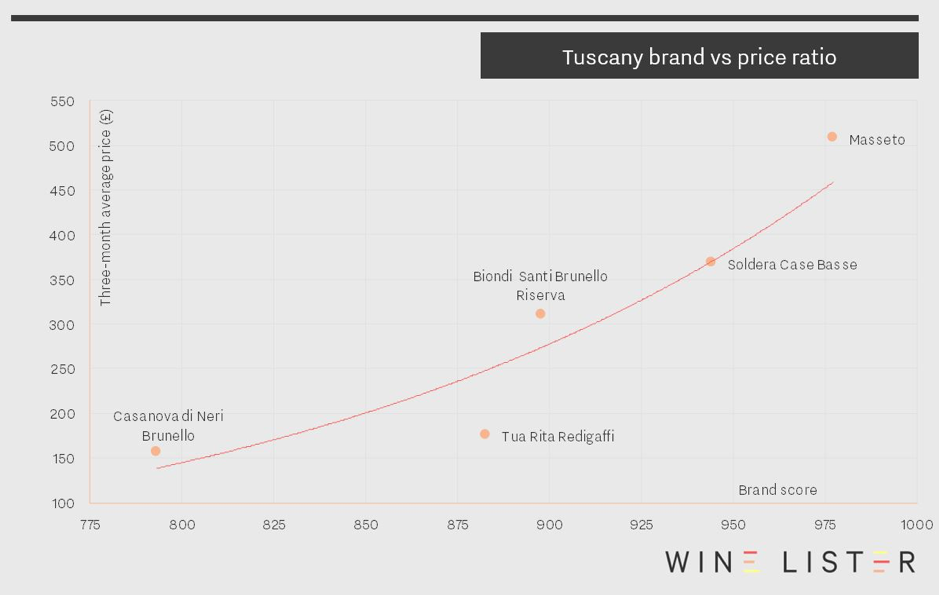

In this week’s top five, we take a break from June’s Bordeaux bias on the vinous calendar to look at the rising prices of Tuscany’s top wines.

However, there’s no escaping Bordeaux with Tuscany’s most expensive wine, since Masseto is distributed through the Place de Bordeaux. With tiny quantities available to purchase via the Place each year – average annual production is 32,000 bottles – Masseto’s price of £511 per bottle makes it well over a third more expensive than the rest of this weeks’ top five, and also the second-most expensive Italian wine on Wine Lister (beaten only by Giacomo Conterno’s Barolo Monfortino Riserva).

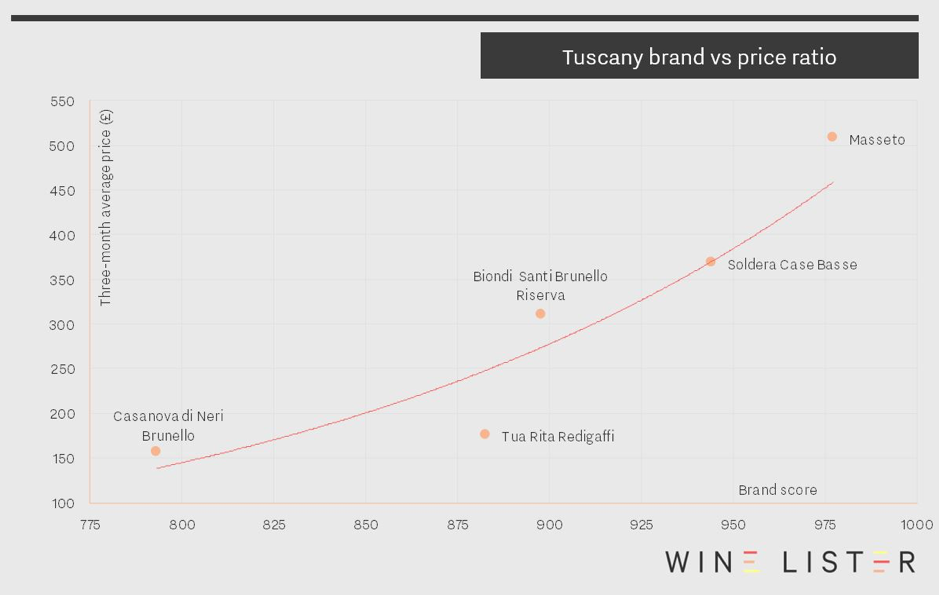

Masseto also achieves the group’s best Brand score (977), the result of featuring in the highest number of the world’s top restaurants (24%) and being over 2.5 times more popular than any of the other four. The chart below confirms a strong relationship between Brand score and price for these wines, with Masseto’s formidable brand strength playing a key role in its high price.

At £367 per bottle, Soldera Case Basse Sangiovese takes the second spot. It achieves the highest Quality and Economics scores of the five (976 and 957 respectively). With an impressive three-year compound annual growth rate (CAGR) of 18.4% – by far the highest of the group – and having added 7.3% to its value over the past six months, Soldera Case Basse continues to cement its position as Tuscany’s second-most expensive wine, and close the gap on Masseto.

Two Brunellos feature amongst Tuscany’s most expensive wines: Biondi Santi’s Brunello Riserva (£289) and Casanova di Neri’s Brunello Cerretalto (£157). Whilst Biondi Santi Brunello Riserva’s appearance might be expected, considering its heritage, the fact that Casanova di Neri Cerretalto is amongst Tuscany’s most expensive wines might be more of a surprise, indicating that Riserva status alone does not currently guarantee higher prices than straight Brunellos.

Rounding out the five is Tuscany’s fourth-most expensive wine and the group’s second 100% merlot – Tua Rita’s Redigaffi. At an average price of £180 per bottle, it is over 2.5 times cheaper than its varietal companion in the group, Masseto.

