A wine’s reputation for quality cannot be determined by one vintage alone – the very best must be consistent, year-in, year-out. Today, we’ve analysed our data to determine which wines have the most consistent Quality scores (one of the three categories, alongside Brand and Economics that feed into Wine Lister’s holistic wine ratings).

Assessing all the wines in our database for which there are Quality scores for more than 30 vintages, we analysed the standard deviation of these scores from vintage to vintage. The top 10 wines below are the most consistent when it comes to quality:

Unsurprisingly, these are all big names that have been able to invest in the newest technologies to see them through the more challenging years. Their reliability is testament to their status as great wines. Seven of the world’s top 10 most consistently qualitative wines are French, although of the five Bordeaux left bank first growths, only Margaux, Latour and Haut-Brion make the cut, joined by Petrus and Cheval Blanc from the right bank. Domaine de la Romanée-Conti is the only producer to boast two wines in the table: La Tâche and Romanée-Conti, also the two most expensive.

Perhaps unexpectedly, the most consistent wine is also the most affordable. At an average price per bottle of £124, Californian Ridge Vineyards Monte Bello sees limited fluctuation in Quality scores between the years, with the vast majority of vintages scoring between 960 and 990. It is followed by Spain’s Bodegas Vega-Sicilia Unico – whose Quality scores on Wine Lister stretch right back to its 1920 vintage, proving almost a century of consistent winemaking.

