Wine Lister is excited to announce the arrival of its new consumer site, aimed at supporting fine wine lovers as they navigate the fine wine seas. All users now have unlimited, free access to the world’s most comprehensive fine wine data hub. Start learning how to buy wine like a pro now, or read on to find out more.

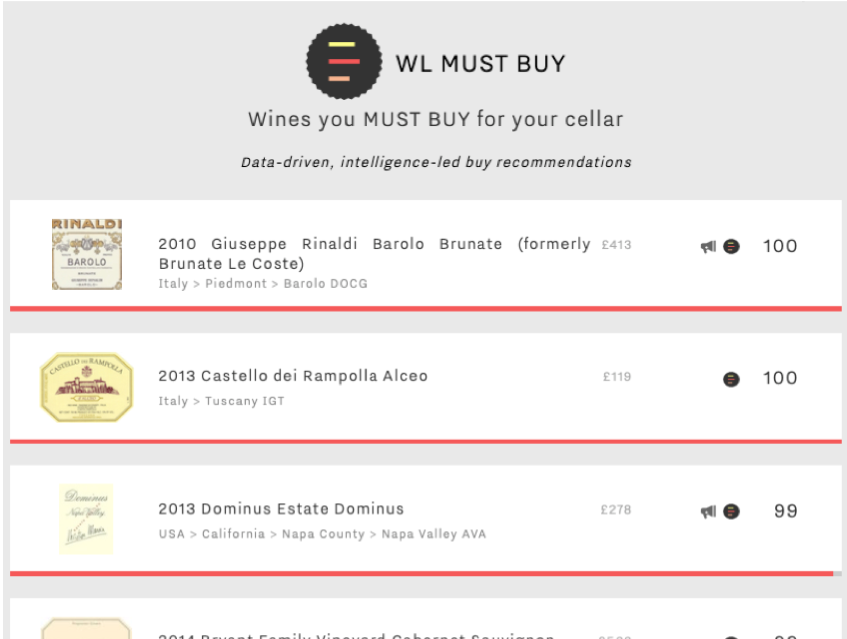

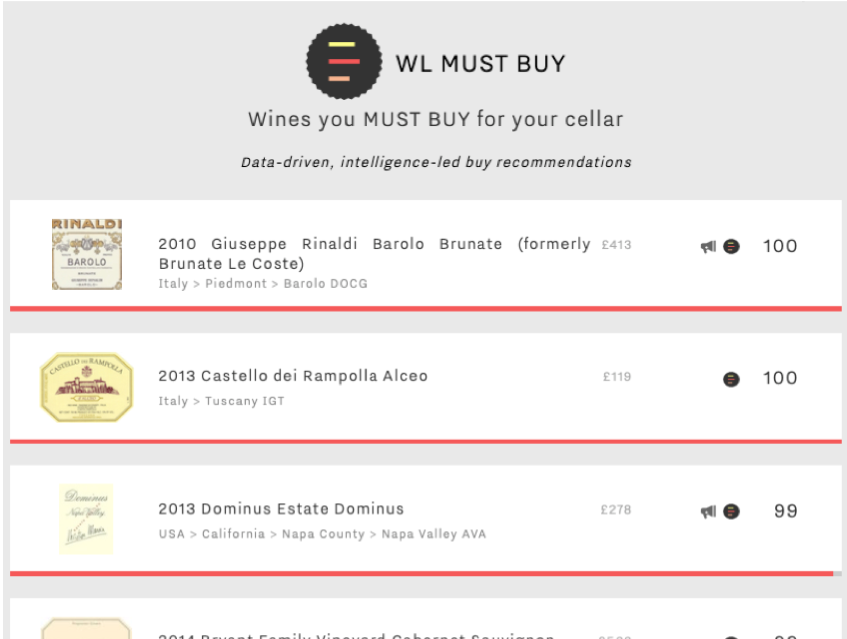

WL MUST BUYs

Wine Lister has created its own buy recommendation tool, which combines Wine Lister data with human intelligence (such as the opinion of key members of the global fine wine trade, plus insight from the Wine Lister team’s trips and tastings), to provide a dynamic list of wines any fine wine buyer should consider for their cellar. All MUST BUYs represent high quality, and value within their respective appellations and vintages.

Browse the full MUST BUY list here.

Browse the full MUST BUY list here.

