As the first major week of Bordeaux 2019 en primeur releases draws to a close, this morning (Friday 5th June) saw the release of the “first of the Firsts”, and the other reds from the Lafite stable.

Carruades de Lafite 2019 opened the stage with a price of £158 per bottle (in-bond), making it the least expensive Carruades available on the market. The Wine Lister team felt the quality of Carruades saw a significant jump up in 2018, and from what we have heard, the 2019 matches it. With this in mind, and given that volume released onto the market is 50% less than last year, this is a sure buy for anyone seeking access to the Lafite prestige with more approachability.

The grand vin, Lafite 2019, has been released at £426 per bottle in-bond – a discount of c.20% on the 2018’s current market price. The crucial factor this year are the volumes available – also 50% less than last year. On top of this, the single tranche released means buyers will only have one shot to get their hands on the 2019 en primeur (as far as we know). Domaines Baron de Rothschild’s Commercial Director, Jean-Sébastien Philippe, calls Lafite a “modern classic” in 2019, with precision, length, and finesse, but impressive ripeness, making it more approachable than the likes of 2018 or 2016.

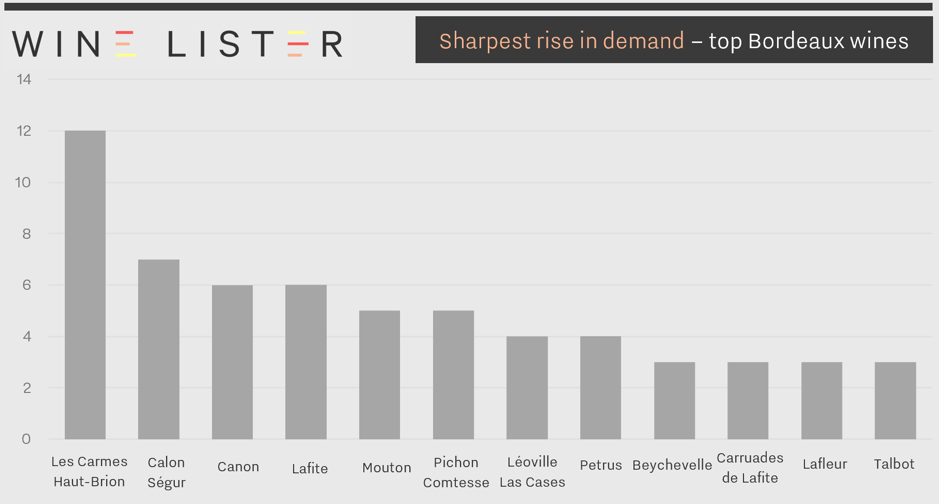

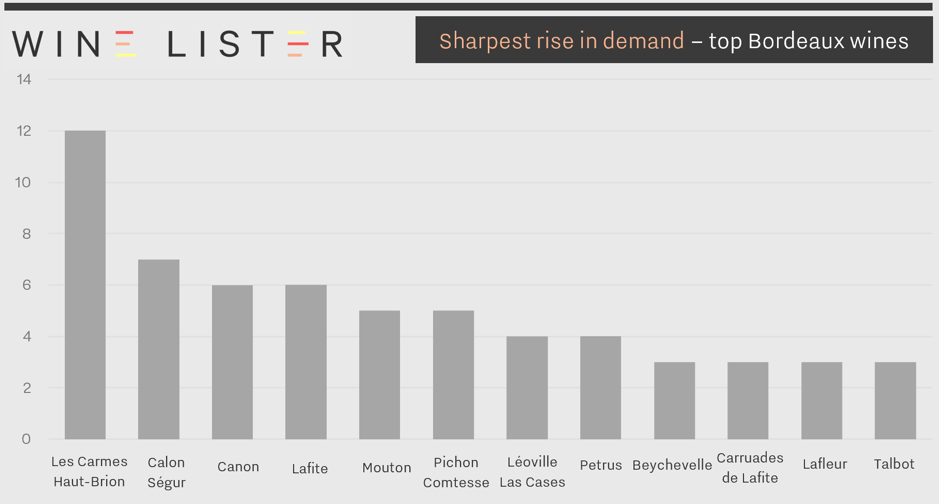

Both Lafite and Carruades were cited by the trade as seeing sharp rises in demand (see below) according to Wine Lister’s 2020 Founding Members’ survey. Competition to access both of these wines will therefore likely be high.

Lafite’s Pomerol property, L’Evangile, has released its 2019 grand vin at £146 per bottle in-bond, 15% below the current market price of the 2018. Once again, the Wine Lister team noticed a distinct quality step up in Evangile’s 2018, which we’ve heard has been equalled in 2019. The 2019 reportedly expresses well the move towards a more modern style, and a wine of increasing tension, florality, and freshness, without losing the plush Pomerol profile.

Duhart-Milon 2019 has also been released, at £52 per bottle in-bond. Though the release price puts it more or less in line with market prices of back vintages 2018 and 2016, there is justification to be found in the excellent quality that the Lafite team believe is there in 2019. Philippe explains that Duhart-Milon’s vines sit on a cooler terroir than those of the estate’s Pauillac neighbours, which means in cooler vintages, the wine can be somewhat “austere”. The increasing average temperatures that Bordeaux has seen during recent growing seasons (2018, 2016, and 2015 vintages) therefore only serve to improve the quality of Duhart-Milon, and 2019 certainly had its fair share of heat.

Keep up to date with further Bordeaux 2019 en primeur releases through Wine Lister’s twitter, or through our dedicated en primeur page.

This week has seen a flurry of further 2019 en primeur releases, including the likes of Palmer, Cos d’Estournel, and Domaine de Chevalier’s red and white.

Released this morning (Thursday 4th June) are wines from the Guinaudeau family, including one of the most in-demand wines from Bordeaux, Château Lafleur. Lafleur 2019 is available (for the lucky few who can get their hands on it) for c.£1,550 per 3 pack case in-bond – the same release price as in 2018. While this goes against the 30%-35% discount on last year’s prices that the trade believe may just make the 2019 campaign a success across the board, Lafleur is one of the few exceptions to this rule.