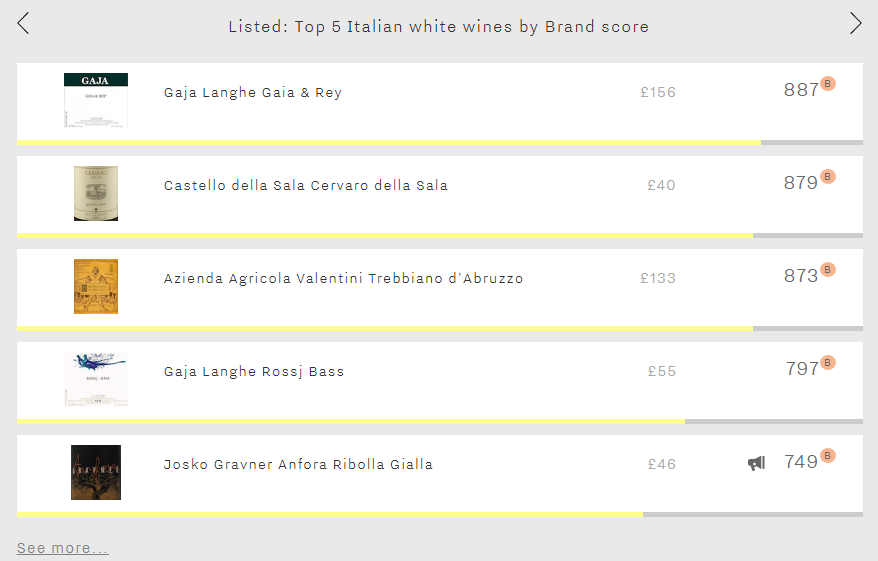

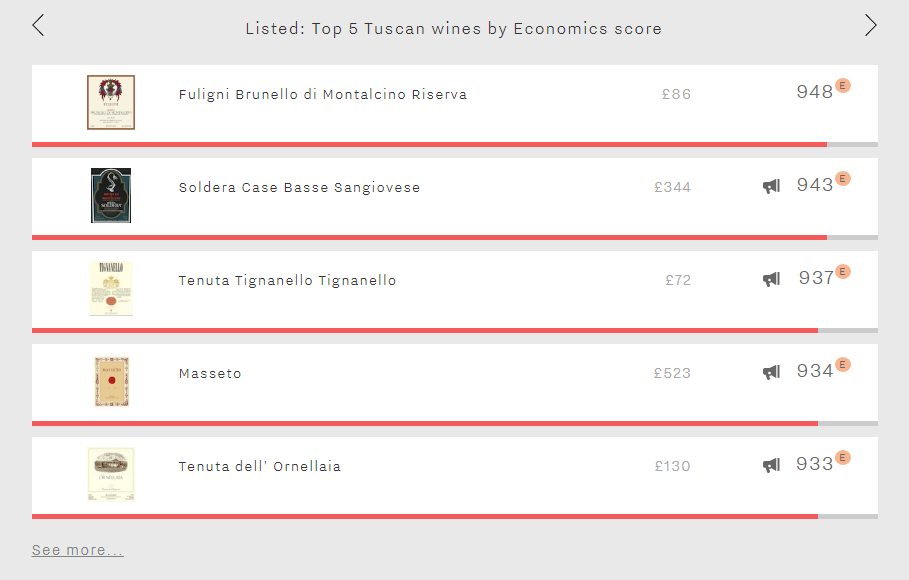

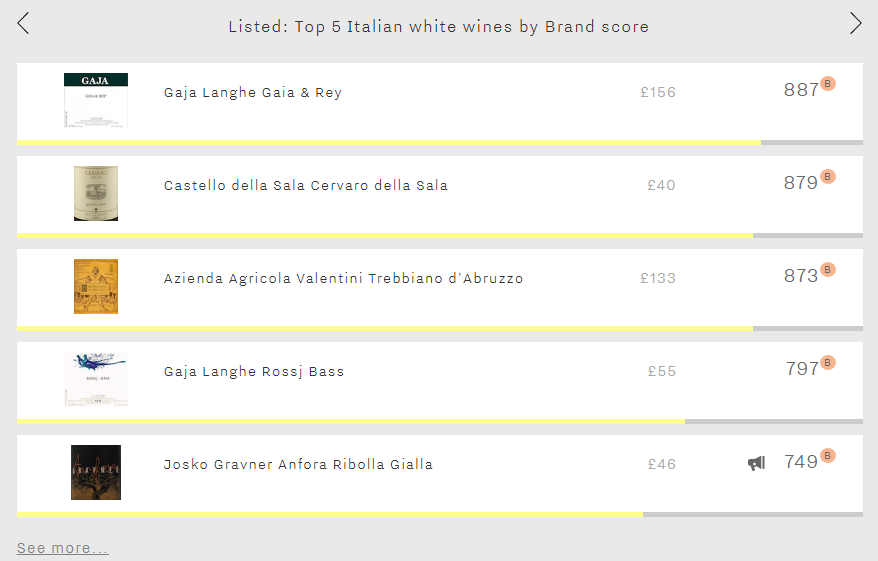

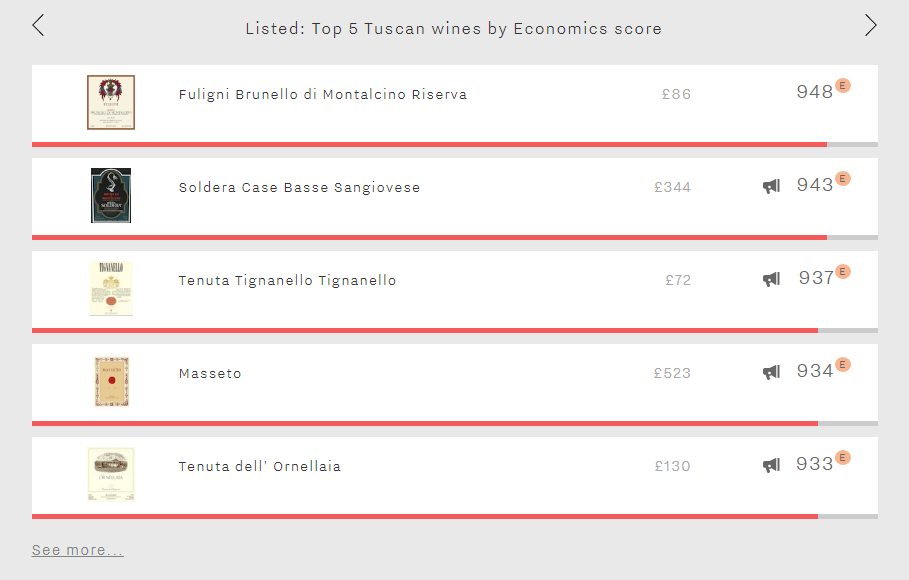

This week’s Listed section features the five Italian white wines with the strongest brands. They comprise two Langhes from Gaja (Gaia & Rey and Rossj Bass), two of Italy’s cult whites (Valentini Trebbiano d’Abruzzo and Gravner Anfora Ribolla Gialla), and Cervaro della Sala (from the Antinori stable).

Whilst these wines all enjoy strong or very strong Brand scores, they do not command the same level of brand recognition as the top five Italian red wine brands, trailing them by c.90-250 points in the Brand category. Tuscan powerhouses Sassicaia, Tignanello, Ornellaia, Solaia, and Gaja’s Barbaresco all achieve Brand scores of over 975 points, with Sassicaia’s outstanding 997 points putting it ahead of the likes of Cheval Blanc and DRC La Tâche.

Wine Lister’s Brand scores comprise restaurant presence and consumer popularity. It is in the latter category that the whites have the most ground to make up. For example Gaja Langhe Gaia & Rey, which featured in our latest blog on new Investment Staples, is present in well over half the number of restaurants of its close relative Gaja Barbaresco, but it receives under a quarter of the number of searches each month on Wine-Searcher. If sommeliers are convinced that these top Italian whites can grace the tables of the finest establishments, they still fly well under the radar of most consumers.

