As we enter into this new year, 2020, it hardly seems possible that wines from the 2010 vintage are now a decade old. Having updated the Wine Lister MUST BUYs for the first time in 2020, we have examined all current recommendations from 2010. Wine Lister’s ground-breaking buy recommendations are data-driven, with an intelligence-based overlay. The algorithm takes into account a wine’s quality and value within its vintage and appellation, as well as the latest industry intelligence from key players in the global fine wine trade. The Wine Lister team then scours the results to identify must-buy wines based on our own tasting experience and market knowledge.

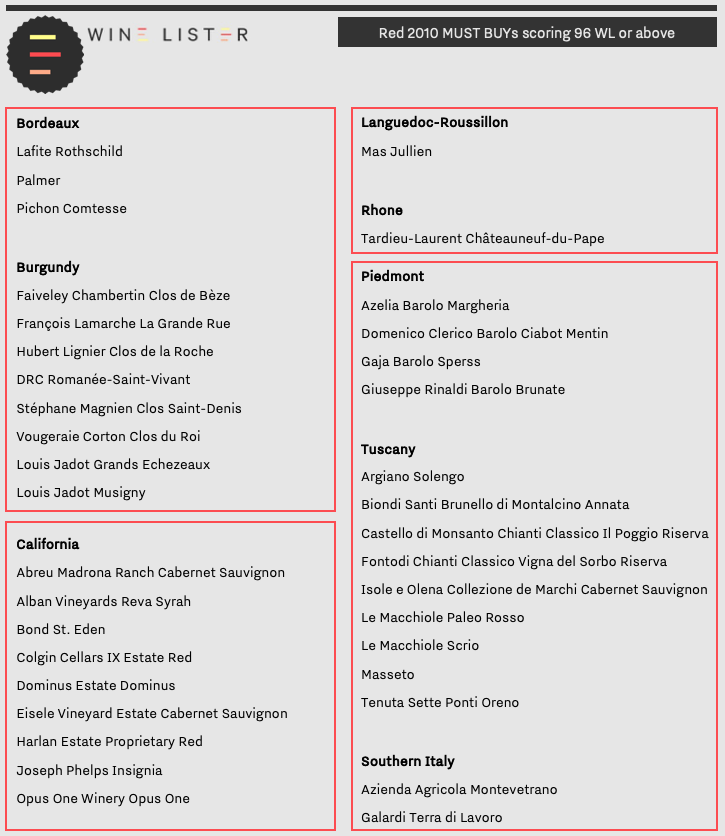

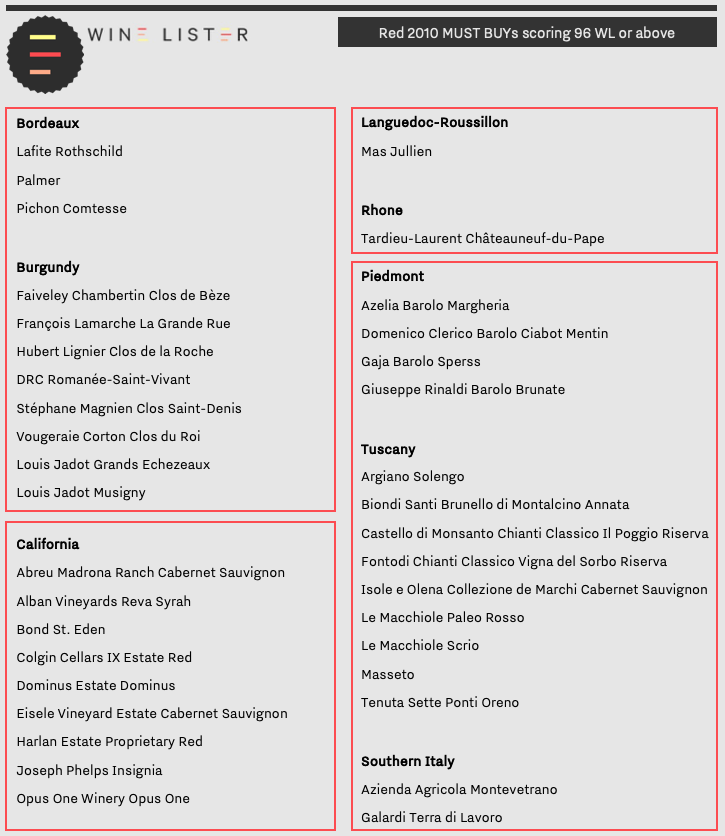

2010 is the number one vintage for MUST BUYs, with 169 – or 10% – of the current count (1,710). An impressive 49 of these achieve WL scores of 96 or above, and are listed below.

As is becoming a regular pattern for MUST BUYs – thanks to the region’s value proposition – Tuscany dominates the list of reds, with nine wines featured from the 2010 vintage earning 96+ WL across the Chianti and Brunello DOCG, and Tuscany IGT appellations. Super-value producer Le Macchiole achieves MUST BUY status for two of its three cuvées in the 2010 vintage (Scrio and Paleo Rosso), while at the other end of the price spectrum is Masseto 2010.

California also achieves nine MUST BUY entries for 2010, including wines from the likes of Dominus, Colgin, Harlan Estate and Opus One. Burgundy follows with one red fewer, and includes François Lamarche’s monopole La Grande Rue.

Piedmont features four Barolos, amongst which is the legendary Giuseppe Rinaldi’s Barolo Brunate (labelled Brunate-Le Coste prior to the 2010 vintage). Bordeaux falls short of its usual ratio of MUST BUYs in 2010, featuring just three wines. Being such an iconic vintage, 2010 Bordeaux in general does not offer the “good value” necessary to make the Wine Lister MUST BUY cut when up against better-value vintages such as 2008 or 2014. However, for Lafite, Palmer, and Pichon Comtesse, the 2010 vintage is of significantly higher quality than other vintages to make it worth paying the price premium – less marked than for many other 2010s. For example, the average premium of 2010 over 2011 for Lafite, Palmer, and Pichon Comtesse is 42%, whereas for Mouton, Léoville Las Cases, and Pichon Baron you have to pay 60% more to get your hands on the better vintage.

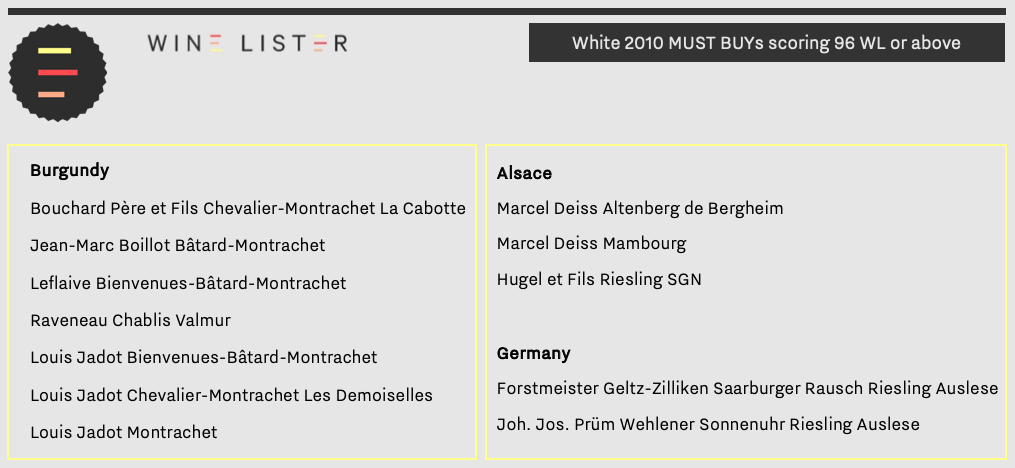

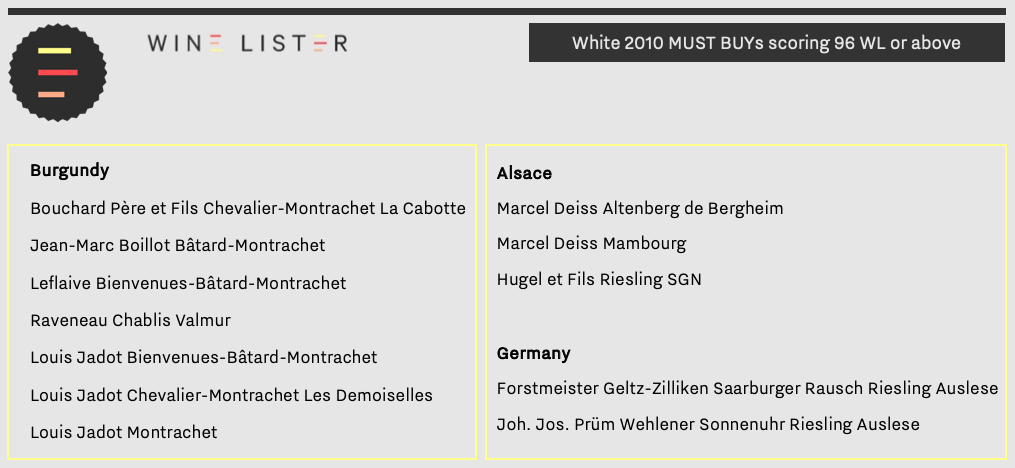

Several whites make the cut in 2010, of which the majority hail from the reigning region of Chardonnay. Burgundy’s Maison Louis Jadot sweeps three of the seven white Burgundy 2010 spots, proving once again the excellent value presented by some of Burgundy’s top quality négociants.