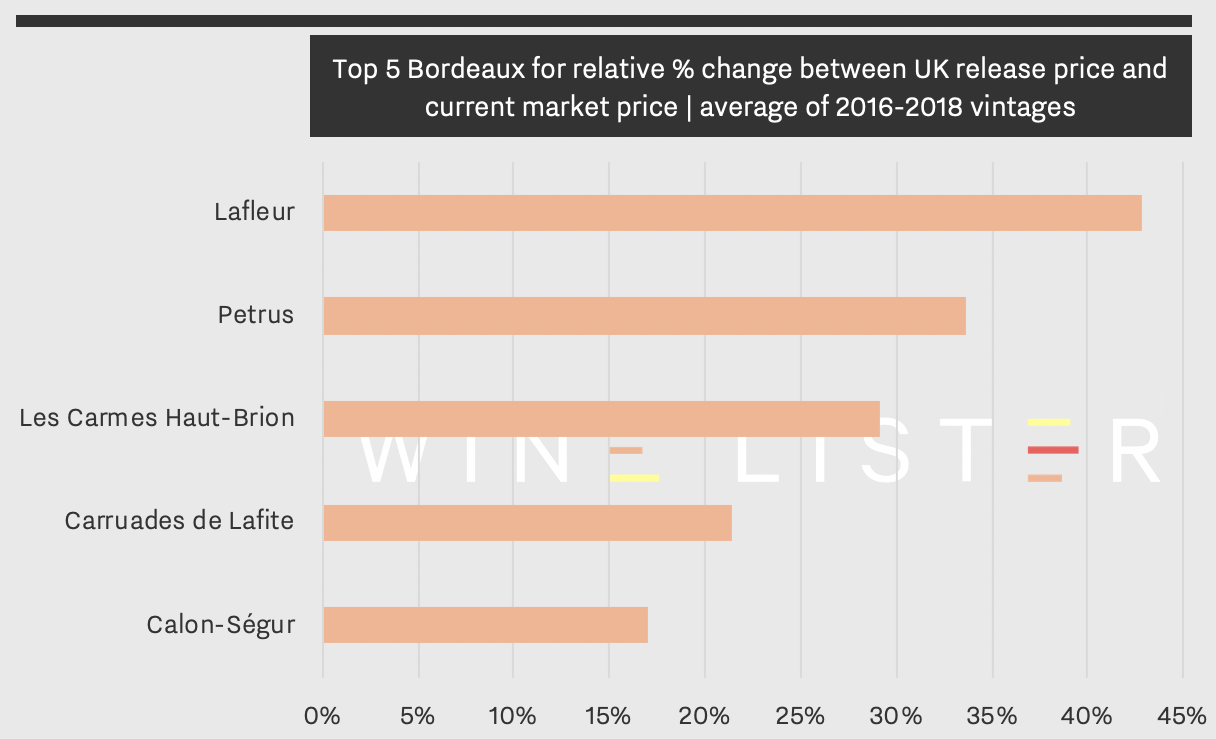

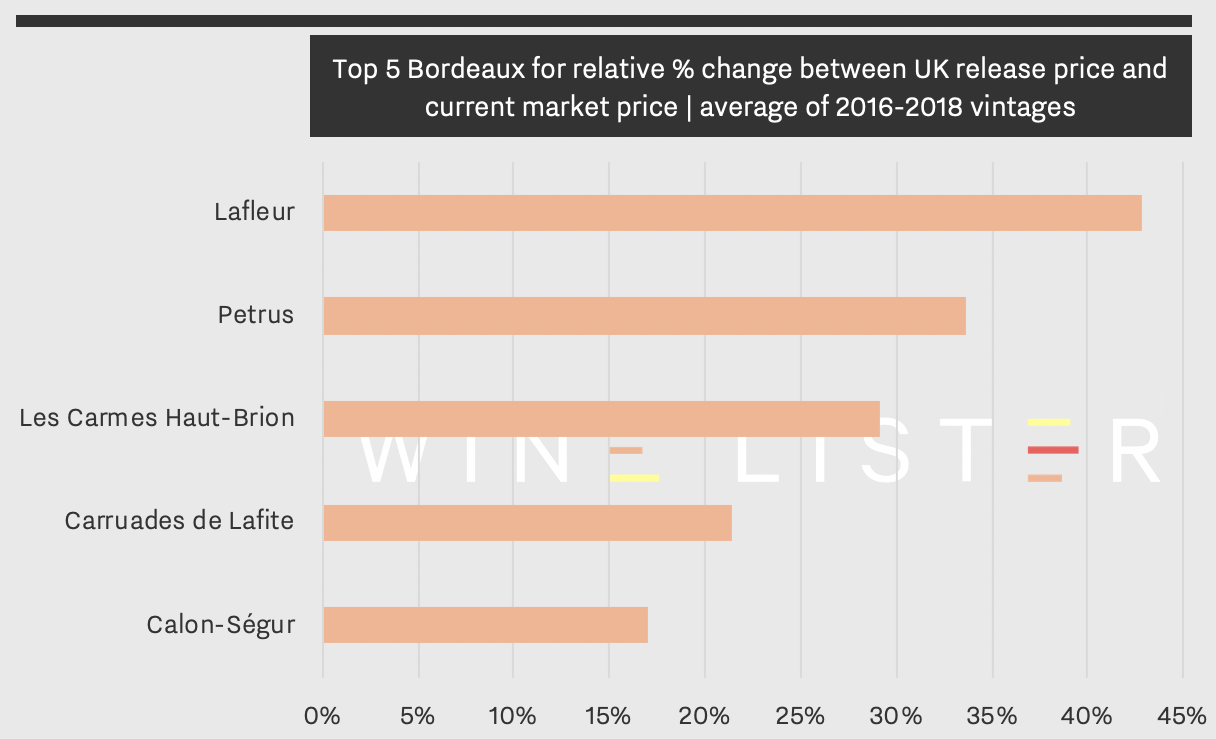

Aside from its impressive and consistent quality, Lafleur boasts one of the smallest-sized estates (4.5ha) for any top Bordeaux property. With rarity on its side, the grand vin is the number one performer for price appreciation after en primeur release.

The chart above shows the top five Bordeaux wines for average percentage increase of the last three vintages – 2018, 2017, and 2016, since their respective releases. The last three releases of Lafleur have seen an average market price increase to date of 43% – 9% more than Petrus.

Perhaps also contributing to the popularity of the Guinaudeau family’s wines is their more “Burgundian” approach to winemaking, with vineyards planted on three separate plots of very different soil types, and the final products aiming to reflect these differences.

For those unable to achieve the dizzy heights of an allocation of the grand vin, the estate’s Perrières de Lafleur (available for £256 per 6-pack in-bond for the just-released 2019 vintage) does exactly this, typically showing mineral, chalky notes from its limestone terroir. Perrières de Lafleur was officially “born” last year, after 15 years of research and testing under the wine’s beta pseudonym, “Acte”.

Finally, at the opposite end of the price spectrum to the flagship wine is Grand Village – the family’s Bordeaux Supérieur, whose quality has come on leaps and bounds over the last few vintages. Grand Village is a Value Pick in every single vintage listed on Wine Lister (2018-2013). If the 2019 is anywhere near the quality of last year, it will surely offer the same impressive quality-to-price ratio.

Follow Bordeaux 2019 en primeur releases through Wine Lister’s twitter, or through our dedicated en primeur page.

