Wine Lister recently looked at red Christmas drinking options with the best Bordeaux under £50, and now that the official ‘sparkling season’ is almost upon us, it is high time to consider options for holiday bubbles. Below we examine the all-round best of the best – the top five Grand Cru Champagnes by Wine Lister score.

The number one Grand Cru Champagne is the indomitable Salon Le Mesnil (983). It fires on all Wine Lister cylinders, with impressive Quality, Brand, and Economics scores of 980, 989, and 981 respectively, meaning that it leads this week’s top five across each category. Moreover, it is the number one white wine on Wine Lister – still, sparkling, dry, or sweet. If you’re after a memorable bottle to kickstart the holiday season, then look no further than Salon 1996, its best ever vintage. As proof of the extraordinary longevity of top Champagne, the 1996 will be drinking well until at least 2025. Though expensive (£550 per bottle in-bond), you would be well-rewarded for paying the high price, Antonio Galloni calling the 1996 “the ultimate expression of Champagne as a wine”.

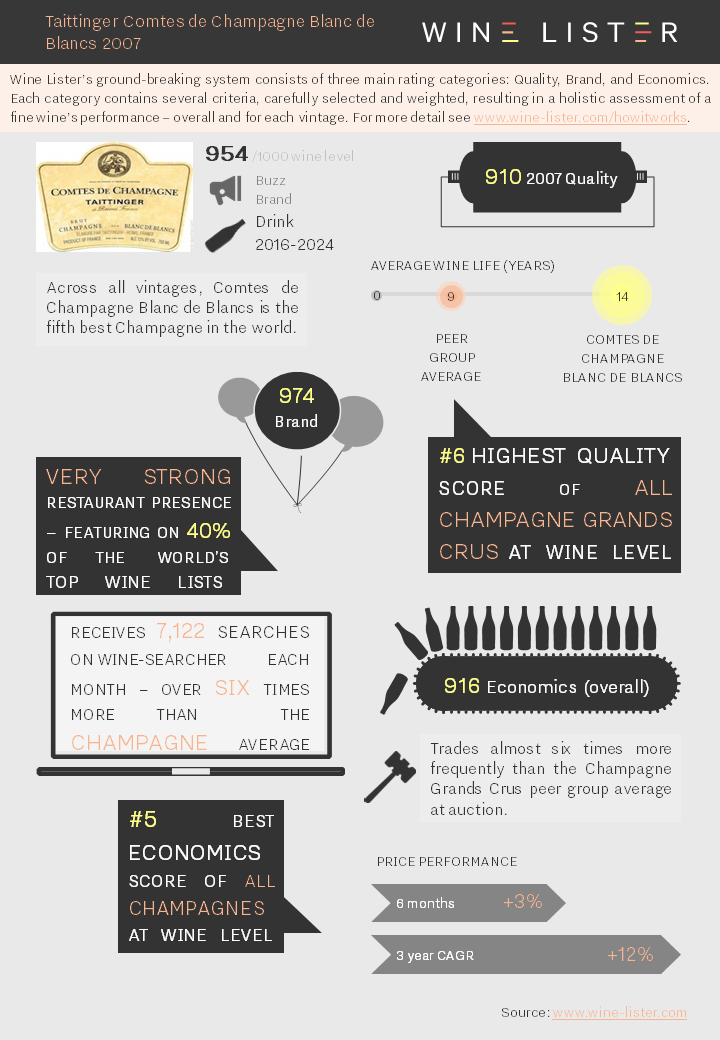

Next comes Taittinger’s Comtes de Champagne, whose main strength is its Brand score (976). This is helped by a production volume of c.170,000 bottles per annum – almost twice that of the other four Champagnes of this week’s group combined. It consequently also achieves the highest auction-trading volumes of the group, having traded 789 bottles over the past four quarters, according to our data partner, The Wine Market Journal.

In third place is Bollinger Vieilles Vignes Françaises. The term “vielles vignes” tends to get banded around quite frequently without much meaning, but in this case it carries rare significance. These old vines are planted on French rootstock, predating the spread of phylloxera which lead to the introduction of louse-resistant American rootstock onto the vast majority of France’s vines. As might be expected given the wine’s unique heritage, it comes with a hefty price tag (£713 per bottle in-bond). However, this rarity backs up its high price with an outstanding Quality score (963) – the joint-second best of this week’s top five.

In fourth place is Jacques Selosse’s Substance Brut (904). The only non-vintage wine of the five, it matches the Bollinger Vieilles Vignes Françaises’ excellent Quality score (963). Its outstanding quality, coupled with its tiny production volume of 2,700 bottles per annum, start to explain the £203 price-tag of this NV grower Champagne.

Finally, in fifth place, is Pierre Péters’ Cuvée Spéciale Les Chétillons Blanc (897). Though in fifth place, its impressive Quality (923) and Economics (922) scores suggest it could be a prime choice for cellaring. It achieves the best short and long-term price growth of this week’s top five, having added 16.7% to its price over the past six months, and recording a three-year compound annual growth rate (CAGR) of 36.5%. Any recent vintage would perhaps therefore be better placed under the Christmas tree (for an extremely lucky recipient), rather than on the Christmas table.

