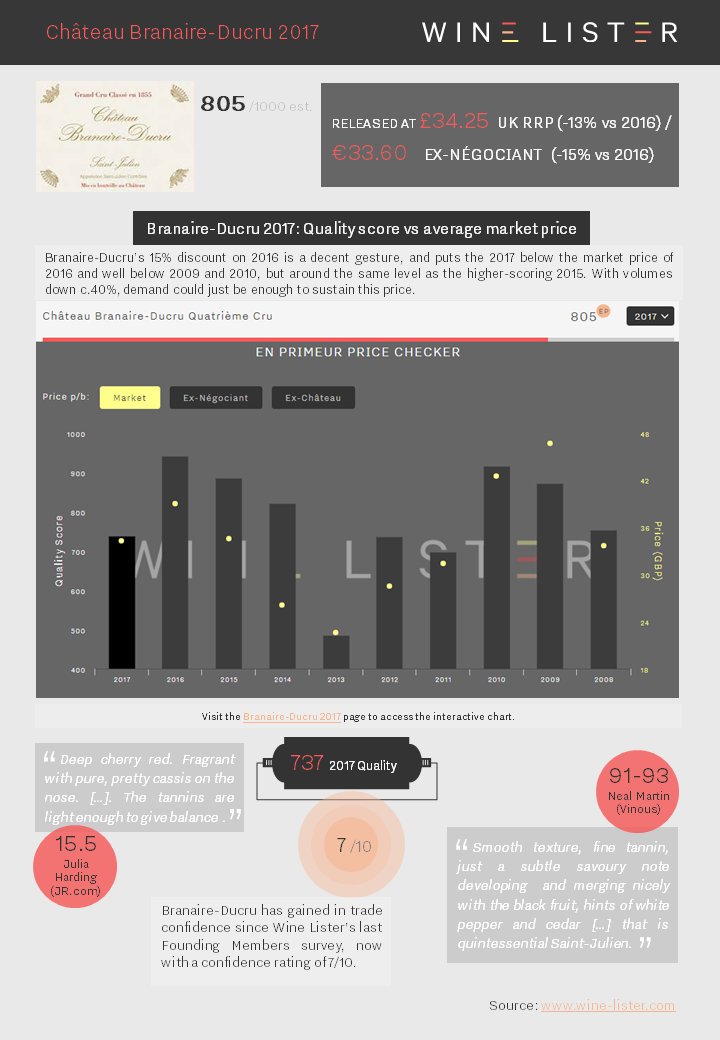

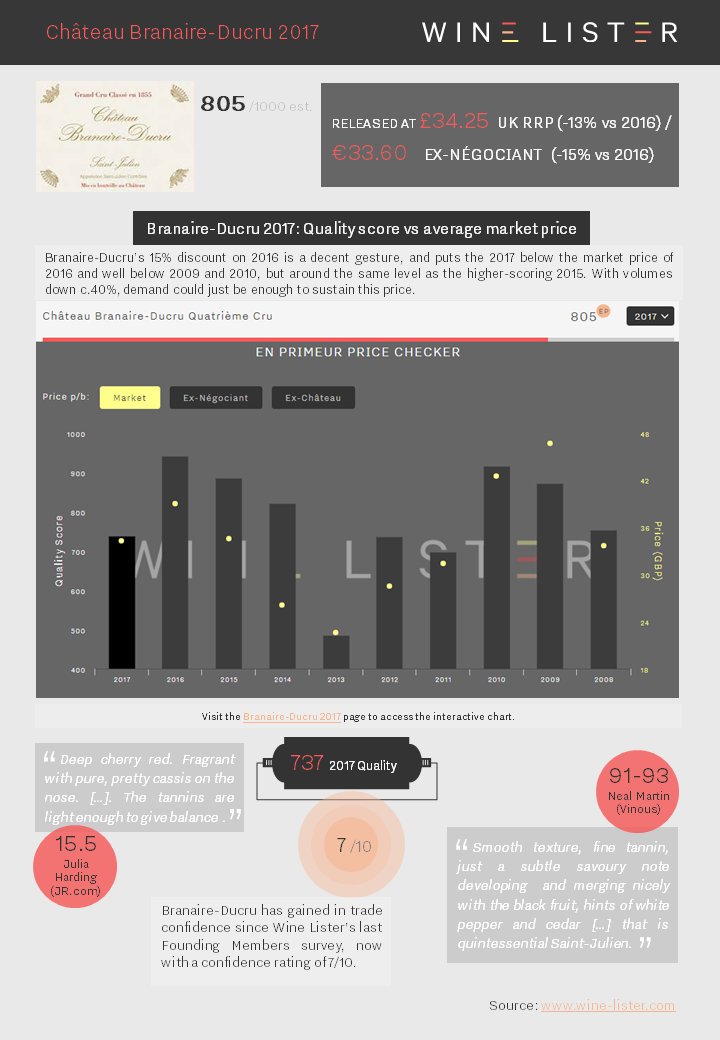

Bordeaux en primeur analysis of Branaire-Ducru 2017, which has been released this morning at €33.60 ex-négociant, 15% down on 2016 (€39.60 last year) and with a U.K. RRP of £34.25, 13% down on 2016.

You can download the slide here: Wine Lister Factsheet Branaire-Ducru 2017.

“I can’t see it being a big campaign.” That is the view of Serena Sutcliffe, Honorary Chairman of Sotheby’s Wine, echoed by some on the Place de Bordeaux. The usually upbeat Mathieu Chadronnier, Managing Director of négociant CVBG, asserts that 2017 Bordeaux en primeur “will be a weak campaign compared to last year”.

This sentiment is also recognised in the semi-official line, from Emmanuel Cruse, Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes, and Barsac. “We all know that over the weeks to come the distribution of this vintage could be slightly more difficult on the commercial side than previous ones,” he accepted, adding reasonably, “We need to recognise that each vintage has its fair price.”

The general (if not unchallenged) consensus is that prices will come down on 2016. “Of course they will,” said Chadronnier, “but not enough.” “We always wait for decreases and they’re never considered enough,” he continued, then asking, rhetorically, exasperated, “what is enough?”

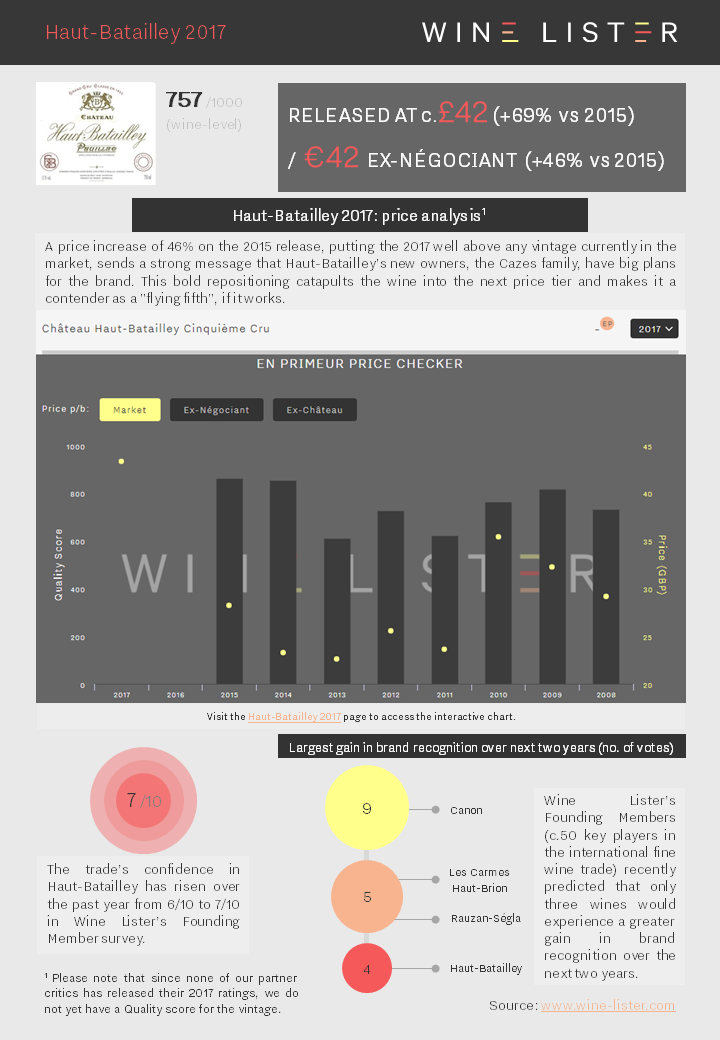

What is enough indeed? Perhaps more than ever before, there is no one size fits all formula. Just as quality and style vary from château to château in 2017 (see part I of our en primeur round-up), so will pricing. Each property has its own brand trajectory, 2017 vintage quality, volume considerations, and price positioning history. This has been epitomised by the wildly different approaches of the first two major releases of the campaign, Palmer and Haut-Batailley.