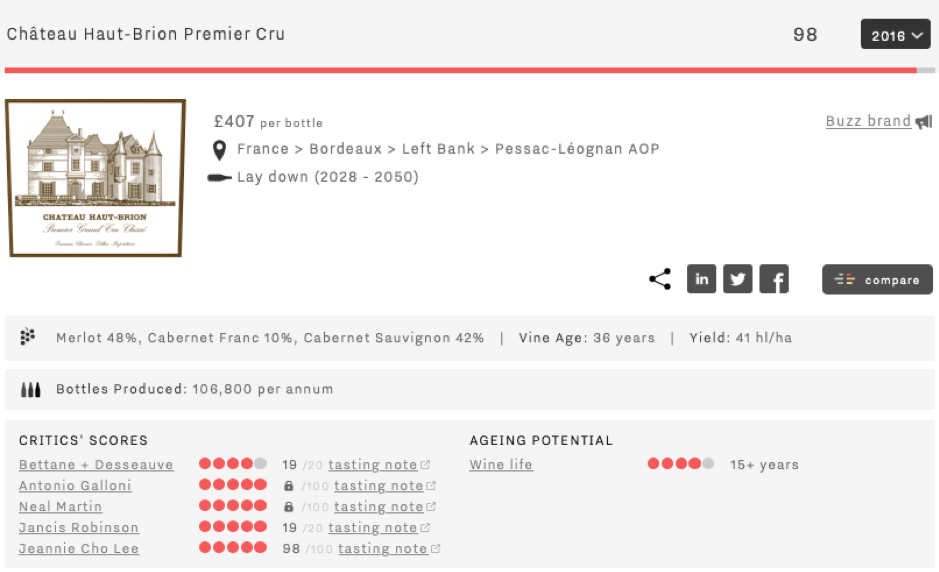

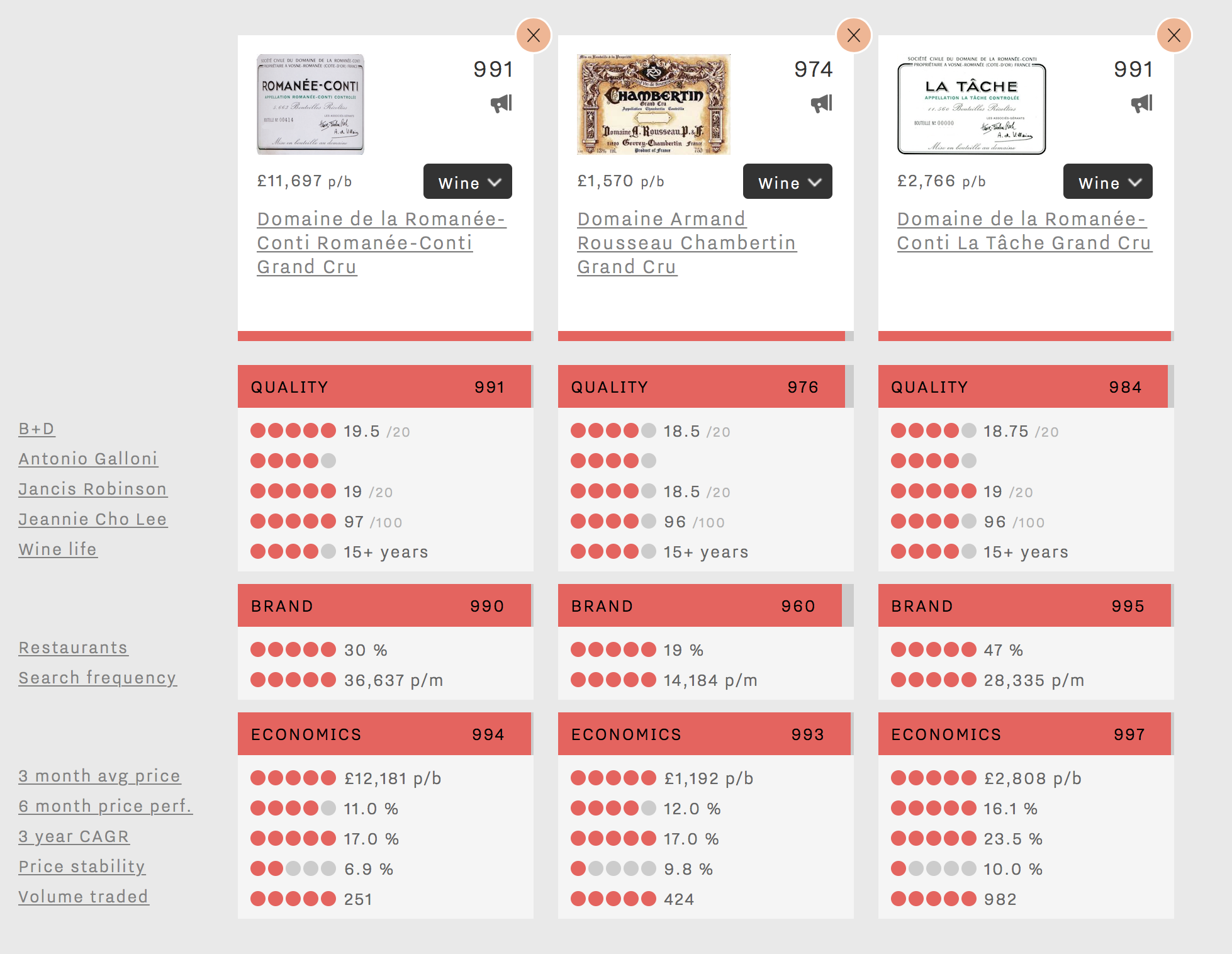

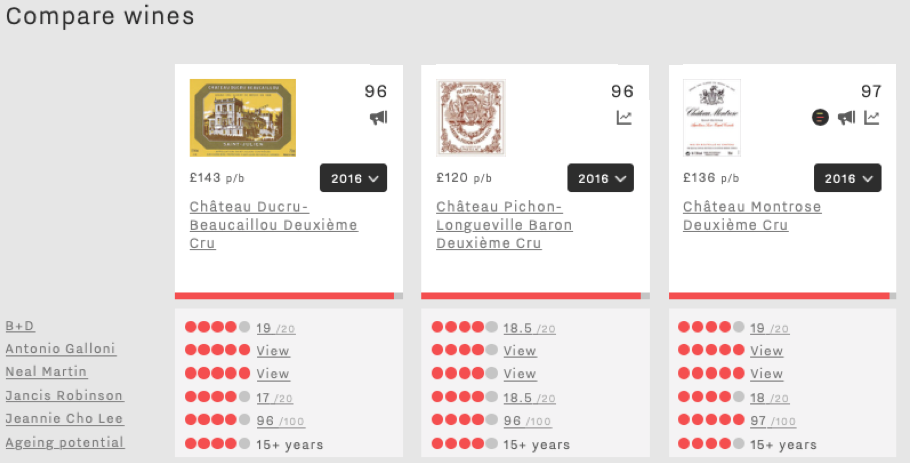

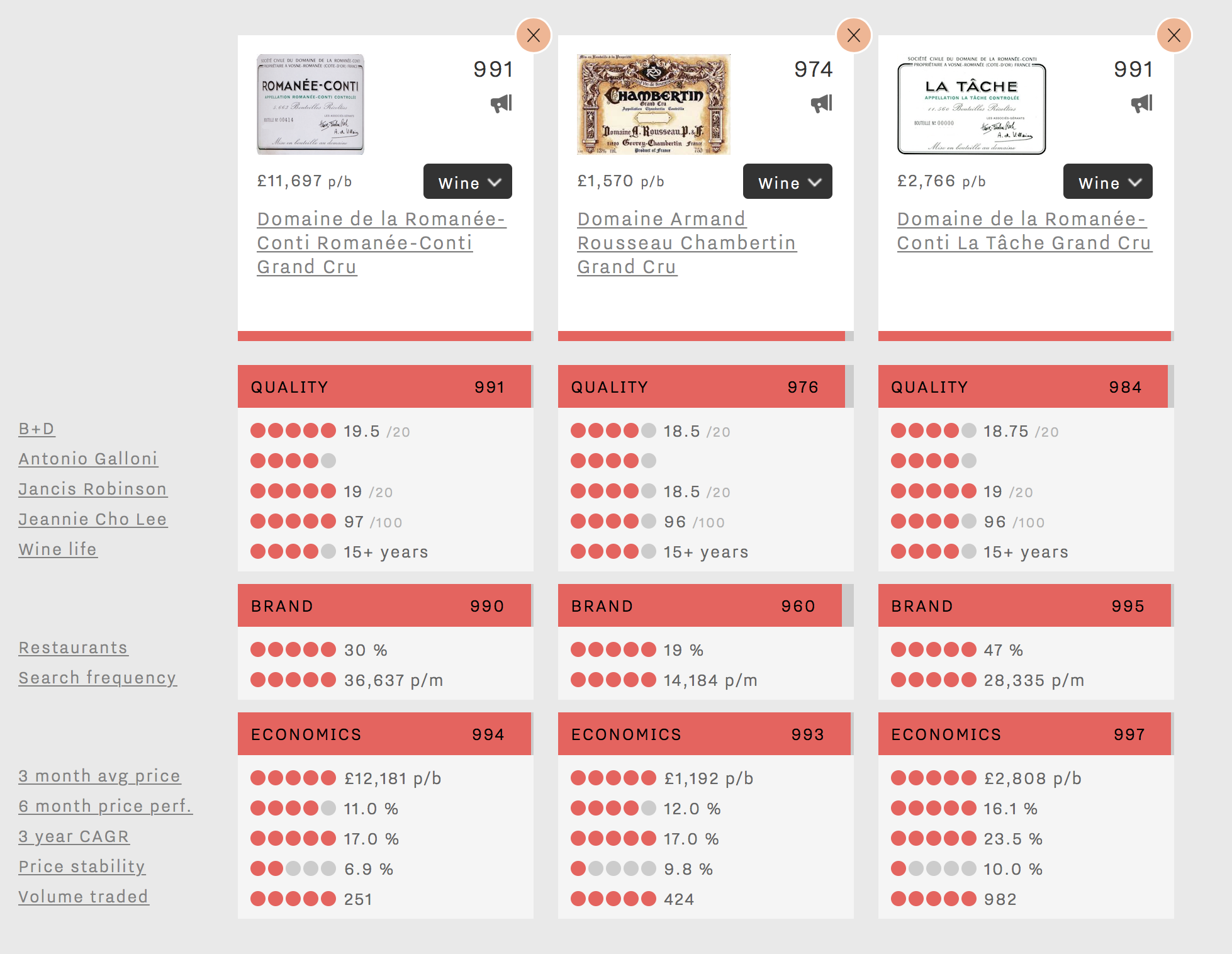

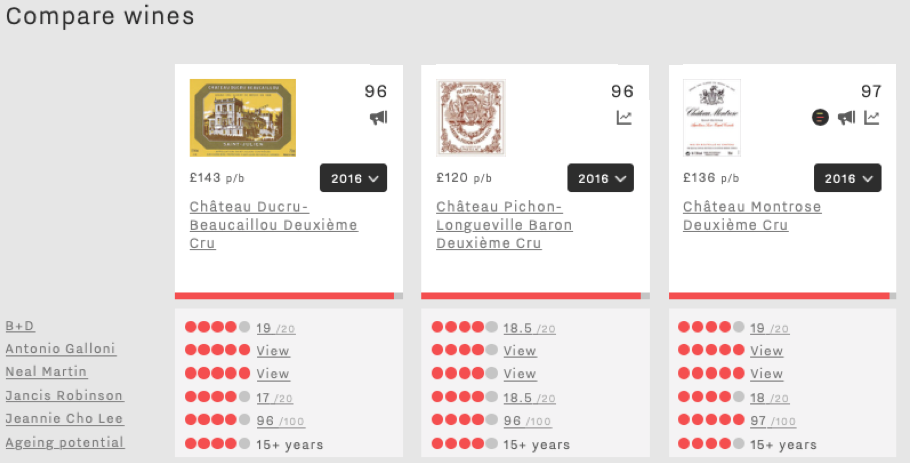

Aggregated, 100-point score

With a focus on quality, the new 100-point Wine Lister Score combines the ratings of five of the world’s most respected wine critics – Jancis Robinson, Antonio Galloni and Neal Martin (Vinous), Bettane+Desseauve, and Jeannie Cho Lee, together with a smaller weighting for the wine’s ageing potential. The score is as objective an indication of wine quality as possible, allowing users to make site-wide comparisons across the 30,000+ wine-vintages on Wine Lister.

See this comparison, or create your own here.

