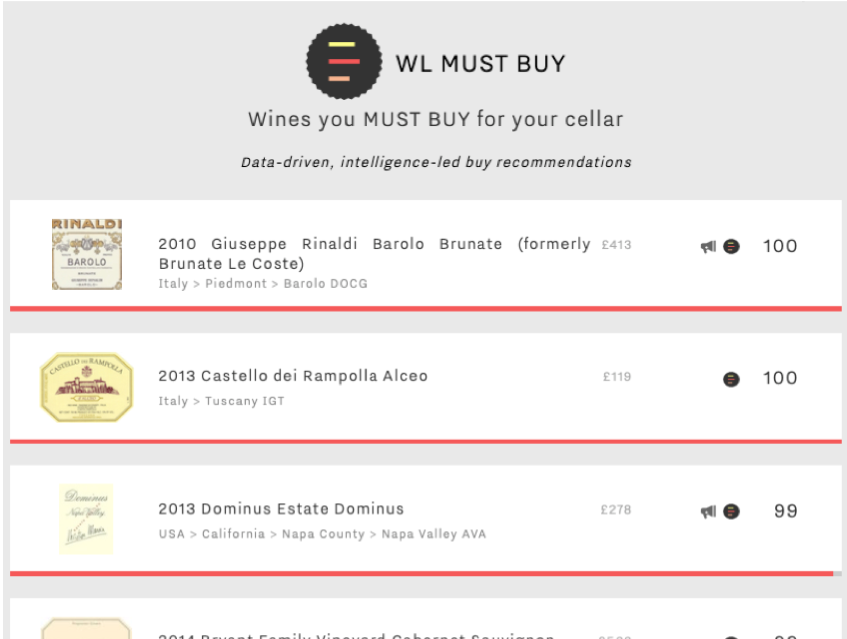

Last week we introduced Wine Lister’s new toy, a dynamic guide to the ultimate wines any fine wine lover should consider for their cellar – WL MUST BUY. While the full list is approximately 1,800 recommendations strong, Wine Lister provides some useful segments to help cut into all that data, aside from the usual criteria that can be found in our advanced search function (region, price, colour, score etc).

Wine Lister Indicators are designed to provide suggestions for your specific buying purpose, whether it be to discover something new (Hidden Gems), impress at a dinner party (Buzz Brands), drink well without breaking the bank (Value Picks), or add to your investment portfolio (Investment Staples).

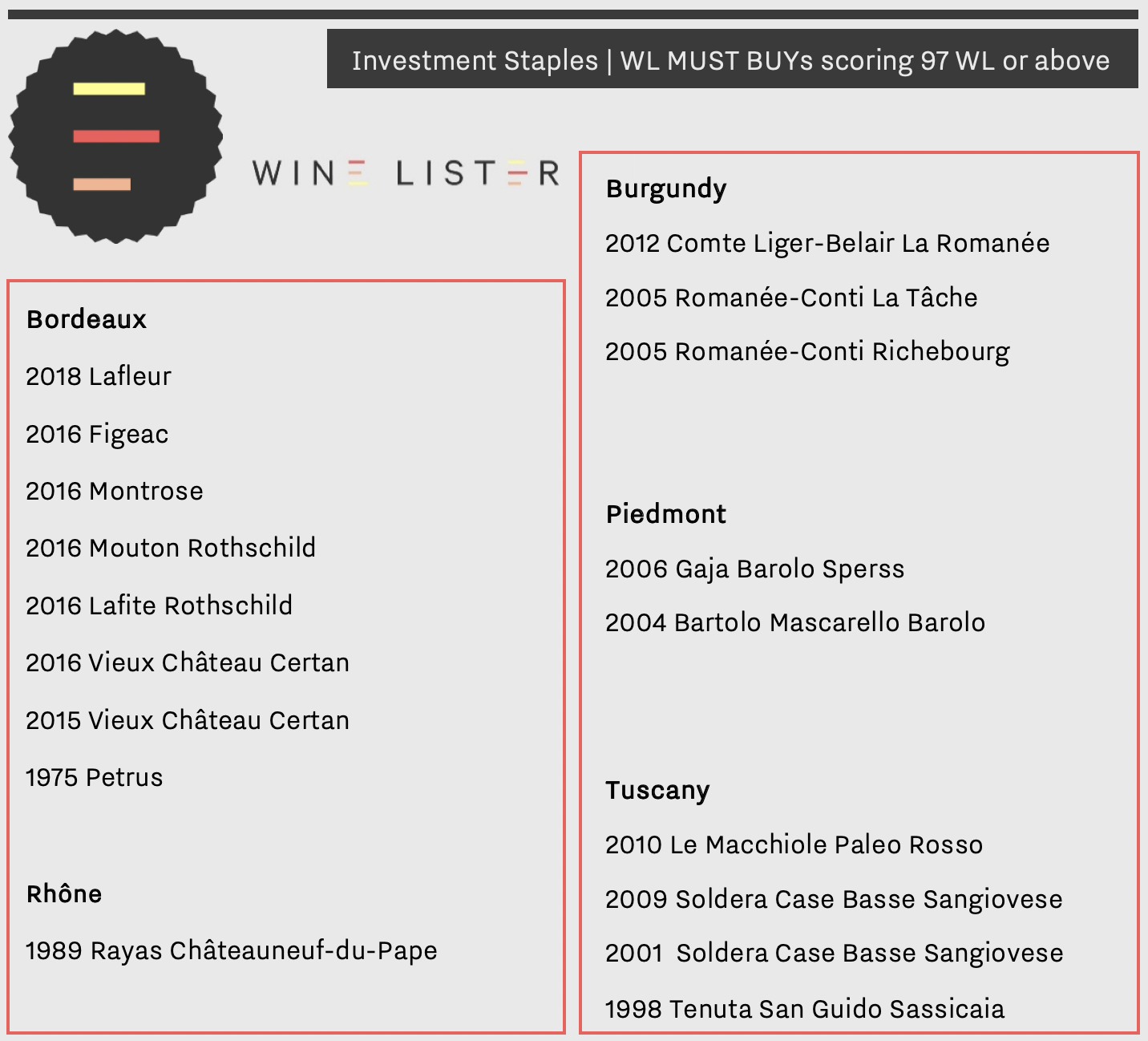

MUST BUYs and Indicators together provide a ready-made source list of the best wines to meet your needs. Below we look at the combination of our MUST BUY algorithm with Investment Staples.

Investment Staples are wines above a certain price, that are long-lived (but not too old), have proven wine price performance or represent good value compared to their peers, and are relatively stable and liquid, with recognition from our network of global fine wine trade members.

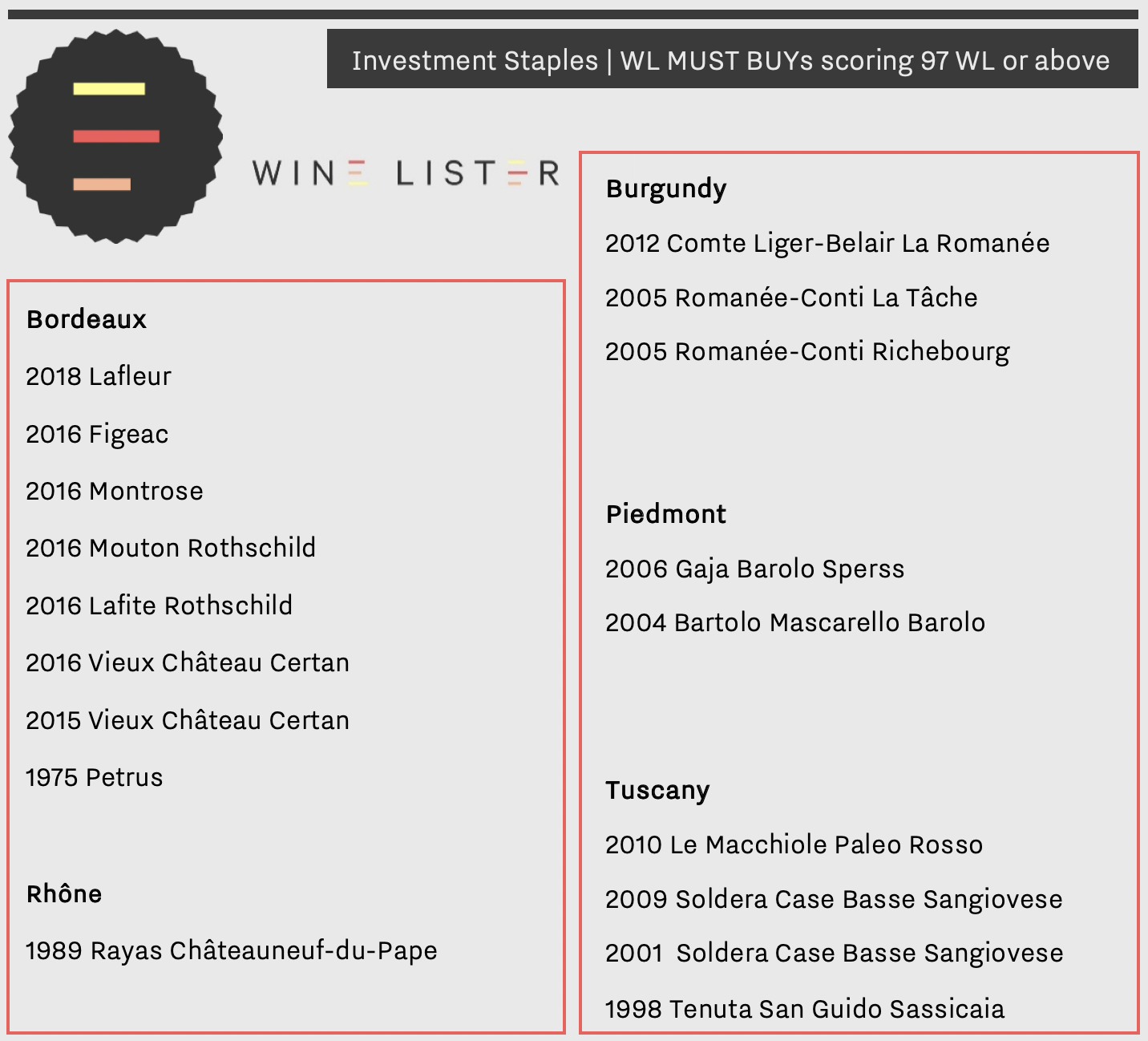

There are 18 MUST BUY Investment Staples that score 97 WL points or above. Perhaps unsurprisingly, Bordeaux represents almost half of these, with eight MUST BUYs, including two first growths (2016 Mouton, and 2016 Lafite), and 1975 Petrus.

These eight Bordeaux have an average price of £511 per bottle, or just under an eighth of the average price of the three Burgundies to qualify as MUST BUY Investment Staples. However, as investments, some of them may require patience – the prices of those from 2016 have yet to increase any significant amount. By contrast, DRC’s La Tâche 2005, Richebourg 2005, and Comte Liger-Belair La Romanée 2012 are testament to Burgundy’s impressive upward price trajectory, having already achieved three-year CAGR (compound annual growth rates) of 21.8%, 23.4%, and 33.1% respectively.

Outside of Bordeaux and Burgundy, Italy holds court with MUST BUY Investment staples from Bartolo Mascarello, and the indomitable Soldera among others.

You can see the full list of MUST BUY Investment Staples here, or check out some other MUST BUY lists, such as MUST BUY Hidden Gems, or MUST BUY Value Picks.

Don’t forget that the MUST BUY list changes weekly. Revisit MUST BUY Investment Staples again next week to see new entries.

Wine Lister has a new toy.

From our user research over the three years since Wine Lister’s inception, it is clear that, even in the purchase of ultra high-end wines, wine buyers enjoy getting “maximum value”. Whether a bottle of wine costs £50, or £5,000, there is satisfaction in knowing that you have purchased “a good buy” – that the quality of your bottle relative to where (or when) it is from, and how much it costs, is worth every penny you spent.