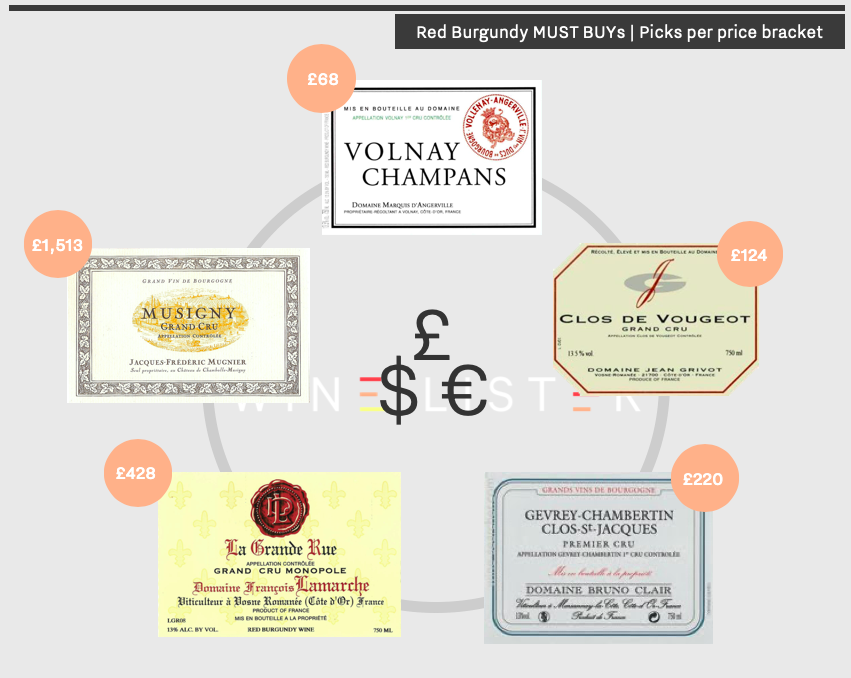

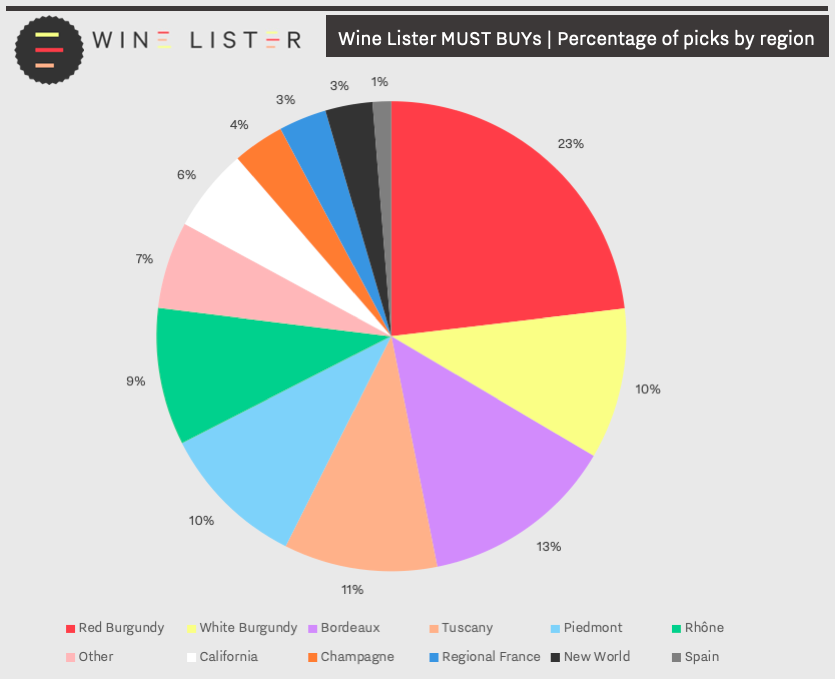

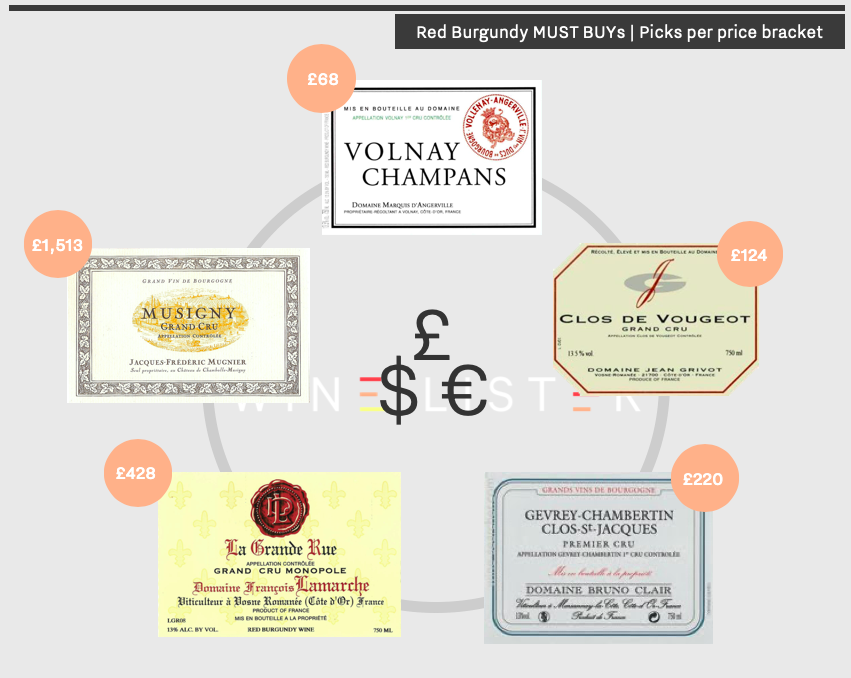

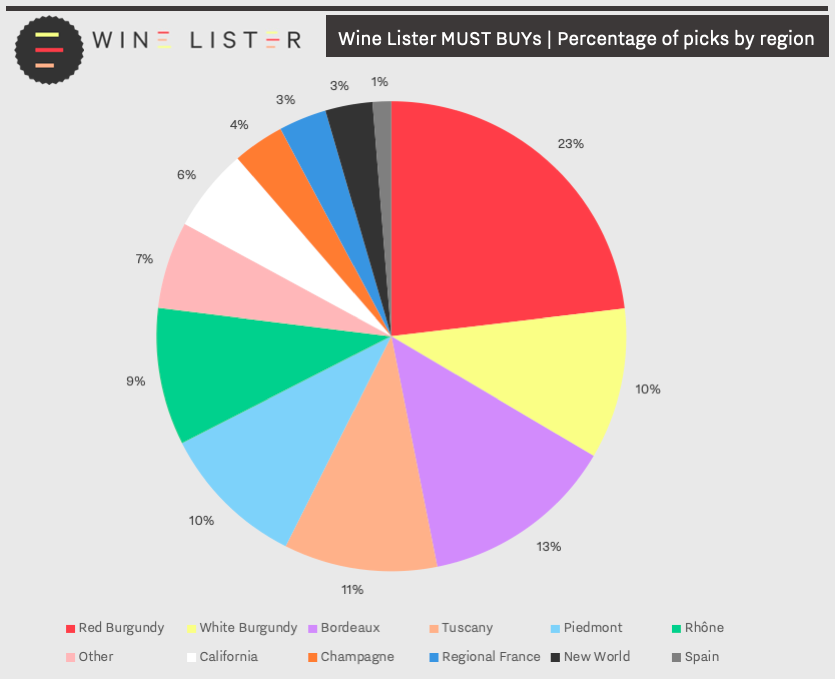

Following our recent investigation into white Burgundy at five different price points, we now turn to red Burgundy – which represents a considerable 23% of Wine Lister’s MUST BUY hoard (376 wines).

These wines cover an even greater range of prices than their white counterparts, from £51 (per bottle in-bond) up to £15,352. Read on below for our picks of red Burgundy MUST BUYs at five different price points.

Prices are shown per bottle in-bond (when buying by the case).

Prices are shown per bottle in-bond (when buying by the case).

Under £75 – 2012 Marquis d’Angerville Volnay Champans

Marquis d’Angerville is widely considered one of the top producers in the Côte de Beaune, and the reference producer in Volnay. Indeed, the domain’s vineyards represent over 10% of all Premier Cru Volnay plantings. D’Angerville’s Volnay Champans is less than half of the cost of its flagship Volnay wine, Clos des Ducs. While both vineyards have south-easterly exposure, Clos des Ducs has calcareous, stony, white marl soil, while the soil in Champans is more clay-driven. The Champans is thus richer and fuller, while the Clos des Ducs (which also enjoys the highest elevation in Volnay) has more complexity and definition. The 2012 Marquis d’Angerville Volnay Champans performs particularly well, achieving a WL Score of 94 – this wine can be purchased from BI Wines & Spirits for £66.67 (per bottle in bond).

Under £150 – 2014 Jean Grivot Clos de Vougeot

Having taken over from his father Jean in 1990, Étienne Grivot (alongside his wife Marielle) has since adjusted his family’s viticultural and vinification methods. While completing his studies in general agriculture, viticulture, and oenology, Étienne noted that the over-fertilised Burgundian soil had become gradually less capable of producing vins de terroir. As well as reducing his overall yields, he now uses organic farming methods and natural yeasts to preserve the expression of where the grapes come from. The 2014 Clos de Vougeot has a WL Score of 94, and was described by Jancis Robinson as having “massively nuanced fruit” – this vintage can be purchased by the bottle from Wilkinson Vintners for £124 (in bond).

Under £350 – 2015 Bruno Clair Gevrey-Chambertin Clos Saint-Jacques

Bruno Clair’s Clos Saint-Jacques Premier Cru plantings are situated within a 6.7ha vineyard (shared with Sylvie Esmonin, Louis Jadot, Fourrier, and Armand Rousseau) encircled by a two-metre wall. Providing protection from prevailing winds, this fortification creates a micro-climate, which, alongside its steep south-easterly facing slope, enables consistent ripening. The 2015 vintage achieves a WL Score of 95. Wine Lister partner critic, Neal Martin describes it thus: “a hint of dark chocolate emanates from the oak infusing the red and black fruit toward the finish, and touches of marmalade and blood orange linger on the aftertaste”. This vintage is available to purchase from Cru World Wine, where the price of a bottle starts at £355 (in bond).

Under £500 – 2010 François Lamarche La Grande Rue

Having been elevated to Grand Cru status in 1992, La Grande Rue provides the setting for François Lamarche’s most prized domain – from which only c.5,500 bottles are produced per year. As of the 2007 vintage, François’ daughter, Nicole, has had total control of the winemaking, and has implemented organic viticulture (certified in 2010), which she believes makes vines more resilient to biotic stress. Described by Jancis Robinson as exhibiting “lovely freshness yet concentration and subtlety too”, the 2010 vintage achieves Lamarche La Grande Rue’s highest WL Score since its 1964 vintage (96), and is available to purchase from Corney & Barrow, where prices start at £540 per bottle (in bond).

Over £500 – 2008 Jacques-Frédéric Mugnier Musigny

Jacques-Frédéric Mugnier maintains his aim of preserving the purest expression of nature within his wine, with minimal interference from technological practices in the vineyard or the cellar. His Musigny is widely considered to be one of the greatest Burgundy reds, and has been described by Wine Lister’s Burgundy specialist critic, Jasper Morris as “brilliantly fragrant in bouquet and notably persistent on the finish”. With a WL Score of 96, the 2008 Jacques-Frédéric Mugnier Musigny is more difficult to source than the preceding wines, however, it is worth informing your merchant of your interest in purchasing it.

In 2004, WL partner critic Jancis Robinson published an article, “Pink champagne – fashionable but too often dire”, whose title summarises the contemporaneous consensus surrounding rosé Champagne. Long-regarded by Champagne producers as a subsidiary wine – one without the required levels of attention placed on their primary project – its quality often fell short.

15 years later, in September 2019, Robinson conversely wrote a piece titled “Pink champagne – a serious wine now”, outlining the attentive methods of production, and the consequential calibre of rosé Champagne amongst its top producers.

This week’s blog post investigates the victorious return of rosé Champagne, as we examine the upward quality and price trends across 10 of its top brands when compared to their white counterparts.