Further analysis tools

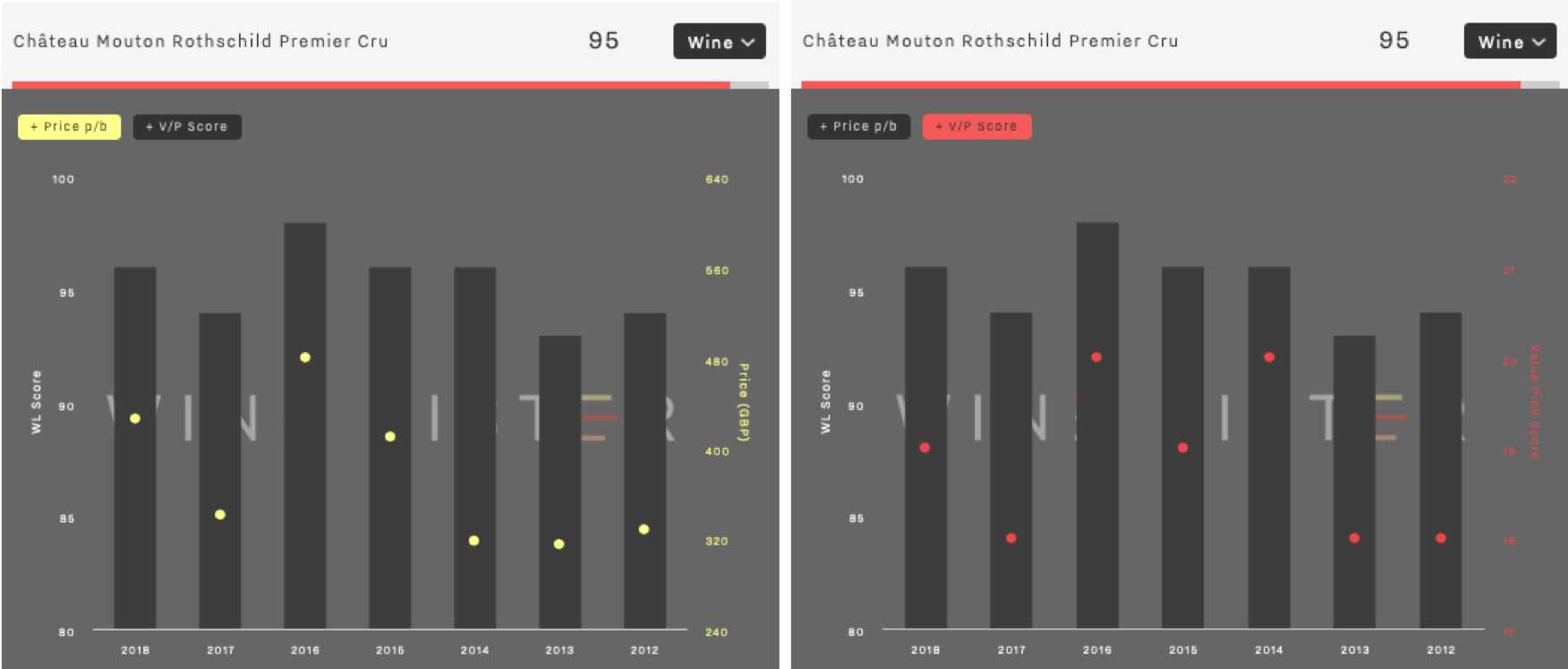

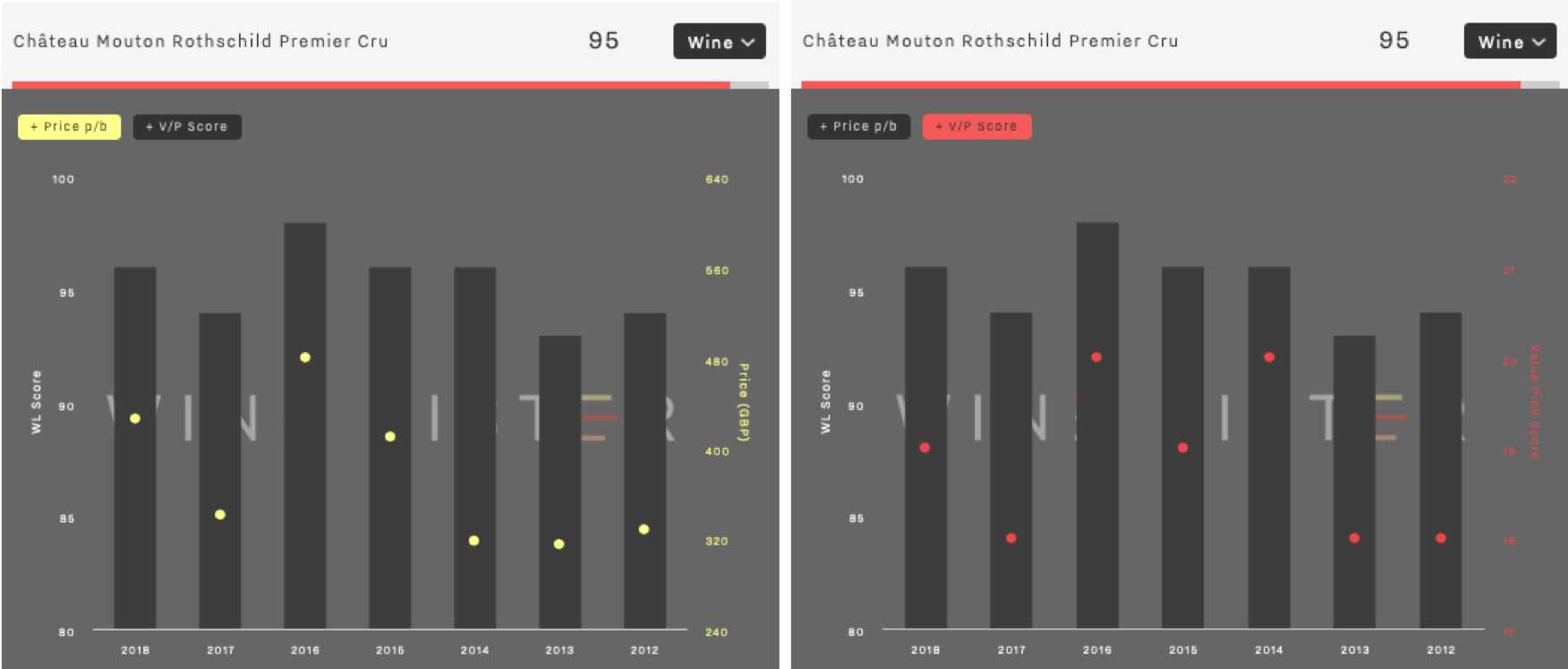

Dynamic charts give users the chance to explore wines they might consider buying or selling in more detail.

The Vintage Value Identifier gives users a clear visual of price to quality ratios across vintages of a given wine, applying a score to this measure of relative value. See the example below for Mouton Rothschild: while the 2016 vintage is higher quality than 2014, its accompanying high price means that both the 2016 and 2014 vintages present the same level of value (the joint-highest of all recent back vintages shown)

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

See the chart for Mouton Rothschild, or search for another wine here.

The Price History chart tracks a wine’s price performance over time, relative to its peer group. This can be done at vintage level, helping collectors to see performance history of a specific wine they might own. See below the example of Domaine Hubert Lignier’s Clos de La Roche 2016, whose price growth over the last year is one of the most impressive of all wines on Wine Lister (57.8%).

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

The same dynamic chart can be used at wine level (an average across vintages, with a stronger weighting for more recent vintages), to give a general indication of a wine’s price trajectory, and therefore whether or not the wine in question could be an investment buy. See below an example for Armand Rousseau’s Chambertin, which on average sees steady price growth, and a CAGR (compound annual growth rate) of 31.8% (though the price has flattened out this year).

Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years

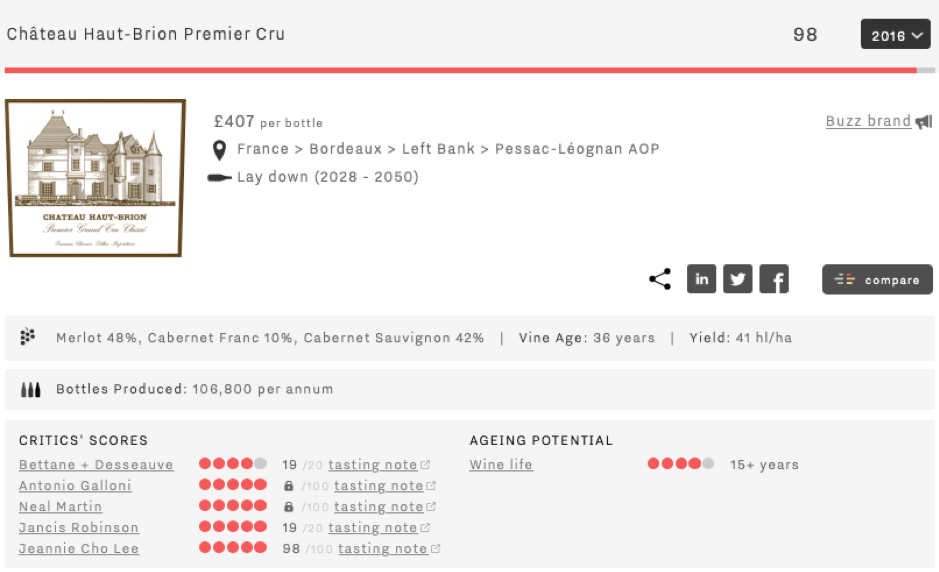

On top of these tools, each wine page gives users further information about the wine in question, including whether the wine qualifies for one of Wine Lister’s four Indicators. Haut Brion, as shown in the example below, is a Buzz Brand. See more information on other segments – Hidden Gems, Value Picks, and Investment Staples, or start browsing here.

We hope that you find the new site informative and useful for developing your fine wine collection. Feedback from our users is always welcome – please don’t hesitate to contact us with any questions or comments here.

At the end of last year, Wine Lister released its first ever Champagne report. As well as exploring a handful of key trends as identified by Wine Lister’s Founding Members, the report also sheds light on top Champagnes as compared to other regions in terms of economic performance.

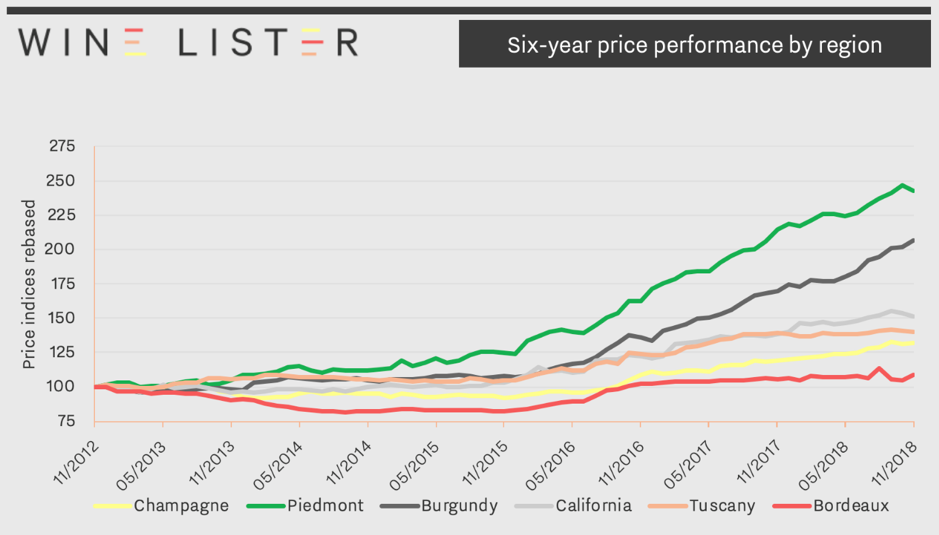

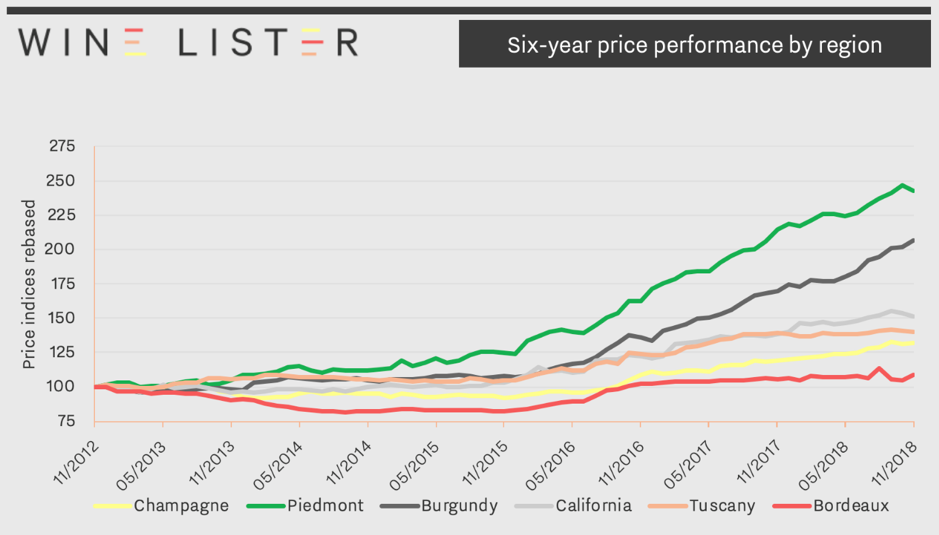

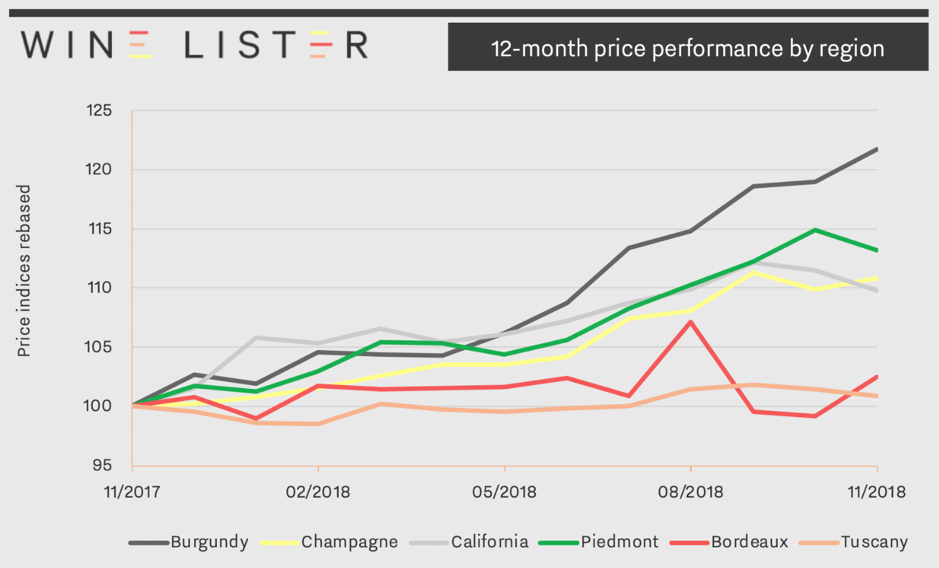

Prices of the top Champagnes (Dom Pérignon, Krug Vintage, Louis Roederer Cristal, Salon Le Mesnil and Dom Pérignon Rosé) have seen a compound annual growth rate (CAGR) of 4.8% over the last six years. Relative to other major fine wine regions, this long-term growth is slow, as shown in the chart below, but also stable.

