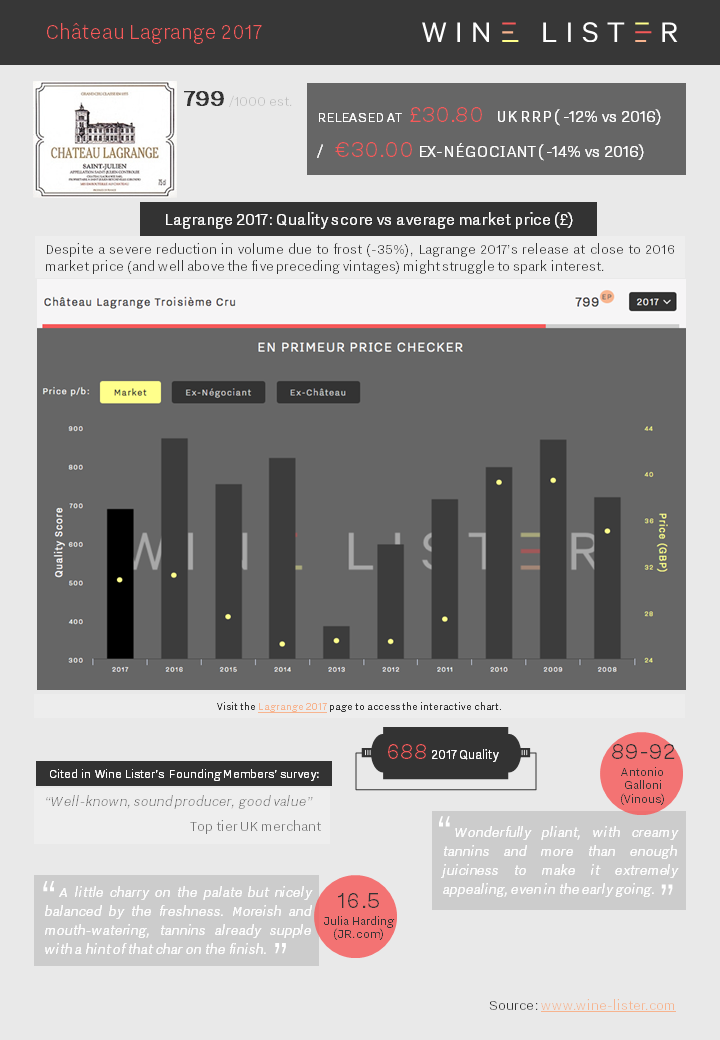

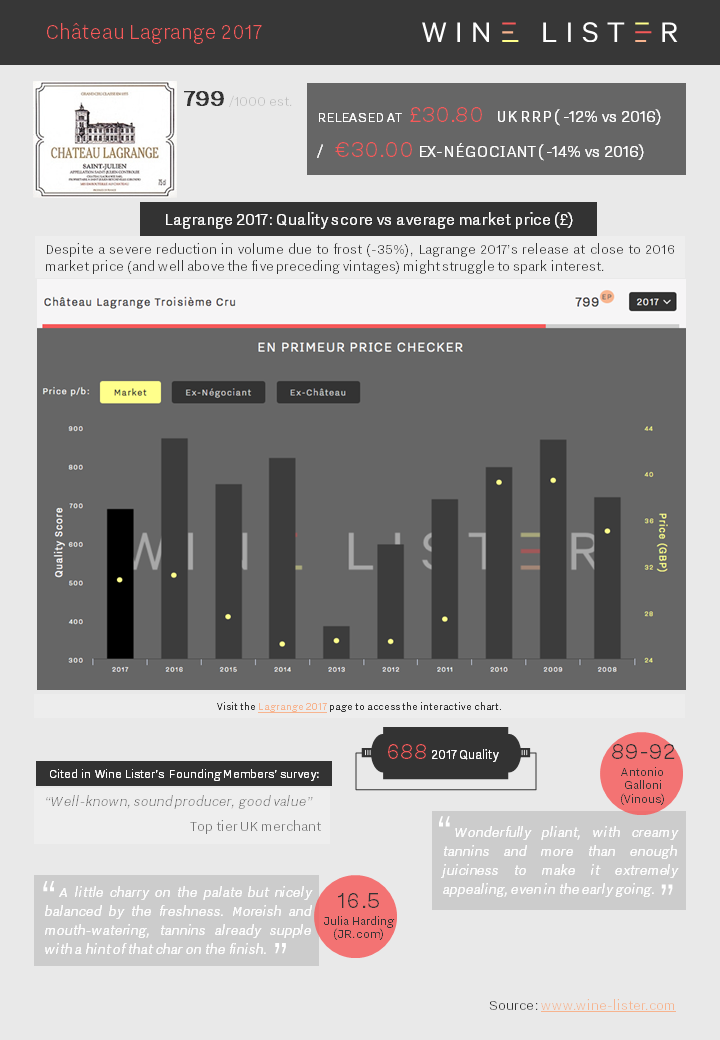

Lagrange 2017 released at €30.00 ex-négociant (14% down on 2016), with a UK RRP of £30.80 (12% down on 2016) and a lower Quality score 688 (vs 871).