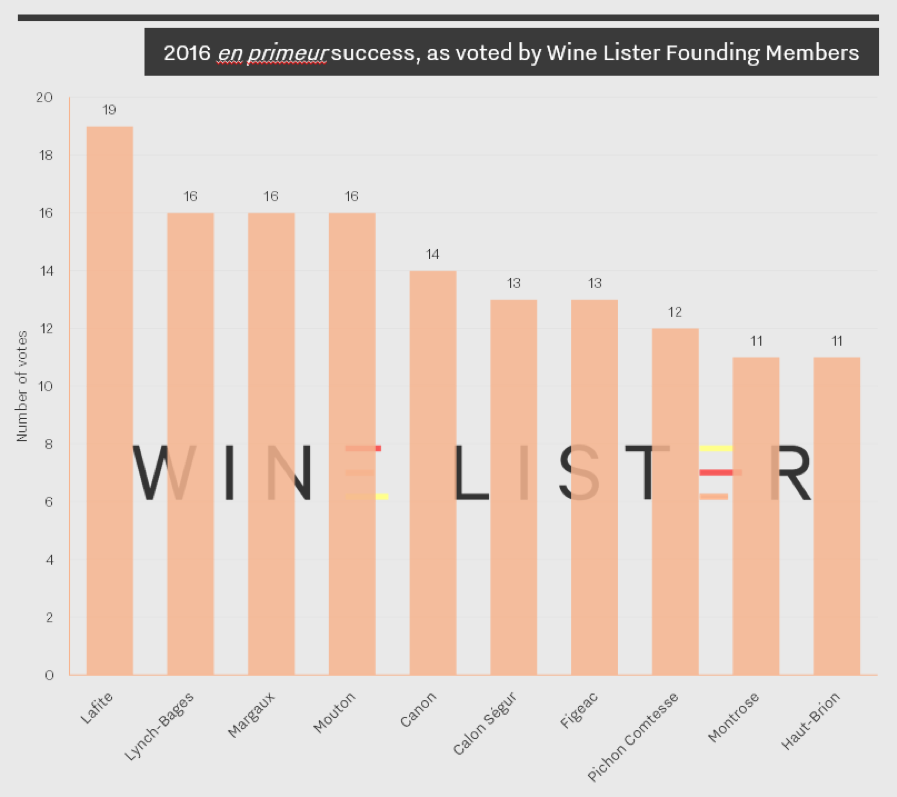

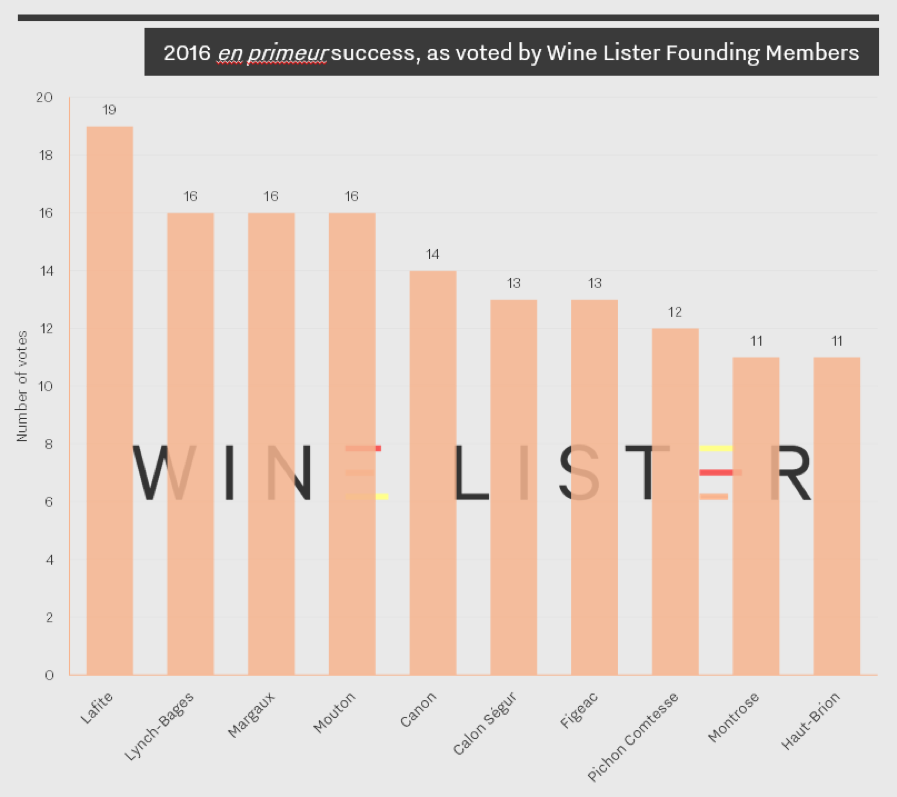

Only a small group of wines can get away with staying around 2015 prices (15-25 according to one Bordeaux courtier). Even fewer, if any, can maintain their 2016 release price. Contenders are arguably the big success stories of the 2016 en primeur campaign. According to Wine Lister’s Founding Members (c.50 key members of the international fine wine trade), first growths aside, these were Châteaux Lynch-Bages, Canon, Calon Ségur, Figeac, Pichon Comtesse, and Montrose.

However, when we put it to some of these producers that they were among a happy few potentially in a position to maintain 2016 prices, most dismissed the idea. “I could even go up and people would buy it,” mused Laurent Dufau, Managing Director of Calon Ségur. “But I won’t”, he concluded, adding “I would rather maintain the trade’s goodwill”. Nicolas Glumineau, Managing Director of Pichon Longueville Comtesse de Lalande, replied firmly, “If the question is will the price be like 2016, the response is evidently not”. He continued, “I’m really very happy with the wine we’ve made, but it’s not the 2016”.

In fact, almost every château we spoke to in Bordeaux said it would reduce the price. “It would not be right to release the 2017 at the same price as the 2016,” said Jean-Valmy Nicolas, Co-Managing Director of Château La Conseillante. “In my opinion our pricing strategy should be based on relative quality, not relative volume,” he said, referring to the impact of the frost on production volumes (down 15% on 2016).

As much as anything else, most Bordelais won’t risk the reputation of the 2016s. For most, following significant price increases for the 2016 vintage, a decrease for 2017 is manageable. This was precisely Edouard Moueix’s point (Managing Director of négociant Jean-Pierre Moueix) when he lamented, “People always compare to the year before, so even if there’s a 10-15% decrease on 2016 it’s still too high.”

For a handful of properties whose 2015s and 2016s were relative bargains, bringing the price down too much in this vintage is going to be a harder pill to swallow. Problematically for them, the market does still think in terms of increase or decrease on the previous vintage, even if this is an overly simplistic approach.

“I don’t believe for a second that prices will go down,” declared Nicolas Audebert, Managing Director of Châteaux Canon and Rauzan-Ségla, two of Bordeaux’s rising stars. Canon was voted the fifth most successful release of last year’s en primeur campaign. This is thanks to the combination of its rising popularity and its reasonable 2016 release price – it sold like hotcakes. Its 2016 price has risen by 23% since release, so arguably it is one of the very few wines that could conceive of not decreasing its price this year.