Certain wines are a safer store of value than others. One of our four Wine Lister Indicators – Investment Staples – enables you to spot these instantly. The bespoke algorithm identifies wines of a high quality level, long-lived and not too old, above a certain price (therefore soaking up the frictional costs of collecting wine), with proven price performance, stability, and liquidity.

This last criterion is measured using the number of bottles traded at wine auctions globally. With the latest quarterly data in from Wine Market Journal, 16 new wine and vintage combinations (across nine producers) have recently become Investment Staples. These wines are all over £50 a bottle, with the majority falling under £400, but the most expensive – Roumier’s 2013 Musigny – costing £4,851.

Several of the new Investment Staples have displayed an upward price trend over the last six months, in particular Leroy’s Vosne-Romanée Aux Brûlées 2013 and Roumier’s 2008 Musigny, both of which have seen increases upwards of 30%.

Wine investment is not often associated with white wines, but six of the new Investment Staples are just that. All possess staying power, and are young enough to have room for improvement. What is more, they are made by some of the finest wine producers there are, allowing them to challenge some of their red neighbours in terms of investment fundamentals. Of these, Roulot’s Meursault Charmes 2012 has the best six-month price performance, plus one of the longest drinking windows based on the average assessment of our partner critics. Jean-Marc Roulot has been a rising star for several years now, but his wines are still in the ascendancy.

The new Investment Staples nearly all hail from Burgundy, with just a handful of entries from Piedmont and the Rhône. Those seeking something a bit different that still possesses the criteria of a solid investment might look to Italian white, Gaia & Rey 2012 from Gaja, which has a drinking window of 2015-2025, 6.3% six-month price performance, and price tag of £124.

To search for more Investment Staples, subscribers can click here, filtering by country, region, type, style, price, and score, to drill down exactly into what wine you’re after.

