Price nearly always plays a part in the decision-making process of purchasing wine. Typically, much emphasis is placed on the importance of “value” – “how much quality am I getting for the price of this bottle”, for which Wine Lister has its very own indicator, Value Picks. However is simply offering “good value” enough?

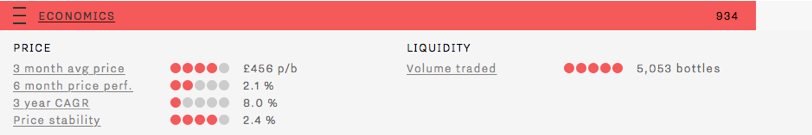

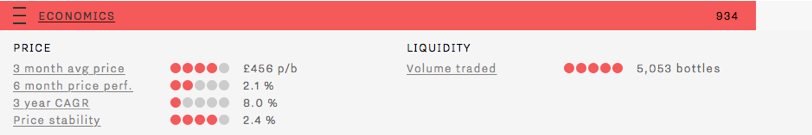

Wines purchased for long-term cellaring carry financial risk just as investment does. With this in mind, Wine Lister’s Economics scores reflect not only a wine’s price, but the performance of that figure over time. As well as a three-month average market price, and six-month / three-year price growth, Wine Lister’s algorithm takes into account price stability as a factor in determining a wine’s Economic strength.

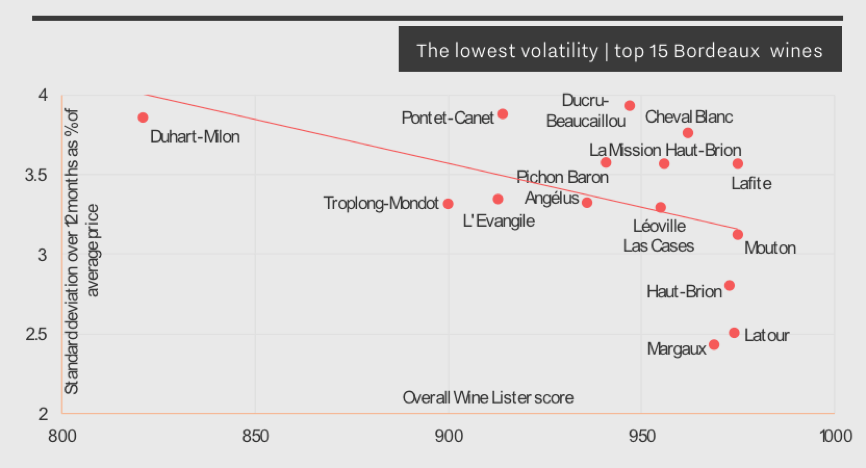

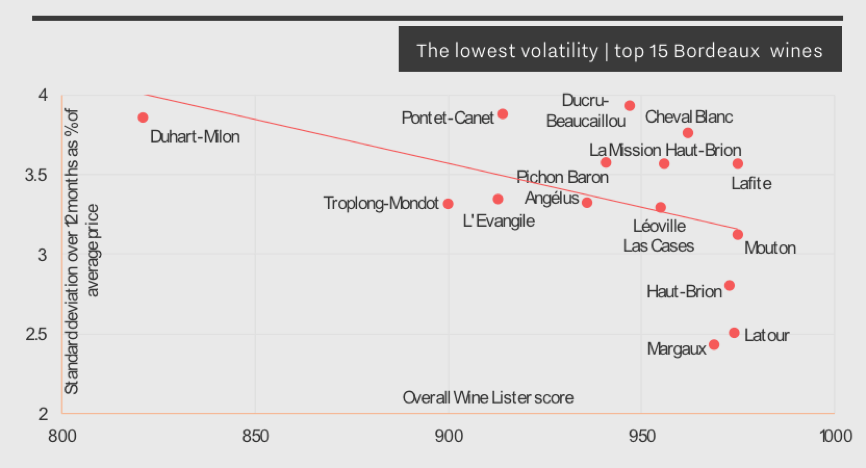

Using historical prices provided by our data partner, Wine Owners, we calculate the standard deviation of a price over the last 12 months, expressed as a proportion of the average price over the same period.

Volatility can be caused by price movements both up and down. Nobody wants to see the price of a wine plummet after purchase, but equally, wines with prices rising too high and too fast display risk too, and are therefore also sanctioned with lower Economics scores.

Below is an extract from this year’s Bordeaux Market Study featuring the 15 most stable Bordeaux wines. All five left bank first growths appear, testament that higher-scoring wines tend to experience less volatility. This is also tied in with liquidity: frequently traded wines tend to benefit from multiple reference points allowing a consistent market price to be determined. Conversely, a wine traded less frequently often sells at a markedly different price from one transaction to the next, resulting in a much more volatile market price.

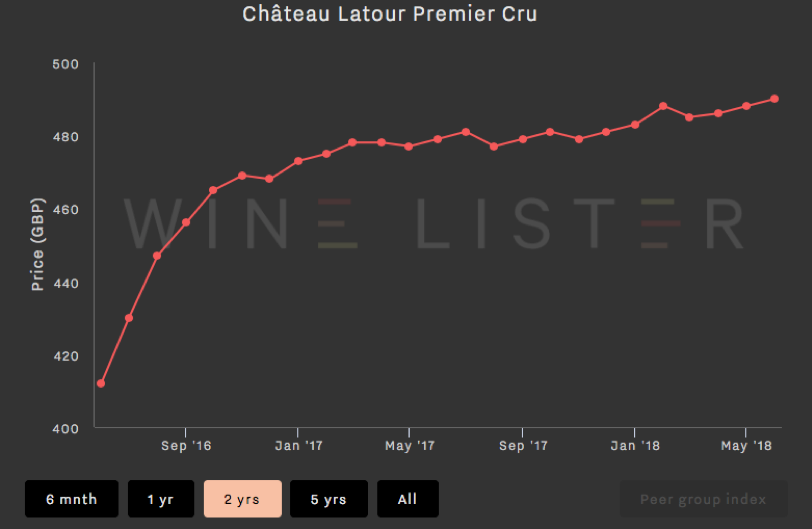

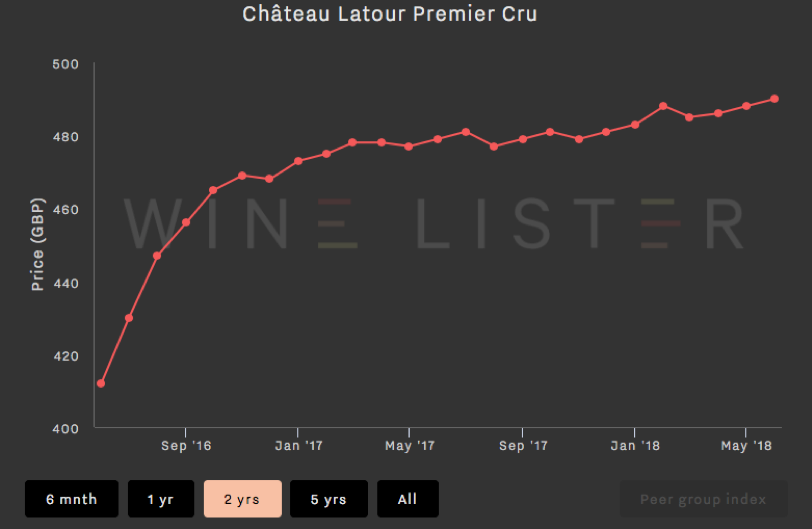

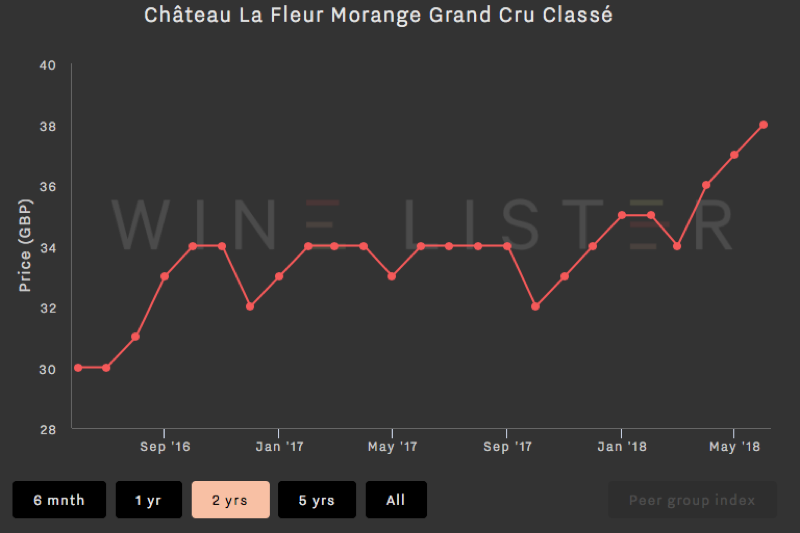

While Château Latour’s slow and steady price growth (as shown in the chart below) results in relatively low six-month price performance and three-year compound annual growth rate (CAGR) ratings, its strong Economics score is thanks to a high three-month average price, a high volume of bottles traded at auction, and a low price deviation of just 2.4% over the last 12 months.

