In last year’s inaugural Bordeaux study, Wine Lister recapped the region’s recent turbulence and concluded that Bordeaux was moving into a more positive phase. This year’s study – published this week, and available for subscribers here in English and French – continues that analysis, examining the region’s global positioning in the market before drilling down into its appellations and more than 100 of its top wines.

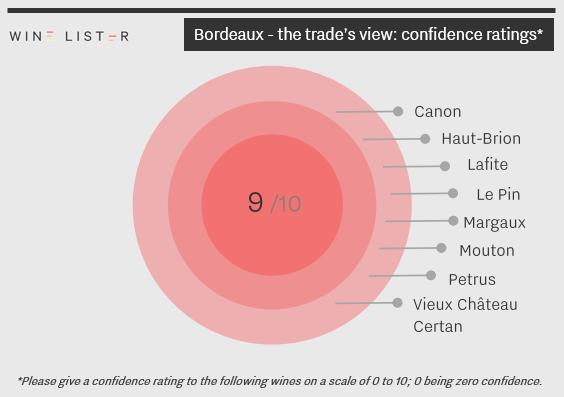

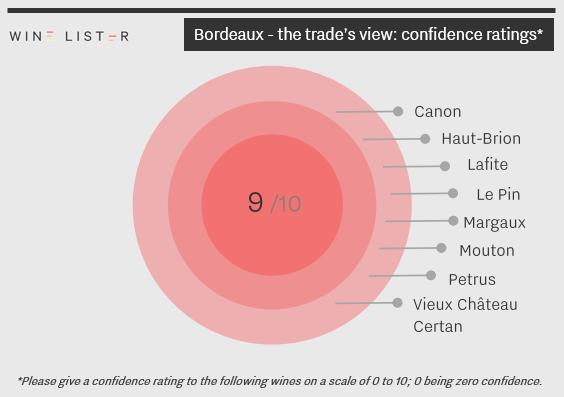

We’ll be revealing a few of the report’s findings over the coming weeks, beginning here with the trade’s view. Earlier in the year we surveyed our Founding Members (49 key fine wine trade players from across the globe), for insight into their confidence in Bordeaux’s individual wines. None got a perfect 10/10, but eight received 9/10, compared to only three last year (Latour, Margaux and Petrus), highlighting the trade’s surging confidence over the last 12 months:

While the majority of wines moved up one place from an 8/10 rating last year, Canon has greatly improved its position within the trade, leaping ahead three points from 6/10. Its 2015 vintage was declared by many to be the estate’s best: our US partner critic Antonio Galloni called it “one of the undisputed stars of the vintage” and awarded it an in-barrel score of 96-98/100. Canon 2016 has also been lauded by the critics, scoring 18.5/20 from our UK partner critic Jancis Robinson.

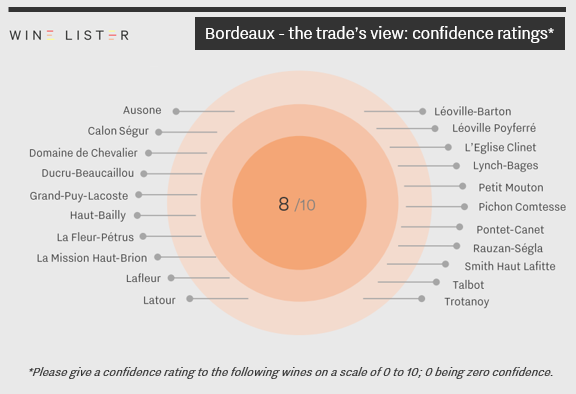

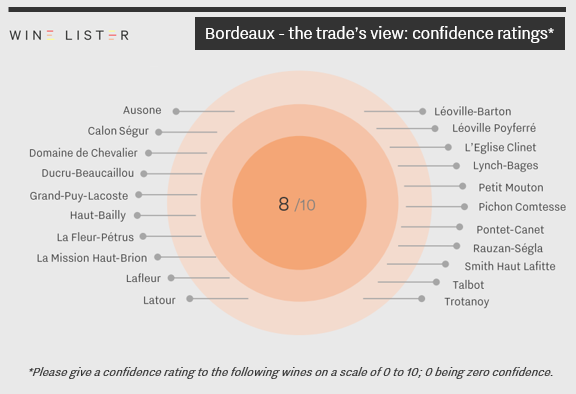

Meanwhile, 21% of the 108 wines surveyed received a confidence rating of 8/10, up from 18% of wines last year. Those whose standing has leapt significantly include Domaine de Chevalier, Haut-Bailly, Petit Mouton, Smith Haut Lafitte and Talbot, all up from 6/10 last year.

Visit Wine Lister’s Analysis page to read the full 48-page report, ‘2017 Bordeaux Market Study – A true return to form?’, available in both English and French.

