Part I of Wine Lister’s annual in-depth Bordeaux report: For better, for worse, examines the state of the market for Bordeaux wines, in the context of 2019 en primeur.

As well as providing insight into the wine trade’s latest position on key wines of the region, the study examines Bordeaux’s disconnect between consumer popularity and its market performance at the start of 2020 (exacerbated by recent macro-economic hits to the UK, Hong Kong, and the US).

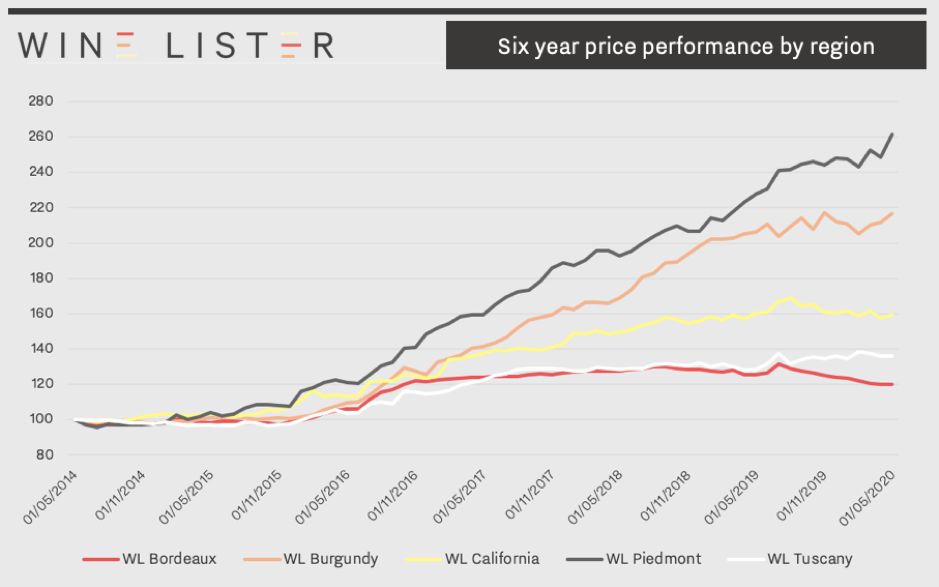

As illustrated below, Bordeaux has achieved the slowest price growth on the secondary market since May 2014, while Piedmont has seen the most impressive growth - likely due to increasing attention given to the region, and the rarity factor of many of its top wines, from which Burgundy also benefits.

The price performance of Bordeaux compared to four other key fine wine regions: Burgundy, California, Piedmont, and Tuscany. The price indices comprise the top five wine brands in each respective region.

A glance at its price performance since May 2019 tells a similar, if more unnerving story - Bordeaux has floundered over the past year, down nearly 5%.

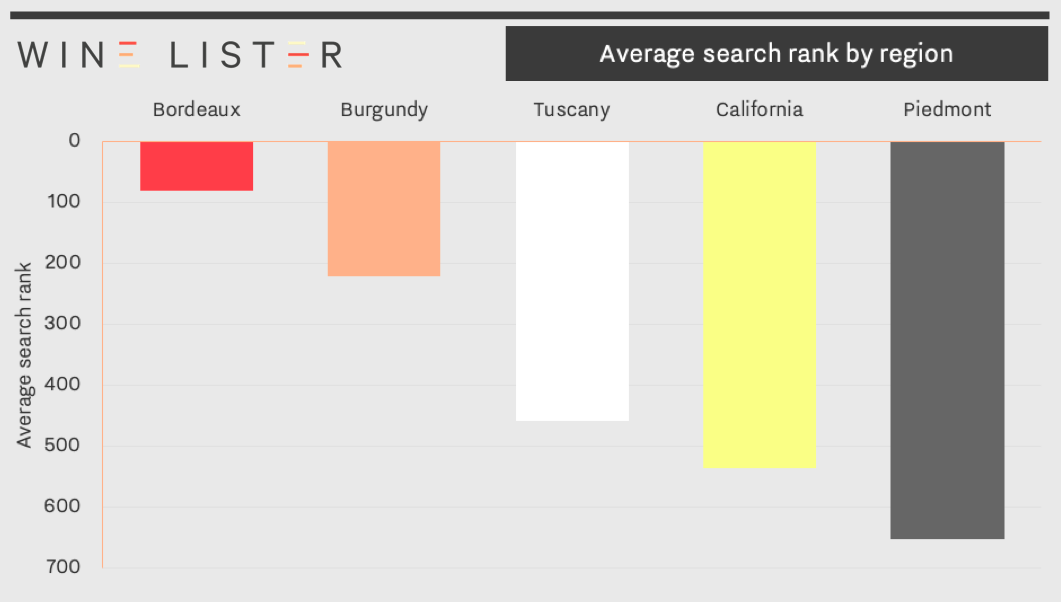

Despite its price performance difficulties, Bordeaux nonetheless continues its legacy as the most popular wine region by a large margin, based on monthly searches made on Wine-Searcher.

The average search rank of Bordeaux compared to four other key fine wine regions: Burgundy, California, Piedmont, and Tuscany. Results are based on the average searches on Wine-Searcher for the 50 top-scoring wines per region over the last year.

The average search rank of Bordeaux compared to four other key fine wine regions: Burgundy, California, Piedmont, and Tuscany. Results are based on the average searches on Wine-Searcher for the 50 top-scoring wines per region over the last year.

Irrespective of its price performance struggles, Bordeaux remains a focus of fine wine buyers – within the trade and beyond – all over the world. The en primeur campaign is a wheel that just keeps on turning, even in spite of a global pandemic. Trade and consumers alike can’t help but back Bordeaux, for richer and poorer.

More insight into the success of the 2019 en primeur campaign will be included in Part II of this study. In the meantime, visit the Analysis page to purchase Part I, or download using your Pro subscription (available in both English and French).