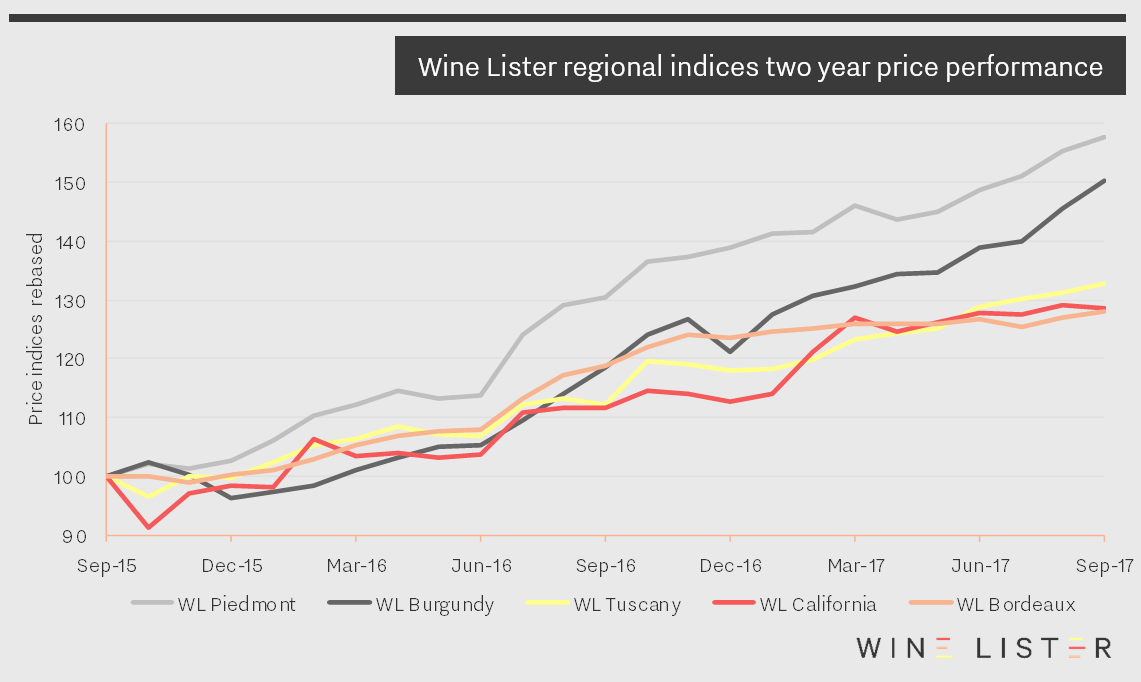

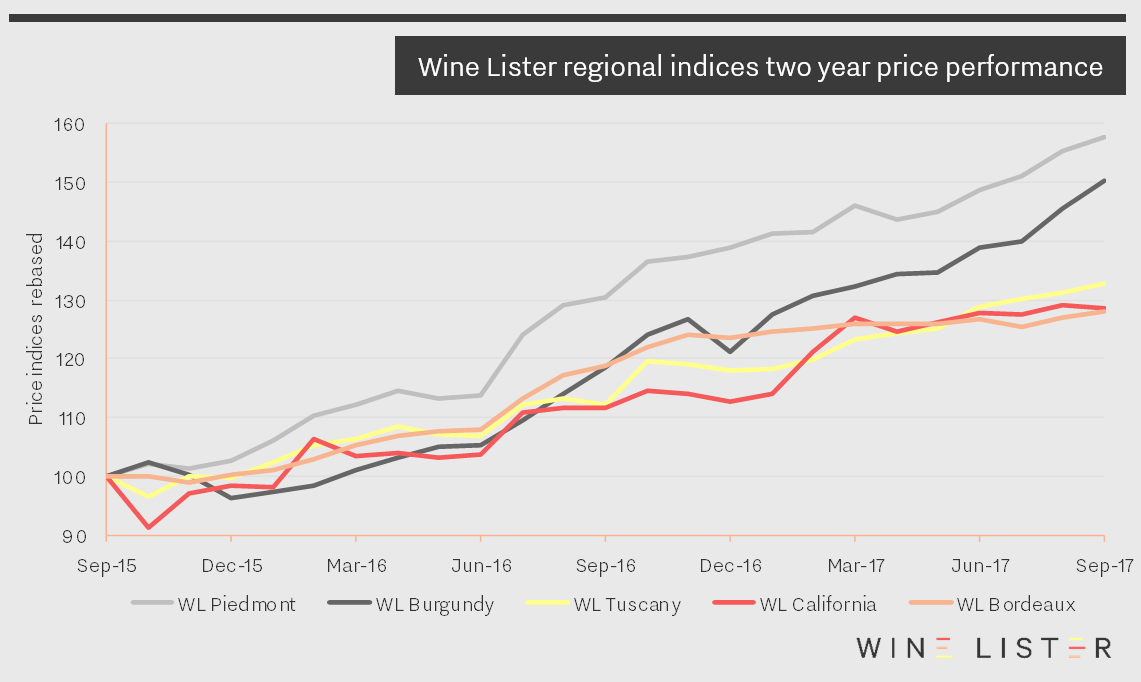

In this blog we look at the price performance of five major fine wine regions over the past two years. Wine Lister’s regional indices use price data from Wine Owners, and each comprises the top five brands in its respective region (according to the Wine Lister Brand score).

In Bordeaux, for example, the top five strongest brands (measured by looking at restaurant presence and online search frequency), are the five first growths, Haut-Brion, Lafite, Latour, Margaux, and Mouton. Posting gains of 28% over two years, and largely stagnating over the last year, the Wine Lister Bordeaux index is the worst performer of the five wine price indices shown below.

Piedmont, meanwhile, has enjoyed a remarkable couple of years. Not only has its index grown by an astonishing 58% over the period, it has also been very consistent, experiencing just three months of negative growth – November 2015, May 2016, and April 2017. Sustained high growth rates suggest a region in demand. The Wine Lister Piedmont index consists of two wines from Gaja – Barbaresco and Sperss (now labelled as a Barolo again after several years of declassification to Langhe Nebbiolo), two Barolos from Conterno – the Monfortino and the Cascina Francia, and finally Bartolo Mascarello’s Barolo.

Next comes the Burgundy index (consisting entirely of Domaine de la Romanée-Conti wines), which has grown by more than 50% over the past 24 months, but with a few more blips. It decreased in value by 4% in December 2015, only managing to recover in March 2016. In a repeat of this festive dip, the index dropped over 5% in December 2016, but recovered the losses in just one month on this occasion. It has started to close the gap on Piedmont over recent months, adding over 15% since May.

Tuscany and California* made similar gains to Bordeaux over the period – up 33% and 29% respectively. The Tuscany index has progressed fairly serenely over the past two years, thanks to its liquid Super Tuscan components. Meanwhile the prices of California’s top wines have been less consistent, enduring a fall of nearly 9% in October 2015, recovering with a dramatic 8% rise in February 2016. This year, having enjoyed strong gains during February and March, their growth rate has since cooled off, adding just 1.5% over the past six months.

*As you will know, California has suffered tragic wildfires in recent weeks. Wine Lister’s partner critic, Vinous, is donating to relevant charities the profits from all maps purchased before the end of November 2018.