You can download the slide here: Wine Lister Factsheet Lagrange 2017

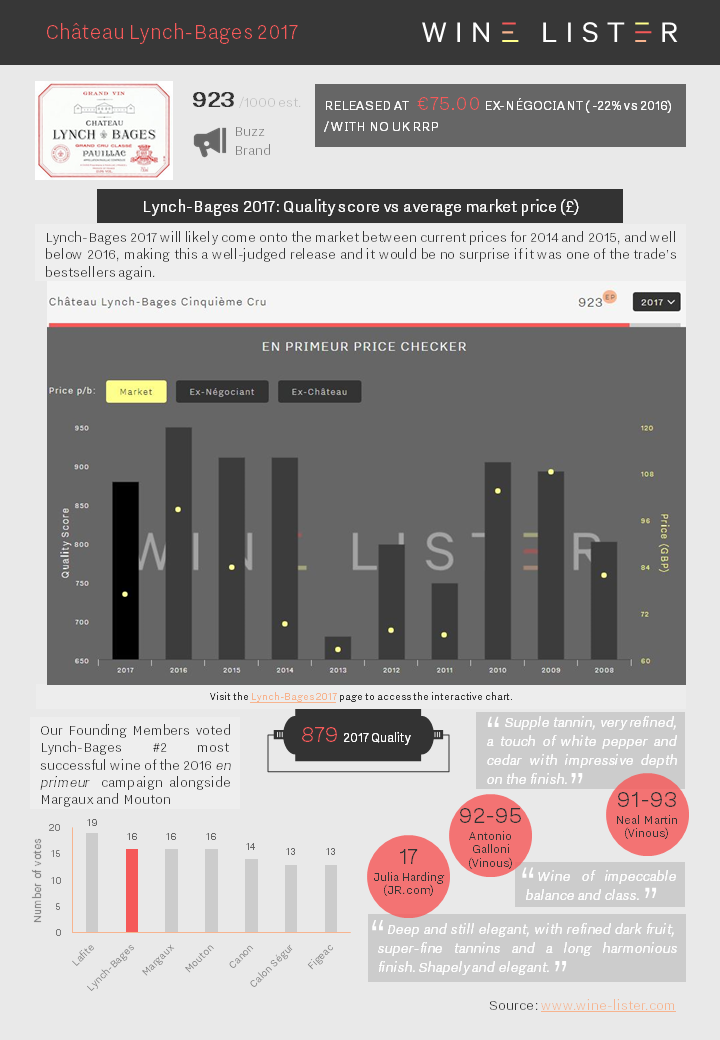

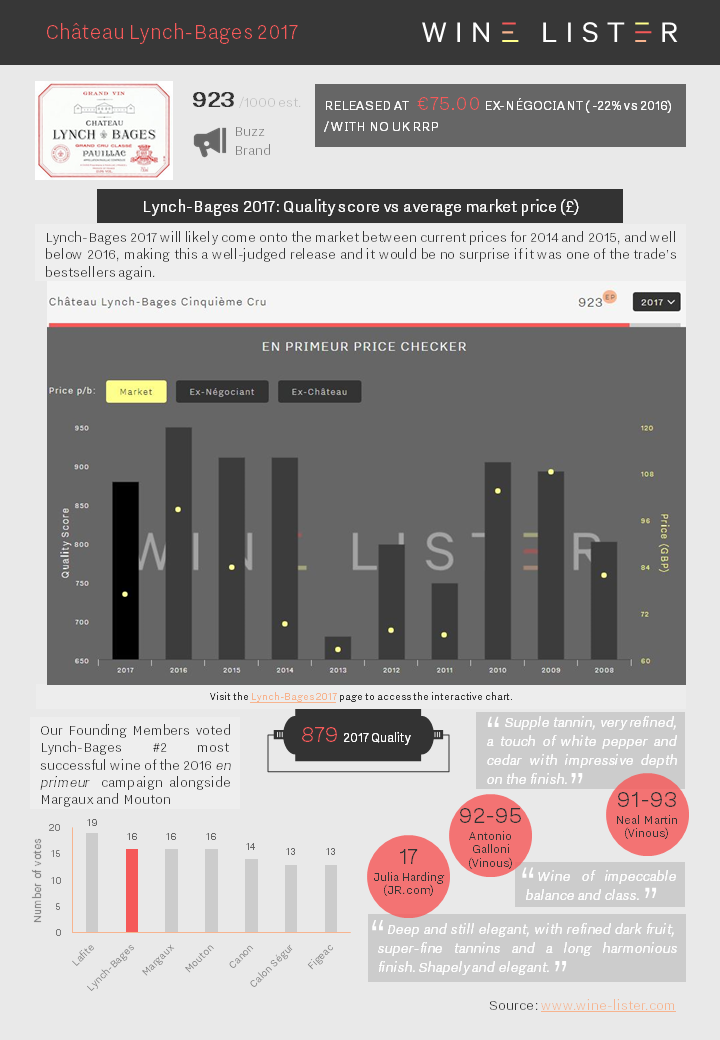

Lynch-Bages 2017 released at €75 ex-négociant (22% down on 2016), with no UK RRP. Its Quality score was down 7% on 2016 (879 vs 949).