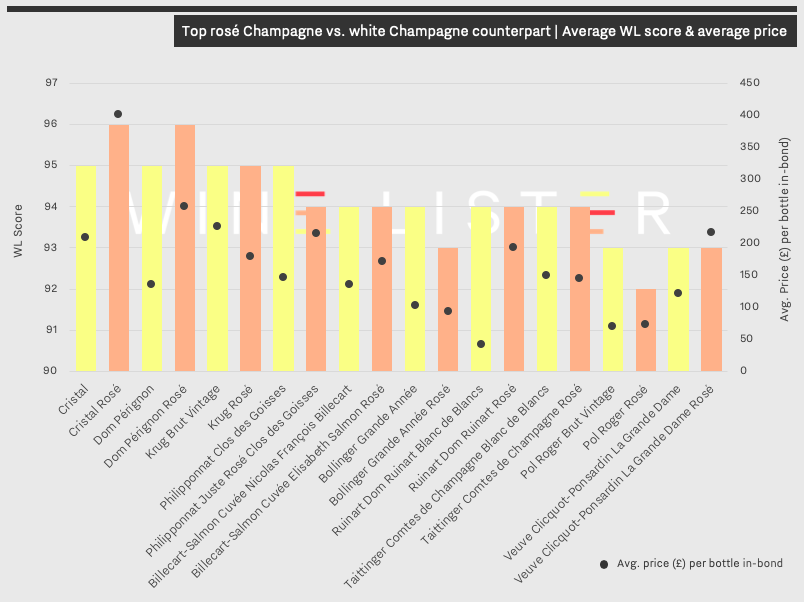

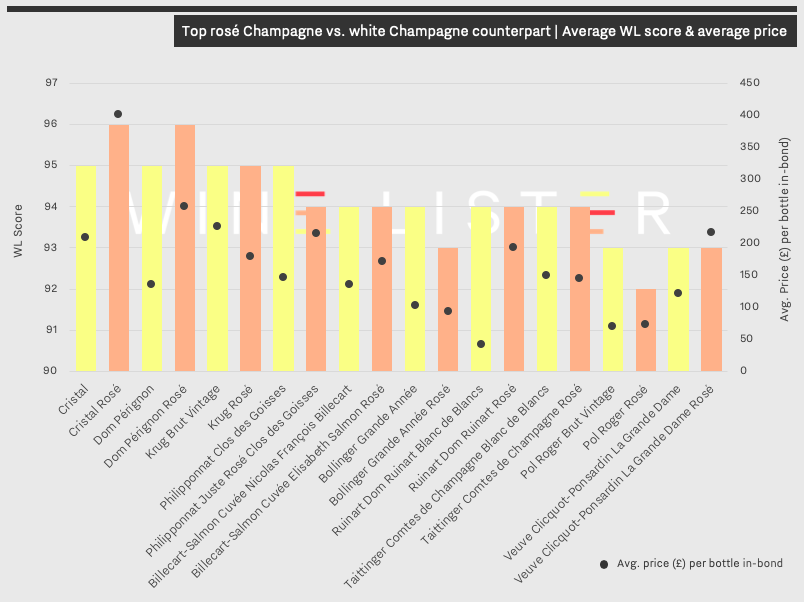

The chart above shows the average WL Score and average price for “pairs” of wines from 10 top rosé Champagne producers whose range includes a rosé.

An initial look at the selected wines reveals the recurrent pattern of rosé Champagnes costing more than their white counterparts, with the exception of Krug Rosé, Bollinger Grande Année Rosé, and Taittinger Comtes de Champagne Rosé. The mean price difference between the two styles of the respective wines is substantial nonetheless, with rosé Champagne costing 46% more on average than its white equivalent (an average of £195 for rosé and £134 for white).

Excluding Pol Roger’s Rosé and Bollinger’s Grande Année Rosé (whose white equivalents supersede them by one WL point), the rosé Champagnes featured above achieve equivalent or higher WL Scores than their white counterparts.

Cristal Rosé is a blend of 55% Pinot Noir and 45% Chardonnay grapes. With a WL Score of 96, at an average price of £401 (per bottle in-bond), this wine is almost double the price of Cristal, which has a WL Score of 95 at £203. Consequential of the generally lower yields of Pinot Noir in continental conditions, Cristal Rosé is Louis Roederer’s rarest and thus most expensive wine, produced solely in years when the grapes have attained perfect maturity.

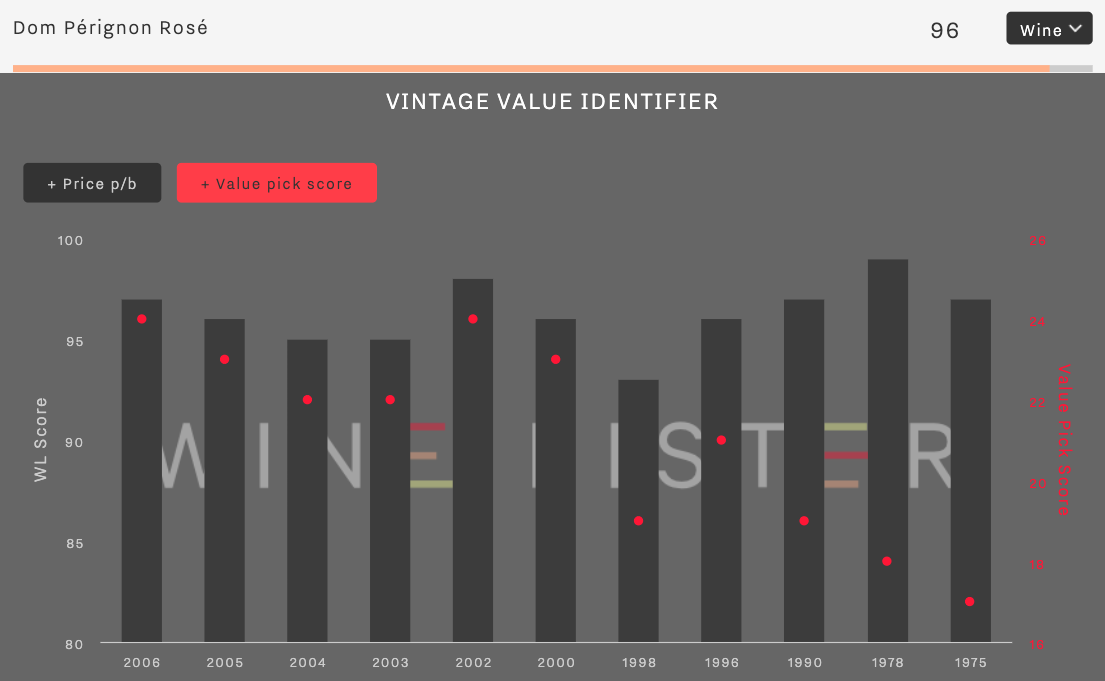

Similarly made in only exceptional vintages, Dom Pérignon Rosé is considered by its producer to characterise its growing year, hence the fluctuating ratio of Pinot Noir and Chardonnay grapes from vintage to vintage. With a WL Score of 96, at an average price of £277 (per bottle in-bond), Dom Pérignon Rosé is over double the price of its white counterpart. Dom Pérignon Vintage Brut has an average price of £131 and has one less WL Score point than its corresponding rosé wine.

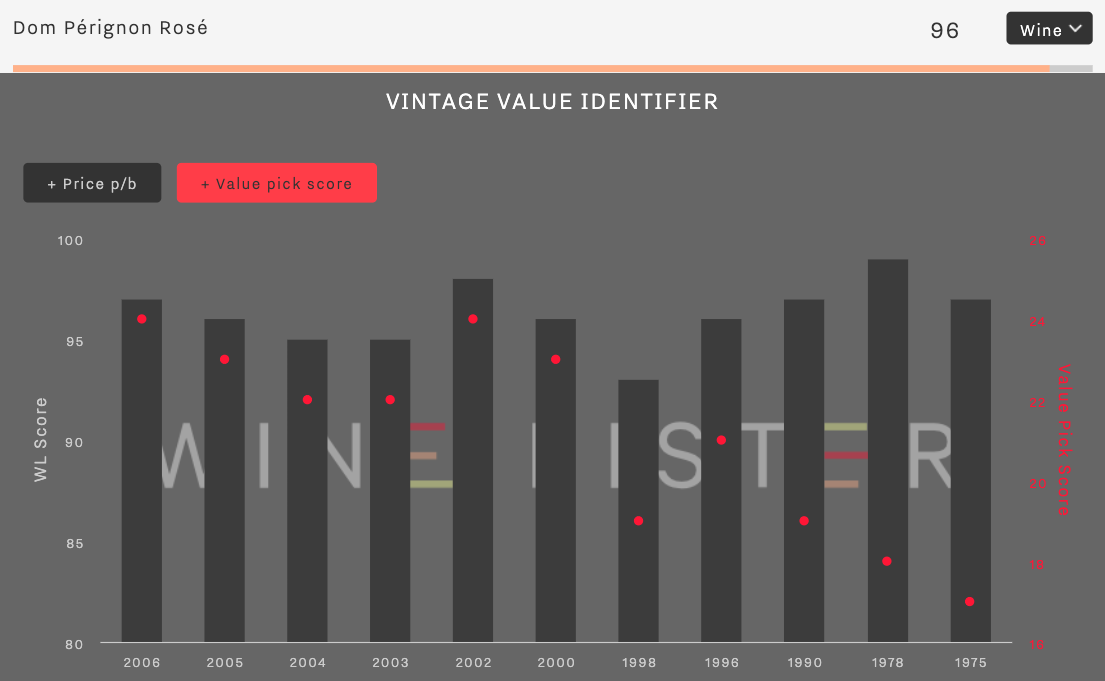

As indicated by its Vintage Value Identifier chart, the 2002 Dom Perignon Rosé exhibits significant quality and value, with a WL Score of 98. Jancis Robinson awarded this wine 20/20 (a rare occurrence), describing it as “pungent and composed with massive energy” – a far cry from her 2004 article. Rosé Champagne has most definitely made a comeback.

The 2002 Dom Pérignon Rosé can be purchased from Berry Bros & Rudd, where a case of three starts at £1,200 (in-bond).

An Easter weekend on lockdown presents as good a time as ever to evaluate your wine collection. While it can be tricky to keep track of what you’ve got and when you should drink it, Wine Lister’s various online tools allow detailed analysis of your collection and can guide future purchases, whether for drinking or investment.

This week’s blog post examines two of the most popular Wine Lister website features amongst collectors, starting with the MUST BUY recommendation tool.