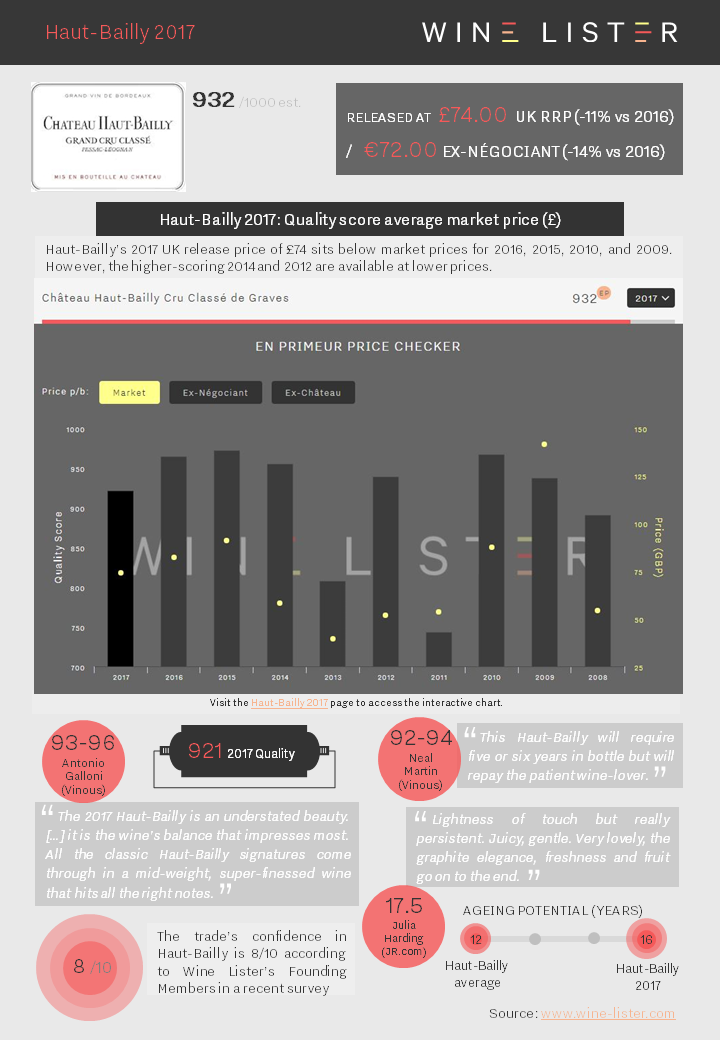

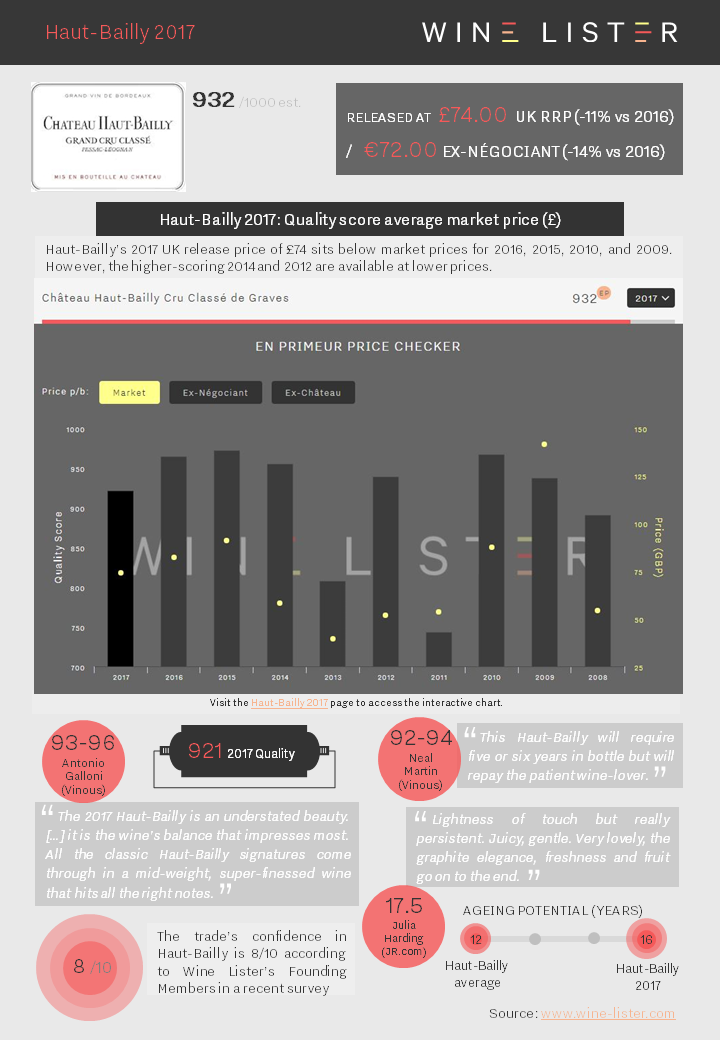

Haut-Bailly 2017 released at €72 ex-négociant (14% down on 2016), with a UK release price of £74 (11% down on 2016), and a lower Quality score: 921 (vs 964).

You can download the slide here: Wine Lister Factsheet Haut-Bailly 2017

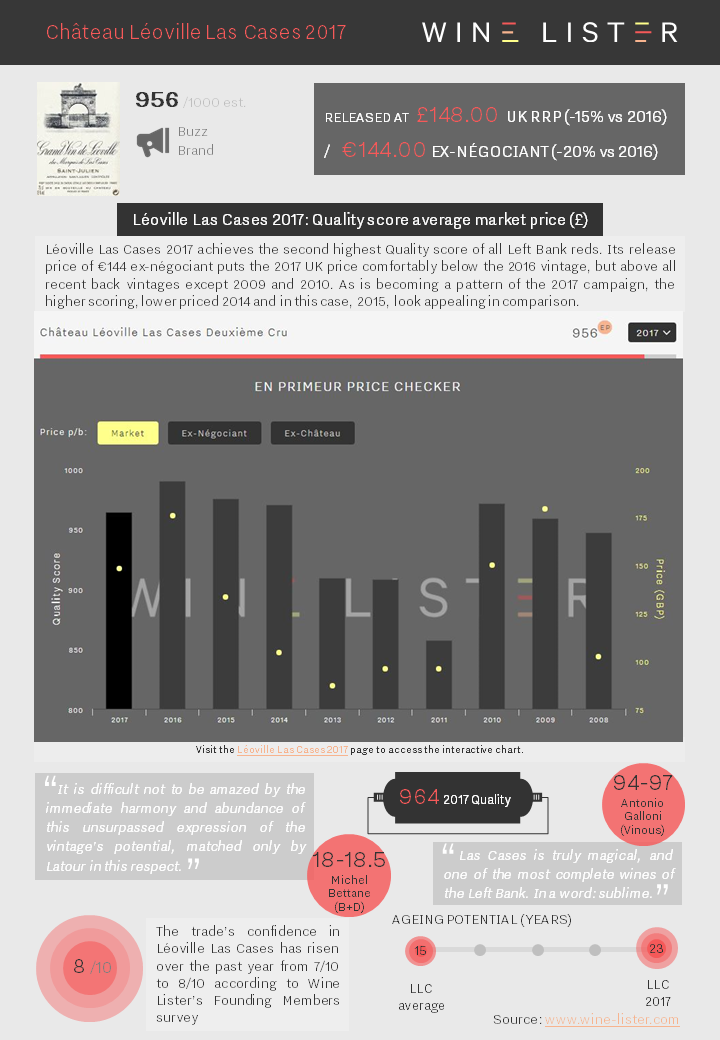

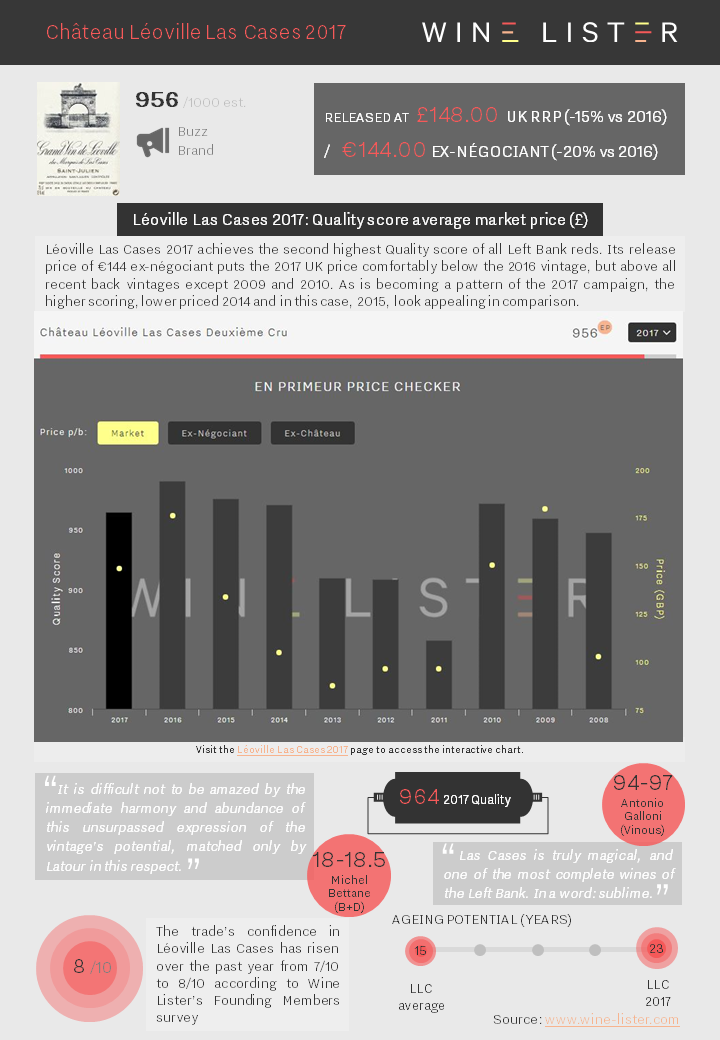

Léoville Las Cases 2017 released at €144 ex-négociant (20% down on 2016), with a UK release price of £148 (15% down on 2016), and a lower Quality score: 964 (vs 990).