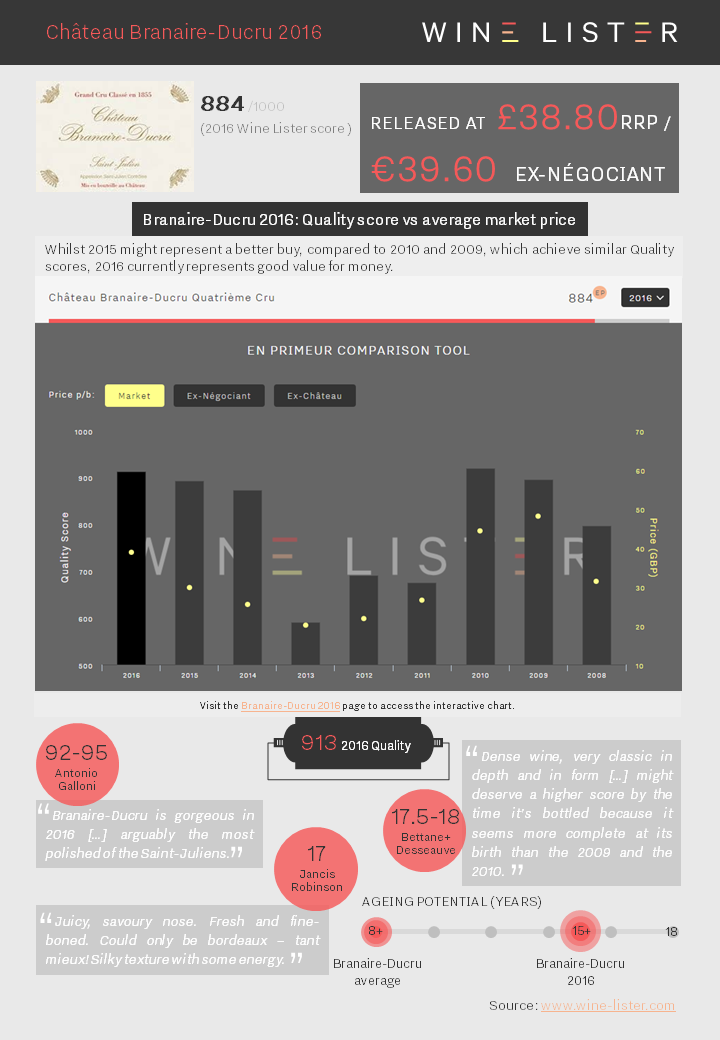

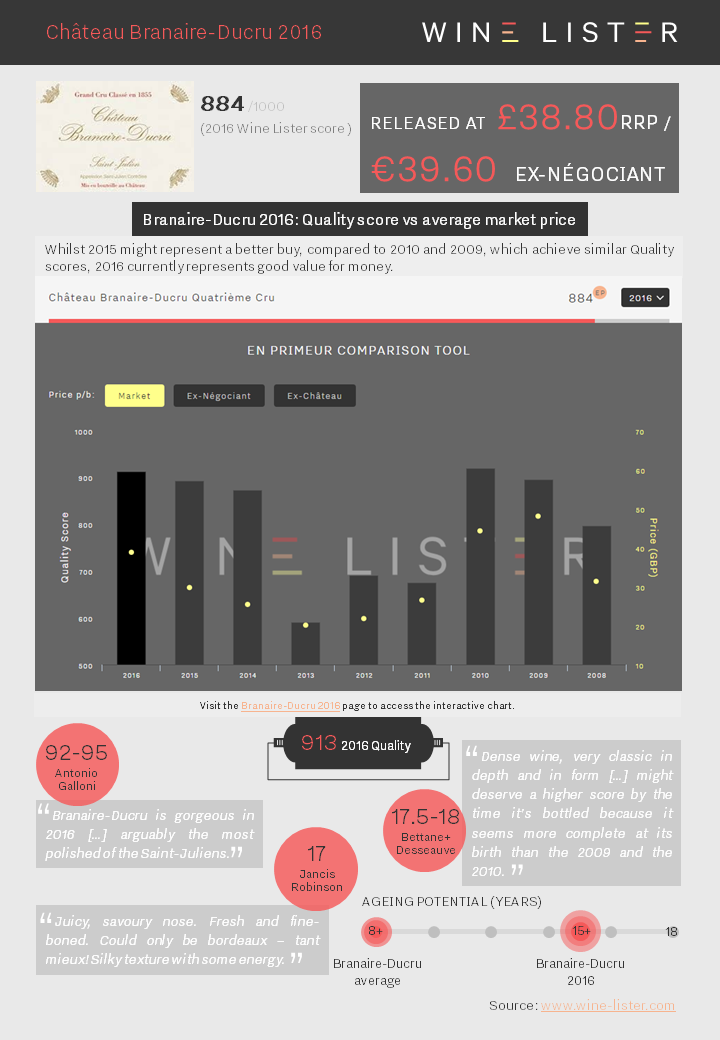

All the facts on Branaire-Ducru 2016, which has been released today at £38.80 RRP:

You can download the slide here: Wine Lister Factsheet Branaire-Ducru 2016

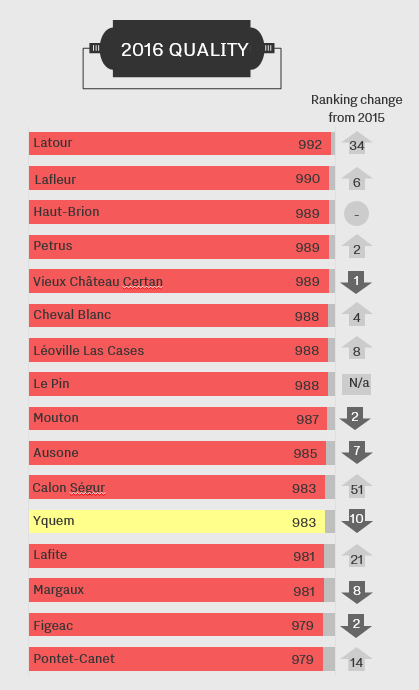

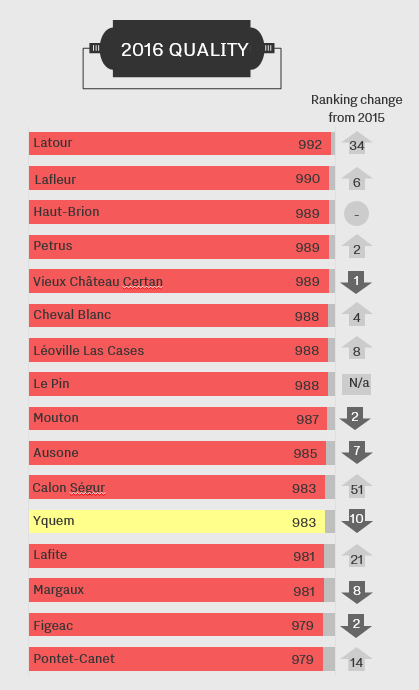

Now that all our partner critics’ scores have been published, we have been able to feed them into Wine Lister’s bespoke algorithm to arrive at Quality scores for the Bordeaux 2016 vintage. The top 15 wines are shown below.

Wine Lister’s Quality score combines the ratings from our partner critics, three of the most respected critics in the world – Jancis Robinson, Antonio Galloni, and Bettane+Desseauve. A small weighting is also added for a wine’s ageing potential.

Ironically, the top wine of the vintage is Latour, not available to buy en primeur since the château withdrew from the system in 2012. The Pauillac first growth surged 34 positions up the table from last year, to 992 points for its 2016 Quality score.

Lafleur is just behind on 990, closely followed by Haut-Brion, Petrus and Vieux Château Certan. In fact, all the usual contenders make an appearance in the top 15, including the five first growths, their right bank equivalents such as Le Pin, Cheval Blanc, and Ausone, and Sauternes’ own first growth, Château d’Yquem.

Less obvious showings that are likely to represent better value include Calon Ségur, which improved a mammoth 51 places on last year, as well as Figeac and Pontet-Canet, in joint 15th position.

The top 40 2016 Quality scores will be listed in our upcoming Bordeaux market study, due for release later this week, and available to subscribers here. Alternatively, see the full ranking on the website.