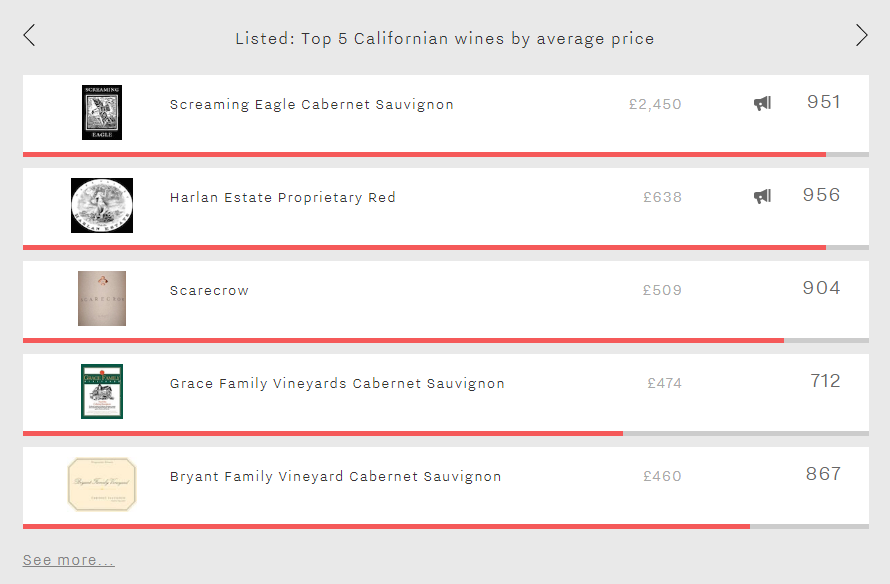

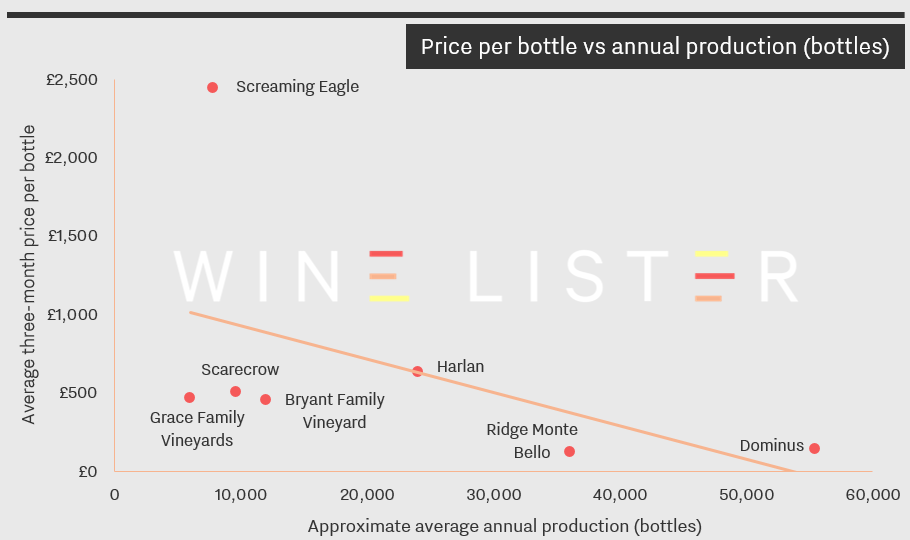

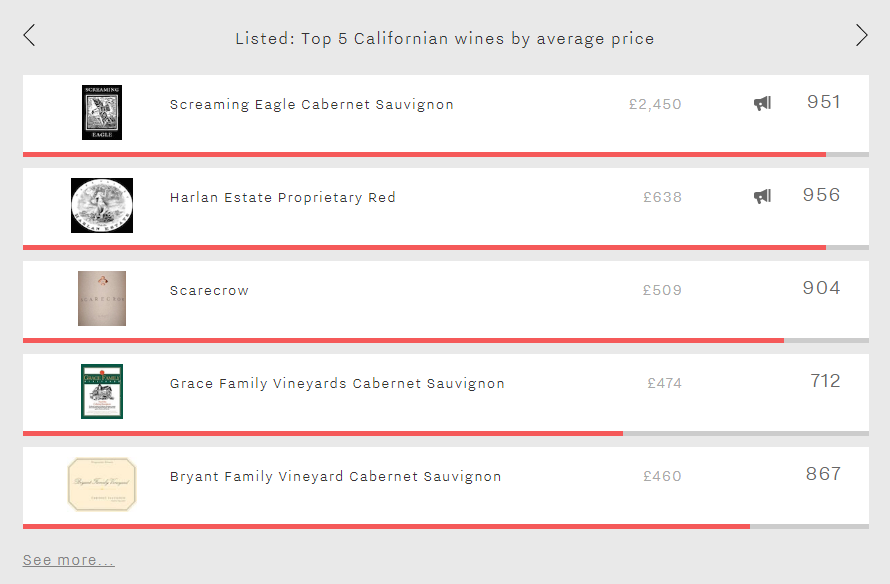

This week’s listed section looks at the five most expensive Californian wines. Unsurprisingly, the list comprises five cult Napa reds, all with small annual productions helping to fuel a healthy supply and demand ratio that keeps consumers thirsty and wanting more.

Leading the way is Screaming Eagle, averaging c.7,800 bottles per year. At £2,450 per bottle, it is the 12th most expensive wine in Wine Lister’s database, just £27 below DRC La Tâche.

Harlan, the third highest-rated Californian wine overall, has an average annual production of c.21,600 bottles, and is the region’s second most expensive wine. At £638, it is available at nearly a quarter of the price of Screaming Eagle.

The next three wines all have lower production volumes than Harlan. At £509, Scarecrow has a similar price point to the likes of Lafite (£522) and Masseto (£524). Fourth-placed Grace Family Vineyards Cabernet Sauvignon achieves a Wine Lister score of 712, considerably lower than the others, but again low production volumes (c.6,000 bottles a year) help it to achieve its hefty price tag of £474. Bryant Family Vineyard Cabernet Sauvignon fills the fifth spot at £460 per bottle.

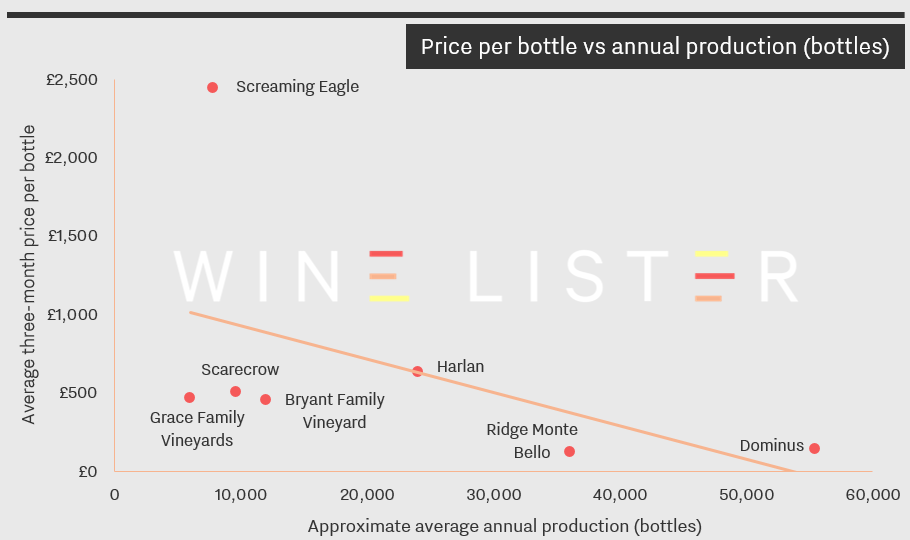

Produced on far greater scales than these five, Dominus and Ridge Monte Bello, Wine Lister’s two overall top-scoring Californian wines, do not make the top five most expensive. The trendline on the chart below confirms the negative correlation between price and production:

Remember that even if you don’t currently have a Wine Lister subscription you can access all the underlying data behind these five wines as well as those featured in other Top 5s, giving you an insight into the wealth of tools at our subscribers’ disposal.