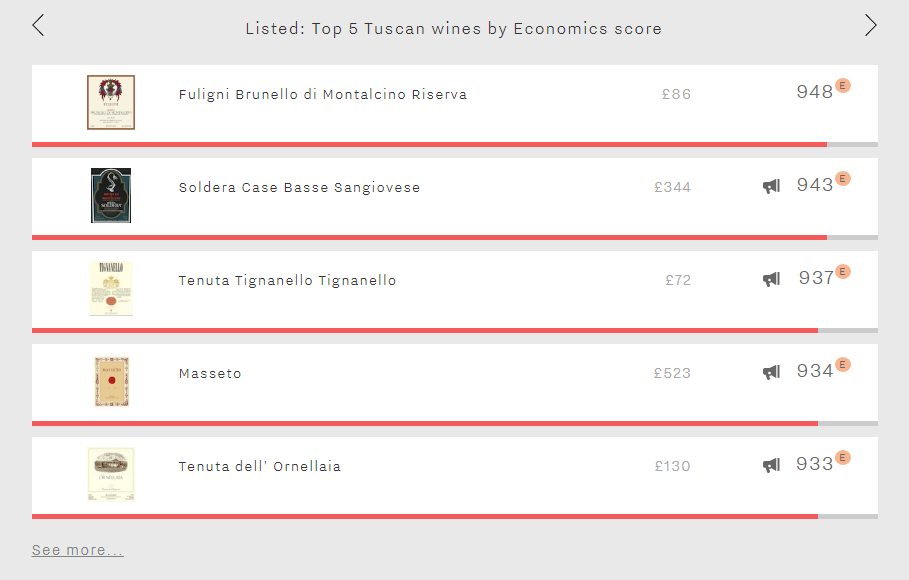

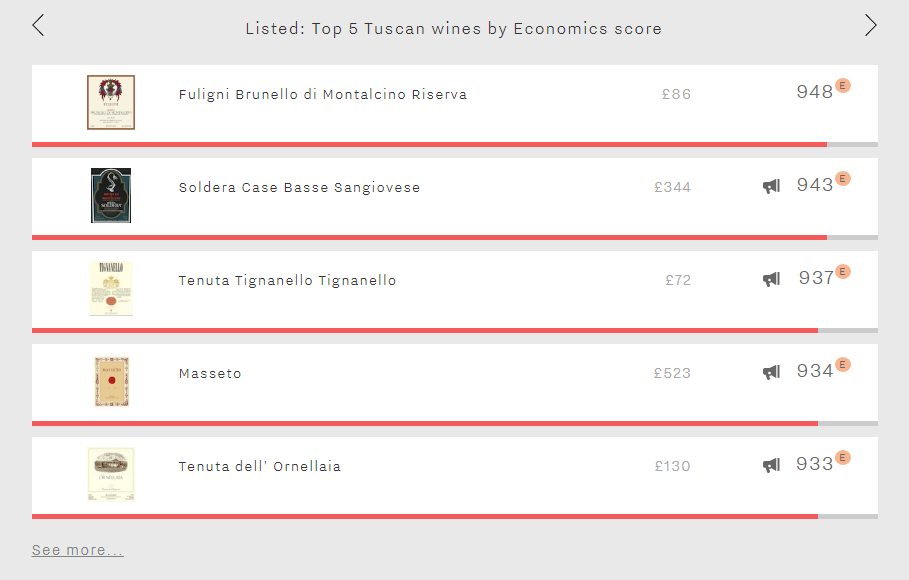

You may have noticed a subtle re-design today on the Wine Lister homepage. This includes moving up and expanding the scope of the “Listed” section: a changing Top 5 of wines from around the world, updated each week.

You can now explore the five most recent Top 5s, even if you’re not yet a subscriber to Wine Lister. For as long as the list is live, this includes access to all the underlying vintage-level data that feeds into one of our Listed wines, including critic scores, restaurant presence, search frequency, and price performance. Simply click on the Listed wine that takes your interest, then select from the drop-down of vintages at the top right of the wine page. What’s more, this allows you to play with tools such as interactive price history and vintage value identifier charts.

Our Listed section addresses a variety of tastes and priorities – some weeks you will see our best Value Picks from a particular region, other weeks will focus specifically on wines with top Brand or Economics scores, or wines of the highest quality from a specific vintage.

To access independent wine ratings, tools, and analysis for all of the thousands of wines and vintages in our database you’ll need to subscribe – or why not try a free 14-day trial?