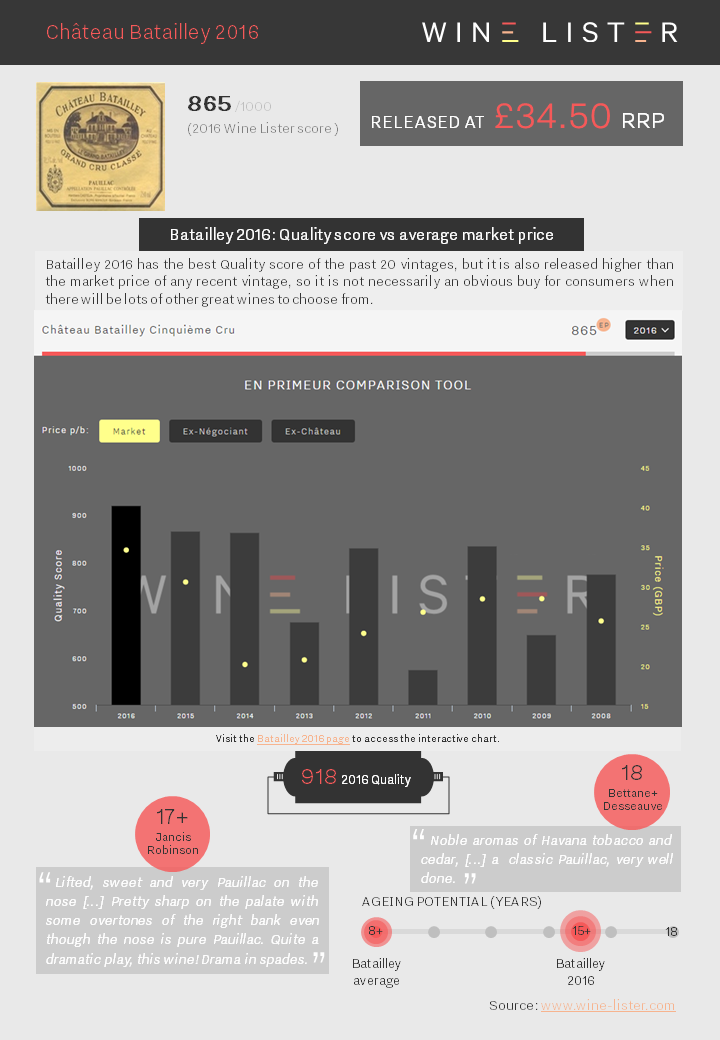

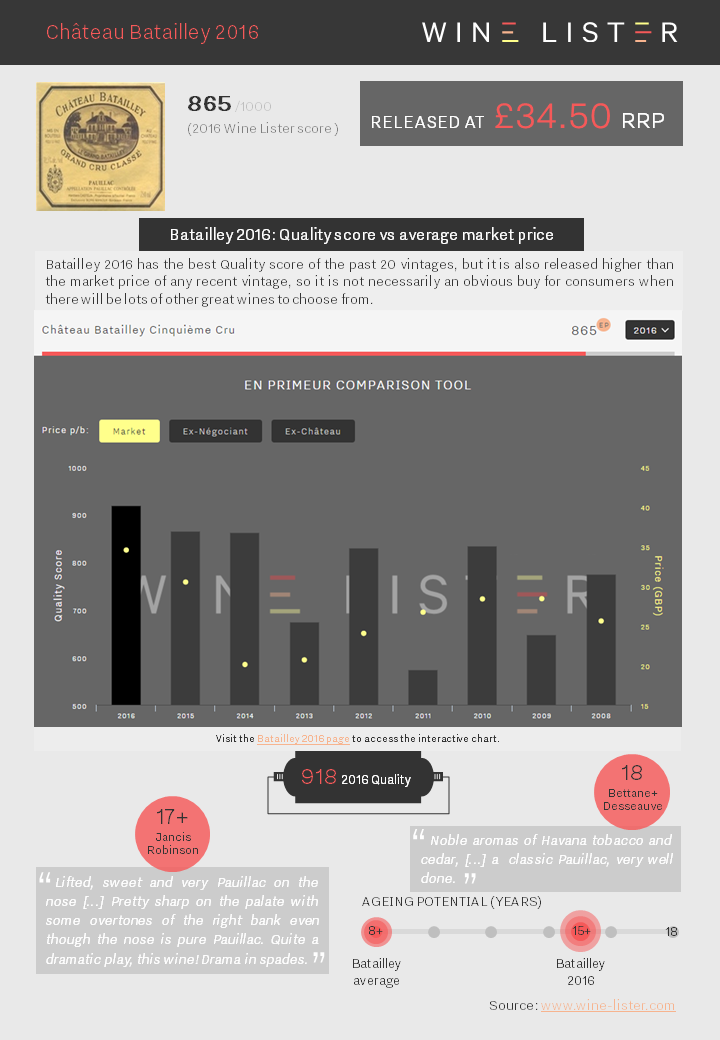

All the facts on Château Batailley 2016, which was released today at £34.50 RRP:

You can download the slide here: Wine Lister Factsheet Batailley 2016

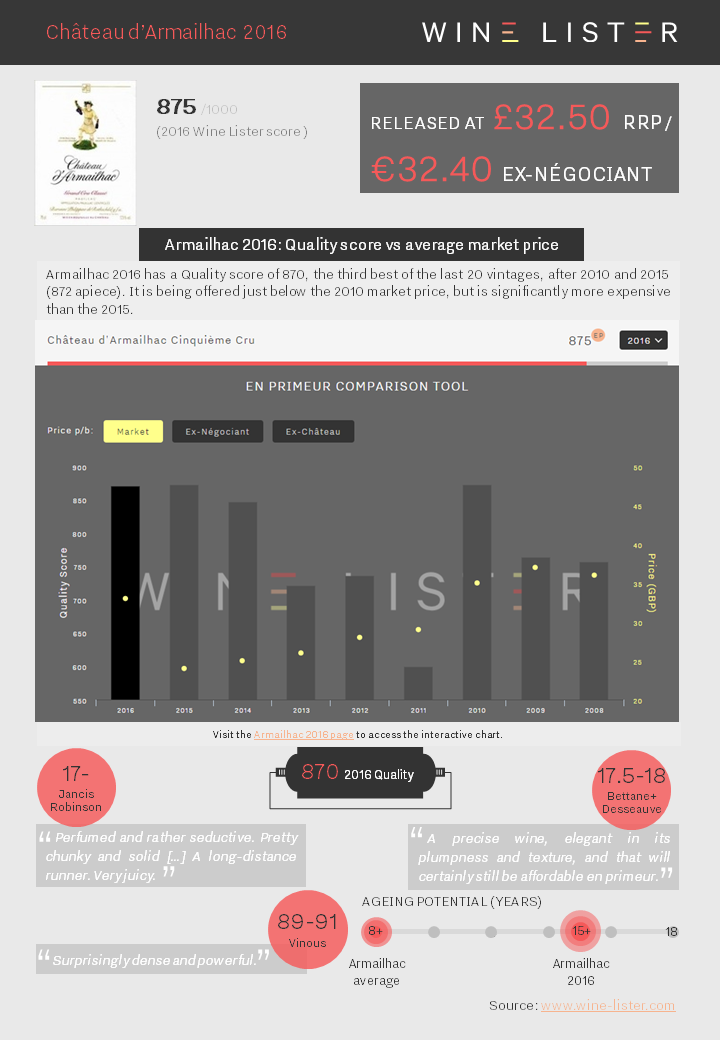

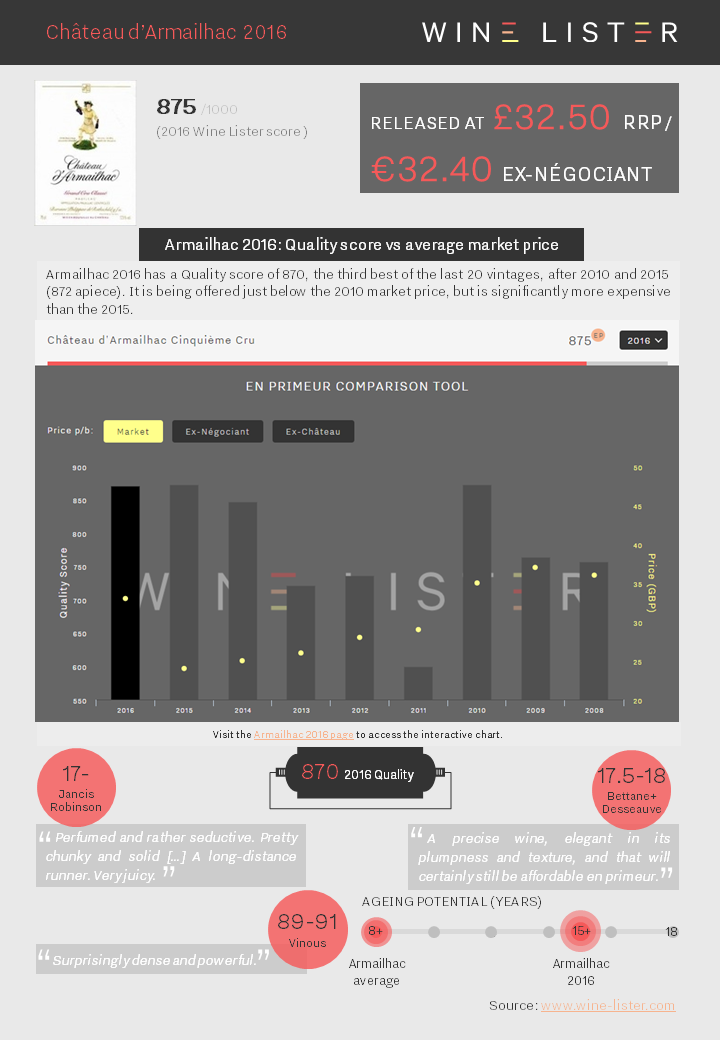

All the facts on Château d’Armailhac 2016, which was released yesterday at £32.50 RRP / €32.40 ex-négociant:

You can download the slide here: Wine Lister Factsheet Armailhac 2016

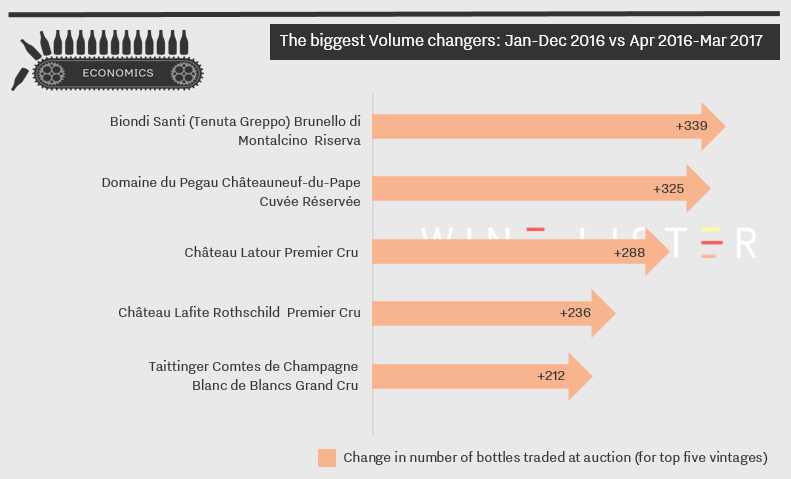

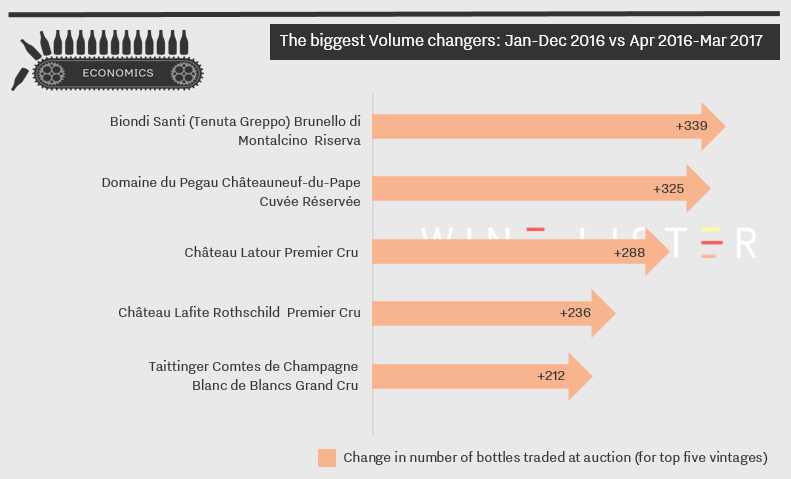

Trading volumes are a key measure of a wine’s success in the marketplace. To evaluate these, Wine Lister uses figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages traded for each wine over the past four quarters.