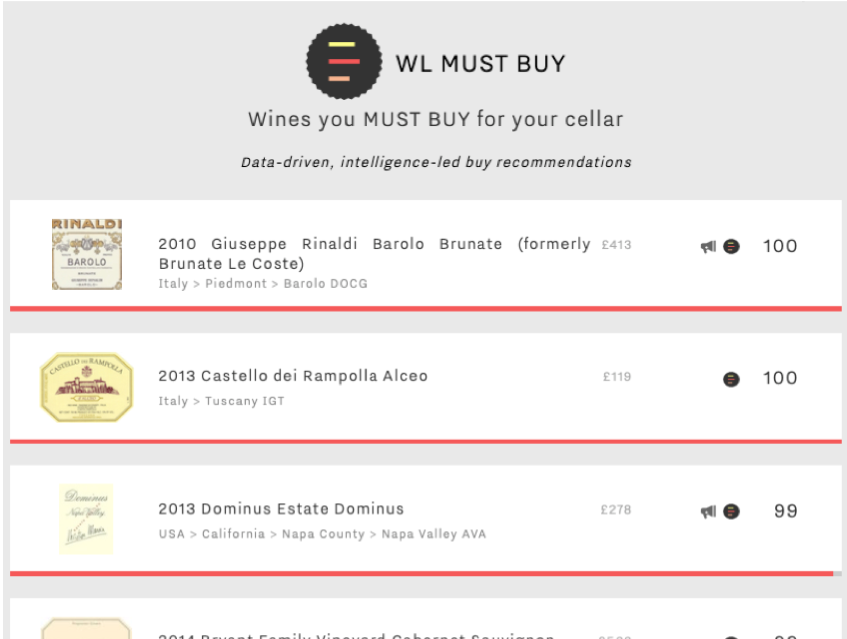

Enter WL MUST BUY, Wine Lister’s new buy recommendation tool – a data-driven algorithm overlaid with human intelligence, and the answer(s) to this very question.

Wine Lister’s proprietary MUST BUY algorithm picks out wines of a predefined, minimum quality level presenting value within their respective vintages and appellations, and overlays the latest industry intelligence from key players in the global fine wine trade. The Wine Lister team then scours the results to identify must-buy wines based on our own tasting experience and market knowledge. This final list is dynamic, constantly changing as new data comes in and when the team reports back from our frequent travels and tastings.

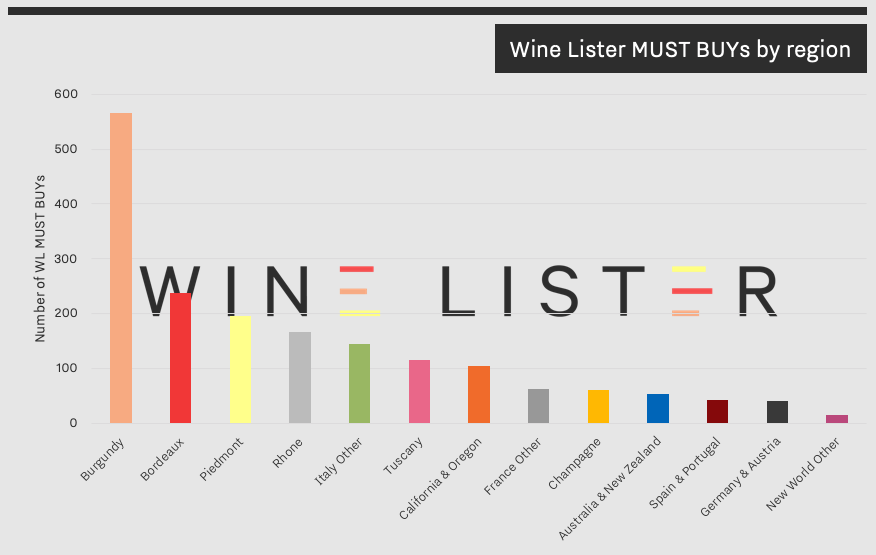

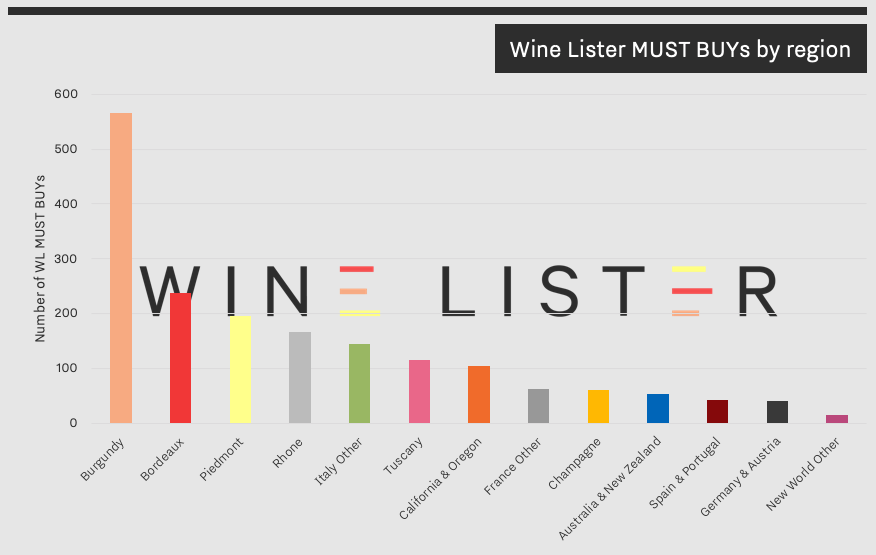

There are currently just over 1,800 MUST BUYs out of the 30,000 + wine-vintages on Wine Lister. See the chart below for a breakdown of MUST BUYs by region.

Perhaps unsurprisingly, Burgundy dominates the MUST BUY list, with more than double the number of MUST BUYs of any other region, taking up 31% of the complete list. Burgundian MUST BUYs range from the well-known, such as Comte Liger-Belair’s La Romanée (2007, 2012, 2013, 2014), or Marquis d’Angerville’s Clos des Ducs (2012, 2015, 2016), through to Hidden Gems such as Stéphane Magnien’s Clos Saint-Denis (2010, 2016), or David Duband’s Clos de la Roche (2013, 2014).

Bordeaux follows, encompassing a wide range from five vintages of Petrus down to two vintages of Château Marsau.

Piedmont, the Rhône and other Italian wines (from the likes of Campania, or Veneto for example) come closely behind in third, fourth, and fifth places. New world MUST BUYs are led by the USA, with 99 wines from California, and six from Oregon, while sparkling wines are represented exclusively by the 60 Champagnes to make the cut.

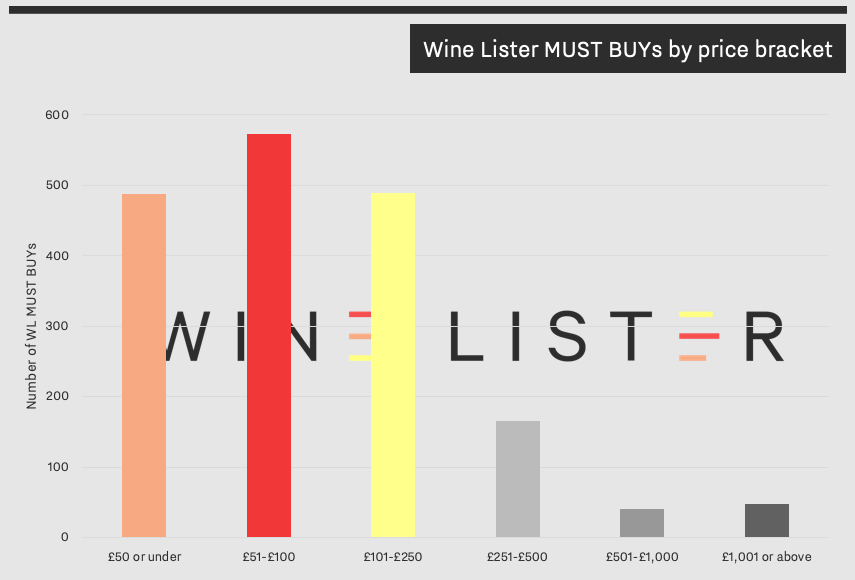

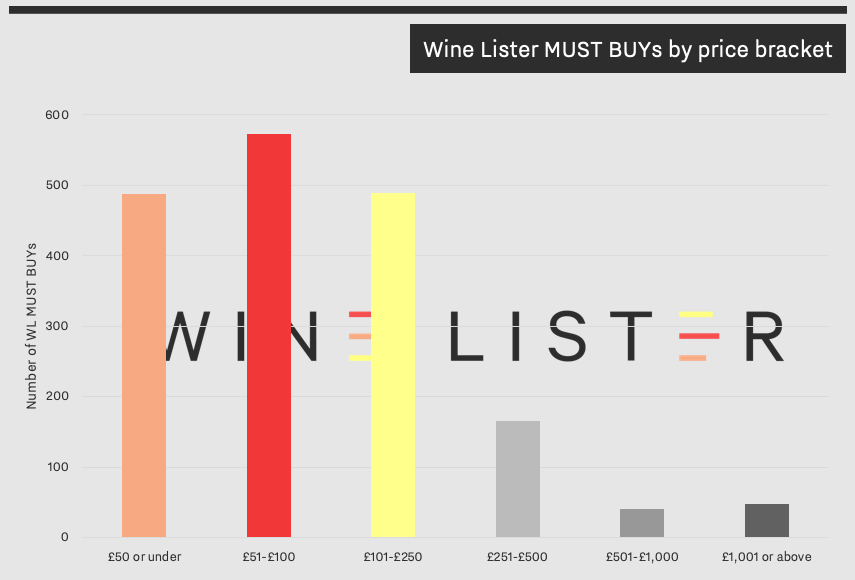

As well as a wide variety of regions covered, the MUST BUY list spans a huge range of prices – see MUST BUYs by price bracket in the chart below.

Though pricing is taken into account within the algorithm, the element of relativity means that high-priced wines are not necessarily disqualified. The most expensive MUST BUY wine is 2006 Romanée Conti, from the wine’s namesake Domaine, at £14,853 per bottle in-bond. The least expensive, is 2011 Condado de Haza, at £9 per bottle in-bond.

