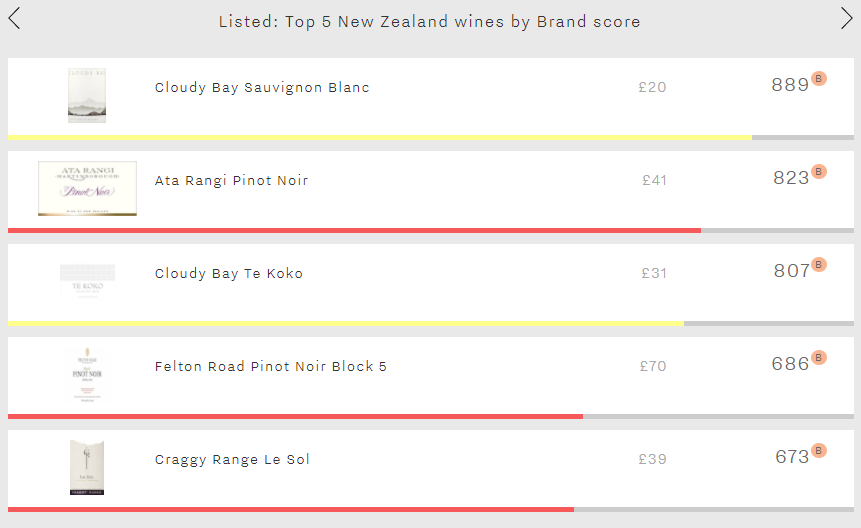

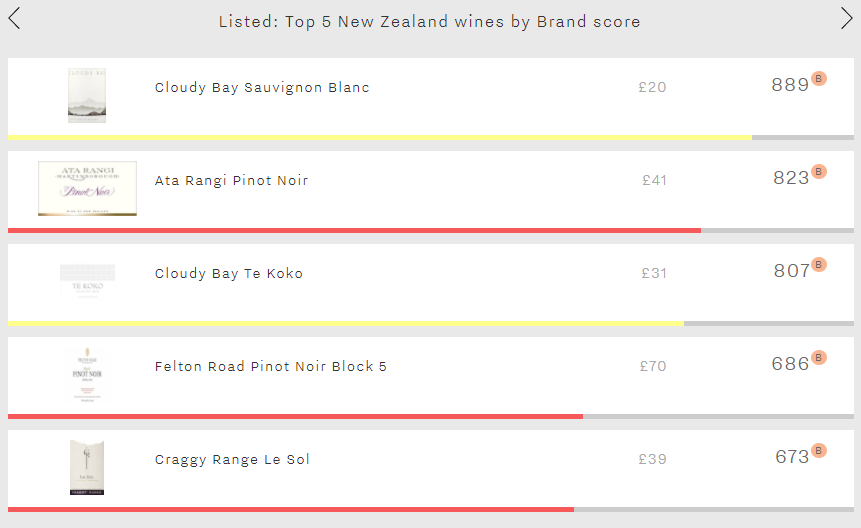

Mention New Zealand, and the first thing that springs to mind will most likely be rugby. The All Blacks are not just the world’s best team, but the foremost brand in rugby. In wine terms, they are the left bank first growths; the team that even people who don’t follow rugby will recognise. Whilst peerless with the oval ball, when it comes to vinous competition New Zealand can’t compete with its Old World counterparts in terms of brand strength. However, as this week’s top five shows, New Zealand’s top brands definitely shouldn’t be discounted.

Cloudy Bay fills two of the five spots with its straight Sauvignon Blanc and Te Koko Sauvignon Blanc. With a very strong score of 889 – putting it ahead of the likes of Haut-Brion Blanc – the straight Sauvignon Blanc dominates the rest of the five across both of Wine Lister’s brand criteria. It receives 56% more searches each month on Wine-Searcher than Ata Rangi Pinot Noir (the group’s second-most popular wine). Te Koko – New Zealand’s third-strongest brand (807) – displays a similar profile to the straight Sauvignon Blanc. Its brand is its strongest facet, comfortably outperforming its Quality and Economics scores (614 and 308 respectively).

Whilst Sauvignon Blanc is New Zealand’s foremost white grape, its most prestigious reds are Pinot Noirs, with Ata Rangi’s offering and Felton Road’s Block 5 both appearing in the top five. Ata Rangi is by far New Zealand’s strongest red brand (823). It is the country’s most visible red in the world’s top dining establishments (11%), and also the most popular with consumers, receiving three times as many searches each month as the Felton Road. Whilst it appears in just 7% of top restaurants, Felton Road Block 5 enjoys the group’s best vertical presence, with two vintages / formats offered on average per list. It is also the most expensive of the five. Incidentally, the two Pinot Noirs comfortably achieve the group’s best Quality scores and are the only two with scores above 800 in the category.

Proving that New Zealand isn’t all Sauvignon Blanc and Pinot Noir, Le Sol – Craggy Range’s Syrah – completes the five, with a Brand score of 673.