You can download the slide here: Wine Lister Factsheet Lynch-Bages 2017

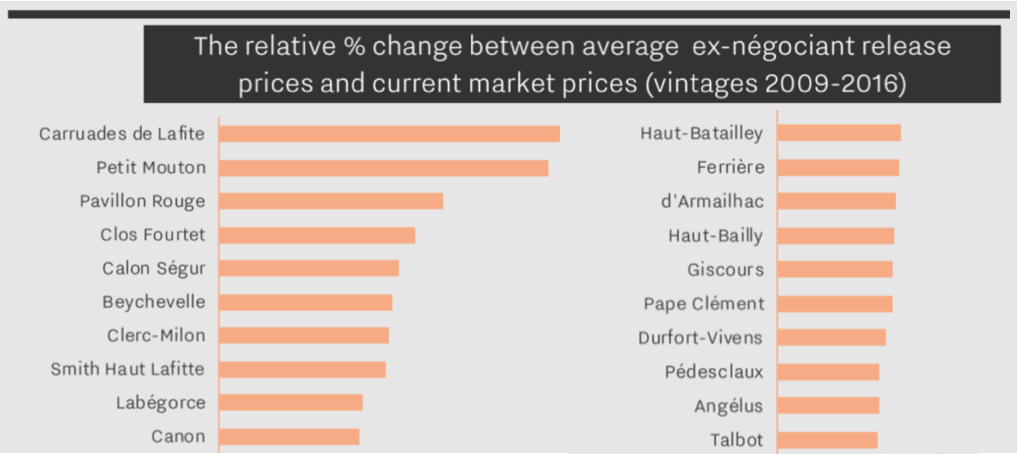

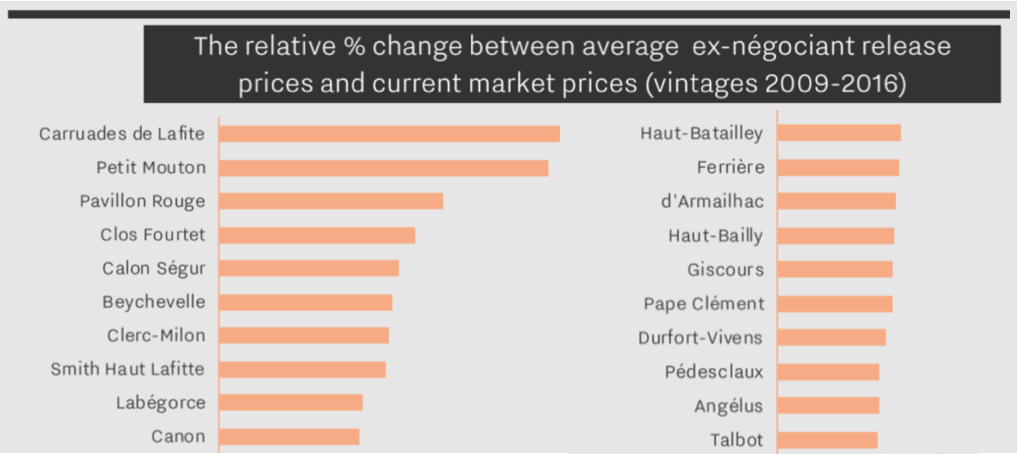

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.