You can download the slide here: Wine Lister Factsheet Léoville Las Cases 2017

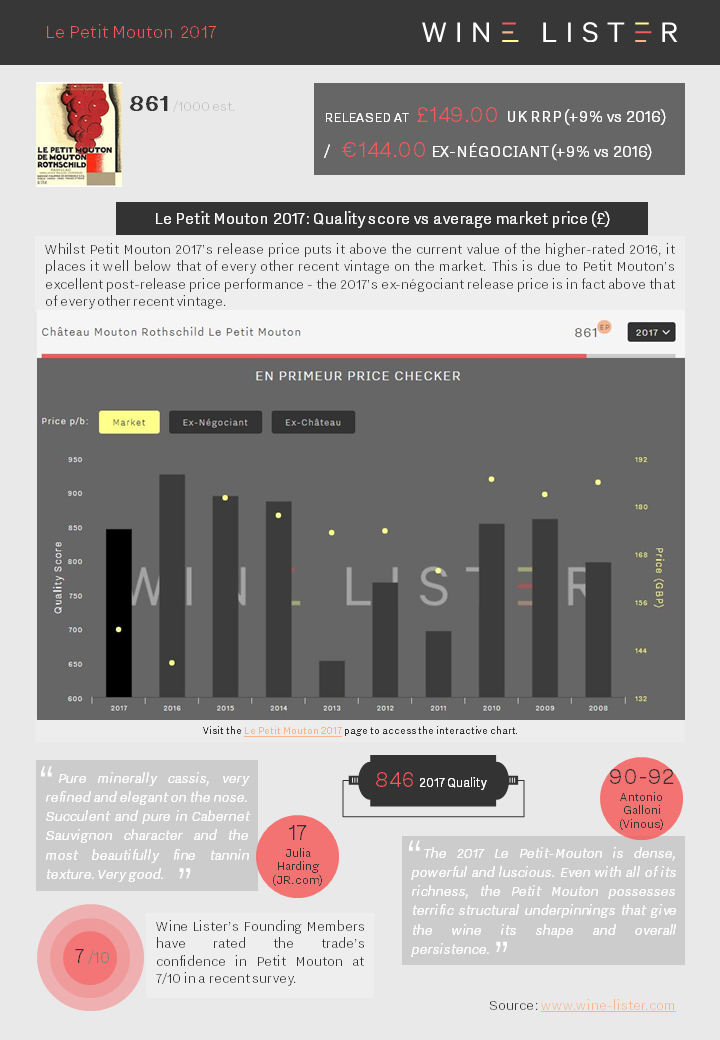

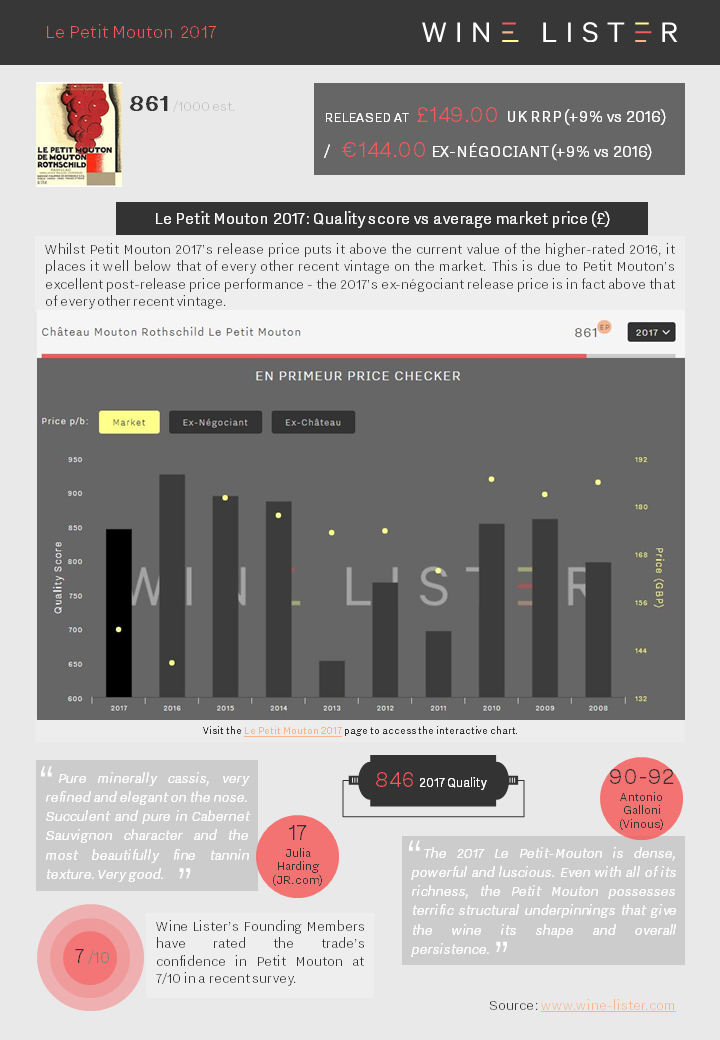

Le Petit Mouton 2017 released at €144 ex-négociant (9% up on 2016), with a UK release price of £149 (also 9% up on 2016), and a lower Quality score: 846 (vs 926).

