Lynch-Bages 2017 en primeur release

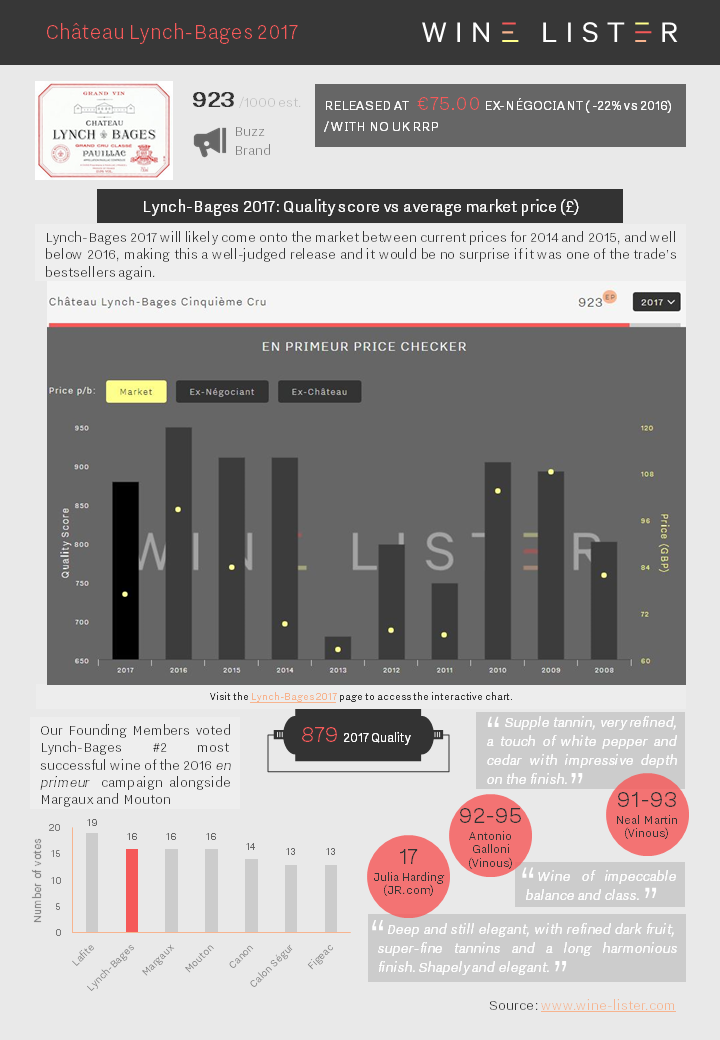

Lynch-Bages 2017 released at €75 ex-négociant (22% down on 2016), with no UK RRP. Its Quality score was down 7% on 2016 (879 vs 949).

You can download the slide here: Wine Lister Factsheet Lynch-Bages 2017

Lynch-Bages 2017 released at €75 ex-négociant (22% down on 2016), with no UK RRP. Its Quality score was down 7% on 2016 (879 vs 949).