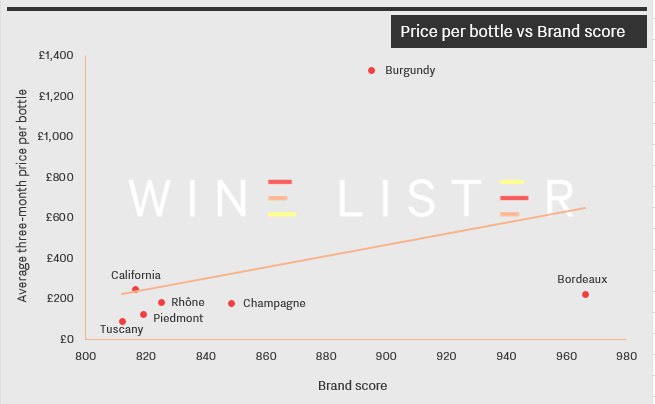

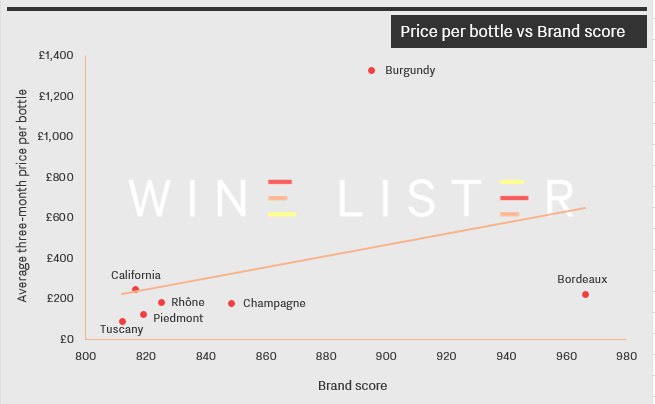

Following on from our recent blog on the relationship between price and quality for seven leading wine regions, today we turn our attention to the role that brand strength plays on price for those same regions. The chart below compares the regions’ average three-month market price to their average Brand scores, using the same 50 overall top scoring wines in each region as in the previous post.

Bordeaux’s crus classés enjoy unassailable brand strength, a product of the success of the region’s classification system and the fact that its châteaux have enjoyed global renown for centuries. If you want brand for your buck, look no further.

Conversely, Burgundy’s extraordinary prices far exceed the level of brand clout commanded by its top crus. Its top wines trail the average Brand score of Bordeaux’s by 7%, but sell for nearly six times as much. This suggests that quality, and perhaps small production levels, play more of a part in the region’s prices.

The five remaining regions are more evenly matched. Tuscany’s wines have both the lowest average Brand score and the lowest prices, followed closely by Piedmont. Meanwhile California’s top 50 wines, which have the second-lowest average Brand score, command the second-highest prices. Top wines from the Rhône and Champagne command similar prices to their Bordeaux counterparts, but with average Brand scores more than 100 points lower.

In today’s blog, we’ve taken a look at the relationship between price and quality for seven leading wine regions. The chart below compares the regions’ average three-month market prices to their Quality scores, with the data calculated from each region’s 50 best-scoring wines (in terms of overall Wine Lister score).

While six regions are clustered relatively close to each other, Burgundy finds itself at the extreme top end of the scale: its wines outperform on quality and have the prices to match. The top 50-scoring wines in Burgundy average a whopping £1,330 per bottle, driven by the likes of DRC La Romanée-Conti at £10,776 and Domaine Leroy Musigny at £7,805.

The Rhône’s wines have the lowest average Quality score but not the lowest prices: at £188 per bottle on average, they are the fourth most expensive of the group. California and Bordeaux display a very similar profile, appearing just above the trendline, indicating that these wines command high prices not simply on account of quality – brand also plays a part.

Champagne and Piedmont, meanwhile, fall below the line, suggesting that as regions they tend to offer value for money. Piedmont’s ranking is particularly impressive: second only to Burgundy in terms of average Quality score, its wines are available for a tenth of the price on average.