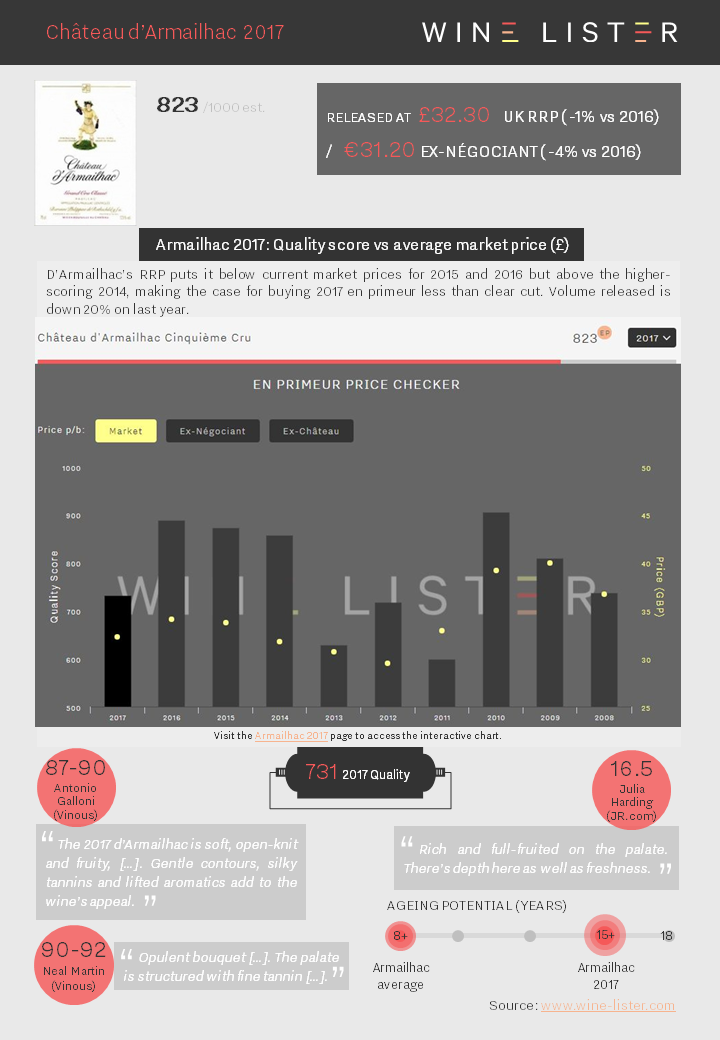

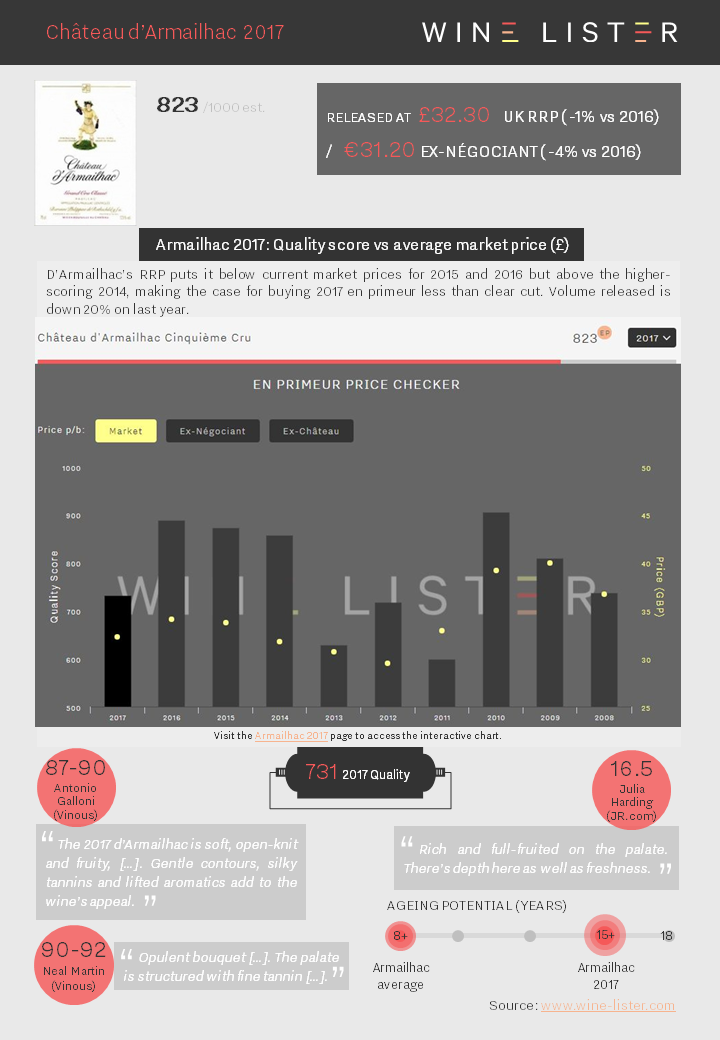

D’Armailhac 2017 released at €31.20 ex-négociant (4% down on 2016), with a UK RRP of £32.30 (1% down on 2016). Its Quality score was down 18% on 2016 (731 vs 888).

