The eyes and ears of the industry are focused on Bordeaux 2017. Price is always a key factor in the commercial success of a fine wine, but never more so than during the annual en primeur period, when release pricing can make or break a wine’s en primeur campaign.

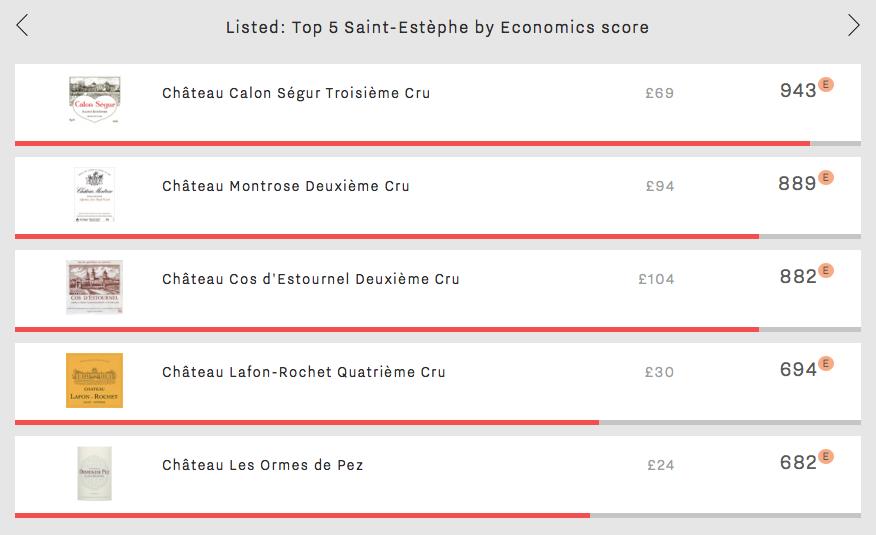

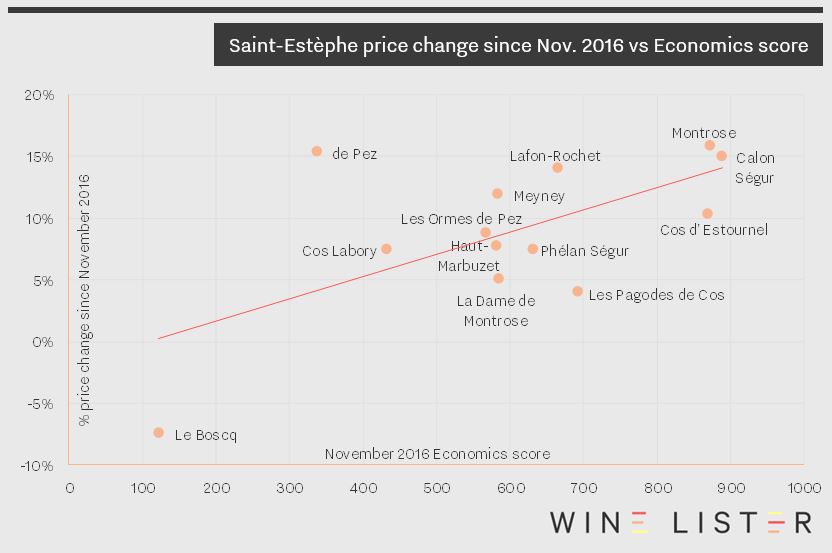

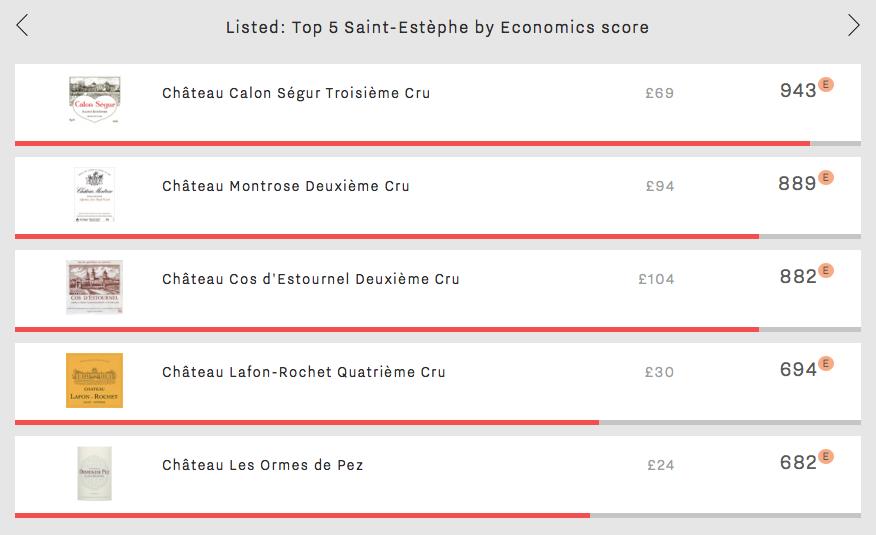

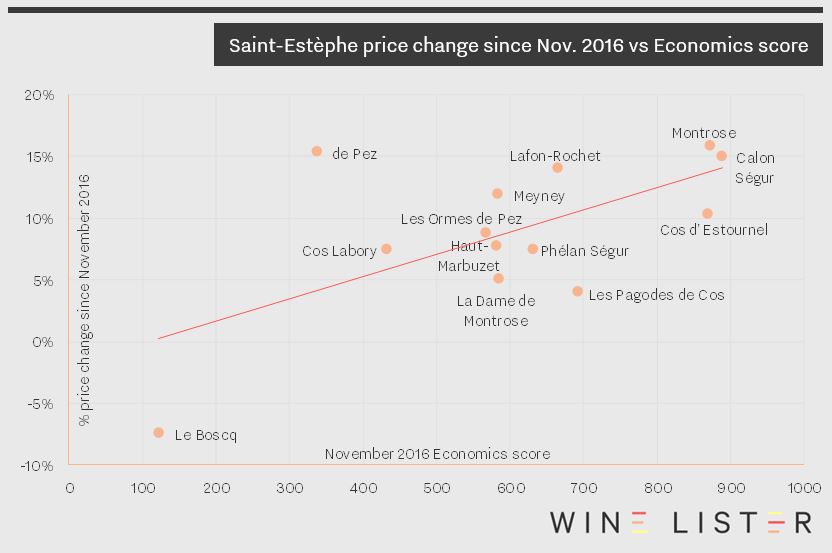

It is therefore timely to take a look at some Bordeaux Economics score successes, this week from Saint-Estèphe. Wine Lister’s Economics score combines five criteria – based on price and volume data – to measure a wine’s commercial success (read more on the Economics score calculation here).

Calon-Ségur has the highest Economics score of all Saint-Estèphe wines (943). Not only does it score 53 points higher than the next wine in its peer group, it is also the number one third growth for Economics score, sitting in eleventh place for Economics of all Bordeaux wines. This is particularly impressive, considering that the average price per bottle of those ranking in the top 10 is £614, nine times higher than Calon-Ségur’s comparatively modest average price tag of £69 (read more about Calon-Ségur’s pricing in the en primeur: part II blog).

The number two Economics score in Saint-Estèphe is held by Montrose (889). It has the highest average Quality score of the five (936) and an average wine life of 15 years. Its steady price growth over the last two years (30%) makes it one to watch for investment potential.

Cos d’Estournel is the most expensive Saint-Estèphe wine at £104 per bottle. Though it comes in third place for Economics, it has the best Saint-Estèphe Brand score of 996, thanks to presence in 52% of the world’s best restaurants and over 23,000 online monthly searches. Its popularity is also clear from its position as the most traded of the five at auction (calculated using data from one of our partners, The Wine Market Journal).

Lafon-Rochet and Les Ormes de Pez take fourth and fifth places, with Economics scores of 694 and 682 respectively. Both are a level below the top three in terms of price per bottle and Quality score, but they match Montrose on long term price performance, with compound annual growth rates (CAGR) of 9%. Saint-Estèphe is an appellation on the rise.

“I can’t see it being a big campaign.” That is the view of Serena Sutcliffe, Honorary Chairman of Sotheby’s Wine, echoed by some on the Place de Bordeaux. The usually upbeat Mathieu Chadronnier, Managing Director of négociant CVBG, asserts that 2017 Bordeaux en primeur “will be a weak campaign compared to last year”.

This sentiment is also recognised in the semi-official line, from Emmanuel Cruse, Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes, and Barsac. “We all know that over the weeks to come the distribution of this vintage could be slightly more difficult on the commercial side than previous ones,” he accepted, adding reasonably, “We need to recognise that each vintage has its fair price.”

The general (if not unchallenged) consensus is that prices will come down on 2016. “Of course they will,” said Chadronnier, “but not enough.” “We always wait for decreases and they’re never considered enough,” he continued, then asking, rhetorically, exasperated, “what is enough?”

What is enough indeed? Perhaps more than ever before, there is no one size fits all formula. Just as quality and style vary from château to château in 2017 (see part I of our en primeur round-up), so will pricing. Each property has its own brand trajectory, 2017 vintage quality, volume considerations, and price positioning history. This has been epitomised by the wildly different approaches of the first two major releases of the campaign, Palmer and Haut-Batailley.

