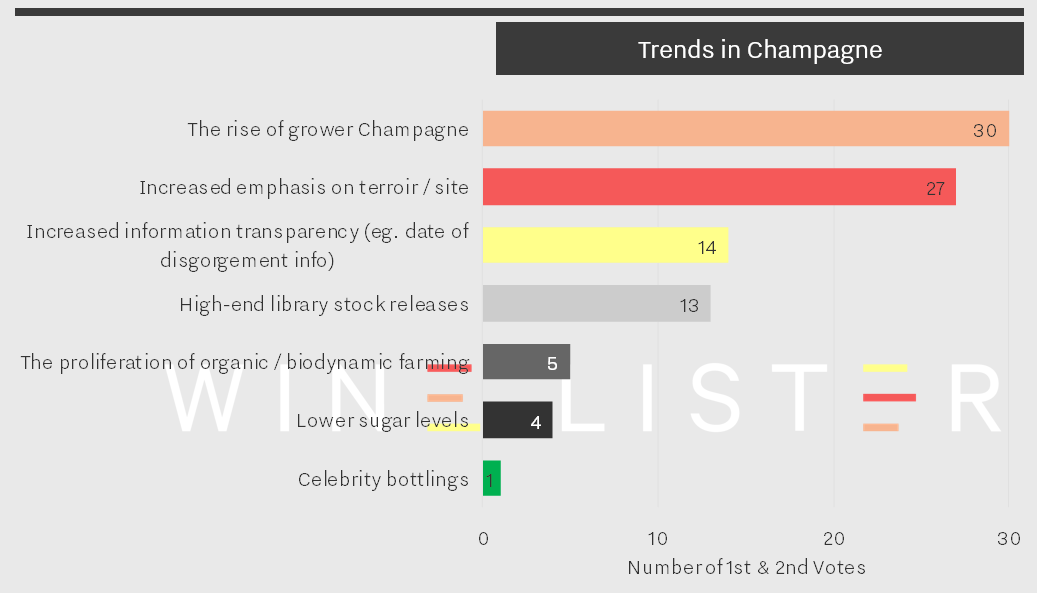

At the beginning of this new year, Wine Lister is prolonging the festive sparkle through a look at the major trends to emerge from our first Champagne report. Wine Lister’s Champagne study analyses a basket of 109 top wines from the world’s premier sparkling region, and includes insight into the major trends of the Champagne market as identified by Wine Lister Founding Members (c.50 key players in the international fine wine trade).

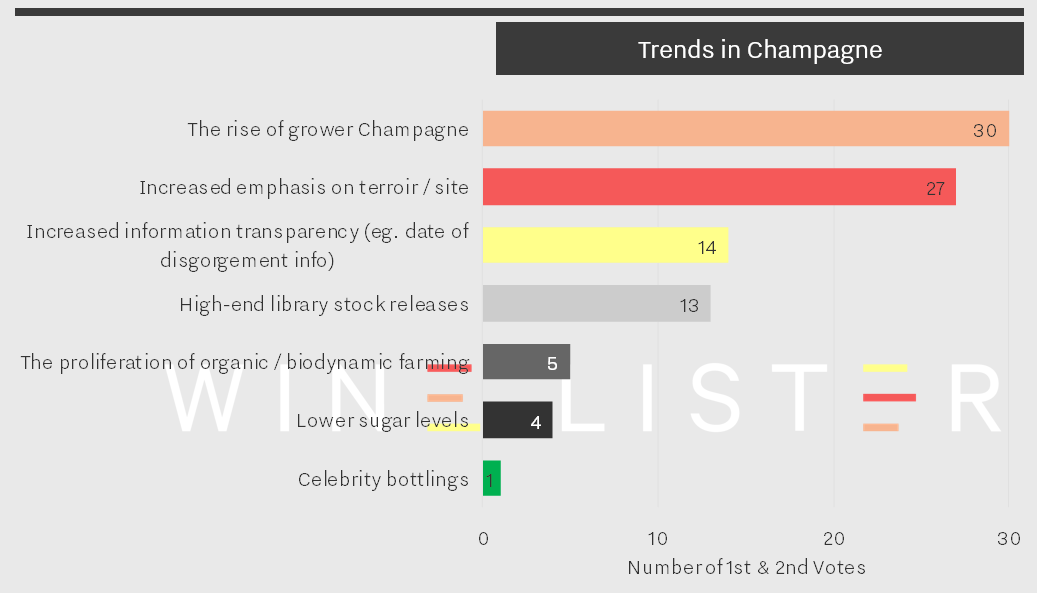

While quality across the board is something to keep us celebrating well in to 2019 (see more on this here), the notable trends could indicate an increase in year-round enjoyment of Champagne. The chart below shows responses to our question, “What are the most important trends in Champagne?” by number of votes.

The trend most-frequently ranked as number one or two by Wine Lister Founding Members was the rise of grower Champagnes, closely followed by the increased emphasis on terroir / site Champagnes. One U.K. merchant remarked that “Consumers are now identifying with specific terroir in Champagne and understanding the value of the grower…” – a comment that further leads us to suspect an increased appreciation of Champagnes as wines, and not just celebratory bubbles.

The “rise of the grower” trend is, however, juxtaposed by continued demand for big brands. Of the basket of wines treated in the study, the grower Champagne segment has seen an increase in popularity (measured by search rank) of 9% since the beginning of 2017. Though this performance is superior to the maison segment’s slight decline in popularity (-4%), grower Champagnes still sit twice as far down the popularity rankings, with an average search rank of 1,620 compared to 775.