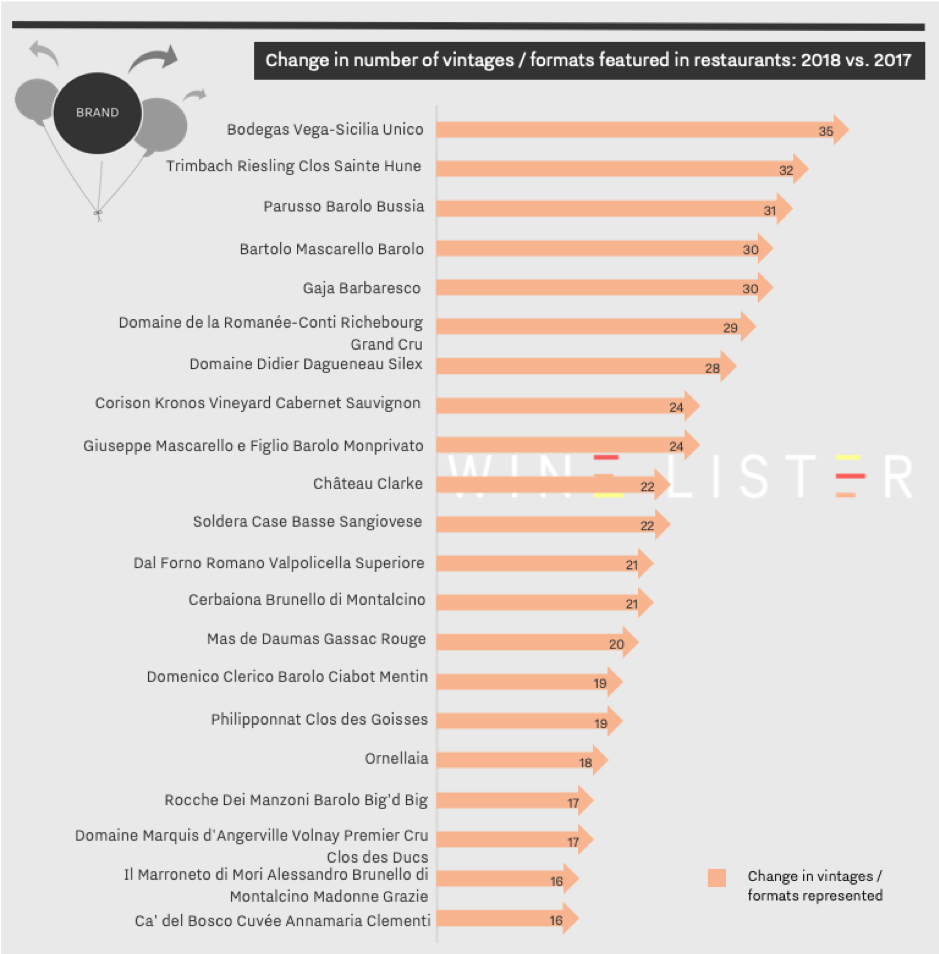

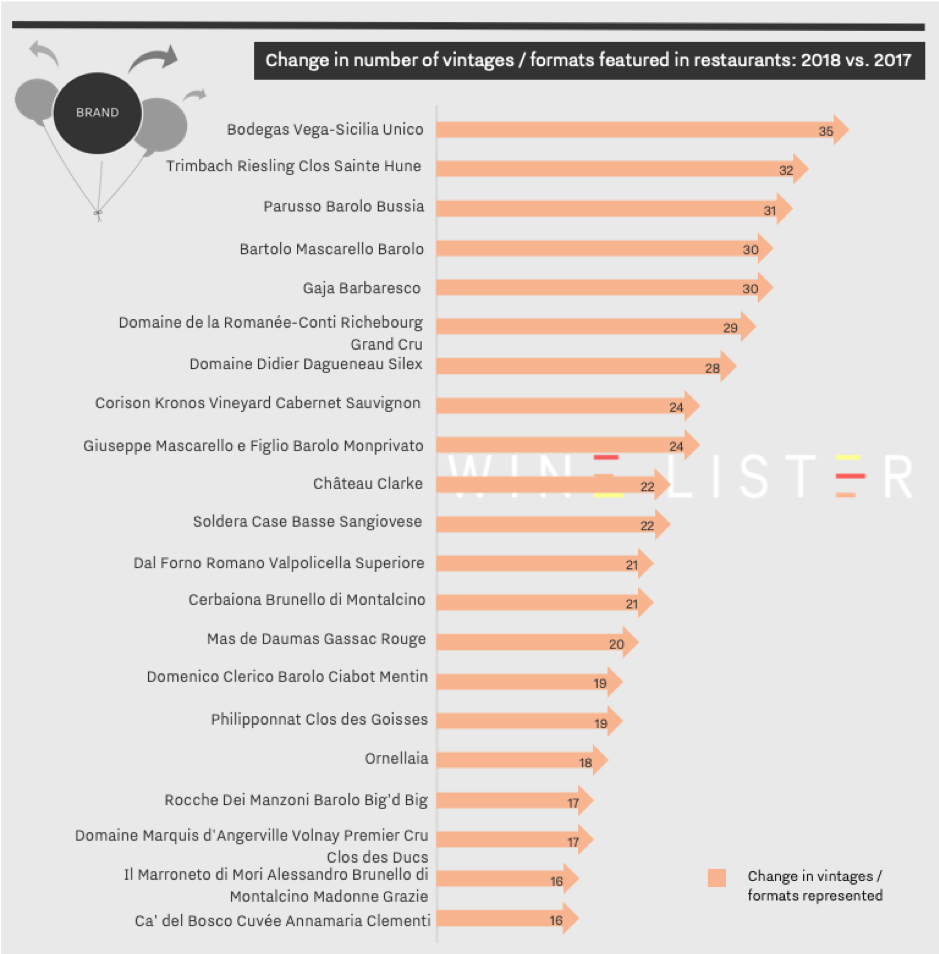

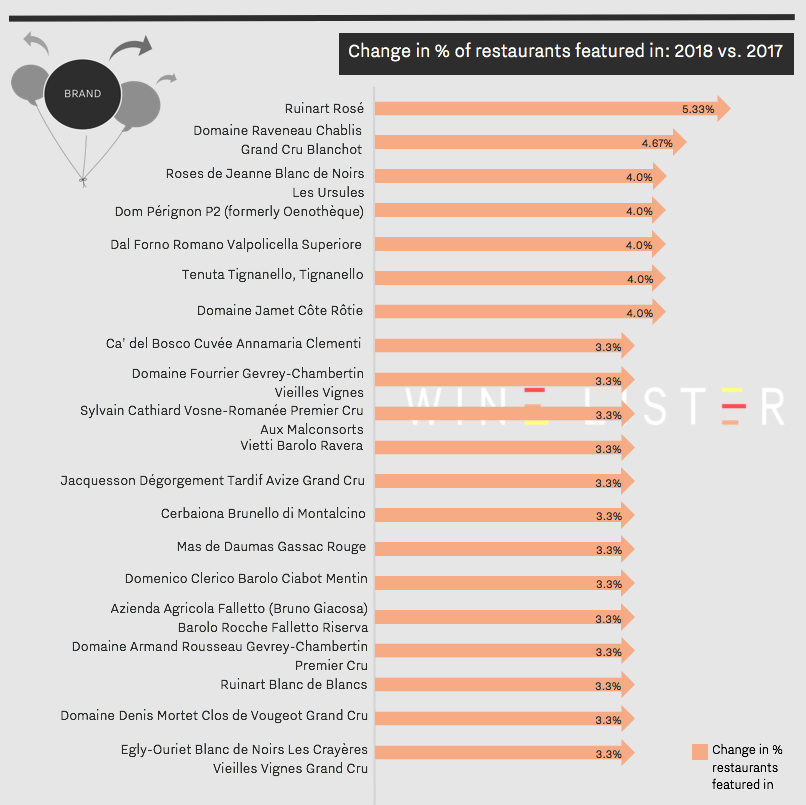

Last week we revealed the top 20 gainers in presence in the world’s best restaurants over the past 12 months. That was in terms of breadth, i.e. the number of restaurants in which a wine features. Wine Lister also analyses the depth of presence – the range of vintages and/or bottle formats of each wine therein. Here we look at the top 21 wines achieving the largest increases in restaurant presence depth since last year.

In first place, with an impressive 35 additional vintages and/or bottle formats listed across the world’s 150 best restaurants since this time last year, is Vega-Sicilia’s Unico. This brings its total references to 250 (almost three and a half in each of the 71 lists in which it features). Given Unico’s average drinking life span of 13 years, and its reputation for longevity (an Unico vertical tasting is an opportunity not to be missed), this result is hardly surprising. Its strong restaurant presence is matched by online popularity (Unico is the 33rd most-searched-for wine in our database), resulting in a Brand score of 992 – the best of any Spanish wine on Wine Lister.

Though Spain takes the number one spot, Italy is the overall biggest mover in increased depth of representation, claiming 12 out of the 21 places shown on the chart below.

Ornellaia is among these, and is also the most thoroughly represented wine of the group, with 280 vintages and/or bottle formats featured across 43% of the world’s best restaurants.

Several others – Cerbaiona Brunello, Dal Forno Romano Valpolicella Superiore, Ca’ del Bosco Cuvée Annamaria Clementi, and Domenico Clerico Barolo Ciabot Mentin – feature in the top gainers for horizontal as well as vertical presence in the world’s best restaurants. The latter is one of five Barolos to feature in the chart above, joined by Parusso Barolo Bussia, Bartolo Mascarello’s Barolo, Giuseppe Mascarello e Figlio Barolo Monprivato, and finally, Rocche Dei Manzoni Barolo Big’d Big, which sees the biggest increase in vertical presence of the whole group. Despite a horizontal representation increase of just 1%, the number of vintages and/or bottle formats listed across the 3% of the world’s best restaurants in which it features has grown from two to 19 in the last 12 months (or in other words, by 850%).