With the first quarter data now in, we look at which wines saw the greatest incremental increase in bottles traded. Although the list is dominated by French wines, top of the table is a Tuscan, Biondi Santi Brunello di Montalcino Riserva. The producer was recently highlighted as one to watch in a survey of Wine Lister’s Founding Members. The rise in auction sales for this wine has had a significant impact on its Economics score, boosting it from 911 to 945/1000. Volume is just one of the five criteria that feed into a wine’s Economics score, along with four different price-related metrics.

The wine seeing the second largest gain in trading volumes, Domaine du Pegau Châteauneuf-du-Pape Cuvée Réservée, also has the lowest Economics score of the table, at 789. Nonetheless, its overall Wine Lister score is very strong at 846 (lifted by a high score for Brand), and with the latest data in from Wine Market Journal its Economics score is on the rise.

The final three wines of the table – two Bordeaux first growths and a prestigious Champagne (Taittinger Comtes de Champagne) – also benefitted from increased trades in the last quarter. All three enjoy very high Economics scores, with Lafite Rothschild the highest, at 955/1000. Meanwhile it seems that 2017 has been a positive year so far for Latour, which was also among the top five wines that saw its number of searches increase significantly in March.

Château Cos d’Estournel took everyone by surprise this morning when it released its 2016 vintage en primeur sooner than expected, at €120 per bottle ex-négociant, the same price as its 2015. Intelligence gathered by Wine Lister suggested that châteaux considered to have made “mistakes” with the release of their 2015 vintage en primeur might release early and at the same price as last year.

However, even the Place de Bordeaux was not expecting a second growth to release its wine the day after the first round of the French presidential elections, and just four days after the terrorist attack in Paris.

Cos d’Estournel is considered to have had a mediocre 2015 en primeur campaign compared to some of its peers, not necessarily pricing too high, but releasing too early. However, reports are that stocks did sell through later in year. Today’s move is bold, but could pay off, if Cos d’Estournel 2016 can harness the excitement that is growing around the Bordeaux 2016 vintage before it has too much competition.

© Château Cos d’Estournel

By sticking to last year’s price, Cos is keeping the Bordeaux trade happy, and early reports are that négociants are wholeheartedly getting behind the release. The weak pound means that Cos d’Estournel 2016 is being offered to consumers in the UK at £117 per bottle, a 10% premium on the 2015 price of £106 per bottle. This might well be palatable given the quality of the wine this year and the goodwill shown by the château in not increasing its euro release price. UK merchants certainly seem to be enthusiastic in terms of their messages to consumers so far.

Wine Lister’s UK partner critic Jancis Robinson awarded the Cos d’Estournel 2016 18 points (compared to 18.5 for the 2015). Our French partner critics Bettane+Desseauve, and our US partner critic, Vinous, will release their Bordeaux 2016 scores later this week.

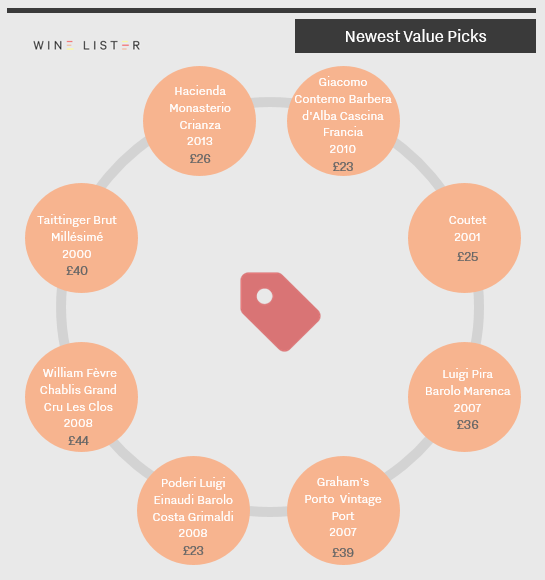

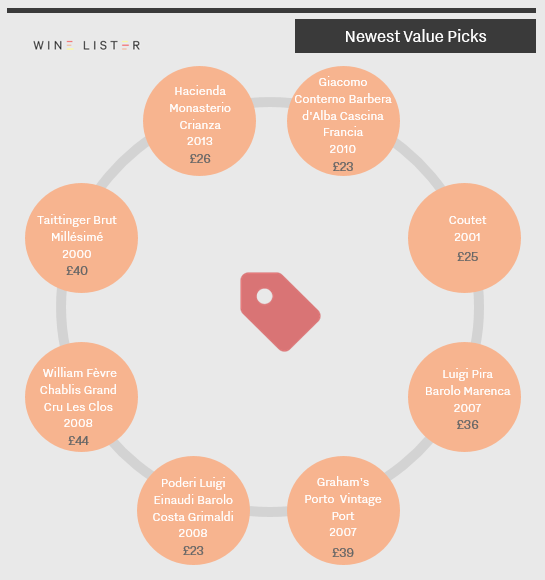

The latest price data is in, enabling Wine Lister’s algorithm to award new Value Pick status to those wines that achieve the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus allowing the finest wines a look-in).