You can download the slide here: Wine Lister Factsheet Lynch-Bages 2017

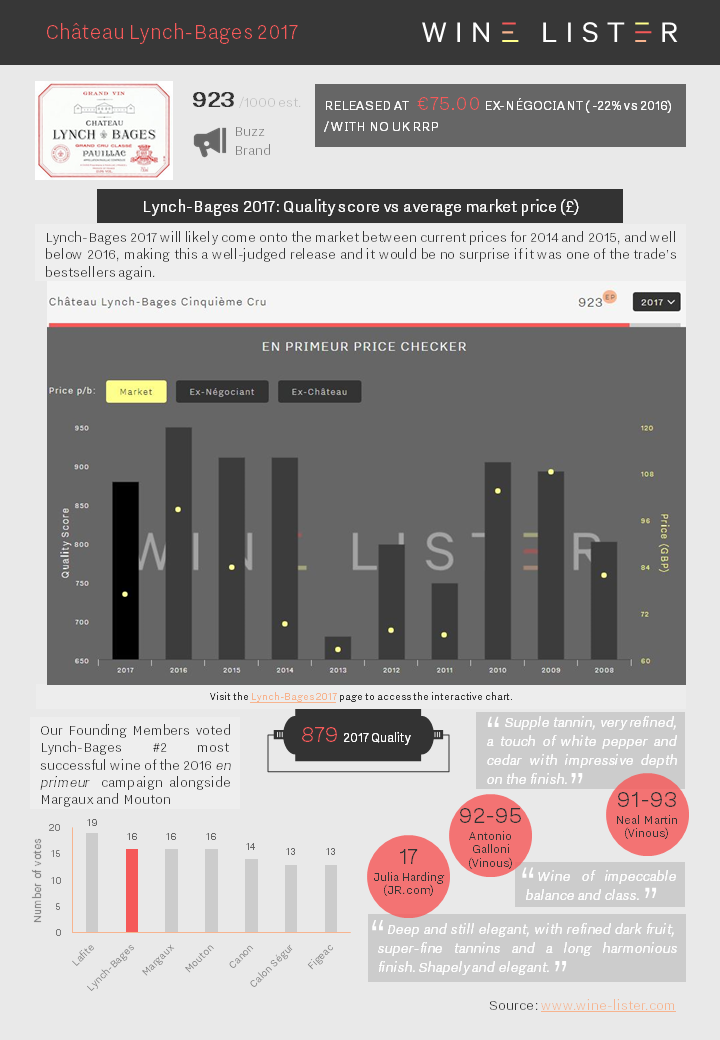

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.

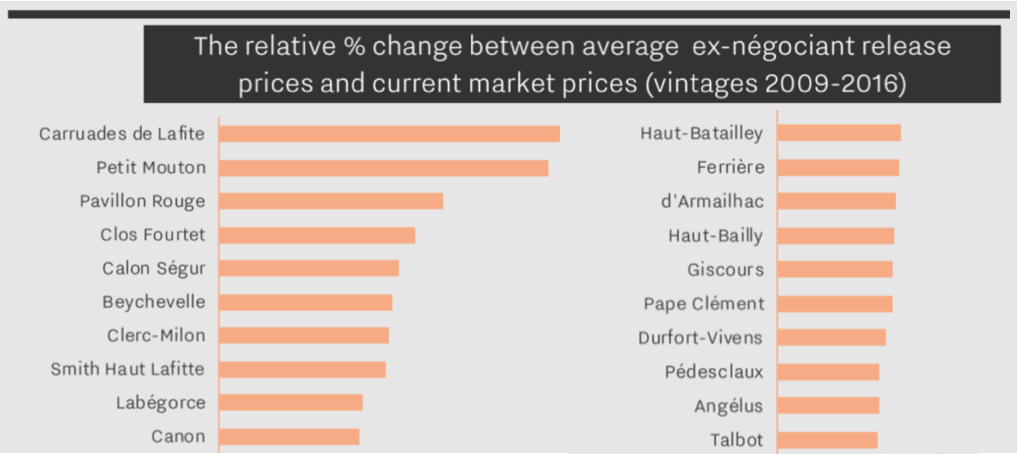

This week, the Listed section travels to the Rhône to consider the region’s top brands. As might be expected, all are red – Chave’s Hermitage Blanc, the region’s top white brand (924), is only the Rhône’s overall 12th strongest. However in a battle between North and South, it is the latter that comes out on top in the form of Beaucastel’s Châteauneuf-du-Pape with a Brand score of 993 – putting it amongst the top 25 brands on Wine Lister.

By far the cheapest of the five, Beaucastel leads across both Wine Lister Brand score criteria – presence in the world’s top restaurants and online popularity. However, whilst it is visible in 49% of the world’s finest establishments (just pipping Chave Hermitage’s 47% to the post), with 2.6 references per wine list on average it achieves the weakest vertical restaurant presence of the group, where Chave’s Hermitage manages the greatest depth (3.9 listings). If Beaucastel’s dominance within the world’s top restaurants is less clear-cut, when it comes to popularity amongst consumers it opens up a wider lead over the competition, receiving 16,565 searches on Wine-Searcher each month on average – 40% more than Jaboulet’s Hermitage La Chapelle – the group’s second-most popular wine.