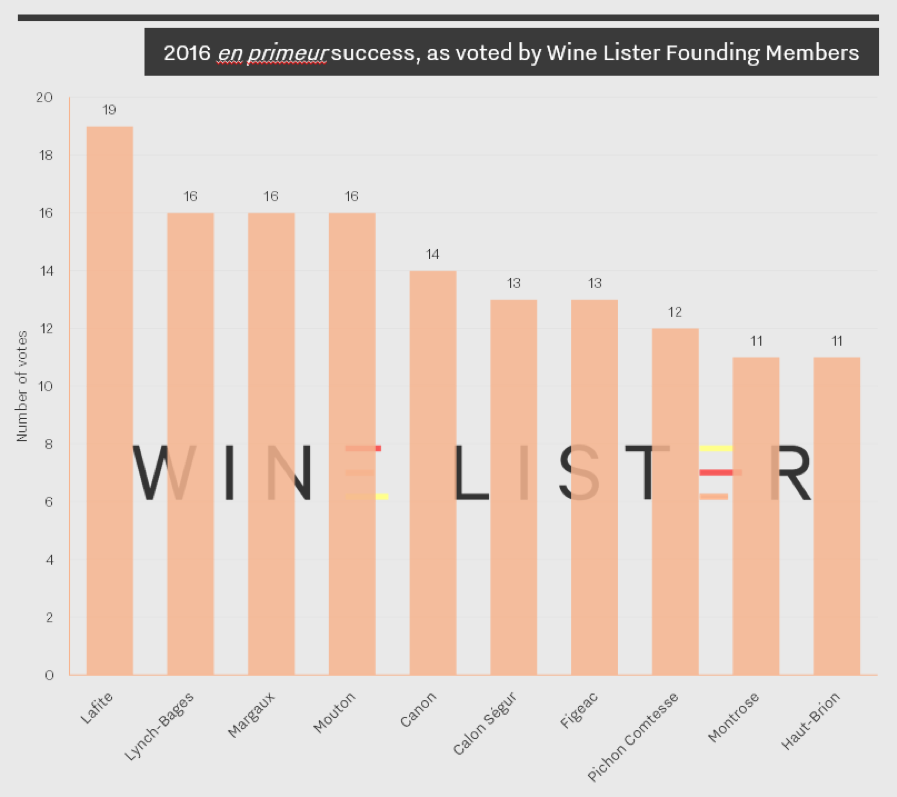

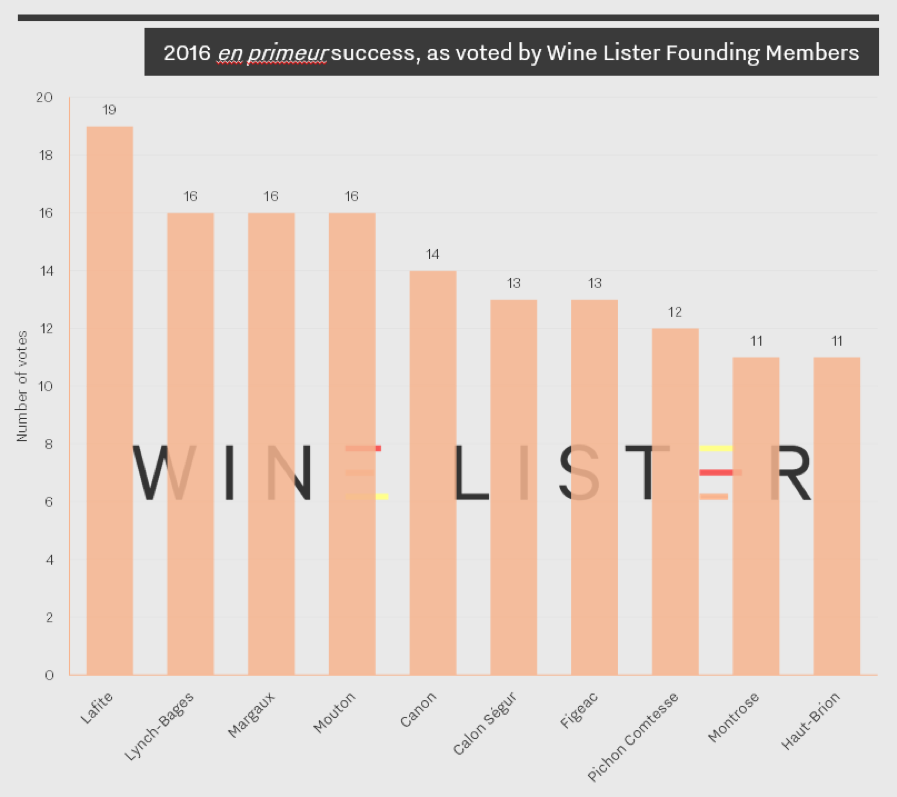

Only a small group of wines can get away with staying around 2015 prices (15-25 according to one Bordeaux courtier). Even fewer, if any, can maintain their 2016 release price. Contenders are arguably the big success stories of the 2016 en primeur campaign. According to Wine Lister’s Founding Members (c.50 key members of the international fine wine trade), first growths aside, these were Châteaux Lynch-Bages, Canon, Calon Ségur, Figeac, Pichon Comtesse, and Montrose.

However, when we put it to some of these producers that they were among a happy few potentially in a position to maintain 2016 prices, most dismissed the idea. “I could even go up and people would buy it,” mused Laurent Dufau, Managing Director of Calon Ségur. “But I won’t”, he concluded, adding “I would rather maintain the trade’s goodwill”. Nicolas Glumineau, Managing Director of Pichon Longueville Comtesse de Lalande, replied firmly, “If the question is will the price be like 2016, the response is evidently not”. He continued, “I’m really very happy with the wine we’ve made, but it’s not the 2016”.

In fact, almost every château we spoke to in Bordeaux said it would reduce the price. “It would not be right to release the 2017 at the same price as the 2016,” said Jean-Valmy Nicolas, Co-Managing Director of Château La Conseillante. “In my opinion our pricing strategy should be based on relative quality, not relative volume,” he said, referring to the impact of the frost on production volumes (down 15% on 2016).

As much as anything else, most Bordelais won’t risk the reputation of the 2016s. For most, following significant price increases for the 2016 vintage, a decrease for 2017 is manageable. This was precisely Edouard Moueix’s point (Managing Director of négociant Jean-Pierre Moueix) when he lamented, “People always compare to the year before, so even if there’s a 10-15% decrease on 2016 it’s still too high.”

For a handful of properties whose 2015s and 2016s were relative bargains, bringing the price down too much in this vintage is going to be a harder pill to swallow. Problematically for them, the market does still think in terms of increase or decrease on the previous vintage, even if this is an overly simplistic approach.

“I don’t believe for a second that prices will go down,” declared Nicolas Audebert, Managing Director of Châteaux Canon and Rauzan-Ségla, two of Bordeaux’s rising stars. Canon was voted the fifth most successful release of last year’s en primeur campaign. This is thanks to the combination of its rising popularity and its reasonable 2016 release price – it sold like hotcakes. Its 2016 price has risen by 23% since release, so arguably it is one of the very few wines that could conceive of not decreasing its price this year.

The only other château to suggest that a price decrease was by no means a given was Cos d’Estournel. Faced with the generalisation of 2017 as below the level of the last two vintages, owner, Michel Reybier, told us that “for us, compared to 2016, the 2017 vintage might even be better.”

Smoke and mirrors: Bordeaux’s Miroir d’eau (water mirror) on the only sunny day of Wine Lister’s en primeur tasting trip. Photo © Ella Lister

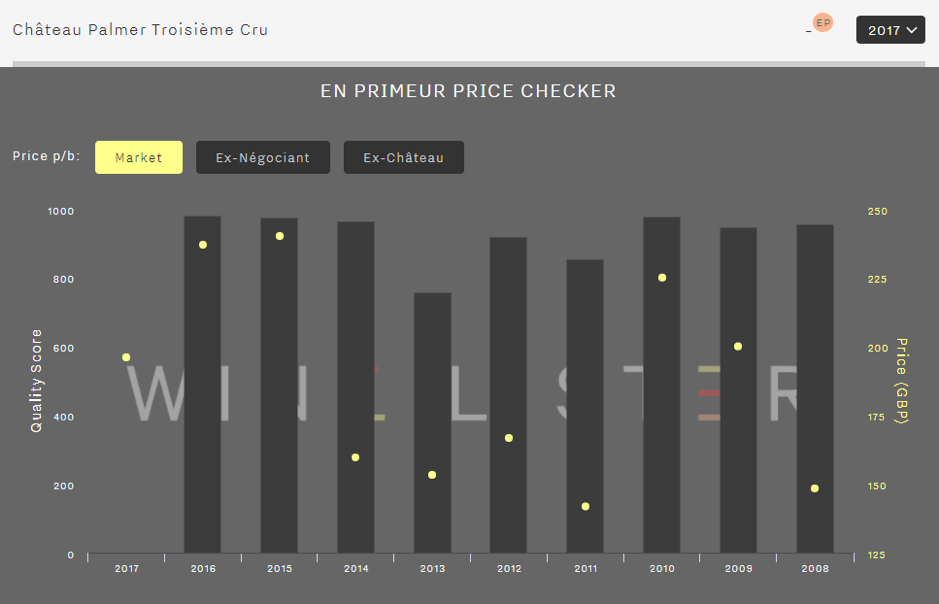

Farr Vintners summed up their thoughts on pricing succinctly, saying “if prices are at around the current market for [2014, 2013, 2012 and 2011], 2017 starts to look very interesting,” cautioning, “at close to current 2016 or 2015 prices the wines will not be worth buying.” Will the threat of not selling be enough to moderate producers’ pricing ambitions?

“They couldn’t care less whether they sell,” said the car hire attendant who rented me my car at Bordeaux airport. If the news has spread that far out of the wine industry, maybe it’s true. Certainly, for a gilded group of crus classés the idea of keeping back stock and selling it for more down the line is appealing. And for what they do release, they can be pretty certain their négociants will back them up and carry the stock (and the risk), even if there are few end buyers.