You can download the slide here: Wine Lister Factsheet Le Petit Mouton 2017

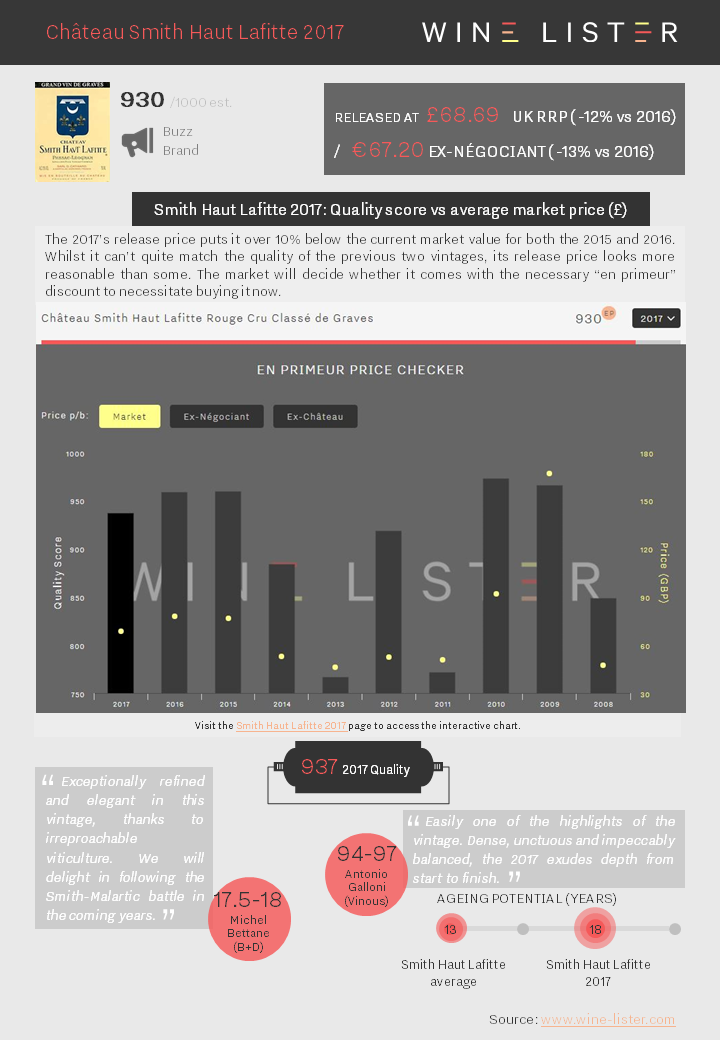

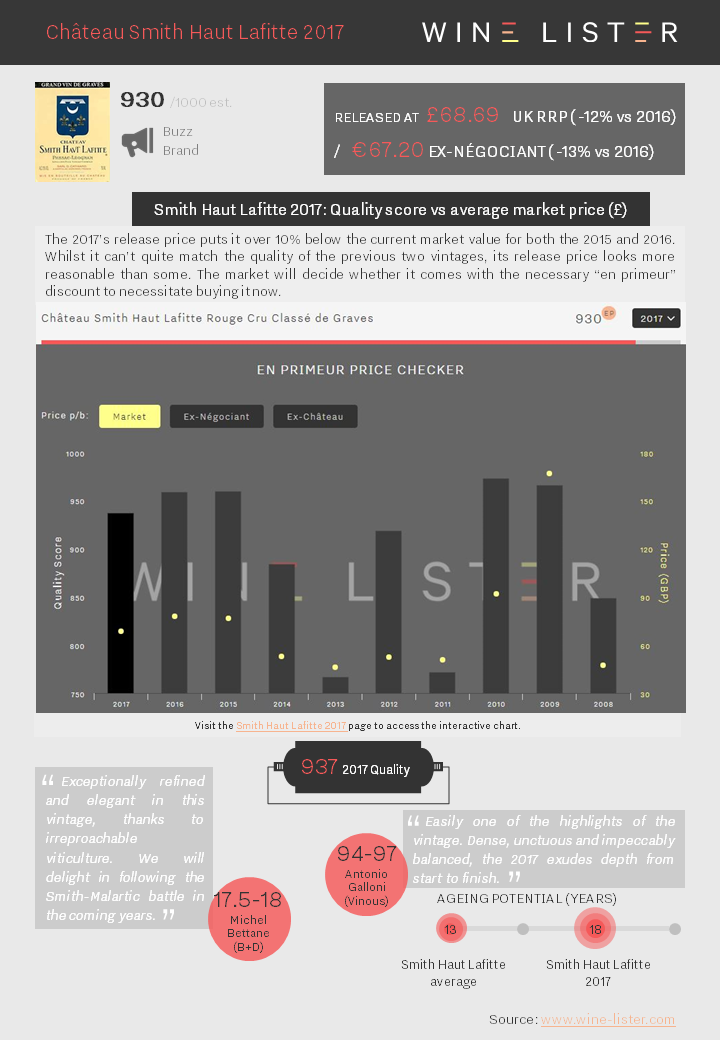

Smith Haut Lafitte Rouge 2017 released at €67.20 ex-négociant (13% down on 2016), with a UK release price of £68.69 (12% down on 2016), and a lower Quality score: 937 (vs 959).

You can download the slide here: Wine Lister Factsheet Smith-Haut-Lafitte Rouge 2017

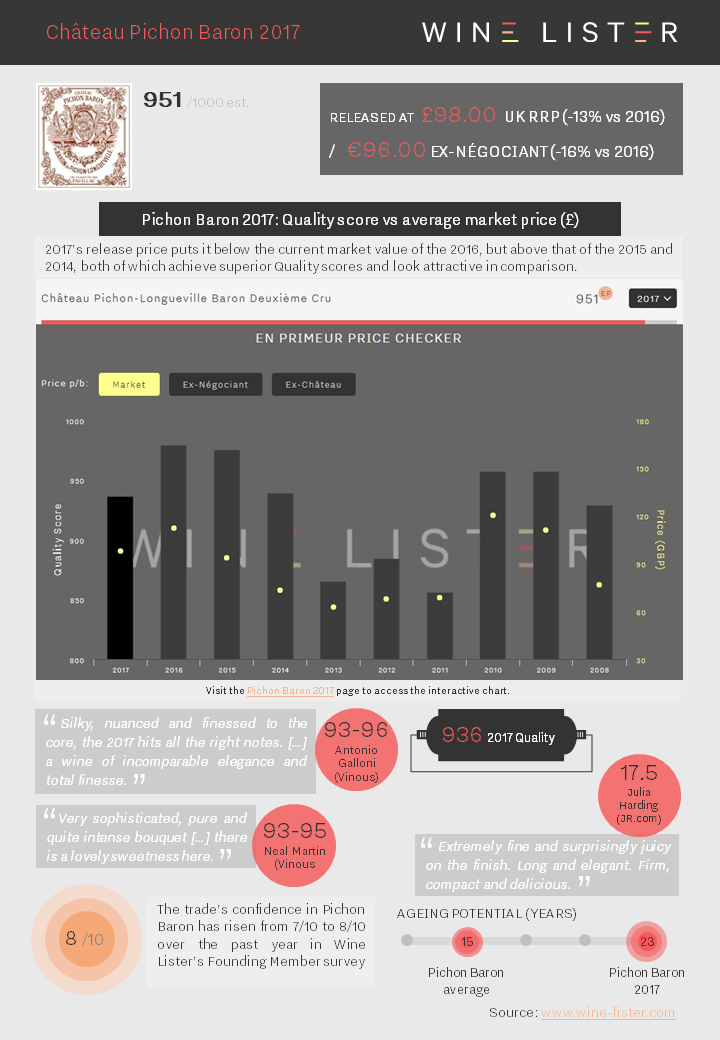

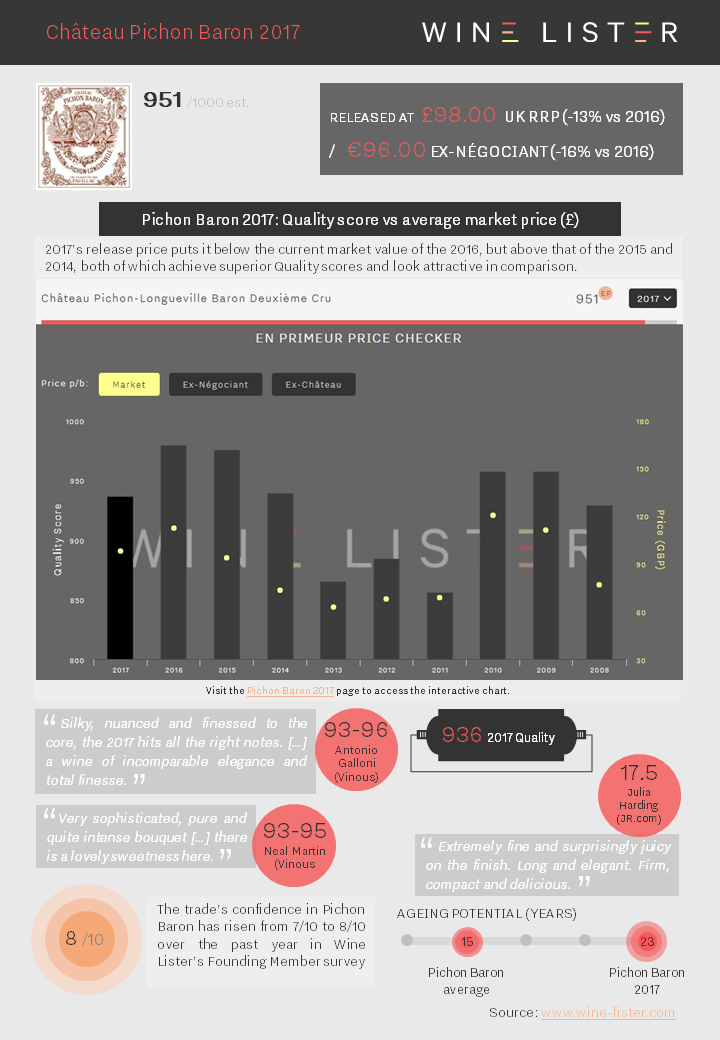

Pichon Baron 2017 released at €96 ex-négociant (16% down on 2016), with a UK release price of £98 (13% down on 2016), and a lower Quality score: 936 (vs 979).