Outside Italy, the overall picture of restaurant presence depth somewhat contradicts that of breadth painted last week. Though Champagnes, and in particular grower offerings, have increased significantly in terms of horizontal presence, their vintage and/or format gains have not been sufficient to make this week’s top 20. This suggests that whilst sommeliers are keen to add more variety of Champagne, they aren’t so worried about listing reams of vintages / formats thereof. Only one Champagne features in the group: Philipponnat’s Clos des Goisses.

Bordeaux is conspicuous by its absence in this list, other than Château Clarke, with 26 overall references up from just four. In fact, Bordeaux’s big names are more likely to find themselves at the very bottom of the list, many having seen their vertical entries on restaurant wine lists shrink significantly. This seems to suggest that as restaurants diversify, they are choosing to hold less Bordeaux stock, still listing the top wines, but not necessarily in multiple vintages or formats.

Part of Wine Lister’s Brand score includes a measure of prestige, achieved by analysing a wine’s presence in the world’s best restaurants. Whether a restaurant makes the cut depend on a combination of measures including the Michelin Guide, San Pellegrino 50 Best Restaurants, and World of Fine Wine Best Wine List Awards.

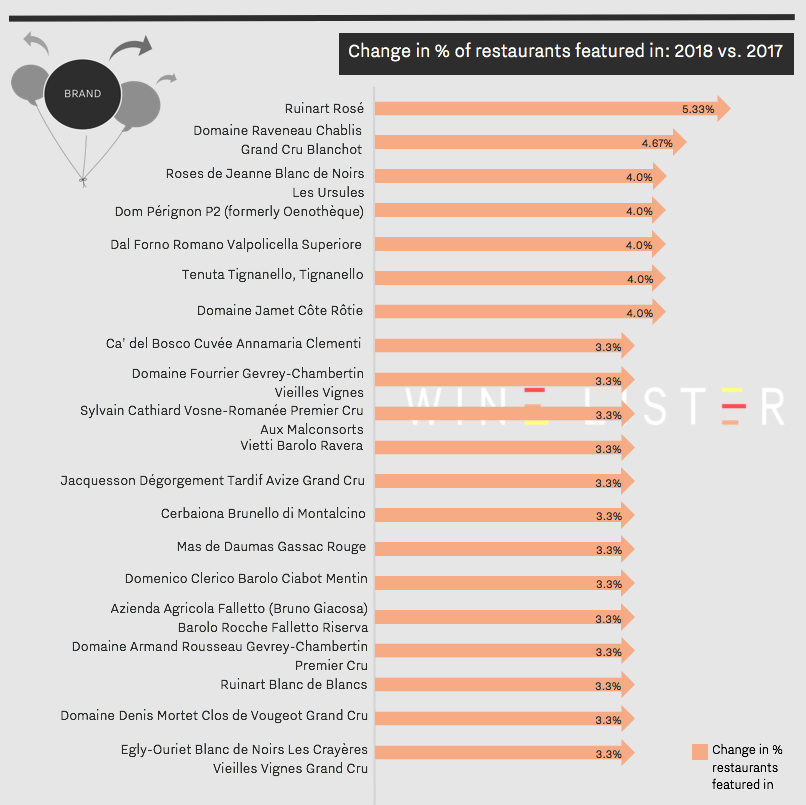

The chosen wine lists are then analysed to give us the breadth (how many restaurants) and depth (how many formats and/or vintages in each restaurant) of presence achieved by each wine on Wine Lister. Looking at the former criterion, the chart below shows the top 20 biggest gainers since our last blog on the subject. (Next week we will be looking at wines with the greatest increase in depth of representation.)