This was confirmed by one large négociant, who told us off the record, “We’ll buy but we won’t sell as much as we want to.” He is “worried about prices,” citing “the usual Bordeaux spiral.” He was referring to the transition period required after a string of good vintages, during which prices are not recalibrated sufficiently. “Châteaux sold the wine last year, everyone’s happy, so they won’t come down enough,” he concluded.

As for timing, we’ve already seen important releases this week, earlier than expected, with Palmer coming out a day earlier than Cos d’Estournel’s surprise release last year, in spite of the tastings taking place a week later. Nonetheless, a long campaign is expected, in part due to an inordinate number of bank holidays in May (in France and the UK). Philippe Dhalluin, Managing Director at Mouton Rothschild, seemed to predict this when he told us “it is not a speculative campaign so it should start off quite quickly.” He added, “We’d like to have an early campaign but May is complicated,” specifying, “I’d like to release before Vinexpo – it’s possible.” Anything is possible in love and en primeur.

Follow us on Twitter and on the blog for real-time coverage of the Bordeaux 2017 en primeur campaign. Check www.wine-lister.com next week for a new dedicated en primeur page where you can find out everything you need to know during the campaign.

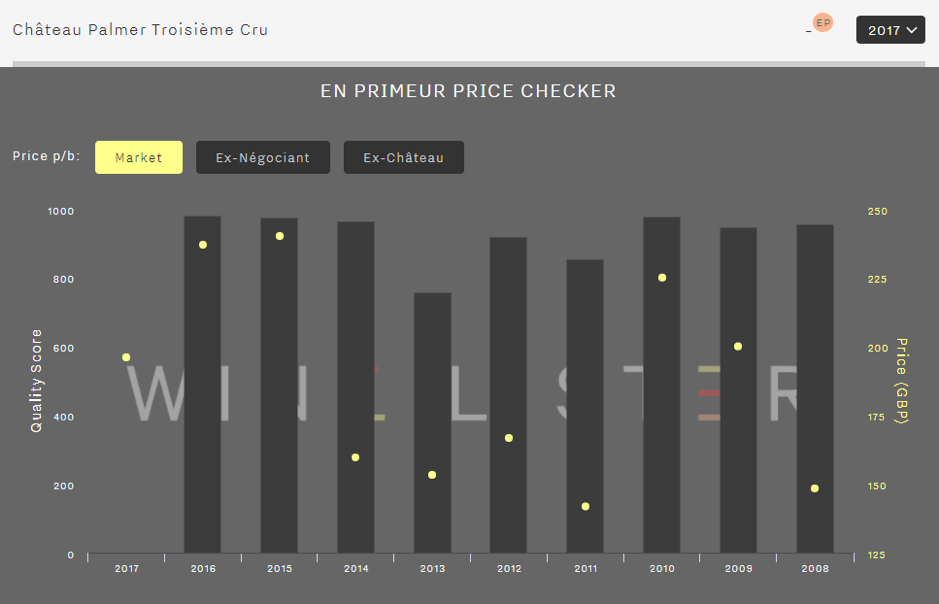

Margaux’s Château Palmer made a surprise move on Monday morning, releasing its 2017 vintage en primeur before anybody expected. At €192 ex-négociant, its price decrease of 20% on the 2016 (€240) is symbolically significant.

For several years the château has only released 50% of its Grand Vin en primeur each year, which has allowed it to develop an aggressive pricing policy, positioning itself well above other third growths and even second growths. The wine’s price had risen 14% for the 2016 vintage, giving it some margin to come down again this year. This neatly places the 2017 between the 2014 and 2015, both in terms of original release prices and current market prices:

This was a smart and strategic move by Managing Director, Thomas Duroux. When we tasted at the château in the second week of April, he shared his thoughts on the campaign, and it was clear he had considered the dynamics of 2017 Bordeaux en primeur very carefully.

Duroux was cautious about the campaign, saying “It’s going to be complicated as there are lots of discouraging factors.” He believes it’s difficult to achieve three good campaigns in a row, and that there is not a huge amount of demand from consumers. He spoke of a confusion around price and volumes, explaining that “just because there’s less wine doesn’t mean consumers are ready to pay more – they don’t care.” As it happens, the Grand Vin was spared frost damage in April 2017, while 15ha of the second wine was hit. Alter Ego was released at just a 2% discount on the 2016.

“We risk having a campaign where prices go down but not enough to be judged attractive by the consumer,” warned Duroux. It remains to be seen whether Palmer 2017’s 20% decrease is enough. With the trade unprepared, and scores not out yet for many important wine critics (including Wine Lister’s partner critics), it is now a waiting game. Négociants have bought their allocations, and for now they are holding a fair amount of stock of Palmer 2017 in Bordeaux.

Sales by UK merchants are modest for the time being. Depending on scores that will be released over the coming 10 days, Palmer might start to seem like a good deal, particularly when (not if) the discounts start to shrink over the course of the campaign. Or indeed when the discounts become premiums, as we saw this morning with the release of Haut-Batailley 2017 – read the blog post here).