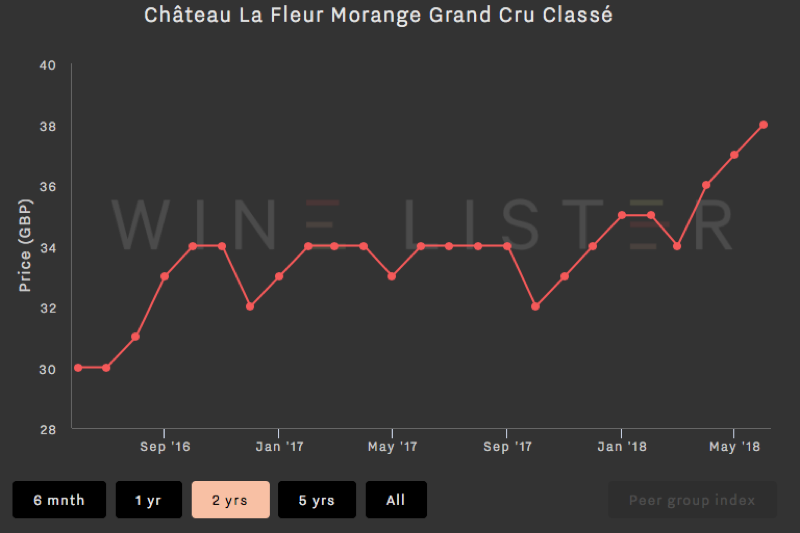

The chart below shows a very different picture – this wine has experienced a 14.7% price increase in six months. Though this in itself is positive, its price has therefore deviated 12.5% in the last 12 months, and the yo-yoing nature of the price over the longer term earns it a much lower Economics score (492).

As July begins, much of the wine world may feel more grey and drizzly than the weather would suggest, due to a case of post-primeurs blues. Indeed, Wine Lister’s founder, Ella Lister, reports in her recent article for JancisRobinson.com that “…the majority of merchants are reporting revenues down approximately two-thirds on 2016”. In that article, a comparison of Quality scores across recent vintages highlights the value proposition of the 2014 vintage. In this blog post we dig a bit deeper.

A few weeks into this year’s en primeur campaign releases, the Wine Lister team noticed a distinct pattern. With almost every new release, we sounded more and more like broken records, echoing that château X’s 2017 release price, while below the last two vintages, made the 2014 look like good value. While it has been pigeonholed as a good but not great vintage, 2014 achieved consistently high critics’ scores that imply its reputation should be better.

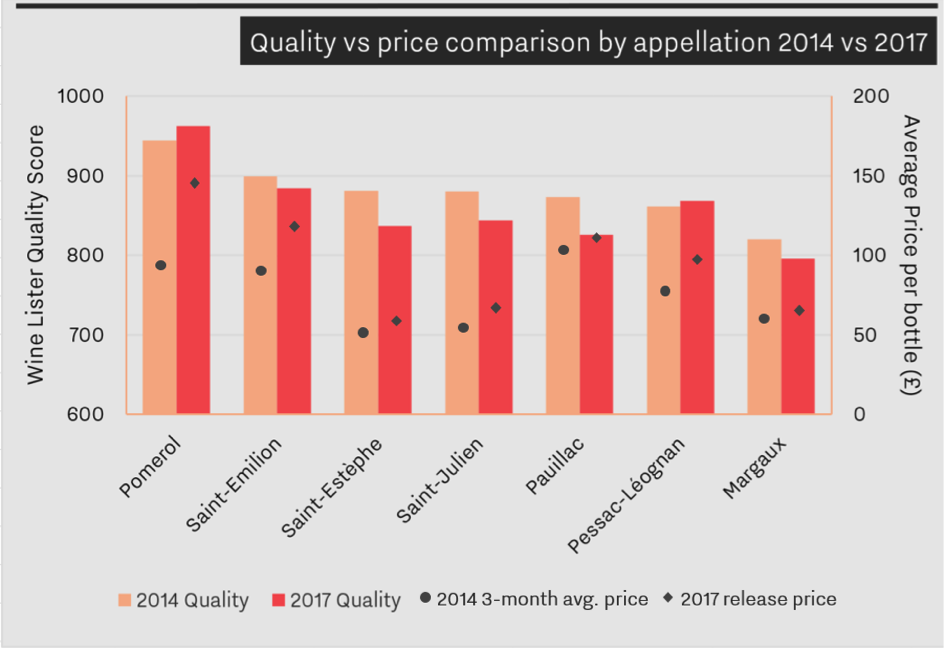

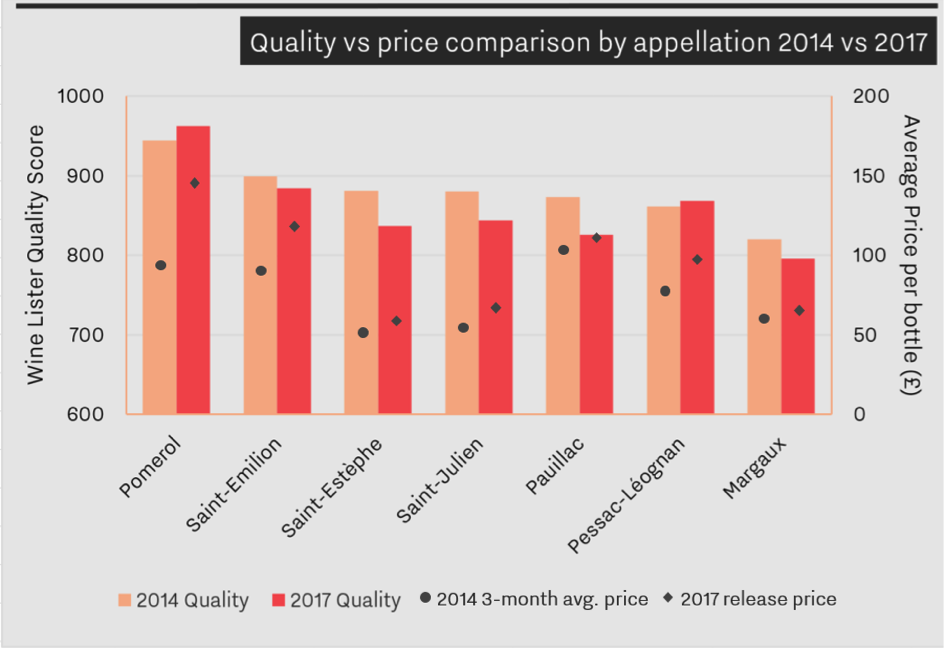

The chart below shows Bordeaux 2014 and 2017 average Quality scores by appellation, comparing 2014 three-month average prices with 2017 release prices.

Based on 75 key Bordeaux classified growths, the chart illustrates the relationship between quality and price (note the price gap for 2014 and 2017 Saint-Émilion, despite similar average Quality scores). Only Pomerol and Pessac-Léognan achieved higher Quality scores on average in 2017 than in 2014, with Wine Lister’s partner critics preferring 2014 across all other appellations.

While the trade puts aside its allocations of 2017 for the time being, perhaps the silver lining is the light this vintage shines on relative value elsewhere. Is it time for merchants and collectors alike to focus on 2014?