Six out of the 20 wines with the biggest increase in restaurant presence are Champagnes. Ruinart appears twice, with its NV rosé having made the greatest improvement, now appearing in 33% of the world’s best restaurants. However, the overall winner – present in more than double the number of restaurants, is Dom Pérignon’s Vintage Brut. Despite not featuring in the top 20 biggest risers above, the Champagne Brand king is now present in 69% of top restaurants worldwide, overtaking last year’s winner, Yquem.

Contrary to our last analysis on the subject, not all the biggest Champagne gainers in restaurant presence are big brands. Ruinart Rosé, Dom Pérignon P2, and Ruinart Blanc de Blancs may well fit this bill, with an average Brand score of 878, but the lesser-known three, grower Champagnes Roses de Jeanne Blanc de Noirs Les Ursules, Jacquesson Dégorgement Tardif Avize Grand Cru, and Egly-Ouriet Blanc de Noirs Les Crayères Vieilles Vignes, do not, as shown by a lower collective Brand score average of 664.

If this alone is not an indication of restaurant wine lists branching out, then perhaps the absence of Bordeaux is (indeed, a handful of Bordeaux wines with strong restaurant presence have lost a little ground since last year’s analysis). This diversification does however appear exclusive to the Old World, with no New World wines in the top 20 gainers.

Burgundy is well-represented amongst the top gainers, with one white, Raveneau’s Chablis Blanchot, and four reds: Sylvain Cathiard’s Vosne-Romanée Aux Malconsorts, Denis Mortet’s Clos de Vougeot, Armand Rousseau’s Gevrey-Chambertin, and Fourrier’s Gevrey Chambertin Vieilles Vignes.

Italy brings a show of diversity with six wines hailing from four different appellations across the 20 biggest movers. Vietti’s Barolo Ravera – one of three Barolos to feature in this list – has the lowest restaurant presence of the group (5%) and Solaia’s younger sibling, Tignanello the highest (47%).

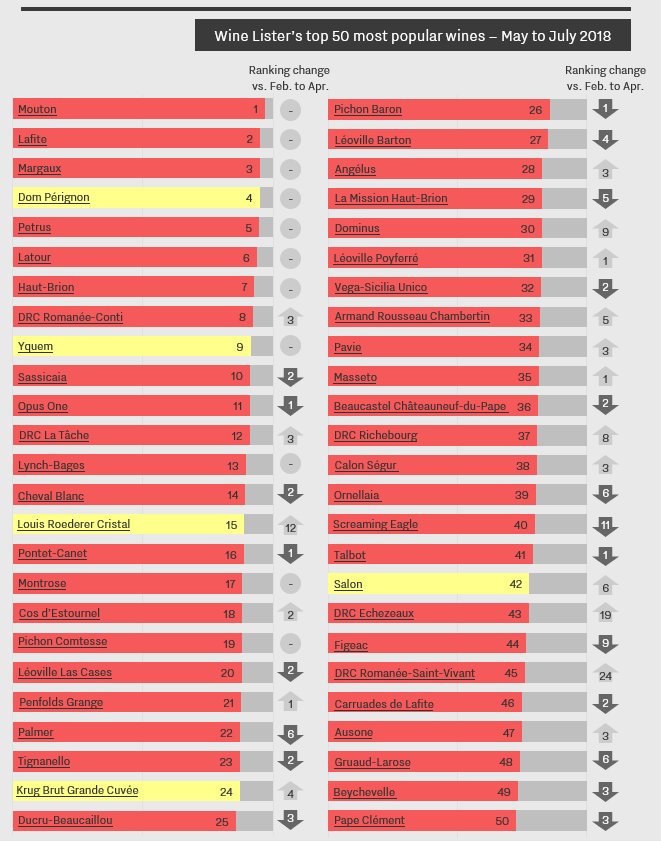

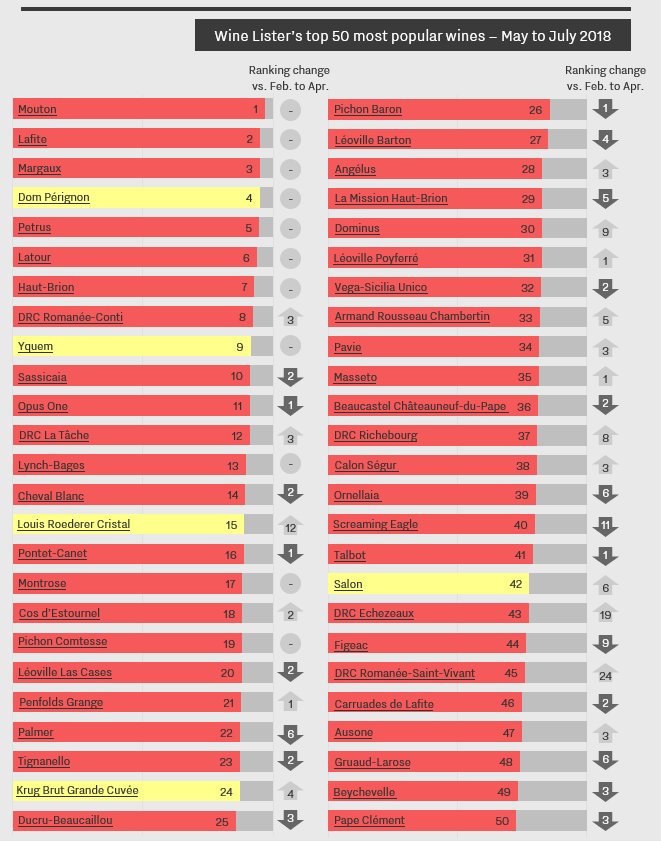

As part of our Brand score, Wine Lister measures popularity using the three-month rolling average searches on the world’s most visited wine site, Wine-Searcher.

We have recently updated our treatment of this data to provide relative results for all 4,000+ wines on Wine Lister. Expressing each wine’s search frequency as a ranking will make it easier for our users to interpret the data. For example, Mouton is the #1 most searched-for wine of all wines on Wine Lister, according to monthly searches on Wine-Searcher.

To mark this transition, here we examine the top 50 most popular fine wines in the world.