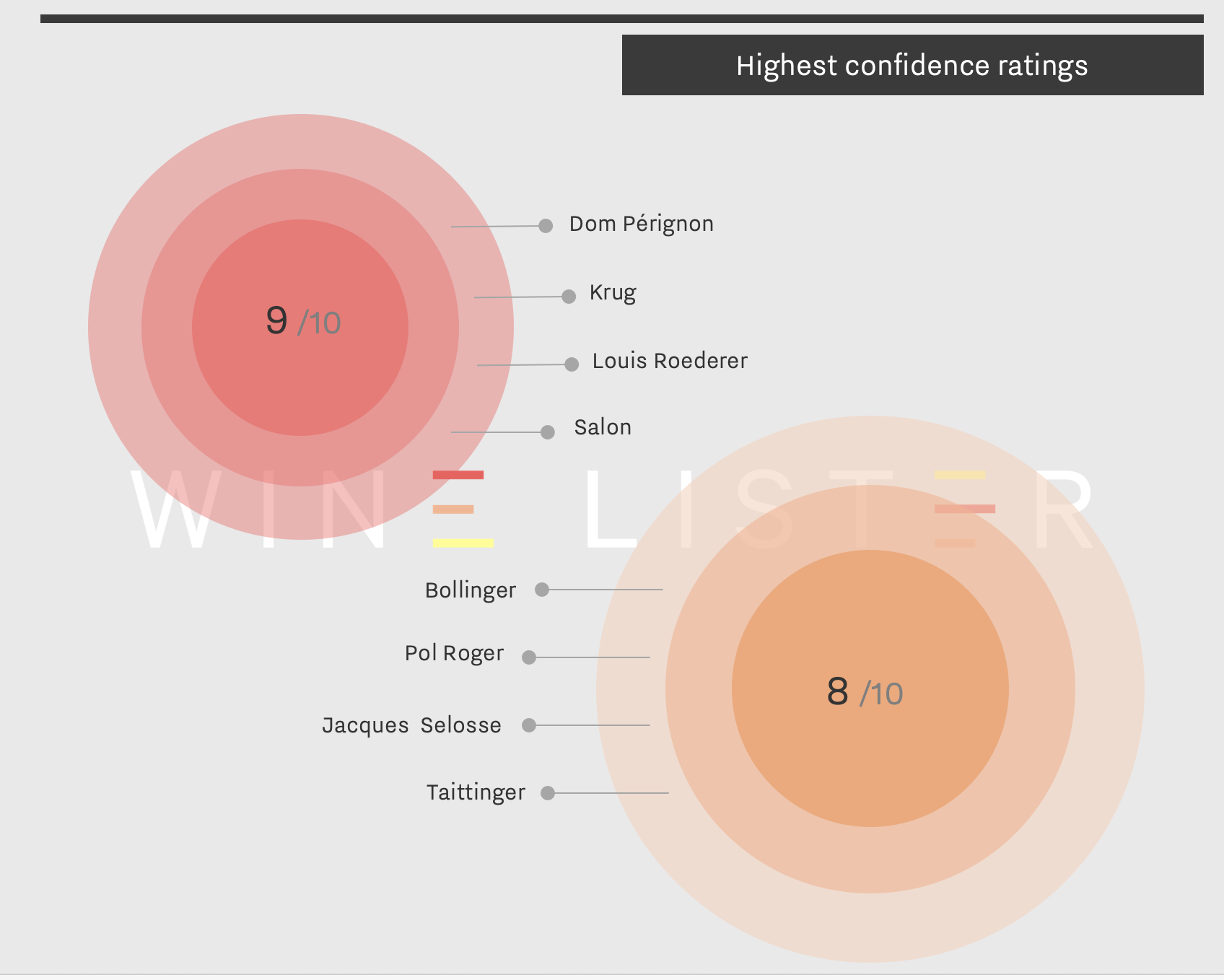

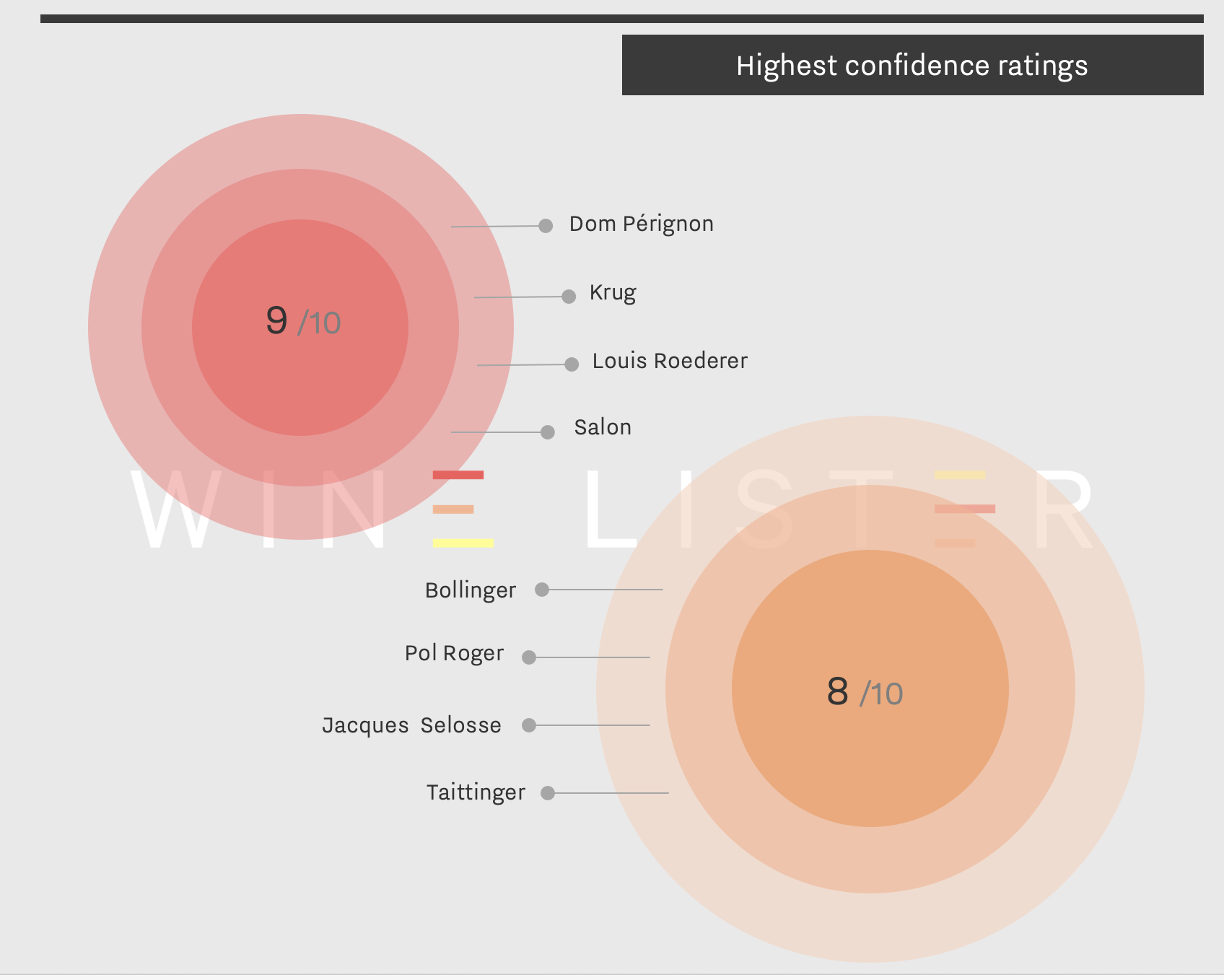

Perhaps predictably, big brands still win the race when it comes down to the bottom line. A U.K. merchant commented, “Small growers are getting much better press, but I suspect the big name cuvées still rule the roost for sales/investment”. Indeed, when asked to award confidence ratings to specific Champagne producers, the trade cited only one grower champagne within the top two confidence scores (9/10 and 8/10), Jacques Selosse. The houses to earn top confidence ratings were Dom Pérignon, Krug, Louis Roederer, Salon, Bollinger, Pol Roger, and Taittinger, as shown on the chart below.

A top tier merchant offers some explanation into the difference in picture painted between the top Champagne trend and Champagne confidence ratings: “Production needs to be small but not so small as to result in a proliferation of Champagnes which the vast majority have never heard of. The big brands which produce great quality are still finding serious demand in the market!”

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

Wine Lister’s Founding Members’ tasting (the second if its kind) was held last week in the most beautiful surroundings at Ten Trinity Square Private Club. Aside from showcasing how Wine Lister data relates to the actual liquid in the bottle, these tastings are an opportunity to thank friends and supporters of Wine Lister, from subscribers to Founding Members.

We were excited to share news of upcoming developments with our guests, including the imminent expansion of Wine Lister’s coverage (almost doubling from the current 20,000 wines scored), as well as the addition of a new rating criterion. Watch this space!

