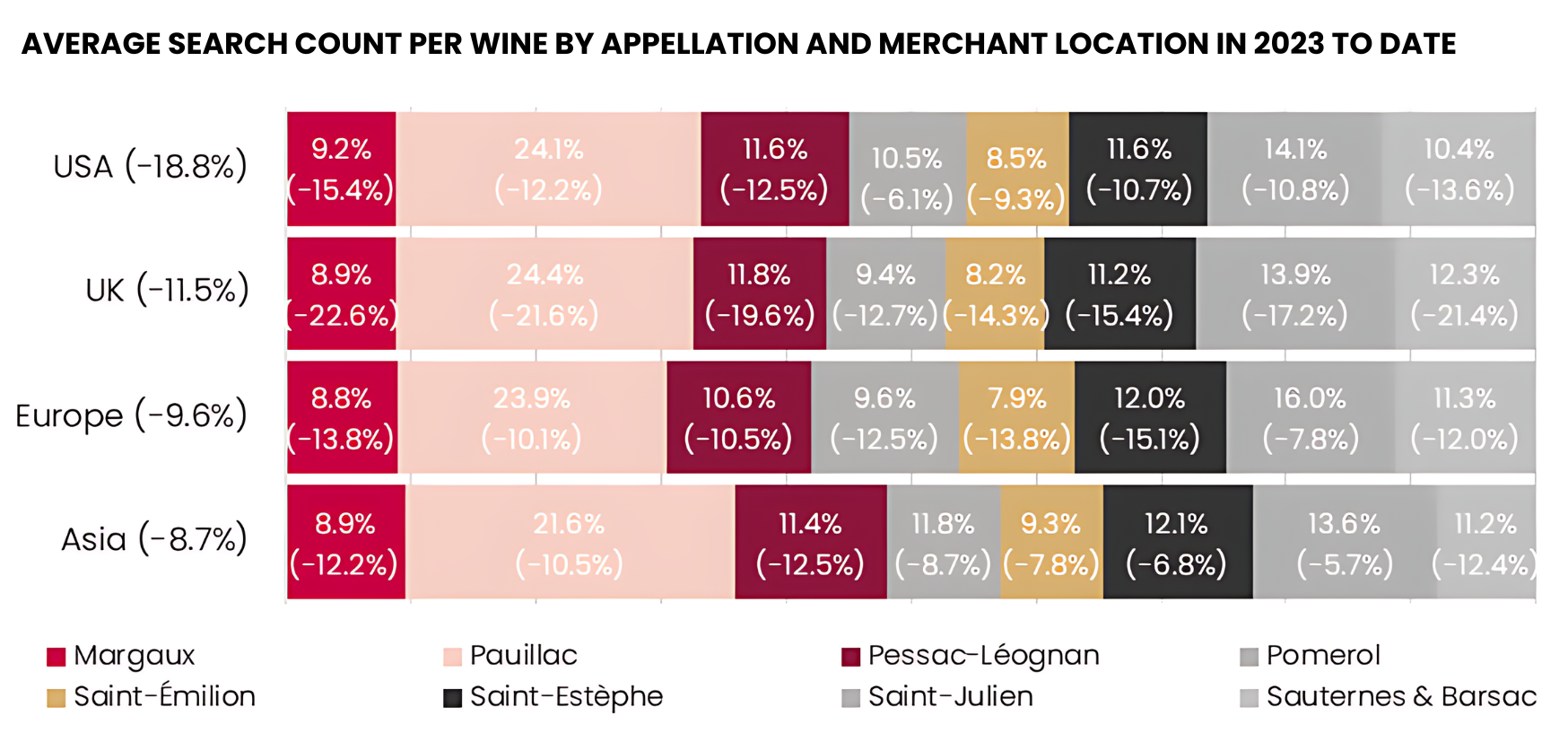

Average search count per wine by appellation and user location in 2023 to date

In Part II of its annual Bordeaux Study, Wine Lister has partnered once more with its price and search data partner, Wine-Searcher, to provide insight into current search activity and trends. The analysis focuses on 125 Bordeaux wines from eight key Bordeaux regions: Margaux, Pauillac, Pessac-Léognan, Pomerol, Saint-Émilion, Saint-Estèphe, Saint-Julien, and Sauternes and Barsac.

The graph above shows the relative importance of each appellation in terms of searches per wine from January to April 2024 in four key user locations: USA, UK, Europe, and Asia. This represents, on average, 1.7 million searches per month worldwide for the subset of 125 wines.

Wine-Searcher’s data shows that, compared to the same four-month period in 2023, searches for Bordeaux are trending downwards. With that being said, in a context of growing supply and contracting demand across all wine regions, Bordeaux still dominates both searches and offers on Wine-Searcher. Over the last 12 months, its share of total searches has increased marginally from 17.3% to 17.9%. Meanwhile, offers for Bordeaux wines increased substantially from 970,000 to 1.1 million (+13.5%), faster than offers for all wines that appear on the platform, which increased from 8.2 million to 9.1 million (+11.0%). This means that its share of total offers has risen from 11.8% to 12.1%.

Margaux, which occupies 9.2% of the searches within the sample, has seen the largest worldwide drop of 15.4% compared to 2023. Sauternes and Barsac, down 13.6% across all locations, has seen the next greatest decrease and now occupies 10.4% of searches. Pauillac, which retains its status as the largest appellation by share of searches (24.1%), still experienced a 12.2% drop.

Out of all the locations studied, interest in Bordeaux wines in the US dropped the most, with total searches for the region down 18.8%. The UK was next, with a 11.5% decrease, followed by Europe (down 9.6%), and then Asia (8.7%).

Purchase the full study here (in French and English) to read more exclusive insights from Wine-Searcher’s analysis.