As the first major week of Bordeaux 2019 en primeur releases draws to a close, this morning (Friday 5th June) saw the release of the “first of the Firsts”, and the other reds from the Lafite stable.

Carruades de Lafite 2019 opened the stage with a price of £158 per bottle (in-bond), making it the least expensive Carruades available on the market. The Wine Lister team felt the quality of Carruades saw a significant jump up in 2018, and from what we have heard, the 2019 matches it. With this in mind, and given that volume released onto the market is 50% less than last year, this is a sure buy for anyone seeking access to the Lafite prestige with more approachability.

The grand vin, Lafite 2019, has been released at £426 per bottle in-bond – a discount of c.20% on the 2018’s current market price. The crucial factor this year are the volumes available – also 50% less than last year. On top of this, the single tranche released means buyers will only have one shot to get their hands on the 2019 en primeur (as far as we know). Domaines Baron de Rothschild’s Commercial Director, Jean-Sébastien Philippe, calls Lafite a “modern classic” in 2019, with precision, length, and finesse, but impressive ripeness, making it more approachable than the likes of 2018 or 2016.

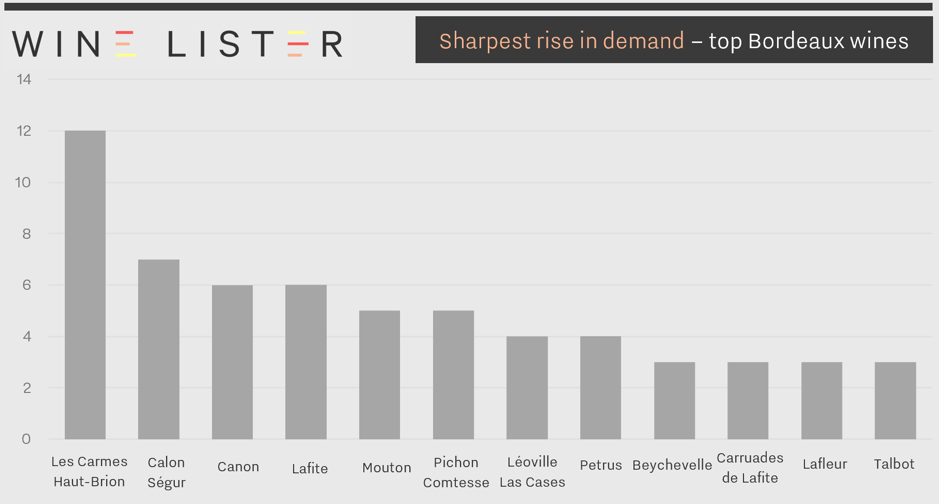

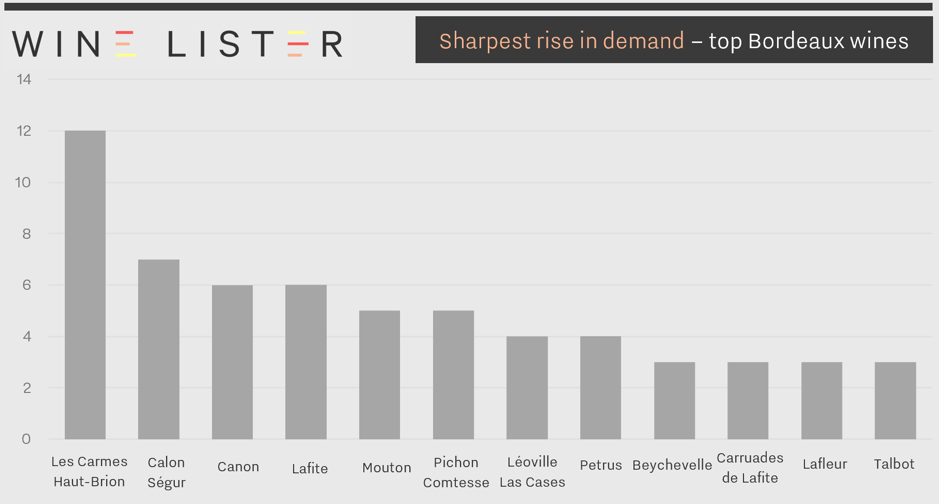

Both Lafite and Carruades were cited by the trade as seeing sharp rises in demand (see below) according to Wine Lister’s 2020 Founding Members’ survey. Competition to access both of these wines will therefore likely be high.

Lafite’s Pomerol property, L’Evangile, has released its 2019 grand vin at £146 per bottle in-bond, 15% below the current market price of the 2018. Once again, the Wine Lister team noticed a distinct quality step up in Evangile’s 2018, which we’ve heard has been equalled in 2019. The 2019 reportedly expresses well the move towards a more modern style, and a wine of increasing tension, florality, and freshness, without losing the plush Pomerol profile.

Duhart-Milon 2019 has also been released, at £52 per bottle in-bond. Though the release price puts it more or less in line with market prices of back vintages 2018 and 2016, there is justification to be found in the excellent quality that the Lafite team believe is there in 2019. Philippe explains that Duhart-Milon’s vines sit on a cooler terroir than those of the estate’s Pauillac neighbours, which means in cooler vintages, the wine can be somewhat “austere”. The increasing average temperatures that Bordeaux has seen during recent growing seasons (2018, 2016, and 2015 vintages) therefore only serve to improve the quality of Duhart-Milon, and 2019 certainly had its fair share of heat.

Keep up to date with further Bordeaux 2019 en primeur releases through Wine Lister’s twitter, or through our dedicated en primeur page.

We say it every year – the prices have to be “right”. While the Bordeaux 2019 en primeur campaign may be exceptional operationally, the same message resounds from the trade as in many a previous en primeur campaign – the prices have to be right.

Chairman of Farr Vintners, Stephen Browett, defines the crux of the matter succinctly; “one thing that is absolutely crystal clear is that for this en primeur campaign to work, Bordeaux must return to the fundamental (and recently ignored) concept that en primeur wines need to reach the consumer at lower prices than physically available vintages”. For at least the last three Bordeaux en primeur campaigns, release prices have generally been too high. The key difference this year is that the Bordelais have a unique opportunity – COVID-19 and the ensuing global economic crisis – to bring prices down significantly without losing face, or undermining the pricing of previous vintages.

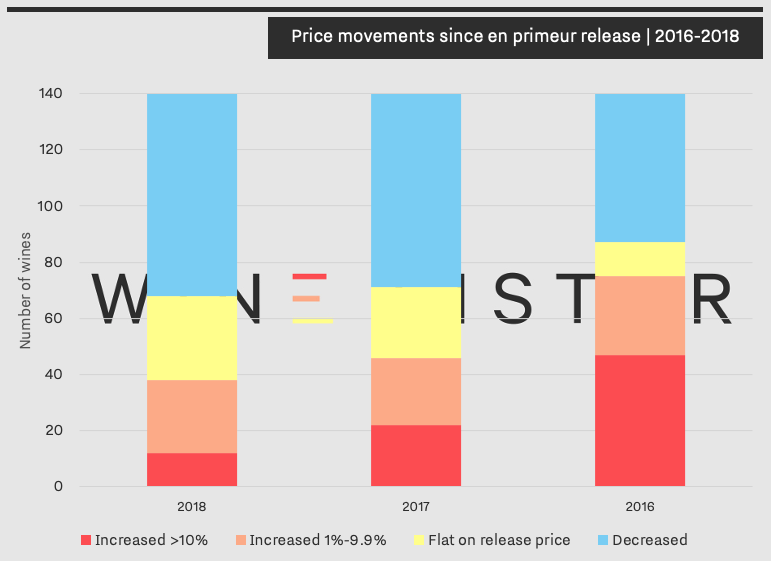

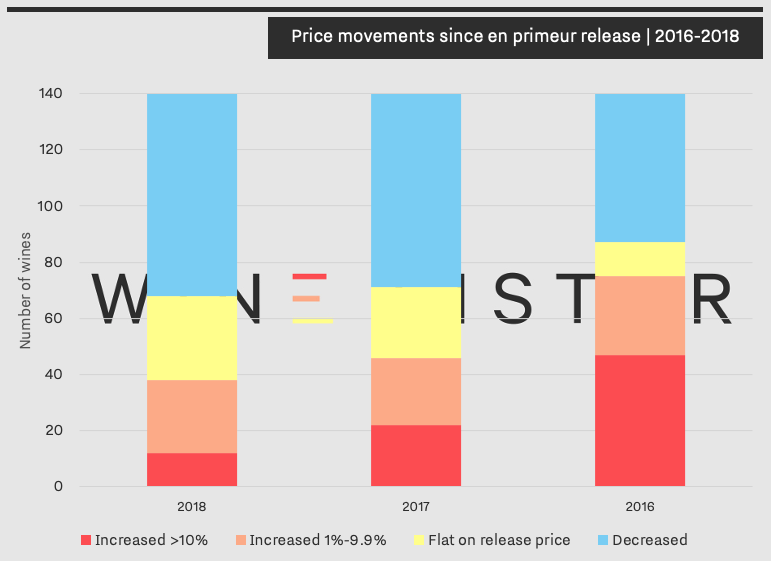

Analysing a basket of 140 top Bordeaux wines, the chart below looks at price movements of the last three vintages on the fine wine market since their respective releases.