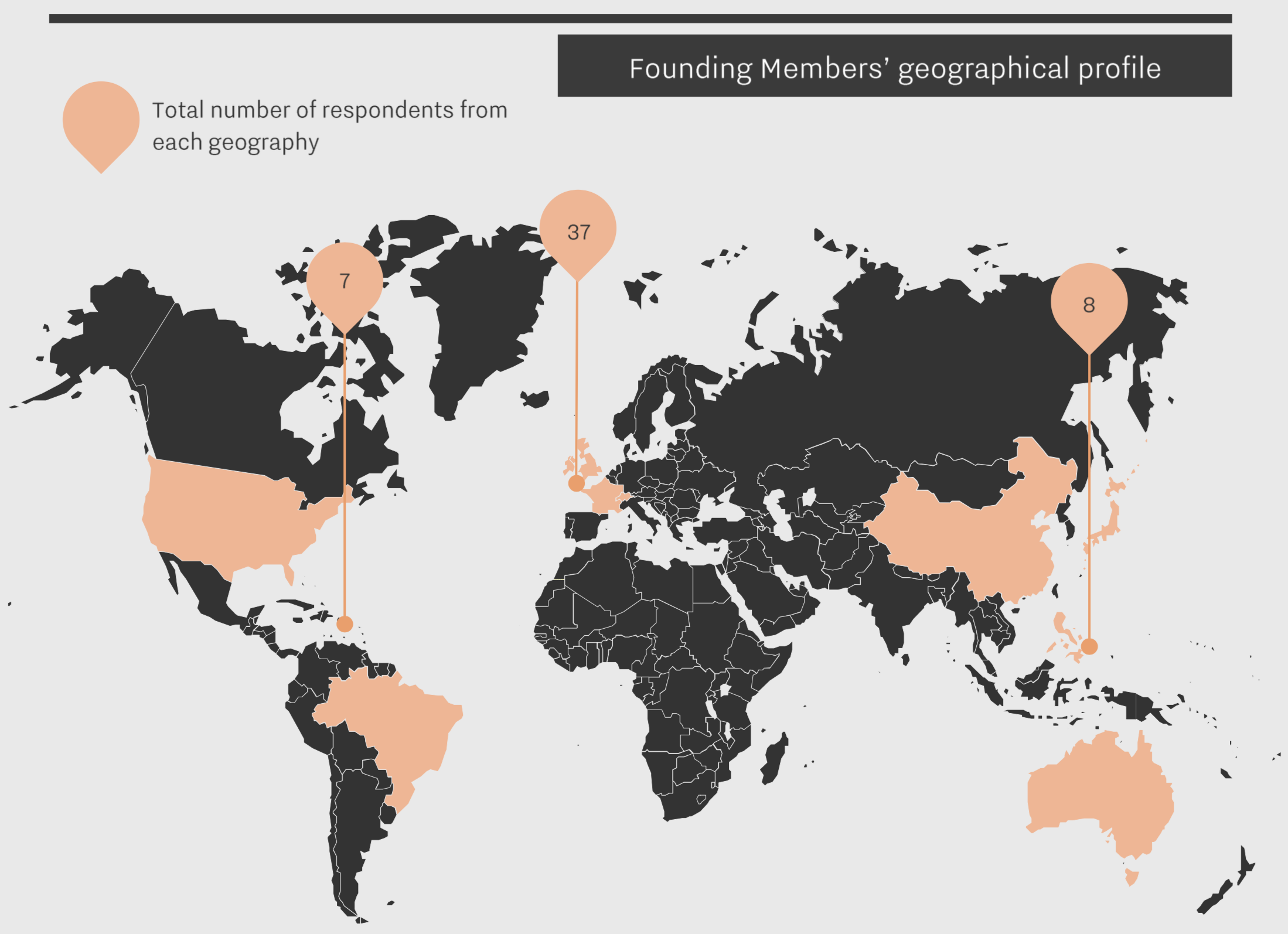

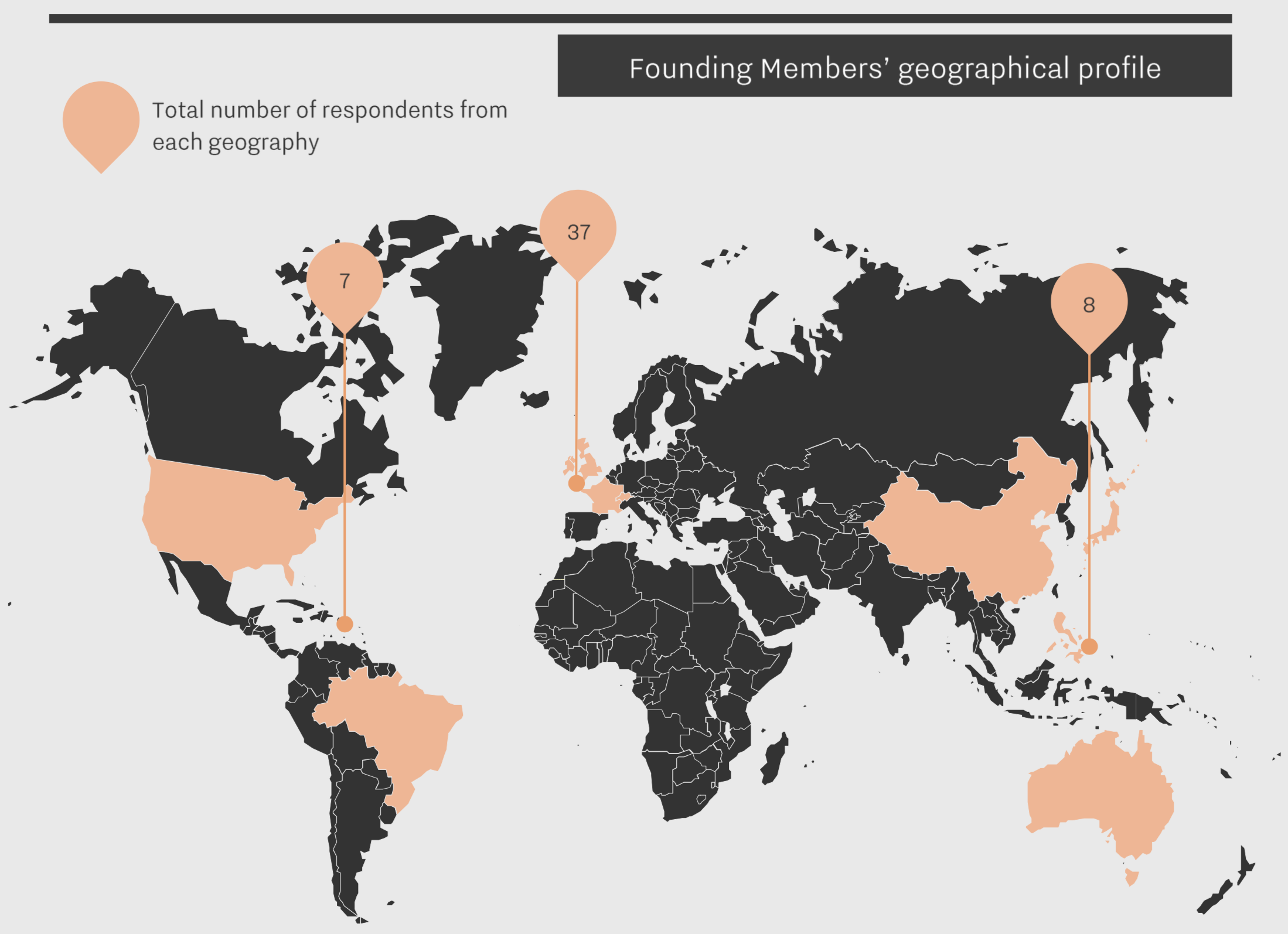

Wine Lister’s Founding Members, more than 50 major players in the international wine trade, make an invaluable contribution to Wine Lister’s research by sharing their market insights with us on a biannual basis. It is Wine Lister’s role as a fine wine intelligence agency to combine this qualitative information with quantitative data to shed analytical light on fine wines from across the world, for example in our regional reports and factsheets.

In one recent trade survey we asked Founding Members the question, “Which wines do you consider hidden gems (wines you rate highly but which are under-appreciated)?”. The responses inspired the wonderfully varied (but consistently delicious) selection of 24 hidden gems tasted last Thursday (see the full list of wines below).

From left to right: Antoine Forterre, Ella Lister, Giles Cooper, Henry Donne, Pascal Kuzniewski, Pierre-Marie Boury, Anthony Vertadier Mabille, Gareth Kristensen, Sara Guiducci.

In an illustration of how Wine Lister brings together market research with hard data, the “raw” hidden gems selected by our Founding Members are then overlaid with critics’ ratings, restaurant presence, and search frequency data. This gives us the final Hidden Gems presented on the Wine Lister website. In other words, Hidden Gems are wines that are rarely found in top restaurants, and not often searched for online, but which receive high ratings from our partner critics, and have been singled out by our Founding Members as not garnering due attention.

The Founding Members’ “raw” hidden gems featured several Bordeaux wines, including 10 out of the 24 wines shown in the tasting. However, none of these achieve final Hidden Gem status due to their already established brands.

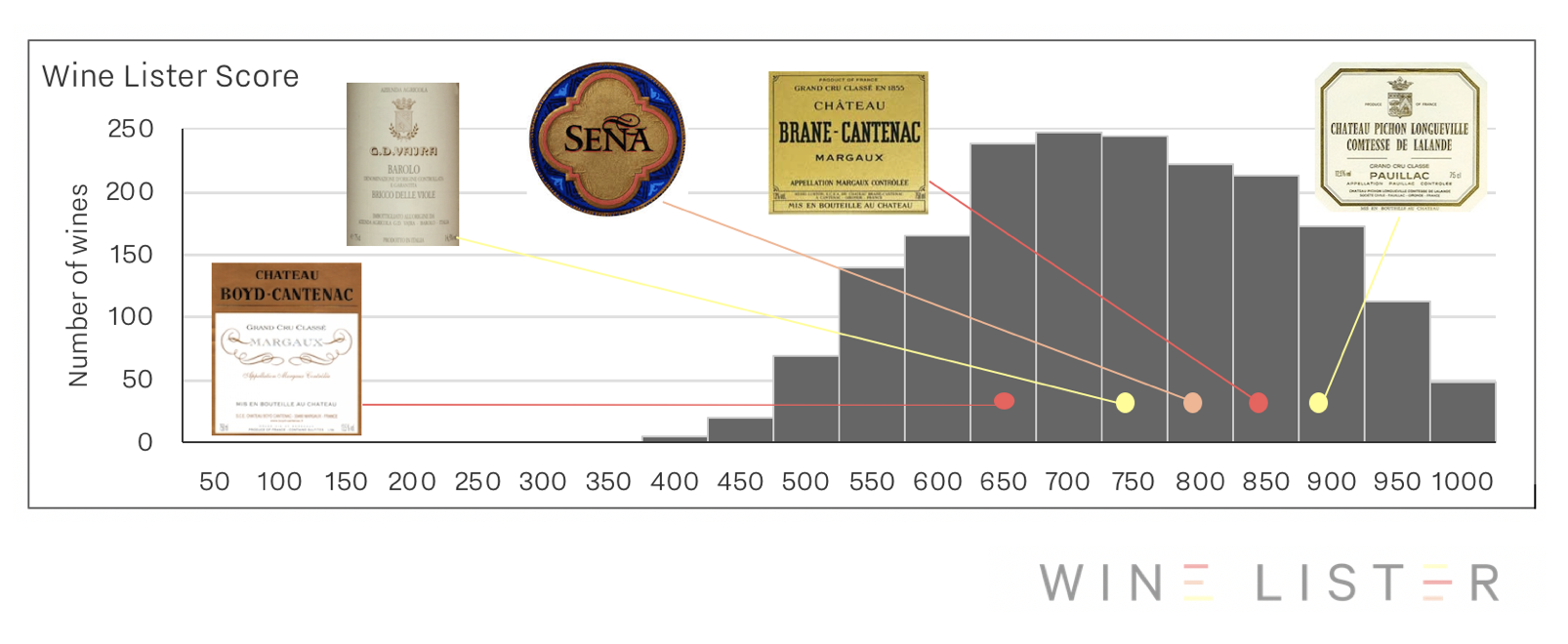

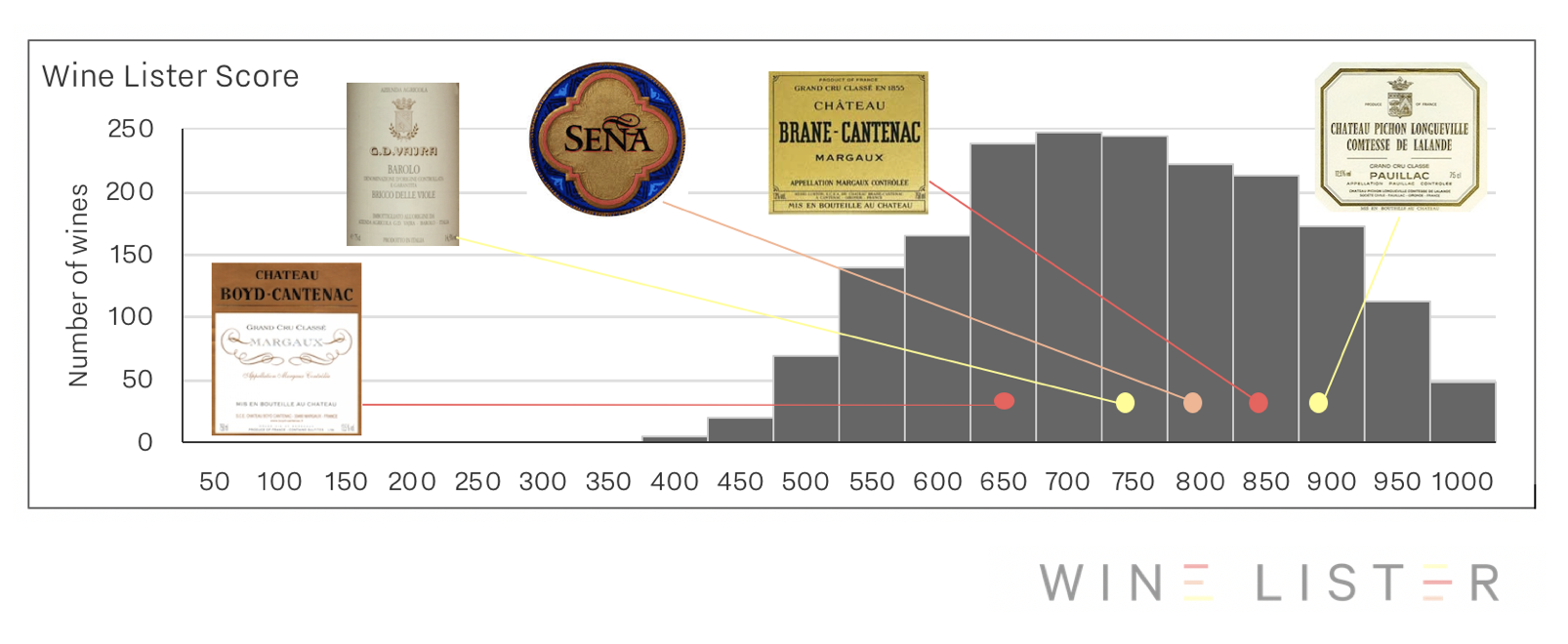

To liven up the evening, we encouraged guests to play “guess the score” – to see how closely they could estimate the Wine Lister score of the wines that they tasted. All the wines were showing beautifully, but Pichon Longueville Comtesse de Lalande 2005 was the wine that our guests successfully identified as having the highest Wine Lister score of the tasting, despite their guesses sitting an average 44 points below Pichon Comtesse 2005’s actual Wine Lister score of 931.