Riesling-based whites also prove a popular option, with entries across Alsace and Germany, however lucky owners of some of these (namely Marcel Deiss’ Altenberg de Bergheim and Zilliken’s Saarburger Raucsch Riesling Auslese), should have patience, and could perhaps even wait until the start of the next decade before opening either of these spectacular wines.

See the full list of 2010 MUST BUYs here.

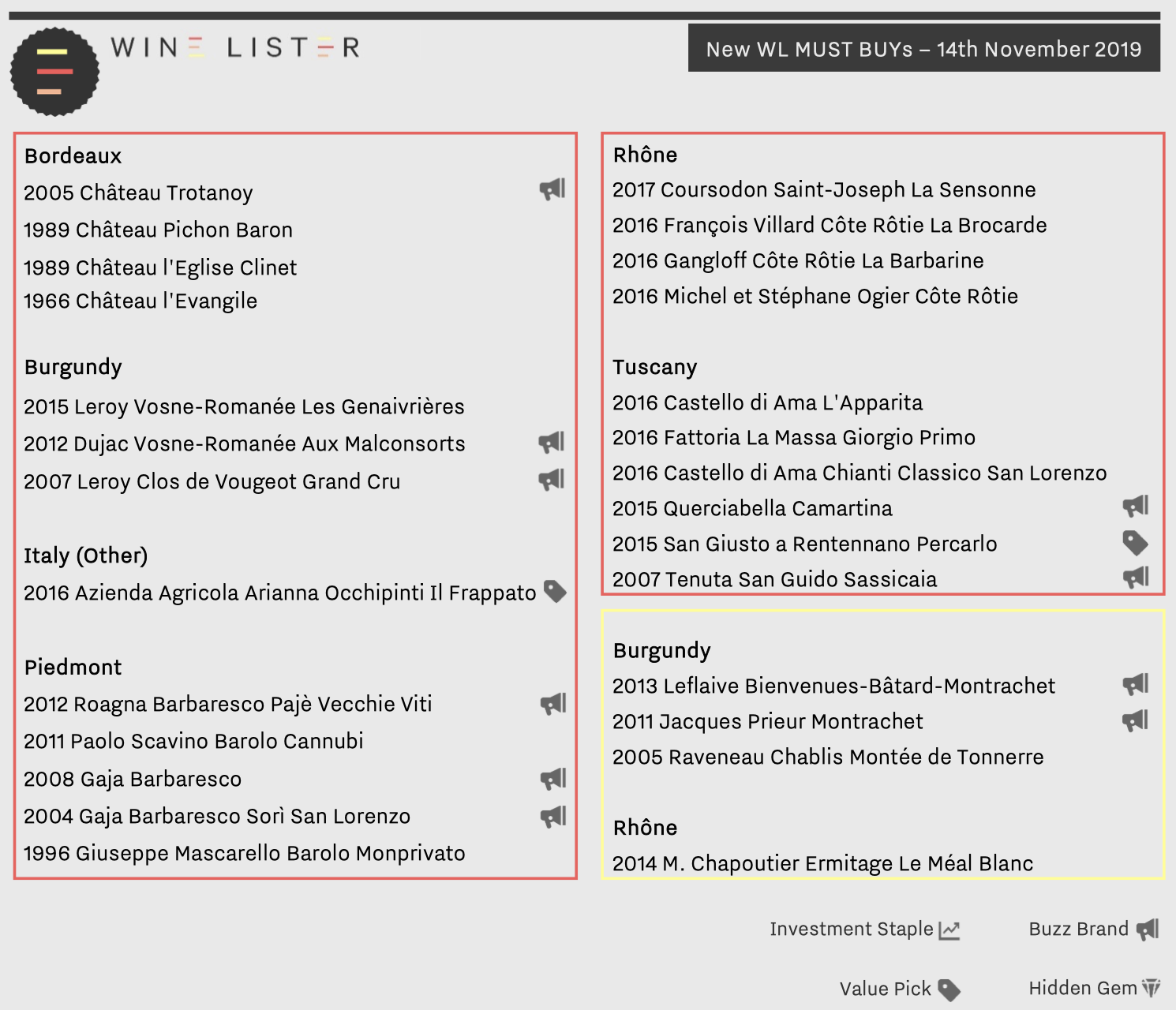

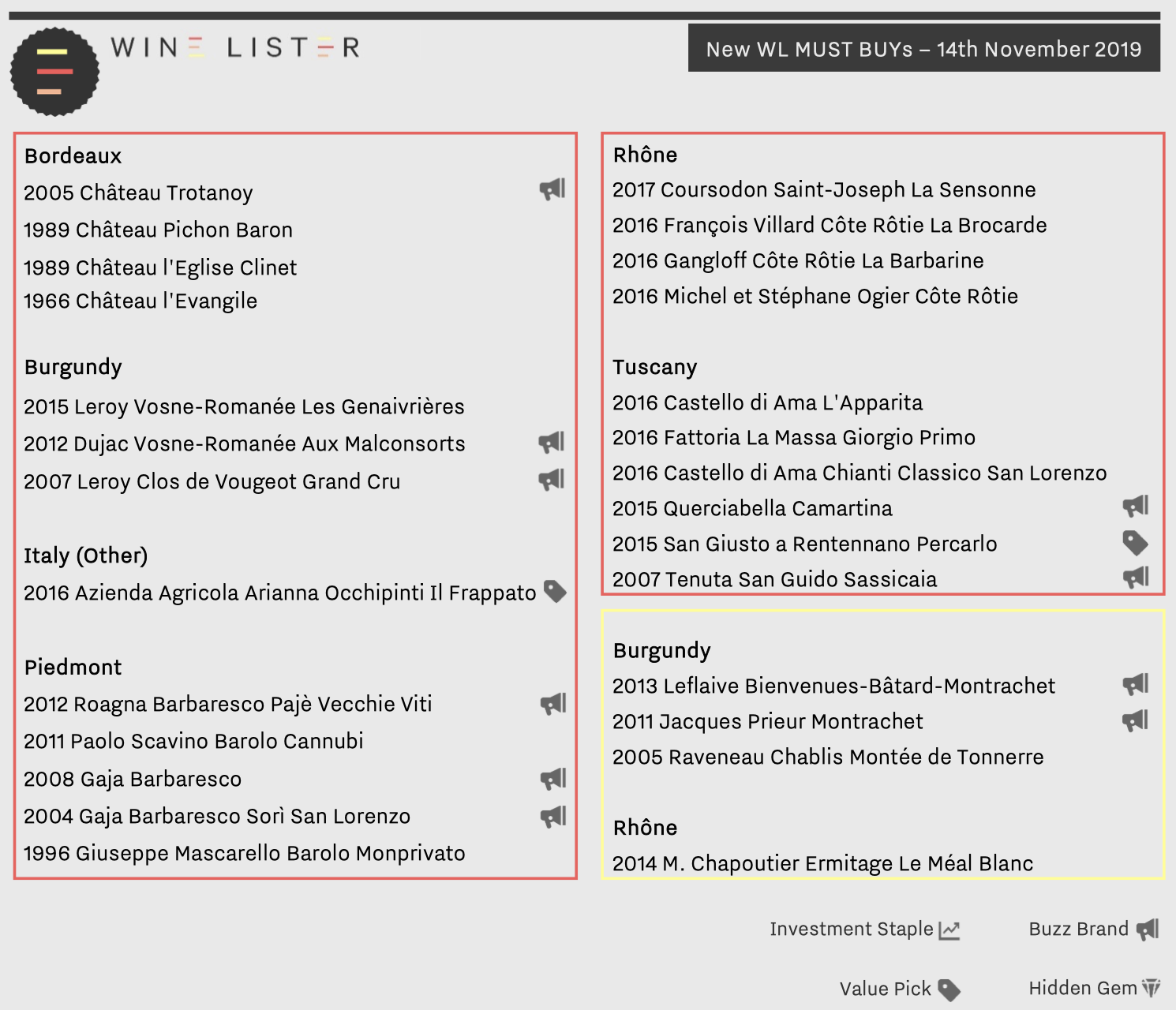

For the last three consecutive updates, Burgundy has worn the crown for highest number of new MUST BUY entries. This week it shares its prime position with Tuscany, as the two regions hold six wines each of the 27 new MUST BUYs. Whilst previous updates have been geographically diverse, this week’s countries of focus are France and Italy only.