You can download the slide here: Wine Lister Factsheet Pichon Baron 2017

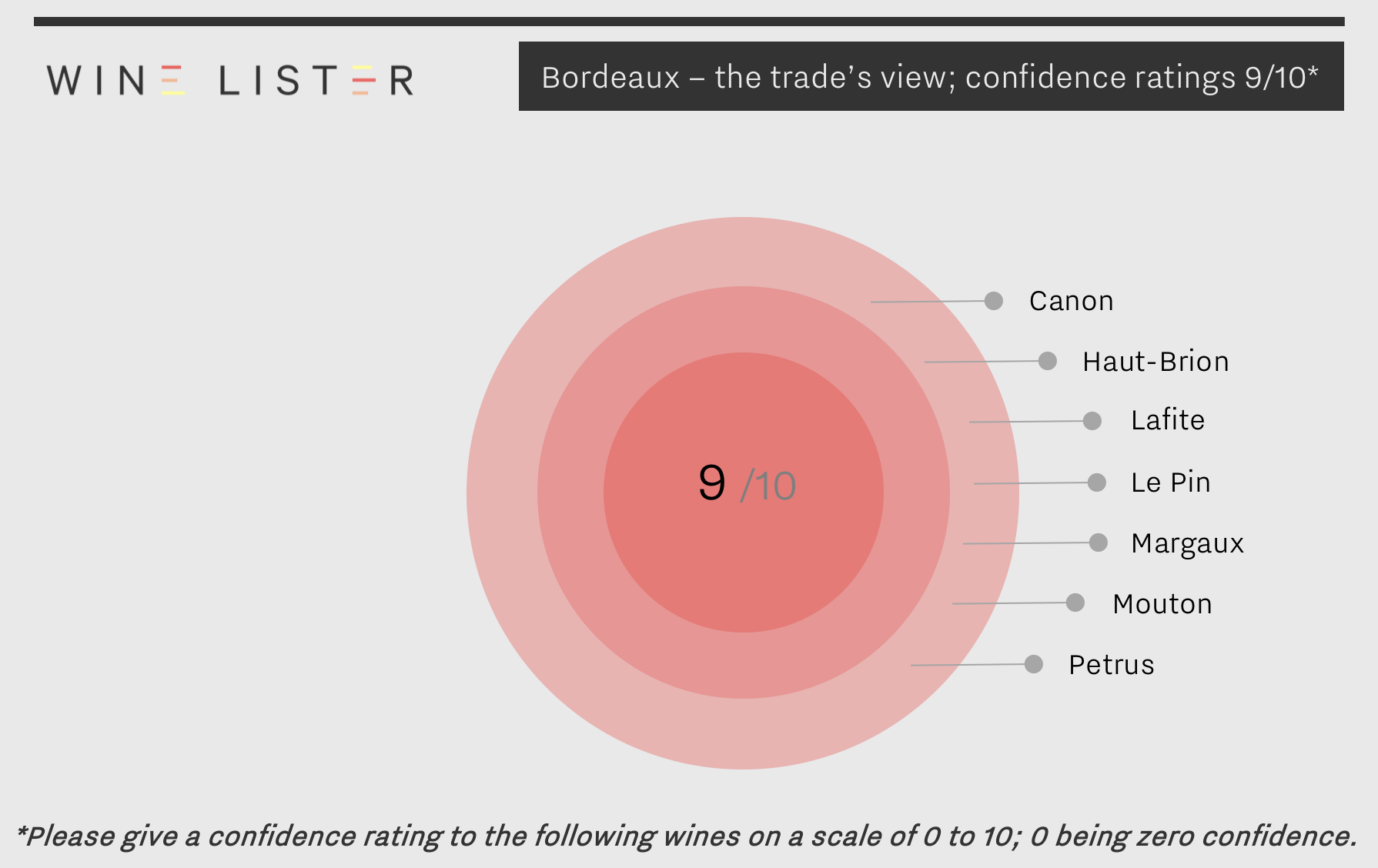

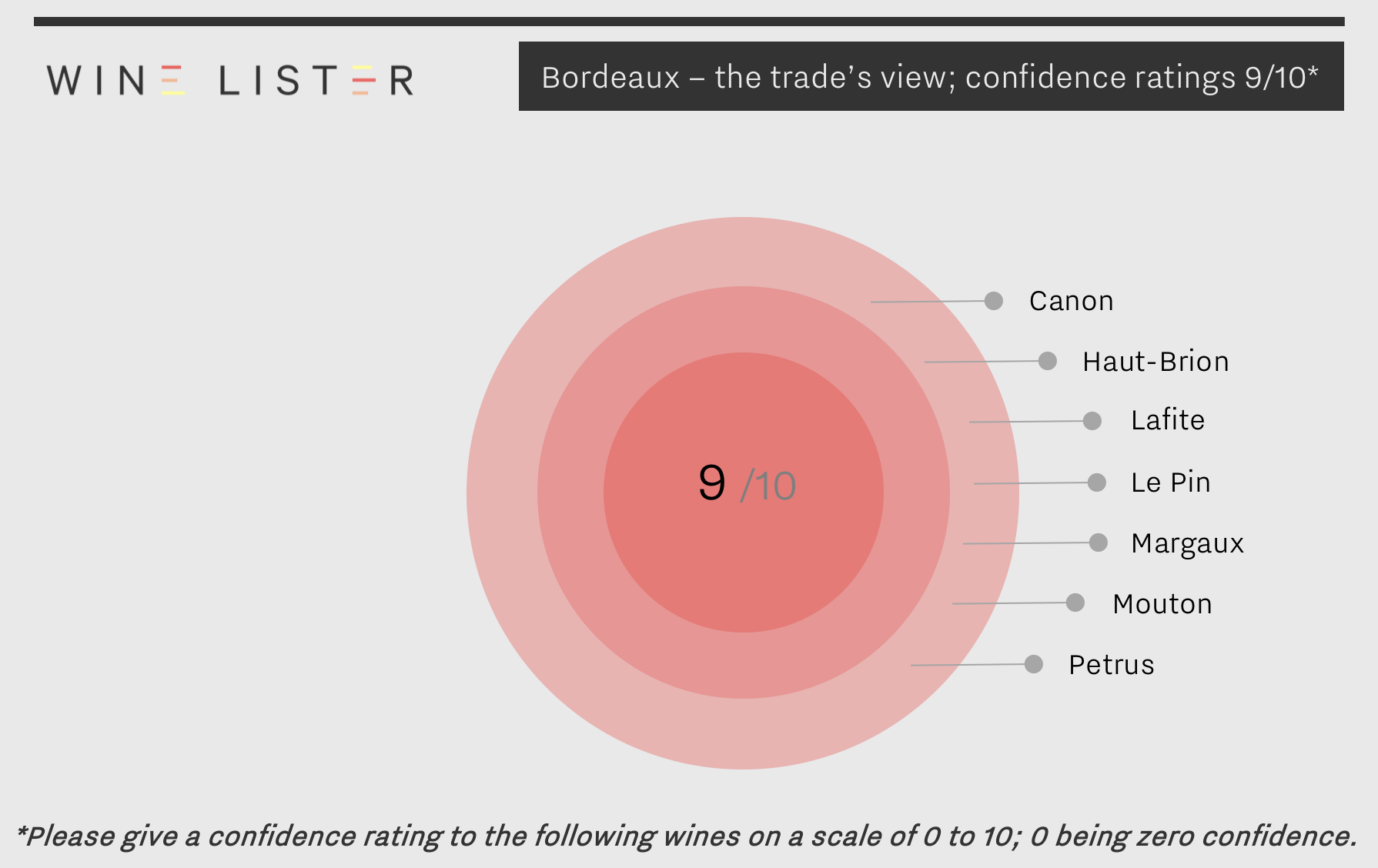

As part of our recently-released Bordeaux study, Wine Lister asked its Founding Members (c.50 key members of the global fine wine trade) to give “confidence” ratings to more than 100 key Bordeaux wines on a scale of 0 to 10; 0 being zero confidence.