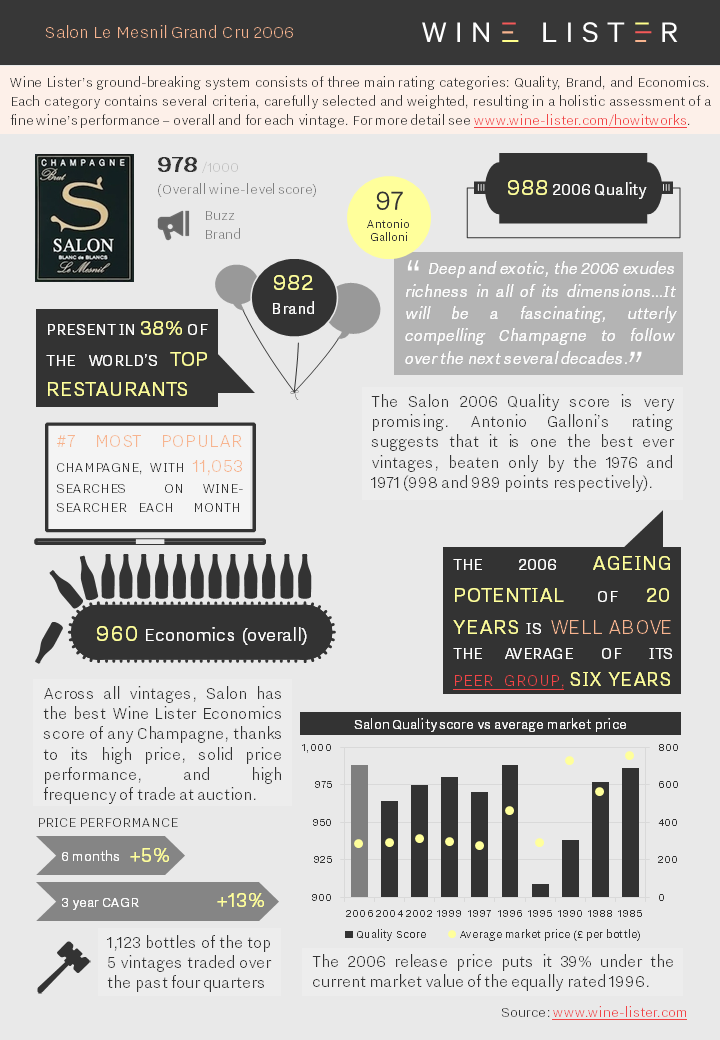

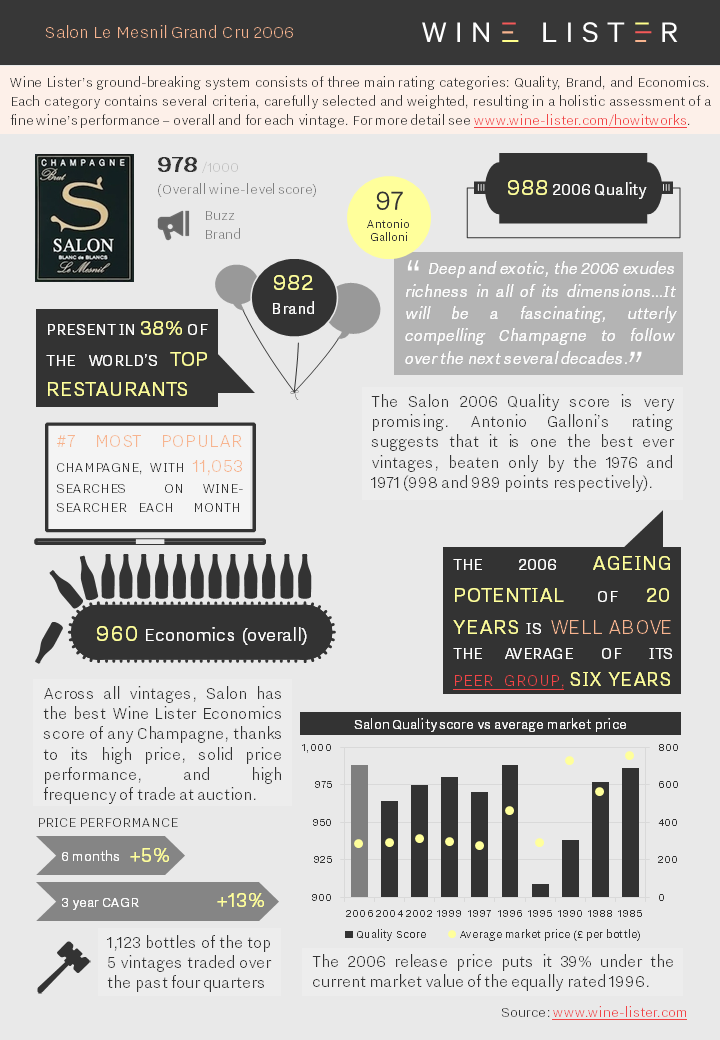

Earlier this month Salon Le Mesnil 2006 was released, the Champagne house’s 40th vintage. Described as “a fascinating, utterly compelling Champagne” by our partner critic Antonio Galloni, we summarise all the key data below:

You can download the slide here: Wine Lister Factsheet Salon 2006

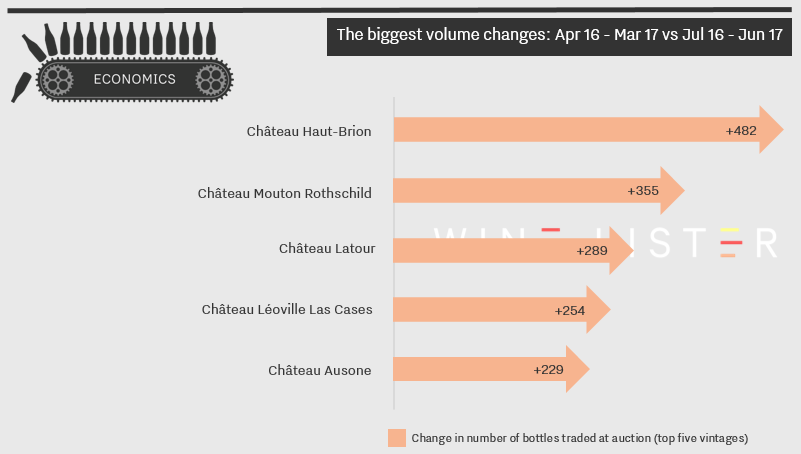

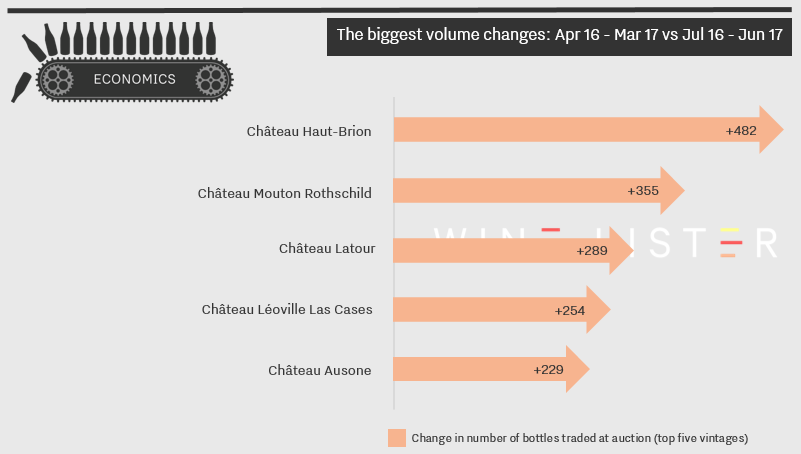

The latest trading data is in, and it is evident that this quarter one region’s wines have had particular success at auction. We’ve calculated which wines have seen the greatest incremental increases in bottles traded by using figures collated by Wine Market Journal from sales at the world’s major auction houses, looking at the total number of bottles sold of the top five vintages for each wine over the past four quarters.

In contrast to last quarter’s data, which saw wines from a variety of regions see trading volumes rise, all five wines in the table below are from Bordeaux. Four are from the left bank, with first growth Haut-Brion benefitting the most from increased trade, while right bank Ausone also makes the cut.

Latour is the only wine to feature two quarters running. This presents an interesting counterpoint to the château’s reported fall in trading volumes on the wine exchange Liv-ex. Since its decision in 2012 to withdraw from the en primeur system, Latour has held back its five most recent vintages. It seems unsurprising, therefore, that the wine is less present than its fellow first growths on trading platforms, where recent vintages tend to attract high volumes of trade. However, this has not affected the wine’s success on the auction market, which favours older vintages, and therefore arguably makes for a fairer comparison.

You may have noticed a subtle re-design today on the Wine Lister homepage. This includes moving up and expanding the scope of the “Listed” section: a changing Top 5 of wines from around the world, updated each week.

You can now explore the five most recent Top 5s, even if you’re not yet a subscriber to Wine Lister. For as long as the list is live, this includes access to all the underlying vintage-level data that feeds into one of our Listed wines, including critic scores, restaurant presence, search frequency, and price performance. Simply click on the Listed wine that takes your interest, then select from the drop-down of vintages at the top right of the wine page. What’s more, this allows you to play with tools such as interactive price history and vintage value identifier charts.