You can download the slide here: Wine Lister Factsheet D’Armailhac 2017

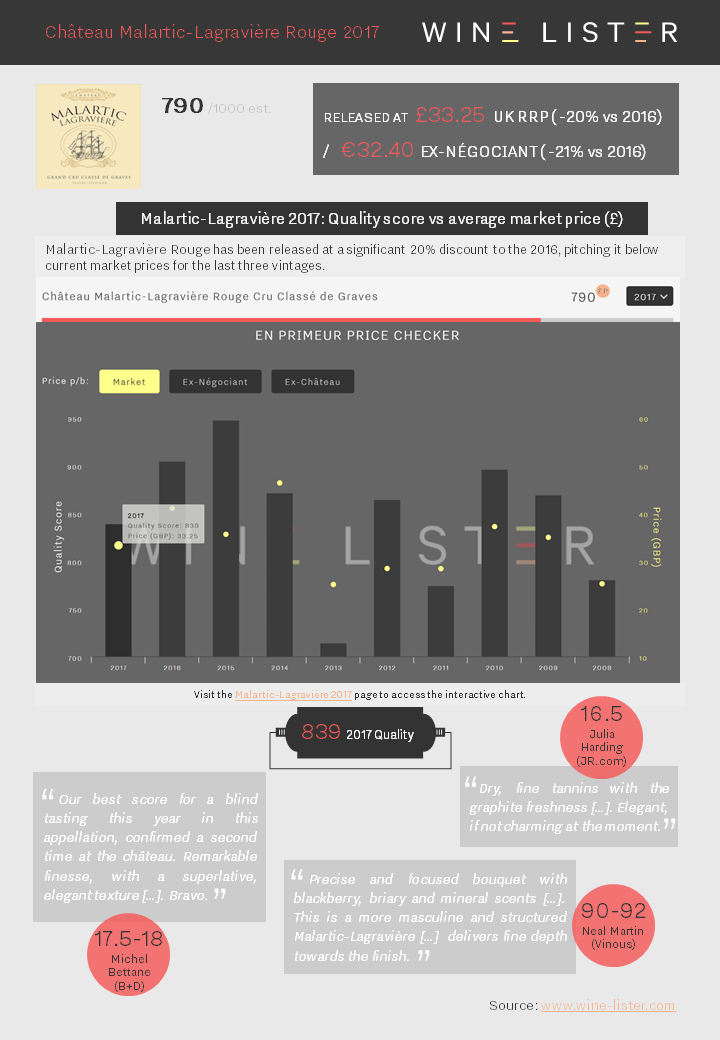

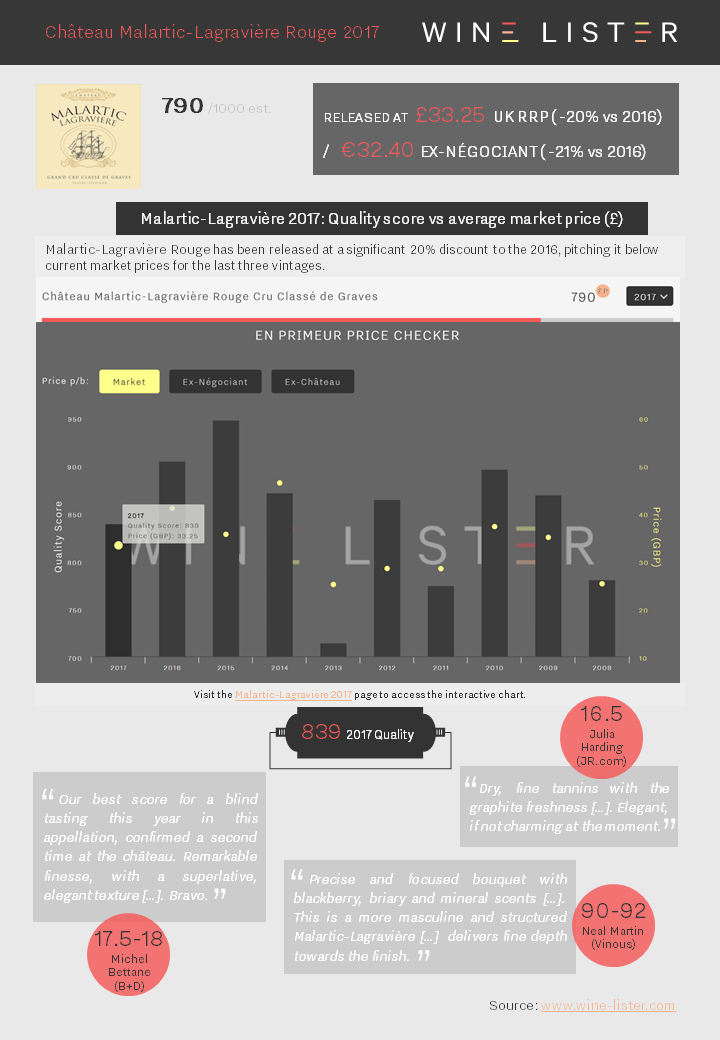

Malartic-Lagravière Rouge released at €32.40 ex-négociant, (21% down on 2016), with a UK RRP of £33.25, 20% down on 2016, and a lower Quality score: 839 (vs 904).

You can download the slide here: Wine Lister Factsheet Malartic-Lagravière Rouge 2017.

Bordeaux 2017 en primeur scores are now out from Julia Harding MW for JancisRobinson.com – our UK partner critic (Jancis Robinson herself was kept in London updating the World Atlas of Wine for its next, eighth edition).

Harding awarded 14 wines a score of 18 or above, with Pomerol the most featured appellation at the top of her scoreboard. Lafleur, Le Pin, Petrus, and Vieux Château Certan all scored 18.5, the highest score given by Harding to any Bordeaux 2017 (while last year Robinson granted seven 2016 Bordeaux 19 points, including four of Harding’s favourites this year).

This Pomerol quartet is joined by another right bank wine, Saint-Emilion Premier Grand Cru Classé B, Figeac, whose tasting note from Harding ends: “Silky, charming, mouth-watering. So succulent, so precise, unforced.”

The only other wine to score 18.5 is the king of Sauternes, Yquem. As we saw in yesterday’s blog summing up Bettane+Desseauve’s top scores, 2017 is successful vintage for sweet whites. Harding’s top wines include La Tour Blanche and Doisy Daëne’s tiny production Barsac – already released at £140 per half bottle – L’Extravagant.

Like our French partner critics, Harding also gives high scores to Ausone, Latour, La Mission Haut-Brion Rouge, and its white sibling – the only dry white in her top table. Mouton Rothschild and Léoville Las Cases also score 18 points.

All these scores are now live on the wine pages of our website for subscribers to view (alongside those of Bettane+Desseauve), with links through to Harding’s tasting notes on JancisRobinson.com. Read Jancis Robinson’s extensive Bordeaux 2017 coverage here.

Neal Martin’s and Antonio Galloni’s scores will be added on Tuesday and Thursday respectively.

“I can’t see it being a big campaign.” That is the view of Serena Sutcliffe, Honorary Chairman of Sotheby’s Wine, echoed by some on the Place de Bordeaux. The usually upbeat Mathieu Chadronnier, Managing Director of négociant CVBG, asserts that 2017 Bordeaux en primeur “will be a weak campaign compared to last year”.

This sentiment is also recognised in the semi-official line, from Emmanuel Cruse, Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes, and Barsac. “We all know that over the weeks to come the distribution of this vintage could be slightly more difficult on the commercial side than previous ones,” he accepted, adding reasonably, “We need to recognise that each vintage has its fair price.”

The general (if not unchallenged) consensus is that prices will come down on 2016. “Of course they will,” said Chadronnier, “but not enough.” “We always wait for decreases and they’re never considered enough,” he continued, then asking, rhetorically, exasperated, “what is enough?”

What is enough indeed? Perhaps more than ever before, there is no one size fits all formula. Just as quality and style vary from château to château in 2017 (see part I of our en primeur round-up), so will pricing. Each property has its own brand trajectory, 2017 vintage quality, volume considerations, and price positioning history. This has been epitomised by the wildly different approaches of the first two major releases of the campaign, Palmer and Haut-Batailley.