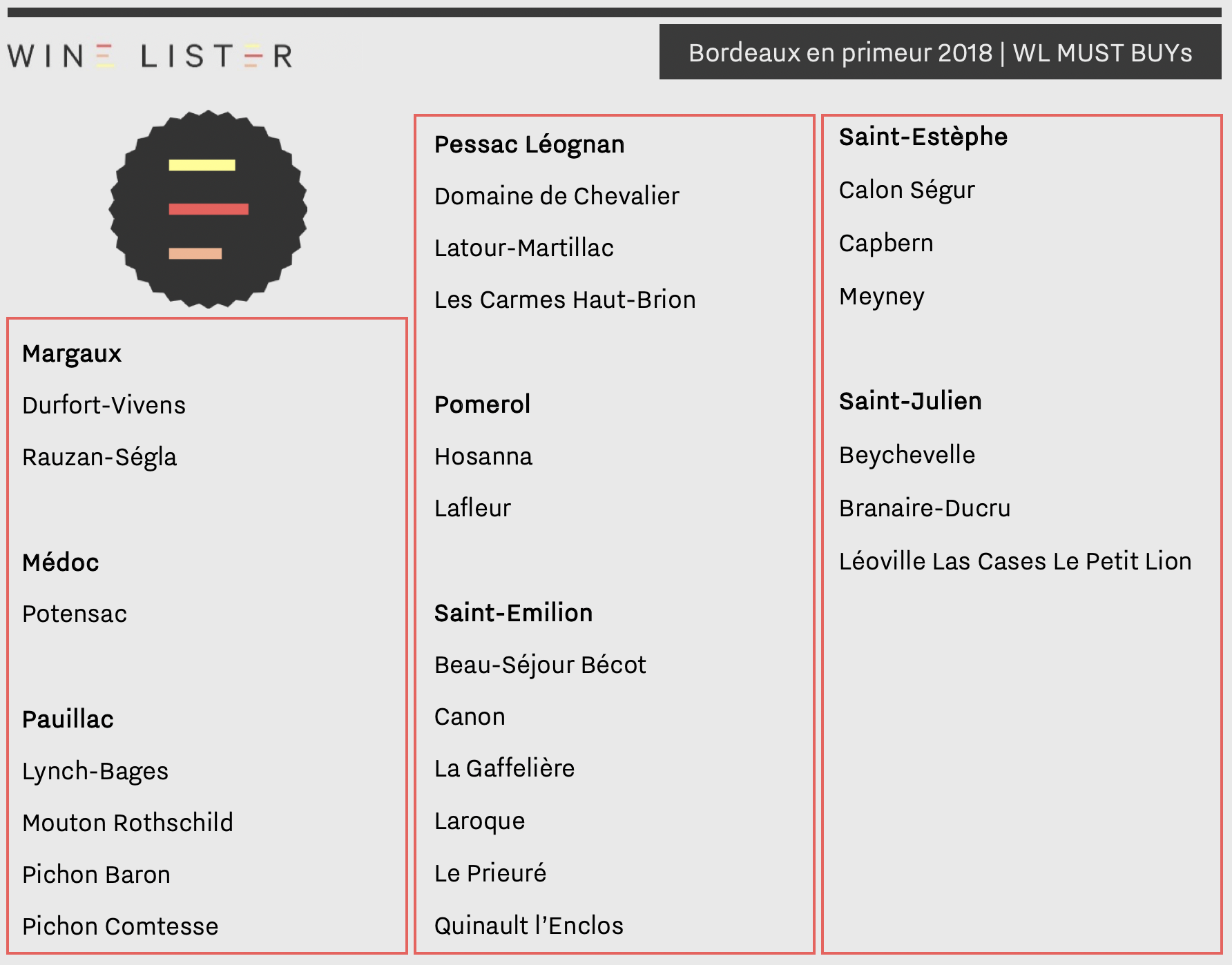

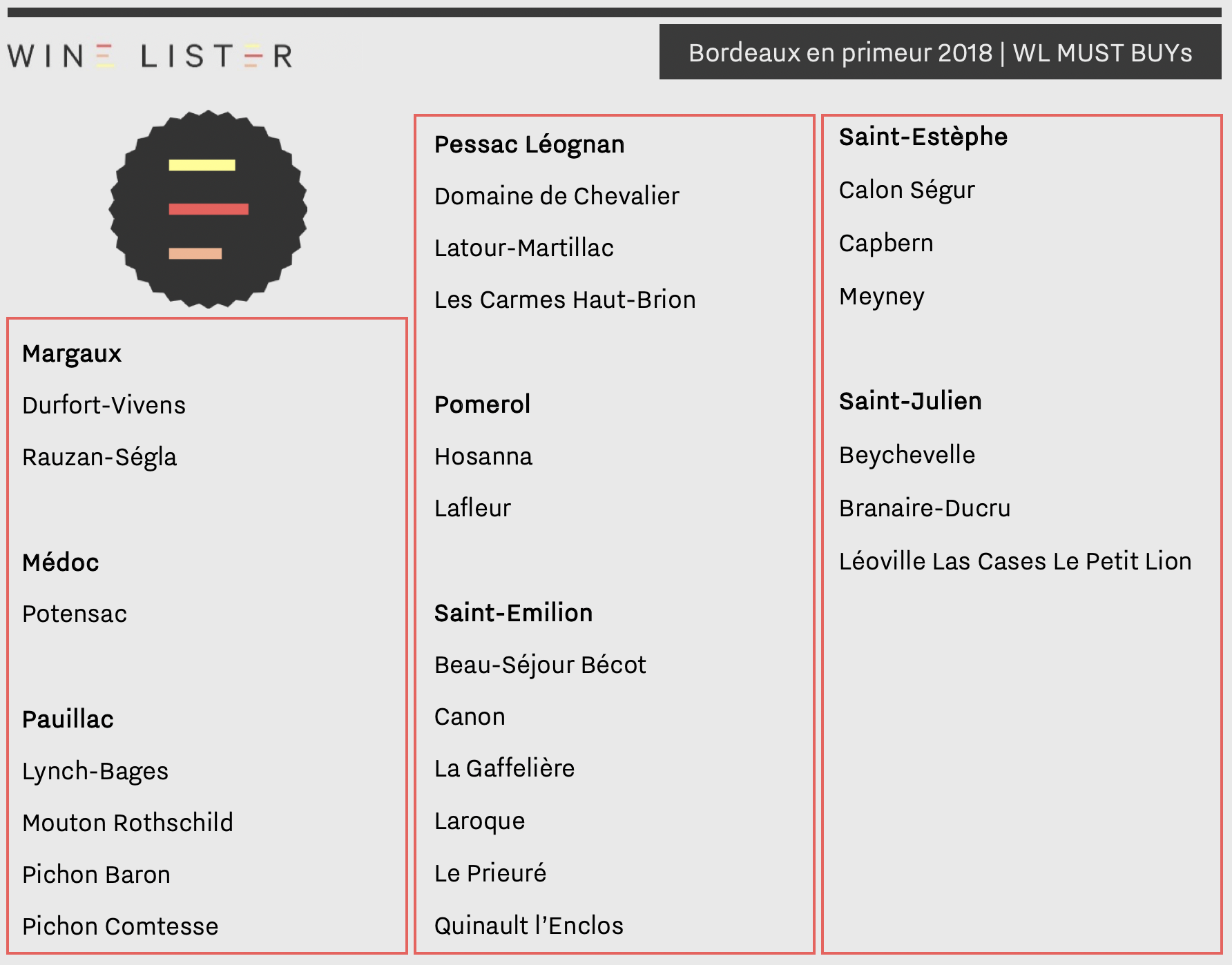

At the end of this year’s Bordeaux en primeur campaign we released our 24 Bordeaux 2018 MUST BUYs – revisit the blog on these here.

Over the coming weeks we will be releasing commentary on top MUST BUYs by segment (region, appellation, colour, price). In the meantime the full list is available for exploration and discovery here. Play to your heart’s content (MUST BUYs are accessible to all on Wine Lister’s new, free site).

Chloe Ashton

September 17, 2019

Wine Lister is excited to announce the arrival of its new consumer site, aimed at supporting fine wine lovers as they navigate the fine wine seas. All users now have unlimited, free access to the world’s most comprehensive fine wine data hub. Start learning how to buy wine like a pro now, or read on to find out more.

WL MUST BUYs

Wine Lister has created its own buy recommendation tool, which combines Wine Lister data with human intelligence (such as the opinion of key members of the global fine wine trade, plus insight from the Wine Lister team’s trips and tastings), to provide a dynamic list of wines any fine wine buyer should consider for their cellar. All MUST BUYs represent high quality, and value within their respective appellations and vintages.

Browse the full MUST BUY list here.

Browse the full MUST BUY list here.

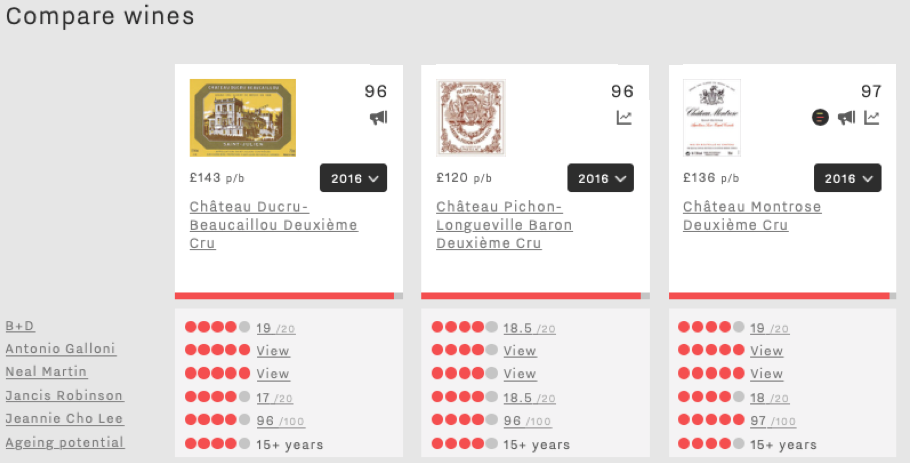

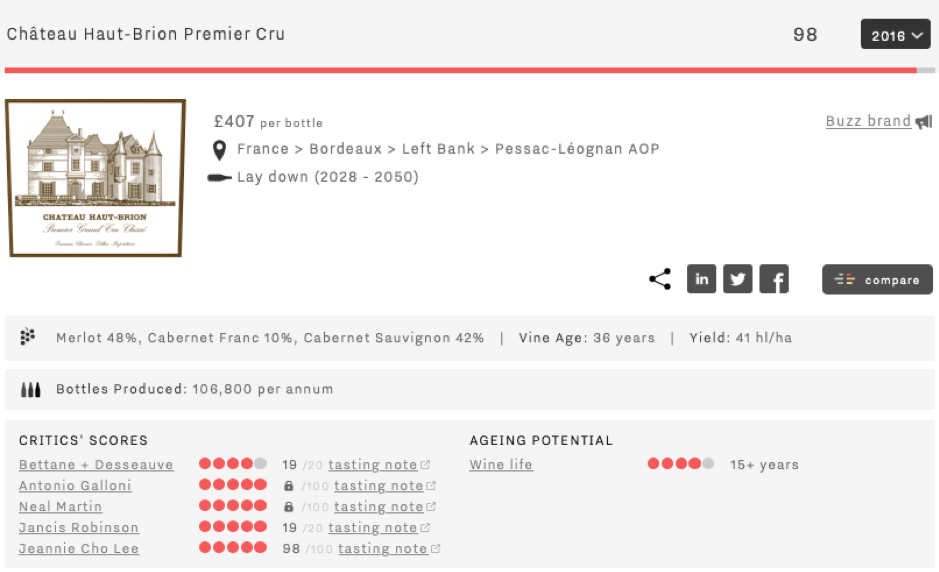

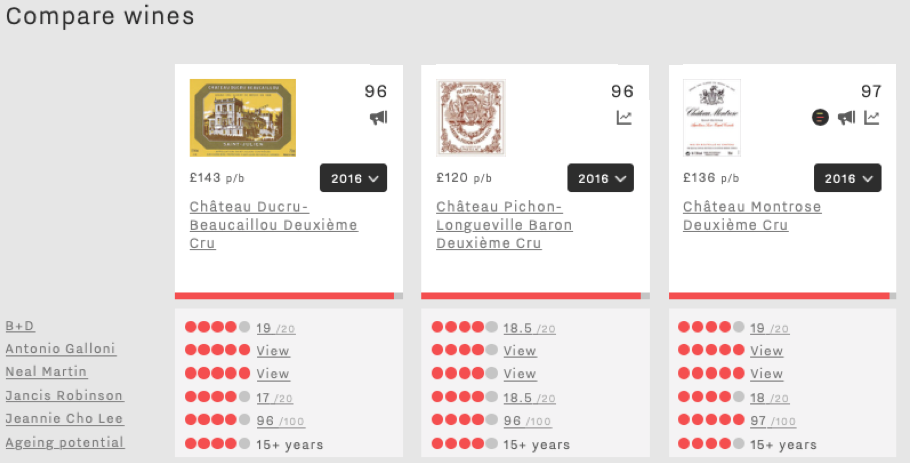

Aggregated, 100-point score

With a focus on quality, the new 100-point Wine Lister Score combines the ratings of five of the world’s most respected wine critics – Jancis Robinson, Antonio Galloni and Neal Martin (Vinous), Bettane+Desseauve, and Jeannie Cho Lee, together with a smaller weighting for the wine’s ageing potential. The score is as objective an indication of wine quality as possible, allowing users to make site-wide comparisons across the 30,000+ wine-vintages on Wine Lister.