Wine Lister’s proprietary recommendation algorithm produces a dynamic list of wines with high quality that show value within their respective vintages and appellations, helping wine lovers buying at almost every level to make the best choices for their desired region, style, or vintage.

There are currently 1,665 MUST BUYs out of the 30,000+ labels on Wine Lister. See the chart below for a breakdown of MUST BUYs by region – an indication of what a diverse portfolio could look like for the modern collector.

While the same chart from a decade ago may have been dominated by Bordeaux, the global demand and secondary market values for Burgundy’s top wines have continued to spiral upwards. Burgundy represents the greatest percentage of MUST BUY wines, with red and white recommendations accounting for 33% of all MUST BUYs collectively. The red Burgundian MUST BUYs feature a range of prices starting from the most expensive, DRC’s Romanée-Conti 2015 (available at £14,500 per bottle in-bond), down to 64 wines priced at £100 or under, including Stéphane Magnien’s Clos Saint-Denis 2010 (available at £76 per bottle).

Bordeaux represents 13% of MUST BUYS, and also encompasses a wide range of prices, from six vintages of Petrus (with an average price of £1,990 per bottle) down to two vintages of Marsau (priced at £12 and £13 respectively). Tuscany, Piedmont, and the Rhône follow closely behind, while California makes up the largest proportion of New world MUST BUYs.

With so much MUST BUY choice available, you may wish to filter these by top regions, and then further by Wine Lister Indicator. For example, filter results by ‘Investment staples’ to see wines that are long-lived (but not too old), and have proven wine price performance, while staying relatively stable and liquid.

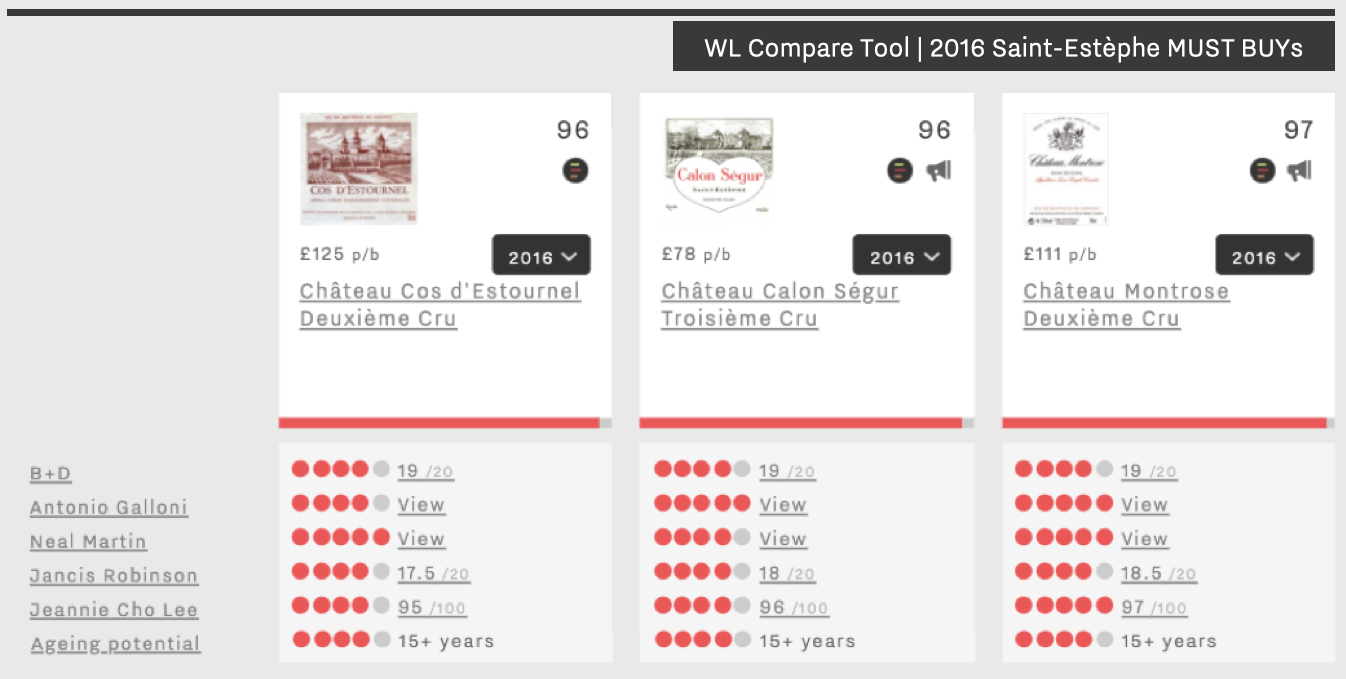

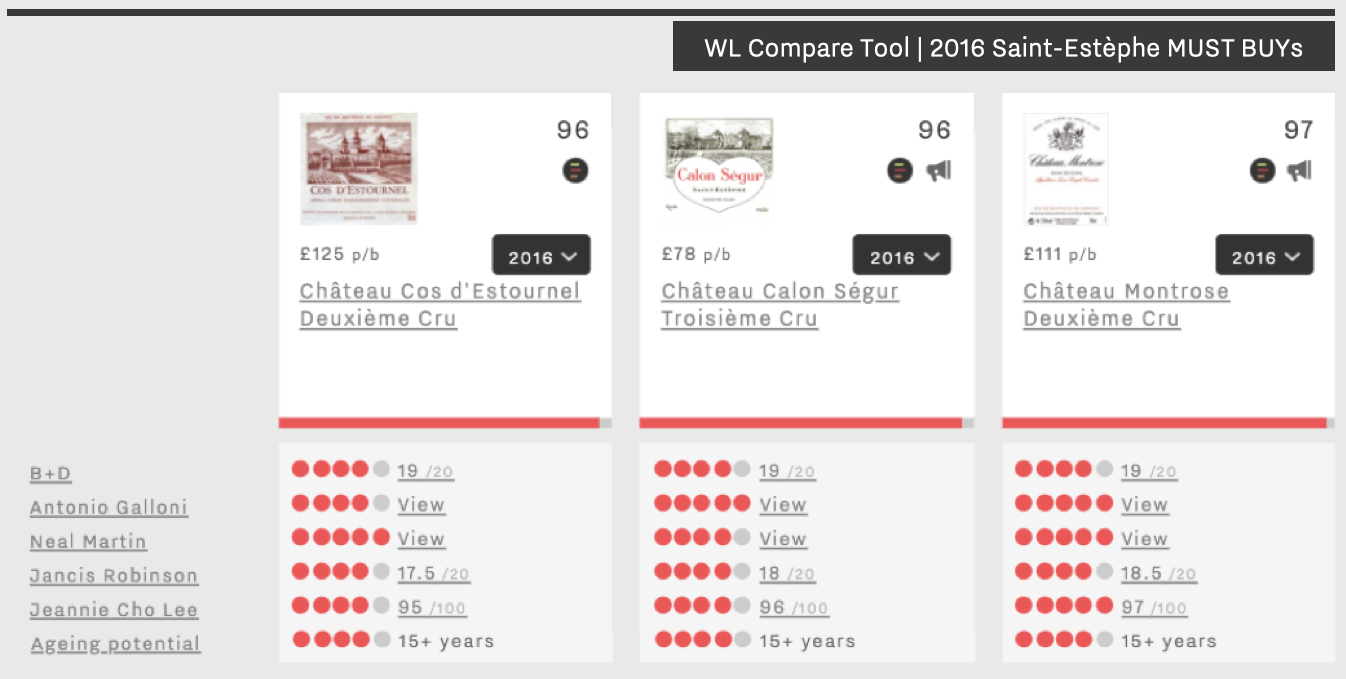

Wine Lister’s Compare tool can then further refine your investigation, by displaying your selected MUST BUYs side by side. This is illustrated below using three 2016 Saint-Estèphe MUST BUYs – Cos d’Estournel, Calon Ségur, and Montrose. While Calon Ségur appears to be the best value, Montrose has the highest scores from Wine Lister’s partner critics, and therefore the better WL score overall.

See the above comparison for yourself, or start your own wine comparison here.

Wine Lister is currently offering a range of portfolio analysis services to private clients, from detailed geographical split and further purchase advice, to investment forecasting and a fully-fledged “drink vs. sell” plan. If you are interested in having your wine collection analysed by our team of fine wine data experts, please don’t hesitate to contact us.

A new “normal” seems to be developing for Bordeaux.

After a fleeting trip around Bordeaux properties on both banks at the start of harvest, the Wine Lister team is excited to see the 2019 vintage take shape.

We must admit this was not our sentiment on the 23rd September, when, on arrival in a dreary, damp Bordeaux, our first thought went to the poor pickers, and of course to the grapes and potential spread of disease in such wet conditions.

Thankfully this worry was quickly cast aside – “the grapes are in an incredibly healthy state. For grape health, this has been a dream year”, said Château Dassault’s Valérie Befve. This, she further explained, was thanks to the combination of a good spring without too much humidity, budburst that was a little cold but without rain, and a dry summer that was hot without having placed too much water stress on the majority of the vines.