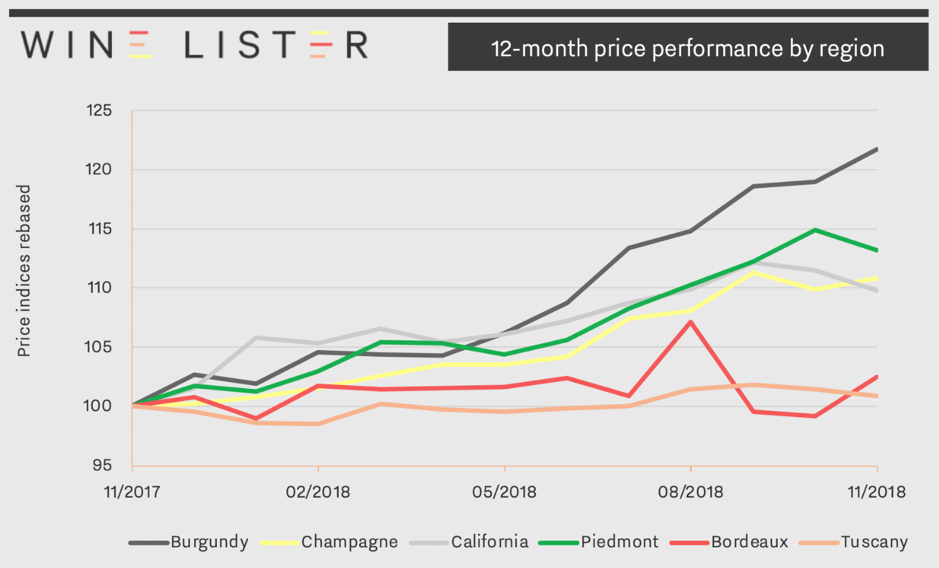

One notable advantage of Champagne as an investment option it its low volatility. Indeed, Champagne prices show a much better level of stability in the secondary market (deviating by just 2.5% from the average price over 12 months) than any other major fine wine region. Slow and steady wins the race.

Moreover, recent price performance shows Champagne accelerating. Prices of top Champagnes are starting to grow at a faster rate than their counterparts in California, Bordeaux, and Tuscany, beaten only by Piedmont and the seemingly unmatchable Burgundy. Indeed, as of December 2018 top Champagnes had seen a 12-month price growth of 11%. The region’s potential for long-term investment is already being acknowledged by the trade, with one of our Founding Members, a top tier UK merchant commenting “Champagne (Salon especially) has experienced solid growth and has become a reliable investment for collectors”.

Salon Le Mesnil is the number one performing Champagne for price performance, with an Economics score of 978, closely followed by Krug’s Clos d’Ambonnay (962). Krug also tops the Champagne Economics charts with its Clos du Mesnil, Brut Vintage, and Collection. Interestingly the only NV Champagne to appear within the top 10 Champagnes for Economics is grower Jacques Selosse’s Brut Initial, with an Economics score of 911. Its price, £106 (per bottle in-bond), is a mere 18% of the average price of the other nine top Champagnes by Economics score.

To read more key findings from our in-depth Champagne study, read the free summary here. (The key findings and full study are also available to download in French on the Analysis page.)

The eyes and ears of the industry are focused on Bordeaux 2017. Price is always a key factor in the commercial success of a fine wine, but never more so than during the annual en primeur period, when release pricing can make or break a wine’s en primeur campaign.

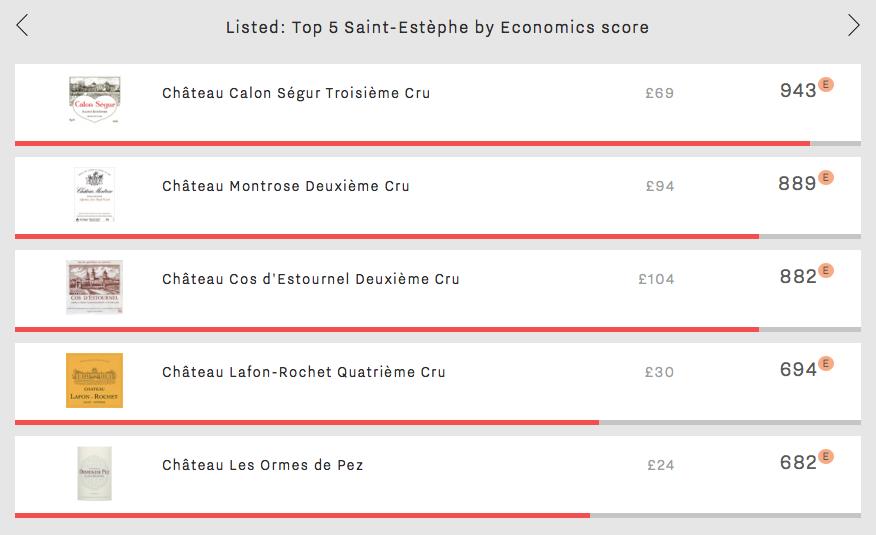

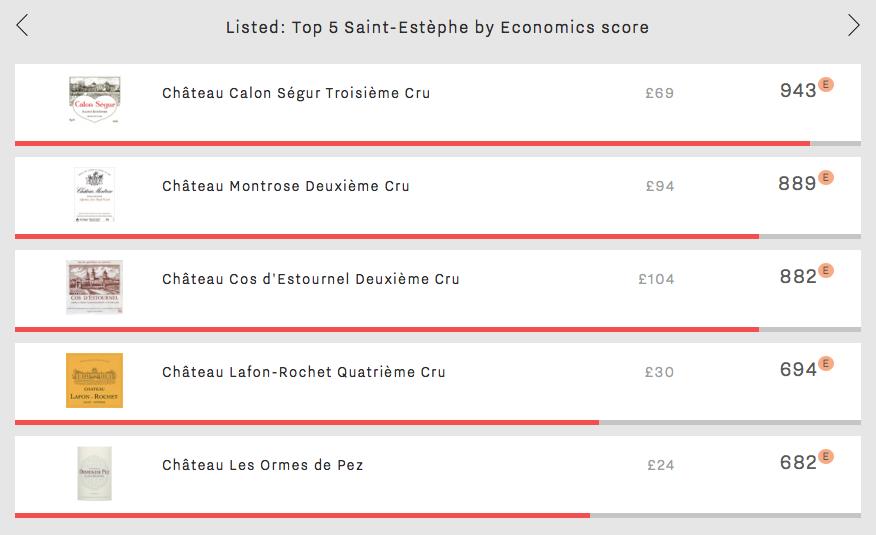

It is therefore timely to take a look at some Bordeaux Economics score successes, this week from Saint-Estèphe. Wine Lister’s Economics score combines five criteria – based on price and volume data – to measure a wine’s commercial success (read more on the Economics score calculation here).

Calon-Ségur has the highest Economics score of all Saint-Estèphe wines (943). Not only does it score 53 points higher than the next wine in its peer group, it is also the number one third growth for Economics score, sitting in eleventh place for Economics of all Bordeaux wines. This is particularly impressive, considering that the average price per bottle of those ranking in the top 10 is £614, nine times higher than Calon-Ségur’s comparatively modest average price tag of £69 (read more about Calon-Ségur’s pricing in the en primeur: part II blog).

The number two Economics score in Saint-Estèphe is held by Montrose (889). It has the highest average Quality score of the five (936) and an average wine life of 15 years. Its steady price growth over the last two years (30%) makes it one to watch for investment potential.

Cos d’Estournel is the most expensive Saint-Estèphe wine at £104 per bottle. Though it comes in third place for Economics, it has the best Saint-Estèphe Brand score of 996, thanks to presence in 52% of the world’s best restaurants and over 23,000 online monthly searches. Its popularity is also clear from its position as the most traded of the five at auction (calculated using data from one of our partners, The Wine Market Journal).

Lafon-Rochet and Les Ormes de Pez take fourth and fifth places, with Economics scores of 694 and 682 respectively. Both are a level below the top three in terms of price per bottle and Quality score, but they match Montrose on long term price performance, with compound annual growth rates (CAGR) of 9%. Saint-Estèphe is an appellation on the rise.

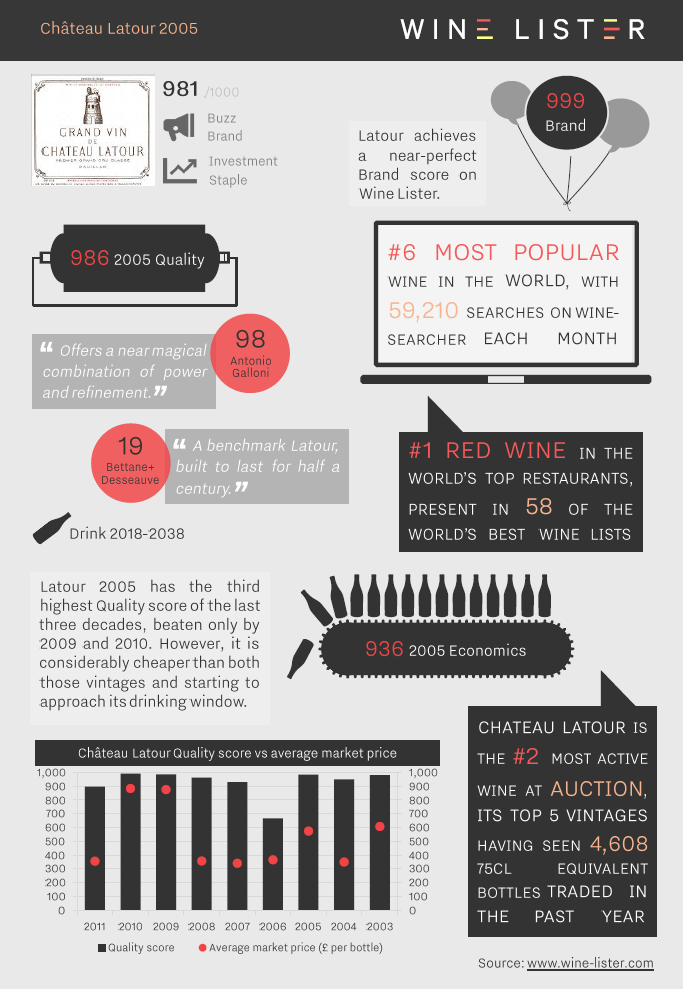

Château Latour has released a parcel of their 2006 this morning at €450 ex-negociant. It is being offered in the UK at c.£430 per bottle. The factsheet below summarises its key points.

You can download this slide here: Wine Lister Factsheet Latour 2006

For wine lovers the world over, Burgundy is a region to be celebrated all year round. That being said, the modern interpretation of the traditional, post-harvest festival, La Paulée de New York, holds its West Coast counterpart this week, celebrating some of Burgundy’s finest producers in San Francisco’s best restaurants.