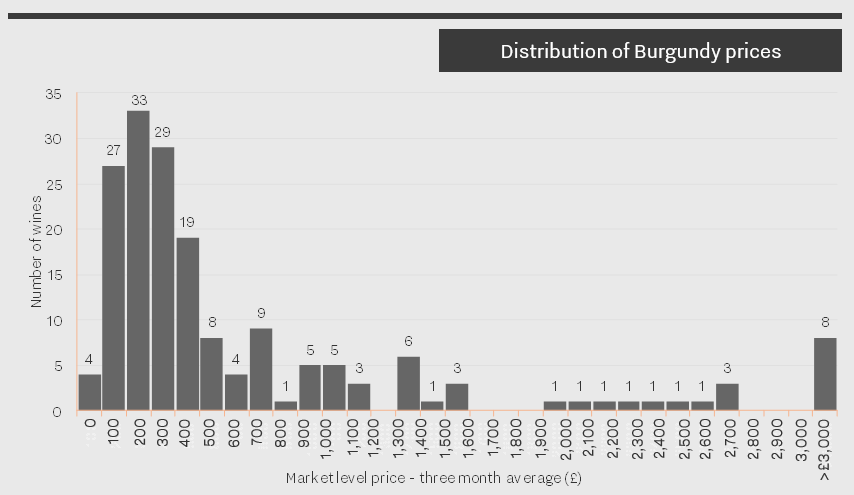

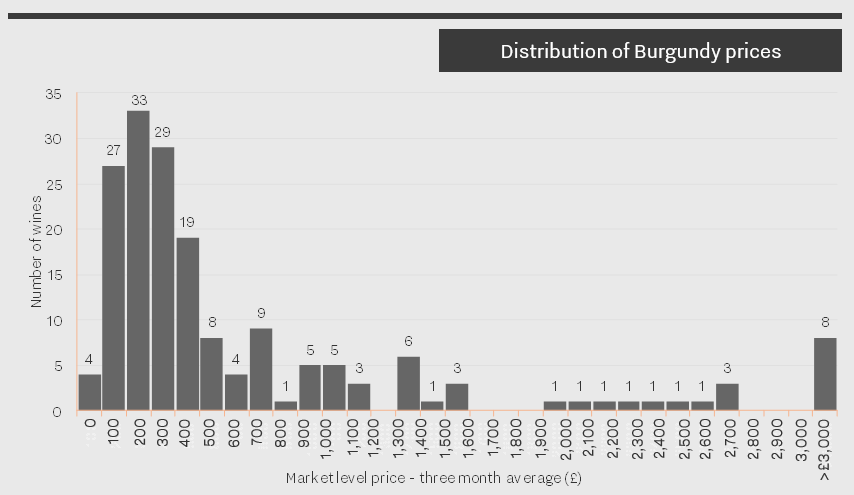

Today marks the close of a busy week of Burgundy 2016 en primeur tastings, with offer prices largely stable on 2015 despite tiny volumes, thanks to the more generous 2017 in the wings. However, prices have been escalating in the secondary market for several years now, with eight of the region’s top wines averaging more than £3,000 per bottle). Eyewatering, yes, but as illustrated in our recently published study, the majority of the region’s top wines are priced between £100 and £500.

To mark this week’s Burgundy en primeur tastings, the latest Listed section picks out the top five red Burgundies priced under £300 per bottle by Wine Lister score. With an outstanding average score of 913 – putting them amongst the very strongest on Wine Lister – and four of the five achieving Buzz Brand status, these wines are worth the price tag.

Leading the way is Grand Cru monopole Clos de Tart with a score of 947. Recently acquired by Artemis Domaines – Latour owner François Pinault’s holding company – it achieves the best Brand and Economics scores of the group (956 and 964 respectively), and is just pipped into second place in the Quality category by Trapet Père et Fils Chambertin Grand Cru (932 vs 940). Its price has increased 9% over the past six months, and now at £275, it looks like it won’t qualify for this group much longer!

Next comes Domaine des Lambrays Clos des Lambrays – part of LVMH’s portfolio since 2014 – with a score of 919. Alongside Marquis d’Angerville Volnay Premier Cru Clos des Ducs, this is the cheapest (or least expensive) of the group (c.£150 each). It enjoys its best score in the Brand category, with the group’s highest level of restaurant presence (25%), and the second-best average monthly online search frequency (5,079).

In third place is Rousseau’s Clos de la Roche Grand Cru with a score of 910. At almost £300 per bottle, it is the most expensive of the group, contributing to its boasting the best score in the Economics category (937). It is also partner critic Jeannie Cho Lee’s favourite wine of the group; she awards it a score of 95/100 on average.

Dropping just below the 900-point mark are Marquis d’Angerville Volnay Premier Cru Clos des Ducs and Trapet Père et Fils Chambertin Grand Cru (899 and 891 points respectively). They display very different profiles. The latter leads the Quality category, with the former lagging 60 points behind (still with a very strong score of 879). However,Trapet’s Chambertin struggles in other categories, with the group’s lowest scores for Brand and Economics (867 and 823). Meanwhile, thanks to the group’s strongest long and short-term growth rates, Marquis d’Angerville’s Volnay Clos des Ducs enjoys an excellent Economics score (939) – the second-best of the five.

If you’d like to discover more about Burgundy and its top wines, then click here if you are a subscriber to view the full regional study, or here to see a preview if you haven’t yet subscribed.