See this comparison, or create your own here.

Further analysis tools

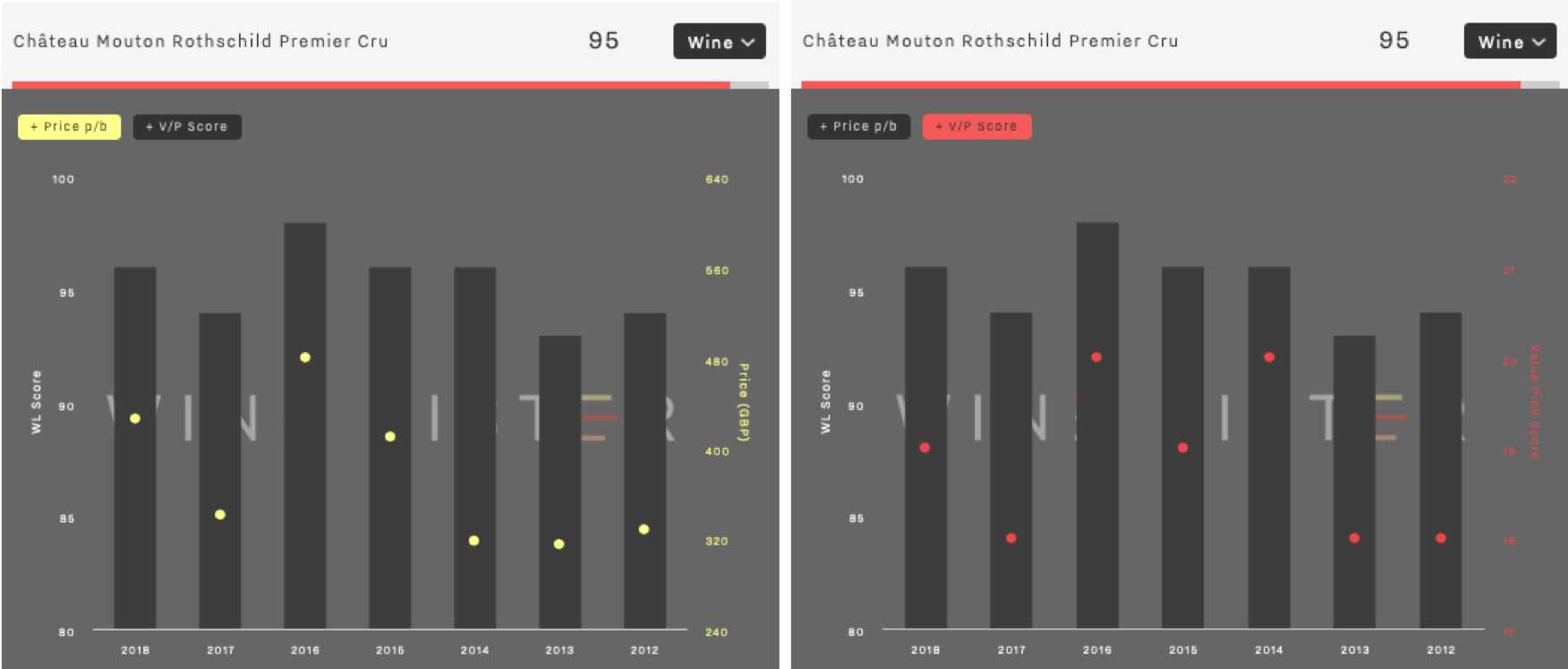

Dynamic charts give users the chance to explore wines they might consider buying or selling in more detail.

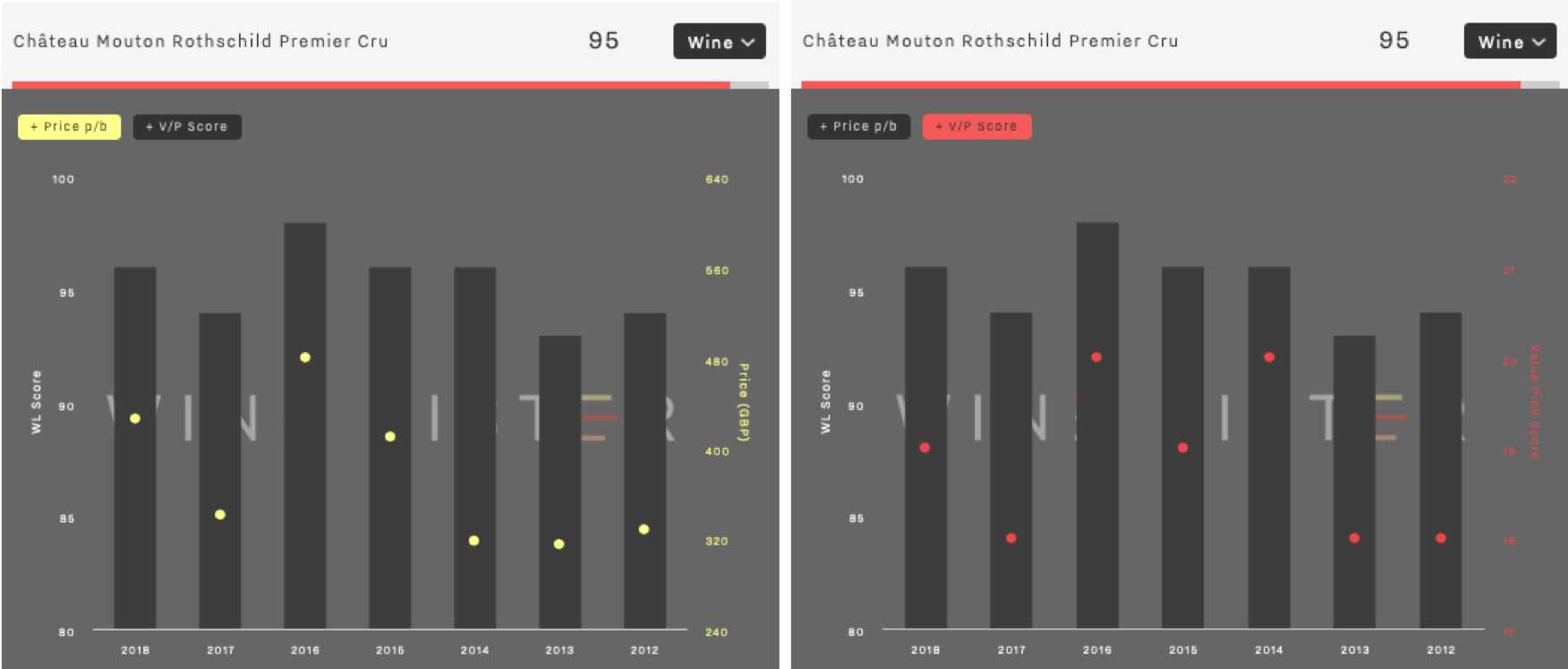

The Vintage Value Identifier gives users a clear visual of price to quality ratios across vintages of a given wine, applying a score to this measure of relative value. See the example below for Mouton Rothschild: while the 2016 vintage is higher quality than 2014, its accompanying high price means that both the 2016 and 2014 vintages present the same level of value (the joint-highest of all recent back vintages shown)

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

See the chart for Mouton Rothschild, or search for another wine here.

The Price History chart tracks a wine’s price performance over time, relative to its peer group. This can be done at vintage level, helping collectors to see performance history of a specific wine they might own. See below the example of Domaine Hubert Lignier’s Clos de La Roche 2016, whose price growth over the last year is one of the most impressive of all wines on Wine Lister (57.8%).

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

The same dynamic chart can be used at wine level (an average across vintages, with a stronger weighting for more recent vintages), to give a general indication of a wine’s price trajectory, and therefore whether or not the wine in question could be an investment buy. See below an example for Armand Rousseau’s Chambertin, which on average sees steady price growth, and a CAGR (compound annual growth rate) of 31.8% (though the price has flattened out this year).

Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years

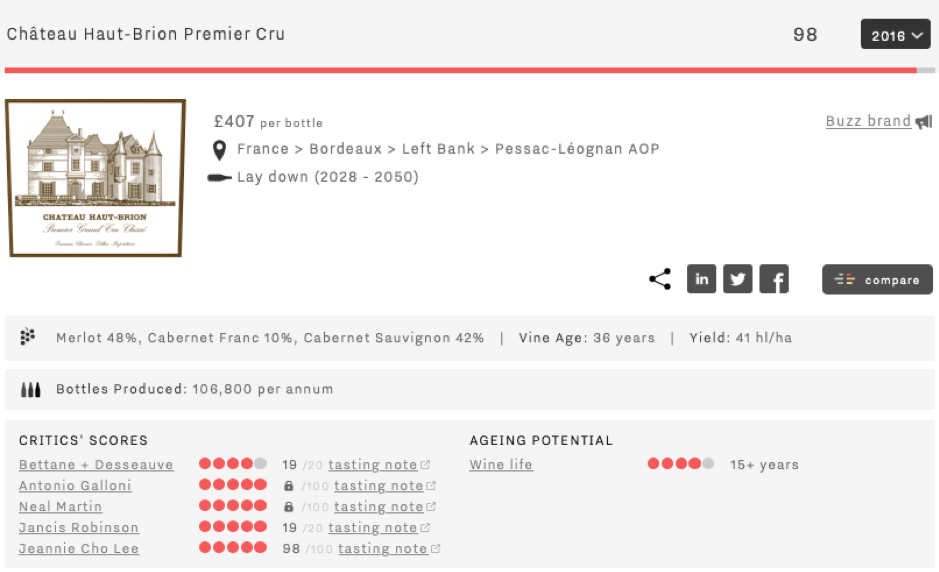

On top of these tools, each wine page gives users further information about the wine in question, including whether the wine qualifies for one of Wine Lister’s four Indicators. Haut Brion, as shown in the example below, is a Buzz Brand. See more information on other segments – Hidden Gems, Value Picks, and Investment Staples, or start browsing here.

We hope that you find the new site informative and useful for developing your fine wine collection. Feedback from our users is always welcome – please don’t hesitate to contact us with any questions or comments here.

Wine Lister spent a week in Bordeaux tasting the 2018 vintage in April, and has dedicated the last two months to covering en primeur releases for its Pro Subscribers. After what has been an unpredictable and puzzling Bordeaux en primeur campaign, we have conducted more than 20 interviews with our Pro Subscribers and Founding Members to find out how it went for them.

Below you will find our conclusions on the Bordeaux 2018 en primeur campaign, which combine our own intimate knowledge of the campaign and its peculiarities with invaluable insights from the trade.

Timing

The campaign lasted 62 days compared to 59 last year (from the date of the first major release to the last standard-channel releases). One clear improvement, thanks to a concerted effort by courtiers, was the spacing out of releases more evenly over the period. However, this did not address the more acute concern around the overall length of the campaign, with the wine trade expected to concentrate on the new Bordeaux vintage for two whole months of the year.

Pricing

A more major frustration was pricing. Over 80% of Wine Lister Pro Subscribers / Founding Members surveyed said prices were too high. On average, prices were up 13% on 2017 and 2% on 2016 release prices. This only made sense where 2016s had gone up in the market since release – not often enough the case. As a result, 2018s came onto the market on average 1% above the current market price of 2016, despite the latter – one of the vintages of the century – being physically available.