All but one of this week’s new Tuscan MUST BUYs can be considered “Super Tuscans”. Buzz Brands Querciabella and Sassicaia make the cut for their 2015 and 2007 respectively. Producer Fattoria La Massa earns another place this week for Giorgio Primo, making its 2016 the sixth MUST BUY vintage of this same wine. 2015 Percarlo from San Giusto a Rentennano and 2016 l’Apparita from Castello di Ama complete the new “Super Tuscans”. A second offering from Castello di Ama is this week’s only new Chianti Classico entry, and brings the producer’s MUST BUY total to eight, equalling Italy’s other top MUST BUY producers, Castello dei Rampolla, and Isole e Olena, in number.

Further North in Italy, Piedmont is by no means overlooked, with Roagna and Paolo Scavino featuring on the new MUST BUY list for Barolo this week (in 2012 and 2011 vintages respectively), alongside Giuseppe Mascarello’s 1996 Barolo Monprivato. Gaja is represented twice, and completes the Piedmont five with the straight Barbaresco and the Sorì San Lorenzo.

France’s chief MUST BUY region, Burgundy, offers three reds and an equal number of whites, with Leroy representing two of the three Pinot Noirs (2015 Vosne-Romanée Les Genaivrières and 2007 Clos de Vougeot). Vosne-Romanée earns another mention through Dujac for its 2012 Aux Malconsorts. Domaine Leflaive, Jacques Prieur, and an older vintage of Raveneau take this week’s new white Burgundy MUST BUY places.

Outside Burgundy, France is also well-represented by the Rhône, with a 2017 from Coursodon, together with 2016s from François Villard, Gangloff, and Michel et Stéphane Ogier. Chapoutier’s 2014 Ermitage Le Méal Blanc completes the latest additions of MUST BUY whites. Older vintages of Bordeaux also make the cut, including a 1966 from l’Evangile, and one 1989 from each bank – l’Eglise Clinet and Pichon Baron.

To help keep track of the weekly updates, check out our latest tool on the search page to help you browse only the newest additions to the full MUST BUY list.

Since its launch in September, Wine Lister’s MUST BUY list has unveiled fine wines across multiple regions, vintages, price points, and drinking occasions, all with the common theme of being so good, that they simply must find their place in fine wine fanatics’ cellars. Wine Lister’s prices are updated weekly, and since price (in the form of value) plays a major part in the MUST BUY algorithm, MUST BUYs too will henceforth be updated weekly.