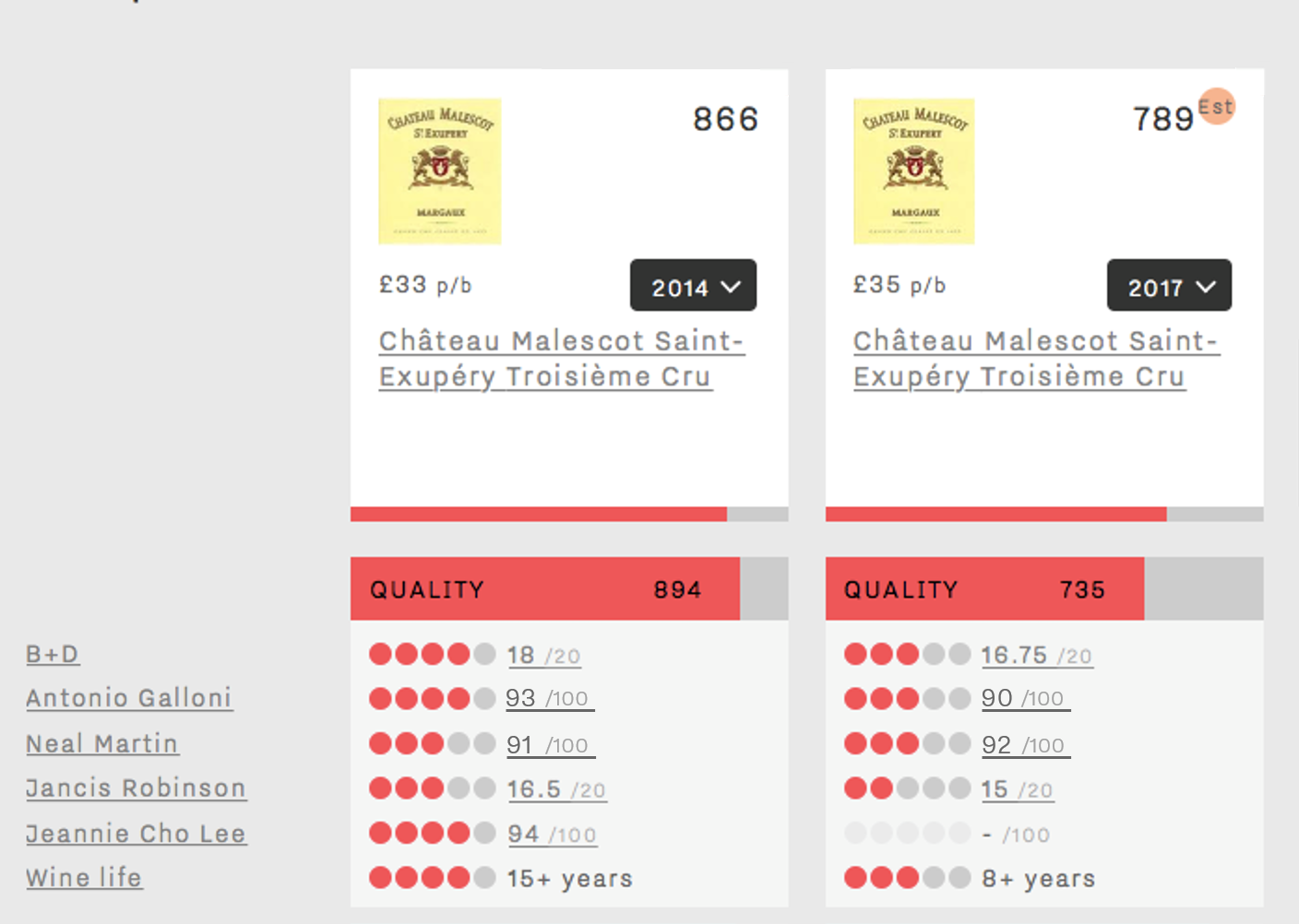

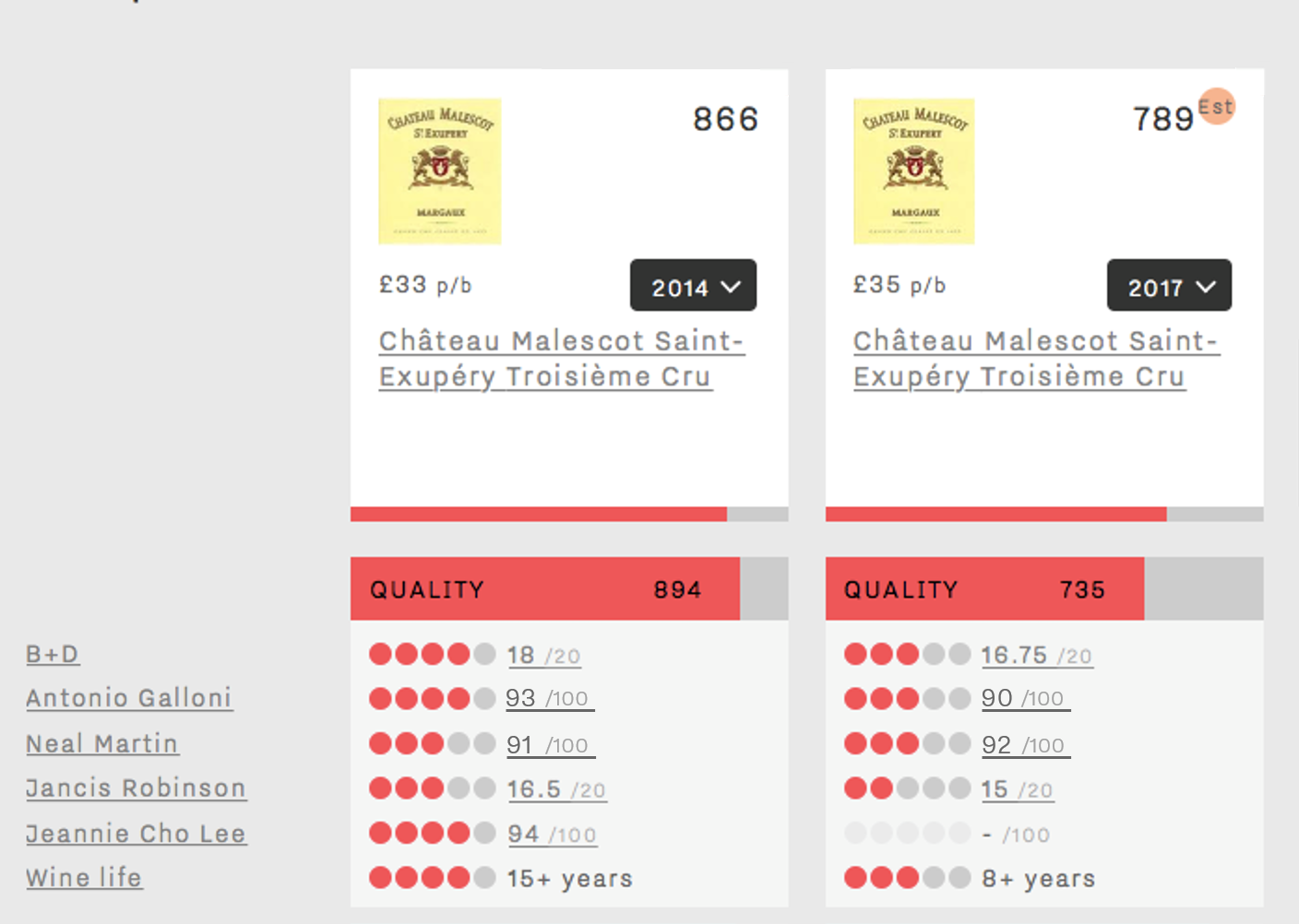

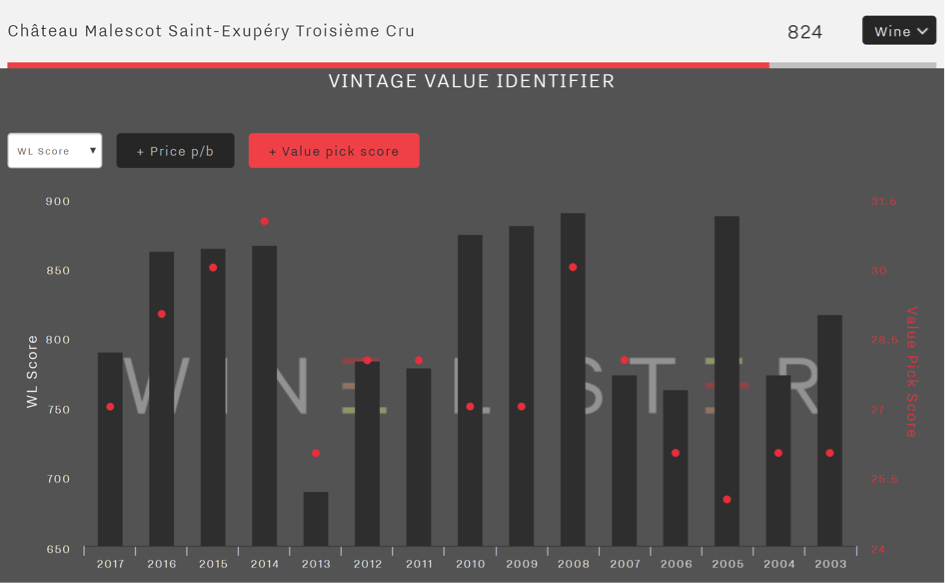

We used Wine Lister’s comparison tool in our search for good-value back vintages in order to compare different vintages and their respective critics’ scores and prices. For example, Malescot Saint-Exupéry achieves a Quality score of 894 in 2014, versus 735 in 2017. Despite the substantial price reduction on the 2016 and 2015 vintages, the 2017 UK market price remains 5% higher than the 2014, the latter receiving higher scores from three of the four Wine Lister partner critics. Neal Martin disagrees, awarding the 2017 a potential 2 points more than 2014 saying, “it is not a complex Malescot St. Exupéry, but I admire the balance and focus”.