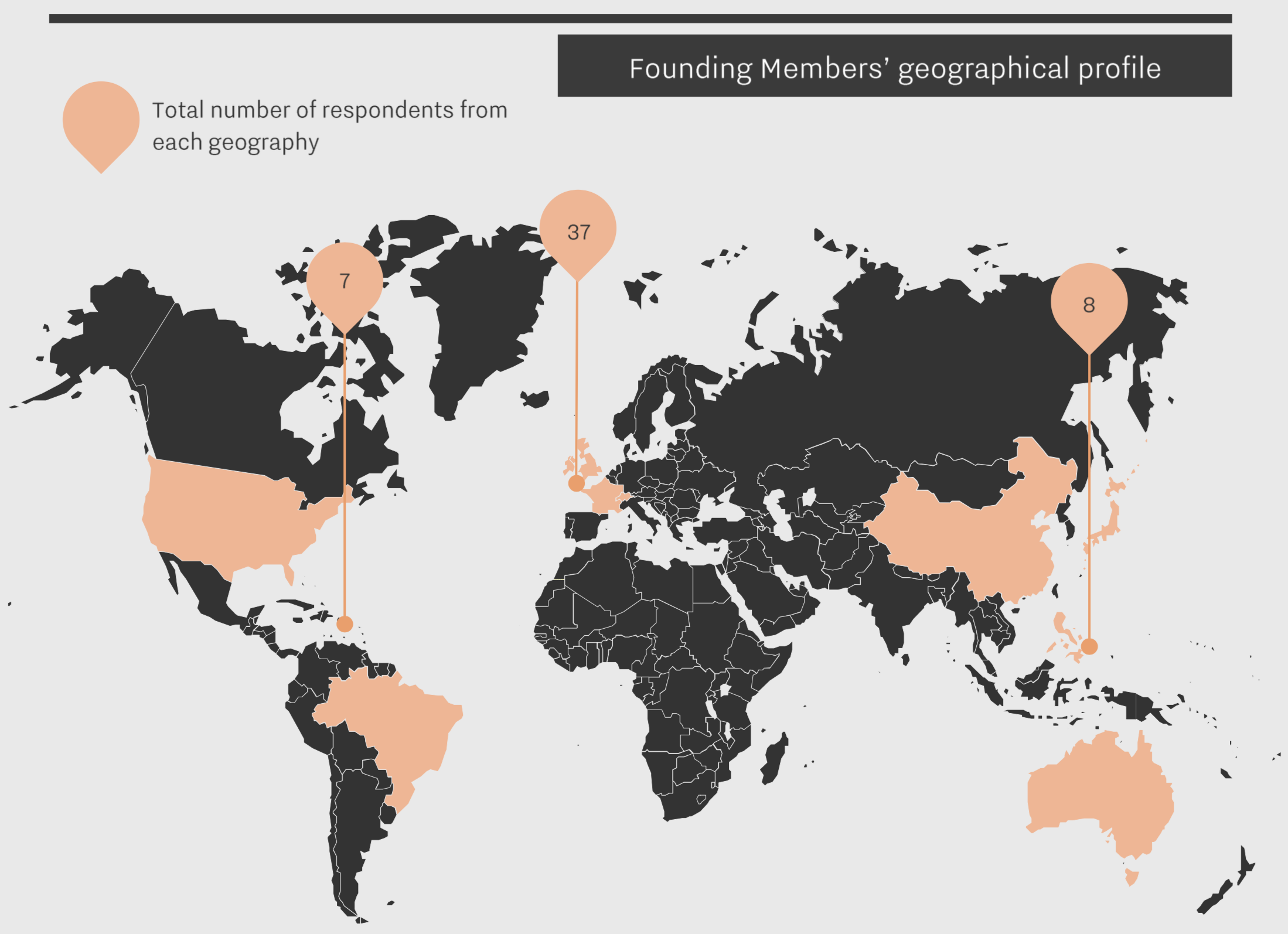

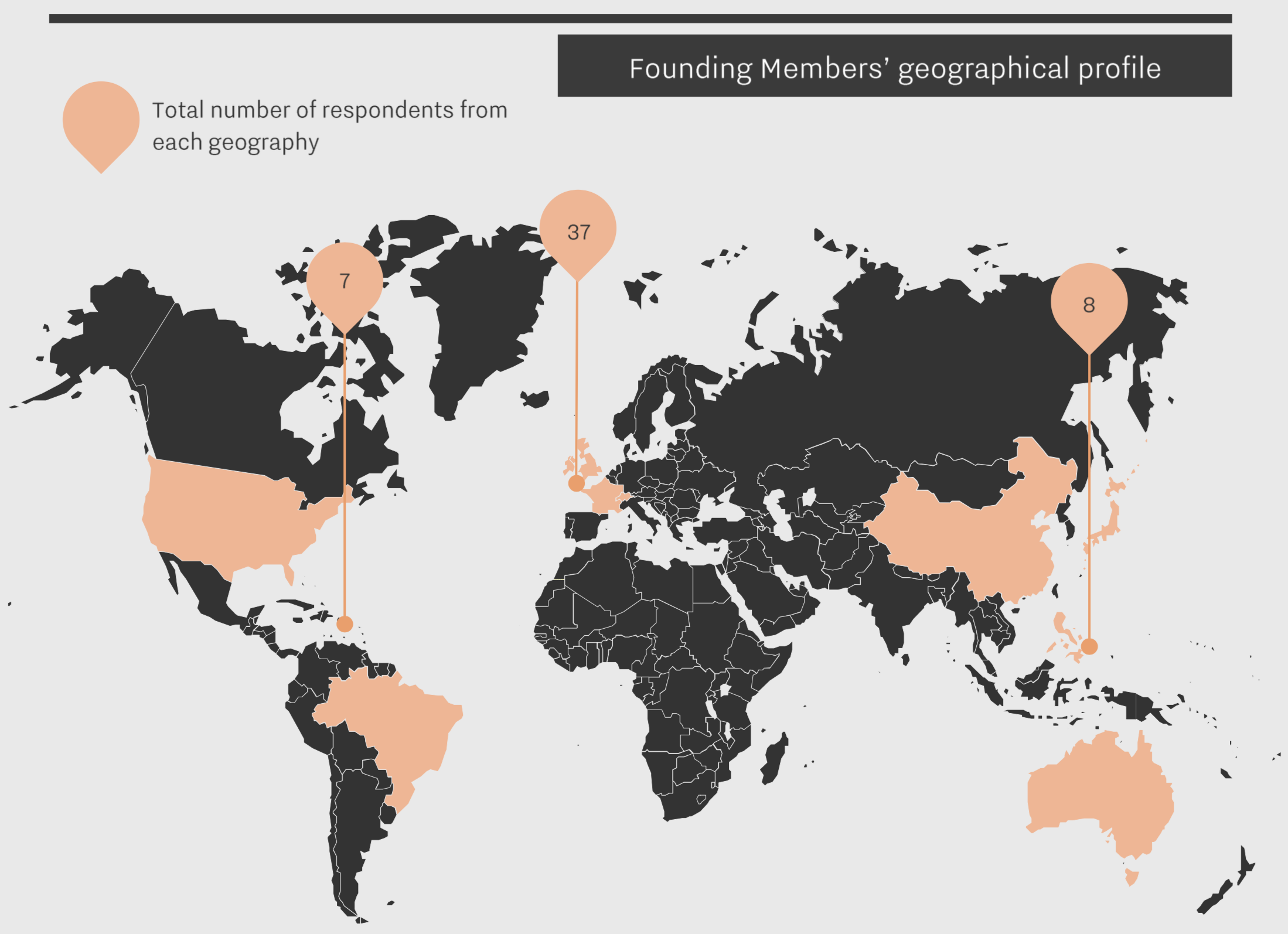

With Burgundy on the brain, we look back at our recent Burgundy study and the results of our Founding Members’ survey. Wine Lister asked 52 key members of the global wine trade across importers, merchants, and auction houses to rate their confidence in certain domaines from 0 to 10.

Our Burgundy study is the first to feature producers with a perfect confidence score. In Burgundy, two producers received a rating of 10/10. It perhaps comes as no surprise that Domaine de la Romanée-Conti (DRC) should be one of them. The other, Domaine Rousseau, is likely to have the strong performance of its Chambertin to thank for its perfect confidence score (Rousseau’s Chambertin holds the fifth best overall Wine Lister score in Burgundy, after four DRC wines).

Six producers achieved a confidence rating of 9/10. D’Auvenay and Domaine Leroy’s marks confirm the trade’s outstanding level of confidence in Lalou Bize-Leroy. Whilst Mugnier and Roumier fly the flag for Burgundy’s top red producers, Coche-Dury and Raveneau show that the trade is sure about the prospects of the region’s most prestigious white wine producers.

26% of producers included in the survey gained a confidence rating of 8/10. Among them, Comtes Lafon, Ente, and Roulot confirm the prospects of Meursault and its top producers.

36% of producers received a score of 7/10 – still a strong result and underlining the trade’s high level of confidence in Burgundy. This confidence seems linked to the region’s consistent price performance, as one US fine wine auction house notes: “The single most interesting trend is pricing. Demand on the primary and secondary market is high, and it’s amazing to see that prices have not gone down at all…in years.”

For context, no Burgundy producer scored below 5/10, compared to 5% of Bordeaux wines in Wine Lister’s Bordeaux study last year.

For more detail on which Burgundy producers achieve top confidence ratings, see our full Burgundy study here, or subscribe to gain access.

For those joining the La Paulée festivities, we wish you a very happy Burgundy week!