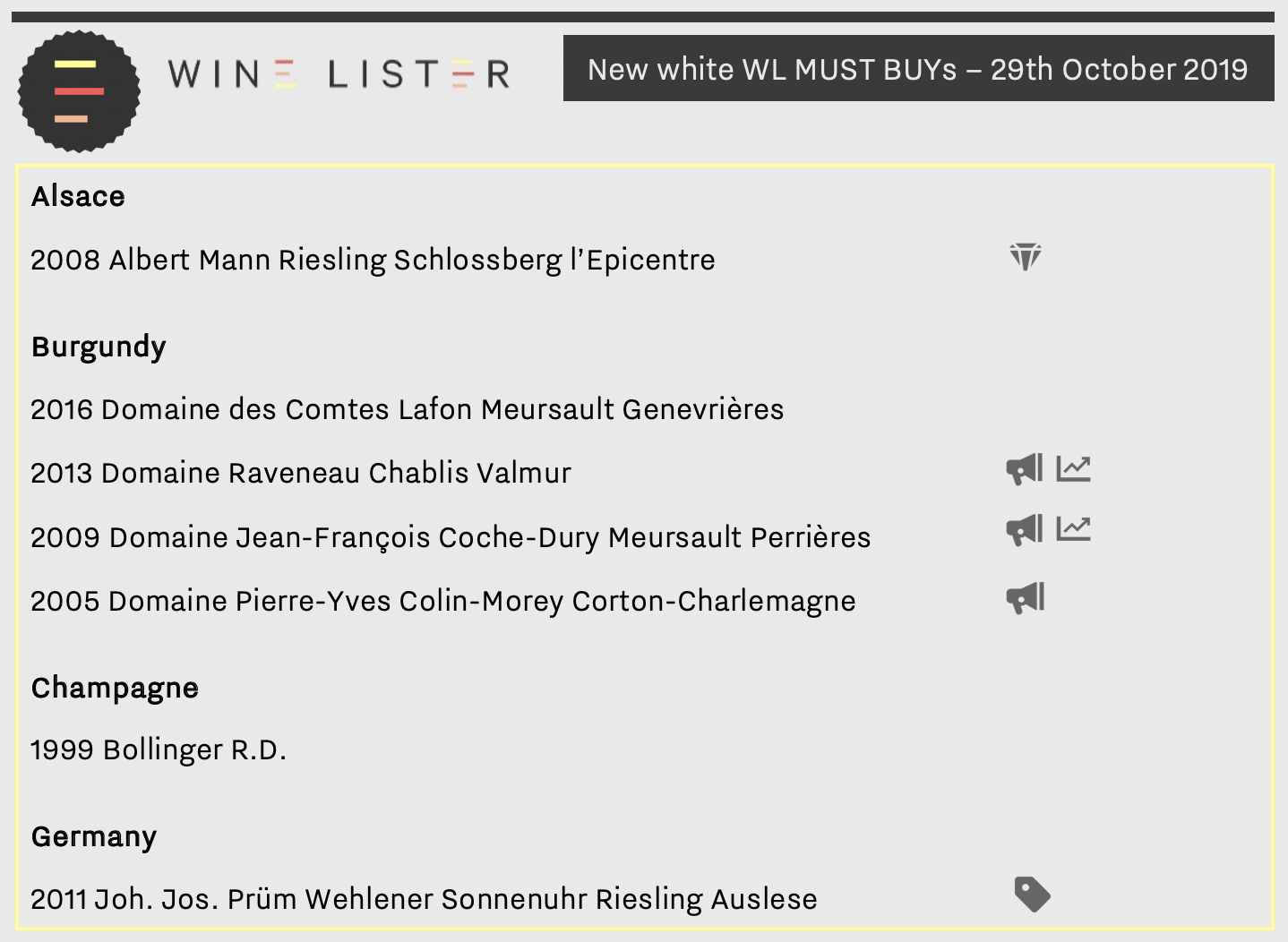

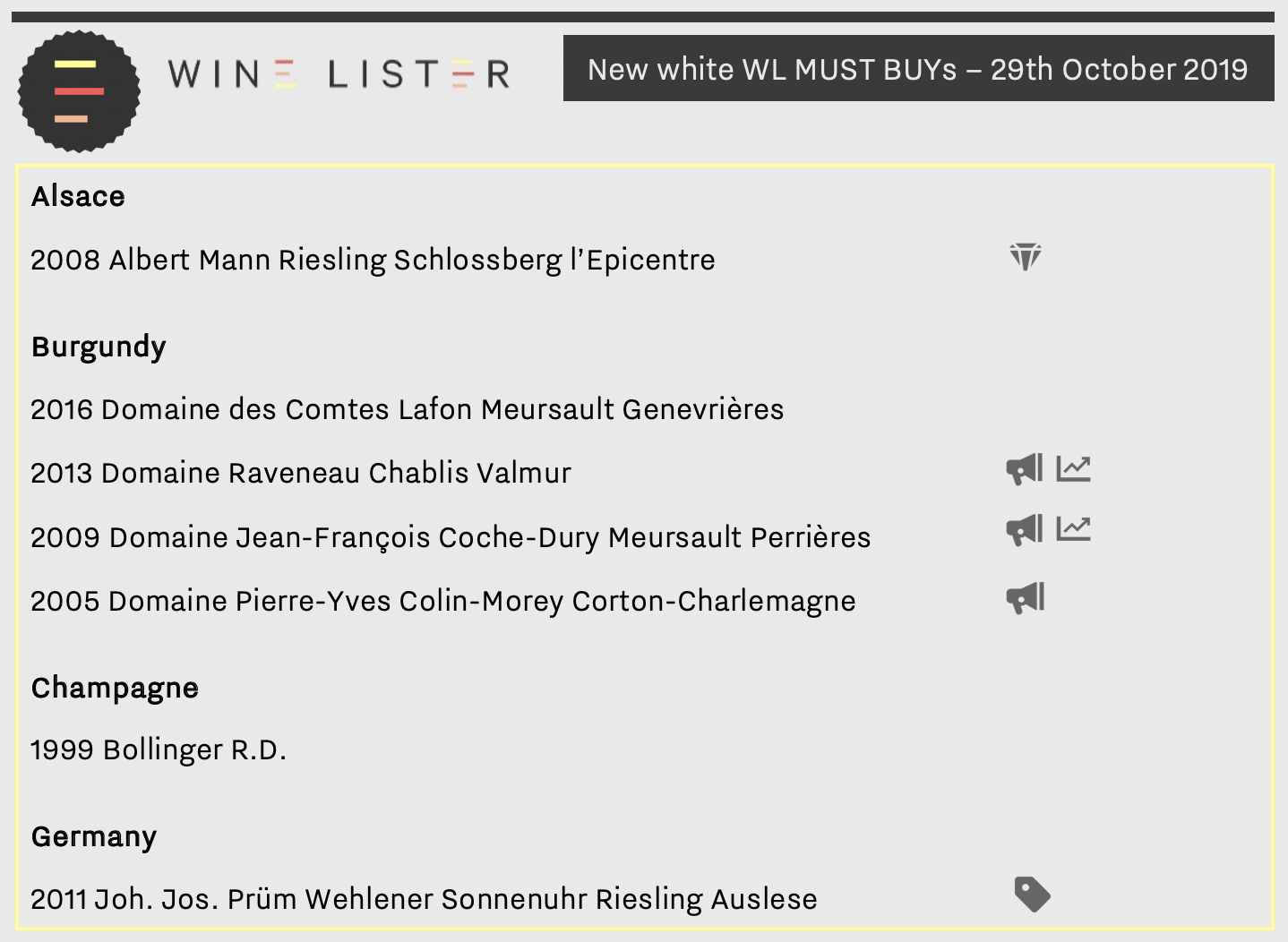

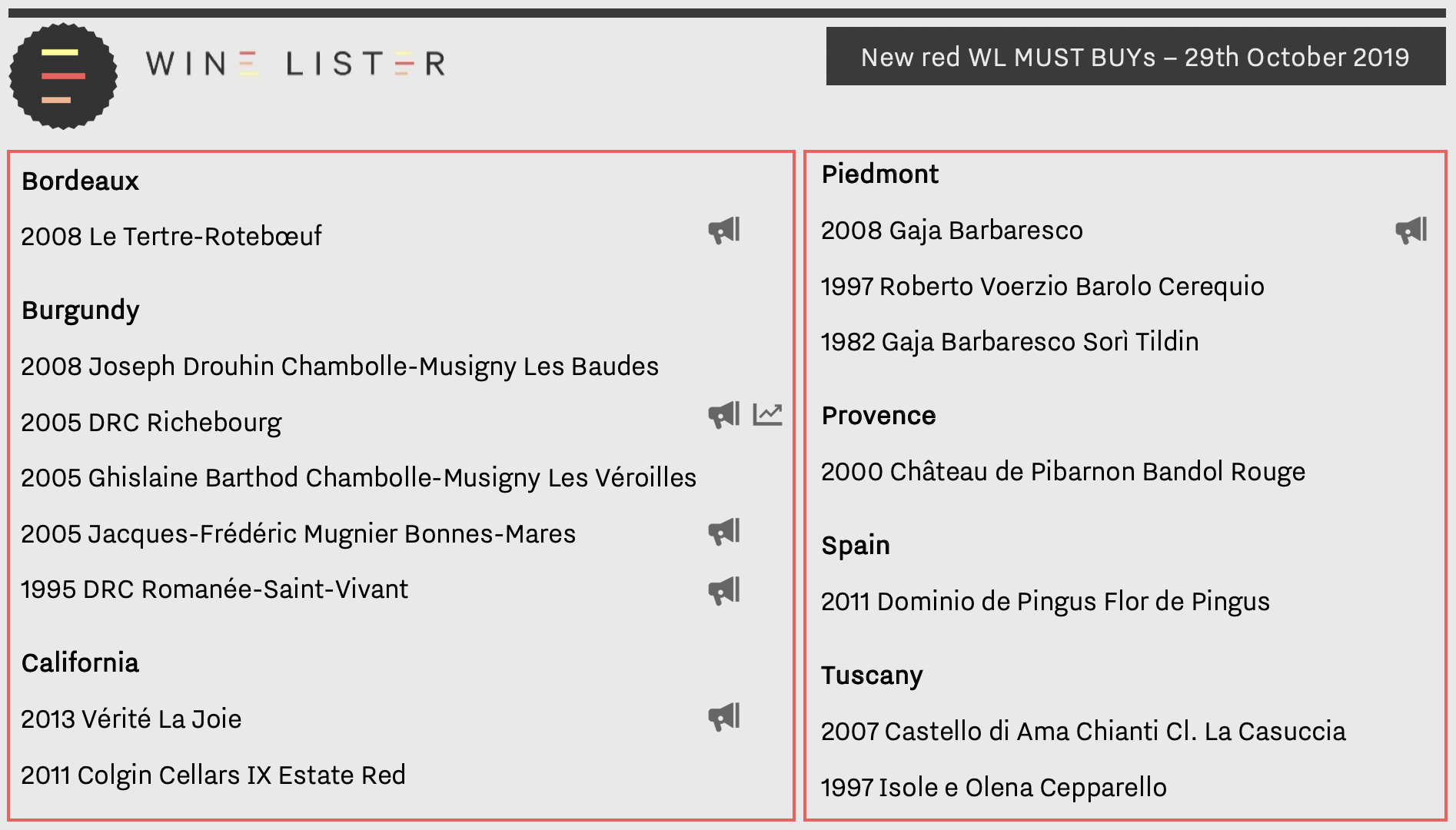

Since its last update, the MUST BUY list has grown by four wines (to 1,697), with 22 new entries, and 18 wines that have fallen off the list. Following the same trend as last week, nine out of the 22 new MUST BUYs (or 41%) are Burgundian. Big names in Burgundy continue to do well, with three new white Buzz Brands hailing from Raveneau, Jean-François Coche-Dury, and Pierre Yves Colin-Morey respectively.

Elsewhere within white entries are two Rieslings, the Alsatian Hidden Gem, Albert Mann’s l’Epicentre 2008, and the indomitable Joh. Jos Prüm’s Wehlener Sonnenuhr, whose 2011 is now one of seven MUST BUY vintages of this sensational Value Pick.

