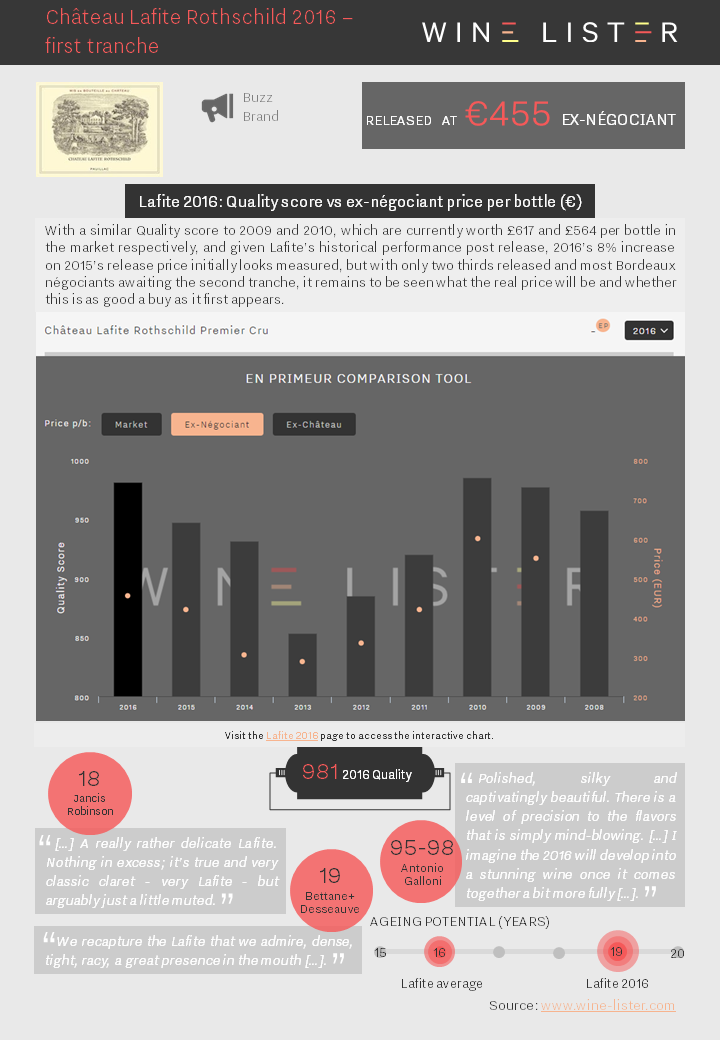

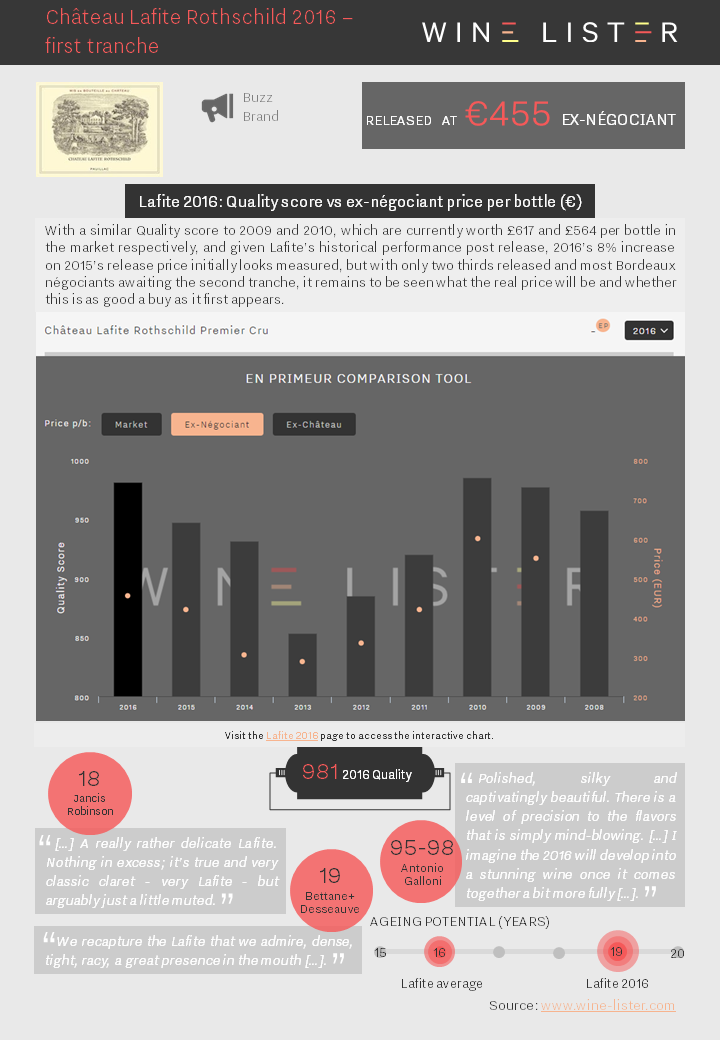

Bordeaux en primeur analysis of Lafite Rothschild 2016, which was the first premier cru of this year’s campaign to release:

You can download the slide here: Wine Lister Factsheet Lafite Rothschild 2016 First Tranche

