When it comes to wine scores, we’re all used to looking at quality and critic ratings. Wine Lister scores incorporate two other crucial measures: Economics and Brand. Today, we take a closer look at these categories in the context of the top Bordeaux crus in our 2017 Bordeaux Market Study.

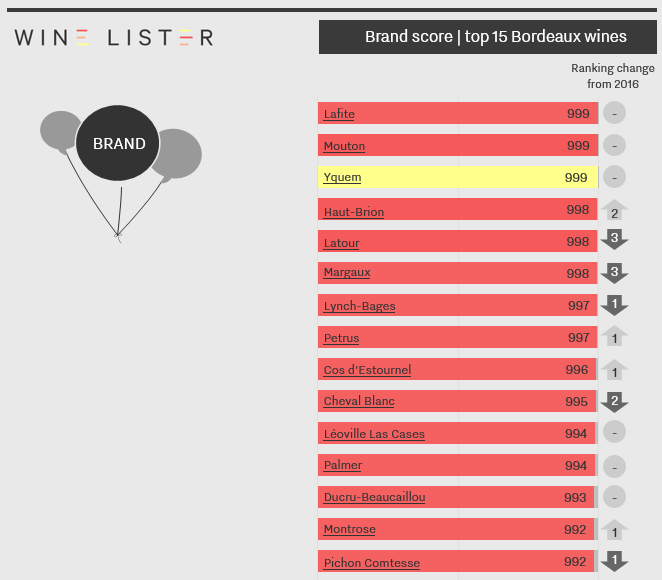

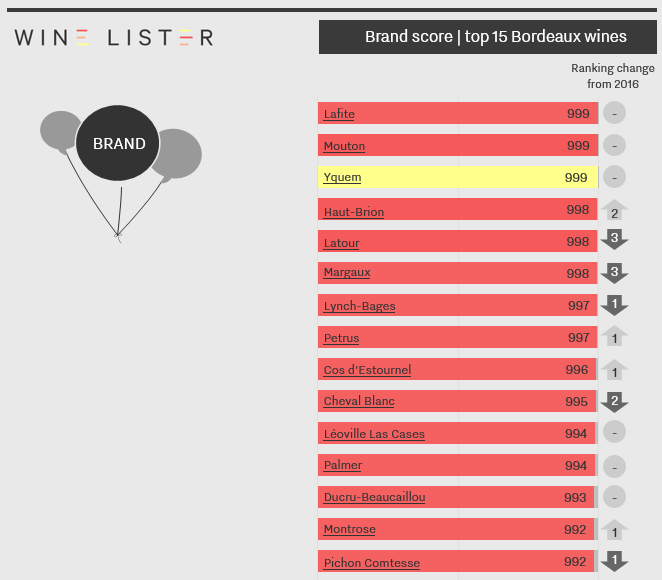

Brand: not much in it

We begin with the Brand category, based on search frequency and distribution. The first thing to notice is that score differentials are incredibly narrow. The 15th wine in Economics terms achieves a score of 932, while the 15th wine in the Brand table gets 992 – testament to the incredible brand strength of Bordeaux crus in general.

Three wines share the top spot, with near-perfect scores of 999 apiece: Lafite, Mouton, and Yquem. Latour and Margaux have lost one point since last year, putting them in joint fourth with Haut-Brion, up one place, while Pauillac and Pomerol powerhouses, Lynch-Bages and Petrus, share seventh position. Only two right bank wines achieve Brand scores in the top 15, and Cheval Blanc is the only Saint-Emilion premier grand cru classé A to feature.

Economics: all change at the top

We now move onto the Economics score, based on a variety of price metrics and liquidity. Unsurprisingly, due to the constantly changing nature of its component parts, the Economics category displays significant changes over a 12-month period. The order of wines in the top 15 has completely changed from the previous year. Compared with the Brand table, the top 15 is also very different: wines have moved in and out, and the order has shifted.

In a continued display of commercial strength, Angélus has moved up three places into pole position, while second and third places are also occupied by right bank wines: Pomerol’s Le Pin and Petrus. The first growths have all moved up the table since last year, in part thanks to improved price performance, although Latour still trails the others. The wine that has most improved on 2016 – a new entrant into the top 15 – is Ausone, up 26 places, while Beychevelle has also seen significant improvement. Pavillon Rouge is the only second wine in the top 15.

For the top Bordeaux crus in terms of overall Wine Lister score – which takes into account a wine’s Quality score as well as those for Economics and Brand – take a look here.

These are excerpts from Wine Lister’s 48-page Bordeaux Market Study – subscribers can download the full report from the Analysis page.

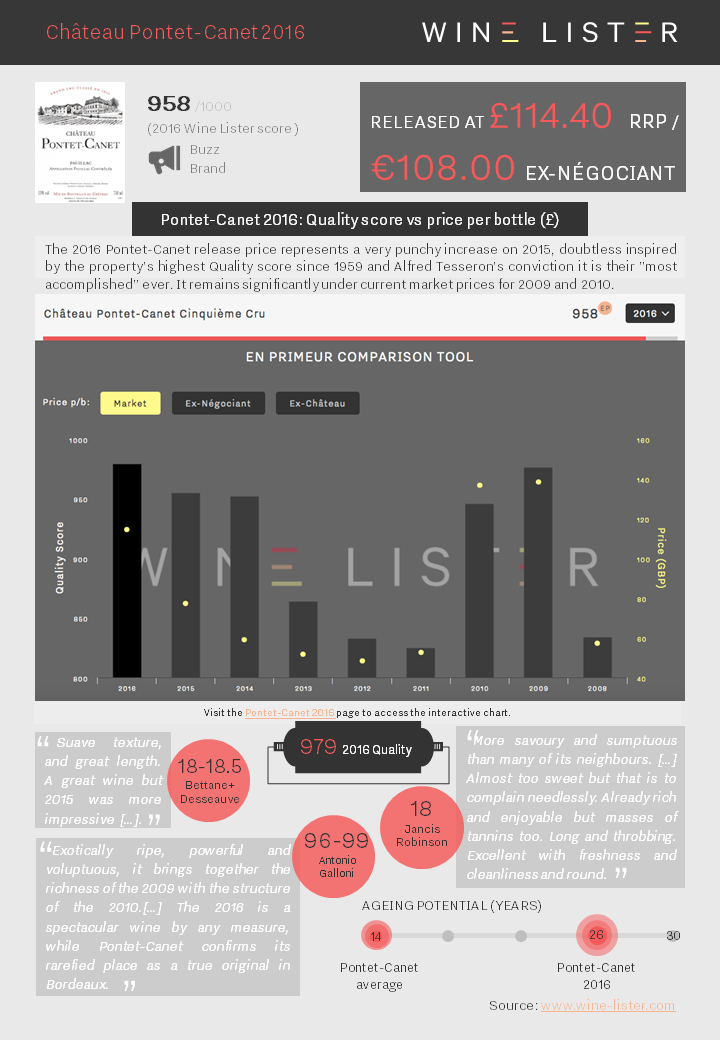

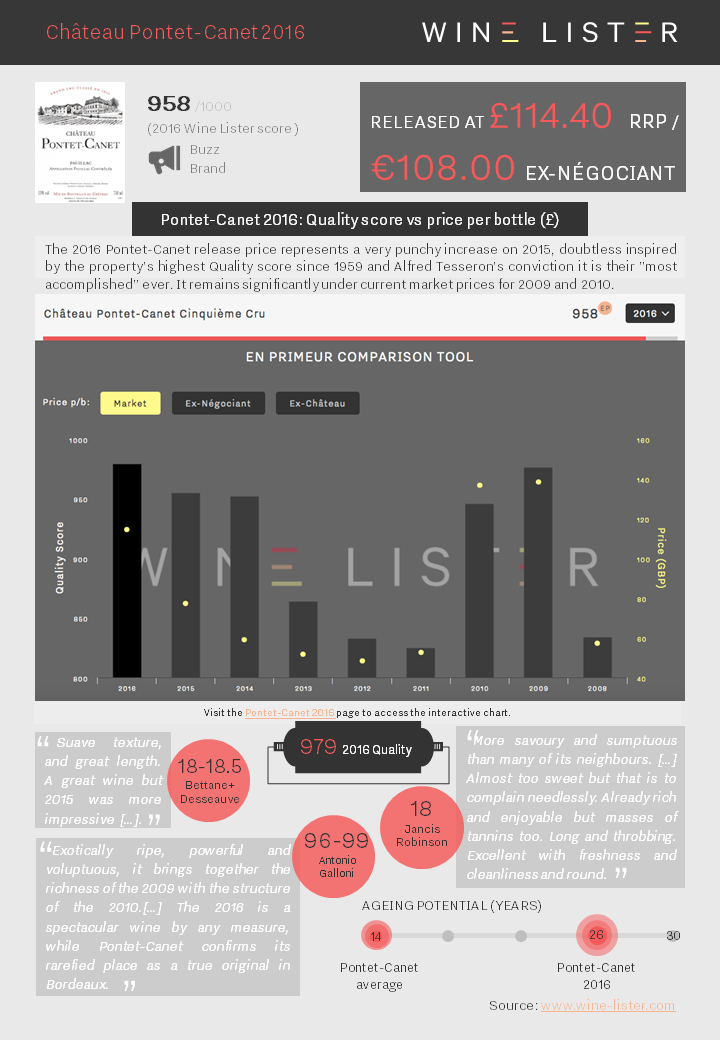

Bordeaux 2016 en primeur analysis of Pontet-Canet 2016, which has been released this morning at €108 ex-négociant, an increase of 44% on 2015, with a UK RRP of £114.40, an increase of 73% on 2015:

You can download the factsheet (from which you can access the wine page and the interactive chart) here: Wine Lister Factsheet Pontet-Canet 2016

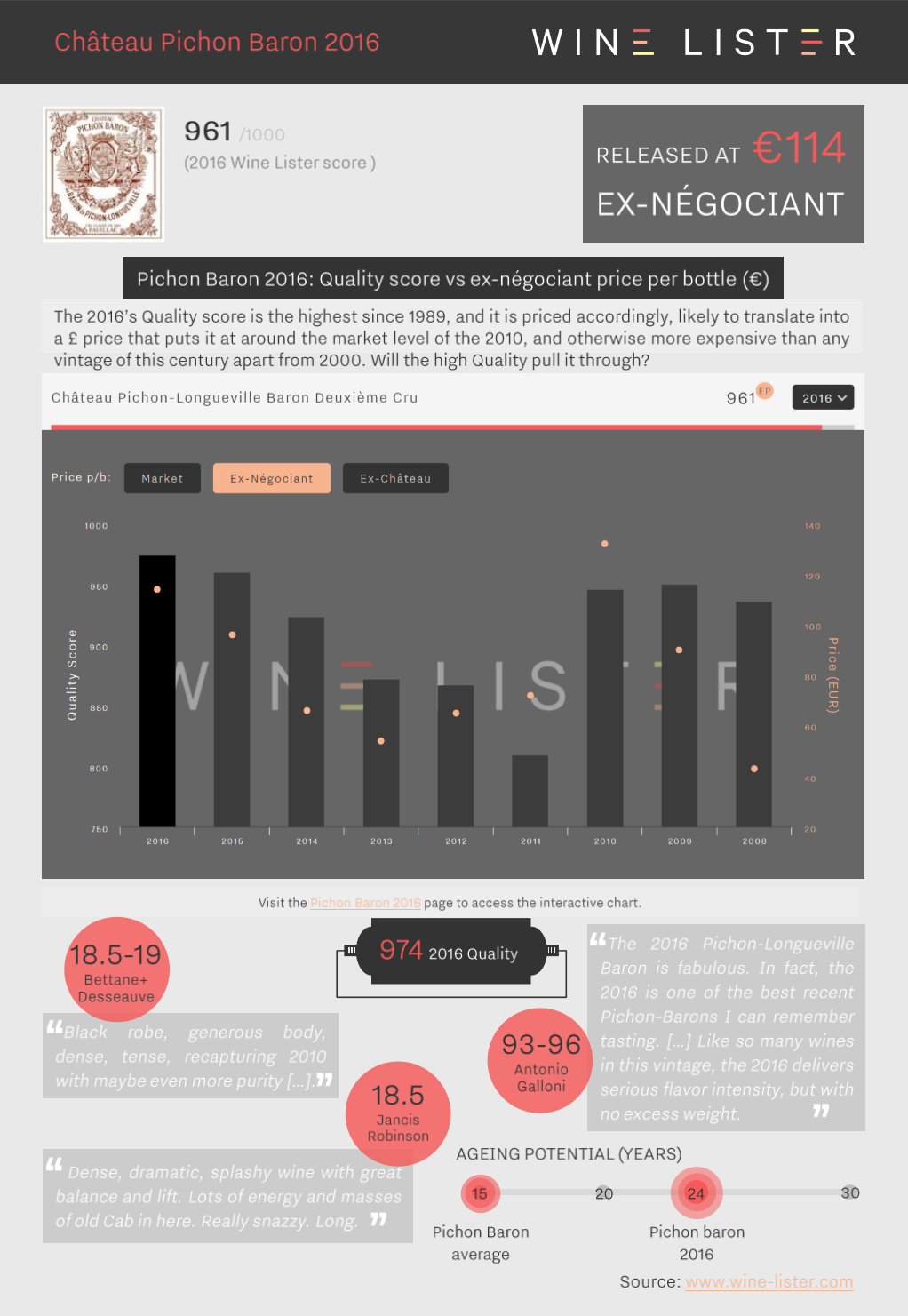

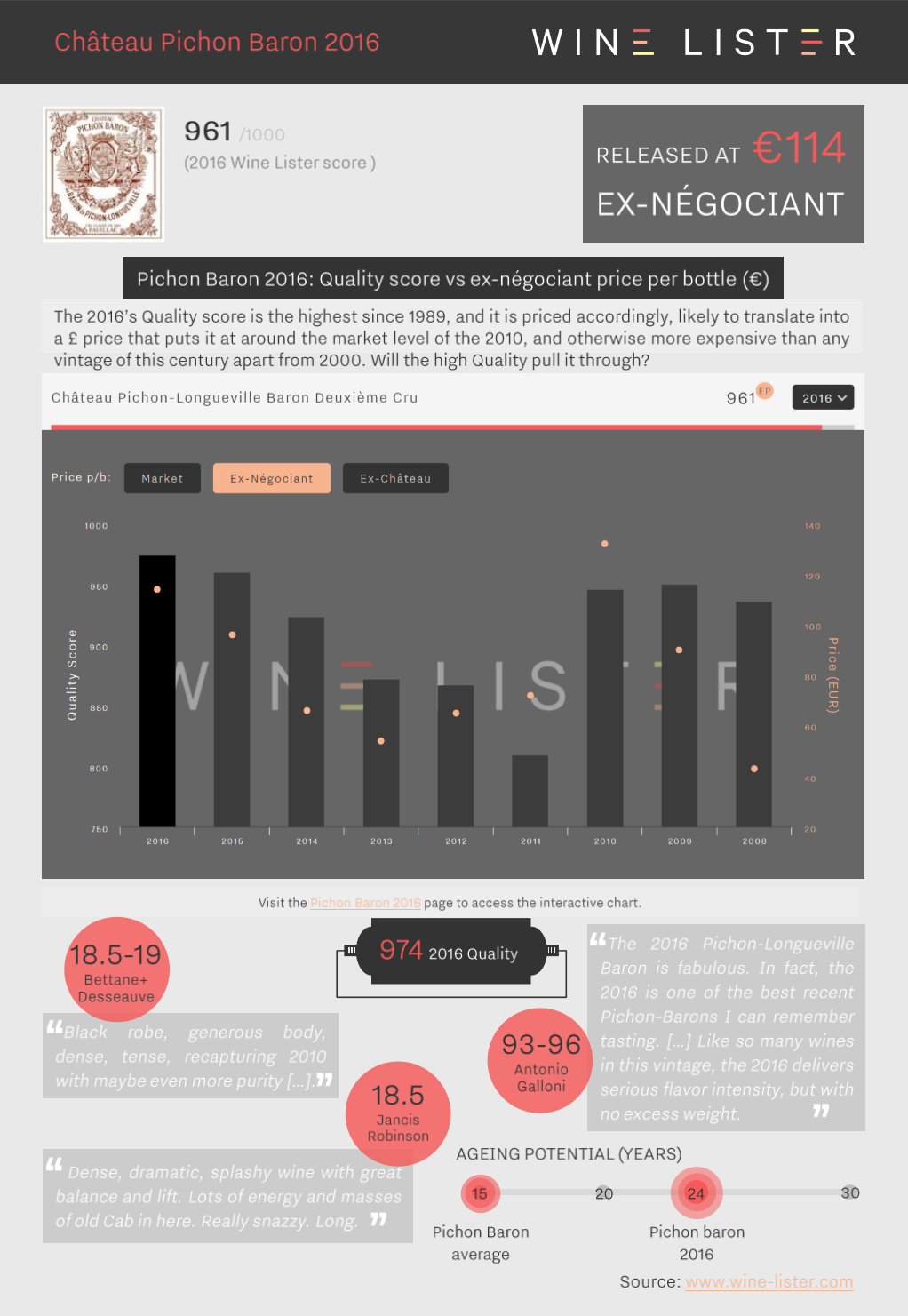

Bordeaux en primeur analysis of Château Pichon-Longueville Baron 2016, which has been released this morning at €114 ex-négociant, an increase of 19% on 2015, with volumes down 20% on last year:

Download the factsheet (and access the interactive chart via the links therein): Wine Lister Factsheet Pichon Baron 2016

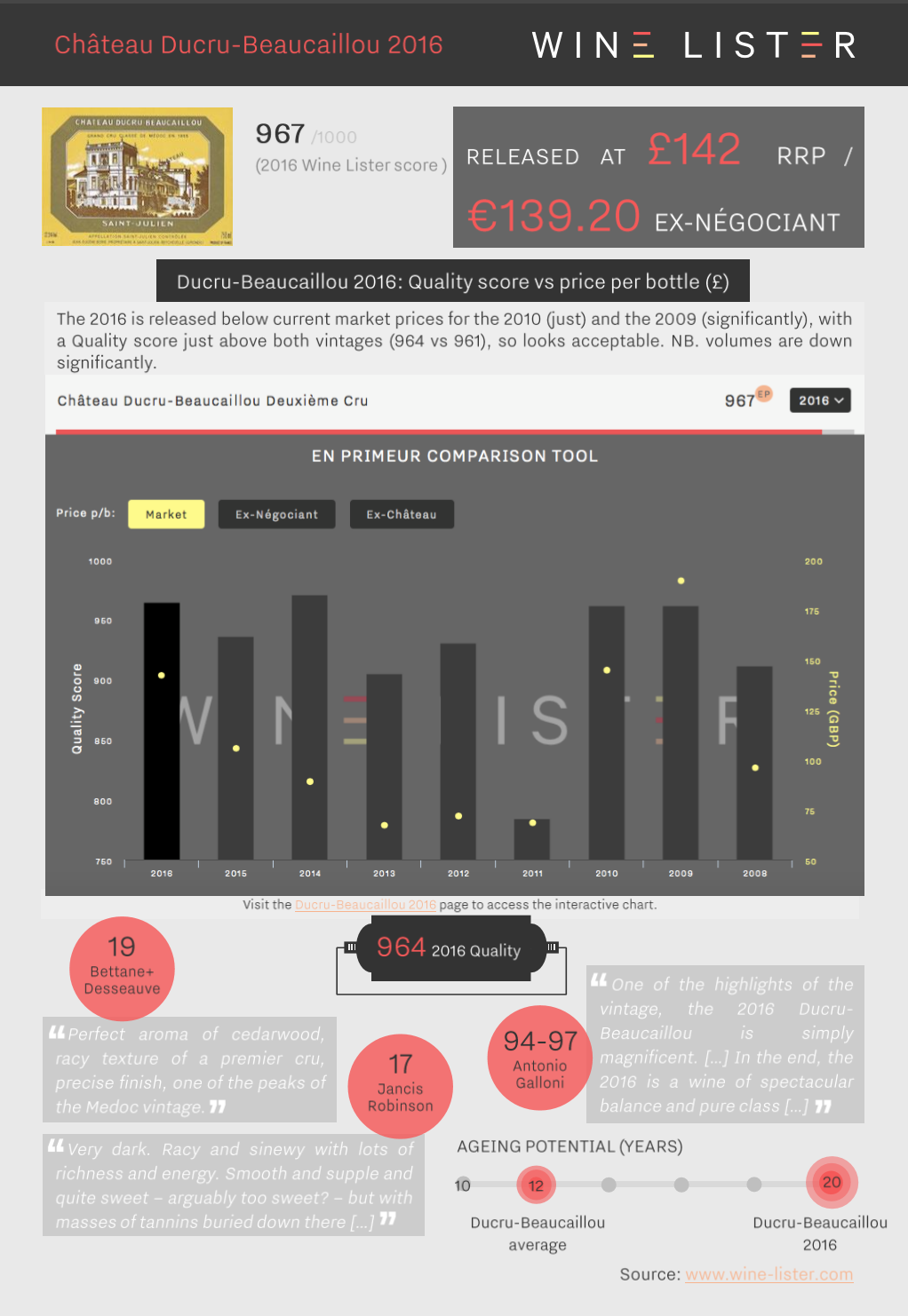

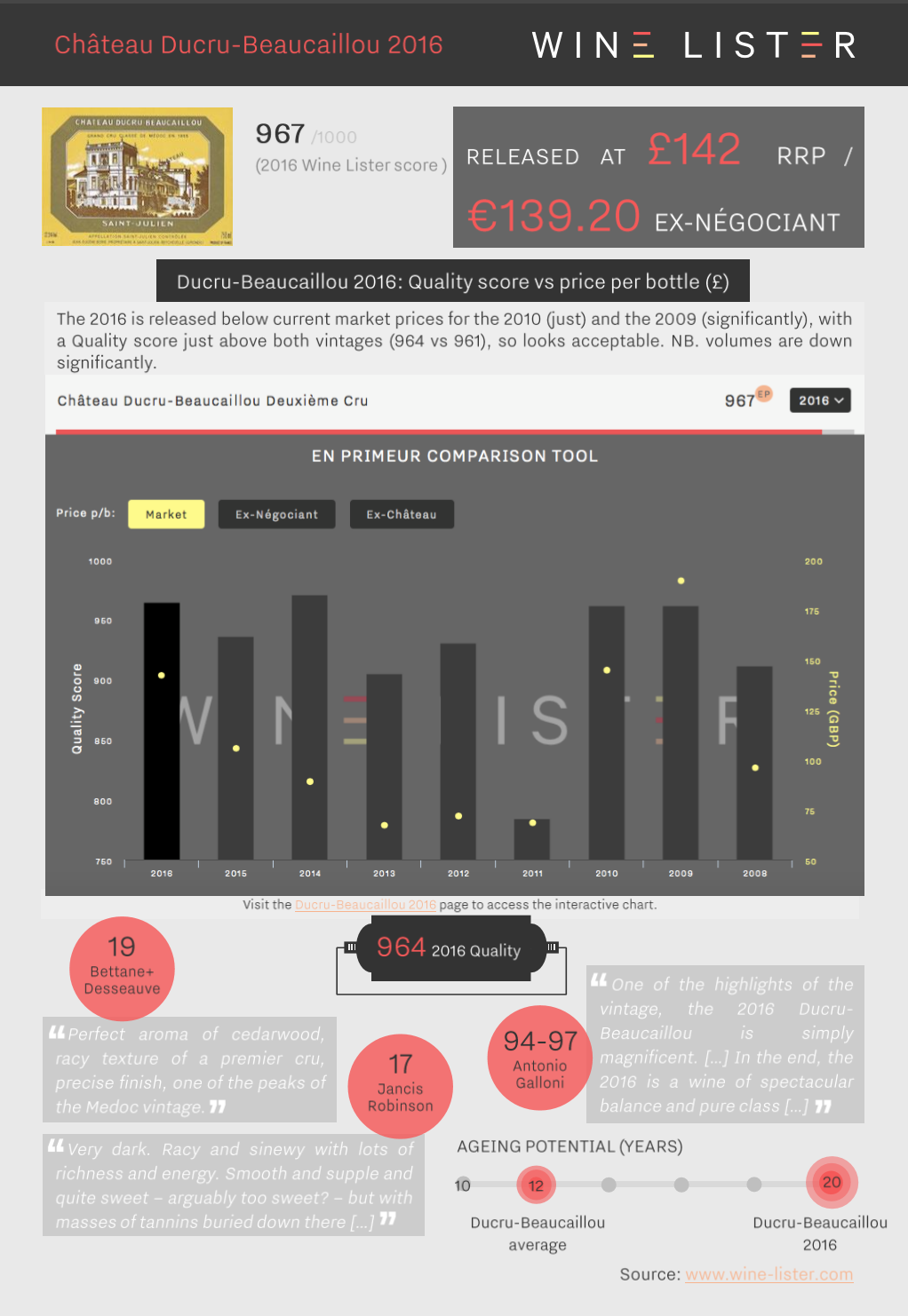

Bordeaux en primeur analysis of Ducru-Beaucaillou 2016, which has been released this morning at £142 in the UK, an increase of 34% on 2015 (16% in € terms):

You can download the factsheet here: Wine Lister Factsheet Ducru-Beaucaillou 2016

Bordeaux en primeur analysis of Léoville Poyferré 2016, which has been released this morning at €66 ex-négociant, a 20% increase on 2015.

You can download the slide here: Wine Lister Factsheet Léoville Poyferré 2016

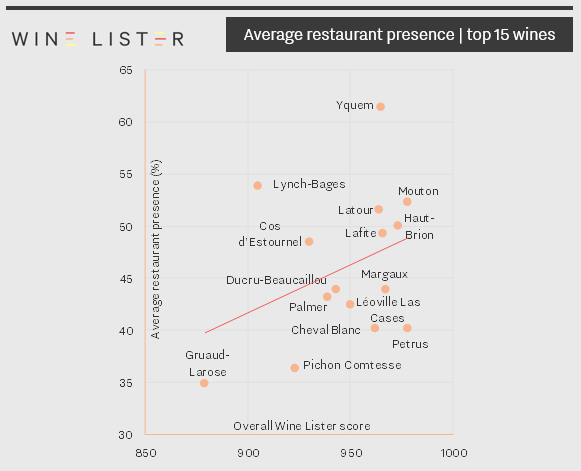

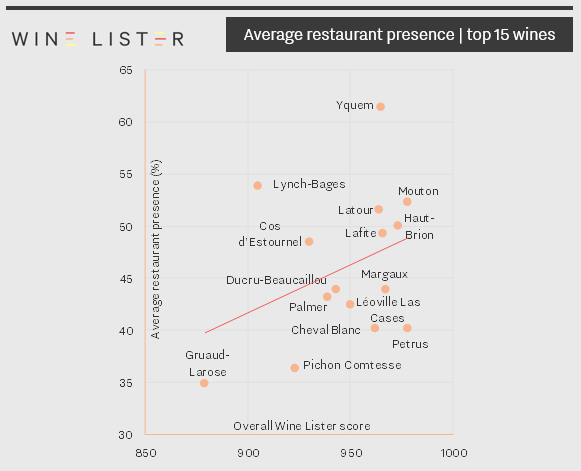

Today’s blog continues to explore some of the findings from the Bordeaux Market Study, by taking a look at global restaurant presence. A fine wine’s prestige and clout on the international market is demonstrated by its distribution across the world’s top restaurants, hence this is one criteria that feeds into our Brand score. (Remember that you can read exactly ‘how it works’ on our eponymous page).

As shown in the chart below, sweet white Yquem dominates: just as it did in the 2016 study (now available to all here). Next comes indomitable fifth growth Lynch-Bages – a wine that the trade has cited as one of the best-selling Bordeaux brands – ahead of all the first growths. Lynch-Bages has overtaken Latour and Margaux since this time last year. Mouton has also moved up the ranks, present in 52% of restaurants compared to 50% in last year’s analysis. Meanwhile, Gruaud-Larose is a new entry into the top 15, replacing Montrose.

This is just a taster of Wine Lister’s 48-page Bordeaux Market Study – subscribers can download the full report from the Analysis page.

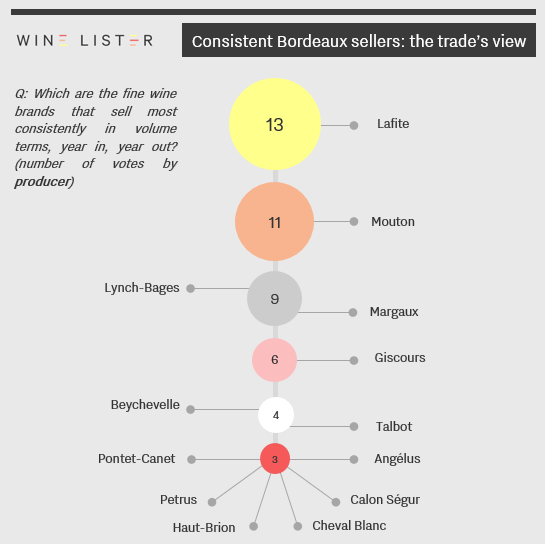

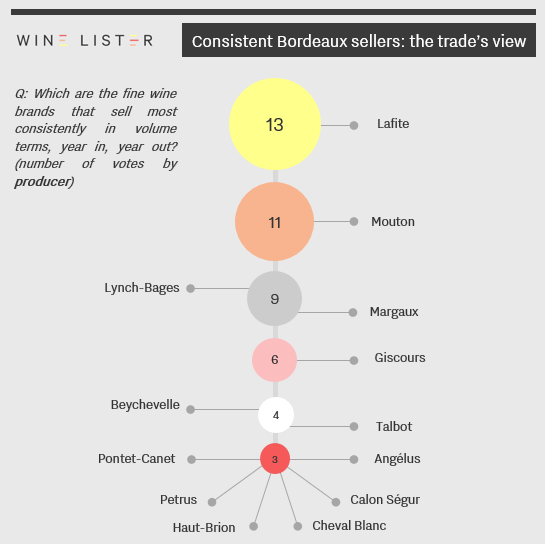

Today’s blog explores another finding from Wine Lister’s 2017 Bordeaux Market Study, released last month. The chart is taken from one of the final sections of the 48-page report, where we surveyed our 49 Founding Members, key players of the global fine wine trade – including merchants, auctioneers, and several high-end retailers – for their views on Bordeaux.

We asked respondents to list 10 fine wine brands from Bordeaux that in their experience sell consistently, year in, year out. Four of the first growths are featured among the responses, with Lafite and Mouton leading the way. Meanwhile, Latour is conspicuous by its absence, with less volume in the market since its withdrawal from en primeur in 2012.

Looking beyond the first growths, Lynch-Bages’ performance here confirms its formidable reputation amongst consumers. Giscours, Beychevelle and Talbot are also highlighted as producers that consistently sell well.

This is just a taster of the Bordeaux Market Study. You can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

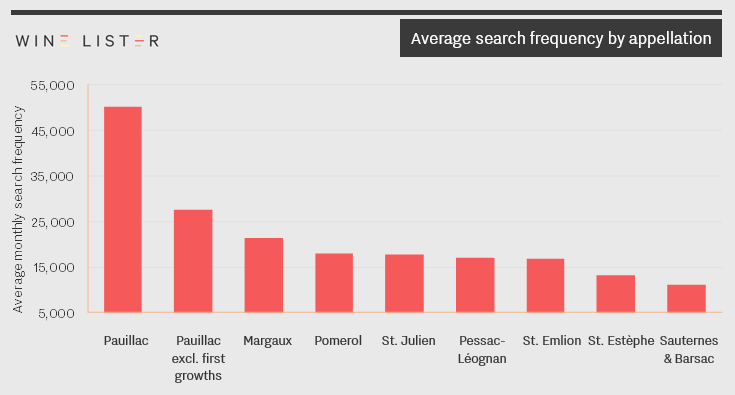

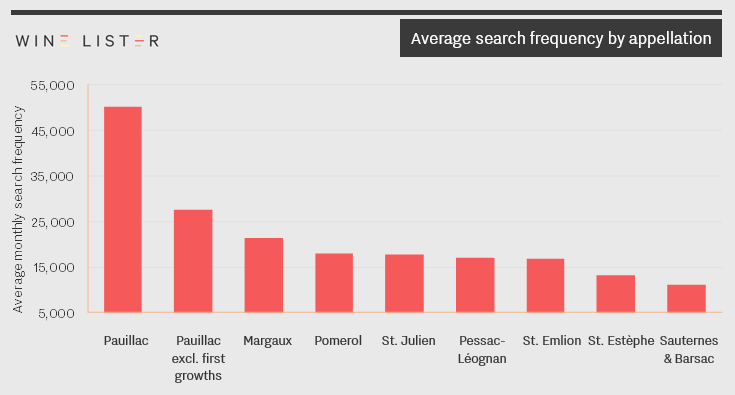

Earlier this month Wine Lister published its annual Bordeaux Market Study, and in recent weeks we’ve published a few nuggets from the 48-page long study on this blog (such as the top-scoring Bordeaux crus, and how to arrive at a 2016 release price). Today, we’re going to explore the popularity of Bordeaux’s individual appellations by looking at the online search frequency from our data partner Wine-Searcher for the six most popular wines of each.

Unsurprisingly, Pauillac – home to three of the five first growths – leads the way, with well over double the number of searches as nearest rival Margaux. If we exclude Châteaux Lafite, Mouton and Latour, the Pauillac average is just under 27,500 searches per month, still 29% ahead of Margaux.

Pomerol comes third, defying low production levels to achieve more average searches for its top wines than Saint-Julien. Pessac-Léognan benefits from the inclusion of Haut-Brion to help it edge ahead of Saint-Emilion, in spite of the latter’s four premiers grands crus classés A, while Saint-Estèphe and Sauternes & Barsac bring up the rear.

This is just a taster of the 2017 Bordeaux Market Study. You can download the full 48-page report from the Wine Lister Analysis page (subscribers only).

Yesterday saw the release of the first tranche of Château Lafite-Rothschild en primeur. It was a surprising move, hinted at late last week, but early for a first growth to release in what is set to be a long campaign. People were momentarily excited – the campaign seemed to be taking off, with a seemingly reasonable price for a first growth that has historically gained in price after release. However, it very quickly became clear that with just half last year’s volume released, and the promise of a second tranche at a higher price, Bordeaux négociants preferred to hold fire and wait it out.

One courtier said, “to my mind it is not a real release of Château Lafite 2016 because [the price of] a part of the volume en primeur is not known.”

The tranche system for Bordeaux en primeur releases was born of two rationales. First, a way of testing the market with an initial, reasonable price on a portion of the volume produced. Second, tranches are a politically adept method for the five Bordeaux first growths to maintain the appearance of releasing at the same price – as has historically been the form – with the possibility thereafter to diverge significantly in price on subsequent tranches.

There are several négociants whose policy is to adhere to the châteaux’s multi-tranche approach, selling on the first at a corresponding price, and the second at a higher price, and so on. However, those négociants had second thoughts yesterday. If they sell the first tranche at the lower price while other négociants await the second tranche and sell at an average price across the two tranches, they will be stuck with a second batch of wine to sell at a higher price than the rest of the market.

That is why the vast majority of négociants yesterday decided not to sell on their Lafite 2016. One négociant explained that the “volume makes it difficult to offer out,” adding “we’re just waiting for the second tranche to offer in one bunch, at an average price.”

So as the entire Place de Bordeaux waits for the second tranche, after which it will sell on the stock at a pro rata price taking into account the price of both tranches, this begs the question: what was the point of separate tranches at all? Had today’s release been on a larger volume, it could have been the touch paper for a sizzling 2016 en primeur campaign. At 50%, unfortunately, it has proved the opposite.

Reports from the Place are that after the Lafite release early yesterday afternoon, not only were there no further releases, but sales on all other wines slowed right down as the local market let Lafite’s move sink in. Not surprising when you consider the importance for a négociant of a first growth’s release in the scheme of an en primeur campaign: it represents a huge sum compared to selling the lesser crus. If yesterday’s events put other châteaux off releasing today, then with the Thursday bank holiday in France, and many bridging to a long weekend, “a whole week of the campaign could be lost,” lamented another négociant (although this is unlikely with another major wine set to release this morning).

Meanwhile, many importers are frustrated by their inability to actually acquire any of the wine and offer it to their customers. One UK merchant concurred, “it’s not a real release,” clarifying, “until the Bordeaux négociants know what their total volumes are – and what their average cost will be – they can’t really offer the wine to the trade so customers are unable to buy it.”

And so we all await the second tranche. One courtier has been led to believe this will be next week, while Château Lafite itself declines to advise on timing.

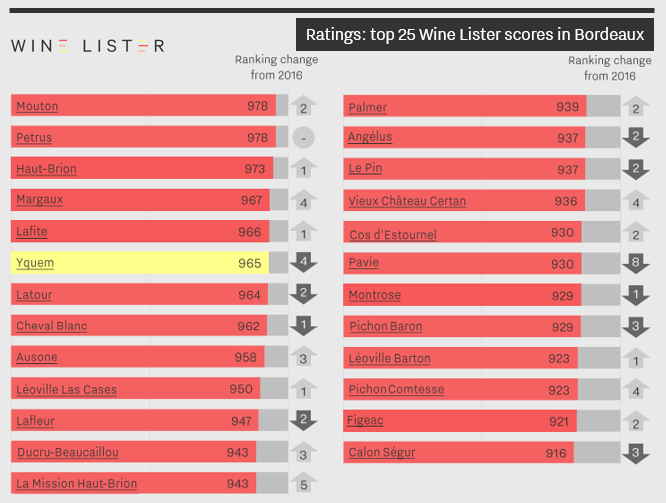

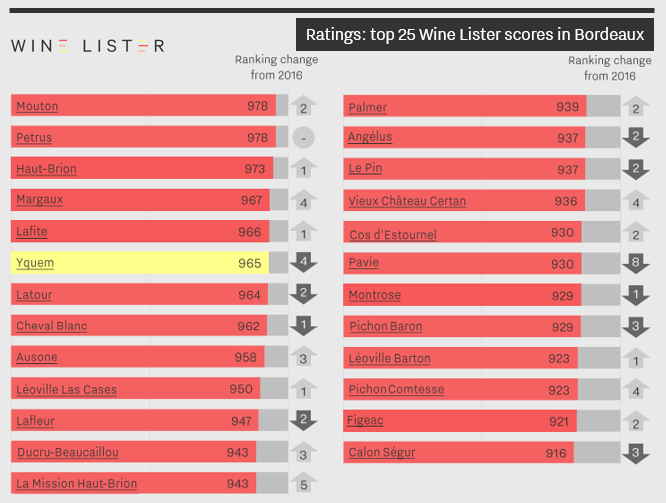

In our third blog post exploring findings from Wine Lister’s recently released Bordeaux Market Study, we look at the top scoring Bordeaux crus as at 28th April 2017. These are the overall Wine Lister scores comprising the three category scores for Quality, Brand, and Economics. They are applied at wine level (an average of the last 30 vintages, with the highest weighting for the most recent vintage – 2016 – and so on).

Nine of the top 25 are from the right bank, and 16 from the left bank. As in last year’s study, the top eight spots are occupied by the five left bank first growths, as well as Petrus, Yquem, and Cheval Blanc, but with a significant reshuffle among these wines. Mouton gains 18 points and climbs two spots to join Petrus at the top of the table this year.

Haut-Brion comes third, one position higher than in 2016. Next come Margaux and Lafite, separated by just one point, although Margaux has surged up the ranking this year, gaining four places.

Yquem, the only white wine in the top 25, drops four places this year, while Latour and Cheval Blanc are also down on last year’s positioning. Ausone comes ninth, up three places from last year, and Léoville Las Cases rounds out the top 10 as the highest placed deuxième cru.

The two newer Saint-Emilion premiers grands crus classés A also feature in the top 25, although Angélus and Pavie have dropped two and eight spots respectively since 2016. Meanwhile Pichon Comtesse and Figeac make their debut into the top 25 this year.

This is just a taster of the Bordeaux Market Study, but you can download the full 48-page report from the Wine Lister Analysis page (subscribers only).