With the days quickly shortening and misty mornings become the norm, we bid farewell to rosé for the year and welcome back old favourites. Autumn is the perfect season for Piedmontese reds, which are not only so redolent of mist-covered hills, but also pair perfectly with the region’s food at this time of year. With that in mind, this week’s Listed section features Piedmont’s top five wines by Brand score.

Whilst Barolo might be the region’s most famous appellation, it is Gaja Barbaresco that tops the table with an outstanding Brand score of 976. It performs extremely well across both of Wine Lister’s Brand criteria – restaurant presence and online popularity – coming first and second respectively. It is visible in 33% of the most prestigious establishments worldwide, and attracts more than 8,400 searches on Wine-Searcher each month.

Giacomo Conterno Barolo Monfortino Riserva comes next (968). The first of three Wine Lister Buzz Brands in the group, it is by far the most expensive. Receiving on average 9,358 searches each month on Wine-Searcher, it is also the most popular wine in the group. Interestingly, despite experiencing the lowest restaurant presence (23%), it enjoys the greatest depth in terms of number of vintages and formats listed (4.4) – testament to its extraordinary ageing potential of over 24 years.

Bartolo Mascarello Barolo (of “no barrique, no Berlusconi” fame) fills the third spot. This staunchly traditional producer enjoys its best scores in the Brand category, with its excellent search frequency of over 7,000 searches each month helping it to a score of 960.

The last two spots are filled by another wine each from Giacomo Conterno and Gaja – Barolo Francia (formerly Casina Francia) and Sperss (now labelled as Barolo again from the 2013 vintage after 17 years declassified to Langhe Nebbiolo) [Friday fun fact – Gaja now labels wines under the Europe-wide DOP classification rather than the strictly Italian DOC status]. Both wines have strong restaurant presence, at 30% and 31% respectively. Either would be a perfect accompaniment to Alba’s famous white truffles, which will be starting to appear in some of those restaurants now.