Tied for second place with a Brand score of 987 are the two Hermitages from Chave and Jaboulet (La Chapelle). Whilst Chave leads in terms of restaurant presence (47% vs 43%), Jaboulet’s La Chapelle receives 6% more searches each month on average. Despite their identical Brand scores, Chave’s Hermitage is the clear winner elsewhere, with comfortable leads in the Quality category (959 vs 910) and Economics category (935 vs 863). Chave’s reward is a 36-point lead at overall Wine Lister score level (964 vs 928), and a price tag over twice that of Hermitage La Chapelle’s.

The Rhône’s overall top wine – Rayas (968) – is the region’s fourth-strongest brand (982). The group’s second Châteauneuf-du-Pape, it comprehensively outperforms the Beaucastel in terms of Quality (961 vs 876) and Economics (959 vs 823). It is thus perhaps the Beaucastel’s significantly larger annual production – roughly seven times Rayas’ – that has helped raise its brand to such lofty heights.

Rounding out the five is Guigal’s Côte Rôtie La Mouline with a score of 959. Whilst it can’t quite keep pace with the remainder of this week’s top five, it leads the two remaining “La Las” – La Landonne and La Turque – by six and 12 points respectively in the Brand category. Similarly to the Rayas, it is perhaps the extremely limited production of the “La Las” that keeps them from achieving even higher Brand scores – the combined annual output across the three cuvées is c.18,000 bottles.

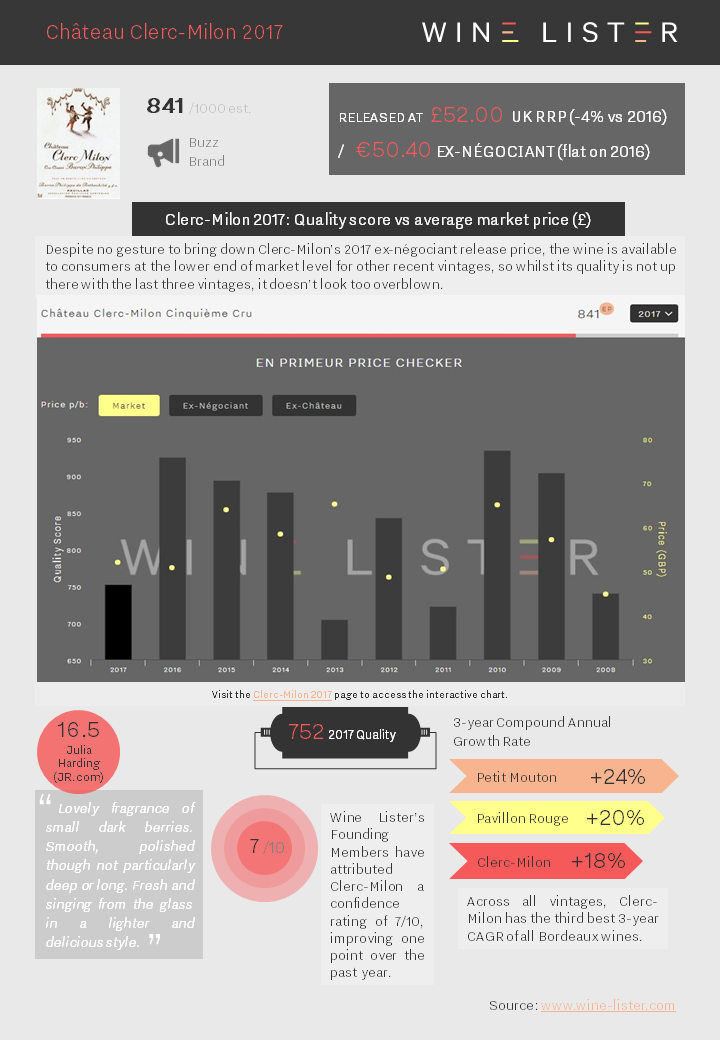

Clerc-Milon 2017 released at €50.40 ex-négociant (no change on 2016), with a UK RRP of £52.00 (4% down on 2016). Its Quality score was down 19% on 2016 (752 vs 925).