Our Listed section addresses a variety of tastes and priorities – some weeks you will see our best Value Picks from a particular region, other weeks will focus specifically on wines with top Brand or Economics scores, or wines of the highest quality from a specific vintage.

To access independent wine ratings, tools, and analysis for all of the thousands of wines and vintages in our database you’ll need to subscribe – or why not try a free 14-day trial?

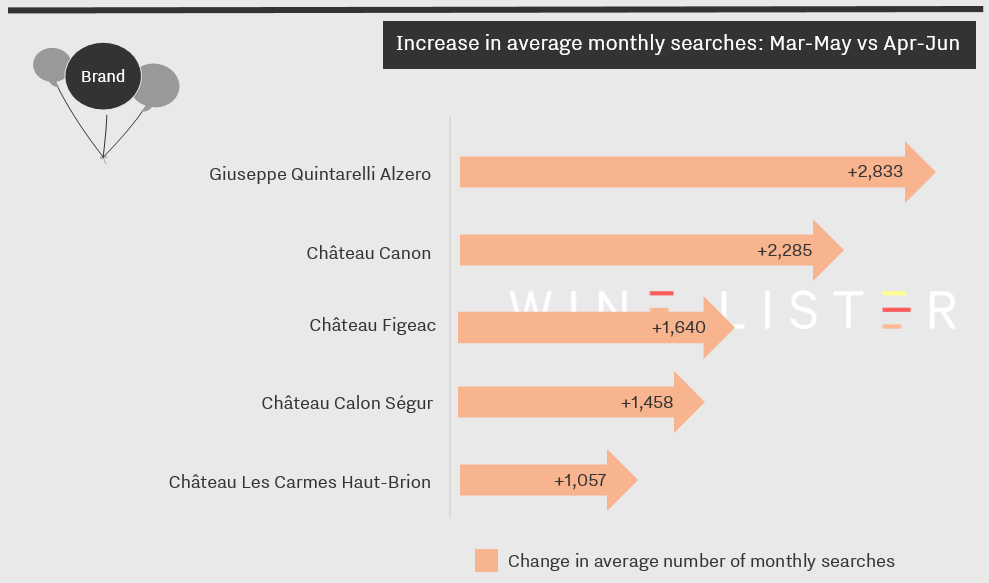

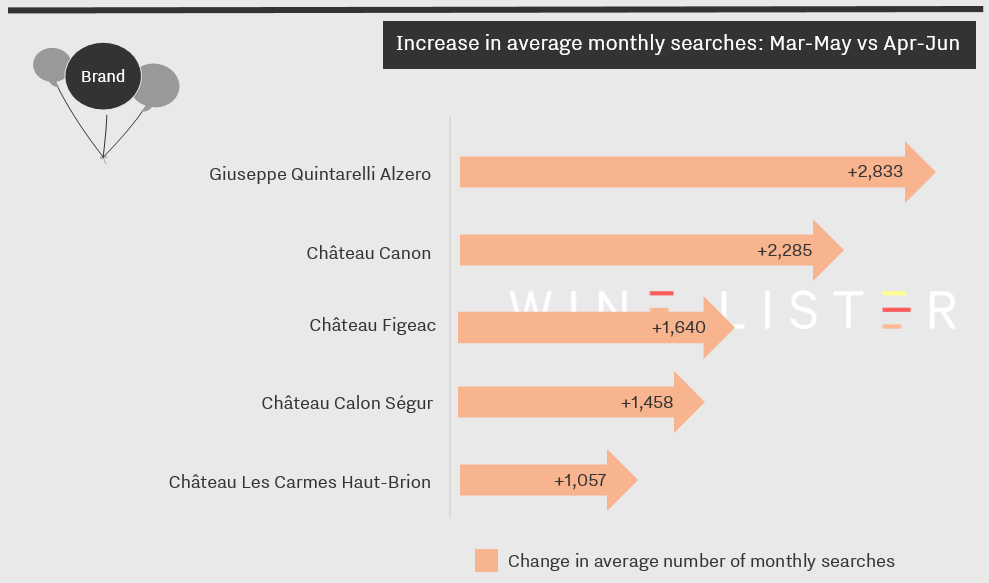

The latest online search frequency data is in from Wine-Searcher, and with it we can see which wines surged in popularity during June. As with May’s results, the effect of the 2016 en primeur campaign is evident, with four of the five spots filled by Bordeaux crus that released their 2016 vintage on or after 31st May.

However, if the en primeur effect is to be expected, the likely reason for Giuseppe Quintarelli Alzero’s appearance at the top of the table could not have been foreseen. On 18th June, NBA star LeBron James posted a photo on Instagram of a bottle of Giuseppe Quintarelli Alzero 2007 that he was enjoying, having spent the day hosting his son’s birthday party. To date it has received well over 200,000 likes, surely contributing to its 168% increase in online search frequency. It appears that whilst La Place de Bordeaux is the fine wine world’s premier marketing machine, it is no match for LeBron James and his 31.8 million Instagram followers.