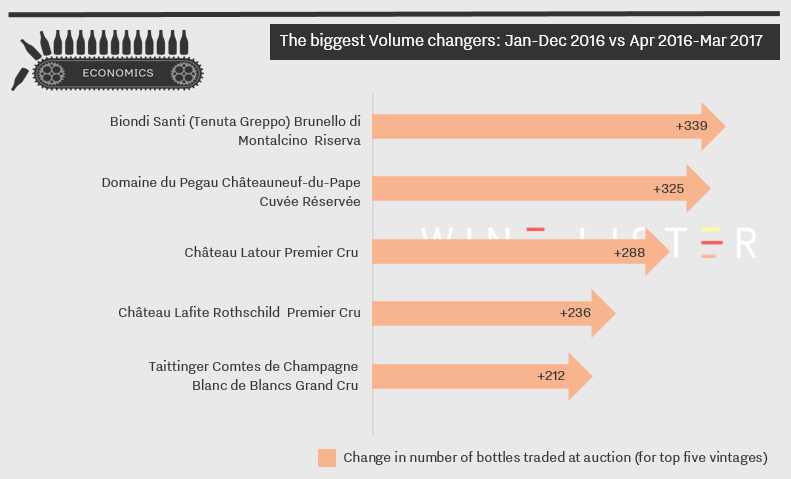

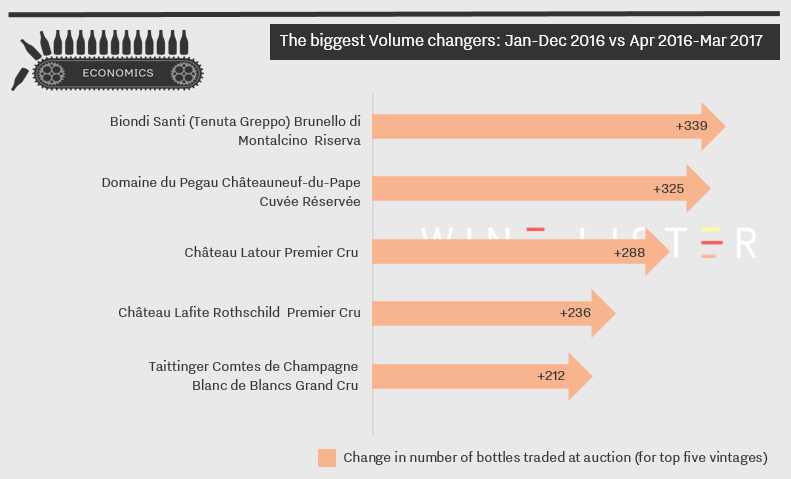

Trading volumes are a key measure of a wine’s success in the marketplace. To evaluate these, Wine Lister uses figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages traded for each wine over the past four quarters.

With the first quarter data now in, we look at which wines saw the greatest incremental increase in bottles traded. Although the list is dominated by French wines, top of the table is a Tuscan, Biondi Santi Brunello di Montalcino Riserva. The producer was recently highlighted as one to watch in a survey of Wine Lister’s Founding Members. The rise in auction sales for this wine has had a significant impact on its Economics score, boosting it from 911 to 945/1000. Volume is just one of the five criteria that feed into a wine’s Economics score, along with four different price-related metrics.

The wine seeing the second largest gain in trading volumes, Domaine du Pegau Châteauneuf-du-Pape Cuvée Réservée, also has the lowest Economics score of the table, at 789. Nonetheless, its overall Wine Lister score is very strong at 846 (lifted by a high score for Brand), and with the latest data in from Wine Market Journal its Economics score is on the rise.

The final three wines of the table – two Bordeaux first growths and a prestigious Champagne (Taittinger Comtes de Champagne) – also benefitted from increased trades in the last quarter. All three enjoy very high Economics scores, with Lafite Rothschild the highest, at 955/1000. Meanwhile it seems that 2017 has been a positive year so far for Latour, which was also among the top five wines that saw its number of searches increase significantly in March.

In the latest of our blogs on the findings from Wine Lister’s Tuscany Market Study – following on from a look at the region’s global standing, and the popularity of its appellations – we turn our attention to its individual wines. Here, we have carried out an in-depth survey with our Founding Members (the key fine wine trade players from across the globe, between them representing more than one third of global fine wine revenues), for insight into their confidence in Tuscany’s individual wines.