You can download the slide here: Wine Lister Factsheet Clerc-Milon 2017

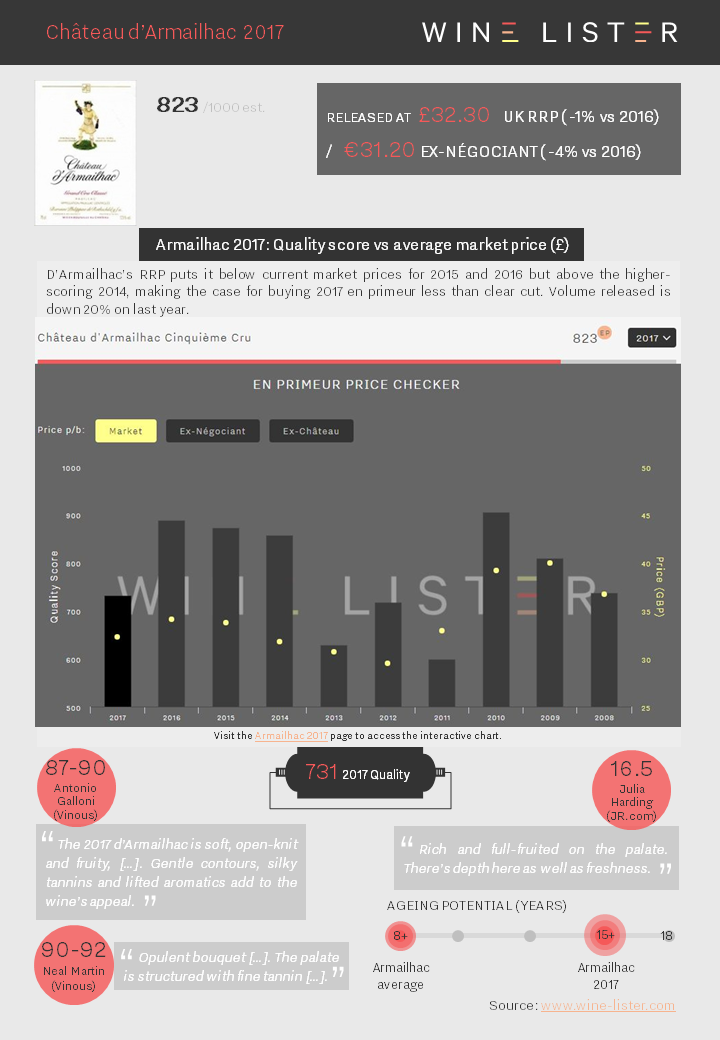

D’Armailhac 2017 released at €31.20 ex-négociant (4% down on 2016), with a UK RRP of £32.30 (1% down on 2016). Its Quality score was down 18% on 2016 (731 vs 888).