The only other château to suggest that a price decrease was by no means a given was Cos d’Estournel. Faced with the generalisation of 2017 as below the level of the last two vintages, owner, Michel Reybier, told us that “for us, compared to 2016, the 2017 vintage might even be better.”

Smoke and mirrors: Bordeaux’s Miroir d’eau (water mirror) on the only sunny day of Wine Lister’s en primeur tasting trip. Photo © Ella Lister

Farr Vintners summed up their thoughts on pricing succinctly, saying “if prices are at around the current market for [2014, 2013, 2012 and 2011], 2017 starts to look very interesting,” cautioning, “at close to current 2016 or 2015 prices the wines will not be worth buying.” Will the threat of not selling be enough to moderate producers’ pricing ambitions?

“They couldn’t care less whether they sell,” said the car hire attendant who rented me my car at Bordeaux airport. If the news has spread that far out of the wine industry, maybe it’s true. Certainly, for a gilded group of crus classés the idea of keeping back stock and selling it for more down the line is appealing. And for what they do release, they can be pretty certain their négociants will back them up and carry the stock (and the risk), even if there are few end buyers.

This was confirmed by one large négociant, who told us off the record, “We’ll buy but we won’t sell as much as we want to.” He is “worried about prices,” citing “the usual Bordeaux spiral.” He was referring to the transition period required after a string of good vintages, during which prices are not recalibrated sufficiently. “Châteaux sold the wine last year, everyone’s happy, so they won’t come down enough,” he concluded.

As for timing, we’ve already seen important releases this week, earlier than expected, with Palmer coming out a day earlier than Cos d’Estournel’s surprise release last year, in spite of the tastings taking place a week later. Nonetheless, a long campaign is expected, in part due to an inordinate number of bank holidays in May (in France and the UK). Philippe Dhalluin, Managing Director at Mouton Rothschild, seemed to predict this when he told us “it is not a speculative campaign so it should start off quite quickly.” He added, “We’d like to have an early campaign but May is complicated,” specifying, “I’d like to release before Vinexpo – it’s possible.” Anything is possible in love and en primeur.

Follow us on Twitter and on the blog for real-time coverage of the Bordeaux 2017 en primeur campaign. Check www.wine-lister.com next week for a new dedicated en primeur page where you can find out everything you need to know during the campaign.

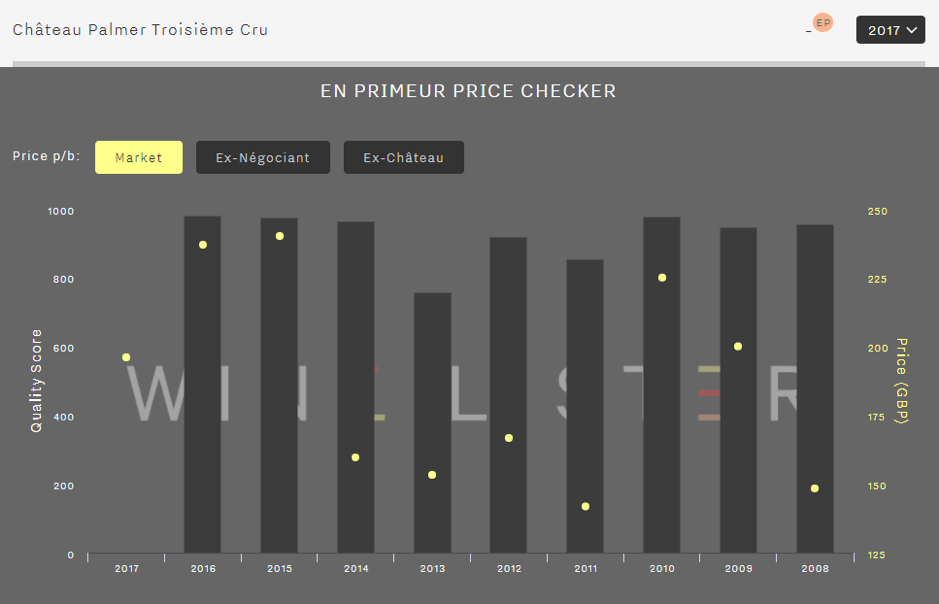

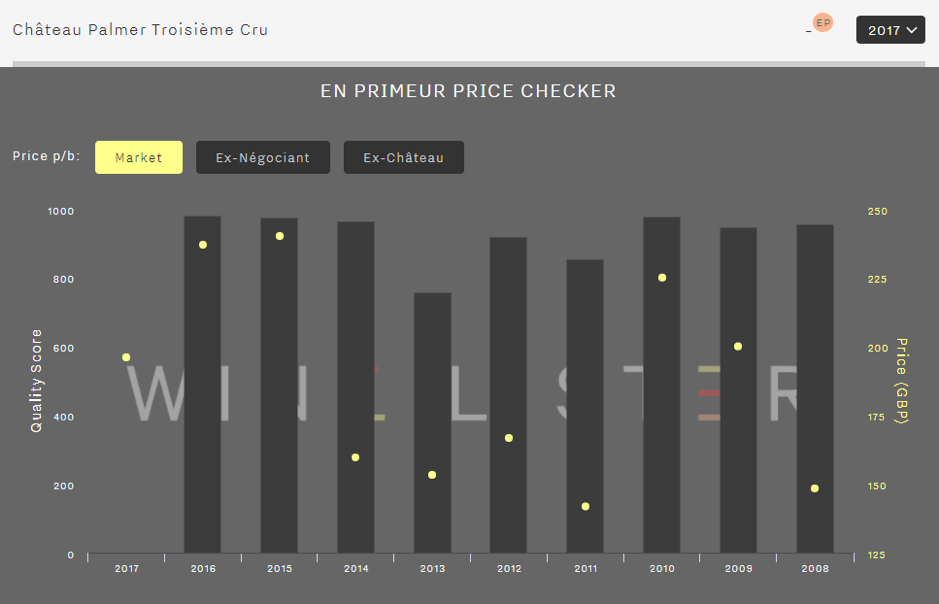

Margaux’s Château Palmer made a surprise move on Monday morning, releasing its 2017 vintage en primeur before anybody expected. At €192 ex-négociant, its price decrease of 20% on the 2016 (€240) is symbolically significant.

For several years the château has only released 50% of its Grand Vin en primeur each year, which has allowed it to develop an aggressive pricing policy, positioning itself well above other third growths and even second growths. The wine’s price had risen 14% for the 2016 vintage, giving it some margin to come down again this year. This neatly places the 2017 between the 2014 and 2015, both in terms of original release prices and current market prices:

This was a smart and strategic move by Managing Director, Thomas Duroux. When we tasted at the château in the second week of April, he shared his thoughts on the campaign, and it was clear he had considered the dynamics of 2017 Bordeaux en primeur very carefully.

Duroux was cautious about the campaign, saying “It’s going to be complicated as there are lots of discouraging factors.” He believes it’s difficult to achieve three good campaigns in a row, and that there is not a huge amount of demand from consumers. He spoke of a confusion around price and volumes, explaining that “just because there’s less wine doesn’t mean consumers are ready to pay more – they don’t care.” As it happens, the Grand Vin was spared frost damage in April 2017, while 15ha of the second wine was hit. Alter Ego was released at just a 2% discount on the 2016.

“We risk having a campaign where prices go down but not enough to be judged attractive by the consumer,” warned Duroux. It remains to be seen whether Palmer 2017’s 20% decrease is enough. With the trade unprepared, and scores not out yet for many important wine critics (including Wine Lister’s partner critics), it is now a waiting game. Négociants have bought their allocations, and for now they are holding a fair amount of stock of Palmer 2017 in Bordeaux.

Sales by UK merchants are modest for the time being. Depending on scores that will be released over the coming 10 days, Palmer might start to seem like a good deal, particularly when (not if) the discounts start to shrink over the course of the campaign. Or indeed when the discounts become premiums, as we saw this morning with the release of Haut-Batailley 2017 – read the blog post here).

