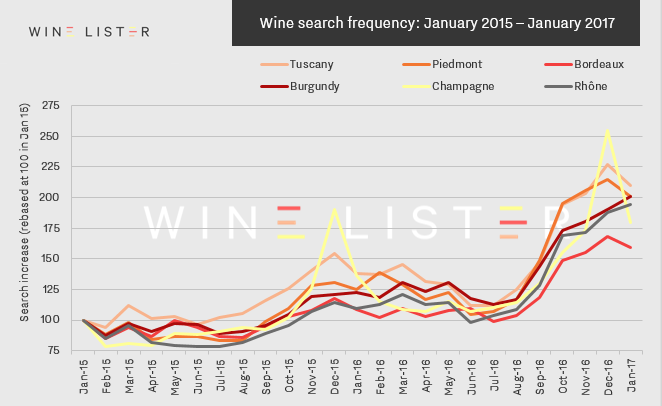

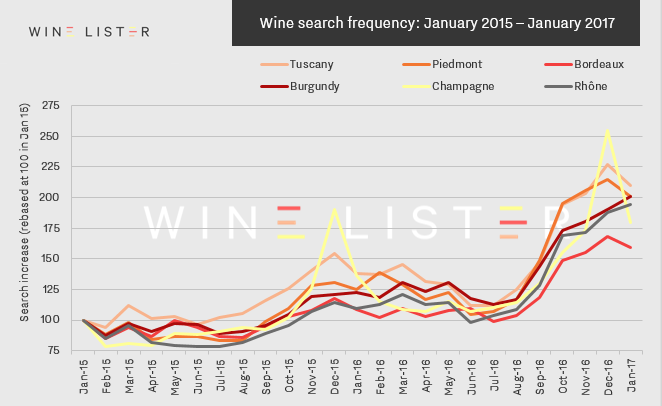

Measuring the number of searches on the world’s most visited wine site, Wine-Searcher, provides a unique insight into an individual wine’s overall popularity. Following on from last week’s blog on wine searches we have aggregated two years’ worth of this data at region level, to put popularity in perspective and map fine wine market trends over time.

Above, we have taken the 50 most searched-for wines from the leading fine wine regions in France and Italy and tracked their changes in search frequency over two years. Despite natural peaks and troughs – including large spikes for Champagne during the festive season – the last six months show an acceleration in searches for wines of every region.

Several wine regions have seen searches more than double in the last two years, with Tuscany, Piedmont and Burgundy as the stand-out performers. Meanwhile, Bordeaux – the most searched-for region in real terms – has struggled to engage new audiences at the same rate as its counterparts. For more on Tuscany’s rising global clout, see our in-depth regional study, available to subscribers on the Analysis page.

To view the popularity of individual wines, simply search for your wine of choice on Wine Lister and explore the Brand score sub-criteria.