You can download the slide here: Wine Lister Factsheet D’Armailhac 2017

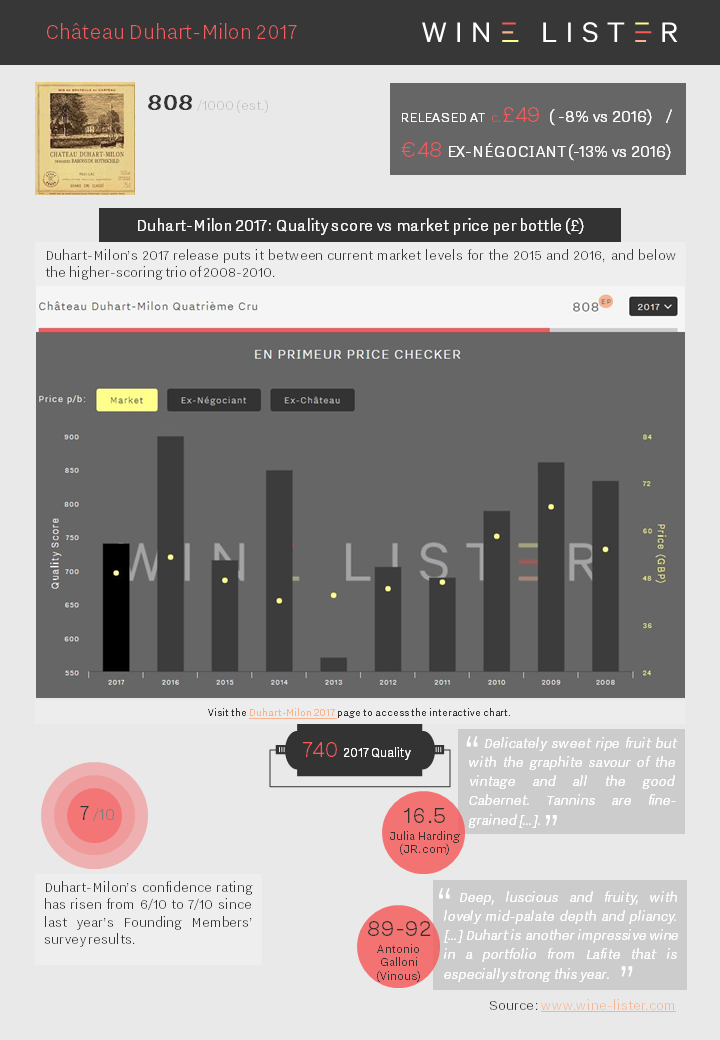

Duhart-Milon 2017 has been released at €48.00 ex-négociant (13% down on 2016), Quality score down 18% on 2016 (740 vs 899).

