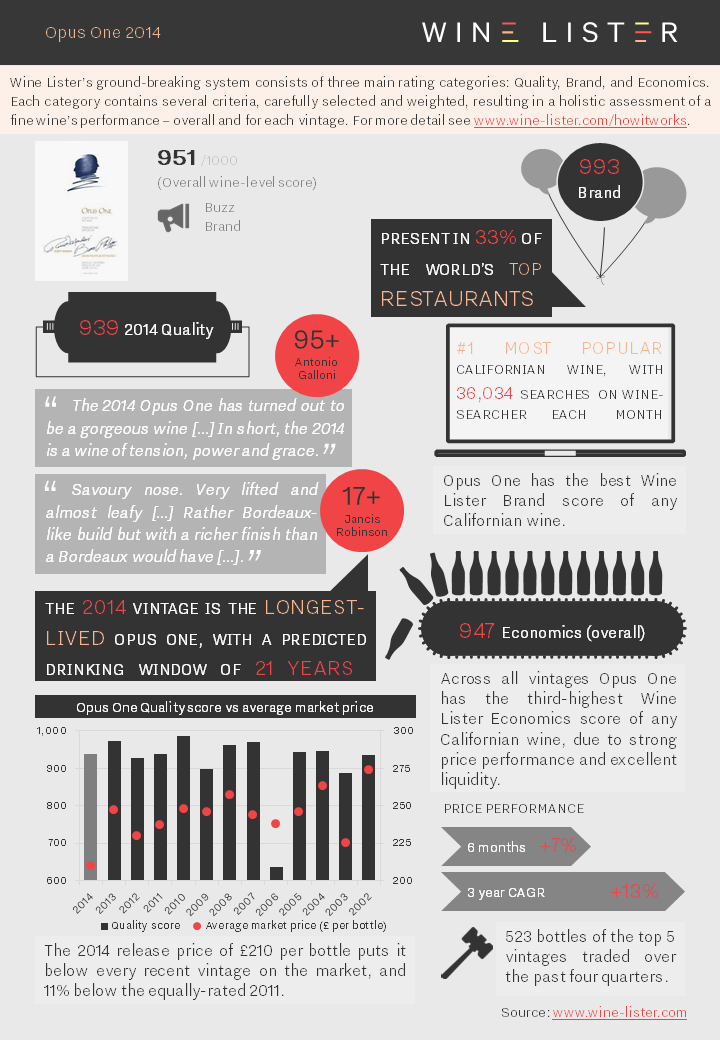

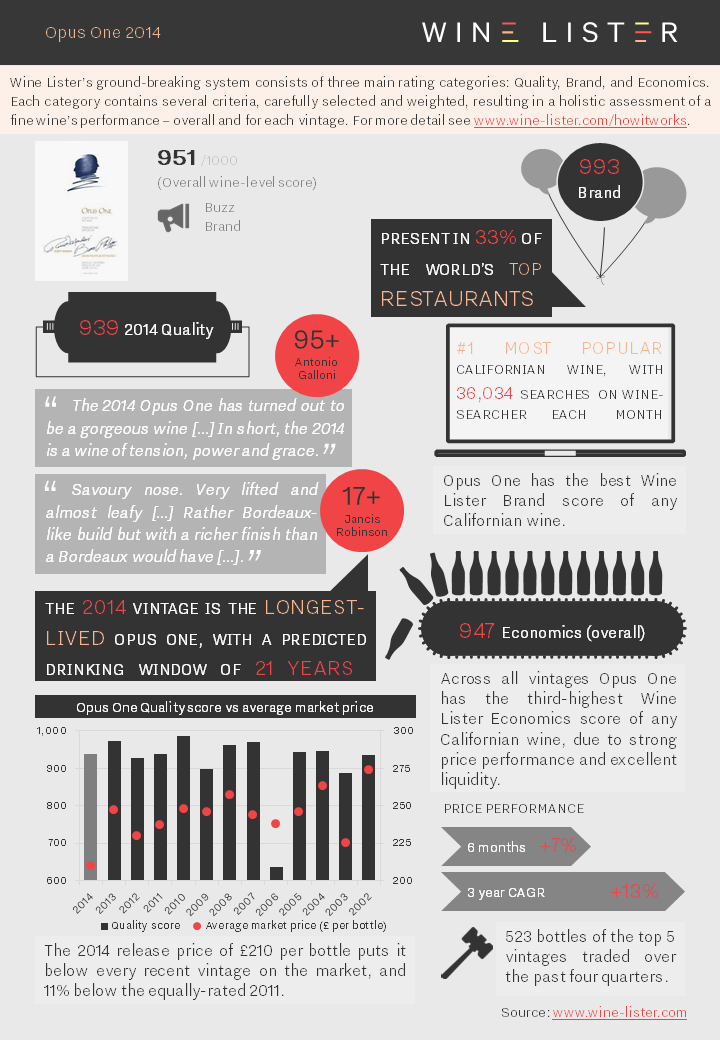

Opus One 2014 was released today at £210 per bottle. Described as a “gorgeous wine” by Wine Lister partner critic Antonio Galloni, we summarise all the key information below:

You can download the slide here: Wine Lister Factsheet Opus One 2014

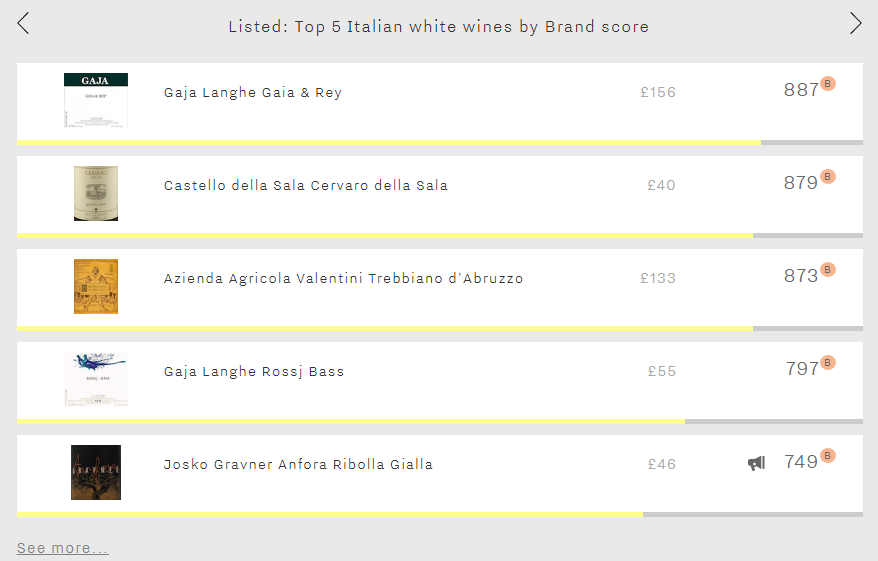

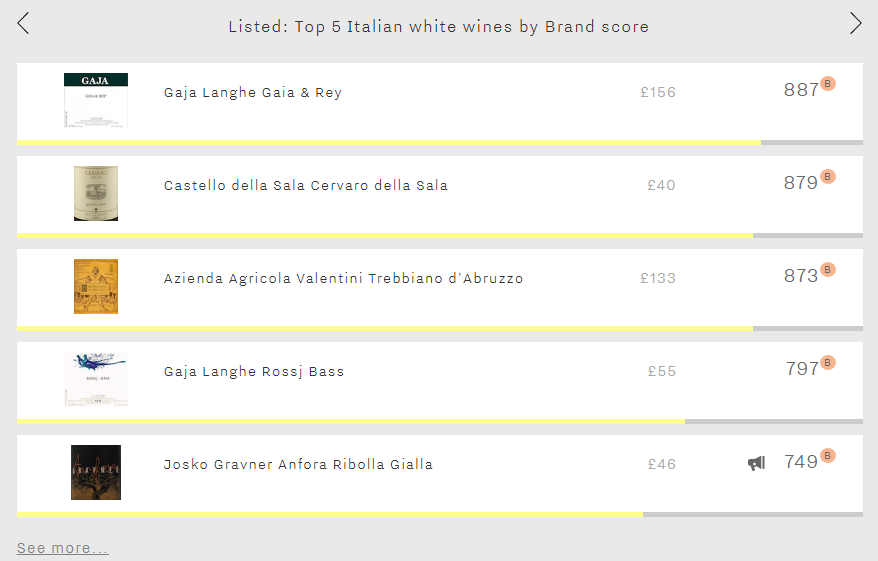

This week’s Listed section features the five Italian white wines with the strongest brands. They comprise two Langhes from Gaja (Gaia & Rey and Rossj Bass), two of Italy’s cult whites (Valentini Trebbiano d’Abruzzo and Gravner Anfora Ribolla Gialla), and Cervaro della Sala (from the Antinori stable).

Whilst these wines all enjoy strong or very strong Brand scores, they do not command the same level of brand recognition as the top five Italian red wine brands, trailing them by c.90-250 points in the Brand category. Tuscan powerhouses Sassicaia, Tignanello, Ornellaia, Solaia, and Gaja’s Barbaresco all achieve Brand scores of over 975 points, with Sassicaia’s outstanding 997 points putting it ahead of the likes of Cheval Blanc and DRC La Tâche.