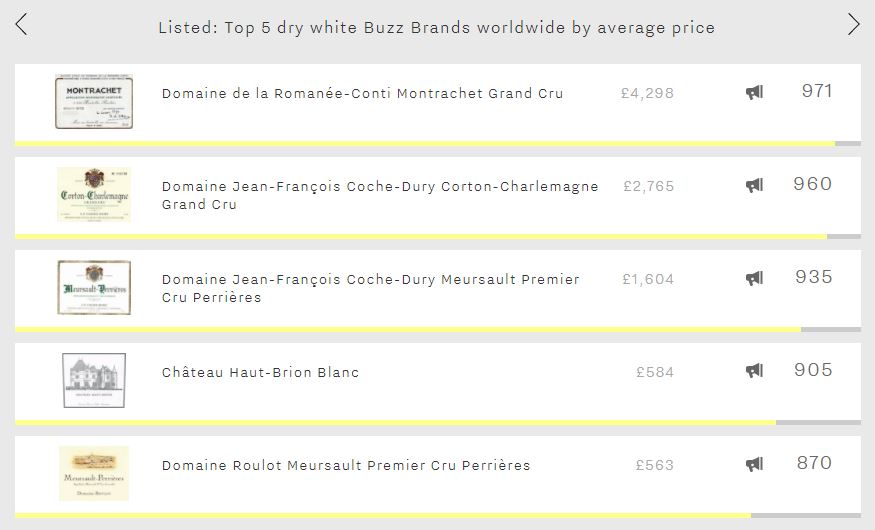

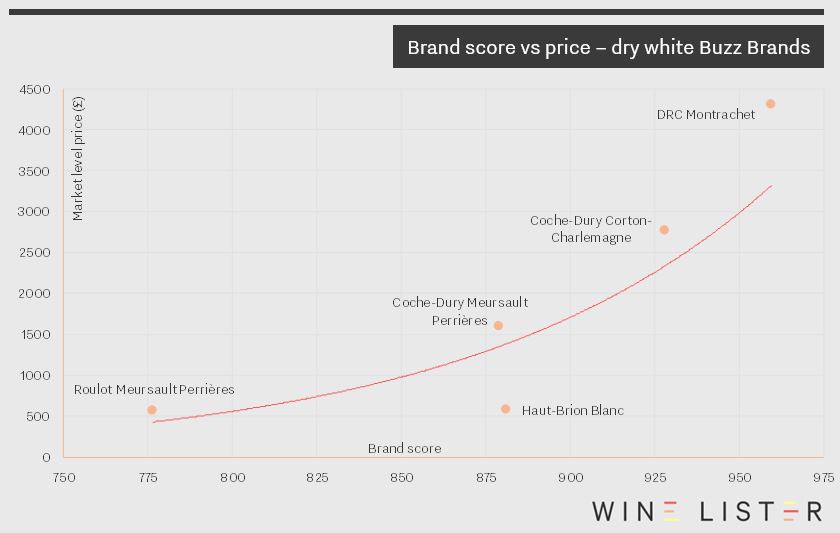

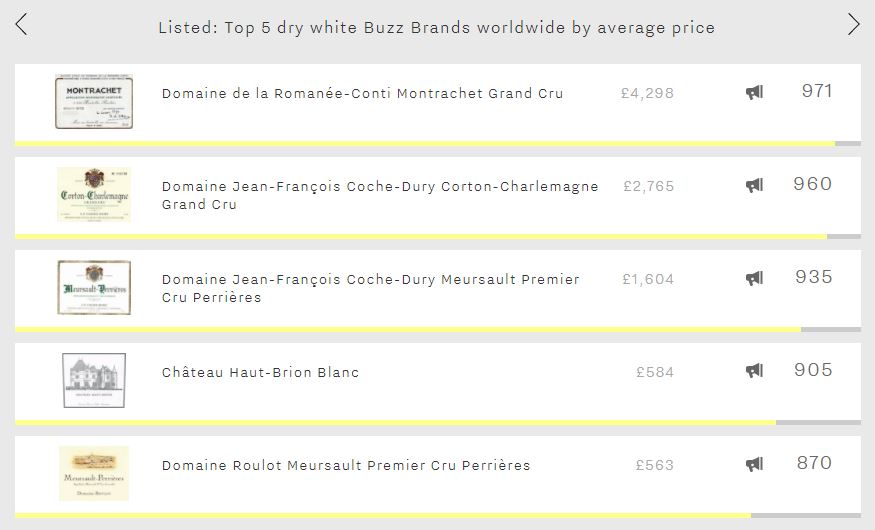

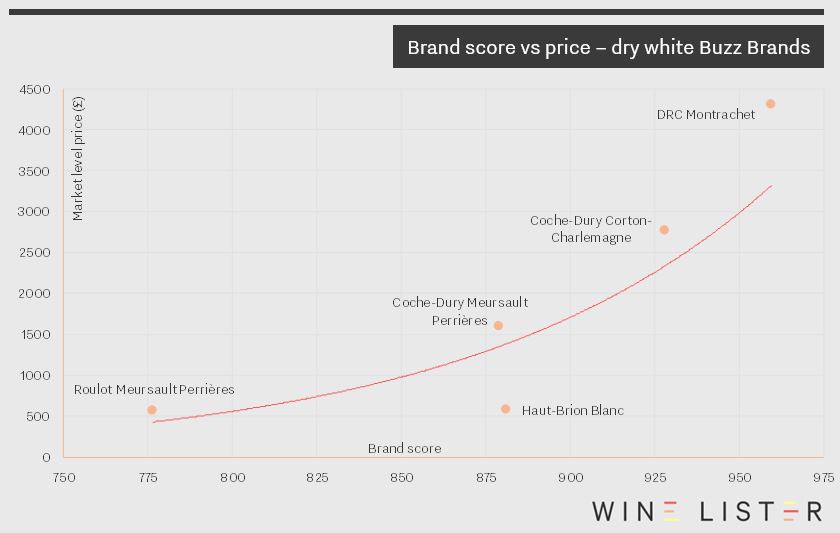

“Buzz Brands” is one of the four Wine Lister Indicators developed to help our users identify wines for different scenarios. A Buzz Brand is a wine with strong distribution in the world’s top restaurants, enjoying high levels of online search frequency or demonstrating a recent growth in popularity, and identified by the fine wine trade as trending or especially prestigious. As such, you wouldn’t expect them to come cheap, and the five most expensive dry whites definitely don’t, costing around £2,000 on average.

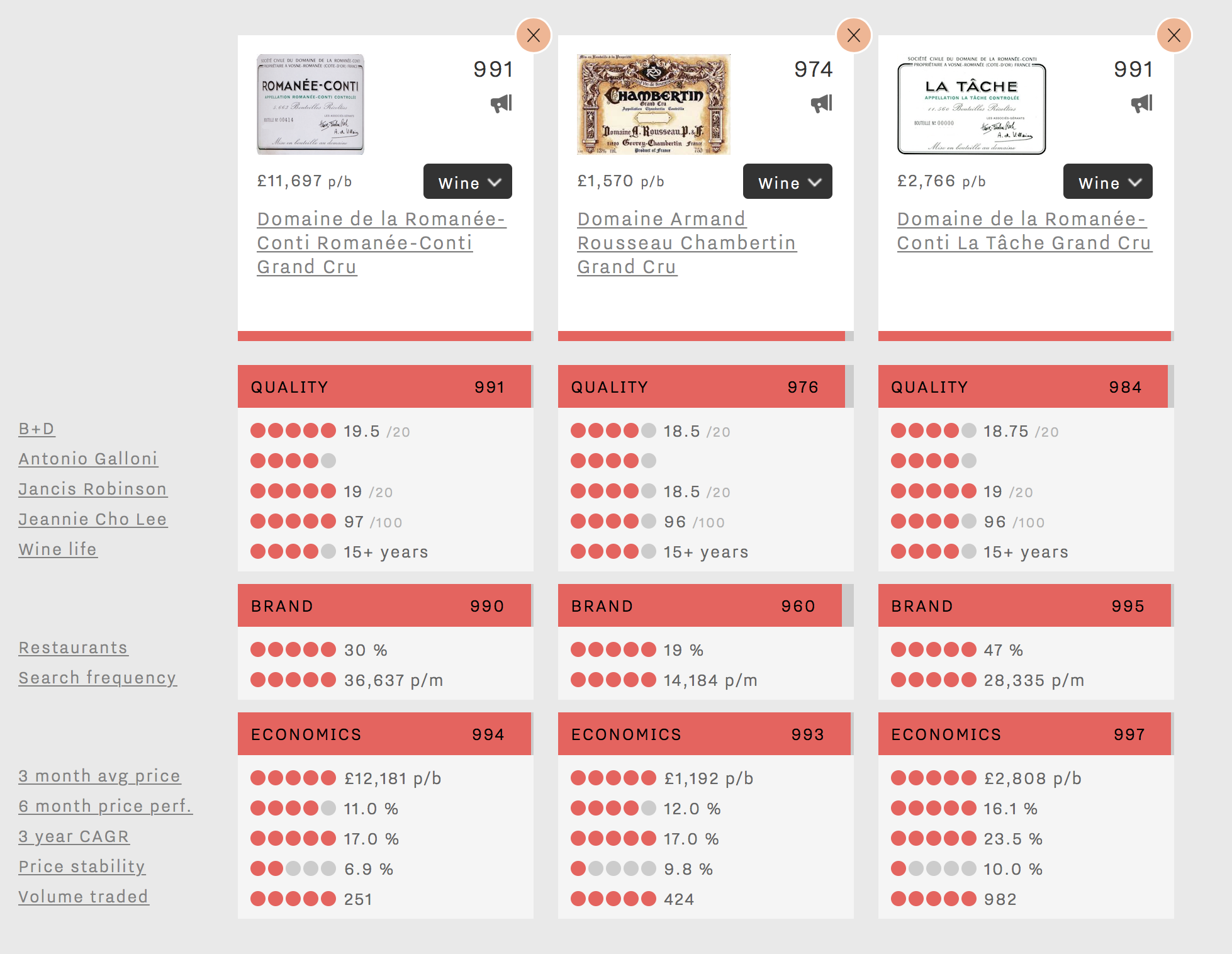

Perhaps unsurprisingly given the miniscule production of its top wines, Burgundy fills four of the five spots (and two of these are from Coche-Dury). DRC Montrachet is the world’s second-most expensive dry white – behind Leflaive’s Montrachet which fails to achieve Buzz Brand status. It achieves the best Quality score of this week’s top five (976), just pipping Coche-Dury’s Corton-Charlemagne to the post (971). It also enjoys the highest Brand score of the group – or any dry white for that matter (960) – the result of appearing in considerably more of the word’s top restaurants than Coche-Dury’s Corton-Charlemagne, which comes second in that criterion (26% vs 19%), and also being nearly 50% more popular than any of the rest of the five.

Whilst Coche-Dury’s Corton-Charlemagne has to settle for second place in the Quality and Brand categories, it not only manages the group’s top Economics score (991), but also the highest of any dry white on Wine Lister. This is thanks to formidable price growth. It has recorded a three-year compound annual growth rate (CAGR) of 25%, and has added 14% to its price over the last six months alone.

It is to be expected that wines from two of Burgundy’s most hallowed grand cru vineyards command the group’s highest prices, but it might come as more of a surprise that two Meursaults from the premier cru Perrières vineyard feature. With over £1,000 separating the considerably more expensive offering from Coche-Dury and Roulot’s expression, it becomes clear that Brand score is a significant driver of price at this rarefied end of the scale, particularly within Burgundy.

Proving that expensive Buzz Brands are not only to be found in Burgundy, Haut-Brion Blanc makes an appearance in the top five. Whilst it is the most liquid of the group – its top five traded vintages have traded 49% more bottles than any other wine in the five – it has experienced by far the lowest growth rates, with a three-year CAGR of 9% compared to the Burgundy quartet’s remarkable average of 22%.

Yes, that question: “which are better, Old World or New World wines?” Traditionalists may argue that the latter lack the prestige and quality of their Old World counterparts. Those with a preference for the New World might see these wines as better value for money, free of the price tag accompanying wines from famously exclusive Old World vineyards.

Wine Lister has compared the top 50 wines by Quality score from Old World and New. The average Quality score of the top 50 wines is 983 in the Old World and 948 in the New. Though both Worlds sit comfortably in the “strongest” section of the Wine Lister 1000-point scale for Quality, the price gap tells a different story. The average price for a top 50 ranking Old World wine is £2,114 per bottle – seven times higher than the average New World equivalent (£297).

The wine with the highest Quality score on Wine Lister is Egon Müller’s Scharzhofberger Riesling TBA, which achieves a wine level Quality score of 995, having fallen just one point shy of the perfect 1,000 point score for the 2010 vintage. Riesling’s quality proliferates in the top 50, with 16 entries across Germany and Alsace. The high critics’ scores are balanced by exceptionally high prices, with an average price of £2,509 per bottle.

Though the Old World Quality top 50 is in fact white wine dominant, red Burgundy is well represented, with 13 entries and an average Quality score of 983 at £3,164 per bottle. Even excluding DRC La Romanée-Conti’s remarkable price (£11,722 per bottle), Burgundy’s remaining 12 finest reds command an average price of £2,450 per bottle.

Champagne wins the price vs quality race for the whites, with an average Quality score across its four entries of 981 at £348 per bottle. Even more impressive are the five Port entries, with an average Quality score of 982 at £244 per bottle.

In contrast to the diverse set of regions represented in the Old World top 50, the New World list is dominated by California (with 40 out of 50 wines hailing from the region). These wines achieve an average Quality score of 948 at £315 per bottle – not quite as good value as the Champagnes and Ports, but seemingly better value than their red Burgundian counterparts.

Though there are fewer entries from Australia (seven in total), the New World’s number one wine for quality comes from the Barossa Valley. Torbreck The Laird has a Quality score of 984 points and a price of £427 per bottle. When comparing this to an Old World wine of the same score, the price difference is evident. Domaine Leroy’s Romanée Saint Vivant benefits from the same Quality score, but is nearly five times more expensive, at £1,975 per bottle.