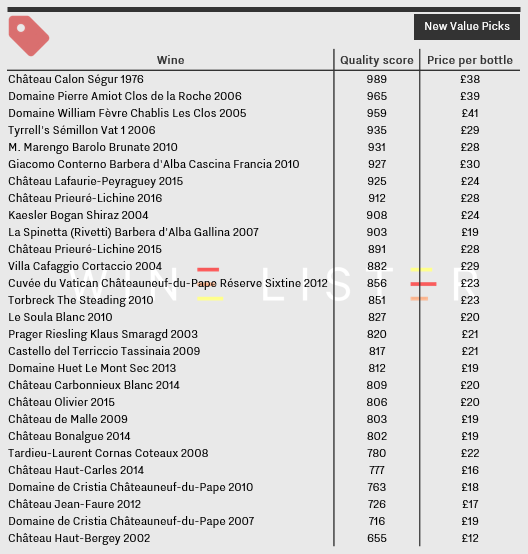

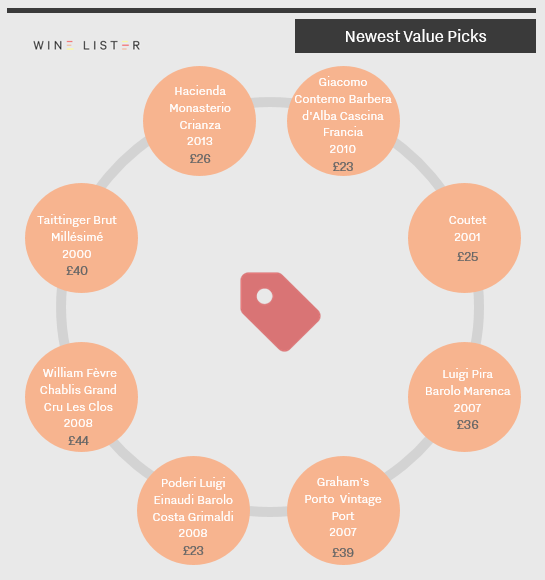

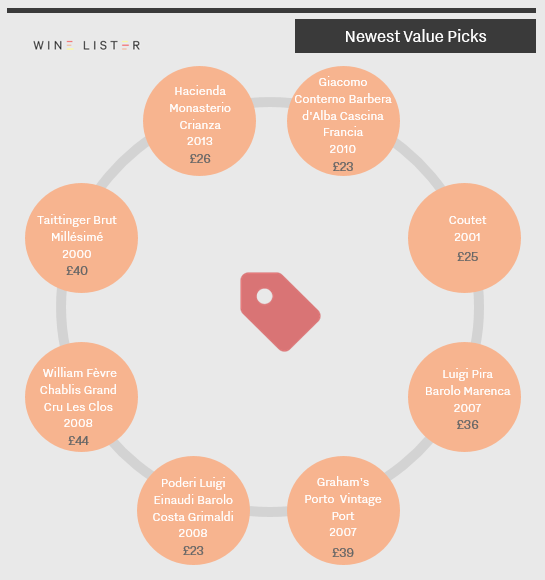

One of Wine Lister’s four Indicators, Value Picks identify the wines and vintages which have the best quality to price ratio, with a proprietary weighting giving more importance to quality, thus giving the finest wines a look-in.

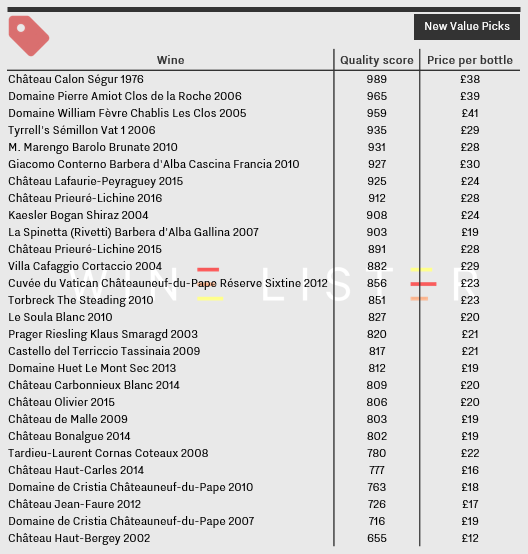

With the latest price data in, 28 new wines have recently qualified as Value Picks. While Value Picks are calculated using a three-month average bottle score for accuracy (in order to take into account any price fluctuations), we have shown the current price per bottle below for ease of comparison. Please note that the price shown is excluding duty and VAT, and often reflects prices available only when purchasing a full case:

Bordeaux dominates the new Value Picks, filling 11 of the 28 spots. Margaux’s Prieuré-Lichine seems a particularly keenly-priced brand at the moment, with both its 2015 and 2016 vintages now Value Picks. With Wine Lister Quality scores of 891 and 912 respectively – very strong and amongst the strongest on Wine Lister’s 1000 point scale – and both priced under £30, they represent excellent value buys. Within Bordeaux, Pessac-Léognan is home to the highest number of new Value Picks. Of those, two are white, with Château Carbonnieux Blanc 2014 and Château Olivier 2015 achieving very similar Quality scores (809 and 806 respectively), and each priced at just £20.

The other wine to feature twice in the latest update is Domaine de Cristia Châteauneuf-du-Pape, with its 2010 and 2007 vintages. The former, which achieves a Quality score of 763, is available at just £18 per bottle. With plenty of life left in it, it looks like a great buy.

Three Piedmontese wines recently qualified as Value Picks – M. Marengo Barolo Brunate 2010, Giacomo Conterno Barbera d’Alba Cascina Francia 2010, and La Spinetta (Rivetti) Barbera d’Alba Gallina 2007. All three achieve powerful Wine Lister Quality scores of over 900 points. You might buy Giacomo Conterno’s wines to impress – the Barolo Cascina Francia is a Wine Lister Buzz Brand, but also averages £157 per bottle. If you’re looking for something more appropriate for a weeknight, the 2010 vintage of the same producer’s Barbera d’Alba, priced at just £30, would be an excellent Value Pick – a perfect example of how Wine Lister’s indicators can help you find the right wine for any situation.