Needless to say, many wines stalled upon release due to over-ambitious pricing. When we asked the trade which wines sold the worst, more than once the reply was, “too many to mention”.

Desire

However, one of the more unfathomable motifs of the campaign was that in several instances, this highly ambitious pricing was accepted by the market, and the wines sold through. These were wines with good momentum behind them and a particularly loyal following, but most of all they were wines with a specific story that superseded any thought of value relative to prior vintages.

Examples of this phenomenon are Domaine de Chevalier and Palmer. Both were released into the market above every recent back vintage, and yet both met with demand thanks to the stories behind each wine. Domaine de Chevalier’s owner, Olivier Bernard, started sowing the seed several months before the campaign saying his 2018 was the best wine he’d ever made, a statement reiterated by the rest of his family and gradually absorbed through the fine wine chain. Unable to use conventional sprays, Palmer lost two-thirds of its crop to mildew, and made a striking, unusual wine that Managing Director Thomas Duroux said would “go down in history”.

“The market is very smart and only follows brands that it’s imperative to buy en primeur,” states Laurent Bonnet, Export Director of négociant L.D. Vins.

It was a campaign that favoured top names, not value wines. Wines below €50 were largely unsuccessful (with a few exceptions such as Laroque, Capbern, and Potensac – the three most affordable Bordeaux 2018 Wine Lister MUST BUYs).

David Suire, Managing Director of Château Laroque – a Bordeaux 2018 WL MUST BUY

Volume

After pricing, the most cited frustration was reduced volumes. On average, leading properties released around 20% less wine than last year. “The number one cause of reduced volumes is lower production in 2018 compared to previous years,” said Mathieu Chadronnier, Managing Director of négociant CVBG, who, like other participants in the campaign would have liked to have more volume to sell of certain wines. “It is a frustration, but there’s nothing we can do about it,” he concluded.

Certainly several properties produced less wine due to mildew and a very dry summer. Others made a commercial decision to keep back more wine – a continuation of the gradual trend for Bordeaux châteaux to release less wine en primeur, whether to create an impression of rarity, and / or to partake in the future upside by selling the bottled wine later once it has – they hope – increased in value.

Bonnet underlines the irony of having less and less stock of the wines that sell well, and too much of those that don’t: “The ‘not enough of in-demand wines / too many wines to hold as stock’ equation is difficult for négociants to resolve,” says Bonnet, cautioning that, “the financial stakes are high.”

Good news stories

While Asian buyers were reported to be less present than in previous years, other geographies remained strong – the US, continental Europe, and especially the UK.

The 10 greatest success stories of the campaign included six Wine Lister MUST BUYs: Calon Ségur, Canon, Carmes Haut-Brion, Rauzan-Ségla, Léoville Las Cases, Mouton Rothschild, and Lynch-Bages.

Revenues were up on 2017 across the board, in many cases very significantly. The majority of respondents reported en primeur revenues the same as or above 2015 levels, with only a couple of exceptions. However, very few managed to equal 2016 revenues.

Future(s)

On the one hand, it seems obvious that the 2018 Bordeaux en primeur campaign could have been more of a roaring success with more astute pricing and in some cases a bit more volume to go around. On the other, many of our Pro Subscribers and Founding Members have been pleasantly surprised by the outcome, and will conclude their campaigns with better revenues than they expected.

This leaves many convinced of the merits of en primeur, if frustrated that it’s not reaching its full potential. “We could have done £35m,” said Max Lalondrelle, Fine Wine Buying Director of UK merchant Berry Bros. & Rudd, which in fact made c.£22m in revenues on the 2018 Bordeaux en primeur campaign.

Meanwhile other members of the trade have ceased their Bordeaux en primeur activity altogether over recent years, and some are questioning its future viability. For the time being, the sun has set on this year’s campaign, but it will rise again next year on the utterly unique global marketing and distribution tool that is en primeur.

Read more about our new MUST BUY tool in our recent blog here.

The Bordeaux 2018 en primeur campaign is over. While the quality of wines available is, for the most part, unquestionably good, release prices have been on the high side to say the least, making the benefit of buying en primeur less obvious than in previous years.

Wine Lister’s brand-new website feature, WL MUST BUY, was launched this week*, especially for Bordeaux 2018 wines, to give valuable guidance as to which wines really are worth snapping up now.

Our ground-breaking MUST BUY recommendations are data-driven, with an intelligence-based, human overlay. The algorithm takes into account a wine’s quality and value within its vintage and appellation, as well as the latest industry intelligence from key players in the global fine wine trade. The Wine Lister team have scoured these results to identify must-buy wines based on our own tastings of Bordeaux 2018s, and insider market knowledge.

Given the dominance of reds in the top Bordeaux 2018 Quality scores, it is no surprise that all of these WL MUST BUYs are red.

Saint-Emilion ranks as our most recommended appellation, with six WL MUST BUYs, including the indomitable Canon, and value successes Le Prieuré, Quinault l’Enclos, and Laroque. These three achieve WL MUST BUY status by first passing the quality filter of Wine Lister’s MUST BUY algorithm (they exceed their collective Quality score average by 192 points in 2018). Their respective prices relative to similar quality 2018s from Saint-Emilion push them through the algorithm’s second step – the value filter. Finally, they have been identified by the fine wine trade and/or the Wine Lister team as wines to watch: Quinault l’Enclos is made by the elite winemaking team of Cheval Blanc, and their best yet, while Laroque has been taken to new heights by winemaker David Suire (who cut his teeth at Larcis-Ducasse).

Pauillac houses four of the “top end” Bordeaux 2018 MUST BUYs – Mouton (released at £426 per bottle in bond), both powerhouse super-seconds, Pichon Baron and Pichon Comtesse, and Buzz Brand Lynch Bages.

Sharing three picks apiece are further left bank appellations Saint-Julien, Saint-Estèphe, and Pessac-Léognan. Capbern, Meyney, and Latour-Martillac are testament to the value proposition available in Saint-Estèphe and Pessac-Léognan respectively. Saint-Julien MUST BUYs are represented by two fourth-growth staples, Branaire-Ducru and Beychevelle, and the second wine of Léoville Las Cases, Le Petit Lion.

Margaux earns two MUST BUYs – Rauzan-Ségla, and biodynamic Durfort Vivens (who made a huge step up in quality this year, and whose 2018 yield was less than a quarter of its usual volume). Pomerol equals this number with Lafleur and Hosanna.

Other wines featured in Wine Lister’s Bordeaux 2018 MUST BUYs list are: Beau-Séjour Bécot, Calon Ségur, Domaine de Chevalier Rouge, La Gaffelière, Les Carmes Haut-Brion, and Potensac.

*Wine Lister launched its MUST BUY tool on Monday at a Telegraph event entitled “Wine for Pleasure or Profit?”, where founder & CEO Ella Lister spoke about going “Back to Bordeaux” for both. You can see slides from the presentation relevant to Bordeaux 2018 MUST BUYs here: Telegraph Back to Bordeaux