Wine Lister Economics scores not only reflect a fine wine’s economic clout, but also predict its future price performance. The economics of fine wine are increasingly important. Some purists wish it weren’t the case (wouldn’t it be wonderful if quality could exist in isolation from pecuniary concerns?), but consider the plight of the producer making an exceptional wine, that without any brand recognition or commercial strategy doesn’t ever see the light of day. It never finds an importer, or its way into the consumer’s glass, let alone the investor’s portfolio.

That is why Wine Lister scores capture 12 data points across three rating categories, to measure the all-round performance of a fine wine in its journey from vine to glass. After Quality and Brand, the third Wine Lister rating category is Economics. The Economics score shows the producer whether its commercial strategy is working, but more than that, it can also serve to indicate to the collector whether the wine makes an economically sound investment.

Bordeaux wines with an Economics score above 900 in November 2016 had increased by 17% in price on average by January 2018. By contrast, those with Economics scores below 600 gained just 8% subsequently. We can see this pattern in action in the chart below, which looks at Saint-Estèphe wines over the same 14-month period. The wines with the highest Economics scores at the beginning of the period proceeded to increase more in price than those with lower scores as a general rule.

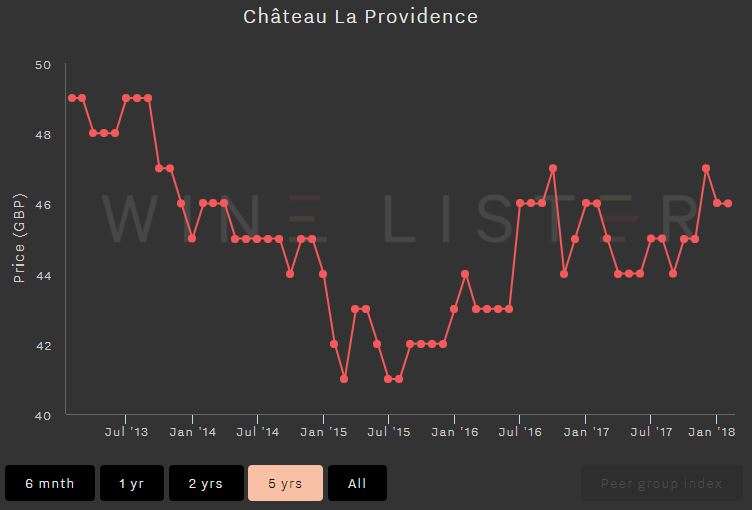

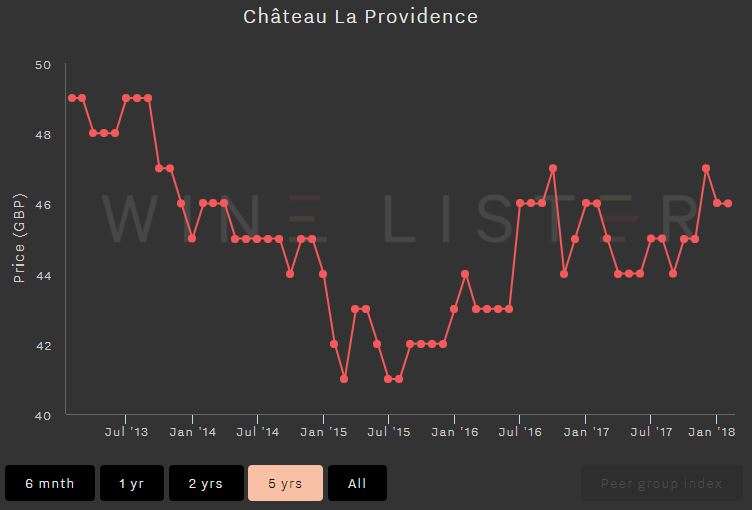

The below screenshots of Wine Lister’s price history tool illustrate graphically the difference between two wines with different economic profiles. Vieux Château Certan’s Economics score lies in the “strongest” portion of the Wine Lister 1000-point scale at 907/1000. While Château La Providence’s Quality score is strong (708/1000) its low Economics score of 389 is the result of a lower price, weak price performance, volatile prices, and modest trading volumes.

Wine Lister analyses five criteria in order to measure a wine’s economic strength, expressed as an Economics score out of 1,000. Four of these criteria use pricing data from our data partner, Wine Owners, while the fifth uses trading volume figures from the Wine Market Journal:

- 3 month average bottle price

This “market price” is the ultimate measure of what people are willing to pay for each wine in each vintage. Data is updated weekly, and bases prices on a three-month rolling average. Prices are shown In Bond per bottle.

- Short-term price performance

A wine’s financial strength also depends on its price performance. Wine Lister calculates price changes over six months for an indication of short-term price trends.

- Long-term price performance

Long-term performance measures a wine’s compound annual growth rate over three years.

- Price stability

Price fluctuations over a 12-month period are distilled into the measure of a wine’s stability. Wines with less volatility are more consistent, less risky and therefore earn a better Economics score.

- Volume traded

Added to pricing information is data on a wine’s liquidity. A wine can have good price performance but lack the current market demand, potentially making it a less attractive wine for investment.

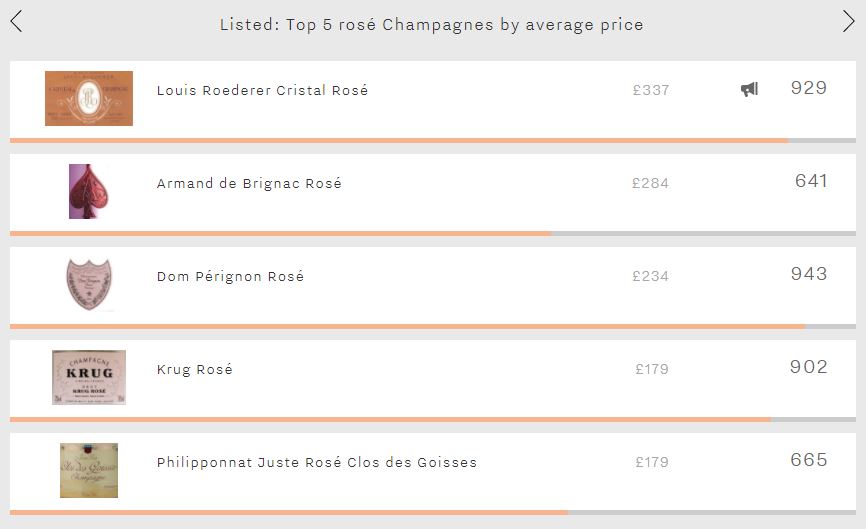

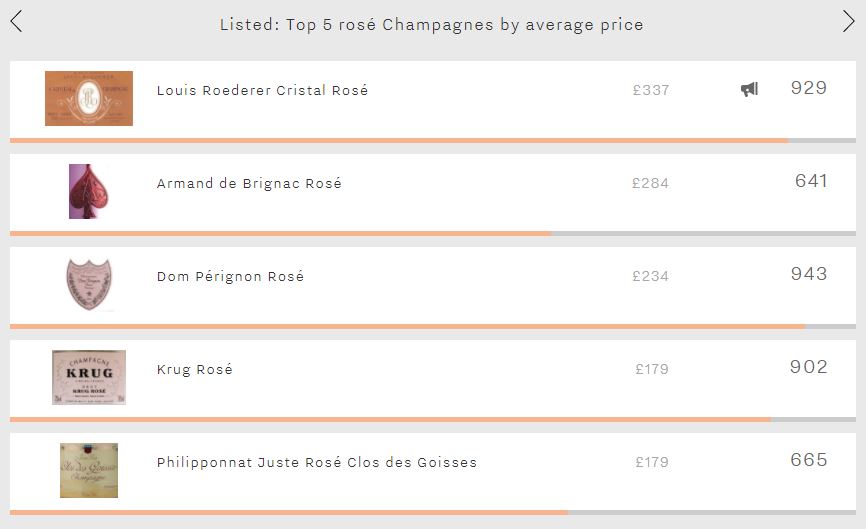

Unintentionally coinciding with today’s International Women’s Day – really, it was a complete accident – this week our Listed section looks at “pink Champagne”, namely the five most expensive rosé Champagnes. We are a bit embarrassed that it looks like we are jumping on the bandwagon and touting the colour pink today. However, as these five contenders show, top rosé Champagne represents a serious vinous offering worthy of any day or occasion.

The world’s most expensive pink Champagne is Louis Roederer’s Cristal Rosé (£337 per bottle). It also achieves the highest Quality score of all rosé Champagnes (972). Whilst it receives excellent scores from each of Wine Lister’s partner critics, it is the outstanding average rating of 97/100 from Antonio Galloni’s Vinous that stands out. Cristal Rosé also pips its white counterpart to the post in the Quality category (972 vs 970), and is over twice as expensive (£337 vs £165 per bottle). However, despite its superior quality, Cristal Rosé trails its white counterpart in the Brand category by 56 points – it features on under half as many of the world’s top wine lists and is searched for 82% less frequently.

The second-most expensive rosé, Armand de Brignac’s offering, is a newcomer to the fine wine world, born in 2006. It experiences the group’s lowest Quality and Economics scores, and second-weakest Brand score. Its high price (£284) can therefore be attributed to its association with Jay-Z. The American rapper featured Armand de Brignac’s white Champagne in the video for “Show Me What You Got” in 2006 – before it even had a US importer – and eventually bought a significant portion of the house in 2014, further aligning the brand with his high-flying lifestyle.

In third place is Dom Pérignon’s rosé (£234). Whilst unable to match the peerless brand recognition of its white counterpart, it does enjoy the best Brand score of any pink Champagne (984). This is thanks to receiving on average 2.5 times as many online searches each month as the second-most popular wine of the five (Cristal Rosé).