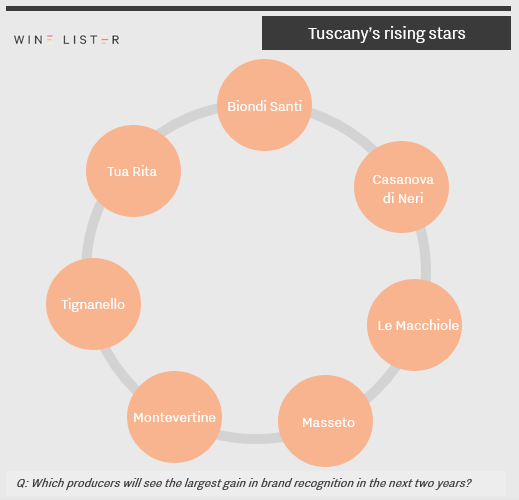

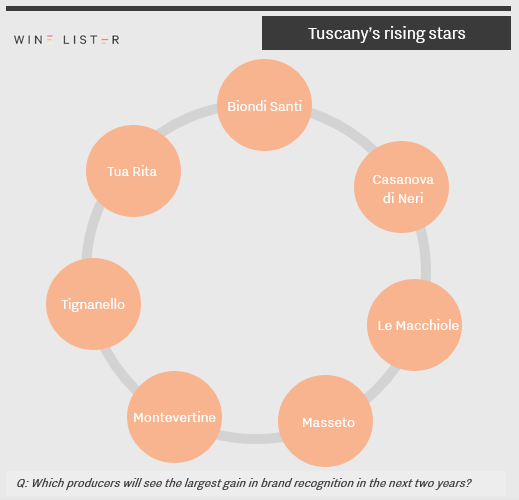

First, we asked respondents which producers are due to see the largest gain in brand recognition in the next two years. More than half those cited are producers whose flagship wines are Super Tuscans / Tuscany IGT: Tenuta Tignanello (Tignanello and Solaia), Masseto, Montevertine (Le Pergole Torte) and Tua Rita (Redigaffi).

Brunello di Montalcino DOCG is home to two contenders, Biondi Santi and Casanova di Neri, while the final producer, Le Macchiole, makes mainly Bolgheri DOC wines.

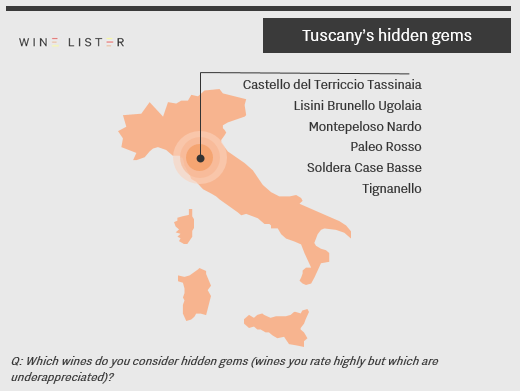

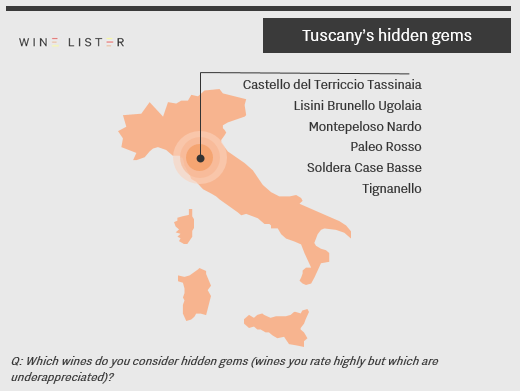

We also asked the trade which individual Tuscan wines they consider to be hidden gems: wines that they rate highly but which they perceive as underappreciated elsewhere. Two of these wines are made by rising star producers above: Tignanello, and Le Macchiole’s Paleo Rosso, suggesting that these wines may not stay underappreciated for long.

Apart from Soldera Case Basse, all of the wines cited have average prices per bottle of £75 and under, combined with strong average Quality scores that vary between 814 (Castello del Terriccio Tassinaia) and 919 (Tignanello).

To take a look at the rest of the survey’s findings – including which Tuscan wines have seen the sharpest rise in demand, which consistently sell out, and which the trade have most confidence in – please log in to Wine Lister and download the report from the Analysis page.