This month, the new Value Picks include a Champagne, a Port, and a sweet white Bordeaux, but it is Piedmont that dominates, with three of its wines achieving Value Pick status: Poderi Luigi Einaudi Barolo Costa Grimaldi 2008, Luigi Pira Barolo Marenca 2007 and Giacomo Conterno Barbera d’Alba Cascina Francia 2010.

Each wine is priced at £44 per bottle or less – with half under £30 – and all have impressive Quality scores (based on ratings from our three partner critics) of 845 or above.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

In the latest of our blogs on the findings from Wine Lister’s Tuscany Market Study – following on from a look at the region’s global standing, and the popularity of its appellations – we turn our attention to its individual wines. Here, we have carried out an in-depth survey with our Founding Members (the key fine wine trade players from across the globe, between them representing more than one third of global fine wine revenues), for insight into their confidence in Tuscany’s individual wines.

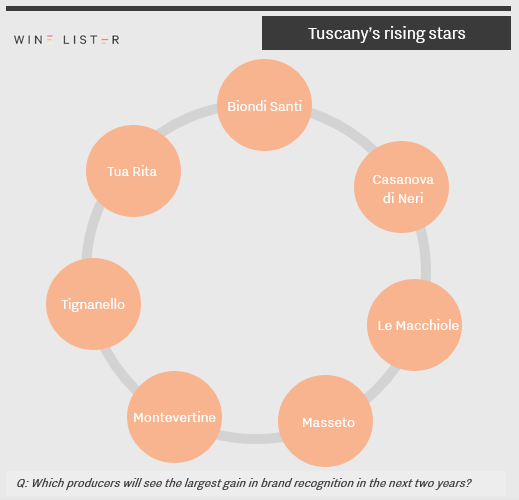

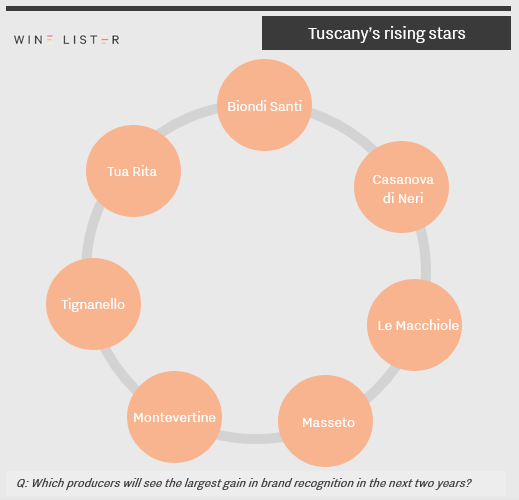

First, we asked respondents which producers are due to see the largest gain in brand recognition in the next two years. More than half those cited are producers whose flagship wines are Super Tuscans / Tuscany IGT: Tenuta Tignanello (Tignanello and Solaia), Masseto, Montevertine (Le Pergole Torte) and Tua Rita (Redigaffi).

Brunello di Montalcino DOCG is home to two contenders, Biondi Santi and Casanova di Neri, while the final producer, Le Macchiole, makes mainly Bolgheri DOC wines.

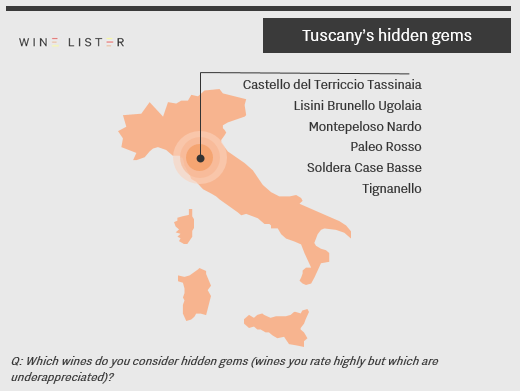

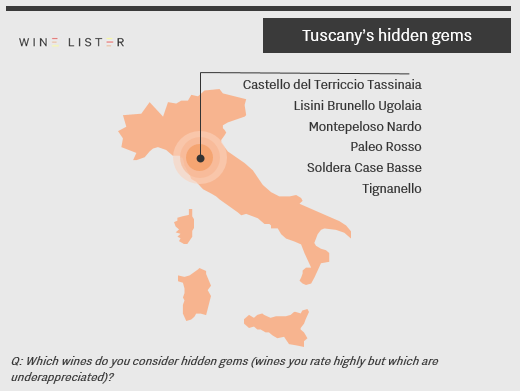

We also asked the trade which individual Tuscan wines they consider to be hidden gems: wines that they rate highly but which they perceive as underappreciated elsewhere. Two of these wines are made by rising star producers above: Tignanello, and Le Macchiole’s Paleo Rosso, suggesting that these wines may not stay underappreciated for long.

Apart from Soldera Case Basse, all of the wines cited have average prices per bottle of £75 and under, combined with strong average Quality scores that vary between 814 (Castello del Terriccio Tassinaia) and 919 (Tignanello).

To take a look at the rest of the survey’s findings – including which Tuscan wines have seen the sharpest rise in demand, which consistently sell out, and which the trade have most confidence in – please log in to Wine Lister and download the report from the Analysis page.