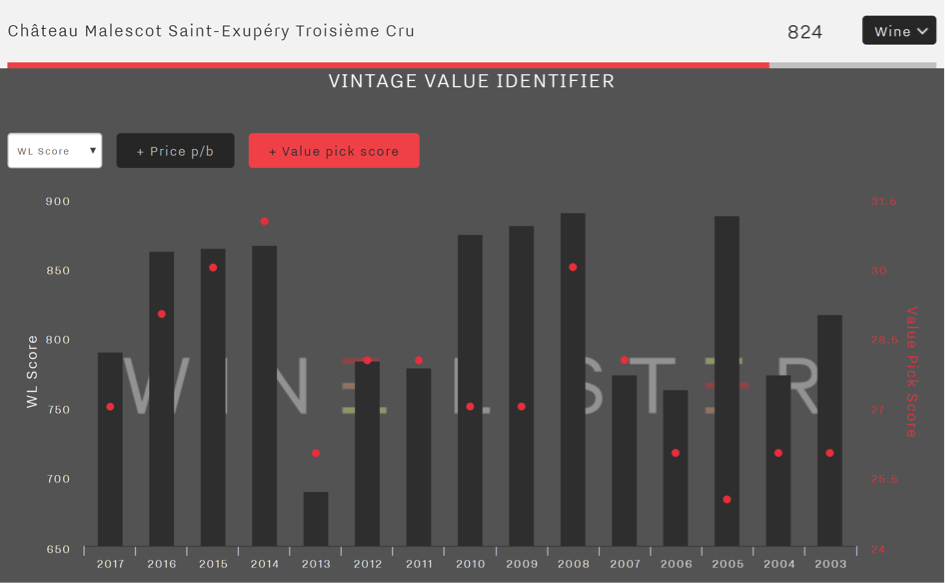

Malescot Saint-Exupéry 2014 has the highest Value Pick score of any recent vintage:

Use the Vintage Value Identifier chart (pictured above) on every wine page to pick out the best value back vintages. For example, Cantenac-Brown’s 2014 looks like a particularly good buy, at £25.50 per bottle for the 2014 (whose Quality score is 800), versus the 2017 at £34.05 per bottle, with a Quality score of 715. Its 2015 looks good too.

Petrus 2017 was released in the UK at £1480 per bottle (19% down on 2016), with a lower Quality score: 971 (vs 991).