Wine Lister’s Brand scores comprise restaurant presence and consumer popularity. It is in the latter category that the whites have the most ground to make up. For example Gaja Langhe Gaia & Rey, which featured in our latest blog on new Investment Staples, is present in well over half the number of restaurants of its close relative Gaja Barbaresco, but it receives under a quarter of the number of searches each month on Wine-Searcher. If sommeliers are convinced that these top Italian whites can grace the tables of the finest establishments, they still fly well under the radar of most consumers.

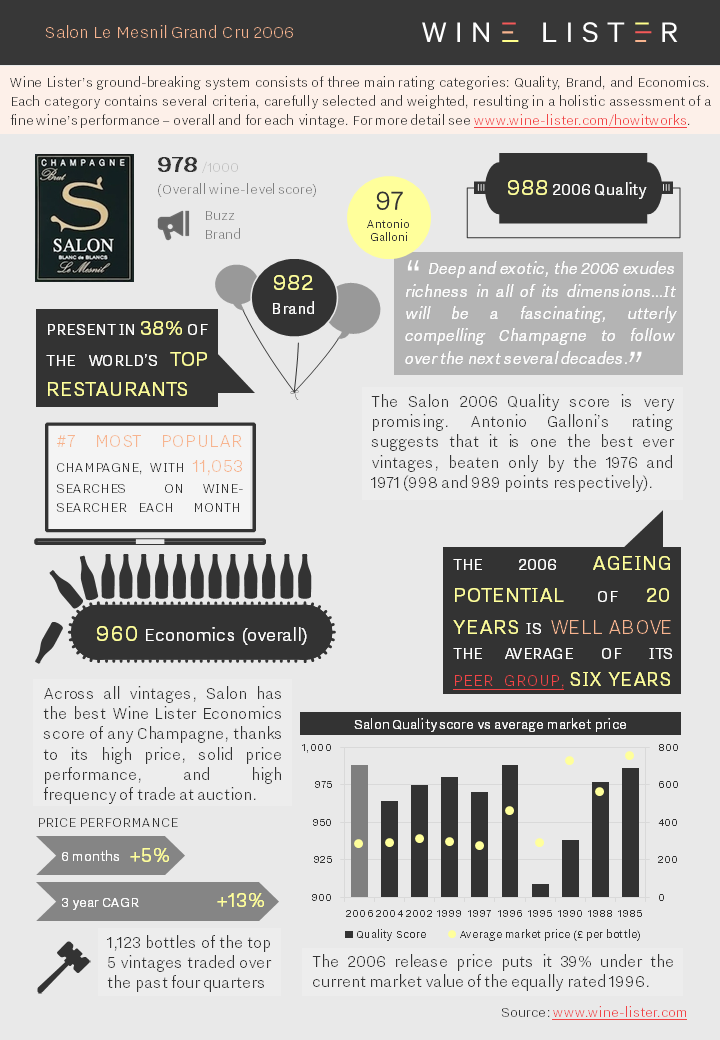

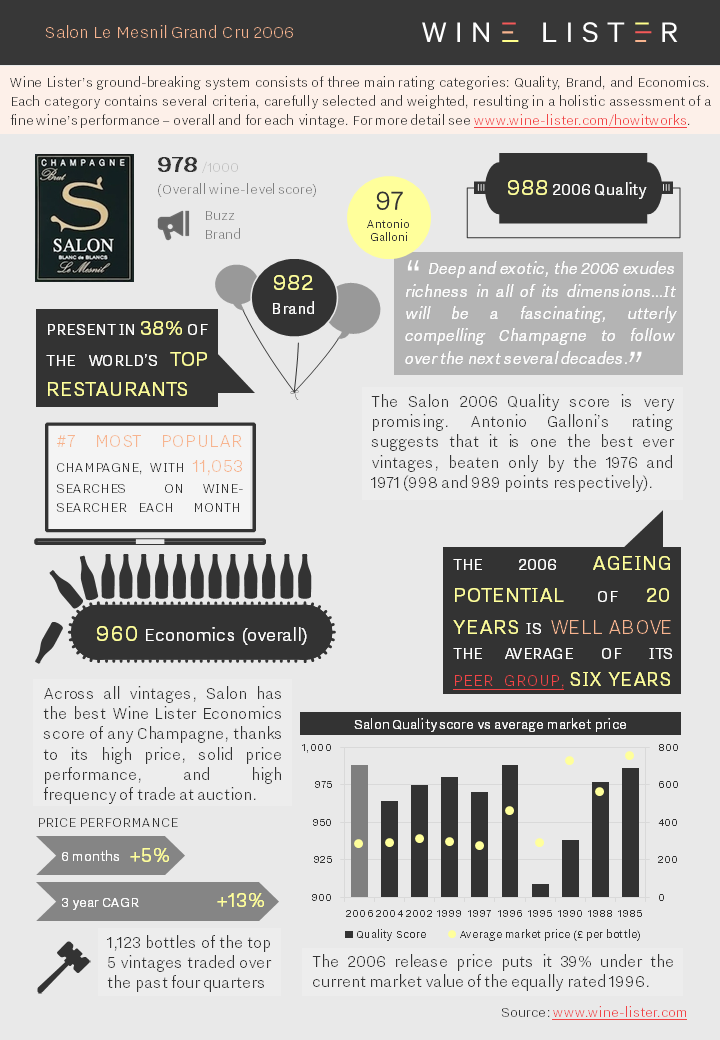

Earlier this month Salon Le Mesnil 2006 was released, the Champagne house’s 40th vintage. Described as “a fascinating, utterly compelling Champagne” by our partner critic Antonio Galloni, we summarise all the key data below:

You can download the slide here: Wine Lister Factsheet Salon 2006

You may have noticed a subtle re-design today on the Wine Lister homepage. This includes moving up and expanding the scope of the “Listed” section: a changing Top 5 of wines from around the world, updated each week.

You can now explore the five most recent Top 5s, even if you’re not yet a subscriber to Wine Lister. For as long as the list is live, this includes access to all the underlying vintage-level data that feeds into one of our Listed wines, including critic scores, restaurant presence, search frequency, and price performance. Simply click on the Listed wine that takes your interest, then select from the drop-down of vintages at the top right of the wine page. What’s more, this allows you to play with tools such as interactive price history and vintage value identifier charts.

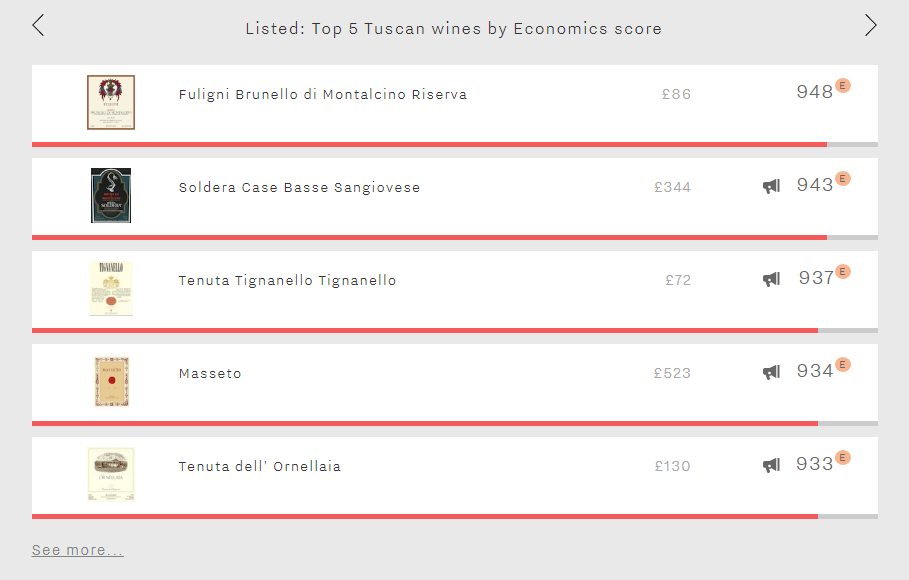

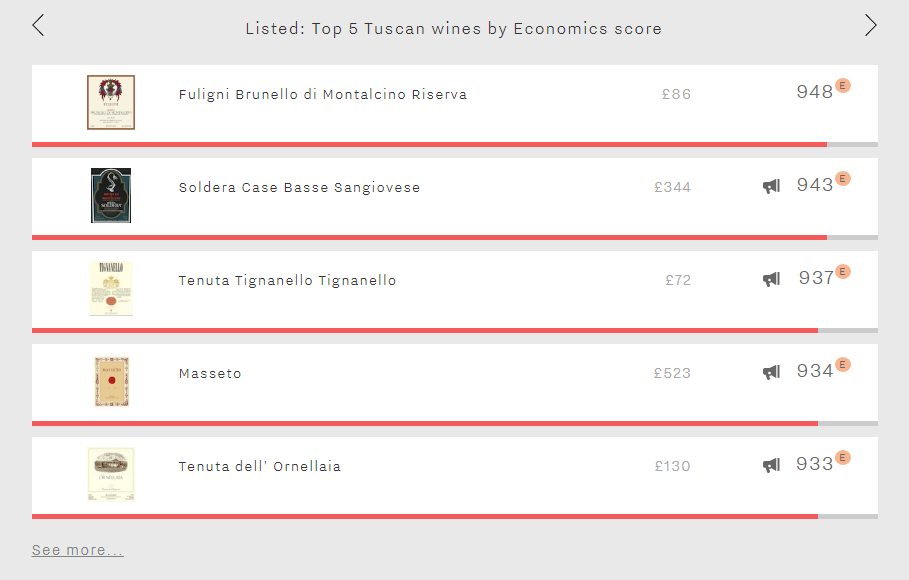

Our Listed section addresses a variety of tastes and priorities – some weeks you will see our best Value Picks from a particular region, other weeks will focus specifically on wines with top Brand or Economics scores, or wines of the highest quality from a specific vintage.