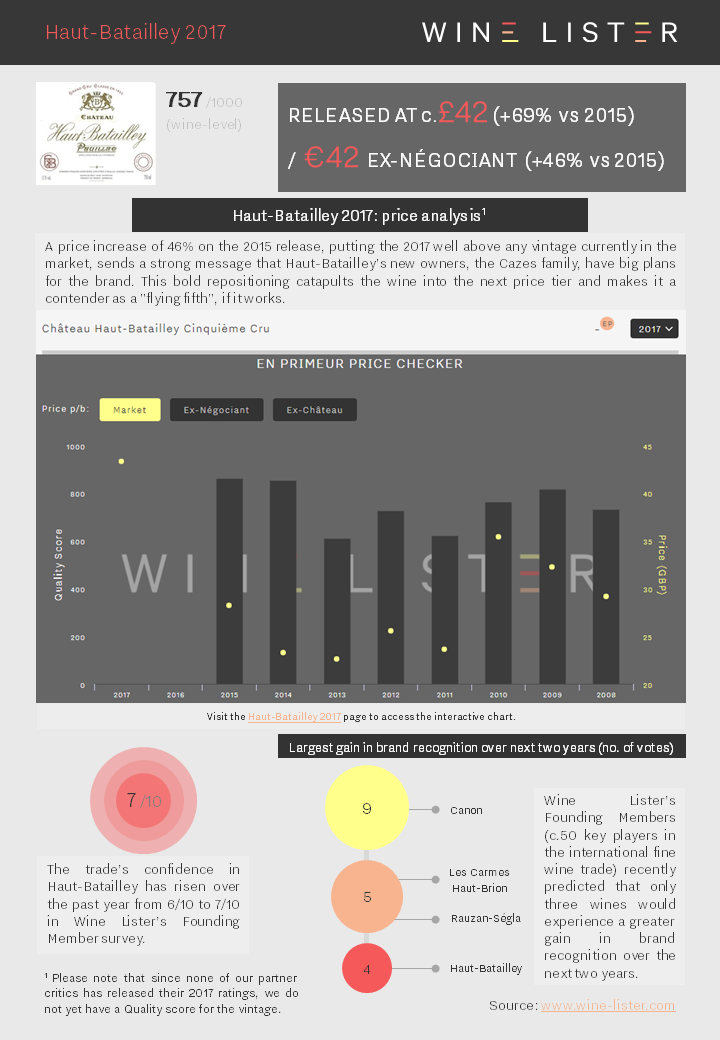

Bordeaux en primeur analysis of Haut-Batailley 2017, which has been released this morning at €42 ex-négociant, 46% up on 2015 (€28.80). It is being offered in the UK at c.£42, 69% above the 2015 release price (£25):

You can download the slide here: Wine Lister Factsheet Haut-Batailley 2017

If you hadn’t already heard about the frost in 2017, you soon will. It was the word on everyone’s lips during last week’s en primeur tastings in Bordeaux. Production volumes were down 40% across the wine region as a whole, with some properties losing their entire crop. Meanwhile others escaped entirely, making Bordeaux 2017 a vintage where both quantity and quality vary greatly from château to château.

The April frost was a “snob”, according to Will Hargrove, Head of Fine Wine at Corney & Barrow, because the very top vineyards were often spared (Petrus and Ausone for example). However, illustrious châteaux such as Cheval Blanc and Figeac might beg to differ. Nonetheless, such less lucky châteaux expended considerable resources to manage frost damage.

Véronique Sanders, Managing Director of Château Haut-Bailly, called it “the vintage of ice and fire”, referring to the dry summer months that followed. Indeed, the weather conditions resulted in many very good wines in 2017, especially suiting Cabernet Sauvignon, which as a result features in greater proportions than usual at many châteaux.

“I will not try to tell you that 2017 is at the level of ’15 or ’16, but if they are great vintages then ’17 is very good.” Those were the words of Olivier Bernard, owner of Domaine de Chevalier and President of the Union des Grands Crus de Bordeaux. “It will be a lovely wine to drink, I promise you,” he continued. The Wine Lister team is in full agreement.

Throughout our six days of tasting, in the Médoc, the Graves, and on the right bank, we were pleasantly surprised over and over again by the quality of the wines, and positively stunned by some, inter alia Les Carmes Haut-Brion, Cos d’Estournel, Figeac, La Fleur-Pétrus, Petrus, Pichon Comtesse de Lalande, Vieux Château Certan. (We can’t wait to find out what our partner critics think, and will add their scores to the website as soon as they’re released).

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

While it is not an easy vintage to generalise about, the Bordeaux 2017s tend to boast vibrancy and freshness. This allows the unique character of each wine to shine through. “I think people understand that Bordeaux is not one style,” reflects Edouard Moueix, Managing Director of négociant Jean-Pierre Moueix, declaring that 2017 is “the archetype of the expression of that diversity,” with “each terroir overexpressed almost”.

The wines have less density and concentration than the 2015s and 2016s, but nonetheless possess the structure to carry them well into the future (while in most cases also being approachable quite early). Finding a comparable vintage is tricky. Analytically speaking, both the excellent 2005 and the difficult 2013 were cited by winemakers, but upon drinking the wines they resemble neither.

At Mouton-Rothschild, Philippe Dhalluin says the wines are somewhere between 2014 (“for the energy”) and 2015 “for the softness”. On the right bank, Moueix describes the 2017 as “like a 2006 with more controlled tannins, while Hubert de Boüard, co-owner of Angélus and consultant oenologist to dozens of other properties, is reminded of 2001 and has named the vintage “l’éclatant” (radiant, or sparkling).

“It’s certainly the best vintage ending in 7 since the famous 1947,” declared Emmanuel Cruse, co-owner of Issan and Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes, and Barsac. To a hall full of Bordeaux château owners and trade at the annual Ban du Millésime dinner, Cruse confirmed that the general feeling about the 2017 vintage was “What a great surprise”. But will it be enough to catalyse a successful en primeur campaign?

Part II of this en primeur round-up will look at the upcoming campaign, considering likely timing, pricing, and volumes, and including views from Bordeaux and the international wine trade. Watch this space.

Our annual Bordeaux study will be released to subscribers in early May. Follow us on Twitter, Facebook, LinkedIn, and the Wine Lister blog for real-time analysis of the 2017 Bordeaux en primeur releases.

Tasting the Guinaudeau stable with Omri Ram, Research and Development Manager & Sales Manager

The past three weeks have seen a flurry of Bordeaux 2023 releases enter the market – almost half of the 174 wines that we include in our en primeur coverage (see Wine Lister’s en primeur page here). Key entries have included first growths Haut-Brion, Lafite Rothschild, and Mouton Rothschild, alongside Right Bank stars, Angélus, Ausone, Cheval Blanc, and Lafleur.

Following a lone release from d’Angludet on Friday 26th April, releases commenced officially on Monday 29th April, with entries from three Sauternes estates (Guiraud, Lafaurie-Peyraguey, and L’Extravagant de Doisy-Daëne), alongside Pauillac’s Batailley. Tuesday 30th April saw the latest releases from the Domaines Delon stable, with Léoville Las Cases offering a 40% discount on its 2022 release price, at £138.50.

Following a French national holiday on Wednesday 1st May, the releases were back with a bang on Thursday 2nd May, with the Domaines Barons de Rothschild (Lafite) group. The first first growth out the gate, Lafite Rothschild’s 2023 came onto the market at a 31% discount on 2022 and below all back vintages on the market (£410), with three major UK merchants informing us that both Lafite and Carruades de Lafite did extremely well. La Lagune and Talbot followed suit on Friday 3rd May – the latter entering the market below all previous vintages at £38.50.