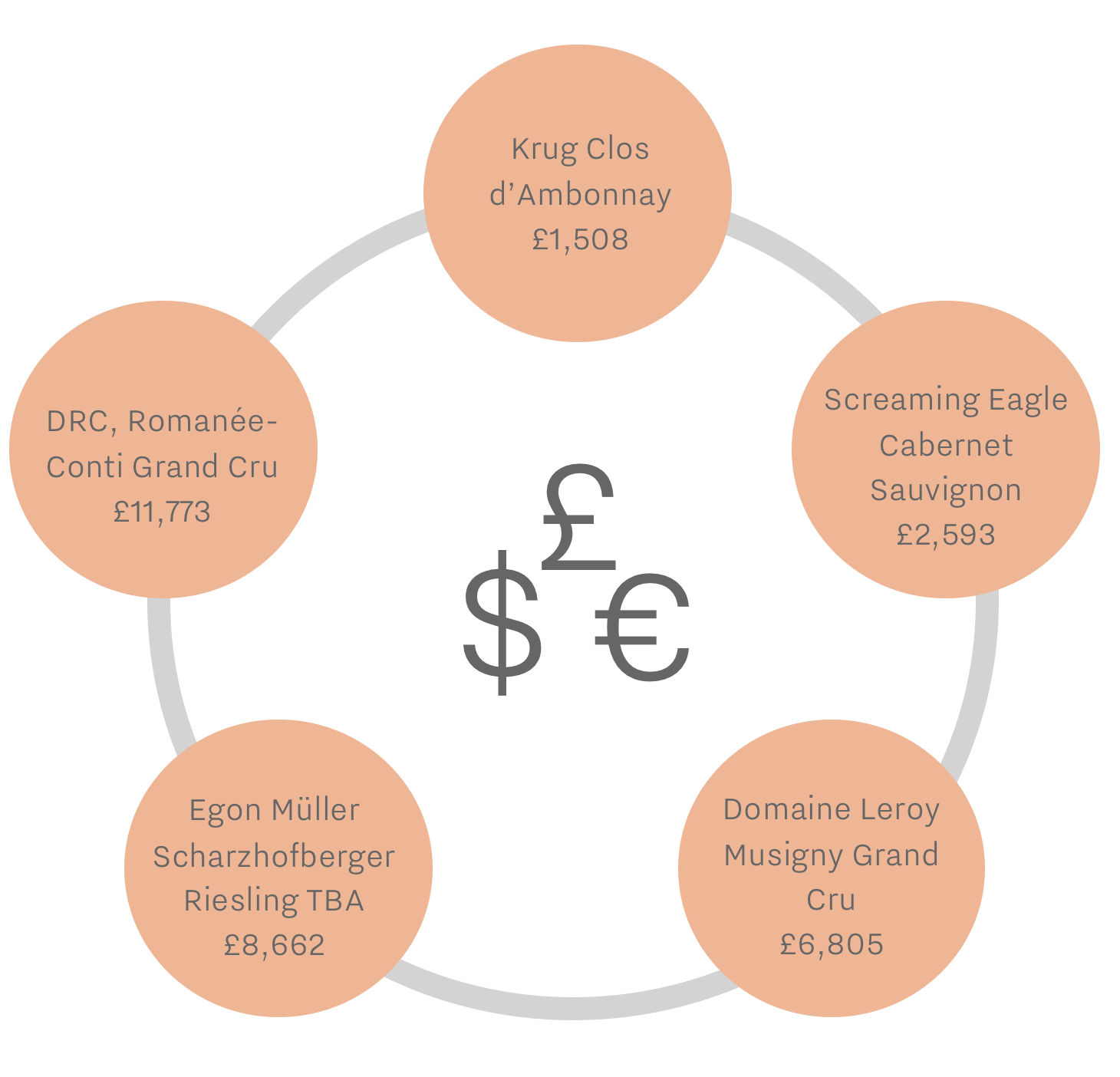

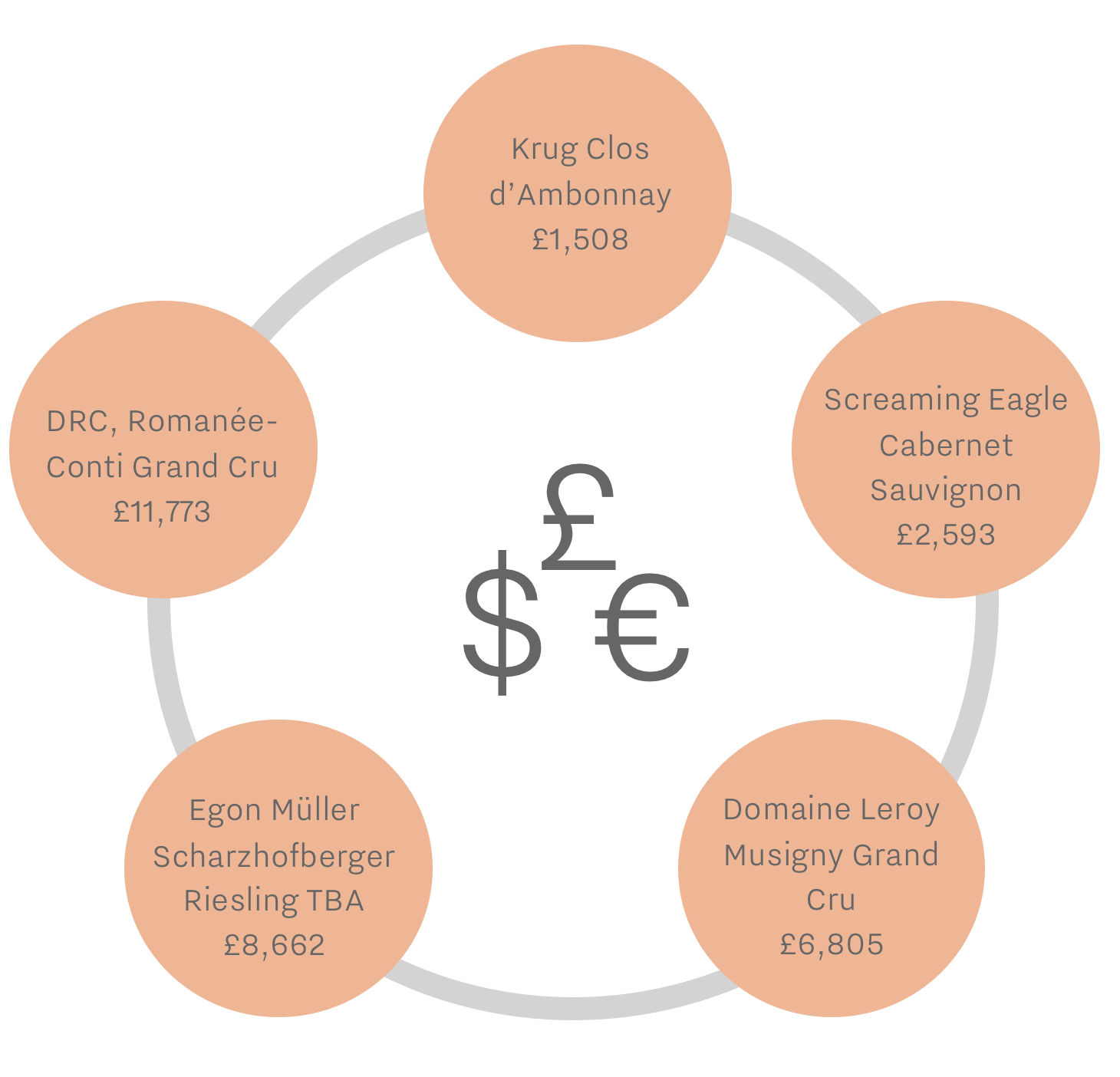

We may have been glad to see the back of January, but it certainly wasn’t all blue. The first month of the year brought excitement to the wine world with Domaine de la Romanée-Conti’s (DRC) 2015 release, and to Wine Lister with our first ever 1000-point Brand score. For much of London’s bustling City, the end of February means one thing: bonus time. The Financial Times’ February edition of How To Spend It already features the iconic DRC – below are some further ideas for wines to blow the budget.

Prices from our data partner, Wine Owners, are shown ex duty and sales tax (VAT) per bottle as averages across Wine Lister featured vintages.

- Krug Clos d’Ambonnay

While Dom Pérignon or Louis Roederer’s Cristal are more commonly associated with City celebrations, those in the know will be toasting with Krug’s famous Pinot Noir expression. With an average Quality score of 969 and a price of £1,367 per bottle for the latest available vintage (2000), a glass of Krug Clos d’Ambonnay is, in itself, cause for celebration.

- Screaming Eagle Cabernet Sauvignon

If you’re one of the lucky few on Screaming Eagle’s direct mailing list, congratulations. It is one of the most talked-about wines by the trade based on the results of Wine Lister’s proprietary Founding Member survey, and counts over 17,000 monthly online searches on Wine-Searcher. The average £2,593 price tag per bottle is therefore a small price to pay, if indeed you are able to get your hands on one of the 7,800 bottles produced each year.

- Egon Müller Scharzhofberger Riesling TBA

Even harder to find is Egon Müller’s Scharzhofberger Riesling TBA. It breaks a number of records, including Wine Lister’s rarest wine (with an average of only 150 bottles produced per annum) and the highest ever average Wine Lister Quality score (995). Prices range from £5,848 per bottle to over £21,000 per bottle for older vintages.

- Domaine Leroy Musigny Grand Cru

The second most expensive of all French wines, let alone in Burgundy, is Domaine Leroy’s Musigny. At just over half the price of DRC Romanée-Conti, averaging £6,805 per bottle, its consistent quality is matched by impressive price growth, with a compound average growth rate of 26%. It featured in last year’s Listed blog, “the best wines money can buy”, which certainly still rings true.

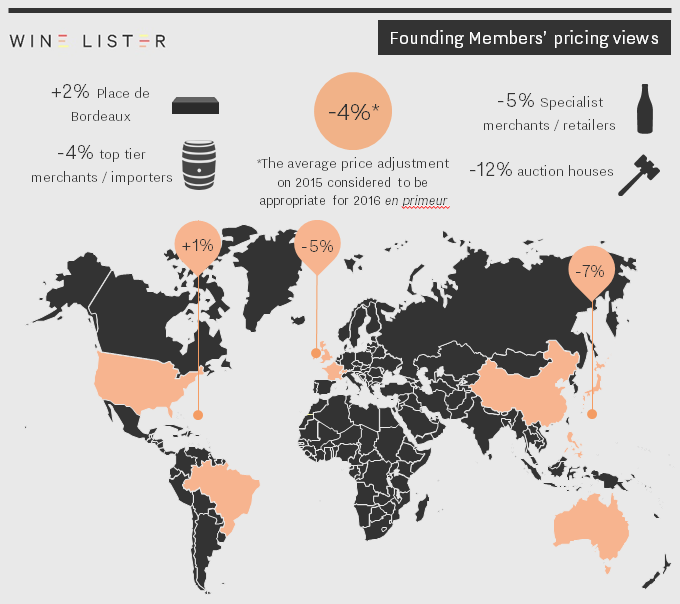

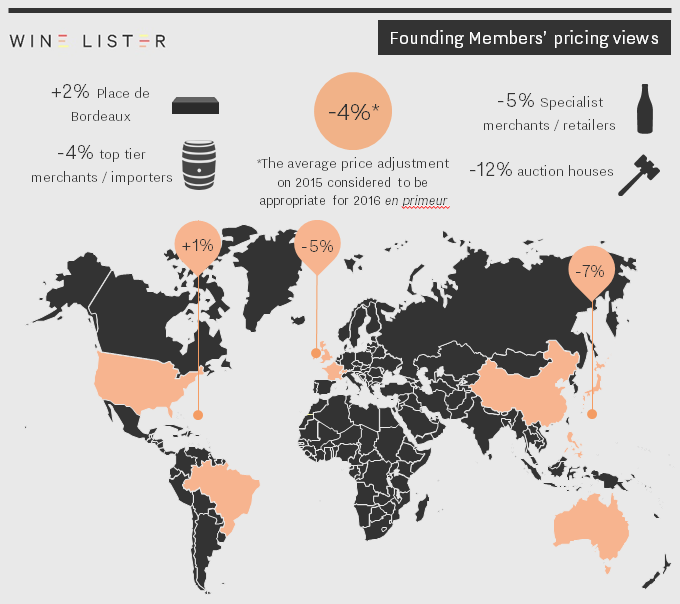

Our recent blog post reported the excellent quality of the Bordeaux 2016 vintage in the face of a tricky growing season, and discussed the generous yields that many producers enjoyed. In theory, the latter should keep en primeur release prices down. We took the temperature during our week in Bordeaux.