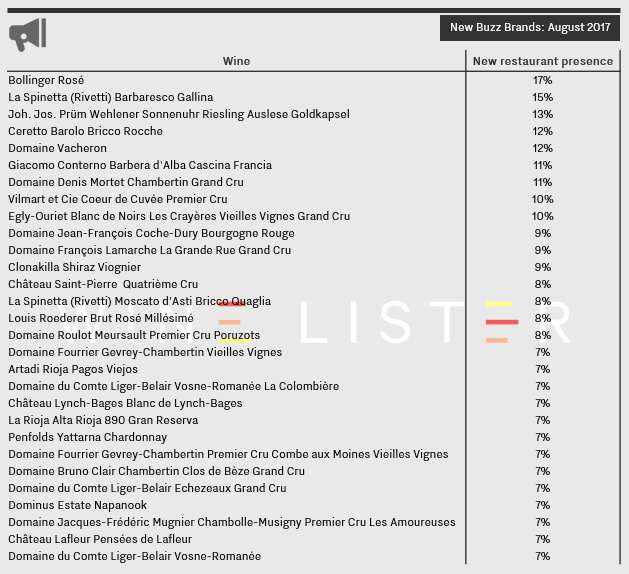

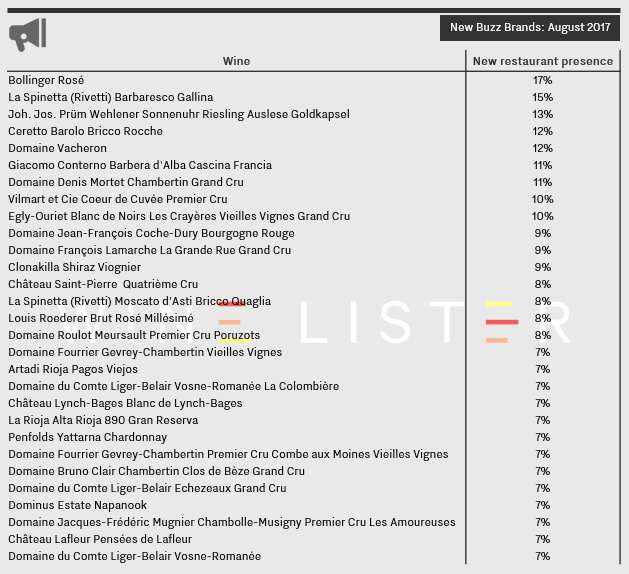

Wine Lister’s four Indicators – Investment Staples, Value Picks, Hidden Gems, and Buzz Brands – were designed to enable users to find the perfect wine for any scenario in just a couple of clicks. Buzz Brands, the most talked-about wines, are sure to impress: they have strong distribution across the world’s top restaurants, show high online search frequency or a recent growth in popularity, and are identified by the fine wine trade as trending or especially prestigious.

Having recently expanded and updated Wine Lister’s restaurant presence coverage, 29 new wines now qualify as Buzz Brands, their global distribution broadening. To achieve Buzz Brand status, a wine must be among the top fifth of all wines that feature at least once on the menus of the world’s best restaurants – prized for their wine lists as well as their food.

Of the 29 wines above, 11 hail from Burgundy, confirming the region’s continued demand amongst the restaurant trade. Domaine du Comte Liger-Belair fares particularly well, with three of its wines becoming new Buzz Brands, thus suggesting it is a producer on an upward trajectory. These wines also benefit from a high online search frequency, as measured by Wine-Searcher, with the wine with the highest number of searches, Domaine du Comte Liger-Belair Echezeaux Grand Cru, seeing 1,400 searches per month.

Champagne has also benefitted from the restaurant presence update, with four wines from the region gaining Buzz Brand status. Of this month’s new Buzz Brands, Bollinger Rosé now has the most impressive distribution, present in 17% of the world’s top establishments.

Piedmont sees four wines attain Buzz Brand status. Two new wines from La Spinetta now qualify as Buzz Brands, with Ceretto Barolo Bricco Rocche and Giacomo Conterno Barbera d’Alba Cascina Francia making up the quartet.

There are three new Bordeaux Buzz Brands, and one carries the accolade of being the most searched-for wine in the table. Château Saint-Pierre receives in excess of 3,700 searches per month, which in addition to appearing on 8% of the world’s very best restaurants makes it well-deserving of its new Buzz Brand status.