The summer heat wave and consequential drought, similar in timing and nature to 2018 (and to an extent, 2016), will likely result in another year where freshness and caution in extraction are key. Befve put this succinctly, noting that the “skin to juice ratio will require delicate management”. This theme, recurring in several of the last Bordeaux vintages, highlights the importance of careful handling in the cellars, and explains in part the purposeful movement towards a fresher, more approachable style, and away from big tannins and high alcohol that need time in bottle to soften.

Left: Sorting of the first Merlot grapes at Pichon Baron. Right: Pichon Baron now uses small vats on wheels to transport freshly-picked grapes into fermentation tanks, since they cause less breakage of grape skins than traditional pumps.

Comparable characteristics seem in play on the left bank too. At Pichon Baron we tasted some of the very first 2019 Merlot grapes, and though the berries are a little smaller than usual (because of the drought), they are in perfect health. Axa Millésimes’ Commercial Director Xavier Sanchez was quick to say that it was far too soon to speculate on quality levels, but that the very early analyses “resembled 2018 and 2016”.

Grapes of high sugar content will need to be vinified with caution in order to balance potentially high alcohol levels. The rain that has fallen in the past 10 days will likely be a welcome gift to the Cabernet Sauvignon from the “grands terroirs” on this front, the majority of which are set to be picked this week.

Sara Lecompte Cuvelier, Managing Director of Léoville Poyferré and Le Crock echoed the positive sentiment on the general quality of grapes for both her properties, in Saint-Julien as in Saint-Estèphe – “We’re hopeful it will be another beautiful vintage, for both quantity and quality this year”.

While successions of good years are by no means unusual for the bordelais, harvests following heatwaves are becoming a pattern. All that remains to be seen is how the winemakers of Bordeaux deal with this “new normal” in the cellar. We are looking forward to finding out next year!

Wine Lister’s first in-depth study of Burgundy published earlier this year was named “Mercury Rising” for a reason. With prices climbing more quickly than any other fine wine region, it is hard to consider the possibility of finding Burgundies of “reasonable value”. This week’s Listed blog brings you the top five Côte de Nuits by Quality score that won’t completely rupture the bank (or in other words, for under £200).

Dominique Laurent takes top spot this week with his Bonnes-Mares Vieilles Vignes, which has a Quality score of 954. Whilst this score sits comfortably amongst the highest of all Bonnes-Mares, the per bottle price of £174 does not – indeed, it is just under five times lower than the combined average price of the other eight best Bonnes-Mares on Wine Lister. Perhaps the lower price can, at least in part, be explained by its modest Brand score (531). For example, despite its Quality score sitting just one point higher, Georges Roumier’s Bonnes-Mares records a Brand score of 934, and is £1,046 more expensive.

In second place is Domaine Charlopin-Parizot’s Charmes Chambertin, with a Quality score of 944. Its high quality is not yet accompanied by an equal level of consumer recognition. With the lowest Brand score of the five (445) resulting from presence in only 2% of the world’s best restaurants and a search frequency ranking of 2,335 (of the c.4000 wines on Wine Lister), this Charmes Chambertin is a Hidden Gem (Wine Lister’s indicator that identifies under the radar wines that warrant discovery).

Domaine Jean Trapet Père et Fils’ Chambertin takes third place this week with a Quality score of 940 and just sneaking in under the £200 mark. While in third place for Quality, it has the highest overall Wine Lister score of the lot (906), thanks to its Brand (868) and Economics (896) scores. Indeed, it beats the combined average scores of the other four wines in this week’s top five in both categories by 310 and 319 points respectively.

The remaining two spots are taken by Domaine Arlaud Clos de la Roche, and Pierre Damoy Chambertin, each with a Quality score of 932. In addition to being by far the cheapest option of this week’s top five (£98 per bottle on average), Arlaud Clos de la Roche’s price is also the most stable, with volatility of just 5.7%. Conversely Damoy Chambertin’s price is the most volatile (8.7%), possibly the result of strong growth rates over both the long and short-term, having recorded a three-year compound annual growth rate of 15.6% and having added 6.5% to its price over the past six months alone.

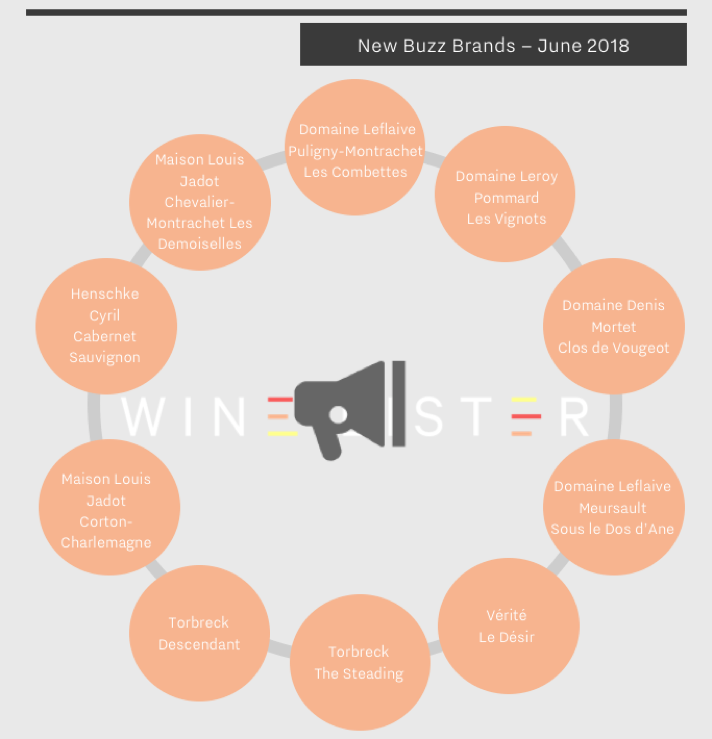

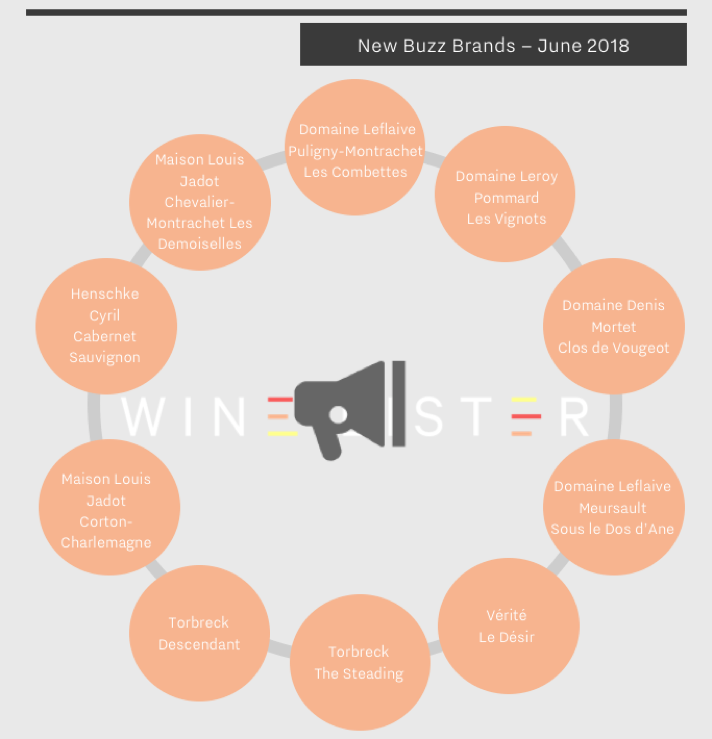

Despite the annual bustle of the en primeur campaign, it is healthy to breathe some non-Bordeaux air once in a while. With Bordeaux 2017 behind us, we examine new Buzz Brands for June from contrasting locations – Burgundy and the New World. One of four Wine Lister Indicators, ‘Buzz Brands’ use Wine Lister’s bespoke algorithms to indicate trending wines found in the highest number of the world’s best restaurants, and with high online search frequency.

This month, 10 new wines have made the Buzz Brand cut, as shown in the image below.

Six Burgundian wines (four whites and two reds) become Buzz Brands in June. This aligns with results of our latest Founding Members’ survey, where Burgundy producers earned the most number of votes (50) from key members of the global fine wine trade as most likely to see the largest brand gains in the next two years.

Louis Jadot and Domaine Leflaive both have two new white Buzz Brand references. Jadot’s Chevalier-Montrachet Les Demoiselles and Corton-Charlemagne have the highest Quality scores of this month’s Buzz Brand additions – 951 and 925 respectively. Domaine Leflaive proves its popularity with presence of its Puligny-Montrachet les Combettes and/or Meursault Sous le Dos d’Ane in 28 out of c.150 of the world’s best restaurants, and votes from the trade as a consistent seller (see p.23 of Wine Lister’s Bordeaux market study 2018 for more).

Of the red Burgundian Buzz Brands, the popularity of Domaine Leroy’s Pommard Les Vignots is perhaps unsurprising, given the producer’s renown, and the wine’s relative affordability (£505 per bottle) compared with Leroy’s more expensive offerings, such as its Musigny Grand Cru (£8,365 per bottle). Denis Mortet’s Clos de Vougeot is the only Côte de Nuits to feature in this month’s Buzz Brand additions.