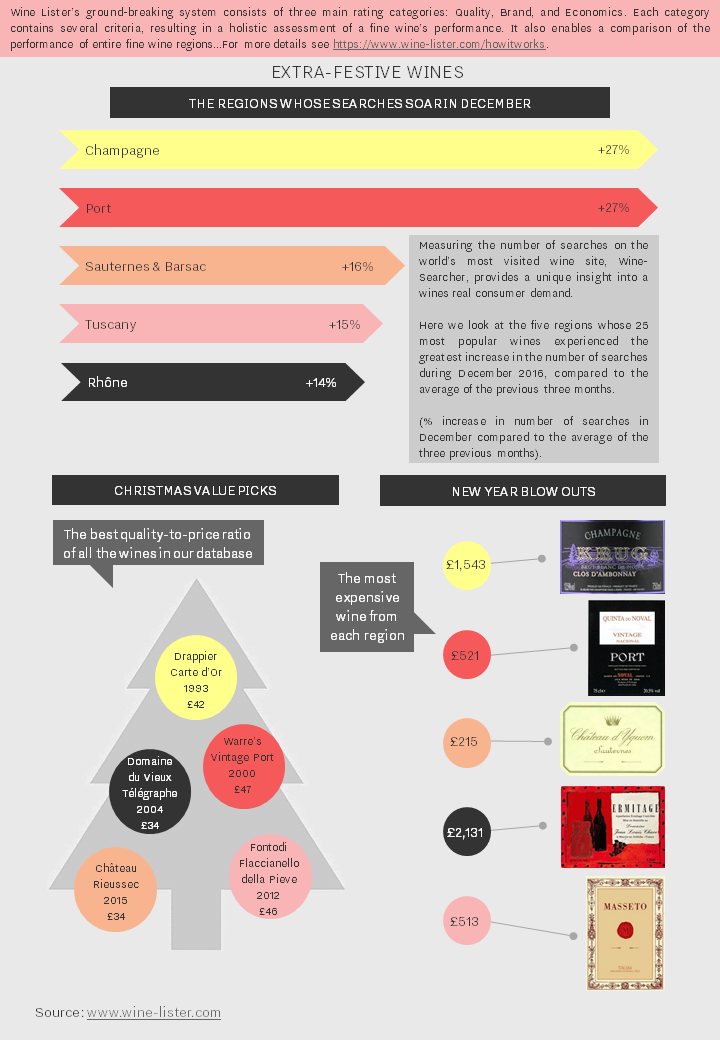

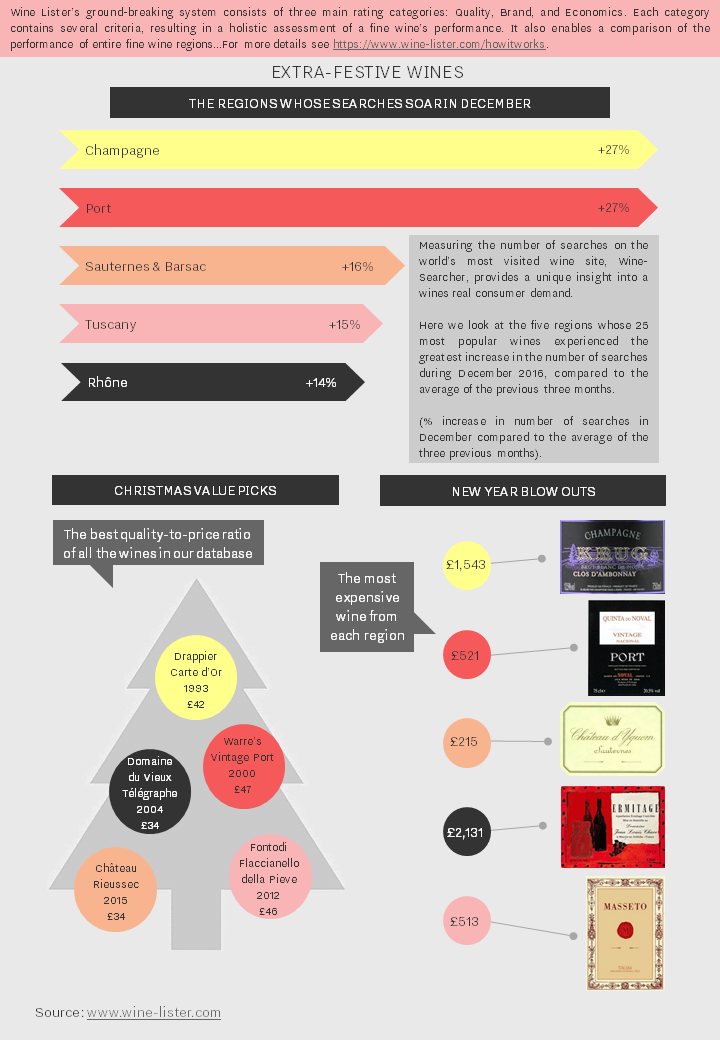

Christmas is a time of tradition. Whether we like it or not, we tend to spend each year doing, eating, and drinking the same as we did the year before. Whilst everybody’s idea of Christmas will be personal, usually based on childhood memories, there are clearly a shared set of rituals that most of tend to follow: mince pies, turkey or goose, crackers, Christmas pudding. There are also certain styles of wine that we associate with Christmas (though these associations are probably not based on childhood memories!). We decided to look a bit further into the online popularity of specific regions and styles of wine to determine whether in fact we do all drink the same things over the festive season.

Comparing the search frequency of each region’s 25 most popular wines on Wine-Searcher during December 2016 compared to the average of the previous three months, the results are conclusive. Champagne and Port both enjoyed a dramatic surge in popularity – receiving over a quarter more searches during December. Whilst Port’s dramatic increase in online search frequency was presumably because it is the classic accompaniment to another festive favourite – Stilton – Champagne’s seasonal rise in popularity must be because it is not just the tipple of choice at Christmas parties, but also at New Year’s celebrations.

It seems that we also tend to favour the sweet whites of Sauternes and Barsac over Christmas, their 25 most popular wines enjoying a 16% increase in online search frequency. When it comes to dry reds, we appear to gravitate towards hearty styles at this time of year, with Tuscany and the Rhône also experiencing noticeable boosts in online popularity (up 15% and 14% respectively).

If you haven’t yet stocked up on those perennial favourites, Wine Lister’s Value Pick search tool can help you effortlessly find top Quality at a reasonable price. Each of our Christmas Value Picks achieves an outstanding Quality score of at least 965, putting them amongst the very best on Wine Lister. With the most expensive – Warre’s Vintage Port 2000 – available for as little as £47, they represent remarkable value.

If you are after a really special bottle for New Year’s, then we also show the most expensive wine from each region. Each of these wines qualify as Wine Lister Buzz Brands, and is sure to help start 2018 with a bang.

Download a PDF version here.

First published in French in En Magnum.

