Wine Lister’s four Indicators – Investment Staples, Value Picks, Hidden Gems, and Buzz Brands – were designed to enable users to find the perfect wine for any scenario in just a couple of clicks. Buzz Brands, the most talked-about wines, are sure to impress: they have strong distribution across the world’s top restaurants, show high online search frequency or a recent growth in popularity, and are identified by the fine wine trade as trending or especially prestigious.

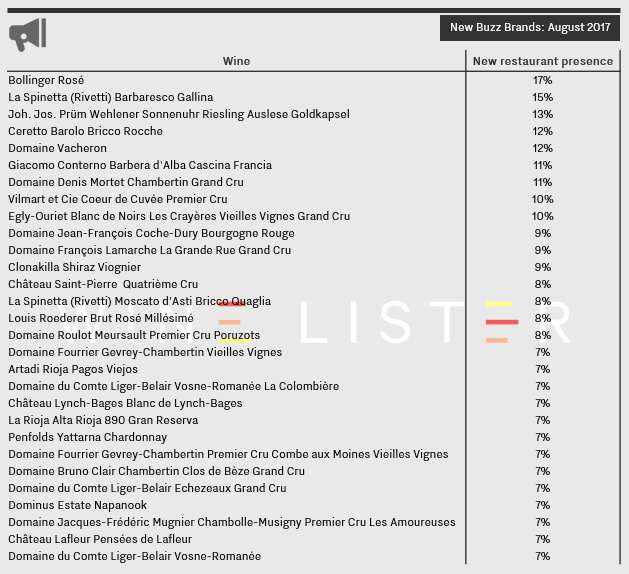

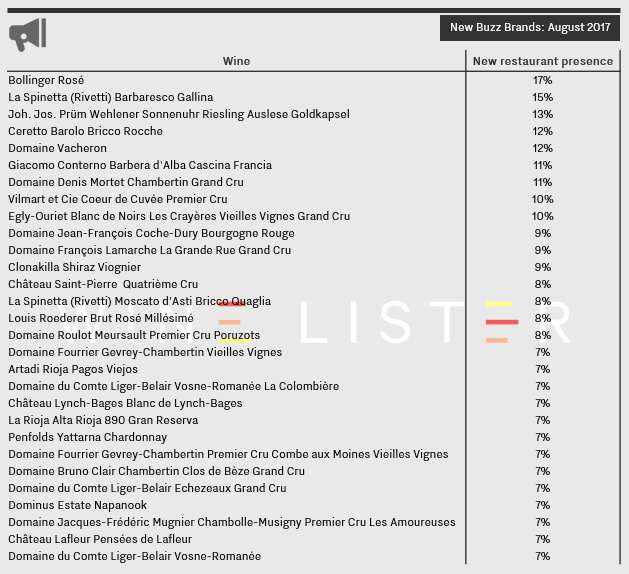

Having recently expanded and updated Wine Lister’s restaurant presence coverage, 29 new wines now qualify as Buzz Brands, their global distribution broadening. To achieve Buzz Brand status, a wine must be among the top fifth of all wines that feature at least once on the menus of the world’s best restaurants – prized for their wine lists as well as their food.

Of the 29 wines above, 11 hail from Burgundy, confirming the region’s continued demand amongst the restaurant trade. Domaine du Comte Liger-Belair fares particularly well, with three of its wines becoming new Buzz Brands, thus suggesting it is a producer on an upward trajectory. These wines also benefit from a high online search frequency, as measured by Wine-Searcher, with the wine with the highest number of searches, Domaine du Comte Liger-Belair Echezeaux Grand Cru, seeing 1,400 searches per month.

Champagne has also benefitted from the restaurant presence update, with four wines from the region gaining Buzz Brand status. Of this month’s new Buzz Brands, Bollinger Rosé now has the most impressive distribution, present in 17% of the world’s top establishments.

Piedmont sees four wines attain Buzz Brand status. Two new wines from La Spinetta now qualify as Buzz Brands, with Ceretto Barolo Bricco Rocche and Giacomo Conterno Barbera d’Alba Cascina Francia making up the quartet.

There are three new Bordeaux Buzz Brands, and one carries the accolade of being the most searched-for wine in the table. Château Saint-Pierre receives in excess of 3,700 searches per month, which in addition to appearing on 8% of the world’s very best restaurants makes it well-deserving of its new Buzz Brand status.

As Wine Lister’s holistic rating system demonstrates, there are many factors (nine criteria, in all) to take into account when calculating a wine’s greatness. One of these is distribution in the world’s top restaurants, our measure of a wine’s prestige and clout on the international market. In order to identify the restaurants that count – not just for the food but for the wine – we have created a matrix of global restaurants with Michelin stars, 50 Best Restaurants, World of Fine Wine Best Wine List awards, and more. We take the most formidable combination of these as the basis for our painstaking analysis.

We are expanding our coverage constantly, and the latest instalment is now in. This year alone has seen an increase of 50%, to 150 restaurants analysed. New entrants come from across the globe, from New York’s Balthazar to Paris’s Carré des Feuillants.

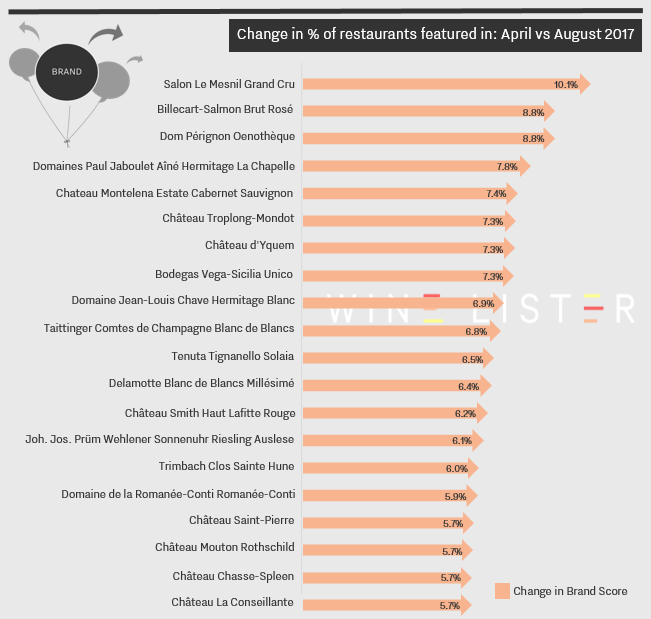

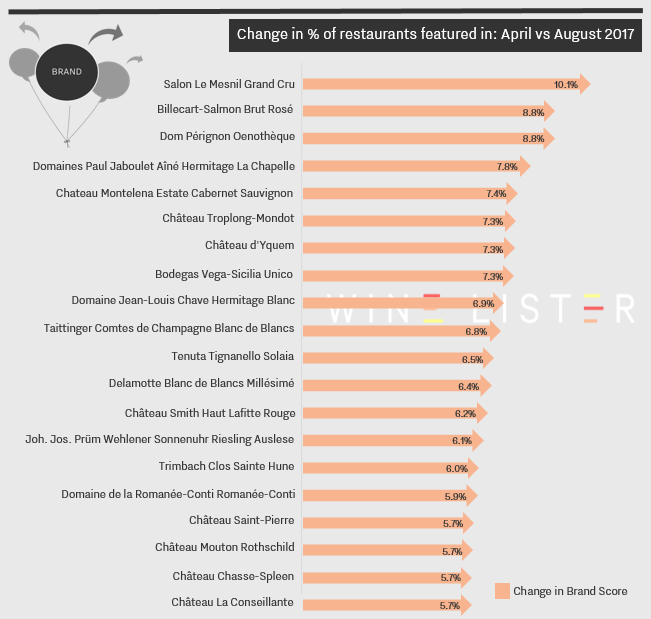

The table below shows the 20 wines to have seen their restaurant presence increase the most since the last update in April:

The top three wines are Champagnes: Salon Le Mesnil, Billecart-Salmon Brut Rosé, and Dom Pérignon Oenothèque (the last all the more impressive since the wine was re-branded a few years ago). None of them, however, is the wine with the largest restaurant presence. That accolade falls to Yquem, which saw its presence increase by 7.3% in the latest update, appearing on 69% of the world’s top wine lists – including Boulud in New York and Sketch in London.

Second most popular of the wines above is Mouton Rothschild, whose restaurant presence increased by 5.7%, and which overall features on 58% of the best restaurants, from The French Laundry in California to L’Atelier de Joël Robuchon in Hong Kong.

It is also interesting to note the wines that have relatively low overall restaurant presence but saw a significant increase in the latest update, suggesting that their stars are on the rise. These include Bordeaux Saint Pierre and Champagne Delamotte Blanc de Blancs Millésimé, which appeared on 2% of the previous restaurant lists but are now at 8% and 9% respectively. Meanwhile, Smith Haut Lafitte Rouge found its restaurant presence tip from 9% to 15% in the latest update.

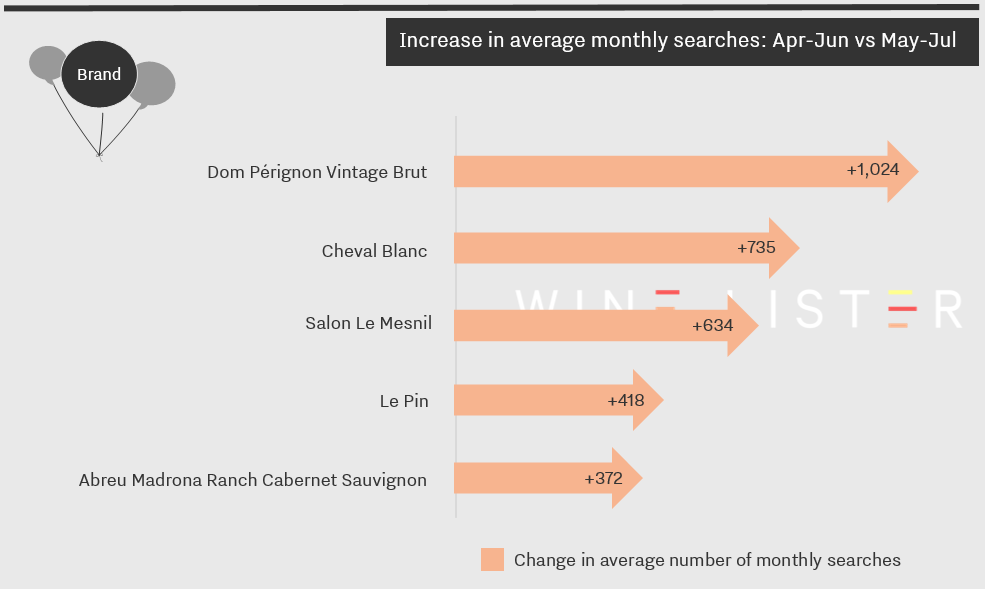

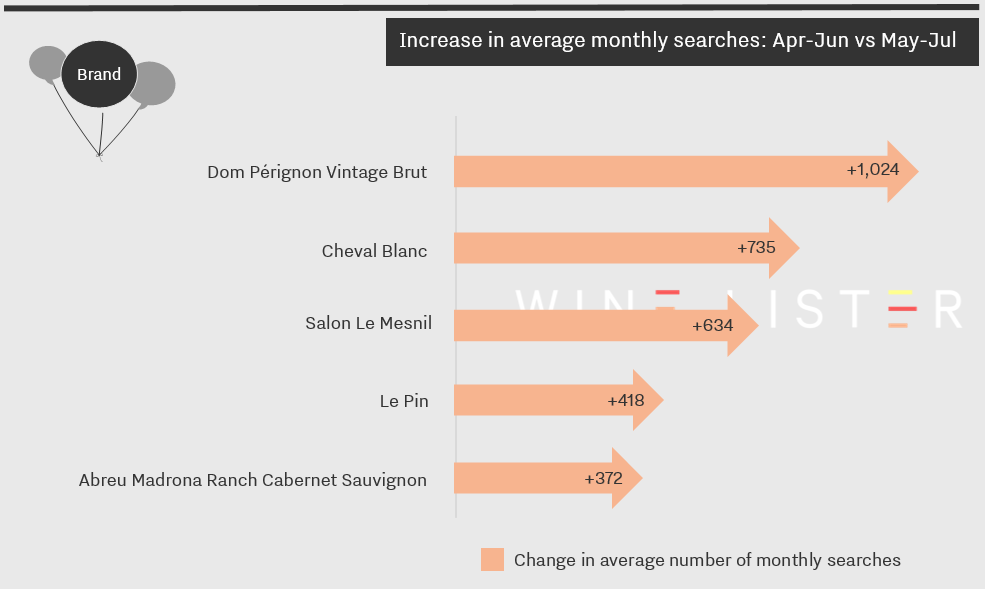

The latest search frequency data is in from Wine-Searcher, and with it we can see which wines enjoyed the greatest popularity gains during July. After the en primeur campaign fuelled the big surges of May and June, July’s top five gainers witnessed more modest gains. There is also more variety this month, with two Champagnes and a Napa joining two Bordeaux right bank heavyweights.

Experiencing the greatest increase in popularity during July was Dom Pérignon Vintage Brut – particularly impressive considering it started from an already extraordinarily strong average of over 54,000 searches each month.

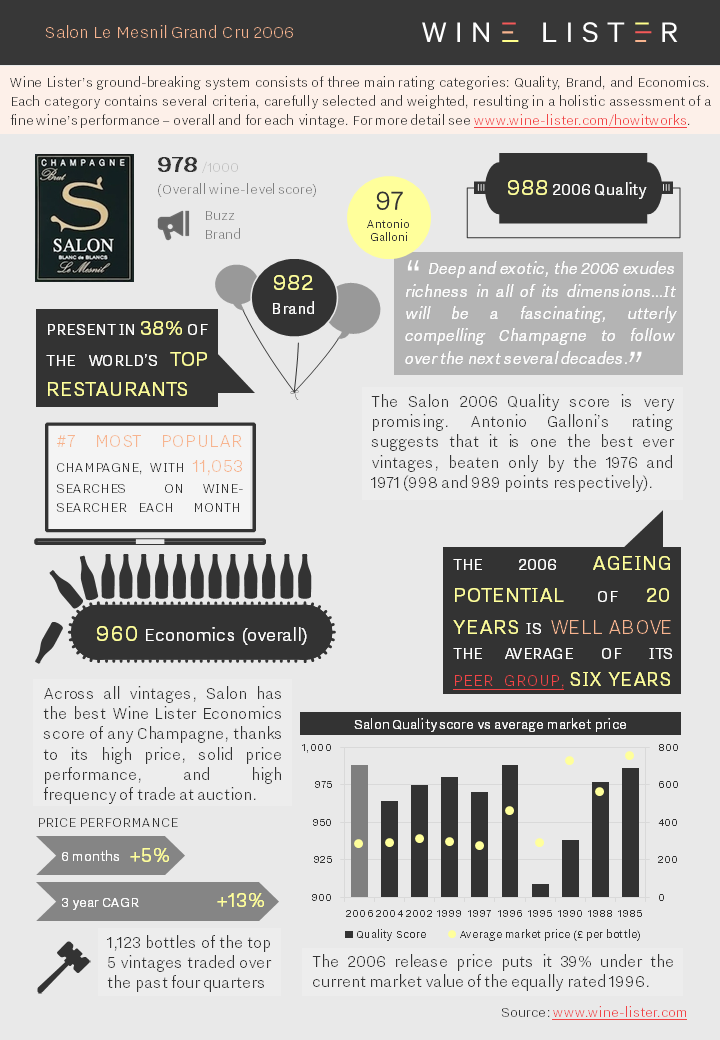

Next came Cheval Blanc, whose 2016 vintage was released in early June, before July saw the release of Salon Le Mesnil 2006. Described by Wine Lister partner critic Antonio Galloni as an “utterly compelling Champagne to follow over the next several decades”, its rise in online popularity suggests that consumers have already started to track its progress.

The last two wines are both produced on very small scales. Le Pin, notoriously rare, released its 2016 vintage in late June, which likely contributed to its increase in online popularity, at least among those lucky few with both an allocation and requisite funds. About 6,000 bottles of Napa Valley’s Abreu Madrona Ranch Cabernet Sauvignon are produced each year. As we saw in our recent post on California’s most expensive wines, production levels play a big role in the region’s prices. Perhaps the rarity of Abreu Madrona, the region’s eighth most expensive wine, is helping to boost its caché.

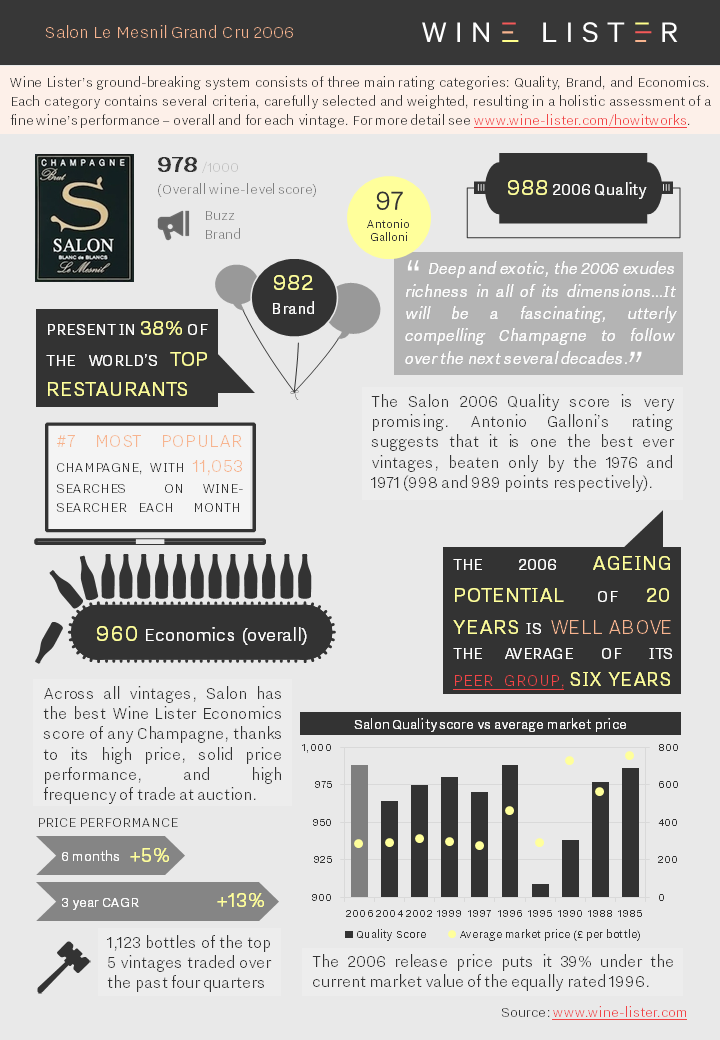

Earlier this month Salon Le Mesnil 2006 was released, the Champagne house’s 40th vintage. Described as “a fascinating, utterly compelling Champagne” by our partner critic Antonio Galloni, we summarise all the key data below:

You can download the slide here: Wine Lister Factsheet Salon 2006

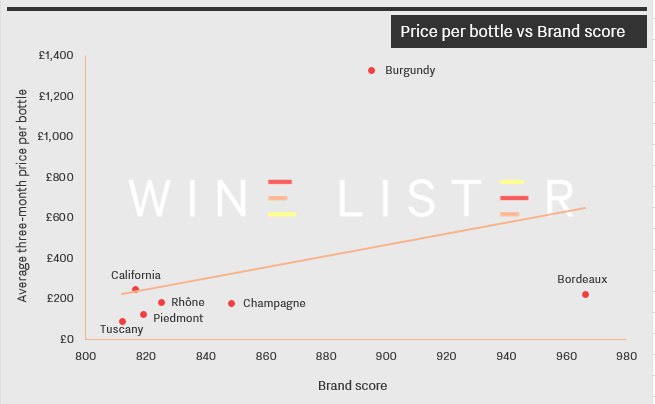

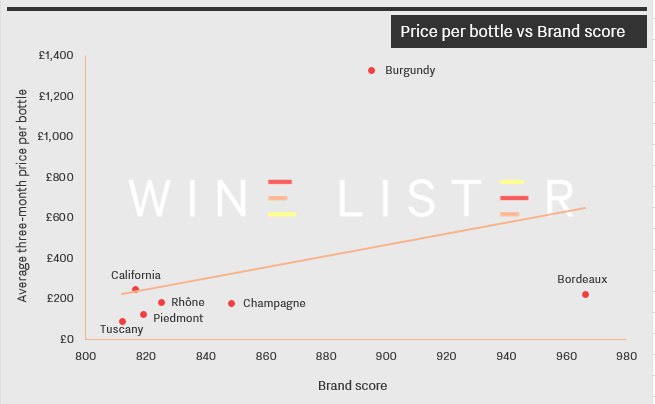

Following on from our recent blog on the relationship between price and quality for seven leading wine regions, today we turn our attention to the role that brand strength plays on price for those same regions. The chart below compares the regions’ average three-month market price to their average Brand scores, using the same 50 overall top scoring wines in each region as in the previous post.

Bordeaux’s crus classés enjoy unassailable brand strength, a product of the success of the region’s classification system and the fact that its châteaux have enjoyed global renown for centuries. If you want brand for your buck, look no further.

Conversely, Burgundy’s extraordinary prices far exceed the level of brand clout commanded by its top crus. Its top wines trail the average Brand score of Bordeaux’s by 7%, but sell for nearly six times as much. This suggests that quality, and perhaps small production levels, play more of a part in the region’s prices.

The five remaining regions are more evenly matched. Tuscany’s wines have both the lowest average Brand score and the lowest prices, followed closely by Piedmont. Meanwhile California’s top 50 wines, which have the second-lowest average Brand score, command the second-highest prices. Top wines from the Rhône and Champagne command similar prices to their Bordeaux counterparts, but with average Brand scores more than 100 points lower.

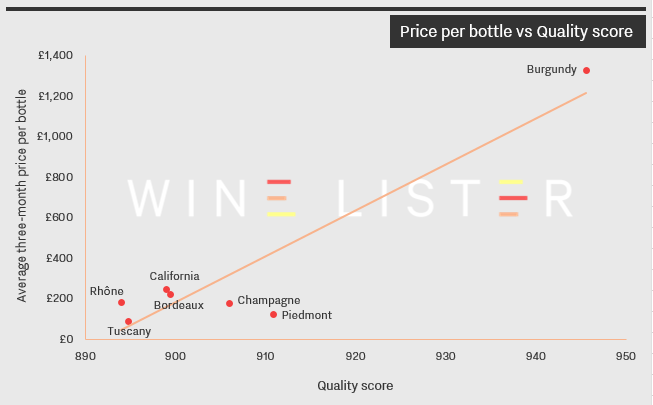

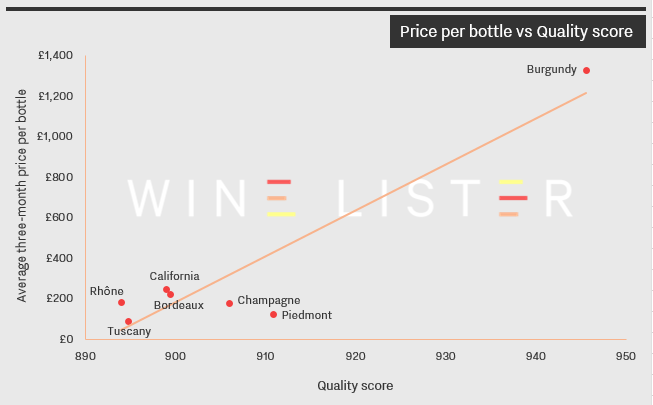

In today’s blog, we’ve taken a look at the relationship between price and quality for seven leading wine regions. The chart below compares the regions’ average three-month market prices to their Quality scores, with the data calculated from each region’s 50 best-scoring wines (in terms of overall Wine Lister score).

While six regions are clustered relatively close to each other, Burgundy finds itself at the extreme top end of the scale: its wines outperform on quality and have the prices to match. The top 50-scoring wines in Burgundy average a whopping £1,330 per bottle, driven by the likes of DRC La Romanée-Conti at £10,776 and Domaine Leroy Musigny at £7,805.

The Rhône’s wines have the lowest average Quality score but not the lowest prices: at £188 per bottle on average, they are the fourth most expensive of the group. California and Bordeaux display a very similar profile, appearing just above the trendline, indicating that these wines command high prices not simply on account of quality – brand also plays a part.

Champagne and Piedmont, meanwhile, fall below the line, suggesting that as regions they tend to offer value for money. Piedmont’s ranking is particularly impressive: second only to Burgundy in terms of average Quality score, its wines are available for a tenth of the price on average.

What makes the perfect wine?

Using the entirety of a 1,000-point scale, Wine Lister’s scores are calculated using nine criteria that define iconic wines. These fall into the categories of Quality, Brand and Economics, giving a 360° view of the finest wines in the world.

Unlike wine critics’ scores, which sporadically feature a perfect 100/100, a perfect Wine Lister score of 1,000/1,000 is practically, though not theoretically, impossible. The perfect wine would have to be the best in the world across every single criterion – a magical combination of ingredients.

The perfect wine does not belong to any one region. In terms of quality, it has the perfect critic score of Sauterne’s unsurpassed Château d’Yquem (1), and the ageing potential of Cockburn’s Vintage Port (2). Its brand is legendary: like Dom Pérignon, it is found throughout the world’s top restaurants (3), and its online monthly searches rival those of Lafite (4).

The perfect wine outperforms on price. Already with a price per bottle to match that of Romanée-Conti (5), its vintages see price increases in both the short- (6) and long-term (7), without undue fluctuation (8). Finally, like Mouton, the perfect wine is traded in large volumes (9).

Download a PDF version here.

First published in French in En Magnum.

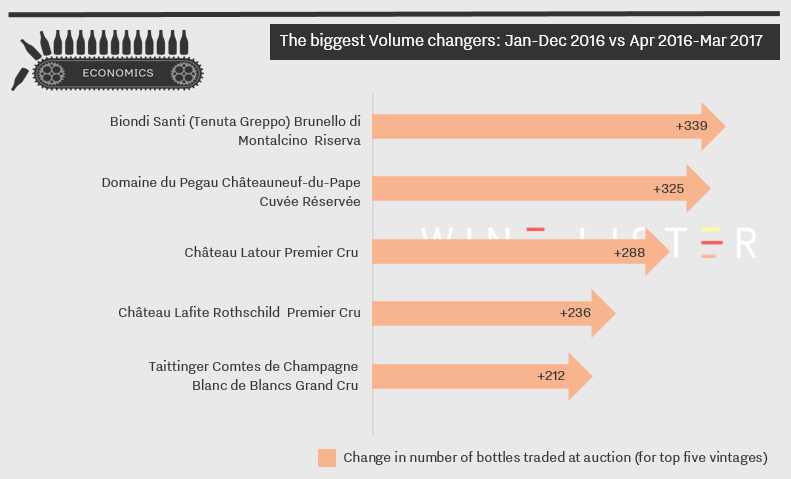

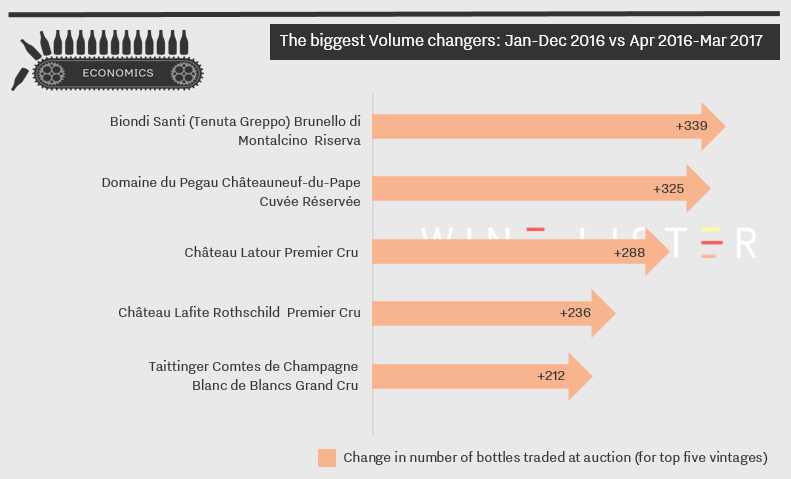

Trading volumes are a key measure of a wine’s success in the marketplace. To evaluate these, Wine Lister uses figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages traded for each wine over the past four quarters.

With the first quarter data now in, we look at which wines saw the greatest incremental increase in bottles traded. Although the list is dominated by French wines, top of the table is a Tuscan, Biondi Santi Brunello di Montalcino Riserva. The producer was recently highlighted as one to watch in a survey of Wine Lister’s Founding Members. The rise in auction sales for this wine has had a significant impact on its Economics score, boosting it from 911 to 945/1000. Volume is just one of the five criteria that feed into a wine’s Economics score, along with four different price-related metrics.

The wine seeing the second largest gain in trading volumes, Domaine du Pegau Châteauneuf-du-Pape Cuvée Réservée, also has the lowest Economics score of the table, at 789. Nonetheless, its overall Wine Lister score is very strong at 846 (lifted by a high score for Brand), and with the latest data in from Wine Market Journal its Economics score is on the rise.

The final three wines of the table – two Bordeaux first growths and a prestigious Champagne (Taittinger Comtes de Champagne) – also benefitted from increased trades in the last quarter. All three enjoy very high Economics scores, with Lafite Rothschild the highest, at 955/1000. Meanwhile it seems that 2017 has been a positive year so far for Latour, which was also among the top five wines that saw its number of searches increase significantly in March.

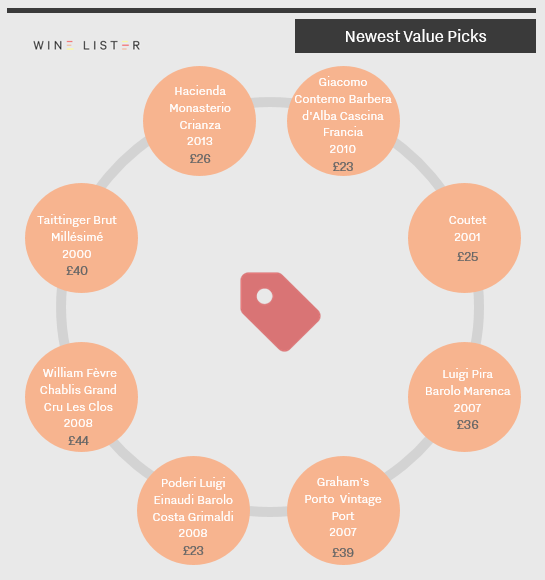

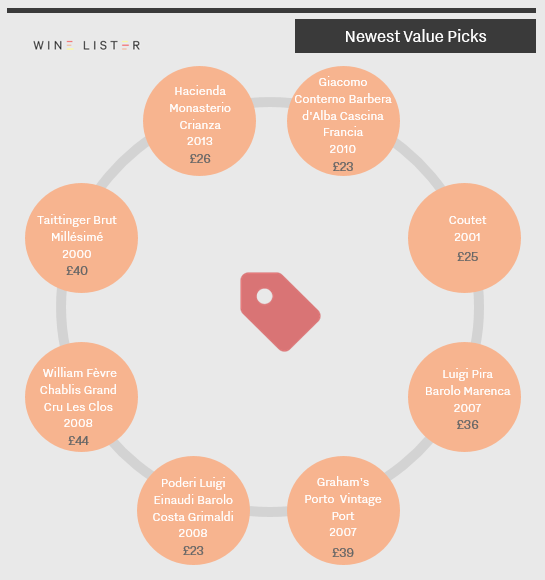

The latest price data is in, enabling Wine Lister’s algorithm to award new Value Pick status to those wines that achieve the best quality to price ratio (with a proprietary weighting giving more importance to quality, thus allowing the finest wines a look-in).

This month, the new Value Picks include a Champagne, a Port, and a sweet white Bordeaux, but it is Piedmont that dominates, with three of its wines achieving Value Pick status: Poderi Luigi Einaudi Barolo Costa Grimaldi 2008, Luigi Pira Barolo Marenca 2007 and Giacomo Conterno Barbera d’Alba Cascina Francia 2010.

Each wine is priced at £44 per bottle or less – with half under £30 – and all have impressive Quality scores (based on ratings from our three partner critics) of 845 or above.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

“Which producers will see the largest gain in brand recognition in the next two years?” That was one of the questions Wine Lister asked its Founding Members, in its latest survey of 49 of the world’s key wine trade players, between them representing well over one third of global fine wine revenues.

Continue Reading →