You can download the slide here: Wine Lister Factsheet Duhart-Milon 2017

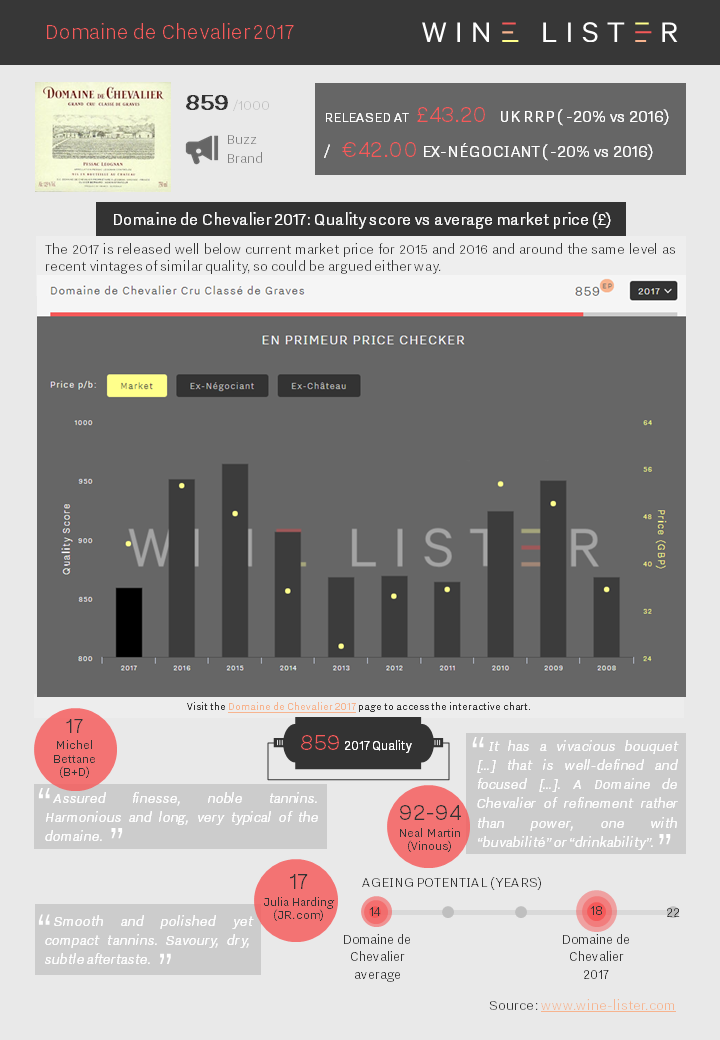

Domaine de Chevalier Rouge 2017 released at €42 ex-négociant (20% down on 2016), with a UK RRP of £43.20 (also 20% down on 2016). Its Quality score was down 10% on 2016 (859 vs 951).

You can download the slide here: Wine Lister Factsheet Domaine de Chevalier Rouge 2017

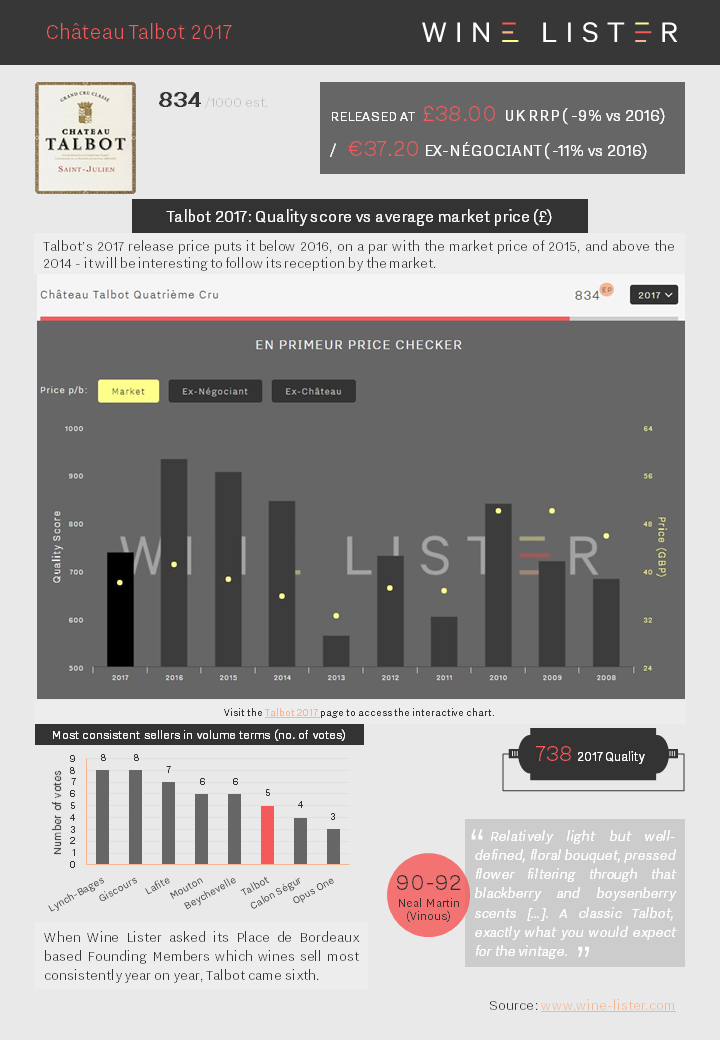

Talbot 2017 has been released at €37.20 ex-négociant, (11% down on 2016), with a UK RRP of £38.00 (9% down on 2016). Its Quality score was down 21% on 2016 (738 vs 934).