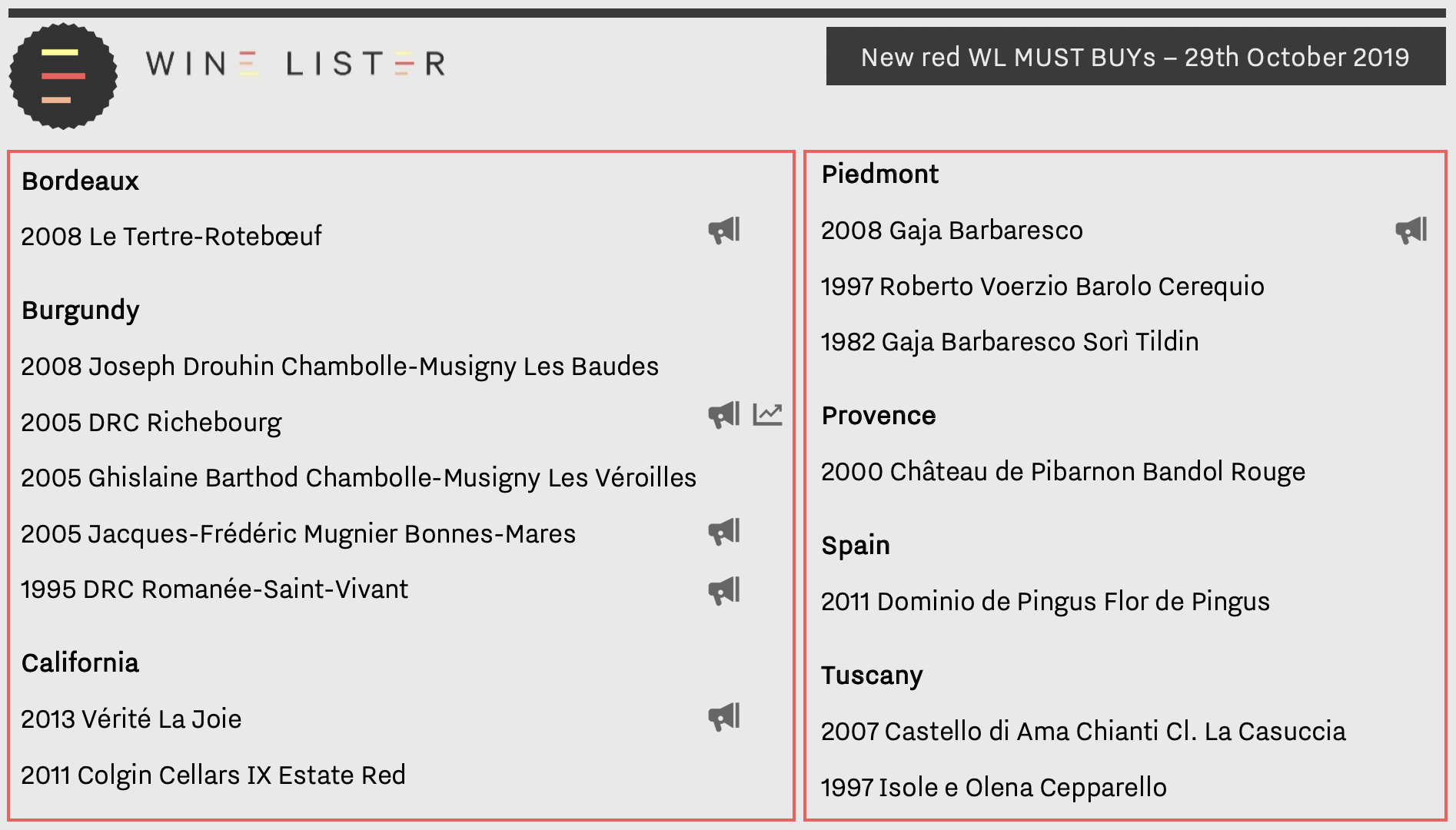

With the clocks turned back and a wintry chill in the air, there are twice as many new red MUST BUYs as white. Burgundy and Italy make the strongest showing, with five reds apiece. Maison Joseph Drouhin sees the addition of its Chambolle-Musigny Les Baudes 2008, bringing the house’s MUST BUY total to 21 wine vintages. Meanwhile Italy’s new MUST BUYs hail from four big name growers: Gaja, Roberto Voerzio, Castello di Ama, and Isole e Olena.

Bordeaux achieves just one entry in Le Tertre-Rotebœuf 2008 (one of nine Bordeaux 2008 MUST BUYs). California also makes its mark, with Vérité’s La Joie 2013 and Colgin Cellars IX Estate Red 2011. Outside of “classic” fine wine regions, Château de Pibarnon’s Bandol Rouge 2000 also enters the fray.

See the full list of current MUST BUYs here.

Wine Lister has almost 150 new MUST BUYs. Since we launched MUST BUYs officially in September, the list has been updated based first on the most recent prices and relative regional or appellational value within vintages, and subsequently on Wine Lister’s most recent trips and tastings. The full MUST BUY list has reduced by 109 (1,693 wines vs. 1,802), and includes 149 new entries.

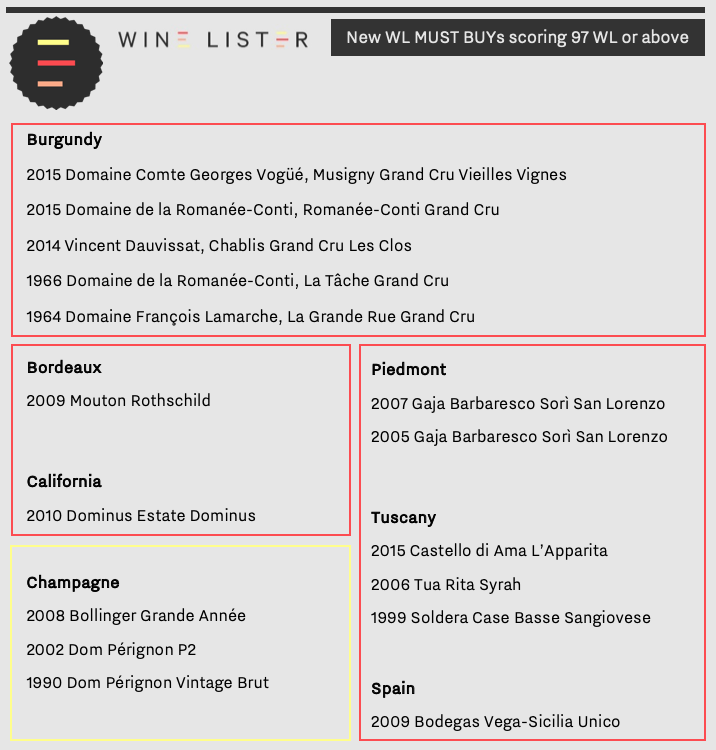

Perhaps unsurprisingly, 62 (or 42%) of new MUST BUYs hail from Burgundy. The 2017 vintage (released for the most part at the beginning of this year) yields 17 results, all worth getting hold of before availability reduces, and prices inevitably rise. Antoine Jobard achieves three mentions, all for 2017 Meursaults (Genevrières, Blagny, and Les Tillets), while Burgundy négociants are well-represented by additional MUST BUYs from Maisons Louis Latour, Louis Jadot, and Joseph Drouhin, who now count totals of 14, 42, and 20 MUST BUYs respectively. The Maisons de Négoce increasingly represent unparalleled value for money as the quality of their wines continues to increase, while their prices have not exploded in the same way as for many domaine wines.

Bordeaux gains 17 new entries, including a 2018 en primeur listing – Domaine de Chevalier Blanc. The remaining new Bordeaux MUST BUYs are mainly older vintages, with premiers and deuxièmes crus from 1982-1999 that are worth uncovering ahead of the festive season. Two Value Picks stand out from the Wine Lister team’s own tasting experiences of late – Capbern 2014 and Haut Carles 2015.

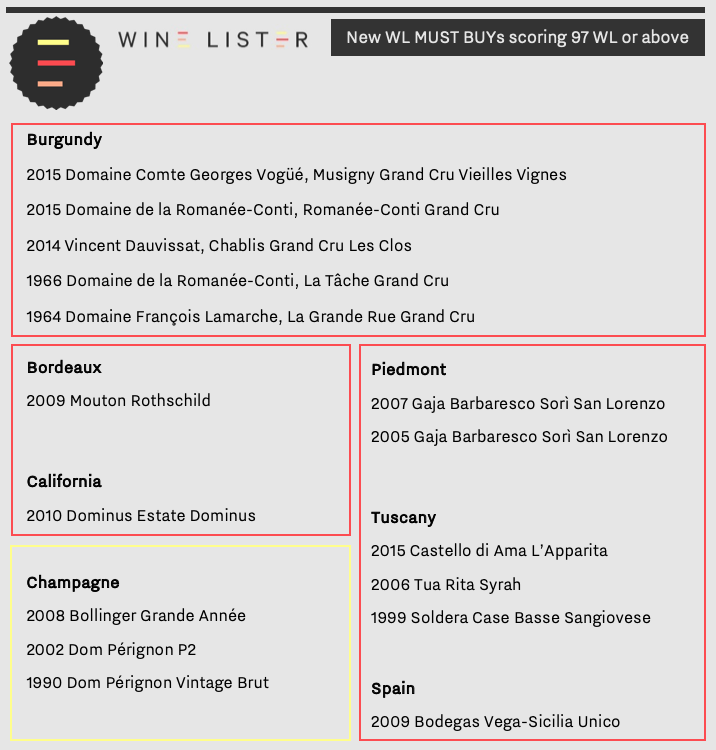

Italy reaps particular success in this new round of MUST BUYs, with 31 listings in total, split between Piedmont (14), Tuscany (15), Veneto (1), and Sicily (1). Gaja leads the charge in Piedmont with two vintages a piece for Barolo Sperss (2005 and 2014), and Barbaresco Sorì San Lorenzo (2005 and 2007). In Tuscany, a fourth vintage of Soldera’s Case Basse makes it into the MUST BUY list (1999), alongside existing MUST BUY vintages 2008, 2009, and 2013. The indomitable Castello dei Rampolla also gains an additional vintage each for Sammarco (1991), and Alceo (2008), making it the most “essential” producer to buy in Italy.

The Wine Lister team was pleased to be able to select from new wines rendered by the MUST BUY algorithm a few gems from recent tastings, including Deutz Cuvée William 2008 and Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs 2010 from a recent trip to Champagne, and Cheval des Andes 2016 – one of the team’s favourites from the September releases through the Place de Bordeaux.