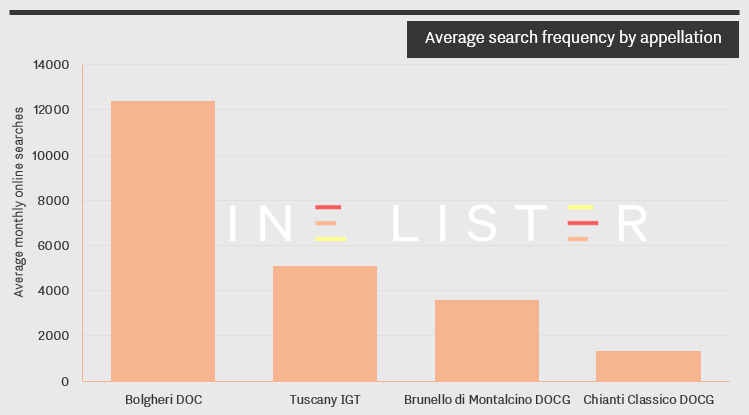

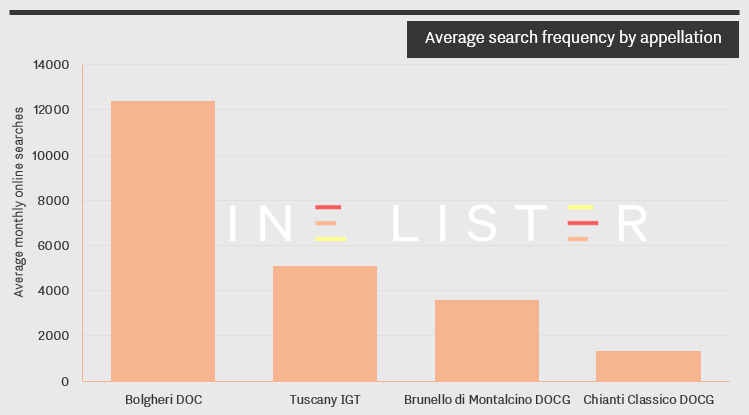

In the second blog exploring some of the findings from Wine Lister’s Tuscany Market Study – following on from our look at how the region ranks globally – we take a look at the popularity of Tuscany’s appellations. The chart below plots the average number of online searches received each month by the 50 wines in this study (based on data from Wine-Searcher), filtered by appellation.

Wines from Bolgheri DOC are by far the most popular amongst consumers, with, on average, more than twice the number of searches than their nearest competitor, Tuscany IGT. They are boosted by internationally established Super Tuscan brands such as Sassicaia and Ornellaia, which have stolen the limelight from more traditional neighbouring DOCGs such as Brunello and Chianti.

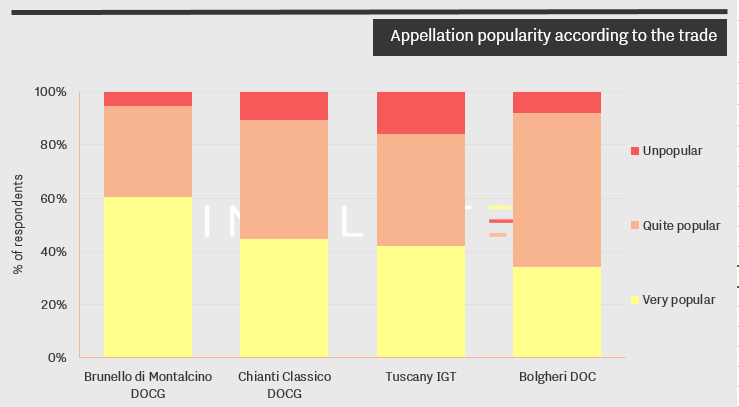

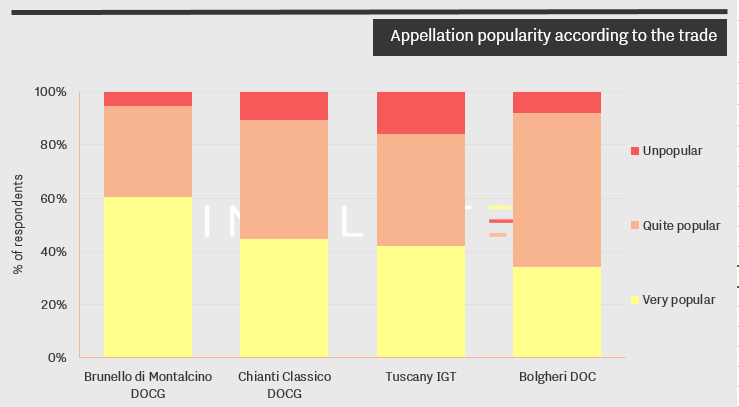

However, perception of each appellation’s popularity tells a different story. At the end of 2016, Wine Lister asked key members of the international fine wine trade about the relative popularity of Tuscan appellations amongst their clientele. Brunello di Montalcino – the third most searched for appellation – came out on top, with nearly 60% of respondents stating that it was very popular with their customers, followed by Chianti Classico.

Tuscany IGT and Bolgheri DOC trail slightly behind, emphasising that it has been the wines themselves, rather than the appellations, that have achieved fame.

In our final blog post on the Tuscany Market study we will focus in on the individual wines themselves: the trade’s view on which are the region’s consistent sellers and which are its rising stars. Wine Lister subscribers can read the full 35-page report here.