Bordeaux 2016s were released three years ago. As shown in the chart above, today just over half of them are worth more than they were en primeur – these 75 wines have increased by an average of 18% since the spring of 2017, although they include the likes of Les Carmes Haut-Brion, Lafleur, and Petrus, which have seen mammoth price increases of 111%, 109%, and 64% respectively. 65 of the top Bordeaux 2016s have either stayed flat or have decreased in price since en primeur release. Assuming an in-bond storage cost of £12 per case for the last year on these, the chances are that many buyers would have saved more money purchasing 2016s now.

The picture is worse for 2017 and 2018 releases, with approximately half of wines having decreased in value. Last year the high quality of the vintage coupled with small quantities available was cited repeatedly as a reason for price hikes. This year, however, there is no glass door to hide behind. The quality of the 2019 vintage is reportedly excellent, but volumes are also good. Add to this the unprecedented context of a campaign during a global pandemic, and the pressure is on more than ever for prices to drop significantly.

Buying Director of BBR, Max Lalondrelle, tells me, “in order for the consumer to put their faith in the product without knowing too much about the quality or style, the wineries will have to offer some relatively good prices to entice consumers to take the risk”. Members of the trade have elsewhere qualified what “good prices” might mean – a price reduction of 30-35% on 2018s. Flying blind and relying on the historical quality of solid brands to make choices in 2019 (in the absence of all the usual critics scores) is one thing – doing so in the face of such an uncertain future for many is another entirely. For releases to work this year, sacrifices will need to be made by the châteaux – quality of the wine must be put aside, as context, and getting the market to bite during such difficult times, will be everything.

The first major release so far has listened to the market – Pontet-Canet’s 2019 is priced 30% lower than 2018s release. Feedback on the release has been good – Chief Executive of Goedhuis, Tom Stopford Sackville, tells us it was “a very encouraging start to the campaign”, and a “positive signal regarding 2019 pricing in general”. If other châteaux follow suit, the campaign could be a memorable one, that, as Browett puts it, inspires “a new confidence” in en primeur “after recent disappointing campaigns”.

The fine wine trade (Wine Lister included) is rooting for Bordeaux, willing its unique selling system to deliver. The equation for pricing this year could in some ways not be simpler – it is hoped that a sufficient number of properties will take this into account, and present prices the market can embrace.

Releases are set to begin in earnest from tomorrow – 2nd June. Follow them through Wine Lister’s Twitter, or through our dedicated en primeur page.

Chloe Ashton

June 1, 2020

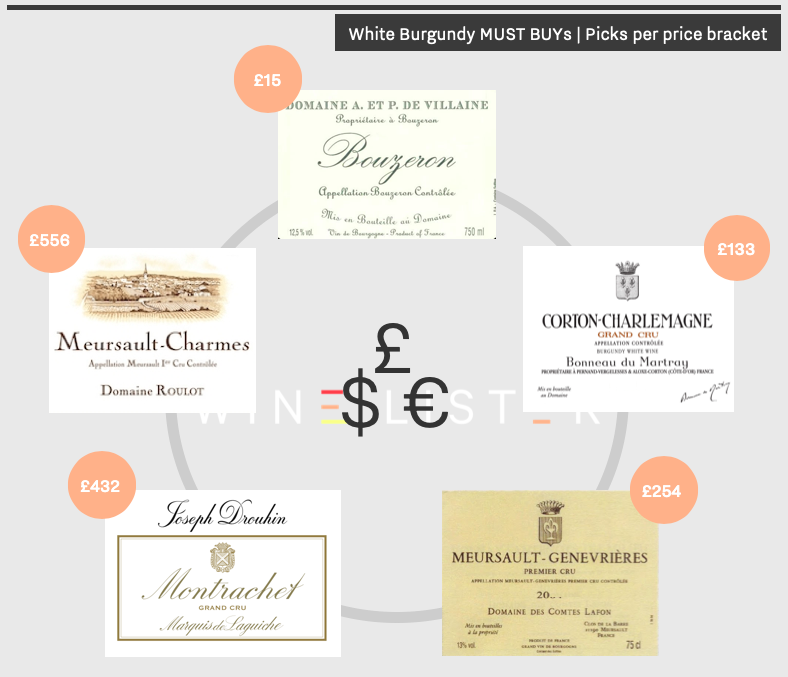

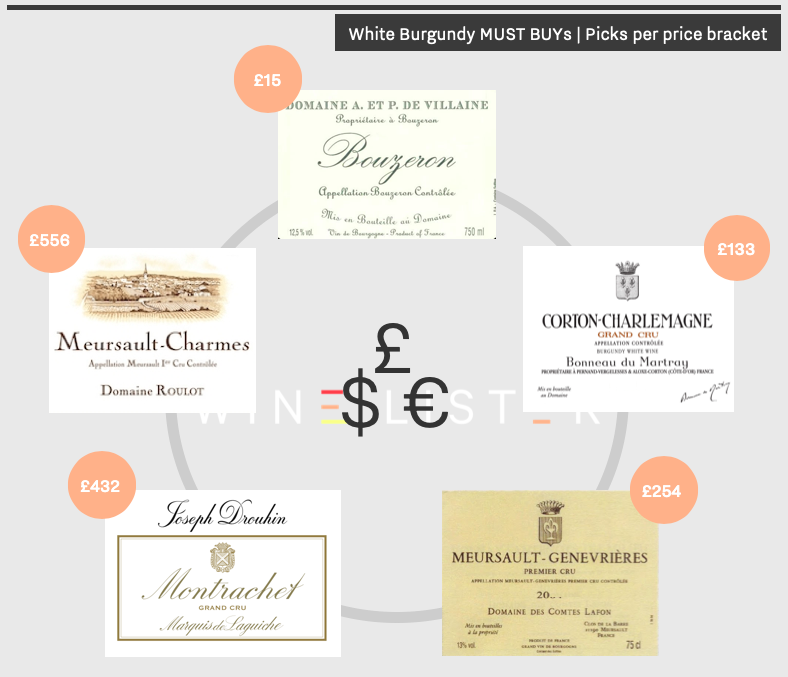

As shown in a recent post on using Wine Lister to build your portfolio, Burgundy is the best-represented region of Wine Lister’s MUST BUY hoard (33%, or 533 wines). 10% of these (161 wines) are white Burgundies, that show high quality and good value within their respective vintages and appellations. These wines cover a vast range of prices, from £15 (per bottle in-bond) up to £1,354.

This week’s blog post examines white Burgundy MUST BUYs at five different price points, to help the hunt of those buying fine wine at every level.

Prices are shown per bottle in-bond (when buying by the case).

Prices are shown per bottle in-bond (when buying by the case).

Under £20 – 2016 Domaine A. & P. de Villaine Bouzeron

Bouzeron’s location in the north of the Côte Chalonnaise provides the setting for Aubert de Villaine’s personal project – one with a humbler reputation than that of his magnum opus, Domaine de la Romanée-Conti. Dispelling the region’s once-unfavourable reputation, de Villaine’s restricted yields and hand-harvesting produces top quality Aligoté Doré. The 2016 vintage achieves a WL Score of 90, and was described by Neal Martin as having “a touch of salinity towards the finish with judicious hints of stem ginger and a hint of rhubarb”. This wine is available to purchase from Justerini & Brooks, where a case of six starts at £90 (in-bond).

Under £150 – 2015 Domaine Bonneau du Martray Corton-Charlemagne

Bonneau du Martray is the largest single owner of vines in Corton-Charlemagne – an appellation that is often said to rival Montrachet. The 2015 vintage was discussed in Wine Lister’s blog on the top 2015 white Burgundies by WL score, in which it was the second highest overall scorer. As of 2018, around 25% of Bonneau du Martray’s Corton-Charlemagne vineyards has been leased to Romanée-Conti – a factor that could drive its price up in the future. For now, this Corton-Charlemagne remains of exceedingly good value in the context of Grand Cru white Burgundy. The 2015 vintage can be purchased from UK merchants such as Goedhuis, where a case of six costs £916 (in-bond).

Under £350 – 2012 Domaine des Comtes Lafon Meursault Genevrières

Despite lacking the Grand Cru status held by Corton-Charlemagne, the higher cost of Domaine des Comtes Lafon’s Meursault Genevrières (Premier Cru) could in part be reflective of the increasing popularity of Meursault. Dominique Lafon is often considered one of the leading producers in Meursault, as reflected in his meticulous vinification process. Spending two winters in wood, and sleeping in some of the deepest and coldest cellars in the region, his wines are bottled nearly two years after harvest – one of the latest bottlings in Burgundy. Achieving a WL score of 94 and ‘Investment Staple’ status, the 2012 vintage is available to purchase from Four Walls Wine Co., where a bottle costs £225 (in-bond).

Under £500 – 2017 Maison Joseph Drouhin Montrachet Marquis de Laguiche

The second Grand Cru white Burgundy examined here is more expensive than Bonneau du Martray’s Corton-Charlemagne, but nonetheless also good value – this time in the context of Montrachet specifically. Hailing from négociant house Joseph Drouhin, its Montrachet Marquis de Laguiche is priced around £432, while the average price of all Montrachet 2017s on Wine Lister is £1,249. Sourcing grapes from vineyards owned by the Laguiche family, the quality here is just as impressive as several Montrachet wines produced by Burgundy domains. Achieving a WL score of 95, the 2017 vintage was described by Jancis Robinson as “Creamy, deep, powerful and endlessly long”. This wine is available to purchase from Berry Bros. & Rudd, where a case of six bottles starts at £2,750 (in-bond).