You can download the slide here: Wine Lister Factsheet Talbot 2017

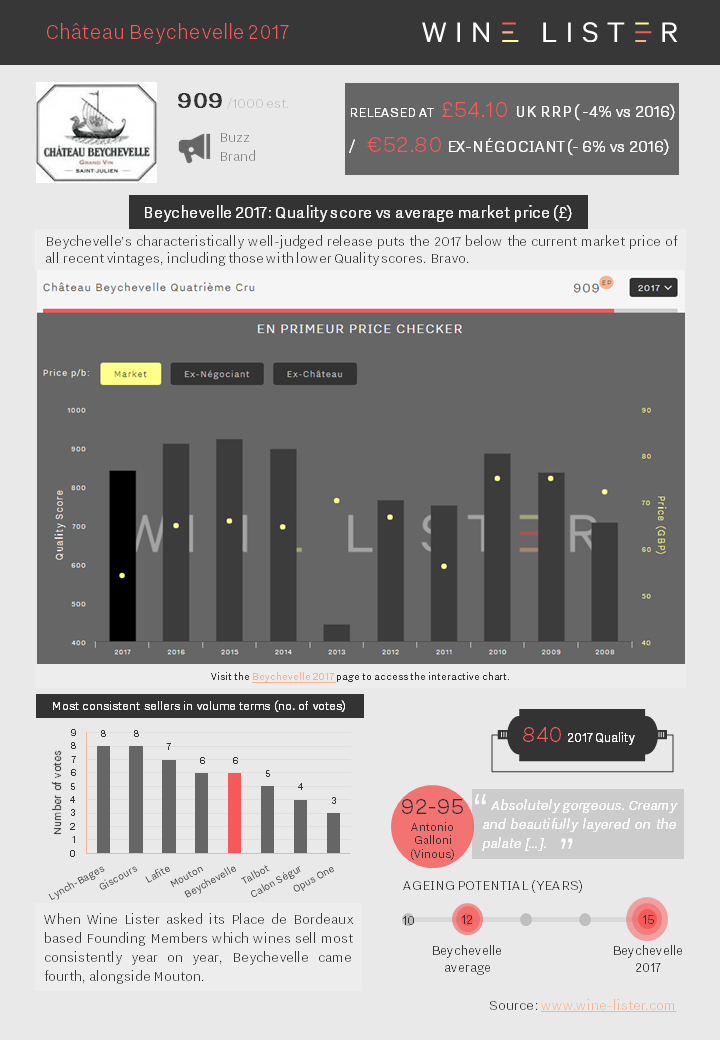

Beychevelle 2017 has been released at €52.80 ex-négociant, (6% down on 2016), with a UK RRP of £54.10 (4% down on 2016), and a lower Quality score: 840 (vs 910).

You can download the slide here: Wine Lister Factsheet Beychevelle 2017

As we outlined in our introduction to the vintage, Bordeaux 2017 eludes generalisation. Striking arbitrarily, the late April frost resulted in a heterogenous Bordeaux vintage in terms of both volumes and quality.