The remaining four wines all hail from the New World – three from South Australia, and one from California. The latter, Vérité’s Le Désir, wins on all fronts with the highest Quality (949), Brand (740), and Economics (603) scores. The Quality comparison is hardly fair, given Le Désir’s price of £233, over four times higher the average of the three Australian representatives. Torbreck’s The Steading and the Descendant combined are present in 15 of the world’s best restaurants. Henschke’s Cyril Cabernet Sauvignon joins its pricier and better-known siblings, Hill of Grace Shiraz and Mount Edelstone Shiraz, as the producer’s third Buzz Brand.

You can see a full list of Wine Lister Buzz Brands here

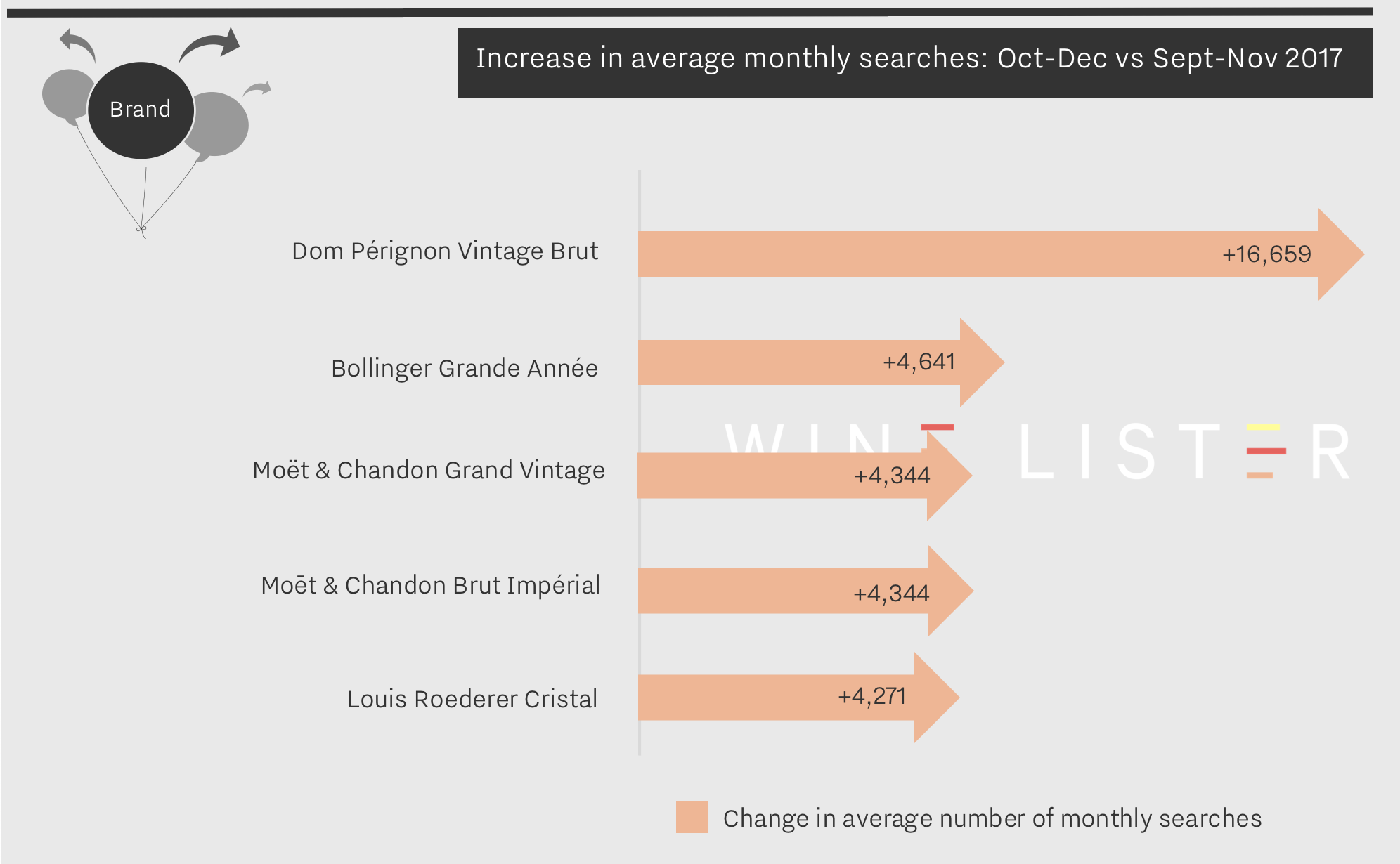

After a distinctly Burgundian start to 2018, we are ringing the changes this week to look at some of our most improved Brand scores, with Champagne dominating.

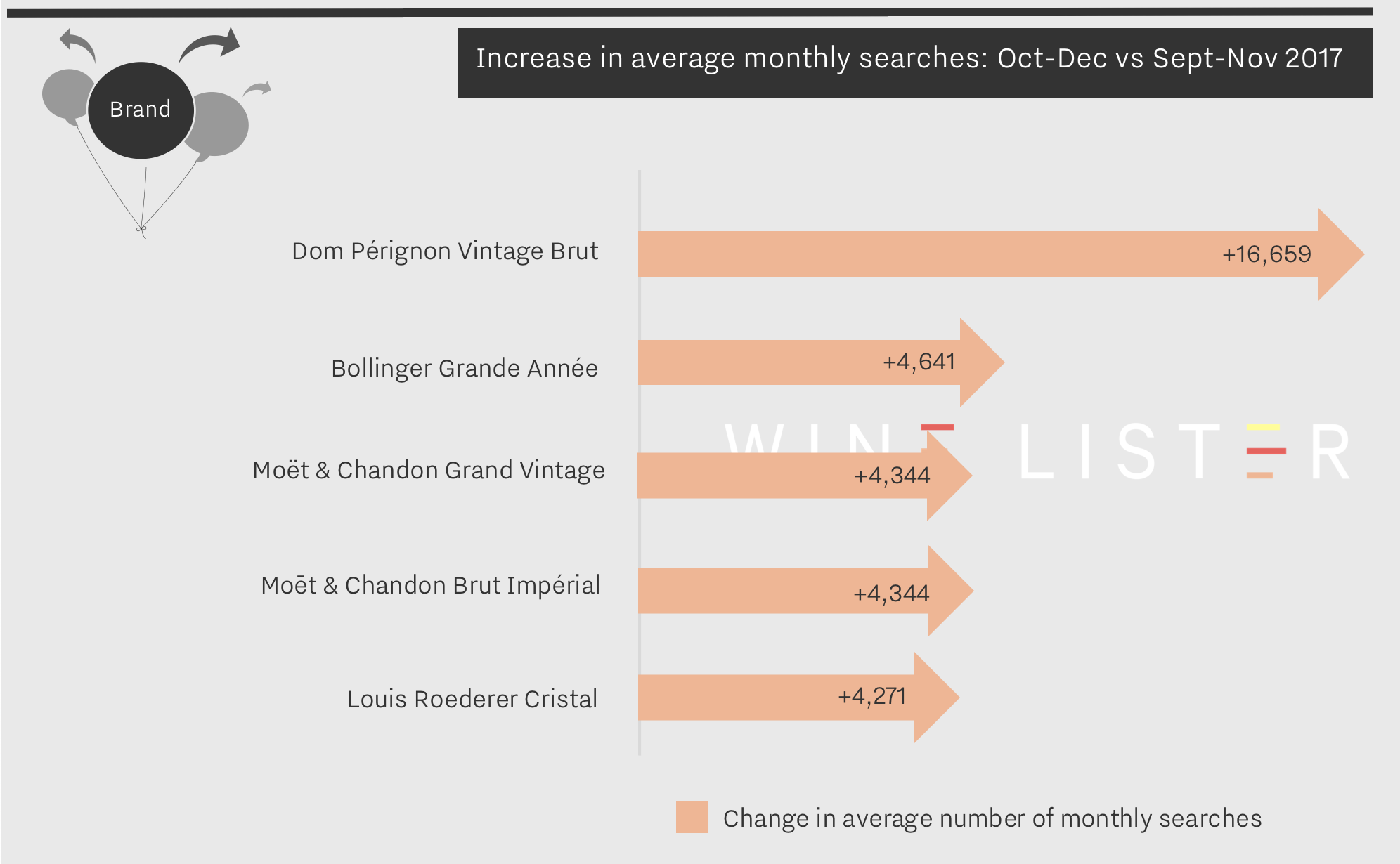

Alongside presence in the world’s best restaurants, Wine Lister’s Brand score measures a wine’s online popularity – as indicated by the number of searches received on Wine Searcher – as a marker of real consumer demand.

The search frequency data for December is in, and it is no surprise that searches in Champagne increased significantly leading up to the Christmas period.

During arguably the busiest period of the year for searching and purchasing wines, these five wines gained between 20% and 77% increase in search frequency. The appearance of Dom Pérignon Vintage Brut at the top of search frequency lists is a shock to no one considering its position as one of the most searched-for wines of all time. Indeed, it consistently held the number one search spot from July to September last year. The Christmas influence still managed to add 16,659 online searches, allowing this almighty brand to achieve Wine Lister’s first ever perfect Brand score (1000)!