Wines featured: Drappier Carte d’Or 1993; Domaine du Vieux Télégraphe Châteauneuf-du-Pape 2004; Rieussec 2015; Fontodi Flaccianello della Pieve 2012; Krug Clos d’Ambonnay; Quinta do Noval Porto Nacional Vintage Port; Château d’Yquem; Jean-Louis Chave Hermitage Cuvée Cathelin; Masseto

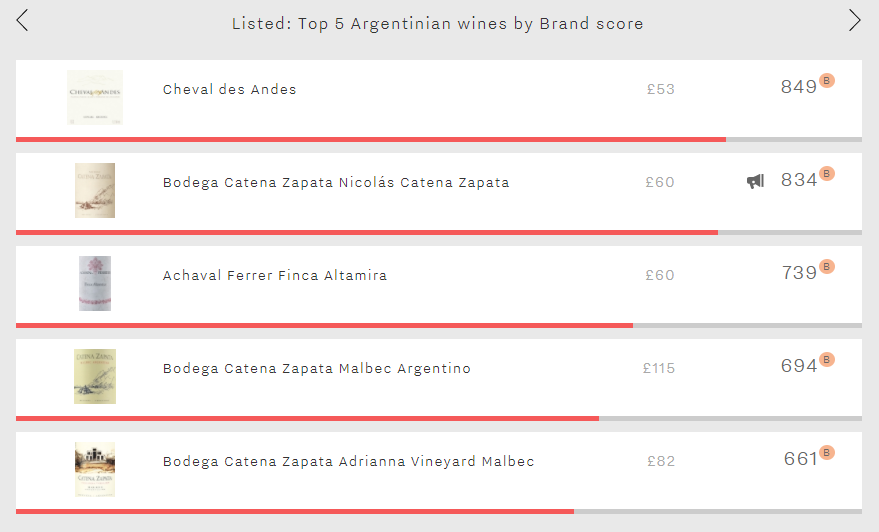

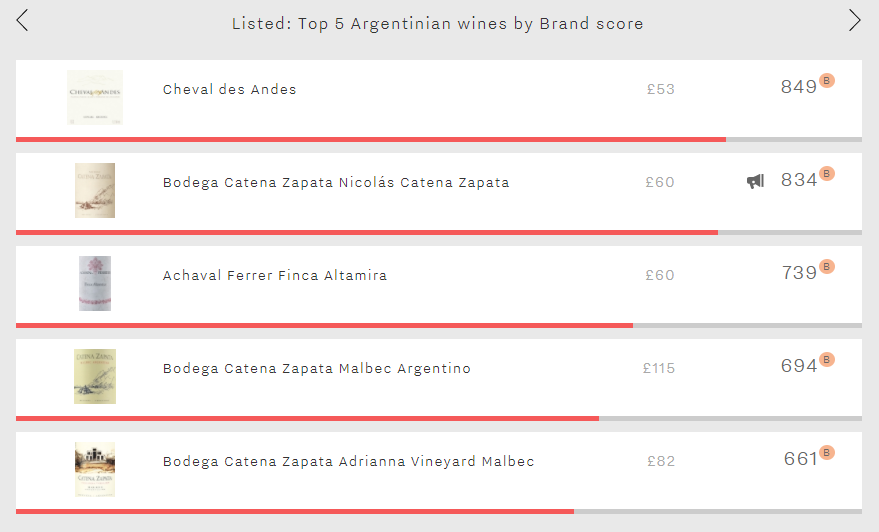

This week’s Listed section ventures out from the Old World to look at Argentina’s top five brands. Wine Lister’s Brand score measures a wine’s performance across two criteria – restaurant presence and online popularity. The five Argentine wines, from three producers, all achieve scores that are either strong or very strong on Wine Lister’s scale, indicating that South America’s strongest brands are now established on the global fine wine market.

With a Brand score of 849, Argentina’s leading icon is Cheval des Andes. A joint venture between Saint-Emilion heavyweight Cheval Blanc and Terrazas de los Andes, it leads the way when it comes to restaurant presence, featuring on 14% of the world’s top wine lists – its closest rival in that criterion, Bodega Catena Zapata Nicolás Catena Zapata appears on 9% of the same lists.

Nicolás Catena Zapata (834) turns the tables in terms of online popularity. The only Buzz Brand of the group, it receives on average 2,349 searches each month on Wine-Searcher, 27% more than Cheval des Andes (1,853). It also achieves the greatest vertical restaurant presence of the group, with 2.7 listings on average per list.

Nearly 100 points behind is third-placed Achaval Ferrer Finca Altamira with a score of 739. Appearing in 7% of restaurants and receiving 999 searches each month, it achieves its best score in the Brand category, comfortably outperforming its Quality score (581) and Economics score (183).

The last two spots are filled by two more wines from Bodega Catena Zapata – Malbec Argentino in fourth place (694) and Adrianna Vineyard Malbec in fifth place (661). Both receive a similar number of searches each month (744 and 793 respectively), and are visible in 6% and 4% of restaurants respectively.