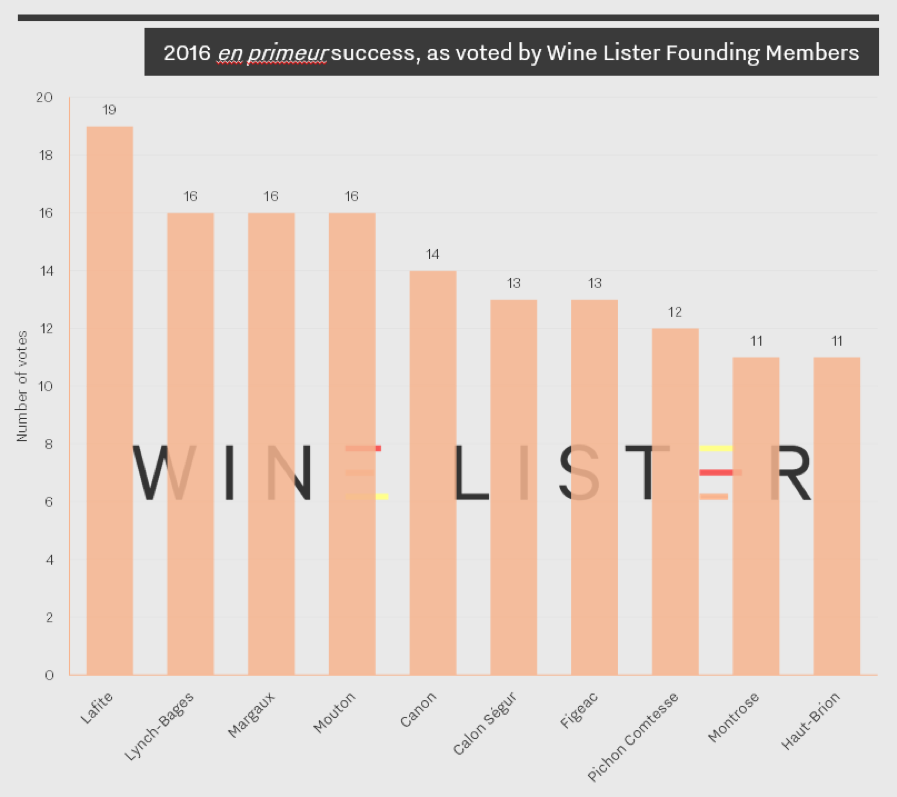

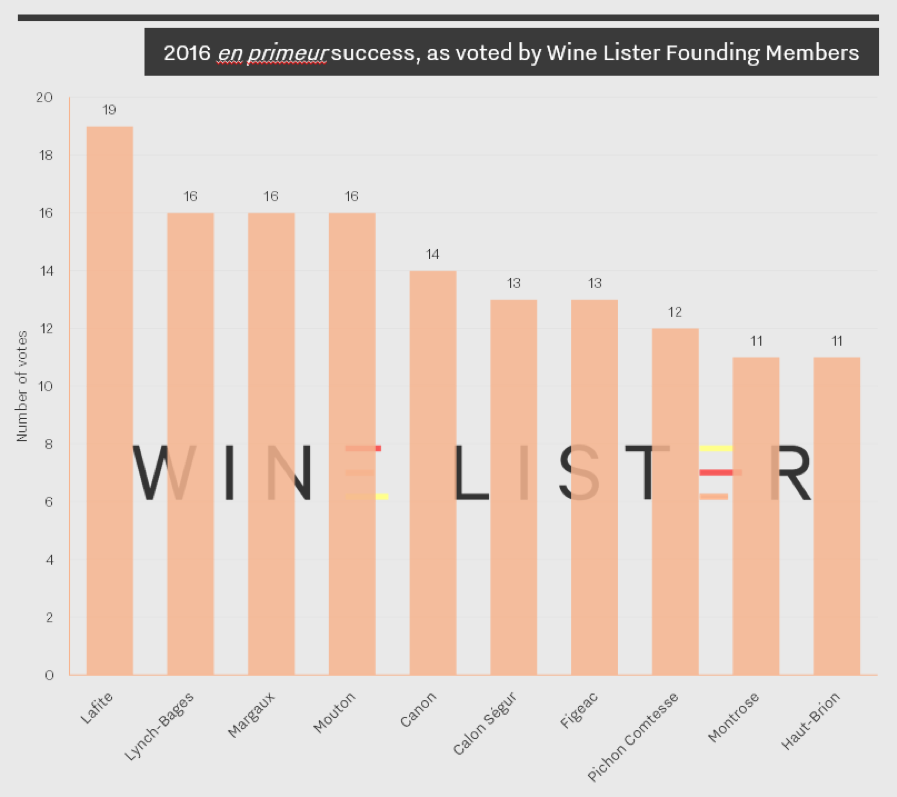

Only a small group of wines can get away with staying around 2015 prices (15-25 according to one Bordeaux courtier). Even fewer, if any, can maintain their 2016 release price. Contenders are arguably the big success stories of the 2016 en primeur campaign. According to Wine Lister’s Founding Members (c.50 key members of the international fine wine trade), first growths aside, these were Châteaux Lynch-Bages, Canon, Calon Ségur, Figeac, Pichon Comtesse, and Montrose.

However, when we put it to some of these producers that they were among a happy few potentially in a position to maintain 2016 prices, most dismissed the idea. “I could even go up and people would buy it,” mused Laurent Dufau, Managing Director of Calon Ségur. “But I won’t”, he concluded, adding “I would rather maintain the trade’s goodwill”. Nicolas Glumineau, Managing Director of Pichon Longueville Comtesse de Lalande, replied firmly, “If the question is will the price be like 2016, the response is evidently not”. He continued, “I’m really very happy with the wine we’ve made, but it’s not the 2016”.

In fact, almost every château we spoke to in Bordeaux said it would reduce the price. “It would not be right to release the 2017 at the same price as the 2016,” said Jean-Valmy Nicolas, Co-Managing Director of Château La Conseillante. “In my opinion our pricing strategy should be based on relative quality, not relative volume,” he said, referring to the impact of the frost on production volumes (down 15% on 2016).

As much as anything else, most Bordelais won’t risk the reputation of the 2016s. For most, following significant price increases for the 2016 vintage, a decrease for 2017 is manageable. This was precisely Edouard Moueix’s point (Managing Director of négociant Jean-Pierre Moueix) when he lamented, “People always compare to the year before, so even if there’s a 10-15% decrease on 2016 it’s still too high.”

For a handful of properties whose 2015s and 2016s were relative bargains, bringing the price down too much in this vintage is going to be a harder pill to swallow. Problematically for them, the market does still think in terms of increase or decrease on the previous vintage, even if this is an overly simplistic approach.

“I don’t believe for a second that prices will go down,” declared Nicolas Audebert, Managing Director of Châteaux Canon and Rauzan-Ségla, two of Bordeaux’s rising stars. Canon was voted the fifth most successful release of last year’s en primeur campaign. This is thanks to the combination of its rising popularity and its reasonable 2016 release price – it sold like hotcakes. Its 2016 price has risen by 23% since release, so arguably it is one of the very few wines that could conceive of not decreasing its price this year.

The only other château to suggest that a price decrease was by no means a given was Cos d’Estournel. Faced with the generalisation of 2017 as below the level of the last two vintages, owner, Michel Reybier, told us that “for us, compared to 2016, the 2017 vintage might even be better.”