You can download the slide here: Wine Lister Factsheet Petrus 2017

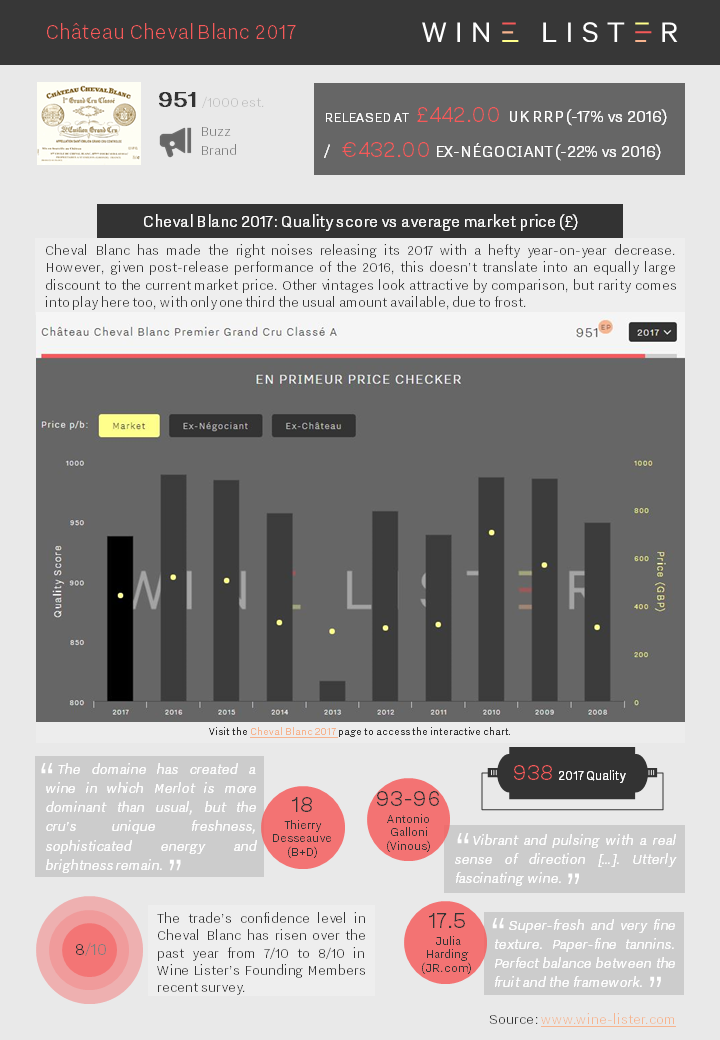

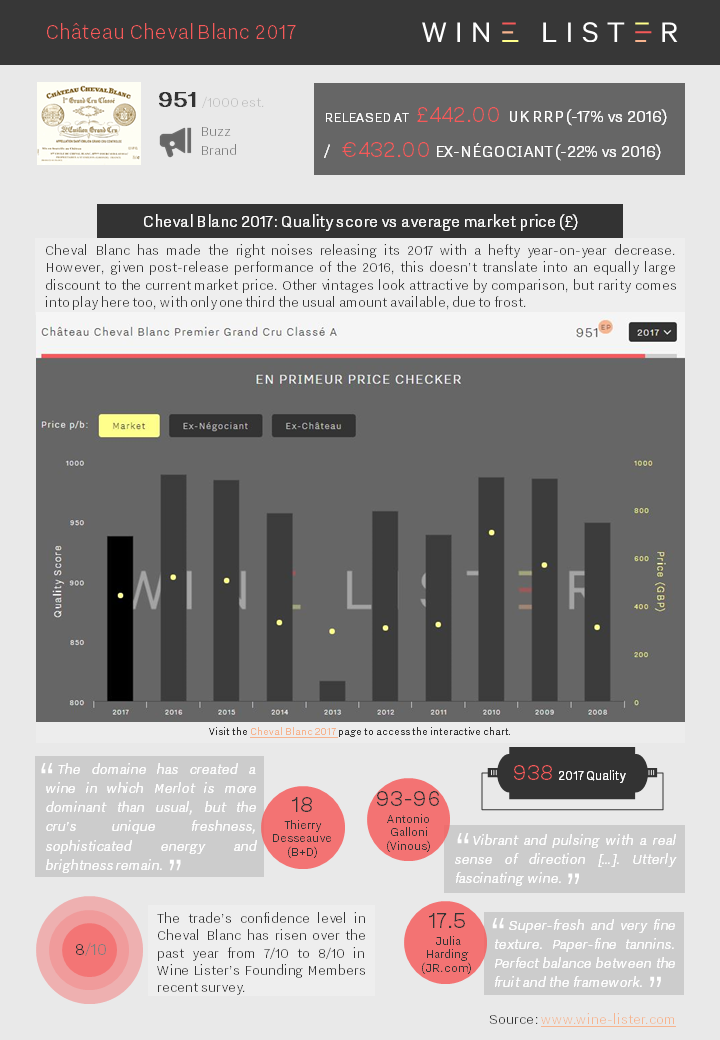

Cheval Blanc 2017 released at €432 ex-négociant (22% down on 2016), with a UK release price of £442 (17% down on 2016), and a lower Quality score: 938 (vs 989).

You can download the slide here: Wine Lister Factsheet Cheval Blanc 2017

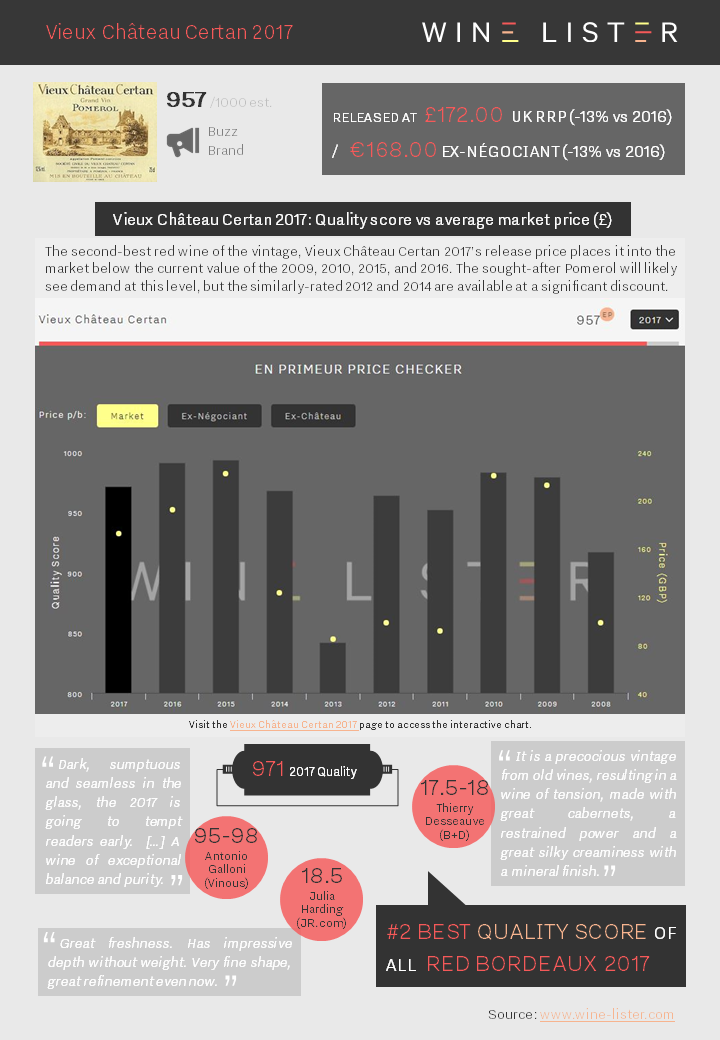

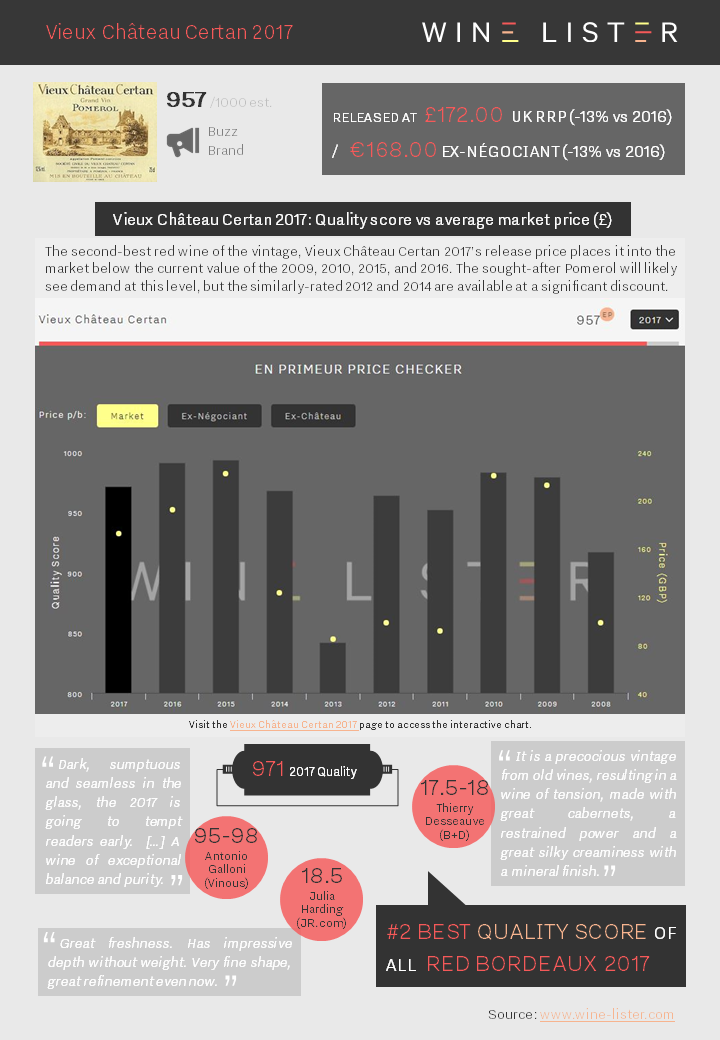

Vieux Château Certan 2017 released at €168 ex-négociant (13% down on 2016), with a UK release price of £172 (also 13% down on 2016), and a lower Quality score: 971 (vs 991).

You can download the slide here: Wine Lister Factsheet Vieux Château Certan 2017

With daily en primeur release alerts and offers for the new 2017 vintage filling our inboxes, the “Bordeaux buzz” at this time of year is undeniable. However, Bordeaux’s popularity does not end with en primeur, as we prove with results of the last quarter’s trading volumes.