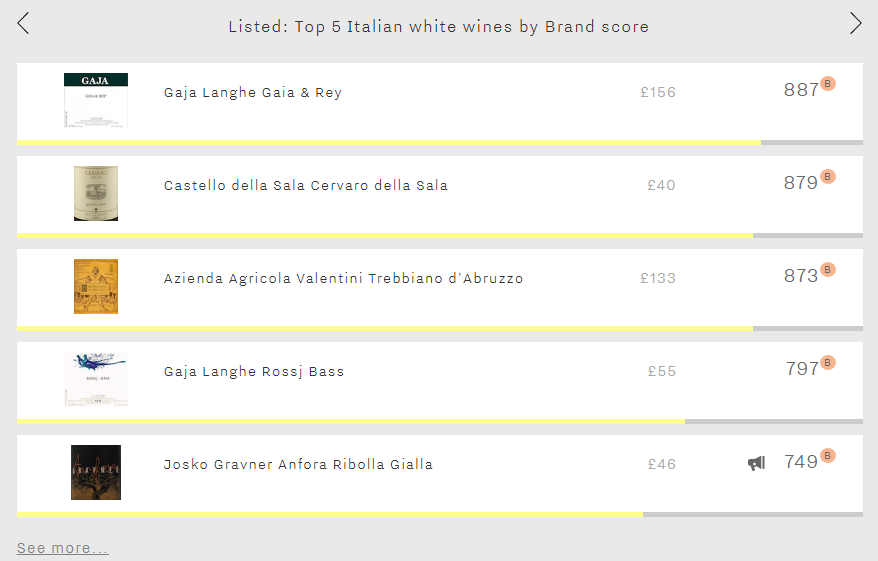

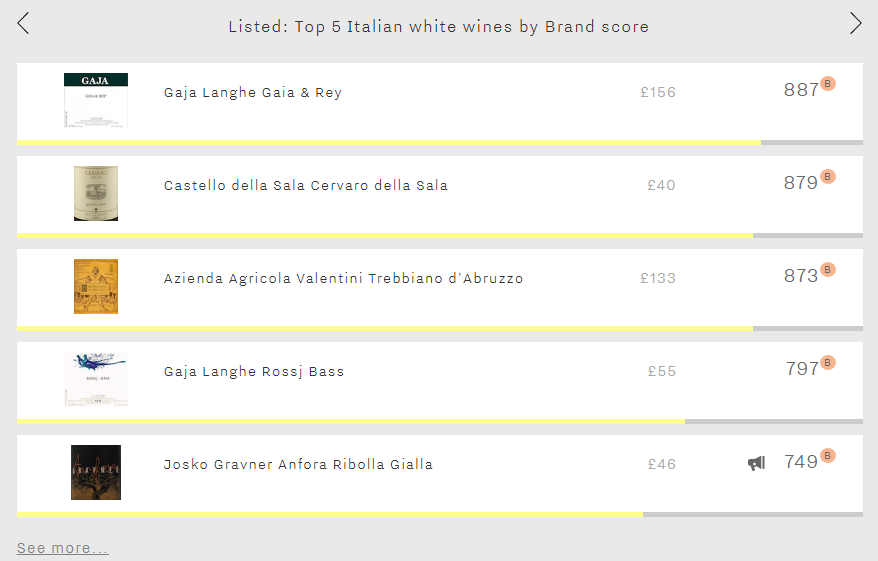

This week’s Listed section features the five Italian white wines with the strongest brands. They comprise two Langhes from Gaja (Gaia & Rey and Rossj Bass), two of Italy’s cult whites (Valentini Trebbiano d’Abruzzo and Gravner Anfora Ribolla Gialla), and Cervaro della Sala (from the Antinori stable).

Whilst these wines all enjoy strong or very strong Brand scores, they do not command the same level of brand recognition as the top five Italian red wine brands, trailing them by c.90-250 points in the Brand category. Tuscan powerhouses Sassicaia, Tignanello, Ornellaia, Solaia, and Gaja’s Barbaresco all achieve Brand scores of over 975 points, with Sassicaia’s outstanding 997 points putting it ahead of the likes of Cheval Blanc and DRC La Tâche.

Wine Lister’s Brand scores comprise restaurant presence and consumer popularity. It is in the latter category that the whites have the most ground to make up. For example Gaja Langhe Gaia & Rey, which featured in our latest blog on new Investment Staples, is present in well over half the number of restaurants of its close relative Gaja Barbaresco, but it receives under a quarter of the number of searches each month on Wine-Searcher. If sommeliers are convinced that these top Italian whites can grace the tables of the finest establishments, they still fly well under the radar of most consumers.

Certain wines are a safer store of value than others. One of our four Wine Lister Indicators – Investment Staples – enables you to spot these instantly. The bespoke algorithm identifies wines of a high quality level, long-lived and not too old, above a certain price (therefore soaking up the frictional costs of collecting wine), with proven price performance, stability, and liquidity.

This last criterion is measured using the number of bottles traded at wine auctions globally. With the latest quarterly data in from Wine Market Journal, 16 new wine and vintage combinations (across nine producers) have recently become Investment Staples. These wines are all over £50 a bottle, with the majority falling under £400, but the most expensive – Roumier’s 2013 Musigny – costing £4,851.