To access independent wine ratings, tools, and analysis for all of the thousands of wines and vintages in our database you’ll need to subscribe – or why not try a free 14-day trial?

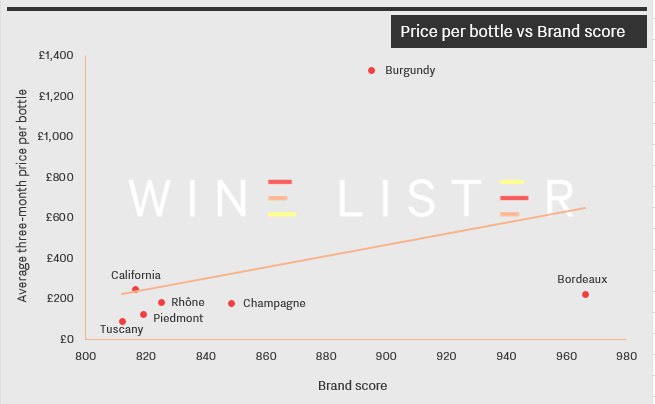

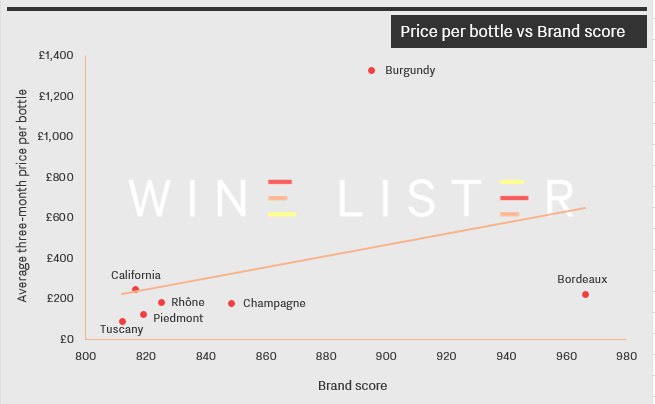

Following on from our recent blog on the relationship between price and quality for seven leading wine regions, today we turn our attention to the role that brand strength plays on price for those same regions. The chart below compares the regions’ average three-month market price to their average Brand scores, using the same 50 overall top scoring wines in each region as in the previous post.

Bordeaux’s crus classés enjoy unassailable brand strength, a product of the success of the region’s classification system and the fact that its châteaux have enjoyed global renown for centuries. If you want brand for your buck, look no further.

Conversely, Burgundy’s extraordinary prices far exceed the level of brand clout commanded by its top crus. Its top wines trail the average Brand score of Bordeaux’s by 7%, but sell for nearly six times as much. This suggests that quality, and perhaps small production levels, play more of a part in the region’s prices.

The five remaining regions are more evenly matched. Tuscany’s wines have both the lowest average Brand score and the lowest prices, followed closely by Piedmont. Meanwhile California’s top 50 wines, which have the second-lowest average Brand score, command the second-highest prices. Top wines from the Rhône and Champagne command similar prices to their Bordeaux counterparts, but with average Brand scores more than 100 points lower.

What makes the perfect wine?

Using the entirety of a 1,000-point scale, Wine Lister’s scores are calculated using nine criteria that define iconic wines. These fall into the categories of Quality, Brand and Economics, giving a 360° view of the finest wines in the world.

Unlike wine critics’ scores, which sporadically feature a perfect 100/100, a perfect Wine Lister score of 1,000/1,000 is practically, though not theoretically, impossible. The perfect wine would have to be the best in the world across every single criterion – a magical combination of ingredients.

The perfect wine does not belong to any one region. In terms of quality, it has the perfect critic score of Sauterne’s unsurpassed Château d’Yquem (1), and the ageing potential of Cockburn’s Vintage Port (2). Its brand is legendary: like Dom Pérignon, it is found throughout the world’s top restaurants (3), and its online monthly searches rival those of Lafite (4).

The perfect wine outperforms on price. Already with a price per bottle to match that of Romanée-Conti (5), its vintages see price increases in both the short- (6) and long-term (7), without undue fluctuation (8). Finally, like Mouton, the perfect wine is traded in large volumes (9).

Download a PDF version here.

First published in French in En Magnum.

When it comes to wine scores, we’re all used to looking at quality and critic ratings. Wine Lister scores incorporate two other crucial measures: Economics and Brand. Today, we take a closer look at these categories in the context of the top Bordeaux crus in our 2017 Bordeaux Market Study.