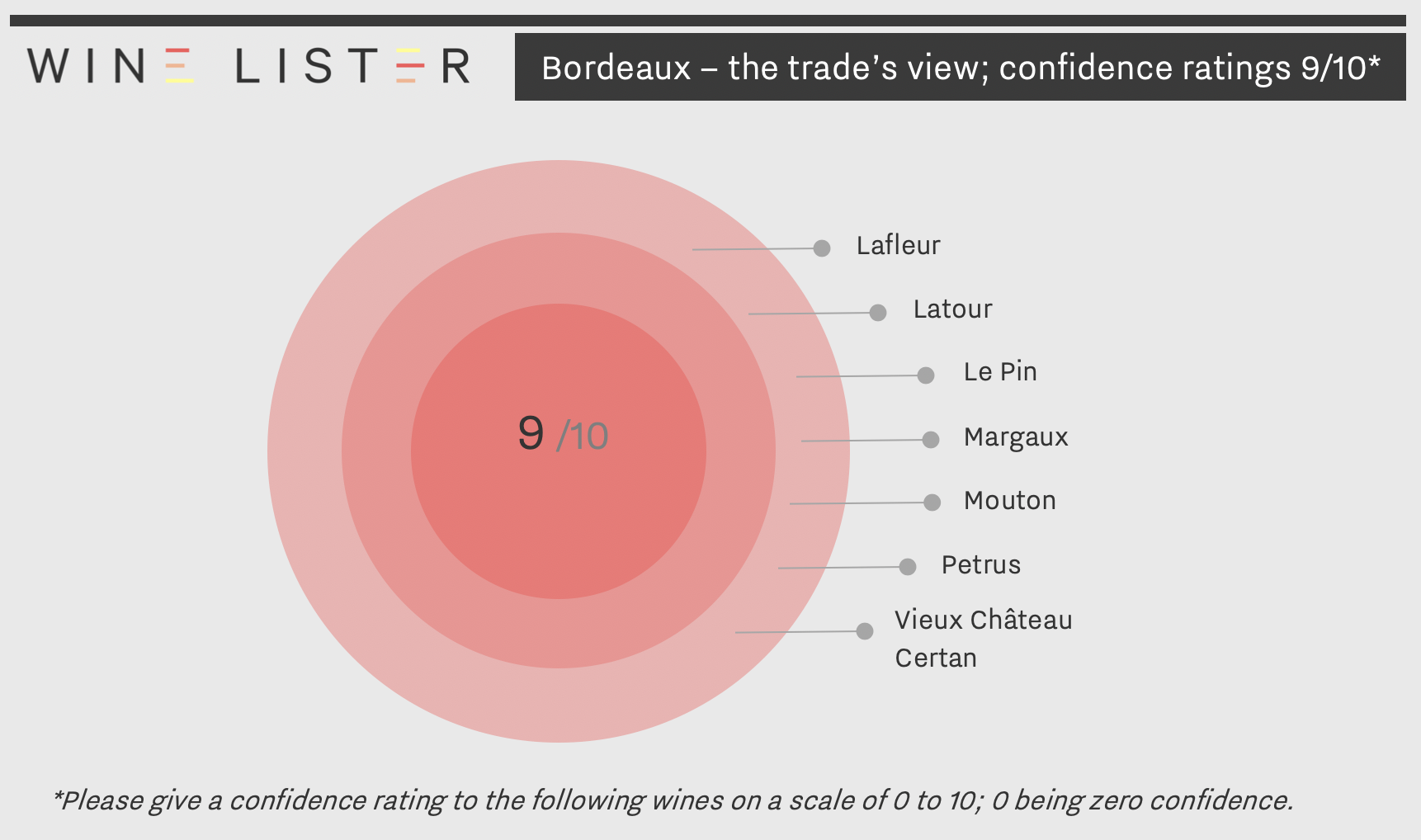

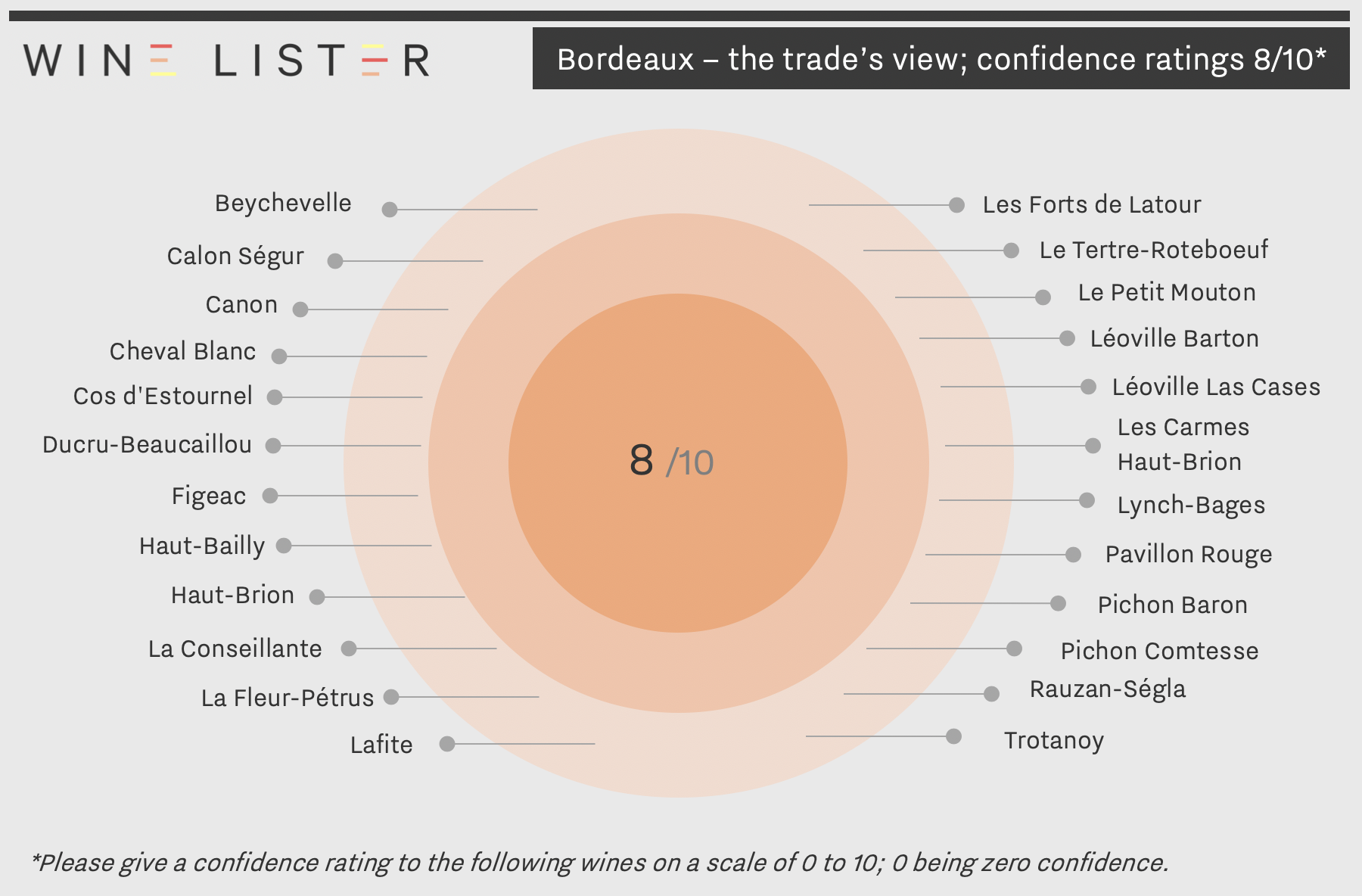

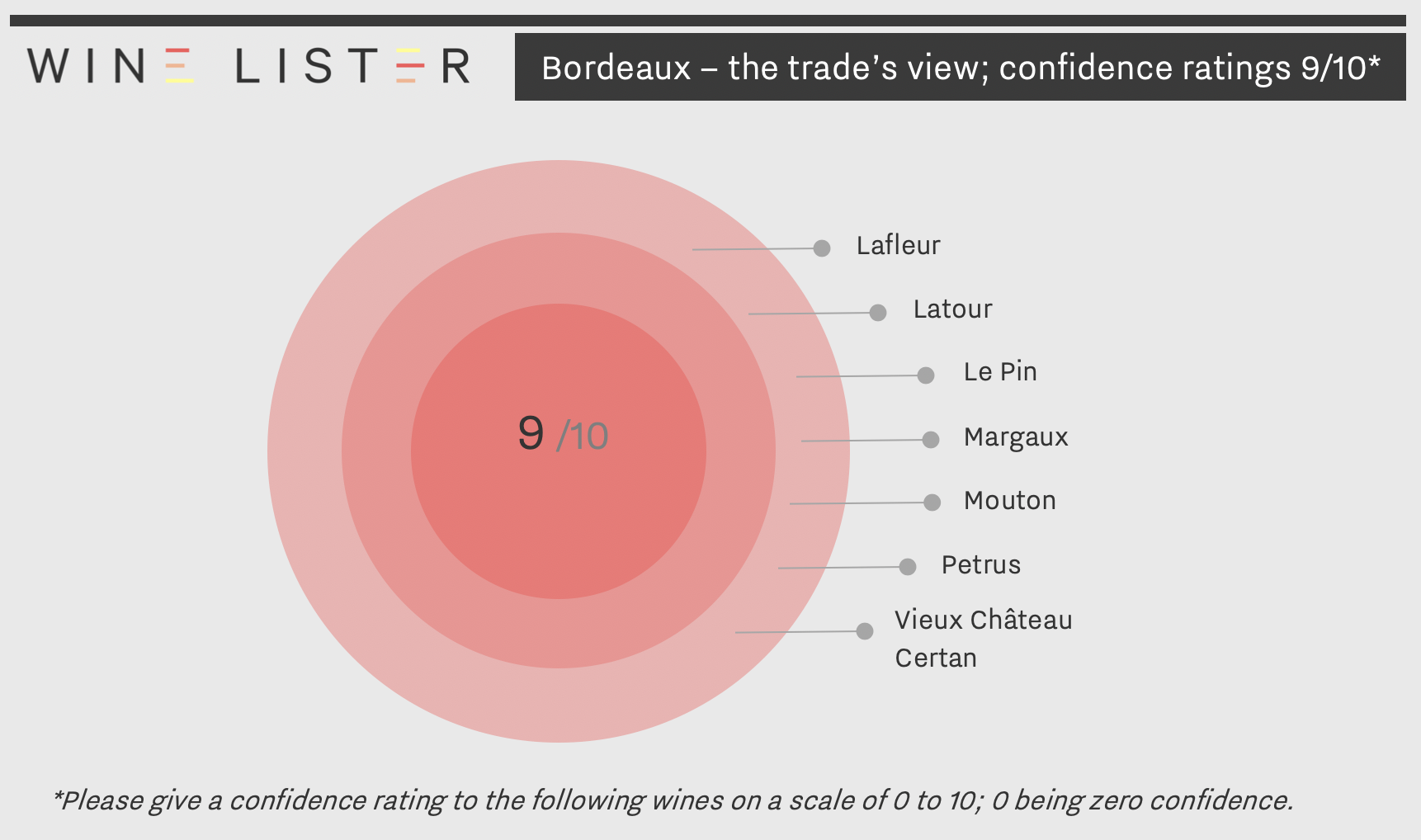

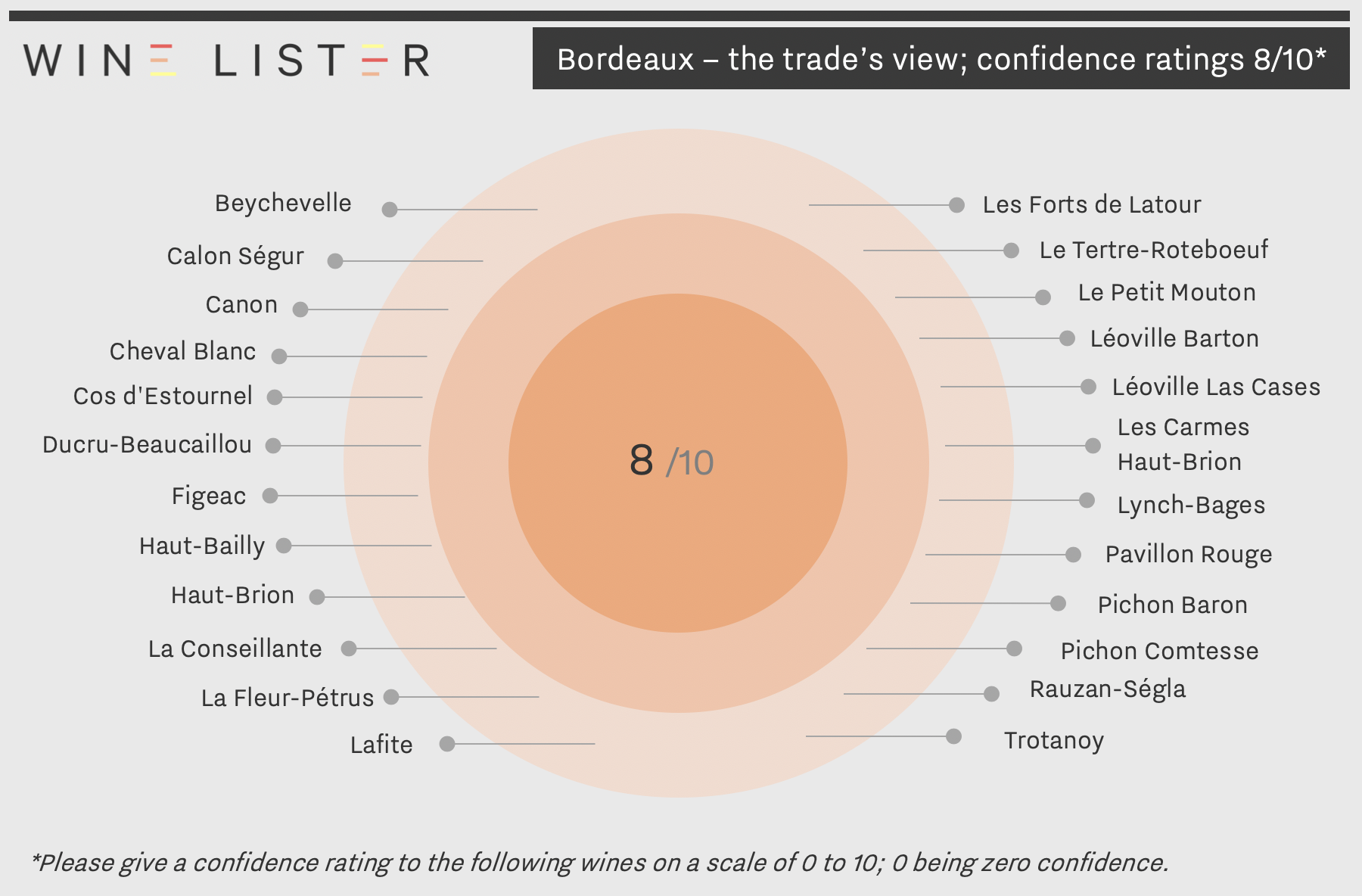

Included in Part II of Wine Lister’s Bordeaux Study 2019 (released last week), are results of our latest trade survey. Wine Lister asks its Founding Members (c.50 key players in the global fine wine trade) to give “confidence” ratings to more than 100 key Bordeaux wines on a scale of 0 to 10; 0 being zero confidence.

For the third consecutive year, no Bordeaux wine received a perfect 10/10. Wines retaining their 9/10 confidence rating since last year are Le Pin, Margaux, Mouton, and Petrus. Joining them in 2019 are Lafleur, Latour, and Vieux Châteaux Certan – the latter being a particular source of interest, given its average price of £139, or just 13% of the average of the rest of the group.

Meanwhile the two remaining left bank first growths, Haut-Brion and Lafite, have slipped down into the next confidence band, receiving an average of 8/10. Saint-Émilion superstar, Canon, has also moved down one point since last year, despite also being cited by the same trade group as a wine seeing the sharpest rise in demand, and a wine of likely future prestige.

The 8/10 category contains 24 wines, compared with 21 in 2018. New entries into the 8/10 category include two of the best performers en primeur – Beychevelle and Les Carmes Haut-Brion. Others moving up to this category are Cos d’Estournel, Les Forts de Latour, and Léoville Barton.

The improved confidence in Pomerol within the top two groups is noticeable, with Lafleur and Vieux Château Certan effectively taking the places of Canon and Lafite, and two wines from the Moueix stable – La Fleur-Pétrus and Trotanoy moving up into the 8/10 category this year (at the expense of Ausone, La Mission Haut-Brion, Léoville Poyferré, Montrose, and Palmer, which have all moved down into the 7/10 group). As well as earning high confidence, Pomerol also achieves the highest number of wines in the 2018 Quality top-25.