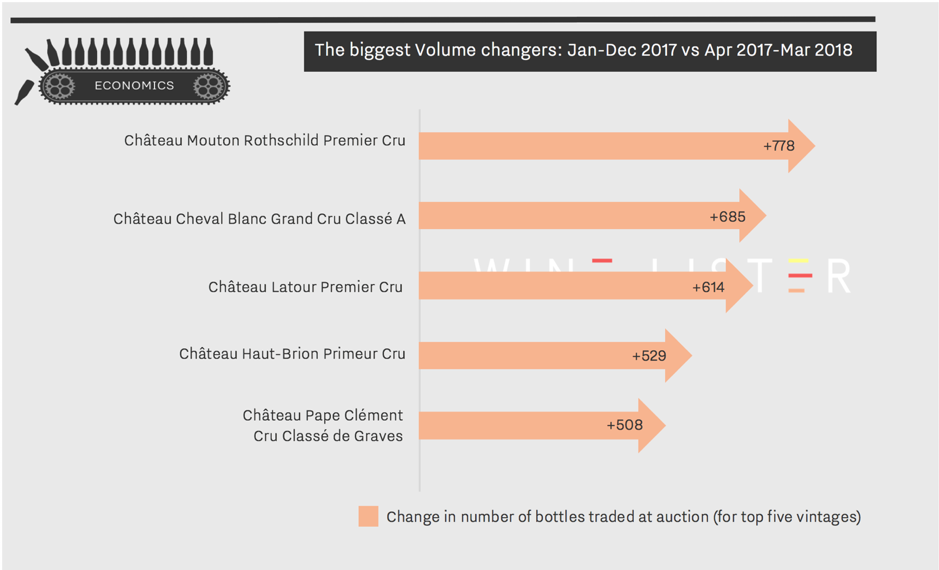

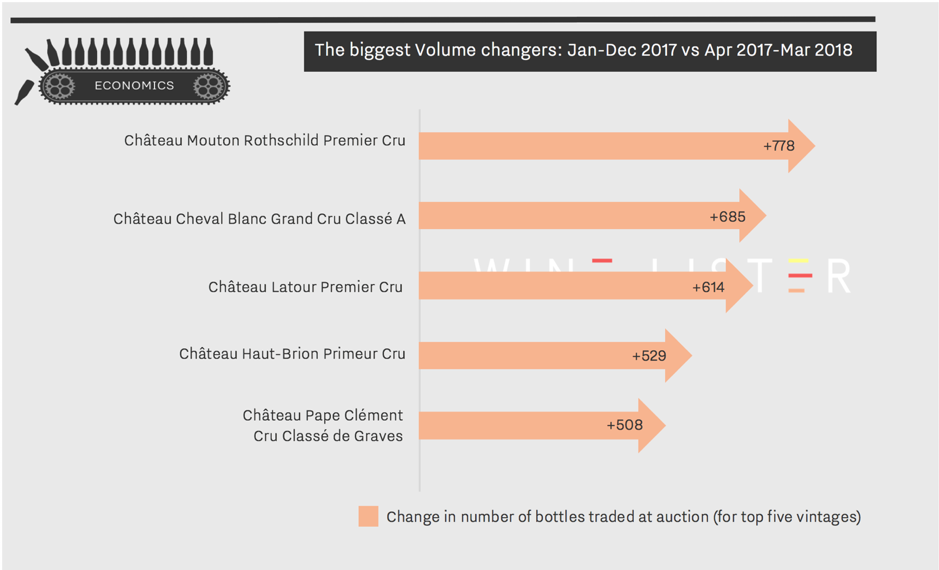

Wine Lister uses figures collated by the Wine Market Journal from sales at the world’s major auction houses to calculate incremental increases in four-quarter trading volumes – in this case, January-December 2017 versus April 2017-March 2018. Auction volumes contribute towards Wine Lister Economics scores, allowing us to measure the liquidity of each wine.

The five wines showing the biggest increases in trading volumes between these two periods all hail from Bordeaux. Indeed, such is the case for the top 20 auction volume increases, with the exception of brand royalty, Dom Perignon (in 10th place).

The wine experiencing the biggest increase in trading volumes is Mouton Rothschild, with 778 additional bottles traded. It has the highest Economics score of the five (956) and a compound annual growth rate (CAGR) of 11.3%. Kicking off the first growth releases of 2017 vintages this week, Mouton Rothschild’s 2017 UK release price sits 17% below last year’s at £360 per bottle.

In second place is right bank powerhouse, Cheval Blanc, whose trading volume increased by 685 bottles with the addition of the most recent quarter’s figures. Though second for incremental change, its total trading volume is at least 30% smaller than any of the left bank first growths.

Latour and Haut-Brion come in third and fourth place, both with 12% trading increases of 614 and 529 respectively.

Finally, trades of Pape Clément keep the Pessac-Léognan property’s red in the top five for trade increases for a consecutive quarter, with 506 more bottles traded in the current period. Despite dropping four places since last quarter’s auction volume results, Pape Clément still achieves the highest proportional change of all five wines at the top, with a 27% trading volume increase.

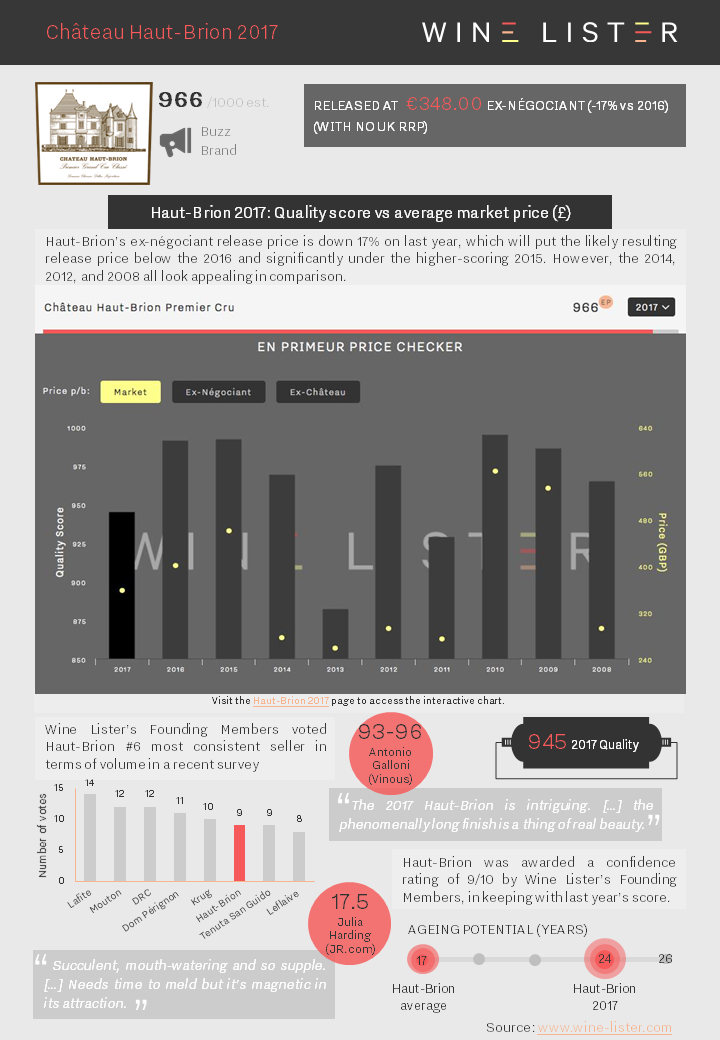

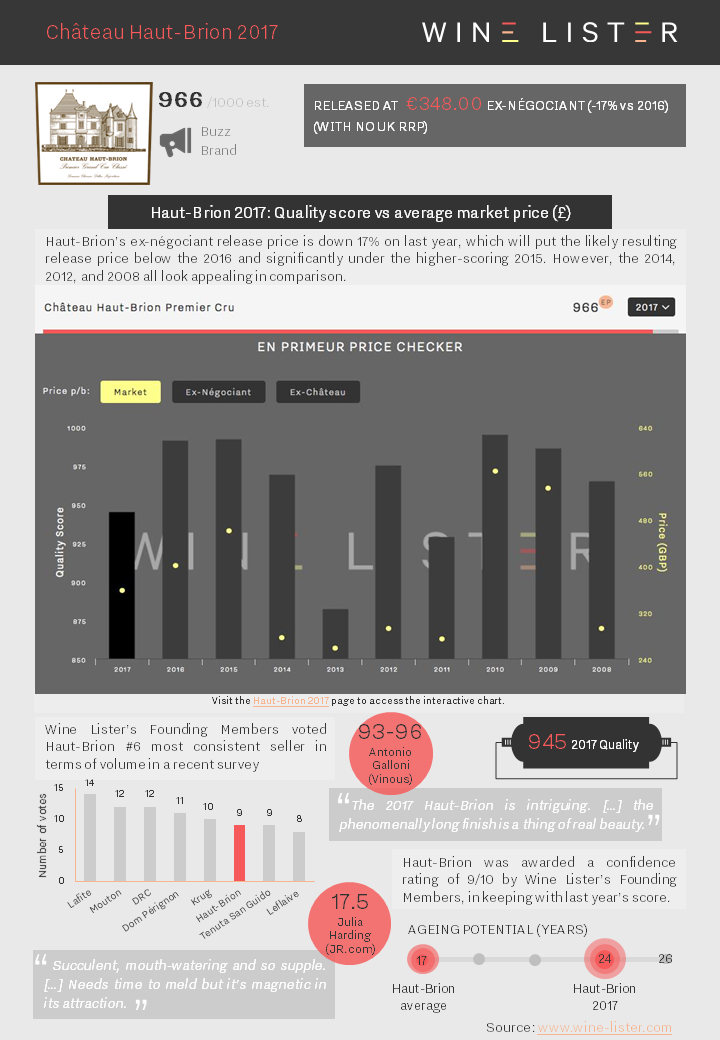

Haut-Brion Rouge 2017 released at €348 ex-négociant (17% down on 2016), which will likely result in a UK release price of c.£358 (c.14% down on 2016) and a lower Quality score: 945 (vs 991).