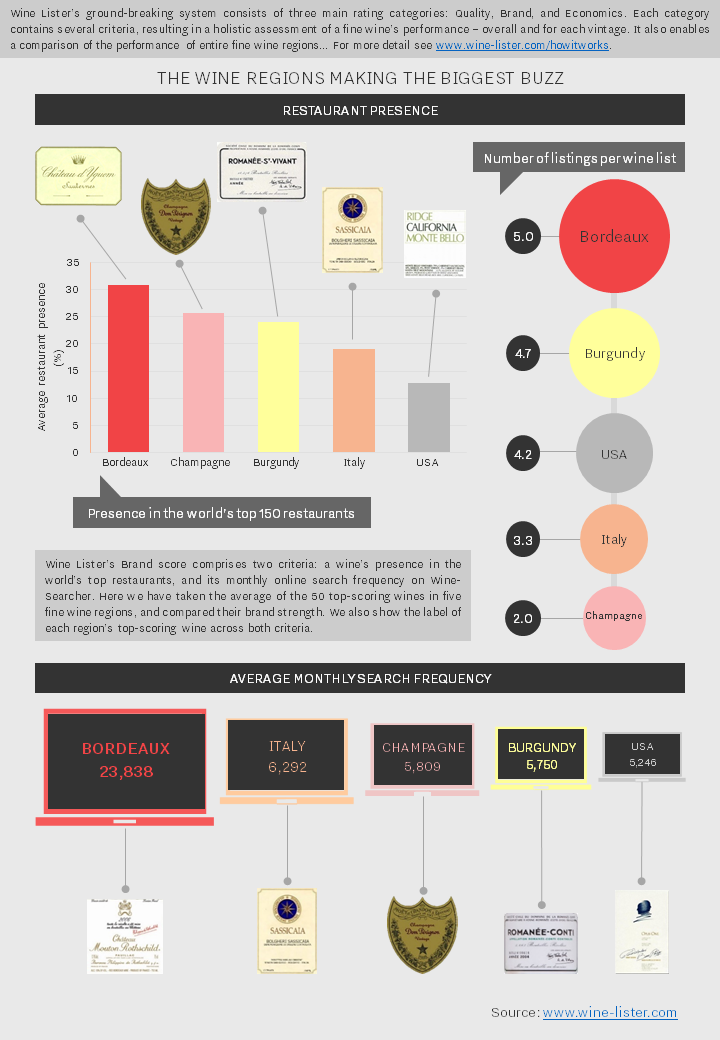

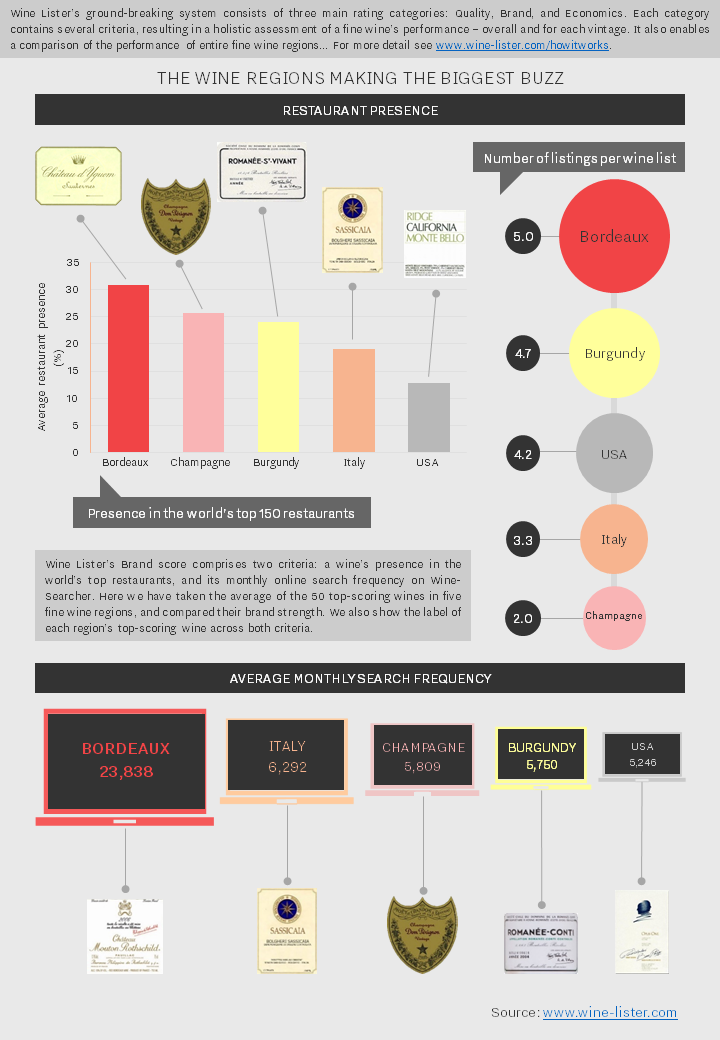

Wine Lister’s Brand category measures a wine’s performance across two criteria: popularity and distribution. In conjunction with its Quality and Economic performance, this allows a holistic assessment of a fine wine. It also enables a comparison of the performance of entire fine wine regions. Below we look at the average scores over both Brand criteria of the top 50 wines in Bordeaux, Burgundy, California, Italy, and the USA.

Bordeaux dominates, with powerhouses Yquem and Mouton demonstrating the success of its classification system and the centuries-old global repute of its top crus. Its best wines are by far the most popular with consumers – searched for nearly four times more frequently on average than second-placed Italy. They are also the best distributed in the world’s most prestigious restaurants, present in 31% on average, and with 5 references per list.

Whilst Champagne comes second in terms of breadth of presence in restaurants, its top wines don’t achieve much depth in terms of vintages or formats listed – presumably because many of them are non-vintage.

Burgundy competes well in terms of restaurant presence, with the likes of Domaine de la Romanée-Conti Romanée-Saint-Vivant Grand Cru enjoying a strong showing in top restaurants. Meanwhile the region is fourth most popular in terms of searches each month on Wine-Searcher.

Italy is unique in that Sassicaia is both its most popular wine and also its best distributed. However, whilst its top wines are the second most popular overall, they also experience the second lowest level of distribution.

Finally, the USA’s best wines achieve a strong level of vertical restaurant presence, but come last in terms of both horizontal presence and popularity, suggesting the New World still has a way to go in terms of brand strength.

Download a PDF version here.

First published in French in En Magnum.