The first seven most searched-for wines for the period of May, June, and July include the five Bordeaux left bank first growths (Mouton, Lafite, Margaux, Latour, and Haut-Brion), right-bank powerhouse, Petrus, and Champagne super-brand, Dom Pérignon. It is perhaps of no surprise that these rankings remain unchanged since the previous period (February to April) .

Burgundian searches in the top 50 are dominated by Domaine de la Romanée-Conti, with Romanée-Conti, La Tâche, Echezeaux, and Romanée-Saint-Vivant all achieving better rankings versus the previous period. These four together achieve an average ranking of 30th place, and an average movement up the search ranking of 11 places.

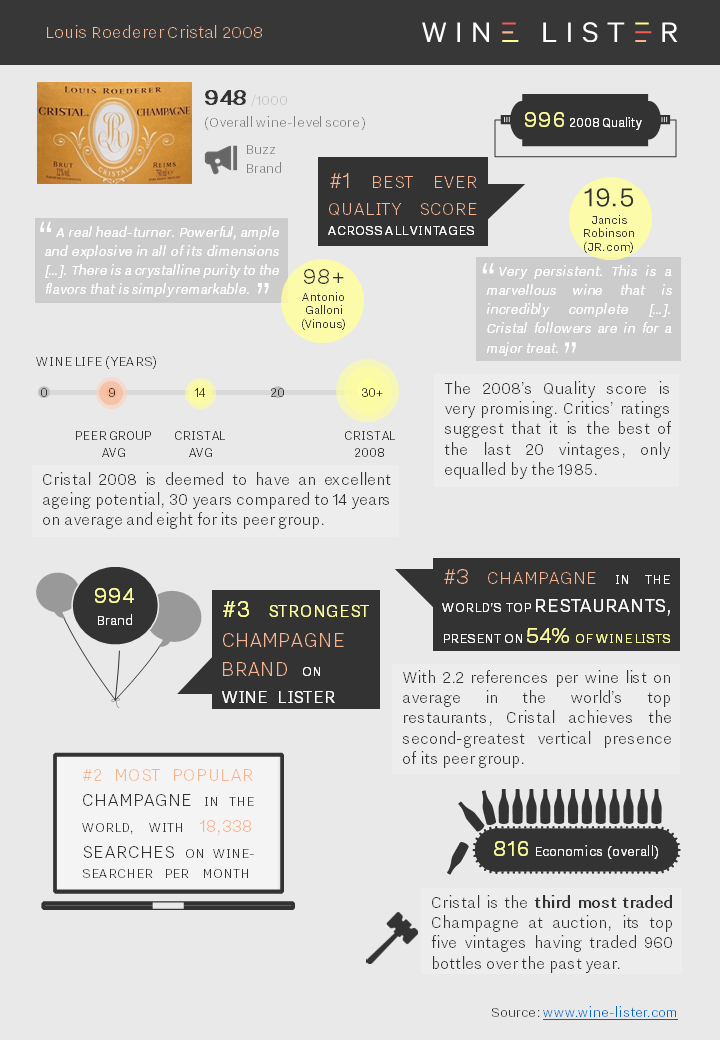

Other than Dom Pérignon, the two remaining Champagnes featured in the top 50 most searched-for wines have moved up the rankings for May-July 2018 compared to the previous three-month period. Louis Roederer’s Cristal was up 12 places, presumably due to the release of its 2008 vintage in June. Krug’s most recent Grande Cuvée (166th edition) was released in late May, explaining its jump four spots up the rankings into 24th place.

More than half of the top 50 most popular wines are Bordeaux, with 30 wines hailing from the region. However, Bordeaux did not see the boost to their search ranking one might have expected during Bordeaux’s en primeur 2017, with one fewer of the region’s wines featuring in the top 50 than before the campaign kicked off. In fact, supporting Wine Lister’s analysis of this year’s lacklustre campaign, searches for many top Bordeaux châteaux actually fell during this period. For instance, Figeac, despite achieving Bordeaux’s 10th best Quality score of the 2017 vintage, slipped nine spots down the rankings.

With England progressing serenely (ahem) through their round of 16 match against Columbia, much Champagne (and probably much more beer) will have been drunk on Tuesday evening. With somewhat tortuous logic therefore, this week’s Listed section focuses on the best Champagnes from the 2000 vintage by Economics score.

Separated by just three points at the top of the table are Philipponnat Clos des Goisses (966) and Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs Grand Cru (963). Despite experiencing the lowest Quality score of the five – a nonetheless hugely respectable 944 – the Philipponnat gets its nose ahead thanks to excellent growth rates over both the long and short-term, with a three-year compound annual growth rate (CAGR) of 20% and having added 33% to its price over the past six months alone. No wonder it is one of the group’s three Investment Staples.

It is interesting that Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs Grand Cru comes in second place in terms of Economic performance, despite it experiencing the group’s lowest overall Wine Lister score for the vintage (910). Its lower Wine Lister score is the result of its Brand score (822) being the weakest of the group by nearly 90 points, confirming the phenomenal head start that the globally renowned houses have over grower Champagnes in terms of brand recognition. It manages second place in terms of economic performance thanks to formidable short-term growth rates, its price having risen 42% since January.

In third place is Krug’s Clos du Mesnil (954), one of three Blanc de Blancs in this week’s top five, and the first of two wines from Krug, with the Brut Vintage recording an Economics score of 907. The two Krugs are almost inseparable, the Brut Vintage’s Wine Lister score of 967 just one point ahead of the Clos du Mesnil, making them the overall top-scoring Champagnes of the vintage. Our partner critics were barely able to separate them either, the Clos du Mesnil’s Quality score just two points ahead (976 vs 974). However, the rarity of the Clos du Mesnil results in it being over 3.5 times more expensive. Furthermore, with the Clos du Mesnil recording a 3-year CAGR of 14% and short-term growth rates of 12%, the price discrepancy is increasing – the Brut Vintage has a 3-year CAGR of 8% and has increased in value by 4% over the past six months. However the feather in the cap for the Brut Vintage is that it is considerably more liquid – presumably because of larger production volumes – its top five vintages having traded 1,279 bottles at auction over the past four quarters, over 11 times as many as the Clos du Mesnil (112).

The remaining spot is filled by Taittinger Comtes de Champagne Blanc de Blancs Grand Cru (922). It is the second-most liquid of the group, its top five vintages having traded 720 bottles at auction over the past year.

Incidentally, 2000 was a European Championships year, not a World Cup year. Fittingly, given the focus of this blog, France won. England failed to make it past the group stages.

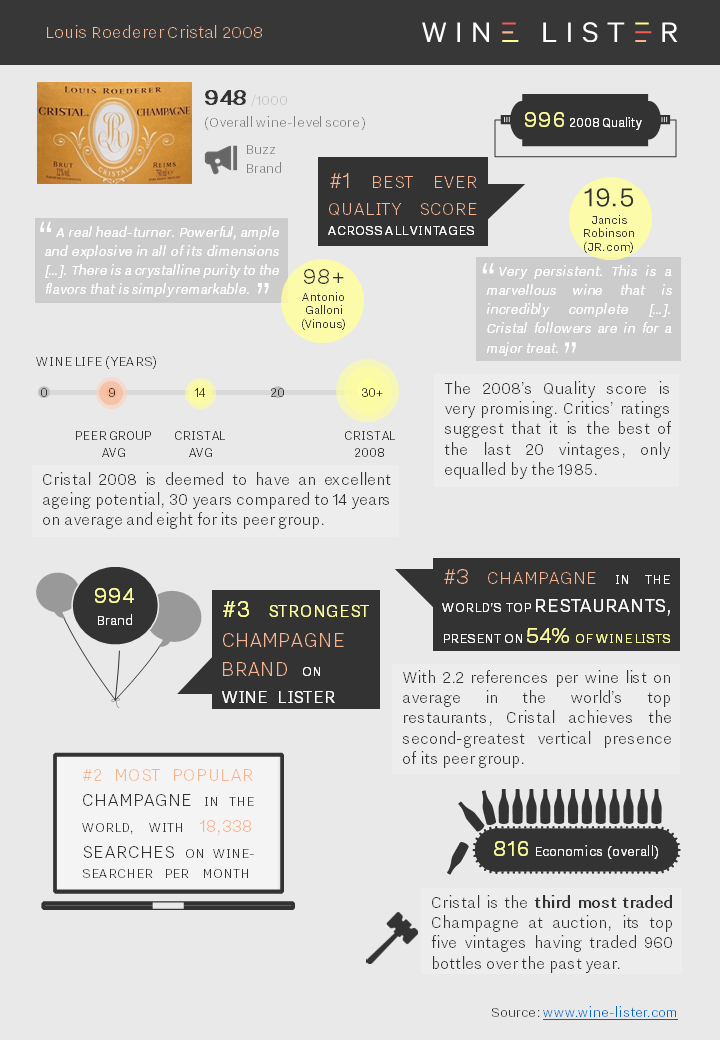

All the facts on Cristal 2008 which has been released today with its best ever Quality score (996).

You can download the slide here: Wine Lister Factsheet Cristal 2008

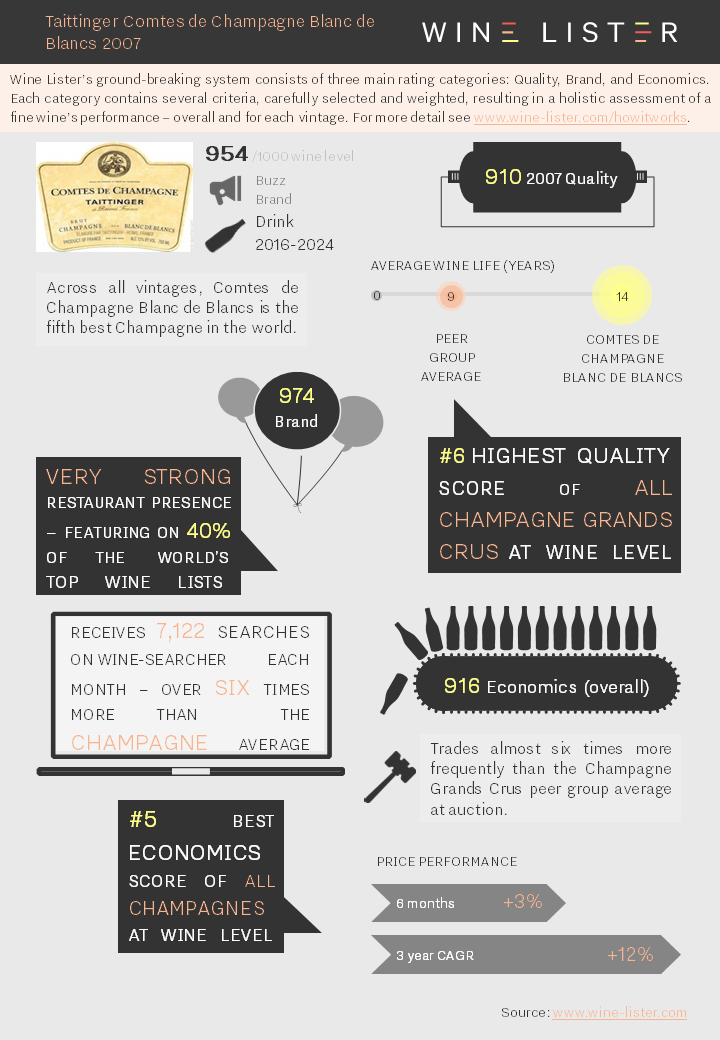

Taittinger Comtes de Champagne Blanc de Blancs has released its 2007 at £75 per bottle. Below we summarise all the key points:

You can download the slide here: Wine Lister Fact Sheet Taittinger Comtes de Champagne Blanc de Blancs 2007

Yes, that question: “which are better, Old World or New World wines?” Traditionalists may argue that the latter lack the prestige and quality of their Old World counterparts. Those with a preference for the New World might see these wines as better value for money, free of the price tag accompanying wines from famously exclusive Old World vineyards.

Wine Lister has compared the top 50 wines by Quality score from Old World and New. The average Quality score of the top 50 wines is 983 in the Old World and 948 in the New. Though both Worlds sit comfortably in the “strongest” section of the Wine Lister 1000-point scale for Quality, the price gap tells a different story. The average price for a top 50 ranking Old World wine is £2,114 per bottle – seven times higher than the average New World equivalent (£297).

The wine with the highest Quality score on Wine Lister is Egon Müller’s Scharzhofberger Riesling TBA, which achieves a wine level Quality score of 995, having fallen just one point shy of the perfect 1,000 point score for the 2010 vintage. Riesling’s quality proliferates in the top 50, with 16 entries across Germany and Alsace. The high critics’ scores are balanced by exceptionally high prices, with an average price of £2,509 per bottle.

Though the Old World Quality top 50 is in fact white wine dominant, red Burgundy is well represented, with 13 entries and an average Quality score of 983 at £3,164 per bottle. Even excluding DRC La Romanée-Conti’s remarkable price (£11,722 per bottle), Burgundy’s remaining 12 finest reds command an average price of £2,450 per bottle.

Champagne wins the price vs quality race for the whites, with an average Quality score across its four entries of 981 at £348 per bottle. Even more impressive are the five Port entries, with an average Quality score of 982 at £244 per bottle.

In contrast to the diverse set of regions represented in the Old World top 50, the New World list is dominated by California (with 40 out of 50 wines hailing from the region). These wines achieve an average Quality score of 948 at £315 per bottle – not quite as good value as the Champagnes and Ports, but seemingly better value than their red Burgundian counterparts.

Though there are fewer entries from Australia (seven in total), the New World’s number one wine for quality comes from the Barossa Valley. Torbreck The Laird has a Quality score of 984 points and a price of £427 per bottle. When comparing this to an Old World wine of the same score, the price difference is evident. Domaine Leroy’s Romanée Saint Vivant benefits from the same Quality score, but is nearly five times more expensive, at £1,975 per bottle.

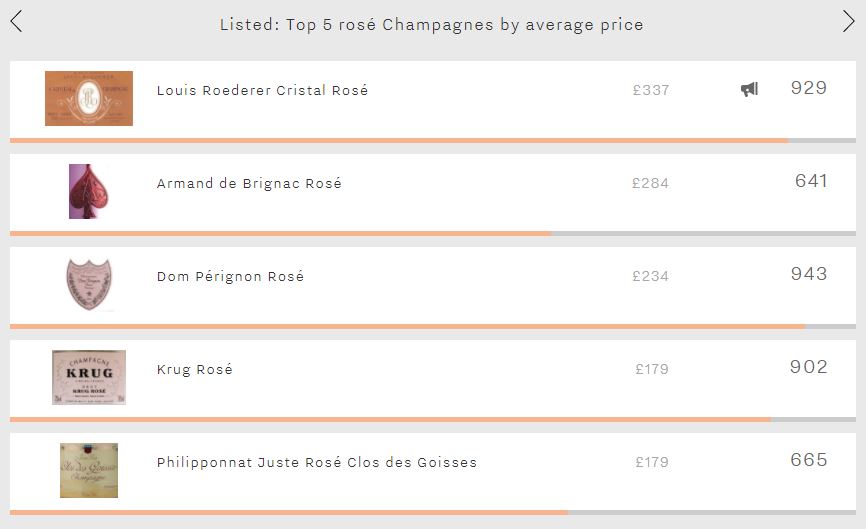

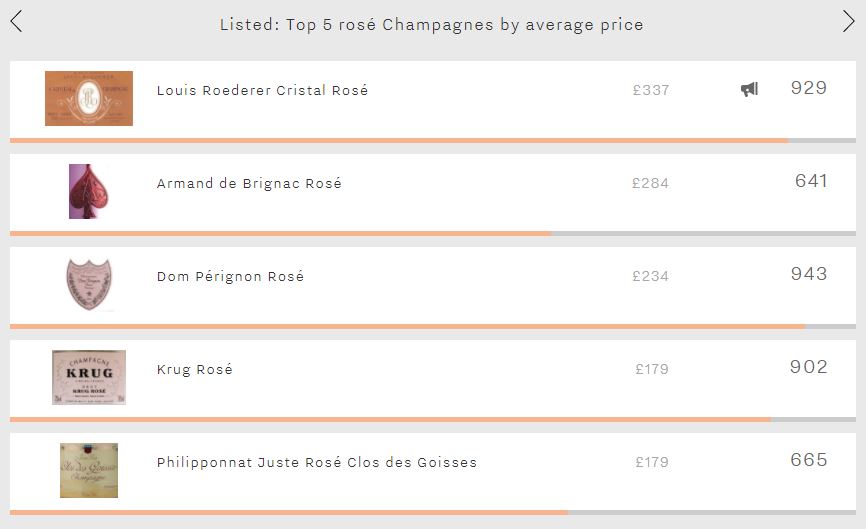

Unintentionally coinciding with today’s International Women’s Day – really, it was a complete accident – this week our Listed section looks at “pink Champagne”, namely the five most expensive rosé Champagnes. We are a bit embarrassed that it looks like we are jumping on the bandwagon and touting the colour pink today. However, as these five contenders show, top rosé Champagne represents a serious vinous offering worthy of any day or occasion.

The world’s most expensive pink Champagne is Louis Roederer’s Cristal Rosé (£337 per bottle). It also achieves the highest Quality score of all rosé Champagnes (972). Whilst it receives excellent scores from each of Wine Lister’s partner critics, it is the outstanding average rating of 97/100 from Antonio Galloni’s Vinous that stands out. Cristal Rosé also pips its white counterpart to the post in the Quality category (972 vs 970), and is over twice as expensive (£337 vs £165 per bottle). However, despite its superior quality, Cristal Rosé trails its white counterpart in the Brand category by 56 points – it features on under half as many of the world’s top wine lists and is searched for 82% less frequently.

The second-most expensive rosé, Armand de Brignac’s offering, is a newcomer to the fine wine world, born in 2006. It experiences the group’s lowest Quality and Economics scores, and second-weakest Brand score. Its high price (£284) can therefore be attributed to its association with Jay-Z. The American rapper featured Armand de Brignac’s white Champagne in the video for “Show Me What You Got” in 2006 – before it even had a US importer – and eventually bought a significant portion of the house in 2014, further aligning the brand with his high-flying lifestyle.

In third place is Dom Pérignon’s rosé (£234). Whilst unable to match the peerless brand recognition of its white counterpart, it does enjoy the best Brand score of any pink Champagne (984). This is thanks to receiving on average 2.5 times as many online searches each month as the second-most popular wine of the five (Cristal Rosé).