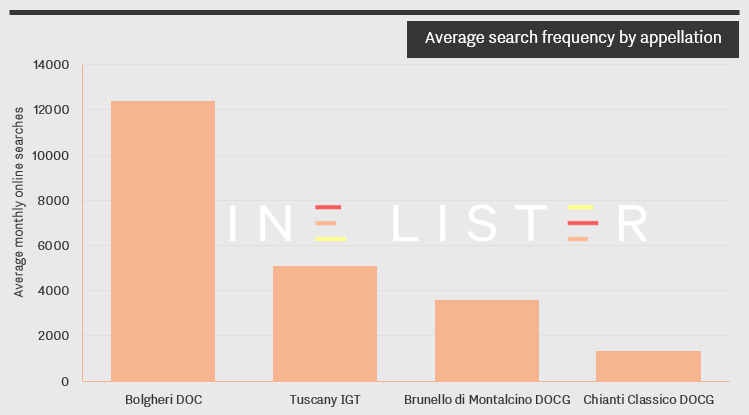

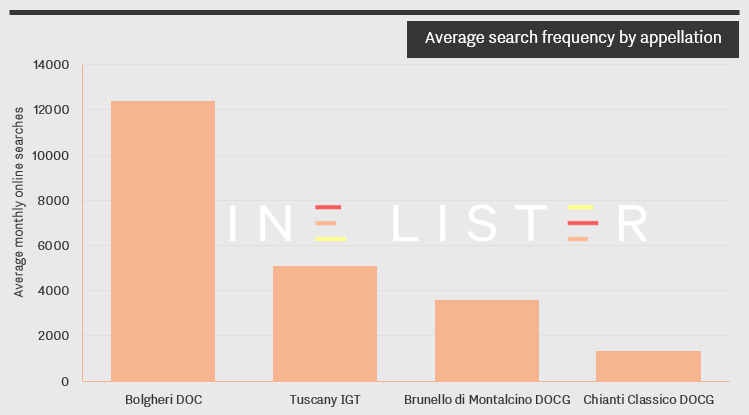

In the second blog exploring some of the findings from Wine Lister’s Tuscany Market Study – following on from our look at how the region ranks globally – we take a look at the popularity of Tuscany’s appellations. The chart below plots the average number of online searches received each month by the 50 wines in this study (based on data from Wine-Searcher), filtered by appellation.

Wines from Bolgheri DOC are by far the most popular amongst consumers, with, on average, more than twice the number of searches than their nearest competitor, Tuscany IGT. They are boosted by internationally established Super Tuscan brands such as Sassicaia and Ornellaia, which have stolen the limelight from more traditional neighbouring DOCGs such as Brunello and Chianti.