Mouton Rothschild and its sibling wines released on Monday 6th May (a UK bank holiday), with the grand vin reportedly selling well according to several trade members across key markets , having offering a 35% discount on the 2022 and sitting below all back vintages at £339. The pace picked up on Tuesday 7th May, with nine new entries including Angélus (which, having been released at £260, offered a 27% discount on the 2022), two Vignobles Cruse-Lorenzetti properties (Lafon-Rochet and Pédesclaux), and Malartic-Lagravière. Following a national holiday across Wednesday 8th and Thursday 9th, the Guinaudeau stable was released on Friday 10th May. Coming onto the market at £603.33 – 3% down on the 2022- Lafleur does not follow the annual vagaries of the rest of Bordeaux, with its ex-négociant release price increasing by just 13% in the last four years. As a result, it has not needed to offer a discount this year in order for to offer value, with it falling below all recent back vintages – some of which have seen their prices increase significantly on the secondary market. We have been told that, as ever, this flew.

The past week saw a wave of new entries, including Saint-Émilion juggernaut, Cheval Blanc (released at £390) and the Barton stable (Léoville-Barton and Langoa-Barton released at £56 and £29.50, respectively) on Monday (13th May). A whopping 15 releases came through on Tuesday, including the Domaine Clarence Dillon clan, led by first growth Haut-Brion (at £315). We are told by trade members around the world that this release did well, sitting below all recent back vintages (apart from the lower-scoring 2017 and 2014), and offering a hefty 39% discount on the 2022. Cited in Wine Lister’s recent Bordeaux Study as one of the top five wines most frequently bought by merchants for their personal cellar (recap here), Lynch-Bages entered the market at £72 (31% down on 2022), below all other previous vintages.

Tasting through Domaine Clarence Dillon’s 2023 offering at La Mission Haut-Brion

Wednesday (15th May) saw new entries from Ausone, CA Grands Crus (Grand-Puy Ducasse and Meyney), and Ducru-Beaucaillou among others. The latter received 96-99, from Wine Lister’s founder and CEO, Ella Lister (for Le Figaro Vin), and was released below all back vintages, at £124. Yesterday (Thursday 16th May) saw entries from the likes of Carbonnieux, Cos d’Estournel, and d’Issan. D’Issan 2023 was released at £37.50 (26% down on 2022), sitting below all available back vintages on the market. This morning (Friday 17th May) saw releases from Gazin (which one top négociant described as an “outstanding deal”), Suduiraut, and du Tertre, among others. Suduiraut 2023 has received record scores from several key critics, including a potential 100-point score from Wine Lister’s partner critic, Antonio Galloni, in 2023 (its first from Vinous), resulting in its highest average critics’ score of (at least) the last decade.

Also released during this period: Blanc de Lynch-Bages, Carbonnieux Blanc, Chapelle d’Ausone, Château Climens, Château Haut-Brion Blanc, Château Kirwan, Château La Mission Haut-Brion, Château La Mission Haut-Brion Blanc, Château La Tour Carnet, Château Labégorce, Château Lynch-Bages, Château Malescot Saint-Exupéry, Château Marquis d’Alesme, Château Pape Clément, Château Pape Clément Blanc, Château Prieuré-Lichine, Cheval Blanc, Cos d’Estournel Blanc, Echo de Lynch-Bages, Fieuzal Blanc, Fieuzal Rouge, Gloria, La Chapelle de La Mission Haut-Brion, La Croix de Beaucaillou, Le Clarence de Haut-Brion, Le Petit Cheval, Magrez Fombrauge, Ormes de Pez, Pagodes de Cos, Quintus, Saint Pierre (Saint-Julien), Siran, Sociando-Mallet.

Wine Lister’s real-time, wine-by-wine analysis of this year’s campaign is available in email newsletter form through a Pro+ subscription. For more information on this, please contact us.

Now that Le Figaro has released more than 500 tasting notes and scores, the French newspaper’s lead taster and Wine Lister’s CEO, Ella Lister, shares her summary of the vintage from a quality and style perspective. She and her colleague, Béatrice Delamotte, spent 11 days in Bordeaux, tasting for 111 hours, covering 1,135 kilometres, visiting 72 châteaux, and discussing the vintage with 84 producers. They tasted 534 en primeur samples, mostly together, and often several times, in order to provide as objective an assessment as possible.

There are no norms in the 2023 vintage, but many brilliant wines that express their terroir and the microclimate of the year – vastly different from one vineyard to the next. Upon arriving in Bordeaux, what was immediately striking was that the reality on the ground rarely tallied with the statistics: a dry growing season on average nonetheless yielded extreme mildew pressure, while the hottest year on record produced wines with “cool weather expression,” in the words of Jean-Emmanuel Danjoy, Estate Manager at Château Mouton Rothschild.

The vintage is hard to pin down, for some recalling the 2019 (“though not the same,” caveats Christian Seely, CEO of AXA Millésimes), and others 2016 (“even if 2016 was more concentrated,” notes Philippe Bascaules Managing Director at Château Margaux). In Pomerol, Alexandre Thienpont of Vieux Château Certan notes 2023’s pedigree, in “total contrast with the exuberant 2022”, and playfully cites 1953 and 1988 as comparable vintages, while Léoville Las Cases write on their tasting booklet: “This vintage reminds us of the 1771”. Not the most helpful reference for common mortals, but the point is made that this vintage evades comparison.

Seely summarises 2023 as granting “periods of freshness and rain at the right time, and a first half of August that made it possible to make wines that were perfectly ripe and had enough of the sunshine character of the year, but also had freshness and balance and harmony.”

Weather conditions allowed the terroir to shine through, rather than dominating the character of the wine. For Pierre-Olivier Clouet, Technical Director at Cheval Blanc, 2023 is “more about terroir expression than vintage expression,” in comparison to 2022 or 2018, adding “2022 is a very nice wine but it’s more 2022 than Cheval Blanc.” At Château Ausone, Constance Vauthier marvelled at the” “completely unique character of each of our wines”.