Conversely, Henschke Mount Edelstone Shiraz 2014, Pédesclaux 2014, and Louis Roederer Brut Premier were all awarded higher scores on average by our guests than their official Wine Lister ratings, but the biggest difference was for G.D. Vajra Barolo Albe 2013. It was awarded an average score of 746 by our guests, 73 points above its actual Wine Lister score, which is brought down by a very low Economics score of 124, due to very little price movement or liquidity. This illustrates how the data-driven elements of Wine Lister scores complement the tasting component.

The wine where our guests came closest with their guesses, just 10 points out, was Brane-Cantenac 2005, estimated at 840 compared to its real Wine Lister score of 850.

Congratulations to the game’s winner, Anneka Swann of BI Wines & Spirits, who was just 37 points out on average. We would also like to thank all our other guests for their valiant efforts at guessing the scores: Adam Brett-Smith, Andrea Frost, Chad Delaney, Charles Metcalfe, James Jackson-Nichols, Nicolas Clerc, Richard Stow, Rupert Millar, Tahir Sultan, and Will Hargrove.

Wines featured in the tasting: Louis Roederer Brut Premier, Philipponnat Clos de Goisses 2007, E. Guigal Condrieu La Doriane 2016, Casa Lapostolle Clos Apalta 2014, Seña 2010, Henschke Mount Edelstone Shiraz 2014, Isole e Olena Syrah Collezione Privata 2011, Tenuta San Guido Guidalberto 2016, Produttori del Barbaresco Barbaresco 2014, G.D. Vajra Barolo Albe 2013, G.D. Vajra Barolo Bricco delle Viole 2009, Domaine Duroché Gevrey-Chambertin Les Jeunes Rois 2015, Domaine Duroché Chambertin Clos de Bèze Grand Cru 2015, Domaine Tempier Cuvée Cabassou 2007, Château La Gaffelière 2014, Le Marquis de Calon Ségur 2014, Château Haut-Bailly La Parde 2012, Château Les Carmes Haut-Brion 2014, Château d’Issan 2011, Château Branaire-Ducru 2012, Château Pédesclaux 2014, Château Pichon Longueville Comtesse de Lalande 2005, Château Brane-Cantenac 2005, Château Lafon Rochet 2010.

Which producers will see the largest gain in brand recognition in the next two years? As part of our recent Bordeaux Market Study, we asked Wine Lister’s Founding Members – c.50 key members of the trade from the world’s largest merchants, top international wine auctioneers and several high-end retailers, together representing well over one third of global fine wine revenues.

While Burgundy achieved the largest number of producers mentioned at least once (50), all 10 of the most-cited producers hail from Bordeaux.

With the en primeur campaign finally in full swing, below are Bordeaux’s biggest rising stars: the region’s top 10 brands expected by Wine Lister Founding Members to see increased recognition in the next two years.

Château Canon received the highest number of votes for the brand likely to see most increased brand recognition over the coming two years, and is therefore the number one rising star in this year’s Bordeaux Study. Canon also achieves the joint-highest confidence rating from the trade (see last week’s blog for details), and appears in the top 10 wines for price performance after en primeur release .

In a show of strength by owner Chanel, another of its properties, Rauzan-Ségla, receives the second-highest number of votes, alongside Les Carmes Haut-Brion.

Haut-Batailley, recently acquired by the Cazes family – and having released no wine in 2016 – is seen as a brand with a bright future (and the new owners clearly think so too – it was released at a very ambitious price of £43 at the end of April).

Other Bordeaux wines voted likely to see the largest gains in brand recognition over the next two years are: Brane-Cantenac, Pavie, Calon Ségur, Figeac, Lafleur, and Pichon Comtesse.

Visit Wine Lister’s Analysis page to read the full report (available in both English and French). Go to p.24 to see how many votes each of the above wines received.

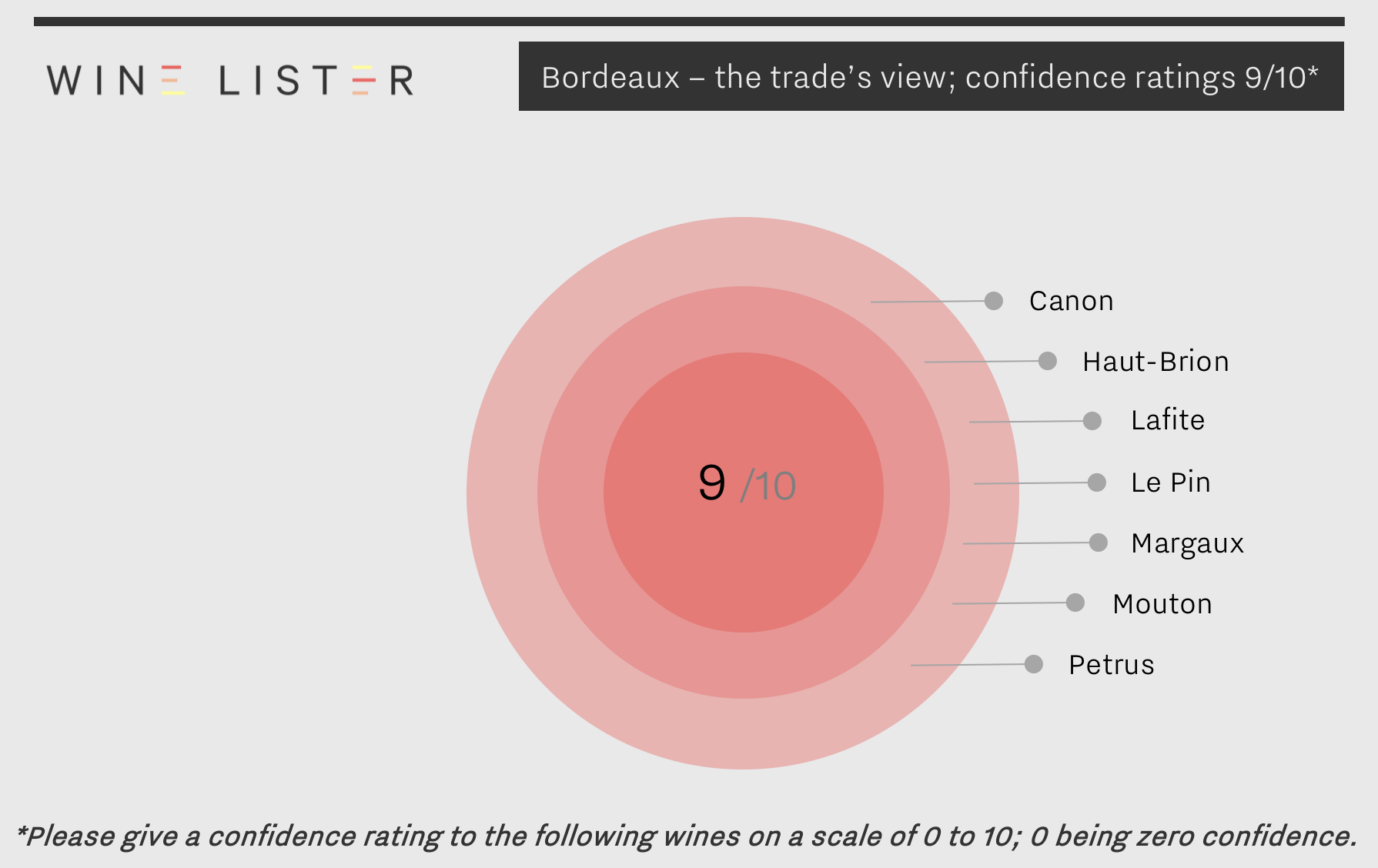

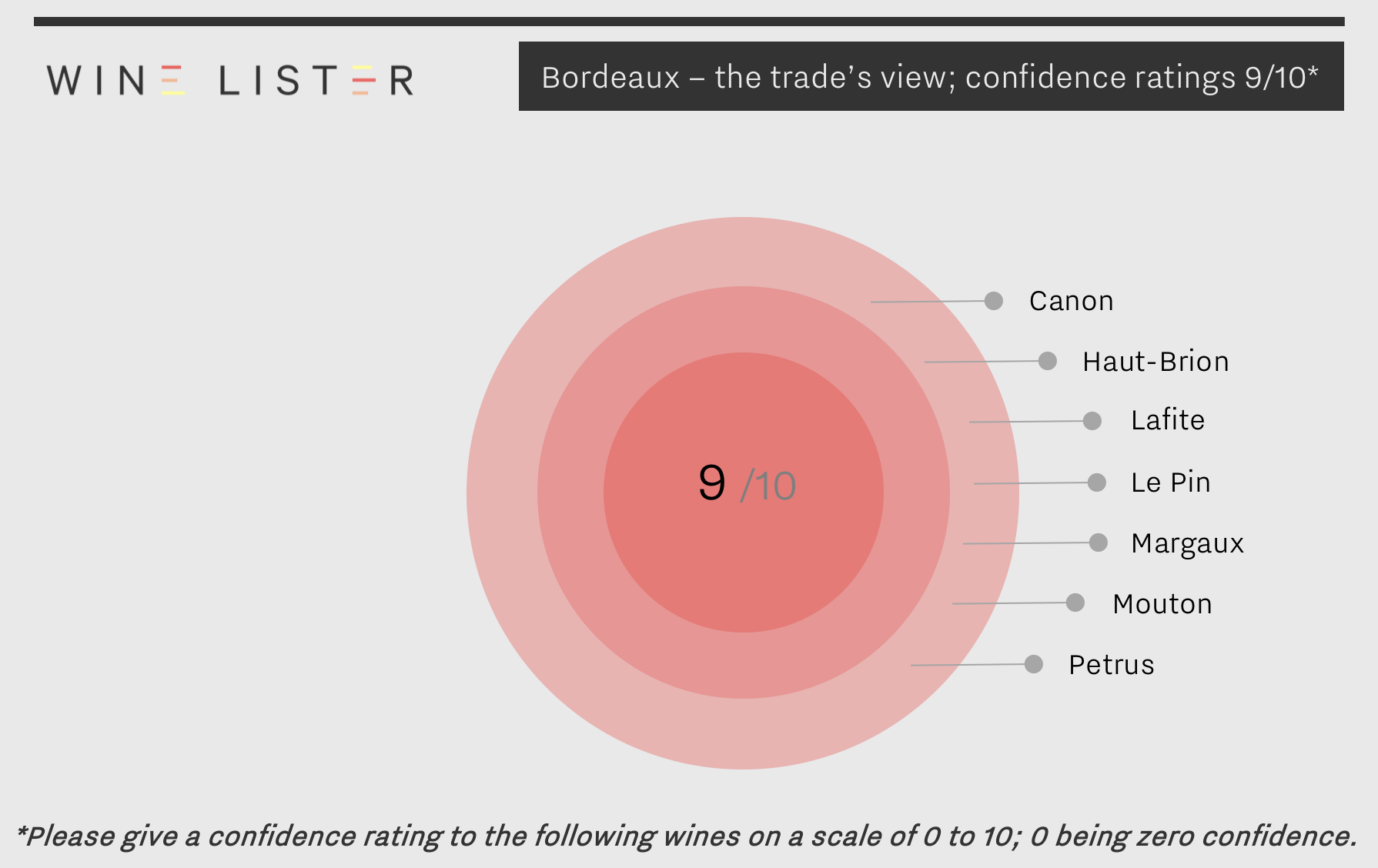

As part of our recently-released Bordeaux study, Wine Lister asked its Founding Members (c.50 key members of the global fine wine trade) to give “confidence” ratings to more than 100 key Bordeaux wines on a scale of 0 to 10; 0 being zero confidence.

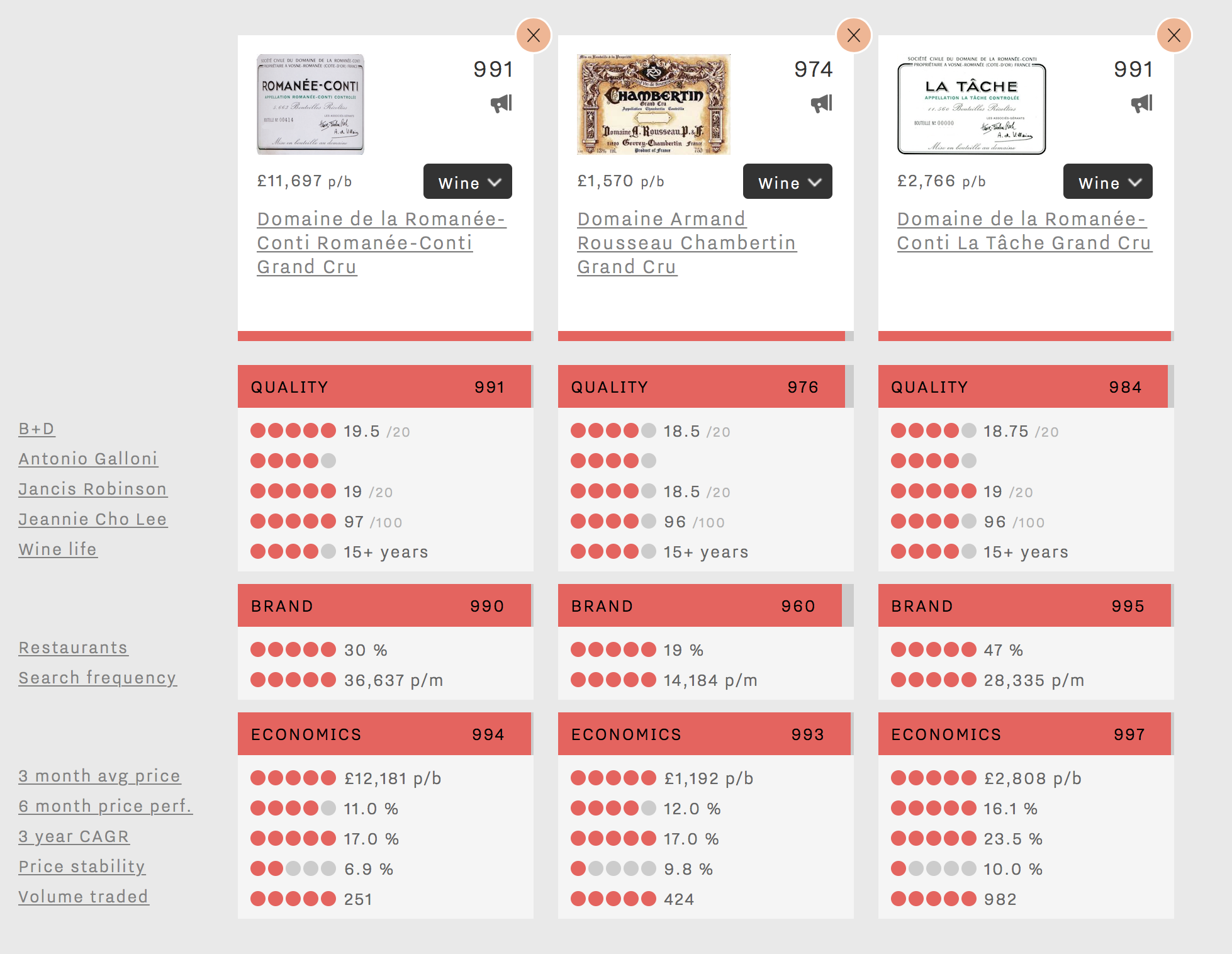

For the second year in a row, no wine received a perfect 10/10, unlike Burgundy, whose Domaine de la Romanée-Conti and Rousseau – as rated across all of their respective cuvées – achieved the perfect score in a survey carried out in Autumn 2017.

Seven wines received a confidence rating of 9/10 from the trade; Canon, Haut-Brion, Lafite, Le Pin, Margaux, Mouton & Petrus. These same seven were awarded 9/10 in last year’s founding members’ survey. Vieux Château Certan is the only château to have dropped down a spot to 8/10.

Canon’s place here is distinctive not just as the only Saint-Émilion to feature, but also as a wine with market prices around £74 per bottle, sitting amongst a group whose average price per bottle is £950. A Wine Lister Buzz Brand, Canon is one of the most talked about wines by the trade.

In carrying out the survey, we did not dictate what factors should influence the respondents’ confidence in the prospects of a wine. Given that they are members of the trade, their considerations are likely to be commercially-driven, taking into account everything from improvements in quality and investment in marketing to new management teams. Canon was deemed a success by trade members for both “ratings and quality improvement”, and its “sales and management team”.

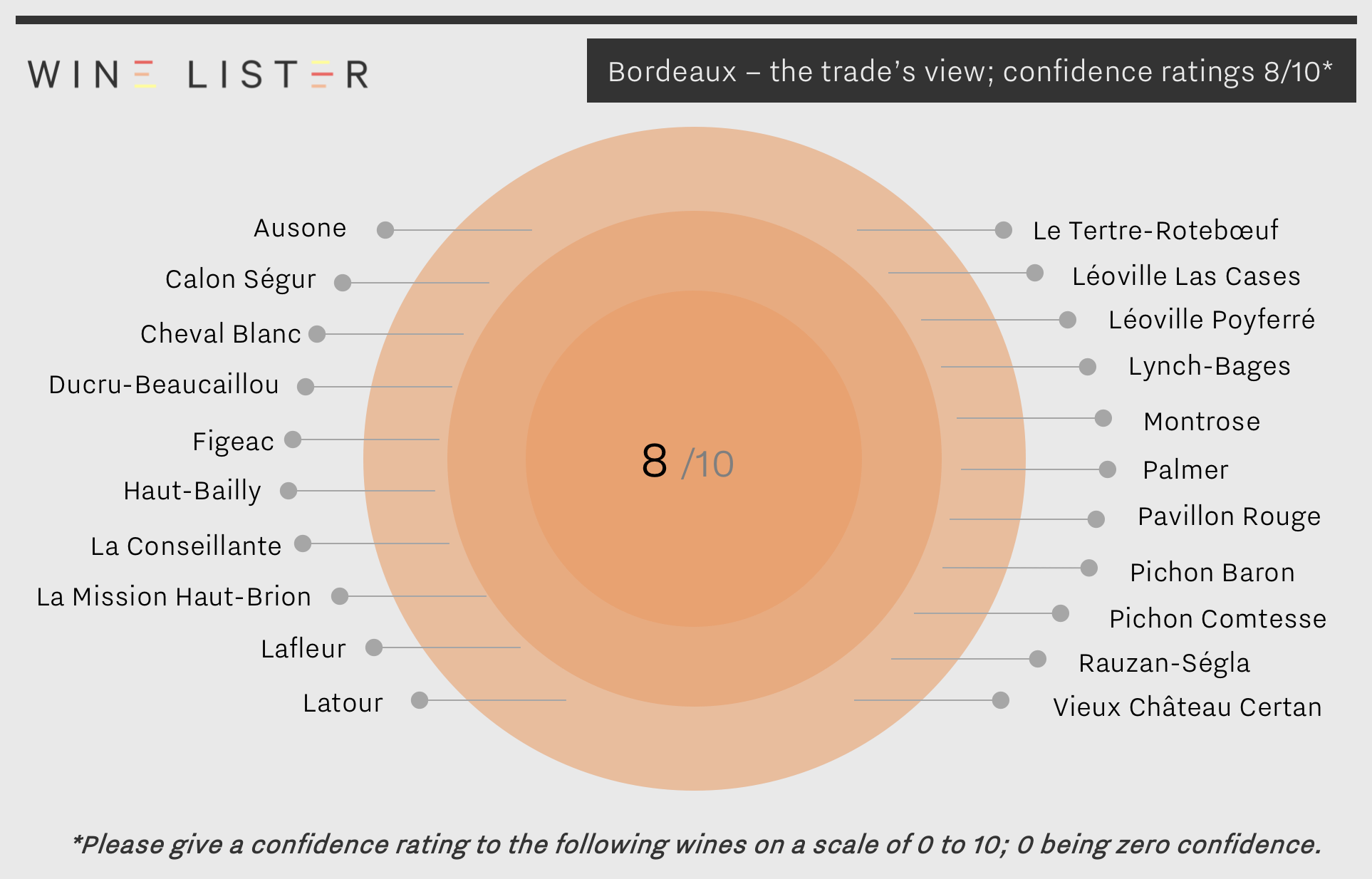

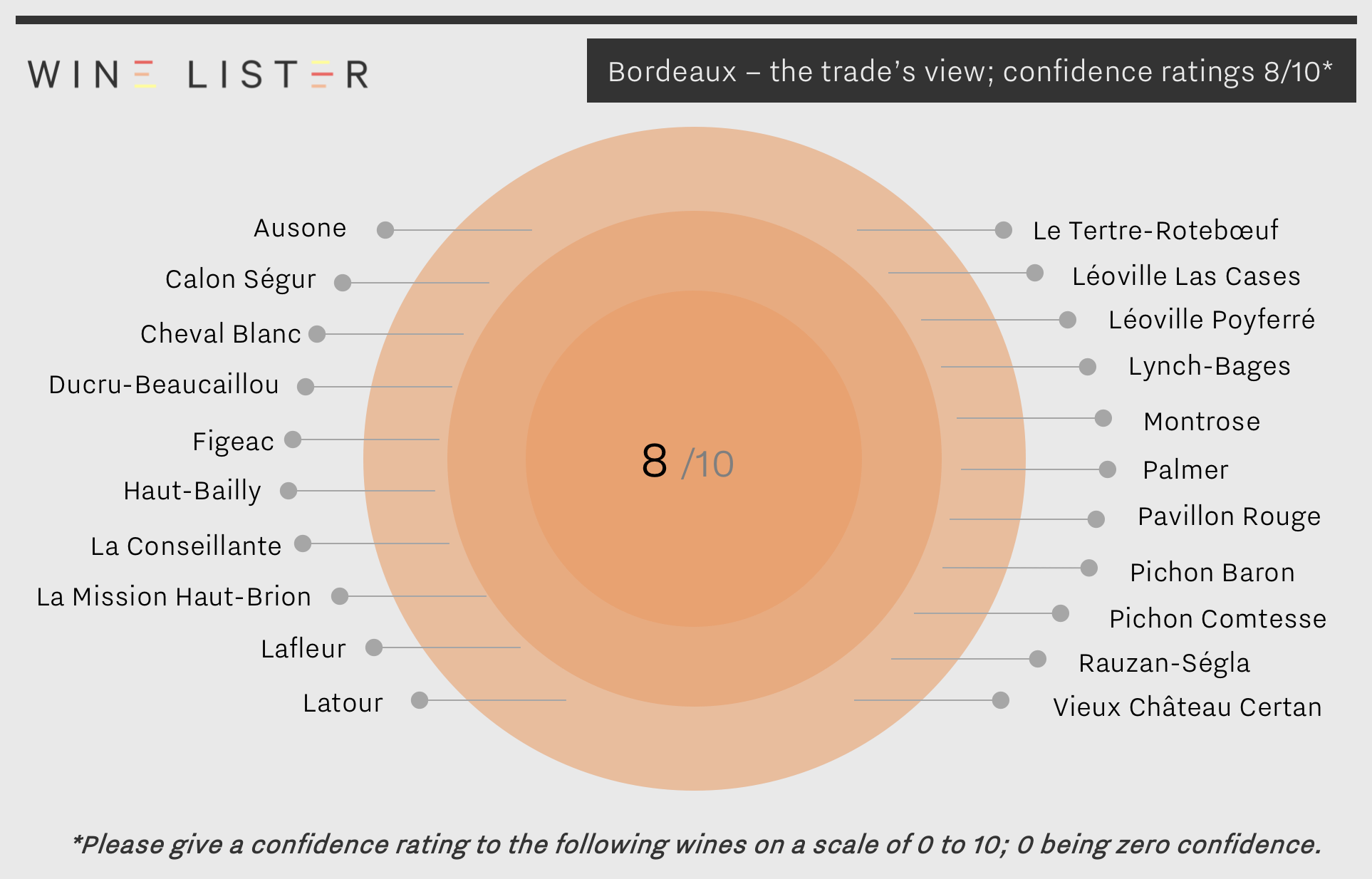

Latour is the only first growth not to feature in the highest-rated group. It was given a confidence rating of 8/10, alongside 20 other wines shown below. Three of these, Pichon Comtesse, Calon Ségur and Rauzan-Ségla (alongside its abovementioned sibling from owners Chanel, Canon) also make the trade’s list of Rising Stars – wines that will see the largest gain in brand recognition in the next two years (more on Bordeaux’s Rising Stars to come next week).

Nine wines have dropped one point in 2018 to a confidence rating of 7/10, however these have been replaced in equal number by Cheval Blanc, Figeac, La Conseillante, Tertre-Rotebœuf, Léoville Las Cases, Pavillon Rouge, Montrose, Palmer, and Pichon Baron, all up one point from their ratings in 2017.

Other wines to receive a confidence rating of 8/10 from the international fine wine trade are Ausone, Ducru-Beaucaillou, Haut-Bailly, La Mission Haut-Brion, Lafleur, and Lynch-Bages.

Visit Wine Lister’s Analysis page to read the full report and see confidence ratings for other wines in the study (available in both English and French).

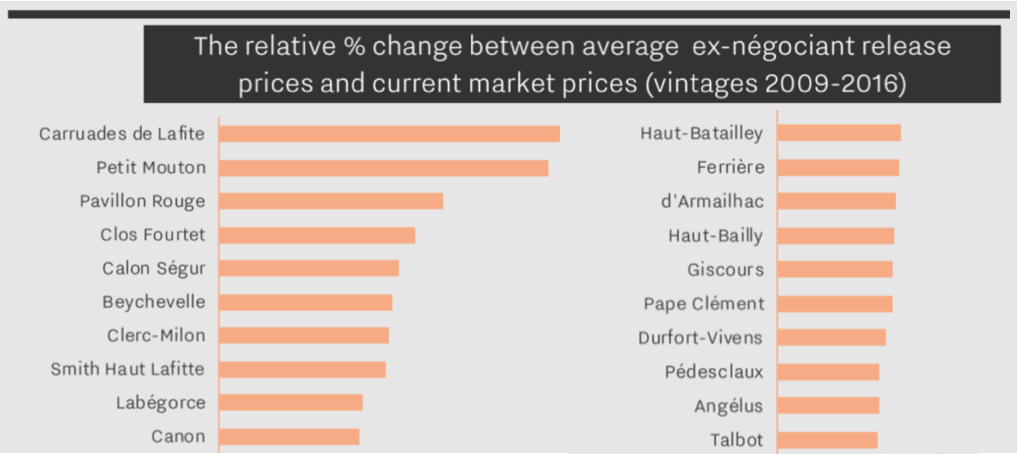

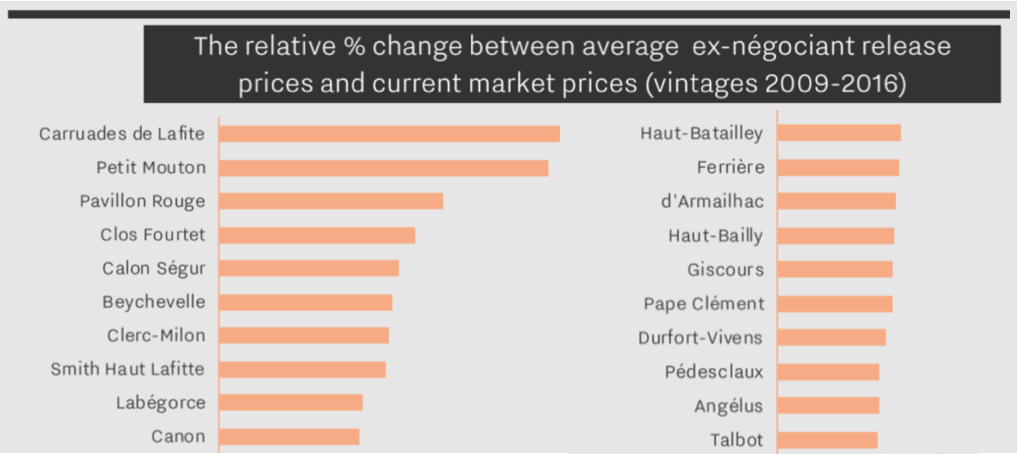

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.

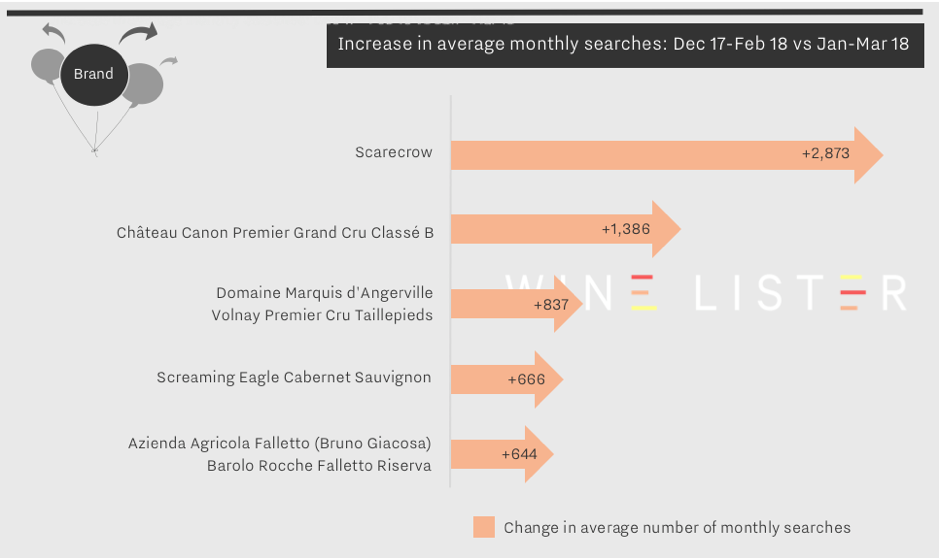

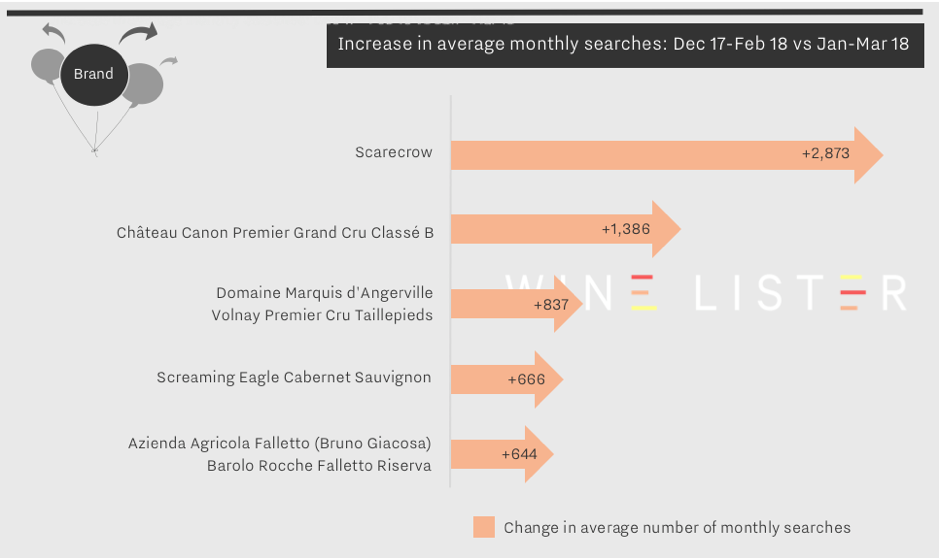

Wine Lister uses data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis.

This month, Château Canon sees a 7% increase in search frequency for January-March 2018 from the previous period. As predicted by our Founding Members (c.50 key members of the fine wine trade), who voted Château Canon number one wine likely to gain the most brand recognition in the next two years in the 2017 Bordeaux Market study, Canon was one of the big successes of last year’s en primeur campaign. Its brand continues to go from strength to strength, with search frequency in 2017 rising 35% between January and October. It will be interesting to see whether this year’s en primeur release has the same impact on its online search frequency as the 2016 vintage.

Two cult Californian wines are among the top five for latest search frequency increases.

Scarecrow saw an increased search frequency of 52% for January-March 2018 compared to the previous period thanks to its latest release in February. The 2015 vintage is as yet unscored by Wine Lister partner critics, however the estate has seen consistent Quality scores between 996-987 since 2010.

Screaming Eagle also makes the top five wines with biggest search frequency increase this month. With 17,831 average monthly searches between January and March 2018, the increase is small relative to its already vast online popularity. Indeed, Screaming Eagle remains the number one most searched for Californian wine on Wine-Searcher.

Burgundy is represented in the top search increases by Marquis d’Angerville, whose Volnay Premier Cru Taillepieds saw double its average number of monthly searches in January-March 2018 compared with the previous period. Guillaume Angerville eschews the scrum of the January Burgundy en primeur tastings in London, preferring to showcase his new vintage each March with a small tasting and lunch – the Taillepieds obviously made an impression, and achieves its highest ever Quality score (969).

Finally, searches for Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva continue to rise into March following the sad passing of Piedmont legend, Bruno Giacosa. The wine saw a bittersweet rise in popularity of 14% in December 2017-February 2018, which continues at a slightly slower pace (10%).

Hidden Gems are one of four Wine Lister “Indicators”, segmenting wines that meet specific sets of criteria into groups. Hidden Gems are those wines rarely found in the top restaurants, and not often searched for online, but which either have high ratings from wine critics, or have been singled out as a hidden gem by Founding Members in Wine Lister surveys.

Last week, Wine Lister celebrated its second birthday with a special tasting of a selection of 27 “raw” hidden gems, identified by our Founding Members (c.50 key players from the international fine wine trade) when asked which wines they rated highly, but which they felt were underappreciated.

Founding Members’ Hidden Gems hail from a variety of regions, producers and vintages. Their average Wine Lister scores vary too, as shown on the histogram below, where the grey columns represent the total number of fine wines currently listed on Wine Lister which fall into each score bucket.

The full list of wines tasted is available here: Wine Lister Founding Members’ Hidden Gems

The Wine Lister team was joined by some of our trade Founding Members, data partners, and other supporters of Wine Lister. We encouraged tasters to share their comments by writing on the tasting table. All the wines were showing beautifully, and G.D. Vajra’s Barolo Bricco delle Viole 2009, tasted from magnum, won widespread praise from all the guests. It also holds the highest Quality score (927) of all wines in the room. One taster even went so far as to name it “the Lafite of Barolo”!

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

Find out what else was said about the wines by following this link to more photos of the event.

Wines featured in the tasting: Louis Roederer Brut Premier, E. Guigal Condrieu La Doriane 2016, Casa Lapostolle Clos Apalta 2014, Seña 2010, Henschke Mount Edelstone Shiraz 2014, Isole e Olena Syrah Collezione Privata 2011, Tenuta San Guido Guidalberto 2016, Tenuta dell’Ornellaia Le Serre Nuove 2015, 2011, 2007, Produttori del Barbaresco Barbaresco 2014, G.D. Vajra Barolo Albe 2013, G.D. Vajra Barolo Bricco delle Viole 2009, Domaine Duroché Gevrey-Chambertin Les Jeunes Rois 2015, Domaine Duroché Chambertin Clos de Bèze Grand Cru 2015, Domaine Tempier Cuvée Cabassou 2007, Château La Gaffelière 2014, Le Marquis de Calon Ségur 2014, Château Haut-Bailly La Parde 2012, Château Les Carmes Haut-Brion 2014, Château Boyd-Cantenac 2013, Château d’Issan 2011, Château Branaire-Ducru 2012, Château Pédesclaux 2014, Château Pichon Longueville Comtesse de Lalande 2005, Château Brane-Cantenac 2005, Château Lafon Rochet 2010.

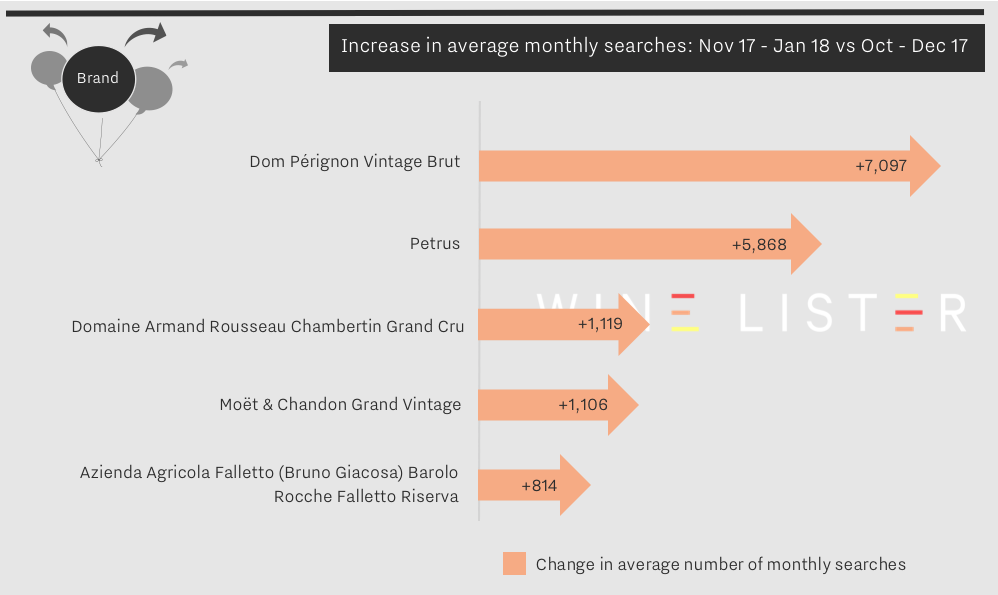

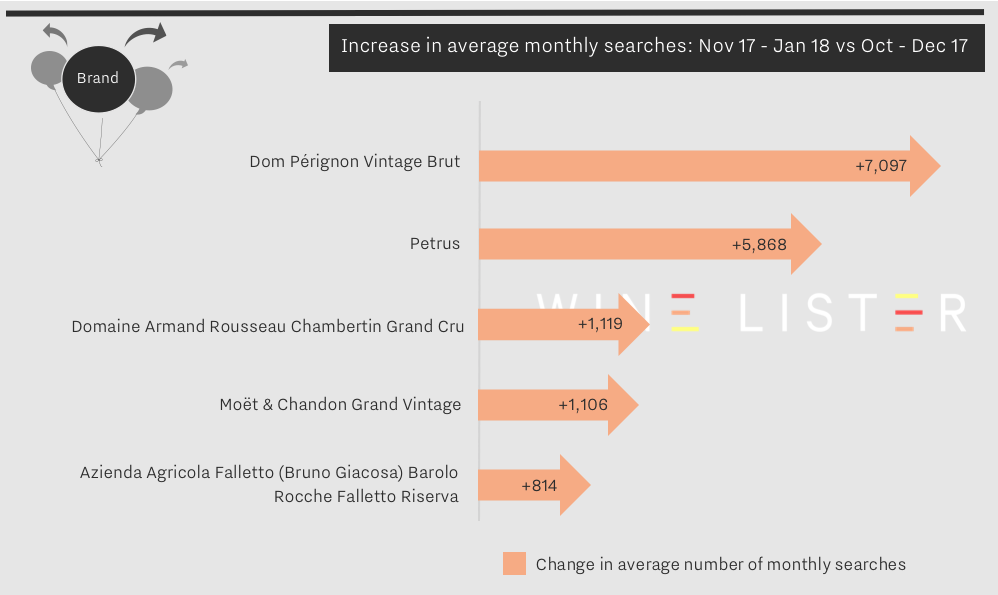

Wine Lister uses search frequency data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis. Wines with the highest search frequency numbers tend to be consistent, with the Bordeaux left bank premiers crus classés generally taking the top spots.

This month’s biggest search frequency gainers also rank as some of the most searched-for wines on Wine-Searcher. Dom Pérignon Vintage Brut is the third most popular wine with over 84,000 searches after Lafite and Mouton, closely followed by Petrus in fourth place. Armand Rousseau’s Chambertin and Moët & Chandon Grand Vintage appear in the top 50, while Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva comes lower down at number 148 out of the circa 5,000 wines on Wine Lister, but its search frequency has recently increased by 15%.

Our last post on online search frequency revealed Wine Lister’s first ever perfect Brand score. Moving on from the Christmas period, Champagne brands still show marked increases in search frequency, but this time they do not stand alone at the top.