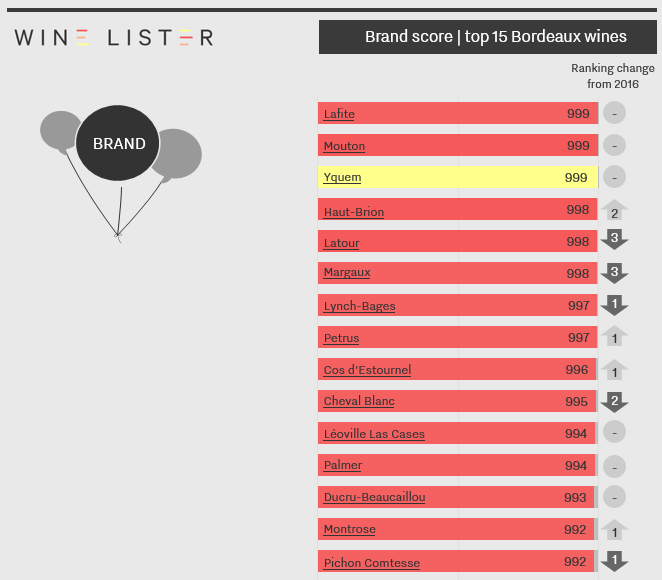

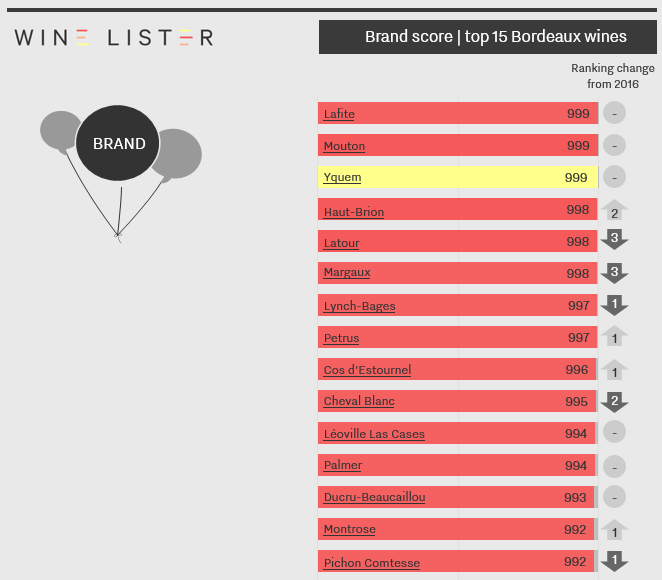

Brand: not much in it

We begin with the Brand category, based on search frequency and distribution. The first thing to notice is that score differentials are incredibly narrow. The 15th wine in Economics terms achieves a score of 932, while the 15th wine in the Brand table gets 992 – testament to the incredible brand strength of Bordeaux crus in general.

Three wines share the top spot, with near-perfect scores of 999 apiece: Lafite, Mouton, and Yquem. Latour and Margaux have lost one point since last year, putting them in joint fourth with Haut-Brion, up one place, while Pauillac and Pomerol powerhouses, Lynch-Bages and Petrus, share seventh position. Only two right bank wines achieve Brand scores in the top 15, and Cheval Blanc is the only Saint-Emilion premier grand cru classé A to feature.

Economics: all change at the top

We now move onto the Economics score, based on a variety of price metrics and liquidity. Unsurprisingly, due to the constantly changing nature of its component parts, the Economics category displays significant changes over a 12-month period. The order of wines in the top 15 has completely changed from the previous year. Compared with the Brand table, the top 15 is also very different: wines have moved in and out, and the order has shifted.

In a continued display of commercial strength, Angélus has moved up three places into pole position, while second and third places are also occupied by right bank wines: Pomerol’s Le Pin and Petrus. The first growths have all moved up the table since last year, in part thanks to improved price performance, although Latour still trails the others. The wine that has most improved on 2016 – a new entrant into the top 15 – is Ausone, up 26 places, while Beychevelle has also seen significant improvement. Pavillon Rouge is the only second wine in the top 15.

For the top Bordeaux crus in terms of overall Wine Lister score – which takes into account a wine’s Quality score as well as those for Economics and Brand – take a look here.

These are excerpts from Wine Lister’s 48-page Bordeaux Market Study – subscribers can download the full report from the Analysis page.