Olivier Bernard, President of the Union des Grands Crus de Bordeaux, declared that quantity is “good for the producers and for the people selling our wine, because it will help the château owners find the right price.” He went on to refer to the ease with which “mistakes” are made when quantity is low, a nod to over-zealous en primeur pricing in the past.

In a recent survey of Wine Lister’s 49 Founding Members (key global wine trade players), the average price adjustment for Bordeaux 2016 considered reasonable on 2015 was a decrease of 4%. Even the Bordeaux trade only suggest a 2% increase. It should be noted that this questionnaire was carried out prior to any tastings, and also that the trade’s interest naturally lies in curbing price rises by the producers.

“What’s for sure is that prices to the consumer need to be significantly lower than current prices of physically available vintages such as 2005, 2009 and 2010,” asserted Stephen Browett, Chairman of Farr Vintners. “Why not allow all our distributors and consumers to make good buys and profitable sales of this vintage, with prices that are relatively stable compared to 2015?,” appealed Nicolas Ballarin, courtier at Blanchy et de Lestapis.

Wine Lister’s Founder, Ella Lister, is more sceptical, saying:

“I would be very surprised if Bordeaux 2016 prices do not increase on 2015, in some cases significantly. Every producer we spoke to said they would be upping prices on last year.”

“Price-wise I don’t think there is anyone who’s thinking about selling 2016 at a lower price than 2015,” confirmed Philippe Blanc, Managing Director of Château Beychevelle, hitting the nail on the head when he added, “the big question is how much more.”

This remains to be seen: the mood is broadly bullish but with a dose of caution. François-Xavier Borie, owner of Grand-Puy-Lacoste, summarised, “demand is good, and perception of the vintage is great,” concluding, “we will without doubt raise the price, but it shouldn’t explode.” His only fear is that things might be confused if certain châteaux adopt a different policy, going for “a high price on low volume.” Nicolas Glumineau, Managing Director of Pichon Longueville Comtesse de Lalande, agrees that partial releases at inflated prices are counterproductive, calling the approach “artificial”, and saying it “doesn’t work to sell only 50% at a higher price.” Pichon Comtesse usually sells 80% of production en primeur.

“It’s a great vintage so it will be expensive,” confirmed Glumineau, disclosing, “my ambition is to raise the price this year, yes.” He is acutely aware, as are his fellow Bordelais, of mitigating factors such as the impending French elections. A Marine Le Pen victory “would affect the stock markets”, he says, and “could devalue the euro relative to the pound.”

Referring to the weak pound post-Brexit, Didier Cuvelier, owner of Léoville Poyferré, admitted, “it’s true England worries us as it’s always what sets the tone of the campaign.” Emmanuel Cruse, Co-owner of Château d’Issan and Grand Maître of the Commanderie du Bontemps, Médoc, Graves, Sauternes and Barsac, cited political uncertainty in the UK, the US, and France, when he announced to a room full of producers and négociants, “we all know the situation isn’t stable, but we need to be positive as the vintage is great and we have made a lot of it.” Mathieu Chadronnier, Managing Director of négociant CVBG, observed, “I really feel a desire here in Bordeaux for this to be a successful campaign.”

Philippe Blanc, Managing Director of Château Beychevelle, who will almost certainly raise the price on 2015, but won’t be first out of the block. Photo © Ella Lister.

How will this positive approach affect timing for Bordeaux 2016? A couple of sources hinted at the possibility of a handful of early releases at the same price as last year, either by châteaux who priced highly last year or perhaps first growths wanting to set a trend. However, by far the dominant view was that the campaign would be a long one, lasting until after Vinexpo (18th-21st June in Bordeaux).

“A good campaign is one where timing follows a pattern – crus bourgeois first, then the fifth growths, the fourths etc.,” expounds Glumineau. Blanc believes, “the general opinion is not to be quicker than need be,” saying “it’s good to have context,” and confirming that Beychevelle “definitely won’t be the leader timing-wise.” Lister concludes:

“We await the first releases with interest, because of course nobody can predict the campaign’s level of success until the party actually gets started.”

Check www.wine-lister.com in early May for our new Bordeaux study, and follow us on Twitter for real-time analysis of the releases.

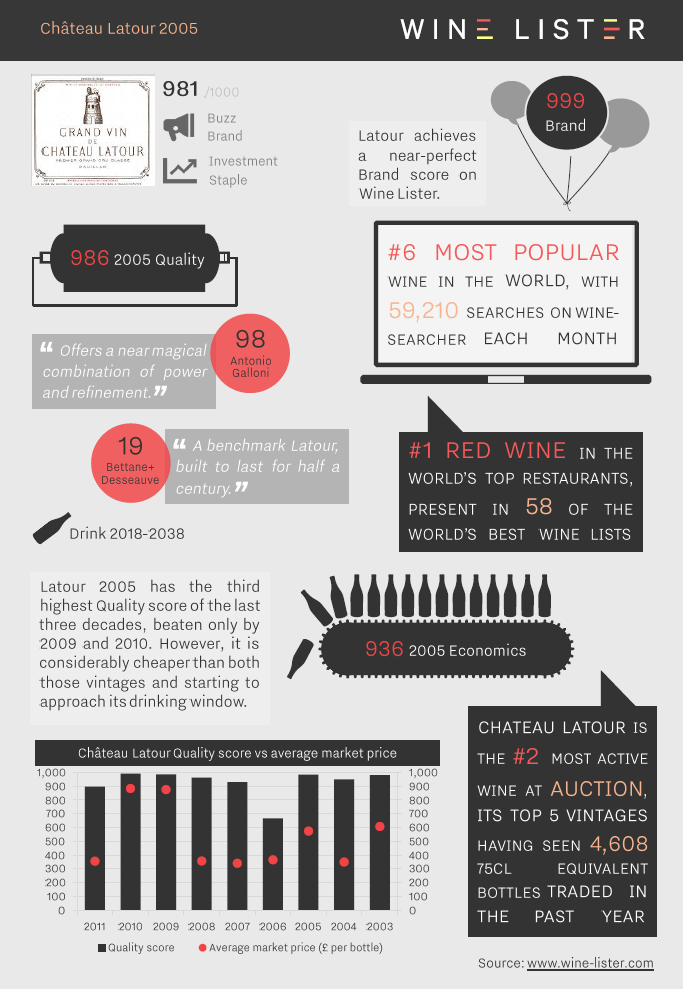

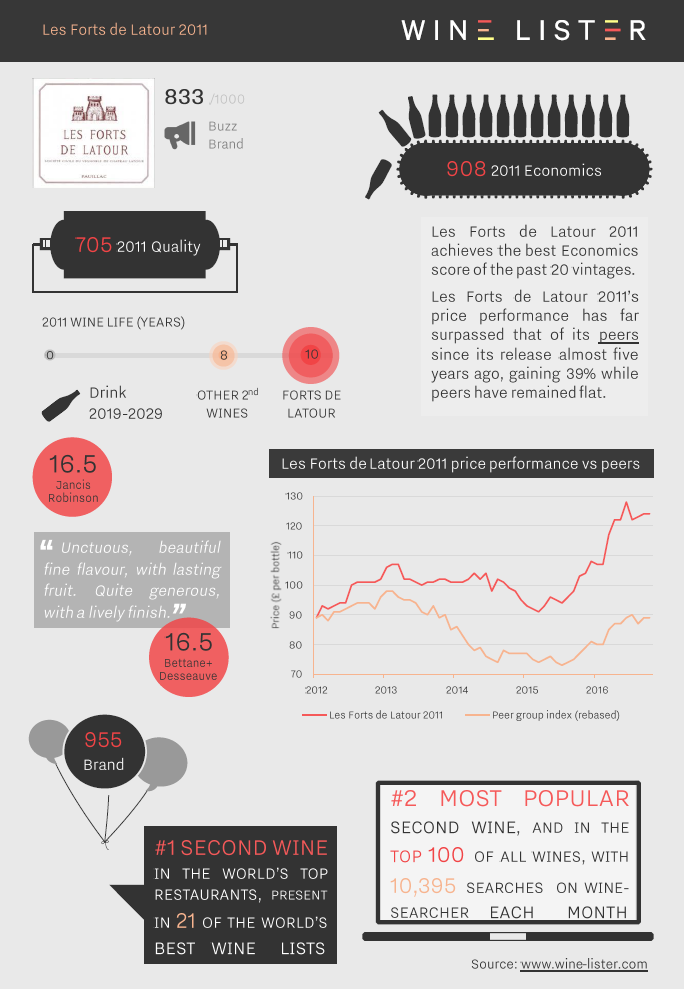

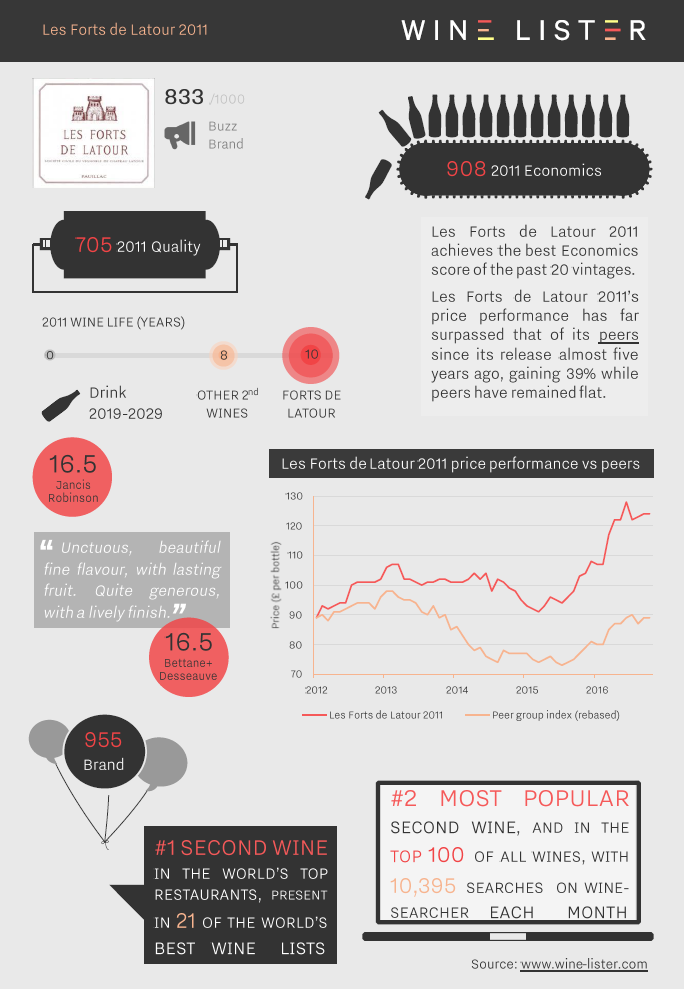

This morning sees the ex-château release of Latour 2005, along with second wine, Les Forts de Latour 2011. We have put together two factsheets bringing together all the most important information about these two formidable wines, both approaching their drinking windows.