You can download the slide here: Wine Lister Factsheet Haut-Brion Rouge 2017

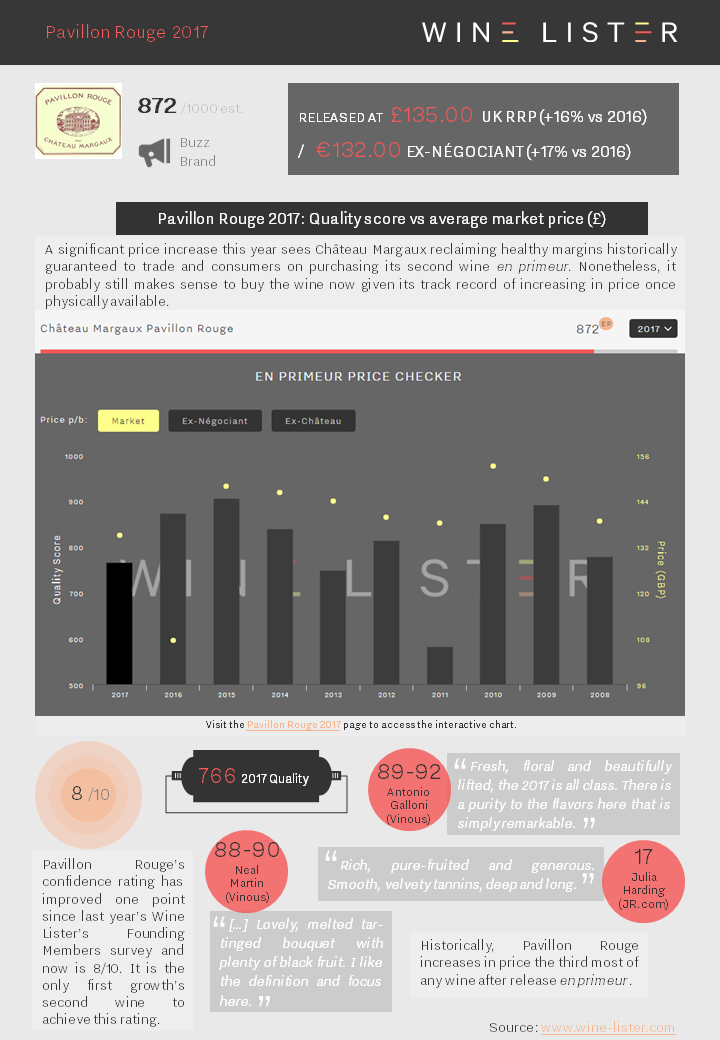

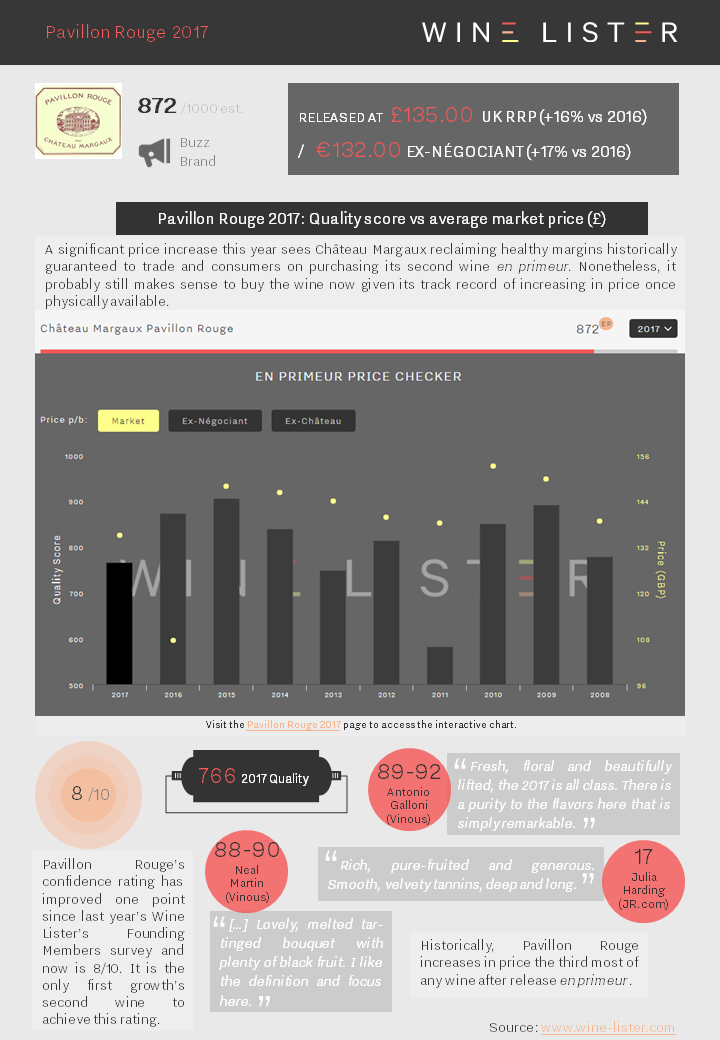

Pavillon Rouge 2017 released at €132 ex-négociant (17% up on 2016), with a UK release price of £135 (16% up on 2016), with a lower Quality score: 766 (vs 873).

