Wine Lister has published Part I of its annual Bordeaux study, titled “Crossing the Red Sea”. For the ninth year running, we have carried out an in-depth survey of key fine wine trade players from across the globe. The 50 CEOs, MDs, and wine department heads we consulted run companies that, between them, represent well over one third of global fine wine revenues.

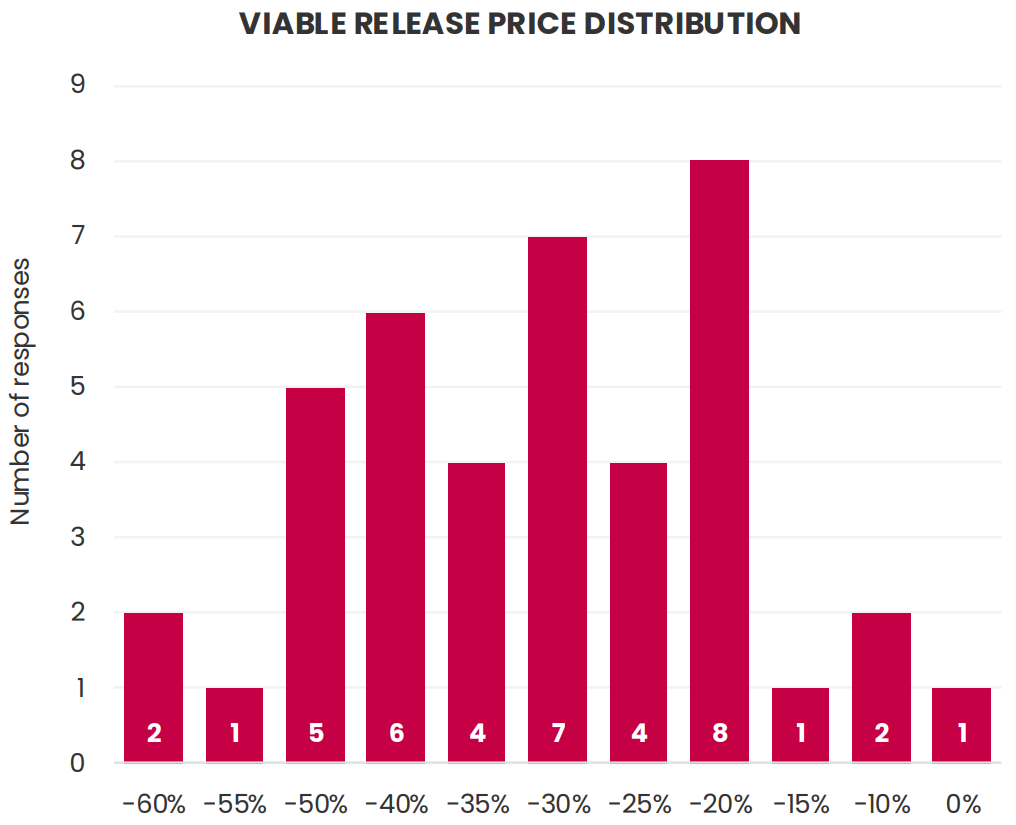

When asked what they thought the maximum viable release price for the 2024 en primeur campaign would have to be to rekindle demand (vs 2023), all but one of the 41 respondents who answered this question called for a price reduction. Our respondents suggest an average discount of -31% on the 2023 vintage, almost identical to last year (30%). This year’s responses are more spread out that last year’s, which were heavily concentrated around the 30% mark. This suggests a lack of consensus on what strategy producers should take for this year’s en primeur pricing, and perhaps implies that some believe price reductions alone will not suffice.