The 2005 Grand Vin has the third-highest Wine Lister Quality score of the last three decades, and looks reasonable value next to the 2009 and 2010:

The 2011 vintage of Château Latour’s second wine, Les Forts de Latour, is an economic powerhouse, with impressive price growth since its release:

You can download the slides here: Wine Lister Factsheet Latour 2005 / Wine Lister Factsheet Les Forts de Latour 2011

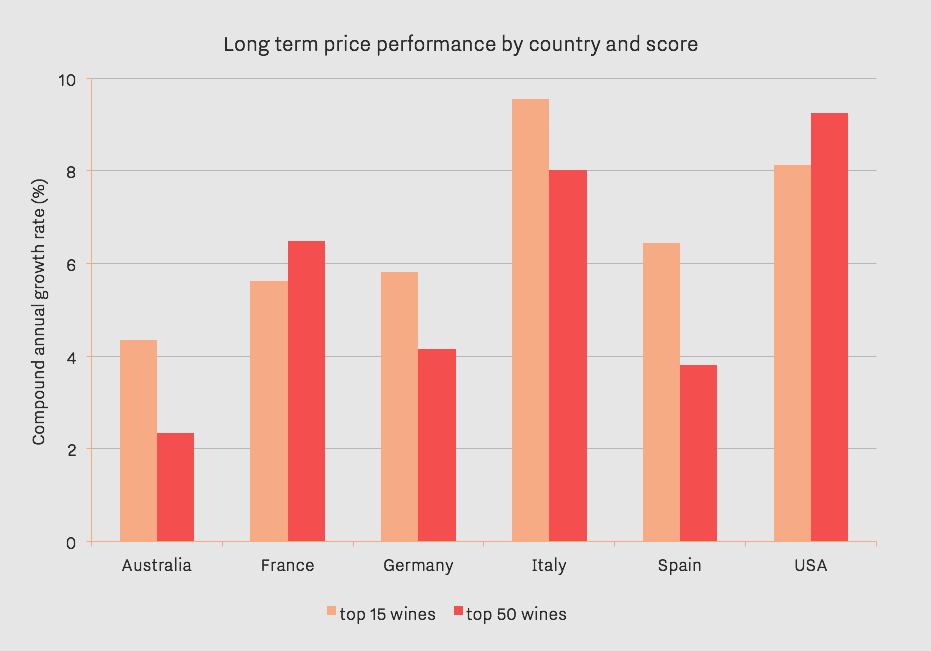

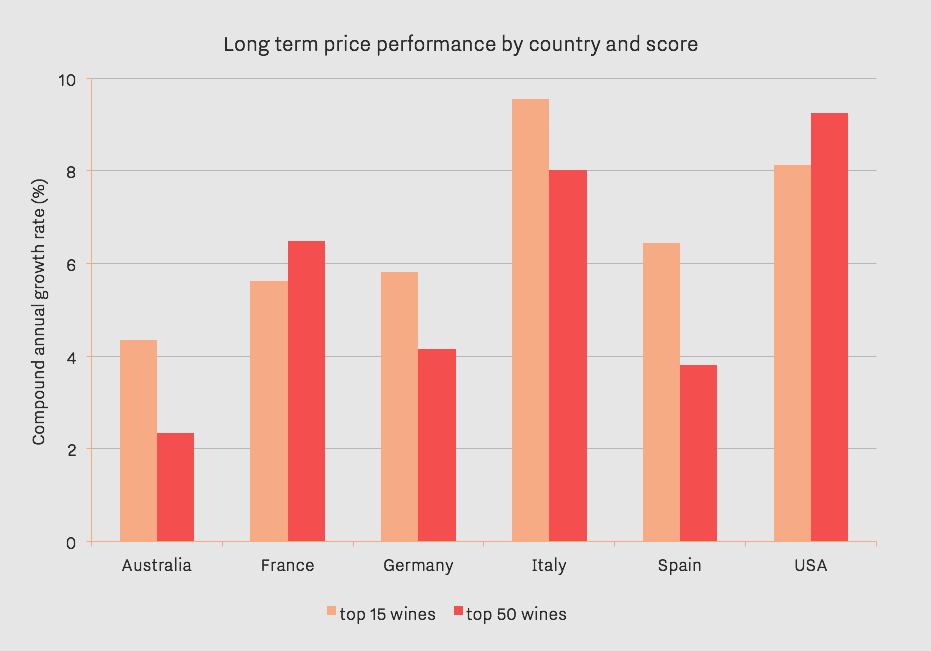

The graph below shows the average long term price performance of top scoring Wine Lister wines by country, and the USA bucks the trend of elites on top (with an early congratulatory nod from France).

We have split out performance for an elite group of the 15 highest-scoring wines, and compared this to performance for a wider panel of 50 wines. For the majority of countries, the elite wines – let’s call them the establishment – have seen their stock rise over the last three years.

In the USA, it is the broader-based group (the red column) that has trumped the establishment (gaining more than 9%). The same is true in France, where a broader group of wines has penned a tale of higher returns.

Our measure of long term price performance is the 3 year compound annual growth rate (CAGR) which facilitates comparison to other investment products.

Elsewhere, Italian wines have seen the best returns among their elite group, averaging annual price gains of almost 10% – the most impressive of any group analysed here. One of the top performing wines in Italy’s top 15 scorers is Bartolo Mascarello’s Barolo (of “no barrique, no Berlusconi” fame), whose average (cross-vintage) price performance is 23% CAGR over the last 3 years.

The elites also outperform the up-and-comers in Spain, Germany, and Australia, perhaps explained by the fact that there are fewer really well established top-end brands in these countries compared to France, and so their respective top 50 groups are less entrenched, and their top 15 groups still have room to grow in recognition and price.

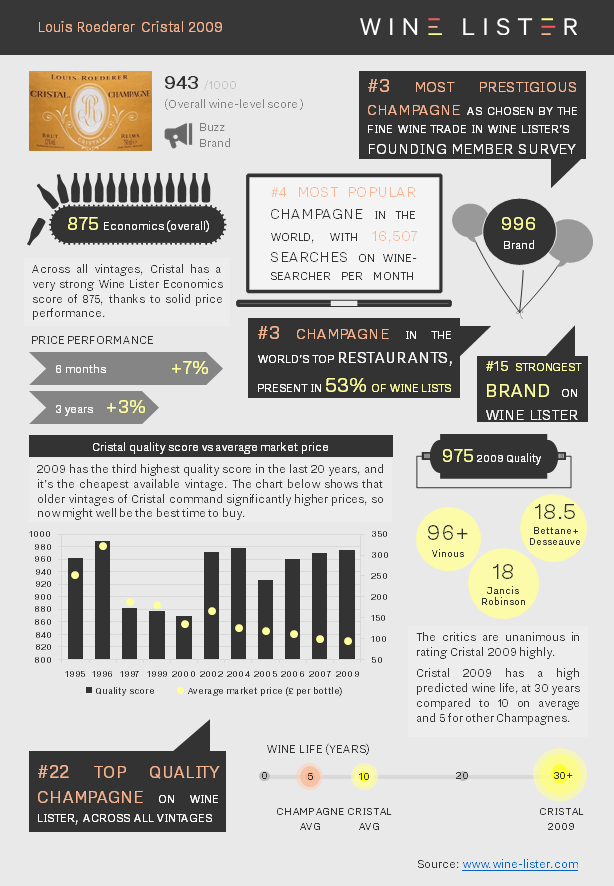

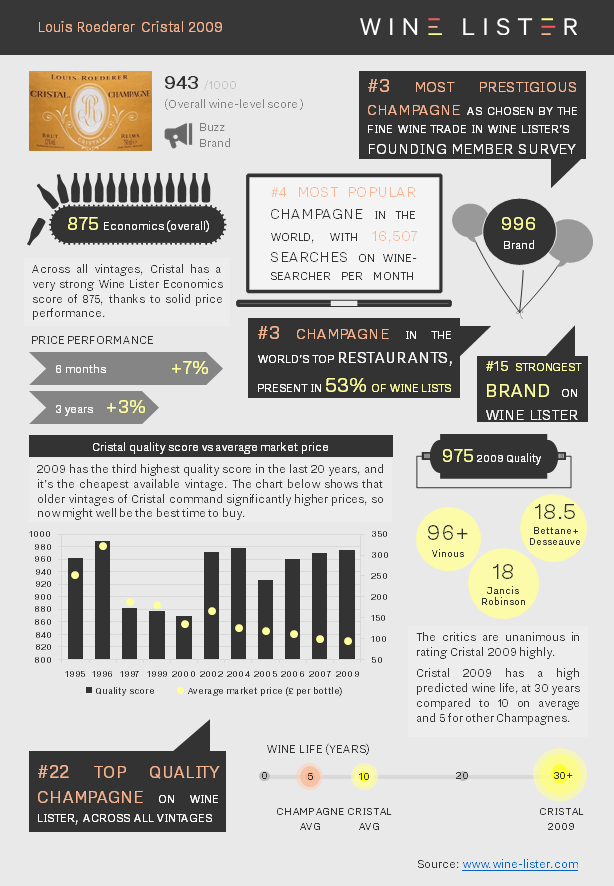

This week saw the launch of Louis Roederer Cristal 2009. Addressing the London audience at the Shard on Tuesday 11th October, the Champagne house’s CEO, Frédéric Rouzaud, called the launch an effort “to help lift you out of depression after Brexit”.

The wine had been released in July, before the critics had tasted the wine, offered at £1,100 per case (91.67 per bottle) by UK merchants. It is still available at this price from BI Wines & Spirits, which seems like a good deal, the cheapest of any available (see the chart below).

Scores are now in from Wine Lister’s three partner critics (Vinous, Jancis Robinson, and Bettane+Desseauve) who are unanimous in their praise of the wine. See their scores alongisde a wealth of other data and analysis below:

You can download the slide here: wine-lister-factsheet-cristal-2009

Browse the full MUST BUY list here.

Browse the full MUST BUY list here.

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right).

Wine Lister’s dynamic Vintage Value Identifier chart, showing price vs. quality (left) and Value Pick score (right). Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s

Hubert Lignier Clos de la Roche 2016’s six-month price performance compared to performance of other Clos de la Roche Grand Cru 2016s Armand Rousseau’s average price performance over two years

Armand Rousseau’s average price performance over two years