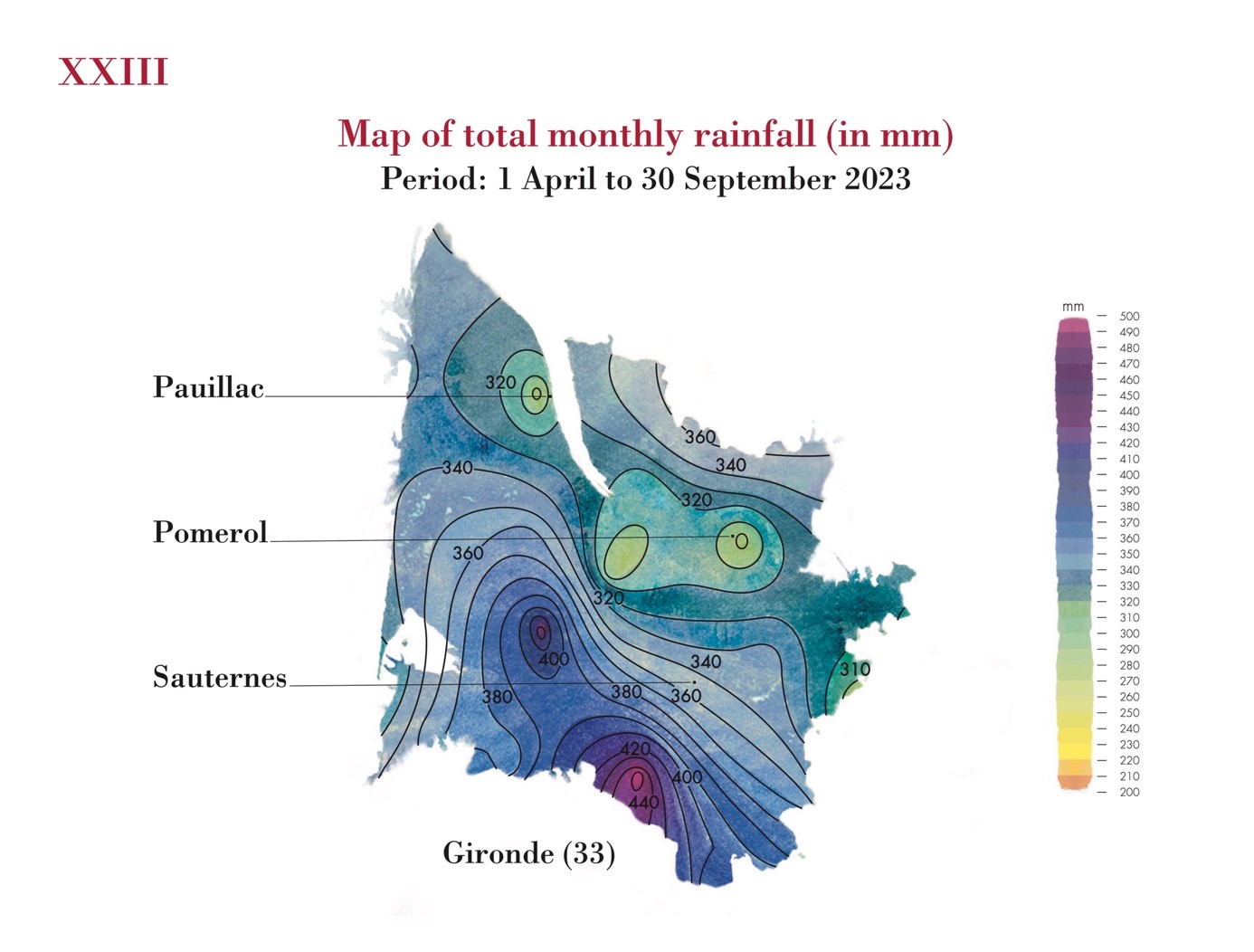

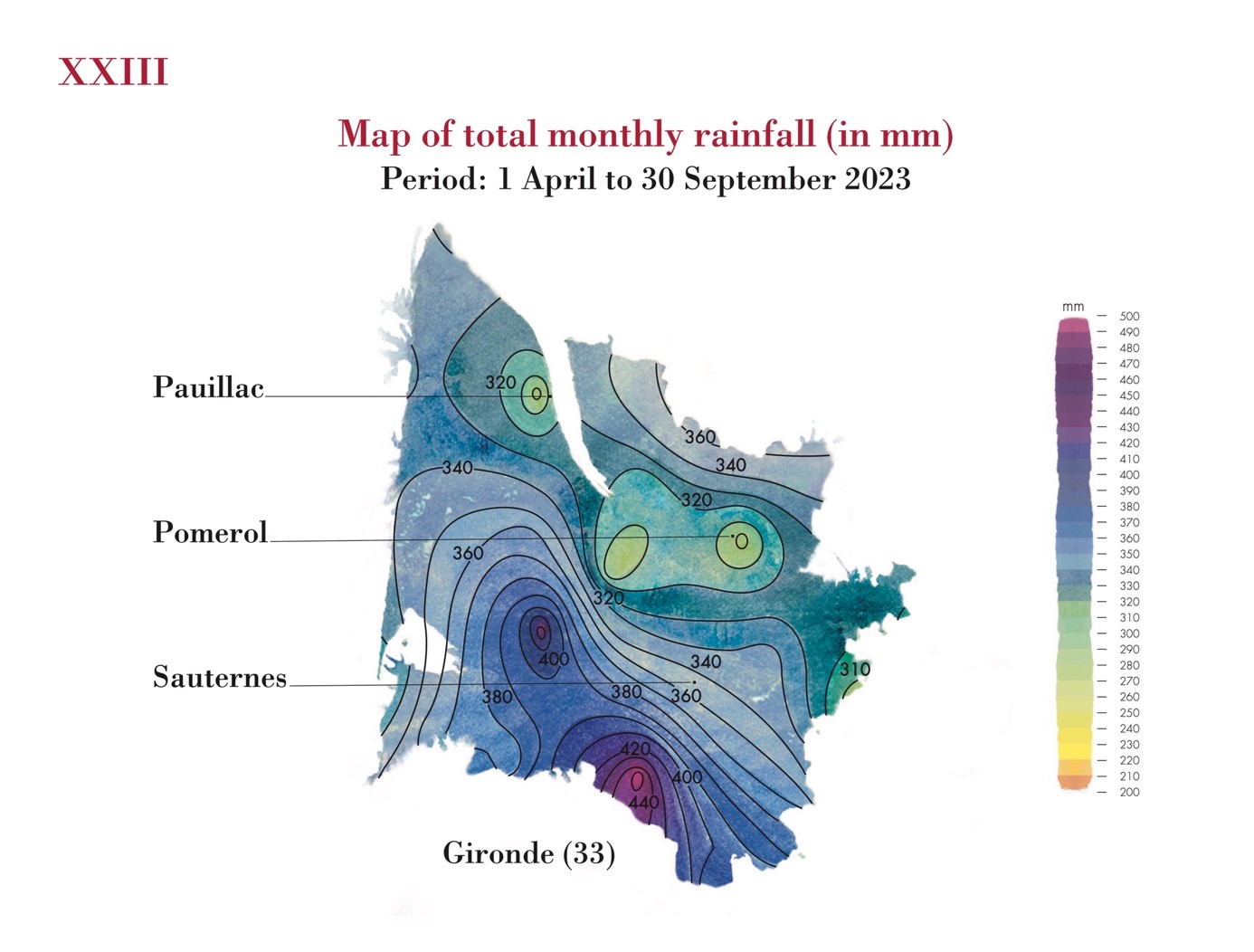

The 2023 vintage is also one of varied microclimatic expression, with sometimes dramatically different conditions from one appellation to another. This was hammered home looking at the rain map from April to September displayed by Domaines Barons de Rothschild for their properties in Pomerol (well under 300mm), Pauillac (around 300mm), and Sauternes (350mm). At Château Montrose in Saint-Estèphe, for example, they had a lot less rain than other appellations, especially in June, and less than average rainfall from April to August, leading Pierre Graffeuille to call 2023 a “hot, dry vintage.”

Credit: Météo France for Domaines Barons de Rothschild (Lafite)

While generalisations are therefore unwise in such a heterogenous vintage, there are patterns common to many wines: a long, temperate growing season has resulted in full phenolic ripeness and high tannin indices on paper, combined with moderate alcohol levels. The most successful wines belie their analytical make-up, with satisfyingly chewy, yet delectable, succulent, silky tannins despite the high polyphenolic content. “The Damocles’ sword was not to extract too much tannin,” explained Benjamin Laforêt, Research and Development Technical Coordinator at Château Angélus.

Though not felt in the better wines, these high levels of tannin can be overpowering and even rustic in the less successful examples. Others quickly adjusted their vinification techniques. “On the first batches we realised extraction was coming fast, so we did a third less pumping over,” recounted Guillaume Thienpont, consultant winemaker at Le Pin. Down the road at Petrus, winemaker Olivier Berrouet was “amazed by the tannic concentration,” so immediately slowed down the volumes of pumping over. “This meant a longer maceration, but we moved the wine less.” In Pessac Léognan, Fabien Teitgen, Managing Director at Smith Haut-Lafitte, concurred: “In 2023 the extractability was incredible, even more than 2022, so we had to be very soft with extraction.”

Also common to most properties (though with certain exceptions) were long harvests and generous yields. Most châteaux we visited recounted longer harvests than average, or even their longest ever, which was the case at Haut-Brion, running from 21st August for the whites and finishing on 4th October for the reds. Even at bijou properties like Beauséjour in Saint-Émilion, picking lasted nine days versus five on average. At Pontet-Canet, harvest lasted 34 days, more than double the usual 12-15. As owner Alfred Tesseron explained, this allowed them “to go in search of grapes wherever they were ripe.”

And there were lots of grapes to pick. At Calon-Ségur, Estate Manager, Vincent Millet hadn’t seen such high yields since 2017. At 45 hl/ha, the property’s yields are representative of many other Cru Classé neighbours in the Médoc. Even organic estates were able to fend off mildew sufficiently to attain abundant yields, with 45 hl/ha at Duhart-Milon and Lafite, and a whopping 53 hl/ha at biodynamic Haut-Bages Libéral, a fact of which Claire Villars-Lurton is immensely proud, as testament to the ability of biodynamic farming to be increasingly resilient the longer it has been in place. Even at Palmer, where yields have been notoriously low over recent years, they managed 32 hl/ha under biodynamics. “We managed the mildew properly this year,” said Managing Director, Thomas Duroux, adding with relief, “we can cover the whole vineyard in six hours now.”