You can download the slide here: Wine Lister Factsheet Pavillon Rouge 2017

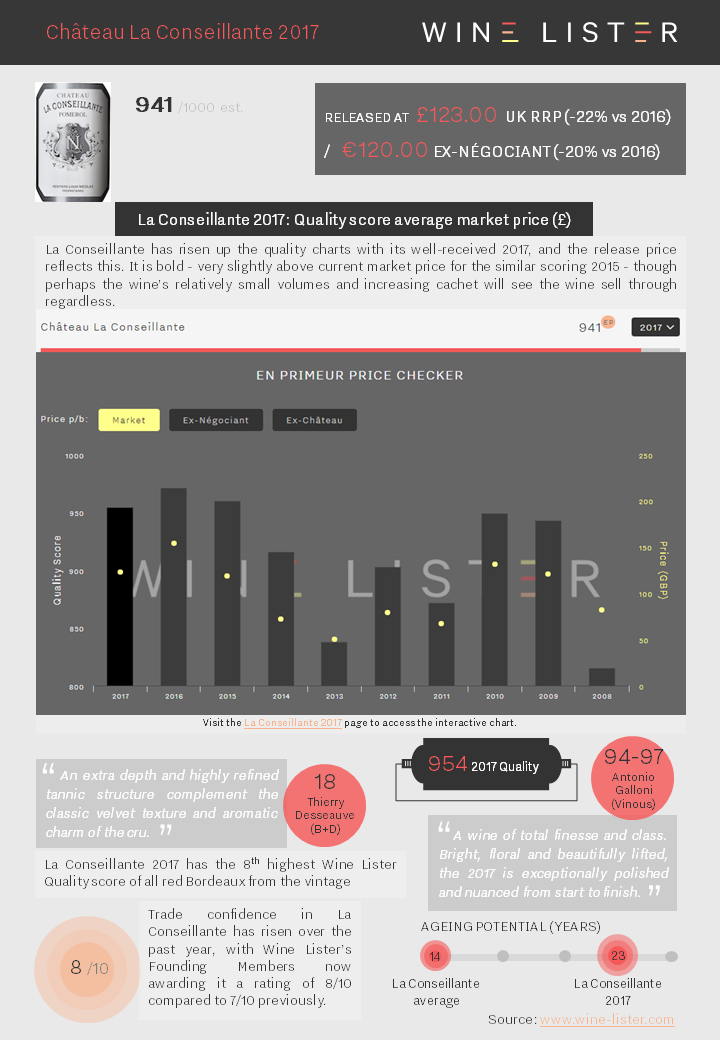

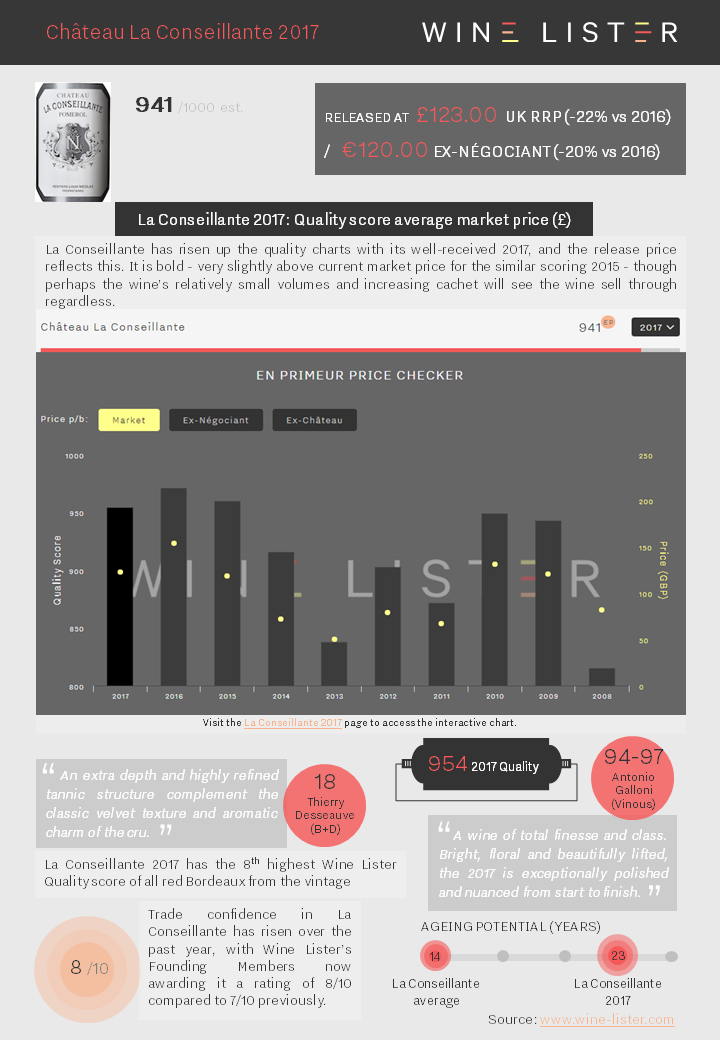

La Conseillante 2017 released at €120 ex-négociant (20% down on 2016), with a UK release price of £123 (22% down on 2016), with a slightly lower Quality score: 954 (vs 971).

You can download the slide here: Wine Lister Factsheet La Conseillante 2017

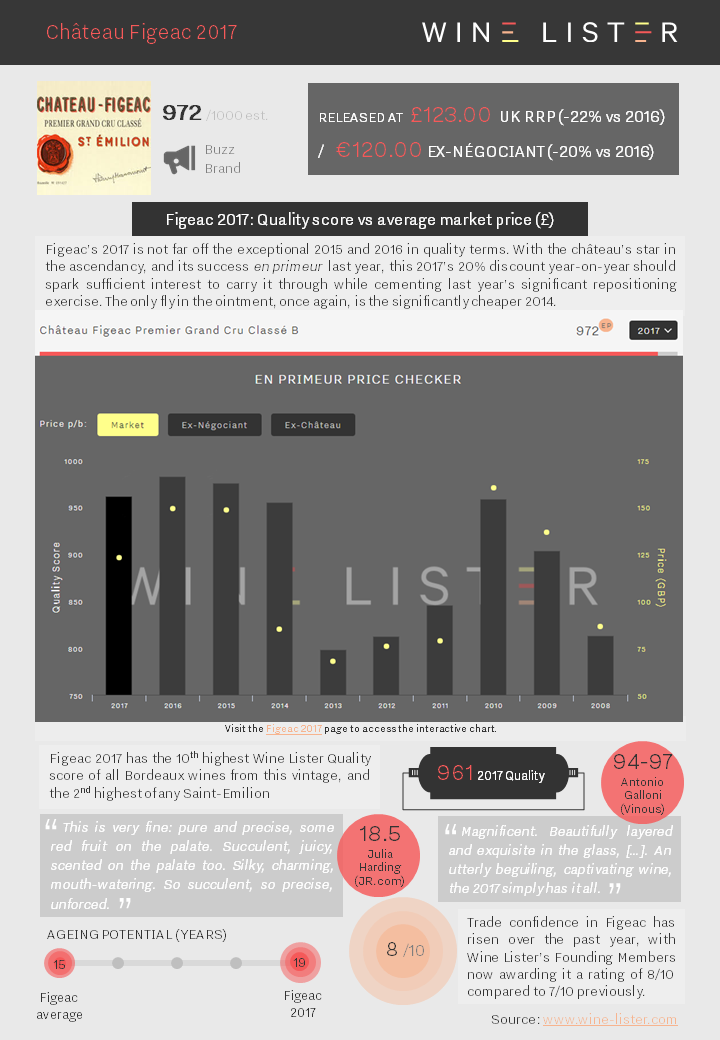

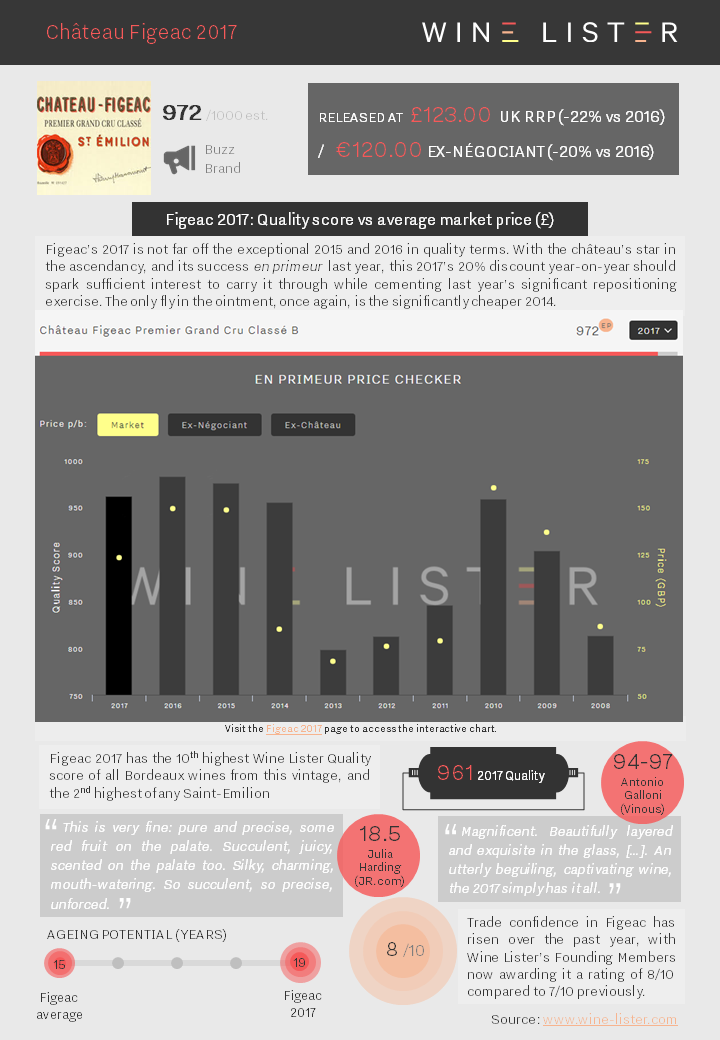

Figeac 2017 released at €120 ex-négociant (20% down on 2016), with a UK release price of £123 (22% down on 2016), with a slightly lower Quality score: 961 (vs 982).

You can download the slide here: Wine Lister Factsheet Figeac 2017