For the second year in a row, no wine received a perfect 10/10, unlike Burgundy, whose Domaine de la Romanée-Conti and Rousseau – as rated across all of their respective cuvées – achieved the perfect score in a survey carried out in Autumn 2017.

Seven wines received a confidence rating of 9/10 from the trade; Canon, Haut-Brion, Lafite, Le Pin, Margaux, Mouton & Petrus. These same seven were awarded 9/10 in last year’s founding members’ survey. Vieux Château Certan is the only château to have dropped down a spot to 8/10.

Canon’s place here is distinctive not just as the only Saint-Émilion to feature, but also as a wine with market prices around £74 per bottle, sitting amongst a group whose average price per bottle is £950. A Wine Lister Buzz Brand, Canon is one of the most talked about wines by the trade.

In carrying out the survey, we did not dictate what factors should influence the respondents’ confidence in the prospects of a wine. Given that they are members of the trade, their considerations are likely to be commercially-driven, taking into account everything from improvements in quality and investment in marketing to new management teams. Canon was deemed a success by trade members for both “ratings and quality improvement”, and its “sales and management team”.

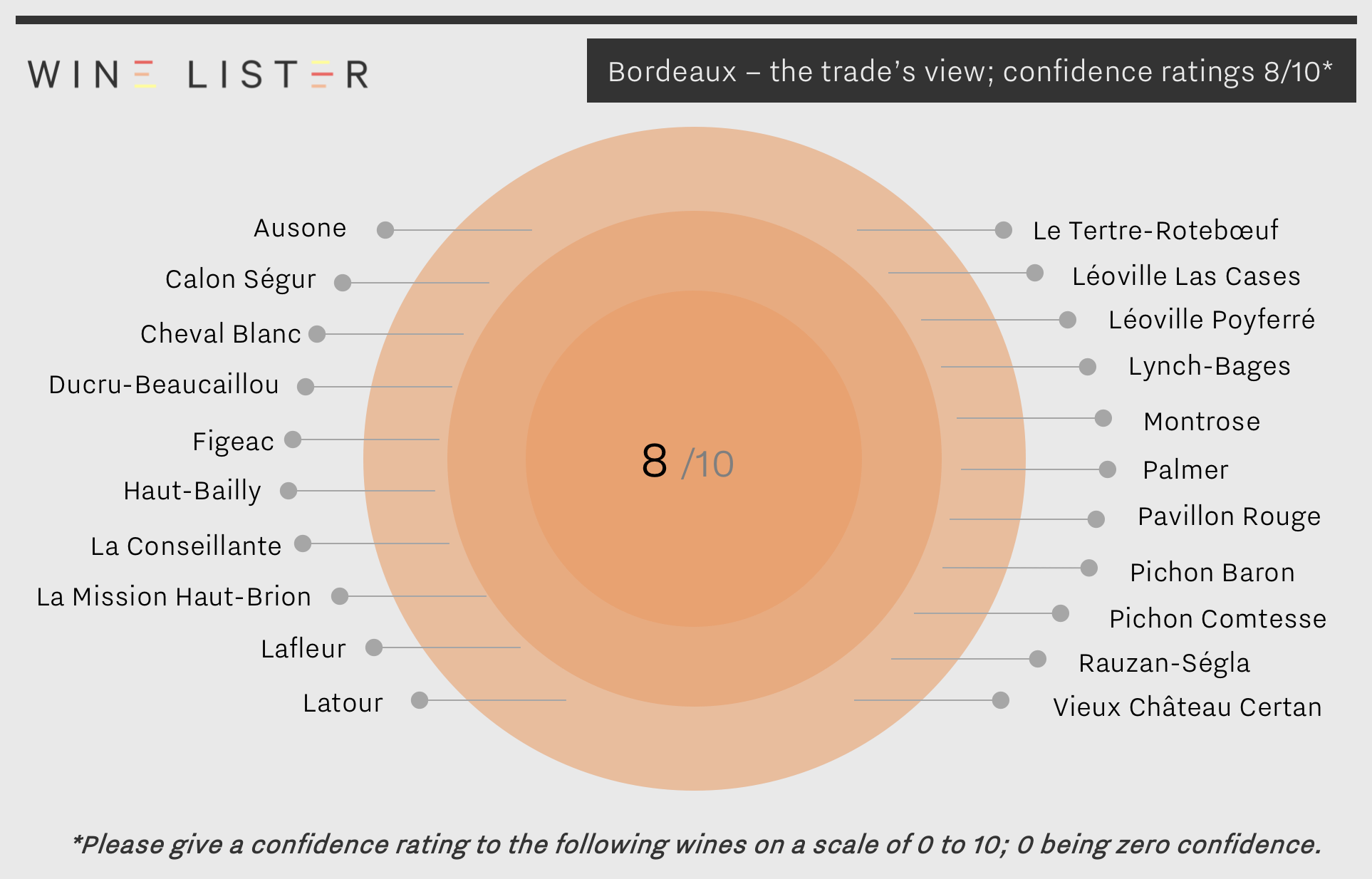

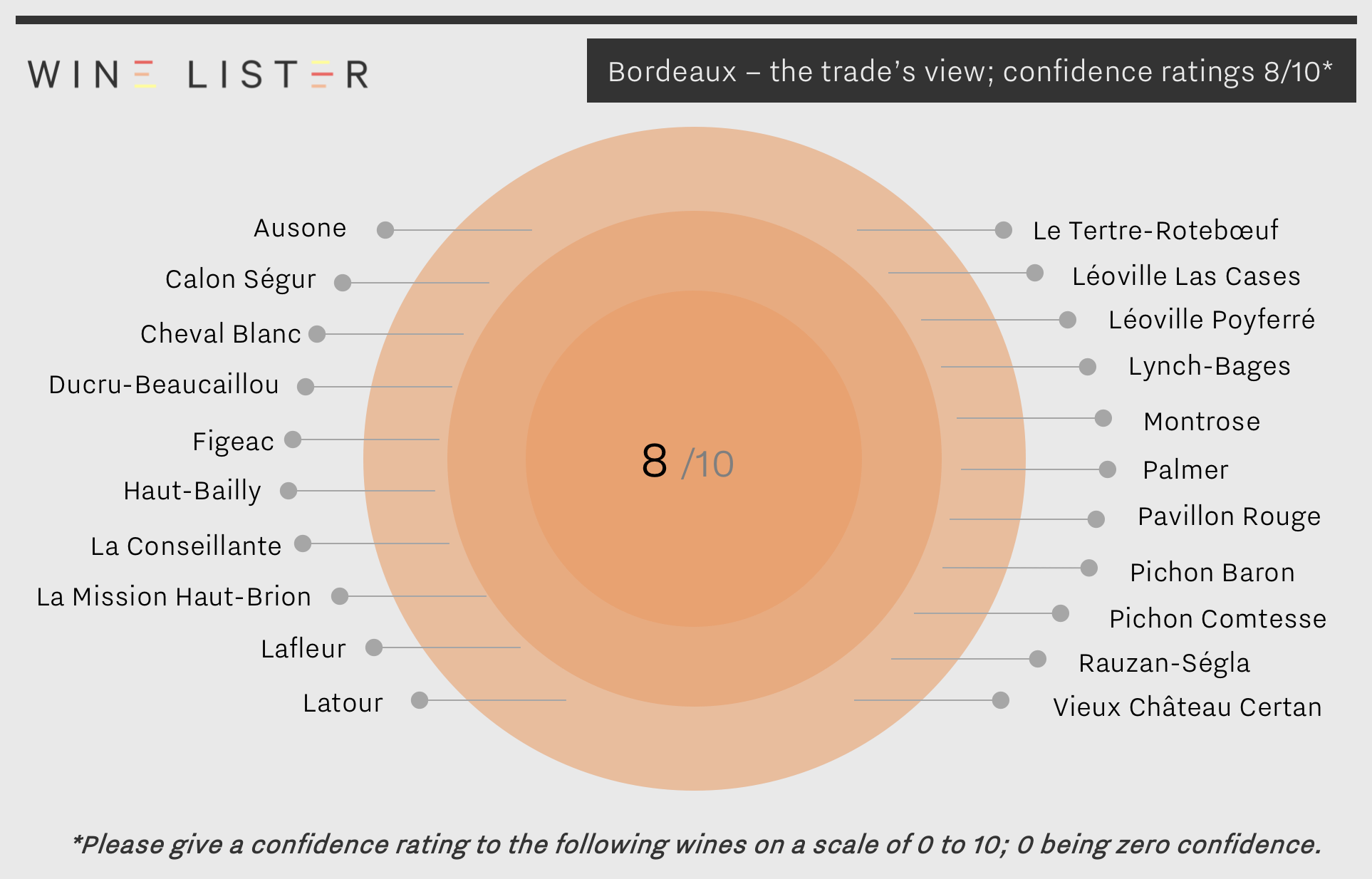