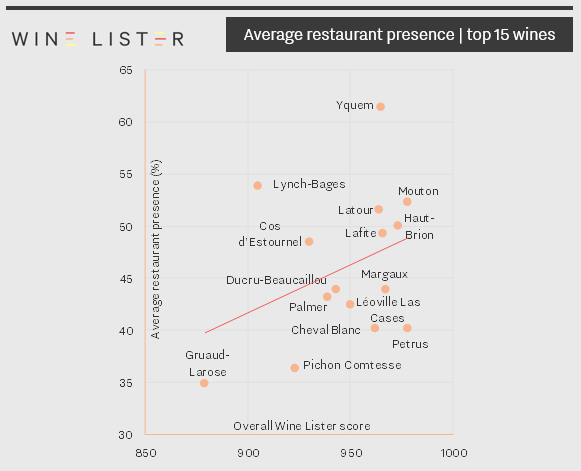

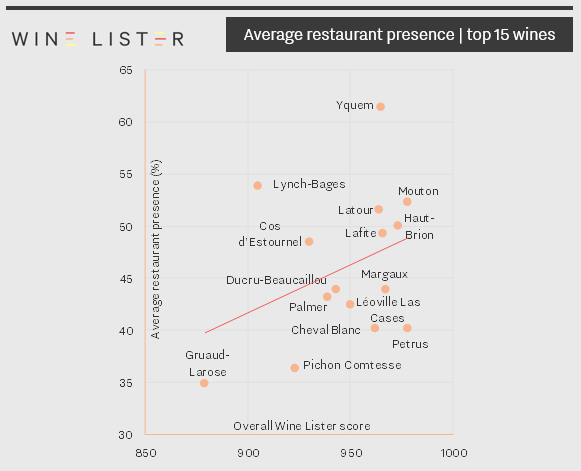

Today’s blog continues to explore some of the findings from the Bordeaux Market Study, by taking a look at global restaurant presence. A fine wine’s prestige and clout on the international market is demonstrated by its distribution across the world’s top restaurants, hence this is one criteria that feeds into our Brand score. (Remember that you can read exactly ‘how it works’ on our eponymous page).

As shown in the chart below, sweet white Yquem dominates: just as it did in the 2016 study (now available to all here). Next comes indomitable fifth growth Lynch-Bages – a wine that the trade has cited as one of the best-selling Bordeaux brands – ahead of all the first growths. Lynch-Bages has overtaken Latour and Margaux since this time last year. Mouton has also moved up the ranks, present in 52% of restaurants compared to 50% in last year’s analysis. Meanwhile, Gruaud-Larose is a new entry into the top 15, replacing Montrose.

This is just a taster of Wine Lister’s 48-page Bordeaux Market Study – subscribers can download the full report from the Analysis page.

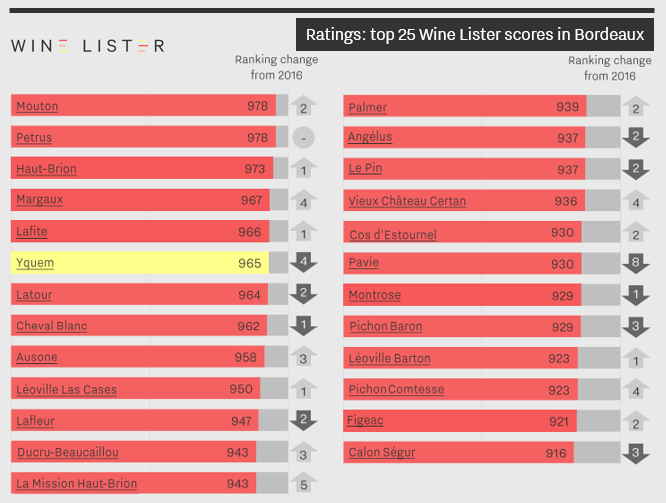

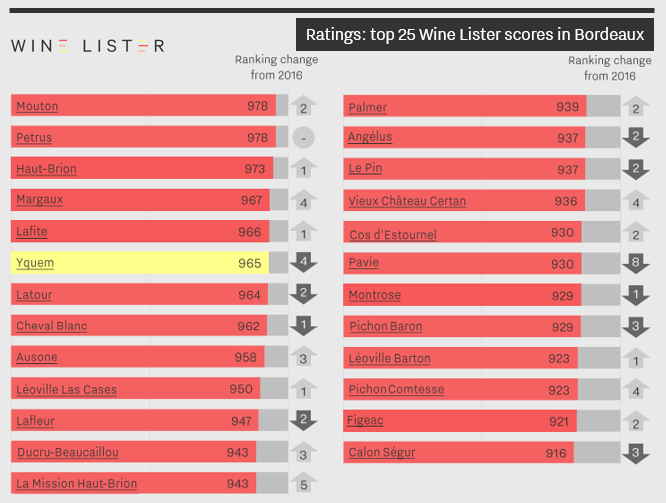

In our third blog post exploring findings from Wine Lister’s recently released Bordeaux Market Study, we look at the top scoring Bordeaux crus as at 28th April 2017. These are the overall Wine Lister scores comprising the three category scores for Quality, Brand, and Economics. They are applied at wine level (an average of the last 30 vintages, with the highest weighting for the most recent vintage – 2016 – and so on).