The last two spots are filled by Krug’s rosé and Philipponnat Juste Rosé Clos des Goisses, each costing £179. The fact that the Krug enjoys a lead of 237 points in terms of overall Wine Lister score yet costs the same shows that when it comes to rosé Champagne, prices don’t always have a rational explanation. The chart below confirms a lack of correlation between price and overall Wine Lister score for these five wines.

For wine lovers the world over, Burgundy is a region to be celebrated all year round. That being said, the modern interpretation of the traditional, post-harvest festival, La Paulée de New York, holds its West Coast counterpart this week, celebrating some of Burgundy’s finest producers in San Francisco’s best restaurants.

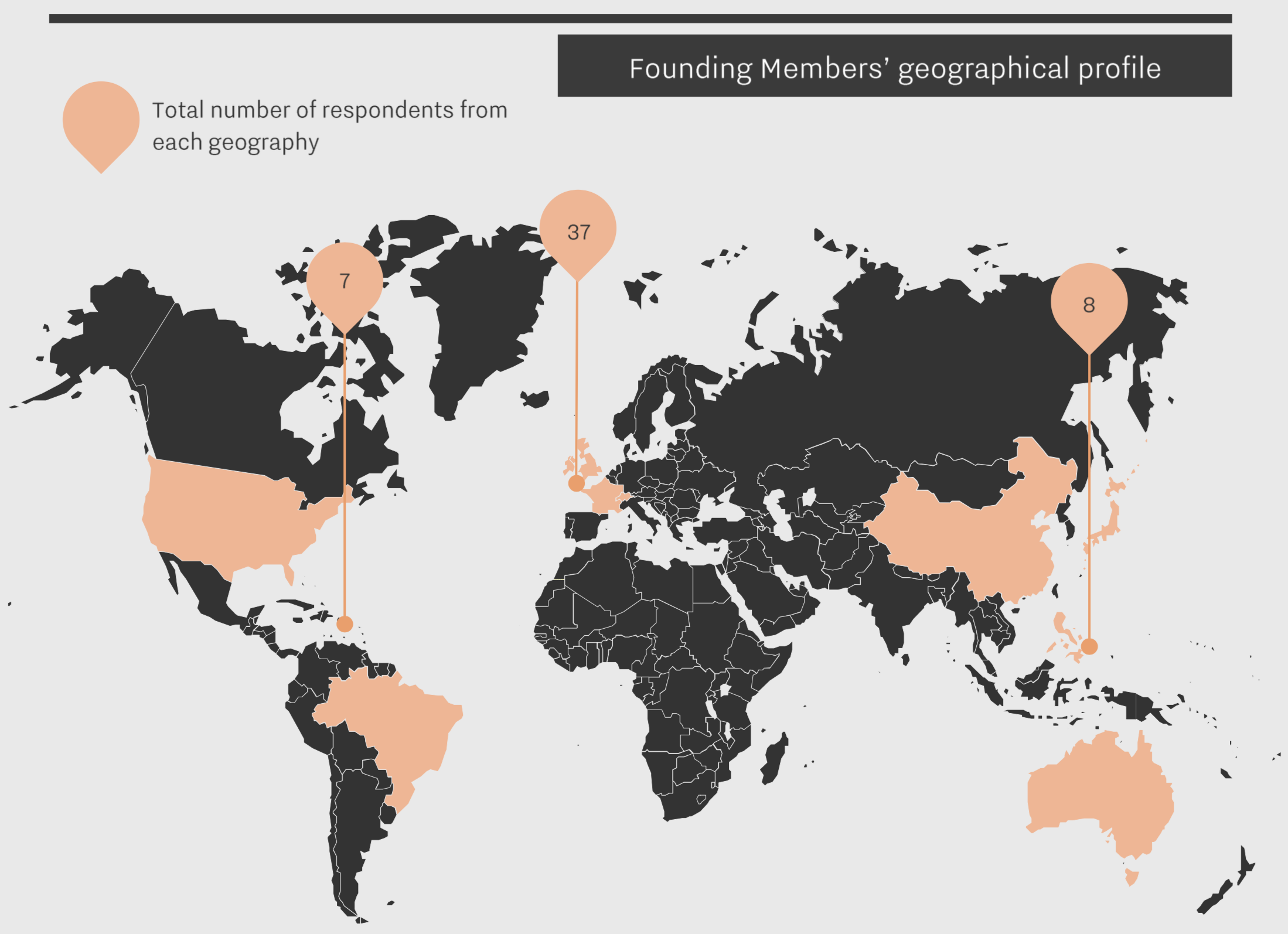

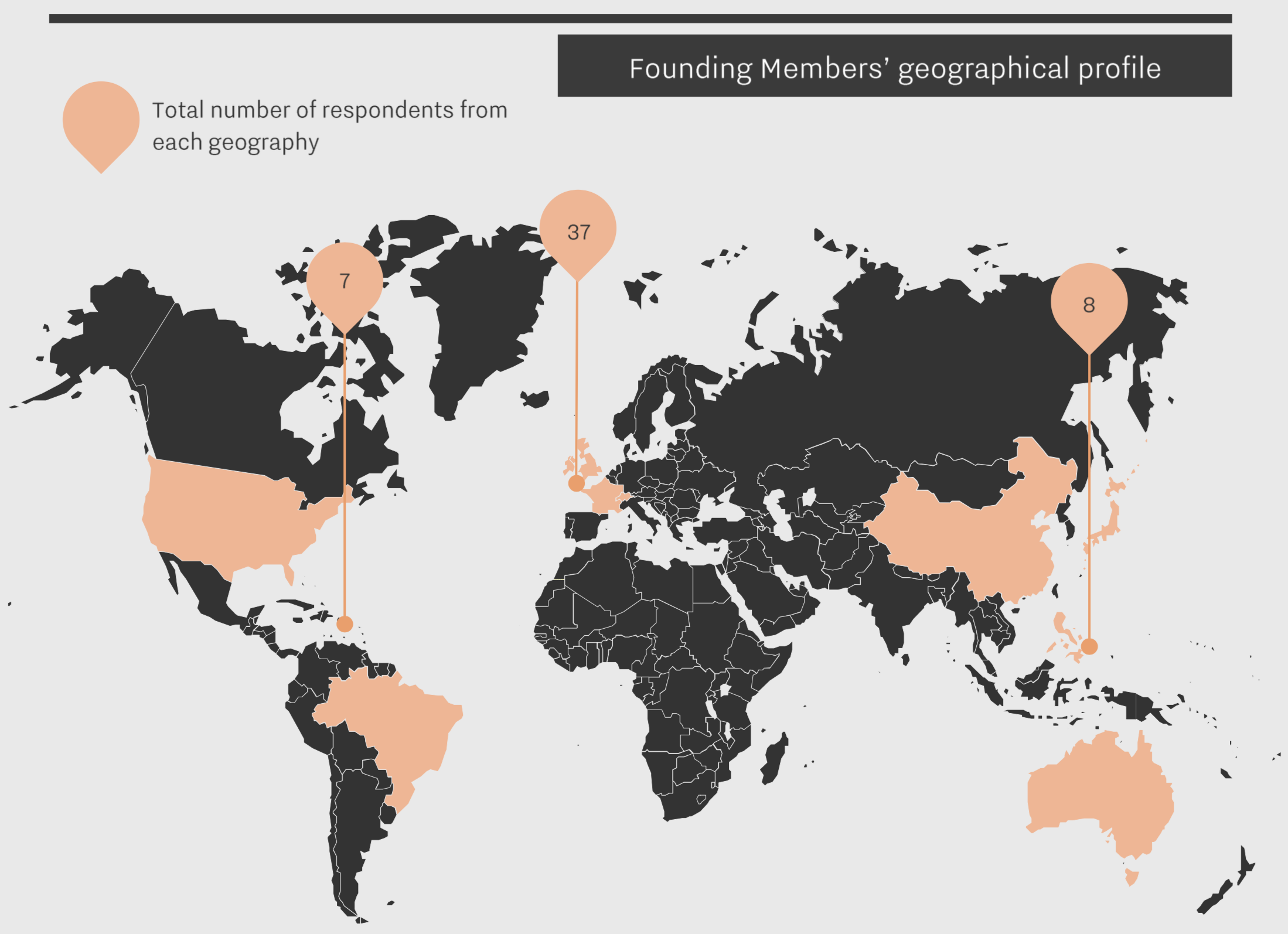

With Burgundy on the brain, we look back at our recent Burgundy study and the results of our Founding Members’ survey. Wine Lister asked 52 key members of the global wine trade across importers, merchants, and auction houses to rate their confidence in certain domaines from 0 to 10.