Latour is the only first growth not to feature in the highest-rated group. It was given a confidence rating of 8/10, alongside 20 other wines shown below. Three of these, Pichon Comtesse, Calon Ségur and Rauzan-Ségla (alongside its abovementioned sibling from owners Chanel, Canon) also make the trade’s list of Rising Stars – wines that will see the largest gain in brand recognition in the next two years (more on Bordeaux’s Rising Stars to come next week).

Nine wines have dropped one point in 2018 to a confidence rating of 7/10, however these have been replaced in equal number by Cheval Blanc, Figeac, La Conseillante, Tertre-Rotebœuf, Léoville Las Cases, Pavillon Rouge, Montrose, Palmer, and Pichon Baron, all up one point from their ratings in 2017.

Other wines to receive a confidence rating of 8/10 from the international fine wine trade are Ausone, Ducru-Beaucaillou, Haut-Bailly, La Mission Haut-Brion, Lafleur, and Lynch-Bages.

Visit Wine Lister’s Analysis page to read the full report and see confidence ratings for other wines in the study (available in both English and French).

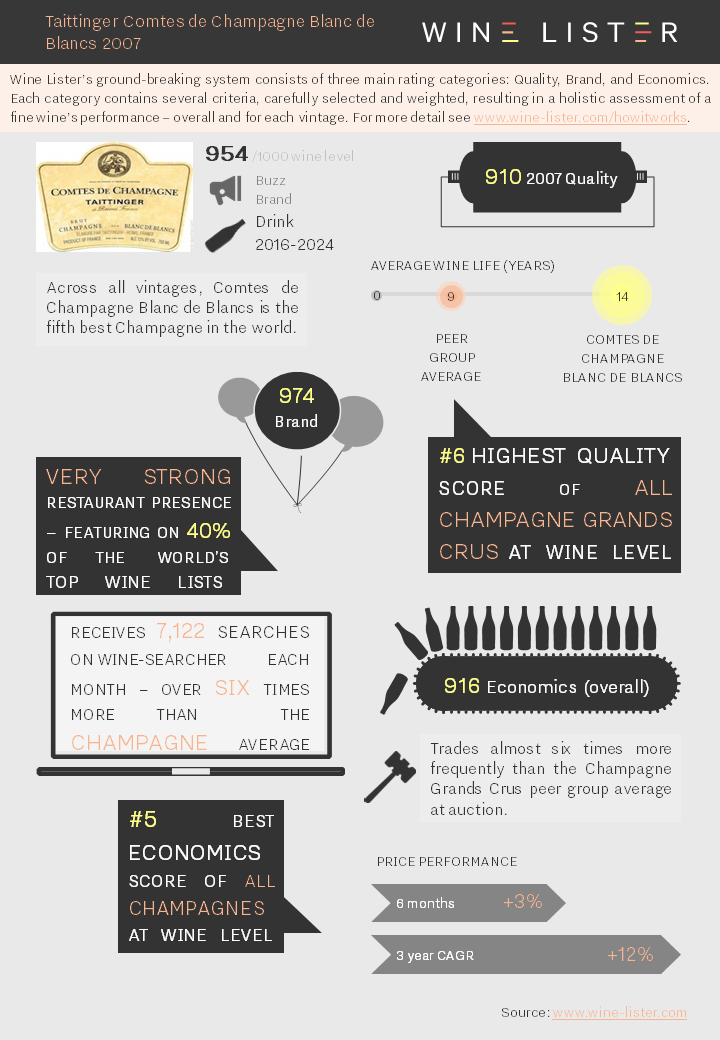

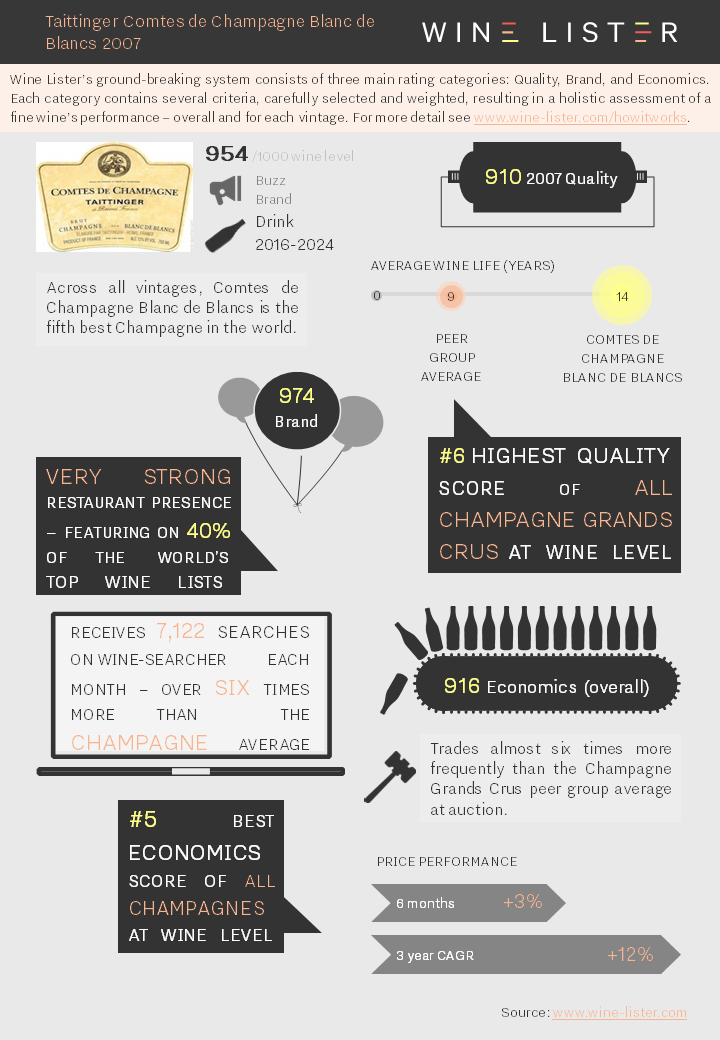

Taittinger Comtes de Champagne Blanc de Blancs has released its 2007 at £75 per bottle. Below we summarise all the key points:

You can download the slide here: Wine Lister Fact Sheet Taittinger Comtes de Champagne Blanc de Blancs 2007