At Ducru-Beaucaillou, Special Advisor on Wine and Markets, Tracey Dobbin MW said the “mildew was easier to control than in 2021.” Nonetheless, controlling it required significant resources for many properties, and some who could not field teams to spray at all the right times lost a high proportion of grapes. “We had to work very, very hard,” recalled Constance Vauthier at Château Ausone. Even for those with less rainfall (for many, the growing season was dryer than average), the high quantity of residual moisture in the soil after heavy rain earlier in the year, combined with hot temperatures, made for conditions which many Bordelais described as “tropical”.

CEO and Director General of Lafite-Rothschild, Saskia de Rothschild told us water management was the key to the vintage. At Les Carmes Haut-Brion, Managing Director, Guillaume Pouthier seconded this statement, underlining the importance of evapotranspiration, and citing several solutions to tackle an excess of water in the ground at the beginning of the season, including cover crops to absorb water, pruning the vines into a Christmas tree shape so water evaporates more easily from the leaves, and working the soil in the early morning to encourage evaporation during the day.

Others were more sanguine about the mildew threat. “We seem to have mildew every spring now,” said Bascaules, who notes rather, “the main problem for us was sunburn.” Nobody was expecting the heatwave that hit at the end of August, and many had removed leaf cover to counter the humidity and allow air flow through the vines, so grapes were left without protection from the hot sun. Nonetheless, this hot, dry fortnight was a blessing, “allowing the plants to sweat out a lot of water,” in Teitgen’s words. “The ball was on the net like in the film Match Point,” recalls Duroux, nail-bitingly. “We really needed that heatwave, to have vines that would invest their energy in the fruit and not on leaf production anymore,” he explained.

Omri Ram, Research and Development Manager & Sales Manager at Château Lafleur, went further: “Until mid-August, we thought the semi-tropical conditions would give a super-duper 2012, ripe and round, but not deep or layered. The two heat spikes late August totally transfigured the style of the wines. We gained layers of complexity and minerality, moving the wines from very good to potentially great.” And so, 2023 was a year of meticulous selection, weeding out the grapes affected by mildew, and sun damage.

The wines display a certain classicism in their freshness, moderate alcohol levels, and with a welcome touch of austerity. For Hubert de Boüard, co-owner at Angélus, they’re “classy wines” rather than classic wines, the latter being “more 2019 or 2001”. But the wines are also modern: precise, silky, and saline. “This vintage is the new style of Bordeaux, not the dense, powerful, oaky wine of 20 years ago,” concludes Pouthier.

So perhaps the most apt tagline for the 2023 vintage in Bordeaux is that chosen by Pichon Comtesse on their tasting booklet: back to the future.

You can discover the hundreds of tasting notes on the Wine Lister and Figaro Vin websites now, including one potentially perfect wine.

As we approach the end of May, the Bordeaux 2020 en primeur campaign is still yet to kick off in full force. The past week has seen a slight lull in en primeur activity, with a selection of mid-level wines trickling onto the market.

Following Pentecost Monday, releases commenced on Tuesday (25th May), with Berliquet 2020 entering the market at £36.25. In the expert hands of Canon and Rauzan-Ségla‘s Nicolas Audebert since 2017, Berliquet is fast becoming a true Saint-Émilion gem to watch. Wine Lister CEO, Ella Lister, notes that she was “totally wowed by this wine – Berliquet’s best yet, on a vertiginous ascent”, detecting “flower pollen, verveine, fennel, and chamomile” on the nose, and a “grounded but melting” texture on the palate.

Nicolas Audebert – Winemaker at Rauzan Segla, Canon, and Berliquet (who released its 2020 vintage on Tuesday 25th May)

Nicolas Audebert – Winemaker at Rauzan Segla, Canon, and Berliquet (who released its 2020 vintage on Tuesday 25th May)

A trio of Margaux properties released their latest vintages on Wednesday morning (26th May), with Kirwan, Prieuré-Lichine, and Marquis de Terme 2020 entering the market in quick succession. At £25.37, Prieuré-Lichine’s latest release falls under the price of all recent back vintages in the market, while a score of 17 from Julia Harding for JancisRobinson.com places it in line with the well-regarded 2019 vintage. Offering good value for quality, the 2020 is described by Julia as “fragrant with the intense aromas of cassis and spicy black plum”, with a full palate that remains “nicely dry and fresh on the finish”.

Added to the mid-week haul is another Margaux estate, du Tertre, who this year received its highest ever score from Julia Harding for JancisRobinson.com (17+). Ella was also impressed by the latest release, which entered the market yesterday (Thursday 27th May), describing “charming, meandering fruit on the palate”. Having been sold by AJ Domaines (owners of fellow Margaux property, Giscours) this year, du Tertre is now under the helm of the Helfrich family, who have hired Cynthia Capelaere (formerly of Villemaurine) as the new Estate Director. As we often see following the sale and acquisition of an estate, this may be one to watch for future investment as it is revitalised by its new owners.

Also released yesterday, Quinault l’Enclos 2020 was described by Ella as “the culmination of the Cheval Blanc team’s work at this property since its acquisition in 2008”. Tasting in Bordeaux, she notes that “the trademark smoked notes have been relegated to the merest hint”, with “rich, dapper fruit” on the nose, and a palate with an “exceptional light-tough and melting mouthfeel”.

Also released this week are: Cantemerle, Chasse-Spleen, Château Les Cruzelles, Grand Corbin-Despagne, Larrivet Haut-Brion, Kirwan, and La Lagune.

The second half of this week has seen releases from first growth Margaux, Super-seconds Pichon Baron, Ducru-Beaucaillou, and more.

The two highest-priced wines released over the last two days have bucked discount trends set by their peers earlier in the campaign. Ausone 2019 was released on Wednesday 17th June, and merchants have been offering the wine for c.£432 per bottle in-bond (or 22% less than the 2018 vintage). Earlier in the campaign, Saint-Emilion Grand Cru Classé “A” neighbour, Cheval Blanc offered a healthier discount on its 2019 (of 32%), resulting in the competitive price of £375 per bottle.

Similarly, the last first growth of the campaign emerged yesterday, its grand vin entering the market at £350 per bottle. Margaux 2019 offers a 16% discount on last year’s release price. Sitting more or less in the middle of 2019 prices from its two Pauillac comrades, Margaux nonetheless looks good when one considers Managing Director Philippe Bascaules’ poignant comment, naming the 2019 “much more Château Margaux” than the 2018. The 2019 also achieves Margaux’s best WL score (98 points) since the 2009 vintage. Volumes released onto the market are identical to last year, which will no doubt help to gain further appeal from buyers missing out on Lafite and Mouton.

Margaux’s second wine, Pavillon Rouge, and dry white, Pavillon Blanc were also released, at £125 and £168 per bottle (in-bond) respectively.

Of the c.100 wines released so far that Wine Lister covers, just eight of them have provided a 30% discount or above on 2018’s release price, while almost 40 wines have offered discounts of less than 15%.

Of the c.100 wines released so far that Wine Lister covers, just eight of them have provided a 30% discount or above on 2018’s release price, while almost 40 wines have offered discounts of less than 15%.

Pauillac powerhouse Pichon Baron also entered the market with its 2019 at £99 per bottle (15% below the current market price of 2018). Wine Lister partner critic, Neal Martin, awards it 96-98 points, simply saying, “this is an outstanding Pauillac”. The same score was given by Martin to Saint-Julien super-second, Ducru-Beaucaillou, which also released yesterday. While both 2019 releases will no doubt find homes among followers of the brands and big en primeur buyers, in each case a recent back vintage also looks appealing in comparison – the 2015 Pichon Baron, and 2014 Ducru-Beaucaillou.