Returning to the en primeur effect, Canon 2016 was released at £73.35 per bottle on 1st June to great acclaim, having achieved its second-best Quality score ever. The leap in search frequency confirms its upward trajectory. Figeac repeats its May performance, surging even further in popularity in June. The 2016 vintage – Figeac’s best since 1989 – was released on 13th June, its 67% increase on the 2015 sterling release price signalling its clear intent to reposition itself.

Calon Ségur and Les Carmes Haut-Brion both comfortably achieved their best ever Quality scores with their 2016 offerings, and sold out quickly, no doubt prompting their surges in online search frequency during June. The next step is to get a famous sportsperson to post a photo of themselves drinking it.

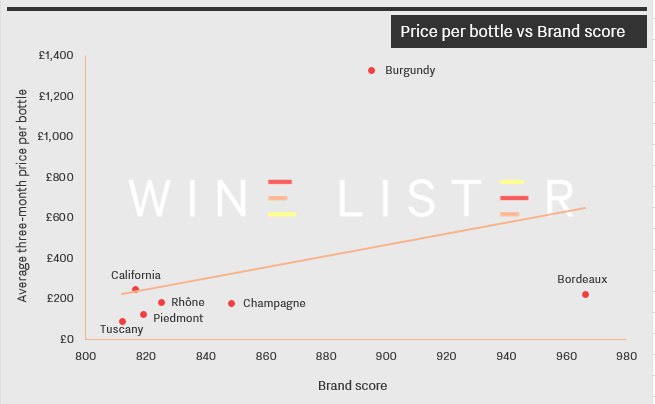

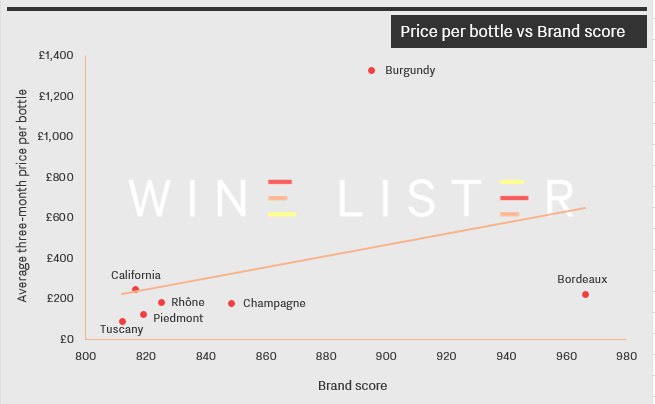

Following on from our recent blog on the relationship between price and quality for seven leading wine regions, today we turn our attention to the role that brand strength plays on price for those same regions. The chart below compares the regions’ average three-month market price to their average Brand scores, using the same 50 overall top scoring wines in each region as in the previous post.

Bordeaux’s crus classés enjoy unassailable brand strength, a product of the success of the region’s classification system and the fact that its châteaux have enjoyed global renown for centuries. If you want brand for your buck, look no further.

Conversely, Burgundy’s extraordinary prices far exceed the level of brand clout commanded by its top crus. Its top wines trail the average Brand score of Bordeaux’s by 7%, but sell for nearly six times as much. This suggests that quality, and perhaps small production levels, play more of a part in the region’s prices.

The five remaining regions are more evenly matched. Tuscany’s wines have both the lowest average Brand score and the lowest prices, followed closely by Piedmont. Meanwhile California’s top 50 wines, which have the second-lowest average Brand score, command the second-highest prices. Top wines from the Rhône and Champagne command similar prices to their Bordeaux counterparts, but with average Brand scores more than 100 points lower.

In today’s blog, we’ve taken a look at the relationship between price and quality for seven leading wine regions. The chart below compares the regions’ average three-month market prices to their Quality scores, with the data calculated from each region’s 50 best-scoring wines (in terms of overall Wine Lister score).

While six regions are clustered relatively close to each other, Burgundy finds itself at the extreme top end of the scale: its wines outperform on quality and have the prices to match. The top 50-scoring wines in Burgundy average a whopping £1,330 per bottle, driven by the likes of DRC La Romanée-Conti at £10,776 and Domaine Leroy Musigny at £7,805.

The Rhône’s wines have the lowest average Quality score but not the lowest prices: at £188 per bottle on average, they are the fourth most expensive of the group. California and Bordeaux display a very similar profile, appearing just above the trendline, indicating that these wines command high prices not simply on account of quality – brand also plays a part.

Champagne and Piedmont, meanwhile, fall below the line, suggesting that as regions they tend to offer value for money. Piedmont’s ranking is particularly impressive: second only to Burgundy in terms of average Quality score, its wines are available for a tenth of the price on average.