Smoke and mirrors: Bordeaux’s Miroir d’eau (water mirror) on the only sunny day of Wine Lister’s en primeur tasting trip. Photo © Ella Lister

Farr Vintners summed up their thoughts on pricing succinctly, saying “if prices are at around the current market for [2014, 2013, 2012 and 2011], 2017 starts to look very interesting,” cautioning, “at close to current 2016 or 2015 prices the wines will not be worth buying.” Will the threat of not selling be enough to moderate producers’ pricing ambitions?

“They couldn’t care less whether they sell,” said the car hire attendant who rented me my car at Bordeaux airport. If the news has spread that far out of the wine industry, maybe it’s true. Certainly, for a gilded group of crus classés the idea of keeping back stock and selling it for more down the line is appealing. And for what they do release, they can be pretty certain their négociants will back them up and carry the stock (and the risk), even if there are few end buyers.

This was confirmed by one large négociant, who told us off the record, “We’ll buy but we won’t sell as much as we want to.” He is “worried about prices,” citing “the usual Bordeaux spiral.” He was referring to the transition period required after a string of good vintages, during which prices are not recalibrated sufficiently. “Châteaux sold the wine last year, everyone’s happy, so they won’t come down enough,” he concluded.

As for timing, we’ve already seen important releases this week, earlier than expected, with Palmer coming out a day earlier than Cos d’Estournel’s surprise release last year, in spite of the tastings taking place a week later. Nonetheless, a long campaign is expected, in part due to an inordinate number of bank holidays in May (in France and the UK). Philippe Dhalluin, Managing Director at Mouton Rothschild, seemed to predict this when he told us “it is not a speculative campaign so it should start off quite quickly.” He added, “We’d like to have an early campaign but May is complicated,” specifying, “I’d like to release before Vinexpo – it’s possible.” Anything is possible in love and en primeur.

Follow us on Twitter and on the blog for real-time coverage of the Bordeaux 2017 en primeur campaign. Check www.wine-lister.com next week for a new dedicated en primeur page where you can find out everything you need to know during the campaign.

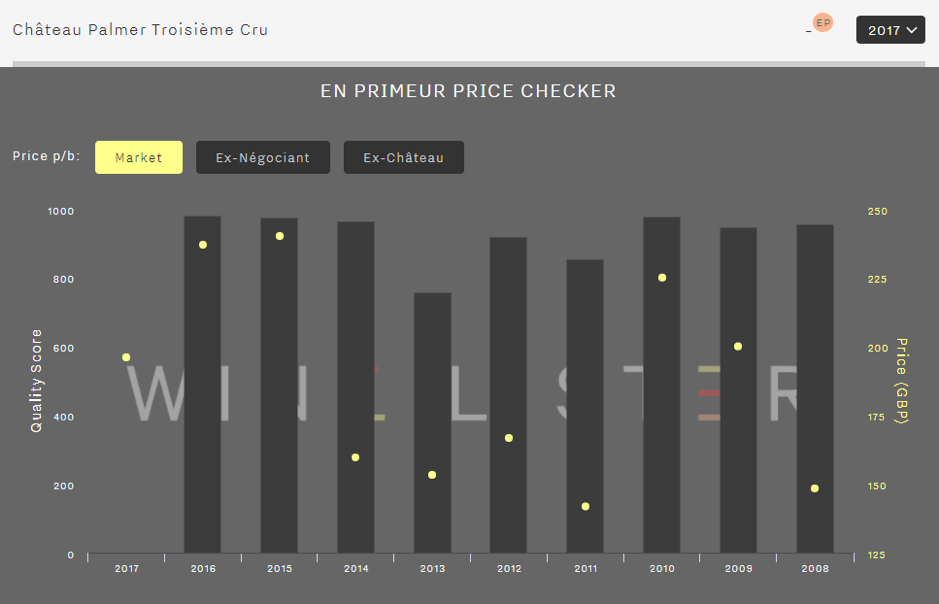

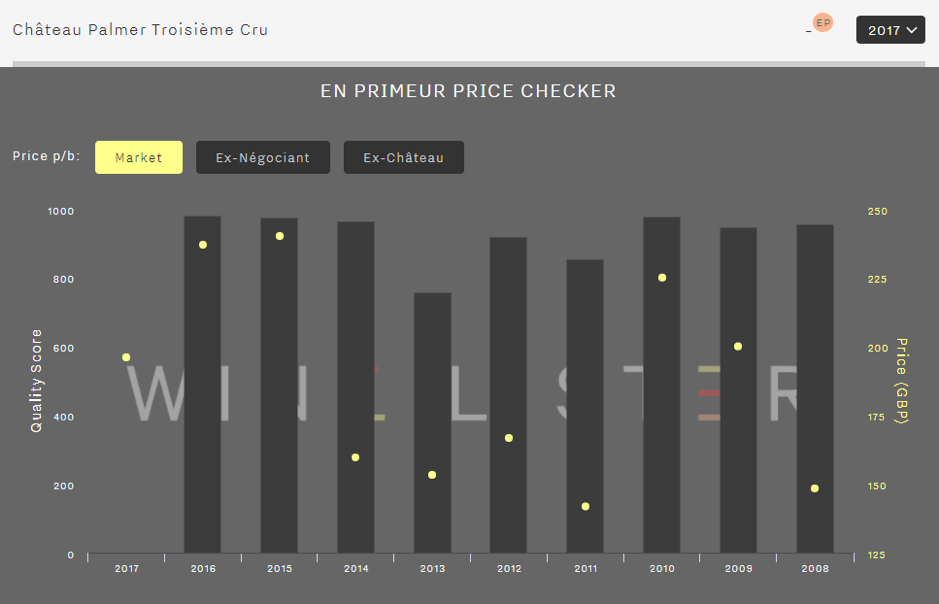

Margaux’s Château Palmer made a surprise move on Monday morning, releasing its 2017 vintage en primeur before anybody expected. At €192 ex-négociant, its price decrease of 20% on the 2016 (€240) is symbolically significant.