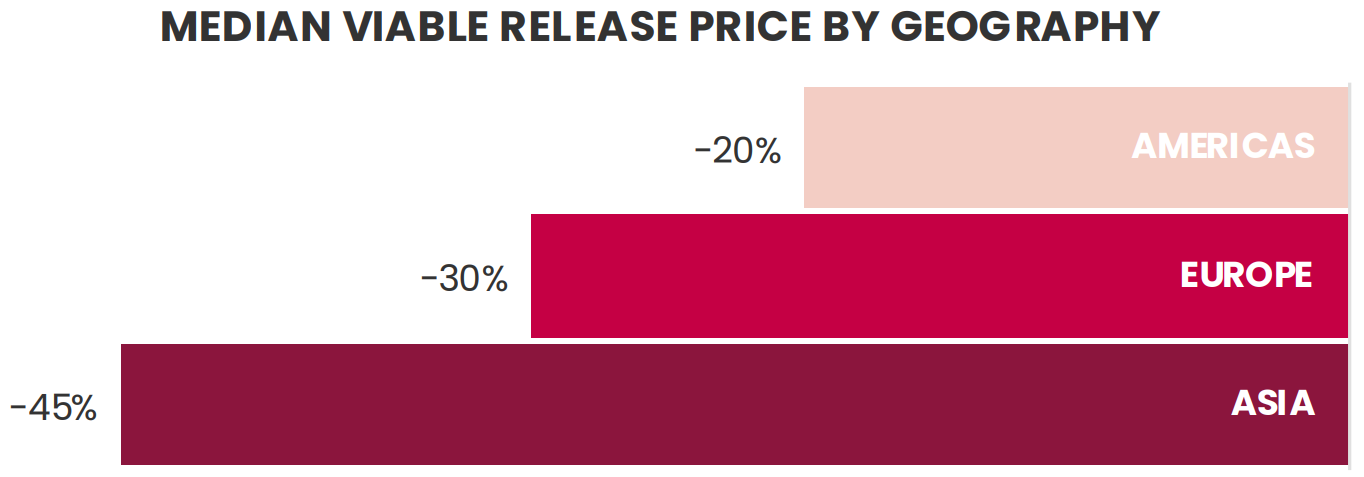

Median viable 2024 en primeur release price change suggested by the trade, split by geography (as featured in Bordeaux Study Part I: Crossing the Red Sea)

In terms of the geographical spread of responses, Asia calls for a -45% discount, while Europe and the Americas suggest -30% and -20%, respectively (noting that both Asia and the Americas have much smaller sample sizes).

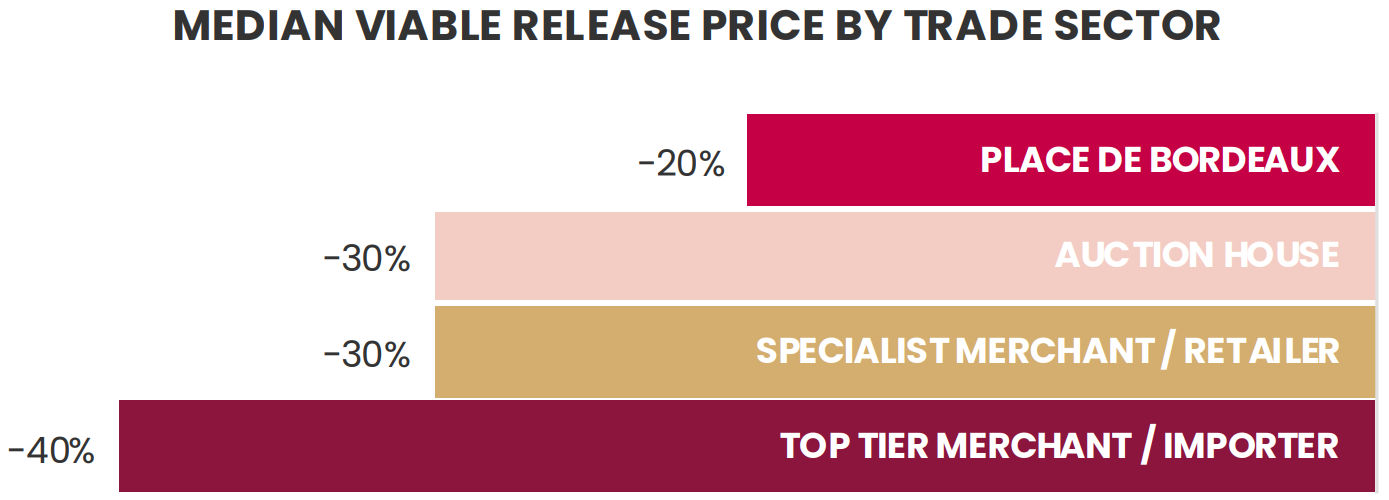

Median viable 2024 en primeur release price change suggested by the trade, split by trade sector (as featured in Bordeaux Study Part I: Crossing the Red Sea)

When we split our responses by trade sector, we found that top tier merchants / importers called for the largest price discount, with a median discount of -40%. Auction houses and specialist merchants / retailers both indicate a -30% discount, and the Place de Bordeaux calls for an average -20% discount.

Purchase the full study here (in either French or English) to read more exclusive insights from the fine wine trade’s leading figures. Pro+ Subscribers can download their study for free here.