Several of the new Investment Staples have displayed an upward price trend over the last six months, in particular Leroy’s Vosne-Romanée Aux Brûlées 2013 and Roumier’s 2008 Musigny, both of which have seen increases upwards of 30%.

Wine investment is not often associated with white wines, but six of the new Investment Staples are just that. All possess staying power, and are young enough to have room for improvement. What is more, they are made by some of the finest wine producers there are, allowing them to challenge some of their red neighbours in terms of investment fundamentals. Of these, Roulot’s Meursault Charmes 2012 has the best six-month price performance, plus one of the longest drinking windows based on the average assessment of our partner critics. Jean-Marc Roulot has been a rising star for several years now, but his wines are still in the ascendancy.

The new Investment Staples nearly all hail from Burgundy, with just a handful of entries from Piedmont and the Rhône. Those seeking something a bit different that still possesses the criteria of a solid investment might look to Italian white, Gaia & Rey 2012 from Gaja, which has a drinking window of 2015-2025, 6.3% six-month price performance, and price tag of £124.

To search for more Investment Staples, subscribers can click here, filtering by country, region, type, style, price, and score, to drill down exactly into what wine you’re after.

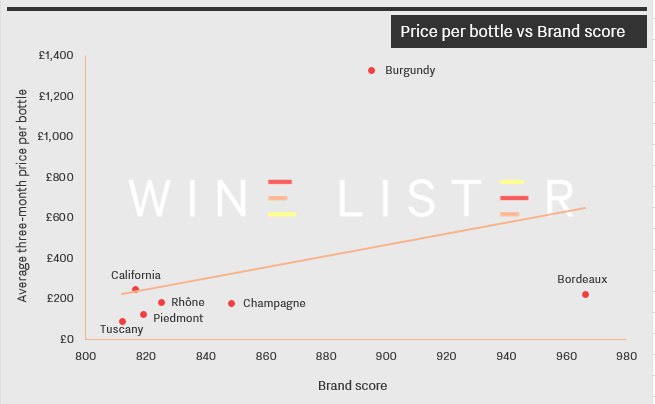

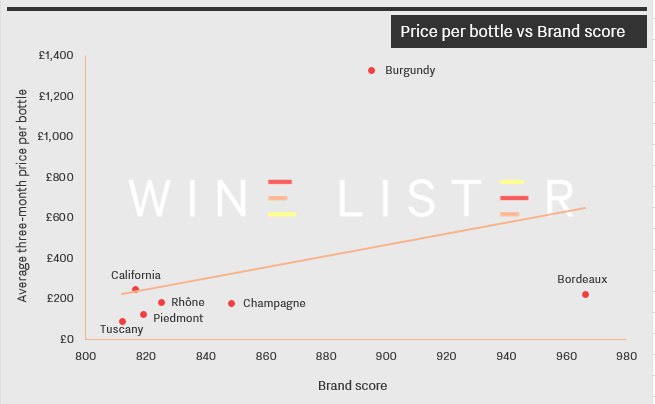

Following on from our recent blog on the relationship between price and quality for seven leading wine regions, today we turn our attention to the role that brand strength plays on price for those same regions. The chart below compares the regions’ average three-month market price to their average Brand scores, using the same 50 overall top scoring wines in each region as in the previous post.

Bordeaux’s crus classés enjoy unassailable brand strength, a product of the success of the region’s classification system and the fact that its châteaux have enjoyed global renown for centuries. If you want brand for your buck, look no further.

Conversely, Burgundy’s extraordinary prices far exceed the level of brand clout commanded by its top crus. Its top wines trail the average Brand score of Bordeaux’s by 7%, but sell for nearly six times as much. This suggests that quality, and perhaps small production levels, play more of a part in the region’s prices.

The five remaining regions are more evenly matched. Tuscany’s wines have both the lowest average Brand score and the lowest prices, followed closely by Piedmont. Meanwhile California’s top 50 wines, which have the second-lowest average Brand score, command the second-highest prices. Top wines from the Rhône and Champagne command similar prices to their Bordeaux counterparts, but with average Brand scores more than 100 points lower.

In today’s blog, we’ve taken a look at the relationship between price and quality for seven leading wine regions. The chart below compares the regions’ average three-month market prices to their Quality scores, with the data calculated from each region’s 50 best-scoring wines (in terms of overall Wine Lister score).