Visit Wine Lister’s Analysis page to buy and/or download the full report, and see confidence ratings for all other wines in the study (available in both English and French).

As en primeur 2018 picks up pace, we consider the 10 Bordeaux wines that any fine wine collector should acquire for their collection. These are based on the results of Wine Lister’s latest Founding Member survey, gathering the views of over 50 key players in the global fine wine trade.

You can download this slide here: 10 must have Bordeaux wines for your collection

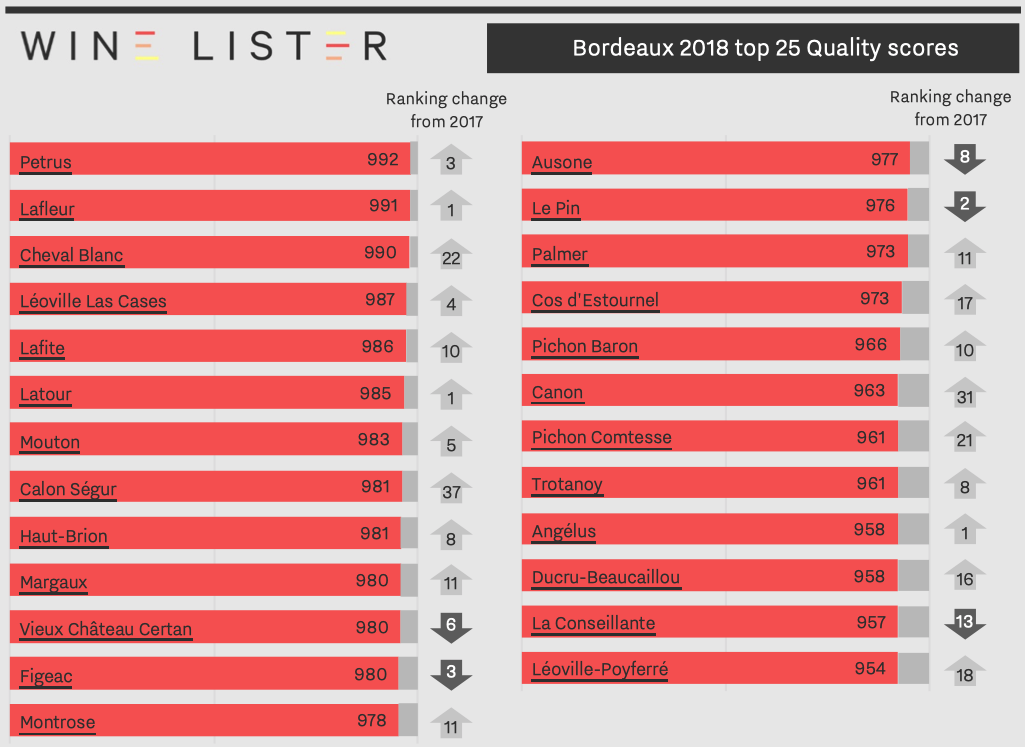

In Bordeaux, 2018 was a winemakers’ vintage. That much is clear from conversations the Wine Lister team had throughout en primeur tasting week, explained further in Bordeaux 2018 en primeur part I : the vintage. Though quality across the board was good in 2018, the greats stand out all the more for being the result of key technical decisions, rather than just terroir.

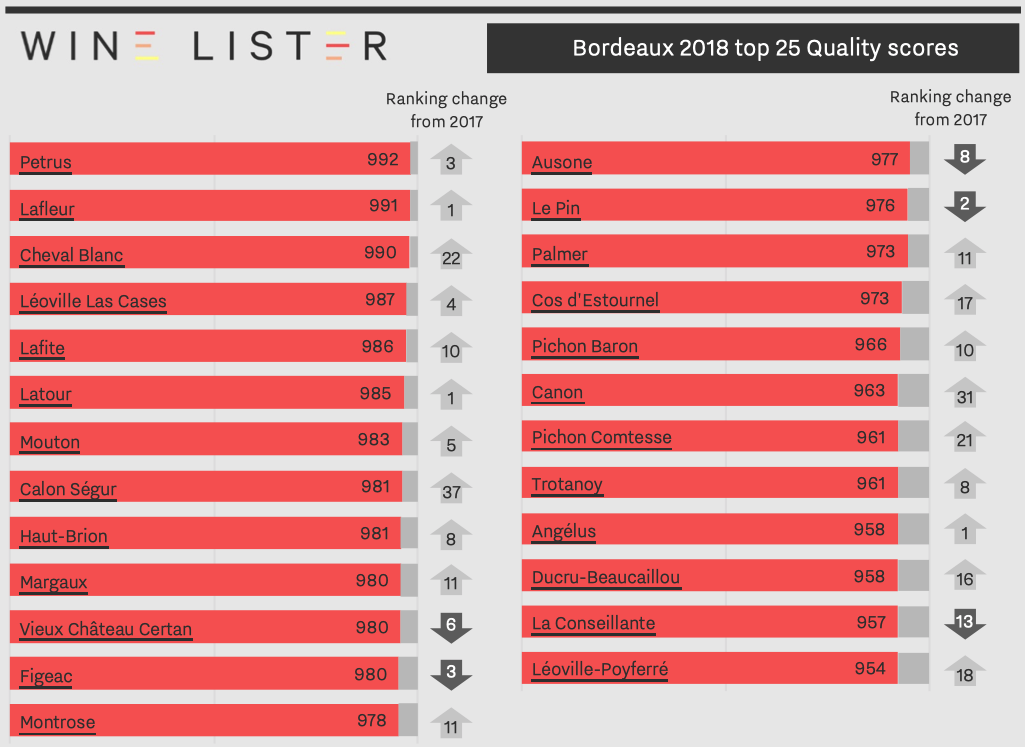

Below we look at the top 25 Bordeaux 2018 red Quality scores, based on the recently-released ratings of Wine Lister partner critics Bettane+Desseauve, Julia Harding for Jancis Robinson, Antonio Galloni for Vinous, and Jeannie Cho Lee. The average Quality score of these top 25 is 975, 25 points higher than the equivalent top red panel in 2017.

Right bank super-appellation, Pomerol earns the highest number of places in the top 25 red Quality scores (6), and includes the first- and second-best wines of the vintage, Petrus and Lafleur. They earn Quality scores of 992 and 991 respectively, and the former is awarded 97-100 points by Wine Lister partner critic, Antonio Galloni, who comments, “From the very first taste, the 2018 Petrus is simply magical”.

Proving the potential for high quality across both banks in Bordeaux 2018, the next highest appellations are Pauillac and Saint-Émilion with 5 wines appearing in the top 25 apiece. Pauillac wins out overall, with an average score of 976 (vs. 974 in Saint-Émilion). Cheval Blanc (990) and Canon (963) show impressive Quality improvements on 2017, moving 22 and 31 places up the rankings respectively.

Pauillac’s top quality wines are made up, perhaps unsurprisingly, of the three Pauillacais first growths, Lafite (986), Latour (985), and Mouton (983), and super-seconds Pichon Baron and Pichon Comtesse. This last is holds the appellation’s most-improved ranking, moving up 21 places from its 2017 position. Julia Harding of JancisRobinson.com writes of Pichon Comtesse 2018, “A gentle and surprisingly subtle beauty”.

Elsewhere on the left bank, Saint-Julien and Saint-Estèphe earn three wines each in the top 25 for Quality. The best of these, Léoville Las Cases, earns a Quality score of 987. The three Saint-Estèphe wines follow consecutively, with front-runner and rising star Calon-Ségur moving up 37 places from its 2017 ranking – the largest improvement of all the top 25 Quality scorers in 2018.

Margaux and Pessac-Léognan appear just thrice between them in the top 25 for Quality, with Margaux (980), tiny-production Palmer (973), and Haut-Brion (981).

Other wines featuring in the top 25 Bordeaux 2018 Quality scores are: Figeac, Vieux Château Certan, Montrose, Ausone, Le Pin, Cos d’Estournel, Ducru-Beaucaillou, Léoville-Poyferré, Angélus, Trotanoy, and La Conseillante.

The campaign in 2018 “won’t be a record breaker,” thinks Mathieu Chadronnier, MD of négociant CVBG, “but everything is there for it to work well.” There are also some potential pitfalls. In this article we consider the role that volume, pricing, and timing will play in the success of the 2018 en primeur campaign – already well underway.

Volume

In 2018, yields were often slightly below 2017 levels. Last year, frost damage provided a cover for releasing less volume into the market. Will mildew serve the same purpose in 2018? There were some extreme mildew casualties across the two banks, mainly for organic and biodynamic properties such as Palmer, which produced just 11 hl/ha. In Pomerol, L’Evangile made 20 hl/ha, less than half what it would have produced under conventional agriculture. In Pauillac, Pontet-Canet made just 10 hl/ha in 2018 – one third of its usual production, losing 15 hl/ha to mildew and another 5hl/ha due to dried out grapes.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

François-Xavier Borie, owner of Grand-Puy-Lacoste, believes that the real burning issue for en primeur is the volume released onto the market – or not. Some châteaux release nearly all their production, and others as little as 30%, keeping the rest back to create an artificial rarity in hope of selling the rest at a higher price later. Borie believes the right amount to release en primeur is “at least 80 percent,” cautioning that “releasing 30 percent and pretending it’s a real price is dangerous.”

Nicolas Ballarin of courtier Blanchy et de Lestapis agrees: “The problem of Bordeaux’s distribution is not in the price but in the fact that we don’t put enough wine into the market en primeur,” he states. “The real paradox is that knowing there’s none left at the château makes it more valued,” explains Ballarin, adding, “the négoce know they won’t get more.” He concludes that “prices only go up if there’s no more wine at the château.”

And after all, every producer’s objective is for their prices to go up. Many try to force this through their en primeur release price, while others let the market do the work. More than ever in 2018, there is no one-size-fits-all approach to bringing them onto the market.

As we saw in part I of our en primeur blog, 2018 was a vintage where producers’ decisions counted for a lot. In the words of Nicolas Glumineau, Managing Director of Pichon Comtesse, it is “a year with very important personal choices.” He was talking about the winemaking, but could just as easily be referring to the sale of the wine. “There won’t be any blanket tendencies,” says Frédéric Faye, Managing Director of Figeac, underlining that, “each château has to decide for itself and not look at its neighbours.”

Pricing

The only golden rule that the trade seem to agree on is that the 2018s should not be priced higher than the 2016s were upon release. “It would be a massive mistake for prices to be above those of 2016,” declared George Wilmoth, Head of Sales at UK merchant Justerini & Brooks. In Bordeaux, Edouard Moueix, Managing Director of Etablissements Jean-Pierre Moueix (producer and négociant), agrees, saying 2018 prices, “cannot be higher than 2016, it’s impossible.”