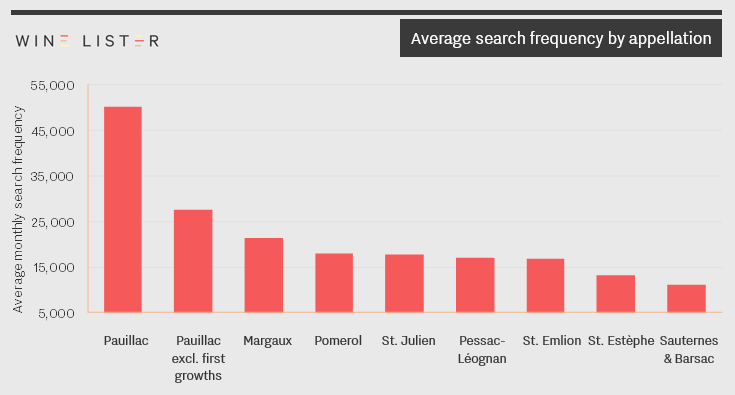

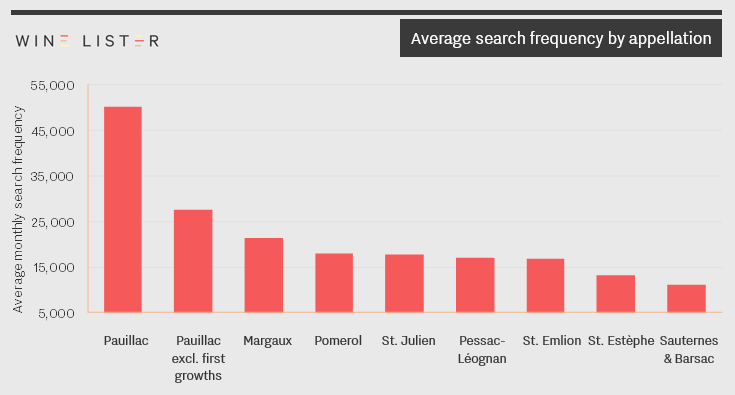

Earlier this month Wine Lister published its annual Bordeaux Market Study, and in recent weeks we’ve published a few nuggets from the 48-page long study on this blog (such as the top-scoring Bordeaux crus, and how to arrive at a 2016 release price). Today, we’re going to explore the popularity of Bordeaux’s individual appellations by looking at the online search frequency from our data partner Wine-Searcher for the six most popular wines of each.

Unsurprisingly, Pauillac – home to three of the five first growths – leads the way, with well over double the number of searches as nearest rival Margaux. If we exclude Châteaux Lafite, Mouton and Latour, the Pauillac average is just under 27,500 searches per month, still 29% ahead of Margaux.

Pomerol comes third, defying low production levels to achieve more average searches for its top wines than Saint-Julien. Pessac-Léognan benefits from the inclusion of Haut-Brion to help it edge ahead of Saint-Emilion, in spite of the latter’s four premiers grands crus classés A, while Saint-Estèphe and Sauternes & Barsac bring up the rear.

This is just a taster of the 2017 Bordeaux Market Study. You can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

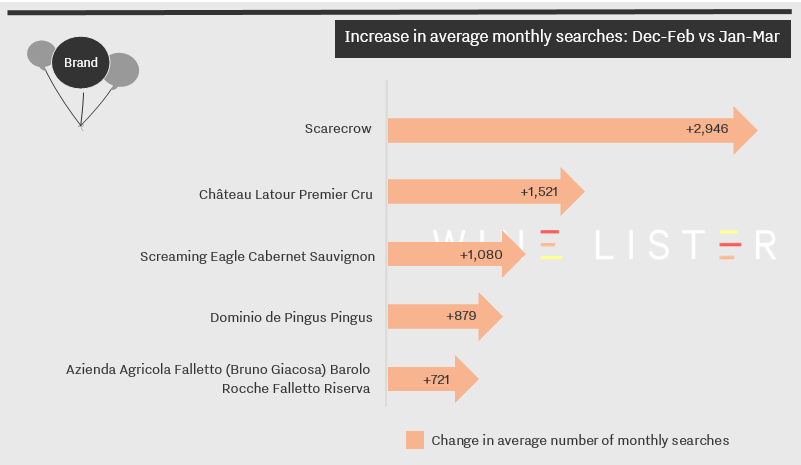

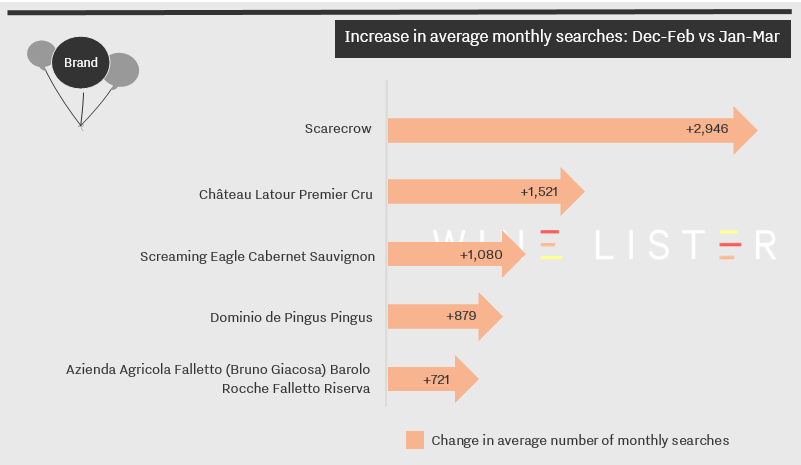

With the latest data now in from Wine Searcher, we took a look at which wines have seen their average monthly searches soar in the last month. The US boasts two wines in this top 5, with searches continuing to increase for Screaming Eagle, and Scarecrow seeing a significant uptick. Bottled relatively recently, Scarecrow 2014 scored 96+ from our US partner critic Antonio Galloni, who described it as “a wine of finesse.” At the end of February, Scarecrow 2014 was the top lot in a Premiere Napa Valley auction, selling for $200,000. The increase in searches has boosted Scarecrow’s Brand score from 868 to 885.

Latour was the only wine from France to see its popularity rise last month, with searches for the Bordeaux first growth no doubt increasing as a result of the ex-château release in mid-March of Latour 2005, for €670 per bottle ex-négociant. Latour has the highest Brand score of all the wines in the table, with a near-perfect 999.

The final two wines to have seen a rise in popularity are Spain’s Pingus, whose 2014 recently received a 100-point score in the Wine Advocate, and Italy’s Azienda Agricola Falletto (Bruno Giacosa) Barolo Rocche Falletto Riserva. In March, Antonio Galloni praised “the genius of Bruno Giacosa” in a vertical tasting, and the increase in searches resulted in the wine’s Brand score rising from 812 to 822.

How is the popularity score calculated and how does it fit into the overall Wine Lister score?