Over £500 – 2015 Domaine Roulot Meursault Charmes

The “blowout” wine of this week’s selection is Domaine Roulot’s Meursault Charmes. Having assumed direction of the estate in 1989, Jean-Marc Roulot has been successful in fine-tuning the distinct style of wine developed by his father, Guy Roulot. While many other wines of this village exhibit richness and concentration, the 2015 Meursault Charmes reflects Jean-Marc’s commitment to achieving a brighter style of Meursault – one which expresses its terroir vividly. Speaking on his aversion to excessive lees-stirring, he says, “I prefer to lose a little volume and power on the palate in order to obtain the ‘ligne droite’ [straight line] and the purity. This haunting purity and directness is evident in every wine Roulot produces.” The wine is available from several UK merchants, including Morgan Classic Wines, and Fine+Rare, from which prices start from £425 (per bottle in-bond).

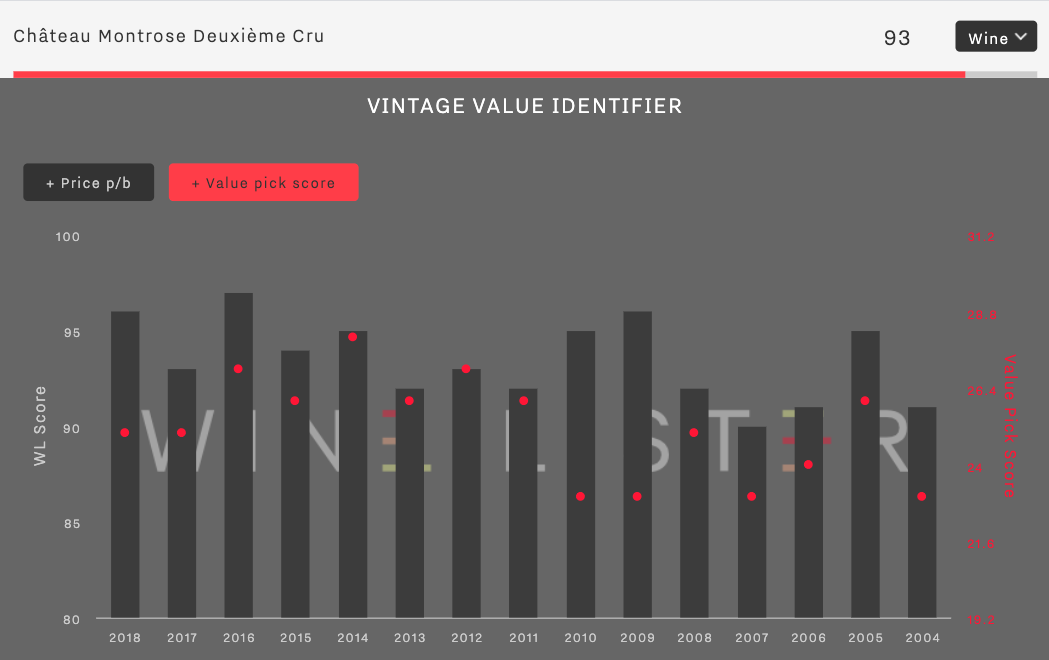

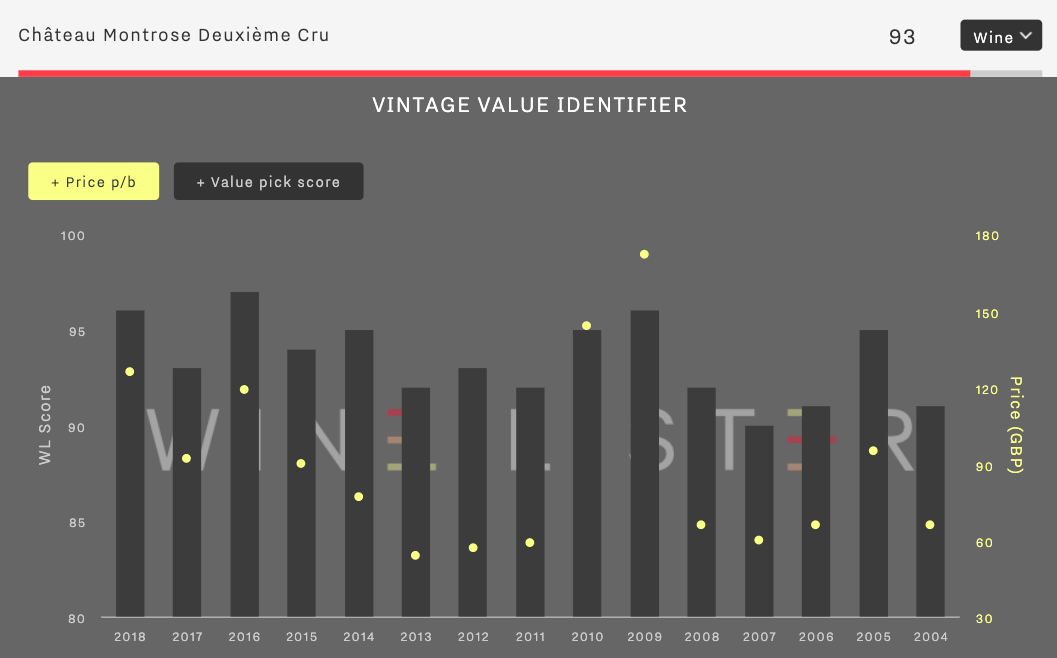

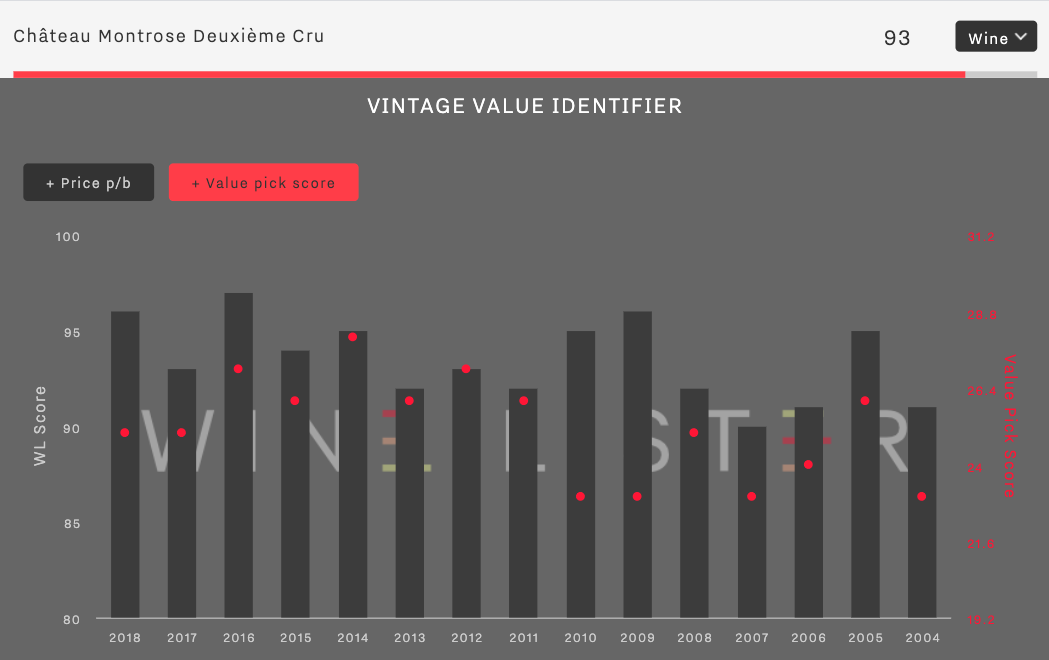

Last week’s blog post examined two of the most popular Wine Lister website features amongst collectors: the MUST BUY recommendation tool and the Compare Tool. Wine Lister’s Vintage Value Identifier helps the modern wine collector to further refine their online investigations.

Featured on each wine page, the dynamic Vintage Value Identifier gives a clear visual of quality-to-price ratios across the vintages of a given wine, and applies a Value Pick Score to measure the relative value.

By performing the price analysis for you, this tool pinpoints exact vintages of your favourite wines that are the best options to buy or sell, based on the impressive quality for their price.

See the example of Montrose below, or by exploring its wine page here.

As indicated by the red dots, and values on the right-hand axis, Montrose’s Value Pick Score fluctuates between vintages. The 2004, 2007, 2009 and 2010 vintages share the lowest Value Pick Score (23), while the 2014 Montrose achieves the highest score of 28.

The 2014 vintage tends to represent excellent value across the board in Bordeaux. This is due to its good (if not excellent) quality overall, and its release after the lesser-quality 2013 (which kept release prices down). Montrose’s 2014 was awarded 96 points by Wine Lister partner critic, Neal Martin, who notes, “a bouquet that exudes class and sophistication: pure and mineral-driven black fruit, cedar and pencil lead, hints of blueberry developing with aeration although it never impedes upon the sense of terroir”.

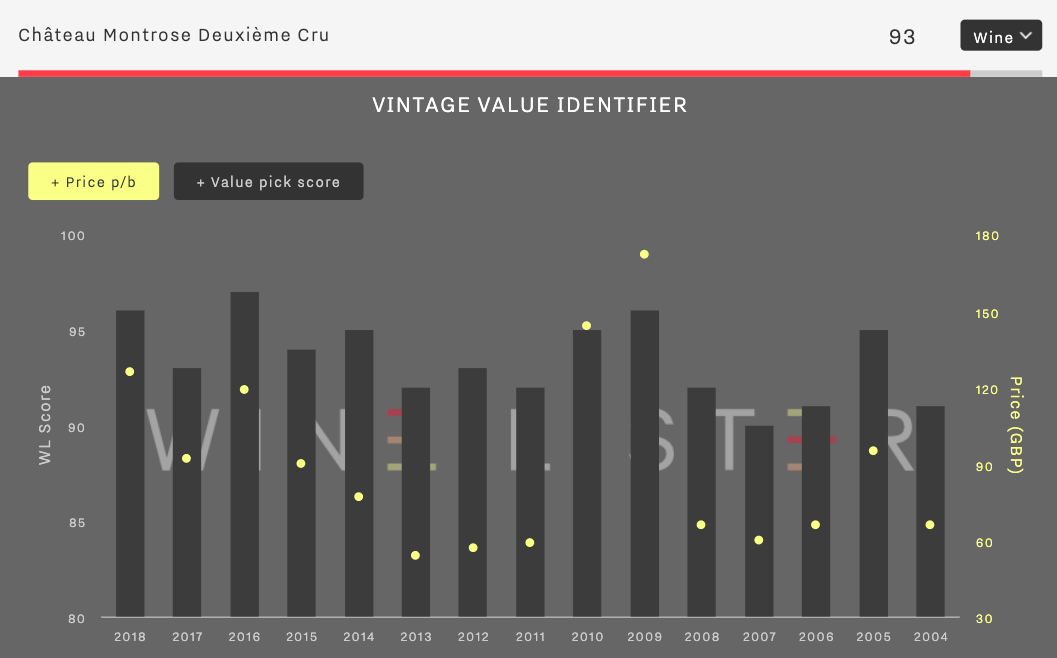

While the true benefit of the Vintage Value Identifier lies in the Value Pick Score, it is still possible to view the pure price vs. quality analysis, as illustrated below:

While Montrose 2009 achieves the second-highest WL Score of the featured vintages, it also commands the highest price (£172 per bottle in-bond, when buying by the case). Achieving MUST BUY status, the 2014 vintage is conversely priced at £77 per bottle in-bond for a similar level of quality (hence the higher Value Pick Score). The 2014 Montrose is available to purchase from Corney & Barrow, Cult Wines, Justerini & Brooks, and BI Fine Wines (the latter in magnums only).

Guiding your future purchases, you can identify good value in back vintages of any wines by using the Vintage Value Identifier on each wine’s page. Click here to start your own analysis.

Wine Lister is currently offering a range of portfolio analysis services to private clients. If you are interested in having your wine collection analysed by our team of fine wine data experts, please don’t hesitate to contact us.

At the end of last year, Wine Lister released its first ever Champagne report. As well as exploring a handful of key trends as identified by Wine Lister’s Founding Members, the report also sheds light on top Champagnes as compared to other regions in terms of economic performance.

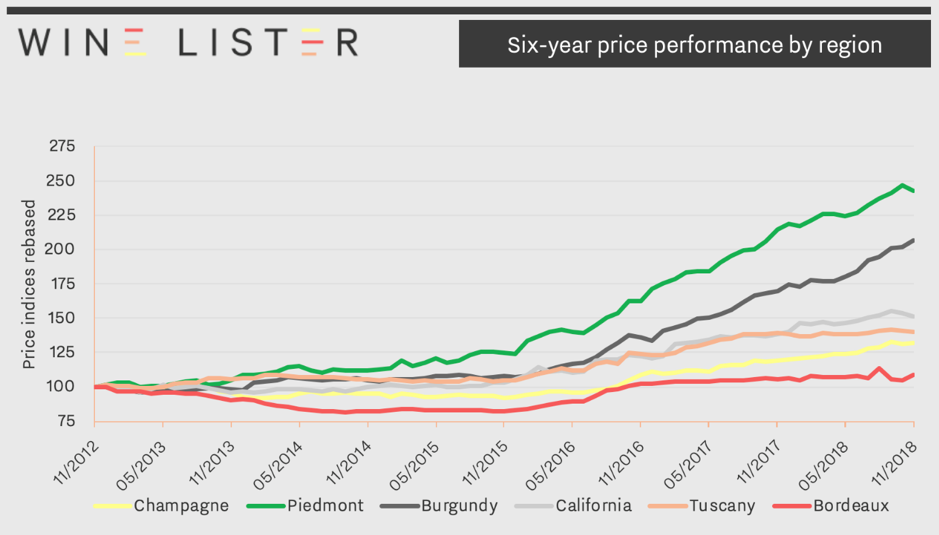

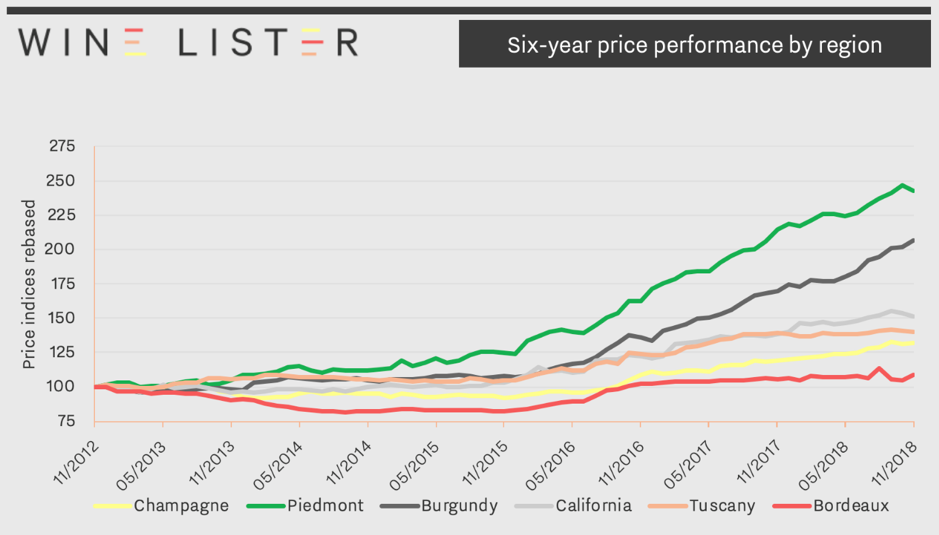

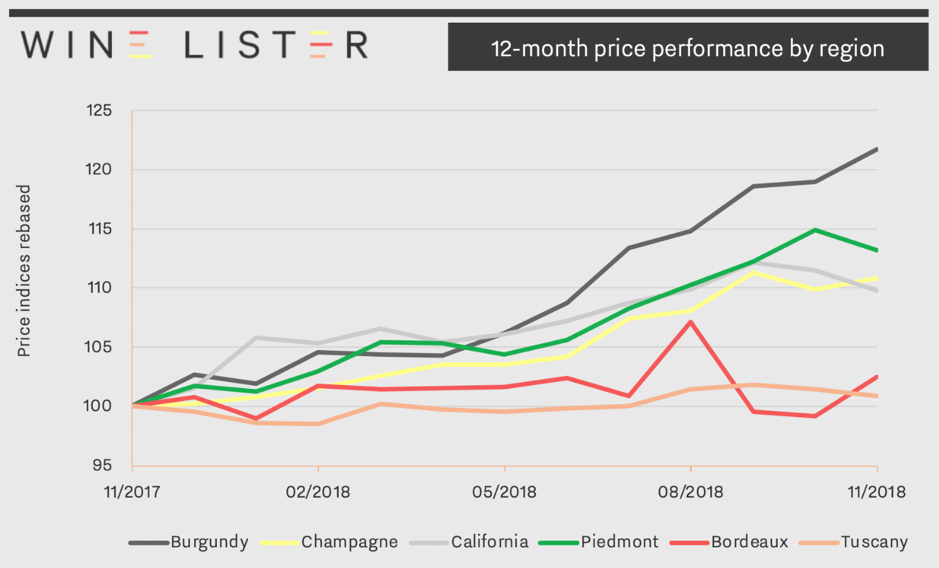

Prices of the top Champagnes (Dom Pérignon, Krug Vintage, Louis Roederer Cristal, Salon Le Mesnil and Dom Pérignon Rosé) have seen a compound annual growth rate (CAGR) of 4.8% over the last six years. Relative to other major fine wine regions, this long-term growth is slow, as shown in the chart below, but also stable.

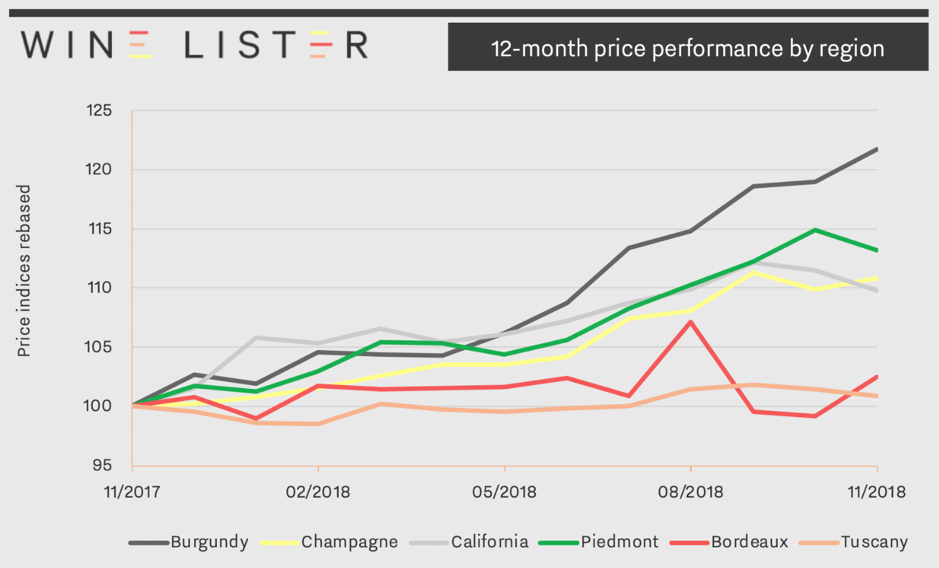

One notable advantage of Champagne as an investment option it its low volatility. Indeed, Champagne prices show a much better level of stability in the secondary market (deviating by just 2.5% from the average price over 12 months) than any other major fine wine region. Slow and steady wins the race.

Moreover, recent price performance shows Champagne accelerating. Prices of top Champagnes are starting to grow at a faster rate than their counterparts in California, Bordeaux, and Tuscany, beaten only by Piedmont and the seemingly unmatchable Burgundy. Indeed, as of December 2018 top Champagnes had seen a 12-month price growth of 11%. The region’s potential for long-term investment is already being acknowledged by the trade, with one of our Founding Members, a top tier UK merchant commenting “Champagne (Salon especially) has experienced solid growth and has become a reliable investment for collectors”.

Salon Le Mesnil is the number one performing Champagne for price performance, with an Economics score of 978, closely followed by Krug’s Clos d’Ambonnay (962). Krug also tops the Champagne Economics charts with its Clos du Mesnil, Brut Vintage, and Collection. Interestingly the only NV Champagne to appear within the top 10 Champagnes for Economics is grower Jacques Selosse’s Brut Initial, with an Economics score of 911. Its price, £106 (per bottle in-bond), is a mere 18% of the average price of the other nine top Champagnes by Economics score.

To read more key findings from our in-depth Champagne study, read the free summary here. (The key findings and full study are also available to download in French on the Analysis page.)

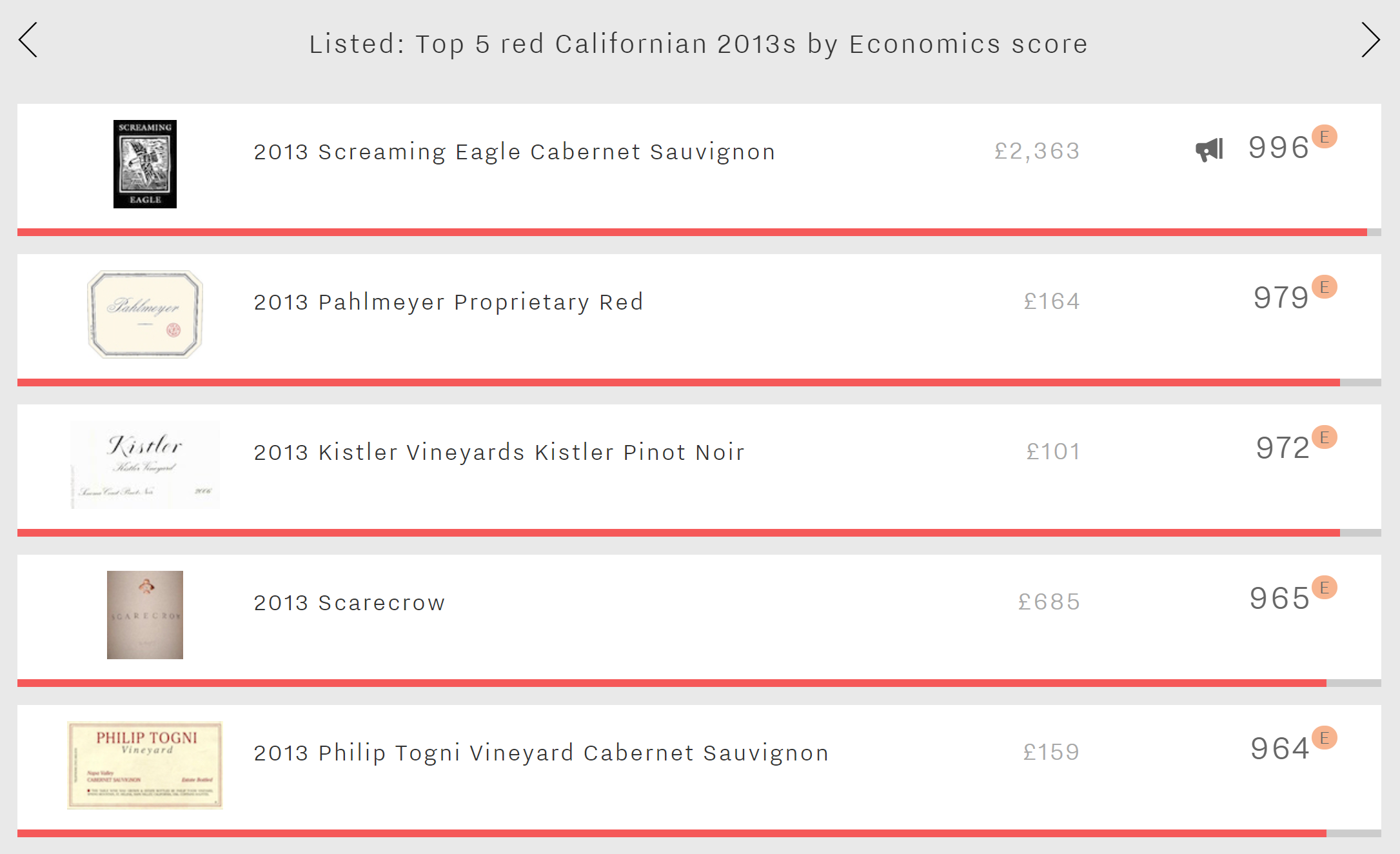

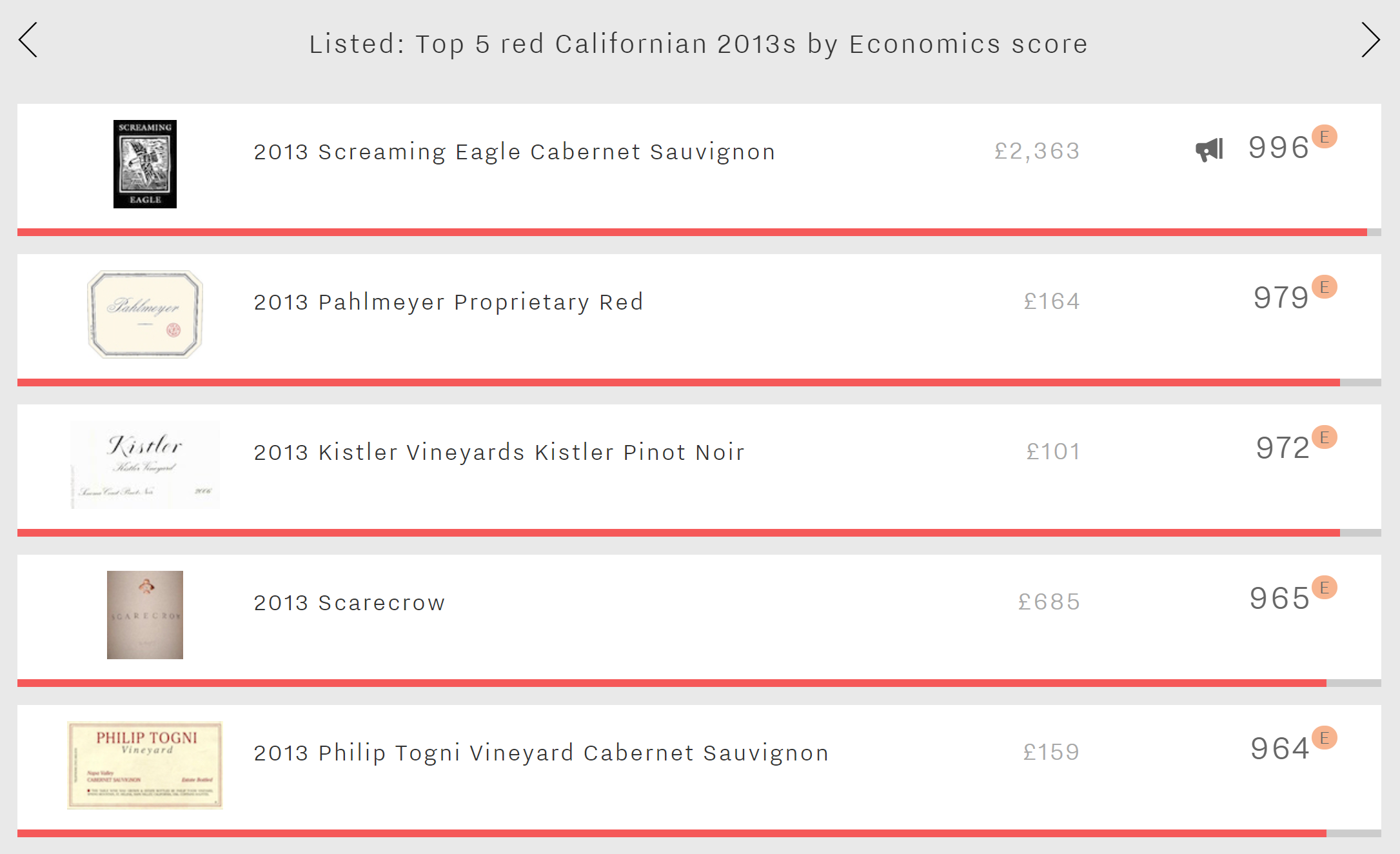

While wines made in The Golden State are not as affected by vintage variation as their European counterparts, the 2013 vintage was for California as close to perfect as they come. The long, hot summer led to Cabernet Sauvignons with extreme fruit concentration and firm structure – a recipe for long-term cellaring. The vintage’s economic credentials seem equally promising, with Economics scores of the top five Californian reds from the 2013 vintage outperforming their respective wine-level average by 114 points (averaging 979 in 2013 versus 864 across all vintages).

Perhaps unsurprisingly, the number one spot is taken by Screaming Eagle Cabernet Sauvignon. At 996, its Economics score is not only the highest of this week’s top five, but of all 2013s on Wine Lister (matched only by 2013 DRC Richebourg). It is also by far the most expensive of the five at £2,363 per bottle – over twice as high as the price of the other four combined. Screaming Eagle’s “mailing list” sales model teamed with tiny production quantities (7,800 bottles per annum on average) means that demand for this wine consistently outweighs supply. This could explain the wine’s strong presence on the secondary market, with 855 bottles traded at auction over the last 12 months (according to figures collated by the Wine Market Journal).

In second place is 2013 Pahlmeyer Proprietary Red. Interestingly, it has the lowest Quality score of the group. Indeed, its 2013 Quality score is 74 points lower than Pahlmeyer’s average (848). Contrastingly, the 2013 vintage receives its best ever Economics score of 979, boosted by a six-month price performance of 18.7%.

The third spot of this week’s top five is occupied by the only Pinot Noir of the group, Kistler Vineyards Pinot Noir, with an Economics score of 972. It is the only wine of the five to have been released before 2016, and thus the only one with a three-year compound annual growth rate (28.2%), whereas Economics scores for the other four 2013s are based upon price performance over the short term only. Kistler’s place in the top five 2013 Californian reds by Economics score is impressive, given its lower price point (£101 per bottle, compared with an £843 average for the other four wines).

The penultimate wine of this week’s top five is 2013 Scarecrow. Alongside its best ever Quality score (987), the 2013 vintage achieves an Economics score of 965, helped by the second-highest three-month average price (£663) and the best price stability of the group (with standard deviation of just 4.1% over the last 12 months).

Last but by no means least is Philip Togni Vineyard Cabernet Sauvignon, with an Economics score of 964. Though fifth for economics, it is number one for Quality, thanks to a 100-point score from Wine Lister partner critic, Antonio Galloni, who calls it “a majestic, towering wine… one of the wines of the vintage”.

Price nearly always plays a part in the decision-making process of purchasing wine. Typically, much emphasis is placed on the importance of “value” – “how much quality am I getting for the price of this bottle”, for which Wine Lister has its very own indicator, Value Picks. However is simply offering “good value” enough?

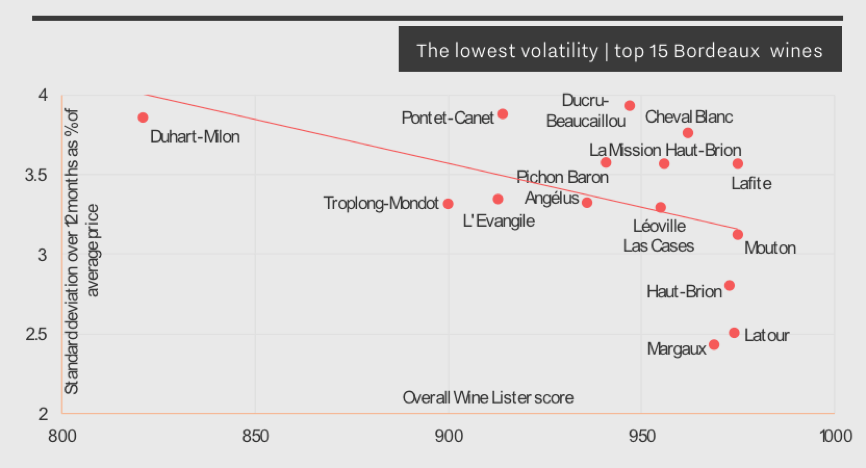

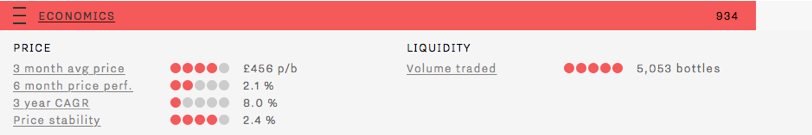

Wines purchased for long-term cellaring carry financial risk just as investment does. With this in mind, Wine Lister’s Economics scores reflect not only a wine’s price, but the performance of that figure over time. As well as a three-month average market price, and six-month / three-year price growth, Wine Lister’s algorithm takes into account price stability as a factor in determining a wine’s Economic strength.

Using historical prices provided by our data partner, Wine Owners, we calculate the standard deviation of a price over the last 12 months, expressed as a proportion of the average price over the same period.

Volatility can be caused by price movements both up and down. Nobody wants to see the price of a wine plummet after purchase, but equally, wines with prices rising too high and too fast display risk too, and are therefore also sanctioned with lower Economics scores.

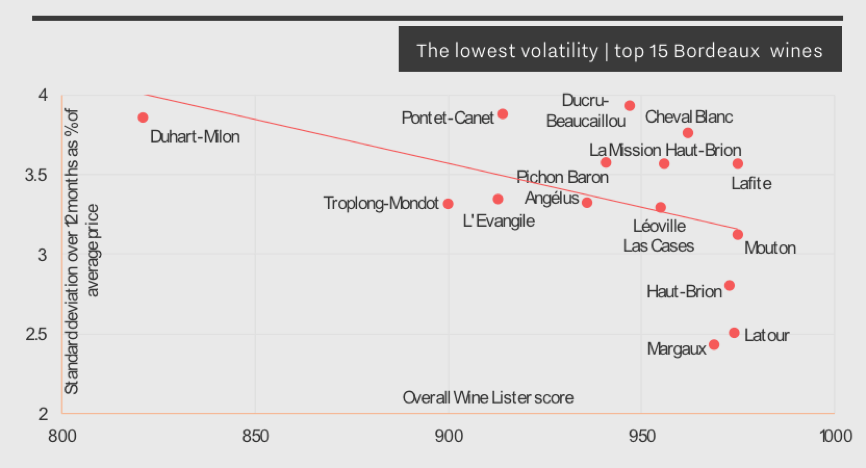

Below is an extract from this year’s Bordeaux Market Study featuring the 15 most stable Bordeaux wines. All five left bank first growths appear, testament that higher-scoring wines tend to experience less volatility. This is also tied in with liquidity: frequently traded wines tend to benefit from multiple reference points allowing a consistent market price to be determined. Conversely, a wine traded less frequently often sells at a markedly different price from one transaction to the next, resulting in a much more volatile market price.

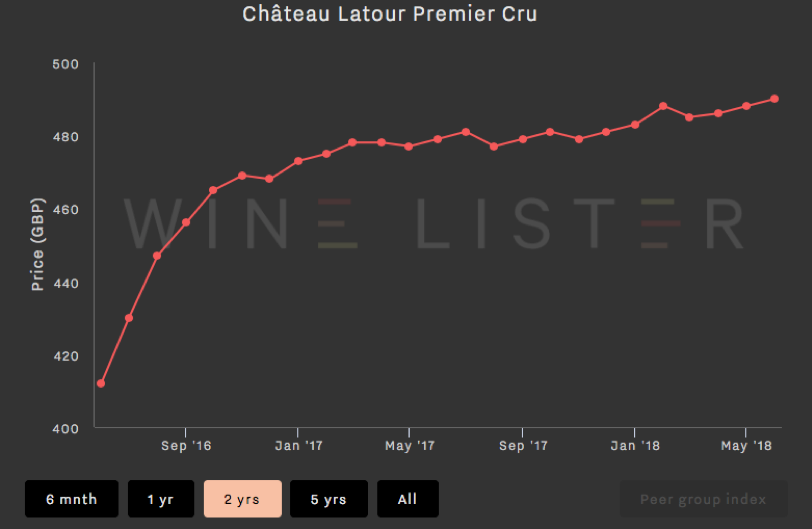

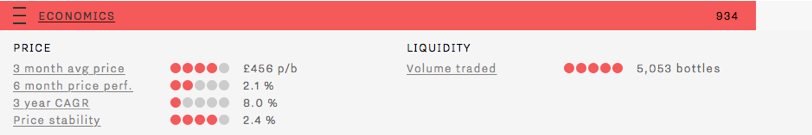

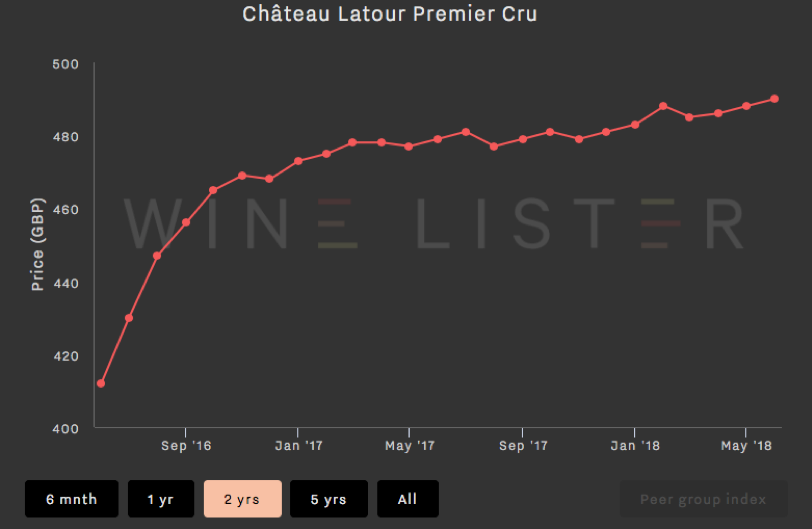

While Château Latour’s slow and steady price growth (as shown in the chart below) results in relatively low six-month price performance and three-year compound annual growth rate (CAGR) ratings, its strong Economics score is thanks to a high three-month average price, a high volume of bottles traded at auction, and a low price deviation of just 2.4% over the last 12 months.

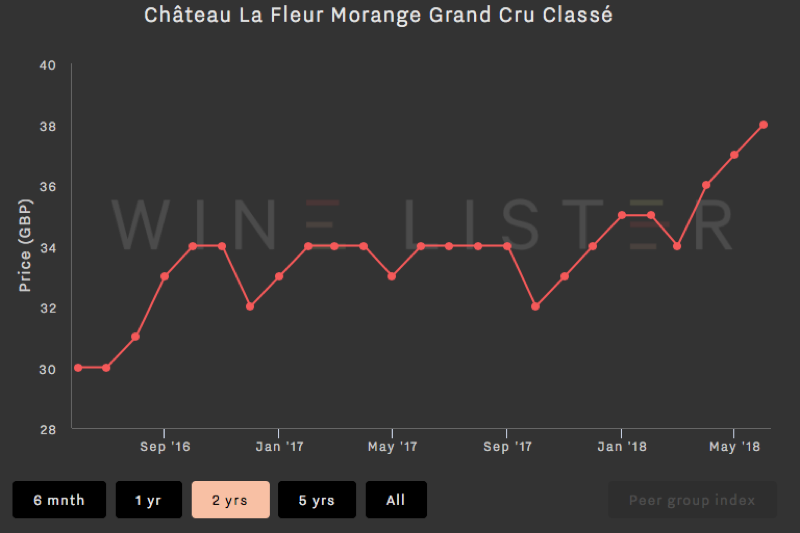

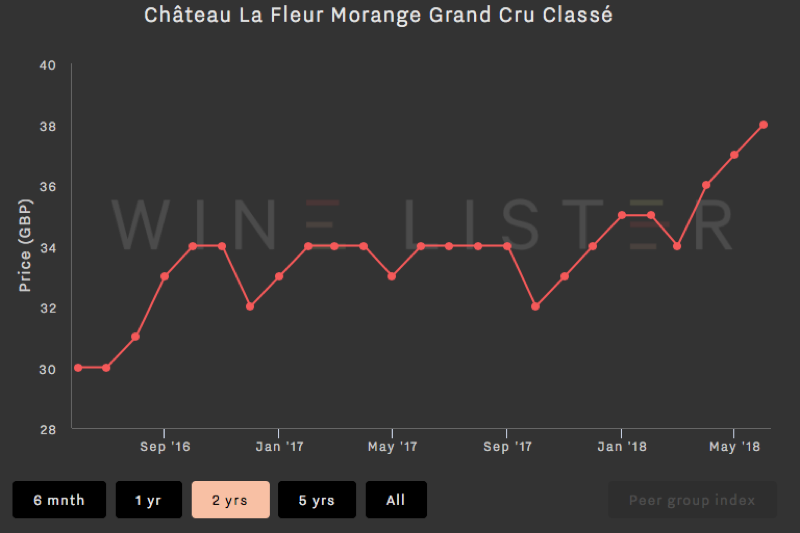

The chart below shows a very different picture – this wine has experienced a 14.7% price increase in six months. Though this in itself is positive, its price has therefore deviated 12.5% in the last 12 months, and the yo-yoing nature of the price over the longer term earns it a much lower Economics score (492).

With England progressing serenely (ahem) through their round of 16 match against Columbia, much Champagne (and probably much more beer) will have been drunk on Tuesday evening. With somewhat tortuous logic therefore, this week’s Listed section focuses on the best Champagnes from the 2000 vintage by Economics score.

Separated by just three points at the top of the table are Philipponnat Clos des Goisses (966) and Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs Grand Cru (963). Despite experiencing the lowest Quality score of the five – a nonetheless hugely respectable 944 – the Philipponnat gets its nose ahead thanks to excellent growth rates over both the long and short-term, with a three-year compound annual growth rate (CAGR) of 20% and having added 33% to its price over the past six months alone. No wonder it is one of the group’s three Investment Staples.

It is interesting that Pierre Péters Cuvée Spéciale Les Chétillons Blanc de Blancs Grand Cru comes in second place in terms of Economic performance, despite it experiencing the group’s lowest overall Wine Lister score for the vintage (910). Its lower Wine Lister score is the result of its Brand score (822) being the weakest of the group by nearly 90 points, confirming the phenomenal head start that the globally renowned houses have over grower Champagnes in terms of brand recognition. It manages second place in terms of economic performance thanks to formidable short-term growth rates, its price having risen 42% since January.

In third place is Krug’s Clos du Mesnil (954), one of three Blanc de Blancs in this week’s top five, and the first of two wines from Krug, with the Brut Vintage recording an Economics score of 907. The two Krugs are almost inseparable, the Brut Vintage’s Wine Lister score of 967 just one point ahead of the Clos du Mesnil, making them the overall top-scoring Champagnes of the vintage. Our partner critics were barely able to separate them either, the Clos du Mesnil’s Quality score just two points ahead (976 vs 974). However, the rarity of the Clos du Mesnil results in it being over 3.5 times more expensive. Furthermore, with the Clos du Mesnil recording a 3-year CAGR of 14% and short-term growth rates of 12%, the price discrepancy is increasing – the Brut Vintage has a 3-year CAGR of 8% and has increased in value by 4% over the past six months. However the feather in the cap for the Brut Vintage is that it is considerably more liquid – presumably because of larger production volumes – its top five vintages having traded 1,279 bottles at auction over the past four quarters, over 11 times as many as the Clos du Mesnil (112).

The remaining spot is filled by Taittinger Comtes de Champagne Blanc de Blancs Grand Cru (922). It is the second-most liquid of the group, its top five vintages having traded 720 bottles at auction over the past year.

Incidentally, 2000 was a European Championships year, not a World Cup year. Fittingly, given the focus of this blog, France won. England failed to make it past the group stages.

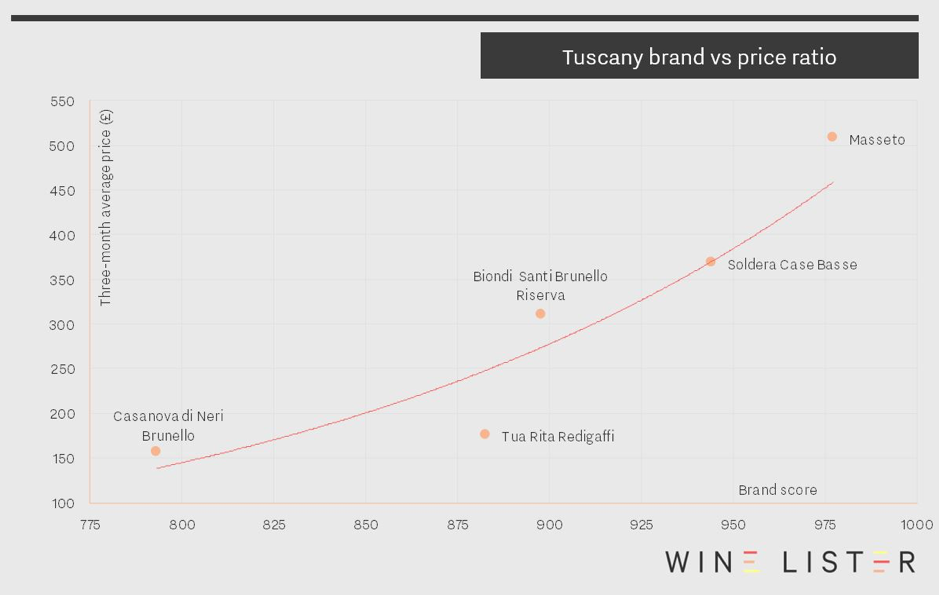

In this week’s top five, we take a break from June’s Bordeaux bias on the vinous calendar to look at the rising prices of Tuscany’s top wines.

However, there’s no escaping Bordeaux with Tuscany’s most expensive wine, since Masseto is distributed through the Place de Bordeaux. With tiny quantities available to purchase via the Place each year – average annual production is 32,000 bottles – Masseto’s price of £511 per bottle makes it well over a third more expensive than the rest of this weeks’ top five, and also the second-most expensive Italian wine on Wine Lister (beaten only by Giacomo Conterno’s Barolo Monfortino Riserva).

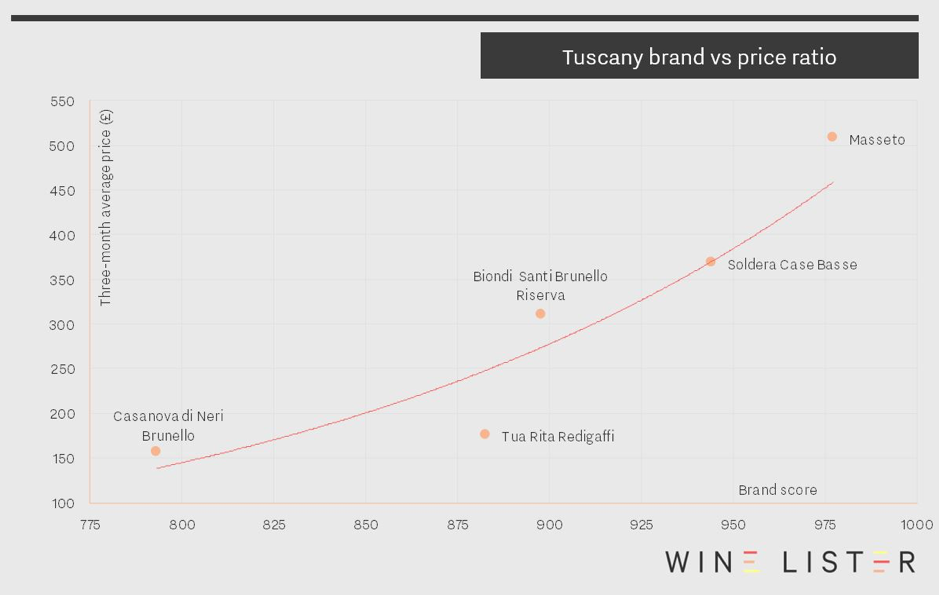

Masseto also achieves the group’s best Brand score (977), the result of featuring in the highest number of the world’s top restaurants (24%) and being over 2.5 times more popular than any of the other four. The chart below confirms a strong relationship between Brand score and price for these wines, with Masseto’s formidable brand strength playing a key role in its high price.

At £367 per bottle, Soldera Case Basse Sangiovese takes the second spot. It achieves the highest Quality and Economics scores of the five (976 and 957 respectively). With an impressive three-year compound annual growth rate (CAGR) of 18.4% – by far the highest of the group – and having added 7.3% to its value over the past six months, Soldera Case Basse continues to cement its position as Tuscany’s second-most expensive wine, and close the gap on Masseto.

Two Brunellos feature amongst Tuscany’s most expensive wines: Biondi Santi’s Brunello Riserva (£289) and Casanova di Neri’s Brunello Cerretalto (£157). Whilst Biondi Santi Brunello Riserva’s appearance might be expected, considering its heritage, the fact that Casanova di Neri Cerretalto is amongst Tuscany’s most expensive wines might be more of a surprise, indicating that Riserva status alone does not currently guarantee higher prices than straight Brunellos.

Rounding out the five is Tuscany’s fourth-most expensive wine and the group’s second 100% merlot – Tua Rita’s Redigaffi. At an average price of £180 per bottle, it is over 2.5 times cheaper than its varietal companion in the group, Masseto.

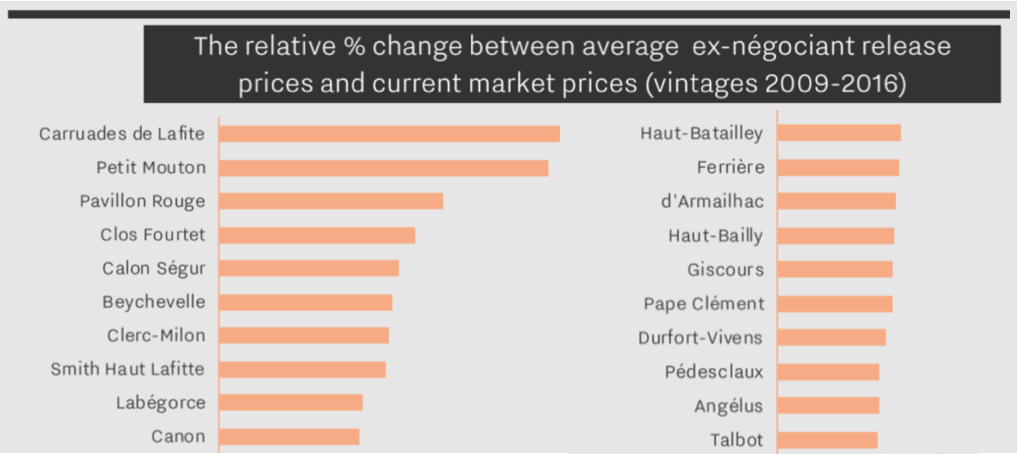

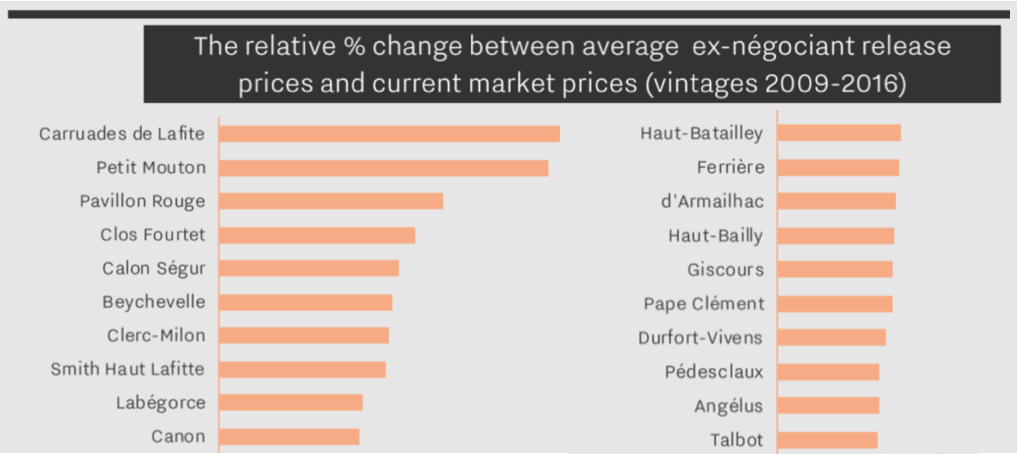

En primeur pricing is a crucial factor in the commercial success of top Bordeaux crus. With this in mind, Wine Lister has dedicated a section of this year’s Bordeaux study to the conundrum. We show historical pricing trends post release for a panel of 76 wines. The analysis indicates the effectiveness of release prices, based on the change between average ex-négociant release and current market prices (2009-2016 vintages):

Above are the top 20 best-performing Bordeaux wines post en primeur release (to view the performance of all 76 wines, see page 14 of the Bordeaux study). The second wines of Lafite and Mouton have enjoyed the greatest gains in the marketplace, with Pavillon Rouge not far behind in third place.

Clos Fourtet is the best of the rest, followed by Calon Ségur, Beychevelle, Clerc-Milon and Smith Haut Lafitte. Lafite is the best-performing first growth, followed by Margaux and Mouton, with Haut-Brion making smaller gains.

This year’s en primeur campaign has not yet been met by the same enthusiasm as the 2016 or 2015 vintages. The average quality of 2017 is lower (by 10% if we take Wine Lister Quality scores for the same 76 wines) – a major factor in explaining price sensitivity, and why the average discount so far of 7% (9% excluding Haut-Batailley’s contrary price hike) is far from sufficient to oil the wheels of the campaign.

In our Bordeaux Market Study 2018, released just last week, we clarify an illustrative methodology for calculating release prices. Wine Lister looks at current market prices for similar recent vintages, and works backwards through three steps:

- Vintage comparison: As there is no obvious comparison for 2017, we apply the average quality to price ratio of the last nine vintages in order to arrive at a derived future market price, based on the average Wine Lister Quality score.

- Ex-château price: By removing the margins taken by the négociant and importer we reach the equivalent ex-château price.

- En primeur discount: Finally, we apply a discount of 10%-20% to incentivise buying en primeur, rather than waiting until the wine is physically available.

The chart below shows the theoretical application of this methodology to a basket of top wines. See page 13 of the Bordeaux study for a more detailed explanation.

Prices released in the campaign thus far have varied from 20% discounts (Palmer, Domaine de Chevalier Rouge) to a 46% increase (Haut-Batailley) on last release prices.

Follow Wine Lister on Twitter for realtime en primeur release information, and use our dedicated en primeur page to compare 2017 release prices to last year.

Other wines featured in the top 20 best-performing Bordeaux post en primeur release are: Labégorce, Canon, Haut-Batailley, Ferrière, d’Armailhac, Haut-Bailly, Giscours, Pape Clément, Durfort-Vivens, Pedesclaux, Angélus, and Talbot.

Subscribers can download a copy of the full Bordeaux Study 2018 from the analysis page.