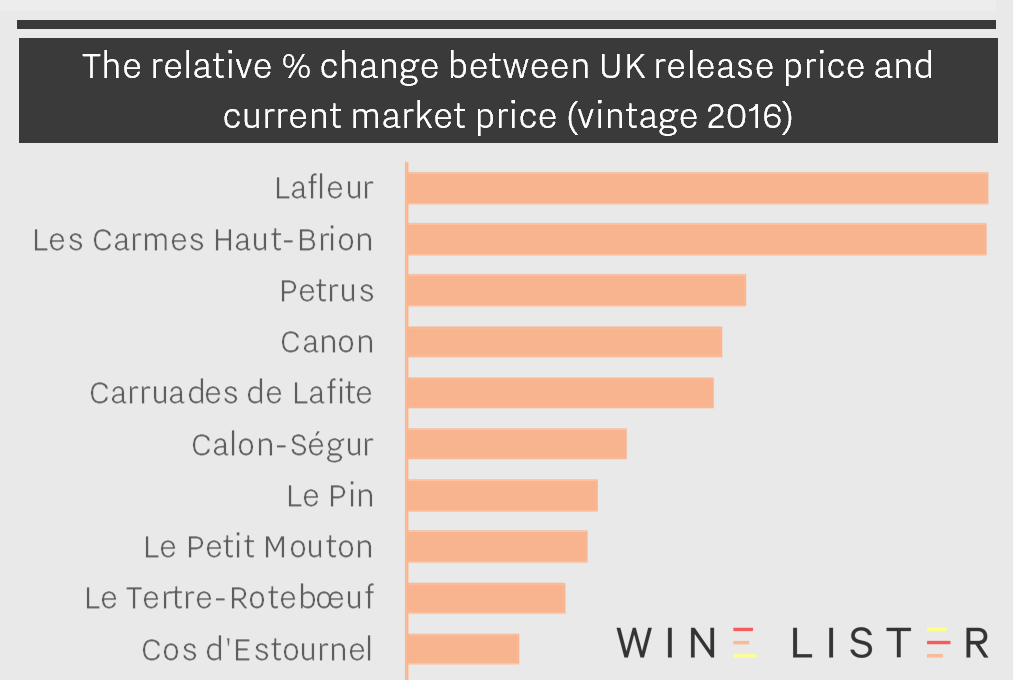

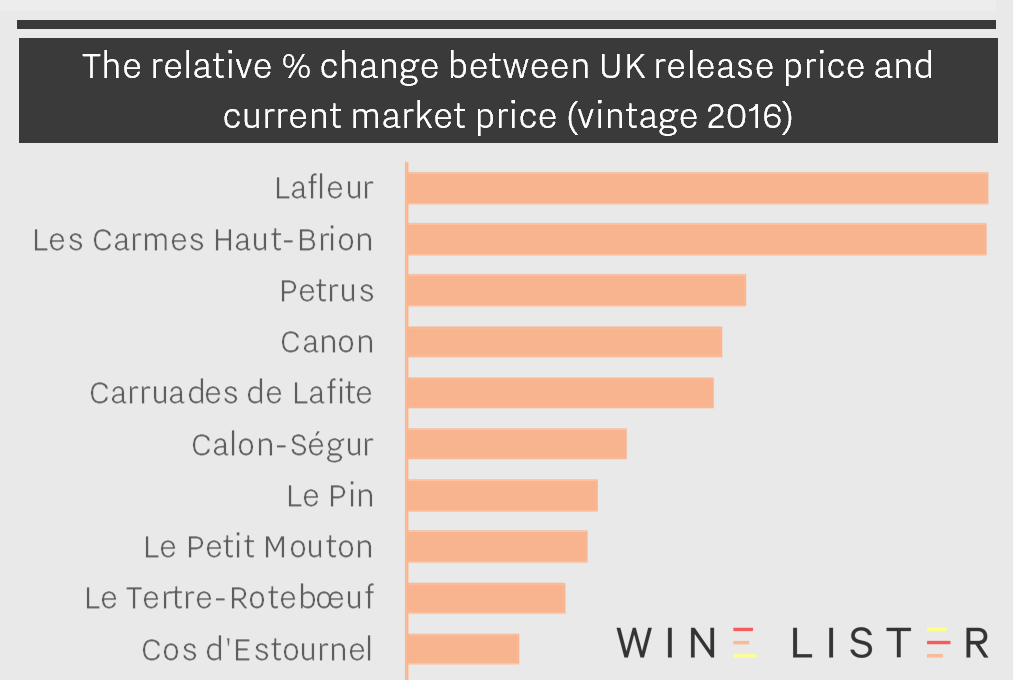

The exception to this rule of course, is where the 2016s have increased significantly since their release. Stephen Browett, Chairman of UK merchant Farr Vintners, reminds us that, “the vast majority of 2016 Bordeaux wines that customers bought en primeur are still available at delivery time at the same price as they paid two years ago, and in some cases less,” but there are exceptions, such as Lafleur, whose 2016 has increased 109% since release. When it released this morning, the château could therefore up its 2016 release price by 12% and still offer a 2018 that remains significantly cheaper than the current market price of the 2016.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

“At the end of the day the châteaux will charge what they can get,” states Mathieu Chadronnier, MD of négociant CVBG. The allocation system in Bordeaux means this is often more than what they should arguably be charging, because négociants don’t want to risk losing share to competitors in future years. However, some did refuse allocations in last year’s campaign, and this could happen again – and maybe on a larger scale – if prices are too ambitious.So far there have only been small instances of this.

Timing

The campaign is a precocious one, with Angélus releasing on 16th April, and a few dozen releases since, including well-known names Branaire-Ducru, Langoa-Barton, and Labégorce. However, it doesn’t really seem to have got going. Some of the Wine Lister team is just back from two days in Bordeaux speaking with négociants and courtiers on the Place, and there is a distinct lack of energy so far.

However, after yesterday’s bank holiday in France, and a handful of releases today, things are set to pick up pace in earnest next week. We expect a series of releases from châteaux that have historically judged their en primeur prices well, and this could breathe some life into the campaign. On the other hand, these are the very same châteaux who can actually conceive of increasing their prices, given their market value has risen sufficiently.

Some fear this will set the wrong precedent for their neighbours, which is why it is more important than ever for each property to consider its pricing strategy in the context of its own performance, and not what its neighbours are doing. Châteaux need to “make sure that their en primeur price to the consumer is lower than that of older vintages,” says Browett. In part I of our recent Bordeaux study, we looked at a case study of a hot property in Bordeaux that did just that in last year’s campaign.

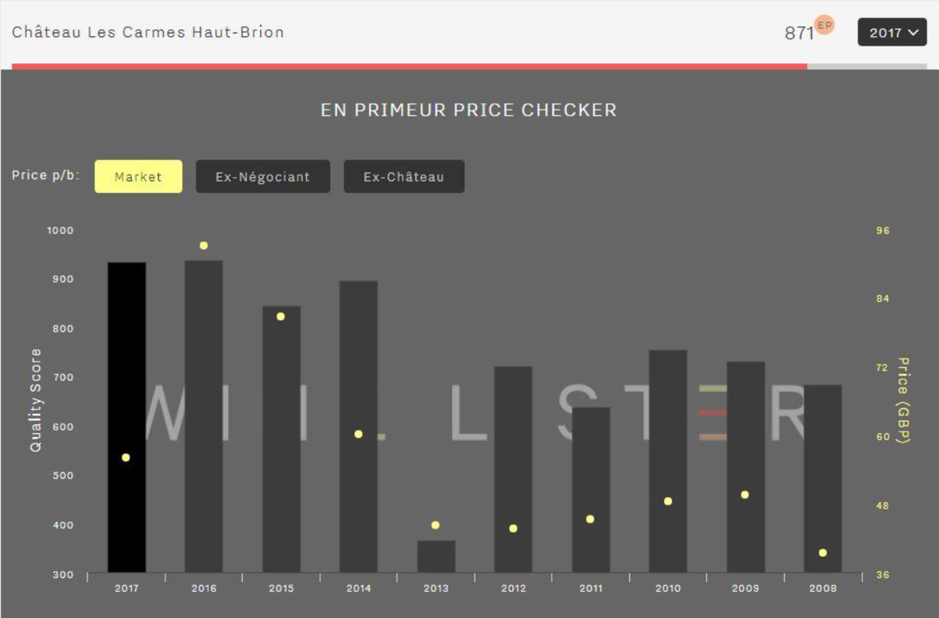

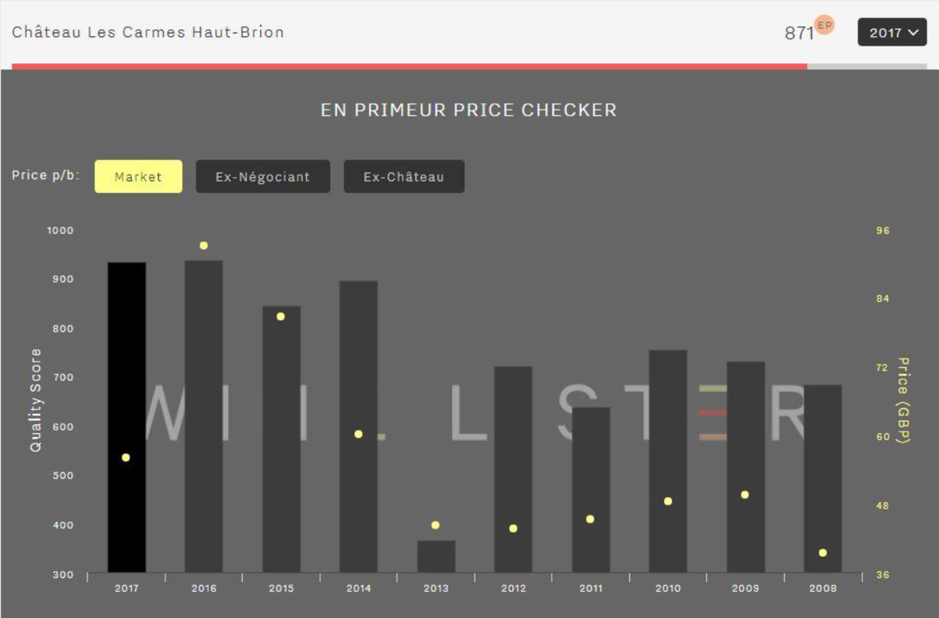

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

Let’s hope that more and more châteaux follow this formula as the campaign continues to unfold next week. The week after that is Vinexpo in Bordeaux, and most big-name releases will begin in earnest from 20th May.

Watch this space for the release of Wine Lister’s Bordeaux Study, Part II, before then.

Yesterday saw the surprise release of Angélus 2018, catching much of the trade off guard. Last year the first major release was Palmer 2017, which came nine days later on 25th April. The year before that, early bird Cos d’Estournel released its 2016 on 24th April.

Angélus 2018 is being offered in the UK at £255 per bottle (£1,530 per case of 6), and in Europe at €295 per bottle. This is 9% below its 2017 price, and equivalent to its 2015 en primeur release price. This makes the wine available at a small discount to the 2009, 2010, and 2016 vintages. However, 2014 and 2015 are physically available in the market for less.

Being the first out of the blocks gives Angélus an advantage: not only does it have the trade’s full attention now, but it also has a long stretch ahead for the wine to sell, and its discount on 2017 may end up looking attractive if others don’t follow suit.

None of Wine Lister’s partner critics has rated the wine yet. We tasted it 10 days ago at the château and found it delightfully fresh, precise, and crystalline, in a more restrained and elevated style than in the past, but still with impressive density. It is an excellent wine, and needs to be at this price.

After years of price repositioning since its promotion to premier grand cru classé A in 2012, Angélus was smart in making this step to “correct” its price (and arguably it could have gone further).

Nonetheless, the gesture seems to have been appreciated by the market, whose hope is that this will start a trend for the upcoming campaign, of châteaux decreasing on last year’s release price. Only time will tell whether others follow suit, or if this is a mere anomaly.

Ella Lister

April 17, 2019

Browse the full MUST BUY list

Browse the full MUST BUY list

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right). Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew.

The cellar at biodynamic estate, Château Palmer, emptier than usual due to tiny production in 2018 following severe attacks of mildew. An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago.

An excerpt from Wine Lister’s Bordeaux Study part I, showing the 10 2016 Bordeaux whose prices have increased the most since their release two years ago. A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).

A masterclass in en primeur release pricing – the chart above shows Carmes Haut Brion’s 2017 release prices versus previous vintages on its day of release last year. Today the market price of 2017 is £65 (16% above release), and the 2016, £133 (109% above release).