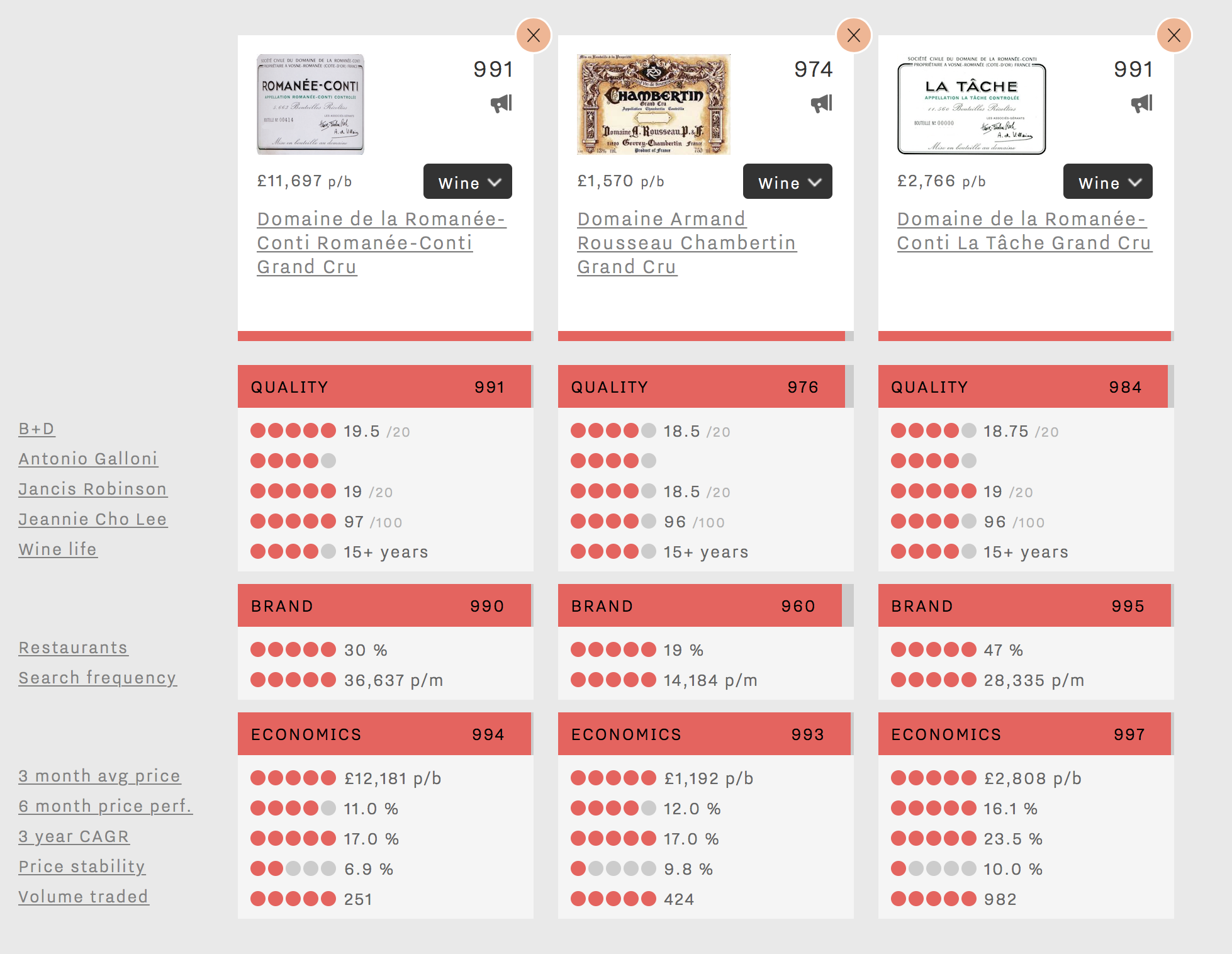

Our Burgundy study is the first to feature producers with a perfect confidence score. In Burgundy, two producers received a rating of 10/10. It perhaps comes as no surprise that Domaine de la Romanée-Conti (DRC) should be one of them. The other, Domaine Rousseau, is likely to have the strong performance of its Chambertin to thank for its perfect confidence score (Rousseau’s Chambertin holds the fifth best overall Wine Lister score in Burgundy, after four DRC wines).

Six producers achieved a confidence rating of 9/10. D’Auvenay and Domaine Leroy’s marks confirm the trade’s outstanding level of confidence in Lalou Bize-Leroy. Whilst Mugnier and Roumier fly the flag for Burgundy’s top red producers, Coche-Dury and Raveneau show that the trade is sure about the prospects of the region’s most prestigious white wine producers.

26% of producers included in the survey gained a confidence rating of 8/10. Among them, Comtes Lafon, Ente, and Roulot confirm the prospects of Meursault and its top producers.

36% of producers received a score of 7/10 – still a strong result and underlining the trade’s high level of confidence in Burgundy. This confidence seems linked to the region’s consistent price performance, as one US fine wine auction house notes: “The single most interesting trend is pricing. Demand on the primary and secondary market is high, and it’s amazing to see that prices have not gone down at all…in years.”

For context, no Burgundy producer scored below 5/10, compared to 5% of Bordeaux wines in Wine Lister’s Bordeaux study last year.

For more detail on which Burgundy producers achieve top confidence ratings, see our full Burgundy study here, or subscribe to gain access.

For those joining the La Paulée festivities, we wish you a very happy Burgundy week!