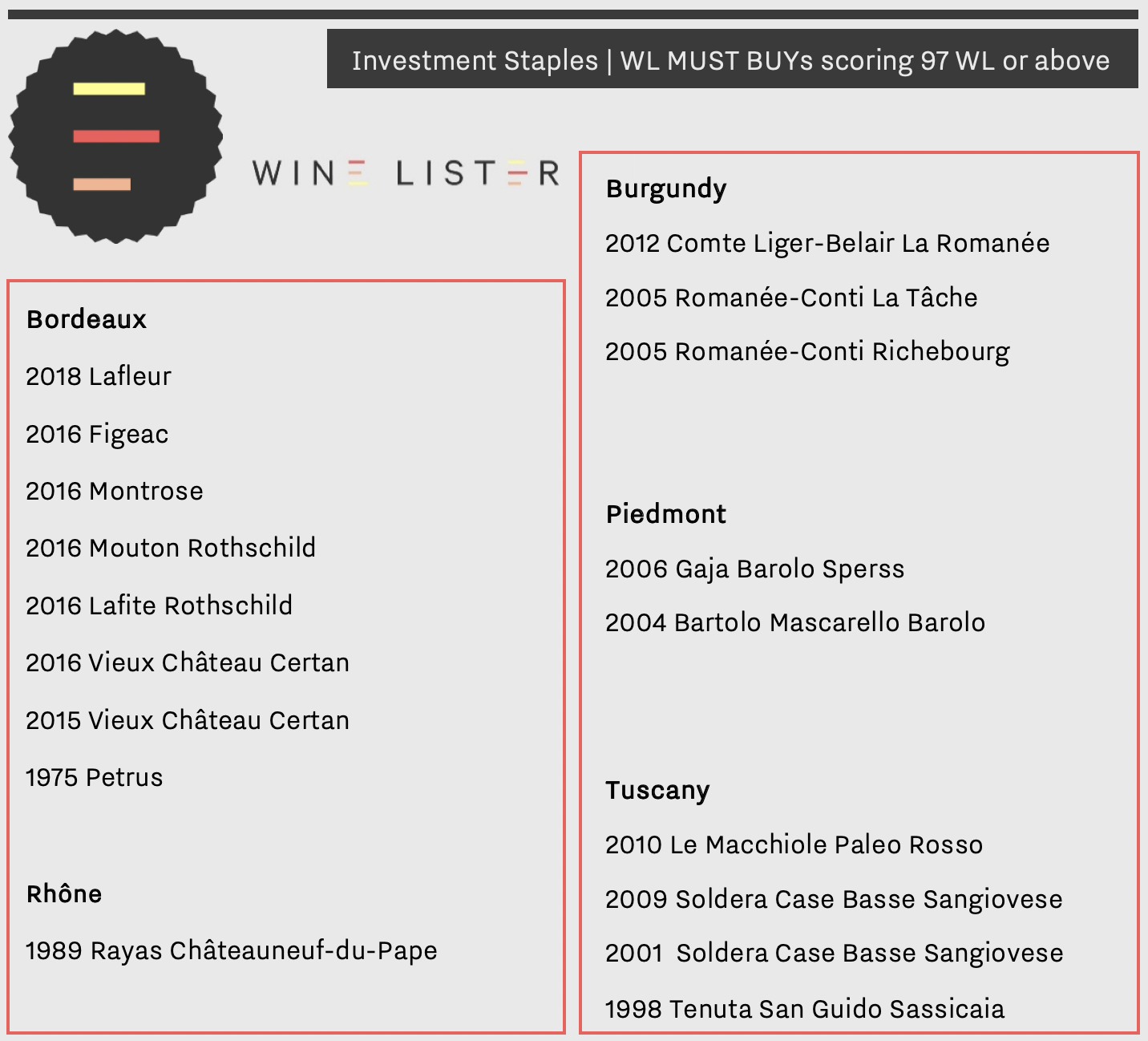

All MUST BUYs are qualified by a minimum quality level, but at the very top of the new MUST BUY scoreboard are 16 wines with WL scores of 97 and above. While Burgundy outperforms Italy in number of new MUST BUYs, they each earn five places in the top scorers, as shown below.

See the full list of MUST BUYs here, and watch this space for weekly MUST BUY updates from here on in.

Last week we introduced Wine Lister’s new toy, a dynamic guide to the ultimate wines any fine wine lover should consider for their cellar – WL MUST BUY. While the full list is approximately 1,800 recommendations strong, Wine Lister provides some useful segments to help cut into all that data, aside from the usual criteria that can be found in our advanced search function (region, price, colour, score etc).

Wine Lister Indicators are designed to provide suggestions for your specific buying purpose, whether it be to discover something new (Hidden Gems), impress at a dinner party (Buzz Brands), drink well without breaking the bank (Value Picks), or add to your investment portfolio (Investment Staples).

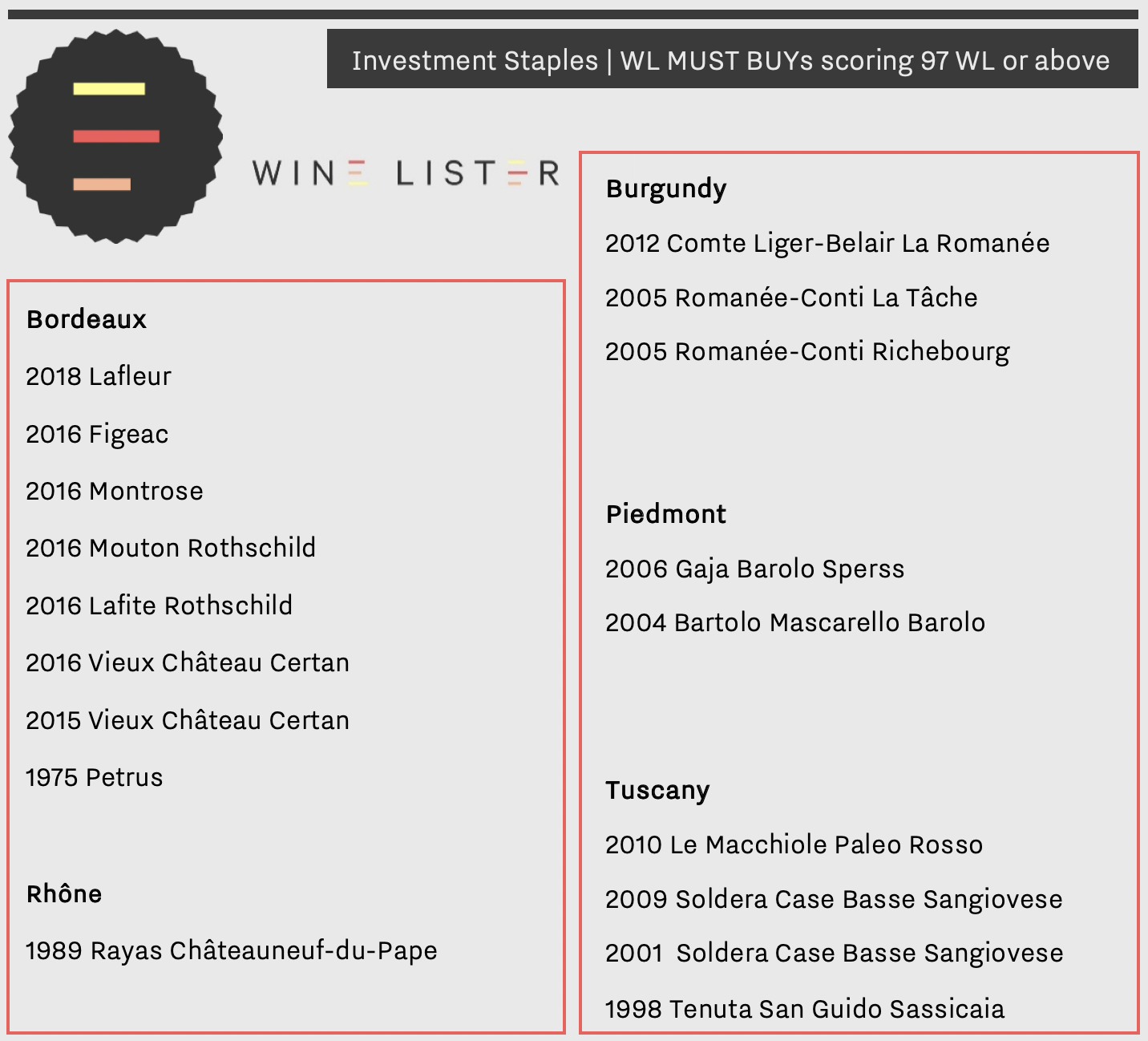

MUST BUYs and Indicators together provide a ready-made source list of the best wines to meet your needs. Below we look at the combination of our MUST BUY algorithm with Investment Staples.