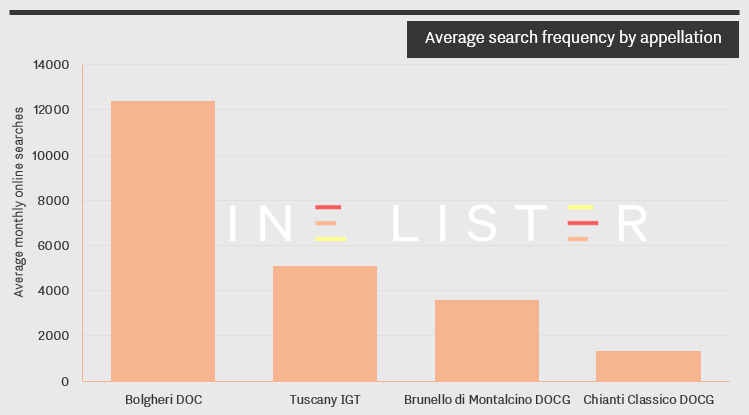

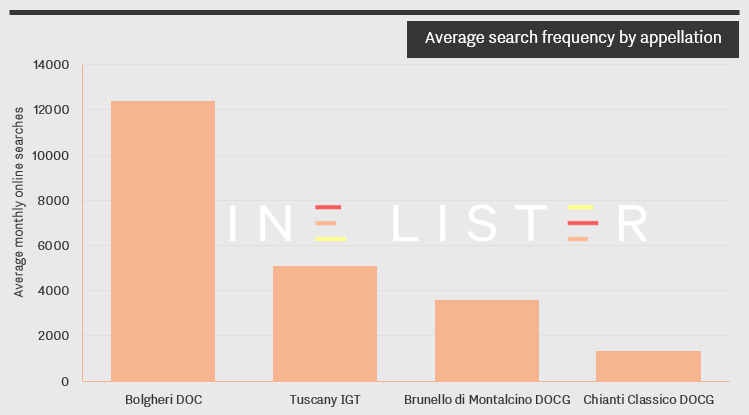

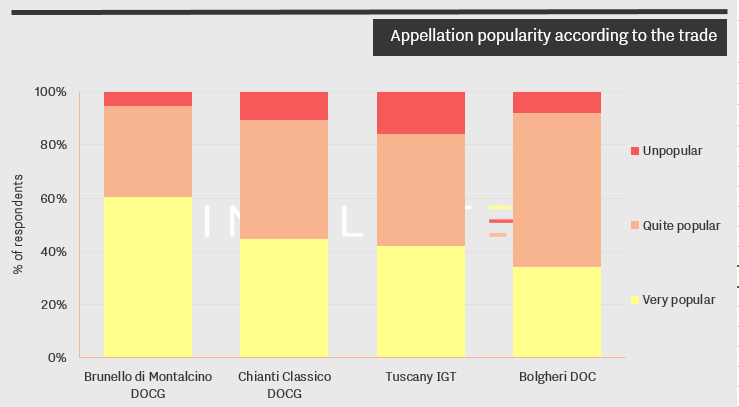

In the second blog exploring some of the findings from Wine Lister’s Tuscany Market Study – following on from our look at how the region ranks globally – we take a look at the popularity of Tuscany’s appellations. The chart below plots the average number of online searches received each month by the 50 wines in this study (based on data from Wine-Searcher), filtered by appellation.

Wines from Bolgheri DOC are by far the most popular amongst consumers, with, on average, more than twice the number of searches than their nearest competitor, Tuscany IGT. They are boosted by internationally established Super Tuscan brands such as Sassicaia and Ornellaia, which have stolen the limelight from more traditional neighbouring DOCGs such as Brunello and Chianti.

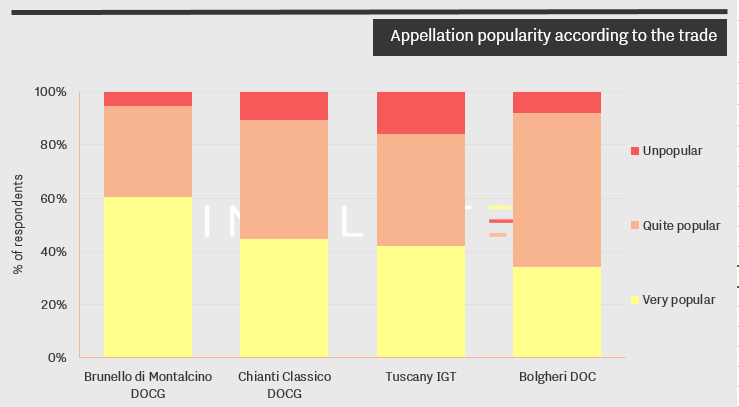

However, perception of each appellation’s popularity tells a different story. At the end of 2016, Wine Lister asked key members of the international fine wine trade about the relative popularity of Tuscan appellations amongst their clientele. Brunello di Montalcino – the third most searched for appellation – came out on top, with nearly 60% of respondents stating that it was very popular with their customers, followed by Chianti Classico.

Tuscany IGT and Bolgheri DOC trail slightly behind, emphasising that it has been the wines themselves, rather than the appellations, that have achieved fame.

In our final blog post on the Tuscany Market study we will focus in on the individual wines themselves: the trade’s view on which are the region’s consistent sellers and which are its rising stars. Wine Lister subscribers can read the full 35-page report here.