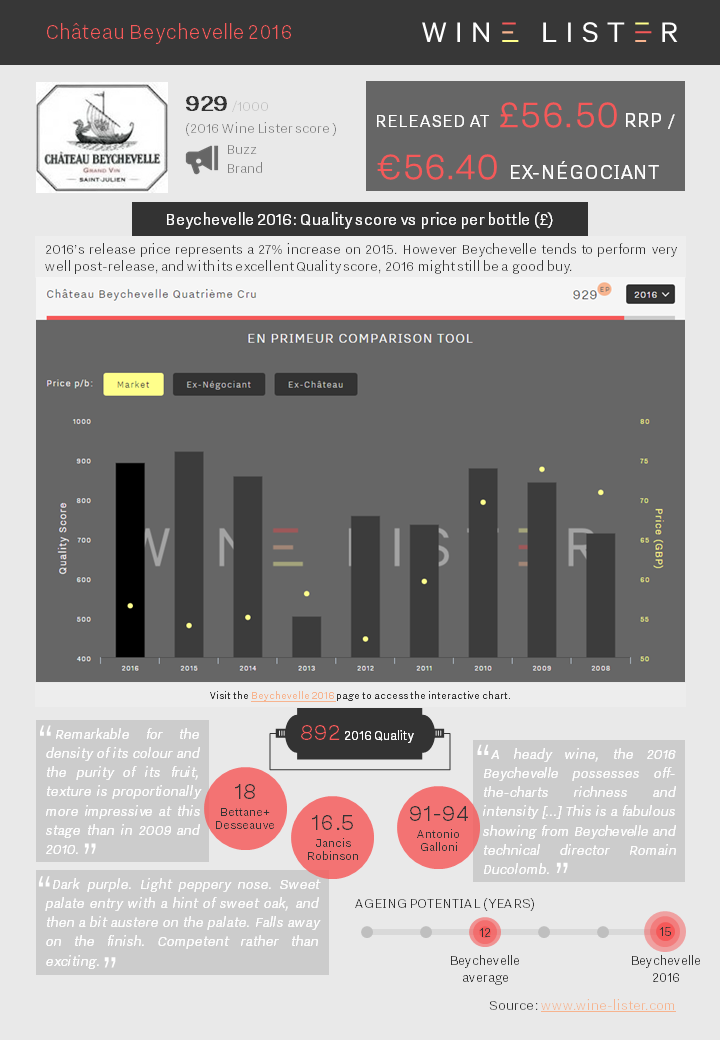

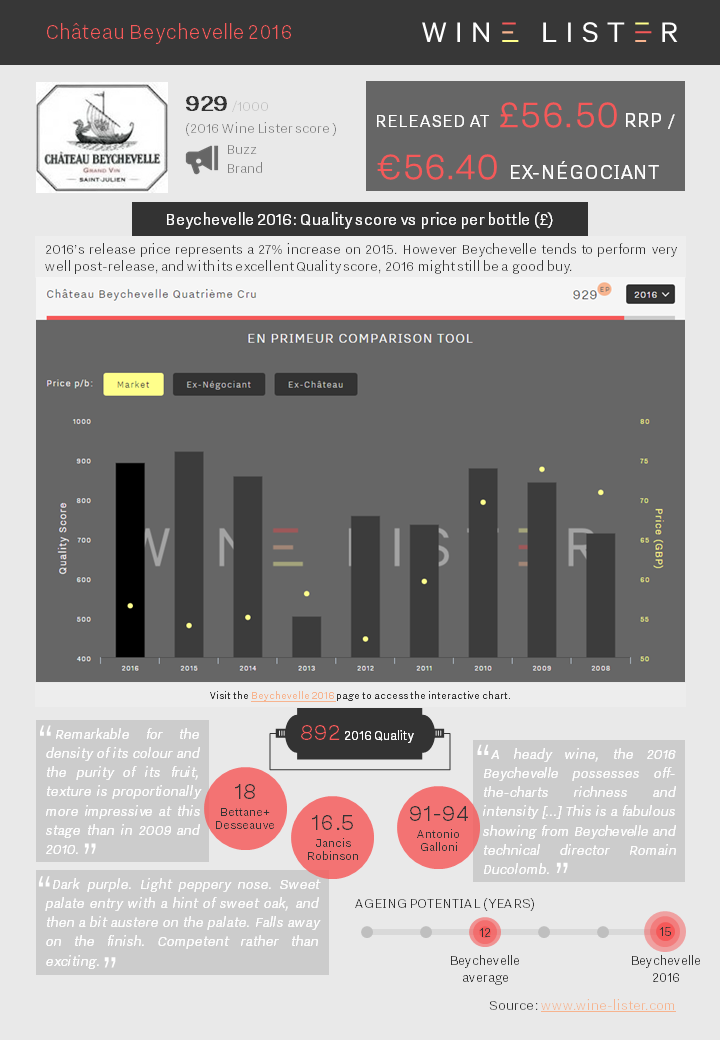

Bordeaux en primeur analysis of Beychevelle 2016, which has been released this morning at £56.50:

You can download the slide here: Wine Lister Factsheet Beychevelle 2016

Bordeaux en primeur analysis of Palmer 2016, which has been released this morning at c.£237.50:

You can download the slide here: Wine Lister Factsheet Palmer 2016

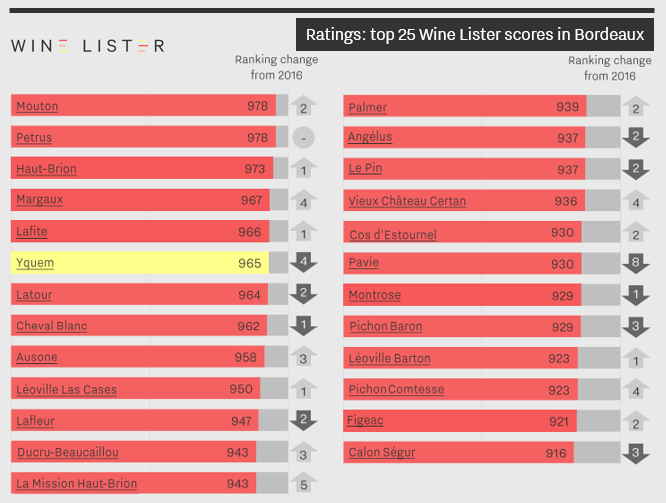

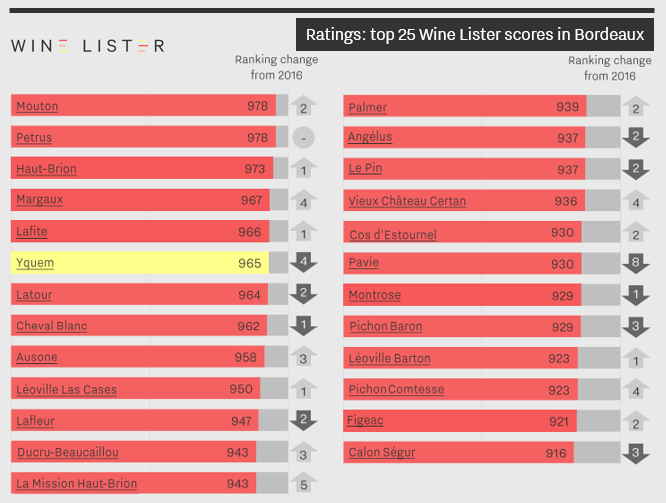

In our third blog post exploring findings from Wine Lister’s recently released Bordeaux Market Study, we look at the top scoring Bordeaux crus as at 28th April 2017. These are the overall Wine Lister scores comprising the three category scores for Quality, Brand, and Economics. They are applied at wine level (an average of the last 30 vintages, with the highest weighting for the most recent vintage – 2016 – and so on).

Nine of the top 25 are from the right bank, and 16 from the left bank. As in last year’s study, the top eight spots are occupied by the five left bank first growths, as well as Petrus, Yquem, and Cheval Blanc, but with a significant reshuffle among these wines. Mouton gains 18 points and climbs two spots to join Petrus at the top of the table this year.

Haut-Brion comes third, one position higher than in 2016. Next come Margaux and Lafite, separated by just one point, although Margaux has surged up the ranking this year, gaining four places.

Yquem, the only white wine in the top 25, drops four places this year, while Latour and Cheval Blanc are also down on last year’s positioning. Ausone comes ninth, up three places from last year, and Léoville Las Cases rounds out the top 10 as the highest placed deuxième cru.

The two newer Saint-Emilion premiers grands crus classés A also feature in the top 25, although Angélus and Pavie have dropped two and eight spots respectively since 2016. Meanwhile Pichon Comtesse and Figeac make their debut into the top 25 this year.

This is just a taster of the Bordeaux Market Study, but you can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