Investment Staples are wines above a certain price, that are long-lived (but not too old), have proven wine price performance or represent good value compared to their peers, and are relatively stable and liquid, with recognition from our network of global fine wine trade members.

There are 18 MUST BUY Investment Staples that score 97 WL points or above. Perhaps unsurprisingly, Bordeaux represents almost half of these, with eight MUST BUYs, including two first growths (2016 Mouton, and 2016 Lafite), and 1975 Petrus.

These eight Bordeaux have an average price of £511 per bottle, or just under an eighth of the average price of the three Burgundies to qualify as MUST BUY Investment Staples. However, as investments, some of them may require patience – the prices of those from 2016 have yet to increase any significant amount. By contrast, DRC’s La Tâche 2005, Richebourg 2005, and Comte Liger-Belair La Romanée 2012 are testament to Burgundy’s impressive upward price trajectory, having already achieved three-year CAGR (compound annual growth rates) of 21.8%, 23.4%, and 33.1% respectively.

Outside of Bordeaux and Burgundy, Italy holds court with MUST BUY Investment staples from Bartolo Mascarello, and the indomitable Soldera among others.

You can see the full list of MUST BUY Investment Staples here, or check out some other MUST BUY lists, such as MUST BUY Hidden Gems, or MUST BUY Value Picks.

Don’t forget that the MUST BUY list changes weekly. Revisit MUST BUY Investment Staples again next week to see new entries.

Wine Lister spent a week in Bordeaux tasting the 2018 vintage in April, and has dedicated the last two months to covering en primeur releases for its Pro Subscribers. After what has been an unpredictable and puzzling Bordeaux en primeur campaign, we have conducted more than 20 interviews with our Pro Subscribers and Founding Members to find out how it went for them.

Below you will find our conclusions on the Bordeaux 2018 en primeur campaign, which combine our own intimate knowledge of the campaign and its peculiarities with invaluable insights from the trade.

Timing

The campaign lasted 62 days compared to 59 last year (from the date of the first major release to the last standard-channel releases). One clear improvement, thanks to a concerted effort by courtiers, was the spacing out of releases more evenly over the period. However, this did not address the more acute concern around the overall length of the campaign, with the wine trade expected to concentrate on the new Bordeaux vintage for two whole months of the year.

Pricing

A more major frustration was pricing. Over 80% of Wine Lister Pro Subscribers / Founding Members surveyed said prices were too high. On average, prices were up 13% on 2017 and 2% on 2016 release prices. This only made sense where 2016s had gone up in the market since release – not often enough the case. As a result, 2018s came onto the market on average 1% above the current market price of 2016, despite the latter – one of the vintages of the century – being physically available.

Needless to say, many wines stalled upon release due to over-ambitious pricing. When we asked the trade which wines sold the worst, more than once the reply was, “too many to mention”.

Desire

However, one of the more unfathomable motifs of the campaign was that in several instances, this highly ambitious pricing was accepted by the market, and the wines sold through. These were wines with good momentum behind them and a particularly loyal following, but most of all they were wines with a specific story that superseded any thought of value relative to prior vintages.

Examples of this phenomenon are Domaine de Chevalier and Palmer. Both were released into the market above every recent back vintage, and yet both met with demand thanks to the stories behind each wine. Domaine de Chevalier’s owner, Olivier Bernard, started sowing the seed several months before the campaign saying his 2018 was the best wine he’d ever made, a statement reiterated by the rest of his family and gradually absorbed through the fine wine chain. Unable to use conventional sprays, Palmer lost two-thirds of its crop to mildew, and made a striking, unusual wine that Managing Director Thomas Duroux said would “go down in history”.

“The market is very smart and only follows brands that it’s imperative to buy en primeur,” states Laurent Bonnet, Export Director of négociant L.D. Vins.

It was a campaign that favoured top names, not value wines. Wines below €50 were largely unsuccessful (with a few exceptions such as Laroque, Capbern, and Potensac – the three most affordable Bordeaux 2018 Wine Lister MUST BUYs).

David Suire, Managing Director of Château Laroque – a Bordeaux 2018 WL MUST BUY

Volume

After pricing, the most cited frustration was reduced volumes. On average, leading properties released around 20% less wine than last year. “The number one cause of reduced volumes is lower production in 2018 compared to previous years,” said Mathieu Chadronnier, Managing Director of négociant CVBG, who, like other participants in the campaign would have liked to have more volume to sell of certain wines. “It is a frustration, but there’s nothing we can do about it,” he concluded.

Certainly several properties produced less wine due to mildew and a very dry summer. Others made a commercial decision to keep back more wine – a continuation of the gradual trend for Bordeaux châteaux to release less wine en primeur, whether to create an impression of rarity, and / or to partake in the future upside by selling the bottled wine later once it has – they hope – increased in value.

Bonnet underlines the irony of having less and less stock of the wines that sell well, and too much of those that don’t: “The ‘not enough of in-demand wines / too many wines to hold as stock’ equation is difficult for négociants to resolve,” says Bonnet, cautioning that, “the financial stakes are high.”

Good news stories

While Asian buyers were reported to be less present than in previous years, other geographies remained strong – the US, continental Europe, and especially the UK.

The 10 greatest success stories of the campaign included six Wine Lister MUST BUYs: Calon Ségur, Canon, Carmes Haut-Brion, Rauzan-Ségla, Léoville Las Cases, Mouton Rothschild, and Lynch-Bages.

Revenues were up on 2017 across the board, in many cases very significantly. The majority of respondents reported en primeur revenues the same as or above 2015 levels, with only a couple of exceptions. However, very few managed to equal 2016 revenues.

Future(s)

On the one hand, it seems obvious that the 2018 Bordeaux en primeur campaign could have been more of a roaring success with more astute pricing and in some cases a bit more volume to go around. On the other, many of our Pro Subscribers and Founding Members have been pleasantly surprised by the outcome, and will conclude their campaigns with better revenues than they expected.

This leaves many convinced of the merits of en primeur, if frustrated that it’s not reaching its full potential. “We could have done £35m,” said Max Lalondrelle, Fine Wine Buying Director of UK merchant Berry Bros. & Rudd, which in fact made c.£22m in revenues on the 2018 Bordeaux en primeur campaign.

Meanwhile other members of the trade have ceased their Bordeaux en primeur activity altogether over recent years, and some are questioning its future viability. For the time being, the sun has set on this year’s campaign, but it will rise again next year on the utterly unique global marketing and distribution tool that is en primeur.

Read more about our new MUST BUY tool in our recent blog here.

The Bordeaux 2018 en primeur campaign is over. While the quality of wines available is, for the most part, unquestionably good, release prices have been on the high side to say the least, making the benefit of buying en primeur less obvious than in previous years.

Wine Lister’s brand-new website feature, WL MUST BUY, was launched this week*, especially for Bordeaux 2018 wines, to give valuable guidance as to which wines really are worth snapping up now.

Our ground-breaking MUST BUY recommendations are data-driven, with an intelligence-based, human overlay. The algorithm takes into account a wine’s quality and value within its vintage and appellation, as well as the latest industry intelligence from key players in the global fine wine trade. The Wine Lister team have scoured these results to identify must-buy wines based on our own tastings of Bordeaux 2018s, and insider market knowledge.

