With so many interesting offers coming in from different merchants, it can be tricky to keep track of what wine you have, let alone where it is, and when it should be drunk. To help you get the most out of your wine collection, Wine Lister has opened up its data analysis and fine wine expertise to private clients, who can now commission all kinds of portfolio analysis, from detailed geographical split and purchase advice, to investment forecasting and a fully-fledged “drink vs. sell” plan.

Wine Lister’s “fantasy cellar”

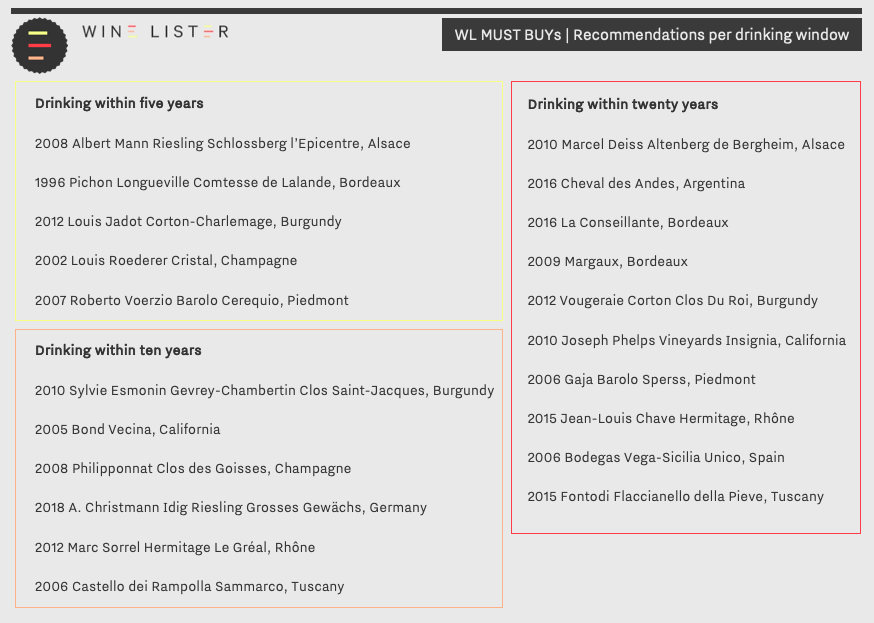

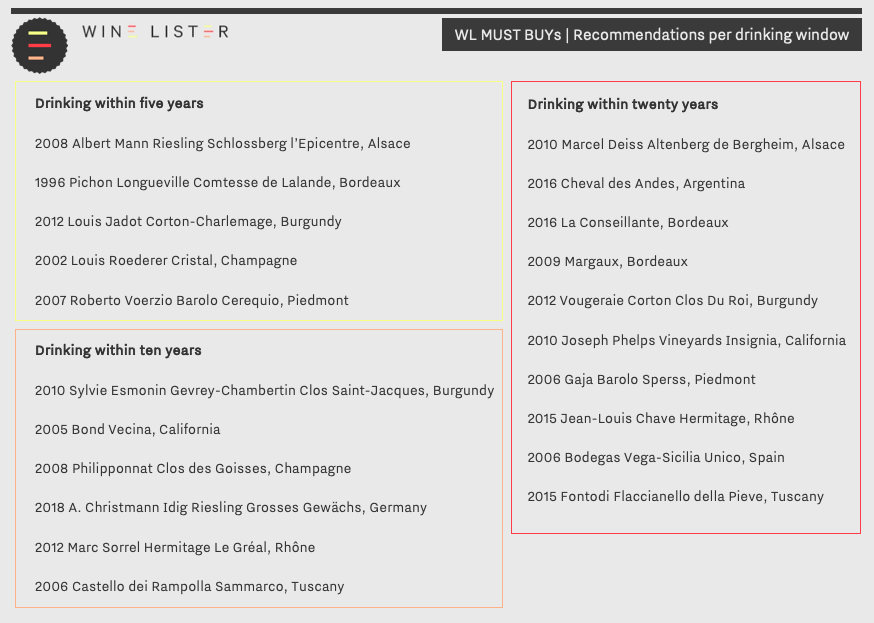

The current list of Wine Lister MUST BUYs – wines showing notable quality and value within their respective vintages and appellations, and wide praise from the international trade – is 1,728 picks strong. While the Wine Lister team would love to own (and enjoy) all of them, below is a short selection to be put away and enjoyed at their best in five, ten, and twenty years, respectively.

Riesling to reserve

With remarkable ageing potential, and good value across the board, Riesling constitutes a brilliant white addition to any wine collection. To be opened within ten years, the 2018 A. Christmann Idig Riesling Grosses Gewächs hails from Germany’s famed Mosel, and is described by Wine Lister partner critic, Jancis Robinson as “the thinking-person’s Riesling”. She notes the “understatement of individual components” in the wine, “which allows the taster to focus on balance and elegance”. Creeping over the border into the Alsace, where Riesling tends to be drier in style, Albert Mann’s 2008 Schlossberg l’Epicentre is ready but will improve – offering optimum enjoyment within the next five years. Another Alsatian, the 2010 Marcel Deiss Altenberg de Bergheim can endure another 20 years of ageing, also providing a reliable white to add to any cellar. Wine Lister partner critic, Antonio Galloni, describes its “perfumed aromas of nectarine, apple blossom, minerals and honey”, calling it “vibrant and penetrating”. With notable value for their quality, the three Rieslings achieve a shared WL score of 96, at £54, £98, and £59 per bottle (in bond), respectively. For something to stash away, the latter is available by the case of six from Millésima UK.

Burgundy on standby

Louis Jadot Corton Charlemagne 2012 is a similarly reliable white to be stored in the cellar, achieving a WL score of 95 at £126 per bottle (in-bond). Barrel-fermented and aged for a further eight to ten months in 100% new oak barrels, the wine has developed complexity and enhanced ageing potential. Production in 2012 was kept notably small – indeed winemaker Frédéric Barnier states, “it is critical to control the yields in Corton-Charlemagne to make a wine of real Grand Cru quality.” It can be purchased by the case of 12 from Fine+Rare Wines, and can be opened within five years. Burgundy also offers an abundance of reds with promising ageing potential, including the 2010 Sylvie Esmonin Gevrey-Chambertin Clos Saint-Jacques, and the 2012 Vougeraie Corton Clos Du Roi. Both wines achieve a WL score of 95, at £192 and £90 per bottle (in-bond), respectively.

Champagne to store

A sure pick to pop open within five years, the 2002 Louis Roederer Cristal was aged on lees for six years, before being matured for a further eight years in bottle after its disgorgement in 2009. Wine Lister partner critic, Jeannie Cho Lee notes that it is a “gorgeous Cristal with a fine line of acidity running through it – it vibrates on the palate”. With a WL score of 96, at £192 per bottle (in-bond), it is available in cases of three from Vinum Fine Wines. With an identical WL score of 96, the 2008 Philipponnat Clos des Goisses can be acquired by the case of six for £850 (in bond) from Justerini & Brooks, to be enjoyed within the next decade.

New World to wait for

For some New World picks that are worth putting away for the future, Napa Valley offerings include the 2005 Bond Vecina (owned by the famed Harlan family) and the 2010 Joseph Phelps Vineyards Insignia. In regards to the former, Antonio Galloni stated that he would “prefer to cellar it, as the future for this wine is unquestionably very, very bright”. With a WL score of 97, at £347 per bottle (in-bond) it is an opulent option to be enjoyed within the next twenty years. Of the 2010 Joseph Phelps Vineyards Insignia, Galloni states similarly that “the 2010 will enjoy a long drinking window once it softens”. Achieving a WL score of 96, at £158 per bottle (in-bond), it is available in cases of six from Goedhuis & Co.

Also featured in the above MUST BUY recommendations are: 2016 Cheval des Andes, 2016 La Conseillante, 2015 Fontodi Flaccianello della Pieve, 2015 Jean-Louis Chave Hermitage, 2012 Marc Sorrel Hermitage Le Gréal, 2009 Margaux, 2007 Roberto Voerzio Barolo Cerequio, 2006 Bodegas Vega-Sicilia Unico, 2006 Castello dei Rampolla Sammarco, 2006 Gaja Barolo Sperss, and 1996 Pichon Longueville Comtesse de Lalande.

For personalised, impartial fine wine purchase recommendations, as well as further wine collection analysis, get in touch with our team at team@wine-lister.com, or download the full Cellar Analysis information pack.

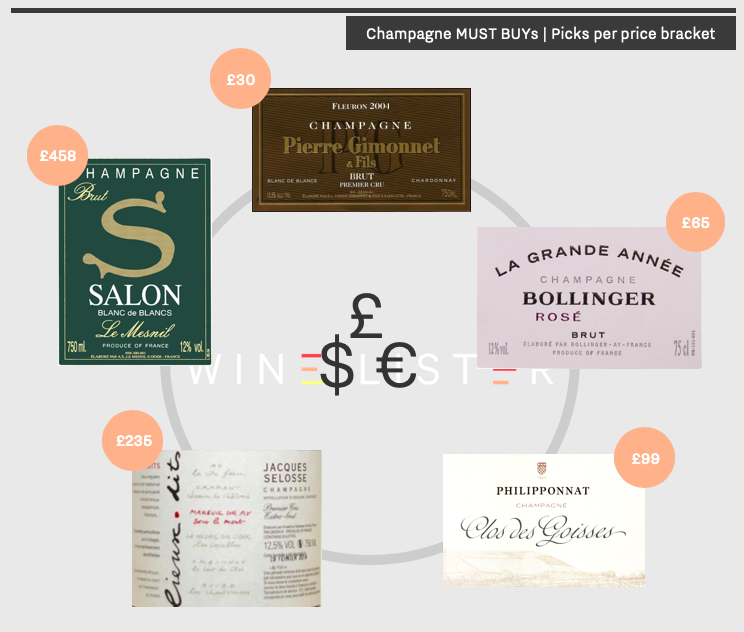

The global pandemic caused considerable losses to the Champagne industry, with estimations that its sales depleted by more than 75% at the height of lockdown. While we have lacked cause for celebration over the past quarter, parts of the world are now returning to a new normal, with restaurants and bars gradually reopening. It is time to raise a toast to our favourite fizz.

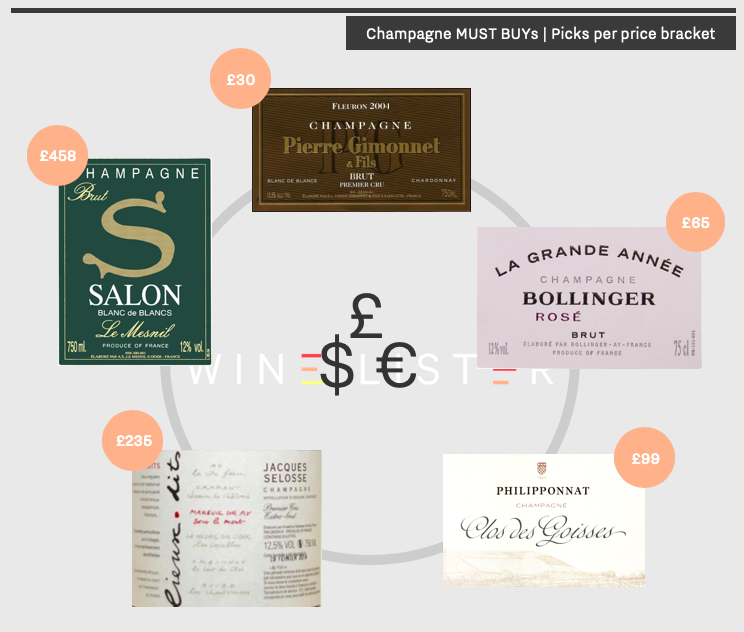

To guide those buying at every level, we have compiled a selection of Champagne MUST BUYs at five different price points.

Under £50 – 2009 Pierre Gimonnet et fils Fleuron Brut Blanc de Blancs

Pierre Gimonnet et Fils is an original member of the Club Trésors de Champagne, which, founded in 1971 by 12 longstanding producers, now includes 29 grower Champagne houses that produce, bottle, and age their wine on-site. Currently managed by third-generation vignerons, Didier and Olivier Gimonnet, the property owns 28 hectares of vineyards around the Côte des Blancs. Made from 100% Chardonnay grapes, the estate’s “Fleuron” is produced solely in excellent years, from grapes selected in the best plots of each vineyard. At £30 per bottle (in-bond), the 2009 Pierre Gimonnet et fils Fleuron Brut Blanc de Blancs was described as “absolutely fabulous” by Wine Lister partner critic, Antonio Galloni. A “tropically-leaning expression of fruit marries with the classic Gimonnet emphasis on tension”, Galloni adds. The 2009 is available to purchase in magnum form from Armit Wines.

Under £75 – 2007 Bollinger Grande Année rosé

Added to the estate’s portfolio in 1976, then manager, Lily Bollinger, agreed to the production of a rosé under one condition – it had to be extraordinary. Only made in the best vintages, the 2007 Bollinger Grande Année Rosé comprises a blend of 72% Pinot Noir and 28% Chardonnay, was fermented entirely in barrels, and aged under natural cork. With a WL score of 93 at £65 per bottle (in-bond), it promises impressive ageing potential. Having tasted the 2007 in 2019, Tim Jackson for JancisRobinson.com notes its “chalky texture with red and black cherry, some orange-citrus and plenty of nutty lees”. The 2007 Bollinger Grande Année rosé is available to purchase by the case from Berry Bros & Rudd.

Under £150 – 2004 Philipponnat Clos des Goisses

At £99 per bottle (in-bond), the 2004 Philipponnat Clos des Goisses achieves a WL score of 96. Clos des Goisses is Philipponnat’s flagship cuvée, produced from 65% Pinot Noir and 35% Chardonnay grapes. Grapes are selected from Philipponnat’s walled Mareuil-sur-Ay vineyard, which, at a 45-degree slant, ensures the optimum ripening of Pinot Noir grapes in Champagne’s cool climate. Julia Harding for JancisRobinson.com notes that there is “a toasty richness on the palate, even a slight note of char and chamomile”, calling it a “complex and unfolding wine that cannot be rushed if you want to enjoy its multi-layered character”. The 2004 Philipponnat Clos des Goisses can be purchased by the case from Fine + Rare Wines.

Under £300 – NV Jacques Selosse Blanc de Noirs Le Côte Faron

Founded in 1949, Jacques Selosse is now run by Jacques’s son, Anselme who took over from his father in 1974. Anselme has been praised for instigating a welcomed change in Champagne, encouraging producers to embrace new ideas of low yields, chemical-free vineyards, and terroir-focussed wines. Having implemented a reduction of yields and organic farming within his own production, Jacques Selosse now produces some of the most sought-after wines from the region. Made from 100% Pinot Noir grapes grown in a single vineyard, La Côte Faron in the village of Aÿ, Jacques Selosse’s NV Blanc de Noirs costs £235 per bottle (in-bond). Antonio Galloni names it “a Champagne of total and pure sensuality”, with “tons of textural resonance”. It is available to purchase by the bottle (in-bond) from BI Fine Wines.

Over £400: 2002 Salon Le Mesnil

At £458 per bottle (in-bond), the 2002 from cult Champagne house Salon Le Mesnil was aged for 11 years on lees before being disgorged and released in 2013. Produced only in exceptional years, and as a quality benchmark for pure Chardonnay Champagnes, Salon Le Mesnil’s signature is making Blanc de Blancs with grapes of extremely high acidity, facilitating extended ageing and consequential complexity. The 2002 Salon Le Mesnil earned a rare 19.5 points from Jancis Robinson, who last tasted it in 2019. She describes it as “rich and nuanced on the palate”, featuring “tertiary notes underneath, with some hay and then real grip on the end. Very long with a fascinating narrative”. There appears to be some availability of the 2002 vintage at Goedhuis & Co.

French readers can find this blog in French translation on Le Figaro Vin’s website.

Sign up to Wine Lister’s free subscription to get market insights delivered straight to your inbox.

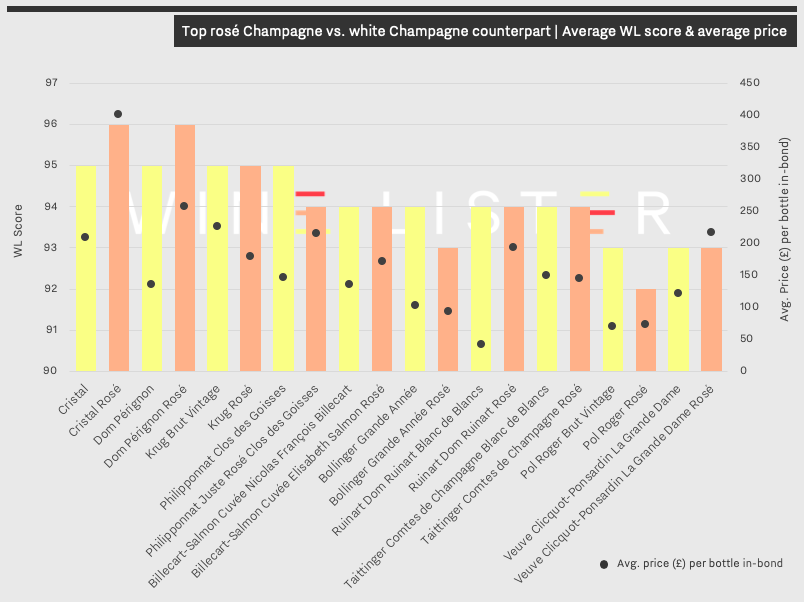

In 2004, WL partner critic Jancis Robinson published an article, “Pink champagne – fashionable but too often dire”, whose title summarises the contemporaneous consensus surrounding rosé Champagne. Long-regarded by Champagne producers as a subsidiary wine – one without the required levels of attention placed on their primary project – its quality often fell short.

15 years later, in September 2019, Robinson conversely wrote a piece titled “Pink champagne – a serious wine now”, outlining the attentive methods of production, and the consequential calibre of rosé Champagne amongst its top producers.

This week’s blog post investigates the victorious return of rosé Champagne, as we examine the upward quality and price trends across 10 of its top brands when compared to their white counterparts.

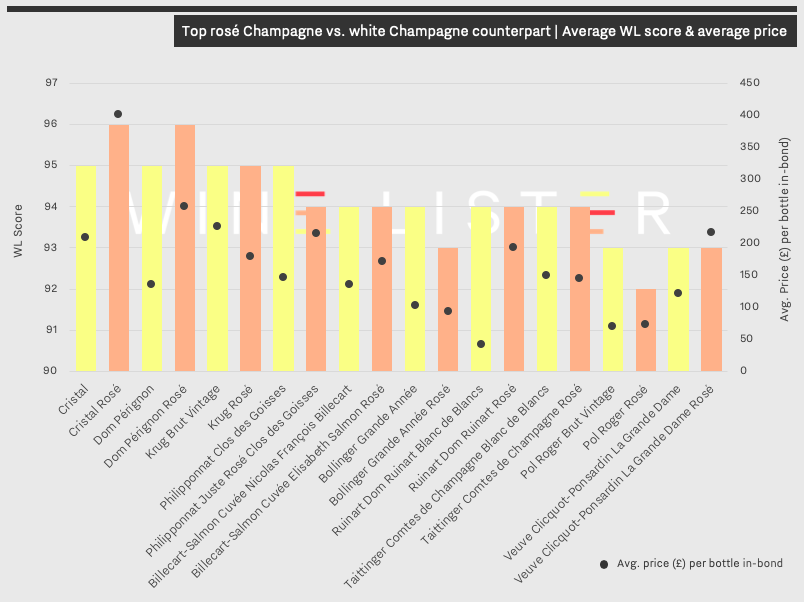

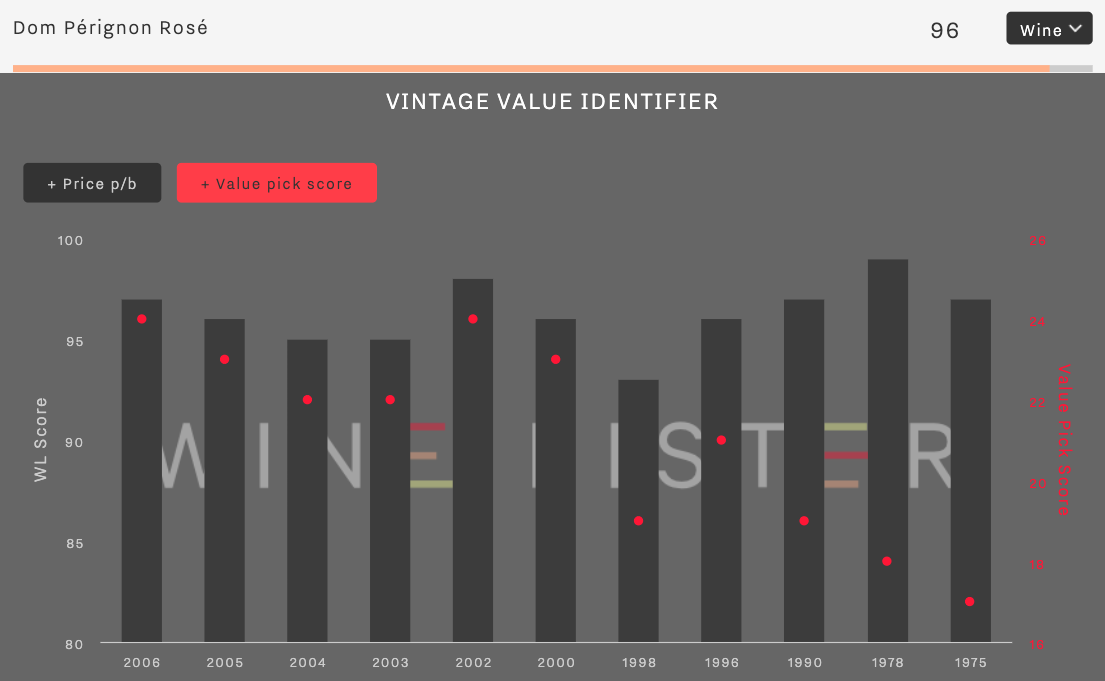

The chart above shows the average WL Score and average price for “pairs” of wines from 10 top rosé Champagne producers whose range includes a rosé.

An initial look at the selected wines reveals the recurrent pattern of rosé Champagnes costing more than their white counterparts, with the exception of Krug Rosé, Bollinger Grande Année Rosé, and Taittinger Comtes de Champagne Rosé. The mean price difference between the two styles of the respective wines is substantial nonetheless, with rosé Champagne costing 46% more on average than its white equivalent (an average of £195 for rosé and £134 for white).

Excluding Pol Roger’s Rosé and Bollinger’s Grande Année Rosé (whose white equivalents supersede them by one WL point), the rosé Champagnes featured above achieve equivalent or higher WL Scores than their white counterparts.

Cristal Rosé is a blend of 55% Pinot Noir and 45% Chardonnay grapes. With a WL Score of 96, at an average price of £401 (per bottle in-bond), this wine is almost double the price of Cristal, which has a WL Score of 95 at £203. Consequential of the generally lower yields of Pinot Noir in continental conditions, Cristal Rosé is Louis Roederer’s rarest and thus most expensive wine, produced solely in years when the grapes have attained perfect maturity.

Similarly made in only exceptional vintages, Dom Pérignon Rosé is considered by its producer to characterise its growing year, hence the fluctuating ratio of Pinot Noir and Chardonnay grapes from vintage to vintage. With a WL Score of 96, at an average price of £277 (per bottle in-bond), Dom Pérignon Rosé is over double the price of its white counterpart. Dom Pérignon Vintage Brut has an average price of £131 and has one less WL Score point than its corresponding rosé wine.

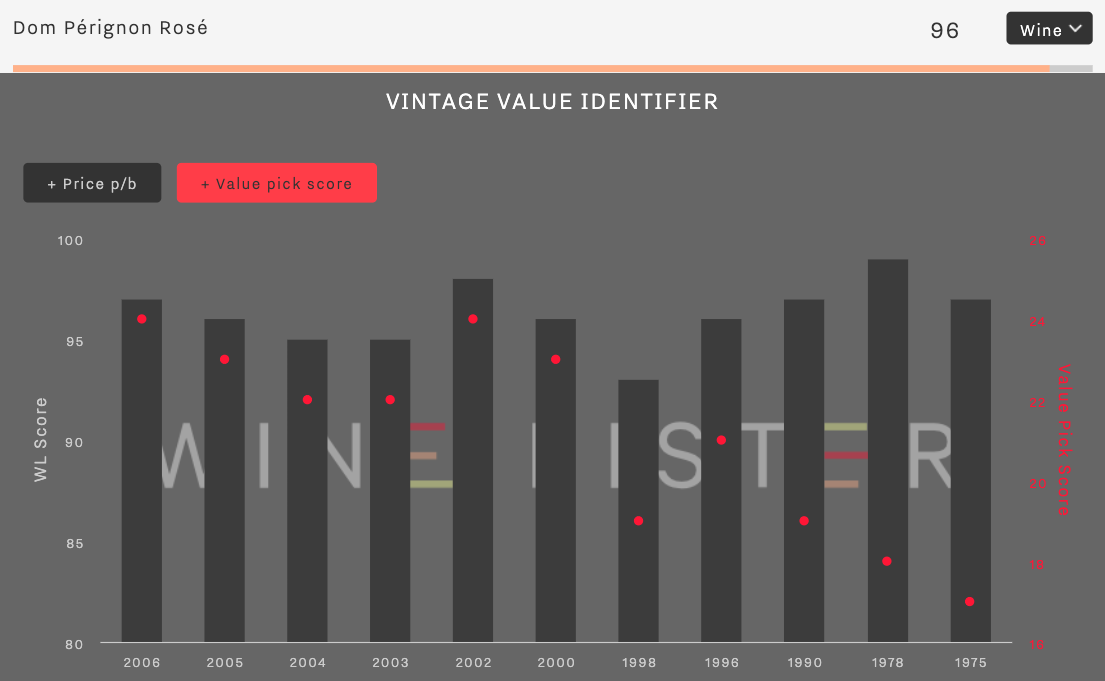

As indicated by its Vintage Value Identifier chart, the 2002 Dom Perignon Rosé exhibits significant quality and value, with a WL Score of 98. Jancis Robinson awarded this wine 20/20 (a rare occurrence), describing it as “pungent and composed with massive energy” – a far cry from her 2004 article. Rosé Champagne has most definitely made a comeback.

The 2002 Dom Pérignon Rosé can be purchased from Berry Bros & Rudd, where a case of three starts at £1,200 (in-bond).

Since its launch in September, Wine Lister’s MUST BUY list has unveiled fine wines across multiple regions, vintages, price points, and drinking occasions, all with the common theme of being so good, that they simply must find their place in fine wine fanatics’ cellars. Wine Lister’s prices are updated weekly, and since price (in the form of value) plays a major part in the MUST BUY algorithm, MUST BUYs too will henceforth be updated weekly.

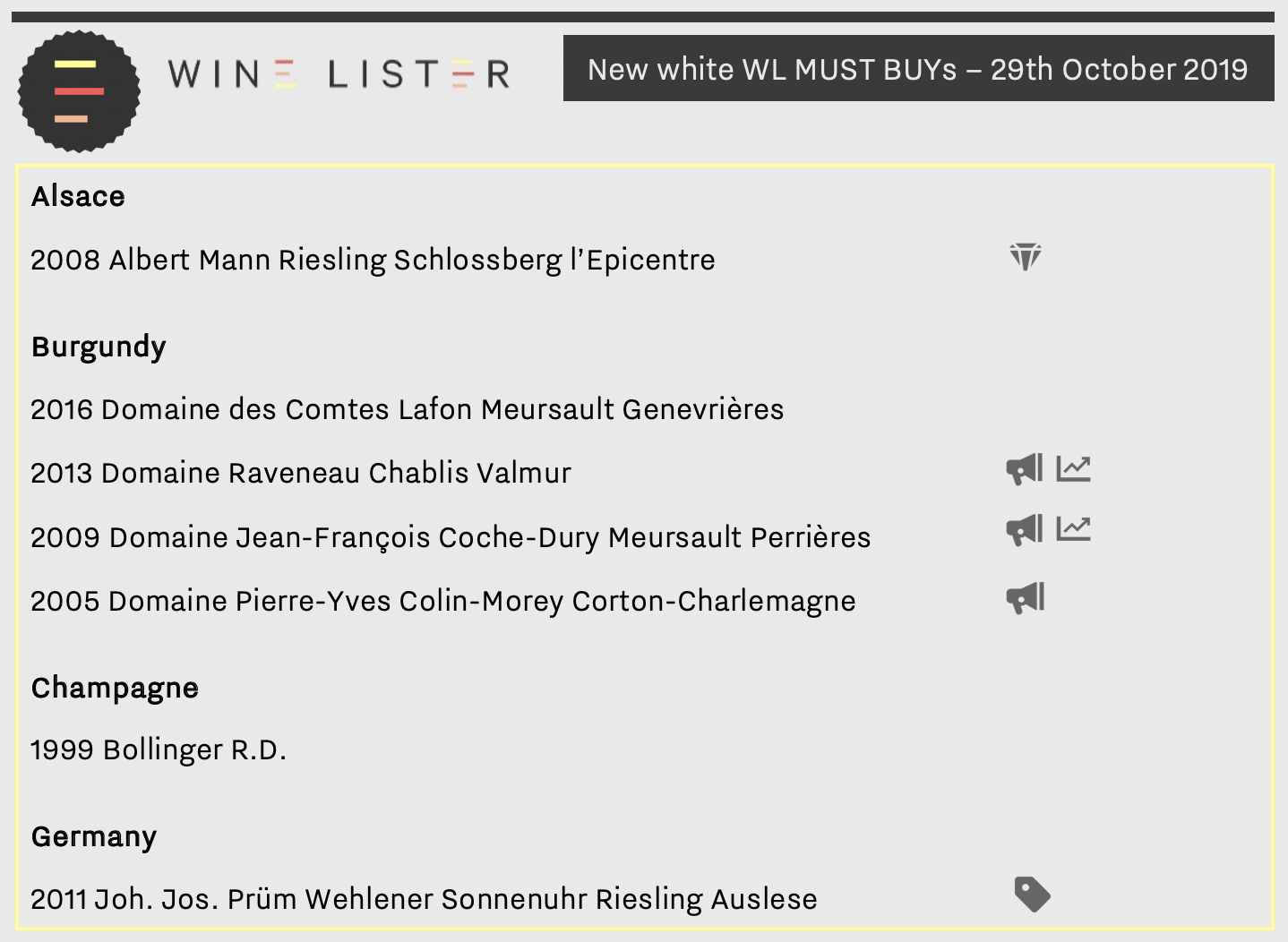

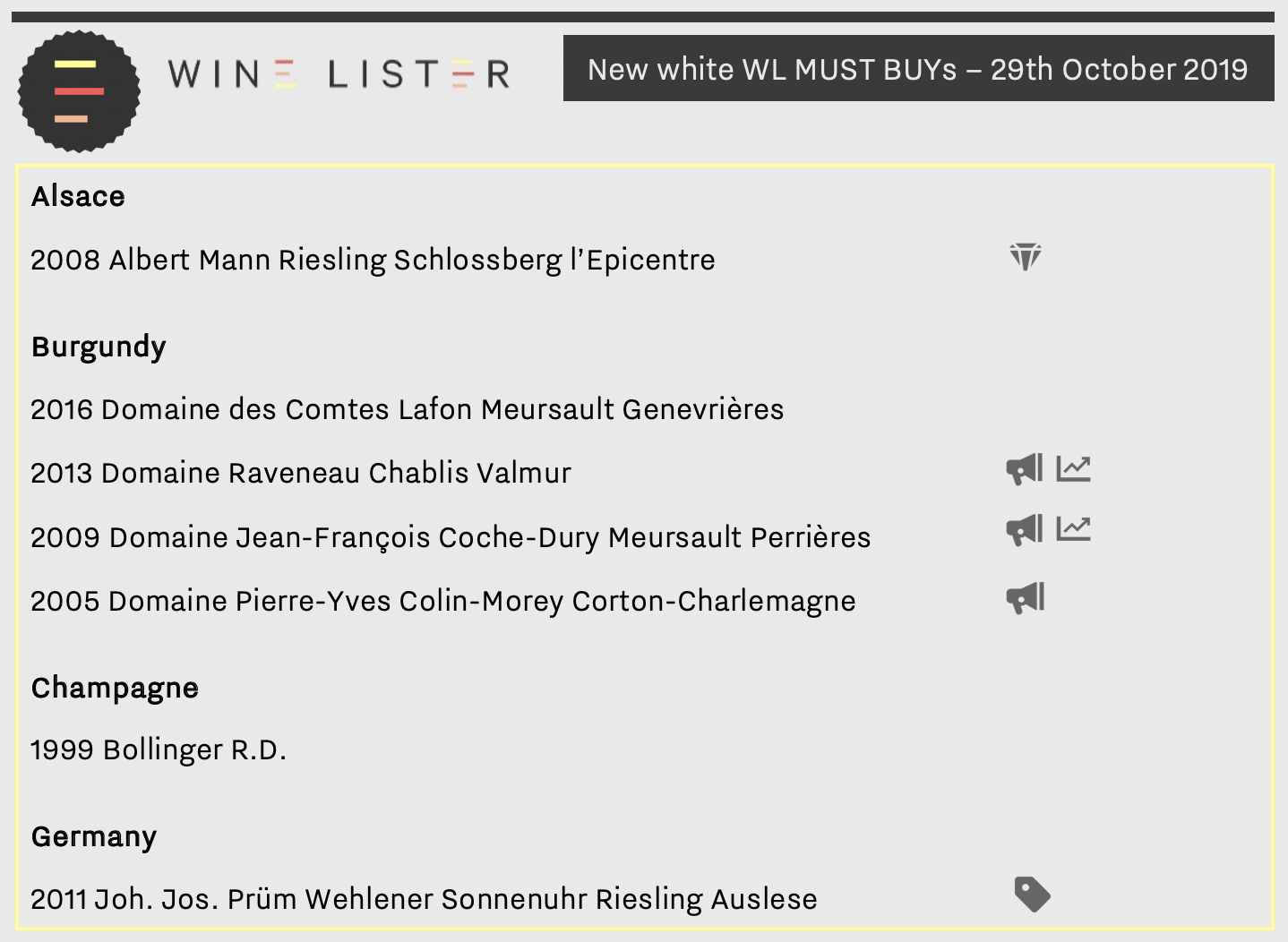

Since its last update, the MUST BUY list has grown by four wines (to 1,697), with 22 new entries, and 18 wines that have fallen off the list. Following the same trend as last week, nine out of the 22 new MUST BUYs (or 41%) are Burgundian. Big names in Burgundy continue to do well, with three new white Buzz Brands hailing from Raveneau, Jean-François Coche-Dury, and Pierre Yves Colin-Morey respectively.

Elsewhere within white entries are two Rieslings, the Alsatian Hidden Gem, Albert Mann’s l’Epicentre 2008, and the indomitable Joh. Jos Prüm’s Wehlener Sonnenuhr, whose 2011 is now one of seven MUST BUY vintages of this sensational Value Pick.

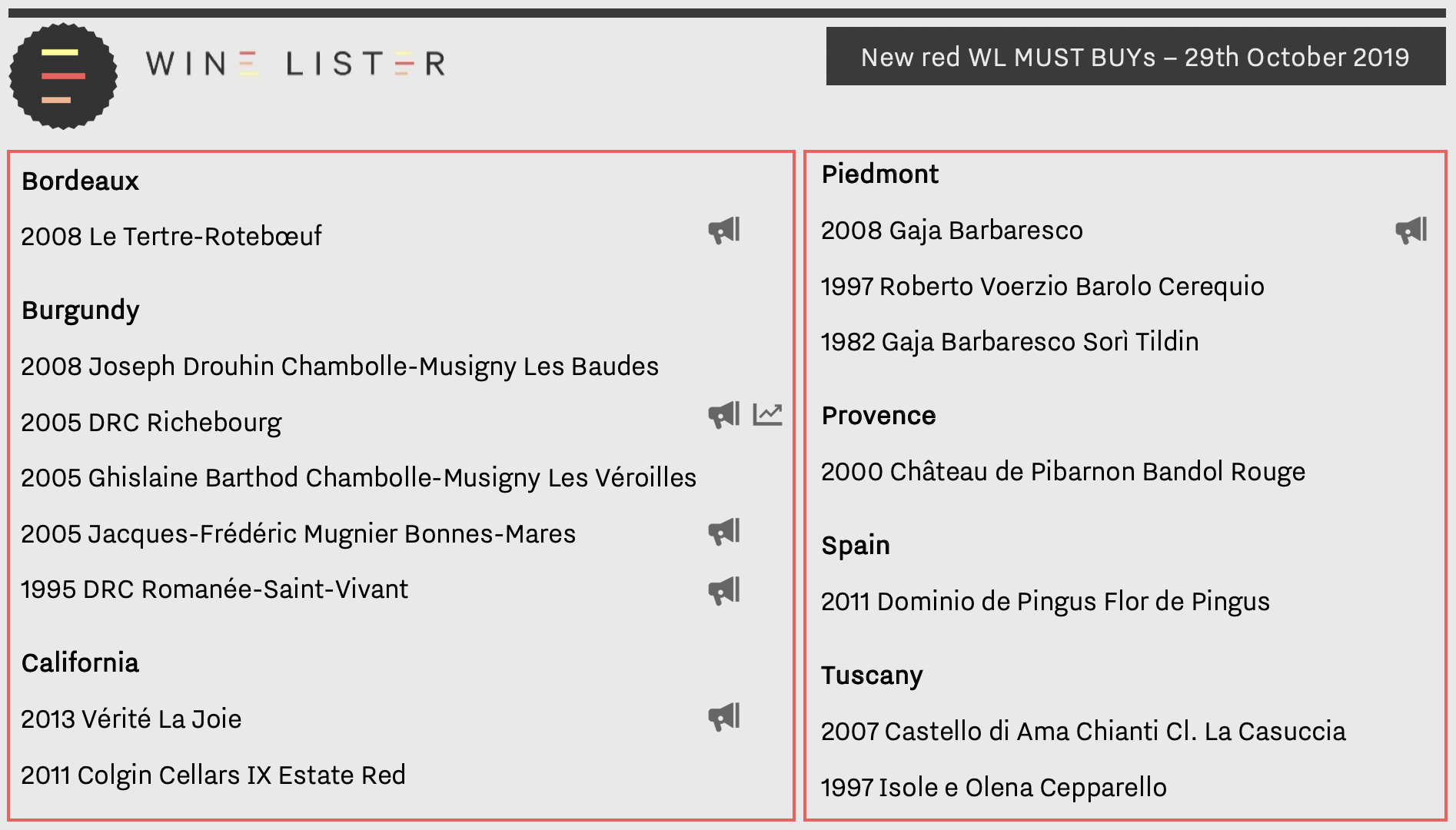

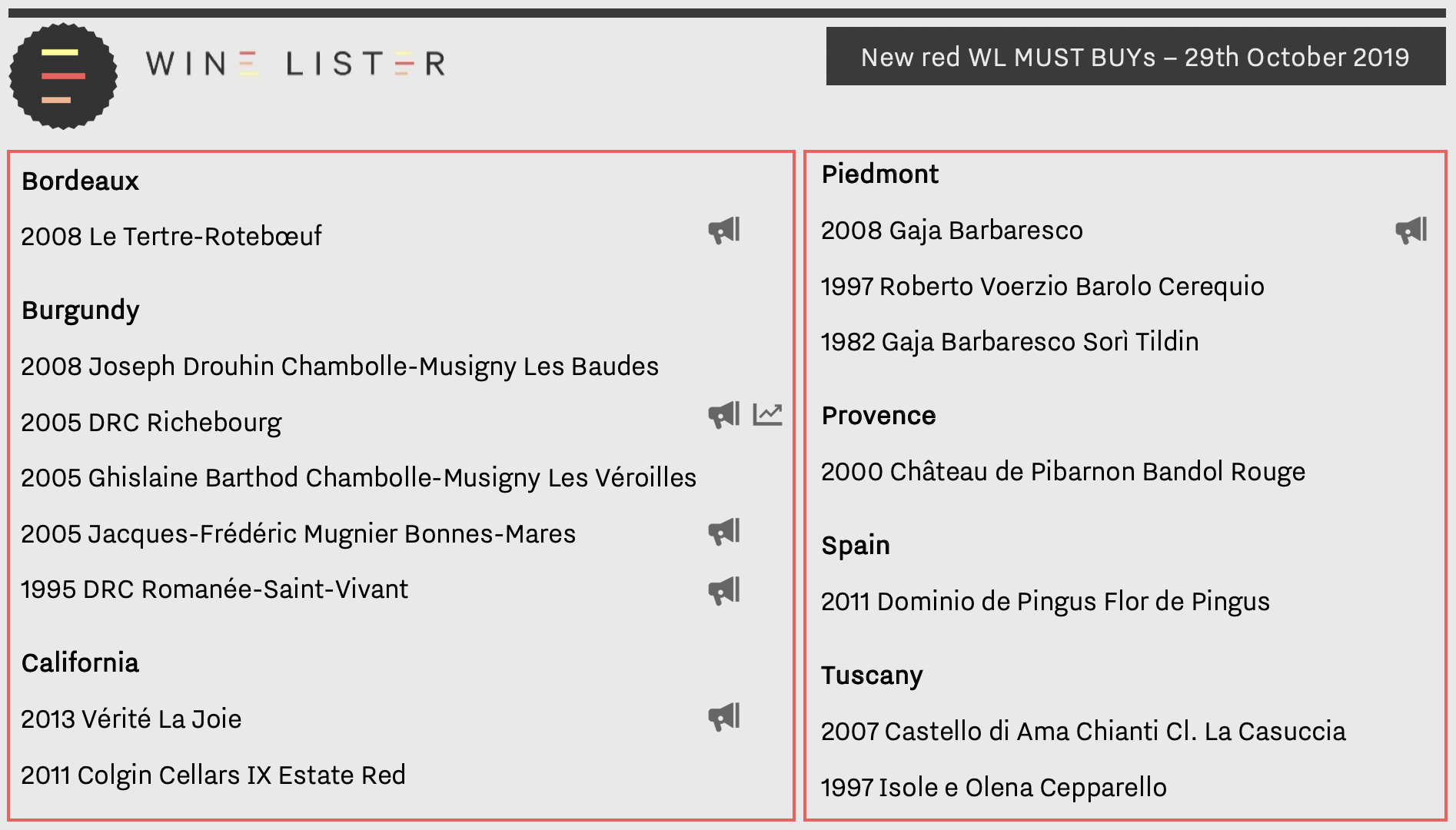

With the clocks turned back and a wintry chill in the air, there are twice as many new red MUST BUYs as white. Burgundy and Italy make the strongest showing, with five reds apiece. Maison Joseph Drouhin sees the addition of its Chambolle-Musigny Les Baudes 2008, bringing the house’s MUST BUY total to 21 wine vintages. Meanwhile Italy’s new MUST BUYs hail from four big name growers: Gaja, Roberto Voerzio, Castello di Ama, and Isole e Olena.

Bordeaux achieves just one entry in Le Tertre-Rotebœuf 2008 (one of nine Bordeaux 2008 MUST BUYs). California also makes its mark, with Vérité’s La Joie 2013 and Colgin Cellars IX Estate Red 2011. Outside of “classic” fine wine regions, Château de Pibarnon’s Bandol Rouge 2000 also enters the fray.

See the full list of current MUST BUYs here.

At the end of last year, Wine Lister released its first ever Champagne report. As well as exploring a handful of key trends as identified by Wine Lister’s Founding Members, the report also sheds light on top Champagnes as compared to other regions in terms of economic performance.

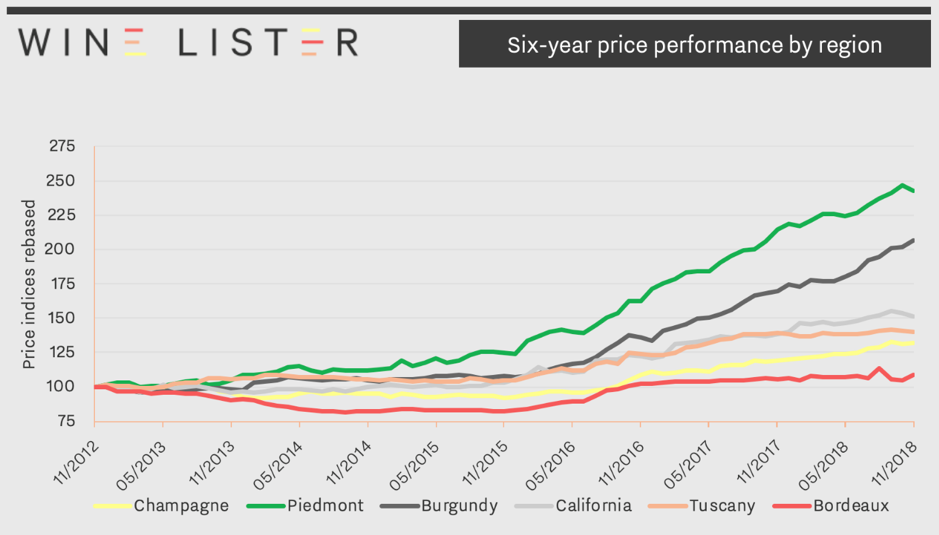

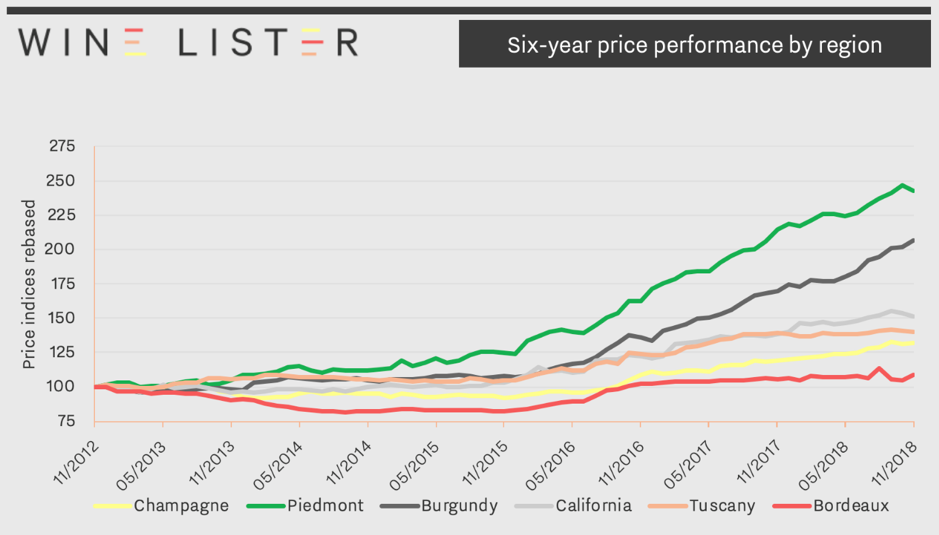

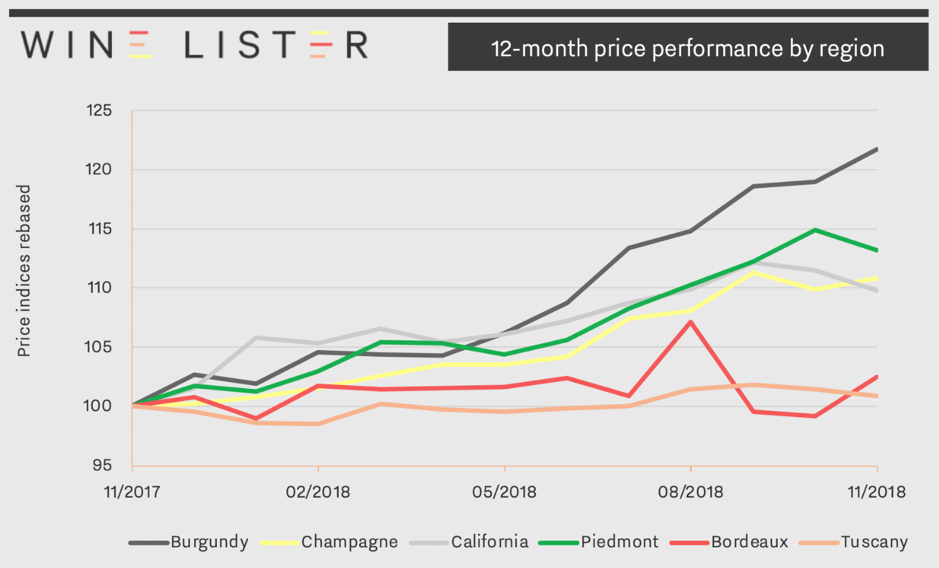

Prices of the top Champagnes (Dom Pérignon, Krug Vintage, Louis Roederer Cristal, Salon Le Mesnil and Dom Pérignon Rosé) have seen a compound annual growth rate (CAGR) of 4.8% over the last six years. Relative to other major fine wine regions, this long-term growth is slow, as shown in the chart below, but also stable.

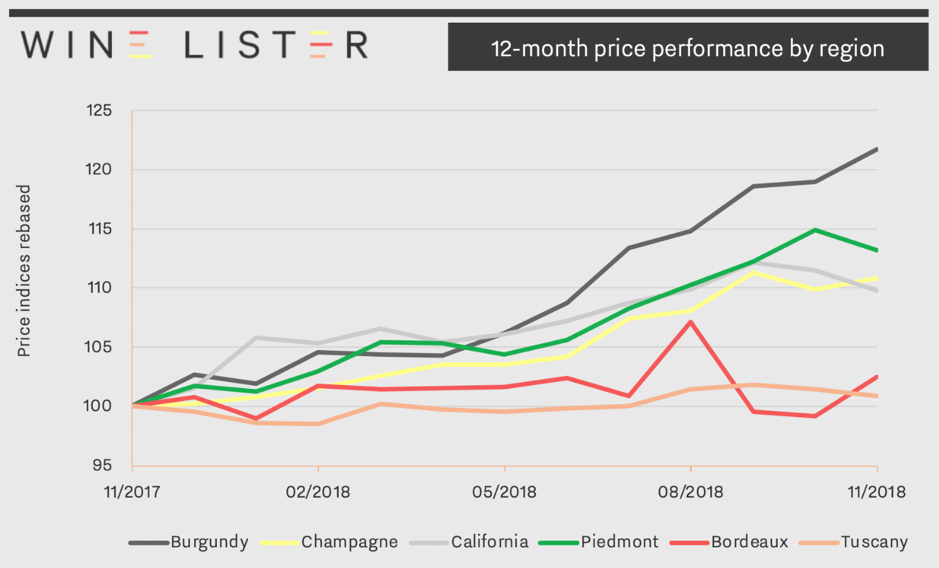

One notable advantage of Champagne as an investment option it its low volatility. Indeed, Champagne prices show a much better level of stability in the secondary market (deviating by just 2.5% from the average price over 12 months) than any other major fine wine region. Slow and steady wins the race.

Moreover, recent price performance shows Champagne accelerating. Prices of top Champagnes are starting to grow at a faster rate than their counterparts in California, Bordeaux, and Tuscany, beaten only by Piedmont and the seemingly unmatchable Burgundy. Indeed, as of December 2018 top Champagnes had seen a 12-month price growth of 11%. The region’s potential for long-term investment is already being acknowledged by the trade, with one of our Founding Members, a top tier UK merchant commenting “Champagne (Salon especially) has experienced solid growth and has become a reliable investment for collectors”.

Salon Le Mesnil is the number one performing Champagne for price performance, with an Economics score of 978, closely followed by Krug’s Clos d’Ambonnay (962). Krug also tops the Champagne Economics charts with its Clos du Mesnil, Brut Vintage, and Collection. Interestingly the only NV Champagne to appear within the top 10 Champagnes for Economics is grower Jacques Selosse’s Brut Initial, with an Economics score of 911. Its price, £106 (per bottle in-bond), is a mere 18% of the average price of the other nine top Champagnes by Economics score.

To read more key findings from our in-depth Champagne study, read the free summary here. (The key findings and full study are also available to download in French on the Analysis page.)

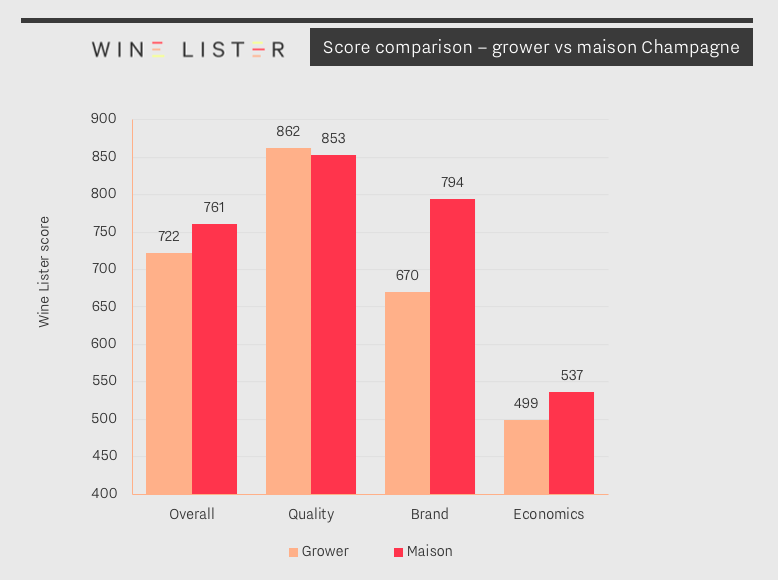

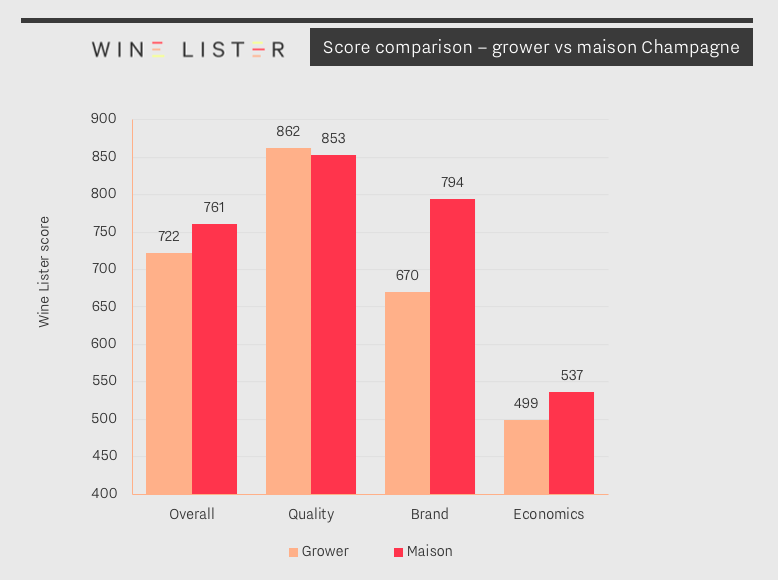

One of the major trends identified in Wine Lister’s first Champagne study was the rise of grower Champagnes. While maison offerings dominate the top 20 highest-quality Champagnes from the basket of 108 studied, growers achieve a higher average Quality score overall (862 vs. 853). This week’s top five looks at the top Champagnes under £100 by Quality score, and helps us examine the grower vs. maison phenomenon further.

The first of this week’s top five is grower Champagne Egly-Ouriet’s Vieillissement Prolongé Extra Brut with a Quality score of 919. Though top of the leader board for Quality, it is the least expensive of this week’s group at an in-bond per bottle price of £55 (or 34% less than the average price of the other four Champagnes). This is perhaps due to it being the only non-vintage Champagne of the group, and provides testament to the great price to quality ratio of N.V. Champagnes across the board.

Next up of this week’s top five is Henri Giraud’s Fût de Chene with a Quality score of 913. For the purposes of Wine Lister’s Champagne study, Henri Giraud was in fact not classed as a grower Champagne, since our definition of ‘grower’ signified properties who use 100% of their own grapes (Henri Giraud buys in 20%). The 1999 vintage earns 18 points from Wine Lister partner critic Jancis Robinson, who calls it “a sort of Montrachet of Champagne”.

Third of this week’s top five is R&L Legras’ St. Vincent. Earning a Quality score of 900, it is the only Blanc de Blancs of the group. In true grower fashion, this little-known Champagne ranks as the 1,985th most-searched-for wine of the c.4,000+ wines on Wine Lister and is present in just 3% of the world’s best restaurants.

The last two Champagnes of this week’s top five may have the same Quality score of 899, but have very different profiles. It is surely a satisfying conclusion that, despite maison Champagne’s stronger brand position overall, these two wines (one maison and one grower) prove the opposite to be true. Maison offering Joseph Perrier’s Cuvée Josephine has the lowest Brand score (474) of this week’s top five, while grower Champagne Vilmart et Cie Coeur de Cuvée earns the highest (779), with a search rank in 854th place and presence in 11% of the world’s best restaurants. The rise of grower Champagnes is in full force.

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

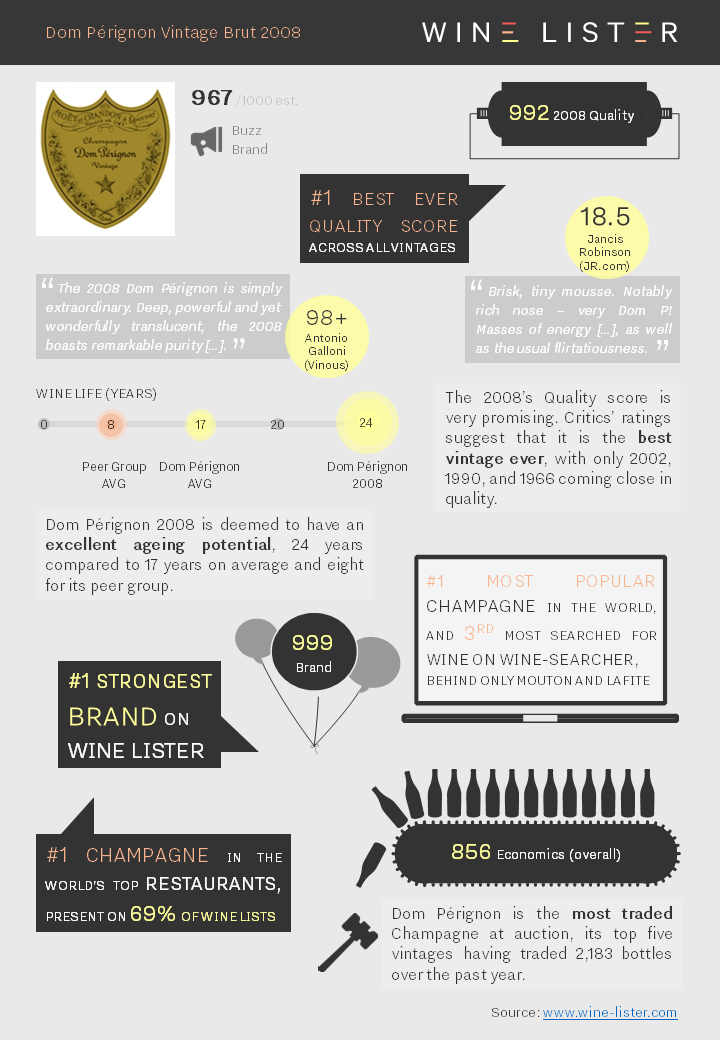

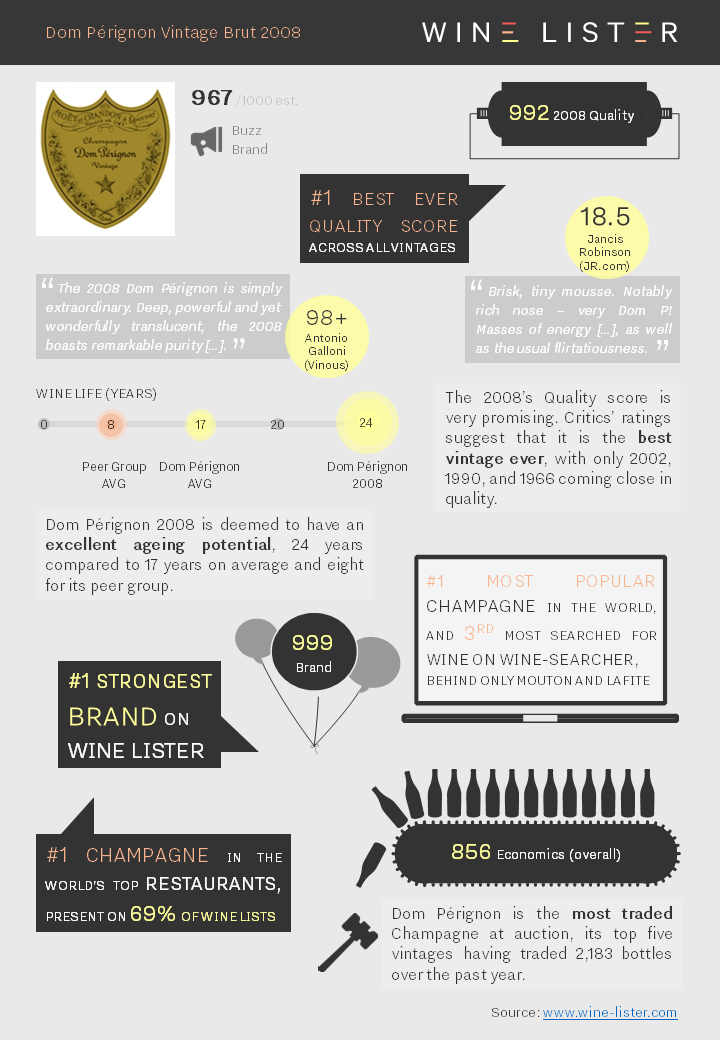

Analysis of the new release of Dom Pérignon 2008, which has received its highest Quality score ever.

You can download the slide here: Wine Lister Factsheet Dom Pérignon 2008

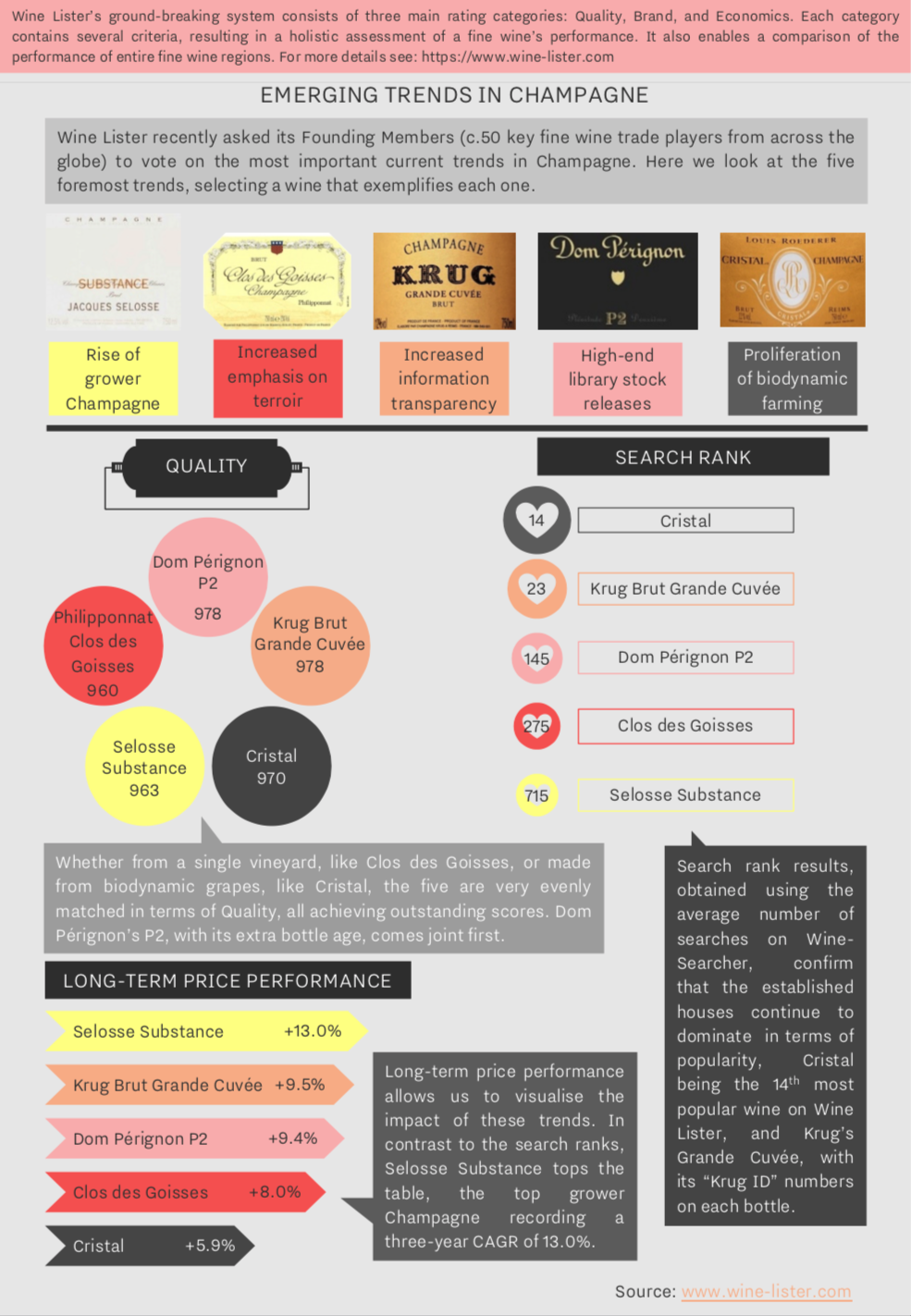

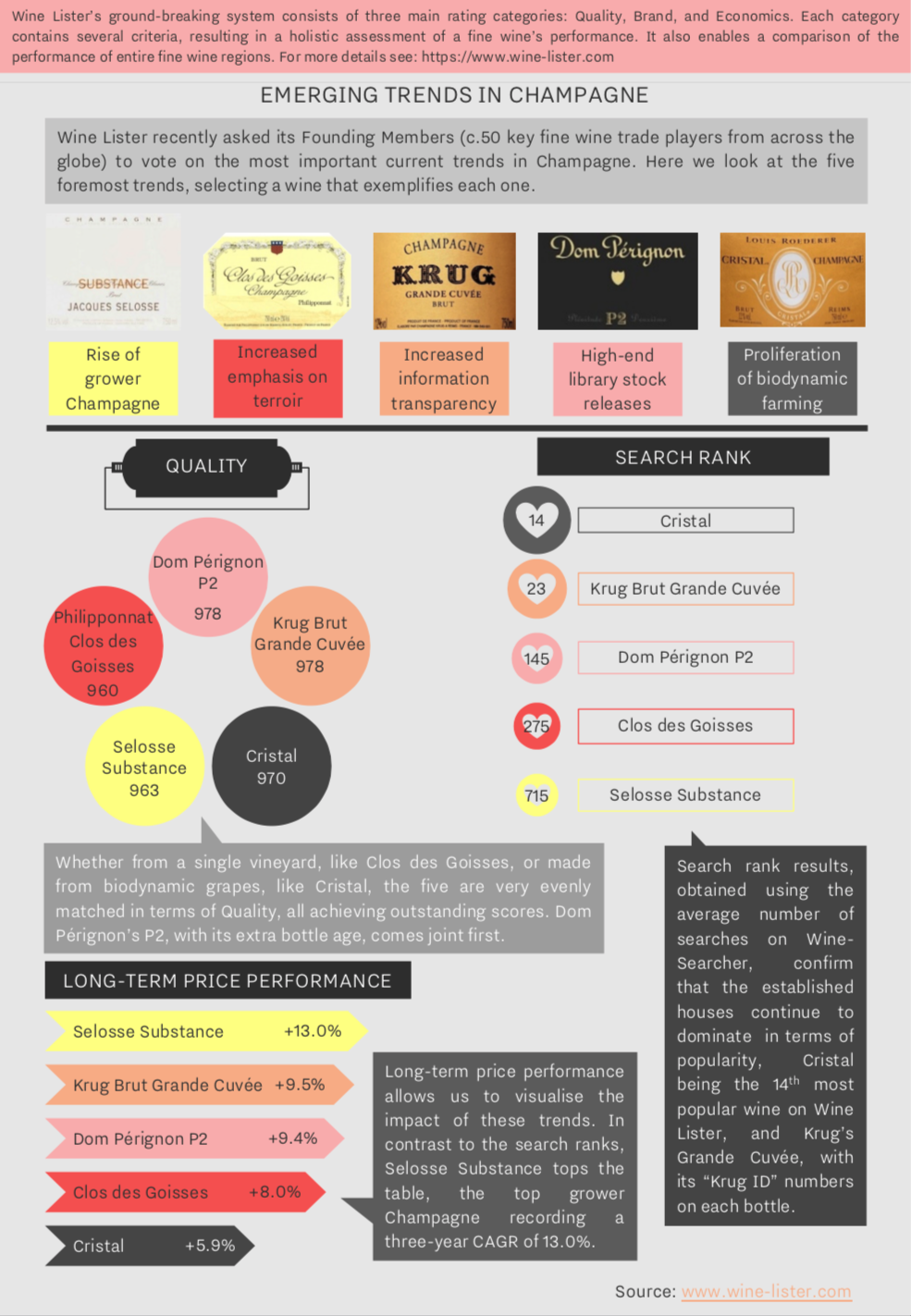

At the beginning of this new year, Wine Lister is prolonging the festive sparkle through a look at the major trends to emerge from our first Champagne report. Wine Lister’s Champagne study analyses a basket of 109 top wines from the world’s premier sparkling region, and includes insight into the major trends of the Champagne market as identified by Wine Lister Founding Members (c.50 key players in the international fine wine trade).

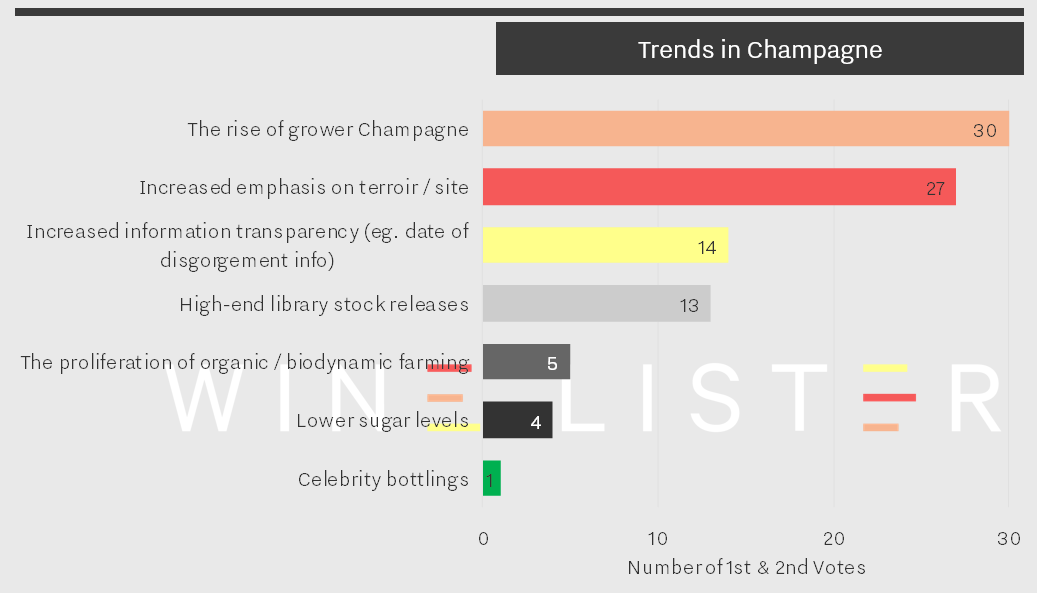

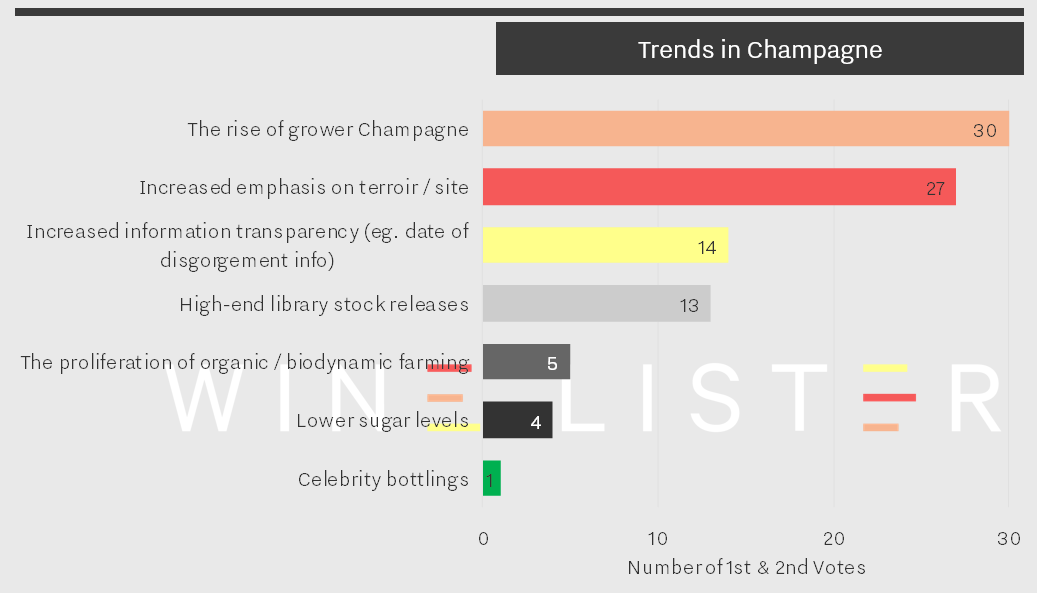

While quality across the board is something to keep us celebrating well in to 2019 (see more on this here), the notable trends could indicate an increase in year-round enjoyment of Champagne. The chart below shows responses to our question, “What are the most important trends in Champagne?” by number of votes.

The trend most-frequently ranked as number one or two by Wine Lister Founding Members was the rise of grower Champagnes, closely followed by the increased emphasis on terroir / site Champagnes. One U.K. merchant remarked that “Consumers are now identifying with specific terroir in Champagne and understanding the value of the grower…” – a comment that further leads us to suspect an increased appreciation of Champagnes as wines, and not just celebratory bubbles.

The “rise of the grower” trend is, however, juxtaposed by continued demand for big brands. Of the basket of wines treated in the study, the grower Champagne segment has seen an increase in popularity (measured by search rank) of 9% since the beginning of 2017. Though this performance is superior to the maison segment’s slight decline in popularity (-4%), grower Champagnes still sit twice as far down the popularity rankings, with an average search rank of 1,620 compared to 775.

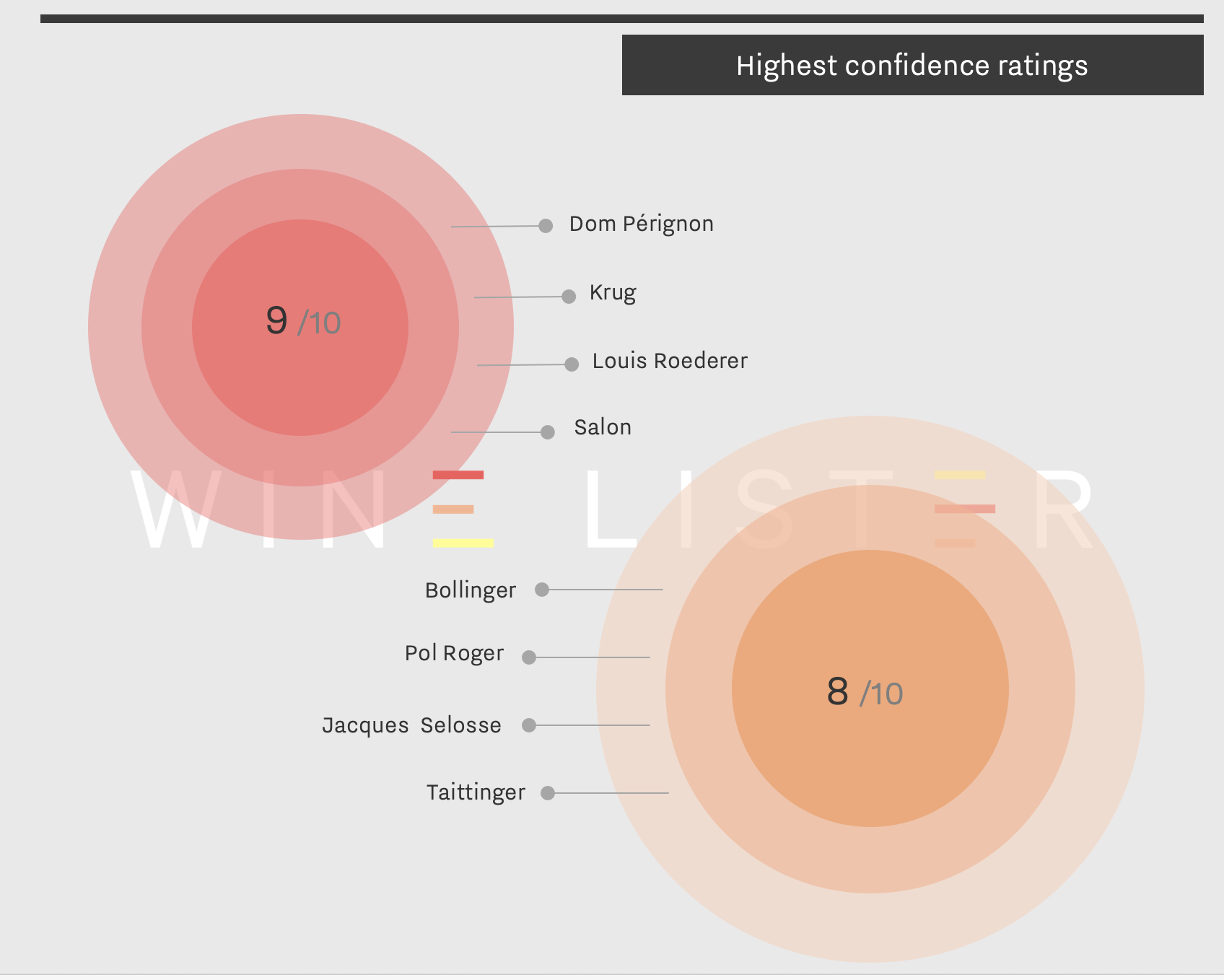

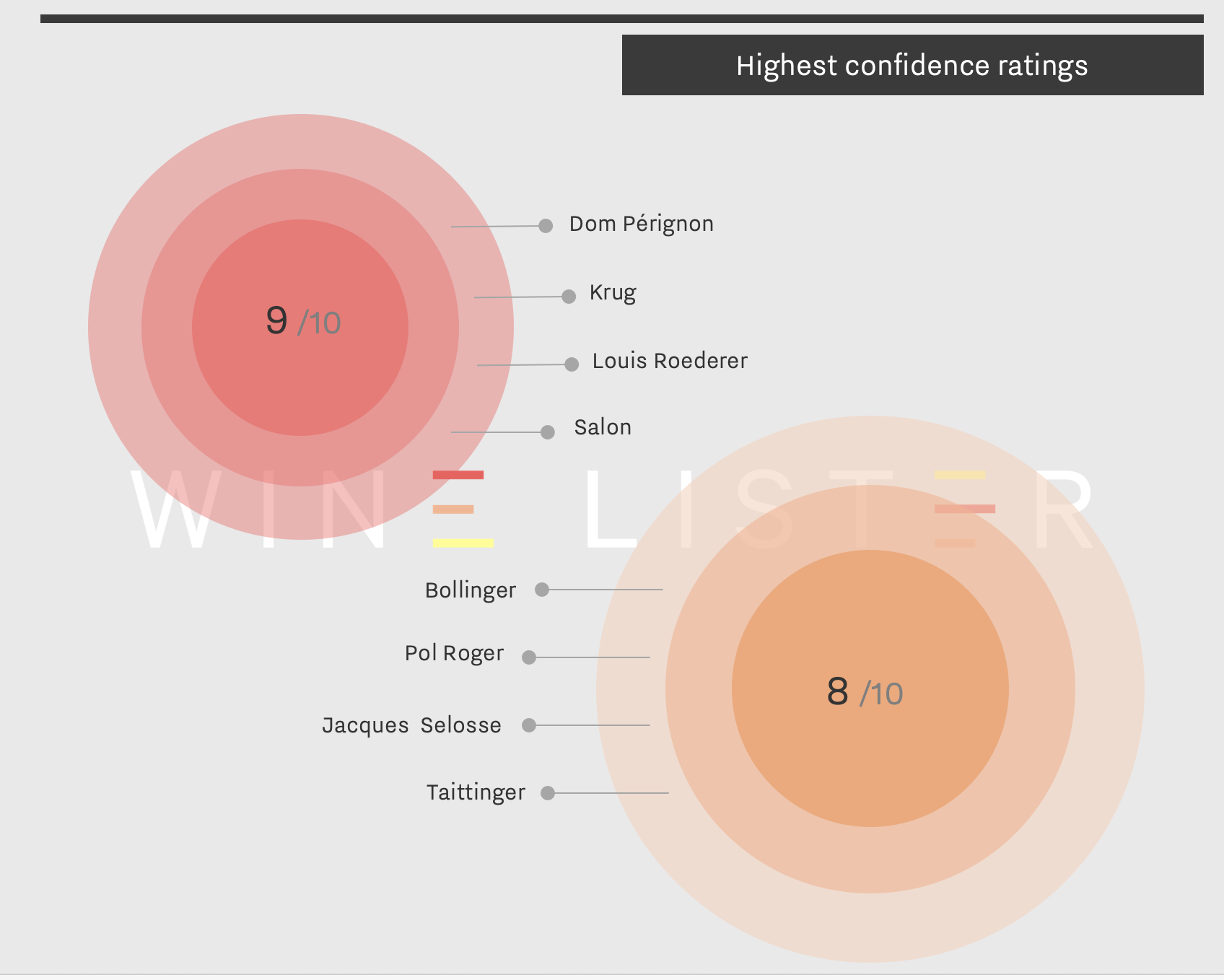

Perhaps predictably, big brands still win the race when it comes down to the bottom line. A U.K. merchant commented, “Small growers are getting much better press, but I suspect the big name cuvées still rule the roost for sales/investment”. Indeed, when asked to award confidence ratings to specific Champagne producers, the trade cited only one grower champagne within the top two confidence scores (9/10 and 8/10), Jacques Selosse. The houses to earn top confidence ratings were Dom Pérignon, Krug, Louis Roederer, Salon, Bollinger, Pol Roger, and Taittinger, as shown on the chart below.

A top tier merchant offers some explanation into the difference in picture painted between the top Champagne trend and Champagne confidence ratings: “Production needs to be small but not so small as to result in a proliferation of Champagnes which the vast majority have never heard of. The big brands which produce great quality are still finding serious demand in the market!”

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

With the festive season fast approaching, what better time to take a look at Wine Lister’s first Champagne study, giving you the inside track on the best Champagnes that money can buy?

The in-depth report covers all angles of this fabled region, from the views of the international trade to all three Wine Lister score categories. In this blog post we drill down to focus on Champagne’s quality. Specifically, here we look at the top 20 Champagnes by Quality score:

The top maison-led Champagnes dominate the top 20 Champagne Quality scores. Dom Pérignon Oenothèque tops the chart with a score of 983, and its successor (P2) comes in fourth, scoring 979. Krug manages an impressive five wines in the top 10 and six in the top 20, testament to the house’s consistently exceptional quality across its whole range. Krug Brut Vintage is second overall with a score of 982, while Krug Brut Grande Cuvée comes fifth, scoring 978. Krug Clos du Mesnil, Collection, and Clos d’Ambonnay round out the top 10 for Krug.

Salon Le Mesnil, the top scoring Champagne by overall Wine Lister score, comes third for Quality with a score of 982. Cristal Rosé is the highest scoring rosé, coming in sixth place overall with a score of 976, six points ahead of Cristal. Krug Rosé, scoring 963, is the only other rosé to make this top 20.

One of the most important trends identified in Wine Lister’s newly-released study is the rise of grower Champagnes. However, this is nascent enough that only one grower producer threatens the top Champagne houses at the top of the Quality leaderboard. That is cult grower Jacques Selosse, with three wines in the top 20, the same number as Dom Pérignon, trailing only behind Krug. The top wine from Selosse based on Quality score is La Côte Faron, coming in seventh with a score of 975. Substance and Les Carrelles also feature.

Despite the maison-led dominance of the top 20 Quality scores, grower Champagnes win the Quality crown overall. Of the 109 wines included in the study, the 29 grower Champagnes received an average Quality score of 862, while the 80 maison bottlings averaged 853, reflecting the excellent quality that grower Champagne can provide:

Watch this space for more on grower vs maison Champagnes, and commentary on other major trends featured in the study.

For a more in-depth look at Champagne, subscribe or log-into read the full report here. Alternatively, all readers can access a five-page executive summary. (Both versions are also available to download in French).

Other wines featured in the top 20 Champagnes by Quality score are: Charles Heidsieck Blanc de Millénaires, Bollinger Vieilles Vignes Françaises, Philipponnat Clos des Goisses, Bollinger R.D., and Taittinger Comtes de Champagne.

Our latest Listed blog focused on the top Grand Cru Champagnes by Wine Lister score. As the holiday season approaches, we look at a different kind of ‘top five’ on a sparkling theme – five of the major trends for the Champagne region, determined by a recent survey of Wine Lister’s Founding members.

Key members of the global fine wine trade identified the rise of grower Champagnes as an emerging trend. Jacques Selosse reigns supreme, with its Blanc de Noirs La Côte Faron achieving the best Quality score of any grower Champagne on Wine Lister (975). Only an average of 1,250 bottles are produced of this each year – half of the production volume of its Substance Brut.

Founding Members also identified an increased emphasis on terroir as something to look out for. Single vineyard expressions of Champagne are well-known and already extremely sought-after, particularly Krug’s Clos du Mesnil and Clos d’Ambonnay. The latter achieves a Quality score of 970, just 10 points above Philipponnat’s Clos des Goisses, but is over 12 times the price (£1,867 vs. £147).

The phenomenon of increased information transparency is perhaps a sign that buyers are becoming more interested in Champagnes as wines, as opposed to just celebratory bubbles. Krug’s Grande Cuvée has used “Krug ID” numbers since 2011, allowing drinkers to see the vintages, vineyard plots, and grapes included in each bottle. Library releases also cater to more “wine-focused” buyers – Champagne Brand King Dom Perignon’s P2, or Bollinger R.D. are the obvious choices for this.

Finally, interest in biodynamically farmed Champagnes is on the rise, such as Louis Roederer’s Cristal, or any cuvée from Jacques Selosse.

Download a PDF of the slide above here.

First published in French in En Magnum.