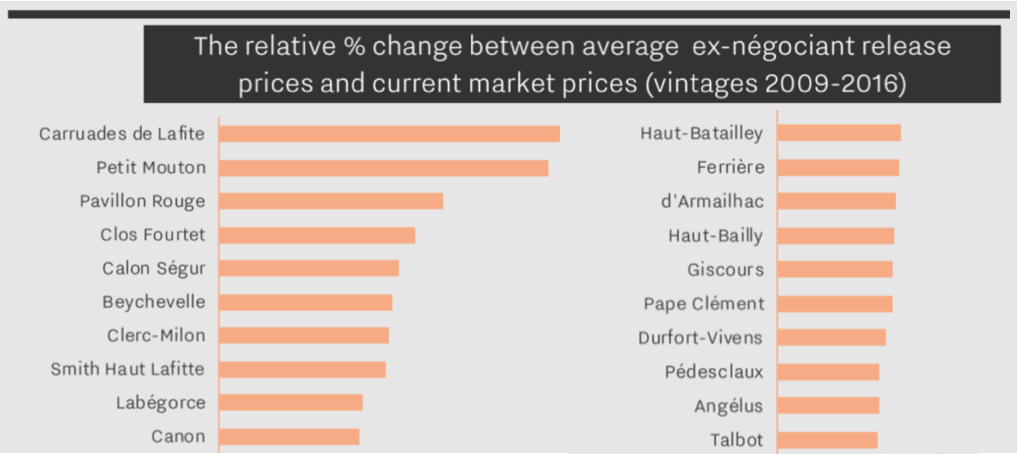

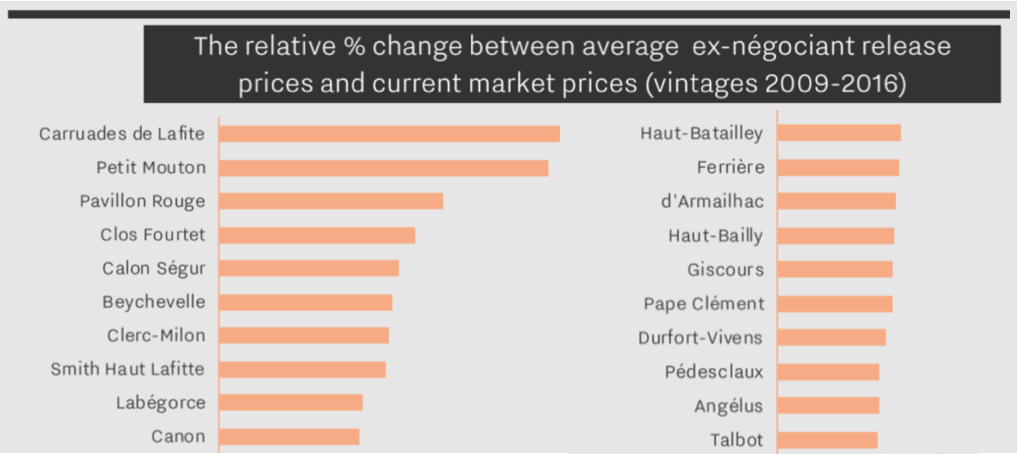

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.

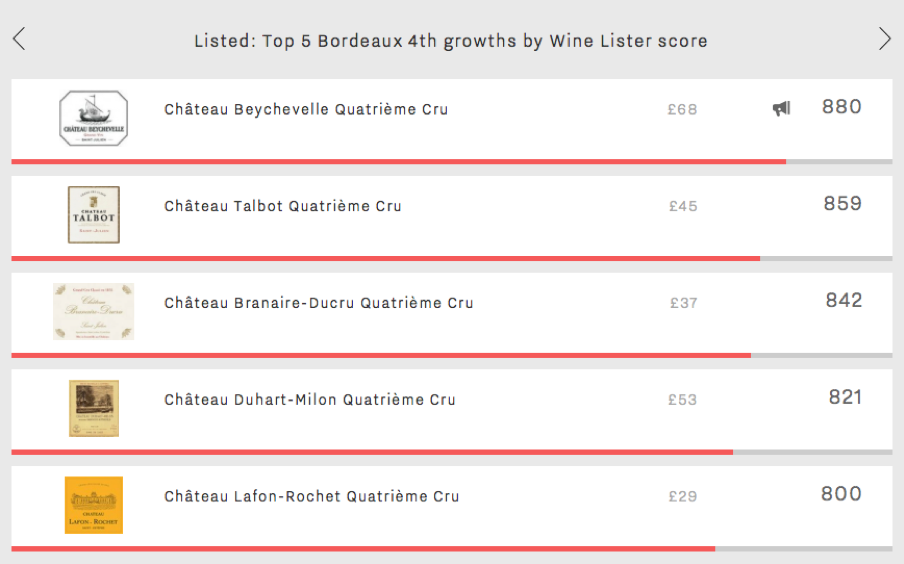

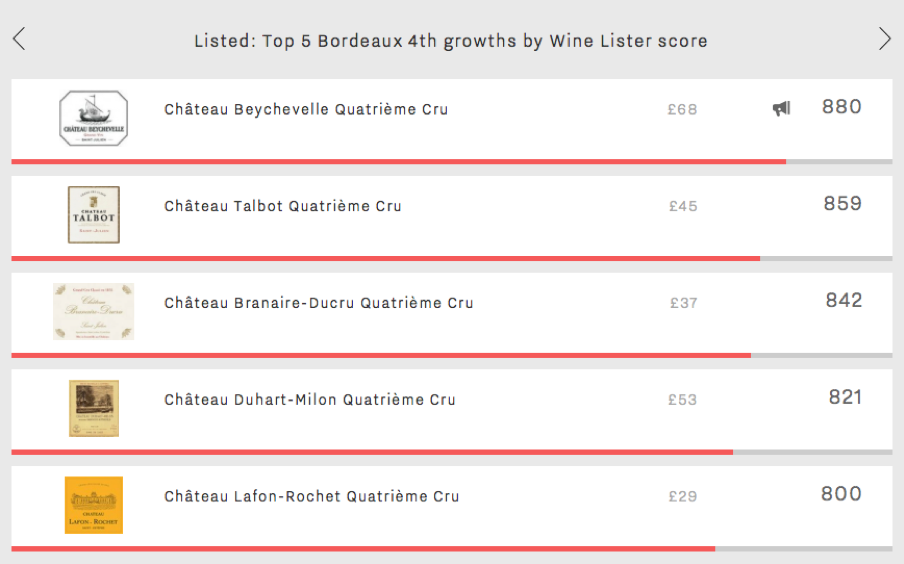

While the wine world lives and breathes Bordeaux during this year’s en primeur season, Wine Lister looks at some high-scoring Bordeaux reds that could easily be overlooked amidst the sea of releases to choose from across Médoc classified growths and beyond. Below we examine the top five fourth growths by overall Wine Lister score.

The highest-scoring Bordeaux fourth growth on Wine Lister is Château Beychevelle, with a score of 879. Its trailing Quality score of 790 is boosted by Brand and Economics scores of 980 and 904 respectively. Meanwhile, Beychevelle’s 2016 and 2015 vintages achieve Quality scores more than 15% higher than its wine-level average. It will be interesting to see how the 2017 vintage (with a Quality score of 805 thus far, based on partner critics Bettane+Desseauve, Neal Martin and Julia Harding MW for Jancis Robinson) is priced during this year’s en primeur campaign in the coming weeks.

In second and third place are Château Talbot and Château Branaire-Ducru, achieving Wine Lister scores of 859 and 842 respectively. Talbot is the most popular of the five, receiving 14,602 searches each month on Wine-Searcher, resulting in the group’s best Brand score (983). Talbot’s position as a ubiquitous Bordeaux brand is no doubt helped by a production level of c.400,000 bottles per annum – over twice as many as Branaire-Ducru.

The fourth entry and only Pauillac to feature, Duhart-Milon, has the lowest Quality score of the five (752), but carries a Brand score of 916 points. It is no surprise that, as part of the Lafite group, it is the most-traded Bordeaux fourth growth at auction, its top five vintages having traded 1,186 bottles over the past four quarters.

Finally, Lafon-Rochet appears in the Listed blog for the second week in a row (previously featuring in the top five Saint-Estèphes by Economics score). At 800 exactly, Lafon-Rochet’s Wine Lister score is safely in the “very strong” category on the 1,000-point scale. In the context of this week’s top five it has the third-highest Quality score (770), but its price per bottle is 41% below the rest – a savvy buy!