While six regions are clustered relatively close to each other, Burgundy finds itself at the extreme top end of the scale: its wines outperform on quality and have the prices to match. The top 50-scoring wines in Burgundy average a whopping £1,330 per bottle, driven by the likes of DRC La Romanée-Conti at £10,776 and Domaine Leroy Musigny at £7,805.

The Rhône’s wines have the lowest average Quality score but not the lowest prices: at £188 per bottle on average, they are the fourth most expensive of the group. California and Bordeaux display a very similar profile, appearing just above the trendline, indicating that these wines command high prices not simply on account of quality – brand also plays a part.

Champagne and Piedmont, meanwhile, fall below the line, suggesting that as regions they tend to offer value for money. Piedmont’s ranking is particularly impressive: second only to Burgundy in terms of average Quality score, its wines are available for a tenth of the price on average.

The latest price data is in, enabling Wine Lister’s algorithm to award new Value Pick status to those wines that achieve the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus allowing the finest wines a look-in).

This month, the new Value Picks include a Champagne, a Port, and a sweet white Bordeaux, but it is Piedmont that dominates, with three of its wines achieving Value Pick status: Poderi Luigi Einaudi Barolo Costa Grimaldi 2008, Luigi Pira Barolo Marenca 2007 and Giacomo Conterno Barbera d’Alba Cascina Francia 2010.

Each wine is priced at £44 per bottle or less – with half under £30 – and all have impressive Quality scores (based on ratings from our three partner critics) of 845 or above.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

Wine Lister has produced its second in-depth regional study, this time on Tuscany – a many-faceted fine wine region that is fast-building its position on the global fine wine stage. We will be revealing some of the findings on the blog in the next few weeks, but the full 35-page report is available for subscribers on the Analysis page.

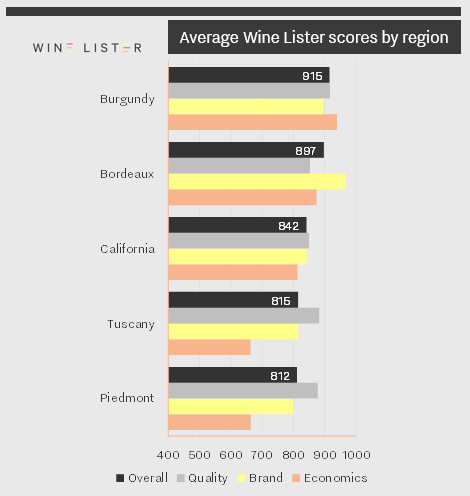

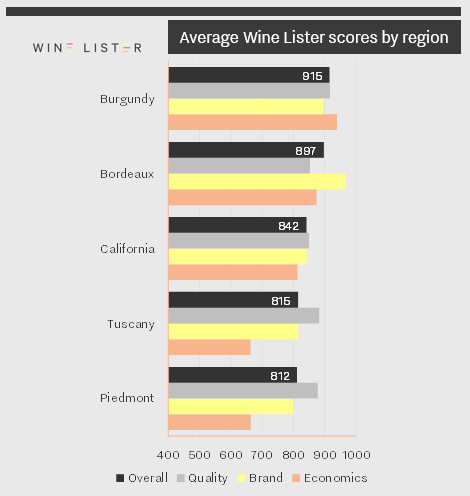

The study focuses on 50 top Tuscan wines, which we have compared below with 50 wines from Piedmont, Bordeaux, Burgundy, and California. Using the three categories that comprise an overall Wine Lister score – Quality, Brand, and Economics – we can put the region’s global positioning in context.

Although Tuscany comes fourth overall – just ahead of Piedmont – its Quality score is bettered only by Burgundy, scoring 883 points to Burgundy’s 917. Quality scores are derived from Wine Lister’s partner critics’ scores and a wine’s ageing potential, and Tuscany’s excellence in this category may be one explanation for its rising appeal.

Tuscany’s Brand score is the fourth best of the group, suggesting that after a handful of top brands such as the Super Tuscans, the rest of the top 50 do not confer the same level of prestige as wines in Bordeaux, Burgundy, or even California. Meanwhile, the region’s commercial clout is the weakest of the group, scoring one point less than Piedmont in the Economics category.

In upcoming posts, we will delve into the trade’s view on Tuscany’s foremost appellations and which are the wines to watch.

“Which producers will see the largest gain in brand recognition in the next two years?” That was one of the questions Wine Lister asked its Founding Members, in its latest survey of 49 of the world’s key wine trade players, between them representing well over one third of global fine wine revenues.

Continue Reading →