Next on the list is Bollinger Grande Année. Its impressive 77% increase in search frequency at the end of last year can also be attributed to the festive season, but may also have been boosted by the release of the 2007 vintage earlier in the year. Bollinger’s new Brand score is up 16 points on the previous quarter at 975.

Our next two appearances hail from the same owner as the first, Champagne divinity LVMH. Moët & Chandon, often considered the definitive Champagne brand holds not one, but two spots in the top five most searched for wines of the last three months. Moët & Chandon Grand Vintage is perhaps a classic Christmas choice, but the appearance of a non-vintage cuvee, the Moët & Chandon Brut Impérial is testament to the power of the Moët & Chandon brand. Each earned an increase in search frequency of 33%, bringing Brand scores to 987 and 938 respectively.

Last but not least, Louis Roederer Cristal takes fifth place with a search frequency increase of 20%. While achieving a fractional increase in searches (4,271) compared with Dom Pérignon, its presence in 54% of restaurants and consistent high quality (Quality score 970) makes Cristal an all-round achiever, and therefore a choice that’s not just for Christmas.

Champagne’s Brand prowess is clear, but these five are the shining stars of their region. It is interesting to note that the sixth most searched-for wine on our most recent list is in fact not a Champagne at all, but Château Margaux (Brand score 998).

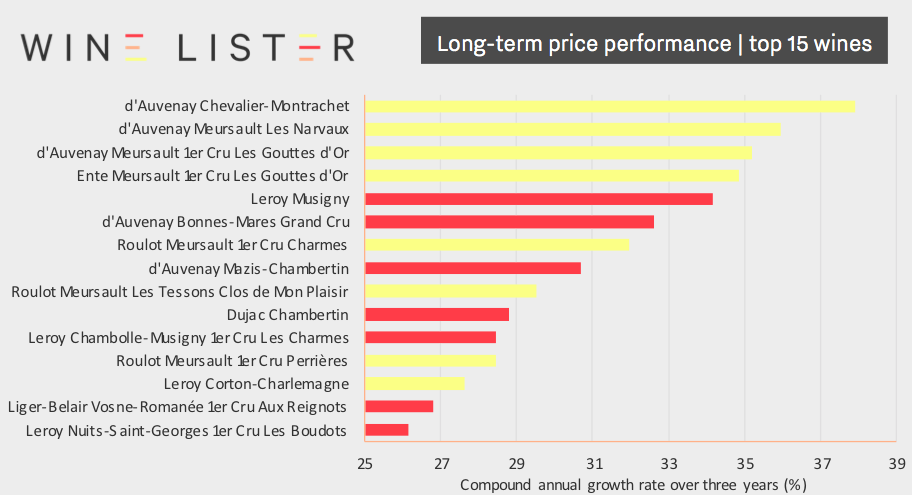

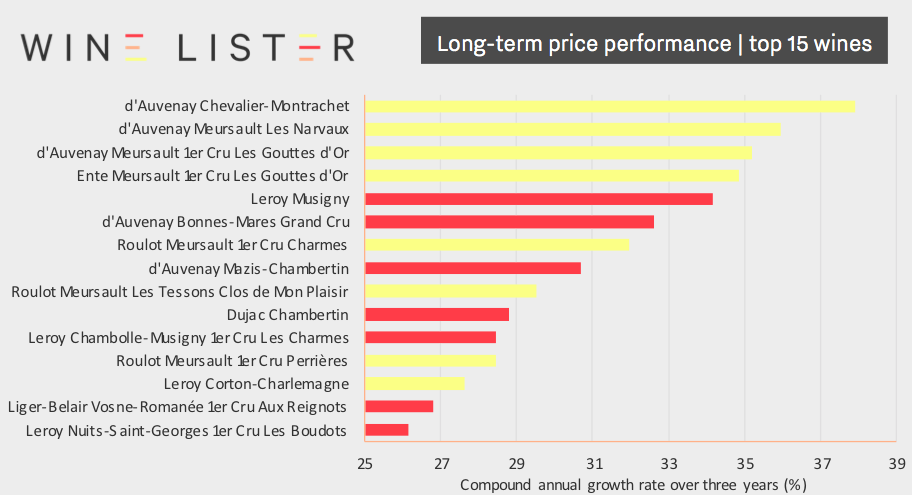

Our most recent market study is out, this time analysing 175 of Burgundy’s finest wines. Last week’s blog gave an overview of the study’s key findings. This week we take a deeper look into one of the upward trends, exploring some of Burgundy’s best price performers.

While it is impossible to argue the position of Domaine de la Romanée-Conti at the top of the Quality and Brand leaderboards, a greater mix of producers excel in long-term price performance. Lalou-Bize Leroy’s Domaine d’Auvenay is a frequent and expected feature within the top price performers, but the list is not without surprises.

Arnaud Ente, while well known by those in the trade, is a quieter name in the global wine world. What Ente lacks in brand presence he makes up for in exceptional quality. Vines, notably his enviable Meursault plots, tend to be harvested late, giving wines their signature opulence. With a Quality score of 909 and a 3-year compound annual growth rate (CAGR) of 34%, Ente’s Meursault Les Gouttes d’Or is one of the best performing whites in Burgundy and the best 5-year price performer.

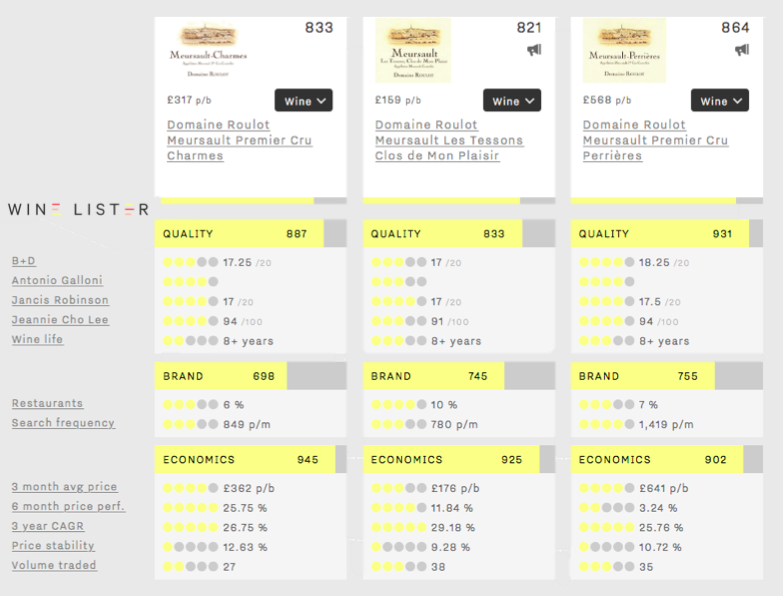

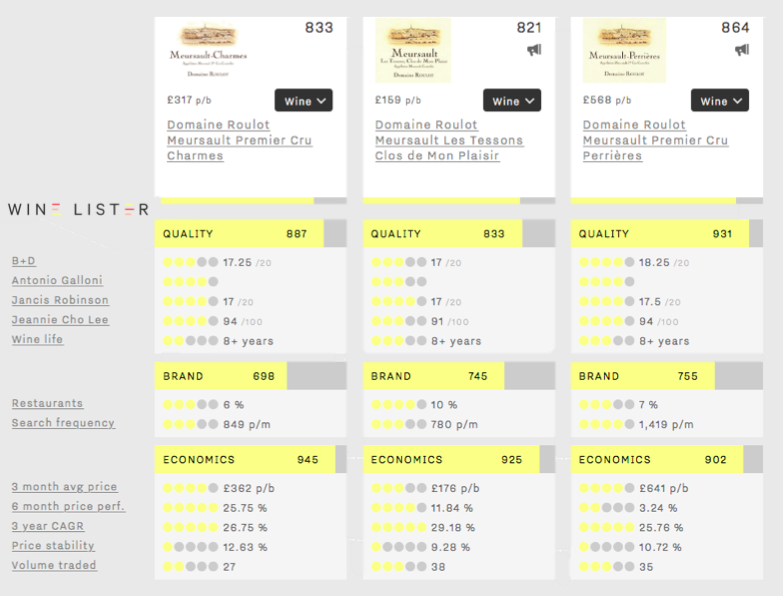

The Meursault village as a whole steals the show on price performance, accounting for 6 of the top 10 wines in the Economics score-criterion. Domaine Roulot, another producer flying slightly under the radar of Burgundy’s biggest brands also demonstrates strong long-term price performance across all three of their Meursault cuvées.

Meursault is not the only white village on the up. According to our Founding Members’ survey, which accompanies the Burgundy market study, the popularity of Saint-Aubin is increasing. Whether searching for the highest quality or the best value, it seems the white vineyards of Burgundy are the places to be this year.

You can read about more Burgundy trends in the full Burgundy market study by subscribing here. Alternatively, a preview of the first 15 pages is available here.