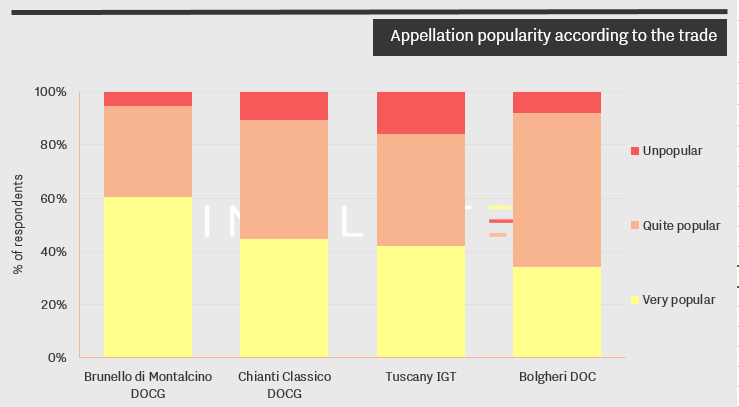

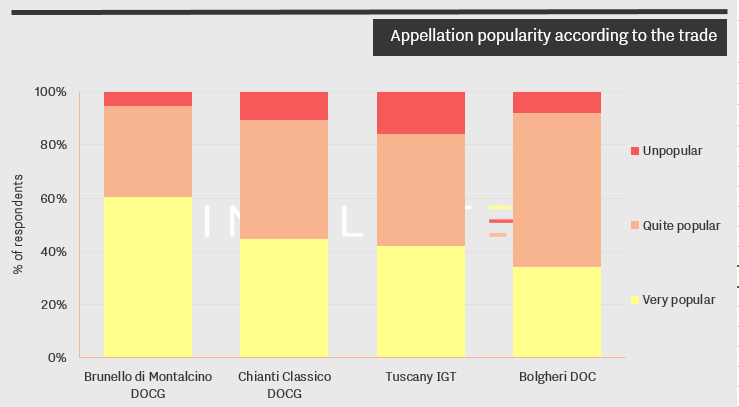

However, perception of each appellation’s popularity tells a different story. At the end of 2016, Wine Lister asked key members of the international fine wine trade about the relative popularity of Tuscan appellations amongst their clientele. Brunello di Montalcino – the third most searched for appellation – came out on top, with nearly 60% of respondents stating that it was very popular with their customers, followed by Chianti Classico.

Tuscany IGT and Bolgheri DOC trail slightly behind, emphasising that it has been the wines themselves, rather than the appellations, that have achieved fame.

In our final blog post on the Tuscany Market study we will focus in on the individual wines themselves: the trade’s view on which are the region’s consistent sellers and which are its rising stars. Wine Lister subscribers can read the full 35-page report here.

Wine Lister has produced its second in-depth regional study, this time on Tuscany – a many-faceted fine wine region that is fast-building its position on the global fine wine stage. We will be revealing some of the findings on the blog in the next few weeks, but the full 35-page report is available for subscribers on the Analysis page.

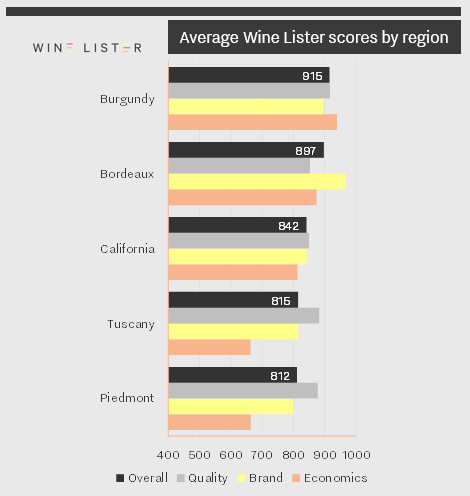

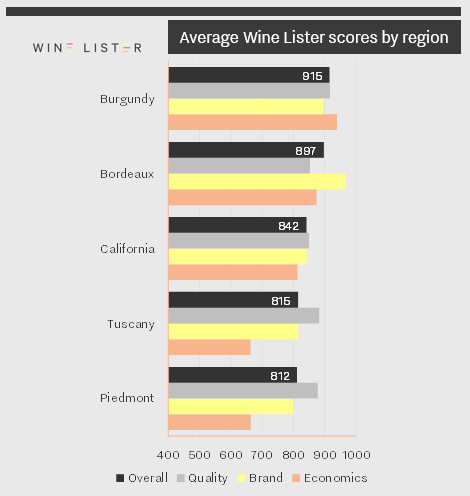

The study focuses on 50 top Tuscan wines, which we have compared below with 50 wines from Piedmont, Bordeaux, Burgundy, and California. Using the three categories that comprise an overall Wine Lister score – Quality, Brand, and Economics – we can put the region’s global positioning in context.

Although Tuscany comes fourth overall – just ahead of Piedmont – its Quality score is bettered only by Burgundy, scoring 883 points to Burgundy’s 917. Quality scores are derived from Wine Lister’s partner critics’ scores and a wine’s ageing potential, and Tuscany’s excellence in this category may be one explanation for its rising appeal.

Tuscany’s Brand score is the fourth best of the group, suggesting that after a handful of top brands such as the Super Tuscans, the rest of the top 50 do not confer the same level of prestige as wines in Bordeaux, Burgundy, or even California. Meanwhile, the region’s commercial clout is the weakest of the group, scoring one point less than Piedmont in the Economics category.

In upcoming posts, we will delve into the trade’s view on Tuscany’s foremost appellations and which are the wines to watch.

“Which producers will see the largest gain in brand recognition in the next two years?” That was one of the questions Wine Lister asked its Founding Members, in its latest survey of 49 of the world’s key wine trade players, between them representing well over one third of global fine wine revenues.

Continue Reading →