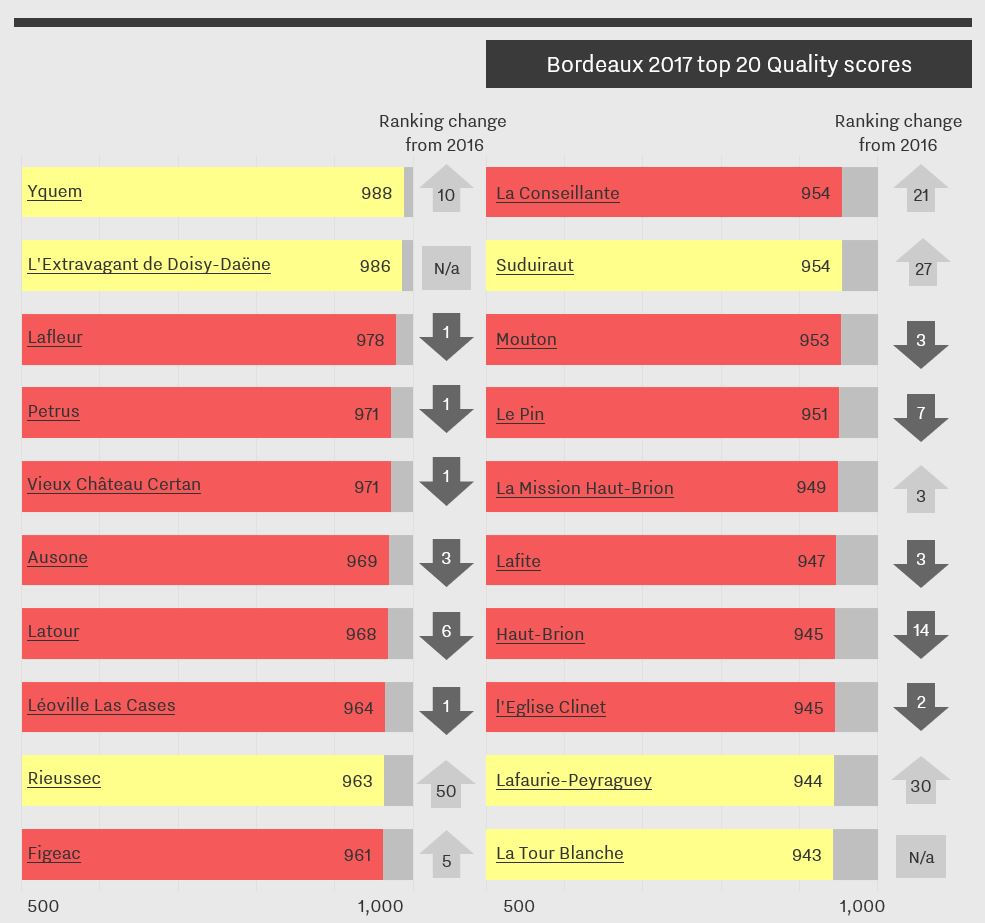

Ahead of the official release of Wine Lister’s latest Bordeaux Market Study tomorrow (don’t forget to subscribe to secure full access, via the Analysis page)*, here we give you a preview of the top 20 Quality scores for Bordeaux 2017. Wine Lister’s Quality scores for Bordeaux 2017 are based on the recently-released scores for four of our five partner critics** – Jancis Robinson, Bettane+Desseauve, and Vinous’ Antonio Galloni and Neal Martin – as well as a small weighting for longevity:

The frequent flashes of yellow in the chart above are testament to the kindness of the 2017 vintage to Bordeaux’s sweet whites, with Yquem and L’Extravagant de Doisy-Daëne achieving first and second places (scoring 988 and 986 respectively). Other sweet wines, Rieussec, Suduiraut, and Lafaurie-Peyraguey make some of the largest gains on their 2016 positions. Sauternes & Barsac stand out as the only appellations whose combined 2017 Quality score is above that of the 2016 (up 21 points).

When it comes to reds, the right bank fares best, and is home to seven of the vintage’s top 10 wines, five of them from Pomerol. Lafleur is the top-scoring red (in third place overall) with a Quality score of 978, followed by Petrus and Vieux Château Certan on 971 apiece. Pomerol’s La Conseillante makes the largest strides of any red wine in the top 20, up 21 places since 2016.

Overall, Pomerol is the highest-scoring appellation of the vintage, with an average Quality score of 959 (nonetheless down 25 points from 2016).

The left bank has fared less well with two of the five left bank appellations seeing score decreases of c.10% (Margaux and Saint-Estèphe, achieving 850 and 829 respectively). Despite dropping six places – from the top spot last year – Latour wins the left bank crown, followed by consistent overperformer Léoville Las Cases.

Other wines featuring in the top 20 Bordeaux 2017 Quality scores are: Ausone, Figeac, Mouton, Le Pin, La Mission Haut-Brion, Lafite, Haut-Brion, l’Eglise Clinet, and La Tour Blanche. You can view Quality scores for wines outside the top 20 here.

*Now published: for more analysis of the 2017 vintage, subscribe to read our Bordeaux Study.

**Jeannie Cho Lee was unfortunately unable to travel to Bordeaux to taste this year.