For several years the château has only released 50% of its Grand Vin en primeur each year, which has allowed it to develop an aggressive pricing policy, positioning itself well above other third growths and even second growths. The wine’s price had risen 14% for the 2016 vintage, giving it some margin to come down again this year. This neatly places the 2017 between the 2014 and 2015, both in terms of original release prices and current market prices:

This was a smart and strategic move by Managing Director, Thomas Duroux. When we tasted at the château in the second week of April, he shared his thoughts on the campaign, and it was clear he had considered the dynamics of 2017 Bordeaux en primeur very carefully.

Duroux was cautious about the campaign, saying “It’s going to be complicated as there are lots of discouraging factors.” He believes it’s difficult to achieve three good campaigns in a row, and that there is not a huge amount of demand from consumers. He spoke of a confusion around price and volumes, explaining that “just because there’s less wine doesn’t mean consumers are ready to pay more – they don’t care.” As it happens, the Grand Vin was spared frost damage in April 2017, while 15ha of the second wine was hit. Alter Ego was released at just a 2% discount on the 2016.

“We risk having a campaign where prices go down but not enough to be judged attractive by the consumer,” warned Duroux. It remains to be seen whether Palmer 2017’s 20% decrease is enough. With the trade unprepared, and scores not out yet for many important wine critics (including Wine Lister’s partner critics), it is now a waiting game. Négociants have bought their allocations, and for now they are holding a fair amount of stock of Palmer 2017 in Bordeaux.

Sales by UK merchants are modest for the time being. Depending on scores that will be released over the coming 10 days, Palmer might start to seem like a good deal, particularly when (not if) the discounts start to shrink over the course of the campaign. Or indeed when the discounts become premiums, as we saw this morning with the release of Haut-Batailley 2017 – read the blog post here).

If you hadn’t already heard about the frost in 2017, you soon will. It was the word on everyone’s lips during last week’s en primeur tastings in Bordeaux. Production volumes were down 40% across the wine region as a whole, with some properties losing their entire crop. Meanwhile others escaped entirely, making Bordeaux 2017 a vintage where both quantity and quality vary greatly from château to château.

The April frost was a “snob”, according to Will Hargrove, Head of Fine Wine at Corney & Barrow, because the very top vineyards were often spared (Petrus and Ausone for example). However, illustrious châteaux such as Cheval Blanc and Figeac might beg to differ. Nonetheless, such less lucky châteaux expended considerable resources to manage frost damage.

Véronique Sanders, Managing Director of Château Haut-Bailly, called it “the vintage of ice and fire”, referring to the dry summer months that followed. Indeed, the weather conditions resulted in many very good wines in 2017, especially suiting Cabernet Sauvignon, which as a result features in greater proportions than usual at many châteaux.

“I will not try to tell you that 2017 is at the level of ’15 or ’16, but if they are great vintages then ’17 is very good.” Those were the words of Olivier Bernard, owner of Domaine de Chevalier and President of the Union des Grands Crus de Bordeaux. “It will be a lovely wine to drink, I promise you,” he continued. The Wine Lister team is in full agreement.

Throughout our six days of tasting, in the Médoc, the Graves, and on the right bank, we were pleasantly surprised over and over again by the quality of the wines, and positively stunned by some, inter alia Les Carmes Haut-Brion, Cos d’Estournel, Figeac, La Fleur-Pétrus, Petrus, Pichon Comtesse de Lalande, Vieux Château Certan. (We can’t wait to find out what our partner critics think, and will add their scores to the website as soon as they’re released).

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

While it is not an easy vintage to generalise about, the Bordeaux 2017s tend to boast vibrancy and freshness. This allows the unique character of each wine to shine through. “I think people understand that Bordeaux is not one style,” reflects Edouard Moueix, Managing Director of négociant Jean-Pierre Moueix, declaring that 2017 is “the archetype of the expression of that diversity,” with “each terroir overexpressed almost”.

The wines have less density and concentration than the 2015s and 2016s, but nonetheless possess the structure to carry them well into the future (while in most cases also being approachable quite early). Finding a comparable vintage is tricky. Analytically speaking, both the excellent 2005 and the difficult 2013 were cited by winemakers, but upon drinking the wines they resemble neither.

At Mouton-Rothschild, Philippe Dhalluin says the wines are somewhere between 2014 (“for the energy”) and 2015 “for the softness”. On the right bank, Moueix describes the 2017 as “like a 2006 with more controlled tannins, while Hubert de Boüard, co-owner of Angélus and consultant oenologist to dozens of other properties, is reminded of 2001 and has named the vintage “l’éclatant” (radiant, or sparkling).

“It’s certainly the best vintage ending in 7 since the famous 1947,” declared Emmanuel Cruse, co-owner of Issan and Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes, and Barsac. To a hall full of Bordeaux château owners and trade at the annual Ban du Millésime dinner, Cruse confirmed that the general feeling about the 2017 vintage was “What a great surprise”. But will it be enough to catalyse a successful en primeur campaign?

Part II of this en primeur round-up will look at the upcoming campaign, considering likely timing, pricing, and volumes, and including views from Bordeaux and the international wine trade. Watch this space.

Our annual Bordeaux study will be released to subscribers in early May. Follow us on Twitter, Facebook, LinkedIn, and the Wine Lister blog for real-time analysis of the 2017 Bordeaux en primeur releases.

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited