With its top ten wines by Quality score costing £225 per bottle on average, Piedmont might seem overindulgent for a low key midweek meal. However, with a little bit of help in the shape of Wine Lister’s Value Pick search tool, it is easy to find wines that will deliver maximum enjoyment at reasonable prices. Value Picks represent the very best quality-to-price ratio wines, with a higher coefficient applied to allow exceptional quality to be recognised. With a remarkable average Quality score of 976, and costing £40 on average, these five Piedmontese wines prove that outstanding quality is available at all price points.

If you’re after top Nebbiolo at a fair price, then Produttori del Barbaresco’s 2013s appear a safe bet, filling three spots. However, the trade-off for top value will be patience – none of the three will enter its drinking window until 2023. However, with each of them lasting over 18 years, you will be able to make the most of your prudent purchases for years to come. And what better way to explore Barbaresco’s crus in an outstanding vintage than with these three? The Asili Riserva achieves the top Quality score of the three (987), 75 points above its wine-level average. It is also the most expensive, but £42 per bottle doesn’t seem unreasonable for such quality. The Montestefano Riserva really outperformed in the 2013 vintage with a Quality score of 972, 125 points above its average score. The market is yet to react – the 2013’s price is currently 16% below its wine-level average.

Proving that if you’re looking for value for money in Piedmont, it’s not just Barbaresco that you should look out for, Domenico Clerico Barolo Ciabot Mentin 2007 is the region’s number one Value Pick. With a Quality score of 989 – thanks to a 98 point score from Antonio Galloni – it is not hard to see why. What’s more, whereas the Produttori del Barbaresco 2013s require cellaring, the Ciabot Mentin is just entering its drinking window.

Showing that Piedmont is not all about Nebbiolo, Giacomo Conterno’s Barbera d’Alba Cascina Francia 2013 fills the remaining spot. The group’s only Buzz Brand, this would be an excellent way to sample one of Giacomo Conterno’s wines at a fraction of the cost of the domaine’s top cuvées – the hallowed Monfortino Riserva costs £608 per bottle on average.

Prices per bottle are provided by our price partner, Wine Owners, whose own proprietary algorithms process millions of rows of incoming price data from Wine-Searcher to calculate a more realistic market level price – the price at which a wine is likely to find a ready buyer – based on market supply and spread models. As lower retail prices are likely to sell first, the prices you see on Wine Lister may be below the Wine-Searcher average in some instances.

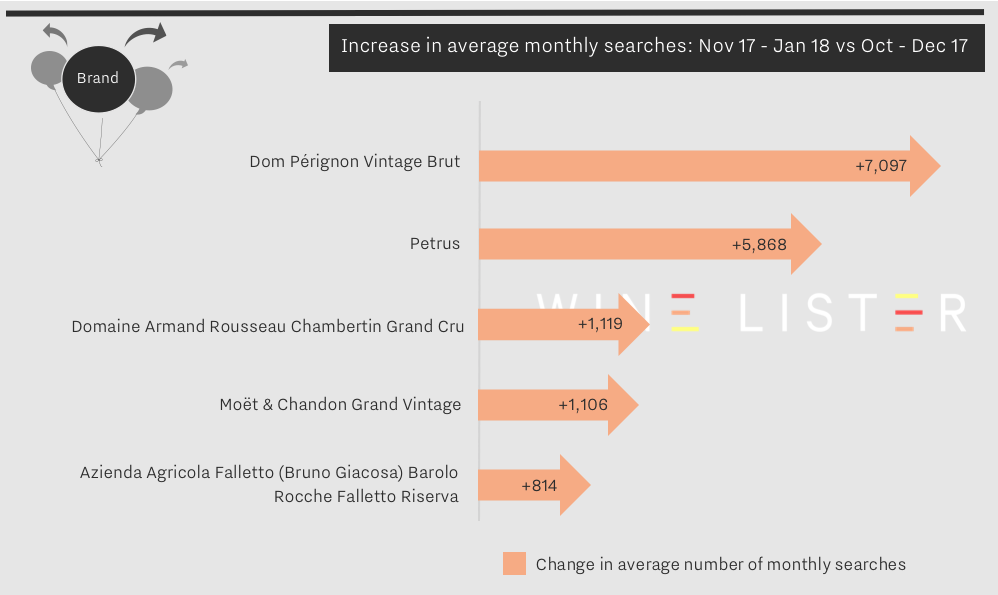

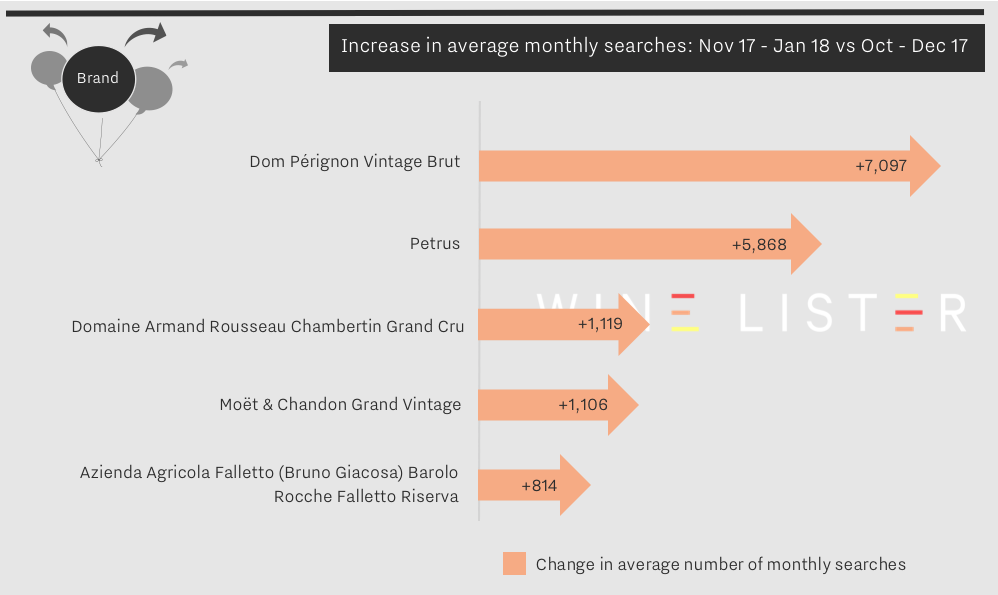

Wine Lister uses search frequency data from our partner, Wine-Searcher, to examine wines with increasing online popularity on a monthly basis. Wines with the highest search frequency numbers tend to be consistent, with the Bordeaux left bank premiers crus classés generally taking the top spots.

This month’s biggest search frequency gainers also rank as some of the most searched-for wines on Wine-Searcher. Dom Pérignon Vintage Brut is the third most popular wine with over 84,000 searches after Lafite and Mouton, closely followed by Petrus in fourth place. Armand Rousseau’s Chambertin and Moët & Chandon Grand Vintage appear in the top 50, while Azienda Agricola Falletto’s Barolo Rocche Falletto Riserva comes lower down at number 148 out of the circa 5,000 wines on Wine Lister, but its search frequency has recently increased by 15%.

Our last post on online search frequency revealed Wine Lister’s first ever perfect Brand score. Moving on from the Christmas period, Champagne brands still show marked increases in search frequency, but this time they do not stand alone at the top.

Dom Pérignon Vintage Brut is the largest gainer in popularity for the second time running. Increasing at a slower rate than in December, its popularity nonetheless grew by 7,097 searches into January, maintaining its 1000-point Brand score. Dom Pérignon remains the only wine to achieve a perfect score from any of the Wine Lister score categories. The other Champagne still riding high on searches is Moët & Chandon Grand Vintage, which increased by 6%.

Bordeaux creeps back onto the map for online searches at the beginning of 2018, with the first growths having featured heavily in searches up to December 2017. Petrus is in second place after Dom Pérignon, with an 8% increase in search frequency. It will be interesting to see if search increases for Bordeaux follow the same pattern as last year as we approach the 2017 en primeur campaign.

Armand Rousseau’s Chambertin appears in third place. Armand Rousseau was only one of two producers to achieve a perfect confidence rating from our Founding Members in our recent Burgundy study.

In fifth place for increased popularity is a bittersweet entry. Searches for Barolo Rocche Falletto Riserva from Azienda Agricola Falletto increased as the wine world learned of the sad passing in January of Piedmont legend, Bruno Giacosa. You can read more on Bruno Giacosa’s legacy in a recent blog on Barbaresco, here.

With the days quickly shortening and misty mornings become the norm, we bid farewell to rosé for the year and welcome back old favourites. Autumn is the perfect season for Piedmontese reds, which are not only so redolent of mist-covered hills, but also pair perfectly with the region’s food at this time of year. With that in mind, this week’s Listed section features Piedmont’s top five wines by Brand score.

Whilst Barolo might be the region’s most famous appellation, it is Gaja Barbaresco that tops the table with an outstanding Brand score of 976. It performs extremely well across both of Wine Lister’s Brand criteria – restaurant presence and online popularity – coming first and second respectively. It is visible in 33% of the most prestigious establishments worldwide, and attracts more than 8,400 searches on Wine-Searcher each month.

Giacomo Conterno Barolo Monfortino Riserva comes next (968). The first of three Wine Lister Buzz Brands in the group, it is by far the most expensive. Receiving on average 9,358 searches each month on Wine-Searcher, it is also the most popular wine in the group. Interestingly, despite experiencing the lowest restaurant presence (23%), it enjoys the greatest depth in terms of number of vintages and formats listed (4.4) – testament to its extraordinary ageing potential of over 24 years.

Bartolo Mascarello Barolo (of “no barrique, no Berlusconi” fame) fills the third spot. This staunchly traditional producer enjoys its best scores in the Brand category, with its excellent search frequency of over 7,000 searches each month helping it to a score of 960.

The last two spots are filled by another wine each from Giacomo Conterno and Gaja – Barolo Francia (formerly Casina Francia) and Sperss (now labelled as Barolo again from the 2013 vintage after 17 years declassified to Langhe Nebbiolo) [Friday fun fact – Gaja now labels wines under the Europe-wide DOP classification rather than the strictly Italian DOC status]. Both wines have strong restaurant presence, at 30% and 31% respectively. Either would be a perfect accompaniment to Alba’s famous white truffles, which will be starting to appear in some of those restaurants now.

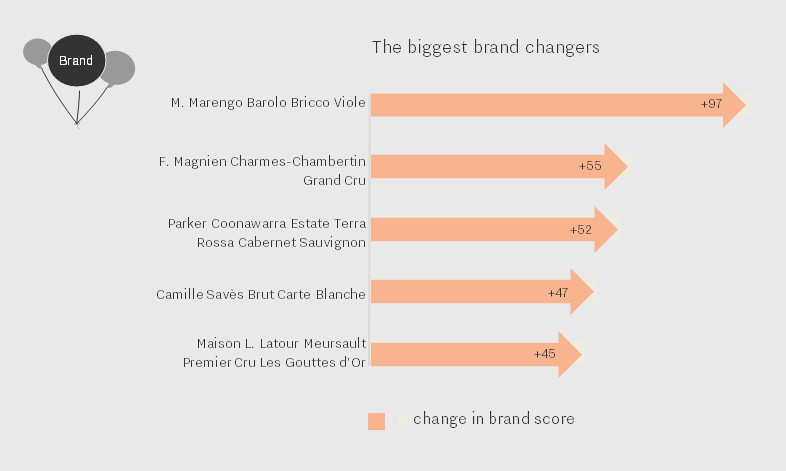

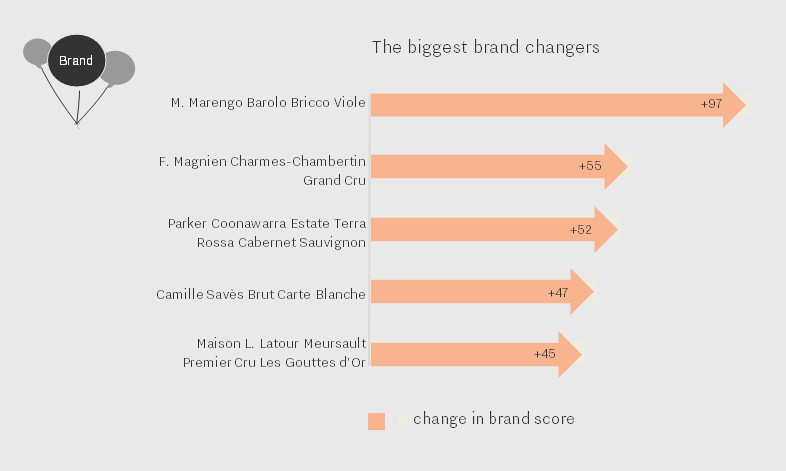

Here’s the latest instalment of our monthly series on biggest Brand gainers.

The latest Wine-Searcher search frequency data is in, allowing us to update our Brand scores with changes to each wine’s popularity (one of the two criteria contributing to the Wine Lister Brand score, the other being a wine’s presence in the world’s top restaurants).

The chart below gives us a breakdown of the five wines which improved their Wine Lister Brand score most during December:

The top five Brand gainers are not concentrated in any one country or region, with Italy, Australia, and three different French regions all represented.

As in November, Barolo is again represented. With a percentage increase of 28% in Brand score, Marengo’s Barolo Bricco Viole saw a surge in monthly online searches, increasing from an average of 103 to 342.

The second biggest gainer is Magnien’s Charmes-Chambertin Grand Cru, whose average monthly searches have doubled, helping raise its overall Brand score above the Wine Lister average to 545/1000.

We’ll be back next month with an update on January’s biggest Brand changers.

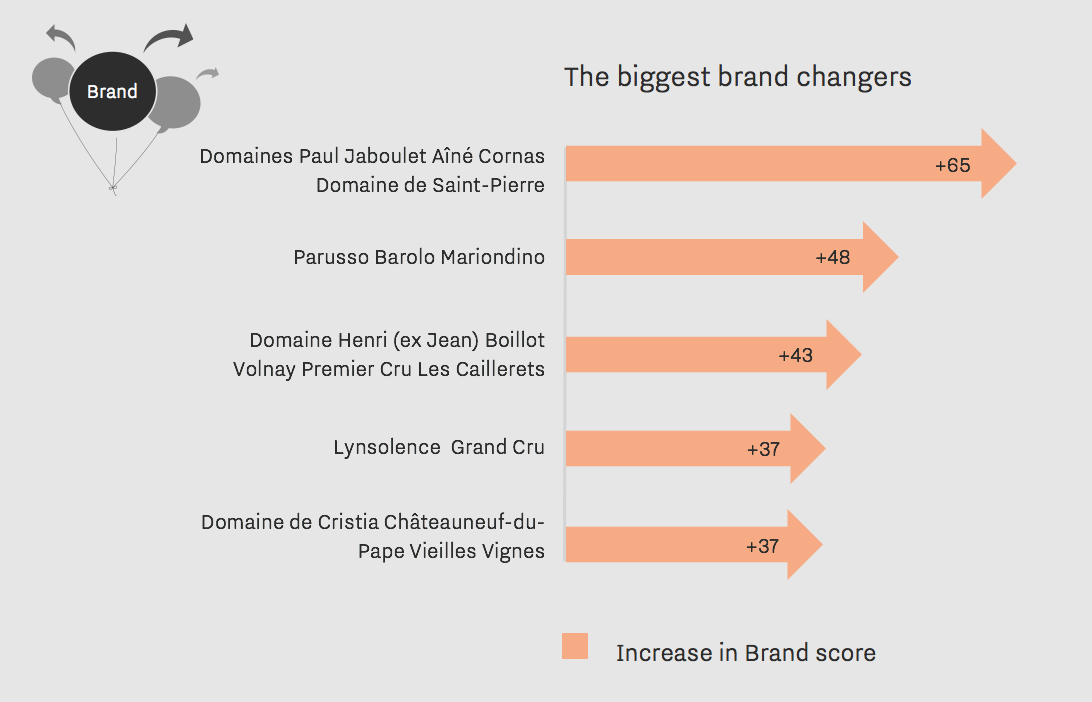

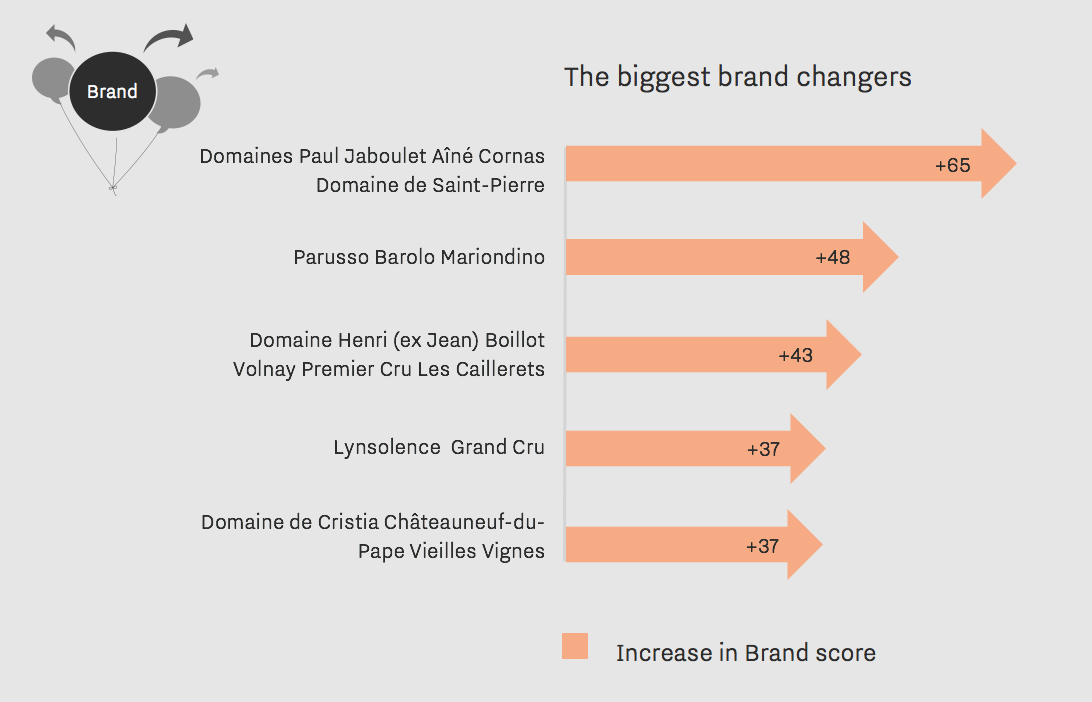

We’ve updated Wine Lister scores to incorporate the latest search frequency data from Wine-Searcher. The higher the relative search frequency of a wine, the higher the popularity score and consequently the better the wine’s Brand score.

The chart below shows the impact of the new online search data on Brand scores, showing the top five biggest gainers.

The brands on the rise in November were spread between several regions, with only the Rhône boasting two in the top five. Gaining most in terms of online searches month on month was Domaines Paul Jaboulet Aîné Cornas Domaine de Saint-Pierre. This saw a recent surge in average monthly searches, from 278 average monthly searches in the three-month period up to the end of October, to 639 now. This resulted in its brand score increasing by 65 points, up to 584 /1000.

Parusso Barolo Mariondino searches also increased substantially in the same period, from 140 to 270, taking its brand score to 434 – still below the average brand strength for wines on Wine Lister.

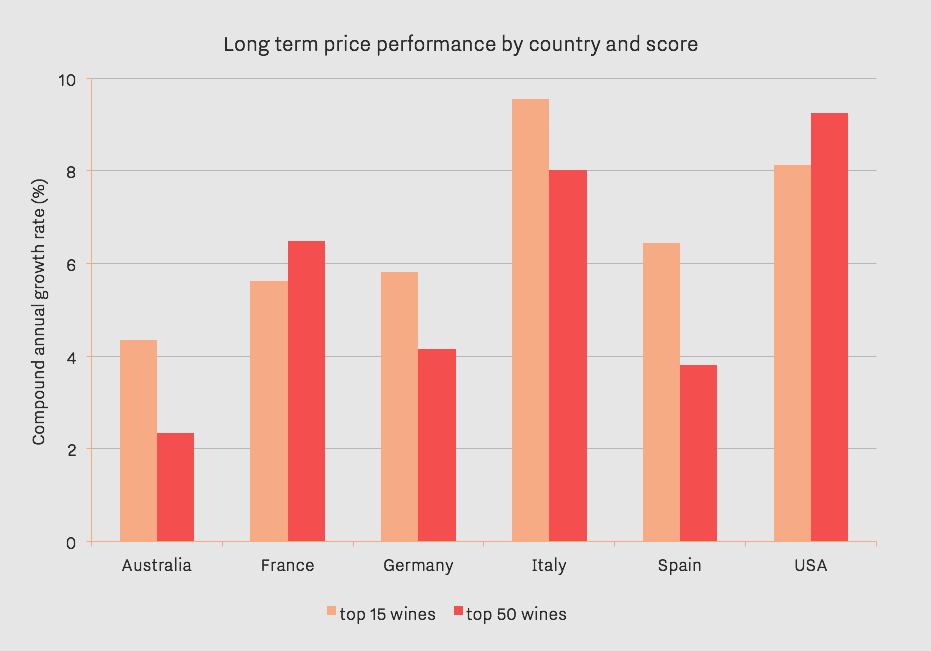

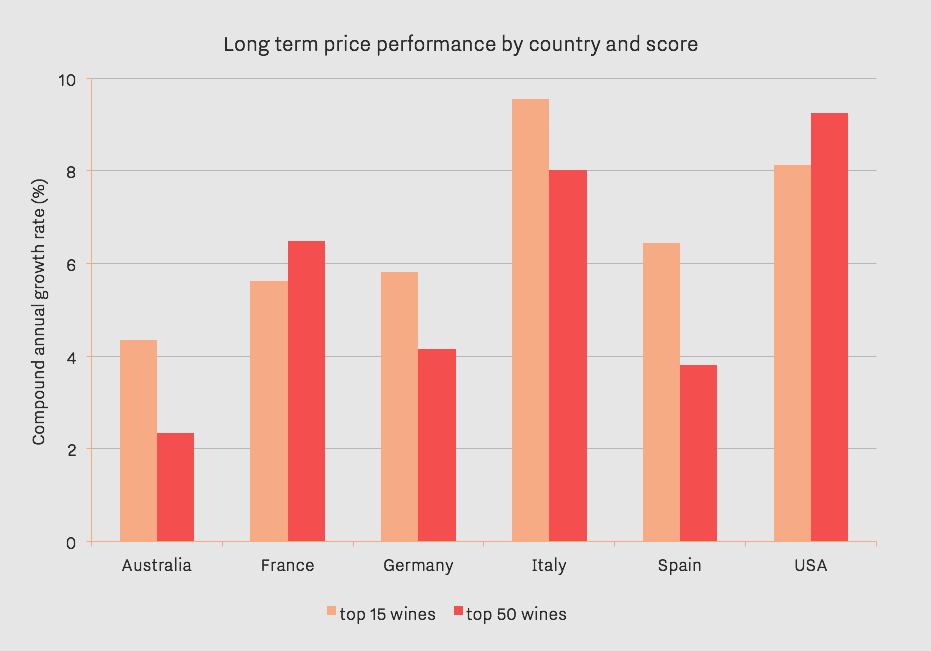

The graph below shows the average long term price performance of top scoring Wine Lister wines by country, and the USA bucks the trend of elites on top (with an early congratulatory nod from France).

We have split out performance for an elite group of the 15 highest-scoring wines, and compared this to performance for a wider panel of 50 wines. For the majority of countries, the elite wines – let’s call them the establishment – have seen their stock rise over the last three years.

In the USA, it is the broader-based group (the red column) that has trumped the establishment (gaining more than 9%). The same is true in France, where a broader group of wines has penned a tale of higher returns.

Our measure of long term price performance is the 3 year compound annual growth rate (CAGR) which facilitates comparison to other investment products.

Elsewhere, Italian wines have seen the best returns among their elite group, averaging annual price gains of almost 10% – the most impressive of any group analysed here. One of the top performing wines in Italy’s top 15 scorers is Bartolo Mascarello’s Barolo (of “no barrique, no Berlusconi” fame), whose average (cross-vintage) price performance is 23% CAGR over the last 3 years.

The elites also outperform the up-and-comers in Spain, Germany, and Australia, perhaps explained by the fact that there are fewer really well established top-end brands in these countries compared to France, and so their respective top 50 groups are less entrenched, and their top 15 groups still have room to grow in recognition and price.