The Barton family wines joined the release fray this week – Léoville Barton, Langoa Barton, and value buy Mauvesin Barton. Wine Lister partner critics give high praise to the flagship release – Léoville Barton. Neal Martin and Antonio Galloni both award it 94-96 points, the latter saying, “what a gorgeous wine the 2019 is”. Together with James Lawther’s score of 18/20 for JancisRobinson.com, Léoville Barton 2019 achieves its highest Wine Lister score since the 2015 (95 points), which still has some availability in the market at around the same price.

Brane-Cantenac released yesterday at £41.50 per bottle. Its 2018 was one of Wine Lister’s absolute favourites during last year’s en primeur tastings, and judging by the latest critical acclaim, the 2019 has achieved another quality step up – James Lawther gives it 17.5 points, and names it “the epitome of fine Margaux”. This wine continues to provide excellent value when compared to similar quality offerings of its appellation.

La Lagune 2019 also entered the market, at £25 per bottle (in-bond). Having produced no wine in 2018, the latest release is priced 19% below the 2017, and is the cheapest recent vintage available on the market. Neal Martin awards it 92-94 points, naming the wine “not impactful, but intellectual”, and noting it will give “25-30 years of drinking pleasure”. With a potential record-level quality at such an attractive price, La Lagune could be the value buy of the entire campaign.

A further favourite, and poster child for good value, Meyney, also released its 2019 on Wednesday. Coming onto the market under £20 per bottle, and as the cheapest Meyney available, the wine is a no-brainer, as it continues to punch above its weight for quality.

Also released on Wednesday 17th and Thursday 18th June were: Canon-la-Gaffelière, Chapelle d’Ausone, Clinet, Clos de l’Oratoire, Croix de Beaucaillou, d’Aiguilhe, and La Mondotte.

We say it every year – the prices have to be “right”. While the Bordeaux 2019 en primeur campaign may be exceptional operationally, the same message resounds from the trade as in many a previous en primeur campaign – the prices have to be right.

Chairman of Farr Vintners, Stephen Browett, defines the crux of the matter succinctly; “one thing that is absolutely crystal clear is that for this en primeur campaign to work, Bordeaux must return to the fundamental (and recently ignored) concept that en primeur wines need to reach the consumer at lower prices than physically available vintages”. For at least the last three Bordeaux en primeur campaigns, release prices have generally been too high. The key difference this year is that the Bordelais have a unique opportunity – COVID-19 and the ensuing global economic crisis – to bring prices down significantly without losing face, or undermining the pricing of previous vintages.

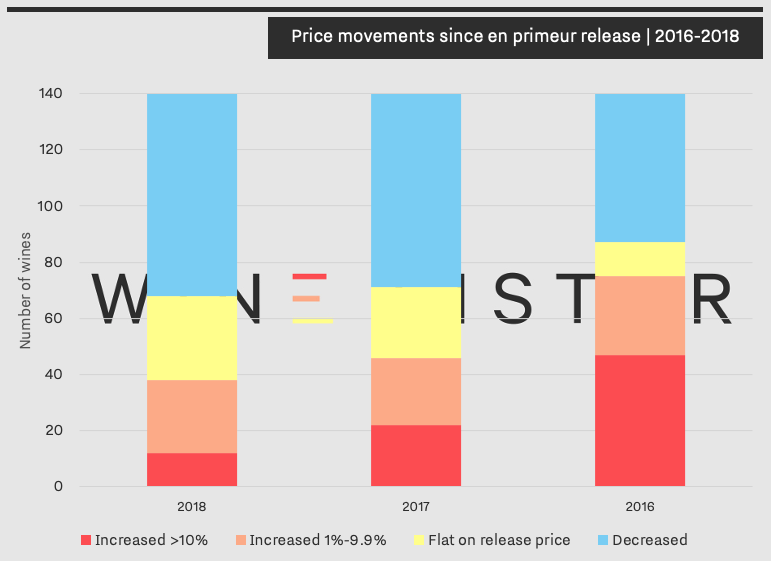

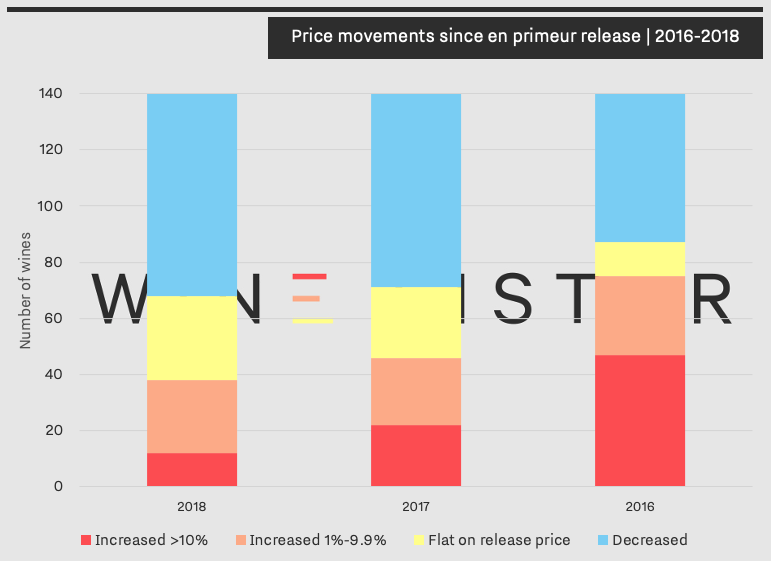

Analysing a basket of 140 top Bordeaux wines, the chart below looks at price movements of the last three vintages on the fine wine market since their respective releases.

Bordeaux 2016s were released three years ago. As shown in the chart above, today just over half of them are worth more than they were en primeur – these 75 wines have increased by an average of 18% since the spring of 2017, although they include the likes of Les Carmes Haut-Brion, Lafleur, and Petrus, which have seen mammoth price increases of 111%, 109%, and 64% respectively. 65 of the top Bordeaux 2016s have either stayed flat or have decreased in price since en primeur release. Assuming an in-bond storage cost of £12 per case for the last year on these, the chances are that many buyers would have saved more money purchasing 2016s now.

The picture is worse for 2017 and 2018 releases, with approximately half of wines having decreased in value. Last year the high quality of the vintage coupled with small quantities available was cited repeatedly as a reason for price hikes. This year, however, there is no glass door to hide behind. The quality of the 2019 vintage is reportedly excellent, but volumes are also good. Add to this the unprecedented context of a campaign during a global pandemic, and the pressure is on more than ever for prices to drop significantly.

Buying Director of BBR, Max Lalondrelle, tells me, “in order for the consumer to put their faith in the product without knowing too much about the quality or style, the wineries will have to offer some relatively good prices to entice consumers to take the risk”. Members of the trade have elsewhere qualified what “good prices” might mean – a price reduction of 30-35% on 2018s. Flying blind and relying on the historical quality of solid brands to make choices in 2019 (in the absence of all the usual critics scores) is one thing – doing so in the face of such an uncertain future for many is another entirely. For releases to work this year, sacrifices will need to be made by the châteaux – quality of the wine must be put aside, as context, and getting the market to bite during such difficult times, will be everything.

The first major release so far has listened to the market – Pontet-Canet’s 2019 is priced 30% lower than 2018s release. Feedback on the release has been good – Chief Executive of Goedhuis, Tom Stopford Sackville, tells us it was “a very encouraging start to the campaign”, and a “positive signal regarding 2019 pricing in general”. If other châteaux follow suit, the campaign could be a memorable one, that, as Browett puts it, inspires “a new confidence” in en primeur “after recent disappointing campaigns”.

The fine wine trade (Wine Lister included) is rooting for Bordeaux, willing its unique selling system to deliver. The equation for pricing this year could in some ways not be simpler – it is hoped that a sufficient number of properties will take this into account, and present prices the market can embrace.

Releases are set to begin in earnest from tomorrow – 2nd June. Follow them through Wine Lister’s Twitter, or through our dedicated en primeur page.

Chloe Ashton

June 1, 2020

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited

Part of the Wine Lister team kicking off their week of en primeur tastings at Petrus. Photo © Wine Lister Limited