Dom Pérignon Vintage Brut is the largest gainer in popularity for the second time running. Increasing at a slower rate than in December, its popularity nonetheless grew by 7,097 searches into January, maintaining its 1000-point Brand score. Dom Pérignon remains the only wine to achieve a perfect score from any of the Wine Lister score categories. The other Champagne still riding high on searches is Moët & Chandon Grand Vintage, which increased by 6%.

Bordeaux creeps back onto the map for online searches at the beginning of 2018, with the first growths having featured heavily in searches up to December 2017. Petrus is in second place after Dom Pérignon, with an 8% increase in search frequency. It will be interesting to see if search increases for Bordeaux follow the same pattern as last year as we approach the 2017 en primeur campaign.

Armand Rousseau’s Chambertin appears in third place. Armand Rousseau was only one of two producers to achieve a perfect confidence rating from our Founding Members in our recent Burgundy study.

In fifth place for increased popularity is a bittersweet entry. Searches for Barolo Rocche Falletto Riserva from Azienda Agricola Falletto increased as the wine world learned of the sad passing in January of Piedmont legend, Bruno Giacosa. You can read more on Bruno Giacosa’s legacy in a recent blog on Barbaresco, here.

For wine lovers the world over, Burgundy is a region to be celebrated all year round. That being said, the modern interpretation of the traditional, post-harvest festival, La Paulée de New York, holds its West Coast counterpart this week, celebrating some of Burgundy’s finest producers in San Francisco’s best restaurants.

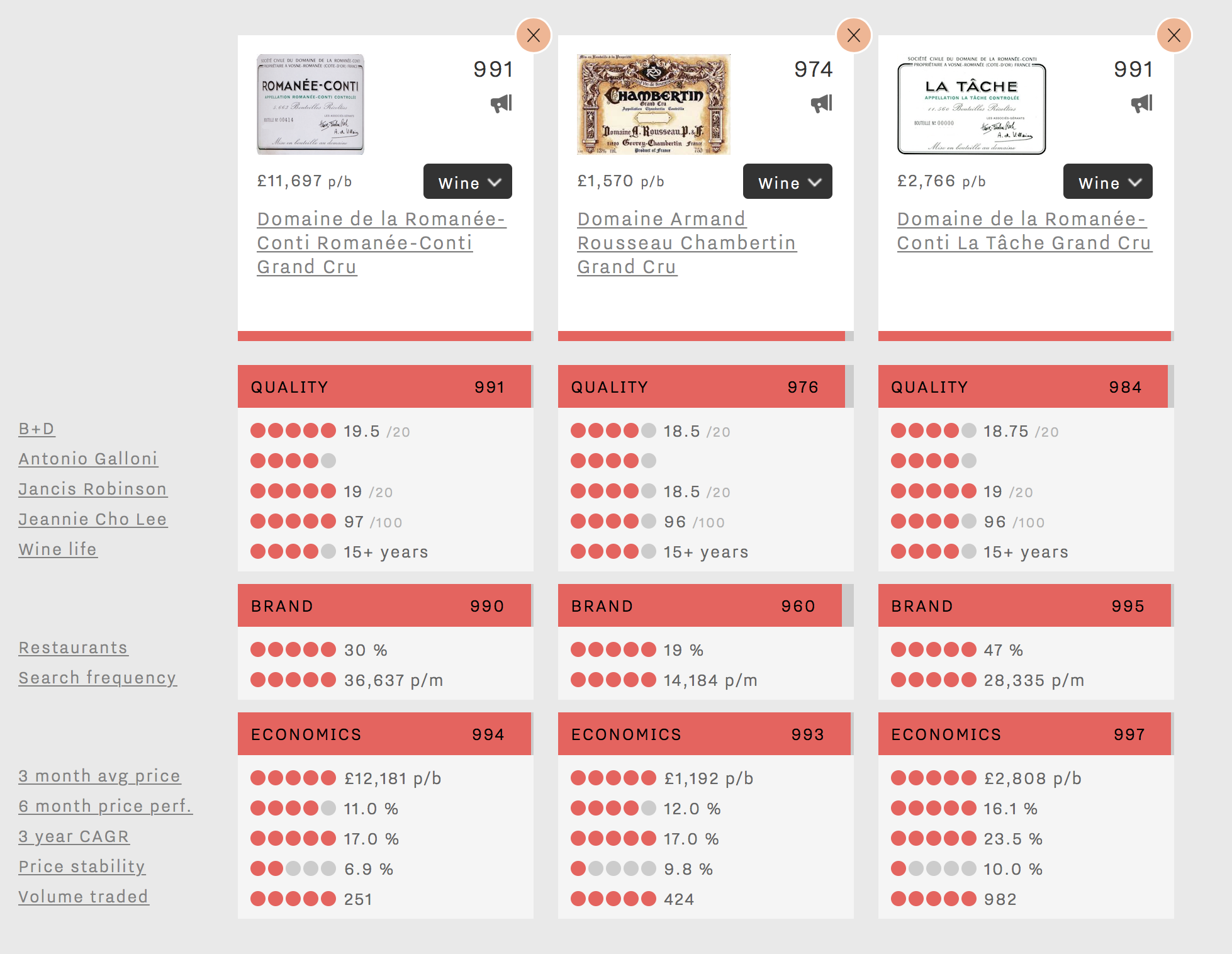

With Burgundy on the brain, we look back at our recent Burgundy study and the results of our Founding Members’ survey. Wine Lister asked 52 key members of the global wine trade across importers, merchants, and auction houses to rate their confidence in certain domaines from 0 to 10.

Our Burgundy study is the first to feature producers with a perfect confidence score. In Burgundy, two producers received a rating of 10/10. It perhaps comes as no surprise that Domaine de la Romanée-Conti (DRC) should be one of them. The other, Domaine Rousseau, is likely to have the strong performance of its Chambertin to thank for its perfect confidence score (Rousseau’s Chambertin holds the fifth best overall Wine Lister score in Burgundy, after four DRC wines).

Six producers achieved a confidence rating of 9/10. D’Auvenay and Domaine Leroy’s marks confirm the trade’s outstanding level of confidence in Lalou Bize-Leroy. Whilst Mugnier and Roumier fly the flag for Burgundy’s top red producers, Coche-Dury and Raveneau show that the trade is sure about the prospects of the region’s most prestigious white wine producers.

26% of producers included in the survey gained a confidence rating of 8/10. Among them, Comtes Lafon, Ente, and Roulot confirm the prospects of Meursault and its top producers.

36% of producers received a score of 7/10 – still a strong result and underlining the trade’s high level of confidence in Burgundy. This confidence seems linked to the region’s consistent price performance, as one US fine wine auction house notes: “The single most interesting trend is pricing. Demand on the primary and secondary market is high, and it’s amazing to see that prices have not gone down at all…in years.”

For context, no Burgundy producer scored below 5/10, compared to 5% of Bordeaux wines in Wine Lister’s Bordeaux study last year.

For more detail on which Burgundy producers achieve top confidence ratings, see our full Burgundy study here, or subscribe to gain access.

For those joining the La Paulée festivities, we wish you a very happy Burgundy week!

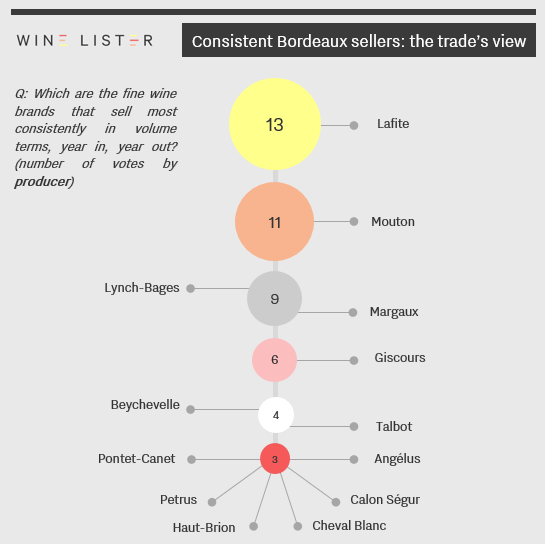

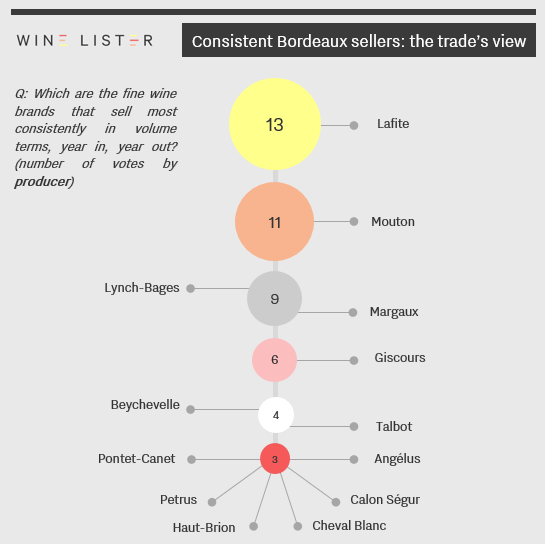

Today’s blog explores another finding from Wine Lister’s 2017 Bordeaux Market Study, released last month. The chart is taken from one of the final sections of the 48-page report, where we surveyed our 49 Founding Members, key players of the global fine wine trade – including merchants, auctioneers, and several high-end retailers – for their views on Bordeaux.

We asked respondents to list 10 fine wine brands from Bordeaux that in their experience sell consistently, year in, year out. Four of the first growths are featured among the responses, with Lafite and Mouton leading the way. Meanwhile, Latour is conspicuous by its absence, with less volume in the market since its withdrawal from en primeur in 2012.

Looking beyond the first growths, Lynch-Bages’ performance here confirms its formidable reputation amongst consumers. Giscours, Beychevelle and Talbot are also highlighted as producers that consistently sell well.

This is just a taster of the Bordeaux Market Study. You can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.

From left to right: David Harvey, Arthur de Lencquesaing, Dan Jago, Charles Lea, Ella Lister, Jancis Robinson, Jan Konetzki, Adam Bruntlett, Katy Andersen, Grant Ashton, Sophie Mclean, Richard Harvey, Greg Sherwood, Aita Ighodaro, Joe Fattorini.