Nine of the top 25 are from the right bank, and 16 from the left bank. As in last year’s study, the top eight spots are occupied by the five left bank first growths, as well as Petrus, Yquem, and Cheval Blanc, but with a significant reshuffle among these wines. Mouton gains 18 points and climbs two spots to join Petrus at the top of the table this year.

Haut-Brion comes third, one position higher than in 2016. Next come Margaux and Lafite, separated by just one point, although Margaux has surged up the ranking this year, gaining four places.

Yquem, the only white wine in the top 25, drops four places this year, while Latour and Cheval Blanc are also down on last year’s positioning. Ausone comes ninth, up three places from last year, and Léoville Las Cases rounds out the top 10 as the highest placed deuxième cru.

The two newer Saint-Emilion premiers grands crus classés A also feature in the top 25, although Angélus and Pavie have dropped two and eight spots respectively since 2016. Meanwhile Pichon Comtesse and Figeac make their debut into the top 25 this year.

This is just a taster of the Bordeaux Market Study, but you can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

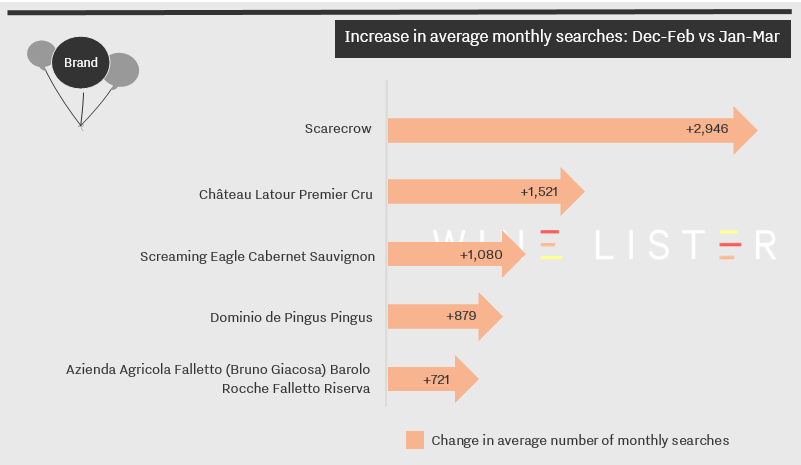

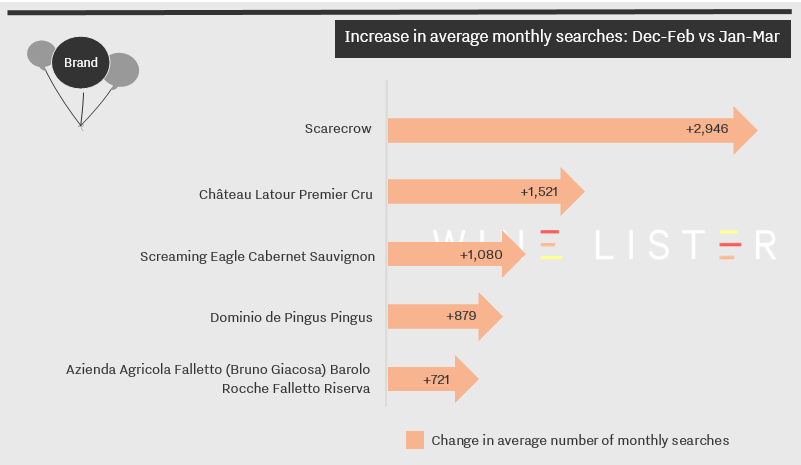

With the latest data now in from Wine Searcher, we took a look at which wines have seen their average monthly searches soar in the last month. The US boasts two wines in this top 5, with searches continuing to increase for Screaming Eagle, and Scarecrow seeing a significant uptick. Bottled relatively recently, Scarecrow 2014 scored 96+ from our US partner critic Antonio Galloni, who described it as “a wine of finesse.” At the end of February, Scarecrow 2014 was the top lot in a Premiere Napa Valley auction, selling for $200,000. The increase in searches has boosted Scarecrow’s Brand score from 868 to 885.

Latour was the only wine from France to see its popularity rise last month, with searches for the Bordeaux first growth no doubt increasing as a result of the ex-château release in mid-March of Latour 2005, for €670 per bottle ex-négociant. Latour has the highest Brand score of all the wines in the table, with a near-perfect 999.

The final two wines to have seen a rise in popularity are Spain’s Pingus, whose 2014 recently received a 100-point score in the Wine Advocate, and Italy’s Azienda Agricola Falletto (Bruno Giacosa) Barolo Rocche Falletto Riserva. In March, Antonio Galloni praised “the genius of Bruno Giacosa” in a vertical tasting, and the increase in searches resulted in the wine’s Brand score rising from 812 to 822.

How is the popularity score calculated and how does it fit into the overall Wine Lister score?