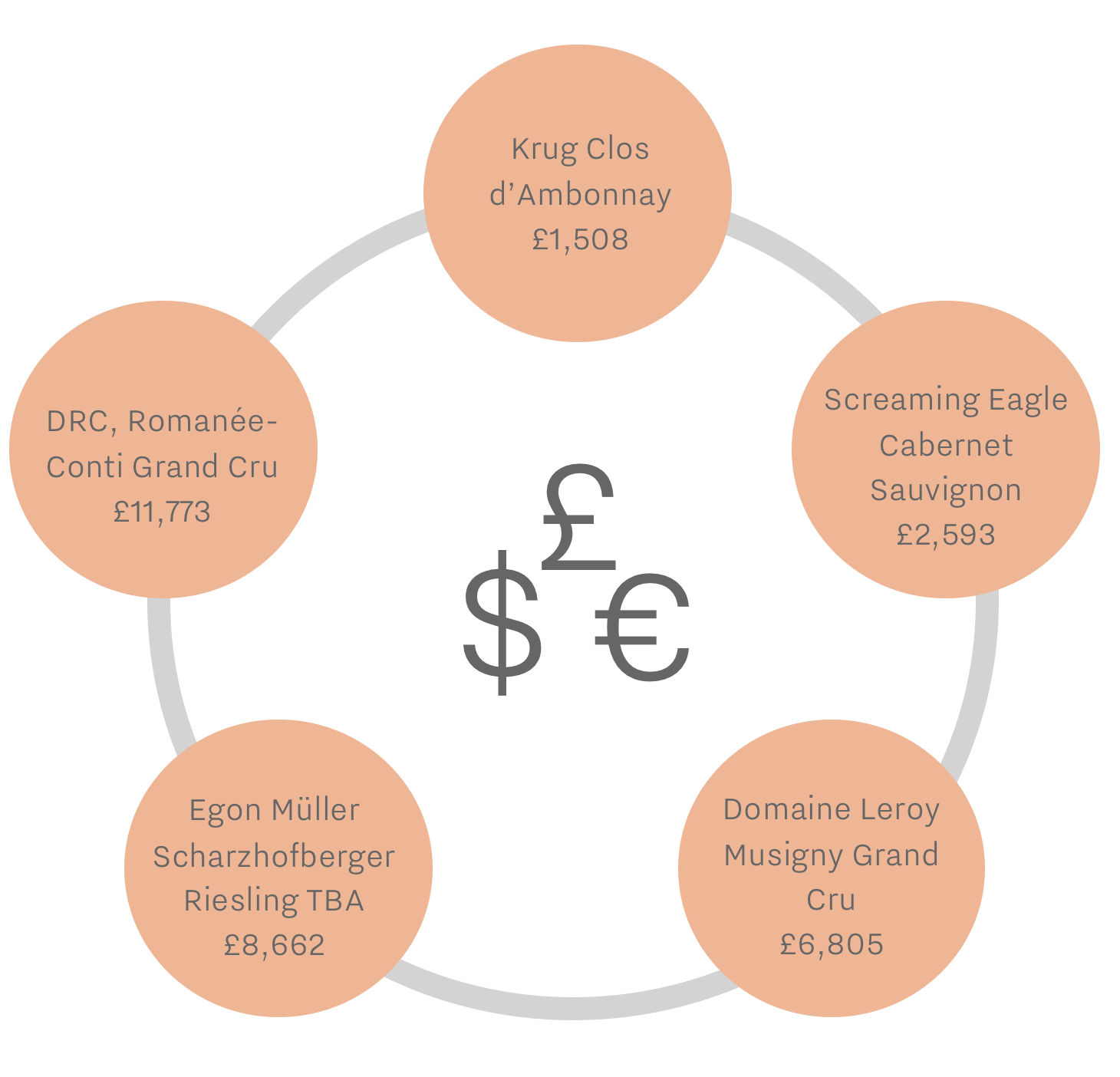

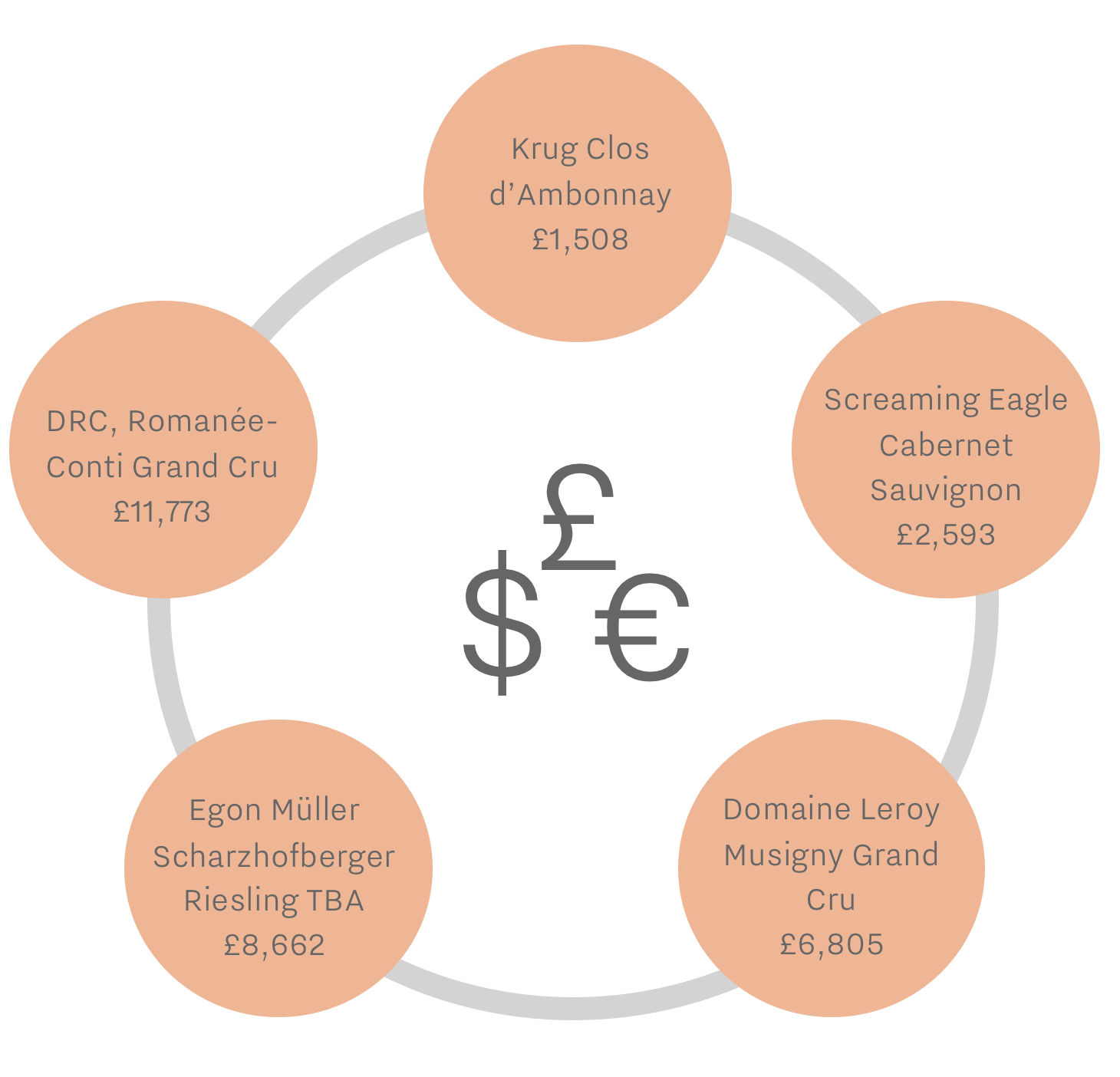

We may have been glad to see the back of January, but it certainly wasn’t all blue. The first month of the year brought excitement to the wine world with Domaine de la Romanée-Conti’s (DRC) 2015 release, and to Wine Lister with our first ever 1000-point Brand score. For much of London’s bustling City, the end of February means one thing: bonus time. The Financial Times’ February edition of How To Spend It already features the iconic DRC – below are some further ideas for wines to blow the budget.

Prices from our data partner, Wine Owners, are shown ex duty and sales tax (VAT) per bottle as averages across Wine Lister featured vintages.

- Krug Clos d’Ambonnay

While Dom Pérignon or Louis Roederer’s Cristal are more commonly associated with City celebrations, those in the know will be toasting with Krug’s famous Pinot Noir expression. With an average Quality score of 969 and a price of £1,367 per bottle for the latest available vintage (2000), a glass of Krug Clos d’Ambonnay is, in itself, cause for celebration.

- Screaming Eagle Cabernet Sauvignon

If you’re one of the lucky few on Screaming Eagle’s direct mailing list, congratulations. It is one of the most talked-about wines by the trade based on the results of Wine Lister’s proprietary Founding Member survey, and counts over 17,000 monthly online searches on Wine-Searcher. The average £2,593 price tag per bottle is therefore a small price to pay, if indeed you are able to get your hands on one of the 7,800 bottles produced each year.

- Egon Müller Scharzhofberger Riesling TBA

Even harder to find is Egon Müller’s Scharzhofberger Riesling TBA. It breaks a number of records, including Wine Lister’s rarest wine (with an average of only 150 bottles produced per annum) and the highest ever average Wine Lister Quality score (995). Prices range from £5,848 per bottle to over £21,000 per bottle for older vintages.

- Domaine Leroy Musigny Grand Cru

The second most expensive of all French wines, let alone in Burgundy, is Domaine Leroy’s Musigny. At just over half the price of DRC Romanée-Conti, averaging £6,805 per bottle, its consistent quality is matched by impressive price growth, with a compound average growth rate of 26%. It featured in last year’s Listed blog, “the best wines money can buy”, which certainly still rings true.

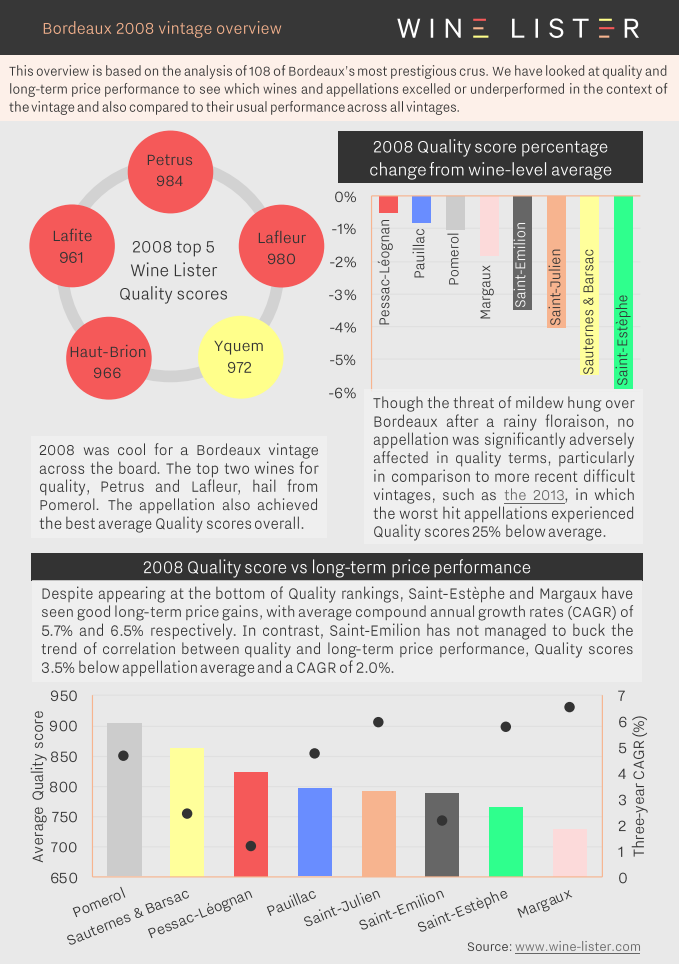

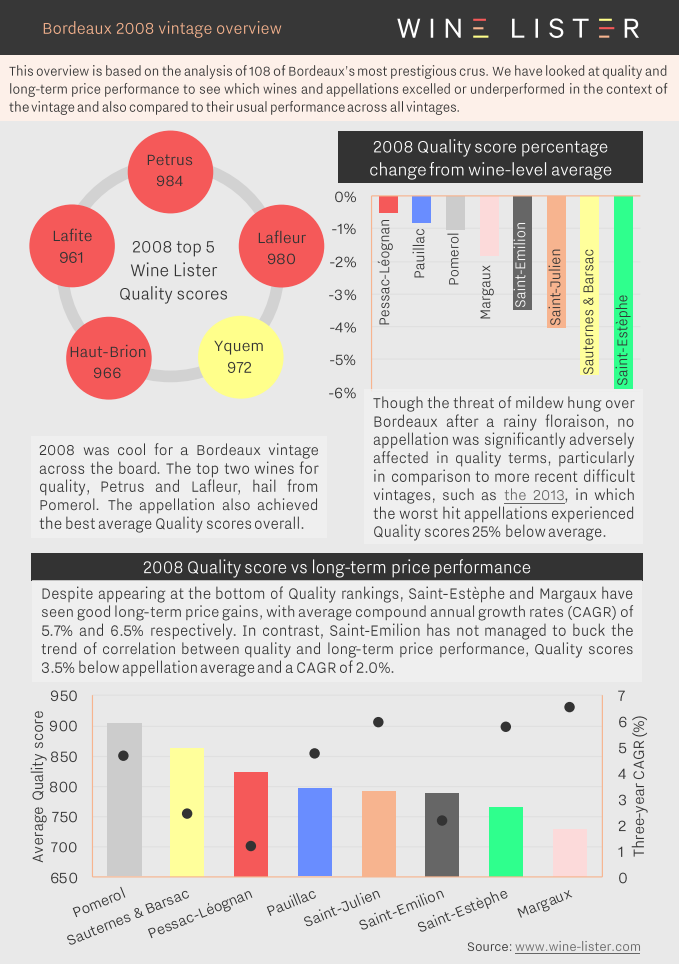

Last week we were lucky enough to taste through the 2008 vintage of Bordeaux grands crus classés at BI Fine Wines’ 10 years on tasting. Below we explore what light Wine Lister scores have to shed on the quality and price performance of different appellations in 2008.

Wine Lister’s holistic and dynamic approach allows us to not only see which appellations produced the vintage’s best wines, but also demonstrates if and how the market has since reacted to each appellation’s relative quality.

You can download the slide here: Wine Lister Bordeaux 2008 vintage overview

Featured wines: Petrus, Lafleur, Yquem, Haut-Brion, Lafite