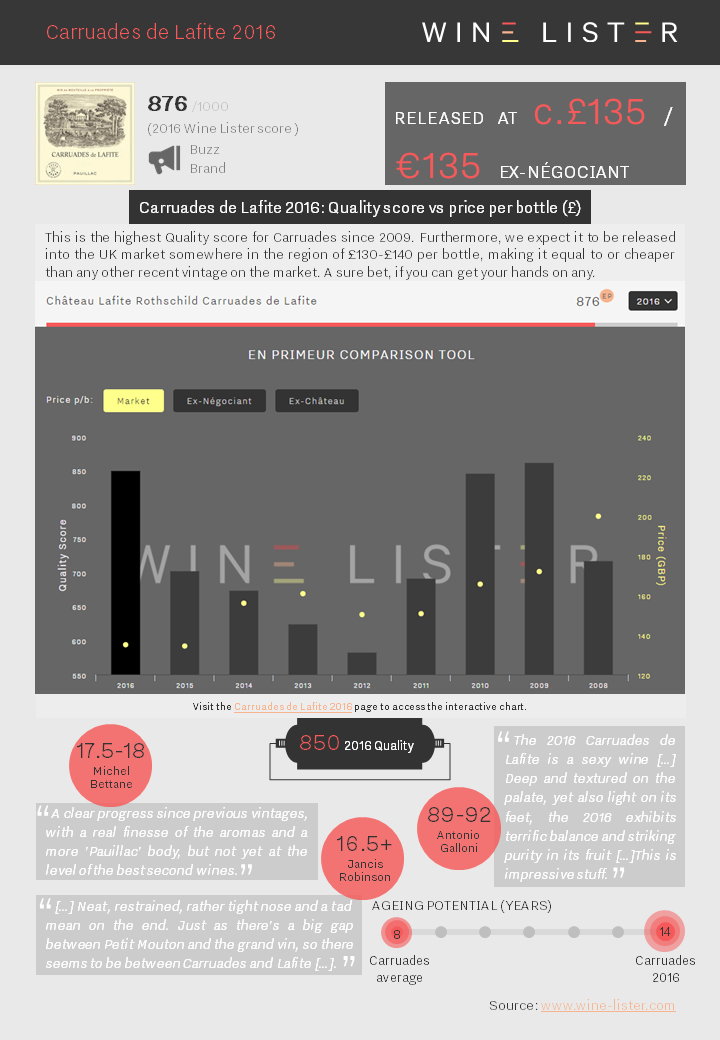

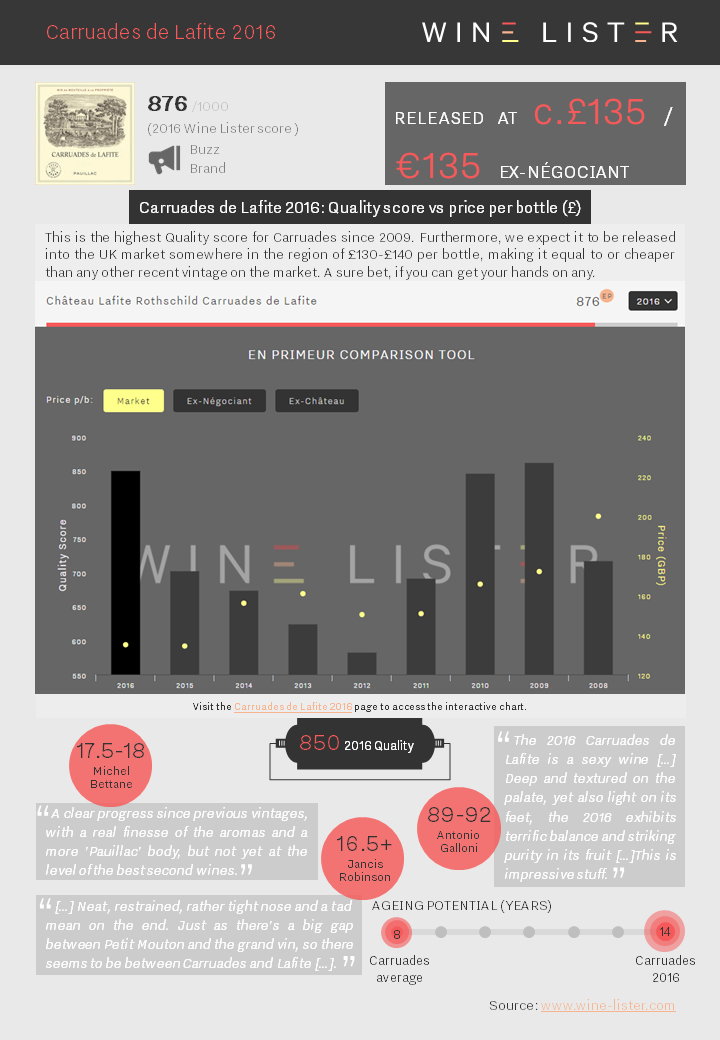

Bordeaux en primeur analysis of Carruades de Lafite 2016, released today and which we expect to be offered in the UK at c.£135 per bottle:

You can download the slide here: Wine Lister Factsheet Carruades de Lafite 2016

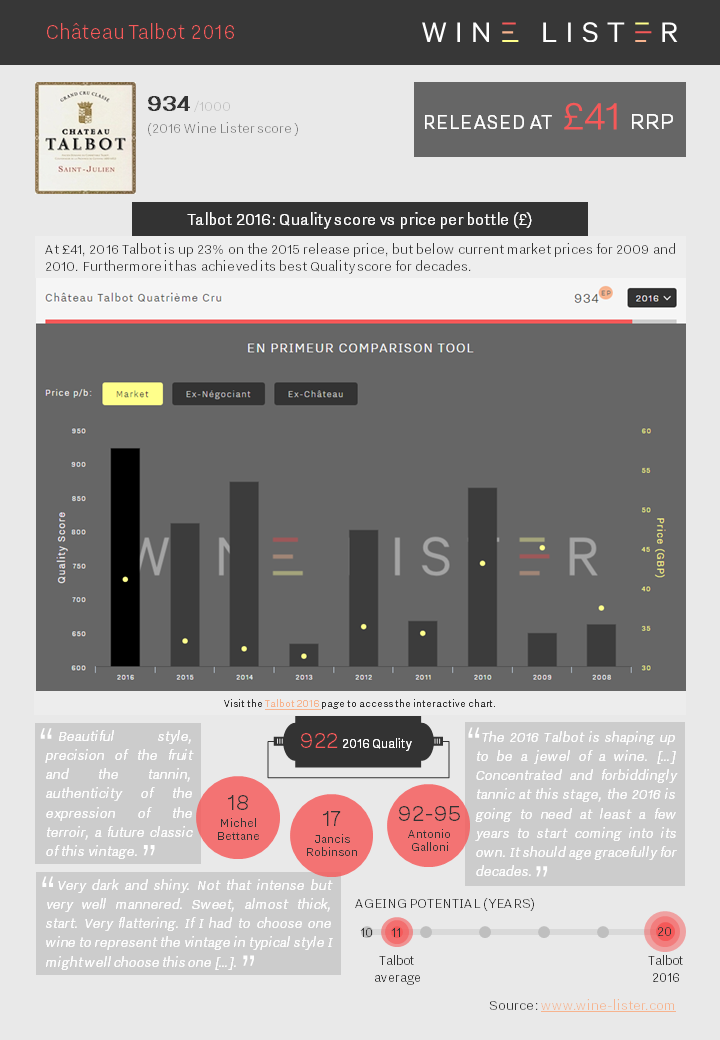

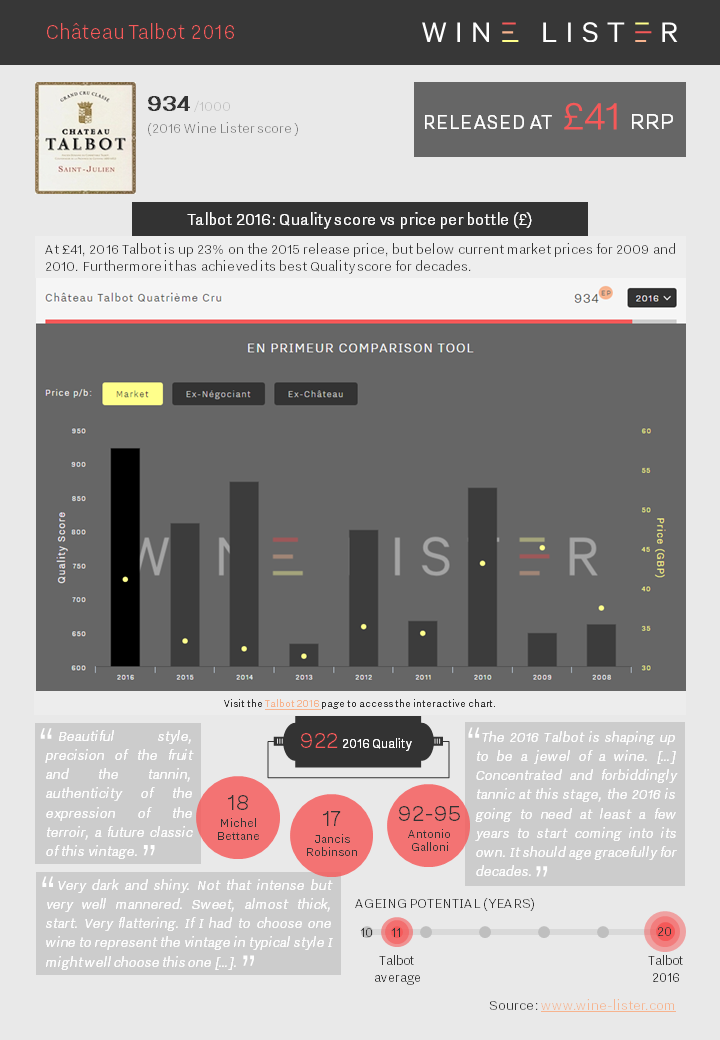

Bordeaux en primeur analysis of Talbot 2016, which was released this morning at £41:

You can download the slide here: Wine Lister Factsheet Talbot 2016

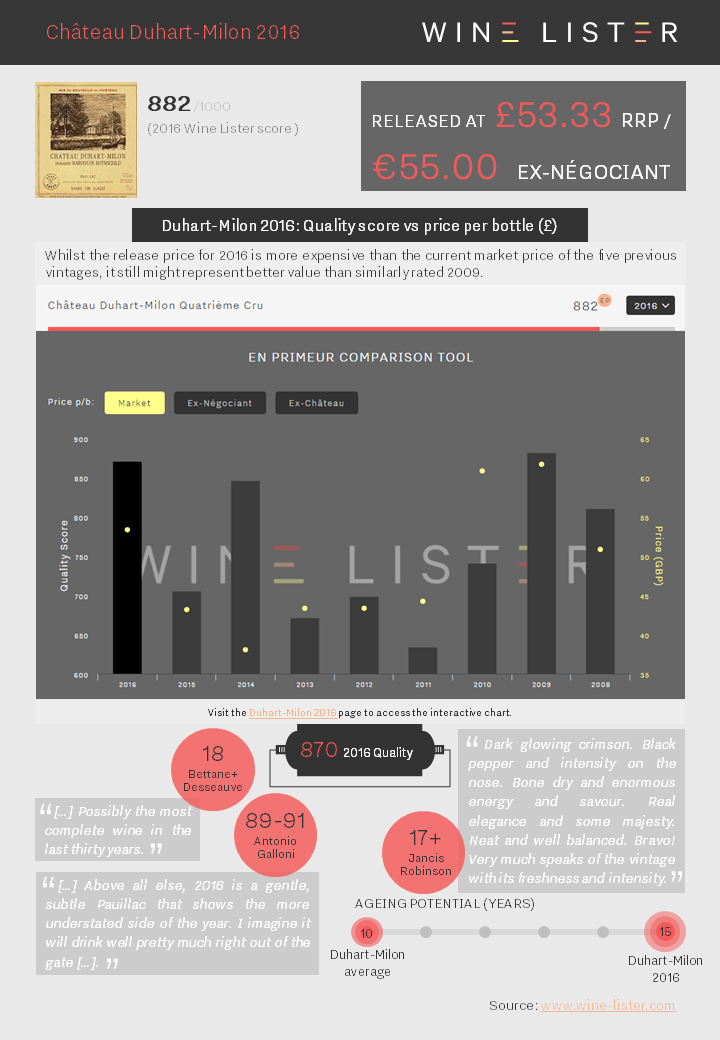

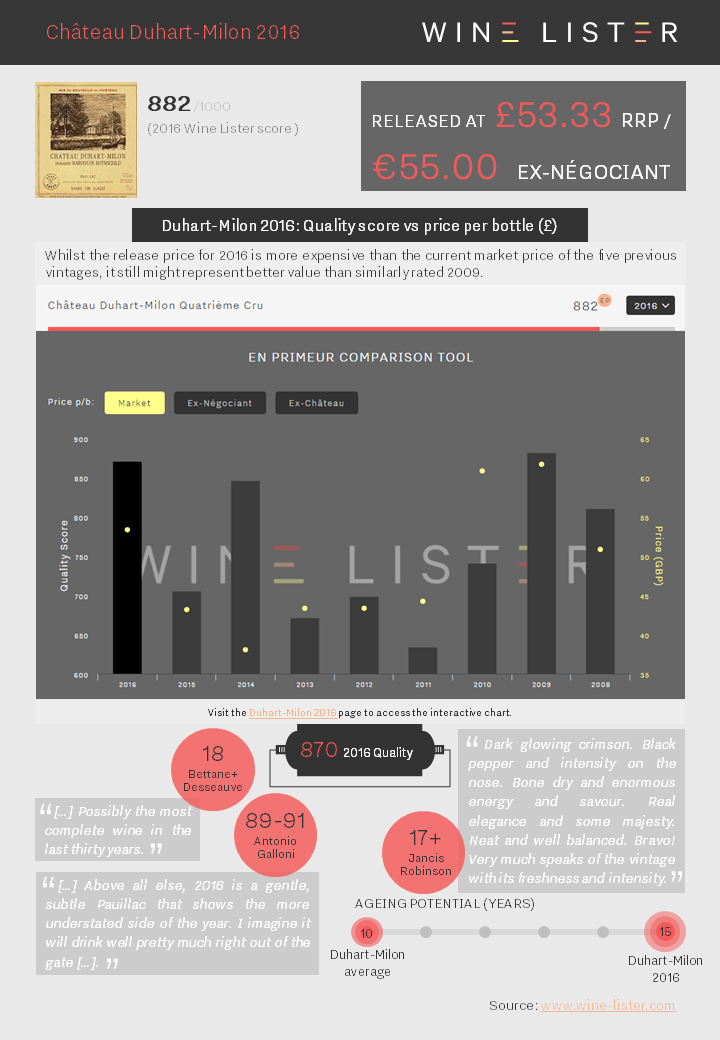

Bordeaux en primeur analysis of Duhart-Milon 2016, which has been released this afternoon at £53.33:

You can download the slide here: Wine Lister Factsheet Duhart-Milon 2016

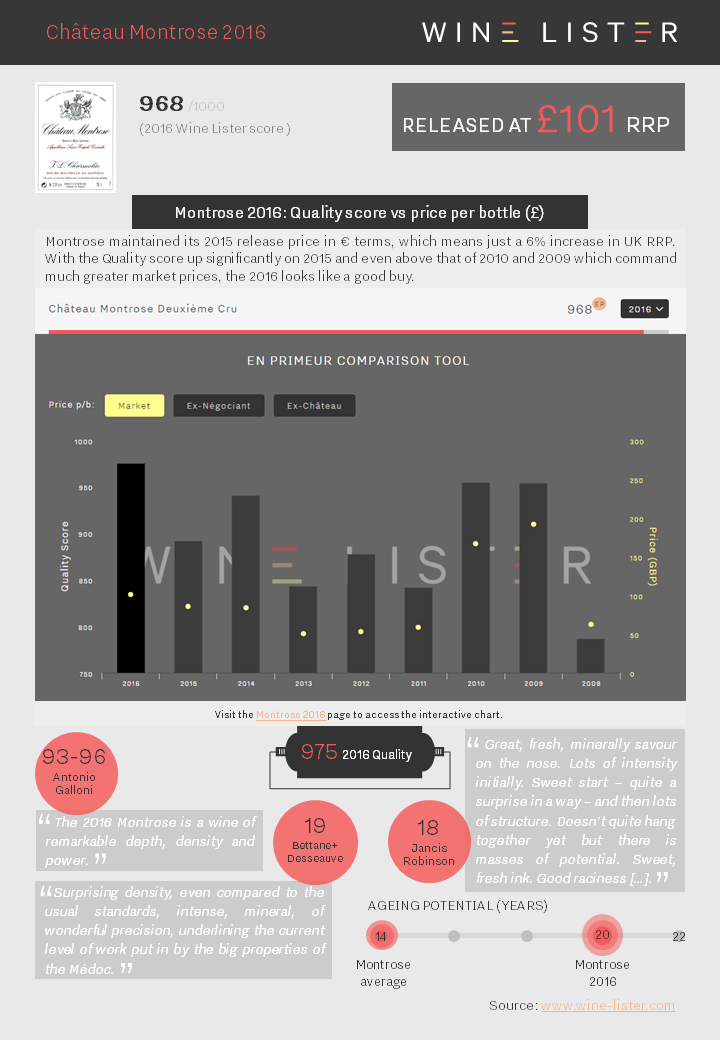

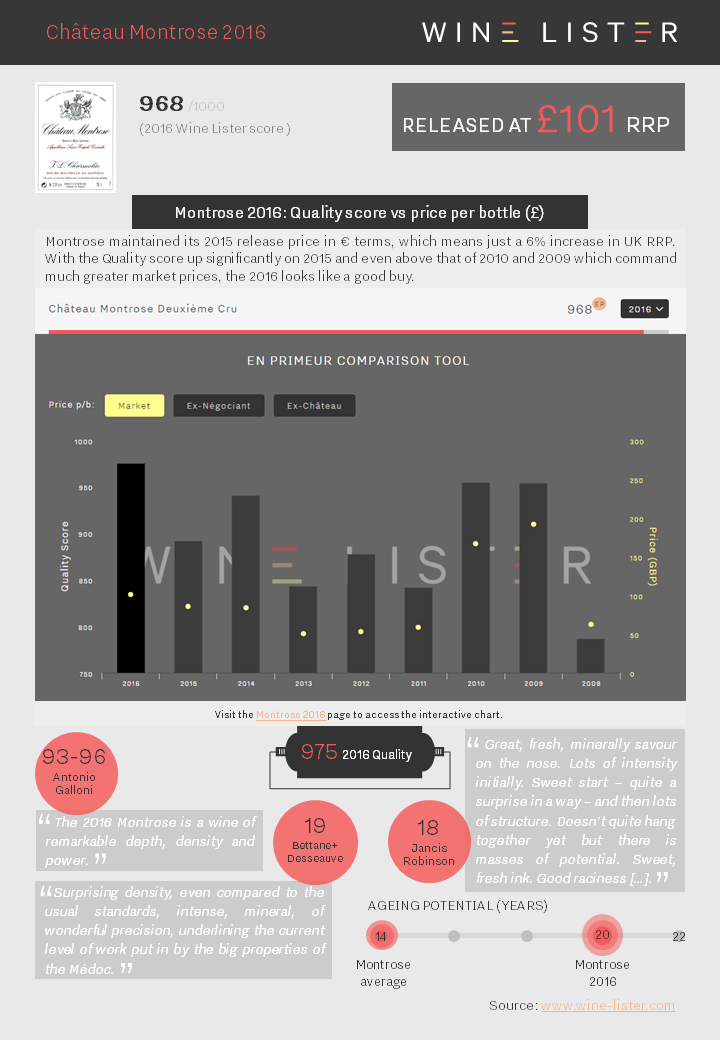

Bordeaux en primeur analysis of Montrose 2016, which has been released today at £101:

You can download the slide here: Wine Lister Factsheet Montrose 2016

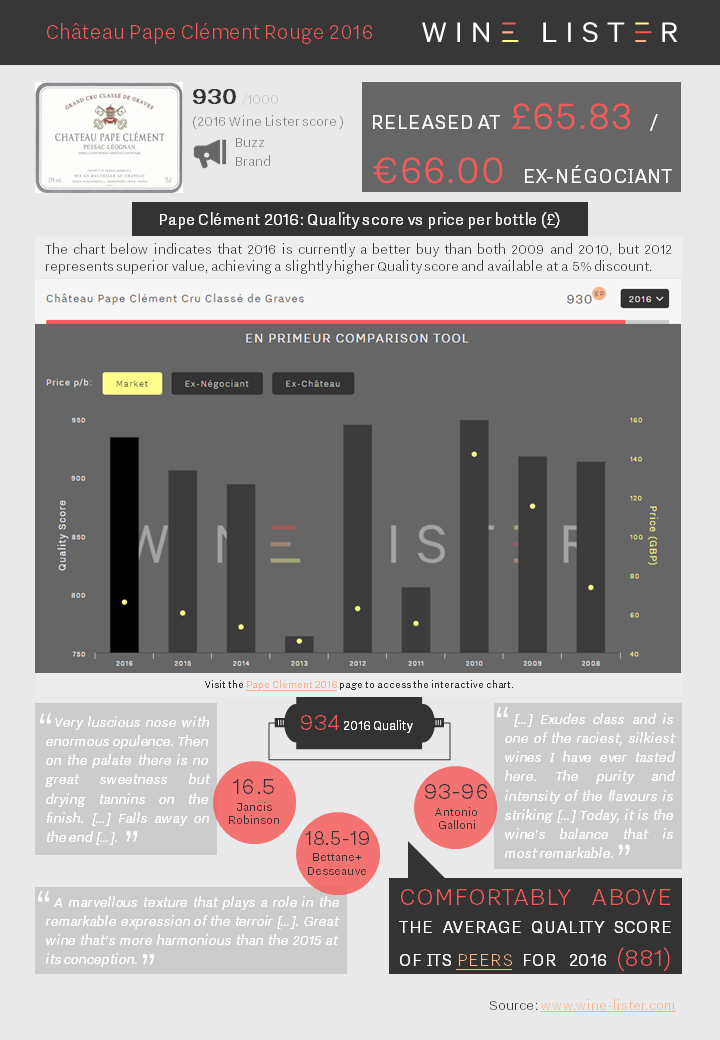

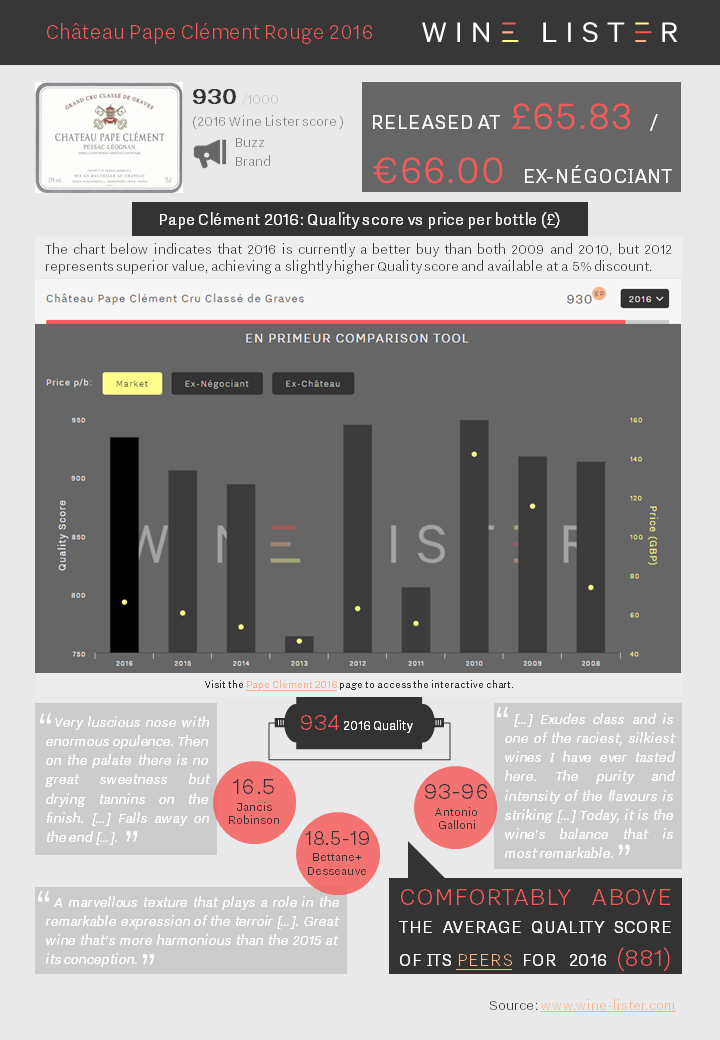

Bordeaux en primeur analysis of Pape Clément Rouge 2016, which has been released today at £65.83:

You can download the slide here: Wine Lister Factsheet Pape Clément Rouge 2016

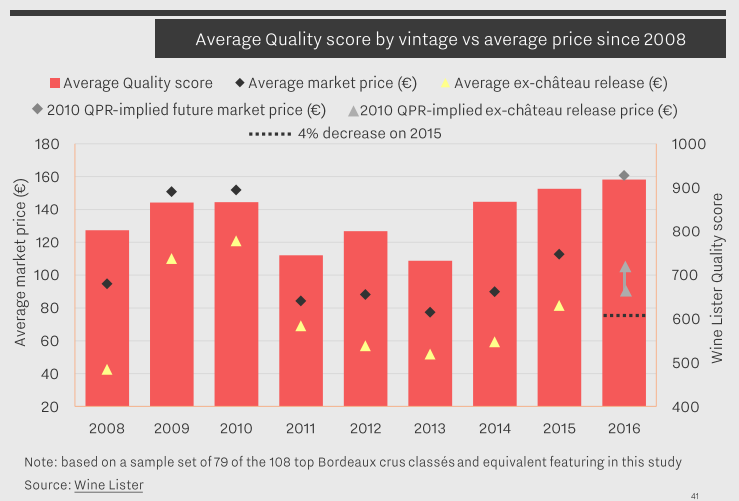

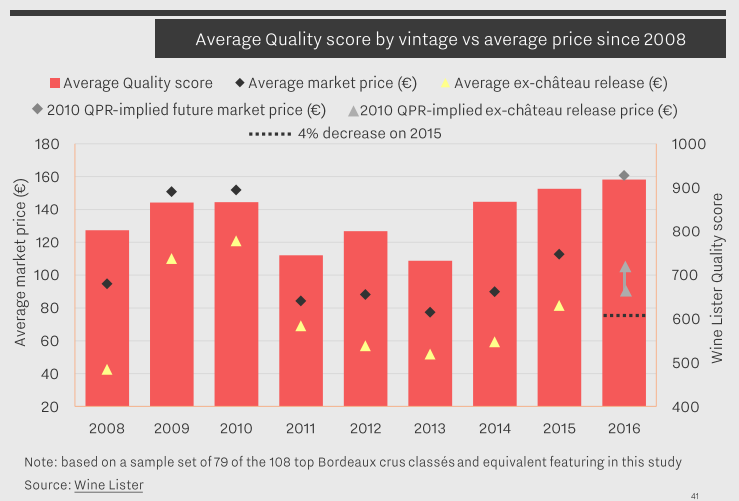

In today’s blog we continue to explore some of the findings from our new in-depth study on Bordeaux, available for subscribers here. Having looked at the wines in which the trade has most confidence, we now turn our attention to Bordeaux 2016, and a key question: how might a château arrive at an appropriate en primeur release price?

Using average figures for 79 of the top Bordeaux crus, we explore two approaches. First, simplistically, we look at release prices of previous vintages, and apply the trade’s suggested decrease of 4% (see here for more) to the average 2015 release price. This is represented by the dotted line.

However, Wine Lister Founding Members were canvassed before having tasted the 2016 vintage, now considered to be excellent, and so the average suggested decrease of 4% on 2015 prices seems unrealistically low. Some châteaux have already released maintaining their 2015 price, which has been well received by the trade, while others have applied increases in euro terms, which in turn are amplified by the current exchange rate when converted into UK offer prices.

For each wine, it is also necessary to take into account the reception by the market of last year’s price, as well as this year’s relative quality.

The second, more sophisticated approach, involves comparing the average Quality scores from the last eight vintages to the current market price for those vintages.

The closest quality rating to 2016 is 2015, but as this vintage is not yet delivered, the most appropriate vintage for comparison is 2010. As such, we have applied the quality to price ratio from 2010, in order to arrive at a derived future market price for the 2016 vintage on average, according to its current quality assessment.

The average price per bottle could be expected to reach €161 in the marketplace in due course.

Margins taken by the négociant and then importers tend to amount to around 25-30%, although this varies from wine to wine.

That would take us to around €117 per bottle at release. Then we apply a 10%-20% “discount” to the consumer for buying en primeur, before they receive the physical product. This suggests an average ex-château release price of €93 to €105 (see chart).

In general, this would mean that 2016s should be priced below current market prices for 2015, and well below 2010 market prices.

For further detail, or to enquire about price analysis on specific châteaux, please email team@wine-lister.com.