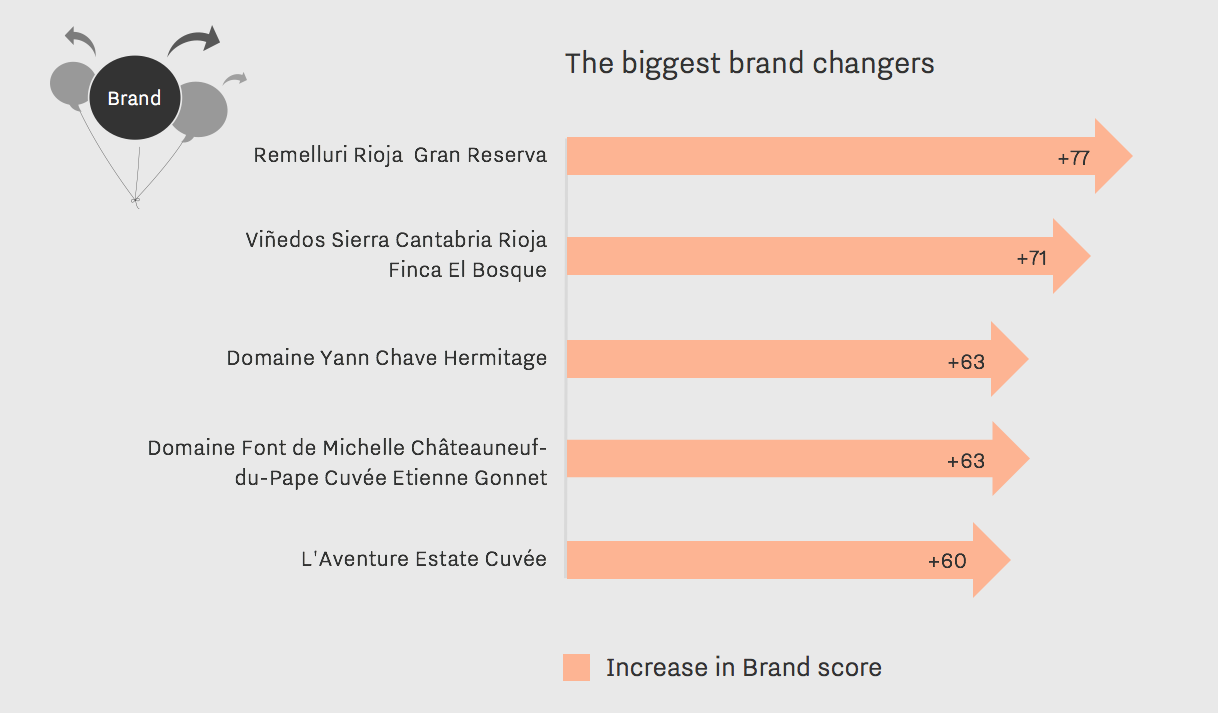

The Wine Lister Brand score algorithm has two components: Distribution and Popularity. The former criterion measures a wine’s presence in the world’s top restaurant wine lists. The latter measures the number of searches for each wine on the world’s most visited wine website Wine-Searcher, our Popularity Partner. We look at the number of times the wine is searched for over a rolling three-month period, and compare this to search frequencies of all other wines. The higher the relative search frequency, the higher the Popularity score.

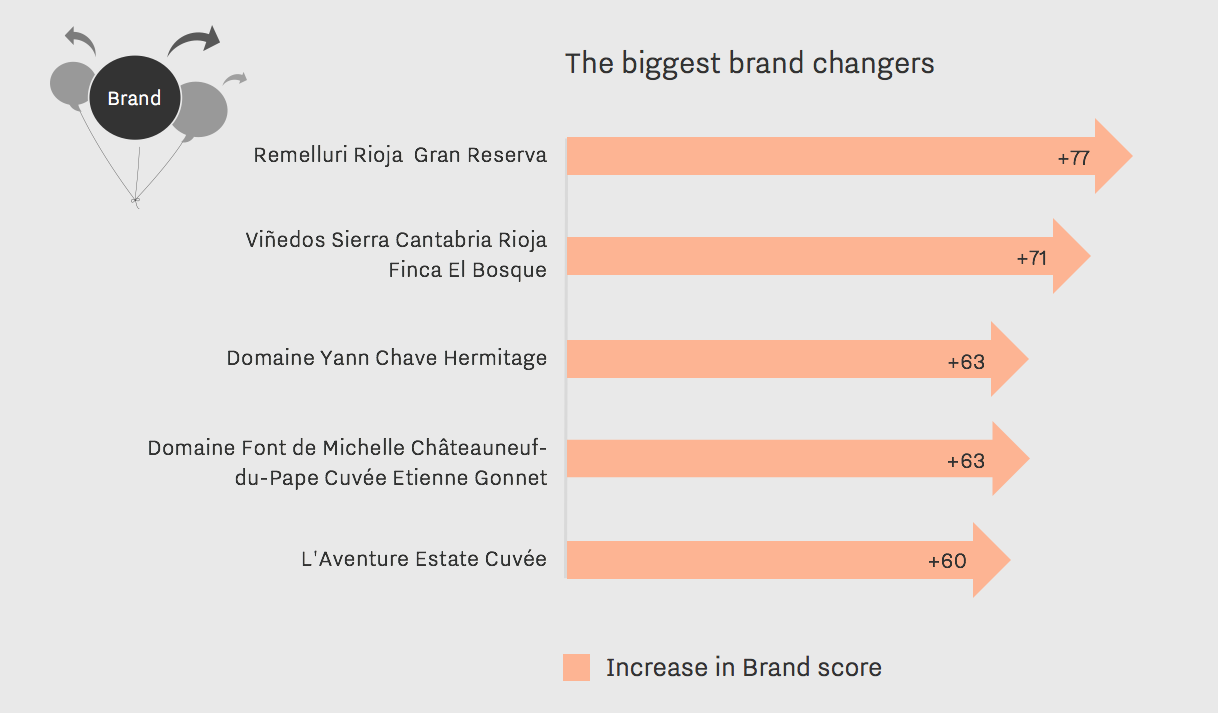

Our latest score update includes updated Wine-Searcher data for October. The chart below shows the impact of new search data on Brand scores, showing the five biggest gainers:

Rioja and the Rhône come out top. The largest gain in Brand score is for Remelluri Rioja Gran Reserva which has seen a considerable surge in user searches (322 monthly searches compared to 172 before the update), as has fellow Rioja, Viñedos Sierra Cantabria Finca El Bosque. In third and fourth place are two wines from the Rhône Valley: Domaine Yann Chave Hermitage and Domaine Font de Michelle Châteauneuf-du-Pape Cuvée Etienne Gonnet. The fifth biggest gainer in Brand terms is Californian adventurer, L’Aventure Estate Cuvée.