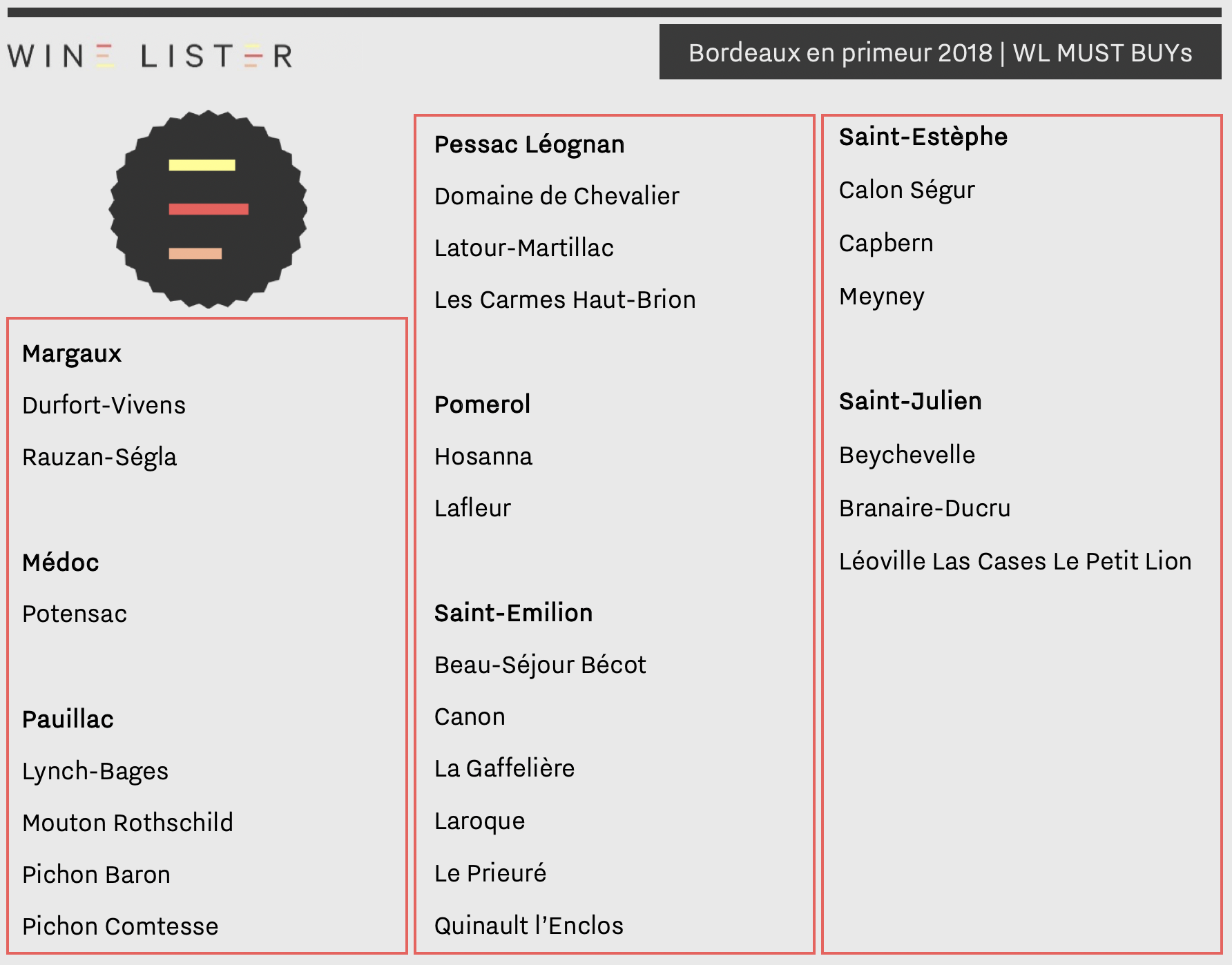

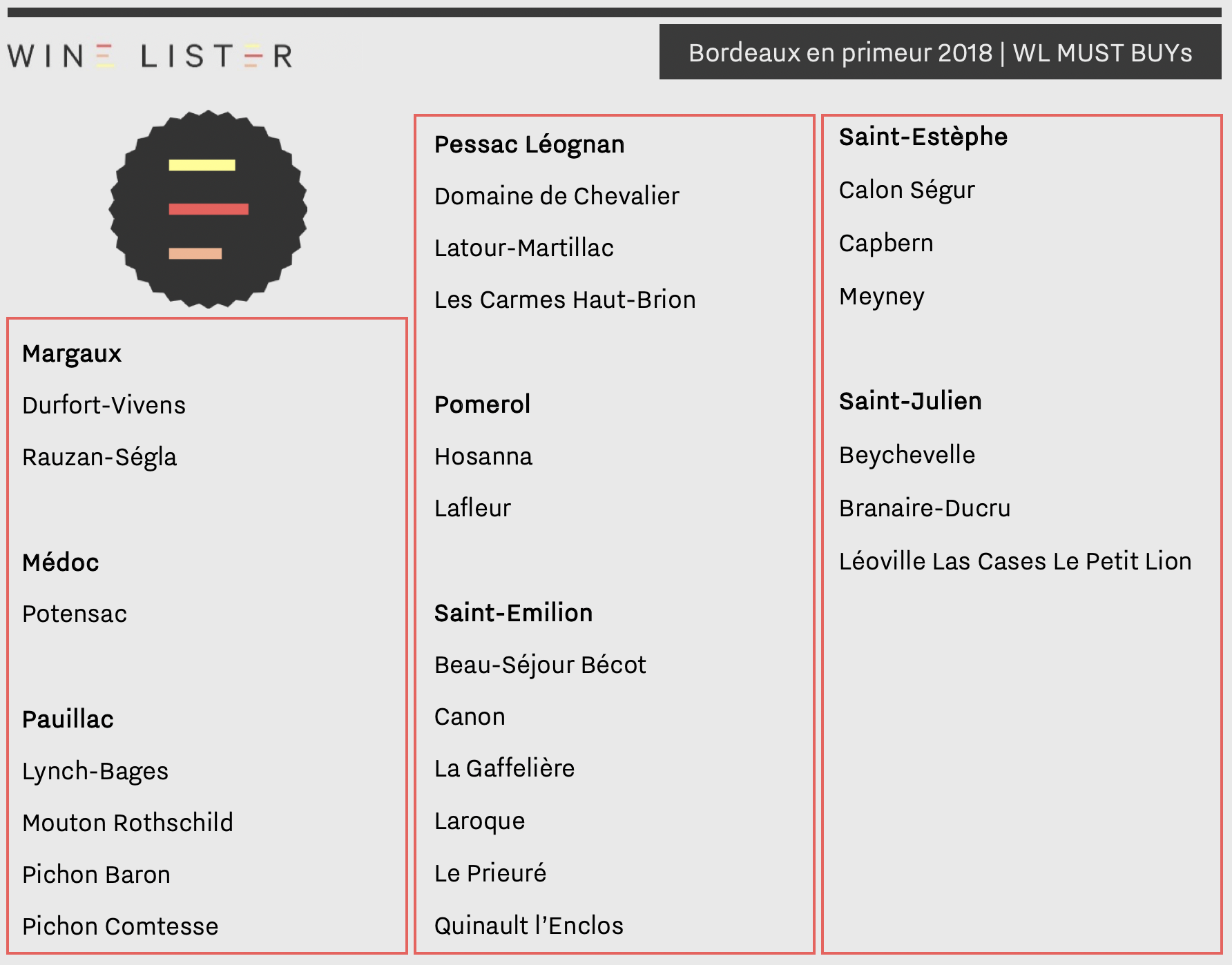

Given the dominance of reds in the top Bordeaux 2018 Quality scores, it is no surprise that all of these WL MUST BUYs are red.

Saint-Emilion ranks as our most recommended appellation, with six WL MUST BUYs, including the indomitable Canon, and value successes Le Prieuré, Quinault l’Enclos, and Laroque. These three achieve WL MUST BUY status by first passing the quality filter of Wine Lister’s MUST BUY algorithm (they exceed their collective Quality score average by 192 points in 2018). Their respective prices relative to similar quality 2018s from Saint-Emilion push them through the algorithm’s second step – the value filter. Finally, they have been identified by the fine wine trade and/or the Wine Lister team as wines to watch: Quinault l’Enclos is made by the elite winemaking team of Cheval Blanc, and their best yet, while Laroque has been taken to new heights by winemaker David Suire (who cut his teeth at Larcis-Ducasse).

Pauillac houses four of the “top end” Bordeaux 2018 MUST BUYs – Mouton (released at £426 per bottle in bond), both powerhouse super-seconds, Pichon Baron and Pichon Comtesse, and Buzz Brand Lynch Bages.

Sharing three picks apiece are further left bank appellations Saint-Julien, Saint-Estèphe, and Pessac-Léognan. Capbern, Meyney, and Latour-Martillac are testament to the value proposition available in Saint-Estèphe and Pessac-Léognan respectively. Saint-Julien MUST BUYs are represented by two fourth-growth staples, Branaire-Ducru and Beychevelle, and the second wine of Léoville Las Cases, Le Petit Lion.

Margaux earns two MUST BUYs – Rauzan-Ségla, and biodynamic Durfort Vivens (who made a huge step up in quality this year, and whose 2018 yield was less than a quarter of its usual volume). Pomerol equals this number with Lafleur and Hosanna.

Other wines featured in Wine Lister’s Bordeaux 2018 MUST BUYs list are: Beau-Séjour Bécot, Calon Ségur, Domaine de Chevalier Rouge, La Gaffelière, Les Carmes Haut-Brion, and Potensac.

*Wine Lister launched its MUST BUY tool on Monday at a Telegraph event entitled “Wine for Pleasure or Profit?”, where founder & CEO Ella Lister spoke about going “Back to Bordeaux” for both. You can see slides from the presentation relevant to Bordeaux 2018 MUST BUYs here: Telegraph Back to Bordeaux