The last two spots are filled by Krug’s rosé and Philipponnat Juste Rosé Clos des Goisses, each costing £179. The fact that the Krug enjoys a lead of 237 points in terms of overall Wine Lister score yet costs the same shows that when it comes to rosé Champagne, prices don’t always have a rational explanation. The chart below confirms a lack of correlation between price and overall Wine Lister score for these five wines.

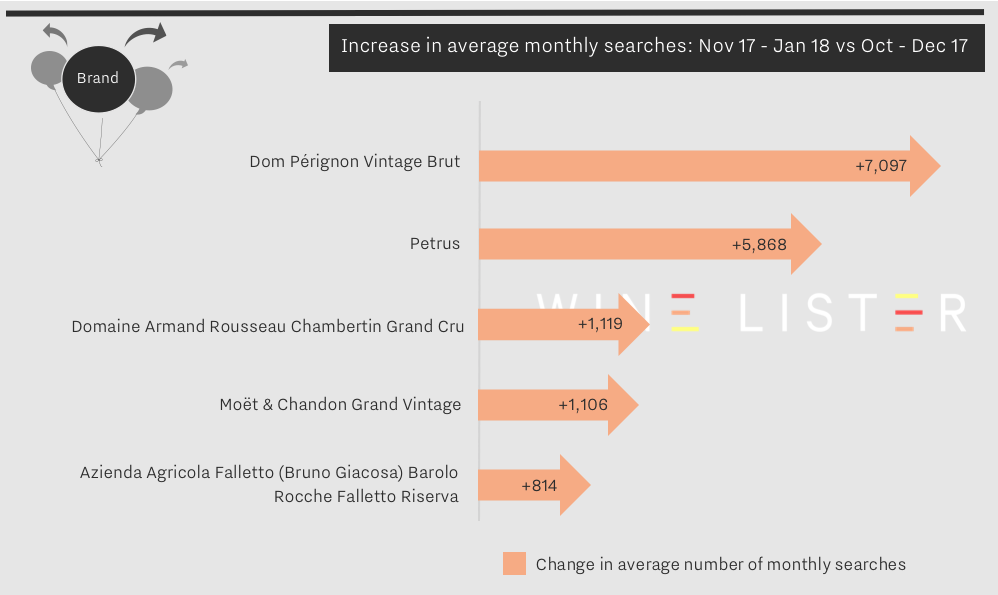

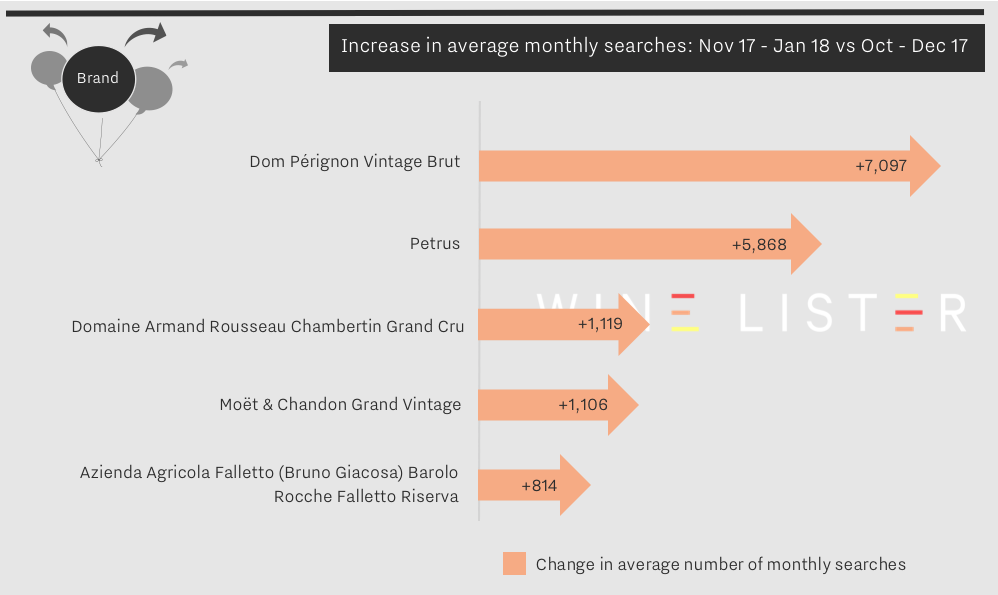

Wine Lister uses search frequency data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis. Wines with the highest search frequency numbers tend to be consistent, with the Bordeaux left bank premiers crus classés generally taking the top spots.

This month’s biggest search frequency gainers also rank as some of the most searched-for wines on Wine-Searcher. Dom Pérignon Vintage Brut is the third most popular wine with over 84,000 searches after Lafite and Mouton, closely followed by Petrus in fourth place. Armand Rousseau’s Chambertin and Moët & Chandon Grand Vintage appear in the top 50, while Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva comes lower down at number 148 out of the circa 5,000 wines on Wine Lister, but its search frequency has recently increased by 15%.

Our last post on online search frequency revealed Wine Lister’s first ever perfect Brand score. Moving on from the Christmas period, Champagne brands still show marked increases in search frequency, but this time they do not stand alone at the top.

Dom Pérignon Vintage Brut is the largest gainer in popularity for the second time running. Increasing at a slower rate than in December, its popularity nonetheless grew by 7,097 searches into January, maintaining its 1000-point Brand score. Dom Pérignon remains the only wine to achieve a perfect score from any of the Wine Lister score categories. The other Champagne still riding high on searches is Moët & Chandon Grand Vintage, which increased by 6%.

Bordeaux creeps back onto the map for online searches at the beginning of 2018, with the first growths having featured heavily in searches up to December 2017. Petrus is in second place after Dom Pérignon, with an 8% increase in search frequency. It will be interesting to see if search increases for Bordeaux follow the same pattern as last year as we approach the 2017 en primeur campaign.

Armand Rousseau’s Chambertin appears in third place. Armand Rousseau was only one of two producers to achieve a perfect confidence rating from our Founding Members in our recent Burgundy study.

In fifth place for increased popularity is a bittersweet entry. Searches for Barolo Rocche Falletto Riserva from Azienda Agricola Falletto increased as the wine world learned of the sad passing in January of Piedmont legend, Bruno Giacosa. You can read more on Bruno Giacosa’s legacy in a recent blog on Barbaresco, here.